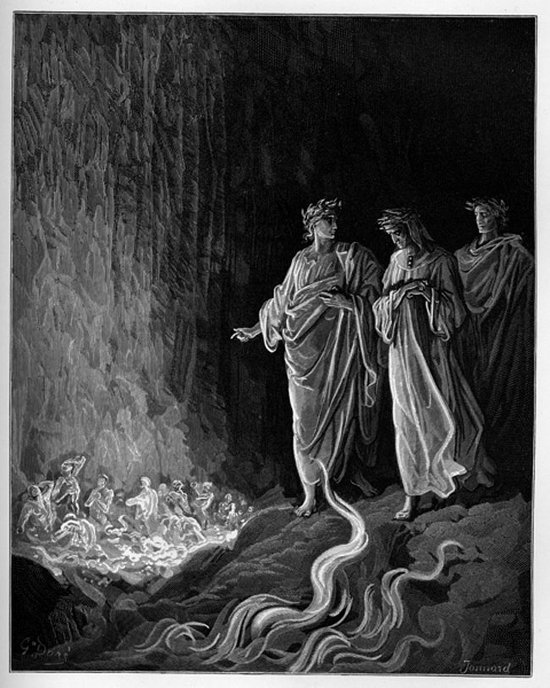

Gustave Doré Dante before the wall of flames which burn the lustful 1868

We’re doing something a little different. Nicole wrote another very long article and I suggested publishing it in chapters; this time she said yes. Over five days we will post five different chapters of the article, one on each day, and then on day six the whole thing. Just so there’s no confusion: the article, all five chapters of it, was written by Nicole Foss. Not by Ilargi.

This is part 3. Part 1 is here:

Global Financial Crisis – Liquidity Crunch and Economic Depression,

and part 2 is here:

The Psychological Driver of Deflation and the Collapse of the Trust Horizon

Energy – Demand Collapse Followed by Supply Collapse

As we have noted many times, energy is the master resource, and has been the primary driver of an expansion dating back to the beginning of the industrial revolution. In fossil fuels humanity discovered the ‘holy grail’ of energy sources – highly concentrated, reasonably easy to obtain, transportable and processable into many useful forms. Without this discovery, it is unlikely that any human empire would have exceeded the scale and technological sophistication of Rome at its height, but with it we incrementally developed the capacity to reach for the stars along an exponential growth curve.

We increased production year after year, developed uses for our energy surplus, and then embedded layer upon successive layer of structural dependency on those uses within our societies. We were living in an era of a most unusual circumstance – energy surplus on an unprecedented scale. We have come to think this is normal as it has been our experience for our whole lives, and we therefore take it for granted, but it is a profoundly anomalous and temporary state of affairs.

We have arguably reached peak production, despite a great deal of propaganda to the contrary. We still rely on the giant oil fields discovered decades ago for the majority of the oil we use today, but these fields are reaching the end of their lives and new discoveries are very small in comparison. We are producing from previous finds on a grand scale, but failing to replace them, not through lack of effort, but from a fundamental lack of availability. Our dependence on oil in particular is tremendous, given that it underpins both the structure and function of industrial society in a myriad different ways.

An inability to grow production, or even maintain it at current levels past peak, means that our oil supply will be constricted, and with it both the scope of society’s functions and our ability maintain what we have built. Production from the remaining giant fields could collapse, either as they finally water out or as production is hit by ‘above ground factors’, meaning that it could be impacted by rapidly developing human events having nothing to do with the underlying geology. Above ground factors make for unpredictable wildcards.

Financial crisis, for instance, will be profoundly destabilizing, and is going to precipitate very significant, and very negative, social consequences that are likely to impact on the functioning of the energy industry. A liquidity crunch will cause purchasing power to collapse, greatly reducing demand at personal, industrial and national scales. With production geared to previous levels of demand, it will feel like a supply glut, meaning that prices will plummet.

This has already begun, as we have recently described. The effect is exacerbated by the (false) propaganda over recent years regarding unconventional supplies from fracking and horizontal drilling that are supposedly going to result in limitless supply. As far as price goes, it is not reality by which it is determined, but perception, even if that perception is completely unfounded.

The combination of perception that oil is plentiful, falling actual demand on economic contraction, and an acute liquidity crunch is a recipe for very low prices, at least temporarily. Low prices, as we are already seeing, suck the investment out of the sector because the business case evaporates in the short term, economic visibility disappears for what are inherently long term projects, and risk aversion becomes acute in a climate of fear.

Exploration will cease, and production projects will be mothballed or cancelled. It is unlikely that critical infrastructure will be maintained when no revenue is being generated and money is very scarce, meaning that reviving mothballed projects down the line may be either impossible, or at least economically non-viable.

The initial demand collapse may buy us time in terms of global oil depletion, but at the expense of aggravating the situation considerably in the longer term. The lack of investment over many years will see potential supply collapse as well, so that the projects we may have though would cushion the downslope of Hubbert’s curve are unlikely to materialize, even if demand eventually begins to recover.

In addition, various factions of humanity are very likely to come to blows over the remaining sources, which, after all, confer upon the owner liquid hegemonic power. We are already seeing a new three-way Cold War shaping up between the US, Russia and China, with nasty proxy wars being fought in the imperial periphery where reserves or strategic transport routes are located. Resource wars will probably do more than anything else to destroy with infrastructure and supplies that might otherwise have fuelled the future.

Given that the energy supply will be falling, and that there will, over time, be competition for increasingly scarce energy resources that we can no longer take for granted, proposed solutions which are energy-intensive will lie outside of solution space.

Declining Energy Profit Ratio and Socioeconomic Complexity

It is not simply the case that energy production will be falling past the peak. That is only half the story as to why energy available to society will be drastically less in the future in comparison with the present. The energy surplus delivered to society by any energy source critically depends on the energy profit ratio of production, or or energy returned on energy invested (EROEI).

The energy profit ratio is the comparison between the energy deployed in order to produce energy from any given source, and the resulting energy output. Naturally, if it were not possible to produce more than than the energy required upfront to do so (an EROEI equal to one), the exercise would be pointless, and ideally one would want to produce a multiple of the input energy, and the higher the better.

In the early years of the oil fuel era, one could expect a hundred-fold return on energy invested, but that ratio has fallen by something approximating a factor of ten in the intervening years. If the energy profit ratio falls by a factor of ten, gross production must rise by a factor ten just for the energy available to society to remain the same. During the oil century, that, and more, is precisely what happened. Gross production sky-rocketed and with it the energy surplus available to society.

However, we have now produced and consumed the lions’s share of the high energy profit ratio energy sources, and are depending on lower and lower EROEI sources for the foreseeable future. The energy profit ratio is set to fall by a further factor of ten, but this time, being past the global peak of production, we will not be able to raise gross production. In fact both gross production and the energy profit ratio will be falling at the same time, meaning that the energy surplus available to society is going to be very sharply curtailed. This will compound the energy crisis we unwittingly face going forward.

The only rationale for supposedly ‘producing energy’ from an ‘energy source’ with an energy profit ratio near, or even below, one, would be if one can nevertheless make money at it temporarily, despite not producing an energy return at all. This is more often the case at the moment than one might suppose. In our era of money created from nothing being thrown at all manner of losing propositions, as it always is at the peak of a financial bubble, a great deal of that virtual wealth has been pursuing energy sources and energy technologies.

Prior to the topping of the financial bubble, commodities of all kinds had been showing exponential price rises on fear of impending scarcity, thanks to the human propensity to extrapolate current trends, in this case commodity demand, forward to infinity. In addition technology investments of all kinds were highly fashionable, and able to attract investment without the inconvenient need to answer difficult questions. The combination of energy and technology was apparently irresistible, inspiring investors to dream of outsized profits for years to come. This was a very clear example of on-going dynamics in finance and energy intertwining and acting as mutually reinforcing drivers.

Both unconventional fossil fuels and renewable energy technologies became focii for huge amounts of inward investment. These are both relatively low energy profit energy sources, on average, although the EROEI varies considerably. Unconventional fossil fuels are a very poor prospect, often with an EROEI of less than one due to the technological complexity, drilling guesswork and very rapid well depletion rates.

However, the propagandistic hype that surrounded them for a number of years, until reality began to dawn, was sufficient to allow them to generate large quantities of money for those who ran the companies involved. Ironically, much of this, at least in the United states where most of the hype was centred, came from flipping land leases rather than from actual energy production, meaning that much of this industry was essentially nothing more than an elaborate real estate ponzi scheme.

Renewables, as we currently envisage them, unfortunately suffer from a relatively low energy profit ratio (on average), a dependence on fossil fuels for both their construction and distribution infrastructure, and a dependence on a wide array of non-renewable components.

We typically insist on deploying them in the most large-scale, technologically complex manner possible, thereby minimising the EROEI, and quite likely knocking it below one in a number of cases. This maximises monetary profits for large companies, thanks to both investor gullibility and greed and also to generous government subsidy regimes, but generally renders the exercise somewhere between pointless and counter-productive in long term energy supply terms.

For every given society, there will be a minimum energy profit ratio required to support it in its current form, that minimum being dependent on the scale and complexity involved. Traditional agrarian societies were based on an energy profit ratio of about 5, derived from their food production methods, with additional energy from firewood at a variable energy profit ratio depending on the environment. Modern society, with its much larger scale and vastly greater complexity, naturally has a far higher energy profit ratio requirement, probably not much lower than that at which we currently operate.

We are moving into a lower energy profit ratio era, but lower EROEI energy sources will not be able to maintain our current level of socioeconomic complexity, hence our society will be forced to simplify. However, a simpler society will not be able to engage in the complex activities necessary to produce energy from these low EROEI sources. In other words, low energy profit ratio energy sources cannot sustain a level of complexity necessary to produce them. They will not fuel the simpler future which awaits us.

Proposed solutions dependent on the current level of socioeconomic complexity do not lie within solution space.

This is part 3. Part 1 is here:

Global Financial Crisis – Liquidity Crunch and Economic Depression,

and part 2 is here:

The Psychological Driver of Deflation and the Collapse of the Trust Horizon

Tune back in tomorrow for part 4: Blind Alleys and Techno-Fantasies

Home › Forums › The Boundaries and Future of Solution Space – Part 3