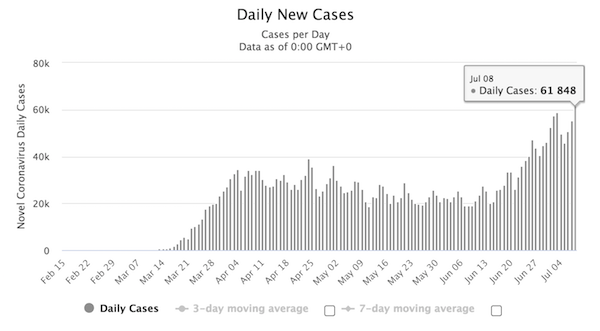

Pablo Picasso Jacqueline in Turkish costume 1955

Christmas in Jerusalem (1921), back before the Nakba, when the three Abrahamic faiths lived side by side in peace in the Holy City.

Trump Xmas

🚨 Trump Campaign Releases New Television Ad — "A Christmas To Remember" pic.twitter.com/cy3i8lSmnL

— Team Trump (Text TRUMP to 88022) (@TeamTrump) December 24, 2023

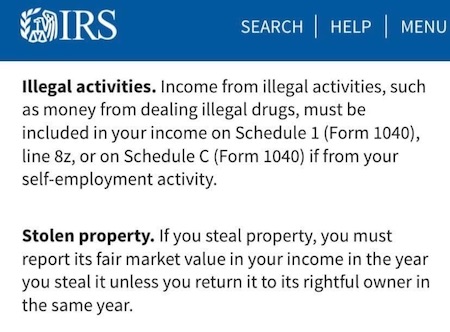

Trump

The actual reason they want you to despise Trump and remove him from the campaign for president. #MAGA #Trump2024NowMorethanEver #Trump2024 pic.twitter.com/3rUA6TKbLx

— JoshWho #SeekingTheTruth (@JoshWhoX) December 24, 2023

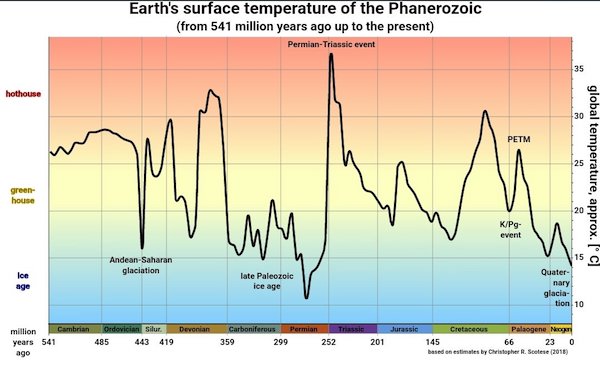

Sowell warning

One of the world's most respected scholars, Thomas Sowell, on the "man-made global warming" hoax:

"Temperatures went up first, and then there was the increase in carbon dioxide. You can’t say that A causes B if B happens first… But [the scientists] who are pushing global… pic.twitter.com/WMBahD6aZW

— Wide Awake Media (@wideawake_media) December 25, 2023

� �

“..GOP members of Congress have never been in a stronger position for border security and they cannot compromise now..”

• Biden Handling Of Southern Border To Cost Him 2024 Election – Congressman (JTN)

As the 2024 presidential election nears, Republicans are sharpening their attacks lines on the chaotic and insecure U.S. southern border, seeing it as one of President Joe Biden’s biggest vulnerabilities. Many in the GOP have been urging the Democrat-controlled Senate and President Biden to pass legislation titled H.R.2, also known as the “Secure the Border Act.” This bill would immediately resume construction of the wall on the southern border, supply border patrol agents with resources and invest in technology for border security. “The Senate has literally sat on it,” Rep. Rich McCormick, R-Ga., said on the Just the News, No Noise TV show. “The president has sat on it. The president has no intention of making this into law. As a matter of fact, to the point where they say ‘we’re not even going to combine it with other things that we want, because we don’t want any compromise in securing our border.'”

“This comes at a great political cost to him, and he is going to lose the election on this single issue, if nothing else,” said McCormick, a Marine combat veteran and emergency room doctor before he joined Congress. According to data released by U.S. Customs and Border Protection in October, there have been a total of 736 terrorist suspects stopped at the border in fiscal year 2023, part of the 3.2 million people who have attempted to enter the country illegally. A poll earlier this month found a whopping 79% of Americans believe the situation at southern border is either an “emergency” or a “major problem.” According to a poll conducted by Monmouth University last week, 69% of those surveyed said they disapproved of Biden’s job when it comes to immigration.

Former Customs and Border Protection Commissioner Mark Morgan said that GOP members of Congress have never been in a stronger position for border security and they cannot compromise now. “Right now we have our own war that we’re fighting,” Morgan said on the “Just the News, No Noise” TV show. “I use that word intentionally: war. We’re fighting it on our own borders, and the cartels are our enemy.” House Homeland Security Committee Chairman Mark Green, R-Tenn., recently announced he would be bringing articles of impeachment against Homeland Secretary Alejandro Mayorkas for his response to the southern border crisis. Rep. Eli Crane, R-Az., told the John Solomon Reports podcast he thinks that Speaker Mike Johnson should hold out and get all of H.R. 2 in the budget deal.

“I’m the type of guy that believes that we could get a lot more than we normally get if we actually were willing to stand and fight,” Crane said. “I don’t usually see that from the Republican Party. It’s one of my many, many frustrations. “It’s not that there’s not plenty of good people in the party. I think that there’s just this attitude that we have to continually capitulate and kick the can down the road.” Morgan also slammed Senate Republicans who signal they want to compromise on border security.

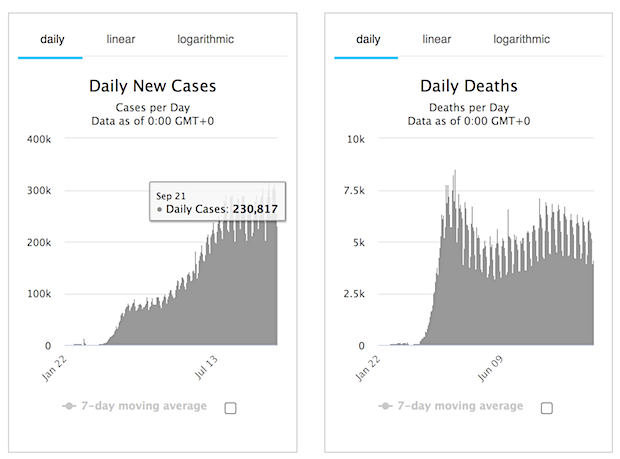

“The number of people apprehended at the US southern border exceeded two million both in the 2022 and the 2023 fiscal years.”

• Thousands Join Huge Migrant Caravan In Mexico Ahead Of Blinken Visit (BBC)

Thousands of migrants have set off on foot from southern Mexico in an effort to reach the United States border. Around 7,000 people mainly from South and Central America, including thousands of children, are estimated to have joined the migrant caravan. They left just days before US Secretary of State Antony Blinken is due to discuss how to curb mass migration with the Mexican president Several border crossings have recently been closed due to a migrant surge. White House national security spokesman John Kirby said US President Joe Biden and his Mexican counterpart, Andrés Manuel López Obrador, shared concern about the “dramatic” increase in migrants crossing their joint border. The number of people apprehended at the US southern border exceeded two million both in the 2022 and the 2023 fiscal years.

In September 2023 alone, US Border Patrol apprehended more than 200,000 migrants crossing the US-Mexico border unlawfully, according to US Homeland Security figures. The latest migrant caravan left from the southern Mexican city of Tapachula, near the country’s southern border with Guatemala, on Christmas Eve. Its leaders carried a banner reading “Exodus from poverty”. Local media said that most of the migrants were from Cuba, Haiti and Honduras, but some came from as far away as Bangladesh and India. Many said that they had decided to join the caravan after waiting for months for transit permits. The migrant rights activist Luis García Villagrán, who is accompanying the caravan, said joining the mass trek north was a last resort for many of the migrants who had been stuck in Tapachula. “The problem is that the southern border [with Guatemala] is open and 800 to 1,000 people are crossing it daily. If we don’t get out of Tapachula, the town will collapse.

“We tell the Mexican state that it has left us no other option but to take the coastal highway and walk as far as we can get,” he said. The migrants covered some 15km on the first morning, after setting off at dawn on 24 December. One Honduran migrant said he had left his home country to escape a criminal gang which had threatened to kill him. José Santos told Reuters news agency: “I was scared so I decided to come to Mexico hoping I’ll be allowed to go to the US.” On Friday, Mexican President Andrés Manuel López Obrador said he was willing to work again with the US to address concerns about migration. The Mexican leader is due to meet the US secretary of state on Wednesday. Their meeting comes at a time when the surge in immigration is a hot political topic in the US with pressure mounting on President Biden to stem the flow across the US southern border.

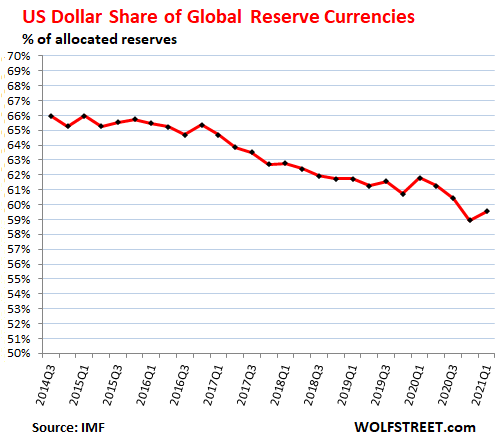

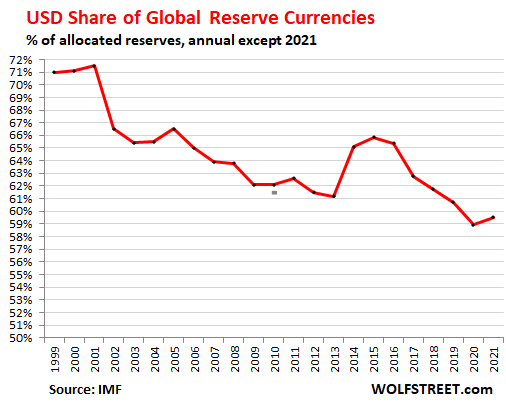

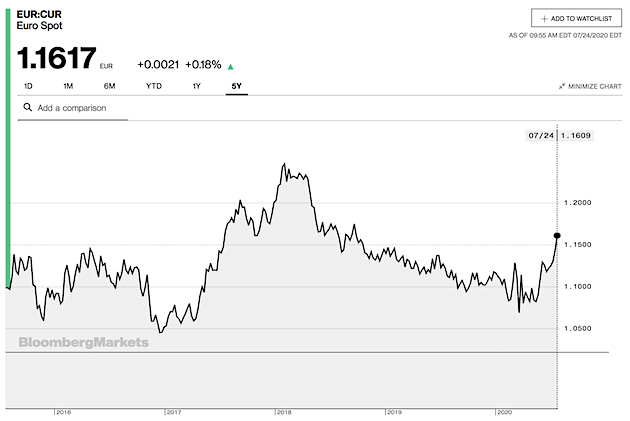

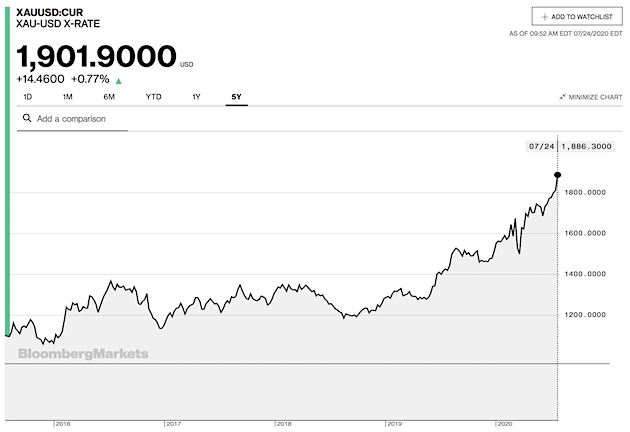

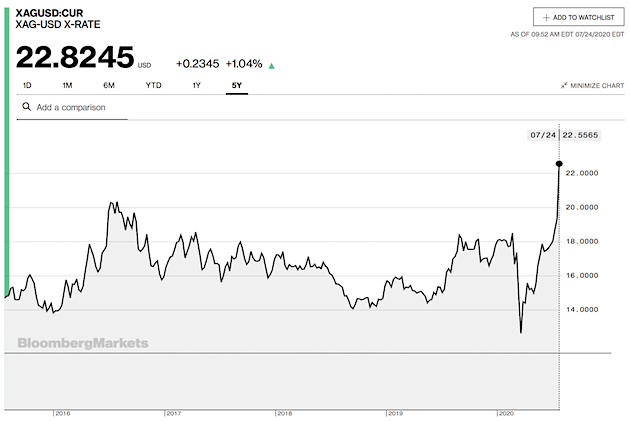

“If America does this to Russia today… then tomorrow it can do this to anyone..”

• Confiscating Russian Assets Would Be ‘Cataclysmic’ For Dollar – Robert Shiller (RT)

The dollar’s standing as a reserve currency would be jeopardized if the West confiscates frozen Russian assets to aid Ukraine, Nobel Prize-winning economist and Yale University professor Robert Shiller said in an interview with Italian news outlet La Repubblica published on Sunday. According Shiller, seizing the assets would give the global community, especially countries which, like Russia, “convert their savings into dollars and thus entrust them in the reliable hands of Uncle Sam,” grounds to doubt the US currency. “If America does this to Russia today… then tomorrow it can do this to anyone. This will destroy the halo of security that surrounds the dollar and will be the first step towards de-dollarization, which many are increasingly confidently leaning toward, from China to developing countries, not to mention Russia itself,” the economist warned.

“I can’t convince myself that this [confiscation of Russian assets] is the right way,” he explained. “In addition to the fact that this will be confirmation for the Russian leader that what is happening in Ukraine is a proxy war, it could paradoxically turn against America and the entire West,” Shiller explained, adding that the situation would likely turn into “a cataclysm for the current dollar-dominated economic system.” Overall, he said that while he sees some moral ground for using Russian assets to aid Ukraine, there is too much risk and “too many unknowns” with regard to the impact of such an action. Shiller is known for his research in financial markets, financial innovation, behavioral economics, macroeconomics and real estate. In 2011, he was named one of Bloomberg’s ‘50 Most Influential People’ in Global Finance, and in 2013, he received the Nobel Prize in Economics for his empirical analysis of asset prices in 2013.

The EU, US, and their allies have frozen roughly $300 billion of Russian foreign exchange reserve assets since last year as part of a sanctions campaign over the Ukraine conflict. Western nations have been mulling ways to use the funds to aid Ukraine for the better part of a year. While no specific plan has so far been finalized, last week’s media reports indicated the US recently stepped-up discussions on the matter with its allies. Washington reportedly wants to “legalize” the confiscation of Russian assets by recognizing Western countries as injured parties in the Ukraine conflict. Russia considers both the initial freezing of its assets and plans to confiscate them unlawful. Speaking to reporters last week, Kremlin spokesman Dmitry Peskov warned that any country considering the move should understand that it would face an immediate mirror response from Moscow.

“In an effort to ensure their financial security other states will now more actively abandon the dollar..”

• Biden Is Destroying The Dollar – Russia’s Top MP (RT)

The US has lost its economic dominance, Russian State Duma Speaker Vyacheslav Volodin wrote on his Telegram channel on Sunday. Attempts to regain it by unleashing “military conflicts, sanctions and trade wars, organizing terrorist attacks and destroying the European economy” have not brought Washington the desired results, according to Volodin. Russia’s top lawmaker called the dollar the only remaining instrument of US influence. However, other countries are increasingly abandoning it because Washington is using the greenback as a weapon in a “political battle.” He added that US President Joe Biden was depriving his own country of its “last advantage,” since such threats do not build confidence in either the country itself or its currency.

The global trend towards using national currencies in trade instead of the dollar began to gain momentum last year, after Ukraine-related sanctions cut off Russia from the Western financial system and froze its foreign reserves. “In an effort to ensure their financial security other states will now more actively abandon the dollar as the world reserve currency,” Volodin wrote. Amid sweeping sanctions on Russia, which have proved ineffective, the US is “hysterically threatening to disconnect banks around the world from their financial system for violating them,” he added. Moscow significantly ramped up the use of national currencies in its foreign trade last year, moving away from the euro and dollar in international transactions. The share of both in Russia’s export settlements fell from 96% in early 2022 to 17% this past September, according to the central bank.

“..Netanyahu knows the Houthis: They will not be deterred by Biden’s maritime flotilla. They will, rather, relish drawing the West into a Red Sea quagmire.”

• Netanyahu Outsmarted by Wily Biden? No, Biden Is the One Being Played (Crooke)

Biden smirked and responded, “I know”, when told by a guest that Netanyahu is drawing the U.S. into a civilisational conflict – and further that Netanyahu blames him (Biden), complaining that the White House wants to block Israel from getting at the root of the problem, by harping on about Gaza and the ‘day after’. In practice, what Netanyahu is doing is simply mounting a classic flanking manoeuvre – attempting to circumvent Biden by pointing to the ‘broader conflict’ with Iran: ‘Why are you pestering me about Gaza when there’s a monumental conflict raging’, suggests Bibi in exasperation? “This is not only ‘our war’ but in many ways your war… This is a battle against the Iranian axis… now threatening to close the maritime strait of Bab Al-Mandeb… It is the interest … of the entire civilized community”, Netanyahu has said – not very subtly.

Biden’s reaction is a smug smile, hinting that he thinks he can outplay Netanyahu (‘the fox’). This is Biden’s approach: He aims to disarm Netanyahu’s allegation of an obstructionist U.S. through a parade of top-level visits that reiterates his unstinting support Israel – and to pre-empt Bibi, through insisting that he (Biden) will take care of the non-Gaza issues (Hizbullah, Yemen etc.). So, the U.S. is assembling a maritime force to confront AnsarAllah in Yemen; the Biden Admin will act to sanction violent settlers in the West Bank; it is warning Baghdad to rein-in the Hashad al Sha’abi; and his envoys in Beirut are trying to forge a ‘diplomatic agreement’ that will include the withdrawal of Hizbullah’s Radwan Forces to the other side of the Litani River in southern Lebanon, and also deal with the unresolved border disputes between Israel and Lebanon.

Biden prides himself on being a hugely experienced foreign policy actor – and thinks himself too wily for Bibi’s tricks. But maybe, Netanyahu – for all his many faults – better understands the Region? Biden clearly is being played. Even though he fails to recognize it. Netanyahu knows that ‘no way’ will Hizbullah disarm, and withdraw to north of the Litani. He knows this, and thus can wait out Biden’s diplomatic failure, before saying that the approximately 70,000 Israeli citizens displaced from the northern towns in the wake of 7 October need to ”go home”, and that if the U.S. cannot remove Hizbullah from the border-fence, then Israel will do it.

Netanyahu is using Biden’s diplomatic Lebanese initiative to build European justification for an Israeli operation in a few weeks’ time to push Hizbullah away from the border with Israel. (An Israeli operation against Hizbullah has been in the works from the outset of the Gaza war). Netanyahu knows too that control over settler violence in the West Bank lies not with him, but is in the hands of his partners: i.e., Ministers Ben Gvir and Smotrich. Neither he, nor Biden can dictate to them – they have been quietly increasing the squeeze on West Bank Palestinians for months. And finally, Netanyahu knows the Houthis: They will not be deterred by Biden’s maritime flotilla. They will, rather, relish drawing the West into a Red Sea quagmire.

Like it or not, Biden’s tactic of containing and pre-empting regional escalation through the U.S. itself becoming lead actor – in lieu of Israel – is clearly drawing the U.S. deeper into conflict. Does Biden believe that the Houthis will just quietly ‘roll-over’ because the Gerald Ford is anchored off Bab Al-Mandeb, or that Hizbullah will accept instruction from Amos Hochstein? The second way that Biden is being outplayed is through him seeing the Israeli problem as ‘just Bibi’ – indulging in personal politics. Of course, it is true that the Israeli PM is moulding Israeli politics to his own survival needs; yet pause a moment to consider what President Herzog said on Tuesday during an interview facilitated by the Atlantic Council, a leading Washington-based think tank.

Herzog has long been viewed as distinctly ‘dovish’ and ‘Leftist’ by the Beltway foreign policy establishment – prior to the war – compared to Netanyahu. In the interview, Herzog said: “We intend to take over the entire Gaza Strip and change the course of history”. He said that the current conflict is a clash of “a set of civilizational values” and he cast Hamas (in pure Manichaean terms) as a “force of evil”, adding that Israel would no longer tolerate Gaza being a “platform for Iran – driving everyone into the abyss of bloodshed and warfare”. Not much daylight then between him and the PM then.

“..the permanent members of the Security Council should cast vetoes only under “rare, extraordinary situations to ensure the council remains credible and effective.”

• Despite Its Shortcomings, UNSC Vote Will Tie Israel’s Hands (Bhadrakumar)

The adoption of a resolution by the United Nations Security Council (UNSC) on Friday with focus on a pause in the fighting in Gaza to allow for the delivery of more humanitarian aid can be seen as a turning point in the tortuous journey toward imposing a sustainable ceasefire. But a caveat must be added that the ultimate litmus test lies in the implementation of the UNSC resolution, as the past history of such resolutions on Palestine does not give cause for optimism. In fact, Israel’s defiance was in full view already. As the Security Council passed the resolution, Israeli forces pushed ahead with their offensive into Gaza on Friday and ordered residents in Al Bureij — an area in central Gaza where Israel had not previously focused its offensive — to evacuate. Israeli military’s chief spokesman Rear Adm. Daniel Hagari said on Thursday: “Our forces continue to intensify ground operations in northern and southern Gaza.”

UN Secretary General António Guterres was spot on when he told reporters after the resolution was passed that “a humanitarian ceasefire is the only way to begin to meet the desperate needs of people in Gaza and end their ongoing nightmare.” The resolution itself is the outcome of week-long intense negotiations between the United States and the Arab countries that sponsored it — the UAE and Egypt, in particular — to settle for the lowest denominator, which meant accepting a Washington-friendly text that enabled the Biden administration to evade responsibility for another veto, for the third time since 7 October. Unsurprisingly, the US negotiators brazenly resorted to pressure tactics by drawing on their usual diplomatic tool box — blackmail, arm-twisting and ultimatums — to water down the text to the extent that important provisions relating to a ceasefire and a UN mechanism to facilitate the delivery of humanitarian aid to Gaza and ensure its monitoring were abandoned.

And, yet, the US abstained in the vote at the end of the day, registering its reservations — principally, that the resolution was silent on the attack by Hamas on 7 October. The unkindest cut of all is that the resolution accommodated the US diktat to replace the language describing an immediate cessation of violence with an ambiguous phrase calling on the parties to “create conditions for a cessation of hostilities.” The wording meets the Israeli requirement to have a free hand to continue with its barbaric military operations.This anomaly, coupled with the absence of any reference to the condemnation of indiscriminate attacks by the Israeli military against civilians almost delivers the wrong signal that the Security Council is effectively becoming an accomplice to the destruction of Gaza — a misnomer that agitated Russia so much that it proposed a last-minute amendment to replace the phraseology in the resolution: “to create the conditions for a sustainable cessation of hostilities” with the unambiguous call “for urgent steps toward a sustainable cessation of hostilities.”

Russia’s demand for an immediate ceasefire was in line with a resolution overwhelmingly passed by the UN General Assembly recently, but the Americans would have nothing of that sort. The unfortunate part is that the Arab sponsors of the resolution caved in to US blackmail to veto the resolution. What transpired between the protagonists behind the scenes is not known. The paradox is that, in reality, the Americans themselves were desperately keen to avoid casting a veto — the third in as many months — that would have made a mockery of President Joe Biden’s bombastic remark in his September speech at the UN last year that the permanent members of the Security Council should cast vetoes only under “rare, extraordinary situations to ensure the council remains credible and effective.”

All indications are that the US is acutely conscious of finding itself “diplomatically isolated and in a defensive crouch,” as the New York Times put it in an acerbic commentary on the Biden administration’s plight as “an increasingly lonely protector of Israel … (that) puts it at odds with even staunch allies such as France, Canada, Australia, and Japan.” The commentary says that what rankles most is that first, when the US seems to have green-lit a massive Israeli military response to 7 October “without guardrails,” it: “painfully confirmed to many in the (global) south this sense that there was a double standard” — and second, even more, “the Russian strategy works, because beyond the United Nations what everyone sees is Russia standing up for international law — and the US standing against it.”

“.. it is imperative that we listen — whether we like it or not — to other voices..”

• New York Times Sparks Outrage Over Running Op-Ed By Hamas Mayor (NYP)

The New York Times ran an op-ed Sunday by Hamas’ handpicked Gaza City mayor — prompting outrage on social media from Israel supporters who slammed the Gray Lady for amplifying “Jew hate.” The essay by Yahya R. Sarraj published on Christmas Eve comes amid fury over Rep. Alexandria Ocasio-Cortez’s social media post that denounced Israel as a violent occupying force and likened Jesus to Palestinians. Sarraj’s op-ed — titled “I Am Gaza City’s Mayor. Our Lives and Culture Are in Rubble” — condemned Israel for “caus[ing] the deaths of more than 20,000 people” and for destroying or damaging “about half the buildings” in the Gaza Strip. The Times’s decision to grant a platform to Sarraj, who was appointed mayor of Gaza City by Hamas in 2019 after a career in academia, sparked an immediate backlash from many on social media.

“I wonder, would NYT also publish an op-ed from Al-Qaeda justifying 9-11? Of course not, but there is no red line to this paper’s Jew-hatred,” tweeted Arsen Ostrovsky, an International Human Rights lawyer who describes himself on X as a Zionist. “Unbelievable. This is a Hamas-appointed Mayor,” another X user wrote, adding: “They slaughtered and raped their neighbors and have the nerve to represent themselves as victims?” Others slammed Sarraj for ignoring the Hamas massacre that led to Israel launching its assault on Gaza. “Literally a member of Hamas, you have no shame or dignity NYT,” wrote an X user. Some did defend the Times for giving voice to Sarraj. “As much as I know so many ppl are angry and upset that the @nytimes published this letter from the Mayor of #Gaza, Yahya R. Sarraj, it is imperative that we listen — whether we like it or not — to other voices,” wrote an X user with handle Keep The Stroke.

“But let’s be clear, Yahya Sarraj, was intricately aware of the tunnels being build under #Gaza. As we all know, Sarraj probably would have been killed and/or family threatened, if he didn’t tow the line. Either way Sarraj was complicit in what has befallen Gaza.” Israel launched a massive military campaign in Gaza following the Oct. 7 terrorist attack by Hamas gunmen which left around 1,200 soldiers and civilians dead. Scores of Israeli soldiers and civilians also were taken hostage and remain in captivity in the Gaza Strip. Times critics also pointed out that former op-ed page editor James Bennet was forced out after the paper’s staffers were outraged over his decision to green-light a guest column by Sen. Tom Cotton (R-Ark.). Cotton used the op-ed in the summer of 2020 to call for a forceful military response to crack down on rioting by Black Lives Matter and Antifa demonstrators in the wake of the killing of George Floyd at the hands of Minneapolis police.

More NYT. Busy holiday season.

• Ukraine Accuses New York Times of ‘Working For The Kremlin’ (RT)

The journalists covering the Russia-Ukraine conflict for the New York Times have been recruited by Russian secret services, Kiev’s information warfare agency has said on Monday. The state-run Center for Countering Disinformation (CCD) made its statement while blasting the NYT for its recent article about the prospects of peace negotiations between Moscow and Kiev. “In order to write this text, the Russian Federation has used American journalists who were recruited during their work in Russia,” the CCD said in a statement on social media, without elaborating. The story published by the New York Times on Saturday lists its Moscow bureau chief Anton Troianovski, together with staff writers Adam Entous and Julian E. Barnes, in the byline.

The article cited “two former senior Russian officials close to the Kremlin,” as well as US and international officials, as claiming that Russian President Vladimir Putin “has been signaling through intermediaries since at least September that he is open to a ceasefire that freezes the fighting along the current lines.” The report further claimed that the Kremlin was using “back-channel diplomacy” to indicate that the Russian leader “is ready to make a deal.” The CCD criticized the Times for their story angle, suggesting that Moscow might be sending a “signal” with the aim of “preventing further military aid for the Ukrainian Armed Forces from the West.” It also said the story was likely aimed at “boosting the rating” of former US President Donald Trump, who is running for reelection against Joe Biden. Trump said on the campaign trail that he will easily end the conflict if he returns to the White House.

“One shouldn’t forget that Russia is playing a game of ‘peace’, while investing more in its defense industry and building up its army. There is no mention of it in the article, obviously,” the CCD said. Kremlin spokesman Dmitry Peskov also dismissed the report as “incorrect,” reiterating that Russia’s military strategy towards Ukraine remains unchanged. He added that Moscow would engage in negotiations “exclusively for the achievement of its own goals.” The negotiations broke down in the spring of 2022, with Russia accusing Ukraine of abruptly walking away from previously agreed-upon terms. Ukrainian officials have since stressed that talks can only resume if Russia recognizes Ukraine’s 1991 borders. Moscow has repeatedly stated that it is impossible.

“Here’s the drill: we won’t take you into NATO, we don’t want war with Russia, but on an individual basis, do whatever you like.”

• Security Guarantees For Kiev Are ‘Just A Scrap Of Paper’ – Medvedev (RT)

Western security guarantees for Ukraine are themselves useless but could pave the way for a NATO military base in the country, which could trigger a direct clash with Moscow, former Russian President Dmitry Medvedev said on Monday. The security declaration, which was first adopted by members of the G7 group in July, promises military assistance to Kiev, as well as frameworks for enhancing Ukraine’s defense industrial base and intelligence sharing. Moscow has denounced the document as an “encroachment on Russia’s security.” Medvedev, who now serves as deputy chairman of Russia’s Security Council, called Kiev’s plan to convince the EU to provide it with security guarantees a new push “to create an anti-Russian consensus.”

At the same time, he suggested that the declaration “has no added value whatsoever.” “This is just a public statement, which means it is a useless scrap of paper,” he said. According to Medvedev, however, the document paves the way for the signing of bilateral security agreements between Kiev and its Western backers. Those deals could lead to arms production cooperation, military training, and other programs beneficial to the “neo-Nazis” in Kiev, he said. Such a deal could even entice some “crazy” Western country to set up a military base in Ukraine, he added. “Here’s the drill: we won’t take you into NATO, we don’t want war with Russia, but on an individual basis, do whatever you like.” This could open the way to a large-scale conflict involving a NATO country and Moscow, Medvedev believes.

“When Russia strikes such a base – and this will inevitably happen because the military personnel of the base came specifically to fight us – will the alliance countries be ready for a collective response?” he asked. The ex-president suggested that in this particular case Article 5 of the NATO Treaty – which stipulates that an attack on one member of the bloc is an attack on the entire alliance – leaves “a lot of wiggle room.” NATO could “respond together, or could leave the country that owns the base in Ukraine to go at it alone,” while the retaliation itself could be by military or other means. The ex-president’s comments come after Andrey Sibiga, the deputy head of Ukrainian President Vladimir Zelensky’s office, said that six EU members – Austria, Croatia, Poland, Hungary, Slovakia, and Malta – have yet to support security guarantees for Kiev, adding that he was sure that they would eventually get on board.

“That’s almost the definition of ‘lawfare’—using the legal system to wage war on your opponents. You pack the court by knocking off a Republican or two.”

• Behind the Democrats’ Efforts to Regulate the Supreme Court (ET)

Democrats’ push to impose a code of conduct on the U.S. Supreme Court is driven by their desire to exert power over a court that hasn’t been ruling their way on key issues, legal experts say. Democrats and their left-wing activist allies have been incensed over the past two years as the court sent abortion matters back to the states, axed affirmative action in college admissions, bolstered gun rights and public prayer, backed a website designer’s right not to promote a same-sex wedding, and strengthened private property rights while weakening the government’s regulatory powers over the environment. Several experts told The Epoch Times that the left cannot accept the conservative majority on the Supreme Court, so it will keep agitating against it and try to undermine its legitimacy in the eyes of the public.

So far, the activism has propelled the court to adopt its first-ever formal code of conduct, issued on Nov. 13, but Democrats say it’s a toothless gesture and won’t fix what they say is a court that’s overly sympathetic to business interests and conservative causes. “The court’s new code of conduct falls far short of what we would expect from the highest court in the land,” Senate Judiciary Committee Chairman Dick Durbin (D-Ill.) said. “While the code of conduct prohibits the appearance of impropriety, it allows the justice to individually determine whether their own conduct creates such an appearance in the minds of ‘reasonable members of the public.’ This is something that justices have repeatedly failed to do over the last few years.” To remedy the supposed crisis at the court, Mr. Durbin backs the proposed Supreme Court Ethics, Recusal, and Transparency (SCERT) Act of 2023, which his committee approved on a party-line vote in July.

The proposal, which Republicans have denounced as unconstitutional, would create a system allowing members of the public to file complaints against justices for violating the proposed code of conduct or for engaging “in conduct that undermines the integrity of the Supreme Court of the United States.” Among other things, it would also impose mandatory recusal standards and create a panel of lower court judges to investigate complaints against the Supreme Court. Democrats are proposing their code of conduct “so they can control the Supreme Court,” said Steven J. Allen, a distinguished senior fellow at Capital Research Center, a watchdog group. “They’re doing this to get rid of one or more Republican appointees so they can be replaced,” Mr. Allen said. “That’s almost the definition of ‘lawfare’—using the legal system to wage war on your opponents. You pack the court by knocking off a Republican or two.”

“..while cheerleading a “brutal apartheid regime that she calls a ‘vibrant democracy..”

• MEP Brands Von Der Leyen ‘Frau Genocide’ (RT)

Irish MEP Clare Daly has called European Commission President Ursula von der Leyen “Frau Genocide” over the EU’s stance on Israel’s military operation in Gaza. She went on to claim that contrary to its professed adherence to democracy, the bloc tramples on the will of the people when it runs counter to its own agenda. Daly, a left-wing politician representing Ireland’s Independents 4 Change political party, said from the European Parliament podium on Sunday that von der Leyen was “elevated to power without a single vote from the citizens.” She went on to accuse the EU Commission president of “swooping in and overriding the foreign policies of elected governments” in recent months, while cheerleading a “brutal apartheid regime that she calls a ‘vibrant democracy.’” The lawmaker concluded: “With defenders of democracy like that, I think I speak for many, many citizens of Europe, when I say: ‘Nein, danke! No, thanks, Frau Genocide!’”

Earlier, Spanish Social Rights Minister Ione Belarra accused Brussels of inaction in the face of what she called “genocide” in Gaza. Media reports also indicate that hundreds of EU staffers slammed von der Leyen for unconditionally supporting Israel. In a speech marking the 75th anniversary of Israel’s founding in late April, von der Leyen praised the country as a “vibrant democracy in the heart of the Middle East.” Following the deadly incursion by Hamas on October 7, Israel launched a massive military operation against the Palestinian Islamist group based in Gaza. Soon after the hostilities broke out, von der Leyen had the Israeli flag projected onto the European Commission building in Brussels as a gesture of solidarity. She reiterated her support when meeting with Prime Minister Benjamin Netanyahu.

Also in October, the Irish Times reported that at least 842 EU staffers had signed a letter denouncing the commission’s stance on Israel. The document reportedly accused von der Leyen of giving a “free hand to the acceleration and legitimacy of a war crime in the Gaza Strip.” According to the Palestinian health authorities, at least 20,000 people have been killed in Gaza since early October, more than half of them children and women. The Hamas raid, which set the spiral of violence in motion, claimed 1,200 lives. The militants attacked, among other places, an open-air music festival, gunning down and abducting participants. The total number of people, both Israeli and foreign nationals, that the radicals took hostage that day was originally around 240, with dozens released since as part of multiple swaps with Israel.

And now a "Defence of Democracy Package" from a Commission led by a figure no member of the public ever voted for, who's spent the last 3 months swooping in & speaking over the foreign policies of elected governments, all to cheerlead for a genocidal apartheid regime. Nein danke. pic.twitter.com/FRkgLj6tew

— Clare Daly (@ClareDalyMEP) December 24, 2023

There is more to the article.

• Germany Uses The Weapon Of Climate Change Against Its Own People (Marsden)

German farmers rolled into Berlin on their tractors last week to have a very public word with the managers who have revoked their long-standing discount – a subsidy on diesel fuel, which powers their farm equipment. It seems that up until now, the government figured that feeding Germans was important enough to support, outweighing any ‘green’ obsessions. But that all changed abruptly for reasons that have little to do with the climate change agenda and more with its desperation for spare change. The drama kicked off when Germany’s coalition government led by Chancellor Olaf Scholz found itself in a bit of a bind recently. Team Scholz had quietly moved €60 billion from a Covid-19 pandemic support fund into a green energy transition fund.

The opposition noticed and finked to the court – which told Team Scholz to put the cash back because the sneaky move was a blatant violation of a law that had been ushered in under former Chancellor Angela Merkel specifically in an effort to ensure that the government was never able to bury itself in debt. Whoops, too late. Subsequently finding themselves underwater on the overall annual budget by an estimated €17 billion, they set about looking for ways to plug the hole. Farmers, Team Scholz apparently figured, can at least be bilked for cash on the pretext that the government tax subsidies for the sinful diesel fuel that powers their equipment deserve to be canceled – sacrificed on the altar of climate change. It all sounds so virtuous, and not at all like scrambling to compensate for a major screwup.

Scholz is presiding over the only major economy set to shrink this year, according to the International Monetary Fund. He stood there with a grin on his face beside US President Joe Biden last year ahead of the Ukraine conflict, as Biden said that Washington would “take care” of the Nord Stream pipeline network (Germany’s economic lifeline of cheap Russian gas). Maybe Scholz was just daydreaming about how green Germany would be without gas. But there’s nothing like getting mugged by the harsh economic reality of German deindustrialization due to a lack of affordable energy to wipe the smirk right off one’s face. So with Germany now strapped for cash, surely it’s time to really get radical about focusing on the most critical interests of the average citizen’s daily life – Ukraine, Ukraine, and Ukraine.

“We are forging ahead with the climate-neutral transformation of our country. We are strengthening social cohesion. And we are standing closely by Ukraine’s side in its defense against Russia,” Scholz said, as parliament agreed on a budget deal. “However, it is clear that we will have to make do with significantly less money to achieve these goals,” he added. No doubt Germans were thrilled to know that Ukraine wouldn’t be going without – unlike Germans. In addition to taxing farmers, jacking up the carbon tax on things like fuel will help get the job done, the government figures. Way to rip off French President Emmanuel Macron’s failed plan that sparked France’s Yellow Vest movement, which gave rise to months of violent unrest. Looking forward to seeing what color vests Germans end up choosing. Green would be fitting.

There are 3 more fronts.

• The 4 Major Battlefronts in Trump’s Ongoing Ballot Dispute (ET)

4. Who Can Sue to Disqualify Trump? Several of the lawsuits seeking to disqualify President Trump have come from a long-shot Republican presidential candidate, John Anthony Castro, who has acknowledged he doesn’t expect to win the 2024 presidential election. In Arizona, a federal judge dismissed Mr. Castro’s lawsuit, saying that it lacked “standing” and failed to show that he was personally impacted in a way that would allow him to bring a lawsuit against President Trump. Judge Douglas Rayes held that while Mr. Castro was likely to appear on Arizona’s ballot, that prospect didn’t “convince the court that Castro is genuinely competing with Trump for votes or contributions, or that he has any chance or intent to prevail in that election.”A judge in West Virginia similarly ruled on Dec. 21 that Mr. Castro lacked standing to challenge President Trump’s candidacy. The Colorado case, meanwhile, stemmed from a group of voters.

The majority in Colorado’s Supreme Court decision allowed the suit, but the dissent argued that the mechanism by which they brought the case was flawed. Related to courts’ enforcement powers is how state law allows judges to review decisions by secretaries of state. This can vary according to state, meaning that voters challenging President Trump may be more or less successful in certain states. In her dissent, Colorado Supreme Court Justice Maria Berkenkotter argued that her state’s voters didn’t show they had a “cognizable claim for relief.” She and the other two dissenting justices held that their colleagues had read the Colorado election code too broadly. The case involved multiple provisions of Colorado law. Section 1-1-113 of Colorado law directs a district court such as Judge Wallace’s to issue an order resolving challenges that voters or political parties bring to prevent an entity such as the secretary of state from breaching their duties.

The plaintiffs in this case sought to prevent Secretary of State Jena Griswold from placing President Trump on the state’s Republican primary ballot. Another section (1-4-1204(4)) builds on that provision by clarifying the timeline for adjudicating that challenge. More specifically, it requires that the challenge must be brought five days after the candidates’ filing deadline, while the court must hold a hearing within five days and issue its conclusion within 48 hours of the hearing. Justice Brian Boatright said in his dissent that the legal timeline was too constricted for a case such as President Trump’s. “It is no mystery why the statutory timeline could not be enforced: This claim was too complex,” he wrote. “The fact it took a week shy of two months to hold a hearing that ‘must’ take place within five days proves that section 1-1-113 is an incompatible vehicle.

“Dismissal is particularly appropriate here because the Electors brought their challenge without a determination from a proceeding (e.g., a prosecution for an insurrection-related offense) with more rigorous procedures to ensure adequate due process.” Yet another section of Colorado code (1-4-1201) dictates that state primaries “conform to the requirements of federal law and national political party rules governing presidential primary elections.”

What that means in practice was disputed by Justice Berkenkotter. “Did the General Assembly intend to grant Colorado courts the authority to decide Section 3 challenges? Based on my reading of [Colorado law], I conclude that the answer to this question is no,” she wrote. She went on to argue that “the term ‘federal law’ [in Section 1-4-1201] is ambiguous at best.”After discussing some of the legislative history, she concluded that “the term ‘federal law’ is most certainly not an affirmative grant of authority to state courts to enforce Section 3 in expedited proceedings under the Election Code.”

“..It’s all one big status-acquisition hustle, the seeking of hierarchical privilege by any means necessary..”

• And So Ends an Era (Kunstler)

You may have noticed that our country, formerly a republic of sovereign individuals, has become one great big racketeering operation run by a mafia-like cabal with Marxist characteristics — or, at least, Marxist pretenses. That is, it seeks to profit by every avenue of dishonesty and coercion, under the guise of rescuing the “oppressed and marginalized” from their alleged tormenters. Apparently, half the country likes it that way. Much of the on-the-ground action in this degenerate enterprise is produced by various hustles. A hustle is a particularly low-grade, insultingly obvious racket, such as Black Lives Matter, DEI (Diversity, Equity, and Inclusion), and “trans women” (i.e., men) in women’s sports. Some of the profit in any hustle is plain moneygrubbing, of course. But there’s also an emotional payoff. Hustlers and racketeers are often sadists, so the gratification derived from snookering the credulous (feelings of power) gets amplified by the extra thrill of seeing the credulous suffer pain, humiliation, and personal ruin. (That’s what actual “oppressors” actually do.)

Categorically, anyone who operates a racket or a hustle is some sort of psychopath, a person with no moral or ethical guard-rails. Hustles are based on the belief that it is possible to get something for nothing, a notion at odds with everything known about the unforgiving laws of physics and also the principles of human relations in this universe. Even the unconditional love of a mother for her child is based on something: the amazing, generative act of creating new life, achieved through the travail of birth. Have you noticed, by the way, that the birth of human children is lately among the most denigrated acts on the American social landscape? The flap over Harvard’s president, Claudine Gay, is an instructive case in the governing psychopathies of the day. I wish I’d been a roach on the tray of petit fours and biscotti brought into the Harvard Overseers’ board-room when they met to consider the blowback from Ms. Gay’s unfortunate remarks in Congress, followed by revelations of her career-long plagiarisms.

The acrid odor of self-conscious corruption in the room must have overwhelmed even the bouquet of Tanzanian Peaberry coffee a’brew, and not a few of the board members must have reached for the sherry decanter as their shame mounted, and the ancient radiators hissed, and their lame rationalizations started bouncing off the wainscoted walls. Apparently, Ms. Gay did not miss an opportunity to cut-and-paste somebody else’s compositions into everything she published going back to her own student years in the 1990s. She even poached another writer’s acknowledgment page. This is apart from the self-reinforcing substance of her published “research” justifying the necessity for DEI activism, for which she has become first an avatar and now a goat. The dirty secret of this perturbation — and the whole Harvard Board knows it — is that Claudine Gay’s career has been about nothing but careerism, and that this is also true of so many on the faculty and administration at Harvard, and surely at every other self-styled elite school from the Charles River to Palo Alto that had joined in the DEI mind-fuck.

It’s all one big status-acquisition hustle, the seeking of hierarchical privilege by any means necessary, including especially deceit, the politics of middle-school girls. Thus, you see on display both the juvenility of elite higher ed and its use of the worst impulses that prevail in social media, stoking envy, hatred, avarice and vengeance as the currency for career advancement. Claudine Gay was notorious earlier, as Dean of the Faculty of Arts and Sciences, for wrecking the careers of faculty members (Ronald Sullivan, Stephanie Robinson, and Roland G. Fryer, Jr.) who refused to play the game like middle-school girls. She had no mercy.

Assange

Julian Assange Thought for the Day #Christmaspic.twitter.com/hP0wPqFGkK

— Stella Assange #FreeAssangeNOW (@Stella_Assange) December 25, 2023

RFK jr

Why, years after Covid, are Americans dying at much higher rates than before the pandemic? Renowned doctor @DrMarcSiegel shares his views @FoxNews.

Why isn't this being investigated? When I’m president, that will change. #Kennedy24 pic.twitter.com/fEt3UCRiUA

— Robert F. Kennedy Jr (@RobertKennedyJr) December 24, 2023

Chickdog

https://twitter.com/i/status/1739325151542497484

Frank Dean

Make America This Again pic.twitter.com/6YA1c1eXFI

— Jack Poso 🇺🇸 (@JackPosobiec) December 25, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.