Pablo Picasso Night fishing at Antibes 1939

It went down a little after, but then the war threats started.

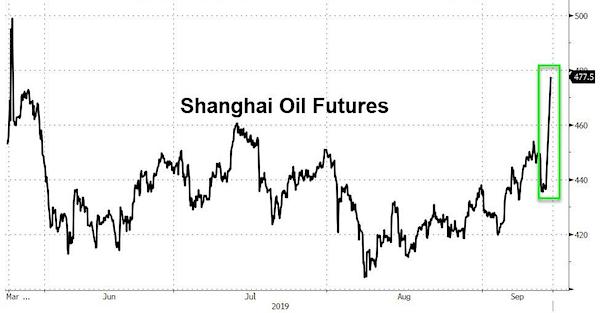

• Oil Explodes 20% Higher, Biggest Jump On Record (ZH)

Shanghai Oil futures are halted limit up.

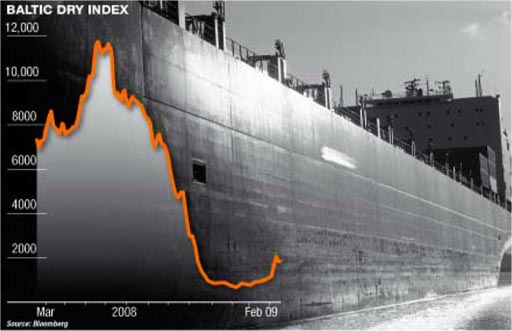

Source: BloombergWith traders in a state of near-frenzy, with a subset of fintwit scrambling (and failing) to calculate what the limit move in oil would be (hint: there is none for Brent), moments ago brent reopened for trading in the aftermath of Saturday’s attack on the “world’s most important oil processing plant”, and exploded some 20% higher, to a high of $71.95 from the Friday $60.22 close, its biggest jump since futures started trading in 1988. As Bloomberg notes, “for oil markets, it’s the single worst sudden disruption ever, surpassing the loss of Kuwaiti and Iraqi petroleum supply in August 1990, when Saddam Hussein invaded his neighbor. It also exceeds the loss of Iranian oil output in 1979 during the Islamic Revolution, according to data from the U.S. Department of Energy.”

Furthermore, in light of news that the Saudi outage could last for months, this could be just the start. As a reminder, according to Morningstar research director, Sandy Fielden, “Brent could go to $80 tomorrow, while WTI could go to $75… But that would depend on Aramco’s 48-hour update. The supply problem won’t be clear right away since the Saudis can still deliver from inventory.” Of course, should Aramco confirm that the outage – which has taken some 5.7mmb/d in Saudi output after 10 drones struck the world’s biggest crude-processing facility in Abqaiq and the kingdom’s second-biggest oil field in Khurais – will last for weeks, expect the crude juggernaut to continue until the price hits $80, and keeps moving higher.

Source: Bloomberg

Does any of this make any sense to you?

• Trump Says US ‘Locked And Loaded’ As Iran Blamed For Saudi Attack (AP)

The U.S. government produced satellite photos showing what officials said were at least 19 points of impact at two Saudi energy facilities, including damage at the heart of the kingdom’s crucial oil processing plant at Abqaiq. Officials said the photos show impacts consistent with the attack coming from the direction of Iran or Iraq, rather than from Yemen to the south. Iraq denied Sunday that its territory was used for an attack on the Kingdom and U.S. officials said a strike from there would be a violation of Iraq’s sovereignty. The U.S. officials said additional devices, which apparently didn’t reach their targets, were recovered northwest of the facilities and are being jointly analyzed by Saudi and American intelligence.

The officials, who spoke on condition of anonymity to discuss intelligence matters, did not address whether the drone could have been fired from Yemen, then taken a round-about path, but did not explicitly rule it out. The attacks and recriminations are increasing already heightened fears of an escalation in the region, after a prominent U.S. senator suggested striking Iranian oil refineries in response to the assault, and Iran warned of the potential of more violence. “Because of the tension and sensitive situation, our region is like a powder keg,” said Iranian Brig. Gen. Amir Ali Hajizadeh. “When these contacts come too close, when forces come into contact with one another, it is possible a conflict happens because of a misunderstanding.”

[..] “Amid all the calls for de-escalation, Iran has now launched an unprecedented attack on the world’s energy supply,” Pompeo wrote. “There is no evidence the attacks came from Yemen.” [..] U.S. officials previously alleged at least one recent drone attack on Saudi Arabia came from Iraq, where Iran backs Shiite militias. Those militias in recent weeks have been targeted themselves by mysterious airstrikes, with at least one believed to have been carried out by Israel. Iranian Foreign Ministry spokesman Abbas Mousavi on Sunday dismissed Pompeo’s remarks as “blind and futile comments.” “The Americans adopted the ‘maximum pressure’ policy against Iran, which, due to its failure, is leaning toward ‘maximum lies,’” Mousavi said in a statement.

“Trouble is, while loanable funds can be created without limit, the things that can be purchased with these funds is finite.”

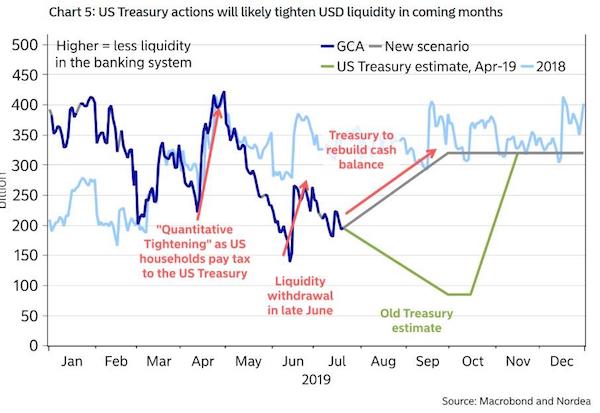

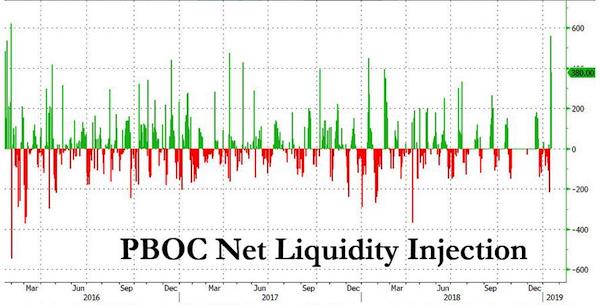

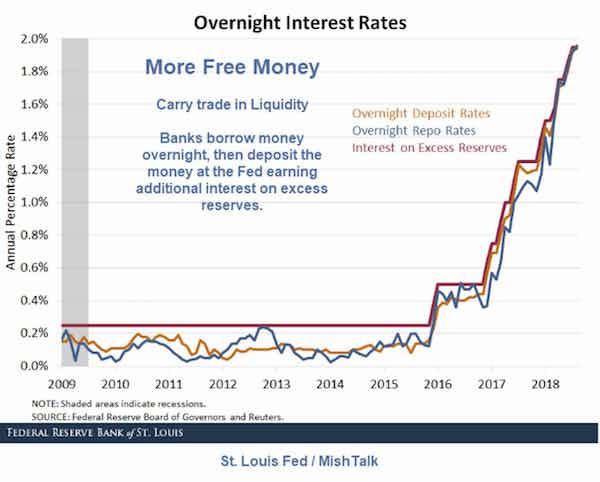

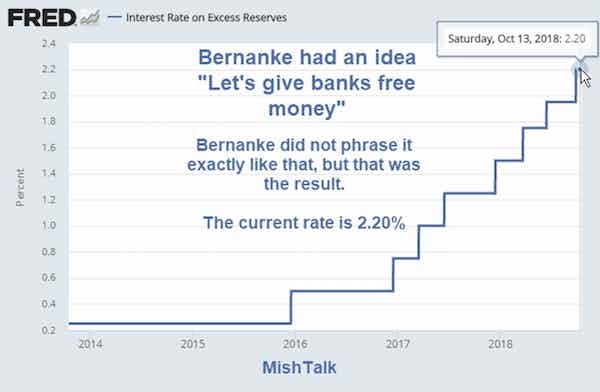

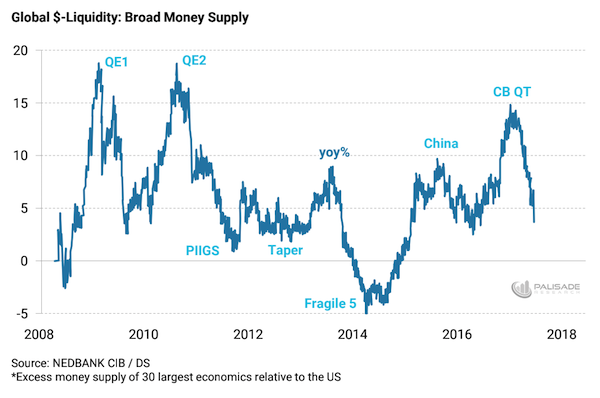

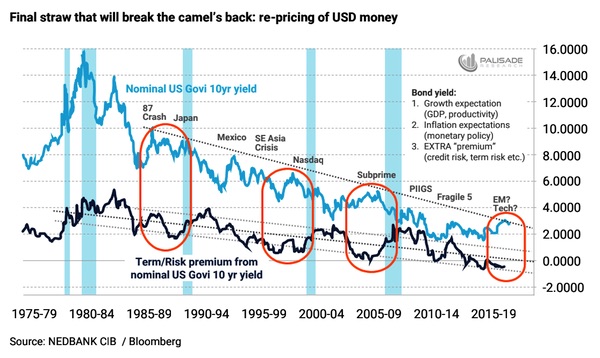

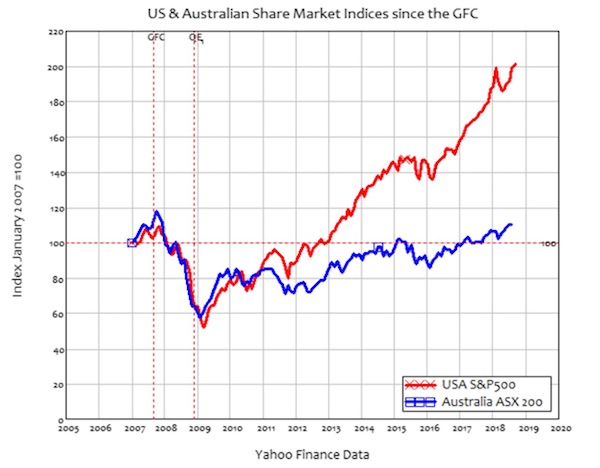

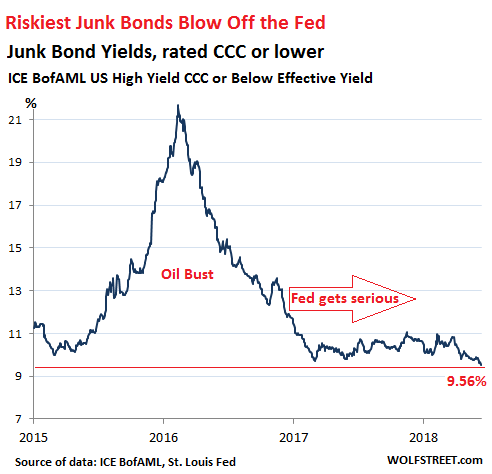

• Liquidity Dies in Darkness (Rivelle)

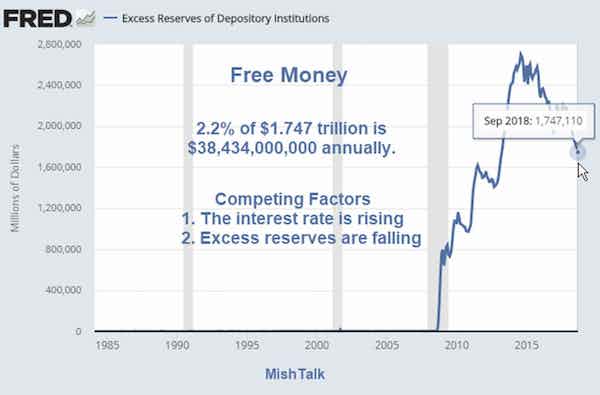

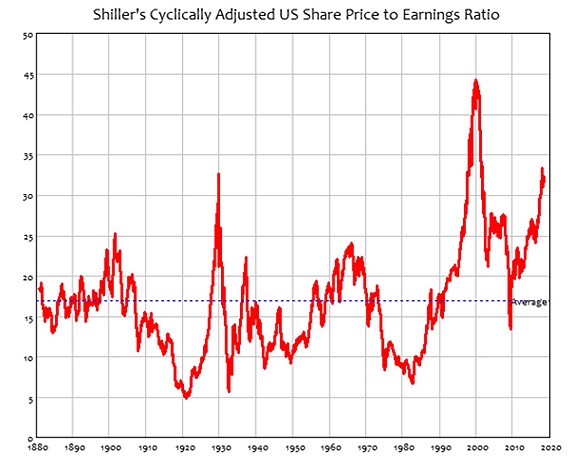

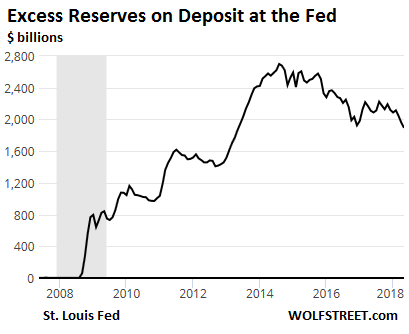

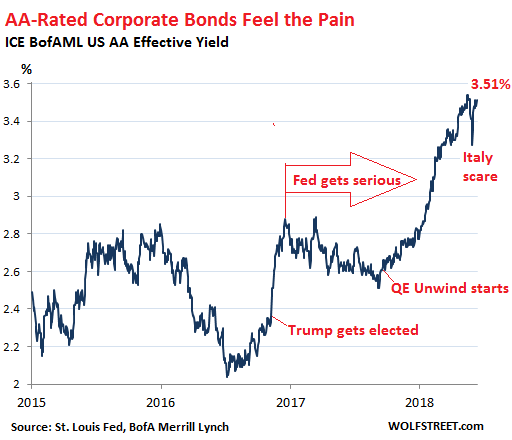

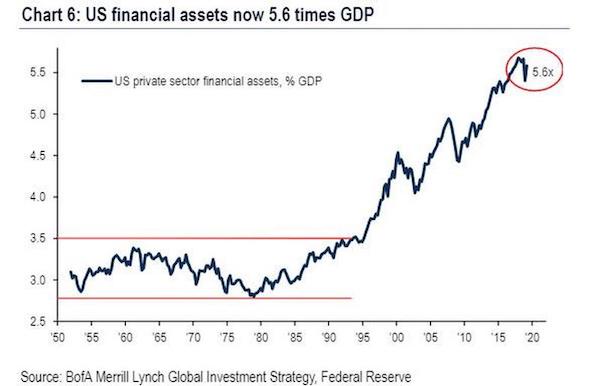

If democracy dies in darkness, so does liquidity in that embodiment of economic democracy, i.e., the capital markets. When information is scarce, investors must color in between the lines. That which is not known nor well quantified must be assumed or modeled. The door is therefore open to different investors reaching quite different conclusions about the underlying value of an asset leading, of course, to illiquidity. More so perhaps than any other in history, this cycle is the wellspring of the theories and actions of the central bankers who, in their infinite wisdom, determined that they could model interest rates better than markets could price them. Central banks have flooded the system with what they call “liquidity” but which are actually nothing more–nor less–than electronically conjured “loanable funds.”

Under the banner of “doing whatever it takes,” trillions in loanable funds were created so that now $17 trillion in global debt is priced to yield less than nothing. The magic trick of inverting economic logic with negative rates results from the capacity of the central banks to create unlimited quantities of loanable funds at no cost. Trouble is, while loanable funds can be created without limit, the things that can be purchased with these funds is finite. But, “free money” not only makes loans cheap, it also erodes the capacity of lenders to ask for such reasonable terms as traditional loan covenants and basic financial disclosure.

Preparing the people for bad news?!

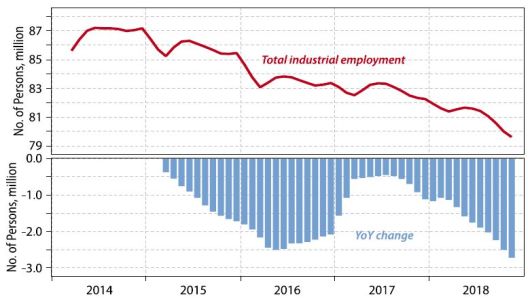

• ‘Very Difficult’ For China’s Economy To Grow 6% Or Faster: Premier Li

Chinese Premier Li Keqiang said it is “very difficult” for China’s economy to grow at a rate of 6% or more because of the high base from which it was starting and the complicated international backdrop. The world’s No.2 economy faced “certain downward pressure” due to slowing global growth as well as the rise of protectionism and unilateralism, Li said in an interview with Russian media which was published on the Chinese government’s website, gov.cn. China’s GDP grew 6.3% in the first half of the year, and Li said the economy was “generally stable” in the first eight months of the year.

“For China to maintain growth of 6% or more is very difficult against the current backdrop of a complicated international situation and a relatively high base, and this rate is at the forefront of the world’s leading economies,” Li was quoted as saying. Analysts say China’s economic growth has likely cooled further this quarter from a near 30-year low of 6.2% in April-June. Morgan Stanley says it is now tracking the lower end of the government’s full-year target range of around 6-6.5%.

4.4% it is.

• China’s August Industrial Output Growth Grinds To 17.5-Year Low (R.)

The slowdown in China’s factory and consumer sectors deepened in August, with industrial production growing at the weakest pace in 17-1/2 years, a sign of increasing weakness in an economy lashed by trade headwinds and soft domestic demand. Production rose 4.4% in August year-on-year, slower than the 4.8% growth in July. Analysts polled by Reuters had forecast output would rise 5.2%. August’s data is the slowest growth since February 2002. [..] The data also showed retail sales growth at 7.5%, below the 7.9% expected in a Reuters poll and the 7.6% increase in July.

Fixed-asset investment for the first eight months of the year rose 5.5%, according to data published by the National Bureau of Statistics, compared with a 5.6% rise forecast by analysts. Data last week showed factory-gate prices fell at their fastest pace in three years and analysts predict that producer deflation will continue to worsen in the coming months. It also follows a factory survey that showed activity shrank for the fourth straight month as the U.S. trade war dragged on. China’s imports of unwrought copper also fell 3.8% year-on-year in August, a metal with wide use in infrastructure, power and consumption.

America’s dying unions.

• General Motors Faces Strike By Almost 50,000 Staff (BBC)

Almost 50,000 General Motors workers have been called out on strike after the car giant failed to reach a pay and conditions deal with the United Auto Workers union (UAW). “We do not take this lightly. This is our last resort,” UAW vice-president Terry Dittes told reporters in Detroit. The sides had set a Saturday night deadline to reach agreement. The strike – from midnight (04:00 GMT) on Monday – is the first at GM, America’s biggest carmaker, since 2007. In that strike, a two-day stoppage cost $300m (£240m). The union’s previous four-year contract with GM expired this weekend, and the two sides had been holding negotiations on wide-ranging issues, including wages, healthcare, profit sharing, and job security.

Right after the Sackler family had transferred their billions to safe locations.

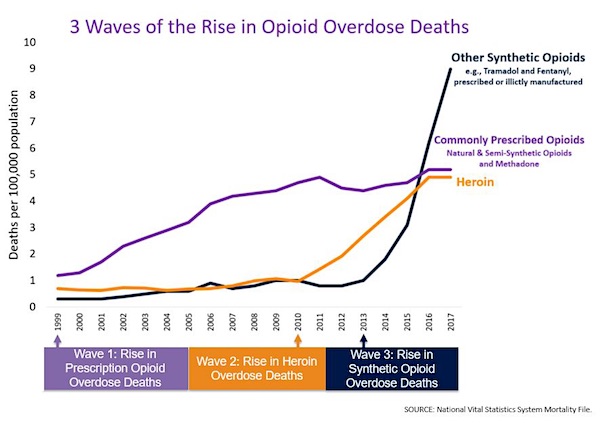

• OxyContin Maker Purdue Pharma Files For Bankruptcy Protection (R.)

OxyContin maker Purdue Pharma LP filed for bankruptcy protection Sunday night, succumbing to pressure from more than 2,600 lawsuits alleging the company helped fuel the deadly U.S. opioid epidemic. Purdue’s board met Sunday evening to approve the long-expected bankruptcy filing, which the company is pursuing to restructure under terms of a proposal to settle the widespread litigation. Purdue, which filed for Chapter 11 protection in a federal bankruptcy court in White Plains, New York, reached a tentative deal to resolve lawsuits with 24 states and five U.S. territories, as well as lead lawyers for more than 2,000 cities, counties and other plaintiffs, the company said.

Two dozen states remain opposed or uncommitted to the proposed settlement, setting the stage for contentious legal battles over who bears responsibility for a public health crisis that has claimed the lives of nearly 400,000 people between 1999 and 2017, according to the latest U.S. data. Thousands of cities and counties, along with nearly every state, have sued Purdue and, in some cases, its controlling Sackler family. The lawsuits, seeking billions of dollars in damages, claim the company and family aggressively marketed prescription painkillers while misleading doctors and patients about their addiction and overdose risks.

I’d rather have a look at overall pollution, not just emissions.

• Industrialized Militaries Are A Big Part Of The Climate Emergency (IC)

A British doctor who co-authored two studies on the environmental impact of U.S. military operations in Fallujah said that the city’s population suffers “the highest rate of genetic damage in any population ever studied.” Much of this impact can be blamed on the use of depleted uranium munitions by U.S. forces. Despite vowing to cease their use, a study by the independent monitoring group Airwars and Foreign Policy Magazine found that the military continued to use the toxic munitions during its most recent bombing campaign in Syria. The fact that fossil fuel emissions have been the major driver of climate change adds another grim irony to these wars.

For decades, the heavy U.S. military footprint in the Middle East has been justified by the need to preserve access to the region’s oil reserves. The industrial extraction of those same reserves has been one of the major drivers of global carbon dioxide emissions. In other words, we have been killing, dying, and polluting to ensure our access to the same toxic resource most responsible for our climate disruption. It took this perfect symmetry between industrial warfare and industrial exploitation of the earth to bring about the unspeakable emergency we now face.

$1 million every minute. And look at the sugary crap we’re eating.

• Farming Subsidies Destroy The World (G.)

The public is providing more than $1m per minute in global farm subsidies, much of which is driving the climate crisis and destruction of wildlife, according to a new report. Just 1% of the $700bn (£560bn) a year given to farmers is used to benefit the environment, the analysis found. Much of the total instead promotes high-emission cattle production, forest destruction and pollution from the overuse of fertiliser. The security of humanity is at risk without reform to these subsidies, a big reduction in meat eating in rich nations and other damaging uses of land, the report says. But redirecting the subsidies to storing carbon in soil, producing healthier food, cutting waste and growing trees is a huge opportunity, it says.

The report rejects the idea that subsidies are needed to supply cheap food. It found that the cost of the damage currently caused by agriculture is greater than the value of the food produced. New assessments in the report found producing healthy, sustainable food would actually cut food prices, as the condition of the land improves. “There is incredibly small direct targeting of [subsidies at] positive environment outcomes, which is insane,” said Jeremy Oppenheim, principal at the Food and Land Use Coalition (Folu), the collaboration of food, farming and green research groups that produced the new report. “We have got to switch these subsidies into explicitly positive measures.”

He said the true global total was likely to be $1tn a year, as some subsidies are difficult to quantify precisely: “That trillion dollars of public funding is available and is a massive, massive lever to incentivise the farming community across the world to act differently.”

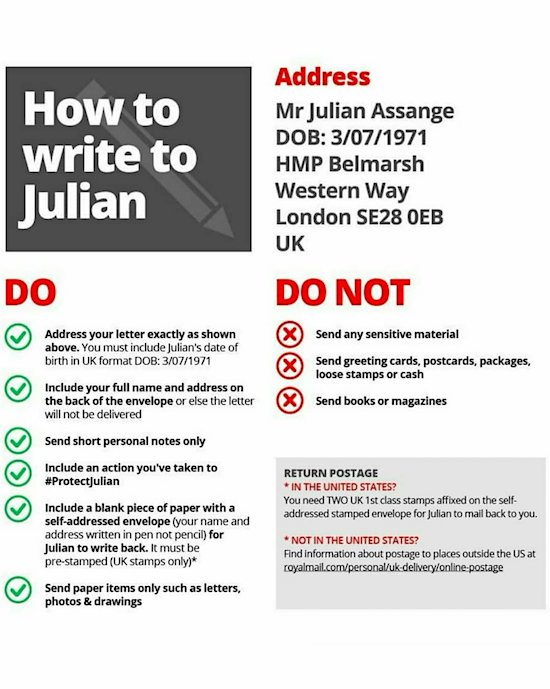

“..all the excuses for Assange’s imprisonment which so-called leftists and liberals in the UK have hidden behind will evaporate.”

• The World’s Most Important Political Prisoner (Craig Murray)

We are now just one week away from the end of Julian Assange’s uniquely lengthy imprisonment for bail violation. He will receive parole from the rest of that sentence, but will continue to be imprisoned on remand awaiting his hearing on extradition to the USA – a process which could last several years. At that point, all the excuses for Assange’s imprisonment which so-called leftists and liberals in the UK have hidden behind will evaporate. There are no charges and no active investigation in Sweden, where the “evidence” disintegrated at the first whiff of critical scrutiny. He is no longer imprisoned for “jumping bail”.

The sole reason for his incarceration will be the publishing of the Afghan and Iraq war logs leaked by Chelsea Manning, with their evidence of wrongdoing and multiple war crimes. In imprisoning Assange for bail violation, the UK was in clear defiance of the judgement of the UN Working Group on arbitrary Detention, which stated:

“Under international law, pre-trial detention must be only imposed in limited instances. Detention during investigations must be even more limited, especially in the absence of any charge. The Swedish investigations have been closed for over 18 months now, and the only ground remaining for Mr. Assange’s continued deprivation of liberty is a bail violation in the UK, which is, objectively, a minor offense that cannot post facto justify the more than 6 years confinement that he has been subjected to since he sought asylum in the Embassy of Ecuador. Mr. Assange should be able to exercise his right to freedom of movement in an unhindered manner, in accordance with the human rights conventions the UK has ratified,”

In repudiating the UNWGAD the UK has undermined an important pillar of international law, and one it had always supported in hundreds of other decisions. The mainstream media has entirely failed to note that the UNWGAD called for the release of Nazanin Zaghari-Ratcliffe – a source of potentially valuable international pressure on Iran which the UK has made worthless by its own refusal to comply with the UN over the Assange case. Iran simply replies “if you do not respect the UNWGAD then why should we?”