René Magritte Companions of fear 1942

Alberta

Alberta Chief Health Officer Deena Hinshaw: Going forward, we’re counting all sick people who decline Covid tests as Covid-positive pic.twitter.com/mDZqT030Gh

— Tom Elliott (@tomselliott) September 27, 2021

“..governments need to restore freedom of movement to transportation workers amid persistent COVID-19 restrictions and quarantines..”

• Warning of Worldwide Supply-chain Collapse Due To Pandemic Restrictions (ET)

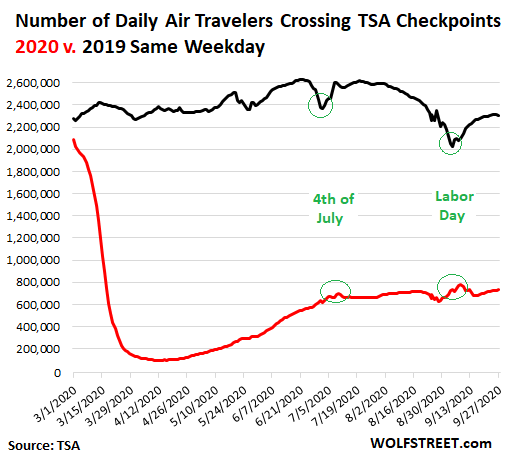

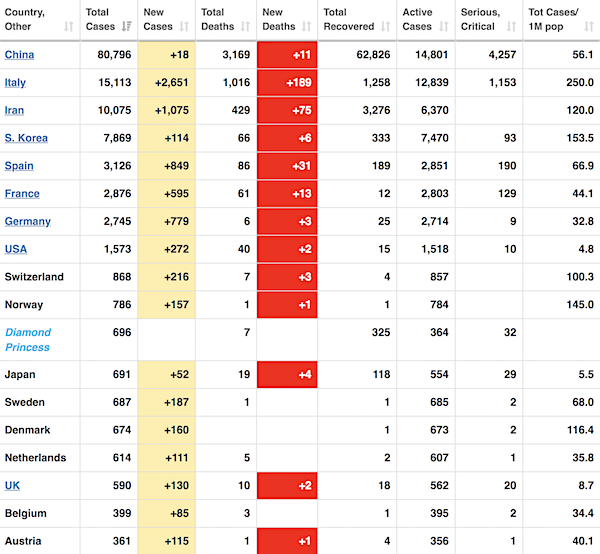

Several industry groups have warned world leaders of a worldwide supply-chain “system collapse” due to pandemic restrictions, coming as Federal Reserve Chairman Jerome Powell suggested that the current period of higher inflation will last until 2022. The International Chamber of Shipping, a coalition of truck drivers, seafarers, and airline workers, has warned in a letter to heads of state attending the United Nations General Assembly that governments need to restore freedom of movement to transportation workers amid persistent COVID-19 restrictions and quarantines. If nothing is done, they warned of a “global transport system collapse” and suggested that “global supply chains are beginning to buckle as two years’ worth of strain on transport workers take their toll,” according to the letter.

It was signed by the International Air Transport Association (IATA), the International Road Transport Union (IRU), and the International Transport Workers’ Federation (ITF), which represent some 65 million transport workers around the world. “All transport sectors are also seeing a shortage of workers, and expect more to leave as a result of the poor treatment millions have faced during the pandemic, putting the supply chain under greater threat,” the letter said. “We also ask that WHO and the ILO raise this at the U.N. General Assembly and call on heads of government to take meaningful and swift action to resolve this crisis now,” they wrote. Meanwhile, retailer Costco said it’s chartering its own container ships between Asia and North America amid supply chain issues worldwide, Chief Financial Officer Richard Galanti said in a recent conference call.

Costco, he said, is dealing with “port delays, container shortages, COVID disruptions, shortages on various components, raw materials and ingredients, labor cost pressures” along with “trucks and driver shortages,” Fox News reported. Gene Seroka, executive director of the Port of Los Angeles, attempted to shed some light on the problem during a recent ABC News interview, noting that there’s a significant backup of container ships off the coast of major ports of entry. “We’re witnessing a pandemic-induced buying surge by the American consumer, the likes of which we’ve never seen,” he told the network on Sept. 29. In remarks on Sept. 29, Powell said that the current spike in inflation is a “consequence of supply constraints meeting very strong demand,” saying it’s “associated with the reopening of the economy, which is a process that will have a beginning, middle and an end.”

Neil Oliver

“It is time for courage and honesty. Not politics.”

• Australia’s Corporations Rebel Against Draconian COVID Lockdowns (ZH)

Australia’s corporate sector has finally had enough of the ongoing lockdowns that have left the country’s economy hobbled and its people cut off from the rest of the world for months. Increasingly frustrated by a slow vaccine rollout and the ongoing lockdowns, the leaders of many of Australia’s biggest companies, including BHP, Macquarie and Qantas have signed a letter demanding that the government acknowledge it’s time to “learn to live with the virus,” as many other countries have done, since “COVIDZero” has finally been exposed as an impossible dream. In the letter – which was reported on by the FT – the signatories allege that Australia is making “big mistakes” in failing to reopen to the world.

By making the lockdowns so severe (and so unceasingly long), the Australian government is putting politics before the well-being of the Australian people ahead of the federal elections that must be held by the end of May – when the Senate’s present term is slated to expire. The companies that signed the letter “…employ almost one million Australians” and warned that lockdowns were having “long-lasting” effects on the economy. However, this shouldn’t be news to Australia’s political elite: Economists at Australia’s central bank, the RBA, already lowered their growth projections after a stronger-than-expected Q2 GDP print.

But all the incremental data seen so far suggests that Q3 could be a disaster – well that, coupled with the intensifying economic pressure from Beijing, which is trying to win a geopolitical stare-down contest with the Australian government by blocking a growing number of imports. As for Australia’s infamous “drawbridge” border policy, the letter’s signatories insisted that the decision to close Australia’s borders was a colossal mistake. “The borders should have never been closed,” Graham Turner, chief executive of travel company Flight Centre, told the Financial Times. “We’re making some very big mistakes here.” “It’s time for corporate Australia to turn its disquiet and rumblings into a roar,” said Greg O’Neill, the chief executive of Melbourne fund manager La Trobe Financial, one of the signatories to the open letter sent by the Business Council of Australia. “It is time for courage and honesty. Not politics.”

Prove them wrong.

• Unvaccinated Believe Boosters Prove Vaccines Are Ineffective (NM)

A survey released Sunday indicates 71% of unvaccinated Americans believe boosters prove COVID-19 vaccines are ineffective. While 78% of Americans who have received some form of COVID-19 vaccine say boosters show how “scientists are continuing to find ways to make vaccines more effective,” according to Newsweek. The survey, conducted by the Kaiser Family Foundation, also found 33% of all respondents agreed the need for boosters proves COVID-19 vaccines are not working as well as promised. The survey contacted 1,519 randomly selected adults from Sept. 13-22. But Kaiser survey was conducted before the Centers for Disease Control and Prevention’s advisory panel recommended adults 65 and older and those at high risk get a booster. Among Democrats who responded, 90% say they received at least one dose of vaccine, compared to only 58% of Republicans. Democrats were twice as likely to say they would get a booster if the CDC or FDA recommended one.

“Dr. Fauci said that he encourages vaccination regardless if it fails to provide quality protection.”

• Fauci Changes Definition Of ‘Fully Vaccinated’ To Include Booster Shots (PM)

In an exclusive interview with The Atlantic, Joe Biden’s chief medical adviser Dr. Anthony Fauci revealed that COVID-19 booster shots don’t keep people alive but can allegedly prevent severe effects from the virus. According to Dr. Fauci, booster shots add crucial temporary protection against the virus and will become a standard regimen in the future. “It is likely, for a real complete regimen, that you would need at least a third dose,” Fauci said. When pressed by The Atlantic’s Ed Yong and the criticism surrounding the lack of long-term protection from the mRNA booster shots, Dr. Fauci said that he encourages vaccination regardless if it fails to provide quality protection.

“I think we should be preventing people from getting sick from COVID even if they don’t wind up in the hospital,” Dr. Fauci said at The Atlantic Festival on Tuesday. Skeptics of the COVID-19 booster shots believe that boosters won’t provide significant protection and will only act as a temporary shield to the virus, contrary to the vaccines that were designed to prevent hospitalization and death. However, Fauci said that he “rejects” skeptics’ notions and insisted it’s beneficial to have temporary protection than no protection; despite the fact that the mRNA COVID vaccine was allegedly designed prevent the virus. During the interview, Fauci explained it’s highly likely that individuals won’t be considered fully-vaccinated unless they get booster shots.

The chief medical adviser explained that the Delta Variant shifted control of the pandemic which led to vaccinations becoming less preventative, thus requiring the need for boosters. Dr. Fauci’s comments regarding the need for boosters to be considered fully-vaccinated comes as states across the country impose strict vaccination mandates, even threatening city and federal employees termination if they aren’t “fully-vaccinated.” However, full vaccination status mandated by cities remains at two doses. It’s unclear if Fauci’s comments will result in the requirement of a third shot.

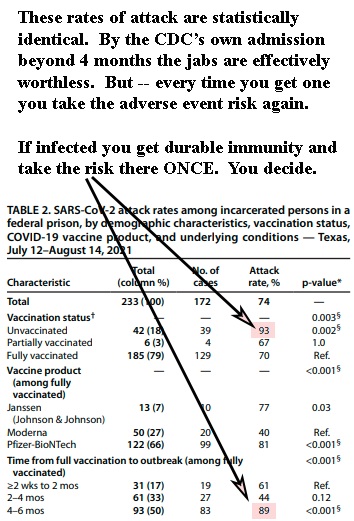

“By the CDC’s own data the vaccines are worthless to protect others after four months.”

• CDC Beclowns All Mandates (Denninger)

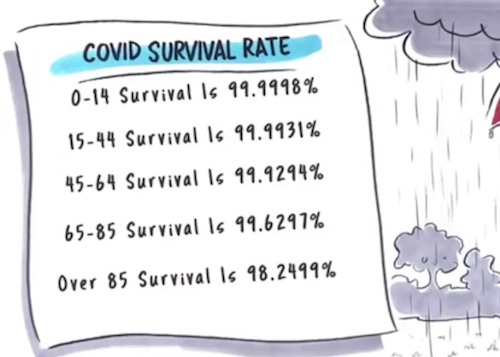

It’s over folks. Seriously, there are now two — and only two — possible paths. Sue, on the basis below. You will win if the judiciary is competent and so is your counsel. Competence is not in my wheelhouse; that is up to you. If you file bull**** you will lose, and should. But if your counsel is competent and your argument clear and concise you win because the CDC has documented that your position is correct — the vaccines are in fact worthless from a public health perspective beyond a period of about four months and you win on the balance of harms in that circumstance for reasons I will explain below. If the judiciary is no longer an arbiter of fact then you have to choose between slavery and revolt. That’s all that’s left if you are in a position that this is impacting your ability to earn a living or otherwise do something necessary. Yes, that gets ugly fast. I would hope the judiciary understands exactly how ugly, and how fast and thus does its job. The bottom line is right here, in this study:

A prison is highly analogous to a hospital or other health-care setting. Both are “conjugal” living arrangements. Both have a locked in component (the patients in one, the prisoners in the other) and a working and mingling in society component (the doctors, nurses, orderlies, janitors, etc. in one, the guards, cooks, janitors and similar in the other.) In both cases the locked-in persons are not really free to leave; in both they typically leave only when allowed by the working component (yes, you can sign yourself out against medical advice in a hospital, but few actually do.) Both confine people, typically two to a room but sometimes one, among the conjugal and locked-in persons. Both therefore are highly-effective places to spread disease — especially airborne pathogens. But — in the prison it is now documented that after four months the vaccine’s effective rate of protection was statistically zero.

The argument for forcing vaccinations in these highly-confined environments, say much less those which have fewer constraints, such as colleges, secondary and primary schools and other workplaces is that people are put at “unreasonable” risk by unvaccinated individuals. Yet the data is that four months post-vaccination there is no statistical difference between vaccinated and not when it comes to attack rates. By the CDC’s own data the vaccines are worthless to protect others after four months. We now know why the JAMA study, which found 83% population immunity as of May which is sufficient to suppress Covid-19 given its experimentally-determined R0, failed to do so. 63% of population was not immune by former infection; they were immune by vaccination and by June and July enough of those vaccinated people had their protection age off sufficiently to be worthless against infection and transmission. This is why, on the facts, the summer surge happened.

Rumble.

• YouTube Bans Channels Airing Criticism of Vaccines (Turley)

YouTube continued the expansion of corporate censorship on the Internet with the encouragement of leading Democratic leaders. The company has banned channels associated with anti-vaccine activists like Joseph Mercola and Robert F. Kennedy Jr. Once again, rather than rebutting or refuting claims made by others, many sought to silence those with opposing views. YouTube will not allow people to hear views that do not comport with an approved range of opinions. The move magnifies concerns that we are seeing the emergence of a new type of state media as private companies conduct censorship operations barred by the Constitution for the government to conduct directly. This move comes days after Sen. Elizabeth Warren (D., Mass.) asked Amazon to steer customers to “true” books on subjects like climate change to avoid their exposure to “disinformation.”

It also follows YouTube censoring videos of jailed Kremlin critic Alexei Navalny before Russia’s parliamentary elections. The move helped Putin and his authoritarian government crack down on pro-Democracy forces. The Google-owned site is now openly engaged in viewpoint regulation to force users to view only those sources that are consistent with the corporate agenda. Facebook banned misinformation on all vaccines seven months ago and Twitter regularly bans those questioning vaccines. These companies are being encouraged by many on the left to expand censorship. Faculty and editors are now actively supporting modern versions of book-burning with blacklists and bans for those with opposing political views.

Columbia Journalism School Dean Steve Coll has denounced the “weaponization” of free speech, which appears to be the use of free speech by those on the right. So the dean of one of the premier journalism schools now supports censorship. Free speech advocates are facing a generational shift that is now being reflected in our law schools, where free speech principles were once a touchstone of the rule of law. As millions of students are taught that free speech is a threat and that “China is right” about censorship, these figures are shaping a new society in their own intolerant images. In one critical hearing, tech CEOs appeared before the Senate to discuss censorship programs. Twitter CEO Jack Dorsey apologized for censoring the Hunter Biden laptop story, but then pledged to censor more people in defense of “electoral integrity.”

Dr. Joseph Mercola’s response to YouTube on the shutdown of his channel on the platform.

Sagan

https://twitter.com/i/status/1443214285774147586

“..for such actions, an internet resource can be designated as breaching fundamental human rights and freedoms..”

• YouTube Could Face Total Ban In Russia (RT)

Officials in Moscow have issued a sternly-worded ultimatum to YouTube’s parent company, Google, saying the video streaming site could face restrictions after it took down two channels run by RT’s German-language service. In the statement, released on Wednesday morning, the country’s national media regulator, Roskomnadzor, said that it “demands all restrictions be lifted from the YouTube channels RT DE and Der Fehlende Part (DFP), run by the news outlet RT, as soon as possible.” According to the authorities, failure to do so would be a violation of Russian law and, “for such actions, an internet resource can be designated as breaching fundamental human rights and freedoms,” and can face a formal warning.

“In the event that the owner of the platform doesn’t comply with the warning, legislation allows us to take measures including completely or partially blocking access to it,” Roskomnadzor added. On Tuesday, the Russian Foreign Ministry had hit out at the decision to remove the two channels as “an act of unprecedented information aggression” and an “obvious manifestation of censorship and suppression of freedom of expression.” According to the diplomats, YouTube acted with the “obvious connivance, if not at the insistence,” of German authorities. Both RT DE and DFP were removed earlier that day, reportedly with no prospect of appeal. YouTube claims that they broke the service’s rules by attempting to circumvent a ‘community guidelines’ strike, handed down for ‘medical misinformation’ in four videos.

The details of the purported breach are not yet clear, but RT’s editor-in-chief, Margarita Simonyan, has said that it amounts to “a declaration of media war against Russia by Germany.” The Russian Foreign Ministry has also warned that it could take steps against German news outlets in retaliation over the decision. “Adopting reciprocal measures against the German media in Russia which, by the way, has been repeatedly shown to have interfered in our country’s internal affairs, seems not only appropriate but necessary,” it said in a statement.

Not a bad idea.

• Red States Should Offer Sanctuary To Businesses, Military, Medics (Smith)

I continue to suspect that the reason for this sudden dive into totalitarianism is because there is something wrong with the vaccines themselves and if there are tens of millions or hundreds of millions of unvaccinated people left, then these people will act as a control group. That is to say, they will act as proof that the vaccines are not safe if things go awry. The establishment can’t allow that. As I have noted in past articles, the average vaccine is tested for 10-15 YEARS before it is released for use on human beings. This is to ensure that there are no damaging health side effects that might not become visible until months or years after the initial jab. A particular danger is the development of autoimmune disorders and infertility associated with mRNA and spike protein technology.

These debilitating ailments might not be noticed for a couple of years after a population has been given the experimental vax. It has already been about a year since the covid vaccines were introduced by emergency authorization, so time is running short for the globalists. The bottom line is, there has been ZERO long term testing of the covid mRNA vaccines. At least none that has ever been revealed to the public. There is NO SCIENTIFIC EVIDENCE that the covid vaccines are safe in the long term, they were developed and released within months of the covid outbreak. Yet, the establishment seems hell bent on forcing 100% of people to take these untested vaccines against their better judgment. It has been almost a century since we last saw government tyranny on this level, but this time it is almost all governments around the world acting in unison to implement mass controls on the public, instead of just a handful of nations.

The Biden Administration and its corporate partners are now implementing a blitzkrieg against the American citizenry. Biden’s vaccine executive orders are creating a culture of “paper’s please” fascism among larger businesses and Big Box retailers. He has recently announced that part of the mandates will include fines against businesses that refuse to enforce proof of vaccination on their employees. These fines will range from $70,000 to $700,000, which could destroy a medium sized company if they actually had to pay.

Medical personnel, primarily in leftist blue states, are now being fired from their positions because they have refused to comply with the vax. This is leaving massive gaps in medical response in places like New York. The unelected governor of New York, Kathy Hochul, claims she has the right to give herself dictatorial powers through executive order, and that these powers include deploying National Guard troops to take over medical duties. If you are familiar with the sordid history of VA hospitals, then you know that you do not want around 90% of military doctors operating on you in any capacity.

Untouchables. Unclean.

• The COVID Caste System (D’Souza)

To understand what’s going on in its widest significance, consider the true meaning of the famous phrase in the Declaration of Independence: “All men are created equal.” What does this phrase mean? At one level, certainly, it means that we enjoy equality of rights. The Constitution goes on to specify not merely equality of rights but also equal treatment under the law. This concept of equality of rights shouldn’t, as Abraham Lincoln emphasized, be confused with equality of outcomes. Human beings are obviously unequal in height, in speed, in beauty, in intelligence, even in moral character. An equal start in the race doesn’t mean, obviously, that all individuals or even all groups must hit the finishing tape at the same time.

Yet at the same time, there’s a broader meaning to the equality provision that goes beyond rights. We aren’t merely equal as human beings, we are “created” equal. This means that we are equally the children of God, and it follows from this that God loves us equally and therefore there’s an equal dignity in persons that derives, ultimately, from the fact that they’re created by a transcendent God. How does this equal dignity play out in American life? It simply means that someone—say Jeff Bezos or Bill Gates—might have more money than you or me, but they aren’t better than you or me. In America, we have maids but not servants, and in many restaurants, we call even the waiter “sir,” as if he were a knight. The political philosopher Irving Kristol once said there’s no restaurant in America to which a CEO could go in the absolute assurance that he wouldn’t also find his secretary dining there.

So the Declaration of Independence affirms a social equality that is the very antithesis of a caste system. Yet precisely what our founding documents reject, the progressive elite, mostly made up of Democrats, is attempting to create for the first time in America a society divided into an elite upper caste and a mass lower caste, with separate rules applying to each group, in accordance with their caste status. It’s unlovely. It’s downright ugly. It’s also immoral. And it’s certainly un-American.

They are lying about the evidence base

“We had months & months of Government lies, there were no plans for Covid Passports and that it was a Conspiracy Theory, now without even a vote they will be imposed. They are lying about the evidence base.” – @silkiecarlo pic.twitter.com/j9uuaZoteg

— 'Sikh For Truth'. (@SikhForTruth) September 27, 2021

“Prevent Unconstitutional Vaccine Mandates for Interstate Commerce Act.”

• Wisconsin Senator Sponsors Bill That Would Ban Vaccine Mandates (JTN)

Wisconsin Sen. Ron Johnson unveiled new legislation Wednesday that would block federal vaccine mandates by utilizing the Interstate Commerce Clause of the U.S. Constitution. Johnson was joined by some of his colleagues from the House and Senate who wish to co-sponsor the bill. In a statement, Johnson explained why he sponsored this bill, and what impacts it may have on the nation. “The Biden administration’s decision to mandate vaccines for working Americans is an outrageous trampling of civil liberties and a dangerous precedent for what a U.S. president can unilaterally impose on the American public,” Johnson said in a statement. “The American people deserve transparency and as much information as possible from the federal government so they may make an informed choice about their own health,” he continued. The bill is titled “Prevent Unconstitutional Vaccine Mandates for Interstate Commerce Act.”

“..held up in Abu Dhabi after arriving from Kabul with 117 people including 59 children.”

• Biden Admin Denies Entry To Chartered Rescue Flight From Afghanistan (ZH)

A nonprofit organized by a loose network of veterans and current service members to help evacuate vulnerable Americans and Afghans from Kabul is seeing a chartered flight with more than 100 Americans and green-card holders being denied entry to the US by the Department of Homeland Security, according to a Reuters report. Bryan Stern, a founder of non-profit group Project Dynamo, which organized the flight, told Reuters during a call from the plan that they are being held up in Abu Dhabi after arriving from Kabul with 117 people including 59 children. The flight includes a mix of American citizens, green card holders and SIV holders. “They will not allow a charter on an international flight into a U.S. port of entry,” Stern said of the Custom’s and Border Patrol, which is part of DHS.

Stern spoke to journalists from aboard the chartered plane, leased from Kam Air, a private Afghan airline. Stern said the group had been sitting for 14 hours already with no clear resolution in sight. Stern’s Project Dynamo is one of several groups working on organizing these types of flights, aimed at getting those who have been approved for entry into the US out of Afghanistan. It’s not clear why the Biden Administration would bar entry to the flights. A DHS official hasn’t commented on the situation to the press. An official who spoke off the record to Reuters said they weren’t familiar with the situation, but that the US sometimes takes time to review flight manifests before allowing chartered flights into the country. After all, Biden has repeatedly said that repatriating Americans and Afghans in danger is a top American priority.

We all know who should be prosecuted.

• Pompeo: Sources for Yahoo News WikiLeaks Report ‘Should All Be Prosecuted’ (Y!)

Former CIA Director and former Secretary of State Mike Pompeo on Wednesday called for the criminal prosecution of sources who spoke to Yahoo News for a story detailing proposals by the intelligence agency in 2017 to abduct WikiLeaks founder Julian Assange and discussions within the Trump administration and CIA to possibly even assassinate him. Pompeo, appearing on Megyn Kelly’s podcast, was asked to respond to the Yahoo News story, which was based on interviews with 30 former U.S. intelligence and national security officials with knowledge of the U.S. government’s efforts against WikiLeaks. “I can’t say much about this other than whoever those 30 people who allegedly spoke to one of these [Yahoo News] reporters — they should all be prosecuted for speaking about classified activity inside the Central Intelligence Agency,” Pompeo said.

At the same time, Pompeo declined to respond to many of the details in the Yahoo News account and confirmed that “pieces of it are true,” including the existence of an aggressive CIA campaign to target WikiLeaks in the aftermath of the organization’s publication of highly sensitive so-called Vault 7 documents revealing some of the CIA’s hacking tools and methods. “When bad guys steal those secrets we have a responsibility to go after them, to prevent [that] from happening,” Pompeo said. “We absolutely have a responsibility to respond. … We desperately wanted to hold accountable those individuals that had violated U.S. law, that had violated requirements to protect information and had tried to steal it. There is a deep legal framework to do that. And we took actions consistent with U.S. law to try to achieve that.”

Pompeo’s comments came as some human rights activists, civil liberties groups and supporters of Assange said the revelations by Yahoo News should be investigated and were grounds to drop the Justice Department’s efforts to extradite Assange from a British prison in order to face criminal charges in the U.S. for publishing classified government secrets in violation of the World War I-era Espionage Act as well for allegedly conspiring to hack into a classified U.S. government network. “We now know that this unprecedented criminal case was launched in part because of the genuinely dangerous plans that the CIA was considering,” said Ben Wizner, director of the American Civil Liberties Union’s Speech, Privacy and Technology Project. “This provides all the more reason for the Biden Justice Department to find a quiet way to end this case.”

“Pompeo [was] advocating things that are not likely to be legal..”

• Improper Pressure From CIA Led To Charges Agaist Assange (Gosztola)

CIA Director Mike Pompeo obsessed over Assange and WikiLeaks, and sought revenge after the publication of “Vault 7” materials, redefining the media organization as a “hostile entity.” (His successor, Gina Haspel, shared his zeal for retaliation.) Pompeo proposed kidnapping Assange in the summer of 2017. His obsession led several CIA officials to draw up plans for assassinating the publisher. “Some National Security Council officials” in President Donald Trump’s administration “worried that the CIA’s proposals to kidnap Assange would not only be illegal but also might jeopardize the prosecution of the WikiLeaks founder,” according to the report. “Concerned the CIA’s plans would derail a potential criminal case, the Justice Department expedited the drafting of charges against Assange to ensure that they were in place if he were brought to the United States.”

Discussions about putting Assange on a rendition flight alarmed senior administration officials, like John Eisenberg, who was the top lawyer for the National Security Council, and his deputy, Michael Ellis. “Pompeo [was] advocating things that are not likely to be legal,” including “rendition-type activity,” one former national security official told Yahoo! News reporters. The Justice Department had yet to indict Assange, “even under seal.” If the CIA kidnapped Assange from the Ecuador embassy, they would be doing so without any “legal basis to try him in the United States.” Meetings involving the CIA, where plans for kidnapping or killing Assange were raised, put pressure on prosecutors at the Justice Department.

“Eisenberg urged Justice Department officials to accelerate their drafting of charges against Assange, in case the CIA’s rendition plans moved forward, according to former officials. The White House told Attorney General Jeff Sessions that if prosecutors had grounds to indict Assange they should hurry up and do so, according to a former senior administration official.”

The Guardian continues to play its bizarro double role.

• Australia Reveals It Raised Case Of Julian Assange With US (G.)

Australia’s foreign minister, Marise Payne, raised the case of the WikiLeaks co-founder Julian Assange with the US secretary of state during her visit to Washington DC this month, the government has revealed. But Australian parliamentarians who support Assange say the government should demand his immediate release, after a US news report this week claimed CIA officials during the Trump administration had discussed abducting and even assassinating the Australian citizen. Assange remains in Belmarsh prison in London as the US government appeals against an earlier court ruling that blocked his extradition to face charges, including allegedly obtaining and publishing classified documents in violation of the US Espionage Act.

In response to questions, a spokesperson for the Department of Foreign Affairs and Trade told Guardian Australia: “Minister Payne has raised the situation of Mr Assange with her US and UK counterparts, most recently with US Secretary of State [Antony] Blinken on 15 September.” The spokesperson said the Australian government conveyed its “expectations that Mr Assange is entitled to due process, humane and fair treatment, access to proper medical and other care, and access to his legal team”. But it is unknown what assurances, if any, Payne secured from those conversations with American and British counterparts.

The case is back in the spotlight after Yahoo News published a detailed account of how the CIA had allegedly discussed kidnapping Assange in 2017, when the fugitive Australian activist was entering his fifth year sheltering in the Ecuadorian embassy. Those deliberations reportedly sparked heated debate among Trump administration officials over the legality and practicality of such an operation. Yahoo News reported that some senior officials inside the CIA and the Trump administration went as far as to request “sketches” or “options” for killing Assange. “There seemed to be no boundaries,” a former senior counterterrorist official was quoted as saying.

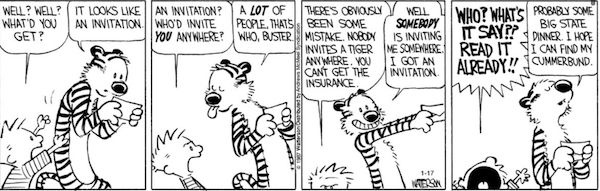

Nobody invites a tiger anywhere. You can’t get the isurance.

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.