Pablo Picasso Guernica [Study] 1937

I simply don’t understand this anymore.

Hawley – Khiara M. Bridges, Professor Of Law, UC Berkeley School of Law, Berkeley, CA

https://twitter.com/i/status/1546892242899668992

Sen. Cornyn: "Do you think that a baby that is not yet born—let's say the day before the mother delivers—do you think that baby has value?"

Prof. Bridges: "I think that the person with the capacity for pregnancy has value & they should have the ability to control what happens." pic.twitter.com/8iTKP7fQYf

— Breaking911 (@Breaking911) July 12, 2022

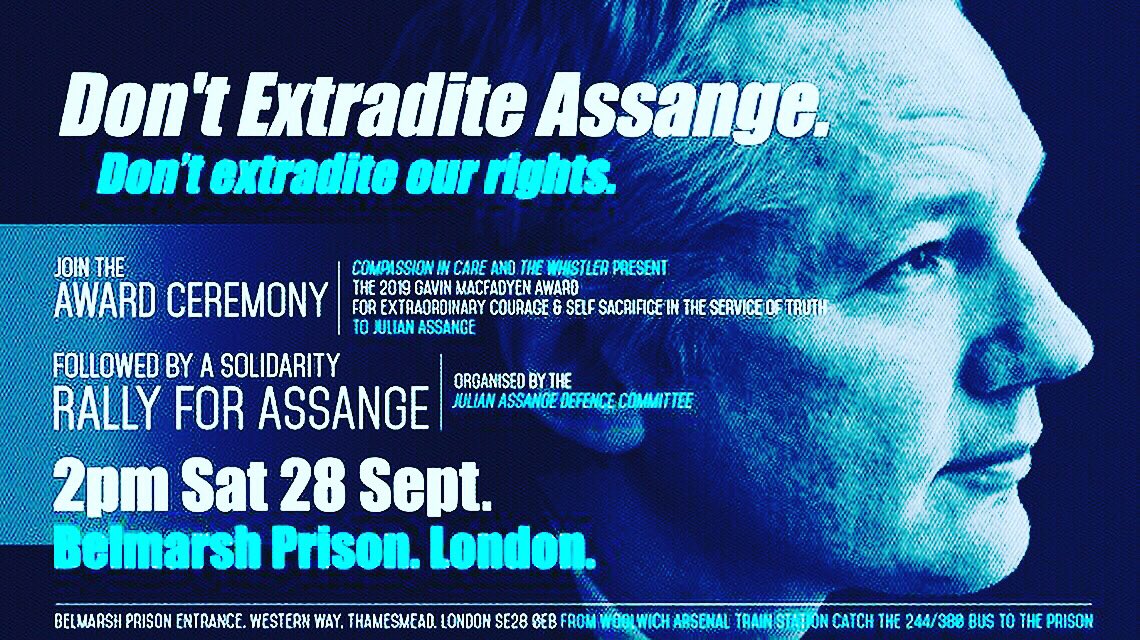

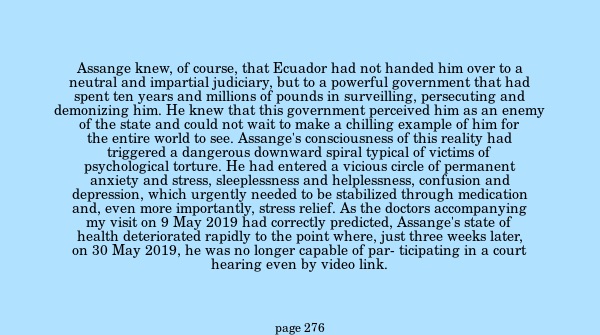

State secrets on the table.

Bolton – Jake Tapper: “One doesn’t have to be brilliant to attempt a coup.”

John Bolton: “I disagree with that. As somebody who has helped plan coup d’etat, not here, but other places, it takes a lot of work.”

https://twitter.com/i/status/1546963273408565249

PaxVax

https://twitter.com/i/status/1546900583919095810

“Russia knew that in order to win a war, you have to win the peace afterwards.”

• The Judgement of the Nations (Batiushka)

Originally, this was not a war, but a limited Operation, still involving a small proportion of the Russian Armed Forces. Had Russia wanted to occupy the Ukraine with massive military violence, in German, with a ‘Blitzkrieg’, in American, with ‘shock and awe’, with hundreds of thousands, perhaps millions, of victims, all could have been done in a couple of weeks. However, this is not Hollywood. That was not the aim. The clear aim was to free the Russian part of the Ukraine and to demilitarise and denazify the rest, so it would no longer present a threat to the Russian World. Obviously, doing this meant not just winning the genodical war which the backers of the Kiev regime had begun in 2014, but also doing it, causing the smallest number of victims among the Russian and Allied military and Ukrainian civilians as possible, and at the same time doing the least amount of damage to civilian infrastructure as possible.

Pictures showing huge damage to civilian infrastructure, especially in Mariupol and Donetsk, show above all the enormous amount of damage done by NATO-backed Kiev regime bombardments over the last eight years. It was clear to Russian military and political planners that the Operation would take at least months, perhaps years, as the whole of the Kiev Armed Forces had been digging in here for eight years. Russia knew that in order to win a war, you have to win the peace afterwards. It was no good doing like the Americans did in Vietnam, Iraq and Afghanistan, destroying infrastructure, making the people hate you and then, once you realise that you have lost, running away, leaving chaos and misery.

The Russian authorities also knew that since NATO had already de facto declared war on Russia in 2014, the Operation to liberate the Ukraine through denazification and demilitarisation would further activate their war effort and provoke many more ‘sanctions’. Now that the Operation has become a NATO war against Russia, much as expected, it is all the more difficult to forecast the future. Many missed the point. The Special Military Operation is not where it is at. The Ukraine is only the location, the battlefield, and the Kiev junta are only the actors on the stage, puppets. This is not primarily a battle of the military and their technologies, although they are very important, this is above all a battle of world views and ensuing realities. This battle is political and economic, spiritual and moral. Why else did the Johnson regime ban the Russian Orthodox Patriarch from visiting the UK?

Here we understand President Putin’s words of 7 July 2022 before Russian parliamentarians that Russia ‘has not even started anything in earnest in the Ukraine yet’, that the military operation in the Ukraine signifies ‘a cardinal break with the US world order, the beginning of the transition from the liberal globalism of US egocentricity to the reality of a multipolar world….the march of history is unstoppable and the attempts of the West to foist its New World Order on the world are doomed to failure’.

Putin – Multipolar world

Putin:

They should have realised they had already lost from the very beginning of our special military operation. Because its beginning also meant the start of a fundamental breakdown of the American world order. pic.twitter.com/Zhop6SUzoZ

— The Sirius Report (@thesiriusreport) July 11, 2022

Of course not. Just a stupid attempt to implicate more of America’s perceived enemies.

• No, Iran Will Not Deliver Armed Drones To Russia (MoA)

In March this year we were treated to an onslaught of obviously false claims that China would deliver weapons to Russia for the fight in Ukraine. “Russia seeks military equipment and aid from China, U.S. officials say – Washington Post – March 13, 2022 “Russia has turned to China for military equipment and aid in the weeks since it began its invasion of Ukraine, U.S. officials familiar with the matter told The Washington Post. The development comes as White House national security adviser Jake Sullivan plans to travel to Rome on Monday to meet with his Chinese counterpart, Yang Jiechi. “We are communicating directly, privately to Beijing, that there will absolutely be consequences for large-scale sanctions, evasion efforts or support to Russia to backfill them,” Sullivan told CNN.

Russia is an exporter of military weapons and China is one of its biggest customers. There is nothing in the Chinese arsenals that Russia can not and does not produce itself. The claim was false from the get go but Sullivan, the mediocre National Security Advisor of the Biden regime, planted it to put pressure on China. It of course did not work. China denied that it had received any request from Russia or that it was in any way willing to ever fulfill one if it would come: No Chinese weapons have been seen in Ukraine. Now an equally stupid claim was launched by the very same liar who launched the fake Chinese weapons claim.

“White House: Iran set to deliver armed drones to Russia” – AP – Jul 7, 2022 “The White House on Monday said it believes Russia is turning to Iran to provide it with “hundreds” of unmanned aerial vehicles, including weapons-capable drones, for use in its ongoing war in Ukraine. U.S. National Security Adviser Jake Sullivan said it was unclear whether Iran had already provided any of the unmanned systems to Russia, but said the U.S. has “information” that indicates Iran is preparing to train Russian forces to use them as soon as this month.” “Our information indicates that the Iranian government is preparing to provide Russia with up to several hundred UAVs, including weapons-capable UAVs on an expedited timeline,” he told reporters Monday.”

Russia has for some time build mass production facilities for its own drones. A decade ago, the Russian Armed Forces possessed fewer than 200 UAVs, and now this figure stands at over 2000, and each year is replenished by 300. Furthermore, the Russian defence industry is conducting R&D on the application of artificial intelligence (AI) in UAVs, with the ambition of enabling them to perform as unified “swarms of drones” in combat zones. Sources claim that this was already tested in 2020, during the Kavkaz-2020 military exercise. Russia has absolutely no need to buy drones from Iran. Besides that it is dubious that Iran would be able to deliver some and certainly not ‘several hundreds’.

The Washington Post notes the weird timing of Sullivan’s claims thereby hinting that it was made for purely political purposes which have nothing to do with Russia: “The revelation comes as President Biden prepares to depart for the Middle East, where he is expected to confer with key allies on a unified regional policy toward Iran. Tensions between Washington and Tehran have been further strained in recent weeks, amid faltering nuclear talks and an uptick in rocket and drone attacks on U.S. military installations in the Middle East, conducted by militia groups armed and funded by Iran.” The whole issues is just a talking point designed to put Iran and Russia into the same ‘baddies’ binder for Biden’s talks in the Middle East. The countries there may not like Iran but they will certainly not allow for a condemnation of Russia. The whole idea is, as many others Sullivan had, stupid to begin with.

Saudi’s No 1 is not the same as America’s.

• Joe Biden’s Oil Gamble Set to Backfire as Saudi Arabia Sticks With Russia (NW)

President Joe Biden’s attempt to lower rising oil prices by convincing Saudi Arabia to increase production looks set to fail as Saudi officials have indicated the country is not willing to abandon its oil production alliance with Russia, which Washington has claimed is part of the reason for sky-high fuel costs. Biden will begin his Middle East trip this week in his first trip to the region since taking office, starting in Israel and the occupied West Bank. He will end his trip in Saudi Arabia. Biden has said that the trip will advance American interests by focusing on the global trade and supply chains the U.S. relies on. Many countries in the West, including the U.S., want Saudi Arabia to produce more oil to help mitigate the growing global energy crisis that was ignited by the Ukraine war.

More production will also punish Russia, a major oil exporter, by bringing global prices down. According to a report in the Wall Street Journal on Sunday, U.S. officials said Biden will discuss Saudi Arabia’s human rights record during the trip. The paper reported that Saudi officials are not likely to make any human rights concessions nor will they be willing to abandon an oil-production partnership with Russia. Saudi Arabia has been looking to secure an oil alliance with Russia for decades but has to walk a tightrope to do this while improving strained relations with the U.S. over its human rights record. Washington and Riyadh have expressed different ideas about what the priorities will be during Biden’s visit. The Biden administration said that the summit of the Arab nations will take center stage, as the president will meet multiple heads of state from the region during the summit.

However, according to the Wall Street Journal, Saudi officials said the meeting between Biden and Saudi King Salman and his leadership team, which includes his son, Crown Prince Mohammed bin Salman, will feature “substantial exchanges between Prince Mohammed and the president on a range of topics and [Saudi officials] have described the summit as peripheral.” The crown prince is considered a pariah by many in Washington after U.S. intelligence agencies concluded in February 2021 that the 36-year-old future king approved the 2018 murder of Washington Post journalist Jamal Khashoggi.

“European stocks plunging 20%. Junk credit spreads widening past 2020 crisis levels. The euro sinking to just 90 cents, before a full-blown recession slams the world’s 2nd biggest economy.”

• The World Braces For Europe’s July 22 “Doomsday” (ZH)

Two weeks ago, when previewing the scheduled 10-day shutdown of the Nord Stream 1 pipeline – which supplies the bulk of European nat gas usage courtesy of Russia – for maintenance, we quoted from DB FX strategist George Saravelos that if the gas shutoff is not resolved in coming weeks this would lead to a broadening out of energy disruption with material upfront effects on economic growth, and of course much higher inflation, or as he puts it, “beyond the market’s worries about slower global growth in recent months, what is unfolding in Europe in recent days is a fresh big negative supply shock.” As such, DB’s Jim Reid said that July 22, the day gas is supposed to come back online, could be the most important day of the year:

“while we all spend most of our market time thinking about the Fed and a recession, I suspect what happens to Russian gas in H2 is potentially an even bigger story. Of course by July 22nd parts may have be found and the supply might start to normalize. Anyone who tells you they know what is going to happen here is guessing but as minimum it should be a huge focal point for everyone in markets.” Fast forward to today when, one day after the start of the scheduled 10-day shutdown period which has already sent flows through to NS 1 pipeline to basically zero… … and the market is now focusing on the worst case scenario: what happens if Russia cuts off all gas on July 22, the day even Bloomberg has now dubbed Europe’s “doomsday scenario.”

Here is a sample of what Wall Street expects to happen then: European stocks plunging 20%. Junk credit spreads widening past 2020 crisis levels. The euro sinking to just 90 cents, before a full-blown recession slams the world’s 2nd biggest economy. And all this power in the palm of Putin’s hand, almost as if he knew precisely how much leverage he had back in February while Europe was – as always – completely clueless. So to help Europe’s braindead bureaucrats, where energy policies have been dictated by a petulant Scandianvian teenager and a bunch of German “greens”, strategists across Wall Street have tried to put numbers on a scenario that would be unthinkable in normal times. The caveat of course is that there are so many variables, such as the length of any shutdown, the extent of supply cuts, and how far countries would go to ration energy, that anyone’s prediction is a guess at best. Even so, the scenarios are catastrophic.

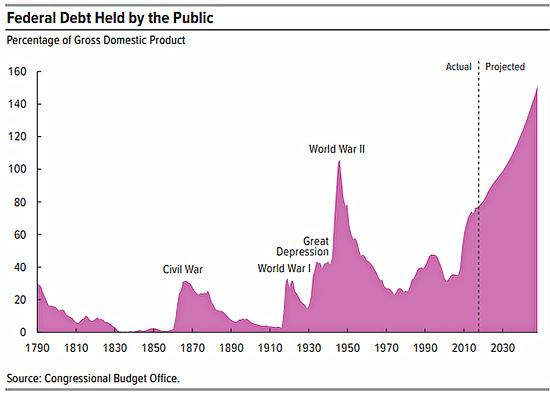

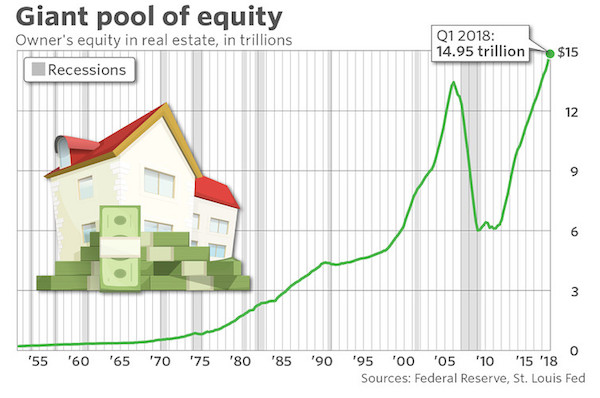

“Washington was already projected to add $100 trillion in baseline deficits over the next three decades due primarily to Social Security and Medicare shortfalls. ”

• Washington Isn’t Ready for Higher Interest Rates (NR)

Congress and the White House are not prepared for a world with higher interest rates, and there’s no backup plan. Weary families have already seen soaring inflation reduce their real wages by 3 percent over the past year. The Federal Reserve and market forces will likely defeat inflation within a reasonable time frame. But the resulting higher interest rates will cost Washington — and taxpayers — for many years to come. Any family shopping for a new home is already feeling the interest-rate crunch. Since last year, the average mortgage rate on a conventional fixed-rate loan has jumped from 2.6 percent to 5.8 percent, pushing up the monthly payment on a median-priced home from $1,289 to $1,877. Interest rates on car loans and small-business loans have jumped as well.

Rates are likely to continue rising. The Federal Reserve has quickly hiked the federal funds rate from 0.25 to 1.75 percent, yet will likely have to go higher to crush inflation. And once inflation is defeated, a more vigilant Fed is unlikely to drop rates back within the 0–2.5 percent range that has prevailed over the past 14 years. Investors will likely demand many years of higher interest rates and an inflation risk premium to avoid getting burned again. Such a scenario helped drive up 1980s interest rates in response to 1970s inflation. Other factors that may drive up interest rates for years to come include a long-awaited productivity surge (which would increase borrowing by making capital investments more profitable, and families more willing to borrow against future wealth), global investors chasing stronger returns in faster-developing economies, and baby boomers finally spending down their decades of retirement savings.

The colossal national-debt surge projected by the Congressional Budget Office would add approximately three percentage points to interest rates over three decades. Washington, perched for now on top of a mountain of debt, can ill afford higher interest rates. For the past few years, short-sighted lawmakers, economists, and columnists have demanded that Congress take advantage of low interest rates by engaging in a massive borrowing spree. Indeed, President Biden’s enormous spending agenda was often justified by the low interest rates on government borrowing. This case never made sense for two reasons. First, Washington was already projected to add $100 trillion in baseline deficits over the next three decades due primarily to Social Security and Medicare shortfalls.

Even with low rates, interest costs were projected by the CBO to become the most expensive item in the federal budget and consume half of all tax revenues within a few decades. Additional borrowing would deepen the hole. Second, Washington never locked in the recent low interest rates. In fact, the average maturity on the federal debt has fallen to 62 months. If interest rates rise at any point in the future, nearly the entire escalating national debt would roll over into those rates within a decade. Consequently, continued federal borrowing means gambling America’s economic future on the hope that interest rates never rise again. And there is no backup plan if rates do rise.

Martin Kulldorff and Jay Bhattacharya

• Democrats Defend Trump Officials’ COVID-19 Response (NW)

With more than one million reported COVID-19 deaths and enormous collateral damage to public health, education, and the economy, our pandemic response was a disaster. Yet some House Democrats are now defending the Trump administration officials responsible for initiating those misguided policies. Two Trump-appointed officials—former CDC director Robert Redfield and White House Coronavirus Response Coordinator Dr. Deborah Birx—formally directed the federal response from the start of the pandemic through January 2021. They adopted lockdowns, including school and business closures, as the centerpiece of the national coronavirus response. In a recent report, Democrats on the Congressional Select Subcommittee on the Coronavirus Crisis defended these Trump officials. In doing so, they reiterated the misunderstandings underpinning the Birx-Redfield-Fauci strategy.

The Trump officials made two fundamental mistakes. First, they failed to prioritize protecting older Americans from a disease that had an infection fatality rate more than a thousand times higher for the elderly than for the young, leading to many unnecessary deaths. Unlike Ebola, but similar to influenza and previously circulating coronaviruses, it was never possible to suppress COVID-19 to achieve “zero COVID.” Many countries tried, but not one succeeded. Lockdowns only prolonged the pandemic. Despite harsh government lockdowns, extensive contact tracing, and constant anxiety-inducing warnings, most Americans got infected. Inevitably so. With their singular focus on COVID suppression, Birx, Redfield, and Anthony Fauci failed to implement measures to protect older, high-risk Americans. They praised governors who ordered hospitals to discharge COVID-infected patients to nursing homes, where they infected other residents.

Excess staff rotation spread the virus both within and between nursing homes. Instead of implementing daily testing at nursing homes, Birx, Redfield, and Fauci used limited resources to test asymptomatic children and students. It was only when Dr. Scott Atlas arrived at the White House in July 2020 that the government made more tests available to nursing homes. When enough people recover from COVID, the country reaches herd immunity. After that, the disease becomes endemic, like other coronaviruses that cause occasional colds. Since the Birx-Redfield-Fauci strategy led to mass infection and eventual herd immunity, it is curious that congressional Democrats now claim these Trump officials were opposed to a “herd immunity strategy.” The truth, now obvious to all, is that all COVID strategies lead to herd immunity. That is how pandemics end.

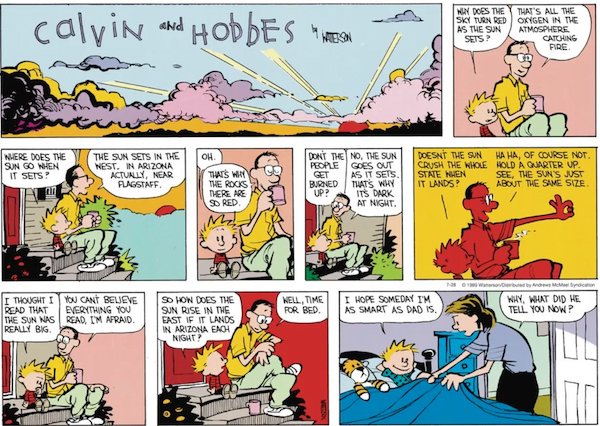

Because it compromises the immune system.

• Covid Booster Significantly Delays End Of Infection (INN)

A new study published in the New England Journal of Medicine (NEJM) has demonstrated that people who are triple-vaccinated (boosted) against COVID recover significantly more slowly from COVID infection and remain contagious for longer than people who are not vaccinated at all. The study did not deal with the severity of illness with or without a vaccine. Researchers swabbed infected people and cultured the swabs, repeating the process for over two weeks until viral replication was not observed. At five days post-infection, less than 25 percent of unvaccinated people were still contagious, whereas around 70 percent of boosted people were still carrying viable virus particles. For those partially vaccinated, around 50 percent were still contagious at this point.

Even more strikingly, at ten days post-infection, one-third of boosted people (31 percent) were found to still be carrying live, culturable virus. By contrast, just six percent of unvaccinated people were still contagious at day 10. In other words, people who have received a booster shot are five times more likely still to be contagious at ten days post-infection than are unvaccinated people. The findings go a long way to explaining why Paxlovid, Pfizer’s anti-viral medication, is often not effective for people who have been vaccinated against COVID, with many experiencing a recurrence of symptoms along with a positive COVID test after completing the five-day regimen (as recently occurred with quadruple-vaccinated Dr. Anthony Fauci). This phenomenon is known as COVID rebound.

“Moderna claims the active substance — mRNA in Spikevax — does not need to be studied for toxicity and can be replaced with any other mRNA without further testing.”

• FDA Colluded With Moderna to Bypass COVID Vaccine Safety Standards (CHD)

According to an ex-pharmaceutical industry and biotech executive, documents obtained from the U.S. Department of Health and Human Services (HHS) on Moderna’s COVID-19 vaccine suggest the U.S. Food and Drug Administration (FDA) and Moderna colluded to bypass regulatory and scientific standards used to ensure products are safe. Alexandra Latypova has spent 25 years in pharmaceutical research and development working with more than 60 companies worldwide to submit data to the FDA on hundreds of clinical trials. After analyzing 699 pages of studies and test results “supposedly used by the FDA to clear Moderna’s mRNA platform-based mRNA-1273, or Spikevax,” Latypova told The Defender she believes U.S. health agencies are lying to the public on behalf of vaccine manufacturers.

“It is evident that the FDA and NIH [National Institutes of Health] colluded with Moderna to subvert the regulatory and scientific standards of drug safety testing,” Latypova said. “They accepted fraudulent test designs, substitutions of test articles, glaring omissions and whitewashing of serious signs of health damage by the product, then lied to the public on behalf of the manufacturers.” In an op-ed on Trial Site News, Latypova disclosed the following findings:

- Moderna’s nonclinical summary contains mostly irrelevant materials.

- Moderna claims the active substance — mRNA in Spikevax — does not need to be studied for toxicity and can be replaced with any other mRNA without further testing.

- Moderna’s nonclinical program consisted of irrelevant studies of unapproved mRNAs and only one non-GLP [Good Laboratory Practice] toxicology study of mRNA-1273 — the active substance in Spikevax.

- There are two separate investigational new drug numbers for mRNA-1273. One is held by Moderna, the other by the Division of Microbiology and Infectious Diseases within the NIH, representing a “serious conflict of interest.”

- The FDA failed to question Moderna’s “scientifically dishonest studies” dismissing an “extremely significant risk” of vaccine-induced antibody-enhanced disease.

- The FDA and Moderna lied about reproductive toxicology studies in public disclosures and product labeling.

“Moderna’s documents are poorly and often incompetently written — with numerous hypothetical statements unsupported by any data, proposed theories, and admission of using unvalidated assays and repetitive paragraphs throughout,” Latypova wrote. “Quite shockingly, this represents the entire safety toxicology assessment for an extremely novel product that has gotten injected into millions of arms worldwide.”

“Trials” in this case doesn’t mean what it usually does. There have been either no “trials” or one very big one.

• The Serious Adverse Events of mRNA Covid-19 Vaccine Trials (Demasi)

In December 2020, the US FDA authorised the Moderna and Pfizer mRNA covid-19 vaccines, claiming “the benefits outweighed the harms.” Now, a group of international researchers has gone back to re-analyse the original trial data upon which that claim was made. A pre-print study (not yet peer-reviewed) by Fraiman and colleagues contradicts the FDA’s claim that the benefits outweigh the harms of the mRNA vaccines. In fact, the authors conclude that the vaccines are associated with an “increased risk of serious adverse events” that surpass the “risk reduction for covid-19 hospitalisation” relative to the placebo group. The conclusion is provocative. While some have criticised the study for fuelling ‘anti-vax’ sentiment, many have welcomed the independent scrutiny of the trial data.

The researchers focused on analysing serious adverse events — specifically, they narrowed it to serious adverse events of “special interest” which were derived from a predefined list by the Brighton Collaboration, an established framework for vaccine safety used for over two decades. The advantage of this method is that it removes adverse events that are unlikely to be vaccine-related such as gunshot wounds and car accidents, thereby removing ‘noise’ from the analysis. They also pooled the trial data for the two mRNA vaccines which increased the sample size and achieved higher confidence in the results (more precision). The upshot of the analysis was that mRNA vaccines were associated with an absolute risk increase of serious adverse events of 12.5 per 10,000 vaccinated people (95% CI 2.1 to 22.9) over placebo.

Put another way, 1 in 800 people experienced a serious adverse event following either one of the mRNA vaccines (95% CI: 437 to 4762). “That is very high for a vaccine. No other vaccine on the market comes close,” says Martin Kulldorff, professor of medicine at Harvard (on leave) and former CDC vaccine safety committee member who was not involved in the study. Kulldorff says the closest any other vaccine on the US market comes to this is the MMRV vaccine which is no longer recommended for 1-yr-olds because they found the excess risk of febrile seizures was 1 in 2300 compared to separate MMR and Varicella vaccines (no excess risk in 5-yr olds). The Fraiman study found that coagulation disorders and cardiovascular problems were driving most of the serious adverse event in the trials, which seems to corroborate reports in the pharmacovigilance databases.

“Every conversation that she described that she had with people from McCarthy to Ratcliffe to Cipollone never happened..”

• Cassidy Hutchinson Begged Trump Officials For ‘Financial Assistance’ (DC)

The Jan. 6 Committee’s key witness, Cassidy Hutchinson, asked former Senior Trump officials for financial assistance and legal help in February after she was subpoenaed by the committee, according to an email obtained exclusively by the Daily Caller. [..] “I was subpoenaed by the 1/6 Committee on November 9, 2020, but was not formally served until Wednesday, January 26, 2021. I’ve had difficulty securing a legal team, and was hoping you may be able to put me in contact with any fundraising organizations and/or attorneys that are involved in this process,” Hutchinson said in the email to the former senior Trump official. “My aunt and uncle applied to refinance their house to loosen up some money since I don’t have much immediate family, but they weren’t approved,” Hutchinson said in a separate email.

Multiple senior Trump officials and a person with first-hand knowledge told the Daily Caller that former White House Chief of Staff Mark Meadows would not answer Hutchinson’s calls after she was subpoenaed. A Meadows spokesperson confirmed those claims to the Daily Caller, saying Meadows didn’t return those calls to avoid the appearance of improperly influencing any testimony. [..] “Cassidy Hutchinson reached out to various people in Trump world asking for both financial assistance and help finding a lawyer. She told us she was in significant financial distress, had no family that could help, and couldn’t even afford food. She also told us Mark Meadows wouldn’t return her calls. To our knowledge, she spoke with multiple lawyers and chose Stefan Passantino to represent her,” a person with first-hand knowledge told the Daily Caller.

The person with first-hand knowledge also said that Trump officials were sympathetic because of her age and lack of employment and said at her request, Trump’s PAC agreed to help her financially and, at her request, suggested attorneys she could interview. The person also said Hutchinson made derogatory comments about the Jan. 6 committee to multiple people in Trump world. A former senior Trump official also mentioned Meadows not returning Hutchinson’s calls and said she reached out to Trump’s circle and asked for help. “She reached out to Trump world and was like, ‘Hey. The committee reached out to me. I really need help.’ She didn’t have a job. She didn’t have money to pay a lawyer. Trump has been trying to be really helpful, especially with young people who weren’t like bad actors on J6, like get you a lawyer. Pay for it. Meadows wasn’t returning her phone calls and like her circle of people, weren’t, like, helpful,” a former senior Trump official told the Caller.

[..] “She was in a horrible, she was in horrible shape financially. She had no employment prospects because like, you know, coming out of the Trump White House election wasn’t exactly, you know, a great line on the resume. And she was desperate,” the other Trump official told the Caller. “Every conversation that she described that she had with people from McCarthy to Ratcliffe to Cipollone never happened,” the official added. Another former senior Trump official told the Caller that Hutchinson was supposed to go work for Trump in Palm Beach, Florida, after leaving the White House and was stunned by Hutchinson’s testimony in front of the committee.

“She made it sound like all these people, I mean, I was in that West Wing, that these people basically were reporting to her and she was giving Meadows advice. And I’m like, What? I was there … But here’s the part that I do know firsthand she was supposed to take a job in Palm Beach,” the former senior Trump official said. “All I know. She was thrilled to go down there. Thrilled. Thrilled. This is after January 20!” the former official continued.

“Facebook, in short, is utterly swarming with spooks.”

• The Ex-CIA Agents Deciding Facebook’s Content Policy (MacLeod)

It is an uncomfortable job for anyone trying to draw the line between “harmful content and protecting freedom of speech. It’s a balance”, Aaron says. In this official Facebook video, Aaron identifies himself as the manager of “the team that writes the rules for Facebook”, determining “what is acceptable and what is not.” Thus, he and his team effectively decide what content the platform’s 2.9 billion active users see and what they don’t see. Aaron is being interviewed in a bright warehouse-turned-studio. He is wearing a purple sweater and blue jeans. He comes across as a very likable, smiley person. It is not an easy job, of course, but someone has to make those calls. “Transparency is incredibly important in the work that I do,” he says.

Aaron is CIA. Or at least he was until July 2019, when he left his job as a senior analytic manager at the agency to become senior product policy manager for misinformation at Meta, the company that owns Facebook, Instagram and WhatsApp. In his 15-year career, Aaron Berman rose to become a highly influential part of the CIA. For years, he prepared and edited the president of the United States’ daily brief, “wr[iting] and overs[eeing] intelligence analysis to enable the President and senior U.S. officials to make decisions on the most critical national security issues,” especially on “the impact of influence operations on social movements, security, and democracy,” his LinkedIn profile reads. None of this is mentioned in the Facebook video.

Berman’s case is far from unique, however. Studying Meta’s reports, as well as employment websites and databases, MintPress has found that Facebook has recruited dozens of individuals from the Central Intelligence Agency (CIA), as well as many more from other agencies like the FBI and Department of Defense (DoD). These hires are primarily in highly politically sensitive sectors such as trust, security and content moderation, to the point where some might feel it becomes difficult to see where the U.S. national security state ends and Facebook begins. In previous investigations, this author has detailed how TikTok is flooded with NATO officials, how former FBI agents abound at Twitter, and how Reddit is led by a former war planner for the NATO think tank, the Atlantic Council. But the sheer scale of infiltration of Facebook blows these away. Facebook, in short, is utterly swarming with spooks.

WEF-coordinated between several countries.

The discussion is priceless.

• Someone Tell The PM The World Needs More Fertilizer, Not Less (TSun)

The Trudeau government’s plan to reduce the use of fertilizers in Canada in the name of fighting climate change is the kind of thinking that globally applied, will lead to skyrocketing food prices and famine.It is another example of how Prime Minister Justin Trudeau’s mantra that the world must move ever faster away from the use of fossil fuels is increasingly becoming disconnected from reality because of rapidly changing global events.The problem right now is that the world needs more fertilizer, not less, for the same reason it needs more fossil fuel energy, not less.The severe shortage of both is happening for the same reasons — supply chain disruptions as countries try to recover economically from the COVID-19 pandemic, along with Russian President Vladimir Putin’s war on Ukraine.

Just as Russia is a major supplier of natural gas and oil to Europe, it is also the world’s largest producer of fertilizer. A global shortage of fertilizer — exacerbated by economic sanctions against Russian fertilizer and Russian export restrictions on fertilizer — is already contributing to higher prices, not just for the fertilizer needed by farmers to grow crops, but for the prices consumers pay for food at the grocery store. At least that’s the case in developed countries like Canada.For developing countries, it raises the spectre of famine. The real “green revolution” in agriculture, which started in the 1960s by making food production increasingly more efficient — in large part due to fertilizers — is literally keeping billions of people around the world alive today.

A global shortage of fertilizer, unless it is meaningfully addressed, will do the opposite over time.Enter the Trudeau government with a policy of reducing greenhouse gas emissions from fertilizers in Canada to 30% below 2020 levels by 2030. That’s an absurdly short time frame which is just as unrealistic as his target of reducing Canada’s greenhouse emissions to 40%-45% below 2005 levels by 2030 and to net zero by 2050. The Liberals, as well as the Conservatives, have never hit a single emission reduction target they’ve set over the past 34 years, and the reason is they set targets which are technologically unfeasible over and over again.

‘Nobody believes you’: Poilievre grills Trudeau as he testifies over WE Charity controversy

This crazy video feels like a sign of these crazy times.

• DUCK AND COVER 2.0: Prepare for a Nuclear Attack (Celente)

The Ukraine War continues to escalate and America and NATO have vowed to do whatever it takes to defeat Russia. As we have forecast, the longer the war drags on, and the more weapons of death that are sent to Ukraine to keep bloodying the killing fields, the hotter it’s going to get, even to the point where there will be a nuclear exchange. Now the message being broadcast via the mainstream media is that the worst is yet to come, and they are warning the people, as they were during the Cold War, to “Duck and Cover.” Yesterday, New York City released a public service announcement warning the people that a nuclear bomb can be dropped and gave them idiotic and moronic instructions on what to do to save their lives after the bomb was dropped.

Assuming that they did not burn or melt in the initial blast, the New York City Emergency Management Department gave New Yorkers a three-step plan reminiscent of the duck-and-cover stupidity they sold the people at the height of the Cold War. The biggest takeaway: you really have to be a stupid dumbbell to swallow the crap from this shit show production. The short video, which looks like it was filmed on a Hollywood set, takes place on a partially bombed city street with a scene with damage that looks more Sesame Street than a nuclear apocalypse. Dressed in black, the presenter is the culturally perfect presenter in America’s dead-woke society. The actor playing the government mouthpiece role appears calm, almost like a flight attendant pointing to emergency exits on a plane and the only indication that something is amiss is the faint sound of sirens going on in the background.

Led by Donkeys

The Tory leadership candidates want credit for telling Boris Johnson to go. But here's what they recently said about him. pic.twitter.com/waYWUYagEm

— Led By Donkeys (@ByDonkeys) July 11, 2022

Mahathir

https://twitter.com/i/status/1546003810253803521

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.