Dorothea Lange American River camp, Sacramento, CA. Destitute family. 1936

“..“We don’t anticipate it will be necessary to reduce rates further,” he said. The throw-away comment was instantly taken to mean that -0.4pc is the absolute floor that will be permitted by Germany.”

• ECB’s Draghi Plays His Last Card To Stave Off Deflation (AEP)

The ECB has pulled out all the stops to avert a dangerous deflation-trap, launching a blast of triple stimulus despite angry criticism from Germany that it is entirely unnecessary and will do more harm than good. The markets reacted wildly to the package of measures, surging at first and then plummeting on creeping fears that the bank has exhausted its policy options and may be defenceless against a fresh shock. Mario Draghi no longer seems able to conjure confidence with his former panache. His magic has, for now, deserted him. The ECB cut the deposit rate by 10 basis points to a historic low of -0.4pc and stepped up the pace of QE from €60bn to €80bn a month. It buttressed the effect with unlimited 4-year loans to banks at near-zero cost, hoping this will limit the damaging side-effects of negative rates for banks.

“We have shown we are not short on ammunition,” insisted Mr Draghi, who was badly burned in December after seeming to over-promise and then falling short. “Mario Draghi has returned to the fray firing a blunderbuss,” said Simon Ward from Henderson Global Investors. Mr Draghi pledged to flood the financial system with fresh liquidity for as long as it takes to keep the fragile economic recovery alive and prevent a deflationary psychology taking hold, yet there was a sting in the tail. “We don’t anticipate it will be necessary to reduce rates further,” he said. The throw-away comment was instantly taken to mean that -0.4pc is the absolute floor that will be permitted by Germany. Marc Ostwald, from Monument Securities, said the ECB has bet everything on one last throw of the dice. “It’s a kitchen sink job, but at the same time Draghi is saying there is a limit to what they can do, that this is it, and there will nothing more,” he said.

The euro surged by more than two cents to $1.12 against the dollar, making it even harder for the ECB to stave off deflation. “It is not what they were hoping for,” said Simon Derrick from BNY Mellon. “What’s clear is that people are very uncomfortable with negative rates, and markets have become hypersensitive to any shift in monetary expectations,” he said. Hans Redeker, currency chief at Morgan Stanley, said foreign exchange traders had latched onto a subtle shift in ECB policy. It is moving away from efforts to force down the yield curve on sovereign debt, switching instead to a drive for lower corporate credit spreads. This is likely to draw money into eurozone assets. Negative interest rates are widely seen as a tool to force down the exchange rate, a form of “currency war” that will no longer be tolerated by the US after the G20 meeting in Shanghai. The ECB’s shift to other tools is a sign that it is backing away from this game. “We’re not in that war at all,” said Mr Draghi. [..]

Professor Richard Werner from Southampton University, the man who invented the term QE, said the ECB’s policies are likely to destroy half of Germany’s 1,500 savings and cooperative banks over the next five years. They cannot pass on the negative rates to savers so their own margins are suffering. “They are under enormous pressure from regulatory burdens already, and now they are reaching a tipping point,” he said. These banks make up 70pc of German deposits and provide 90pc of loans to small and medium firms, the Mittelstand companies that form the backbone of German industry. Prof Werner said these lenders are being punished in favour of banks that make their money from asset bubbles and speculation. “We have learned nothing from the financial crisis. The sooner there is a revolt in Germany, the better,” he said.

How can you fight deflation when you don’t know what it is?

• Draghi Can Cut Borrowing Costs, But He Can’t Make Companies Borrow (BBG)

Mario Draghi’s plans to buy corporate bonds will cut financing costs for European companies, if history is any guide. Getting the firms to actually borrow and spend money will be harder. Corporations already have hefty incentives to sell debt, with average yields on investment-grade bonds in the region below 2 percent for a second year. But they have little appetite to raise money to invest in new factories and equipment, because the economic outlook is so weak. “If you don’t need the funds then why should you raise them?” said Ivo Kok, the treasurer of Alliander NV, an investment-grade Dutch gas and electricity distribution company. “It is more of a risk to have an awful lot of cash around that you’re not putting to work.”

The ECB said on Thursday that it will start buying investment-grade corporate bonds sometime toward the end of the second quarter, as part of a broader bond purchase program. To help stave off deflation and stimulate growth, it plans to buy €80 billion of debt a month, also including eurozone government bonds, asset-backed securities, and covered notes. The central bank is also taking steps to provide cheap funding to banks through a program known as “targeted longer-term refinancing operations.” That financing, which essentially pays banks to borrow, is meant to encourage more lending. The ECB’s efforts are already looking like they may cut companies’ borrowing costs. A measure of investment-grade corporate credit risk, the Markit iTraxx Europe Index, dropped to its lowest point in two months.

Banks are seen benefiting too – notes issued by Italian lenders Intesa Sanpaolo and UniCredit, the biggest users of the TLTRO facility, were among the gainers. But even before the ECB’s moves, companies had access to cheap credit, said Gary Herbert at Brandywine Global Investment Management. “Is there a need to lever up a balance sheet to grow a business when underlying customers aren’t demanding more of what you make?” Herbert said.

“Japan has a number of unusual traits that make it a very good proving ground for macro models, including a shrinking population, inefficient labor markets, an economy out of sync with the rest of the world and a government willing to engage in dramatic economic experiments.”

• Japan, An Economics Lab Where Theories Go to Die (BBG)

The main thing you have to understand about macroeconomic theory – both of the type used by academics and the type employed by private-sector forecasters – is that it doesn’t really work. Events are constantly taking macro people by surprise, counterexamples to pet theories are a dime a dozen, and the rare theory that can be tested against available data is usually rejected outright. In macroeconomics, your choice of model is usually between “awful” and “very slightly less awful.”

Most macroeconomic theories can be easily tested: all we have to do is take a look at Japan. Japan has a number of unusual traits that make it a very good proving ground for macro models, including a shrinking population, inefficient labor markets, an economy out of sync with the rest of the world and a government willing to engage in dramatic economic experiments. Once we start examining theories used to explain the U.S. economy, and apply them to Japan, we find that these theories usually fail.

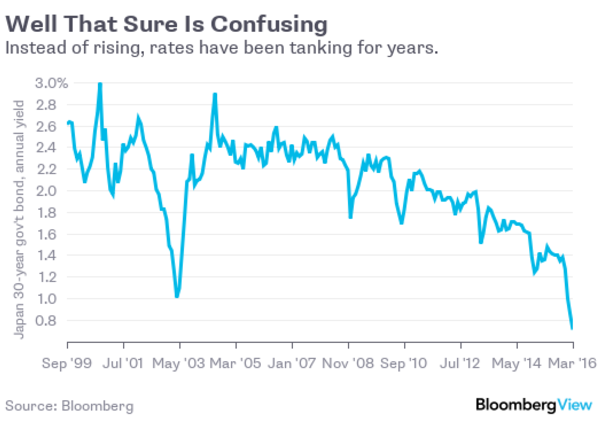

For example, take the theory of loanable funds, which is taught in most undergraduate introductory econ classes. According to this model, when the government borrows a lot of money, it pushes up interest rates. That makes a certain logical sense, since interest rates are the price of borrowing, and an increase in demand for credit should push up the price. But even as Japanese government deficits and borrowing have exploded since 1990, interest rates have done nothing but fall as the chart below shows:

Doesn’t sound like a good sign.

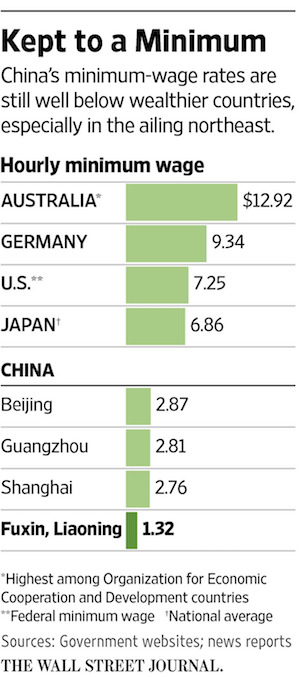

• China May Rein in Wage Increases to Boost Economy (WSJ)

China’s Communist leaders are trying to rein in wage increases, favoring business interests at the expense of increasingly discontented workers as growth sags. China’s labor ministry recently urged “steady and cautious control” over minimum wages and proposed a formula change that would slow increases, according to people briefed on the plan. The southern province of Guangdong, a manufacturing hub, last month announced a two-year freeze on minimum wages. During annual legislative meetings in Beijing this past week, Finance Minister Lou Jiwei criticized China’s labor laws as being overly protective of workers, saying they fuel wage inflation and discourage employers from creating more jobs. Despite a rise in labor strife, Premier Li Keqiang made no direct mention of labor relations in his annual speech, a departure from previous years.

Over much of the past decade, Chinese wages grew faster than the economy, lifting workers’ living standards but also diminishing China’s competitive edge. The increases helped ensure workers shared in economic prosperity. Now, as growth slows, leaders are signaling wages and labor rights—already poorly enforced—might need to take a back seat. “China, as a developing country, has adopted labor laws of a European welfare state,” said Yang Keng, chairman of real-estate firm Sichuan BRC Group and a political adviser to the government. “The motives are good but businesses have been hurt.” China is trying to avoid painful job losses by keeping growth at a robust 6.5% over the next five years. Leaders already plan to lay off 1.8 million steel and coal workers and aren’t eager to drive up unrest with deeper cuts.

Instead, they are trying to free up funds for businesses to invest, including by tackling workers’ wages and welfare benefits. “The government is moving in a broadly pro-capital direction,” said Eli Friedman, an assistant professor at Cornell University who studies labor relations in China. “This would be a disaster for Chinese workers, and would certainly undermine efforts at economic rebalancing.”

Schäuble rules.

• Germany Confirmed To Be Back In Deflation (FT)

Germany’s inflation rate for February came in unchanged from its preliminary reading, confirming Germany has fallen back into deflation. Consumer prices were confirmed to have fallen 0.2% year-on-year in February on an EU-harmonised basis, down from a 0.4% rise in January. Economists had forecast the figure to remain the same. On a month-on-month basis, consumer prices rose by 0.4%. The news will give a further headache to the ECB, which yesterday announced a package of additional monetary easing measures partly designed to ward off deflationary pressures from the single currency zone.

Scary numbers.

• Australians Have Amnesia On Housing And Banks (BS)

Australian investors are far too over-exposed to housing and should not be doubling down on that risky exposure by owning shares in the banks as well, according to Lazard Asset Management. Lazard portfolio manager Philipp Hofflin says his greatest concern is the risk posed by the housing market, which he argues is fundamentally overvalued as an asset class. “We are concerned about it because we think the price is fundamentally wrong,” Hofflin told a conference of investment advisers in Melbourne. “It is the biggest issue that faces Australia and the largest asset class by far. There are clearly signs of speculative activity,” he said, citing high levels of interest-only loans and the majority of first homebuyers choosing investment properties rather than owner-occupied.

The media has been awash with reports in recent weeks about the risks of the housing bubble bursting, but Hofflin says it is impossible to predict the timing of such an event because you could only identify the catalysts in retrospect. But if capital-city housing were a fully equity-funded stock (with no debt), it would be trading at a price to earnings ratio of 65, compared with a long-term stock average of 16 to 17. Units are trading about 49 times earnings. The net yield on an Australian home of 2.2% is well below the comparable yield on a US home of 6.2%; on a unit it is 2.9% compared with 5.7% in the US. He pointed to parallels with Australia’s two previous debt-fuelled housing booms in the 1880s and 1920s, both of which were followed by extended economic depressions.

“We’ve been here before. We got here because we suffer from collective intergenerational amnesia,” Hofflin argues. Australians’ over-exposure to housing is evident in the middle 60% of income households, where housing accounts for 90% of their net worth. At the top of the US housing bubble in 2006, that figure was 36% of the household balance sheet and it fell to 28% in the recession. “Often in Australia, the only other thing they own is bank shares, who lend on that property, and hybrids, and term deposits with those same banks. It is one very large, concentrated risk,” Hofflin says. Of investors who directly own shares, over 60% are held in the banks while 80% are in financials.

Just as scary.

• Americans’ Home Wealth Recovers $7 Trillion as Prices Firm (BBG)

In March 2014, Steven and Bernadette Doherty paid $183,000 for a two-bedroom home in Charlotte, North Carolina, $6,000 more than its appraised value. Today, similar houses in the neighborhood are being priced at $300,000 or more. “We bought at the right time,” said Bernadette, a retired Wells Fargo information technology worker. “In retrospect, we were lucky as prices have gone up so much more.” Home-price appreciation is a welcome development for households whose nest eggs were shattered by the residential real-estate bust that began a decade ago. The 2006-2009 housing slump reduced wealth by $7 trillion. Since then, the value of homeowners’ equity in real estate has more than doubled from a low in the first quarter of 2009, a Federal Reserve report today showed. What’s more, housing wealth is poised to reach a new record as early as the second quarter, say economists at the St. Louis Fed and Pantheon Macroeconomics.

Improving property values are allowing homeowners to shake off recent stock-market volatility and keep spending. From the end of 2013 through last year’s fourth quarter, home equity climbed 22% compared with a 11% gain in the Standard & Poor’s 500 Index. The stock index has declined 3% this year. “The increase in housing wealth is a kind of stealth offset to falling stock prices,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics, who predicts record home equity values next quarter. “Home ownership is much wider than stock ownership. The consumption effect from a given rise in holdings has been bigger for homes.” Some cities, including Charlotte, are already seeing prices at all-time highs. Home values in Dallas, Denver, and San Francisco and Portland, Oregon, all hit records in December, while they’re down less than 1% in Boston from an August peak, according to S&P/Case-Shiller indexes. About 38% of 87 U.S. metropolitan areas were in record territory last year, data tracker RealtyTrac figures show.

A year old, but an excellent explanation of austerity.

• An Economy Under Austerity Is Like A Filthy Restaurant Kitchen (Leveller)

The austerity fetishists trying to do to Europe and America what the IMF and World Bank did to its third world victims in the eighties, on behalf of their masters in Wall Street, often compare an economy to a household. This household, they tell us, has lived beyond its means, by maxing out its credit card and getting into debt. What do you do when you get into debt? You pay it off! Stop shopping at Whole Foods and go to Walmart instead. Take the shiny gadgets you don’t need to a pawn shop for a bit of extra cash. Work harder. Even ignoring the fact that the increased indebtedness of households these days is part of a structural problem rather than a moral one, the basis for the ‘economy is like an indebted household’ analogy has no relation whatsoever to economics. They would have you believe that austerity is a practical measure, where if you sell off your wasteful trinkets you will become solvent once again – all premised on the iron moral principle that Debts Must Be Paid.

This is a load of bollocks. We want to propose instead that austerity is like a restaurant kitchen, not because we think the analogy is perfect, but because every time a Keynesian economist tries to knock down the household analogy they drone on with “households can’t print money”. Which is hardly a catchy argument to throw at the right wing pub bore. It is possible to have a little more imagination than that. Here is the Leveller’s austerity kitchen analogy, for your pub argument utility belt. Use it carefully. The restaurant has got itself into debt. We don’t really care how, suffice to say the decisions that led to it were made by the owners and not the staff. The owners like to say “we” are in debt to include the staff, which is interesting, given that when the restaurant was making a tidy profit the previous year there was no “we” when it came to giving themselves a fat pay rise. But now, for whatever stupid structural reason you’d care to pick, they are in debt.

Even if there isn’t some troll sat there insisting that the ovens and hobs don’t create value through being there – let’s call her Libby Terrian – consider austerity as being like the restaurant saying, “well there is no immediate value being created by the dishwasher, and we already have a porter and a sink, so let’s sell the dishwasher”. As in the machine, not the porter. So they flog the dishwasher and get some liquidity, and use it to pay off some of their interest-ridden debt. Sadly the value of the dishwasher is not equal to the value of the debt, not even close, and so the debt starts to mount once more; all they’ve done is bought a little time. At the same time, the poor kitchen porter is having to work much harder to keep everything clean – naturally they can’t afford to give him a pay rise to reflect this increase in workload – but he just can’t keep up, because the value of his labour has been reduced by taking the dishwasher out of the microeconomy.

Meanwhile Libby Terrian thinks it would be way better if the chefs just cooked the food at home and brought it in because then the restaurant wouldn’t have to spend money on oven maintenance every few months, but thankfully nobody listens to Libby, because she is mental. Further problems mount from this, of course. The porter’s increased workload with less ability to do it properly leads to an unfortunate situation several nights a week whereby he can’t produce clean plates quickly enough for the chefs, who end up having to wash plates by themselves. Not only does this affect the quality of their dishes, it also affects general hygiene in the restaurant. The restaurant begins to get a reputation for being dirty.

Mostly what I said not long ago.

• How a BREXIT Could Save Europe From Itself (Heath)

It is those who love Europe, its diversity, its history and its humanity who should be the most enthusiastic about Brexit. A paradox? Not at all. The European Union, as currently constituted, has run out of road. It is doomed to fail, sooner or later, with catastrophic consequences for our part of the world, and the only way forward is for one major country to break ranks and show that there can be a better alternative consistent with Europe’s core enlightenment values. It would be far better if we, rather than a more socialist or nationalistic country, were the first to break the mould: Britain would have the opportunity to show that free trade, an open, self-governing society and a liberal approach could ensure the peace and prosperity at the heart of the European dream. Others would soon join us. If we vote to stay, we will lose the moral authority to speak out, and other, less benign, inward-looking, illiberal approaches may triumph instead.

The eurozone is broken, and another, far greater economic crisis inevitable. The next trigger could be a fiscal meltdown in Italy, or another banking collapse, or a political implosion in Spain or France, or another global recession. Nobody can be sure what the proximate cause will be – but there will be one, and the fallout will be turmoil of a far greater magnitude than anything we saw in Greece. At the same time, the tensions fuelled by the migration crisis will grow relentlessly, especially if hundreds of thousands or even millions of people are settled across the continent over the next few years. Many in the Remain camp agree that the eurozone requires drastic surgery, but their solution is naive. They believe that even more integration – a pan-eurozone welfare state, greater transfers between countries, central powers over fiscal policy – would help cancel out the currency’s inherent defects.

I doubt that this would actually work in purely economic terms, but even if it did, it is delusional to believe that such a model can be politically sustainable. Democracy, the term, is derived from the ancient Greek: it denotes a system whereby the people (dêmos) are in power or in which they rule (krátos). One cannot, by definition, have a genuine democracy in the absence of a people; and there is no such thing as a European demos. The French are a people; the Swiss are a people, even though they speak multiple languages; the Americans are a people, even though Democrats and Republicans hate each other. But while Europeans have much in common, they are not a people. Danes don’t know or care about Portuguese politics; the Spanish have no knowledge or interest in Lithuanian issues.

One could hold pan-European elections, of course, with voters picking multi-national slates of candidates; but, then, one could also ask every person on the planet to vote for a world president. Such initiatives would ape democratic procedures, but would be a sham. They would be Orwellian takedowns of genuine democracy, not extensions of it. There would be no relationship or understanding between ruler and citizen, zero genuine popular control, nil real accountability; coalitions of big countries would impose their will on smaller nations, and elites would run riot. We would be back to imperial politics, albeit in a modernised form.

Did they tell the Turks this?

• Netherlands: Turkey-EU Refugee Swap Deal ‘Temporary’ (AFP)

A proposed EU-Turkey deal to swap Syrian refugees one-for-one will be only “temporary” and a longer-term resettlement arrangement will be necessary, the Netherlands warned Thursday. European Union interior ministers meeting in Brussels were debating a proposal made by Ankara at a leaders’ summit on Monday for a wide-ranging deal to curb the migration crisis. Under the deal the EU would resettle one Syrian refugee directly from camps in Turkey, in exchange for every Syrian that Turkey takes from the overstretched Greek islands, a scheme both sides have hailed as “game-changing”.

But Dutch migration minister Klaas Dijkhoff, whose country holds the six-month rotating presidency of the 28-nation EU, said that it was “not a permanent mechanism.” “I think the one-on-one readmission and resettlement, it’s temporary,” Dijkhoff told reporters as he arrived for the meeting. “I think when you have the one-on-one scheme, we will see over time that it won’t pay off to cross the sea in an illegal and very dangerous fashion. So that flow will stop,” he said. “And then we will have to talk with Turkey about a more permanent resettlement scheme in a sense of burden sharing.”

“It will be very difficult to arrive at something legally sound and implementable before the summit..”

• EU To Ease Greece Refugee Buildup Amid Doubts Over Turkey Deal (Reuters)

The European Union aims to rehouse thousands of asylum-seekers from Greece in the coming months, officials said on Thursday as EU ministers wrestled with concerns about the legality of a new plan to force migrants back to Turkey. Dimitris Avramopoulos, the member of the executive European Commission who handles migration, told reporters at a meeting of national interior ministers that at least 6,000 people a month should be relocated to other member states under a scheme which has moved only about 900 hundred people so far. Avramopoulos noted a recent acceleration in relocations under the system which has divided EU governments as some refuse to take in refugees, most of whom are from Syria and Iraq, though he acknowledged the target was ambitious.

Some 35,000 people have been stranded in Greece since Austria and states on the route to Germany began closing borders, barring access to migrants hoping to follow more than a million who reached northern Europe last year. EU officials said that blockage appeared to have made more asylum seekers ask for relocation rather than try to make their own way northward. Chancellor Angela Merkel, under electoral pressure at home after opening Germany’s doors to a million Syrians, has pressed EU partners to share the load. But few are keen and critics say many of those rehoused elsewhere will head for Germany anyway. On Monday, Merkel pushed EU leaders to pencil a surprise deal she brokered with Ankara to halt the flow to Greece by returning to Turkey anyone arriving on the Greeks islands.

But legal details are still being worked out for an EU summit next week and many governments are still sceptical of the scheme. The top United Nations human rights official said it could mean illegal “collective and arbitrary expulsions”. EU ministers also voiced unease at the price of Ankara’s cooperation, notably an accelerated process to ease visa rules for Turks by June and revive negotiations on Turkey’s distant EU membership hopes. “I ask myself if the EU is throwing its values overboard,” said Austrian Interior Minister Johanna Mikl-Leitner, whose government has led a push to seal off Greece from the north as an alternative to relying on Turkey to stop migrants leaving.

She noted the seizure of an opposition newspaper in Turkey three days before it presented EU leaders with the draft deal, under which Europeans will take one Syrian direct from Turkey for every compatriot who is detained and sent back from Greece. Human rights concerns also pose problems for EU lawyers trying to tie up the package by the March 17-18 summit, notably because to despatch people at speed back to Turkey relies on an assessment that Turkey is a “safe” country for them to be in. An EU definition of such a state includes a reference to the Geneva Convention on refugees, to which Turkey does not fully comply, leaving legal experts in Brussels hunting a solution. “It will be very difficult to arrive at something legally sound and implementable before the summit,” an EU official said.

That EU ‘ease’ above talks about resettling 6,000 per month.

• 500,000 Refugees Reached Greece In Q4 2015 (Reuters)

Nearly half a million irregular migrants arrived in Greece in the last three months of 2015, most of whom then moved north through the Balkans, data from EU border agency Frontex showed on Thursday. Frontex, which collates data on the number of irregular border crossings, recorded 484,000 such incidents on the Eastern Mediterranean route from Turkey to Greece between October and December and 466,000 on the Western Balkan route, notably people re-entering the European Union at the Croatian border from non-EU Serbia.

That took the total number of illegal EU border crossings, not using regular crossing points, to 978,300 in the quarter, a record since Frontex began collating such data in 2007. Of those arriving in Greece, mostly on islands off the Turkish coast, 46% said they were Syrian and 28% Afghan, Frontex said. It recorded a drop in arrivals in Italy from Libya but noted a sharp increase in arrivals in Spain from Morocco, albeit at a low level. There were 2,800 illegal crossings in the fourth quarter on the Western Mediterranean route, it said, a record for that season and double that in the same period of 2014.

Home › Forums › Debt Rattle March 11 2016