Pablo Picasso Self portrait 1965

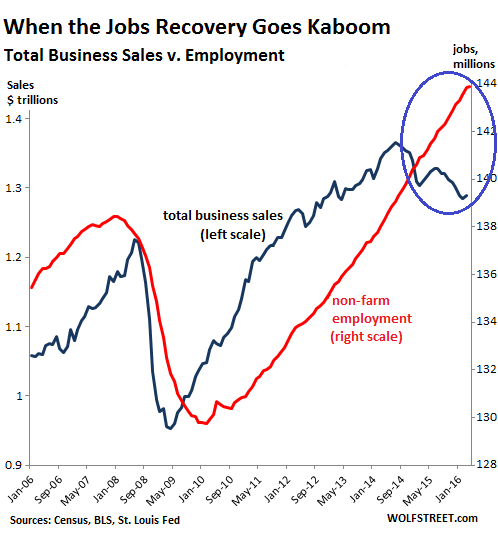

“On April 28, HOOPP CEO Jim Keohane told BNN in an interview that “for every $1 we lend Home Capital, they’re going to provide us with $2 of mortgages as collateral. That’s where we get our protection from.” So the C$2 billion loan would be backed by C$4 billion in mortgages. In other words, in the eyes of Keohane, these mortgages might be actually worth, when push comes to shove, 50 cents on the dollar.”

• Are Canada’s Homes and Mortgages Worth Just 50 Cents on the Dollar? (WS)

Home Capital is Canada’s biggest “alternative” mortgage lender. It’s not a bank – which today is part of its problem because it cannot create money to lend out; it has to obtain it first by attracting deposits and borrowing money through other channels. Through its subsidiary, Home Trust, it specializes in high-profit mortgages to risky borrowers, with dented credit or unreliable incomes who don’t qualify for mortgage insurance and were turned down by the banks. This includes subprime borrowers. Since revelations of liar loans surfaced in 2015, things have gone to heck. Now it’s experiencing a run on its deposits. Teetering at the abyss, it obtained a $2 billion bailout loan on Thursday. The terms are onerous. And on Friday, the crux of the deal emerged – the amount of mortgages it has to post as collateral. It’s a doozie.

It sheds some light on what insiders think mortgages and the homes that back them are worth when push comes to shove. A bone-chilling wake-up call for the Canadian housing and mortgage market. This is when the whole construct started falling apart: On July 15, 2015, Home Capital announced that originations of high-margin uninsured mortgages had plunged 16% and originations of lower-margin insured mortgages had plummeted 55%, and that it had axed an unspecified number of brokers. Shares plunged 25% in two days. On July 30, 2015, it disclosed, upon the urging of the Ontario Securities Commission, the results of an investigation that had been going on secretly since September 2014 into “falsification of income information.” Liar loans. It suspended 45 mortgage brokers who’d together originated in 2014 nearly C$1 billion in residential mortgages, or 12.5% of its total.

The scandal festered. Short sellers circled in formation. On April 26, 2017, Home Capital announced that it’s experiencing a run on its deposits. As of the end of March, its subsidiary Home Trust sat on about C$2 billion in high-interest savings accounts (HISA) it is offering to regular savers. But these folks were pulling their money out, it said, and the pace of the run was accelerating. It also disclosed that it was finalizing a $2 billion bailout loan from the Healthcare of Ontario Pension Plan (HOOPP) which has about $70 billion in assets. The loan would “have a material impact on earnings….” So an expensive loan.

Home Trust would pay a non-refundable commitment fee of $100 million; would be required to make an initial draw of $1 billion at an interest rate of 10%; and would pay a 2.5% standby fee on undrawn funds. So the initial $1 billion for the first 12 months would cost it $225 million in fees and interest, a juicy 22.5%! Once the credit line is fully utilized, the cost of the loan would drop to 15%. Its shares collapsed by 65%. On Friday, April 28, it announced that another C$290 million in deposits were yanked out on Thursday, after C$472 had been yanked out on Wednesday. Its HISA deposits were down to C$521 million, having plunged 75% since late March.y

Kept the lights on for 100 days.

• US Congress Does Bare Minimum to Keep Government Open Next Week (BBG)

Congress gave itself one more week to agree on a spending bill to fund the U.S. government through September, leading into President Donald Trump’s 100th day in office Saturday by keeping the lights on. The 382-30 House vote Friday was followed quickly by unanimous Senate passage of the stopgap spending bill hours before the shutdown deadline. Trump signed the bill Friday evening, according to a White House official. “We feel very good” that lawmakers will be able to pass a full spending bill next week, White House press secretary Sean Spicer told reporters earlier in the day. Leaders of both parties say they’re close to agreement on a broader spending plan after Republicans signaled they would accept Democratic demands that the Trump administration promise to continue paying Obamacare subsidies and to drop its bid for immediate funds for a wall on the Mexican border.

“You shouldn’t create artificial deadlines,” Alabama Republican Representative Gary Palmer said in support of the short-term measure. “If there are things we need to work through, we need to take the time to work through them.” Vermont Senator Patrick Leahy, the top Democrat on the Appropriations Committee, said both sides have made progress on issues including more funds for the National Institutes of Health, opioid funding for states, Pell college grants and money for transit. But he said the talks remain snagged over Republican demands for policy “riders.” “Let’s not govern by partisan manufactured crisis,” he said on the Senate floor. “Stop posturing,” he added as he called for a speedy resolution on the bill sometime next week. “This is no way to govern,” Leahy said before the Senate vote.

Sixteen House Republicans voted against Friday’s stopgap measure. The short-term fix to ward off a government shutdown – on a deadline set months ago – shows the stubborn dysfunction of Congress even with a unified Republican government. House GOP leaders on Thursday abandoned efforts to vote this week on their plan to repeal and replace Obamacare for lack of support in their party. A vote is still possible next week.

Eye-opening to say the least. Make the coffee extra strong before viewing. Lots of ground gets covered, quickly. And don’t mothball those pitchforks and torches just yet.

• All the Plenary’s Men (BestEvidence)

“The King can do no wrong.”

—William Blackstone, Commentaries on the Laws of England“When the president does it, that means that it is not illegal.”

—Ex-President Richard Nixon, interview with David FrostThe question at bar is why the U.S. Department of Justice has failed to prosecute any too-big-to-fail banks or—more importantly—their bankers, even for admitted crimes. It’s a crucial question, because after eight straight years of unremitting prosecutorial failure, it looks very much as if a select group of top banks can, in fact, do no wrong. If that’s the case, then our constitutional republic isn’t merely in trouble. It’s dead. A person or group of people who satisfy Blackstone’s criterion for ultimate sovereign power—the power to commit crimes with impunity—can’t exist in a nation where the law reigns supreme. And yet here we are a decade after the financial crisis began in earnest, and not one TBTF bank executive has gone to jail.

Legally, the TBTF banks are indistinguishable from the King, since the power to commit crimes with impunity swallows all other sovereign powers; such a power isn’t even supposed to exist in the U.S., and yet it does. Moreover, since there can’t be two kings in a kingdom, the entire U.S. government, from the president on down, is just one of the King’s men under this formulation of power. The real job of the U.S. government, then, isn’t to represent the will of the people at all, it’s to do the King’s bidding. A nation that isn’t governed by law is governed by instead by a king—it’s one or the other—and the president’s inferiority to such an above-the-law sovereign was confirmed over 40 years ago with Nixon’s ouster. The president, unlike the King, answers to the law (despite Nixon’s opinion).

Now, you may say that while the TBTF banks might arguably have the de facto power of the King, that’s a far cry from wielding such power formally (i.e., having de jure criminal immunity). The reply to that objection is set forth in this film, “All the Plenary’s Men,” which is a sequel to “The Veneer of Justice in a Kingdom of Crime.” Another objection, raised by the DOJ itself, is that it HAS prosecuted TBTF bankers, citing cases like that of Raj Rajaratnam. These cases, however, in fact reveal the DOJ acting on behalf of the criminal global banking cartel. On that score, the DOJ’s abysmal track record is by now so extensive and so thorough that it’s possible to spot legal patterns in the DOJ’s protracted miscarriage of justice, and, as you’re about to see, those patterns are very deeply disturbing indeed.

What’s been going on cuts right past a garden variety constitutional crisis like Watergate straight to a crisis of sovereignty. The backdrop for all of this is HSBC’s exoneration in December of 2012 for laundering money for drug dealers and terrorists, about which the House Financial Services Committee issued a report in July of 2016. Whether it was due to the political circus in town at the time, or to the Republican authorship of that report (albeit without dissent), it didn’t get nearly the scrutiny it deserved. You see, prosecutors working on the HSBC case were actually going to indict the bank, but they got overruled, and HSBC and its team of criminals skated. The story of how exactly that reversal came about reveals, if not the King himself, then certainly many of the King’s top men.

“It concentrates the mind, as Samuel Johnson once remarked, like waiting to be hanged.”

• The National Blues (Jim Kunstler)

You can read it in the bodies of the people in the new town square, i.e. the supermarket: people prematurely old, fattened and sickened by bad food made to look and taste irresistible to con those sunk in despair, a deadly consolation for lives otherwise filled by empty hours, trash television, addictive computer games, and their own family melodramas concocted to give some narrative meaning to lives otherwise bereft of event or effort. These are people who have suffered their economic and social roles in life to be stolen from them. They do not work at things that matter. They have no prospects for a better life — and, anyway, the sheer notion of that has been reduced to absurd fantasies of Kardashian luxury, i.e. maximum comfort with no purpose other than to enable self-dramatization. And nothing dramatizes a desperate life like a drug habit. It concentrates the mind, as Samuel Johnson once remarked, like waiting to be hanged.

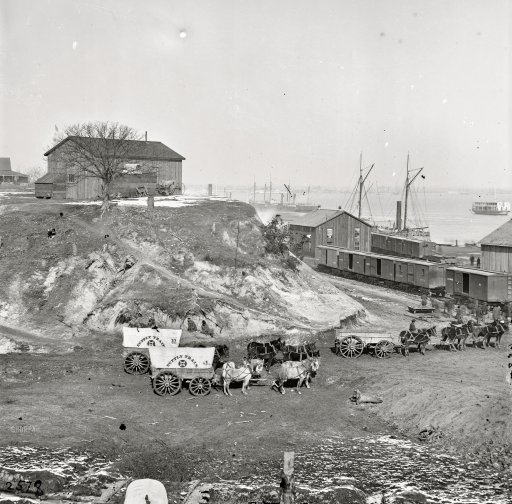

[..] The eerie thing about reading the landscape of despair is that you can see the ghosts of purpose and meaning in it. Before 1970, there were at least five factories in my little town, all designed originally to run on the water power (or hydro-electric) of the Battenkill River, a tributary of the nearby Hudson. The ruins of these enterprises are still there, the red brick walls with the roofs caved in, the twisted chain-link fence that no longer has anything to protect, the broken masonry mill-races. The ghosts of commerce are also plainly visible in the bones of Main Street. These were businesses owned by people who lived in town, who employed other people who lived in town, who often bought and sold things grown or made in and around town.

Every level of this activity occupied people and gave purpose and meaning to their lives, even if the work associated with it was sometimes hard. Altogether, it formed a rich network of interdependence, of networked human lives and family histories. What galls me is how casually the country accepts the forces that it has enabled to wreck these relationships. None of the news reports or “studies” done about opioid addiction will challenge or even mention the deadly logic of Wal Mart and operations like it that systematically destroyed local retail economies (and the lives entailed in them.) The news media would have you believe that we still value “bargain shopping” above all other social dynamics. In the end, we don’t know what we’re talking about.

I’ve maintained for many years that it will probably require the collapse of the current arrangements for the nation to reacquire a reality-based sense of purpose and meaning. I’m kind of glad to see national chain retail failing, one less major bad thing in American life. Trump was just a crude symptom of the sore-beset public’s longing for a new disposition of things. He’ll be swept away in the collapse of the rackets, including the real estate racket that he built his career on. Once the collapse gets underway in earnest, starting with the most toxic racket of all, contemporary finance, there will be a lot to do. The day may dawn in America when people are too busy to resort to opioids, and actually derive some satisfaction from the busy-ness that occupies them.

Funny but true.

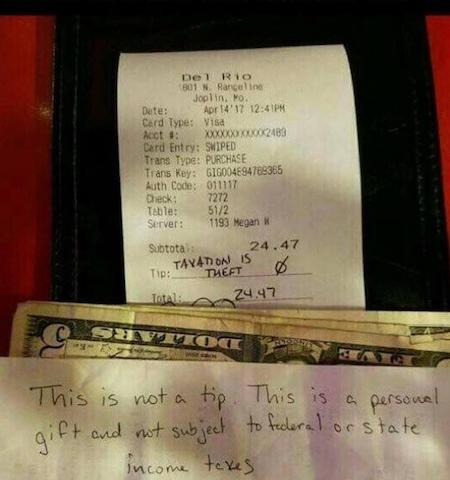

• ‘Taxation Is Theft’ Meme Goes Mainstream (TAM)

The month of April is a nightmare for anyone with a conscience, as we only have until “tax day” — which usually falls on April 15 — to give the taxman what he says he deserves. So if you pay taxes to Uncle Sam and you’re also aware you’re paying for mass murder in the Middle East and in U.S. streets due to the drug war, you should also feel sick to your stomach as you write that check. To a restaurant customer, this may have served as enough incentive to remind his server that taxation is always immoral — but he didn’t stop there. Last week, a customer at a Missouri restaurant gave the waitress a “personal gift” instead of a tip, writing the now popular line “Taxation is theft” in the tip section of the receipt. In a second note, the fiscally conscious customer added: “This is not a tip. This is a personal gift and not subject to federal or state income taxes.”

With major progressive news outlets like ATTN: reporting on this story, left-leaning reporters started to debate wages in the food and service industries, discussing the fact that tips end up being factored as wages, meaning they are always taxable. But as that discussion developed, reporters were quick to realize that when personal gifts are in the mix, the taxman can’t take part of those earnings away. After all, a gift would have to exceed $13,000 to be subject to taxation, meaning that even if the customer had spent hundreds, the “personal gift” would not amount to anything close to the requirements stipulated by the IRS.

With that, ladies and gentlemen, it becomes easier to not only tip with class, but also with substance, giving your waiter a lesson on what’s moral and how to legally go around the rules to make sure they enjoy their full tip — not just the percentage deemed to be fit by the federal government. As this story becomes part of the popular movement ignited by libertarians, expect to see more progressive news outlets becoming familiarized with the actual concept of taxation. What’s left for us to find out is if they are going to change their tune and start attacking people like this customer when the two-party pendulum swings once again and a fully Democratic slate takes over Washington. Are they going to remain consistent in discussing taxation from the point of view of the worker, or are they going to side with the leech? Only time will tell.

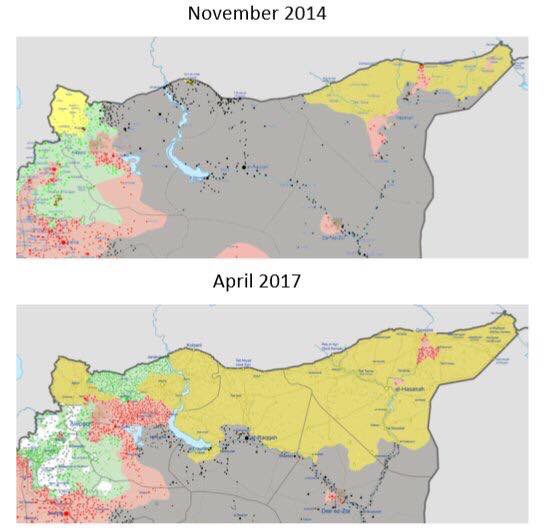

From separate map picked up on Twitter: “When ISIS was winning Turkey was just watching. Now when ISIS is getting defeated by Kurds, Turkey starts attacking Kurds. Turkey = ISIS.”

• Erdogan: Turkey and US Can Wipe Out ISIL in Raqqa (AlJ)

Turkish President Recep Tayyip Erdogan said on Saturday if Ankara and Washington were to join forces they could turn the Syrian city of Raqqa into a “graveyard” for Islamic State of Iraq and the Levant (ISIL). Erdogan also suggested he could launch cross-border operations against Kurdish rebels at any time, just days after the military carried out air strikes in Syria and Iraq, drawing concern from the United States. “America, the coalition, and Turkey can join hands and turn Raqqa into a graveyard for [ISIL],” Erdogan told a business summit in Istanbul. “They [ISIL] will look for a place to hide.” Erdogan’s comments come ahead of a meeting with US President Donald Trump on May 16 – their first face-to-face summit since the real estate mogul and reality TV star took office in January.

Ankara is hopeful about a relationship with Washington under Trump after ties frayed in the final years of Barack Obama’s administration, which limited cooperation between the NATO allies. The two countries have bitterly disagreed over the role of the Kurdish People’s Protection Units (YPG) in Syria. Turkey views the YPG as the Syrian extension of the Kurdish PKK group, which has waged a deadly insurgency against the Turkish state since 1984. But the US is concerned that Turkey’s military operations in Syria are more focused on preventing Syrian Kurds from forming an autonomous region in northern Syria, along Turkey’s border, that could embolden Turkey’s own Kurdish minority.

@Furiouskurd: When ISIS was winning Turkey was just watching. Now when ISIS is getting defeated by Kurds, Turkey starts attacking Kurds. Turkey = ISIS.

As the only party involved, the Kurds fight for their own land. And they have liberated lots of prisoners, women, children.

• ISIS Suffers Heavy Casualties In Kurdish Fighters’ Advances In Raqqa (FNA)

The Kurdish-led Syrian Democratic Forces (SDF) continued the anti-ISIL Euphrates Rage Operation in Western Raqqa and managed to drive the terrorists out of more neighborhoods in al-Tabaqa city, killing over 40 of them. The SDF engaged in heavy fighting with ISIL in al-Tabaqa city and managed to take control of the neighborhoods of al-Nababeleh, al-Zahra and al-Wahab, killing 23 militants. In the meantime, the Kurdish fighters managed to push ISIL back from al-Wahabah and Radio Station in al-Tabaqa, killing 20 militants and capturing 10 others. In relevant developments in the province on Tuesday, the SDF stormed ISIL’s defense lines and took full control over the villages and settlements of Kabash al-Sharqi, Um al-Tonok, Rayan, Tishrin farm, Mosheirehe al-Shamaliyeh, Mosheirefeh al-Janoubiyeh, al-Rahiyat, Beir Jarbou, Jarwa, al-Hattash, Hazimeh, Khalwa Abideh, Holo Abd, Abareh, al-Kaleteh, Sukriyeh and Zohra, inflicting major losses on ISIL.

The Kurdish forces also won back a key neighborhood in the Southern sector of Tabaqa city following a large advance on its Western urban. In the meantime, the SDF managed to seize control over the Alexandria suburb, and now the Kurds have swept through the adjacent Wahab neighborhood. Kurdish forces also secured the island of Jazirat al-Ayd, a few kilometers North of Lake Assad. According to latest reports, around 40% of Tabaqa city has been brought under Kurdish control with just a few hundred ISIL militants left in its Northern sector and around the city center.

‘..double suspension..’

• Russia Backs China Call To Stop N. Korea Nuke Tests, US-S. Korea Drills (RT)

Russia has supported a Chinese initiative in the UNSC intended to stabilize the situation on the Korean peninsula. It calls on the North to refrain from missile and nuclear testing, while the US and South Korea should halt military drills in the area.

“Members of the [UN] Security Council have unanimously called upon DPRK [Democratic People’s Republic of Korea] to stop missile and nuclear tests and to fulfil UNSC resolutions,” the Russian Foreign Ministry said in a statement on Saturday following a United Nations Security Council (UNSC) session held in New York earlier on Friday. The UNSC called for a political and diplomatic solution to the nuclear crisis on the Korean Peninsula, the ministry added.“In this context, the Russian Federation supported a Chinese proposal for a ‘double suspension’ (Pyongyang is to stop missile and nuclear tests and the US and South Korean militaries are to halt drills near North Korea) as a starting point for political negotiations.” However, the council was not able to agree on a common solution, the ministry added. The UNSC session was joined by Russian Deputy Foreign Minister Gennady Gatilov, who urged Washington and Seoul to reconsider their decision to station a THAAD anti-missile system on the Korean Peninsula, warning that it will serve as a “destabilizing factor” in the region.

Gatilov said the Terminal High Altitude Area Defense (THAAD) had been deployed “in line with the vicious logic of creating a global missile shield,” while warning that it is also undermining the security and deterrent capacities of adjacent states, such as China, thus threatening “the existing military balance in the region.” “It is not only we who perceived this step very negatively. We are once again urging both the United States and the Republic of Korea to reconsider its expediency, and other regional states not to yield to the temptation of joining such destabilizing efforts,” the deputy foreign minister said. Ahead of the UNSC session, Chinese Foreign Minister Wang Yi told reporters that a peaceful solution to the Korean crisis is the “only right choice.” “Peaceful settlement of the nuclear issue on the Korean Peninsula through dialogue and negotiations represents the only right choice that is practical and viable,” Wang said.

Very few Brazil politicians are not involved in one scam or another.

• Brazil Paralyzed by Nationwide Strike, Driven by Corruption and Impunity (GG)

Just over one year ago, Brazil’s elected President, Dilma Rousseff, was impeached – ostensibly due to budgetary lawbreaking – and replaced with her centrist Vice President, Michel Temer. Since then, virtually every aspect of the nation’s political and economic crisis – especially corruption – has worsened. Temer’s approval ratings have collapsed to single digits. His closest political allies – the same officials who engineered Dilma’s impeachment and installed him in the presidency – recently became the official targets of a sprawling criminal investigation. The President himself has been implicated by new revelations, saved only by the legal immunity he enjoys. It’s almost impossible to imagine a presidency imploding more completely and rapidly than the unelected one imposed by elites on the Brazilian population in the wake of Dilma’s impeachment.

The disgust validly generated by all of these failures finally exploded this week. A nationwide strike, and tumultuous protests in numerous cities, today has paralyzed much of the country, shutting roads, airports and schools. It is the largest strike to hit Brazil in at least two decades. The protests were largely peaceful, but some random violence emerged. The proximate cause of the anger is a set of “reforms” that the Temer government is ushering in that will limit the rights of workers, raise their retirement age by several years, and cut various pension and social security benefits. These austerity measures are being imposed at a time of great suffering, with the unemployment rate rising dramatically and social improvements of the last decade, which raised millions of people out of poverty, unravelling.

[..] During the past three years, Brazilians have been subjected to one revelation after the next of extreme corruption pervading the country’s political and economic class. Scores of corporate executives and long-time party leaders are imprisoned. They include the head of the Brazilian construction giant Odebrecht, the House Speaker who presided over Dilma’s impeachment, and the former governor of the state of Rio de Janeiro. The current House Speaker, and Senate President, and nine of Temer’s ministers are now targets of criminal investigations for bribery and money laundering, as are numerous governors.

In sum, the vast bulk of the top-shelf political and economic elite have proven to be radically corrupt. Billions upon billions of dollars have been stolen from the Brazilian public. Recently released recordings from the judicial confessions of Marcelo Odebrecht, scion of one of Brazil’s richest families, depict a country ruled almost entirely through bribes and criminality, regardless of the ideology or party of political leaders. And yet, even in the wake of this oozing and incomparable elite corruption, the price that is being paid falls overwhelmingly on the victims – ordinary Brazilians – while the culprits prosper.

Melenchon seeks to hold on to his voters for the June parliamentary elections.

• Mélenchon: France To Choose Between Extreme Right And Extreme Finance (IC)

The leader of a far-left movement who won nearly 20% of the vote in the first round of France’s presidential election, Jean-Luc Mélenchon, told his seven million voters in a YouTube address on Friday that he would not tell them how to vote in the final-round run-off next weekend. As for himself, Mélenchon said that he would cast a ballot, and that it would not be for Marine Le Pen, the candidate of the far-right National Front, who courted his voters in a video of her own on Friday. But Mélenchon also refused to say, like the leaders of other parties across the political spectrum – and celebrities including the French soccer legend Zinedine Zidane – that he would vote for Le Pen’s centrist rival, the former banker Emmanuel Macron, to stop the far-right from gaining power.

Instead, Mélenchon predicted that forcing France to choose between a candidate of “the extreme right” and one of “extreme finance” would led to a political crisis, and left open the possibility that he would submit a blank ballot, a form of protest vote permitted under French electoral law. (Mélenchon’s platform included provisions for voting to be made mandatory, and for blank ballots to be recognized under law.) The appeal for unity, to construct a barrage, or dam, against the rising tide of the far-right, Mélenchon said, was, in fact, a disguised attempt to force voters like him, who profoundly disagree with Macron’s economic policies, to endorse his project. Amid fears that widespread abstention and protest votes for neither candidate could lower the threshold for Le Pen to win with 50% of the valid votes cast, Mélenchon’s refusal to join the sort of united front against Le Pen that led to her father’s defeat in 2002 caused anxiety to spike.

Chameleons and parrots are us.

• Matteo Renzi Tries The Macron Approach (Pol.)

Matteo Renzi toned down the EU-critical rhetoric of his final months as Italian prime minister during his visit to Brussels on Friday to drum up support for his bid to be restored as head of the Democratic Party (PD) in its primaries this weekend. With aides suggesting on social media that French presidential hopeful Emmanuel Macron’s pro-EU stance, which helped him beat Euroskeptic Marine Le Pen in the election’s first round, could be a boost for Renzi, he talked about “Angela, François and I” when referring to German Chancellor Angela Merkel and French President François Hollande. Renzi even stood in front of a display showing the EU flag, and felt the need to explain why, in the run-up to his failed constitutional referendum that cost him the prime ministership last December, he had removed the EU flag from behind his desk.

“It wasn’t anger, it was calculated gesture,” Renzi told PD followers at a hotel near the European Parliament, adding that it was in response to the European Commission demanding Italian action on its budget deficit when it had been hit by an earthquake. The Italian and international media have speculated about the similarities between Renzi and Macron, with Renzi’s slogan for the PD primary this Sunday — In Cammino (“on the way”) — almost a direct translation of the name of Macron’s centrist political movement, En Marche. One close Renzi aide, Giuliano Da Empoli, wrote on Facebook the day after Macron’s first-round victory on April 23 that the French result “shows that one can be at the same time a convinced pro-European and a harsh critic of the status quo.”

That was the tone Renzi tried to strike in Brussels on Friday, repeating his line that the EU “needs radical change” and taking a dig at Germany for its trade surplus, while warning about the dangers of populism. “With the radicals you win the primary elections but then you lose the elections,” he told the audience. In the French campaign, which comes to a head with the second-round vote on May 7, the candidate closest to Renzi’s Democratic Party was Benoît Hamon, who won the ruling Socialist Party’s primaries but took only 6% of the vote on election night. That must resonate for Renzi, who wants to regain control of the PD to prepare a bid for a new term as prime minister in elections due early next year.

“Nobody has united here against the U.K.,” German Chancellor Angela Merkel told reporters..” She’s right, all everyone’s done is side WITH Germany. Without a word.

• EU Throws Down Brexit Gauntlet to Britain as Talks Edge Closer (BBG)

European Union governments threw down the gauntlet to the U.K. ahead of Brexit talks, listing demands Prime Minister Theresa May must satisfy before they will discuss the trade deal she wants and urging her to be more realistic in her expectations. Any doubts about the scale of the task facing Britain in withdrawing from the EU after four decades were laid to rest at a Brussels summit of the region’s leaders on Saturday. A tough negotiating stance was endorsed unanimously, within minutes and to applause. The U.K. responded by saying it’s bracing for a confrontation. The complexity comes down to the fact that a departure from the world’s biggest trading bloc has never been done and was never supposed to happen. The EU is striving to ensure the U.K. is worse off outside it than inside, not least to avoid setting a precedent.

After agreeing to the terms of separation, then it’s a matter of getting down to the business of what a future relationship might look like. “Nobody has united here against the U.K.,” German Chancellor Angela Merkel told reporters as she left the meeting. “The British people have made a decision, which we will have to respect. But we remaining 27 now get together in order to speak with one voice.” The Brexit discussions will begin soon after the U.K.’s June election, which May called in part to strengthen her mandate going into talks. The first orders of business will be guaranteeing the rights of 3 million EU citizens living in the Britain and calculating a financial settlement one leader said would be at least €40 billion euros ($44 billion). Only once “sufficient progress’’ is made on those thorny topics and reinforcing the border between the two Irelands will the EU’s attention turn to trade. That looks unlikely to happen before December.

Merkel tries to deflect the blame for what’s gone wrong, blames local officials for sweeping things under the carpet. Yeah, she would never have had any reason to do just that herself. Plus, she blames ‘Europe’s haphazard policing of its outer borders’, something for which no-one carries more responsibility than … Merkel, the de facto boss of the EU. Mutti Merkel’s just another politician going wherever the wind blows.

• Merkel Talks Tough on Migrants in Election Campaign Warm-Up (BBG)

German Chancellor Angela Merkel is talking tough on migrants and crime as she hits the campaign trail for two state elections next month, giving a foretaste of her bid for a fourth term in September. Merkel’s hardened rhetoric was on display in North Rhine-Westphalia, Germany’s most populous state, where her Christian Democratic Union is seeking to end seven years of Social Democratic rule on May 14. On Friday, she’s campaigning east of Hamburg in Schleswig-Holstein, where two polls this week suggest her party has a slim lead over the SPD ahead of a regional vote on May 7. At a CDU rally in the rural Westphalian town of Beverungen, Merkel reaffirmed her push to return migrants who don’t qualify for asylum and attacked the state’s Social Democrat-led government as soft on crime.

She said local officials “tried to sweep under the carpet” lapses in policing around mass sexual assaults on women in Cologne on New Year’s Eve in 2015, an incident that stoked an anti-immigration backlash. “The opportunity for improvement was there,” Merkel told the crowd on Thursday. “Things didn’t get better, so it’s time for a change.” As polls suggest that both Germany’s anti-immigration AfD party and her Social Democratic challenger Martin Schulz are in retreat for now, Merkel is using the opening to rally her CDU behind traditional themes of public safety. At a security conference this week, she said Europe’s haphazard policing of its outer borders compares unfavorably to U.S. immigration checks and must be strengthened.

PricewaterhouseCoopers gets the first half right: as I’ve said numerous times, Greece cannot recover under present conditions imposed by the Troika. But then PwC loses the thread. Pity but predictable.

• PwC: Greece Must Reform Or Forget Recovery (K.)

The extent of the destruction the Greek economy has suffered in the last few years, also undermining the effort to restructure it, becomes clear when comparing specific data, not on a quarterly or annual basis, but over the longer term. The country remains in a vicious cycle of recession, the economy will not grow by more than 1% this year, and any positive signs have proved temporary or insufficient to alter the overall picture. According to “Economic Outlook for Greece 2017-2018,” a study by PricewaterhouseCoopers (PwC), investment in the country’s economy dropped from €60 billion in 2010 to €20 billion last year. Investments are showing no signs of sustainable recovery as savings remain in the red and banks continue to deleverage their financial reports.

Consumption has been in constant decline, with a small recovery last year followed by a fresh drop in recent months. The average disposable income has gone down primarily due to the increased taxation and hikes in social security contributions, while the capital controls remain and banks are dependent on emergency liquidity assistance (ELA) for their financing. PwC notes that disposable incomes are unlikely to grow significantly anytime soon. There are just a few domestic investments that could fuel a recovery and no significant funding for investments is expected from abroad. At the same time it will be hard for fiscal performance to post a significant improvement without any deep structural reforms, including in the social security system.

The banks’ lack of liquidity, the delayed repayment of the state’s dues to its suppliers and the capital controls are likely to persist. PwC further argues that despite the delays in the second bailout review, Greece could avoid any unforeseeable tension and political events and achieve some growth, but not any greater than 1%, and the same challenges will remain next year too. An exit from the vicious cycle, says PwC, will require not only a change in the Greek debt’s sustainability terms, but also a drastic acceleration of structural reforms and the boosting of competitiveness and growth.