James Ensor Baths at Ostend 1890

Yeadon

Dr. Michael Yeadon says, in his view, the COVID gene-based vaccines are toxic by design

"They have definitely killed 100s of thousands of people bc they trigger blot clotting, neurological problems, immune destruction of tissues & so on. They are just horrible." pic.twitter.com/d8bUYiroi0

— Taylor Hudak (@_taylorhudak) June 21, 2022

“By the far the largest share of Americans—52 percent—say it is Biden’s energy policies that are to blame for high gas prices.”

• Just 11% of Americans Blame Putin for High Energy Prices (BB)

President Joe Biden’s attempts to convince the American people that Russian leader Vladimir Putin is responsible for high gas prices and inflation has failed, polling data released Tuesday showed. “With the biggest single driver of inflation being Putin’s war against Ukraine, @POTUS has taken action to blunt the impact of Putin’s Price Hike for families,” the White Hosue falsely claimed on Monday. The American public is not buying what the Biden White House is selling. Just 11 percent of Americans think Putin is to blame for high energy prices, according to a poll of 1,000 U.S. likely voters taken by Rasmussen between June 16 and June 19. Biden has also sought to blame oil companies and refiners for high prices but just 29 percent find that convincing.

By the far the largest share of Americans—52 percent—say it is Biden’s energy policies that are to blame for high gas prices. Biden has nominated at least two opponents of fossil fuel to key financial regulation posts—although those nominations were ultimately defeated. On the campaign trail, Biden said a number of times that he would end fossil fuels and stand athwart fossil fuel expansion. One of his first actions as president was to cancel the permits needed for the Keystone Pipeline. Biden increased the royalty rate—essentially, a tax rate—on oil production on federal lands by 50 percent this year, the first hike in 100 years. It’s only now that high gas prices have become a political liability for the president that his administration has pivoted to claiming the Biden administration is not opposed to fossil fuel extraction.

Eighty percent of Republicans think Biden’s policies are most to blame for rising fuel costs. Most troubling for Biden, 54 percent of voters not affiliated with either major party blame Biden. Among Democratic voters, only 24 percent blame Biden, 46 percent blame major oil companies, and 20 percent blame Putin. So Biden’s “Putin price hikes” message is not even resonating within his own party. The issue of gas prices has increasing salience with voters. Ninety-two percent of voters view the rising price of gasoline, home heating oil and other petroleum products as a serious problem, including 68 percent who consider rising fuel costs a Very Serious problem. In April, 83 percent said rising petroleum prices were a serious problem.

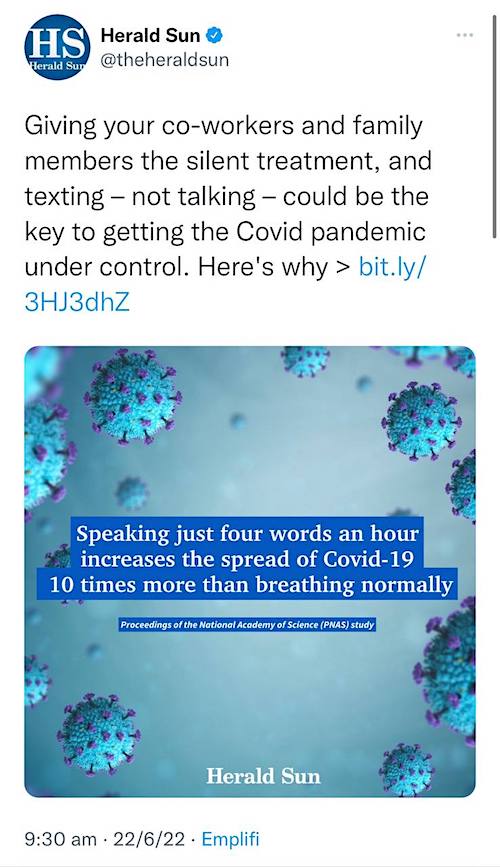

A single word

Current state of affairs … in a single word.

Sound ON pic.twitter.com/OTH2RjdNGP

— Wall Street Silver (@WallStreetSilv) June 21, 2022

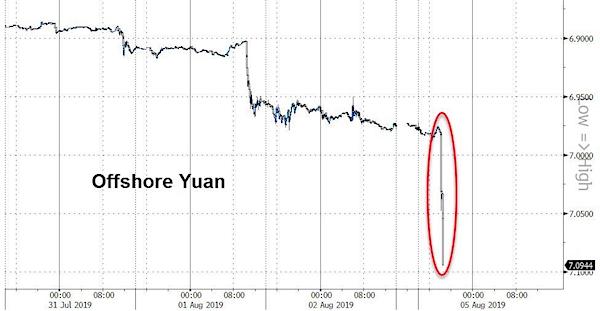

Will it get too strong?

• Ruble Rises To Seven-year High, Best Performing Currency In The World (BNE)

Russia’s ruble jumped 6% against the euro on June 21 to a seven-year high, making it the best performing currency in the world. By 1338 GMT, the ruble had gained 6.3% to trade at 58.75 versus the euro , its strongest point since early June 2015, reports Reuters. And the ruble was up 4.6% against the dollar at 57.47, just below the 57.0750 it traded at on June 17, its strongest level since late March 2018. Analysts say the rate is largely artificial as its value has been boosted by the strict capital controls imposed by the Central Bank of Russia (CBR) following Russia’s invasion of Ukraine on February 24.

The value has also been pushed up by soaring commodity prices that has earned Russia a windfall of over €100bn of payments for oil and gas exported to Europe since the war began. The value has been lowered further by the extreme sanctions imposed by the West on Russia that has seen the volume of imports, predominantly equipment and machinery, cut in half leading to record current account surpluses. Some economists have dubbed the current strong ruble “Dutch Disease on steroids” as the value of the currency is being pushed up by the same commodity export inflows that pushed up the Netherlands guilder when that country began to produce gas.

The government has become concerned by the high level of the ruble and is working to weaken it back to its fair value that economists estimate to be around RUB65-70. However, with the sanctions in place the authorities have fewer tools at their disposal. The so-called budget rule that automatically syphons off excess earnings to the National Welfare Fund (NWF) to sterilise them has been suspended after the West seized some $300bn of CBR reserves. Another alternative is to reduce the inflow of revenues from raw material exports.

“Total imports from Russia increased 80% year-on-year to almost $10.3 billion.”

• Russia Leapfrogs Saudi Arabia As China’s Biggest Oil Supplier (Fortune)

Russia has reclaimed its position as China’s biggest oil supplier, overtaking Saudi Arabia in May as Beijing cashed in on discounted Russian energy. Last month, Chinese imports of Russian oil surged by 55% from a year earlier, according to data from the Chinese government. The increase meant Russia surpassed Saudi Arabia as China’s biggest source market for oil, recovering the top spot after a gap of 19 months. China imported around 8.42 million tons of crude oil from Russia in May, the data showed—the equivalent of 1.98 million barrels per day, according to Reuters. Meanwhile, China’s purchases of Russian liquefied natural gas rose 54% from the previous May. Total imports from Russia increased 80% year-on-year to almost $10.3 billion.

China and Russia have maintained strong political and economic ties since the latter’s invasion of Ukraine, with the country’s two presidents holding a “warm and friendly” phone call last week in which they committed to deepening the relationship between their two countries. Western sanctions on Russian energy in the wake of the invasion of Ukraine have forced Moscow to slash the price of its energy exports as it searches further afield for buyers to plug the gap set to be left by Europe. In May, Reuters reported that the spot price of Russian oil was around $29 less per barrel than it was before the invasion of Ukraine and well below the price of oil from the Middle East, Africa, the U.S. and Europe.

The price of Urals—Russia’s main export blend—averaged $73.24 a barrel between mid-April and mid-May, according to Bloomberg, making it almost a third cheaper than Brent crude futures over the same period. Urals is usually traded at a discount to Brent crude, but the gap between the price of the two products is reported to have widened drastically since Russia invaded Ukraine in late February. According to data from Finnish fuel refiner Neste, Urals was priced, on average, at $33.63 less than Brent over the five days to Monday. A year earlier, the price difference was around $1.50, according to Neste.

“As the locked-down multitudes spent some of their furlough money on scarce imports, prices began to rise.”

• Inflation as a Political Power Play Gone Wrong (Varoufakis)

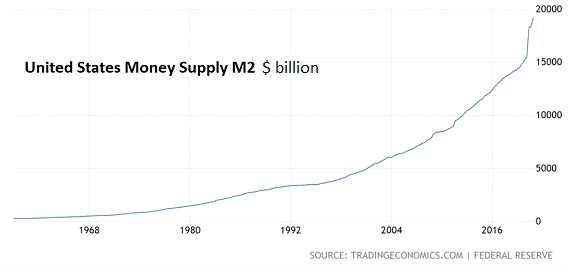

For 50 years, the US economy has sustained the net exports of Europe, Japan, South Korea, then China and other emerging economies, while the lion’s share of those foreigners’ profits rushed to Wall Street in search of higher returns. On the back of this tsunami of capital heading for America, the financiers were building pyramids of private money (such as options and derivatives) to fund the corporations building up a global labyrinth of ports, ships, warehouses, storage yards, and road and rail transport. When the crash of 2008 burned down these pyramids, the whole financialized labyrinth of global just-in-time supply chains was imperiled. To save not just the bankers but also the labyrinth itself, central bankers stepped in to replace the financiers’ pyramids with public money.

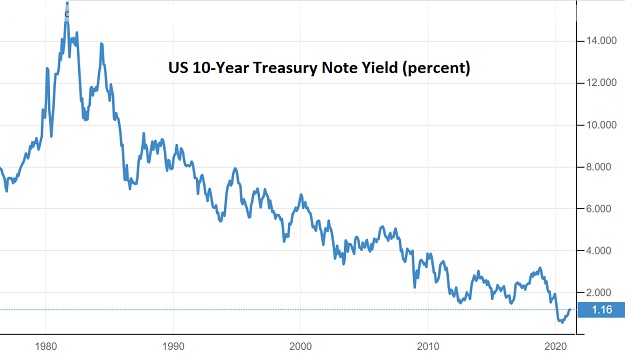

Meanwhile, governments were cutting public expenditure, jobs, and services. It was nothing short of lavish socialism for capital and harsh austerity for labor. Wages shrunk, and prices and profits were stagnant, but the price of assets purchased by the rich (and thus their wealth) skyrocketed. Thus, investment (relative to available cash) dropped to an all-time low, capacity shrunk, market power boomed, and capitalists became both richer and more reliant on central-bank money than ever. It was a new power game. The traditional struggle between capital and labor to increase their respective shares of total income through mark-ups and wage increases continued but was no longer the source of most new wealth.

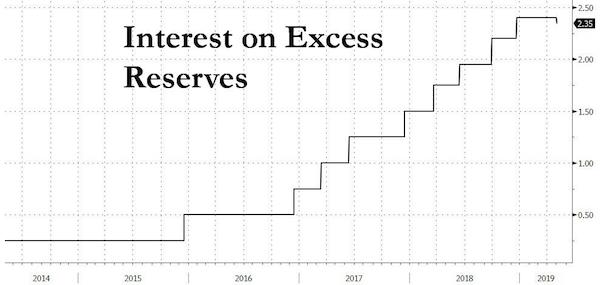

After 2008, universal austerity yielded low investment (money demand), which, combined with plentiful central-bank liquidity (money supply), kept the price of money (interest rates) close to zero. With productive capacity (even new housing) on the wane, good jobs scarce, and wages stagnant, wealth triumphed in equity and real-estate markets, which had decoupled from the real economy. Then came the pandemic, which changed one big thing: Western governments were forced to channel some of the new rivers of central-bank money to the locked-down masses within economies that, over the decades, had depleted their capacity to produce stuff and were now facing busted supply chains to boot. As the locked-down multitudes spent some of their furlough money on scarce imports, prices began to rise.

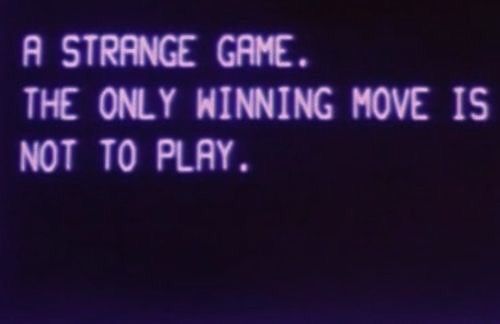

Corporations with great paper wealth responded by exploiting their immense market power (yielded by their shrunken productive capacity) to push prices through the roof. After two decades of a central-bank-supported bonanza of soaring asset prices and rising corporate debt, a little price inflation was all it took to end the power game that shaped the post-2008 world in the image of a revived ruling class. So, what happens now?

Inflation

https://twitter.com/i/status/1539163807729303552

“Biden has thoroughly backed up Republican-appointed Federal Reserve Chairman Jerome Powell in endorsing a financial crash in hope that it will roll back U.S. wage levels.”

• The Fed’s Austerity Program to Reduce Wages (Michael Hudson)

The Federal Reserve Board’s ostensible policy aim is to manage the money supply and bank credit in a way that maintains price stability. That usually means fighting inflation, which is blamed entirely on “too much employment,” euphemized as “too much money.”[1] In Congress’s more progressive days, the Fed was charged with a second objective: to promote full employment. The problem is that full employment is supposed to be inflationary – and the way to fight inflation is to reduce employment, which is viewed simplistically as being determined by the supply of credit.

So in practice, one of the Fed’s two directives has to give. And hardly by surprise, the “full employment” aim is thrown overboard – if indeed it ever was taken seriously by the Fed’s managers. In the Carter Administration (1777-80) leading up to the great price inflation of 1980, Fed Chairman Paul Volcker expressed his economic philosophy in a note card that he kept in his pocket, to whip out and demonstrate where his priority lay. The card charted the weekly wage of the average U.S. construction worker. Chairman Volcker wanted wages to go down, blaming the inflation on too much employment – meaning too full. He pushed the U.S. bank rate to an unprecedented 20 percent – the highest normal rate since Babylonian times back in the first millennium BC. This did indeed crash the economy, and with it employment and prosperity.

Volcker called this “harsh monetary medicine,” as if the crash of financial markets and economic growth showed that his “cure” for inflation was working. Apart from employment and wage levels, another victim of Volcker’s interest-rate hike was the Democratic Party’s fortunes in the 1980 presidential election. They lost the White House for twelve years. The party thus is taking great courage – or simply being ignorant – by entering on this autumn’s midterm election by emulating Mr. Volcker’s attempt to drive down wage levels by financial tightening, which already has crashed the stock market by 20 percent. President Biden has thoroughly backed up Republican-appointed Federal Reserve Chairman Jerome Powell in endorsing a financial crash in hope that it will roll back U.S. wage levels. That is the policy of the Democratic Party’s donor class and hence political constituency.

“We have to think ahead. And that’s not something the last outfit did very well. That’s something we’ve been doing fairly well. That’s why we need the money. Thank you all very much.”

• Biden: We Need More Money for the Second Pandemic (Celente)

President Joe Biden warned Americans Thursday that there is going to be a second pandemic and we need to be ready. Transcript from the White House: “Well, we’ll get through at least this year. We do need more money. But we don’t just need more money for vaccines for children, eventually; we need more money to plan for the second pandemic. There’s going to be another pandemic. We have to think ahead. And that’s not something the last outfit did very well. That’s something we’ve been doing fairly well. That’s why we need the money. Thank you all very much.”

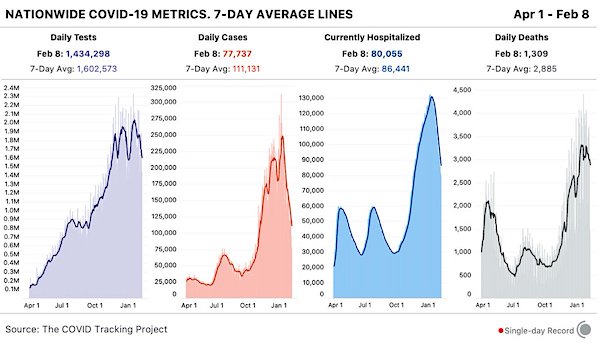

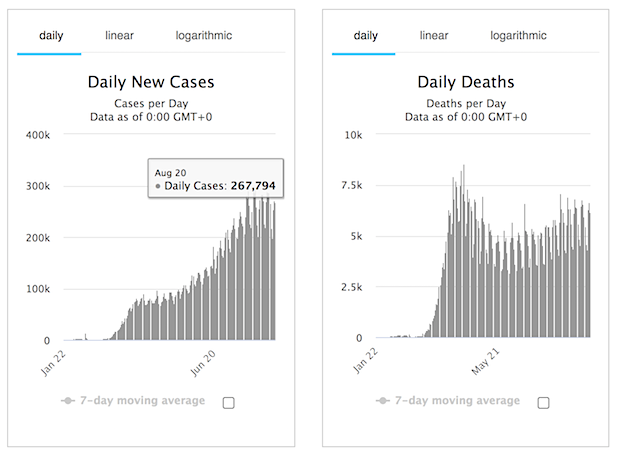

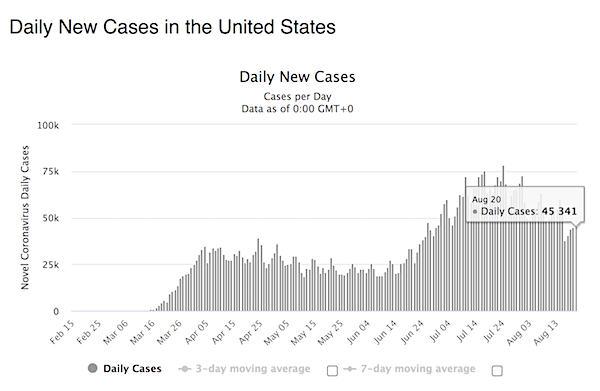

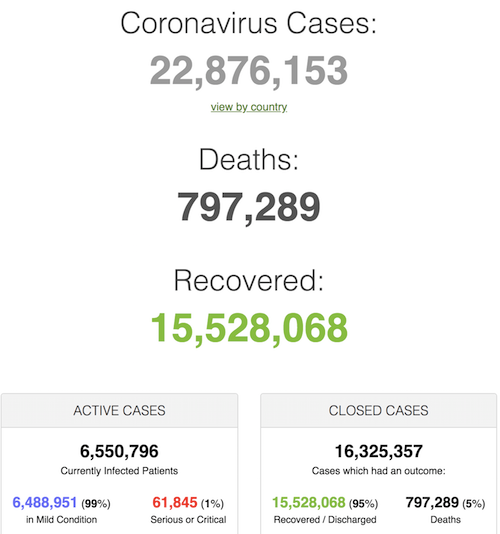

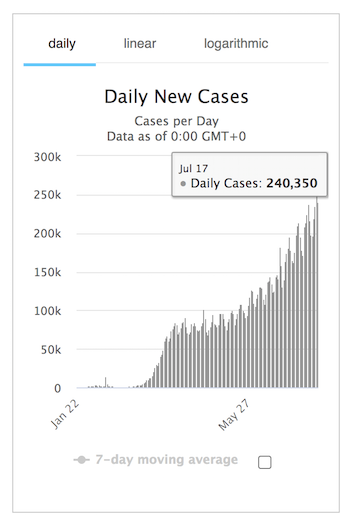

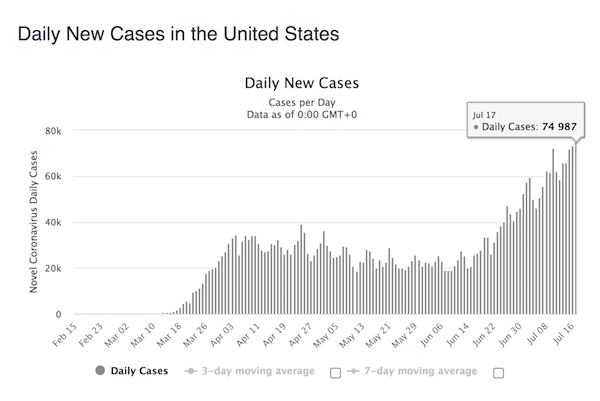

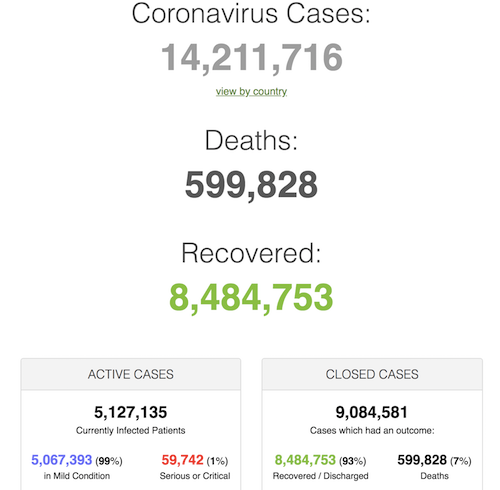

Bloomberg reported last week that researchers believe that there is a 50/50 chance of another pandemic in the next 25 years. The report said that the Biden administration wants $88.2 billion in funding to adjust the pandemic preparedness in the U.S. to focus on a central White House response. “The plan is aimed at avoiding confusion that has plagued the U.S. pandemic response. The government would need to invest tens of billions of dollars to back the ideas in the new plan to strengthen U.S. biodefense, people familiar with the new plan told Bloomberg.” 1 Americans are still getting infected with COVD. About 300 people in the United States are dying from the virus each day and the average number of new infections each day was over 100,000 since the end of May.

“So buy Italy, sell Germany, and ignore anyone who says sell dollars.”

• Be Warned, A Full-blooded European Sovereign Debt Crisis Is Coming (Blain)

Welcome to the age of divergence! A new long-term trend is upon us. Buy Dollars, Sell Europe. Unfortunately, it’s likely to play into Putin’s hands in Ukraine. Hurts to say it, but Europe is going to struggle most with what’s coming next. It’s got limited choices between galloping inflation, economic misery, and political instability. Being Europe, there is a significant risk it’s likely to reap the non-benefits of all three. After the US and UK hiked interest rates this week, the global inflation threat is so pronounced that even the Swiss National Bank surprised markets by joining the central bank tightening trend. The Bank of Japan – well, they have a different view, keeping up QE and zero interest rates, but they have a different demography, and a tumbling yen that doesn’t particularly bother them.

Thus far, central banks are struggling in this crisis. Addressing the massive exogenous inflation shock of the Ukraine war, following the exogenous shock of the pandemic with 50 basis point rate hikes, feels like treating a gaping flesh wound with a kid’s sticky plaster. It isn’t going to stop inflation. The Bank of England is now predicting Q3 inflation of 11% and raising interest rates is a massive problem for markets. Reading through acres of market research, the credibility of central banks is being called into question around the globe. They face a devil or the deep blue sea choice – how to a) preserve jobs and economic stability by avoiding a market crash, or b) slash inflation? And/or is not an option. It’s a thankless task, made more complex by the consequences of the last 13 years of monetary experimentation.

The ECB? It exists in the same economic world as the rest of us. But being a committee of 19 national members makes it somewhat unwieldy. At the best of times, steering an economy with imprecise monetary tools is challenging. For the ECB, it’s a compromise at best. That’s a major reason that 10 years after the last European Sovereign Debt Crisis, absolutely nothing is fixed about the debt-raddled south. [..] A full-blooded European Sovereign Credit Crisis is coming, and perversely it will give us a clear investment winner! I am not for one second suggesting Italy is an attractive investment proposition, but it’s a screaming speculative opportunity! Buy Italy!

That’s because keeping Italy and several other debt-stressed members in the Euro remains the defining policy of the ECB, and thus the European Union. So buy Italy, sell Germany, and ignore anyone who says sell dollars. Why would you? The US may longer be the globally trusted world policeman, but it’s still the global hegemon. There is not a credible dollar replacement. US Treasuries remain the ultimate safe haven, and if folk sell Treasuries, it’s because they need dollars to pay as the benchmark for all commodity and finished goods trade.

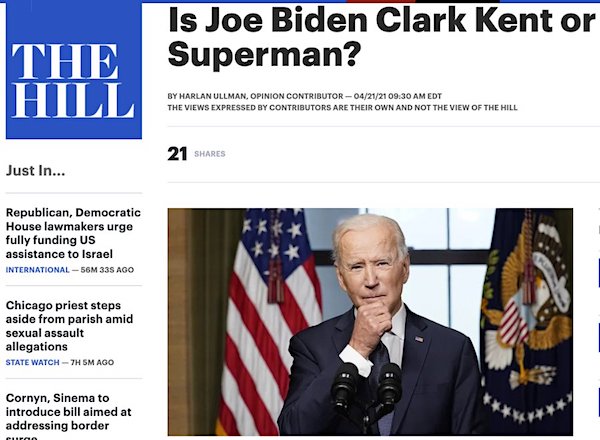

“..what we learn from the profile is that DeSantis is smart, serious, hard-working, focused, honest, and apparently incorruptible..”

• The New Yorker Accidentally Makes Ron DeSantis Look Awesome (NR)

The New Yorker set out to do a hit piece on Florida governor Ron DeSantis. But what we learn from the profile is that DeSantis is smart, serious, hard-working, focused, honest, and apparently incorruptible. He ignores media “noise” and does what he thinks is best for Florida based on analysis of data and science. He grew up in a working-class neighborhood, then attended Yale, where he worked several jobs to pay tuition, and Harvard Law School. He served in the military in Iraq. The main thing the New Yorker hates about DeSantis is his effectiveness and hence the implicit threat he poses to Democrats: “Like Trump with a brain.”

Quotes from the piece: “He’d read all the medical literature — all of it, not just the abstracts.” “Ron’s strength as a politician is that he doesn’t give a f**k. . . . Ron’s weakness as a politician is that he doesn’t give a f**k. Big donors? He doesn’t give a s**t. Cancels on them all the time.” “He’s good-looking. . . . His wife is really good-looking. His family is beautiful. They look like they’re from central casting.” “He’s a serious guy. Driven.” “He was stubborn. If he set his mind to something, you couldn’t shake him. He was focussed and motivated. He didn’t get that from me.” [This is Ron DeSantis Sr. speaking. DeSantis’s dad opened the door in a Florida State University T-shirt and proceeded to chat amiably about his son’s baseball prowess.]

“Ron was a voracious worker, and he worked at phenomenal speed. He was a superb writer, especially for his age.” “He’s so f***ing smart and so creative. You couldn’t even plagiarize off his work. He’d take some angle, and everyone knew there was only one person who could have done that.” “He’s just incredibly disciplined.” And summations by the author of the piece, Dexter Filkins: “DeSantis has an intense work ethic, a formidable intelligence, and a granular understanding of policy.” He’s “articulate and fast on his feet.” He’s “dogged and precise.”

Looks like an election time PR piece.

• Can DeSantis Displace Trump as the GOP Combatant-in-Chief? (New Yorker)

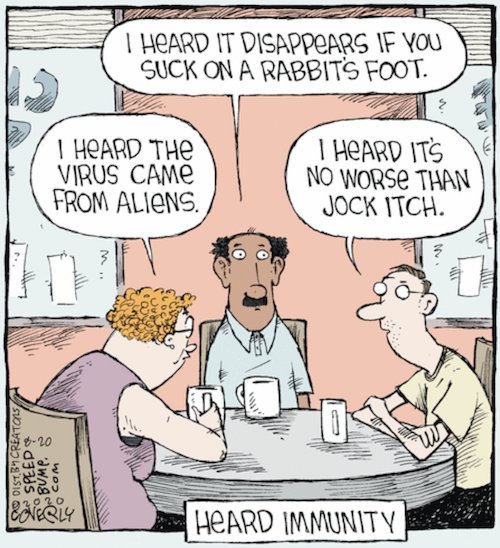

One Sunday afternoon in September, 2020, Jay Bhattacharya, an epidemiologist at Stanford University, was at home in Los Altos when he got an unexpected call. It was Ron DeSantis, the governor of Florida, and he wanted to talk about the coronavirus. In the early months of the pandemic, Bhattacharya had established himself as an outlier among public-health experts. He is one of three scientists who drafted the Great Barrington Declaration, which argued that many governments were doing more harm than good by shutting down economies and schools. The only practical approach, they said, would be to protect the most vulnerable—mainly by isolating the elderly—and allow everyone else to go about their lives until vaccines and herd immunity neutralized the disease. With covid-19 killing hundreds of Americans every day, the signers of the declaration became pariahs in their profession. “I’ve lost friends,” Bhattacharya told me. “I’m lucky to have tenure.”

DeSantis, young and aggressively confident, was similarly convinced that he could find a better way to handle the virus. Talking with him, Bhattacharya was surprised by his command of the research. “He’d read all the medical literature—all of it, not just the abstracts,” he told me. The science, though, remained unclear—Did the virus linger on surfaces? Did it travel in droplets or in a fog?—and many politicians found that the most appealing solutions were the ones that fit their ideology. For DeSantis, who espouses a libertarian vision of small government and personal freedom, the ideas in the Great Barrington Declaration resonated. In his view, the government, apart from protecting the elderly and making treatments available, should do almost nothing.

Initially, as the virus began spreading in Florida, DeSantis had ordered a statewide lockdown, in accordance with Dr. Anthony Fauci’s recommendations. Three weeks later, he changed his mind. “We will never do any of these lockdowns again,” he said. After talking to Bhattacharya, he lifted nearly all remaining restrictions—on schools, government buildings, stores, restaurants, and other private businesses—and halted the enforcement of mask mandates. As the death toll mounted, he was mocked by critics as “DeathSantis” and denounced by the mainstream press. “Any public distrust of this administration has been well-earned,” the Miami Herald editorial board wrote. “We can’t trust the governor with our lives.” A former political adviser with knowledge of the covid response told me that DeSantis was unfazed: “We were getting crucified, but to him it was just noise.” DeSantis revels in defying what he sees as a corrupt and self-satisfied liberal establishment.

Those who work closely with him say that he is unique among elected officials in his disregard for public opinion and the press. “Ron’s strength as a politician is that he doesn’t give a fuck,” a Republican consultant who knows him told me. “Ron’s weakness as a politician is that he doesn’t give a fuck. Big donors? He doesn’t give a shit. Cancels on them all the time.”

FDR=peace. Truman=war.

• How Did America Become Ruled By Its Military-Industrial Complex? (Zuesse)

A document dated 21 January 1946 from the U.S. Joint Chiefs of Staff, and titled “STATEMENT OF EFFECT OF ATOMIC WEAPONS ON NATIONAL SECURITY AND MILITARY ORGANIZATION”, opened with a “Memorandum by the Chief of Staff, U.S. Army,” which itself opened:

“Upon reading the Joint Strategic Survey Committee’s statement on the above subject (J.C.S. 1477/5), I obtained a somewhat unfavorable over-all impression. While most of the specific statements made seem reasonable, the over-all tone seems to depreciate the importance of of the development of atomic weapons and to insist unnecessarily strongly that the conventional armed services will not be eliminated. While I agree entirely, so far as the immediate future is concerned, with the latter concept, I have not felt that there is strong public demand at the present that the services be in fact eliminated. The general tone of the statement might therefore be misconstrued by Congress and the public, and be looked upon as an indication of reactionism on the part of the military and an unwillingness under any circumstances to reduce the size of the military establishment.”

That was at a time when the widespread American assumption was that there would continue to be no standing army in this country. Within less than two years of FDR’s death on 12 April 1945, such a permanent-war U.S. Government became officially created. FDR’s plan for a U.N. that would internationally outlaw all empires became replaced by Truman’s plan for an America that would itself become what Hitler, himself, had only aspired to create: the world’s very first all-encompassing global empire. Truman’s dream is today’s American dream, in today’s Washington DC; and here was how the Nobel Peace-Prize-winning U.S. President, Barack Obama (the other of history’s slickest liars), stated it to graduating West Point cadets, on 28 May 2014:

“The United States is and remains the one indispensable nation. That has been true for the century passed and it will be true for the century to come. … Russia’s aggression toward former Soviet states unnerves capitals in Europe, while China’s economic rise and military reach worries its neighbors. From Brazil to India, rising middle classes compete with us, and governments seek a greater say in global forums. … It will be your generation’s task to respond to this new world. ” It’s endlessly onward and upward, for the U.S. All other nations are “dispensable.” And that objective is backed-up now, by half of the world’s military expenditures. This is how it happened. It happened by deceit, at every step of the way.

Britain is rotting on all sides simultaneously.

• British ‘Watchdog’ Journalists Unmasked As Security State Lapdogs (Cook)

Events of the past few days suggest British journalism – the so-called Fourth Estate – is not what it purports to be: a watchdog monitoring the centers of state power. It is quite the opposite. The pretensions of the establishment media took a severe battering this month as the defamation trial of Guardian columnist Carole Cadwalladr reached its conclusion and the hacked emails of Paul Mason, a long-time stalwart of the BBC, Channel 4 and the Guardian, were published online. Both of these celebrated journalists have found themselves outed as recruits – in their differing ways – to a covert information war being waged by Western intelligence agencies.

Had they been honest about it, that collusion might not matter so much. After all, few journalists are as neutral or as dispassionate as the profession likes to pretend. But as have many of their colleagues, Cadwalladr and Mason have broken what should be a core principle of journalism: transparency. The role of serious journalists is to bring matters of import into the public space for debate and scrutiny. Journalists thinking critically aspire to hold those who wield power – primarily state agencies – to account on the principle that, without scrutiny, power quickly corrupts. The purpose of real journalism – as opposed to the gossip, entertainment and national-security stenography that usually passes for journalism – is to hit up, not down.

And yet, each of these journalists, we now know, was actively colluding, or seeking to collude, with state actors who prefer to operate in the shadows, out of sight. Both journalists were coopted to advance the aims of the intelligence services. And worse, each of them either sought to become a conduit for, or actively assist in, covert smear campaigns run by Western intelligence services against other journalists. What they were doing – along with so many other establishment journalists – is the very antithesis of journalism. They were helping to conceal the operation of power to make it harder to scrutinize. And not only that. In the process, they were trying to weaken already marginalized journalists fighting to hold state power to account.

Both the Supreme Court and the U.S. Court of Appeals for the Ninth Circuit come out against Bayer.

• Court Orders EPA to Reassess Glyphosate Risk to Human Health, Environment (CHD)

In a historic victory for farmworkers and the environment on June 17, the U.S. Court of Appeals for the Ninth Circuit sided with the Center for Food Safety (CFS) and its represented farmworker and conservation clients by overturning the U.S. Environmental Protection Agency’s (EPA) decision that the toxic pesticide glyphosate is safe for humans and imperiled wildlife. Glyphosate is the active ingredient in Monsanto-Bayer’s flagship Roundup weedkiller, the most widely used pesticide in the world. The 54-page opinion held the Trump administration’s 2020 interim registration of glyphosate to be unlawful because “EPA did not adequately consider whether glyphosate causes cancer and shirked its duties under the Endangered Species Act (ESA).”

Represented by the Center for Food Safety, the petitioners in the lawsuit included the Rural Coalition, Farmworker Association of Florida, Organización en California de Lideres Campesinas and Beyond Pesticides. A consolidated case is led by Natural Resources Defense Council and includes Pesticide Action Network. “Today’s decision gives voice to those who suffer from glyphosate’s cancer, non-Hodgkin’s lymphoma,” said Amy van Saun, senior attorney with the Center for Food Safety and lead counsel in the case. “EPA’s ‘no cancer’ risk conclusion did not stand up to scrutiny. Today is a major victory for farmworkers and others exposed to glyphosate. Imperiled wildlife also won today, as the court agreed that EPA needed to ensure the safety of endangered species before greenlighting glyphosate.”

[..] As to its cancer conclusion, the court concluded that EPA flouted its own Cancer Guidelines and ignored the criticisms of its own experts. EPA’s “not likely to cause cancer” conclusion was inconsistent with the evidence before it, in the form of both epidemiological studies (real-world cancer cases) and lab animal studies. In addition to its lack of conclusion as to non-Hodgkin’s lymphoma risk (the cancer most tied to glyphosate), the court also concluded that EPA’s general “no cancer” decision was divorced from its own guidelines and experts when EPA selectively discounted evidence that glyphosate causes tumors in animals.

1000s of lawsuits. $15 billion set aside. Let’s make sure it’s not enough.

• US Supreme Court Denies Bayer Bid To Block Roundup Lawsuits (AFP)

The US Supreme Court on Tuesday declined to hear a bid from Bayer-owned Monsanto that aimed to challenge thousands of lawsuits claiming its weedkiller Roundup causes cancer, a potentially costly ruling. The high court did not explain its decision, which left intact a $25 million ruling in favor of a California man who alleged he developed cancer after using the chemical for years. The decision marks a major blow to the German conglomerate’s legal fight against Roundup-related cases, and Bayer has set aside more than $15 billion to deal with a wave of US lawsuits linked to the weedkiller.

“Bayer respectfully disagrees with the Supreme Court’s decision,” the company said in a statement. Bayer has been plagued by problems since it bought Monsanto, which owns Roundup, in 2018 for $63 billion and inherited its legal woes. The German firm says it has not committed any wrongdoing, and maintains that scientific studies and regulatory approvals show Roundup’s main ingredient glyphosate is safe. Glyphosate is nonetheless classified as a “probable carcinogen” by the International Agency for Research on Cancer at the World Health Organization (WHO).

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.