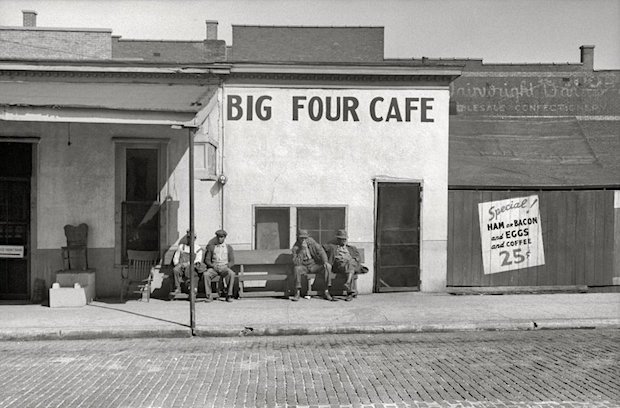

Walker Evans Vicksburg, Mississippi. “Vicksburg Negroes and shop front.” 1936

Watched a fair bit of the Trump team arguments in the Senate yesterday, quite a bit seemed to make sense, but it no longer appears to matter. Tricky, because in the end the law is the law. But what that is, is ultimately up to the Supreme Court. Until it gets involved, every word said is one too many. So I won’t say too much about this.

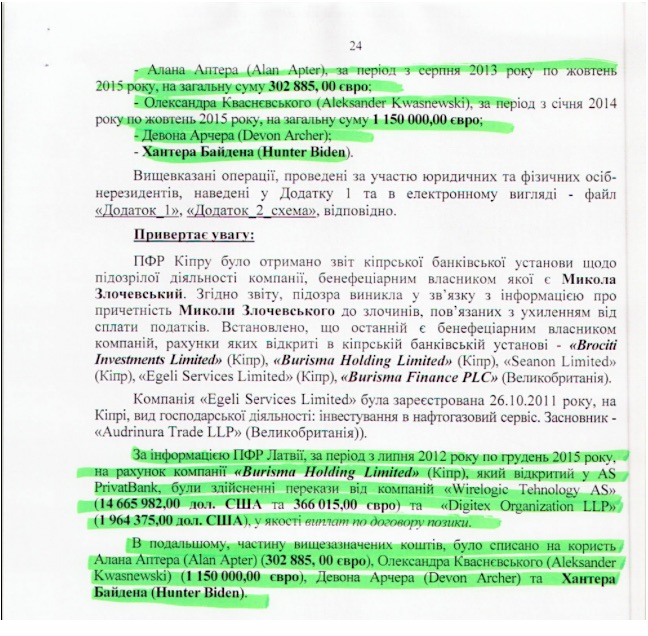

I do wonder why Democrats argue that the Biden corruption story has been debunked (please tell me when and by whom) but the Russia meddling tale stands tall (remember Mueller?). But them, that is just the character of the “conversation”. Everyone only talks to those who already agree with them. Boring as hell. Yesterday, I said:

“There doesn’t appear to be any underlying proof for Bolton’s claim that Trump tied aid to an investigation (or he wouldn’t/couldn’t have held on to it for so long). That in turn makes it another he said/she said topic, and we’ve seen enough of those in this “trial” process.

Moreover, if Trump would have asked for an investigation into a guy who was kicked out of the Navy for cocaine abuse only to land a very plush job just months later at a very corrupt company operating in a field and a country that he knew nothing about, while his dad was US VP, would that have been a high crime?”

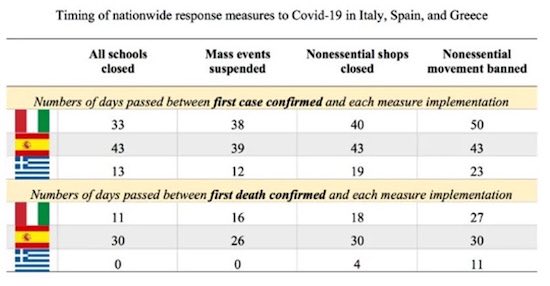

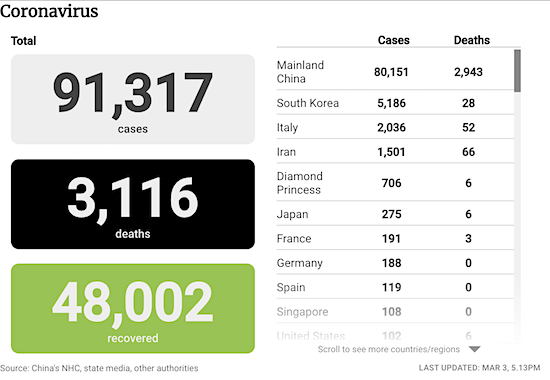

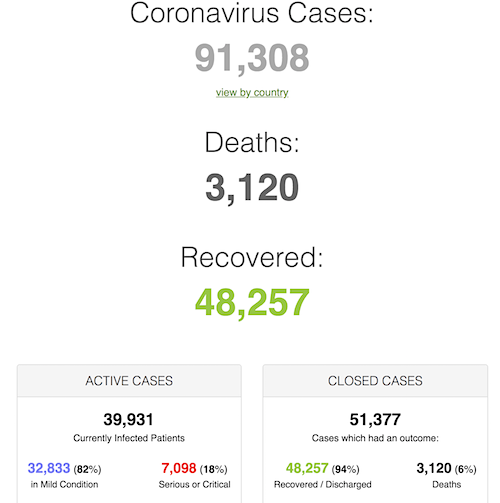

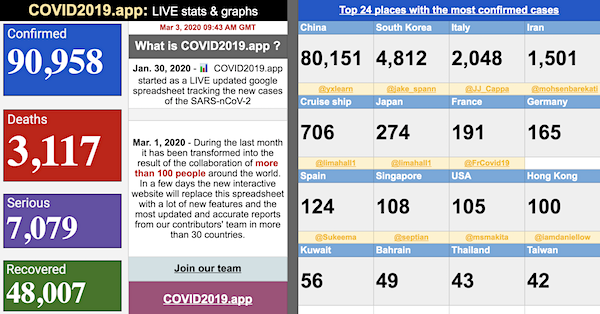

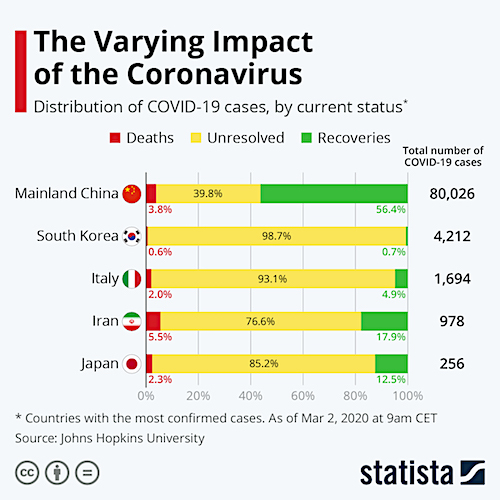

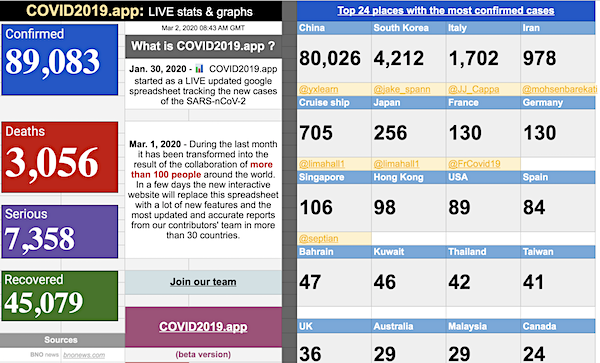

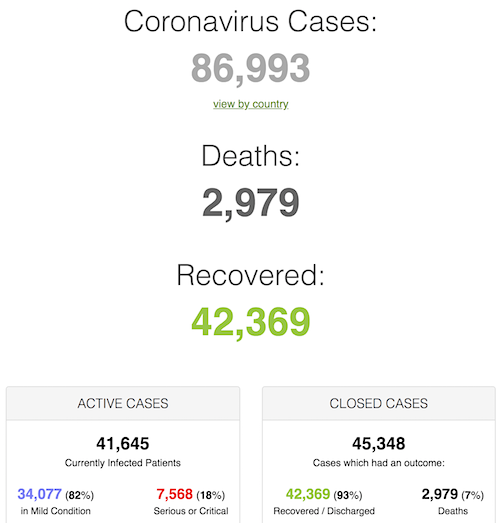

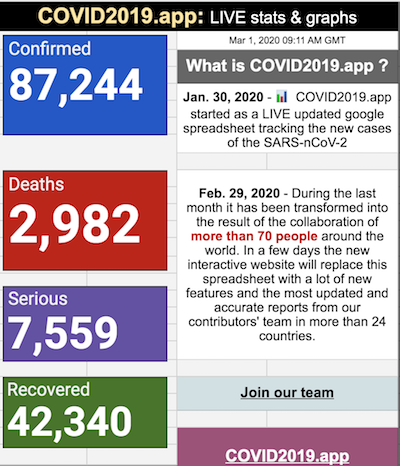

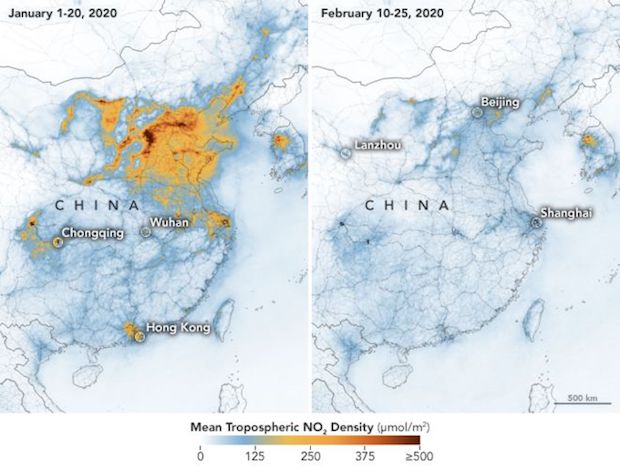

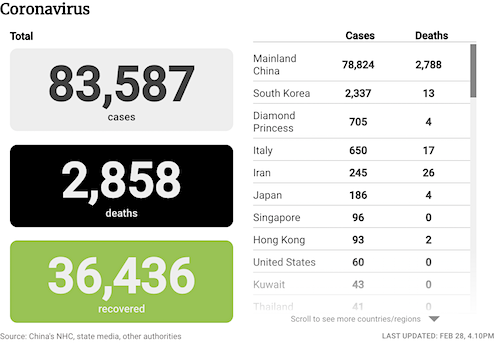

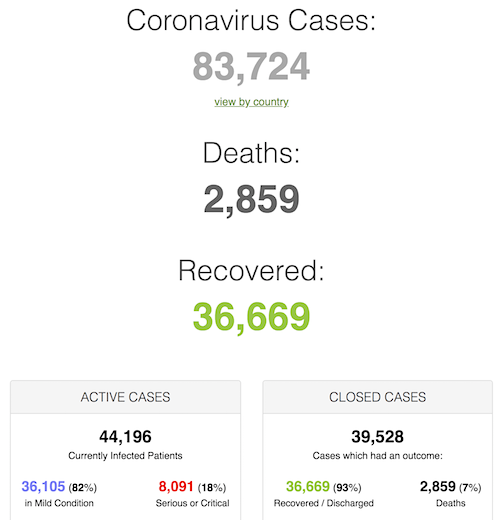

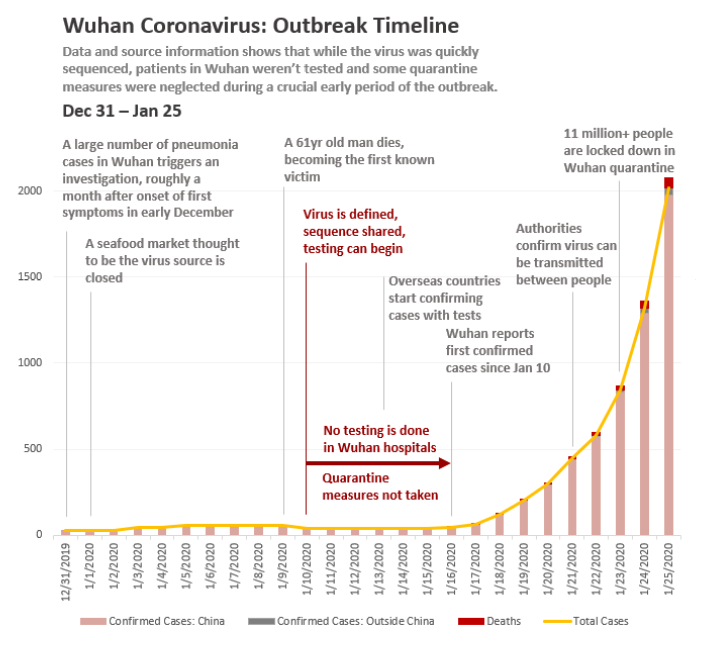

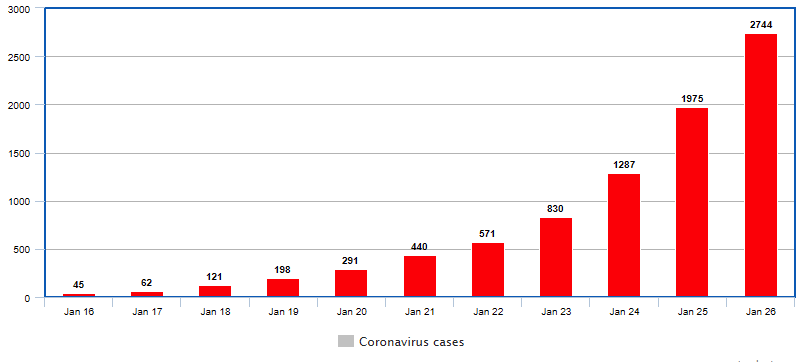

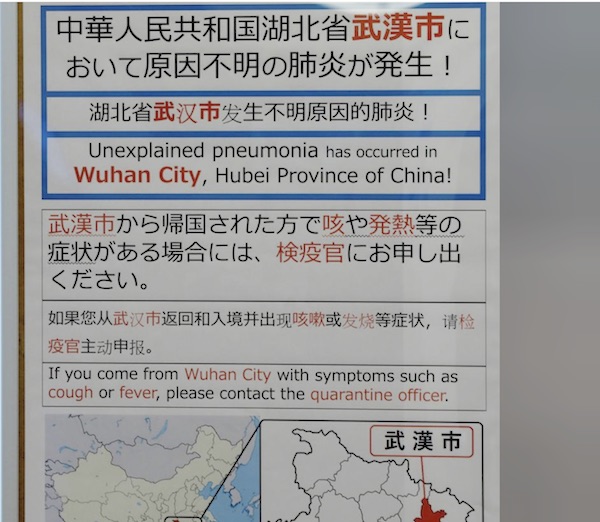

Given developments in the past 24 hours, we can’t very well not focus on the coronavirus. Note: Some of the numbers appear more than once in the articles below, but they all have different numbers as well. China’s official data today say:

• Hubei infections 2,714 (up 1291 overnight – 91% surge).

• China total infections 4,515. (Almost as many cases outside Wuhan as inside. The virus spreads).

• 1,000 people in critical condition

• 30,453 under observation

• ..nearly 7,000 more cases suspected and awaiting confirmation .. From 5,800 Monday

• 2 days in a row of 15 deaths added, followed by 2 days with 25 added. Too much coincidence.

• A few days ago, the big news was a 1,000 bed hospital being built in 1 week. Today, the news is that 100,000 beds (!) are being reserved (opened up) in existing Hubei hospitals.

• China tells people not to travel abroad, US tells Americans not to travel to China. Businesses are getting hurt. So are stock “markets”, obviously.

• Hong Kong scientist says: at the peak of the pandemic [April/May], as many as 150,000 new cases could be confirmed every day in Chongqing alone

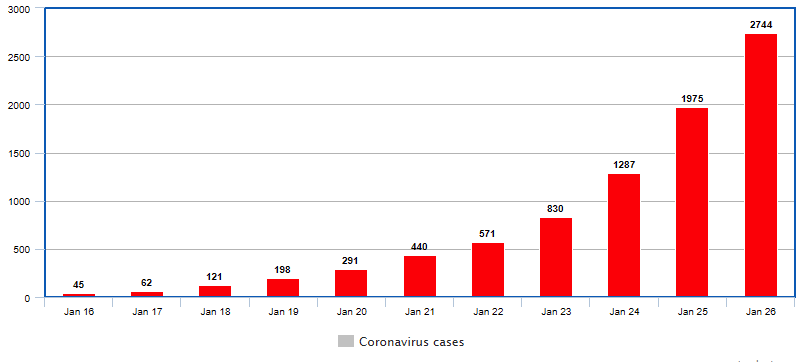

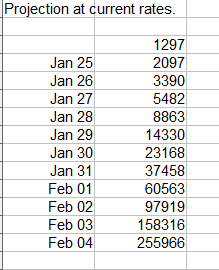

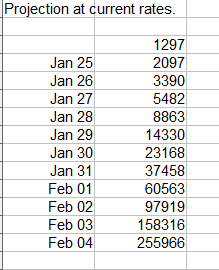

And we are still skirting close to the Fibonacci sequence:

Fibonacci

Medical supplies sent to Wuhan: 14,000 protective suits and 110,000 pairs of gloves. Emergency supplies of 3 million masks, 100,000 protective suits and 2,180 pairs of goggles.

• Coronavirus Has Killed 106 And Infected 4,515 People In China (CNBC)

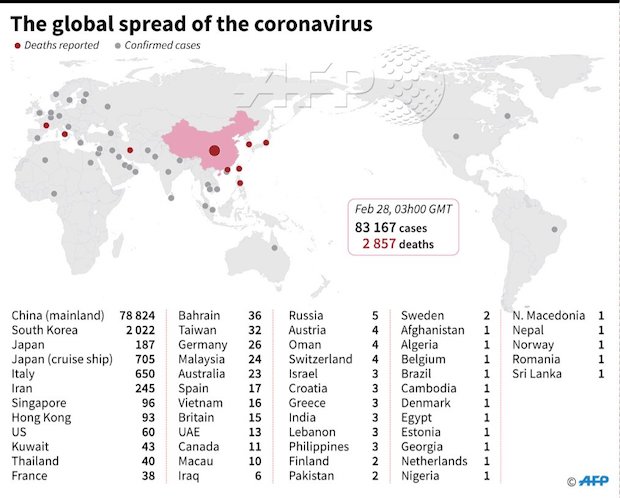

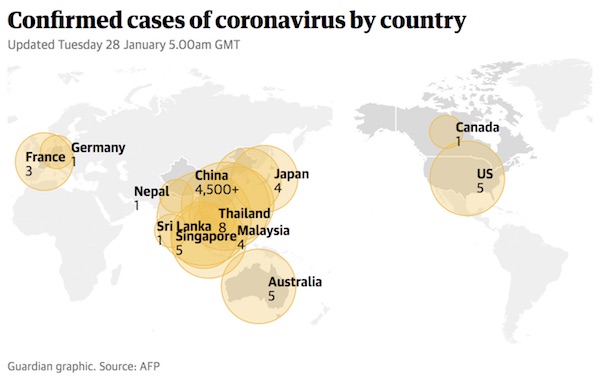

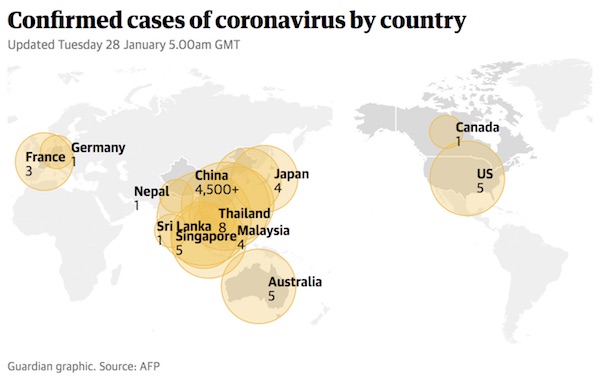

Chinese health authorities said Tuesday that the coronavirus outbreak has killed 106 people and infected 4,515. The officials also said 60 people had been discharged. The majority of the reported cases are in mainland China, where local authorities have quarantined several major cities and canceled Lunar New Year’s events in Beijing and elsewhere. The U.S. Department of State on Monday raised its travel advisory for China from Level 2 to Level 3 asking Americans to “reconsider travel to China due to the novel coronavirus.” They added that some areas have “added risk.” [..] Multiple cases of the virus have been confirmed in Hong Kong, Macao, Taipei, Thailand, Vietnam, South Korea, Singapore, Malaysia, Japan, Australia, France and the United States.

On Monday, local authorities in Germany confirmed the country’s first case. Nepal has confirmed one case. Cambodia confirmed its first case on Monday, according to Reuters, citing Health Minister Mam Bunheng. Sri Lanka also confirmed its first case on Monday, Reuters reports. [..] China stepped up efforts to increase medical supplies to Wuhan that includes transferring 14,000 protective suits and 110,000 pairs of gloves from the central medical reserves, according to the State Council. Emergency supplies of 3 million masks, 100,000 protective suits and 2,180 pairs of goggles were also made available. More than 1,600 medical staff are said to be sent to the Hubei province, where Wuhan is located, to assist in containing the virus.

Read more …

Beijing annd Shanghai may be about to be locked down. Hong Kong residents demand for the border to be closed.

• Coronavirus Death Toll Climbs To 106, Infections Rise To 4,515 (BBC)

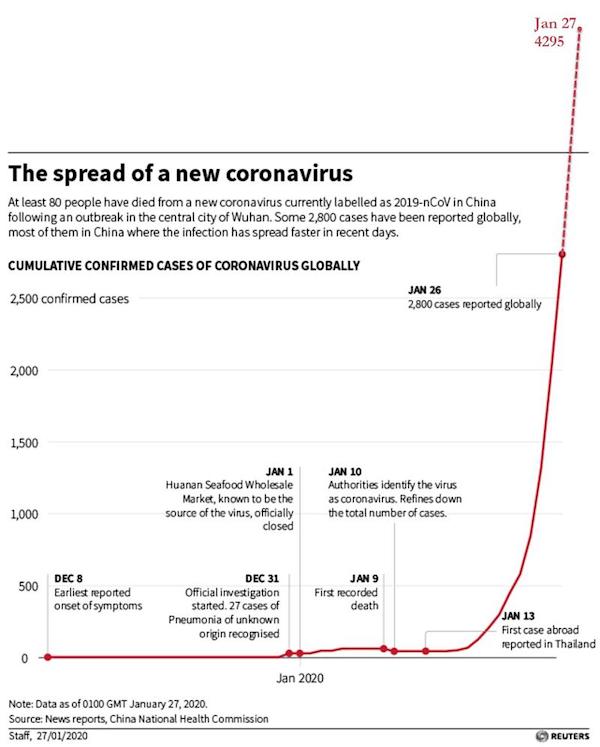

The death toll from the new coronavirus now stands at 106, as cases of new infections have almost doubled in a day, Chinese authorities have said. The number of total confirmed cases in China rose to 4,515 as of 27 January, up from 2,835 a day earlier. Travel restrictions have been tightened and wearing masks in public is now mandatory in some cities. The city of Wuhan is at the epicentre of the outbreak but it has spread across China and internationally. Wuhan, and the province it is located in Hubei, are already effectively in lockdown with transport restrictions in and out of the area.

On Tuesday, the country’s immigration administration encouraged citizens to reconsider the timing of overseas travel to reduce cross-border movement. Beijing and Shanghai have introduced a 14-day observation period for people arriving from Hubei. Of the 106 deaths in China, 100 were in Hubei province while the province’s number of reported infections is at 2,714. Authorities have postponed the new semester for schools and universities nationwide, without giving a resumption date.

Read more …

They will all have to spend 14 days in quarantine.

• US and Japan To Fly Out Citizens As Coronavirus Deaths Rise (G.)

The death toll from the coronavirus has risen to 106, Chinese officials confirmed on Tuesday, as countries scrambled to fly their citizens out of the city at the centre of the outbreak. Japan said it would send a chartered flight to Wuhan on Tuesday night to evacuate its citizens, while the US government is also preparing an airlift. The state department had planned a flight for Tuesday evening, but it was unclear if it would land as scheduled. Both South Korea and France are also aiming to fly out citizens this week. Several countries have also stepped up their warnings over travel to China, including the US, which now advises citizens to avoid non-essential visits to any part of the country.

[..] Around 4,515 cases of the illness have now been recorded across China, with almost 1,000 people in critical condition, according to state media. On Tuesday, Beijing confirmed the city’s first death from the virus. Though the number of cases appears to have risen quickly, from 2,887 on Monday, this was likely to be due to better reporting, and the numbers remain small compared with the population. Japanese foreign minister Toshimitsu Motegi said around 650 Japanese citizens were hoping to return to Japan, and that the first flight could carry around 200 passengers. He added the government was making arrangements for additional flights that would leave for Wuhan as early as Wednesday.

It was not clear if a US flight scheduled to land in Wuhan at 10pm on Tuesday would arrive as scheduled, with some reports suggesting it had been delayed until Wednesday. American citizens have been told there is only limited space available on the plane. [..] China has encouraged citizens to reconsider the timing of overseas travel, and introduced sweeping measures to try to stop the spread of the disease across the country. On Monday, officials postponed the end of this week’s Lunar New Year holiday until at least 2 February in an effort to reduce the chances of infection during what is the country’s busiest travel season. In Shanghai, which has recorded 66 cases of the virus, the end of the holiday has been postponed until 9 February.

Travel restrictions have been announced in many cities, with long-distance bus services banned, while big chains have said they will temporarily close their stores in some areas. There were nearly 7,000 more cases suspected and awaiting confirmation, China’s national health commission said on Monday.

Read more …

Hubei has 2714 cases, but opens up 100,000 hospital beds. Nuff said.

• China Coronavirus Cases Almost Double Overnight (ZH)

• 4,515 Cases confirmed worldwide

• 106 Dead worldwide

• 2714 Cases in Hubei (up 1291 overnight – a stunning 91% surge)

• 100 Dead in Hubei (up 24 overnight – a 24% surge)

While China currently has about 3,000 total cases as reported earlier, according to the latest report from China’s Center for Disease Control, the real number of infections may be substantially higher, because as of Jan 26 (the update for Jan 27 is due shortly) some 30,453 people are currently under observation for the coronavirus. Needless to say, it is very likely that a substantial number of these people will end up positive for the disease, even as the total of people under observation grows by thousands every single day.

Earlier in the day, the epicenter of the coronavirus outbreak, China’s Hubei Province, is opening up 100,000 hospital beds in an effort to contain the disease, the province’s vice governor announced on Jan. 27. In a press conference on Jan. 27 evening, Hubei vice governor Yang Yunyan said authorities have designated 112 medical institutions to treat patients with the deadly novel coronavirus, according to Chinese state media. They have freed up around 100,000 hospital beds in the province, with 3,000 of them in Wuhan city alone, where the disease first broke out. As the Epoch Times observes, “The urgency and scale of the authorities’ orders have raised fears that the outbreak has spread far more widely than authorities admit.”

Read more …

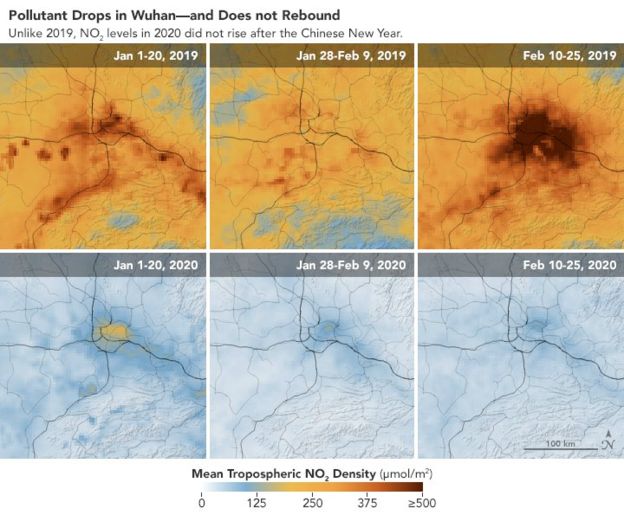

“..peak between late April and early May, and at the peak of the pandemic, as many as 150,000 new cases could be confirmed every day in Chongqing alone..”

• Hong Kong Scientist Insists 44,000 Already Infected In Wuhan (ZH)

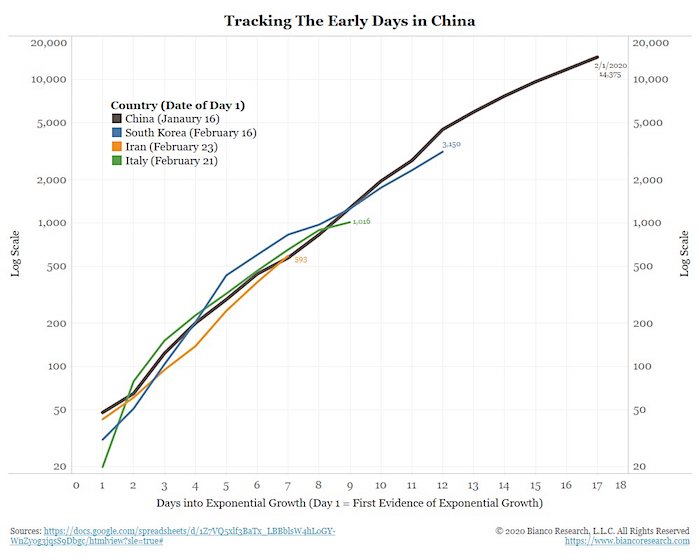

University of Hong Kong academics are urging the city’s government to embrace “draconian” measures to stop history from repeating itself. Hong Kong was rocked by SARS 17 years ago, when the virus – one of seven coronavirus strains (a family that also includes nCoV and MERS) – tore through the city’s financial district, causing 300 deaths, according to the SCMP. As we mentioned earlier, the dean of HKU’s med school revealed research during a presser on Monday showing that the virus had already infected nearly 44,000 people in Wuhan. Meanwhile, Professor Neil Ferguson, at least the second UK academic to publicly share his projections, said over the weekend that 100,000 people could already be infected with the virus around the world, according to the Guardian. Lead researcher and dean of HKU’s faculty of medicine Gabriel Leung said their models indicated that the number of cases in China would double in 6.2 days.

Officials around the world have only confirmed 2901 cases so far, while 2839 of those are in Mainland China. Among other things, Leung said sustained human-to-human transmission has already been proven. “We have to be prepared, that this particular epidemic may be about to become a global epidemic,” he said. Though Leung warned that additional measures to contain the virus could improve projections, the team’s model predicted the number of infections in five mainland megacities – Beijing, Shanghai, Guangzhou, Shenzhen and Chongqing – would peak between late April and early May, and at the peak of the pandemic, as many as 150,000 new cases could be confirmed every day in Chongqing alone because of its large population and intense travel volume with Wuhan.

Since Leung sits on Carrie Lam’s advisory committee, he said he would encourage “draconian” steps to stop the virus, including a travel lockdown, cancellation of all public gatherings, and forcing all companies to come up with work-from-home arrangements. “Substantial, draconian measures limiting population mobility should be taken immediately,” he said, calling for the cancellation of mass gatherings, along with school closures and work-from-home arrangements. Possibly with an eye toward Beijing, Leung called on the government to take “one, two, three or more steps” to broaden the scope of the border closure.

Read more …

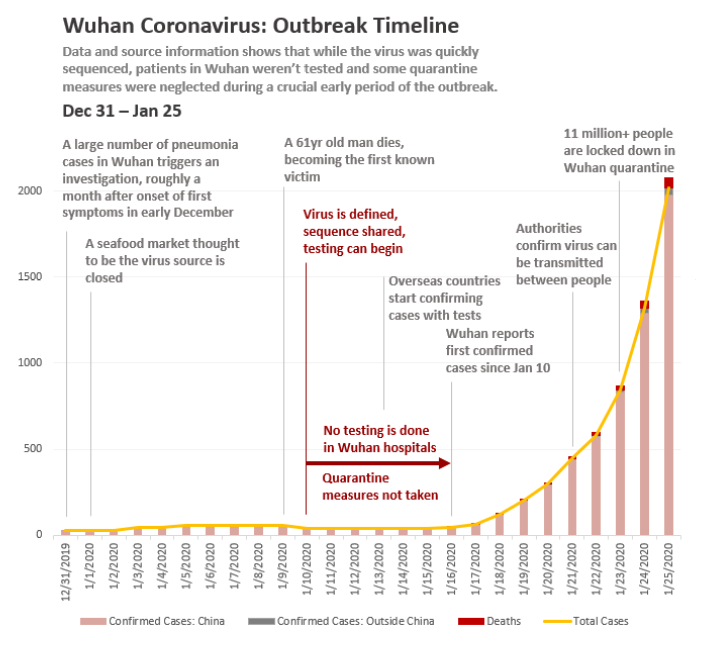

Fist death was Jan 10, but “testing kits for the disease were not distributed to some of Wuhan’s hospitals until about Jan. 20”..

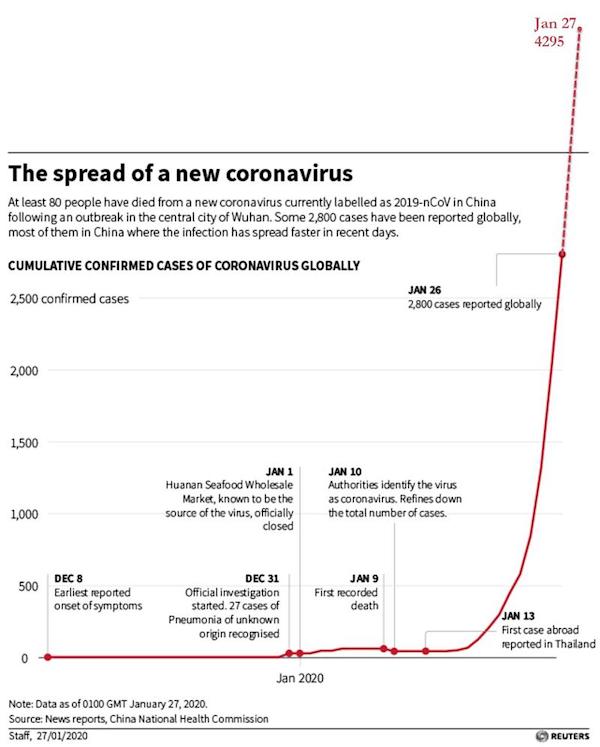

• How Testing Woes Slowed China’s Coronavirus Response (R.)

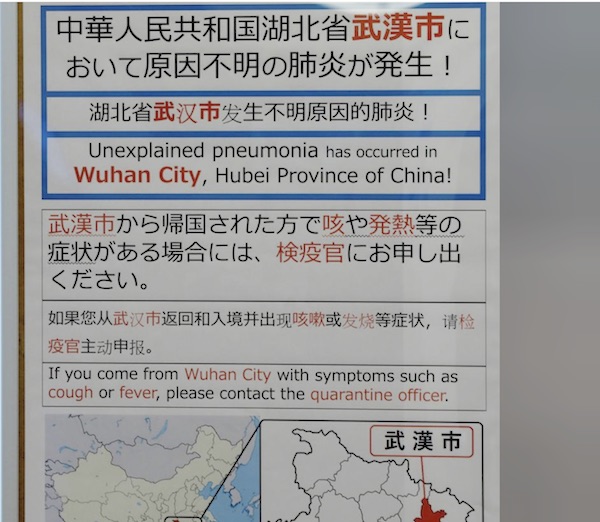

“My brother and I have been queuing at the hospital every day. We go at 6 and 7 in the morning, and queue for the whole day, but we don’t get any new answers,” Zhang told Reuters. “Every time the responses are the same: ‘There’s no bed, wait for the government to give a notice, and follow the news to see what’s going on.’ The doctors are all very frustrated too.” [..] Officially known as 2019-nCoV, the new form of coronavirus was first identified as the cause of death of a 61-year-old man in Wuhan on Jan. 10, when China shared gene information on the virus with other countries. Some, such as Japan and Thailand, started testing travelers from China for the virus within three days.

However, testing kits for the disease were not distributed to some of Wuhan’s hospitals until about Jan. 20, an official at the Hubei Provincial Center for Disease Control and Prevention (Hubei CDC) told Reuters. Before then, samples had to be sent to a laboratory in Beijing for testing, a process that took three to five days to get results, according to Wuhan health authorities. During that gap, hospitals in the city reduced the number of people under medical observation from 739 to just 82, according to data compiled by Reuters from Wuhan health authorities, and no new cases were reported inside China.

REUTERS/Kim Kyung-Hoon

Despite the lack of reliable data and testing capacity in Wuhan, Chinese authorities assured citizens in the days after the virus had been identified that it was not widely transmissible. In previous weeks, it had censored negative online commentary about the situation, and arrested eight people it accused of being “rumor spreaders.” “The doctor didn’t wear a mask, we didn’t know how to protect ourselves… no one told us anything,” a 45-year-old woman surnamed Chen told Reuters. Her aunt was confirmed to have the virus on Jan. 20, five days after she was hospitalized. “I posted my aunt’s photos on (Chinese social media site) Weibo and the police called the hospital authorities. They told me to take it down.”

[..] Wuhan’s mayor, Zhou Xianwang, told Chinese state television on Monday he recognized that “all parties were not satisfied with the disclosure of our information.” But he pointed to strictures placed upon him by provincial and national leaders. “In local governance, after I receive information, I can only release it when I’m authorized,” he said. Zhou told a media briefing on Sunday that a further 1,000 people could be diagnosed with the virus in Wuhan, based on the number of patients yet to be tested.

Read more …

Apple has announced potential iPhone delivery issues.

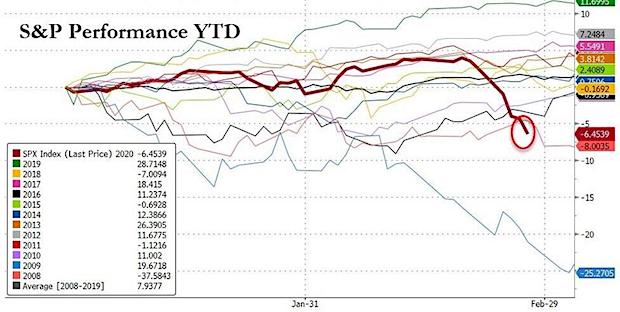

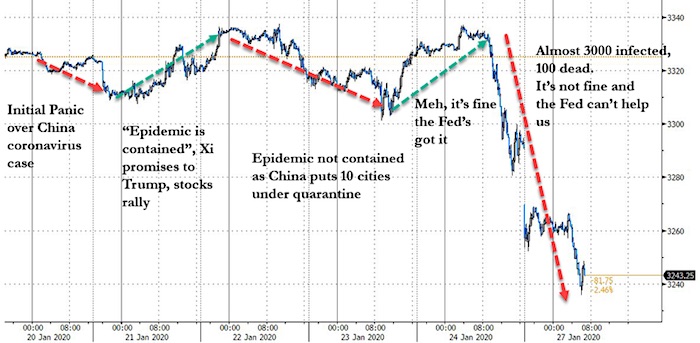

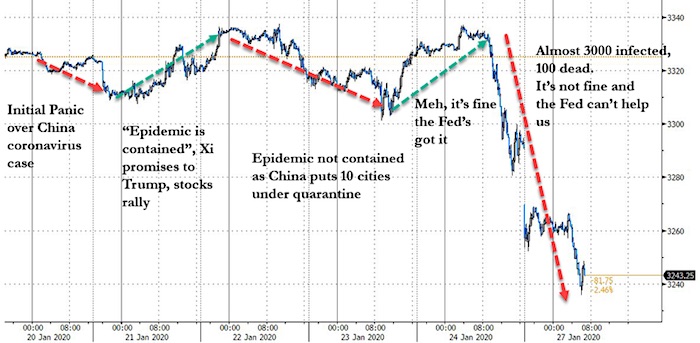

• Coronavirus ‘Significant Threat’ To Chinese Economic Growth (G.)

The coronavirus outbreak will have a “significant” impact on Chinese growth, economists have warned, with the “wildcard” of still unknown infections posing potentially serious risks for the global economy. Shares in Asia Pacific continued to fall on Tuesday in the wake of heavy losses at the start of the week which has seen the death toll from the outbreak in China almost double in two days to 105. The number of infections has risen to 4,500, – that’s up 45% from Monday, with China’s authorities confirming the virus can be transmitted by “respiratory droplet transmission” or by touch. Markets in mainland China are closed until 3 February at the earliest, providing a bulwark to losses, but the financial contagion has spread across Asia and the rest of the world.

South Korea, where a fourth case was confirmed on Tuesday, saw its Kospi index fall more than 3% and Australia’s ASX200 was off 1.3%. Shares in Europe and the US suffered similar heavy losses on Monday. The yuan, China’s currency, dropped to its lowest level for a month. Economists agreed that the outbreak will have a negative impact in China but the lack of understanding about how the virus spreads and how bad it might be was adding to uncertainty to the mix and compounding investor concerns. Citigroup said on Tuesday: “The wildcard is not the fatality rate, but how infectious the Wuhan virus is. The economic impact will depend on how successfully this outbreak is contained.” “The outbreak is developing too rapidly to predict with any confidence the final extent of the economic damage,” said Capital’s chief Asia economist Mark Williams. “But it is now certain that the outbreak will have a significant impact on China’s GDP this quarter.”

Read more …

” The Chinese make up 30% of all tourists visiting Japan and nearly 40% of the total sum foreign tourists spent last year..”

• Japan Warns About Risks To Economy From China Virus Outbreak (R.)

Japanese Economy Minister Yasutoshi Nishimura warned on Tuesday that corporate profits and factory production might take a hit from the coronavirus outbreak in China that has rattled global markets and chilled confidence. Asian stocks extended a global selloff as the outbreak in China, which has killed 106 people and spread to several countries, fueled concern over the damage to the world’s second largest economy – an engine of global growth. “There are concerns over the impact to the global economy from the spread of infection in China, transportation disruptions, cancellation of group tours from China and an extension in the Lunar Holiday,” Nishimura told a news conference after a regular cabinet meeting.

“If the situation takes longer to subside, we’re concerned it could hurt Japanese exports, output and corporate profits via the impact on Chinese consumption and production,” he said. China is Japan’s second largest export destination and a huge market for its retailers. The Chinese make up 30% of all tourists visiting Japan and nearly 40% of the total sum foreign tourists spent last year, an industry survey showed. The outbreak could hit Japanese department stores, retailers and hotels, which count on a boost to sales from an inflow of Chinese tourists visiting during the Lunar Holiday.

Read more …

And it’s early days still..

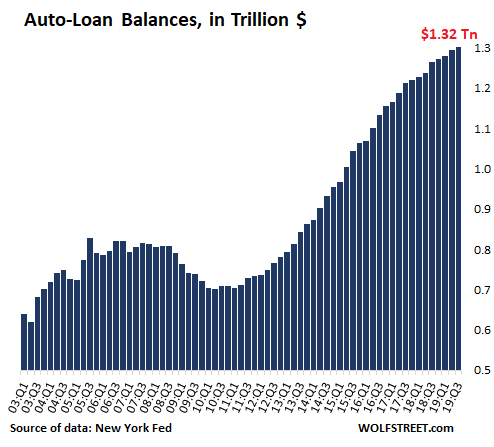

• Coronavirus Prompts Automakers To Evacuate Workers From China (CNBC)

Automakers are withdrawing employees from China and weighing whether to suspend manufacturing in the country as the virus that emerged in the city of Wuhan less than a month ago ravages the mainland. Most major automakers have restricted or banned travel to the country due to the fast-spreading disease, which as of Monday had taken the lives of at least 82 people in China and sickened 2,900 worldwide. Manufacturing in China was temporarily halted in honor of the Lunar New Year, which kicked off this weekend, but normal operations were due to resume this week. Automakers across the globe with operations in China could keep those plants closed even longer, people familiar with the matter said. Automakers with notable operations in Wuhan include GM, Honda and Nissan, which currently has a facility under construction with Wuhan-based Dongfeng.

Honda Motor and PSA Group are withdrawing employees working around Wuhan, a city of 11 million people. A Honda spokesman on Monday confirmed 30 “associates and their families” who work at the plant near Wuhan were being sent home to Japan. PSA Group said in an email to CNBC that the decision to repatriate its employees working in Wuhan will be done “according the proposition of the French authorities in complete cooperation with Chinese authorities.” They are expected to start flying French citizens home from Wuhan by the middle of this week, company spokesman Pierre-Olivier Salmon said. Nissan also has plans to withdraw a majority of its employees and their family members from the Wuhan area back to Japan, a person familiar with the company’s plans told CNBC on Monday.

General Motors, which is by far the largest U.S. automaker in China, is “taking it one day at a time” regarding the outbreak, according to a spokesman. It hasn’t yet decided whether it will extend the work stoppage in China beyond Feb. 2, particularly at an assembly plant in Wuhan that employs about 6,000 workers, he said. The automaker operates 15 assembly plants with Chinese partners in the country. “Out of an abundance of caution, GM has placed a temporary restriction on travel to China,” the company said. “Employees are also reminded to take necessary protection measures suggested by medical authorities. GM will continue to closely monitor this situation.” Others, such as Ford Motor, Fiat Chrysler and Volkswagen of America, are said to be doing the same regarding business operations and travel to the country.

Read more …

Secret deal with the Fed?!

• Boeing Secures Over $12 Billion In Financing To Fight 737 Max Crisis (CNBC)

Boeing has secured commitments of more than $12 billion in financing from more than a dozen banks, according to people familiar with the matter, as the industrial giant shores up its balance sheet amid the nearly yearlong grounding of the 737 Max. The manufacturer was trying to secure a loan of at least $10 billion, CNBC reported last week. [..] The size of the loan, at least $2 billion more than originally sought, is a vote of confidence in the manufacturer from lenders. Boeing is expected to detail its financing strategy when it reports earnings before the market opens on Wednesday.

The financing will be a two-year delayed-draw loan, the people said, meaning that Boeing doesn’t have to use it all immediately, and is set to cost 100 points over Libor. [..] The timing of the jets’ return to service is still uncertain. Boeing last week said it doesn’t expect regulators to recertify the 737 Max until midyear, but the head of the Federal Aviation Administration recently told airlines that the agency’s approval may come before that. New CEO Dave Calhoun told reporters last week that the company is planning to resume 737 Max production before the planes return to service.

Read more …

But it’s the west that’s doing the meddling…

• Oil Chief Urges West To Call Out Foreign Meddling In Libya Conflict (G.)

World powers will be complicit in the collapse of the rule of law in Libya if they do not do more to call out the countries backing those responsible for disrupting the country’s oil exports, the head of the Libyan national oil corporation has said. Mustafa Sanalla said too many western powers were happy to let the countries meddling in Libya sign non-intervention agreements that they had no intention of honouring. He said his country was facing “a disaster and a nightmare” as a nine-day blockade of oil ports by forces loyal to the Libyan National Army (LNA), headed by Gen Khalifa Haftar, continued. Oil production has fallen from 1.2m barrels a day to 260,000 barrels.

Sanalla said production would soon drop to 70,000 barrels, and the cumulative impact would be a loss of $440m. He said it would soon be impossible to pay 1.3m public sector salaries in east and west Libya, requiring the country to look for loans on the international market. The production blockage could also be causing long-term damage to Libyan pipelines, as crude oil left in pipes will corrode them. Sanalla, seen as one of the few authoritative neutral voices in Libya, said: “The international community has to understand that if it tolerates or even rewards those who break the law in Libya, then it will be complicit in the end of the rule of law in our country. And that means more corruption, more crime, more injustice and more poverty.”

He said world powers “seem happy when they secure agreement from a wide range of countries to international statements calling for ceasefires and political settlements. But they know that many of those countries will sign anything and then continue to supply weapons to the war fighters, and to pour poison into social media with their sophisticated disinformation campaigns, undermining the very solutions they have officially supported. “We need not just words but action from UN security council members, particularly the UK, US and France, who all pride themselves on their support for the rule of law. We need them to call out the hypocrisy of those countries – or those within their governments – who prefer instead to pursue their own national interests at the expense of the Libyan people.”

Read more …

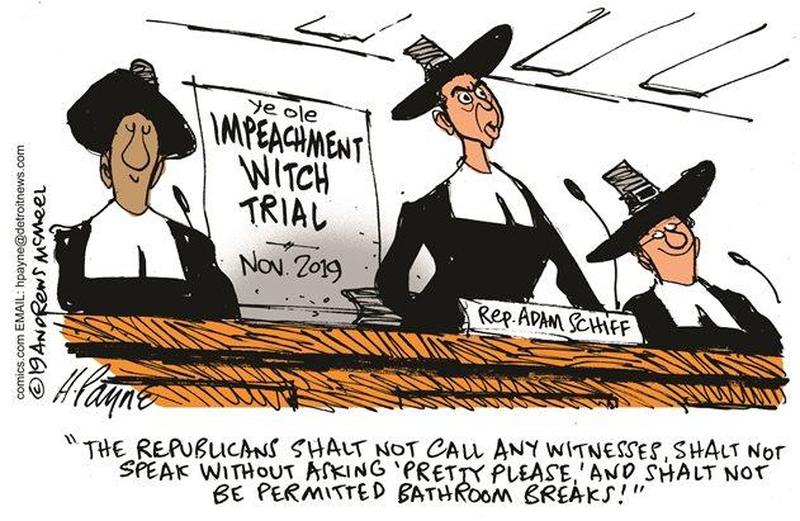

“..Adam Schiff has been hurling false accusations and retailing mendacious narratives for three years. He deserves the most public disgrace that can possibly be arranged..”

• Canary Trap (Kunstler)

Surely Adam Schiff thinks that testimony from John Bolton was his ace-in-the-hole to corroborate the House’s impeachment case. Maybe his staff (of former NSC moles) had a hand in orchestrating the leaks from the NSC to The New York Times at exactly the right moment — hours before Mr. Trump’s lawyers would begin to argue the main body of his defense in the Senate, to produce an orgasmic gotcha. But what if Mr. Trump’s lawyers and confidants were ahead of the scheme and knew exactly when and how Mr. Schiff would call the play? It’s actually inconceivable that Mr. Trump’s team did not know this play was coming. Do you suppose they didn’t know that Mr. Bolton had written a book on contract for Simon & Schuster, and much more?

After all, a president has access to information that even a sedulous bottom-feeder like Mr. Schiff just doesn’t command. Maybe the canary trap is only the prelude to a booby trap — and remember, boobies are much larger birds than canaries. Maybe, despite prior protestations about not calling witnesses, the Bolton ploy will actually be an excuse for Mr. Trump’s defense team to run the switcheroo play and accede to the calling of witnesses. Perhaps they are not afraid of what Mr. Bolton might have to say in the ‘splainin’ seat. Perhaps what he has to say turns out to be, at least, the proverbial nothingburger with mayo and onion, or, at worst, a perfidious prevarication motivated by ill-will against the employer who sacked him ignominiously.

Perhaps Mr. Trump’s lawyers are longing for the chance to haul in some witnesses of their own, for instance the “whistleblower.” It is also inconceivable that the actual progenitor of this mighty hot mess would not be called to account in the very forum that his ploy was aimed to convoke. And from the unmasked “whistleblower,” the spectacle would proceed straightaway to Adam Schiff himself in the witness chair. That will be an elongated moment of personal self-disfigurement not seen in American history since William Jennings Bryan was left blubbering in the courtroom at Dayton, Tennessee, 1925, after he spearheaded the malicious prosecution of John Scopes for teaching evolution in a high school biology class…

…or the moment of national wonder and nausea in June 1954 when Army Chief Counsel Joseph Welch rose from his chair and asked witch-hunting Senator Joseph McCarthy, “At long last, have you left no sense of decency?” In a deeply imperfect world, California’s 28th congressional district has produced a true marvel: the perfect scoundrel. Adam Schiff has been hurling false accusations and retailing mendacious narratives for three years. He deserves the most public disgrace that can possibly be arranged, on nationwide television, with all his many media enablers at CNN and MSNBC having to call the play-by-play. Then the nation needs to expel him from the House of Representatives. And then, maybe, the USA can get on with other business.

Read more …

They must shame him on a daily basis. And the Queen for letting him get away.

• Prince Andrew Told To ‘Stop Playing Games’ Over Epstein Inquiry (G.)

A US lawyer has called on Prince Andrew to “stop playing games” and assist authorities with their investigation into the Jeffrey Epstein sex trafficking inquiry. Lisa Bloom, who represents five of Epstein’s alleged victims, said it was time for the Duke of York to “do the right thing” and speak with investigators in the US. The US attorney Geoffrey Berman said at a news conference on Monday that Andrew had provided “zero cooperation”, despite his lawyers being contacted by prosecutors and the FBI as part of the investigation. Bloom told BBC News on Tuesday: “It is time for anyone with information to come forward and answer questions. “Prince Andrew himself is accused of sexual misconduct and he also spent a great deal of time with Jeffrey Epstein. So it’s time to stop playing games and to come forward to do the right thing and answer questions.”

She said Berman had been left with “no choice” but to comment publicly about Andrew’s alleged lack of cooperation into the investigation. She said: “He [Berman] doesn’t have the power to subpoena Prince Andrew as part of the criminal investigation, so what else can he do except use the power of the press to come forward publicly and say: ‘You know what, Prince Andrew, you said you would fully cooperate with law enforcement and you have not done it.’”] Berman, who is overseeing the Epstein investigation, told reporters outside the disgraced financier’s New York mansion that “to date, Prince Andrew has provided zero cooperation”. Buckingham Palace was not commenting on the matter, but a source said: “This issue is being dealt with by the Duke of York’s legal team.”

Read more …

What year is this?

• Aid Groups Seek Safe Ports For Nearly 500 Migrants Rescued In The Mediterranean (RT)

Nearly 500 migrants rescued in the Mediterranean by two boats run by aid agencies were looking for safe ports in Malta and Italy, the groups said on Monday. The ‘Ocean Viking’ vessel run by SOS Mediterranee in partnership with Doctors Without Borders (MSF) was carrying 407 people rescued in a total of five operations carried out over 72 hours. Another 78 people were taken on board the ‘Alan Kurdi’, run by the Sea-Eye organization based in Germany. They were rescued in two operations. Sea-Eye tweeted on Sunday that the ‘Alan Kurdi’ was headed for Italy, after Malta refused them a safe port.

Ocean Viking has rescued 184 men, women and children on two inflatable rafts, off the Libyan coast. Despite the winter, bad weather, and very few vessels dedicated to the rescue in the area, “boats are still leaving Libya in numbers,” Aloys Vimard, MSF’s coordinator on board the Ocean Viking, told AFP. “The survivors tell us about the deteriorating security situation in Libya where there is active conflict.” MSF had refused an offer to land them at Libya as “it is not a safe place.”

Read more …

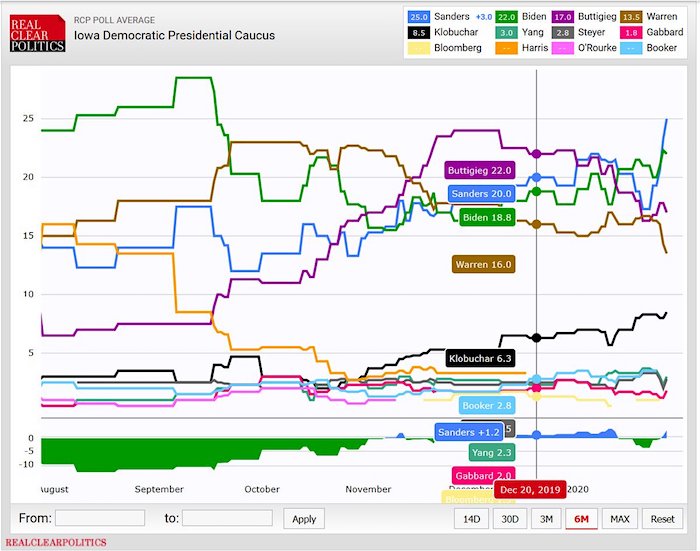

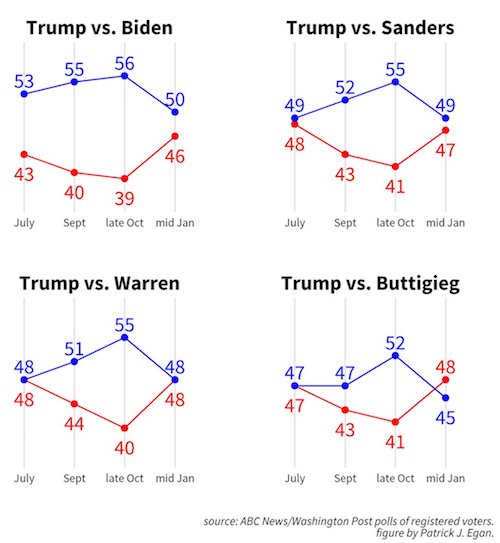

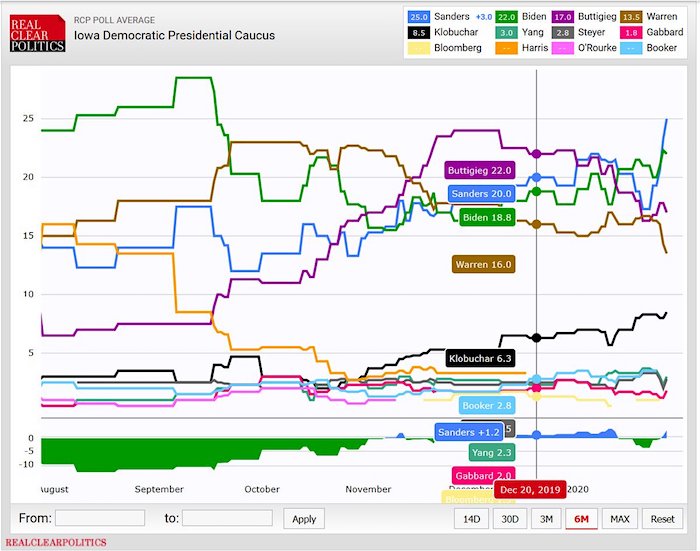

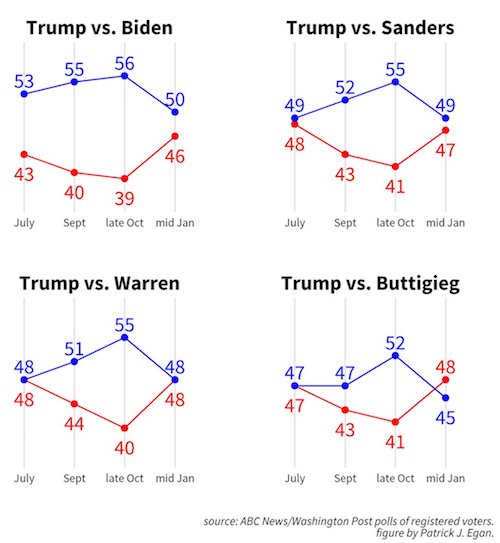

Bernie leads in Iowa one week before the primary, and Trump is catching up on all Democrats.

Include the Automatic Earth in your 2020 charity list. Support us on Paypal and Patreon.