Arnold Genthe San Francisco, “Grant Avenue at Sacramento Street.” 1930

It’s just a bubble popping.

• British Pound Sterling Plunges As Brexit Fears Continue To Swirl (CNBC)

The British pound plunged to fresh 31-year lows on Wednesday, swamped by continued fears over the U.K. leadership vacuum and the country’s potential exit from the EU. The pound tumbled as low as $1.2796 during Asia trade on Wednesday, it’s lowest since 1985, after ending Tuesday’s trade around $1.2960. The U.K. currency later recovered to trade around $1.2881 at 12:27 p.m. SIN/HK. Analysts were concerned that the continued political uncertainty will hurt capital inflows and spur companies to delay investments, potentially tipping the economy into a recession. The Bank of England (BOE) had begun taking preemptive steps to protect the British economy in the wake of June 23 U.K. referendum vote to leave the European Union (EU).

On Tuesday, BOE Governor Mark Carney sent a clear message to Britain’s cautious bankers: They needed to start lending more money. The central bank cut the amount of capital it required banks to hold in reserve, which freed up an extra 150 billion pounds ($196 billion) for lending. Carney had previously signaled more monetary easing would likely be put in place in the near term. But that wasn’t assuaging the market much, analysts said. “As Carney as put it himself, there isn’t so much he can do. Monetary policy, which the Bank of England is in charge of, cannot fix structural issues. It’s very apparent with Brexit that investors will stay away from the U.K. because of the certainty,” Axel Merk, chief investment officer at Merk Investments, told CNBC’s “Rundown” on Wednesday.

He noted that not only has the U.K. yet to invoke Article 50 of the Lisbon Treaty, which will formally start negotiations for an exit from the EU, it wasn’t clear who the country’s next leader would be. The ruling Conservative party is in the midst of finding a successor to Prime Minister David Cameron, who resigned after his “remain” camp lost the referendum. “You’re not going to make a big investment decision if you don’t have that sort of certainty,” Merk said. “The only thing the Bank of England can do obviously is provide the ability of banks to lend, but if there are no takers, it doesn’t help all that much.”

And if one bubble pops….

• Asia Markets Tumble As Investors Scurry Into Safe-Haven Plays (CNBC)

Markets in Asia were sharply lower on Wednesday, as investors scurried into safe-haven plays on global growth concerns, sending bond yields to record lows. Renewed Brexit jitters also sent the British pound tumbling to a fresh 31-year low. The British pound dropped to a fresh 31-year low early Wednesday amid Brexit concerns, trading at $1.2860 as of 11:04 a.m. HK/SIN, after dropping as low as $1.2796 earlier. The tumble began overnight as investors flocked to safe-haven assets such as U.S. Treasurys, the yen and the greenback after three U.K. real estate funds halted selling and the Bank of England relaxed regulations to encourage banks to lend out more money.

Japan’s Nikkei 225 dropped 2.96%, after earlier tumbling some 3.2% on the back of fresh yen strength. The Japanese yen, a safe-haven asset, traded at 100.71 against the dollar as of 11:04 a.m. HK/SIN, compared with levels near 103 on Friday. “There’s a high level of complacency in dollar/yen trade as the markets have no defined direction other than chasing risk sentiment,” said Stephen Innes, a senior trader at OANDA. “I expect further probes lower as the latest Brexit sell-off is simply the tip of the iceberg.” The yen strength saw Japanese exporters tumble, with shares of Honda off 5.9%, Toyota down 3.09% and Nissan down 3.82%.

What? I can’t have Schadenfreude? First they blow a giant bubble and when it pops they all come to mama? Know what I think? “Someday a real rain will come and wash all this scum off the streets..”

“The problem these funds face is that it takes time to sell commercial property to meet withdrawals, and the cash buffers built up by the managers have been eroded by investors heading for the door.”

• Third London Asset Manager Suspends Trading in Property Fund (BBG)

Three of the U.K.’s largest real estate funds have frozen almost £9.1 billion ($12 billion) of assets after Britain’s shock vote to leave the European Union sparked a flurry of redemptions. M&G Investments, Aviva Investors and Standard Life Investments halted withdrawals because they don’t have enough cash to immediately repay investors. About £24.5 billion is allocated to U.K. real estate funds, according to the Investment Association. “The dominoes are starting to fall in the U.K. commercial property market,” said Laith Khalaf, a senior analyst at Hargreaves Lansdown. “The problem these funds face is that it takes time to sell commercial property to meet withdrawals, and the cash buffers built up by the managers have been eroded by investors heading for the door.”

The pound fell to its weakest level in three decades against the dollar Tuesday, surpassing lows reached in the aftermath of the Brexit vote, as the freezing of the property funds spooked global markets. Bank of England Governor Mark Carney pledged to shore up financial stability on a day when a survey showed a plunge in U.K. business confidence. The rush by private investors to withdraw money prompted M&G, which held 7.7% in cash before the vote, to suspend its £4.4 billion Property Portfolio fund and Aviva Investors to freeze its £1.8 billion Property Trust on Tuesday. Standard Life halted trading on its£ 2.9 billion U.K. real estate fund on Monday. The cash position for Aviva and Standard Life’s funds at the end of May was 9.3% and 13.1% respectively, documents showed.

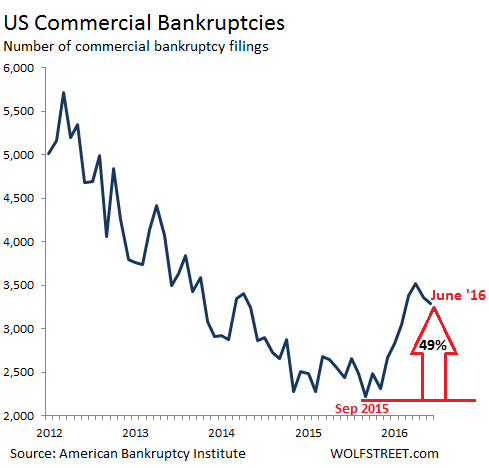

“Total US commercial bankruptcy filings in June soared 35% from a year ago..”

• The Big Unravel: US Commercial Bankruptcies Skyrocket (WS)

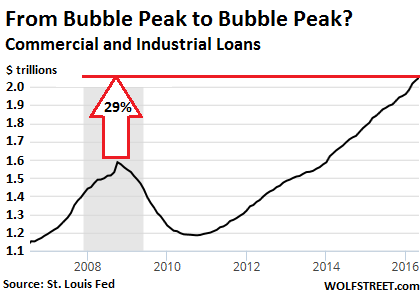

This year through June, there have been 91 corporate defaults globally, the highest first-half total since 2009, according to Standard and Poor’s. Of them, 60 occurred in the US. Some of them are going to end up in bankruptcy. Others are restructuring their debts outside of bankruptcy court by holding the bankruptcy gun to creditors’ heads. In the process, stockholders will often get wiped out. These are credit fiascos at larger corporations – those that pay Standard and Poor’s to rate their credit so that they can sell bonds in the credit markets. But in the vast universe of 19 million American businesses, there are only about 3,025 companies, or 0.02% of the total, with annual revenues over $1 billion; they’re big enough to pay Standard & Poor’s for a credit rating.

About 183,000 businesses, or less than 1% of the total, are medium-size with sales between $10 million and $1 billion. Only a fraction of them have an S&P credit rating, and only those figure into S&P’s measure of defaults. The rest, the vast majority, are flying under S&P’s radar. About 99% of all businesses in the US are small, with less than $10 million a year in revenues. None of them are S&P rated and none of them figure into S&P’s default measurements. So how are these small and medium-size businesses doing – the core of American enterprise? Total US commercial bankruptcy filings in June soared 35% from a year ago, to 3,294, the eighth month in a row of year-over-year increases, the American Bankruptcy Institute (in partnership with Epiq Systems) reported today.

During the first half, commercial bankruptcy filings soared 29% to 19,470. Among the various filing categories: Chapter 11 filings (company “restructures” its debt at the expense of stockholders and unsecured creditors by shifting ownership to creditors, but continues to operate) soared 36% to 499 in June and 25% in the first half to 3,220. Chapter 7 filings (company throws in the towel and “liquidates” by selling its assets and distributing the proceeds to creditors) jumped 28% in June to 1,909, and 25% in the first half to 11,211.

Then so will the bankers.

• In London, Banker Bonuses Are Set To Disappear (ZH)

Not only will Brexit be used as an excuse for companies to lower earnings guidance and for central banks to provide more quantitative easing, but it may also be a scapegoat for banker bonuses in London being slashed – everyone can let out their collective gasp now. As we have been covering, banker jobs have been getting cut for quite some time now, most recently with RBS announcing it will be cutting another 900 jobs. Times have been difficult for banks leading up to Brexit, but now, as Bloomberg reports, the message London’s investment banks are giving staff this year is that in the aftermath of Brexit, just be thankful to have a job, and forget a fat bonus at the end of the year.

“It’s a great opportunity to blame Brexit, giving people the message ‘you’re lucky enough to have a job'” said Stephane Rambosson, managing partner at DHR executive search firm in London, adding that bonuses could fall 30% or more in some areas. Jason Kennedy, CEO of recruitment firm Kennedy Group in London said “Reality is going to kick in, today it’s about job preservation, rather than bonuses. Things are going to change, and some people shouldn’t expect any bonuses.”

Jon Terry, a partner at PricewaterhouseCoopers in London, at least admits that things were falling apart even before Brexit: “If we hadn’t had the referendum results, this year was looking pretty tough anyway. We haven’t seen an end to various fines and compensation related to payment protection insurance and Libor. There are still billions of pounds being charged to the accounts. Ever since the financial crisis, there has been a need for reshaping the spend on compensation costs. Brexit is possibly one of the biggest catalysts for the next stage of reduction.”

From a German source, no less. Throw that towel!

• Deutsche Bank: The Downfall Of An Institution (Deutsche Welle)

It has been nearly a year since John Cryan assumed the leadership of Germany’s still-largest bank. He took the reins from Anshu Jain, who was chosen to realize his own predecessor Josef Ackermann’s dream of 25% returns. Jain did what he was expected to do. And the bank is still dealing with the consequences. 7,800 lawsuits have been carried out against the bank worldwide. Most of them are pretty manageable, some were settled for billions upon billions. But a few still carry a destructive power that would cost the bank its existence – money laundering accusations in Russia, for example, or investigations by the SEC over peculiar dealings with mortgage-backed securities.

Cryan is making a tremendous effort, portraying himself at times as the man behind the wrecking-ball, at others as the chief builder. He has almost completely replaced the bank’s leadership. With an iron broom, he has swept away many of his inherited messes, accepting record losses of over $6 billion in the process. But his efforts have yet to yield any success. Deutsche’s share price has halved itself once again this year. Employee moral is in the cellar. Even the technology is breaking down – in June, double-bookings were recorded on three million accounts, ATMs stopped giving out cash, card purchases weren’t going through. Meanwhile the bank keeps talking away about an “image problem.”

So it’s clear that things continue to get worse. Cryan stresses over and over that he doesn’t see the bank as a takeover candidate. Certainly oversight authorities would take a very close, very skeptical look at such a deal. But even if a competitor from the US or China were able to afford Deutsche Bank out of pocket, they likely wouldn’t want anything to do with it in its current condition. As of now, that’s the only real insurance against an acquisition.

Pretty funny too.

• Inequality, Debt and Credit Stagnation (Steve Keen)

This was my keynote speech at the French Association for Political Economy (AFEP) annual conference in Mulhouse, France (the other keynote was given–in French–by my good friend Marc Lavoie, who is now based at the University de Paris 13). In this presentation, I:

• Disparage the “secular stagnation” explanation that Larry Summers has regurgitated for the tepid level of economic growth today. As did Hansen in the 1930s, Summers ponders “why growth would remain anaemic in the absence of major financial concerns?“, when financial concerns are obvious if you understand credit;

• Explain why credit plays a crucial role in both aggregate demand and aggregate income, once you understand that banks originate loans rather than act as financial intermediaries; and

• Show that my 1992 complex systems model of Minsky’s “Financial Instability Hypothesis” can be derived by working from strictly true macroeconomic identities, in an alternative to Lucas’s “microfoundations” approach to building macroeconomic models.

Beppe!

• Eurosceptic 5 Star Movement Biggest Party In Italy: Survey (EP)

Beppe Grillo‘s movement would be the first Italian party, overtaking PD (Socialists) with 32% of consensus, according to a new survey by Demos. 5 Star Movement won in two of the most important Italian cities (Rome and Turin) in the last administrative election in Italy.

Demos for Repubblica:

• 5 Star Movement (EFDD): 32%

• Partito Democratico (S&D): 30%

• Lega Nord (ENF): 11,8%

• Forza Italia (EPP): 11,5%

• Fratelli d’Italia (-): 3%With the new electoral system, the runoff would see 5 Star Movement winning against PD (54,7% vs. 45,3%)

Down goes Jean-Claude. He ain’t no Van Damme.

• EU Commission: CETA Should Be Approved By National Parliaments (DW)

European Commission chief Jean-Claude Juncker is expected to scrap plans to fast-track a trade agreement with Canada through the EU. After pressure from Germany and France, Juncker appears to be backtracking. Juncker will reportedly propose a mixed agreement – one that requires both the approval of the European parliament and national legislatures – at an European Commission meeting on Tuesday. Last week he was reported saying he “personally couldn’t care less” whether lawmakers get to vote on the deal. A report in the Financial Times noted that Germany and France wanted their national parliaments to be involved, which would inevitably lengthen the process.

The deal was scheduled to be signed at the end of October during a summit in Brussels with Canadian Prime Minister Justin Trudeau, and it was due to be implemented in 2017. Trade ministers in Germany, France, Italy, the Netherlands and UK have reportedly said they will support the Comprehensive Economic and Trade Agreement, or CETA. CETA is similar to the agreement under negotiation between the EU and US and has drawn strong criticism in EU countries. Canadian and EU leaders concluded CETA in 2014, but implementation was delayed due to last-minute objections in Europe. This was related to an investment protection system to shield companies from government intervention.

With opposition to the EU’s impending free trade deal with Canada apparently growing, German Chancellor Angela Merkel said recently that the German parliament should be consulted on the EU’s free trade deal with Canada. “It is a highly political agreement that has been widely discussed,” said Merkel, adding that the “Bundestag is allowed to be involved of course… in national decisions”. German Economy Minister Sigmar Gabriel told the Tagesspiegel daily that Juncker’s comment was “incredibly stupid” and “would stoke opposition to other free trade deals,” including with the US. German media has also described Juncker’s position as badly timed given the growing skepticism among European voters about the EU.

“The end result is a mess, but a strangely inevitable and even curiously beautiful one.”

• The Beauty Beneath Brexit’s Bedwetting (Welsh)

If democratic aliens came down from Mars and looked at the EU referendum result, they’d be compelled to take the view that the UK, hopelessly fragmented by de-industrialisation and neoliberalism, is now finished as a political entity. The debate will rage on about the extent to which leave voters gave the smug, complacent neoliberal establishment a kicking, or were duped by toytown fascists into swallowing the same policies of the past 30 years, only significantly amped up. Whatever side you come down on, the process has bolstered a toxic, chauvinistic right wing, not just in England, but also Europe and beyond. The EU referendum redesignated the United Kingdom of Great Britain and Northern Ireland as Little England.

Scottish voters, favouring the emotional and practical investment in the European ideal, decisively rejected this approach. The end result is a mess, but a strangely inevitable and even curiously beautiful one. We live in an era of great turbulence, with economic decline running in paradoxical tandem with technological advance. It is only to be expected that our antiquated institutions haven’t been able to keep up, and our nation states, political parties and supranational bodies are starting to unravel. Politicians now seem perennially in the business of chaos management, and the suspicion must be that this process has only just begun. The inevitable chorus of voices crying out for “a period of stability” sadly misses the point: we aren’t at that place in our history, and trying to impose inertia on those fluid times may only be inviting further discord.

As has been postulated, with much hand-wringing, it was obvious to many that the leave campaign didn’t believe it would win, merely wishing to register a protest, and was thus left thinking: what have we done? But let’s remember that no democrat can defend the commission-led EU, and nobody in the remain camp had a serious reforming vision of Europe, any more than those in leave offer much of clue as to what they’ll do with their increasingly hollow-looking victory. Remain’s leaders would have kept us straitjacketed into the EU’s current death-by-a-thousand-cuts version of corporate neoliberalism. At least now, shed of that distraction, we have our governmental elites much more clearly in our sights.

The shape of things to come.

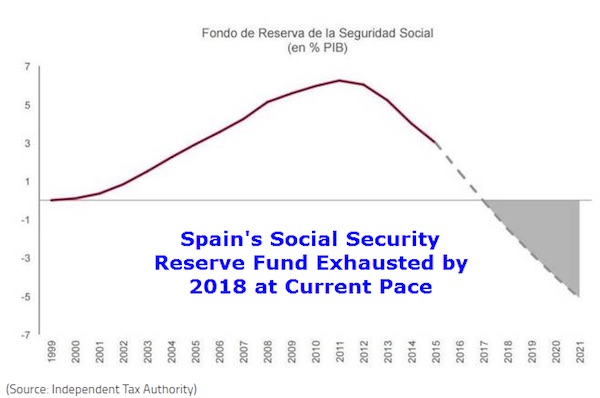

• Spain’s Social Security Program Will Go Bust in 2018 (Mish)

Spain’s Social Security system is expected to go broke by 2018. In the US, concerns over such matters are virtually nonexistent. But Spain cannot print Euros, and is already deep in the hole on meeting budget deficit targets. Via translation from El Confidencial, Spain’s Social Security Reserve Fund Exhausted by 2018:

The Social Security reserve fund will run out of money in 2018. The cause in bonus payments to pensioners, which consumes every six months (in December and July) over €8.5 billion. Revenue from social security contributions are not sufficient to meet the payment obligations. Starting in 2018, only an extraordinary contribution by the State would make it possible for Social Security can meet its commitments.

The financial problems of Social Security are not a temporary problem. The government itself expects that this year the public pension system will register equivalent to 1.1% of GDP deficit (about 11 billion euros ), while in 2017 planned is an imbalance equivalent to 0.9% of GDP. In 2016, revenues from social security contributions recorded an accumulated a deficit of 12.24% compared to expectations. The deviation is even higher than the already recorded in 2015.

Spain has missed watered down budget deficit targets a half-dozen times. Spain is already under pressure from Brussels to cut spending or hike taxes, by 8 billion euros. Something has to give.

Extremely damning.

• In Clinton Case, Obama Administration Nullifies 6 Criminal Laws (Zuesse)

There can be no excuse for Obama’s depriving the public, via a grand jury decision, of the right to determine whether a full court case should be pursued in order to determine in a jury trial whether Hillary Clinton’s email system constituted a crime (or several crimes) under U.S. laws. The Obama Administration’s ‘finding’ that “clearly intentional and willful mishandling of classified information” would need to have been proven, in order for her to have been prosecuted under any U.S. criminal law, is a flagrant lie: none of the above six U.S. criminal laws requires that, but the only way to determine whether even that description (“clearly intentional and willful mishandling of classified information”) also applies to Clinton would be to go through a grand jury (presenting the above-cited six laws) and then to a jury case (to try her on those plus possibly also the charge that there was “clearly intentional and willful mishandling of classified information”).

But now, those six laws are effectively gone: anyone who in the future would be charged with violating any one of those six laws could reasonably cite the precedent that Ms. Clinton was not even charged, much less prosecuted, for actions which clearly fit the description provided in each one of those U.S. criminal laws. Anyone in the future who would be charged under any one of these six laws could prove discriminatory enforcement against himself or herself. (In the particular case discussed there, discriminatory enforcement was ruled not to have existed because the enforcement of the criminal law involved was judged to have been random enforcement, but this condition would certainly not apply in Clinton’s case, it was clearly “purposeful discrimination” in her favor, and therefore enforcement of the law against anyone else, where in Clinton’s case she wasn’t even charged — much less prosecuted — for that offense, would certainly constitute discriminatory enforcement.) So: that’s the end of these six criminal laws.

The U.S. President effectively nullified those laws, which were duly passed by Congress and signed into law by prior Presidents. And that’s the end, the clear termination, of a government “of laws, not of men”.

Yeah, that is strange. Why go public with that unless you want to influence opinion? Which is not your job…

• FBI Director Comey Preempts Justice Department (Intercept)

FBI Director James Comey took the unprecedented step of publicly preempting a Justice Department prosecution when he declared at a press conference Tuesday that “no reasonable prosecutor” would bring a case against Hillary Clinton for her use of a private email server. The FBI’s job is to investigate crimes; it is Justice Department prosecutors who are supposed to decide whether or not to move forward. But in a case that had enormous political implications, Comey decided the FBI would act on its own. “Although the Department of Justice makes final decisions on matters like this, we are expressing to Justice our view that no charges are appropriate in this case,” he said. Prosecutors could technically still file criminal charges, but it would require them to publicly disagree with their own investigators.

One of Comey’s likely motivations was avoiding the appearance that Department of Justice lawyers had biased the investigation due to their desire to avoid prosecuting a major party’s presidential nominee. He repeatedly assured the audience that “no outside influence of any kind was brought to bear.” Comey’s announcement also satisfied the public’s desire for a resolution sooner rather than later. But Matthew Miller, who was a spokesman for the Department of Justice under Attorney General Eric Holder, called Comey’s press conference an “absolutely unprecedented, appalling, and a flagrant violation of Justice Department regulations.” He told The Intercept: “The thing that’s so damaging about this is that the Department of Justice is supposed to reach conclusions and put them in court filings. There’s a certain amount of due process there.”

Legal experts could not recall another time that the FBI had made its recommendation so publicly. “It’s not unusual for the FBI to take a strong positions on whether charges should be brought in a case,” said University of Texas law professor Steve Vladeck. “The unusual part is publicizing it.”

“James Comey was the chief prosecutor in the Southern District of New York between 2003 and 2005. He had no problem keeping me in Federal Prison on contempt of court without any charges, indictment, or a civil complaint..”

• The Department Of “Just Us” (Martin Armstrong)

To indict someone, the criteria is supposed to be “intent.” Comey has used that to pretend there is no evidence that Hillary “intentionally” erased anything. Comey also stated that Hillary’s lawyers erased her emails using a keyword search program and they did not “read” the emails. He added that he would not recommend charges against Hillary or her aides. “Although we did not find clear evidence that Secretary Clinton or her colleagues intended to violate laws governing the handling of classified information, there is evidence that they were extremely careless in their handling of very sensitive, highly classified information,” Comey declared.

It was Comey who indicted Frank Quattrone for claiming he instructed his people to erase emails in his technology-industry banking group at Credit Suisse Group’s Credit Suisse First Boston, based upon a single email that read “clean up those files” in December 2000. That was more than enough for his “intent” requirement to obstruct justice. This further illustrates the double standard of justice for them vs. us.

[..] James Comey was the chief prosecutor in the Southern District of New York between 2003 and 2005. He had no problem keeping me in Federal Prison on contempt of court without any charges, indictment, or a civil complaint describing any crime whatsoever that they even admitted openly in court. There were never any charges or complaint filed, and they publicly stated, “[T]here is no description of criminal liability.” Yet, Comey allowed me to be held in prison, entirely arbitrarily, with absolutely nothing whatsoever; Comey completely violated my civil rights, those of my family, and all 240 employees. So he is not someone who upholds the Constitution when it goes against government or the banks. As they say, the Department of Justice is really “Just Us” in reality. He has proven that once again.

Home › Forums › Debt Rattle July 6 2016