Andrew Wyeth Christina’s world 1948

Any questions?

• The CDC Is Manipulating Data To Prop-up “Vaccine Effectiveness” (OffG)

The US Center for Disease Control (CDC) is altering its practices of data logging and testing for “Covid19” in order to make it seem the experimental gene-therapy “vaccines” are effective at preventing the alleged disease. They made no secret of this, announcing the policy changes on their website in late April/early May, (though naturally without admitting the fairly obvious motivation behind the change). The trick is in their reporting of what they call “breakthrough infections” – that is people who are fully “vaccinated” against Sars-Cov-2 infection, but get infected anyway. Essentially, Covid19 has long been shown – to those willing to pay attention – to be an entirely created pandemic narrative built on two key factors:

• False-postive tests. The unreliable PCR test can be manipulated into reporting a high number of false-positives by altering the cycle threshold (CT value) • Inflated Case-count. The incredibly broad definition of “Covid case”, used all over the world, lists anyone who receives a positive test as a “Covid19 case”, even if they never experienced any symptoms. Without these two policies, there would never have been an appreciable pandemic at all, and now the CDC has enacted two policy changes which means they no longer apply to vaccinated people. Firstly, they are lowering their CT value when testing samples from suspected “breakthrough infections”. From the CDC’s instructions for state health authorities on handling “possible breakthrough infections” (uploaded to their website in late April):

“For cases with a known RT-PCR cycle threshold (Ct) value, submit only specimens with Ct value ≤28 to CDC for sequencing. (Sequencing is not feasible with higher Ct values.)” Throughout the pandemic, CT values in excess of 35 have been the norm, with labs around the world going into the 40s. Essentially labs were running as many cycles as necessary to achieve a positive result, despite experts warning that this was pointless (even Fauci himself said anything over 35 cycles is meaningless). But NOW, and only for fully vaccinated people, the CDC will only accept samples achieved from 28 cycles or fewer. That can only be a deliberate decision in order to decrease the number of “breakthrough infections” being officially recorded.

Secondly, asymptomatic or mild infections will no longer be recorded as “covid cases”. That’s right. Even if a sample collected at the low CT value of 28 can be sequenced into the virus alleged to cause Covid19, the CDC will no longer be keeping records of breakthrough infections that don’t result in hospitalisation or death. From their website: “As of May 1, 2021, CDC transitioned from monitoring all reported vaccine breakthrough cases to focus on identifying and investigating only hospitalized or fatal cases due to any cause. This shift will help maximize the quality of the data collected on cases of greatest clinical and public health importance. Previous case counts, which were last updated on April 26, 2021, are available for reference only and will not be updated moving forward.” Just like that, being asymptomatic – or having only minor symptoms – will no longer count as a “Covid case” but only if you’ve been vaccinated.

The CDC has put new policies in place which effectively created a tiered system of diagnosis. Meaning, from now on, unvaccinated people will find it much easier to be diagnosed with Covid19 than vaccinated people.

Consider…

Person A has not been vaccinated. They test positive for Covid using a PCR test at 40 cycles and, despite having no symptoms, they are officially a “covid case”.

Person B has been vaccinated. They test positive at 28 cycles, and spend six weeks bedridden with a high fever. Because they never went into a hospital and didn’t die they are NOT a Covid case.

Person C, who was also vaccinated, did die. After weeks in hospital with a high fever and respiratory problems. Only their positive PCR test was 29 cycles, so they’re not officially a Covid case either.

Seriously wondering what they pay their PR people.

• CDC Head Now Differentiates Between Dying ‘From’ Vs. Dying ‘With’ Covid (Fox)

Centers for Disease Control and Prevention Director Rochelle Walensky drew criticism on Sunday for her method of identifying COVID-19 deaths in the U.S., making a sudden distinction between those who died “from” the virus and those who died “with” it. During an interview on CNN’s “State of the Union,” Walensky was asked about vaccinated Americans who have contracted the virus – and whether anyone has died from an infection, despite being inoculated. Walensky said the CDC is aware of 223 so-called “break-through” infections in vaccinated Americans, but clarified that many of those individuals died due to other causes. “Not all of those 223 cases who had COVID actually died of COVID,” she said. “They may have had mild disease but died, for example, of a heart attack.”

But critics pounced on Walensky’s reasoning. “After all this time, we are going to start distinguishing died ‘with’ Covid from died ‘from’ Covid,” one Twitter user wrote. “How anyone lives with the dishonest reporting of numbers is beyond me. Either we treat all the deaths with the same questioning or none of them, Period.” Another user wrote: ‘So she literally just admitted that the covid death count isn’t a real count of covid deaths. The response to this pandemic gets more baffling by the day.” Others suggested that all COVID-19 deaths should be re-examined to determine whether the person died “from” the virus or “with” it. “Sounds like 500k cases need to be reviewed to more accurately distinguish ‘with’ and ‘from’,” one user said. “Hmm, thought I heard this same sentiment expressed in the past.”

Close to 47% of the adult population in the U.S. is fully vaccinated, according to data published by the CDC, while nearly 60% of the adult population – or roughly 157 million people – has received at least one dose. The vaccination rate is expected to rise shortly following the Food and Drug Administration’s approval this week for the use of the Pfizer vaccine in children between the ages of 12 and 15. More than 32.7 million Americans have been infected with COVID-19, and more than 582,000 people died from the virus, according to the CDC.

No, of course not, it’s just a sales campaign.

• Is The Pfizer Vaccine As Effective As Claimed? (P&R)

Using the simple ‘cases per 1000 tests’ (rather than the biased ‘incident rate per 100,000 person days’), results in an approximate ‘vaccine effectiveness’ measure of 75.7%. While this is much less than the 95% headline figure, it is still impressive, so it is strange why the study failed to account for the difference in proportions tested. It appears that the failure to adjust the vaccine effectiveness calculation for different testing protocols for vaccinated and unvaccinated people is not restricted to this Pfizer study in Israel. The data in the FDA briefing document on the Pfizer vaccine (dated 10 Dec 2020) suggests there was a similar problem with the phase 3 trial of the vaccine. This was a randomized, double-blinded and placebo-controlled trial of the vaccine in 44,000 uninfected participants.

It similarly reports a 95% effectiveness measure based on the fact that (post injection) there were 162 confirmed Covid-19 cases among the placebo participants compared to just 8 among the vaccinated participants. However, the study also reports that there were a much larger number of ‘suspected but unconfirmed’ cases and that these were more evenly spread between placebo participants (1,816 such cases) and vaccinated participants (1,594 such cases). This seems to suggest that a disproportionately small number of vaccinated participants with symptoms received PCR tests compared to placebo participants with symptoms. Clearly the failure to properly adjust for both a decreasing infection rate and different testing protocols for vaccinated and unvaccinated people casts doubt on the validity of the studies.

It is also worth noting that, even if we ignore all of the above issues and accept as undisputed the number for ‘COVID-19 related deaths’ in the Israel study (715 among the unvaccinated and 138 among the vaccinated), then the absolute percentage increase in risk of death for an unvaccinated person is just 0.036%. That means that, even if we accept the 95% effectiveness measure, for every 10,000 unvaccinated people, about 3 or 4 would die as a result of not being vaccinated. And this brings us to the final (and critical) problem with the study. It does not provide any information about the number of adverse reactions – in particular the number of deaths – due to the vaccine. Hence, it does not provides the necessary information to make an informed decision about the overall risk/benefit of the vaccine.

Follow the science, you said? If they had enough vaccines, they would make it two. But they don’t, and everyone wants tourism, so it’s one.

• One Shot Is Enough To Obtain An EU Covid Travel Certificate (CC)

You are expected to need only one injection this summer to travel in the European Union. So people don’t have to wait for both shots before they can apply for a Covid travel certificate, EU sources say. In recent weeks, there have been crowded meetings within the European Union over the Covid travel certification. Today, the member states, the European Parliament and the European Commission are back together. The exact terms of the travel certificate are expected to become clear at the end of the week. There are still a number of points on which negotiators disagree. For example, it appears that there will be no free PCR tests for people who want to apply for a travel certificate. The European Parliament wanted to take care of this, as it would make an unfair difference between those who were vaccinated and did not have to pay for it and those who would have to pay for a PCR test before traveling.

But according to diplomats from the European Union, a number of countries, including the Netherlands, do not like this. They think the countries themselves revolve around this. In their opinion, therefore, a free injection should not be imposed from the European Union. The board is likely to issue its opinion on pricing for PCR tests. According to the sources, the Cabinet will decide next Friday the conditions and prices for exams in the Netherlands. Travelers who go on vacation by car will likely avoid a lot of trouble. The intention is that there will be no border controls. Once in the country, you can check. But it is not clear how. The PCR test should be done 72 hours before departure, but if travelers are not screened at the border, this is difficult to prove.

Where did we lose track?

• Vaccine Cocktails Could Be On The Menu (RT)

A Spanish study has suggested that administering a second dose of Pfizer to those who received AstraZeneca as their first dose is safe. It saw antibodies increase seven-fold compared to those who were given no second jab at all. The CombivacS study, which enrolled 676 participants who had already received a first dose of AstraZeneca and gave them a second dose of Pfizer, has produced positive preliminary results. Of the total cohort, 450 people were given Pfizer as their second dose, and the remaining 226 have not received any second dose and are being observed as the control group.

Published on Tuesday, the study, launched by the Carlos III Health Institute, reported that the combination was both safe and effective. Jesus Antonio Frias, coordinator of the ISCIII Clinical Research Network, said, “A more than seven-fold increase in neutralizing antibodies was observed 14 days after vaccination.” According to Magdalena Campins, of the Vall d’Hebron University Hospital in Barcelona, very few side effects have been reported, other than minor pain at the injection site and general discomfort or headaches.

The data reinforces the findings of a larger British study that published its preliminary results last week. It said there were no immediate safety concerns about mixing AstraZeneca and Pfizer jabs, but noted that adverse reactions were heightened. The researchers suggested it was possible that these were more prevalent among younger people, but did not elaborate. Spain commenced its study following the government’s decision to stop using AstraZeneca for those under the age of 60. The study’s findings will inform whether the nearly two million essential workers who received a first dose of AstraZeneca’s Covid-19 shot will receive a second dose, and which jab they will be given.

Fear is a harsh mistress.

• Unvaccinated Americans Twice As Likely To Feel Comfortable Ditching Masks (F.)

A majority of Americans still say they would not feel comfortable performing most activities without a mask even amid new public health guidance, a new Morning Consult poll finds—but unvaccinated Americans are far more likely to be OK with going maskless, suggesting new mask guidelines might not incentivize a lot of them to get the shot. No more than 48% of U.S. adults would be comfortable doing any of the activities polled without a mask—with outdoor dining being the activity with the highest degree of comfort and international flights having the lowest degree—according to the poll, which was conducted May 14-17 among 2,200 respondents. For every single activity polled, unvaccinated Americans were dramatically more likely to say they’d be comfortable going maskless than their vaccinated counterparts.

Unvaccinated people were approximately twice as likely as vaccinated people to say they’re comfortable not wearing a mask at the movies (40% unvaccinated comfortable versus 20% vaccinated), a shopping mall (41% versus 21%), an amusement park (41% versus 21%), a religious gathering (41% versus 21%), museums (42% versus 22$), a work conference (40% versus 19%), the gym or exercise class (40% versus 20%) and going to school (40% versus 21%). The biggest discrepancies between unvaccinated Americans and vaccinated were in their comfort level going unmasked on a cruise (36% unvaccinated comfortable versus 16% vaccinated), public transportation (33% versus 12%) and on airplanes to domestic locations (34% versus 14%) and international locations (31% versus 12%).

It’s for the rest of your life.

• Canada Invests $200 Million To Build An mRNA Vaccine Plant (CBC)

The federal government today announced a $200-million investment to help a Mississauga, Ont.-based company build a plant that can churn out millions of mRNA vaccines. Innovation Minister François-Philippe Champagne said the money will be used to expand an existing site owned by Resilience Biotechnologies Inc. to provide “made-in-Canada solutions such as vaccines and treatments for future pandemics.” The funds will expand Resilience’s manufacturing and fill-finish capacity for a number of vaccines and therapeutics, including mRNA shots like the ones now being used to fight COVID-19, Champagne said. The government says the plant expansion will create 500 permanent jobs and 50 co-op placements for students once construction is complete in 2024.

The addition of some 55,000 square feet of factory space will allow Resilience to manufacture between 112 million and 640 million doses of mRNA product each year. The goal is to leave Canada less dependent on foreign vaccine makers when the next pandemic hits. Resilience is a contract development and manufacturing organization (CDMO), which means it assembles products developed by other companies. It’s standard for big pharmaceutical companies like AstraZeneca, Merck and Pfizer to outsource the actual drug manufacturing process to third parties. Some companies have sold their manufacturing sites to focus on research and development. A Novartis-owned plant in Boucherville, Que. was sold to Avara, a contract manufacturing operation, in 2018.

Tie this in with Jan. 6.

• New York Investigation Into Trump Organization Now Criminal (R.)

The New York state attorney general’s office has told the Trump Organization that its investigation of the company is now a criminal probe, not purely civil. Cyrus Vance, Manhattan’s district attorney, has also been investigating the business run by former president Donald Trump for more than two years. “We have informed the Trump Organization that our investigation into the organization is no longer purely civil in nature,” spokesman Fabien Levy said in a statement for New York state attorney general, Letitia James. “We are now actively investigating the Trump Organization in a criminal capacity, along with the Manhattan DA,” he said.

Vance’s office has said in court filings it was investigating “possibly extensive and protracted criminal conduct” at the former president’s Trump Organization, including tax and insurance fraud and falsification of business records. Vance’s probe began after Trump’s former lawyer and fixer Michael Cohen paid hush money to silence two women before the 2016 election about claimed sexual encounters with Trump. That probe has accelerated since Republican Trump lost his bid for a second term to president Joe Biden, a Democrat. James, who like Vance is a Democrat, is leading a separate criminal probe into whether Trump’s company falsely reported property values to secure loans and obtain economic and tax benefits.

“Asian NATO”

• The Glass House Where the Power Elite Gather to Throw Stones (MPN)

The United States is the nation that most threatens democracy worldwide, far more than Russia or even China. That is the headline finding from a new worldwide poll of 53 countries commissioned by the Alliance of Democracies (AoD). The poll also found that the global public considers rising inequality and the increased power of the super rich to be the greatest threat to liberty and democracy. This was likely not the response the Alliance of Democracies wished to hear as it opened its third annual Democracy Summit in Copenhagen this week — precisely because the organization represents the U.S. government and the wealthy elite more generally. Featuring an all-star panel of American officials, Western heads of state and military leaders, this year’s summit was somber in tone and focused on the “urgent need” for Western nations to unite and come up with a “transatlantic response” to counter both Russia and China.

To that end, there was talk of building an “Asian NATO” and of further controlling what can be said online, all in the service of defending and upholding democracy from these foes. The Alliance of Democracies was founded in 2017 by former Prime Minister of Denmark Anders Fogh Rasmussen. As Secretary General of NATO between 2009 and 2014, he also oversaw the Iraq and Afghanistan occupations, as well as the attack and regime-change operation in Libya, which saw ISIS-affiliated jihadists take control of the country. Together with future President Joe Biden and former Director of Homeland Security Michael Chertoff, Rasmussen also founded the Transatlantic Commission on Election Integrity (TECI), an AoD body at the forefront of accusing Russia of election meddling in the U.S. Biden was one of the inaugural speakers at the first Democracy Summit in 2018.

The great and the good — including presidents, journalists and business magnates — gathered both in person and virtually to discuss the supposed threats to the democratic order, with Rasmussen in particular pushing for a more formal military, political and economic alliance among the world’s “democracies” against Russia and China. The well-dressed and soft-spoken Dane also introduced lineups of speakers who argued for regime change in states the alliance does not feel are democratic enough for their liking.

“We must therefore guard against believing that our enemies are the Russians, the Chinese or whomever the logic of divide-and-rule would pit us against.”

• Is The Age Of Permanent War Finally Over? (Krainer)

Recent events in the world have given me great hope that we might finally emerge from the century of permanent war. The Great Reset agenda seems to be losing steam and those in charge of implementing it are losing conviction (with the exception, perhaps, of the very top echelon in power). At the same time, the ranks of people who are opposed to it and are willing to take a stand, appear to be swelling. Since the very start of the great pandemic of 2020, something about the public health response didn’t feel right. It was clear from the measures that were enacted and from measures that were not enacted that their purpose had little to do with public health. Instead, they seemed to further a different agenda. Soon we learned that this was all connected to World Economic Forum’s hugely ambitious Fourth Industrial Revolution or the Great Reset.

But the agenda and the steps taken seemed rushed, panicked and frankly, hopeless. Many of the solutions and technologies that would need to be rolled out and ready to use turned out to be non-existent or only in conceptual stages of development. As months went on, the events proved this impression correct as we watched the authorities muddle through, destroying their own credibility in the process. In a very recent interview Dr. Rainer Fullmich stated as follows: “We have a whistleblower and she told us that the original plan was to roll this out in 2050. But then those who are involved with this got greedy and pulled things forward to 2030 and then to 2020 and that’s why so many mistakes are happening.”

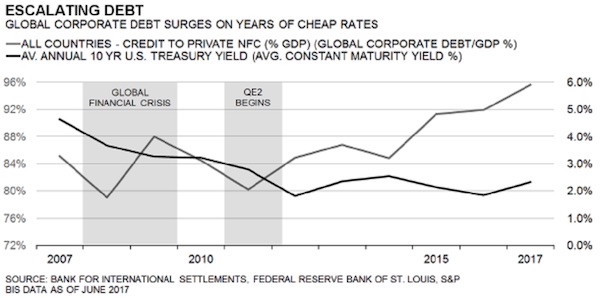

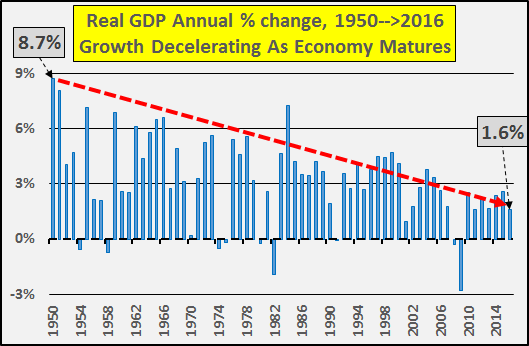

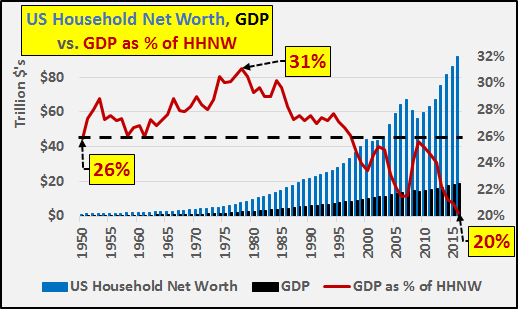

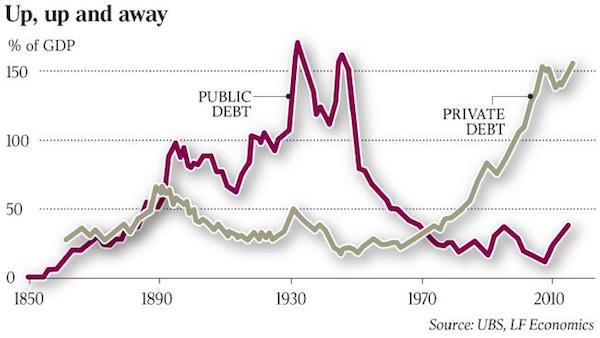

I do not believe that the people involved with this got greedy — I believe that their concern is with the fragility and imminent demise of the financial system which is their key mechanism of control over all the levers of influence in society. The implosion of that system would also jeopardize their position of power, so they rushed the Great Reset right off the back of the 2020 pandemic to try and front-run the collapse and give themselves an iron-fisted control of things ahead of the unfolding crisis. From their various documents and white papers, it is also evident that they had anticipated the public pushback. As I wrote last August, they have “surely planned diversions to misdirect our grievances… One of the greatest means of diversion are wars. We must therefore guard against believing that our enemies are the Russians, the Chinese or whomever the logic of divide-and-rule would pit us against.”

By the Norwegian Refugee Council

“..buried with their dreams and the nightmares that haunted them..”

If this doesn’t break your heart…

• Israel Kills 11 Children Receiving Trauma Care in Their Homes (NRC)

The Norwegian Refugee Council confirmed that 11 of over 60 children killed by Israeli air strikes in Gaza over the last week were participating in its psycho-social program aimed at helping them deal with trauma. All of the children between 5 and 15 years old were killed in their homes in densely populated areas along with countless other relatives who died or received injuries. “We are devastated to learn that eight children we were helping with trauma were bombarded while they were at home and thought they were safe,” said NRC’s Secretary General Jan Egeland. “They are now gone, killed with their families, buried with their dreams and the nightmares that haunted them. We call on Israel to stop this madness: children must be protected. Their homes must not be targets. Schools must not be targets. Spare these children and their families. Stop bombing them now.”

The children NRC assisted included Lina Iyad Sharir, 15, who was killed with both of her parents in their home on May 11 in Gaza City’s Al Manara neighborhood. Her two-year-old sister Mina sustained third degree burns and remains in critical condition. Hala Hussein al-Rifi, 13, was killed on the night of May 12 when an air strike hit the Salha residential building in Gaza City’s Tal Al-Hawa neighborhood. The attack also killed four-year-old Zaid Mohammad Telbani and his mother Rima, who was five months pregnant. Zaid’s sister remains missing and is presumed dead.

Multiple air raids on 16 May in Al Wahda Street in central Gaza City killed six children that NRC worked with, together with several family members. These included Tala Ayman Abu al-Auf, 13, and her 17-year-old brother. Their father, Dr Ayman Abu al-Auf, was the head of internal medicine at Gaza City’s Shifa hospital. He was also killed. The same attacks also killed Rula Mohammad al-Kawlak, 5, Yara, 9, and Hala, 12 – all sisters – together with their cousin Hana, 14, and several other of their relatives, as well as sisters Dima and Mira Rami al-Ifranji, 15 and 11, and neighbour Dana Riad Hasan Ishkantna, 9.

Merkel would have never given in.

• Biden To Waive Sanctions On Company In Charge Of Nord Stream 2 (Axios)

The Biden administration will waive sanctions on the corporate entity and CEO overseeing the construction of Russia’s Nord Stream 2 pipeline into Germany, according to two sources briefed on the decision. The decision indicates the Biden administration is not willing to compromise its relationship with Germany over this pipeline, and it underscores the difficulties President Biden faces in matching actions to rhetoric on a tougher approach to Russia. The State Department will imminently send its mandatory 90-day report to Congress listing entities involved in Nord Stream 2 that deserve sanctions. Sources familiar with the drafting of the report tell Axios the State Department plans to call for sanctions against a handful of Russian ships.

The State Department will also acknowledge that the corporate entity in charge of the project (Nord Stream 2 AG) and its CEO (Putin crony and former East German intelligence officer Matthias Warnig) are engaged in sanctionable activities. However, the State Department will waive the applications of those sanctions, citing U.S. national interests. This planned move seems at odds with Secretary of State Antony Blinken’s statement, made during his confirmation hearing: “I am determined to do whatever we can to prevent that completion” of Nord Stream 2. This planned move also sets up a bizarre situation in which the Biden administration will be sanctioning ships involved in the building of Nord Stream 2 but refusing to sanction the actual company in charge of the project.

Sources close to the situation say that top Biden officials have determined that the only way to potentially stop the project — which is 95% complete — is to sanction the German end users of the gas. And the Biden administration is not willing to rupture its relationship with Germany over Nord Stream 2.

“..it is preferable to speak of a basic income than of a universal income..”

• From Basic Income To Inheritance For All (Piketty)

The Covid crisis is forcing us to rethink the tools of redistribution and solidarity. Proposals are springing up everywhere: basic income, job guarantee, inheritance for all. Let’s say it straight away: these proposals are complementary and not substitutable. In the long run, they must all be implemented, in stages and in this order. Let’s start with basic income. Such a system is dramatically lacking today, especially in the South, where the incomes of the working poor have collapsed and containment rules are unenforceable in the absence of a minimum income. Opposition parties had proposed introducing a basic income in India in the 2019 elections, but the ruling nationalist-conservatives in Delhi are still dragging their feet.

In Europe, various forms of minimum income exist in most countries, but with many shortcomings. In particular, there is an urgent need to extend access to them to younger people and students (this has already long been the case in Denmark), and especially to people without a fixed address or bank account, who often face insurmountable obstacles. It is worth noting in passing the importance of the current discussions on central bank digital currencies, which should ideally lead to the creation of a genuine public banking service, free and accessible to all, the antithesis of the systems dreamt up by private operators (whether decentralised and polluting, like bitcoin, or centralised and inegalitarian, like the projects of Facebook or private banks).

It is also essential to extend the basic income to include low-paid workers, with a system of automatic payment on pay slips and bank accounts, without people having to ask for it, linked to the progressive tax system (also deducted at source). Basic income is an essential but insufficient tool. In particular, its amount is always extremely modest. Depending on the proposal, it is generally between half and three quarters of the full-time minimum wage, so that, by construction it can only be a partial tool in the fight against inequality. For this reason, it is preferable to speak of a basic income than of a universal income (a notion that promises more than this minimalist reality).

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.