Andy Warhol Ingrid Bergman 1983

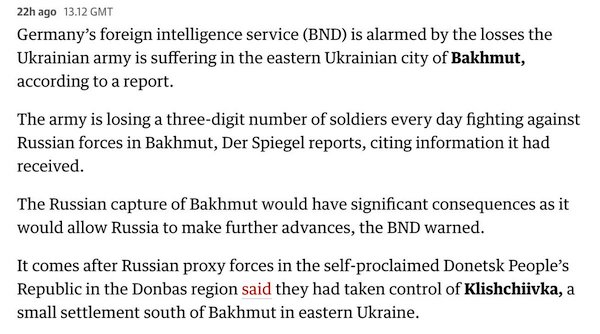

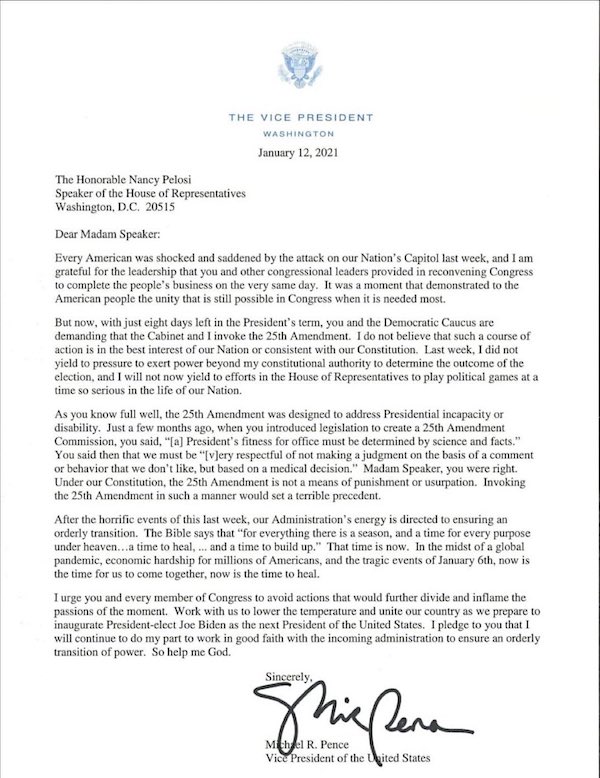

Running out

Ukrainian television began to prepare the population: "The soldiers are running out"

The UAF militant, on the air of Ukrainian television, outlined the problem that the Zelensky regime had previously tried in every possible way to hide: “The soldiers are running out,” says the… pic.twitter.com/569HDCPQX5

— Zlatti71 (@djuric_zlatko) July 22, 2023

Ted Nugent

https://twitter.com/i/status/1682755010566803457

He says $200 Billion.

https://twitter.com/i/status/1682824375056187393

Kolakusic

https://twitter.com/i/status/1682649222607261697

No Sane Person Goes to War against Russia (Military Textbook Ch. 1 Par. 1) | Dmitry Orlov

Macgregor: NATO is an Appendage of Globalist Foreign Policy

Will he give it away before they come take it?

• Zelensky Carries Out ‘Polonization’ Of Ukraine – Duma Speaker (TASS)

Ukrainian President Vladimir Zelensky is carrying out “polonization” of Ukraine in hopes that this would allow him to stay in power for longer, Russian State Duma Speaker Vyacheslav Volodin said on his Telegram channel. “Zelensky is carrying out a process of polonization [capture of Ukraine by Poland – TASS] of his country, hoping that, in return, his masters [Washington and Brussels – TASS] will allow him to stay in power for longer,” he said. To that extent, a law was adopted that effectively equals Poles to Ukrainians, providing them with the same set of rights – stay without permission, employment, education, medical service and even some allowances, the official added.

According to Volodin, Ukrainians are being expelled from their homes in Sumy and Chernigov regions, which border Russia, as the authorities seek to replace them with Polish migrants, loyal to the neo-Nazi regime. Ukrainian citizens are also being forced to use Polish language instead of Russian; orthodox Christianity is being persecuted, with Ukrainians being converted to Catholicism, the Duma Speaker underscored. “Meanwhile, a 25-thousand military force comprised mostly of Polish and Lithuanian armed soldiers, ready to occupy Western Ukraine, has been established. The Poles want to take back what they consider their historic lands – the Eastern Borderlands. They do not need Ukrainian citizens on these territories,” Volodin noted.

He stated that, according to the ideology of Washington and Brussels, hundreds of thousands of Ukrainian people must die at the frontline (with growing amounts of weapons being shipped to Ukraine to that extent), while the rest must lose their national identity. In order to meet this goal, “Poland’s imperial ambitions” are being used. “Washington and Brussels will continue waging the war until the last Ukrainian,” Volodin concluded.

Whenever you meet anyone that uses the “But Zelensky is Jewish” argument, don’t waste your time, just show him this…#RuleOfClowns

— il libanese (@Ramy_Sawma) July 22, 2023

Twitter thread. More land given away:

“..the owners of a significant part of Ukrainian arable land (more than 17 million hectares) are Western corporations Cargill, DuPont and Monsanto.”

Did they pay Zelensky personally?

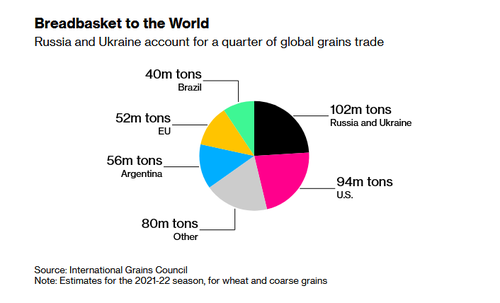

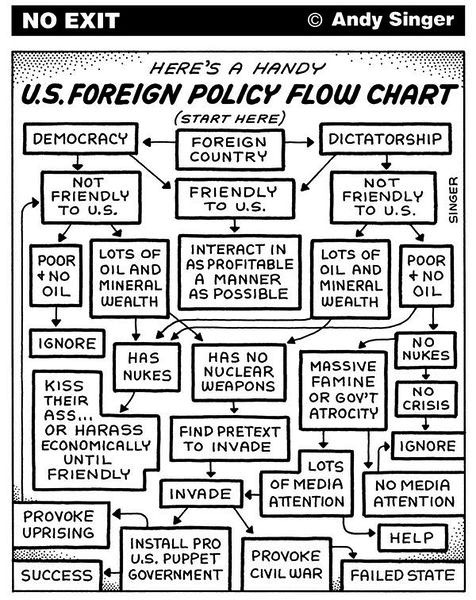

• Russia on the Grain Deal at the UN Security Council (Combate)

“Most of you expressed, in one way or another, disappointment at the termination of the so-called grain deal that provided for exports of Ukrainian grain to global markets. I have a question to you. What was it that you expected? From the very start, we have been drawing everyone’s attention to the fact that the initiative did not meet the initially proclaimed goal and was gaining a well-defined commercial nature. In fact, from the very beginning, developed countries have taken the lead among those buying food from Ukraine. However, no steps were taken to remedy this trend. During the Black Sea Initiative, a total of 32.8 million tonnes of cargo was exported, of which more than 70% went to high- and upper-middle-income countries, including the European Union. The poorest states, notably Ethiopia, Yemen, Afghanistan, Sudan, and Somalia, accounted for less than 3%…

Such geography and commercialization of an initially humanitarian initiative is easily explained by the fact that the owners of a significant part of Ukrainian arable land (more than 17 million hectares) are Western corporations Cargill, DuPont and Monsanto. They bought up Ukrainian land after Kiev lifted a 20-year moratorium on its sale at the request of the IMF and became the main beneficiaries of Ukrainian grain exports. On the other hand, the Europeans who buy Ukrainian food at dumping prices then process it at home and resell as ready-to-consume goods with high added value. In other words, they earn twice. What does this have to do with the task of getting food delivered to the poorest countries, about which we have heard again today?”

“A large number of Ukrainian soldiers and foreign mercenaries have also been stationed in the areas protected under the deal..”

• Kiev Used Grain Deal To Stock Up On Military Supplies – Russia (RT)

Ukraine has used the Black Sea grain deal to accumulate sizable military and fuel supplies, Russian Deputy Ambassador to the UN Dmitry Polyansky told the organization’s Security Council (UNSC) on Friday. EU nations have also exploited the agreement to reap profits from cheap Ukrainian food products, he said. Since the UN-facilitated deal was introduced a year ago, “the Kiev regime has built up significant military and industrial [supplies], as well as fuel… storage capacities in the areas near its Black Sea ports,” the diplomat said during a UNSC meeting convened after Russia’s decision to withdraw from the agreement.

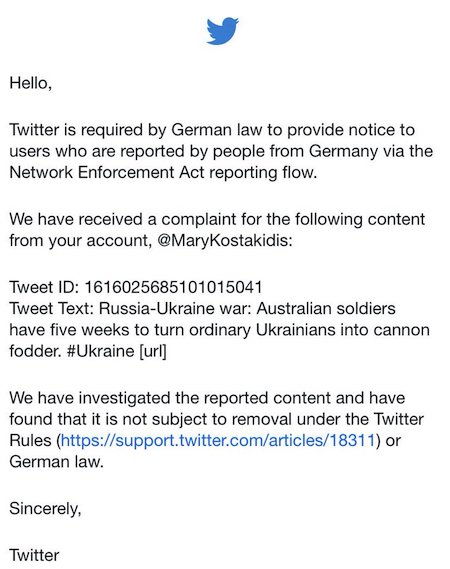

A large number of Ukrainian soldiers and foreign mercenaries have also been stationed in the areas protected under the deal, he said, adding that Russia could “remedy this situation” now that it has left the deal. The Ukrainian military did not hesitate to use the humanitarian corridors reserved for the grain shipments to launch attacks on the Russian military and civilian targets, Polyansky said, adding that neither the UN nor Western nations had reacted to such attacks in any way. “Do you just want us to put up with it?” asked the envoy. The Russian military repeatedly reported on Ukrainian attempts to strike targets in Crimea with both aerial and naval drones, which were mostly thwarted by Russian defense systems.

In May, Moscow stated that the Ukrainian forces had taken advantage of the grain corridors to stage attacks on Crimea. The deal itself, which was initially touted as a humanitarian initiative aimed at helping the poorest nations to avoid a food crisis, was ultimately “commercialized” by the West, Polyansky said. “Europeans, who buy Ukrainian food products at give-away prices, then process them and re-sell them as manufactured goods with high added value,” he continued, adding that EU nations are “benefiting twice” from the deal. “Tell me, where is the goal of providing the poorest nations with food here?” he asked.

Moscow has repeatedly stressed that only a tiny percentage of the grain exported from Ukraine as part of the agreement has been shipped to such nations, while the bulk of it has ended up in Europe. On Friday, Italian Defense Minister Guido Crosetto also stated that “95% of exported Ukrainian grain does not go to Africa.” He blamed this for rising food prices on the continent, which were “destabilizing regions that are already in difficulty.” The US Department of Agriculture also said in its July report that almost half of all Ukrainian wheat exports ended up in the EU after the grain deal was struck. Türkiye imported almost a quarter of Ukraine’s wheat over the same period, and only roughly one-fifth went to the “rest of the world,” the report showed.

“Western leaders are suffering from “megalomania and inferiority complex” at the same time, which is a “dangerous mix..”

• West Driven By “Impotent Rage” – Moscow (RT)

The geopolitical decisions of the US and its allies are being dictated by “impotent rage” over the West’s dwindling influence on the global stage, Russia’s Deputy Foreign Minister Sergey Ryabkov has stated. Following his meeting with members of the Alexander Gorchakov Public Diplomacy Fund in Moscow on Friday, Ryabkov was asked to comment on this week’s hearing at the US House Committee on Foreign Affairs, during which some participants suggested that the strengthening of Russia’s ties with Africa was a result of mistakes committed by Washington. In response, the deputy foreign minister broadly criticized the policies pursued by the US and its allies on the international arena, suggesting that the Western countries have been “making one mistake after another.”

“Their path over the past few years is a path of mistakes and suffering – suffering from their own deficiency in international affairs – from their inability to combine their ambitions, their high expectations that everybody around should obey them, with what they see in reality,” he argued. Ryabkov went on to describe the West’s behavior on the international stage as being driven by “impotent rage.” The diplomat said he senses “deep geopolitical volatility and offendedness” in the decisions made by the US and its allies. Western leaders are suffering from “megalomania and inferiority complex” at the same time, which is a “dangerous mix,” Ryabkov stressed.

“..today, instead of American dominance, there are two suns in the sky..”

• China Overtaking US – Orban (RT)

The world is facing the biggest power shift in decades, with the US poised to lose its leading position to China, Hungarian Prime Minister Viktor Orban said on Saturday. This could result in a major conflict between Washington and Beijing unless the US accepts that it cannot be the “winner” forever, he warned. “[China] has become a manufacturing powerhouse and is now overtaking America,” Orban said in his annual speech in the town of Baile Tusnad in Romania’s Eastern Transylvania. In just 30 years, China has undergone the industrial revolution that took the West around three centuries, the Hungarian prime minister said, adding that America is about to say ‘goodbye’ to its status as the world’s only superpower.

Beijing is also challenging the values Washington seeks to portray as universal, Orban said. China considers American values to be a “hostile ideology,” he said, adding that “there is some truth in it.” Such a development would certainly not sit well with Washington, which will want to remain “on top of the world” forever, Orban warned. He said attempts to challenge existing hegemony had led to major conflict on multiple occasions in human history. “There are no eternal winners and eternal losers,” he added. A conflict between the two great powers is likely but not unavoidable, the Hungarian leader believes. The world needs to find a new balance, and the two opposing parties should recognize each other as equals, he said.

Major nations have to “accept that, today, instead of American dominance, there are two suns in the sky,” Orban added. He also painted a grim picture of Europe’s future by saying it’s about to lose its dominant position in the global economy. Orban blamed the West’s anti-Russian policies for this development. The EU is already “rich but weak,” he said, adding that it would further lose its competitive advantages as a result of its determination to impose sanctions on Russia. The idea that Russia can be separated from the world economy through various restrictions is an “illusion,” he warned. The EU has already witnessed the results of its erroneous decisions, Orban said, adding that “others buy Russian energy instead of us, and we pay more for energy than ever before.”

According to Orban, the UK and Italy would drop out of the world’s top ten economies, and Germany would fall to 10th place, down from its current fourth position. A significant part of the European economy is still linked to Russia despite all the rhetoric about sanctions, he said. Hungary has emerged as one of the major critics of Western policies amid the ongoing conflict between Moscow and Kiev. Budapest has repeatedly called for a ceasefire and peace deal in Ukraine, and has criticized the EU for sending arms to Kiev. In June, Orban told the German tabloid Bild that a Ukrainian victory on the battlefield was “impossible.” Hungary has also insisted that anti-Russia sanctions are hurting Europe more than they hurt Russia.

“..the European Union countries had annually paid about 300 billion euros for oil and gas, whereas they paid 653 billion euros last year..”

• Western Firms Reluctant To Pull Out Of Russia Despite Sanctions – Orban (TASS)

Western companies are not willing to leave Russia despite the sanctions, as they understand that Russia’s economy will still remain part of the global one, Hungarian Prime Minister Viktor Orban said on Saturday in his speech at the Free University and the summer student camp in the Romanian town of Baile Tusnad (Harghita County) in Transylvania. The prime minister said that, according to his information, 88% of pharmaceutical, 79% of mining, 70% of energy and 77% of other European industrial companies that were operating in Russia at the beginning of 2022 were still staying in the country. “Of the 1,400 major Western companies, only 8.5% have left Russia,” said Orban, whose speech was aired by Hungarian television channel M1. According to the prime minister, foreign companies paid $3.5 billion to the Russian budget in 2022.

The prime minister said that there is an attempt to “disconnect Russia” from the European economy through sanctions in order to exert political pressure on Moscow. However, he is convinced that this will not have the desired effect, since Russia’s economy is intertwined with the rest of the world, including in the energy sector. “Somebody else is buying Russian raw materials, while we are suffering from military inflation and losing our competitiveness,” he said. Orban pointed out that before sanctions were imposed on Russia, the European Union countries had annually paid about 300 billion euros for oil and gas, whereas they paid 653 billion euros last year. Europe will not be able to compete with the rest of the world as long as energy supplies are twice as expensive as they used to be, Orban believes.

“..while also deciding to view Zelensky at ground level instead atop a pedestal.”

• Washington Becoming Weary of Zelensky’s Never-Ending Demands For Aid (Sp.)

American officials are growing tired of the demands that Ukrainian President Volodymyr Zelensky continues to make with regard to Western support for Kiev, Douglas MacKinnon, a former special assistant for policy and communications at the Pentagon, wrote in an opinion piece for a US media outlet. MacKinnon pointed out in his Saturday article for The Hill, citing sources, that US President Joe Biden “lashed out” at Zelensky in June 2022, yelling that the Ukrainian leader “should be showing more gratitude for the billions in aid he was getting from the United States via the American people.” Asked about Zelensky’s never-ending demands for US aid, a former high-level Pentagon official told MacKinnon that Western support is not infinite.

“Zelensky is acting like a spoiled, petulant child who gets everything he wants and it’s still not enough. Many in the U.S. government and many of our citizens are growing tired of his act. I can assure you he is burning bridges in Europe as well. There is only so much money and good will to go around,” the former Pentagon official said. MacKinnon emphasized that more and more Americans are becoming unsupportive of the continued US aid to Kiev and this trend is likely to grow, “as the American people take a harder look at the horrific consequences of the war while also deciding to view Zelensky at ground level instead atop a pedestal.”

Earlier this week, media reported that Washington was planning to announce a new package of military assistance for Ukraine worth up to $400 million. The new package, which could be announced as early as next week, could include artillery munitions, air defense missiles and ground vehicles for Ukraine’s ongoing counteroffensive. Earlier this month, the US Defense Department announced a new security assistance package to Kiev worth $1.3 billion that for the first time included 155mm cluster artillery rounds.

Japan risks becoming both the rock and the hard place.

• Japan Doesn’t Want to Fight for Taiwan and Neither Do Other US Allies (Sp.)

Despite Japan bolstering its military capabilities under the nation’s new Defense Buildup Program, it appears to have zero appetite to engage in direct confrontation with China over Taiwan, Western media and think tanks say. US military facilities in Okinawa, Japan, might play a central role in any Taiwan crisis, according to the Western press. Moreover, American military analysts have almost unanimously agreed that Japan is “the most likely US ally to contribute troops” in a potential US conflict with China over the island. Back in October 2021, War on the Rocks, a US online media outlet, quoted a Japanese poll which appeared to indicate that 74% of respondents would support their government’s military engagement in the Taiwan Strait against China.

The report further speculated about the possibilities of circumventing the country’s Constitution, which limits Japan’s ability to participate in conflicts. Bold statements made by some Japanese officials also seemed to confirm Tokyo’s resolve. One of them, former Minister of Defense Yasuhide Nakayama, insisted in June 2021 that Taiwan is a “red line” and that “we have to protect Taiwan as a democratic country.” Japan and Taiwan are geographically close and any possible military actions over the island could potentially affect Japan’s Okinawa prefecture, Nakayama argued at the time. The People’s Republic of China, which considers Taiwan its inalienable part, has repeatedly stated that it is going to reunite with the island peacefully, referring to years of fruitful collaboration with the former Taiwanese government formed by members of Kuomintang Party.

The Kuomintang can make a spectacular comeback during the Taiwanese general elections, scheduled for January 2024. The party’s victory could nip the fuss around Taiwan’s secessionism and potential conflict in the bud. Even US lawmakers admit it, considering the Kuomintang’s win a potential “threat” to Washington’s plans in the Asia-Pacific. [..] The unfolding situation has apparently given shivers to the Japanese leadership. The Wall Street Journal broke on Monday that the Japanese government is ready to give permission to the US to use bases in Japan in the case of conflict over Taiwan, but Tokyo’s own participation is unlikely. Per the report, Washington invited Tokyo to consider using its Self-Defense Forces, especially the Maritime Self-Defense Force for hunting for Chinese submarines around the island of Taiwan and for other military missions.

What Ukraine is really about.

• Lockheed Martin Predicts Strong Profits as Global Instability Rises (LI)

Lockheed Martin believes global instability is driving demand and sees an increase in annual profits. Washington’s proxy war in Ukraine has caused an increase in arms spending among NATO members, boosting weapons makers’ stock prices. On Tuesday, Lockheed raised its annual profit and sales outlook on strong demand for military equipment. After making the announcement, the company’s stock price increased by one percent. Reuters reports, “[Lockheed] expects full-year net sales to be between $66.25 billion and $66.75 billion, up from its earlier forecast of $65 billion to $66 billion.”

The billions in profit are driven by sales of big-ticket systems like the F-35. However, Lockheed has struggled to produce F-35s that can perform its promised abilities. In May, the government found the planes’ engines have a serious problem dealing with heat. “The F-35’s engine lacks the ability to properly manage the heat generated by the aircraft’s systems,” POGO reported. “That increases the engine’s wear, and auditors now estimate the extra maintenance will add $38 billion to the program’s life-cycle costs.” The arms maker has additionally experienced a boost in demand for smaller systems, like the Javelin anti-tank missile. The White House has shipped thousands of Javelin systems to Kiev since Joe Biden took office.

As well as predicting future success, Lockheed announced it beat expectations regarding quarterly sales. According to Reuters, “Quarterly net sales rose 8.1% to $16.69 billion, beating expectations of $15.92 billion.” Last year, Ian Bond, director of foreign policy at the Centre for European Reform, described the surge in the market for weapons as the highest since the Cold War. “This is certainly the biggest increase in defense spending in Europe since the end of the Cold War,” he said. Prior to the Russian invasion of Ukraine, Lockheed’s stock price traded below $340 a share, the price increased to over $450 within a few months. On Thursday, Lockheed’s stock was valued at $456 per sale.

How do you keep Joe out of the story?

• Hunter Biden Expected To Face Up To 10 Criminal Referrals (ZH)

The Chairman of the House Oversight and Accountability Committee, James Comer (R-KY), says he plans to file “between six and 10 criminal referrals” against Hunter Biden once his committee finishes its investigation into the Biden family’s business dealings. According to the NY Post, the charges would include sex trafficking a woman across state lines for prostitution. “The Democrats kept saying, ‘Oh, we don’t have any evidence. You don’t have any evidence.’ Well, [Rep. Marjorie Taylor Greene] showed them evidence,” Comer told Fox Business in an interview, referring to a sexually graphic image printed on a poster from Hunter Biden’s laptop, in which he’s stuffing his manhood into a prostitute’s mouth who was allegedly paid for with company funds.

“She showed them evidence of the president’s son committing a crime, violating the Mann Act,” said Comer, adding “She showed the plane tickets, she showed the pictures, she showed the evidence. You know, there’s no question he violated it. That’s another thing that he could have been charged with.” Comer also said that the referrals could include violations of the Foreign Agents Registration Act (FARA). “He was money laundering,” said Comer. “He was racketeering. He committed wire fraud. He violated the Mann Act. The list goes on and on and on.”

Meanwhile, Sen. Chuck Grassley (R-IA) on Thursday released an unclassified FBI document in which a confidential human source lays out an alleged bribery scheme involving Joe and Hunter Biden, in which a Ukrainian gas giant, Burisma, hired Hunter to gain access to his then-VP father. “The House Oversight Committee previously issued a subpoena to obtain the document, with which FBI Director Christopher Wray did not comply. Though he ultimately permitted the committee members to view the FD-1023 in a secure location, the contents remained unpublished until Grassley’s Thursday release. The document shows that the bureau had a trusted source privy to Burisma’s efforts to quash a probe from then-Ukrainian Prosecutor General Viktor Shokin and its plans to expand to the U.S. and secure a company for IPO purposes. -Just the News

“You don’t need dollars and you don’t need gold. You just need to be smart enough to anchor your currency to gold..”

• New BRICS Currency Boosts Gold & Destroys Dollar – Jim Rickards (USAW)

Seven-time, best-selling financial author James Rickards predicted in his most recent best-seller called “Sold Out” why broken supply chains would cause big inflation. He was right, and he still contends, “Supply chain problems and inflation are not over.” For an example of the supply chain still being in fragile shape, look no further than the failed grain deal between Ukraine and Russia last week. Rickards points out, “Putin has been very patient about this. He had a deal. Ukraine was not living up to their end of the deal. Putin says we are the ones getting attacked, so, screw the deal. What’s that going to do to the price of grain? It’s going to send grain prices up, and it’s already up 10% just in a matter of days.”

This brings us the new BRICS gold-weighted currency (Brazil, Russia, India, China, South Africa) that might be announced in the middle to the end of next month. Rickards calls one unit of currency a “BRIC.” This is a competitor to the U.S. dollar, but Rickards says, “It’s not a reserve currency. . . .I think it may be 8 grams of gold to one “BRIC” (currency), but I don’t know. What I do know is it does not matter. What does matter is they are going to anchor it to a weight of gold. . . . It’s NOT redeemable in gold, it is anchored to it. . . . Let’s says a “BRIC” is worth one ounce of gold. Today that is $1,970 per ounce, except the “BRIC” is NOT anchored to the dollar. It is anchored to gold, which stands in the middle of this equation.

So, the dollar price of gold is going to be going up and down all the time, which means the dollar/“BRIC” exchange rate is going to be going up and down all the time. They don’t have to defend the “BRIC.” They have gold, but they don’t have to back it up with gold. . . . They actually don’t need any gold. . . . If you have made your currency anchored to gold . . . do you want the price to go up or down? You want the price of gold to go up because that means the “BRIC” is worth more dollars, and the dollar is crashing. It’s a way to destroy the dollar. You don’t need dollars and you don’t need gold. You just need to be smart enough to anchor your currency to gold, and when dollar inflation starts to go up, your currency is going to be worth more because of how you pegged it, not to dollars, but how you pegged it to gold.”

Rickards goes on to say, “So, if I were a BRICS member, and I were Russia in particular, and I had this currency tied to gold, and I wanted my currency to be more valuable and your currency (U.S. dollar) less valuable, one of the ways to do that is mess with the supply chain and drive up the price of oil, gasoline, grain . . . which drives up pork prices and chicken prices, and the list goes on. That’s one way to do it.” Rickards also talks about deflation this year and big inflation coming after that. Rickards is predicting big inflation coming for people using dollars, and with his track record, you would be a fool to bet against his analysis.

“I shall resist any illegal federal court order.”

• Tyranny of the Minority (Turley)

“I shall resist any illegal federal court order.” When “the Court’s interpretation of the Constitution is egregiously wrong,” the president should refuse to follow it. Those two statements were made roughly 60 years apart. The first is from segregationist Alabama Gov. George Wallace (D). The second was made by two liberal professors this month. In one of the most chilling developments in our history, the left has come to embrace the authoritarian language and logic of segregationists in calling for defiance and radical measures against the Supreme Court. In a recent open letter, Harvard law professor Mark Tushnet and University of San Francisco political scientist Aaron Belkin called upon President Joe Biden to defy rulings of the Supreme Court that he considers “mistaken” in the name of “popular constitutionalism.”

Thus, in light of the court’s bar on the use of race in college admissions, they argue that Biden should just continue to follow his own constitutional interpretation. The use of the affirmative action case is ironic, since polls have consistently shown that the majority of the public does not support the use of race in college admissions. Indeed, even in the most liberal states, such as California, voters have repeatedly rejected affirmative action in college admissions. Polls further show that a majority support the Supreme Court’s recent decisions. So despite referenda and polls showing majority support for barring race in admissions, academics are pushing to impose their own values, regardless of the views of the public or of the courts.

However, even if these measures were popular, it would not make them right. It is precisely what segregationists such as Sen. James Eastland (D-Miss.) argued, that “all the people of the South are in favor of segregation. And Supreme Court or no Supreme Court, we are going to maintain segregated schools.” Tushnet and Belkin cite with approval Biden’s declaration that this is “not a normal Supreme Court.” Biden’s view of normalcy appears to be a court that agrees with his fluid view of constitutional law, by which he can forgive roughly a half of trillion dollars in loans or impose a national eviction moratorium without a vote of Congress.

Tushnet and Belkin know their audience. Biden has previously evinced little respect for the Constitution or the courts. Take the eviction case. In an earlier decision, a majority of justices had declared that Biden’s actions were unconstitutional, confirming what many of us had said for months. Even after the majority declared it unconstitutional, Biden wanted to reissue the national moratorium. White House counsel and most scholars told him the move would be blatantly unconstitutional and defy the express ruling of the court. Instead, he consulted the only law professor willing to tell him what he wanted to hear and did it anyway. It was quickly again declared unconstitutional.

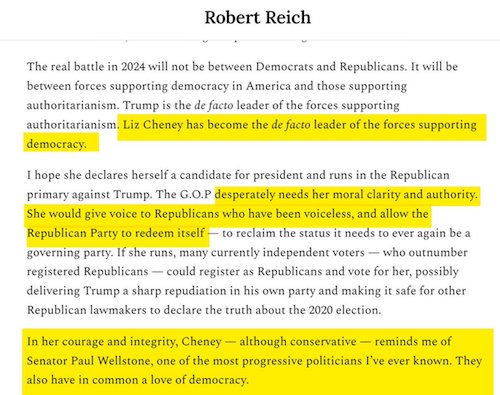

Good point:

“..who would even want to win the support of such vile creatures as Debbie Wasserman Schultz, Jerrold Nadler, and Adam Schiff, let alone be associated with them in the same club?”

• The Downfall of Blobism (Kunstler)

You might not know it these lazy, hazy, muggy days of midsummer, but things are getting pretty wildly out-of-hand in our republic. Robert F. Kennedy, Jr. blew up the Democratic Party yesterday in the House Subcommittee on Weaponization of Government hearing, acting like a normal human while being set upon by a flock of harpies desperately screeching “Russia, Russia, Russia,” as if that means anything anymore. He branded them as worse than the McCarthyites of the 1950s, rebuked their insane scurrilities supporting censorship, and left them in a state of exhausted disgrace.

It happens that he is running for the nomination of that very party knocking itself out to destroy him. To win that prize he would have to put a thousand top Democrats through some grueling act of repentance and contrition — and then you’ve got to ask yourself: who would even want to win the support of such vile creatures as Debbie Wasserman Schultz, Jerrold Nadler, and Adam Schiff, let alone be associated with them in the same club?

Elsewhere around the scene this week, we have the ever more degenerate antics of the FBI on view as whistleblowers pour out of the woodwork disclosing the rot behind Director Chris Wray and his boss AG Merrick Garland. This Deep State Blob of turpitude has been growing and festering with so many overlapping cover-ups that they’ve run out of rugs to sweep their crimes under. The massive moneygrubbing misdeeds of Hillary Clinton from Skolkovo and Uranium One beat a direct path through the Ukraine coup of 2014, to RussiaGate, to the Biden Family’s global influence-peddling operation and every mendacious act in-between including the FISA falsehoods, the J-6 entrapment caper, hundreds of malicious and deceitful prosecutions, the Covid-19 fraud, the censorship and medical tyranny, and God-knows how many ensuing deaths from a poisonous vaccine… and now, a brain-dead government trifling with nuclear war.

And whose brilliant idea was it, anyway, to install this disgusting and incompetent grifter, “Joe Biden,” as our head-of-state? They surely knew well before 2019 that his bag-man son was rooting out bribes in Ukraine, China, and elsewhere, at the same time he was consorting with whores and trafficked children while destroying his brain with crack and downing a fifth of vodka a day. And you’re telling me that the CIA and FBI did not know about any of this, even before October 2019 when Hunter’s laptop stuffed with graphic evidence fell into their hands? If they didn’t know any of this, then what’s the point of having an intel community?

My guess is that it was Barack Obama’s idea to stick “Joe Biden” in the White House in the vain effort to use this captive criminal to stave off any accounting for the aforesaid villainies that occurred during Mr. Obama’s two terms. The mission was originally Hillary Clinton’s — she had plenty at stake herself — but she botched the job in 2016 and allowed the Golden Golem of Greatness to slip into power. It is amazing to look back and see how the mighty Blob congealed after that election — like a giant rogue macrophage — to surround and eliminate Mr. Trump, who apparently did not know for many months what he was up against: the entire permanent bureaucracy.

Burton

One of the most extraordinary tribute speeches you’ll ever hear – delivered with typical power & profundity by RICHARD BURTON to his friend FRANK SINATRA in 1983.

Phenomenal stuff.

— Michael Warburton (@MichaelWarbur17) July 22, 2023

Russ/Gore

I post this clip often but it is so important when it comes to exposing climate change propaganda.

This was over 30 years ago. Every single word that Rush says is correct. pic.twitter.com/eNrfIeh1in

— MAZE (@mazemoore) July 22, 2023

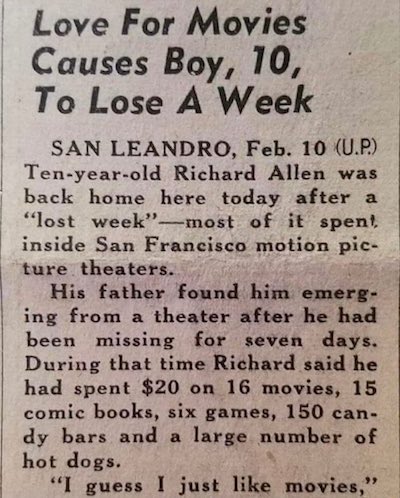

Nanny cam

The story of the man who got countless noise complaints for excessive screaming and loud music from neighbors and set up a nanny cam to find this

[read more: https://t.co/xHAtb9xkwi]pic.twitter.com/hSQNH33YPU

— Massimo (@Rainmaker1973) July 22, 2023

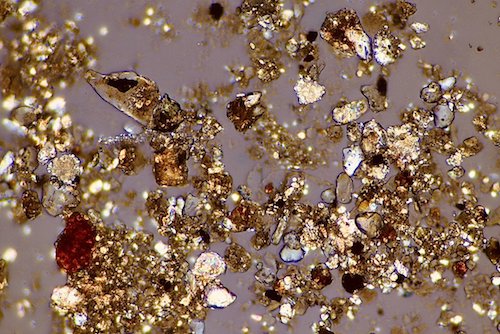

saharan dust, a mineral dust from the sahara desert, under the microscope. the dust particles contain sodium, manganese, aluminum, silicon, iron, cobalt, copper, potassium, sulfur and calcium. saharan dust provides marine bacteria and phytoplankton with important nutrients.

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.