NPC Balloon at Shriners convention, Washington DC 1923

Cash is the king of the world.

• Fears Of Financial Instability Keep Demand For Banknotes Strong (FT)

Money doesn’t grow on trees, but in the middle of a forest deep in the Bavarian countryside it comes pretty close. An hour’s drive south of Munich hidden by spruces is Louisenthal, the mill and printing presses that help produce banknotes for about 100 currency zones. Giesecke & Devrient, owner of Louisenthal, is one of a few companies competing to make the 160bn banknotes printed each year. While the world’s central banks usually hold monopoly licences on printing local currencies, up to 70bn banknotes are printed on material produced in the private sector. Although people are becoming comfortable with paying for goods and services electronically, banknote production is thriving. One reason for the enduring appeal of cold, hard cash is the global economic downturn.

Giesecke & Devrient expects banknote production to rise by 5% a year for the “foreseeable future”, despite projections of double digit increases in the use of cards and other forms of electronic payments. “Cash is 100% reliable in times of crisis. It’s in periods of panic where a solid financial system has to prove itself,” said Ralf Wintergerst, a Giesecke & Devrient board member. “In a crisis situation, the demand for cash typically rises sharply. The reason for this is trust in real currency.” The turmoil in Greece, which not only sparked speculation of a return to the drachma but also led to a surge in demand for cash, is a case in point. The number of banknotes in circulation in Greece was €45.2bn at the end of May: a level last seen in June 2012, the last time fears of a Grexit sparked a bank run.

In 2012, the ECB had to fly additional supplies of banknotes to Athens from around the region. The €45.2bn amounts to a little over €4,000 for every Greek. ECB data also show leaps in the demand for banknotes following the collapse of Lehman Brothers, the US investment bank, in 2008. Most of this increased demand was for higher denomination notes such as the €200 and €500 bills: a clear sign the leaps were down to hoarding by anxious savers. The enduring appeal of banknotes is not just down to the financial crisis. More than half of payments in stable, advanced economies such as Germany’s are still made in cash, while globally the figure is about 80%. Notes also need to be replaced frequently, with low value bills such as the €5 bill taken out of circulation as often as once every six months.

Full title: “Doomsday Clock For Global Market Crash Strikes One Minute To Midnight As Central Banks Lose Control”. Quite something for the Telegraph.

• Doomsday Clock For Global Markets Strikes One Minute To Midnight (Telegraph)

When the banking crisis crippled global markets seven years ago, central bankers stepped in as lenders of last resort. Profligate private-sector loans were moved on to the public-sector balance sheet and vast money-printing gave the global economy room to heal. Time is now rapidly running out. From China to Brazil, the central banks have lost control and at the same time the global economy is grinding to a halt. It is only a matter of time before stock markets collapse under the weight of their lofty expectations and record valuations. The FTSE 100 has now erased its gains for the year, but there are signs things could get a whole lot worse.

1 – China slowdown China was the great saviour of the world economy in 2008. The launching of an unprecedented stimulus package sparked an infrastructure investment boom. The voracious demand for commodities to fuel its construction boom dragged along oil- and resource-rich emerging markets. The Chinese economy has now hit a brick wall. Economic growth has dipped below 7pc for the first time in a quarter of a century, according to official data. That probably means the real economy is far weaker. The People’s Bank of China has pursued several measures to boost the flagging economy.

The rate of borrowing has been slashed during the past 12 months from 6pc to 4.85pc. Opting to devalue the currency was a last resort and signalled the great era of Chinese growth is rapidly approaching its endgame. Data for exports showed an 8.9pc slump in July from the same period a year before. Analysts expected exports to fall only 0.3pc, so this was a huge miss. The Chinese housing market is also in a perilous state. House prices have fallen sharply after decades of steady growth. For the millions who stored their wealth in property, it makes for unsettling times.

” Japan’s economy grew just 2% since Abe took office in December 2012, even as he deployed fiscal stimulus roughly equal to 3% of GDP.”

• Japan Economy Shrinks 1.6% In Q2 In Setback For ‘Abenomics’ (Reuters)

Japan’s economy shrank at an annualized pace of 1.6% in April-June as exports slumped and consumers cut back spending, adding pressure on Prime Minister Shinzo Abe to step up his policy drive to lift the economy out of decades of deflation. China’s economic slowdown and its impact on its Asian neighbors has also heightened the chance that any rebound in growth in July-September will be modest, analysts say. The gloomy data adds to signs that Japan’s economy is at a standstill and heightens pressure on policymakers to offer additional monetary or fiscal stimulus later this year. The contraction in GDP compared with a median market forecast of a 1.9% fall and followed a revised expansion of 4.5% in the first quarter, Cabinet Office data showed on Monday.

“If weak private consumption persists, that would be a further blow to Abe’s administration, which is facing falling support rates ahead of next year’s Upper House election,” said Hiromichi Shirakawa, chief Japan economist at Credit Suisse. “This could raise chances of additional fiscal stimulus.” Private consumption, which makes up roughly 60% of economic activity, fell 0.8% from the previous quarter, double the pace expected by analysts. It was the first decline since April-June 2014, when a sales tax hike hit consumption, as households spent less on air conditioners, clothing and personal computers. Overseas demand shaved 0.3 percentage point off growth as exports to Asia and the United States slumped.

The data looks likely to force the BOJ to cut its forecast of a 1.5% economic expansion for the current fiscal year when it reviews its long-term projections in October. But the weak consumption underscores a dilemma the central bank faces that may discourage it to expand stimulus. Economics Minister Akira Amari acknowledged that consumption may have been hit by rising food prices, as the BOJ’s easing weakened the yen and pushed up import costs. Aides close to Abe have signaled that additional monetary easing is unwelcome as further yen falls will push up food costs further and hurt consumption. That puts the onus of the government to underpin growth despite diminishing returns. Japan’s economy grew just 2% since Abe took office in December 2012, even as he deployed fiscal stimulus roughly equal to 3% of GDP.

Term of the day: “beach-towel Lebensraum”.

• Summer Crisis Tests Europe’s New Nationalisms (Alastair Macdonald)

High summer and life, for many in Europe, is a beach. This year again the Mediterranean is the stage for two seasonal dramas: the one, the annual vacations that give many their main chance to meet fellow Europeans from other countries; the other, the washing ashore of desperate refugees from wars and poverty in the Middle East and Africa, some already dead. The first is a chance for pleasure, discovery and to enjoy the peace and open borders that most cite as the main benefits of the European Union, 70 years after the end of World War Two – even if accompanied by national stereotype grumbles about beach-towel Lebensraum, noisy joie de vivre and importunate seaside Romeos.

The second has triggered a poisonous round of every-man-for-himself bickering among the EU’s 28 governments and the Union institutions in Brussels over how to deal with record numbers of migrants arriving by sea and land and heading across Europe. More even than that other Mediterranean summer theater that has been the Greek volte-face on German-prescribed austerity to stay in the euro zone, EU divisions on the migration crisis have brought on dire warnings that populist nationalism could propel Europe back toward its nightmarish divisions of last century. Amid confrontation with Russia in the east, and with Britain soon to vote on breaking away in the west, this summer sees a bout of soul-searching over whether the bloc can ever subsume national rivalries to a common good.

Can half a billion citizens ever feel “European” more than Austrian, Belgian or Croatian? “If this is your idea of Europe, you can keep it,” a furious Italian Prime Minister Matteo Renzi was quoted telling fellow EU leaders as traditionally Europhile Italy lost patience with a lack of help. Hungary, which tore the first rent in the Iron Curtain in the daring summer of 1989 before the Berlin Wall fell, is building a fence on its border with Serbia; Britain is adding fencing too, round its Channel Tunnel beachhead at Calais. Even founder members France and Italy have feuded on their frontier.

At the eye of the storm is Jean-Claude Juncker, president of the European Commission, the bloc’s Brussels executive. Claiming – despite scepticism from national capitals – a democratic mandate due to being the lead center-right candidate in last summer’s elections to the European Parliament, Juncker has become a vocal critic of governments for lacking solidarity. “Je m’en fous!” he snapped – “I don’t give a damn” – in singularly undiplomatic French during a June summit, as equally irritated leaders rejected his demand for mandatory quotas on member states to take in asylum seekers from Italy and Greece.

“These people are either perpetually renting their vehicles or just driving them until the repo man shows up.”

• US Department Store Results Imploding (Jim Quinn)

The government issued their monthly retail sales this past week and four of the biggest department store chains in the country announced their quarterly results. The year over year retail sales increase of 2.4% is pitifully low in an economy that is supposedly in its sixth year of economic growth with a reported unemployment rate of only 5.3%. If all of these jobs have been created, why aren’t retail sales booming? The year to date numbers are even worse than the year over year numbers. With consumer spending accounting for 70% of our GDP and real inflation running north of 5%, it’s pretty clear most Americans are experiencing a recession, despite the propaganda data circulated by the government and Fed.

The only people not experiencing a recession are corporate executives enriching themselves through stock buybacks, Wall Street bankers using free Fed Bucks while rigging the the markets in their favor, politicians and government bureaucrats reaping their bribes from billionaire oligarchs, and the media toadies who dispense the Deep State approved propaganda to keep the ignorant masses dazed, confused, and endlessly distracted by Cecil the Lion, Bruce/Caitlyn Jenner, Ferguson, and blood coming out of whatever. You won’t hear CNBC, Bloomberg, the Wall Street Journal or any corporate mainstream media outlet reference the fact retail sales growth is at the exact same levels as when recession hit in 2008 and 2001. Their job is to regurgitate the message of economic recovery and confidence in the future, despite overwhelming evidence to the contrary.

Retail sales are actually far worse than the 2.4% reported number. Excluding the subprime debt fueled auto sales, retail sales only grew by 1.3% in the last year. The automakers are practically giving vehicles away as their lots are stuffed with inventory. The length of auto loans and the average amount of auto loans are now at all-time highs. The percentage of subprime auto loans is surging to record levels, as defaults begin to rise. The percentage of vehicles being leased is also at an all-time high. To call these “auto sales” strains credibility. These people are either perpetually renting their vehicles or just driving them until the repo man shows up.

CHina’s main problem: leveraged investments made with a far too positive view of the future. Beijing has an ocean liner on its hands that needs to be turned on a dime.

• Problems For China’s Economy Extend Far Beyond Currency (FT)

The sudden fall in China’s currency last week spurred a lively debate about whether the move was a victory for market reform or a competitive devaluation designed to shore up flagging exports. But even those who believe the 3% drop was aimed at exporters acknowledge that a weaker renminbi by itself is radically insufficient to cope with the challenges facing China’s economy. “Currency depreciation to stimulate export growth is neither useful nor necessary,” said Qu Hongbin, HSBC chief China economist. He notes that while China’s exports have fallen this year, “exporters across Asia faced the same challenge, suggesting that the underlying problem is sluggish demand in developed markets”.

China’s economy officially grew at an annual rate of 7% during the first half of this year, neatly in line with the government’s full-year target. However, some doubt that figure — Capital Economics, for example, reckons it is 5-6% — and there are widespread suggestions that further stimulus will be needed to prevent a slowdown. Yet an export revival would boost growth only marginally. Contrary to received wisdom, China has not pursued so-called “export-led growth” for the past decade. Net exports subtracted 3% from annual growth in Chinese gross domestic product on average from 2004 to 2014. Meanwhile, investment contributed an average of 52% of growth each year.

The importance of investment explains why data released last week will keep Premier Li Keqiang awake at night. Fixed-asset investment grew at its slowest pace since 2000 in the first seven months of 2015, led by a collapse in property investment. Factory output in July was also barely above the four-year low touched in March. “China economic data for July may have lacked the lethal explosive force of last night’s detonation in the industrial city of Tianjin, but it laid bare the wider deterioration of domestic macroeconomic conditions,” Chen Long at Gavekal Dragonomics wrote last week.

Though property sales have begun to inch up following 13 consecutive months of decline, the market remains saddled with a huge overhang of unsold flats. That has caused developers to pull back on new construction, hitting demand for basic materials such as steel and cement. Faced with this slowdown, factories that produce these commodities are cutting back both on current output and investment in new capacity.

“By shattering a 10-year consensus held by everyone from deposit holders in Hong Kong to high-yield-bond investors in Europe, the unwind in capital flows could be of seismic proportions.”

• And Now For China’s Great Foreign-Capital Unwind (MarketWatch)

Among the many unknowns in China is just how much of its prodigious credit boom has been built on foreign capital. After last week’s high-stakes gamble to devalue the yuan, we may soon find out. So much investment and hot money had bought into Beijing’s flagship policy of a strong yuan pegged to the U.S. dollar — which has appreciated about 30% since 2005 — that this reversal moves into almost uncharted territory. By shattering a 10-year consensus held by everyone from deposit holders in Hong Kong to high-yield-bond investors in Europe, the unwind in capital flows could be of seismic proportions.

While some explain last week’s surprise yuan devaluation as little move than an overdue step toward a market-determined exchange rate, a more plausible interpretation is that the People’s Bank of China jettisoned its exchange rate policy as a last resort; a culmination of events after which the pain of attempting to hold its currency peg to the U.S. dollar finally became unbearable. This scenario would be supported by data released last Friday for July, showing the biggest monthly surge in money outflows since 1998 as foreign-exchange funds held at Chinese banks fell by 249.1 billion yuan ($39 billion). Meanwhile, another sign of stress is that short-term borrowing costs in the interbank markets in China and Hong Kong spiked last week, suggesting again that investors were pulling out of the yuan.

The overnight Shanghai interbank offered rate (or Shibor) leapt 1,380 basis points to 1.667% over the past week, reaching a near 4-month high, and the one-month Shibor jumped to 2.495%, a one-week high. For some time Beijing has been under pressure to hold together the “impossible trinity” of a closed capital account, independent monetary policy and a tightly managed exchange rate. Capital outflows ratchet up the pain as the central bank has to buy yuan to support the peg and withdraw liquidity from the economy. This was difficult enough when authorities have been attempting to provide sufficient liquidity to put a floor under a foundering economy.

But then the stock market rout heaped further pressure on the PBOC as it was given ultimate responsibility, through a massive state-buying scheme, to also keep shares from falling. If this wasn’t enough, the central bank had just pushed the problem of near-bankrupt municipal authorities out of its in-tray. Weeks earlier the central government had strong-armed state banks into buying 2 trillion yuan’s worth of debt swap bonds designed to refinance broke municipal authorities. It is hardly a stretch to state that with the central government lining up to be on the hook for municipal authority debt and stock-market losses, this deteriorating picture would persuade some investors to get out of yuan.

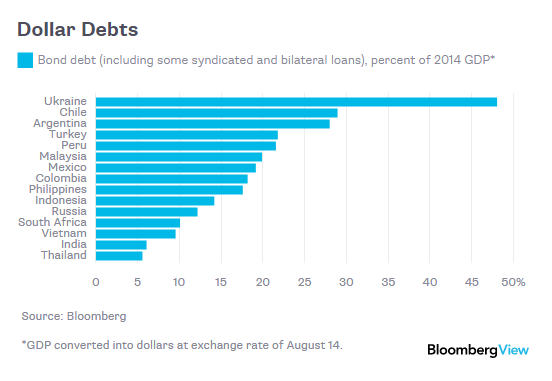

Dollar-denominated debt takes center stage.

• China Devaluation Makes Debt Burden Heavier for Others (Bloomberg)

China’s surprise move to weaken the yuan will have repercussions far beyond last week’s market turmoil. For one: Governments and companies in emerging markets will have a harder time paying the dollar-denominated debt they have amassed. The yuan’s depreciation – by almost 3% against the U.S. dollar – triggered instability and exchange-rate declines across emerging markets. As of Friday evening in Asia, the Malaysian ringgit was down 3.8% from a week earlier. The Turkish lira, Mexican peso and Russian ruble also fell sharply. The depreciations might help the countries’ exports remain competitive. But they also expose a vulnerability: Over the past several years, borrowers in emerging markets have built up more than $2 trillion in dollar-denominated debt.

When the U.S. currency was cheap and the Federal Reserve was holding interest rates close to zero, that debt seemed like a great deal. Now, with the dollar getting stronger and the Fed set to start raising rates, it’s becoming more of a burden. If investors decide the debts aren’t sustainable, they could pull out en masse, starting a dangerous spiral of declining exchange rates and financial stress that could render otherwise viable companies and governments insolvent. One can only hope that regulators are trying to understand where the resulting losses would be concentrated, and how to mitigate the potential fallout.

“They’re happy to let markets go in the direction they want, namely up..” “There’s fear in the government, which is most fearful of the people..”

• Volatility Reveals Beijing’s Market Anxiety (WSJ)

Turmoil in China’s currency and stocks has highlighted the anxiety the Communist Party feels over the power and dynamism that markets represent. Even as market-opening policies have allowed hundreds of millions of Chinese to break out of poverty to build the world’s second-largest economy, the party’s ambivalence can be seen across the economic landscape. The leadership keeps fences around the currency, restricts capital flows and operates a central bank that lacks independence. Many Chinese economic planners have a solid understanding of markets. Still, there remains a “deep-seated narrative of the evils of capitalism, even though they embrace huge parts of it,” said Kerry Brown, director of the University of Sydney’s China Studies Center.

The tug of war has left China dragging its heels on financial overhauls necessary to continue improving living standards at a pace Chinese people have become used to. “The government knows it has to implement a more efficient system because it no longer has double-digit growth that can buy people’s loyalty,” said Mr. Brown. “It’s an epic clash of systems.” The stock market is a basic building block of any financial system, including China’s, but no Chinese president has publicly embraced share ownership. “Where does the stock market’s money come from?” asked Jiang Zemin a month before the Shanghai exchange’s 1990 opening, according to an account in a biography of the former president by American banker Robert Lawrence Kuhn.

President Xi Jinping pledged to let markets take a “decisive role” in the economy, and when stocks rose it was called his bull market in state media. But as the Shanghai Composite started falling sharply in mid-June, regulators under him quickly halted initial public offerings, leaned on state institutions to buy shares and blocked large shareholders from selling. On Friday, China’s stock regulator said government entities would hold shares for years as needed to stabilize the market. “They’re happy to let markets go in the direction they want, namely up,” said Alexander Wolf, economist with Standard Life Investments. “It’s like a car they don’t allow to go in reverse.”

One likely reason for China’s early intervention in the stock market is Beijing’s extreme sensitivity to social unrest in a system where discontent is often repressed. “There’s fear in the government, which is most fearful of the people,” said the University of Sydney’s Mr. Brown.

Guess that would still be a surprise to some?!

• China’s Woes Echo in US Earnings (WSJ)

With the U.S. recession behind them and the European fiscal crisis fading, American companies are grappling with a new threat: China’s economic blues. In quarterly conference calls, U.S. executives recited a litany of pain, from mild to severe, resulting from a slowdown in China’s economy, the world’s second-largest. Engine-maker Cummins, for example, said demand for excavators in China fell 34% in the second quarter from a year ago with no signs of improvement. For such companies as Weyerhaeuser, less construction in China means logs and lumber pile up in the U.S., pushing down prices. “China was weak in the quarter, and we expect it to be weak as we move forward,” Robyn Denholm, CFO of Juniper Networks, told investors.

China pulled down the networking-gear maker’s Asia-Pacific revenues by 3% from the prior quarter; without China, they would have risen 11%. China’s policy makers are stimulating the economy to counter slackening consumer demand and falling factory output. Authorities have intervened in financial markets by devaluing the currency, a move that would help Chinese exporters while pinching some U.S. companies by making their products more expensive for Chinese buyers. Chinese officials are trying to keep the economy growing at 7% in 2015, the country’s slowest pace in more than two decades. It comes at a tough time for U.S. businesses. Overall, companies in the S&P 500 index are on track to eke out a 1.2% increase in second-quarter earnings, according to data from Thomson Reuters.

That is the slowest growth since fall 2012. The modest earnings growth was recorded on a 3.5% decline in revenues—the biggest drop in nearly six years—suggesting that much of the profit gain is from cost-cutting, buybacks or other maneuvers, rather than increased sales. Excluding the hard-hit energy sector, big-company profits fared better in the June quarter. Earnings are poised to rise 8.7%, though revenue growth has remained tepid at just under 1.5%, its lowest level since fall 2009, according to Thomson Reuters. China remains a relatively small part of operations at most big U.S. companies: Just 16 companies in the S&P 500 index say they collected 10% or more of their sales there, with most of those in the technology sector, according to data from Wells Fargo Securities.

“.. it helps to have scapegoat social groups whose desperate state is an example of what can happen if you do not pay your debts and work for whatever pittance you are offered..”

• Austerity – Elite Terrorism Against Ordinary People (Brian Davey)

So let’s start by reframing the debate about austerity. When Yanis Varoufakis describes what has happened to Greece as “Fiscal Waterboarding” he is part way in the direction that I mean. His description of austerity as a form of terrorism is also right. The purpose of austerity is to create insecurity and instill fear in the general population in order to protect the finance and banking sector from popular rage against the crimes the participants of this sector have committed against ordinary people. This rage ought to have given rise a long time ago to legal actions and desperately needed fundamental reforms to take away from bankers the right to create money, a right which they have abused at tremendous cost to ordinary people.

Instead of a rage focused on collective reforms what we are being subjected to is a policy of deliberately spreading insecurity together with the scapegoating of vulnerable people. Attention and emotion is directed away from the financiers and their political representatives onto easier targets who cannot fight back and who had no part in creating our difficulties. Peoples’ anger and discontent is channelled towards people weaker than themselves which also serves to exacerbate the sense of fear by making the prospect of “social descent” into the vulnerable groups – even more of a frightening prospect. The people who run the mass media and the PR industry have been only too willing to help.

So what, exactly is this fear that is being instilled in people? I am writing here of the sort of ruin in which because one does not have money to pay the rent, one can be evicted from where one lives and through that lose the ability to maintain relationships. Where one can fail in one’s responsibilities to dependents and from this point on fall in a downwards spiral, lose one’s job, lose everything else and that includes one’s emotional and mental equilibrium. Elite terrorism does not operate by setting off bombs but by creating fear of being pushed beyond one’s coping capacities into life management breakdowns.

For that fear to be generalised it helps to have scapegoat social groups – “swarms” as David Cameron calls them – whose desperate state is an example of what can happen if you do not pay your debts and work for whatever pittance you are offered. The mentality of the elite can be observed from comments like those of the economist Hayek. Unemployment was necessary, he wrote, as an alternative to corporal punishment for disciplining the labour force. In the absence of a “reservoir” of unemployed, he wrote “discipline cannot be maintained without corporal punishment, as with slave labour”.

I have yet to read it, but here it is for your scrutiny.

• Greece’s Third MoU (Memorandum of Understanding) Annotated (Yanis Varoufakis)

The Third Greek MoU is now enshrined in Greek Law. Written in troika-speak it is almost impossible to decypher by those not speaking this unappetising language. Click the link for the complete MoU text annotated liberally by yours truly – in pdf form. It is best read in conjunction with my annotated version of the EuroSummit Agreement of 12th July.

Great little 10 minute interview.

• Varoufakis And Lamont Interviewed On Their Peculiar Political Friendship (YV)

Further to this piece on my unlikely friendship with Lord Lamont, the BBC’s Radio 4 interviewed us, together. To hear the interview, on World At One, click on the play button below.

Wait till these start wobbling.

• Still Vulnerable: The Euro Area’s Small And Medium-Sized Banks (Mody, Wolff)

The ECB’s 26 October 2014 publication of the results of a comprehensive assessment of 130 banks under its oversight (ECB, 2014) identified problems in terms of non-performing assets and capital shortfalls. Nevertheless, the outcome brought a sense of relief to financial markets. Unlike stress tests conducted in July and December 2011 by the European Banking Authority, the ECB’s assessment was considered broadly credible.The assessment showed that the largest banks appear to be out of the woods. However, in our recent research we show that the small and medium-sized banks (SMBs) – and among them the unlisted banks – remain under considerable stress.

The ECB data covers 130 banks in 19 countries, which can be divided into three size categories: small (assets below €100bn), medium (assets between €100bn and €500 billion) and large (assets more than €500 billion). Of the €22 trillion in assets in total, the ‘small’ group has 84 banks with €3.1 trillion, the ‘medium’ group has 33 banks with €6.3 trillion, and the ‘large’ group has only 13 banks with aggregate assets of €12.5 trillion. Thus, ‘small’ banks have about 14% and ‘medium’ banks have 29% of total bank assets in the euro area.SMBs thus control a sizeable share of the euro area’s bank assets. They have also received substantial bail-outs. During recent periods of market pressure, SMBs have become closely interconnected in the market’s perception, thereby posing a broader systemic risk.

Though there is no cause to believe that the vulnerabilities of SMBs will lead to widespread banking distress, their weakness could delay the recovery.To measure the vulnerability of individual banks, we conducted a simple ‘stress test’ which asks the following question: if 65% of a bank’s non-performing loans have to be written off, then after accounting for provisions, what would the bank’s equity/assets ratio be? Contrary to the ECB, we look at non risk-weighted equity. If the ratio falls below 3%, we consider the bank to be ‘under stress’. This, we acknowledge, is very crude. It is intended only to assess where the current trouble spots are without claiming to detect all problems.

Limbo land.

• This Latest Greek Deal Is Nothing to Celebrate (Bloomberg ed.)

At the end of last week, amid much smiling and hand-shaking, European finance ministers said they were ready to give Greece a new bailout of 86 billion euros. It’s the third time in five years they’ve declared victory in the battle to revive the Greek economy. This latest triumph shows every sign of being as durable as those previous failures. The first challenge is to get the deal, regardless of its merits, up and running. Germany’s parliament is due to vote on it this week, and rebellion is stirring in Chancellor Angela Merkel’s party. The bailout is thought likely to pass despite the protests, thanks to support from other parties in the Bundestag – but skepticism in Germany and some other euro-area countries runs deep.

That’s a problem because it suggests low or zero tolerance of any departure by Greece from the program it has agreed to – an extraordinarily demanding series of tax increases, spending cuts and structural reforms. The scope of the plan all but guarantees some backsliding. Greece is resentful and agreed to the terms only under extreme duress. Prime Minister Alexis Tsipras’s ruling Syriza party is deeply split on the issue, and fresh elections may soon be necessary. Supposing that these difficulties can be overcome, and the program is followed conscientiously, will it work? That depends on what “work” means. The program assumes that output will contract even further both this year and next. Recovery after that, according to the IMF and most observers, will depend on new debt relief.

Speaking after last week’s meetings, IMF Managing Director Christine Lagarde said: “I remain firmly of the view that Greece’s debt has become unsustainable and that Greece cannot restore debt sustainability solely through actions on its own.” This complicates things even more. The IMF is rightly embarrassed by its participation in the two previous bungled bailouts, and has warned that it won’t join the third unless debt relief “well beyond what has been considered so far” is part of the plan. Germany and its supporters, on the other hand, have opposed new debt reduction throughout – while insisting that IMF participation in the new bailout is vital.

Merkel this weekend said lower interest rates and new maturity extensions – though not, presumably, outright write-downs – were possible, and she was confident the IMF would sign up. German Finance Minister Wolfgang Schaeuble, who has spent most of this year insisting on steely-eyed clarity about Greece’s obligations, says he is “assuming” the fund will get on board. If this is clarity, one shudders to think what confusion would look like.

PASOK is irrelevant.

• Greek Opposition Party Refuses To Back Tsipras In Any Confidence Vote (Reuters)

Greece’s socialist PASOK party joined the main opposition on Sunday in saying it would not back Prime Minister Alexis Tsipras if he calls a confidence vote following a rebellion in the governing party over a new bailout deal. Tsipras had to rely on opposition groups including PASOK to win a parliamentary majority on Friday in favour of the bailout programme, Greece’s third with international creditors since 2010. By contrast, Tsipras suffered the biggest rebellion yet among anti-bailout lawmakers from his leftist Syriza party, forcing him to consider a confidence vote that would pave the way for early elections if he loses. PASOK made clear that while it had backed the government over bailout for the sake of saving Greece from financial ruin, that support would not extend to any confidence vote in the coming weeks.

The party blamed Tsipras and Panos Kammenos, who leads the minority partner in the coalition government, for the fact that Greece had to take yet another bailout with tough austerity and reform conditions demanded by the euro zone and IMF. “The government has signed the third and most onerous bailout. All the negative consequences for the country and its citizens bear the signatures of Mr Tsipras and Mr Kammenos,” the party said in a statement. “We have no confidence in the Tsipras-Kammenos government and of course will not give it if we are asked.” PASOK, once the dominant force on the Greek left, now has just 13 members in the 300 seat parliament but Tsipras may need all the support he can get. Crucially, it did not say whether it would vote against the government, or merely abstain.

On Friday, support for the government from within its own coalition parties fell below 120 votes, the minimum needed to survive a confidence vote if some others abstain. The main conservative opposition party, New Democracy, has also said it would not back the government, which won power in January on promises to reverse austerity policies. Tsipras was forced to back down to secure the new deal. Opinion polls show Tsipras remains popular, even though he presided over the closure of banks for three weeks, the imposition of capital controls and a near brush with financial collapse. This has raised doubts about how much the opposition parties may want to force new elections.

Someone’s going to torpedo the deal.

• Merkel Fights To Contain Greece Rebellion (FT)

Chancellor Angela Merkel is fighting to contain the largest revolt from her party this week when the German parliament votes on a new, €86bn rescue plan for Greece. Ms Merkel has rescheduled trips to Italy and Brazil to maximise her time in Berlin and party managers have been mobilised to dissuade potential rebels from voting against the bailout in the Bundestag on Wednesday. She took to national television on Sunday evening to rally support for the bailout deal, saying Greek prime minister Alexis Tsipras had changed his approach after a “real confrontation” with creditors. Greece’s third international bailout, which was approved by eurozone finance ministers on Friday night, faces a stormy ride through some of the bloc’s parliaments this week as doubts over its viability continue to surface.

The deal is certain to get German legislative approval thanks to support from the Social Democrats, but a big rebellion by Christian Democrats and their Bavarian sister party, the CSU, would represent the biggest challenge to Ms Merkel since she took power a decade ago and could dent her reputation for political invulnerability. It could also raise concerns that if the three-year Greece rescue runs into difficulties over implementation in Athens or debt relief, opposition to handing over loan instalments could grow in Berlin and among an increasingly sceptical German population.

Parliamentary approval in Germany and a few other eurozone states, including the Netherlands and Estonia, is the final political hurdle for the rescue deal, following months of difficult negotiations in which Greece came close to default, financial meltdown and exit from the single currency. Crucially for conservative MPs, finance minister Wolfgang Schäuble on Friday backed the deal, despite considerable misgivings about the radical left Greek government s willingness to deliver the promised reforms. He told Bild-am-Sonntag newspaper on Sunday that Greece would have to implement reforms to the letter of the agreement. “We shall pay attention. Any further aid will be dependent on it”, he said.

Mr Schäuble was unable to secure a guarantee that the IMF will join the new rescue plan in the autumn, which could add to sceptical lawmakers concerns. The fund may not decide until October whether to take part and has indicated it will only do so if the eurozone grants debt relief to Athens. Adding to Berlin’s discomfit, Christine Lagarde, IMF chief, on Friday said the eurozone needed to make “concrete commitments” … to provide significant debt relief, well beyond what has been considered so far .

�

And now Angela starts to gamble. Great timing.

• Angela Merkel Expects IMF Involvement In Greek Debt Deal (Guardian)

Angela Merkel has said that she expects the IMF to take part in a new €86bn bailout for Greece, as the German chancellor prepares to face Bundestag opposition to the package in a vote on Wednesday. In an attempt to reassure sceptical MPs, Merkel said the head of the IMF, Christine Lagarde, would ensure the fund’s participation if conditions on Greek pension reform and debt relief were met. “Mrs Lagarde, the chief of the IMF, made very clear that if these conditions are met, then she will recommend to the IMF board that the IMF takes part in the programme from October,” Merkel told the broadcaster ZDF. “I have no doubts that what Mrs Lagarde said will become reality.”

Representatives from Merkel’s Christian Democratic Union and its Bavarian sister party, the Christian Social Union, want the IMF involved because of its reputation for rigour. Lagarde, who has been pressing eurozone countries to provide Athens with “significant” debt relief, reiterated at the weekend that Greece’s European creditors must make “concrete commitments” on relieving the debt burden. She has said the IMF will wait until October to decide whether to participate. That would force lawmakers to vote without any guarantees that the Washington-based institution would have a role. In a nod to IMF calls for debt relief, Merkel said there was room to ease the burden on Greece by extending the maturities on its debt and reducing interest rates.

Greece’s three European creditors – the EC, ECB and the ESM bailout fund – also admitted last week that they had “serious concerns” about the level of Greek debt. Meanwhile, Merkel’s finance minister, Wolfgang Schäuble, told the Bild am Sonntag newspaper that the deal reached last week was “responsible” and ensured that Athens had to execute tough reforms in return for aid. “After truly arduous negotiations, they understand now in Greece that the country cannot get around real and far-reaching reforms,” he said, referring to changes that include an overhaul of the Greek VAT regime and the state pension system.

The cynicism of making such statements AFTER so many have already drowned is suffocating. Merkel should act, not talk. As Europe’s de facto leader, there’s blood on her hands. Lots of blood.

• Merkel Says Migrants Bigger Challenge For EU Than Debt Crisis (AFP)

Chancellor Angela Merkel today condemned a surge in German attacks on refugee shelters and warned that the issue of asylum could become a bigger challenge for the European Union than the Greek debt crisis. Asked about more than 200 arson attacks against homes for asylum-seekers seen in Germany this year as the country faces a record influx of refugees, Merkel said: “That is unworthy of our country.” Merkel warned that waves of refugees would “preoccupy Europe much, much more than the issue of Greece and the stability of the euro”. “The issue of asylum could be the next major European project, in which we show whether we are really able to take joint action,” she told ZDF public television.

For Germany, where some officials have said the number of asylum-seekers could top 600,000 this year, Merkel said the issue posed particular challenges. With thousands of refugees sleeping in tents and authorities saying they are overwhelmed with applications, Merkel said the current situation was “absolutely unsatisfactory”. She called for the European Union to establish a list of safe countries of origin, where citizens are not under threat of violence or persecution. Last week Germany’s interior minister said it was “unacceptable” that 40 percent of asylum-seekers in his country were from the Balkans, calling it “an embarrassment for Europe”.

About half of Germany’s 300,000 asylum applications since January have come from the southeast European region that includes Albania, Bosnia, Bulgaria, Croatia, Kosovo, Macedonia, Montenegro and Serbia. Berlin is looking at ways to deter such claims in order to better serve people from crisis zones such as Syria, Iraq and Afghanistan. The UN refugee agency has said the number of people driven from their homes by conflict and crisis has topped 50 million for the first time since World War II, with Syrians hardest hit.

What better way to illustrate Cameron’s, and British, hypocrisy?

• The Exploitation Of Migrants Has Become Our Way Of Life (Felicity Lawrence)

When the foreign secretary, Philip Hammond, talked of the threat to the UK from “marauding migrants” at Calais last week, I decided to review the stories of the hundreds of foreign-born workers I have met in more than a decade of writing about their lives in the UK: those working for the mainstream economy, albeit hidden in the shadows of its long subcontracted supply chains, whether in food production, construction, care work, cleaning or catering. What becomes immediately clear is the deep dishonesty at the heart of much of the rhetoric on this issue. The right claims to be tough on immigration, but it is the opposite of tough on the causes of immigration. It promotes a business model that depends on a constant churn of workers to carry out jobs that are underpaid and insecure at best, and all too often dirty, dangerous, and degrading.

It requires not just immigration, but immigration without end, since only the newly arrived, the desperate and the vulnerable will tolerate the conditions that have been created, as the roll call of migrant workers I have met, with its constantly changing nationalities, shows. [..] The zero-hours agency habits pioneered in the food and agriculture sector have spread across the economy. In the south-east, Ukrainian and Chinese workers are the predominant nationality on the domestic building sites I have seen, providing cheap hard labour to dig out new underground floors for affluent renovations by hand. We have created jobs that are inhuman, and incompatible with any normal settled existence.

Instead of regulating these sectors properly, taxpayers’ money has been used to augment inadequate pay in the form of tax credits to low-paid UK and EU workers – introduced by Labour – subsidising profitable businesses with corporate welfare. The Conservatives have trumpeted their intention to move from tax credits to a living wage. But enforcement of the national minimum wage, never mind a living wage, has been feeble and inadequate under successive administrations, including theirs. The government’s migration advisory committee calculated in 2014 that that a business might statistically expect a visit from one of just 142 national minimum wage inspectors once every 250 years. The government has increased the team this year to 230, hardly enough to make employers quake.

A sustained assault on union rights has seen the steep decline of recognition and collective bargaining that might take on the asymmetries of power in the work place. The Conservatives have announced yet more anti-union legislation. Equally dishonest is the myth that migration can be controlled, if only we had sharper razor wire, or more border dogs, or more deportations of illegal immigrants. As the Ministry of Defence’s strategic trends programme makes clear, today’s large-scale migrations are a historic force, just as those from rural areas to emerging cities were in the industrial revolution.

The Greeks have a lot more decency than most Europeans. Why there are not entire teams of German, Dutch, British volunteers helping out on the Greek islands is beyond me. Instead, they go to lie on the beaches.

• Volunteers Fill Aid Void In Greece’s Migrant Crisis (Reuters)

Father Efstratios Dimou knows all about physical suffering and his family has also known what it is to be a refugee. Now the Orthodox priest leads a small army of volunteers on the island of Lesbos tackling Greece’s crisis within a crisis. Despite suffering from lung cancer, Dimou – along with fellow volunteers from near and far – has toured the island offering people help that the Greek state, mired in a five-year debt crisis, can scarcely afford to provide any more. Once Dimou’s group Aggalia – Greek for “Embrace” – fed only the local poor, victims of the long economic depression. But now Greece is struggling with what Prime Minister Alexis Tsipras has called a “humanitarian crisis within the economic crisis”.

He has acknowledged his cash-strapped government cannot cope with boatloads of migrants fleeing war and poverty who are crossing to the Greek islands from neighboring Turkey. So once again Aggalia is trying to fill the gap created by strained government resources. “State services are virtually non-existent so volunteers are stepping in. We are doing as much as we can, but there are so many arrivals,” said Dimou, known as “Papa Stratis”, who is permanently hooked up to an oxygen tank because of his chronic respiratory condition. Greece has become the biggest European gateway for migrants from the Middle East, Asia and Africa seeking a safer and better life. Numbers exceeded 135,000 this year at the last count, more even than those making the perilous crossing of the Mediterranean to Italy.

On Lesbos, local people often sympathize with the migrants’ plight because among the population of about 75,000 are many descendents of refugees from Turkey. Dimou, 57, himself is the third generation of a family that arrived as refugees. In the 1920s huge numbers of ethnic Greeks were forced out of Turkey, many settling on Greek islands such as Lesbos which lies in sight of the Turkish coast. Under this “population exchange”, hundreds of thousands of Muslims living in Greece were forced to move in the opposite direction. Dimou has long set off from his home town of Kalloni, touring the island in a sturdy old car he affectionately calls “Tarzan”, helping where he can. “We fed 100 people today,” he told Reuters. “We offer them love, a plate of food and hope.”

“We are in the process of killing off our only known companions in the universe, many of them beautiful and all of them intricate and interesting.”

• How Humans Cause Mass Extinctions (Paul and Anne Ehrlich)

There is no doubt that Earth is undergoing the sixth mass extinction in its history – the first since the cataclysm that wiped out the dinosaurs some 65 million years ago. According to one recent study, species are going extinct between ten and several thousand times faster than they did during stable periods in the planet’s history, and populations within species are vanishing hundreds or thousands of times faster than that. By one estimate, Earth has lost half of its wildlife during the past 40 years. There is also no doubt about the cause: We are it. We are in the process of killing off our only known companions in the universe, many of them beautiful and all of them intricate and interesting. This is a tragedy, even for those who may not care about the loss of wildlife.

The species that are so rapidly disappearing provide human beings with indispensable ecosystem services: regulating the climate, maintaining soil fertility, pollinating crops and defending them from pests, filtering fresh water, and supplying food. The cause of this great acceleration in the loss of the planet’s biodiversity is clear: rapidly expanding human activity, driven by worsening overpopulation and increasing per capita consumption. We are destroying habitats to make way for farms, pastures, roads, and cities. Our pollution is disrupting the climate and poisoning the land, water, and air. We are transporting invasive organisms around the globe and overharvesting commercially or nutritionally valuable plants and animals. The more people there are, the more of Earth’s productive resources must be mobilized to support them.

More people means more wild land must be put under the plow or converted to urban infrastructure to support sprawling cities like Manila, Chengdu, New Delhi, and San Jose. More people means greater demand for fossil fuels, which means more greenhouse gases flowing into the atmosphere, perhaps the single greatest extinction threat of all. Meanwhile, more of Canada needs to be destroyed to extract low-grade petroleum from oil sands and more of the United States needs to be fracked. More people also means the production of more computers and more mobile phones, along with more mining operations for the rare earths needed to make them. It means more pesticides, detergents, antibiotics, glues, lubricants, preservatives, and plastics, many of which contain compounds that mimic mammalian hormones.

Indeed, it means more microscopic plastic particles in the biosphere – particles that may be toxic or accumulate toxins on their surfaces. As a result, all living things – us included – have been plunged into a sickening poisonous stew, with organisms that are unable to adapt pushed further toward extinction. With each new person, the problem gets worse. Since human beings are intelligent, they tend to use the most accessible resources first. They settle the richest, most productive land, drink the nearest, cleanest water, and tap the easiest-to-reach energy sources.

Home › Forums › Debt Rattle August 17 2015