Russell Lee Hamburger stand in Harlingen, Texas Feb 1939

On this relatively quiet Sunday, why not delve into a topic that’s as timely as it is controversial topic: the US greenback. I see it moving a lot lately, and I see a lot of opinions being expressed on those moves. But for most of those opinions, I got to say: I’m sorry, but I don’t think so.

There’s such a huge amount of entrenched and ingrained ideas in the financial world about the dollar and inflation and gold, and an awful lot of it is in desperate need of, for lack of a better term, mental flexibility.

You can claim that the dollar will perish, and that’s true enough, but it will be – near – the last of all fiat currencies to do so. You can claim inflation is on the way, but that can’t happen without increased spending. And consumers who get poorer all the time cannot increase their spending.

You can claim the golden days of gold are nigh again, and that prices have been manipulated (not that I doubt that), but as long as the dollar’s alive, why should we assume that at least the American dollar generated part of the manipulation will stop? Gold will rise to the top once more alright, it always has, but it’s what to do in the meantime that’s more interesting for all but the 1%.

The Automatic Earth has always said that the US dollar would come out the winner among currencies. Simply because there is no other way. Eventually, the greenback will go the way of all fiat money, but that’s not going to happen tomorrow morning, and we need to find something to do with ourselves until it does.

The fact that the dollar is the world reserve currency is important, but it’s not no.1. Today’s world is drowning in debt, and a huge majority of it is denominated in US dollar. Yank up interest rates and dollar demand will soar like a BUK rocket. No matter what Russia and China and India invent in non-dollar trade. Too little too late.

The US Fed has prevented the dollar surge from happening over the past 7-8 years, and the entire globe has hidden and/or financed its deficits courtesy of that, but the Fed, for one reason or another, has decided to stop playing that game. Not only will there be fewer dollars made available (QE tapering), but the Fed funds rate will also be raised.

Present numbers from Fed sources being chewed on in the press are well above 1% in a year or so, from 0.25% now. Count your blessings, emerging markets. The question is: why would they do that at this point? I think a large part of the explanation is to be found in what I talked about in The Fed Has A Big Surprise Waiting For You.

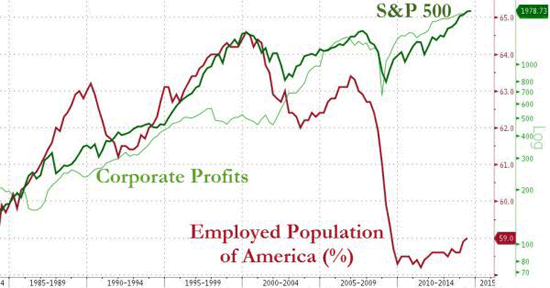

That is, Wall Street sees its profit sources drying up because everybody and their pet hamster is on the same side of the trade. Which means if you can get them to stay there, and change the rules of the game behind their back in the meantime, potential profits are stupendous.

In The Fed Has A Big Surprise Waiting For You, I focused on interest rates (only). But I think what’s true for rates there, is also valid for the dollar: the Fed is changing its views and policies. And no, it does not have everybody’s back, not investors and, but that does hardly need repeating, Main Street.

Most people will still see the recent rise of the dollar in FX markets as just that, something that happens due to market mechanisms. Really, what market? It would be naive to think the Fed, which has controlled asset markets up to the point of being a direct buyer of stocks, and propped up the US housing market for years, would let the dollar either slide or rise as much as we’ve seen lately, and not act. Therefore, if you follow my point, it must have acted.

For the same reason that you shouldn’t assume too easily that the economy is recovering, you shouldn’t too easily assume the Fed is not aware of what happens to the USD, or doesn’t have a handle on it. Just as it would be silly, for that matter, to disregard off-hand the connection between economic depression and increasing cries for war, but that’s perhaps for another day.

Let’s turn to what others have to say about the dollar vs other currencies. First, a few quotes from the Australian rainforest, where the world’s finance ministers were gathered. I’m not sure whether to think the setting is too much for them, or that it fits just right. They sure produced some whoppers.

Currencies Back on Agenda as G-20 Monetary Policies Split

The dollar has climbed over the past three months against all 16 major peers tracked by Bloomberg, touching a six-year high versus the yen and a 14-month peak against the European currency.

• U.S. Treasury Secretary Jacob J. Lew renewed a call for member nations to avoid currency intervention in a bid to gain a competitive edge.

• South Korean Finance Minister Choi Kyung Hwan said divergent monetary policies “have the risk of increasing uncertainties in global financial markets,” while volatile foreign capital flows “could also have an impact on the foreign exchange rates.”

• “It’s important for foreign-exchange rates to move in a stable manner by reflecting economic fundamentals,” Bank of Japan Governor Haruhiko Kuroda said. Kuroda said this month he would do what’s needed to achieve the BOJ’s inflation target as he continues unprecedented easing.

• The ECB has cut interest rates to record lows and committed to boost its balance sheet to the levels it had at the height of the sovereign debt crisis in 2012. German Finance Minister Wolfgang Schaeuble told the G-20 meeting today that expansive fiscal and monetary policies could risk creating a bubble in equity and property markets, according to a German delegation official. ECB Governing Council member Jens Weidmann told Bloomberg that monetary policy should not be expansionary for longer than necessary to ensure price stability.

• [..] After finance ministers and central bank chiefs met in Moscow in July 2013, they pledged: “We will refrain from competitive devaluation and will not target our exchange rates for competitive purposes.” Lew yesterday revisited language from that communique. Lew told South Korea’s Choi that countries must meet “commitments to move toward market-determined exchange rates.”

• Choi said the South Korean government is “not at all” intervening in the foreign-exchange market to determine the won’s level. Lew’s comments were “reiterating the importance” of the issue, rather than singling out South Korea, Choi said. While Choi said he lets the market determine the strength of the won, it’s different when moves are extreme. “If there is a very sudden tilting toward one direction in a very short period of time in the foreign exchange market, then there would be some smoothing operations.”

Note to Self: If and when Jack Lew says that “countries must meet “commitments to move toward market-determined exchange rates”, he’s actually saying that at present there are no market-determined exchange rates. Not a minor thingy.

What’s happening with the US dollar is exceptional, it’s not some sort of fluke:

Dollar Has Longest Winning Streak Since 1967 on Divergence

The dollar had its longest stretch of weekly gains since Lyndon Johnson was in the White House after the Federal Reserve signaled an end to unprecedented monetary stimulus measures next year. The U.S. Dollar Index advanced for a 10th straight week, the longest since at least March 1967, when Johnson was in the fourth year of his presidency.

“The dollar is the No. 1 trend across all asset classes going into the end of the year,” Neil Azous, founder of Stamford, Connecticut-based research firm Rareview Macro LLC, said in a phone interview. “It’s back to trading interest-rate fundamentals.”

[..] “ … the dollar has been so depressed over the last few years, and now that depression is unwinding, like a coiled spring,” Douglas Borthwick, head of foreign exchange at Chapdelaine & Co., said. “The Dollar Index will continue to stay bid as long as the Japanese continue to make motions of quantitative easing while Europe makes more noise about expanding their balance sheets.”

[..] The U.S. Dollar Index has rallied 5.9% this year, set for the biggest annual gain since 2008, when the Fed began the first of three rounds of bond purchases under the quantitative-easing stimulus strategy. The gauge lost 4.2% in 2009.

[..] The dollar has risen 3.2% in the past month in a basket of 10 developed-nation currencies tracked by Bloomberg Correlation-Weighted Indexes. The yen has lost 3.3%, the biggest decline, and the euro has fallen 1.1%. Sterling has gained 0.9%.

Mr Borthwick is right, but I’m not sure he understands why he is. He’s dead on remarking that “the dollar has been so depressed over the last few years”, but he should note that it’s the Fed that has been depressing the dollar, not the markets. The recent surge doesn’t even have to be due to active support, the simple lifting of whatever measures kept it down is sufficient.

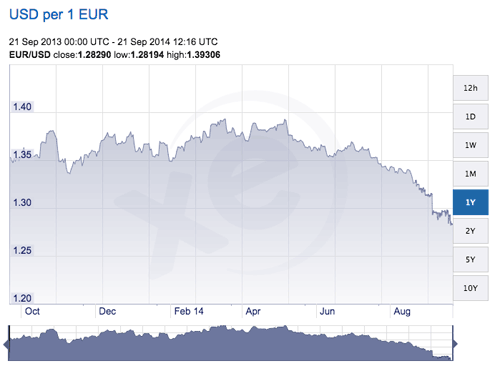

Keep your cool and shrink the amount of available dollars. That’s all it takes. The, from a market point of view, insanely high prints for the Euro against the USD, which lasted for years at $1.30 to $1.40, are let go. Big move. Not in the least for US businesses.

Dollar’s Rally Bad News For Oil, Multinationals

The asset with the greatest prowess of late has been the U.S. dollar, and if its rally continues, it threatens to eat into the earnings of multinational companies. The greenback’s recent gains have lifted the dollar index – a measure of the dollar’s value relative to six currencies – for 10 consecutive weeks.

That marks the dollar’s longest rally since the index was created in 1973 – and could pose significant headwinds to dollar-sensitive sectors of the market, particularly companies that respond to commodity prices affected by the greenback, and multinationals that do much of their business overseas.

“For the past few years, the U.S. dollar has been trading in a relatively quiet trading range. This summer, something changed. We are now seeing a new uptrend develop,” said Adam Sarhan, founder and CEO of Sarhan Capital in New York. Analysts have already pointed fingers at the dollar for the decline in prices of commodities like precious metals, corn and oil in recent weeks. U.S. multinationals with large streams of revenue from overseas also stand to lose.

[..] Much of the calculus of whether the dollar’s rise will become a net negative for U.S. stocks depends on domestic inflation rates, as well as the speed and scale of the currency’s gains, market watchers said. “The euro zone is fragile … the British pound is also weak, and geopolitical or economic woes remain a threat. As long as it is a healthy and normal advance, they should be able to adjust and prepare for it,” Sarhan said. “But if the move is very large, fast or erratic, those consequences [could] be immeasurable.”

Yes, something changed alright. Fed priorities did. Jim Rickards gives his view:

Jim Rickards: ‘World In Indefinite Depression’ (RT)

RT: The Chinese Central bank is now offering stimulus. Is this a part of a new round of “currency wars”?

Jim Rickards: Yes, that is right. I think this is one long “currency war”. We are now getting into more of a battle, more of a confrontation. The US dollar is the only strong currency that cannot last: the US cannot have a strong currency, because we are desperate for inflation. We have done all the quantitative easing, we have raised the zero, we have issued further guidance, we have done a twist, and we have done three versions of QE. We have done everything possible. The only thing left is to try to cheapen the currency and in fact the dollar is getting stronger.

The Fed might not have minded a stronger dollar: six months ago it did look like the economy was getting stronger. We saw strong second quarter GDP. So it was a little bit of a good day. And Europe was desperate for the help: they were stepping into recession. Japan`s economy collapsed in the second quarter. So you could see the feds saying “ok…we will have a stronger dollar and give Europe and Japan a break”. But that is over. Now the US is becoming a loser and we are the ones who need to take a break. The only way to get it is a cheaper dollar. I would look for that in the months ahead.

Jim, it’s not six months ago, it’s more recent than that. Look:

And the biggest drop was even over just the past month or so:

I know, this is the EUR/USD situation only, but that IS the most important data. What happens vs the yen is much less relevant, because Shinzo Abe is a desperate man willing do anything to beggar his currency. And China is too opaque to draw any conclusions from. Besides, the Euro is by far the biggest reserve currency behind the USD.

And after that, Jim, you’re just absolutely missing the mark. The rise of the dollar just got started. The Fed is not looking for a cheap dollar. Not anymore. You may argue that we’re watching a headfake, but it’s not that “the Fed might not have minded a stronger dollar”: they actively want a stronger dollar. For the same reason they want higher interest rates: the profits of Wall Street banks.

There are tens of trillions – mostly in US dollars – outstanding in interest rate derivatives. The mood in that camp has become as complacent, ‘Fed has my back’, as it has in stock markets. That means there are no profits there anymore. That’s what Minsky meant when he said that stable markets MUST lead to instability: it’s about profits. Stability will always only remain an illusion.

If and when the Fed takes its hands off the US dollar rate, da greenback will rise like crazy vs the Euro, go to par and probably beyond. And that would still only be normal, there’s no reason why they wouldn’t be at par. But it’s also a 30% move. And that sounds like the promise of real profits.

The Fed never sought to ‘protect’ Main Street or main investors, other than as something collateral, some sort of piggybacking. The big money going forward is in a higher dollar and higher interest rates. So that’s what we’ll have. There won’t be too many parties, big or small, gearing or hedging up for that, even if they have that flexibility, so it’s OK to give away a little of the game plan.

I’m not saying that I know all the details and ins and outs here, but I do think a lot of questions never get asked on this topic, and I do think the role the Fed plays is very poorly understood. The Fed has long given up on the US economy.

• Global Finance Chiefs Said to Warn of Growing Economic Risks (Bloomberg)

Group of 20 finance chiefs will warn that risks to the global economy have increased in recent months, an official said, citing the latest draft of a communique due to be released today. Finance ministers and central bank governors meeting in Cairns, Australia, will acknowledge in the statement that the outlook is uneven among countries, the official from a G-20 nation said yesterday, asking not to be identified because the document hasn’t been made public. G-20 economies today will also commit to taking growth-boosting measures to spur recovery. “Ambitious goals to increase sustainable growth rates are certainly welcome against the background of sluggish growth and sticky unemployment in some countries,” European Central Bank Governing Council member Jens Weidmann said in an interview yesterday. The global economic recovery has faltered since a February G-20 meeting in Sydney, as signs that Europe risks slipping into deflation offset more bouyant economies in the U.S. and U.K. and the wealth effects of stock-market gains.

In Asia, Japan’s revival is being blunted by a sales tax increase and concerns are mounting that China’s 7.5% growth target for 2014 is becoming harder to attain. G-20 economies have submitted individual plans to boost gross domestic product by an additional 2% over five years, a goal the group committed to in February. The group will say in their statement that measures proposed so far will boost GDP by 1.8%. Members will commit to additional action to meet their target ahead of a summit of G-20 leaders in Brisbane, Australia, in November, the official said. Even as the group discusses longer-term measures to lift economic output, officials in the U.S. and Canada are pressing for more immediate steps to boost demand. Some European countries should consider additional fiscal measures to bolster growth, even if they temporarily delay efforts to shrink their budget deficits, Canadian Finance Minister Joe Oliver said in an interview. U.S. Treasury Secretary Jacob J. Lew said the global economy continues to underperform, particularly Europe and Japan.

• Currencies Back on Agenda as G-20 Monetary Policies Split (Bloomberg)

Currencies are back on the G-20 agenda as diverging monetary policies from the U.S. to Japan threaten to increase exchange-rate volatility. Foreign-exchange “coordination” will be reflected in tomorrow’s communique in Cairns, Australia, echoing a pledge by Group-of-20 economies in July 2013 in Moscow, South Korean Finance Minister Choi Kyung Hwan said in an interview today. The U.S. dollar has climbed as the Federal Reserve edges closer to its first interest-rate increase since 2006, while easing by the European Central Bank and the Bank of Japan are weighing on the yen and euro. In Cairns yesterday, U.S. Treasury Secretary Jacob J. Lew renewed a call for member nations to avoid currency intervention in a bid to gain a competitive edge.

Divergent monetary policies “have the risk of increasing uncertainties in global financial markets,” Choi said. Volatile foreign capital flows “could also have an impact on the foreign exchange rates.” The dollar has climbed over the past three months against all 16 major peers tracked by Bloomberg, touching a six-year high versus the yen and a 14-month peak against the European currency. “It’s important for foreign-exchange rates to move in a stable manner by reflecting economic fundamentals,” Bank of Japan Governor Haruhiko Kuroda, who is also in Cairns, said yesterday. “It’s natural for it to move in accordance with changes in economic fundamentals.”

Kuroda said this month he would do what’s needed to achieve the BOJ’s inflation target as he continues unprecedented easing. The ECB has cut interest rates to record lows and committed to boost its balance sheet to the levels it had at the height of the sovereign debt crisis in 2012. German Finance Minister Wolfgang Schaeuble told the G-20 meeting today that expansive fiscal and monetary policies could risk creating a bubble in equity and property markets, according to a German delegation official, who briefed reporters on condition of anonymity in line with policy. ECB Governing Council member Jens Weidmann told Bloomberg News in Cairns that monetary policy should not be expansionary for longer than necessary to ensure price stability.

[..] After finance ministers and central bank chiefs met in Moscow in July 2013, they pledged: “We will refrain from competitive devaluation and will not target our exchange rates for competitive purposes.” Lew yesterday revisited language from that communique. According to a statement from the U.S. Treasury Department, [U.S. Treasury Secretary Jack Lew] told South Korea’s Choi that countries must meet “commitments to move toward market-determined exchange rates.”

[..] In a statement in April this year in Washington, G-20 finance chiefs said they were committed to “exchange rate flexibility” among other steps to help meet their goal of boosting gross domestic product by an additional 2% over five years. Choi said the South Korean government is “not at all” intervening in the foreign-exchange market to determine the won’s level. Lew’s comments were “reiterating the importance” of the issue, rather than singling out South Korea, Choi said. While Choi said he lets the market determine the strength of the won, it’s different when moves are extreme. “If there is a very sudden tilting toward one direction in a very short period of time in the foreign exchange market, then there would be some smoothing operations,” he said. “But that is something that is done not only in Korea but in all other countries.” He described “smoothing” as the minimum level of effort made by the currency authority in times of such extreme fluctuations.

• OK, I Get It. Things Are Coming Unglued (WolfStreet)

As long as major stock indices around the world keep soaring (forget for a moment the carnage in smaller stocks), and as long as bonds trade at near all-time highs, and as long as the yield of dubious government debt is close to zero or below zero so that borrowing has become a profit center for governments and a loss center for investors, as long as we live in this wondrous world, who cares about the global economy? This is a resounding theme. Super-ugly data about Japan’s economy piles up, and people say, “Yeah but look, the Nikkei surges.” And this discussion is over. It doesn’t matter that the Nikkei surges as the Bank of Japan is buying every JGB that isn’t nailed down. It’s buying them from banks, pension funds, and individual investors to pile them up on its balance sheet where they can be selectively defaulted on without sparking social chaos. Everyone seems to have accepted the alternative to social chaos, namely a gradual loss of “wealth.”

So banks, pension funds, and other investors are selling their JGBs to the Bank of Japan and are looking at stocks as a place to stash their proceeds. This buying is unrelated to what companies in the Nikkei are doing. It’s an effort to get rid of increasingly toxic JGBs. And hedge funds anticipate that pension funds and other investors are shifting into stocks, and they front-run them, and the Nikkei surges…. But off to the side, in Cairns, Australia, the finance honchos of the G-20 are meeting this weekend. And they’re already jabbering. They’re lamenting just how badly the global economy is faltering. But it was overshadowed by the iPhone 6 razzmatazz and the IPO hoopla of Alibaba, whose shares give investors ownership in a mailbox company in the Cayman Islands that has a contract with some Chinese outfit, and nothing more. But hey, the purpose of owning a stake in a mailbox company is to make a buck and get out. An equation that might work for a while in this era of endless liquidity.

• Jim Rickards: ‘World In Indefinite Depression’ (RT)

We are in global depression which started in 2007 and is going to continue indefinitely, Jim Rickards, economist and author of “Currency Wars: The Making of the Next Global Crisis,” told RT. China’s central bank is injecting a combined 500 billion Yuan into the country’s top banks – a move signaling the deep concerns of an economic slowdown in China. A downturn in China`s economy, as investment is scaled back in Chinese real estate, has prompted economists to forecast further financial defaults and slowing economic growth in the second half of the year. Will this monetary easing fix China’s short-term problem and put it back on the path to prosperity in the long-term? Erin from “Boom Bust” asked economist, Jim Rickards, in her show.

RT: The Chinese Central bank is now offering stimulus. Is this a part of a new round of “currency wars”?

Jim Rickards: Yes, that is right. I think this is one long “currency war”. We are now getting into more of a battle, more of a confrontation. The US dollar is the only strong currency that cannot last: the US cannot have a strong currency, because we are desperate for inflation. We have done all the quantitative easing, we have raised the zero, we have issued further guidance, we have done a twist, and we have done tree versions of QE. We have done everything possible. The only thing left is to try to cheapen the currency and in fact the dollar is getting stronger. The Fed might not have minded a stronger dollar. Six months ago it did look like the economy was getting stronger. We saw strong second quarter GDP. So it was a little bit of a good day. And Europe was desperate for the help: they were stepping into recession. Japan`s economy collapsed in the second quarter. So you could see the feds saying “ok…we will have a stronger dollar and give Europe and Japan a break”. But that is over. Now the US is becoming a loser and we are the ones who need to take a break. The only way to get it is a cheaper dollar. I would look for that in the months ahead.

RT: PIMCO says that Chinese growth will slow to 6.5% over the next year and this is despite the official 7.5% target now in place. Do you think PIMCO is right?

JR: Yes, it is about to go down further. I have been going for Chinese growth to get to 3 or 4%. I would say that China`s growth is already at 4%. I know they print 7.5%. But about half of the GDP they produce is wasted. So if I build a $5 billion train station in a small town that is $5 billion of GDP- this money is completely wasted because 10 people getting on the train are not going to pay for a $5 billion station. So you go around China with these ghost cities we have talked about before… So it is generating GDP, but it is completely wasted. If you adjusted the published GDP figures for the amount of waste, their actual growth is probably already roughly 4%. That is going to go lower.

!!!

• Families Of German MH17 Victims To Sue Ukraine (Reuters)

Survivors of German victims of Malaysian Airlines flight MH17 downed over Ukraine plan to sue the country and its president for manslaughter by negligence in 298 cases, the lawyer representing them said on Sunday. Professor of aviation law Elmar Giemulla, who is representing three families of German victims, said that under international law Ukraine should have closed its air space if it could not guarantee the safety of flights. “Each state is responsible for the security of its air space,” Giemulla said in a statement emailed to Reuters. “If it is not able to do so temporarily, it must close its air space. As that did not happen, Ukraine is liable for the damage.” Bild am Sonntag Sunday mass newspaper quoted Giemulla as saying that by not closing its airspace, Ukraine had accepted that the lives of hundreds of innocent people would be “annihilated” and this was a violation of human rights.

The jetliner crashed in Ukraine in pro-Russian rebel-held territory on July 17, killing 298 people, two-thirds of them from the Netherlands. Four Germans died in the crash. Ukraine and Western countries have accused the rebels of shooting the plane down with an advanced, Russian-made missile. Russia has rejected accusations that it supplied the rebels with SA-11 Buk anti-aircraft missile systems. Giemulla planned to hand his case to the European Court of Human Rights in about two weeks, accusing Ukraine and its President Petro Poroshenko of manslaughter by negligence in 298 cases. He would also push for compensation of up to one million euros ($1.3 million) per victim, Bild am Sonntag reported.

Idiots.

• Ukraine Defense Minister ‘Claims’ Russia Used Nukes (RT)

A reported claim by Ukraine’s Defense minister that Russia used tactical nuclear weapons against his troops sparked sarcastic comments from Moscow and criticism from the rival Ukrainian Interior Ministry. The allegations, by Col. Gen. Valery Geletey, were first reported by Roman Bochkala, one of the Ukrainian journalists accompanying the minister in his recent trip to Poland. “So Russia did use tactical nuclear weapons against Ukrainian troops,” the journalist wrote on his Facebook page, citing Geletey’s words. The nuclear weapons in question are rounds for 2S4 Tyulpan self-propelled mortars. The journalist reported the minister as saying that Russia supplied some of those to rebel forces and used at least two 3-kiloton nuclear rounds in the battle for Lugansk airport. “If it were not for the Tyulpans, we could have been holding the airport for months and nobody would have ousted us from it,” the general was cited as saying.

The allegations understandably provoked a small media storm in Ukraine and even comments from the Russian Defense Ministry, which expressed doubt that a general could actually have said it. If the minister did say all that, the Russians joked, then “the Ukrainian security service should investigate what the Polish friends slipped into Geletey’s glass.” “Speaking seriously, Geletey’s habit of justifying the failures of the punitive operation in southeastern Ukraine with the alleged actions of the Russian armed forces start to resemble paranoia,” the Russian ministry added. And ever-sarcastic Deputy Prime Minister Dmitry Rogozin, who supervises Russian defense and security, tweeted a picture of Geletey with his hands stretched out saying: “they nuked us with a bomb this big.”

The Ukrainian general himself later denied the nuclear allegations, saying that the journalist had misinterpreted his words. “Everyone knows that Russia is de facto using Ukrainian territory as a testing range for its new weapons,” Geletey wrote on his Facebook page. “What else than for testing did the Russians send 2S4s into our territory?” “I stress that only competent specialists armed with special equipment may test whether or not a nuclear or any other weapon that we don’t know of was used. In particular they need to take radiation samples on the ground. Unfortunately, we cannot do that because Lugansk airport is currently under control of the terrorists and the Russian military,” he added.

If anything, the defense minister and the journalist, who misreported his words, have given ammo to critics of Ukraine, said Anton Gerashchenko, an aide to Interior Minister Arsen Avakov. “Why would anyone make such statements that can be easily checked and proven false?” he wrote on his Facebook page. “In the end Russia and the entire world will now ridicule us. Too bad, it’s nothing new for us.” The two Ukrainian ministries involved in the military campaign against rebel forces in the east have been trading accusations lately. The latest round of bickering this week came after Geletey said in an interview that “there were no real heroes” among the commanders of the Interior Ministry’s National Guard, who are now seeking seats in parliament. Avakov responded with a demand for an apology from his fellow minister.

Too late.

• Russia to Consider Diversifying Away From Western Debt Securities (WSJ)

Russia is considering diversifying its debt portfolio away from countries that have imposed sanctions on Moscow and into the papers of its Brics partners, Finance Minister Anton Siluanov said Saturday. Australia, Canada, the European Union, Japan, the U.K. and the U.S. have imposed sanctions against Russia in recent months to punish it for the annexation of the Ukrainian region of Crimea and for supporting anti-Kiev rebels in eastern Ukraine. The sanctions have pressured Russia’s finances, prompting the Kremlin to seek tighter ties with the emerging world. Speaking on the sidelines of an annual investment forum in the Black Sea town of Sochi, Mr. Siluanov said the Finance Ministry wants to diversify its investment basket, and is looking for higher yields without too much risks.

He said the ministry will consider buying papers issued by Brazil, India, China and South Africa, which along with Russia are known collectively as the Brics countries. “[We would like to] walk away from investing in papers of the countries that impose sanctions against us,” Mr. Siluanov said, adding that the reshuffle would be carried out gradually. He didn’t elaborate on when the first purchases of Brics debt may take place. Mr. Siluanov said such a move wouldn’t be aimed at punishing the West because Russia’s share in their papers is so small they wouldn’t feel the effect. When asked whether the diversification would mean Russia was preparing for financial isolation in the long term, Mr. Siluanov said he hopes Western sanctions would be lifted soon but said that his ministry should be ready for other scenarios.

• Russia Pledges State Funds to Business as Sanctions Limit Growth (Bloomberg)

Russia will remain committed to developing its market economy as the state offers billions of dollars of aid to help the country’s biggest companies weather sanctions imposed by the U.S. and Europe. Prime Minister Dmitry Medvedev met with business leaders to discuss state aid to cope with the strain as Russia’s economic slowdown is exacerbated by the sanctions, Economy Minister Alexei Ulyukayev said today at an investment forum in the Black Sea city of Sochi, site of the Winter Olympics. The government is trying to revive its $2 trillion economy, growing at its slowest since a contraction in 2009 as U.S. and European Union sanctions compound cooling consumption and falling oil prices.

Concerns that the arrest of billionaire Vladimir Evtushenkov, the richest Russian to face criminal charges since Mikhail Khodorkovsky a decade ago, signal an attack on private business have intensified outflows. The ruble weakened to a record against the dollar and the 50-stock Micex index fell to six-week low as Russia’s political and business elite mingled in Sochi. The sanctions are a “pointless and ugly decision toward Russia but we’ll manage without” foreign financing, Medvedev said in an interview with TV channel Rossiya 24. The government is holding off discussing another round of tit-for-tat measures, he said, after Russia last month banned some food imports from the U.S., the EU, Norway, Canada and Australia.

• ‘Europe To Lose Its Share Of Russian Market Due To Foolish Sanctions’ (RT)

Europe will not regain its share of the Russian market after the sanctions war is over, as it will already be occupied by other local and foreign businesses, Russian Prime Minister Dmitry Medvedev has warned. Russia and the West will eventually “come to agreements sooner or later, as sanctions don’t last forever,” Medvedev said in an interview with Vesti 24 TV channel. “These foolish sanctions will pass, but international relations will continue. And currency markets will open up,” he added. The prime minister stressed that “the niches in our [Russian] economy, which will by then be occupied by local produces or other foreign producers…our European counterparts wouldn’t be able to come back.” According to Medvedev, “this is the price Europe will have to pay” for trying to put Russia under economic pressure. He assured that Asian and Latin American companies – which will replace the Europeans on the Russian market – will maintain their positions after relations between Moscow and the EU return to normal.

Word.

• ‘Whatever Is Offered To Scotland Has To Be Available To Wales Too’ (RT)

The Scottish referendum is a real victory for people power, although the UK establishment was against it. Now Wales needs to ensure that its needs and demands are heard as well, leader of the Party of Wales (Plaid Cymru), Leanne Wood, told RT.

RT: Scotland walked a very long road to get this referendum. Have they blown their chance?

Leanne Wood: What has happened in Scotland has been remarkable. It has been a David and Goliath battle really, with the “yes” campaign almost achieving what they set out to achieve from a very low base. The entire corporate media was against social media, the entire British establishment was against ordinary Scots coming together in town halls. So even though they haven’t created a new state as the result of the referendum yesterday, they have achieved a great amount for democracy. And I want to whole heartedly congratulate the Scots for the way in which they conducted this debate.

RT: The Scottish breakaway campaign was very strong, and yet it failed. What kind of example does this give to your movement which is aimed at independent Wales?

LW: I would say it didn’t fail actually. The fact that so many people were engaged, so many people were talking about this and that there was very little apathy in the run-up to this campaign, it tells me that this is a real victory for people power.

RT: Before the referendum, the pro-union parties promised more powers for Scotland if they chose to stay. When can we expect this process to start?

LW: Today, it has to happen straight away. I have to say that the promises that have been made to people of Scotland, I am skeptical about them being delivered. But what I would say is that at the very basic minimum whatever is offered to Scotland has to be available to Wales too. There is a very real risk that we will have second or even third-class devolution here in Wales, while first-class devolution is being offered to Scotland. And that situation is simply not acceptable – we must have first-class devolution here in Wales too.

They know how to do it.

• French Farmers Torch Tax Office In Brittany Protest (BBC)

French vegetable farmers protesting against falling living standards have set fire to tax and insurance offices in town of Morlaix, in Brittany. The farmers used tractors and trailers to dump artichokes, cauliflowers and manure in the streets and also smashed windows, police said. Prime Minister Manuel Valls condemned protesters for preventing firefighters from dealing with the blaze. The farmers say they cannot cope with falling prices for their products. A Russian embargo on some Western goods – imposed over the Ukraine crisis – has blocked off one of their main export markets.

About 100 farmers first launched an overnight attack on an insurance office outside Morlaix, which they set light to and completely destroyed, officials said. They then drove their tractors to the main tax office in the town where they dumped unsold artichokes and cauliflowers, smashed windows and then set the building on fire. French media said the farmers then blocked a busy main road in Morlaix in both directions. In a statement, Mr Valls “vigorously” condemned the “looting and destruction by fire” of the buildings. He said violence was not justified and the perpetrators would be prosecuted.

Word.

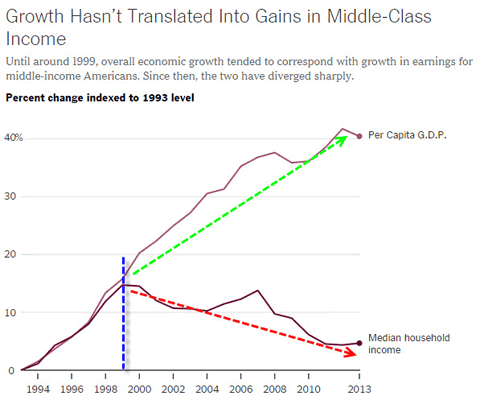

• You Can’t Feed a Family With GDP (NY Times)

The most important thing to know about the state of the United States economy was revealed in a report Tuesday morning that Wall Street barely noticed. Every year, the Census Bureau delivers a sweeping set of numbers that give the richest annual picture of how much Americans are making, how many are living in poverty, and how many have access to health insurance. The numbers are backward-looking, covering conditions from a year ago. But the new numbers, released Tuesday, in many ways tell us more about how well the economy is serving — or failing — the mass of Americans than data that create hyperventilation in the financial markets. The census numbers on what American families made last year are as mediocre as they are predictable.

We now know that if your household brought in $51,939 in income last year, you were right at the 50th percentile, with half of households doing better and half doing worse. In inflation-adjusted terms, that is up a mere 0.3 percent from 2012. If you’re counting, that’s an extra $180 in annual real income for a middle-income American family. Don’t spend your extra $3.46 a week all in one place.

• 8 Ways The Obama Administration Is Blocking Information (AP)

The fight for access to public information has never been harder, Associated Press Washington Bureau Chief Sally Buzbee said recently at a joint meeting of the American Society of News Editors, the Associated Press Media Editors and the Associated Press Photo Managers. The problem extends across the entire federal government and is now trickling down to state and local governments. Here is Buzbee’s list of eight ways the Obama administration is making it hard for journalists to find information and cover the news:

1) As the United States ramps up its fight against Islamic militants, the public can’t see any of it. News organizations can’t shoot photos or video of bombers as they take off — there are no embeds. In fact, the administration won’t even say what country the S. bombers fly from.

2) The White House once fought to get cameramen, photographers and reporters into meetings the president had with foreign leaders overseas. That access has become much rarer. Think about the message that sends other nations about how the world’s leading democracy deals with the media: Keep them out and let them use handout photos.

3) Guantanamo: The big important 9/11 trial is finally coming up. But we aren’t allowed to see most court filings in real time — even of nonclassified material. So at hearings, we can’t follow what’s happening. We don’t know what prosecutors are asking for, or what defense attorneys are arguing.

Far too many people missing.

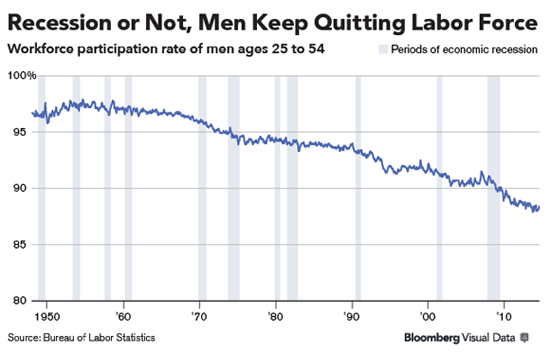

• Missing Men in U.S. Workforce Risk Permanent Separation (Bloomberg)

Too few men like Kaminski are returning to work in a decades-long puzzle about prime working-age males ages 25 to 54 falling away from the U.S. labor force. Their participation rate slid to 88.4% in August in a steady decline from 97.9% in 1954. Over the last 10 years, the slump was the steepest for those ages 25 to 34. About 7 million male Americans waste their best years of wealth formation not employed or even trying to find work. The pattern will persist, economists say, putting some men – particularly those without a college degree – at risk of permanent isolation from the job market. The pace of decline was among the fastest during the last two contractions and the drop has continued in the current expansion, according to data compiled by Bloomberg from Labor Department reports. This shows the labor-market recovery isn’t strong enough for some men to find jobs or even continue looking.

A key reason is the change in labor demand: the gradual disappearance of construction and manufacturing positions, especially those demanding relatively few skills, such as furniture, shoe or leather-goods making, said David Autor, professor of economics at Massachusetts Institute of Technology in Cambridge. “The trend will remain downward,” Autor said in a phone interview. “I don’t see any recovery for low-skilled labor demand coming. There’s never going to be a great time in America again to be a high-school dropout.” A fall in inflation-adjusted earnings for less-educated men, more stay-at-home dads and a surge in the number of veterans with military-service disability benefits also contribute to the decline, according to Bureau of Labor Statistics economist Steve Hipple. The number of veterans receiving such assistance rose 42% to 3.7 million in 2013 from 2.6 million in 2005, U.S. Department of Veterans Affairs data show. About 40% were 54 years old or younger, and about 89% were men.

• China Will Not Alter Policy Based On One Economic Indicator (Reuters)

China will not dramatically alter its economic policy because of any one economic indicator, Finance Minister Lou Jiwei said on Sunday, in remarks that came days after many economists lowered growth forecasts having seen the latest set of weak data. Lou made the comments at a meeting of finance ministers and central bank governors from the G-20 countries in Australia, according to a statement from the People’s Bank of China, China’s central bank. “China will not make major policy adjustments due to a change in any one economic indicator,” he said. Economists dialed back their growth forecasts last week after data showed factory output grew at its weakest pace in nearly six years in August.

China’s total social financing aggregate, a broad measure of lending in the economy, was the weakest in nearly six years, data showed earlier this month, indicating credit levels were far below average. China cannot rely on government spending to increase infrastructure investment, Lou added. The economic stimulus measures adopted by China to confront the international financial crisis had boosted economic growth, but they also brought excess capacity, environmental pollution, and the growth of local government debt along with other problems, Lou said. As a result, China cannot completely rely on public financial resources to make large-scale investments in infrastructure.

• US Court Tosses Argentina, Citigroup Appeal In Bond Case (Reuters)

A U.S. appeals court on Friday dismissed an appeal by Citigroup Inc and Argentina of a judge’s order blocking the bank from processing payments on $8.4 billion in bonds issued under the country’s local laws following its 2002 default. The 2nd U.S. Circuit Court of Appeals in New York in a brief order declined to find it had jurisdiction, because the order Citigroup and Argentina appealed over was a “clarification, not a modification” of a prior decision by U.S. District Judge Thomas Griesa. The appellate court, though, said nothing in its decision was intended to prevent Citigroup from seeking further relief from Griesa. Citigroup faces regulatory and criminal sanctions by Argentina, which defaulted again in July, if it cannot process the $5 million payment by Sept. 30, Karen Wagner, Citigroup’s lawyer, said during arguments Thursday.

America can’t make a decent car anymore.

• GM Recalls Another 221,000 Cars Over Braking Problem (MarketWatch)

General Motors announced a recall of 221,000 new cars worldwide over a fault with braking that could cause excessive heat and poor performance. The new recall covers 2013-2015 Cadillac XTS and 2014-2015 Chevrolet Impala cars and was prompted by an investigation by the National Highway Traffic Safety Administration opened in April. 205,000 of the recalled cars were sold in the U.S. GM said it was not aware of any crashes, injuries or fatalities as a result of this condition. The automaker recalled more than 29 million cars in 2014, with issues ranging from faulty ignition switches to wiring flaws.

• Chrysler Recalls 230,000 Cars Over Fuel-Pump Defects (MarketWatch)

Chrysler, a subsidiary of Fiat SpA, announced on Saturday it is recalling more than 230,000 SUVs over a problem with fuel pump relay that may cause the cars to stall. About 189,000 of those were sold in the U.S.

The recall affects 2011 Jeep Grand Cherokee and Dodge Durangos, which will need to get a new relay circuit to improve the fuel-pump relay durability. Chrysler decided to recall cars after reviewing a pattern of repairs and complaints. There have been no accidents or injuries because of the problem, the company said. Customers with recalled cars can take them to dealers for free replacement of the fuel-pump relay starting Oct. 24, according to Chrysler. In June 2014 Chrysler recalled 696,000 minivans from 2008-2010 models for the ignition switch problems. Faulty ignition switch problems were much more prevalent in cars made by General Motors. GM has recalled more than 29 million cars through North America since the start of the year.

• Climate Change Changes Everything (Amy Goodman)

The climate crisis is worsening faster than predicted, by every scientific measure, and is paralleled by another crisis: the failure of the U.N. climate negotiation process. “You have been negotiating all my life,” student activist Anjali Appadurai said as she addressed the formal climate negotiations in Durban, South Africa, back in 2011. The climate negotiations have been in a virtual gridlock, with nations, most notably the United States under President Obama, blocking progress and protecting their national interests while the planet heats up, potentially irreversibly. Appadurai, the designated youth speaker, said. “You’ve given us a seat in this hall, but our interests are not on the table. What does it take to get a stake in this game? Lobbyists? Corporate influence? Money?” Three years later, the United Nations is now holding a special climate summit in New York City on Tuesday, with more than 100 world leaders expected.

Unlike the formal U.N. climate negotiations, the goal of this nonbinding summit, the UN says, is “to raise political will and mobilize action, thereby generating momentum toward a successful outcome of the negotiations.” After 20 years, U.N. officials have apparently realized that, if left to the usual suspects of government and industry participants, the efforts to achieve a legally binding climate accord, slated for Paris in December 2015, will fail. Grass-roots action is now seen as a critical component for success. Environmental activists protested in outrage at the climate summit in Copenhagen in 2009, when President Obama showed up and derailed the U.N. negotiations by holding closed-door meetings with the world’s largest polluting nations. Back then, the United Nations responded by ejecting the activists.

The U.N. climate negotiations are held around the world, but always in tightly secured convention facilities, far from people most directly impacted by climate change, and far from the sight and sound of climate activists who converge at the summits, hoping to pressure the negotiators to reach a deal before it is too late. Just days before Ban Ki-moon’s invite-only summit next week, a broad coalition will hold the People’s Climate March, expected to be the largest march addressing climate change in history. People from all walks of life will gather on Central Park’s west side on Sunday. Organizers expect over 100,000 people.

Hmmm.

• How the People’s Climate March Became a Corporate PR Campaign (Arun Gupta)

I’ve never been to a protest march that advertised in the New York City subway. That spent $220,000 on posters inviting Wall Street bankers to join a march to save the planet, according to one source. That claims you can change world history in an afternoon after walking the dog and eating brunch. Welcome to the “People’s Climate March” set for Sunday, Sept. 21 in New York City. It’s timed to take place before world leaders hold a Climate Summit at the United Nations two days later. Organizers are billing it as the “biggest climate change demonstration ever” with similar marches around the world. The Nation describes the pre-organizing as following “a participatory, open-source model that recalls the Occupy Wall Street protests.” A leader of 350.org, one of the main organizing groups, explained, “Anyone can contribute, and many of our online organizing ‘hubs’ are led by volunteers who are often coordinating hundreds of other volunteers.”

I will join the march, as well as the Climate Convergence starting Friday, and most important the “Flood Wall Street” direct action on Monday, Sept. 22. I’ve had conversations with more than a dozen organizers including senior staff at the organizing groups. Many people are genuinely excited about the Sunday demonstration. The movement is radicalizing thousands of youth. Endorsers include some labor unions and many people-of-color community organizations that normally sit out environmental activism because the mainstream green movement has often done a poor job of talking about the impact on or solutions for workers and the Global South. Nonetheless, to quote Han Solo, “I’ve got a bad feeling about this.”

Home › Forums › Debt Rattle Sep 21 2014: What Game Is Being Played With the US Dollar?