Unknown General Patrick’s headquarters, City Point, Virginia 1865

The OECD is late to the game, and fails to comprehend the scale and urgency of that crisis.

• World Faces Pensions Crisis, Warns OECD (Tel.)

The global pensions crisis has been laid bare by new analysis that shows people retiring today can expect half the income of those who became pensioners at the start of the millennium. The stark findings by the OECD will be presented in a report this week that highlights the impact of ultra-low interest rates on global retirement incomes. It shows that a person buying an annuity today who saved 10pc of their wages into a pension for 40 years can expect just over half the earnings of someone who saved the same amount but retired 15 years ago. The think-tank’s analysis of defined contribution schemes, where the value of pension pots can rise or fall depending on how investments perform, highlights the challenge faced by many pension providers in the current low growth and low inflation environment

Pension funds invest around 40pc of their assets in fixed income securities, according to the OECD, including lower yielding government bonds. “We’ve had more than half a decade of very low interest rates and that means someone who has been putting money into a savings account or into a pension fund – the value of their lifetime retirement is about half the value of someone who retired in 2000,” said Catherine Mann, the OECD’s chief economist. Tom McPhail, head of pensions research at Hargreaves Lansdown, said the OECD’s findings were consistent with its UK research. “Someone that started putting money in a pension in the 1960s was investing at a time when baby boomers were entering the workforce. But the last 16 years and the financial crisis have had an extremely negative impact on asset prices.”

Sometime down the line, the big banks will be broken up. But it’s not something the politicial system can achieve with a few votes. Because it is owned by those same banks.

• The Case For A Super Glass-Steagall (David Stockman)

Donald Trump can instantly get to the left of Hillary with respect to Wall Street and the one percenters by embracing Super Glass-Steagall. The latter would cap U.S. banks at $180 billion in assets (<1% of GDP) if they wished to have access to the Fed’s discount window and have their deposits backed by FDIC insurance. Such Federally privileged institutions would also be prohibited from engaging in trading, underwriting, investment banking, private equity, hedge funds, derivatives and other activities outside of deposit taking and lending. Instead, these latter inherently risky economic functions would be performed on the free market by at-risk banks and financial services companies.

The latter could never get too big to fail or to manage because the market would stop them first or they would be disciplined by the fail-safe institution of bankruptcy. No taxpayer would ever be put in harms’ way of trades like those of the London Whale. By embracing this kind of Super Glass-Steagall Trump would consolidate his base in the flyover zones and reel in some of the Bernie Sanders throng, too. The latter will never forgive Clinton for her Goldman Sachs speech whoring. And that’s to say nothing of her full-throated support for the 2008 bank bailouts and the Fed’s subsequent giant gifts of QE and ZIRP to the Wall Street gamblers. Besides, breaking up the big banks and putting Wall Street back on a free market based level playing field is the right thing to do.

Today’s multi-trillion banks are simply not free enterprise institutions entitled to be let alone. Instead, they are wards of the state dependent upon its subsidies, safety nets, regulatory protections and legal privileges. Consequently, they have gotten far larger, more risky and dangerous to society than could ever happen in an honest, disciplined market. Foremost among these artificial props is the Fed’s discount window. The latter provides cheap, unlimited funding at a moment’s notice with no questions asked. The purpose is to insure banking system liquidity and stability and to thwart contagion, but it also nullifies the essential bank management discipline and prudence that comes from fear of depositor flight.

The big boys smell big profits.

• Payday Loans a Crony Capitalist Target (WSJ)

To voters living comfortably in Cambridge, Mass., or the suburbs of Seattle, the payday lending crackdown sounds just right: Those storefront entrepreneurs of dubious extraction are preying upon the poor. They should be banned. But for the Consumer Financial Protection Bureau, the creation of Dodd-Frank which has been busy demonstrating the dangers of an unrestrained regulatory state, a slogan that polls well with liberal voters is only a starting point. The end result of its new payday rules, like all Obama regulatory endeavors, is to concentrate more power in the hands of Washington lobbyists and politicians and the companies that can afford to pay for them.

CFPB director Richard Corday’s 1,300-page regulatory edict will require payday lenders, an industry largely made up of thousands of storefront operators, to run full credit checks on prospective borrowers (average loan $392) to test their sources of income, need for the loan, and ability to keep financing their living expenses while paying it back. Perversely, this will make it hard or impossible to serve those customers who use the payday lending service most appropriately—who borrow when pinched but then promptly repay and don’t roll over their debt. The industry will become more focused on retaining habitual users, those who take out loans many times a year and get caught in “debt traps,” continually rolling over what are supposed to be short-term, high-margin loans.

The massive record-keeping and data requirements that Mr. Corday is foisting on the industry will have another effect: It will drive out the small, local players who have dominated the industry in favor of big firms and consolidators who can afford the regulatory overhead. It will also favor companies that can substitute big data for local knowledge like, like . . . Well, like LendUp, the Google-backed venture that issued a statement Thursday applauding the CFPB rules. Google’s self-interest has become a recurrent theme in Obama policy making, not surprising considering a study in April that found that 250 Googlers had come or gone from administration employment, and Google lobbyist visits to the Obama White House vastly outnumbered those of any other company.

“Something has to give – and it’s starting to..”

• What Makes this Jobs Report so Truly Ugly (WS)

[..] ..we suspected that the March jobs report, released in early April, would be a debacle. We based this on an analysis of the divergence over time between the reports issued by payroll processing company ADP and the jobs reports issued by the Bureau of Labor Statistics. That divergence had been going on for months. Eventually it reverts to the mean. We postulated that March would be that month. Instead, it happened two months behind schedule, so to speak, as today’s jobs report was precisely that sort of debacle. This is what was “expected”: The Labor Department was expected to report, according to Wall Street economists, a “moderate” gain of 158,000 jobs in May, “moderate” given that the Verizon strike kept 35,000 workers off their jobs. The “whisper number” was around 200,000 jobs.

And this is what we got: The BLS reported that the economy had added 38,000 jobs, the lowest since September 2010. Furthermore, the April job gains of 160,000 were chopped down by 37,000 and the March job gains of 208,000 were chopped down by 22,000. Hence, with 59,000 jobs revised away, and with only 38,000 jobs “created” in May, the net total in today’s report was a net loss of 21,000 jobs. We haven’t seen that since the Financial Crisis. A number of sectors, including manufacturing, shed jobs, and the labor participation rate dropped for the second month in a row, to 62.6%. Just about the only good number was the magic headline unemployment rate, which fell sharply, from 5% in April to 4.7%, the lowest since the Great Recession began, leaving some folks scratching their heads and searching for answers.

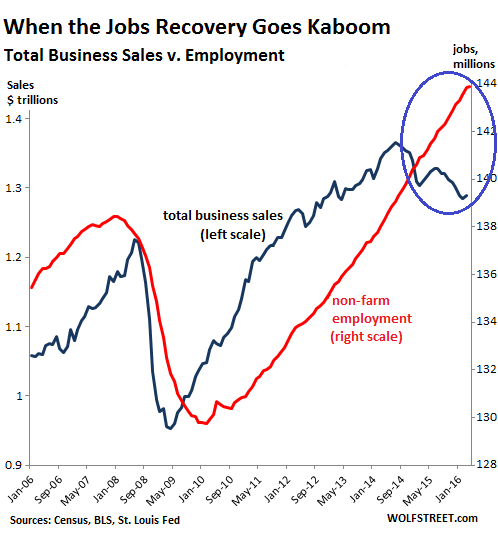

[.] Staffing agencies are cutting back because companies no longer need that many workers. Total business sales in the US have been declining since mid-2014. Productivity has been crummy and getting worse. Earnings are down for the fourth quarter in a row. Companies see that demand for their products is faltering, so the expense-cutting has started. The first to go are the hapless temporary workers. This is the reality for businesses: The chart below shows the gaping disconnect between declining total business sales (all businesses, not just the S&P 500 companies) and total nonfarm employment. Something has to give – and it’s starting to:

Anything else is just noise. Unemployment stats become illusionary.

• Americans Not In The Labor Force Soar To Record 94.7 Million (ZH)

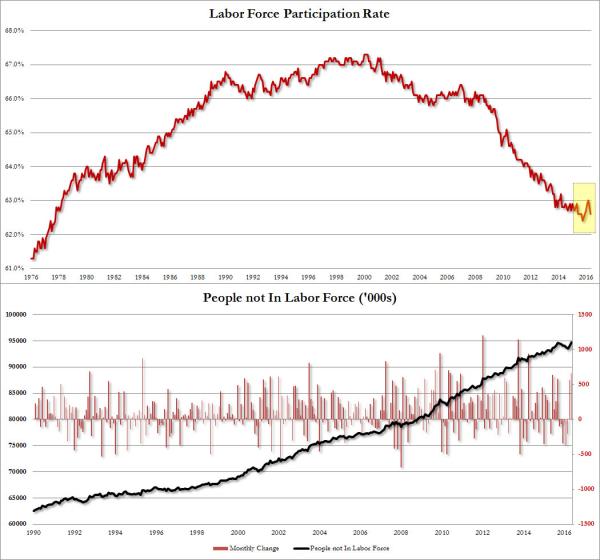

So much for that much anticipated rebound in the participation rate. After it had managed to rise for 5 months in a row through March, hitting the highest level in one year, the disenchantment with working has returned, and the labor force participation rate promptly slumped in both April and May, sliding 0.4% in the past two months to 62.60%, just shy of its 35 year low of 62.4% hit last October.

This can be seen in the surge of Americans who are no longer in the labor force, who spiked by 664,000 in May, hitting an all time high of 94.7 million. As a result of this the US labor force shrank by over 400,000 to 158,466K, down from 158,924K a month ago, and helped the unemployment rate tumble to 4.7%, the lowest level since 2007. Adding the number of unemployed workers to the people not in the labor force, there are now over 102 million Americans who are either unemployment or no longer looking for work.

Cooked.

• Higher Australian Household Debt Mounts To ‘Unsustainable’ Levels (Aus.)

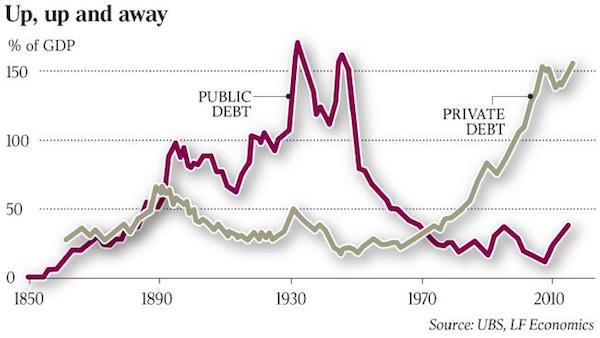

‘If something cannot go on forever, it will stop’, said Herbert Stein, economic adviser to presidents Nixon and Ford. Stein was mocking concerns about the “unsustainable” US current account and budget deficits in the late 1980s. He had a point, both grew much larger. Calling things unsustainable is often a cover for expressing disapproval for other reasons. The federal budget has been in surplus in fewer than 20 of the 116 years since Federation, so deficits are clearly sustainable. What isn’t sustainable is a rising stock of public debt (and interest payments) as a share of national income. Both main political parties are rightly and routinely admonished for doing little to stem the rising tide of federal and state government debt, which has tripled to about 34% of GDP over the past 10 years.

But the spectacular ascent of private debt, which has doubled to about 160% of GDP over the past 20 years, hasn’t rated a mention by either side of politics in this election. Public debt peaked above 170% of GDP during the Great Depression but private, and in particular household, debt has never been remotely close to its present proportion. Its previous peak of just over 60% occurred in the 1880s property boom, and we know what happened after that. Almost all the increase in private debt since the 1990s has entailed households borrowing to buy houses to live in and (increasingly) to rent out. Ever lower interest rates and financial deregulation have fuelled a mutually reinforcing explosion of dwelling prices and debt.

Finance textbooks teach that banks lend to businesses, which reinvest the funds in the economy. But the reality is that they lend to households to buy and invest in houses. In the past 20 years the stock of business credit, $852 billion in April, has dropped from half to a third of the total lending. Australian households overtook the Swiss as the world’s most indebted this year, with outstanding debt equivalent to 125% of GDP and no let up in sight. Combined owner-occupier and investor loans outstanding have risen from $1.2 trillion to $1.6 trillion in the past five years. While the national accounts this week showed gross national income shrank 0.4% over the year to March, housing credit increased 7.2%.

A conversation that must and will be conducted. This from Charles Murray is not all that bad.

• A Guaranteed Income for Every American (WSJ)

First, my big caveat: A UBI will do the good things I claim only if it replaces all other transfer payments and the bureaucracies that oversee them. If the guaranteed income is an add-on to the existing system, it will be as destructive as its critics fear. Second, the system has to be designed with certain key features. In my version, every American citizen age 21 and older would get a $13,000 annual grant deposited electronically into a bank account in monthly installments. Three thousand dollars must be used for health insurance (a complicated provision I won’t try to explain here), leaving every adult with $10,000 in disposable annual income for the rest of their lives. People can make up to $30,000 in earned income without losing a penny of the grant.

After $30,000, a graduated surtax reimburses part of the grant, which would drop to $6,500 (but no lower) when an individual reaches $60,000 of earned income. Why should people making good incomes retain any part of the UBI? Because they will be losing Social Security and Medicare, and they need to be compensated. The UBI is to be financed by getting rid of Social Security, Medicare, Medicaid, food stamps, Supplemental Security Income, housing subsidies, welfare for single women and every other kind of welfare and social-services program, as well as agricultural subsidies and corporate welfare. As of 2014, the annual cost of a UBI would have been about $200 billion cheaper than the current system. By 2020, it would be nearly a trillion dollars cheaper.

After bringing down Greek banks, they now try to keep their own standing.

• Italy And France Are Urging Caution Over Bank Capital (R.)

Excessive capital requirements can backfire, Italy’s economy minister said on Saturday, defending a joint French-Italian proposal to cap the amount of reserves that euro zone banks should have to wipe out before they can be rescued. Rules in force since the beginning of this year require euro zone banks to respect a minimum requirement for their own funds and eligible liabilities (MREL) in order to qualify for access to a bank-financed rescue fund in case of failure, and avoid full liquidation. In a joint paper, seen by Reuters, Paris and Rome raised doubts on the rationale of introducing a floor for MREL and urged instead a cap that should not exceed 8% of banks’ debt. IEconomy Minister Pier Carlo Padoan told an economic conference on Saturday there was a risk banks could be asked to raise too much capital too quickly, which would leave them vulnerable if tough markets made it hard to raise funds.

“Instead of stronger banks we end up with weaker ones,” he said. “The French-Italian initiative at this very delicate stage of the creation of a banking union is a voice calling for caution. We’re all going in the same direction, a stronger banking system, let’s do so at the right pace, let’s not exaggerate please.” Following the euro zone debt and banking crisis, EU countries have designed a banking union meant to strengthen lenders’ financial stability, but have not yet brought the plan to completion. Germany, the dominant power in the euro zone, is dragging its feet on a European bank deposit guarantee scheme, widely regarded as a missing link in the project. “If we don’t accept risk-sharing why are we wasting our time with the euro?,” Padoan said.

A hilarious example of where EU-induced Greek tax measures can and do lead.

• Self-Harming Taxation, Or The Liquidation Of The Kulaks (Georganas)

[..] Even the infamous case of the VAT in Greece (which has risen to be among the highest in the EU) does not yield a clear negative fiscal effect. Of course it’s not enough to show that VAT revenues fell after the rates rose, since at the same time, many other factors changed, harming the Greek economy. It is notoriously hard to isolate the effect of every change, the same way as it’s hard to predict what the effect of smaller fiscal deficits in the middle of a multidimensional crisis will be (by the way that’s the issue at the heart of the whole fiscal multipliers debate, involving the IMF, Greece and the EU).

In the recent Ryanair case though, economic investigators would probably be able to find a smoking gun. Because of a €12 tax per passenger, the no-frills airline recently decided to reduce its flights to Greece. The total damage for the country due to lower visitor numbers is clearly higher than the benefit of the tax revenue. This is an extreme case of a long bureacratic tradition in Greece, agencies taking measures with a. a very narrow own-receipts goal, which is also viewed b. in a very myopic sense, ignoring second-level effects (what we call general equilibrium effects) Typically, an agency or ministry that wants to be able to boast of “results” takes a measure with immediate benefit for itself, that could however be causing a net loss for the country as a whole, or even its own government.

A classic example is the “voluntary exit”: civil servants at government agencies or utilities being let go to lower the salary item on the agency’s budget (as the government has requested), but increasing the burden for pension funds, that again is covered by the same government, often at greater cost. In the tourism sector, the €12 per capita tax is negligible next to the more than €700 that the average European summer visitor spends in the country (that’s why in Hania, for example, hoteliers have allied to subsidize Ryanair’s activity). Even if the government ignores the country’s benefit and only cares about its tax revenues, it seems to be ignoring the €300 of additional VAT and income tax that every tourist brings.

Home › Forums › Debt Rattle June 5 2016