Caravaggio Burial of St. Lucy 1608

Djokovic

So before the sanctimonious virtue mob pile into Novak Djokovic for making a personal decision on his medical autonomy, perhaps they should also watch this video about what else he has done during the pandemic.pic.twitter.com/rsp5Q9Baib

— James Melville (@JamesMelville) January 10, 2022

Fauci started out saying that who disagrees with him is against science. This is a lot more dangerous. Now anybody who disagrees with him is trying to kill him.

• Rand Paul Driving Violent Threats Against Me, Fauci Says (R.)

Dr. Anthony Fauci, the top U.S. infectious disease official, on Tuesday accused Republican Senator Rand Paul of spreading misinformation that has sparked threats of violence against him and his family while distracting the public from the fight against the COVID-19 pandemic. At a Senate health committee hearing, Fauci had his latest heated back-and-forth with Paul, a lawmaker from Kentucky and supporter of former President Donald Trump. Fauci said Paul was focused on misinformed attacks rather than oversight aimed at addressing the health care crisis that has so far killed more than 800,000 people in the United States. Paul’s website accuses Fauci of “ignoring good advice, and lying about everything from masks to the contagiousness of the virus” and on Tuesday the senator accused Fauci of smearing other scientists who disagreed with him.

Fauci said Paul was distorting the truth. “There you go again, you just do the same thing every hearing,” Fauci told the senator, accusing him of making personal attacks that had no relation to reality. ‘ “He’s doing this for political reasons,” Fauci continued, pointing to fundraising appeals on Paul’s website next to a call to have Fauci fired. “It distracts from what we’re all trying to do here today, (which) is get our arms around the epidemic and the pandemic that we’re dealing with, not something imaginary,” Fauci said. Fauci has faced sharp criticism from some conservatives and death threats from people who object to measures such as vaccination and masking that he has advocated to halt the pandemic. Fauci said misinformation had fueled such threats. “What happens when he (Paul) gets out and accuses me of things that are completely untrue is that all of a sudden, that kindles the crazies out there and I have … threats upon my life, harassment of my family and my children,” Fauci said.

Sen. Rand Paul (R-KY) and Dr. Anthony Fauci clash – part 2 pic.twitter.com/I0YaJ1iDTf

— Nietzsche fan (@nietzsche_1984) January 11, 2022

“A planner who believes he is The Science leads to an arrogance that justifies in his mind using government resources to smear and destroy the reputations of other scientists that disagree with him..”

• Fauci Confronts Rand Paul Over Murder Plot (RT)

Senator Rand Paul (R-Kentucky) has accused Dr. Anthony Fauci of being responsible for over 800,000 US deaths from the coronavirus. The Biden administration’s covid czar said Paul’s criticism put his life in danger. The latest clash between Paul and Fauci came on Tuesday at the Senate Health Committee hearing on the US response to Covid-19 variants. At one point, President Joe Biden’s chief medical adviser held up a printout of a page on the Kentucky senator’s website, with a “Fire Dr. Fauci” banner, to claim that such rhetoric inspired a California man arrested last month for allegedly plotting to murder him. The man, arrested in Iowa on December 21, had an AR-15 rifle and multiple magazines, and told police he was driving to Washington, DC to kill Fauci, the doctor told senators.

“You are making a catastrophic epidemic for your political gain,” Fauci told Paul. Paul pointed to Fauci, as the lead architect of the US government’s pandemic response, and asked how he could call any of it – the lockdowns, mask and vaccine mandates, boosters – a success when over 800,000 people have died. The libertarian-leaning Republican also called out Fauci for being a central planner whose arrogance led to compounding mistakes. “The idea that a government official like yourself would claim unilaterally to represent science and that any criticism of you would be considered a criticism of science itself is quite dangerous,” Paul said. “A planner who believes he is The Science leads to an arrogance that justifies in his mind using government resources to smear and destroy the reputations of other scientists that disagree with him,” the senator added.

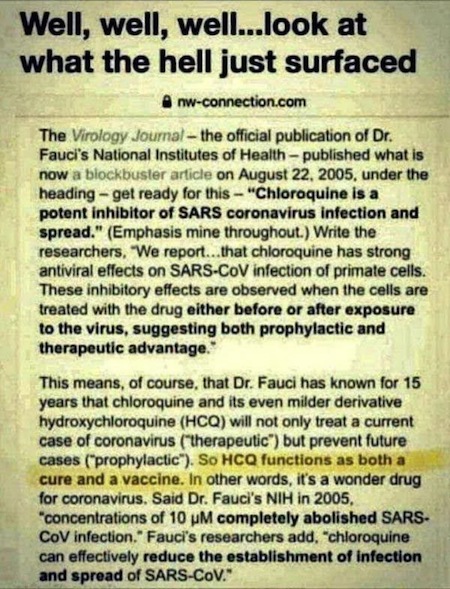

“This is not only antithetical to the scientific method, it is the epitome of cheap politics and it is reprehensible.” This was a reference to last month’s revelations that Fauci had worked with National Institutes of Health (NIH) Director Francis Collins in 2020 to discredit critics of lockdowns who signed the Great Barrington Declaration. Emails released by Congress showed Collins asking Fauci for a “quick and devastating published take down of its premises” and later praising him for an “excellent” job.

.@RandPaul to Fauci: "Do you really think it’s appropriate to use your $420,000 salary to attack scientists that disagree with you?" pic.twitter.com/tpjwypg1qz

— The Post Millennial (@TPostMillennial) January 11, 2022

“How can an injection in the deltoid stimulate an immunity in the mucus?”

• A 30-year Lie On Misplaced Vaccines (Girardot)

In the accelerated development of anti-COVID vaccines, the focus was essentially on developing the right “code” to transfer to the immune system, mainly on the relatively narrow Spike protein, as you all know by now. They also focused on the best delivery vehicle – the lipid nanoparticle – and optimal manufacturing processes. However, vaccine effectiveness depends on many other factors. A systems approach was needed, not a pinpoint solution approach. It’s not enough to find and to present the right antigens – with the right quality – to the immune system, even packed into the latest and greatest technology…

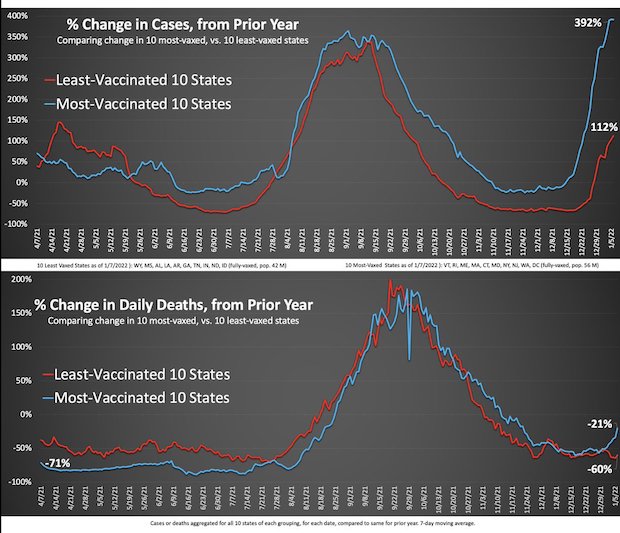

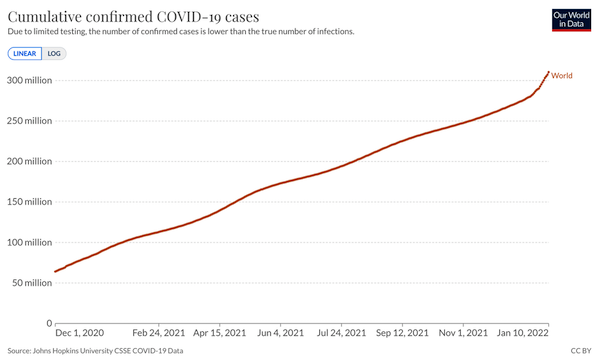

Unfortunately, after a year of vaccination and 9.5 billion doses, vaccine failure is visible to everybody to acknowledge: unforeseen transmission, explosion of cases… If you believe “Our World In Data”, we’ve had 240 million infections in 2021 – when we vaccinated like never before. We only had 70 million in 2020 when we had no vaccines… Based on case numbers, the vaccine is not even putting a dent in the epidemic. Either by media-induced panic, by sheer incompetence, or possibly by customary corruption, vaccine stakeholders have presented a completely false narrative on anti-COVID vaccine effectiveness.

For nearly a year now, I have been exposing two critical inconsistencies in terms of the location of the vaccine-induced immunity that make it nearly impossible for these vaccines to be effective: How can an injection in the deltoid stimulate an immunity in the mucus? Respiratory virus like SARS-COV-2 typically propagate in the mucus: mouth, nose, digestive tract and lungs. For propagation to be stopped in the mucus, notably in the lungs, a preemptive immune arsenal needs to be stimulated there. This is exactly what occurs once recovered from a natural infection: a sterilising immunity is provided by potent resident memory T and B-cells – along with neutralising IgA antibodies – that are positioned in large numbers as a sentinel force to kill in-the-egg any starting infection.

I have addressed this at length in my June article comparing natural immunity and vaccine-induced immunity as well as in my August article on pre-existing immunity. I am not alone in thinking along these lines; many renowned scientists share a similar perspective that intramuscular vaccines cannot work for mucosal viruses. [..] .. it is very unlikely that any intramuscular vaccines can ever work to stop COVID; the vaccines are injected in the wrong location: the muscle, too far away from the virus entry point to stimulate any response there. This is not related to mRNA or DNA technologies, attenuated virus vaccines are also de facto ineffective. This is simply a question of location of where the vaccine is delivered… And the fact that millions have been vaccinated against the flu in the arm every year for decades, most likely uselessly shouldn’t change this reality …

Given the emphasis of vaccine manufacturers and public health authorities on antibodies, you’re all probably thinking: – “Hey Marc ?! What about neutralising antibodies?” The question is: What can antibodies do to stop a propagation that is cell-to-cell? To start, vaccine-induced antibodies are also misplaced … circulating in the blood away from the mucus. And, even if a few antibodies were to migrate to the mucus, they would very much be useless against a virus that propagates cell-to-cell. Fundamentally, cell-to-cell propagation means the virus expansion happens out-of-reach of antibodies (at least before Omicron). Antibodies can’t bind with viruses that are inside cells, only T-cells can chase down virions inside cells by instructing infected cells to self-destruct…

..“simply because everybody who could be infected will be infected..”

• Omicron May Be Headed For A Rapid Drop In US and Britain (AP)

Scientists are seeing signals that COVID-192 s alarming omicron wave may have peaked in Britain and is about to do the same in the U.S., at which point cases may start dropping off dramatically. The reason: The variant has proved so wildly contagious that it may already be running out of people to infect, just a month and a half after it was first detected in South Africa. “It’s going to come down as fast as it went up,” said Ali Mokdad, a professor of health metrics sciences at the University of Washington in Seattle. At the same time, experts warn that much is still uncertain about how the next phase of the pandemic might unfold. The plateauing or ebbing in the two countries is not happening everywhere at the same time or at the same pace.

And weeks or months of misery still lie ahead for patients and overwhelmed hospitals even if the drop-off comes to pass. “There are still a lot of people who will get infected as we descend the slope on the backside,” said Lauren Ancel Meyers, director of the University of Texas COVID-19 Modeling Consortium, which predicts that reported cases will peak within the week. The University of Washington’s own highly influential model projects that the number of daily reported cases in the U.S. will crest at 1.2 million by Jan. 19 and will then fall sharply “simply because everybody who could be infected will be infected,” according to Mokdad.

In fact, he said, by the university’s complex calculations, the true number of new daily infections in the U.S. — an estimate that includes people who were never tested — has already peaked, hitting 6 million on Jan. 6. In Britain, meanwhile, new COVID-19 cases dropped to about 140,000 a day in the last week, after skyrocketing to more than 200,000 a day earlier this month, according to government data. Kevin McConway, a retired professor of applied statistics at Britain’s Open University, said that while cases are still rising in places such as southwest England and the West Midlands, the outbreak may have peaked in London. The figures have raised hopes that the two countries are about to undergo something similar to what happened in South Africa, where in the span of about a month the wave crested at record highs and then fell significantly.

More about the “Covid leads to diabetes” nonsense.

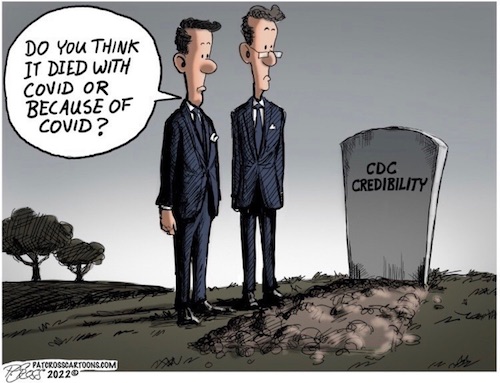

• Medical Experts Shred Latest CDC COVID-19 Study (JTN)

Even as CDC Director Rochelle Walensky has started sounding more like COVID-19 policy skeptics, the agency continues promoting research that fits its agenda but quickly provokes professional challenge. For the second time in less than a month, medical experts pounced on the methodology of a study published in the agency’s Morbidity and Mortality Weekly Report, which is not peer-reviewed. The CDC’s COVID and diabetes researchers found that children and teens who recovered from infections are “up to” 2.5 times likelier to develop diabetes, which was uncritically reported across mainstream media Friday. The increased risk to this age group shows the importance of COVID prevention, “including vaccination for all eligible persons,” researchers wrote. “Prevent COVID-19 by using tools like masks and #vaccines for those eligible,” the agency tweeted.

Medical professors at the University of Pittsburgh, University of California San Francisco and Harvard’s medical and public health schools quickly provided informal — and highly critical — peer review. The study has “really really major limitations,” according to Walid Gellad, director of Pitt’s Center for Pharmaceutical Policy & Prescribing, citing its own disclosures. The researchers used a “single ICD-10-CM code, did not include laboratory data at the time of diagnosis, and could not reliably distinguish between type 1 and type 2 diabetes,” the study says. It’s also missing information on “covariates” including obesity that “could have affected the association” between infection and diabetes. “The CDC is back with a new piece of propagan— I mean, a new publication,” UCSF’s Vinay Prasad wrote in a lengthy analysis, calling the study “embarrassing.”

The analysis “hinges on the idea that age-sex matched kids without covid should be comparable to the kids who got covid in terms of risk of diabetes,” but the infection may be more likely to affect “kids of lower socioeconomic status, of certain races, and kids who were already overweight or suffering from medical problems,” he wrote. “Does the CDC attempt to correct for any of these confounders? Not at all,” Prasad said. Also not considered: “the true denominator” of infections as determined by seroprevalance and the increased blood tests for kids who get treated for COVID. He was baffled why the CDC claimed the study showed the need for child vaccinations, “a topic of wide global debate, with differing recommendations by nation (US vs UK).”

How do you get 27 different countries to agree on this though?

• Spain First EU Country To Suggest Downgrading Covid To ‘Like The Flu’ (Sun)

SPAIN could be the first European country to downgrade Covid-19 to a” flu-like” status – just two years after clocking 1,000 deaths a day from the virus. Spanish PM Pedro Sánchez pushed his EU counterparts to debate the possibility of treating Covid like the flu. The European leader told a local radio channel the situation in Spain “is not what we faced a year ago” and that it was time “to evaluate the evolution of COVID to an endemic illness”. The move would see lockdowns and daily infection counts scrapped in favour of a system that would track Covid cases like the regular flu. It comes as a string of positive studies show Omicron is milder than other strains, with data revealing the risk of hospitalisation is 50 to 70 per cent lower than with Delta. Covid booster jabs protect against Omicron and offer the best chance to get through the pandemic, health officials have repeatedly said.

The Sun’s Jabs Army campaign is helping get the vital extra vaccines in Brits’ arms to ward off the need for any new restrictions and protect the NHS. The measure is set to meet stiff resistance from Germany and France where vaccinations rates remain low and where French President Emmanuel Macron has promised to make engaging in public life as tough as possible for the unvaccinated. Sánchez cited Spain’s “exemplary” vaccine uptake which has seen more than 90 per cent of the population over 11 years old become fully vaccinated and 85 per cent of over 60s get a booster as a case for the radical change. Spain has also seen their fatality rate drop to 1 per cent, down from 13 per cent at the height of the first wave of Covid-19 when it experienced 1,000 deaths a day. In the UK, 83 per cent of the population aged 12 and over are fully vaccinated while 63 per cent have had their booster jab, according to the latest government figures.

Houston, we have a problem.

• Repeated Covid Boosters Not Viable Strategy Against New Variants – WHO (G.)

World Health Organization experts have warned that repeating booster doses of the original Covid vaccines is not a viable strategy against emerging variants and called for new jabs that better protect against transmission. “A vaccination strategy based on repeated booster doses of the original vaccine composition is unlikely to be appropriate or sustainable,” the WHO Technical Advisory Group on Covid-19 Vaccine Composition (TAG-Co-VAC) said in a statement published on Tuesday. The group of experts, who are working to assess the performance of Covid-19 vaccines, called for the development of new vaccines that not only protect people who contract Covid against falling seriously ill but also better prevent people from catching the virus in the first place, in order to deal with emerging Covid variants such as Omicron.

“Covid-19 vaccines that have high impact on prevention of infection and transmission, in addition to the prevention of severe disease and death, are needed and should be developed,” the advisory group said. This, it said, would help lower “community transmission and the need for stringent and broad-reaching public health and social measures”. It also suggested that vaccine developers should strive to create jabs that “elicit immune responses that are broad, strong, and long-lasting in order to reduce the need for successive booster doses”. As the virus evolves and until new vaccines are available, “the composition of current Covid-19 vaccines may need to be updated”, the group said.

According to the WHO, 331 candidate vaccines are being worked on around the world. The UN health agency has so far given its stamp of approval to versions of eight different vaccines. A growing body of evidence indicates that the Omicron Covid variant is not only far more transmissible than previous variants, but also better at dodging some vaccine protections. Earlier this week, Pfizer Inc chief executive Albert Bourla said a redesigned Covid-19 vaccine that specifically targets the Omicron variant is likely to be needed and his company could have one ready to launch by March.

“We know now that two-thirds of deaths for Americans with COVID are people with six or more comorbidities.”

• It Turns Out That, If You Doubted Covid’s Deadliness, You Were Correct (AT)

Walensky has acknowledged that, when it comes to vaccinated people who still died from COVID, almost 80% of them had one foot in the grave and one foot on a banana peel: “The overwhelming number of deaths, over 75%, occurred in people who had at least four comorbidities. So, really, these are people who were unwell to begin with. And yes, really encouraging news in the context of Omicron; this means not only just to get your primary series but to get your booster series. And yes, we’re really encouraged by these results.” The study, from the CDC, says: “Among 1,228,664 persons who completed primary vaccination during December 2020–October 2021, severe COVID-19–associated outcomes (0.015%) or death (0.0033%) were rare. Risk factors for severe outcomes included age ≥65 years, immunosuppressed, and six other underlying conditions. All persons with severe outcomes had at least one risk factor; 78% of persons who died had at least four.”

Another interesting thing that emerged during the same appearance is that, as with any other virus, people are most contagious when they’re not yet symptomatic. This renders much of the ten-day lockdown period irrelevant, as even Walensky conceded: “Isolation, we talk about isolation in the context of people who’ve had a positive test, who know that they are infected. And we now have dozens of studies referenced on the CDC website that have demonstrated that you are most infectious in the one to two days before your symptoms and the two to three days after your symptoms. So by five days after your symptoms, the vast majority of your contagiousness is really behind you.”

Dr. Scott Atlas appeared on Tucker Carlson to discuss Walensky’s revelations and was unimpressed. When it comes to morbidity, he said, it’s long been known, only it was kept from the American public. Atlas also reminded Tucker and his audience that there’s a huge difference between being hospitalized for COVID and being hospitalized with COVID. As even Fauci conceded, the latter was mostly true for children. Atlas then said something truly surprising that will further devastate those on the left: “We know now that two-thirds of deaths for Americans with COVID are people with six or more comorbidities.” In other words, unless your health is fragile to begin with, you’re going to be fine

Tucker Atlas

Tucker Carlson & Dr. Scott Atlas discuss how the CDC is finally coming clean after their years-long deception about Covid death numbers.

"This was an intentional inculcation of fear in the American public." pic.twitter.com/EYCUigvdF8

— Scott Morefield (@SKMorefield) January 11, 2022

This is all about control, not health. Otherwise this tax would be levied on smokers and fat people too.

• Quebec Plans To Hit Unvaccinated With A ‘Significant’ Tax (NP)

The Quebec government wants to impose a “significant” financial penalty on the “small minority” of Quebecers who refuse to get vaccinated against COVID-19. Premier François Legault made the announcement — which would be a first in Canada — during a press conference on Tuesday. He said he was working on the tax with Finance Minister Eric Girard while also reviewing the measure’s legality. “Unfortunately, there is still a small minority, about 10 per cent of the population, that refuses to get vaccinated,” Legault said. “I sense the frustration from Quebecers towards that minority that … is clogging our hospitals.” “That is why I am announcing that we are currently working on a health contribution that will be charged to all Quebec adults who refuse to get vaccinated,” he continued, adding that people with medical exemptions would be excluded from the new tax.

Legault did not announce any details nor a date for the new tax, nor did he specify the amount except to say that it would be “significant.” The premier said that unvaccinated Quebecers currently occupy 50 per cent of intensive care unit beds in the province, despite being one tenth of the population. “It is shocking,” he said. “People who refuse to get vaccinated impose a burden on (health care) personnel and an important financial burden on the majority of Quebecers.” “All adults in Quebec who don’t accept to go get at least a first dose in the next few weeks will have a bill to pay because there are consequences on our health system and its not up to all Quebecers to pay for that,” he added. The measure, which is sure to be controversial both in the province and in Canada, was immediately criticized by opposition party Québec Solidaire as “radical” for “completely” forgetting vulnerable people such as the homeless or those suffering from severe mental health issues.

WTF guidance.

• Scots May Have To Wear Facemasks In Public For Years To Come – Sturgeon (DM)

People in Scotland may have to wear masks in public places for years to come, Nicola Sturgeon has warned. The First Minister insisted that tough curbs dramatically imposed on hospitality venues and large gatherings from Boxing Day had stemmed the spread of Covid, despite official figures showing that Scotland’s virus rate is higher than England’s. And furious business leaders said Miss Sturgeon’s ‘gamble’ with restrictions must end after they failed to make ‘any meaningful difference’ to infections in Scotland. Speaking ahead of today’s announcement about extending restrictions beyond next week, Miss Sturgeon said face coverings ‘might be required in the longer-term to enable us to live with it [Covid] with far fewer protective measures’.

In England, Covid restrictions could start to be lifted this month after Michael Gove said Britain was moving towards a situation where it could ‘live with’ the virus. Downing Street is examining options to lift Plan B measures in stages if cases remain too high to remove them all in one go. Extending Covid passes, due to expire on January 26, would require another bruising clash with Tory backbenchers, which No10 wants to avoid.

But some ministers are pushing for the WFH guidance to be removed first, arguing that it causes the most damage to the economy. Miss Sturgeon told STV’s Scotland Tonight: ‘Sometimes when you hear people talk about learning to live with Covid, what seems to be suggested is that one morning we’ll wake up and not have to worry about it any more, and not have to do anything to try to contain and control it. ‘That’s not what I mean when I say “learning to live with it”. Instead, we will have to ask ourselves what adaptations to pre-pandemic life — face coverings, for example — might be required in the longer-term to enable us to live with it with far fewer protective measures.’

Is this a good thing, or not?

• Covid Loses 50% Of Ability To Infect After 10 Seconds In Office Air (NYP)

The coronavirus loses about 50 percent of its ability to infect about 10 seconds after it becomes airborne in a typical office environment, according to a new study about how the deadly bug survives in exhaled air. “People have been focused on poorly ventilated spaces and thinking about airborne transmission over meters or across a room,” said Prof. Jonathan Reid, director of the University of Bristol’s Aerosol Research Centre, the Guardian reported. “I’m not saying that doesn’t happen, but I think still, the greatest risk of exposure is when you’re close to someone,” said Reid, the lead author of the study, which has not yet been peer-reviewed. “When you move further away, not only is the aerosol diluted down, there’s also less infectious virus because the virus has lost infectivity (as a result of time),” he added.

The UK university researchers’ findings highlight the impact of short-range transmission — and stress the importance of physical distancing and masking up as the best way to avoid infection. While still worthwhile, ventilation was deemed to be less effective, the news outlet reported. The study determined that viral particles quickly lose moisture and dry out after they are expelled from the lungs. The particles’ pH also rises rapidly when the carbon dioxide in their environment drops, the news outlet reported. The relative humidity of the surrounding air affects how fast the particles dry out. When under 50 percent, such as the relatively dry air in an office, the virus had become half as infectious within 10 seconds. But at 90 percent humidity, 52 percent of particles remained infectious after five minutes, dropping to about 10 percent after 20 minutes.

“..Though Biden had spent 36 years in the Senate and repeatedly defended the filibuster when Democrats were in the minority..”

• Biden Backs Calls To Abolish Key Senate Procedure (RT)

US President Joe Biden has called for the Senate to change the rule requiring 60 votes to move a bill forward, saying it was the only way to pass the two Democrat initiatives federalizing elections and ensure “majority rule.” Speaking in Atlanta, Georgia on Tuesday, Biden declared “this is the moment to decide to defend our elections, to defend our democracy.” He said he’d been having “quiet conversations” about the change with members of Congress over the past two months. “I’m tired of being quiet,” Biden said, raising his voice. “Today, I’m making it clear. To protect our democracy, I support changing the Senate rules whichever way they need to be changed, to prevent a minority of senators from blocking actions on voting rights.” “The majority should rule in the US Senate,” he added.

While Democrats have a nine-vote majority in the House of Representatives, the Senate is split 50-50, with Vice President Kamala Harris acting as the tie-breaker. While this 51-vote majority has been used to approve Biden’s nominations, the long-standing filibuster rule requiring at least 60 votes to pass bills stands in the way of the Freedom to Vote Act and the John Lewis Voting Rights Advancement Act. Both have been proposed by Democrats as a way of imposing a federal standard on US elections in response to what they called “voter suppression” bills passed by Republican state legislatures after the controversial 2020 vote. Repeating that accusation on Tuesday, Biden argued that “history has never been kind to those who sided with voter suppression over voter rights,” and compared anyone opposed to the bills to racists and segregationists.

Though Biden had spent 36 years in the Senate and repeatedly defended the filibuster when Democrats were in the minority, on Tuesday, he argued that “the threat to our democracy is so grave that we must find a way to pass these voting rights bills.” Last week, on the anniversary of the January 6 Capitol riot, Biden called the 2020 election “the greatest demonstration of democracy in the history of this country.” Officially, Biden won the highest number of votes in US history.

On track to lose the midterms.

“..Jan. 6, which he described as a moment “so stark” it “stopped time”..”

• Biden, Harris Bash Republicans As ‘Totalitarian’, Wanting ‘Jim Crow 2.0’ (JTN)

President Biden and Vice President Kamala Harris at a rally Tuesday in Georgia bashed Republicans several times throughout voting rights speeches. Former President Donald Trump and the GOP were accused by Biden and Harris of making it more difficult for people to vote, trying to create a totalitarian state and being on the side of Confederate President Jefferson Davis. Both officials mentioned the Jan. 6 attack on the Capitol. “Across our nation anti-voter laws could make it more difficult for as many as 55 million Americans to vote. That is one out of six people in our country,” Harris said during her push to institute national election reform through the Democrat-led Freedom to Vote Act and the John Lewis Voting Rights Act. Republicans have stood against these laws, which they say will eviscerate state voter ID laws and create more election fraud.

“The proponents of these laws are not only putting in place obstacles to the ballot box, they are also working to interfere with our election to get the outcomes they want and to discredit those that they don’t,” Harris jabbed at the GOP over Jan. 6 and possibly over the discredited Trump-Russia scandal. “If we stand idly by, our entire nation will pay the price for generations to come,” Harris grimly said. She also voiced her support for abolishing the filibuster, which she said was not constitutionally protected. “Senate Republicans have exploited arcane rules to block these bills. And let us be clear: the Constitution of the United States gives the Congress the power to pass legislation and nowhere, nowhere does the constitution give a minority the right to unilaterally block legislation.”

Biden began his speech by reflecting on Jan. 6, which he described as a moment “so stark” it “stopped time” and divides “all that came before and everything that followed.” He also said Jan. 6 was a “dreadful day when a dagger was literally held at the throat of American democracy.” While several Jan. 6 rioters have been charged with carrying knifes, such as Douglas Jensen who allegedly carried a knife with a 3-inch blade in his pocket at the time, there is no evidence to support anyone “literally” brought a dagger into the Capitol, much less held it against someone’s throat.

GOAT

Twitter, explained in 15 seconds pic.twitter.com/4dp4qytgwf

— David Hobby (@strobist) January 10, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.