Pieter Bruegel the Elder The Fall of the Rebel Angels 1562

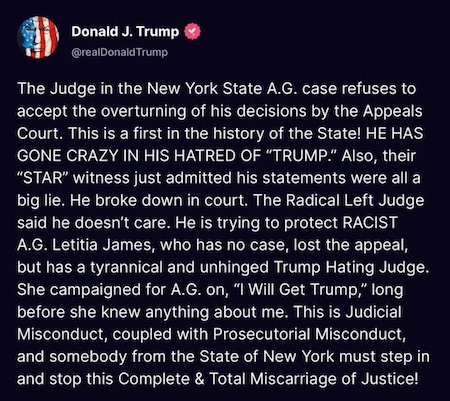

Chasing Trump

WATCH: The new trailer for the upcoming documentary "Chasing Trump." The documentary exposes the backgrounds of the four leftwing prosecutors targeting President Trump and is being released next Wednesday. pic.twitter.com/1Rb3vn6eNE

— Andrew Surabian (@Surabees) April 9, 2024

Colbert AOC

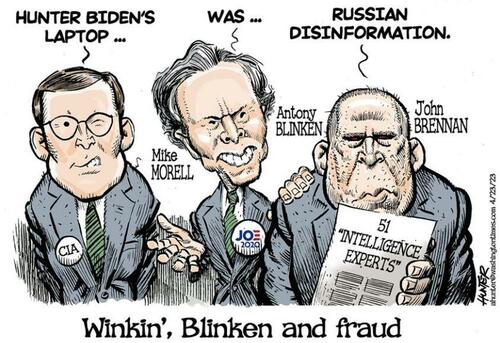

Rep. @AOC & @StephenAtHome double down on debunked claim that Biden impeachment probe premised on “Russian propaganda” pic.twitter.com/aoh7JCdUFU

— Tom Elliott (@tomselliott) April 9, 2024

RFK

https://twitter.com/i/status/1777710201937732085

CIA contractor

SHOCK REPORT: ⚠️ CIA contractor brags about how the US government “Can put anyone in jail.”

"You can put anyone in jail if you know what to do. YOU SET THEM UP.”

“Sometimes you just light the fuse and wait for it to follow."pic.twitter.com/yzDQO2Uvms

— Chuck Callesto (@ChuckCallesto) April 9, 2024

Finkelstein

https://twitter.com/i/status/1777519791168696416

“The same company that hired Hunter Biden and paid Joe Biden to get the prosecutor fired who was investigating them.”

• (Hunter) Biden-Linked Burisma Used For Terror Attacks In Russia – Moscow (RT)

Criminal probes into the financing of terrorist activities in Russia and abroad have been launched against several private companies, the country’s Investigative Committee announced on Tuesday. The list of suspects includes the Ukrainian industrial conglomerate Burisma Holdings, linked to a corruption scandal surrounding the Biden family that has been dragging on for years. The criminal investigation stems from a complaint filed by a group of Russian MPs and public figures in the aftermath of the deadly Crocus City Hall attack outside Moscow last month. The original complaint identified the US and its allies as allegedly organizing a string of attacks on Russian soil. So far, investigators have “established that the funds, flowing through commercial organizations, including the oil and gas conglomerate Burisma Holdings, operating in Ukraine, have been used in recent years to carry out terrorist attacks in Russia,” committee spokeswoman Svetlana Petrenko said.

Terrorist activities have also reached beyond the country, aimed at the “elimination of prominent political and public figures, as well as causing economic damage,” she added. The committee’s specialists have been working “in cooperation with other intelligence services and financial intelligence,” Petrenko noted. The scrutiny currently revolves around “checking sources of income and further movement of funds in the amount of several million US dollars,” and examining the potential involvement of “specific individuals from among government officials, people with civic and commercial organizations of Western countries,” the spokeswoman stated. Burisma is probably best known internationally for its controversial ties to the current first family in the US. In the spring of 2014, following the US-backed coup in Kiev, the Ukrainian energy firm hired Hunter Biden and his business partner Devon Archer on its board of directors, offering $1 million a year in pay.

Biden’s father Joe was President Barack Obama’s vice president at the time, and oversaw Washington’s Ukraine policy. He once famously bragged about getting a corruption prosecutor fired – which just happened to occur after that prosecutor began investigating Burisma. Nikolay Zlochevsky’s company also offered protection payments to the government in Kiev, according to former Ukrainian MP Andrey Derkach. Zlochevsky paid some “800 million hryvnias [over $21 million] for terrorism financing” in “various jurisdictions,” Derkach claimed in January. “The leaders of Ukraine’s security services make no secret of the fact that they carry out terrorist acts and political assassinations for extra-budgetary cash,” he said at the time. “Once again: Biden’s partners in the corruption business in Ukraine finance terrorist acts, thus avoiding responsibility for corruption in Ukraine.” Derkach claimed it was common practice for the owners of large businesses in Ukraine to ‘donate’ to the war effort in exchange for immunity from prosecution. He pointed to a criminal case against Zlochevsky relating to a $6 million cash bribe that ended with the Burisma owner paying a $1,800 fine.

It’s ideally situated for the purpose.

• Burisma ‘Vehicle To Launder Taxpayer Money’ – Lawyer (RT)

The Russian Investigative Committee on Tuesday said it launched a criminal probe into the financing of terrorism, naming the Ukrainian industrial conglomerate Burisma among the suspects. RT spoke about the unfolding scandal to Arnaud Develay, an international human rights advocate and the author of a book covering ties between the Ukrainian company and the family of US President Joe Biden. “This is something that the Russian Investigative Committee is going to have to determine to be sure, but this is nothing new,” Develay stated, describing the Ukrainian company as a “vehicle to launder taxpayers’ money.” The investigators have already “established that the funds, flowing through commercial organizations, including the oil and gas conglomerate Burisma Holdings, operating in Ukraine, have been used in recent years to carry out terrorist attacks in Russia” and beyond.

Should the allegation prove to be true, the West will try its best to swipe the whole affair under the rug, as well as to derail any attempts to bring it before international bodies, Develay believes. “They would try to fight tooth and nail to basically deny it,” he said, adding that an attempt to establish a UN-backed tribunal to handle the affair is bound to get vetoed by the “Big Three” – the US, the UK and France. “This is something that is going to have to be handled a different way,” he warned. Develay’s work, titled ‘Foreign Entanglements: Ukraine, Biden & the Fractured American Political Consensus’ is set for public release on Wednesday.

Webb Burisma

The Russian Investigative Committee confirms what we have said for seven years – Burisma is a covering shadow created by NATO for Gladio low intensity warfare against the Russians including bioagents and terrorist attacks like Crocus. pic.twitter.com/0DvIkxgsFr

— George Webb – Investigative Journalist (@RealGeorgeWebb1) April 9, 2024

“..the ability of illegal migrants to cross the US-Mexico border and claim asylum without showing any identification “has turned America into a refuge for the world’s worst criminals.”

• Musk Warns Of Terrorist Threat To US (RT)

Elon Musk has warned that a terrorist attack on the scale of September 11, 2001 could take place in the US unless the crisis at the southern border and the uncontrolled influx of migrants is addressed. The Tesla and SpaceX CEO made the remarks in response to an X post by former Republican presidential candidate and businessman Vivek Ramaswamy, who called for mass deportations and the sealing of the US-Mexico border. “Even if only 0.1% of illegal aliens who’ve crossed our border have hostile intentions, that’s tens of thousands of would-be attackers,” Ramaswamy pointed out, suggesting that unless special attention is paid to the issue, “we’re paving the way for another 9/11-scale tragedy.” Musk replied, saying it is “only a matter of time” before such a disaster unfolds.

Previously, the billionaire argued that the ability of illegal migrants to cross the US-Mexico border and claim asylum without showing any identification “has turned America into a refuge for the world’s worst criminals.” His claim followed reports that Venezuela’s homicide rate had dropped to its lowest in 22 years – with some suggesting this was due to Venezuelan gangs moving to the US. Meanwhile, a Politico report published last month suggested that US President Joe Biden was considering offering permanent residency to millions of illegal immigrants. Musk responded to the news by accusing the US Democratic party of intentionally opening up the southern border in order to “import voters.”

There are currently thought to be around 10.5 million illegal immigrants living in the US, according to data compiled by Pew Research in 2021. However, according to figures from the Department of Homeland Security, at least 6.3 million more have entered the US in the years since. In February, Musk claimed Biden’s plan to keep the Democrats in power was a “very simple” one, which involves getting “as many illegals in the country as possible,” then legalizing those people “to create a permanent majority.” The state of the US-Mexico border has become one of the key issues in US politics over the past year amid a historic influx of millions of immigrants. Republican lawmakers have been demanding tighter controls and more money to be set aside to deal with the border crisis, prompting them to use a multi-billion-dollar aid package for Ukraine as leverage.

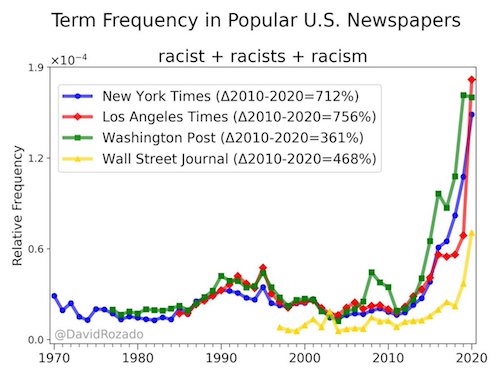

“A lot of people still run under the illusion that the legacy newspapers they read are actually true. There is so much nonsense in them..”

• No Russian Misinfo On X, But Western Influence Ops Present – Musk (RT)

The owner of X (formerly Twitter), Elon Musk, has rejected accusations that Russian misinformation was widespread on his platform. The entrepreneur, who describes himself as a champion of free speech, has been accused of making the social network vulnerable to Russian activities by changing its content moderation protocols after purchasing Twitter in 2022. His latest denial came on Tuesday, while he was discussing X on ‘In Good Company’, a podcast. Host Nicolai Tangen suggested that Russian activity via fake accounts was “huge” in Germany. “We don’t see a lot of Russian activity, to be frank, on the system. We see very little,” Musk responded. “We do see a lot of attempts to influence things, but they seem to be coming from the West, not from Russia.”

Tangen’s remark apparently referred to claims made by Berlin in January. The German government said that the use of specialized monitoring software had allowed it to identify an estimated 50,000 fake accounts engaged in a pro-Russian misinformation campaign on X. Local press claimed that the messaging was strikingly similar to that of the right-wing opposition party AfD. Germany is not alone in its wariness regarding Moscow’s influence; this week US Congressman Mike Turner, who chairs the House Intelligence Committee, accused some fellow Republicans of repeating ‘Russian propaganda’ in the chamber.

“It is absolutely true we see, directly coming from Russia, attempts to mask communications that are anti-Ukraine and pro-Russia messages, some of which we even hear being uttered on the House floor,” the Ohio congressman told CNN’s Jake Tapper. Similar remarks came last week from House Foreign Affairs chair Michael McCaul, another Republican lawmaker. In his interview, Musk hailed X as arguably “the best source of truth on the Internet” that, he argued, by far surpasses traditional news outlets in terms of accuracy thanks to user-driven fact-checking tools. “A lot of people still run under the illusion that the legacy newspapers they read are actually true. There is so much nonsense in them,” he lamented.

“We need to get our employees in Brazil to a safe place or otherwise not in a position of responsibility, then we will do a full data dump..”

• Musk: Starlink Free for Brazil Schools If Government Cancels Contract (ET)

SpaceX CEO Elon Musk has said he will provide Starlink services free of charge for schools in Brazil if the government chooses to follow through and cancel a contract for the service in the country. Many schools in Brazil have reported using the company to provide internet access to their citizens. Starlink terminals connect to the company’s satellites in low Earth orbit and provide high-speed communications. Brazil’s government has reportedly announced plans to suspend all contracts with Starlink. Prompting Mr. Musk to offer the service free of charge. “Starlink will provide free Internet for schools in Brazil if the government won’t honor their contract,” he said in an April 8 social media post. The moves come amid a growing stoush between social media company X, also owned by Mr. Musk, and the Brazilian government.

According to an April 6 post on the platform, the global affairs team announced they were being “forced by court decisions to block certain popular accounts in Brazil.” “We do not know the reasons these blocking orders have been issued. We do not know which posts are alleged to violate the law. We are prohibited from saying which court or judge issued the order, or on what grounds,” the post said. The global affairs team claimed the company had been threatened with fines if they didn’t comply with the order. They also said they were unable to provide a list of which accounts were impacted. “We believe that such orders are not in accordance with the Marco Civil da Internet or the Brazilian Federal Constitution, and we challenge the orders legally where possible,” the post from the global affairs team said.

“The people of Brazil, regardless of their political beliefs, are entitled to freedom of speech, due process, and transparency from their own authorities.” The announcement came after a report by investigative journalist Michael Shellenberger and colleagues David Ágape and Eli Vieira, titled “Twitter Files Brazil.” Mr. Shellenberger said that sitting members of Brazil’s Congress and journalists were among those named by Brazil’s highest court for censorship. He has shared his findings on X. Mr. Musk announced soon after he had removed all content restrictions in Brazil in defiance of the order.

[..] Mr. Musk has made serious allegations of corruption against Justice de Moraes and Brazilian President Luiz Inácio Lula da Silva. In a follow-up April 8 post, Mr. Musk claims that events have since escalated and all Twitter Brazil employees are in danger of arrest. Once safe, he will release the information proving his allegations. “We need to get our employees in Brazil to a safe place or otherwise not in a position of responsibility, then we will do a full data dump,” he said. “They have been told they will be arrested. Save the Brazilian X employees.”

https://twitter.com/i/status/1777796067225989299

“A second AI system, sadistically named “Where’s Daddy?”—and how sick is this?—was then used to track Hamas suspects to their homes..”

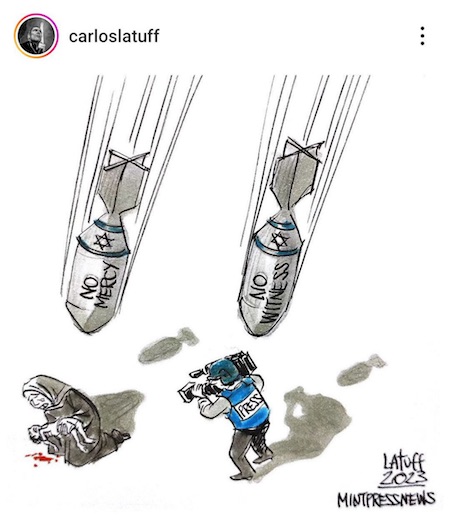

• ‘Automated Murder’: Israel’s ‘AI’ in Gaza (Patrick Lawrence)

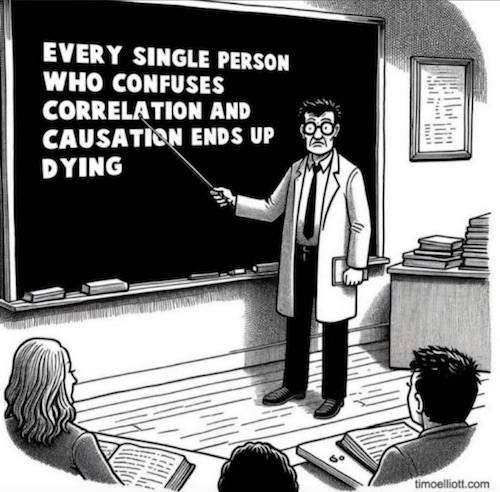

ZURICH—“Technological change, while it helps humanity meet the challenges nature imposes upon us, leads to a paradigm shift: It leaves us less capable, not more, of using our intellectual capacities. It diminishes our minds in the long run. We strive to improve ourselves while risking a regression to the Stone Age if our ever more complex, ever more fragile technological infrastructure collapses.” That is Hans Köchler, an eminent Viennese scholar and president of the International Progress Organization, a globally active think tank, addressing an audience here last Thursday evening, April 4. The date is significant: The day before Köchler spoke, +972 Magazine and Local Call, independent publications in Israel–Palestine, reported that as the Israel Defense Forces press their savage invasion of the Gaza Strip, they deploy an artificial intelligence program called Lavender that so far has marked some 37,000 Palestinians as kill targets.

In the early weeks of the Israeli siege, according to the Israeli sources +972 cites, “the army gave sweeping approval for officers to adopt Lavender’s kill lists, with no requirement to thoroughly check why the machine made those choices or to examine the raw intelligence data on which they were based.” Chilling it was to hear Köchler speak a couple of news cycles after +972 published these revelations, which are based on confidential interviews with six Israeli intelligence officers who have been directly involved in the use of AI to target Palestinians for assassination. “To use technologies to solve all our problems reduces our ability to make decisions,” Köchler asserted. “We’re no longer able to think through problems. They remove us from real life.” Köchler titled his talk “The Trivialization of Public Space,” and his topic, broadly stated, was the impact of technologies such as digital communications and AI on our brains, our conduct, and altogether our humanity.

It was sobering, to put the point mildly, to recognize that Israel’s siege of Gaza, bottomlessly depraved in itself, is an in-our-faces display of the dehumanizing effects these technologies have on all who depend on them. Let us look on in horror, and let us see our future in it. We see in the IDF, to make this point another way, a rupture in morality, human intelligence, and responsibility when human oversight is mediated by the algorithms that run AI systems. There is a break between causality and result, action and consequence. And this is exactly what advanced technologies have in store for the rest of humanity. Artificial intelligence, as Köchler put it, is not intelligence: “It is ‘simulated intelligence’ because it has no consciousness of itself.” It isn’t capable, he meant to say, of moral decision-making or ethical accountability.

In the Lavender case, the data it produced were accepted and treated as if they had been generated by a human being without any actual human oversight or independent verification. A second AI system, sadistically named “Where’s Daddy?”—and how sick is this?—was then used to track Hamas suspects to their homes. The IDF intentionally targeted suspected militants while they were with their families, using unguided missiles or “dumb” bombs. This strategy had the advantage of enabling Israel to preserve its more expensive precision-guided weapons, or “smart” bombs. As one of +972’s sources told the magazine: “We were not interested in killing [Hamas] operatives only when they were in a military building or engaged in a military activity… . On the contrary, the IDF bombed them in homes without hesitation, as a first option. It’s much easier to bomb a family’s home. The system is built to look for them in these situations.”

BUT: “.. if Kiev gets the money, “they will win the war and beat Russia.”

• Ukraine ‘Losing The War’ – Chuck Schumer (RT)

Ukraine is failing on the battlefield because of a lack of American funding, Senate Majority Leader Chuck Schumer said on Monday. He demanded the House Republicans pass the $61 billion aid bill as soon as possible. Schumer, a New York Democrat, brought up Ukraine in a speech about the upcoming US legislative agenda. The Democrat-majority Senate passed the funding proposal in mid-February, but the Republican-majority House has not voted on it yet. “The situation in Ukraine is desperate,” Schumer said, claiming that the funding bill has been “collecting dust” for 55 days while “our friends in Ukraine fight and die on the battlefield with no support.” With each passing day, Ukraine is running out of more soldiers, ammunition and hope, he added. “Let’s be blunt: the biggest reason Ukraine is losing the war is because the hard-right in the Congress has paralyzed the US from acting. That’s it, that’s the reason,” Schumer said.

By passing the bill, House Speaker Mike Johnson would “do the right thing for Ukraine, for America, and for democracy,” the New York Democrat argued. Otherwise, he claimed, the Republicans would hand a “large victory” to Russian President Vladimir Putin. Schumer made much the same argument while visiting Ukraine in late February, claiming that if Kiev gets the money, “they will win the war and beat Russia.” Democrats have sought to split the GOP into “moderates” and “MAGA Republicans” – referring to former US President Donald Trump’s campaign slogan ‘Make America Great Again’ – to get support for their legislative agenda in both chambers of Congress. The tactic has paid off in the Senate, where 22 Republicans voted in favor of funding Ukraine, more than offsetting three Democrats who were opposed.

Republicans currently have a razor-thin majority in the 435-member House, with 218 seats to the Democrats’ 213. Johnson became speaker in late October, after a group of disgruntled GOP lawmakers voted to oust his predecessor Kevin McCarthy for striking a secret deal with the Democrats to pass Ukraine funding. The US has provided Ukraine with $113 billion in various forms of assistance since the start of hostilities. Meanwhile, Russia has repeatedly condemned Western arms shipments to Ukraine, saying these will only prolong the conflict, while making the West a direct participant in the hostilities.

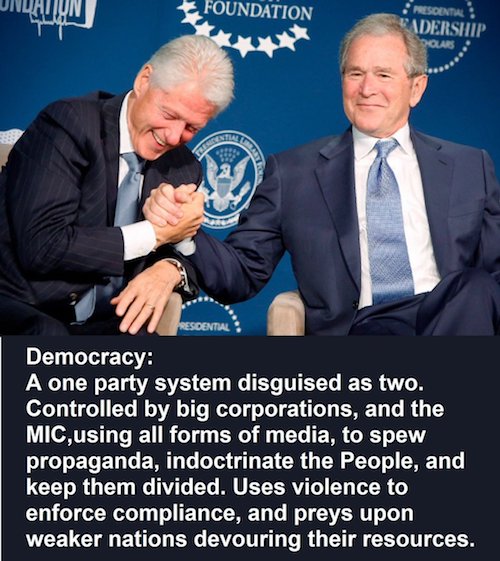

Everybody knows.

• Ukrainian NATO Membership ‘Fundamentally Unacceptable’ – Moscow (RT)

Ukrainian accession to NATO would pose a threat to Russia’s national security and is fundamentally unacceptable, Moscow’s ambassador to the US, Anatoly Antonov, has said. The Russian envoy was responding to comments by US State Department spokesman Matthew Miller, who claimed at a press briefing on Monday that Kiev could become a member of the military bloc once the conflict with Moscow has ended. “Ukraine’s accession to NATO is unacceptable to us under any circumstances,” Antonov stated on Tuesday. “This is a threat to Russia’s national security.” “Only politicians ignorant of the fundamental interests of the Russian Federation can expect that we could accept Kiev’s entry into a bloc which is hostile to us,” he added. Antonov further accused Washington of ignoring Moscow’s core interests and refusing to accept Russia’s “categorical opposition” to Kiev’s potential NATO membership.

Speaking at a NATO foreign ministers meeting in Brussels last week, US Secretary of State Antony Blinken insisted that Ukraine will be allowed to join the bloc, claiming that the commitment of its members to Kiev remains “rock solid.” The purpose of NATO’s next summit in July will be to “help build a bridge to that membership and to create a clear pathway for Ukraine moving forward,” Blinken added. Russia has for years voiced concern about NATO’s expansion toward its borders, viewing the US-led bloc’s policies as an existential threat. Russian President Vladimir Putin has warned for nearly two decades that NATO’s eastward expansion undermines Russian national security, and that moving the bloc’s forces into Ukraine would cross a “red line.” According to Antonov, Moscow offered the West a diplomatic way to defuse tensions over NATO expansion and Ukraine in 2021, but the appeal was rejected by Washington.

Arestovich

Zelensky's advisor, Alexey Arestovich, argued in 2019:

– Attempting to join NATO will pressure Russia to invade

– "Our price for joining NATO is a big war with Russia"

– Predicting the war would start between 2020-22, with remarkable detailshttps://t.co/8iEn5wSUd9 pic.twitter.com/9fmw5X1DYl— Glenn Diesen (@Glenn_Diesen) April 9, 2024

All this ‘pre-war’ talk is crazy irresponsible. Kick ’em by the curb.

• ‘High-Intensity War In Europe No Longer A Fantasy’ – Borrell (RT)

A full-scale military conflict in Europe has become more likely due to the standoff with Russia, the EU High Representative for Foreign Affairs and Security Policy, Josep Borrell, has claimed, while warning member states against relying on the US to defend them. Several other European officials have cited a heightened military threat in recent months, with UK Defense Secretary Grant Shapps saying last week that the world is moving from a “post-war to a pre-war” state due to the alleged threat emanating from Russia, China, Iran and North Korea. Polish Prime Minister Donald Tusk made a similar “pre-war” assessment in March. Speaking at a Forum Europa gathering in Brussels on Tuesday, Borrell claimed that the “possibility of a high-intensity conventional war in Europe is no longer a fantasy” and that the bloc must “do everything to avoid it”.

The EU’s top diplomat alleged that Russia poses a growing threat to the continent, citing the conflict with Ukraine, and accused Moscow of seeking to destabilize the union. According to Borrell, while a military conflict in Europe is not imminent and “not going to start tomorrow,” citizens should understand that the “US umbrella that has protected us during the Cold War and after, may not be open all the time.” “Maybe, depending on who is ruling Washington, we cannot rely on the Americans’ support and American capacity to protect us,” he said. Describing the EU as being surrounded by a “ring of fires” and instability, Borrell called on member states to become more self-sufficient with their security and to ramp up their defense spending.

He added that while NATO is as “irreplaceable” as ever, Europeans should start building their own “pillar” within the US-led bloc. The diplomat acknowledged that Brussels’ stance on the conflicts in Gaza and in Ukraine is not fully shared by many non-Western audiences. Borrel’s remarks follow suggestions from numerous Western civilian and military officials in recent months that Russia could attack NATO within a few years. Speaking in late March, Russian President Vladimir Putin dismissed such speculation as “nonsense.” He argued that talk of a potential Russian attack on Poland, the Czech Republic, or the Baltic countries is propaganda coming from governments that seek to scare their citizens “to extract additional expenses from people, to make them bear this burden on their shoulders.”

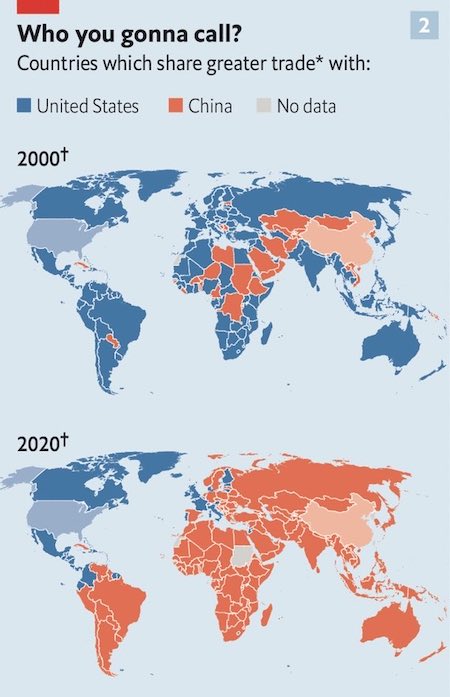

China’s been saying this for a while, but not many in the west seem to know it.

• China Sending Message That ‘It Has Russia’s Back’ If West Escalates (Sp.)

On Tuesday, Russian Foreign Minister Sergey Lavrov met with Chinese President Xi Jinping, sending a strong message to the West that the two countries will continue their strategic relationship. The meeting came a day after US Treasury Secretary Janet Yellen traveled to China and warned it against partnering with Russia. The meeting between Lavrov and Xi, particularly right after Yellen’s visit, is a “message” to the West that China “will have the back of Russia” if the conflict in Ukraine is escalated by the West, lawyer and journalist Dimitri Lascarus told Sputnik’s The Critical Hour on Wednesday. “The timing of announcements such as these tell you a lot,” Lascarus said, pointing to not only Yellen’s visit but the increasingly provocative attacks on Russia by Ukraine’s intelligence services such as the mass shooting outside of Moscow which Russia has blamed Ukraine and its backers in the US and UK for, among other provocations.

“Of course, we have this ongoing drama with little Napoleon in France [French President] Emmanuel Macron, talking about sending a few thousand French troops to their deaths in Odessa,” Lascarus recalled. “I wouldn’t be surprised at all if it has been interpreted by both the Russian and Chinese governments as an attempt to provoke Russia into a direct attack on a NATO country.” “I think [China is] sending a message that China will have the back of Russia if this escalates. And, no one should have any illusions about that,” Lascarus explained. “They see, I believe, that there is a series of escalations happening here and there are no adults in the room, and they need to send an unequivocal signal that China will have Russia’s back in the event that this escalates out of control,” he added.

While neither government has any “reservations about the necessity” of their alliance, Lascarus argued that the West is forcing them to strengthen their relationship because of its aggressive actions. “Every day, Western governments are acting in a way which makes this partnership even more compelling to the Russian and Chinese governments.” With public sentiment turning against the “Ukrainian disaster” in both Europe and the US, Lascarus noted that polls show that the vast majority of French citizens think the country is heading in the wrong direction. “[France] has been one of the primary architects of this disastrous neocon policy in Ukraine,” he explained. “So we’re seeing already, that the political days of these characters are all numbered.” “The real question we have to confront as citizens of the West is, do we have an actual, competent, ethical, and principled alternative to these people? I don’t know that we do. But one thing is for sure, the public has enough and they’re on the way out the door.”

Lavrov

https://twitter.com/i/status/1777580903339876516

“..to literally take over these social networks, [which] all these big tech people thought was going to be this lovely garden of earthly delights and turn it into a prison.”

• ‘Russiagate’ About Seizing Power as Much as Stopping Trump (Sp.)

On Sunday, US Rep. and chair of the House Permanent Select Committee on Intelligence Michael R. Turner (R-OH) claimed that it is “absolutely true” that members of the US Republican party are repeating “pro-Russia messages” on the House floor, without naming the members. The US establishment disproven conspiracy that former US President Donald Trump was controlled by the Kremlin is about seizing control of social media and the internet as much as it is designed to harm Trump’s political ambitions, Serbian-American journalist and columnist Nebojsa Malic told Sputnik’s Fault Lines on Tuesday. Malic argues that the “completely fabricated” Russiagate conspiracy was “not just to sabotage the Trump presidency, but to literally take over these social networks, [which] all these big tech people thought was going to be this lovely garden of earthly delights and turn it into a prison.”

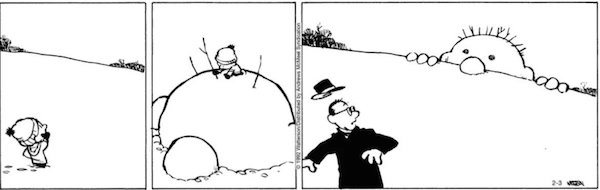

Last year, a panel of federal judges ruled that the US intelligence agencies’ contact with social media companies, urging them to take down specific posts and block or ban certain users, likely constituted government censorship. The administration of US President Joe Biden has appealed the case to the Supreme Court. “Russiagate was the pretext that started this entire ball rolling, and it wasn’t even based on anything real. And now they want to do it all over again,” Malic explained. “I was listening to [Senate Majority Leader, Senator] Chuck Schumer (D-NY) speak yesterday about how Ukraine is losing the war because [House Speaker, Rep.] Mike Johnson (R-LA) doesn’t want to give them money. No, Ukraine is losing the war because it has always been [losing] because it is fighting an industrial war it cannot win,” Malic continued. “The West can’t win because it doesn’t have the industrial capabilities because in the past 30 years, we shut down our industry and turned everything over to finance, but Chuck Schumer is too thick to understand that.”

The reality on the ground in Ukraine has turned many against US support for NATO’s proxy war in Russia, with more Americans (37%) saying the US spends too much on Ukraine than too little (27%) and only 13% responded that they were either “extremely confident” or “very confident” Ukraine will defeat Russia, compared to 49% who say they are “Not too confident” or “Not confident at all.” People are asking “How is this helping freedom and democracy, exactly?” Malic contended. “And [the establishment’s] response is ‘shut up, Russian Agent.’” “This is a breakdown. Because, again, the blob’s agenda is to use Russia’s phantom menace for a power grab at home on one hand, and to push for this geopolitical fantasy that Russia needs Ukraine to be a global empire,” Malic said, explaining that Russia doesn’t want a global empire.

“They voluntarily dissolved the Soviet Union in ‘91, believing all of these stories about freedom and democracy and capitalism and human rights, and they got taken advantage of. Demographically, the country was worse off in the ‘90s than during World War Two,” Malic explained. “When we talk about the golden age of the 1990s, post-Cold War, freedom, democracy, transition from socialism, this is a horror story to these people and nobody in America seems to understand this because they didn’t live through it.” However, Malic said that it is “theoretically possible” that the “blob” actually wants Trump to win the election to give them an excuse to get out of Ukraine. “Maybe they want to get out of this Ukrainian quagmire and blame somebody else for it. They might want Trump to get elected so they can say ‘Okay, well, it’s all his fault. Had we kept the Democrats in power, we would have totally won the war. But, oh, well, what can we do? We just have to move on to the next war,’ which will be China.”

“..from 1789 to 2023, no former or sitting president has faced criminal charges for their official acts, and for good reason..”

• Jack Smith Urges SCOTUS to Reject Trump’s Presidential Immunity Claim (ET)

Special counsel Jack Smith in his final filing before the hearing is urging the Supreme Court to reject former President Donald Trump’s presidential immunity claim and deny any motions to delay a trial on charges related to the 2020 federal election conspiracy case. Prosecutors from the DOJ allege President Trump attempted to overturn the 2020 election result on Jan. 6, 2021, charging him with four counts of conspiracy and obstruction. Former President Trump has denied he did anything wrong by calling for transparency and audits of the vote counts in swing states, and maintains presidential immunity for his actions on that day, which prevents prosecution for any actions he took while still in the top job. In a fresh court brief on April 8, Mr. Smith pressed that President Trump’s argument for presidential immunity over official acts as president has no grounding in the Constitution, the nation’s history, or Americans’ understanding that presidents are not above the law.

“The President’s constitutional duty to take care that the laws be faithfully executed does not entail a general right to violate them,” Mr. Smith said in the brief. “The Framers never endorsed criminal immunity for a former President, and all Presidents from the Founding to the modern era have known that after leaving office they faced potential criminal liability for official acts.” According to Mr. Smith, former President Richard Nixon’s official conduct revealed during the Watergate scandal is the closest historical precedent for this situation. Mr. Smith says President Nixon eventually accepted a pardon from his successor, former President Gerald Ford, and that “his acceptance of a pardon implied his and President Ford’s recognition that a former President was subject to prosecution.”

“Since Watergate, the Department of Justice has held the view that a former President may face criminal prosecution, and Independent and Special Counsels have operated from that same understanding,” he said. Mr. Smith claims that despite President Trump’s claim of presidential immunity, all former presidents knew and wholly understood they were open to facing criminal charges for conduct while in the White House. [..] “The effective functioning of the presidency does not require that a former president be immune from accountability for these alleged violations of federal criminal law,” he said. “To the contrary, a bedrock principle of our constitutional order is that no person is above the law, including the president.”

Former President Trump has continued to argue that official acts by presidents should have immunity from criminal prosecution. Last month, he asked the Supreme Court to hold that he and other former presidents enjoy absolute criminal immunity from prosecution for official acts during their time in office. According to him, from 1789 to 2023, no former or sitting president has faced criminal charges for their official acts, and for good reason. “The President cannot function, and the Presidency itself cannot retain its vital independence if the President faces criminal prosecution for official acts once he leaves office,” President Trump’s brief to the Court says. “The threat of future prosecution and imprisonment would become a political cudgel to influence the most sensitive and controversial Presidential decisions, taking away the strength, authority, and decisiveness of the Presidency.”

[..] the Court has historically upheld a level of presidential independence and ruled in the 1982 decision of Nixon v. Fitzgerald that a president enjoys absolute immunity from civil liability for acts that fall within the “outer perimeter” of his official duties. A secondary issue that may be addressed is the demarkation between personal and official acts during President Trump’s tenure, and a possible separation of actions he can be prosecuted for, and actions covered by presidential immunity. The outcome for the case could impact President Trump’s other legal battles, in which he also argues presidential immunity as a defense. A federal appeals court recently ruled that several civil cases against President Trump related to Jan. 6 could go forward, finding that the actions cited personal acts of a candidate rather than official acts of a president. The question whether this immunity applies to former presidents is also new territory.

He gets blamed for adhering to the Supreme Court decision.

“I blame myself for Lindsey Graham, because the only reason he won in the Great State of South Carolina is because I Endorsed him!”

• Trump Body-Slams Lindsey Graham For Insisting On Nationwide Abortion Limit (ZH)

South Carolina Sen. Lindsey Graham dared to criticize Donald Trump’s new stance advocating that abortion law should be left to individual states — and was promptly subjected to withering fire from the former president. On Monday morning, Trump posted a video in which he implicitly rejected the idea of creating a federal limit on abortions, saying that, in the wake of the Supreme Court’s Dobbs decision that overturned Roe v Wade, abortion is now a state-by-state issue: “States will determine by vote or legislation or perhaps both, and whatever they decide must be the law of the land; in this case, the law of the state. Many states will be different…many will have a different number of weeks, or some will [be] more conservative than others, and that’s what they will be. At the end of the day, this is all about the will of the people.”

The announcement disappointed proponents of a federal ban who had been encouraged by February media reports that Trump had told his advisors and others that he favored a 16-week federal limit on abortions, with exceptions for rape, incest or to save the mother’s life. Graham quickly posted a tweet-thread declaring his “respectful” disagreement with Trump’s new stance, saying that a states’ rights rationale against a federal limit “will age about as well as the Dred Scott decision,” which helped perpetuate slavery. Trump responded via Truth Social, writing that “Senator Lindsey Graham is doing a great disservice to the Republican Party, and to our Country.” He elaborated on the political realities: “[Democrats] love this Issue, and they want to keep it going for as long as Republicans will allow them to do so. Terminating Roe v. Wade was, according to all Legal Scholars, a Great Event, but sometimes with Great Events come difficulties. Many Good Republicans lost Elections because of this Issue, and people like Lindsey Graham, that are unrelenting, are handing Democrats their dream of the House, Senate, and perhaps even the Presidency…”

A few hours later, Trump was back for more, this time chiding both Graham and Marjorie Dannensfelser, who leads SBA Pro-Life America. Dannensfelser had issued a statement saying her organization was “deeply disappointed in President Trump’s position.” With that particular scolding message, Trump took a more philosophical tack, saying Graham and Dannensfelser “should study the 10th Amendment.” A cornerstone of federalism, that final component of the Bill of Rights states that “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.” By deferring to the states on abortion, Trump is taking the truly “conservative” position on the issue, compared to those who advocate for national regulation. As James Madison summed up the federal system:

“The powers delegated by the proposed Constitution to the federal government are few and defined. Those which are to remain in the State governments are numerous and indefinite. [Federal powers] will be exercised principally on external objects, as war, peace, negotiation, and foreign commerce… The powers reserved to the several States will extend to all the objects, which, in the ordinary course of affairs, concern the lives, liberties and properties of the people.” In a third Truth Social posting, Trump threw in another jab at Graham while also boasting about the power of a Trump endorsement: “I blame myself for Lindsey Graham, because the only reason he won in the Great State of South Carolina is because I Endorsed him!”

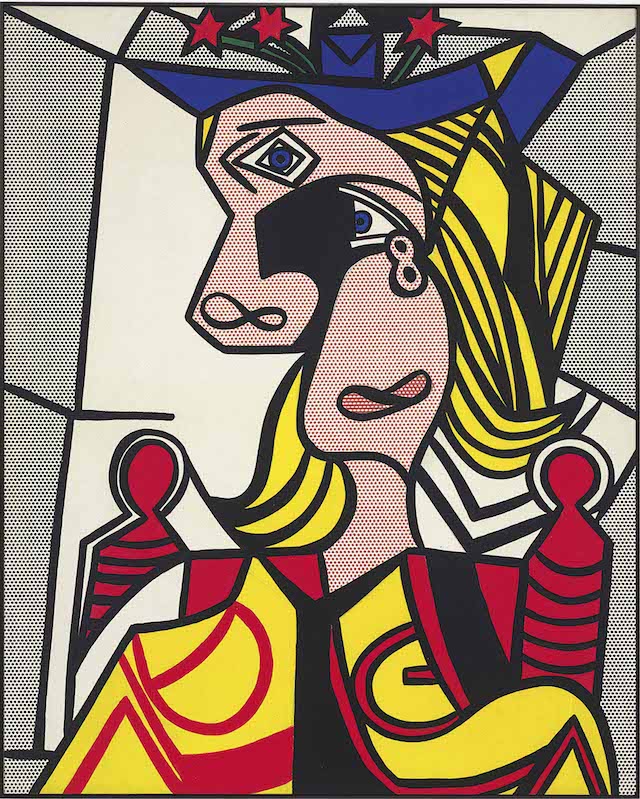

Live 500 meter high in a flat in a 170km straight-line city. No thanks.

• Neom: Saudi Arabia ‘Scales Back’ Goals Of Megacity Project (MEE)

Saudi Arabia has scaled back some of its ambitions for its desert megacity Neom, according to a report by Bloomberg. The $1.5 trillion megacity project, which organisers claim will be 33 times the size of New York City, is due to include a 170km straight-line city. When launching The Line in 2021, the Saudi government had announced that 1.5 million people would be living in the city by 2030. Officials now expect there to be fewer that 300,000 residents by that time, according to a source cited by Bloomberg on Friday. The source said that officials expected only 2.4km of the 170km city to be completed by 2030. As a result of the scaling back, one contractor dismissed some of the workers it employs on site, according to a document seen by Bloomberg.

Neom – part of Saudi Arabia’s Vision 2030 strategy to diversify the economy and move away from oil reliance – is being built in the northwestern Tabuk province. Middle East Eye reported last year that construction was under way on The Line, based on satellite imagery. The Line is due to have no cars or roads, and a high-speed rail service running across the length of the city, Saudi Arabia’s Crown Prince Mohammed bin Salman announced three years ago. Two parallel, mirrored buildings that are nearly 500 metres tall and 120km wide are also planned as part of the project, according to designs uncovered in 2022.

In addition to the horizontal city, Neom is also touted to include an eight-sided city that floats on water, a ski resort with a folded vertical village, and a Red Sea luxury island resort called Sindalah. The Sindalah project is due to open later this year. Sources told Bloomberg that work was continuing on other parts of the Neom project, and Saudi officials still backed the overall aims of The Line. The sources added that Saudi Arabia’s Public Investment Fund, which is providing most of the funding for the project, has yet to confirm its 2024 budget for Neom. The scaling back of the megacity project comes as the Public Investment Fund cash reserves dropped to $15bn in September, its lowest levels since 2020.

Extended video "The Line" —Saudi's Neom Mega-City Project pic.twitter.com/9tFGIhBKdm

— VisionaryVoid (@VisionaryVoid) April 8, 2024

Fell just 2%? Barely a tumble.

• Boeing Shares Tumble After NYT Reveals Whistle-Blower Report (ZH)

Shares of Boeing are moving lower in early afternoon trade following a report from The New York Times of an engineer at the airplane manufacturer turned whistle-blower, revealing that sections of the 787 Dreamliner fuselage are improperly fastened together, posing structural integrity risks. Sam Salehpour, who worked on the 787 Dreamliner fuselage for more than a decade, detailed to NYT in a series of interviews that were packaged into documents and sent to the Federal Aviation Administration that the widebody plane is produced in several large sections by different manufacturers, and not all pieces were the same shape when they were fitted together. He said this could create structural issues over time. On April 17, Senator Richard Blumenthal, a Democrat of Connecticut and the chairman of the Senate Homeland Security and Governmental Affairs Committee’s investigations subcommittee, will hold a hearing featuring Salehpour to address his concerns about the 787 Dreamliner.

“Repeated, shocking allegations about Boeing’s manufacturing failings point to an appalling absence of safety culture and practices — where profit is prioritized over everything else,” Blumenthal said in a statement. Recall, in 2014, an Al Jazeera undercover report found that workers at the 787 factory in South Carolina were not confident in the plane’s manufacturing quality, with at least one worker callin it “f**king sh*t.” “This is the culture that Boeing has allowed to exist,” Katz said, adding, “This is a culture that prioritizes production of planes and pushes them off the line even when there are serious concerns about the structural integrity of those planes and their production process.” Boeing responded to the NYT report and said it was “fully confident in the 787 Dreamliner,” adding, “These claims about the structural integrity of the 787 are inaccurate and do not represent the comprehensive work Boeing has done to ensure the quality and long-term safety of the aircraft.” Investors were spooked by the report, which is yet another issue for Boeing. Shares in New York tumbled 2% around noon.

Heroes

Some heroes don’t wear capes. pic.twitter.com/4s7kGVUvIi

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 9, 2024

Cloud seeding

"Residents want to know why cloud seeding was carried out a day before the worst flooding in 40 years"

Australian TV reported public complaints over Tasmania confirming the operation to spray "salt crystals" into the clouds and linking the action "to save the planet from global… pic.twitter.com/yfcpi95gjg— Camus (@newstart_2024) April 9, 2024

Red Wolf

A beautiful red wolf. There are fewer than 20 red wolves left in the wild. pic.twitter.com/hJw0IzlEw8

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 8, 2024

Humpback

Without a doubt one of the largest Humpback Whales I’ve ever seen!

The scale is truly mind-boggling when you consider each of those dolphins is around 7ft (or 2 meters) long! pic.twitter.com/Ic26Nbwcz5

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 9, 2024

Parkour

https://twitter.com/i/status/1777445115415482483

Swan

The other swans aren't gonna believe this pic.twitter.com/WtIHrxfga1

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 9, 2024

Dolly

Dolly Parton managing to play a D Major chord while wearing acrylic nails will never cease to amaze me pic.twitter.com/I6sCxYynVL

— Historic Vids (@historyinmemes) April 9, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.