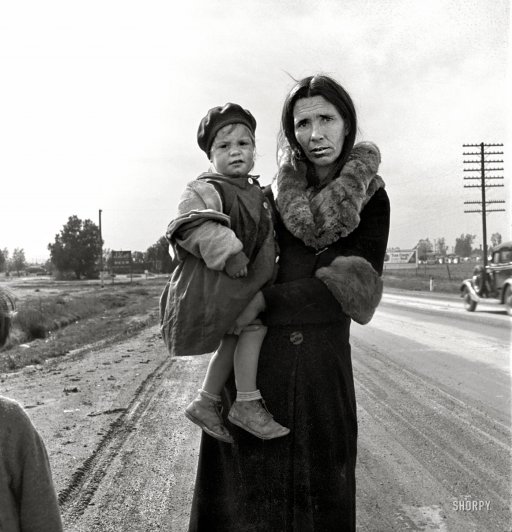

Dorothea Lange Homeless mother and child walking from Phoenix to Imperial County CA 1939

Now that Trump is sealed in to become America’s 45th president in a month’s time, comparisons to Hitler and nazism seem to become the flavor of the day. Sad. Almost as sad as the multiple deadly attacks that have taken place over the last 24 hours. But there is enough to read about that everywhere. I’ll focus on things that may seem less important.

“They absolutely cannot have any significant drop in prices without risking real social instability.”

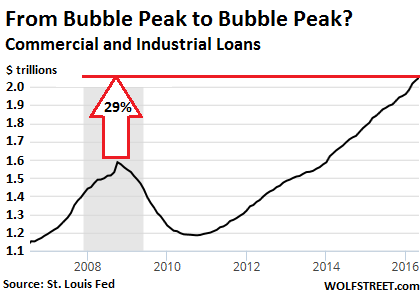

• China Talks the Talk on Property Curbs, but Can it Walk the Walk? (BBG)

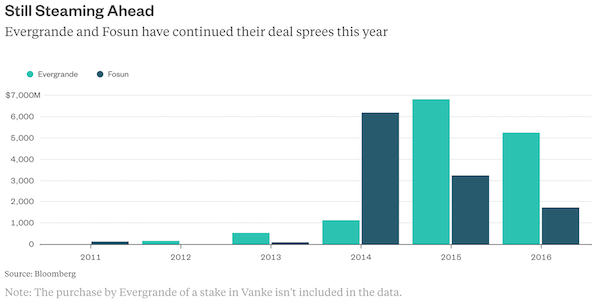

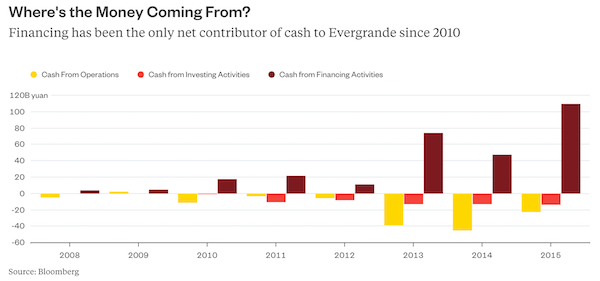

China is talking the talk about reining in the speculation that fueled spiraling property prices. The test will be whether it can walk the walk should growth start to falter. [..] With the leadership wed to Xi’s goal of annual growth averaging 6.5 percent through 2020, the challenge will be to achieve that amid another slowdown in the crucial property engine. “Policy makers are trying now to contain the property market by talking,” Zhu said. “That unfortunately is too late and does little to dispel the speculative sentiment and expectation that’s built up over the past one-and-half decades. The situation has already gone beyond a soft landing.” China’s highly leveraged developers are feeling the heat. Regulators in October choked off a key source of funding with the Shanghai Stock Exchange raising the threshold for property firms to sell bonds on their platform.

Medicine being administered to the bond market is also raising risks of dangerous side-effects as policy makers try to discourage risky investments made on borrowed money. Authorities have increased short-term money-market rates and tightened rules on using debt as collateral to buy even more securities. That’s sparked a jump in borrowing costs, prompted firms to cancel bond offerings and fueled speculation defaults will spread next year amid a near-record 4.5 trillion yuan of maturities. Christopher Balding, an associate professor at Peking University in Shenzhen, cites the risk of increased credit growth for mortgages and real estate. Longer-term household loans increased by 569.2 billion yuan last month, accounting for more than two thirds of total new yuan loans. That was just shy of the 571.3 billion yuan record in September. The growth pace is likely to moderate, though “that isn’t saying a lot,” Balding said. “They absolutely cannot have any significant drop in prices without risking real social instability.”

“They’ve also swiped their credit or debit cards again and again – in one case, as many as 800 times – so that each transaction remained below the limit.”

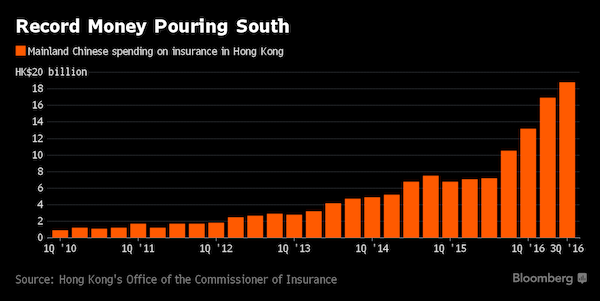

• China May Be Losing Cat-and-Mouse Game With ‘Hong Kong Insurance’ Buyers (BBG)

It’s a game of cat-and-mouse that has gone on for most of this year, with Beijing showing no signs of winning yet. Each time China tightens up on money flowing out of the country for purchases of Hong Kong insurance, new routes seem to emerge. In the latest clampdown, which started on Saturday, MasterCard Inc. and Visa Inc. added restrictions on purchasing all but the cheapest insurance policies using credit cards issued in China, according to people with knowledge of the matter. Chinese have been spending billions of Hong Kong dollars on insurance products that are linked to investments, as a way of channeling money out of China. Chinese residents will “actively seek ways to get around the curbs no matter what,” said Bloomberg Intelligence analyst Steven Lam.

Mainland purchases of Hong Kong insurance may rise to fresh records after reaching a high of HK$18.9 billion ($2.4 billion) in the third quarter, he said. Tenacious mainland buyers have bypassed restrictions by channeling money through online payment services or by using Hong Kong money changers, who allow money to be received in Hong Kong based on domestic transfers to accounts within China. They’ve also swiped their credit or debit cards again and again – in one case, as many as 800 times – so that each transaction remained below the limit. The latest Visa and MasterCard rules restrict multiple swiping. Weakness in the yuan is encouraging Chinese residents to put their money into products denominated in either Hong Kong or U.S. dollars. That’s adding to the headaches for Chinese officials concerned that capital flight could further contribute to yuan depreciation. Outflows are estimated to have totaled more than $1.5 trillion since the beginning of 2015.

One would almost hope the new technocrats fail miserably.

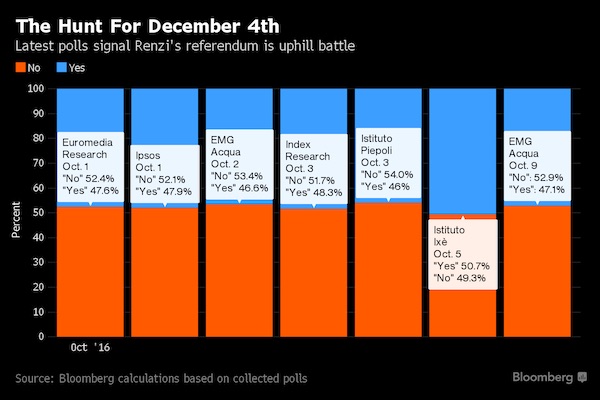

• New Italy PM Asks Parliament To Approve Borrowing €20 Billion For Banks (BBC)

The Italian government will seek parliamentary approval to borrow up to €20bn to support its fragile banking sector and potentially rescue Monte dei Paschi di Siena. The country’s third-largest bank needs to raise €5bn in fresh capital by the end of the month. If Monte dei Paschi cannot arrange a private sector bailout, a state rescue may come as early as this week. It is saddled with bad loans and is deemed to be the weakest major EU bank. Italian Prime Minister Paolo Gentiloni, whose government has only been in office for a week, is under pressure because private investors would suffer any losses under EU bailout rules.

He described the move as a “precautionary measure”, adding: “We believe it is our duty to take this measure to protect savings. I hope all the political movements in parliament share this responsibility.” However, Italy’s economy minister, Pier Carlo Padoan, stressed the funds would be used to ensure adequate liquidity in the banking system and support other struggling banks. Officials have also said they were examining a scheme to compensate retail investors for any losses incurred. Mr Gentiloni’s predecessor, Matteo Renzi, resigned after losing a referendum on constitutional reform and was regularly accused of being too close to the banks.

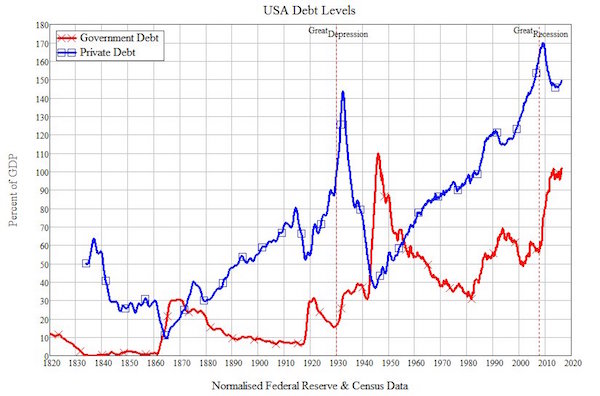

“We are a country sitting on $20 trillion in debt, living far beyond our means. Power can oftentimes be an illusion, and in any case it doesn’t last forever.”

• After Aleppo: We Need A New Syria Policy (Ron Paul)

Over the past week, eastern Aleppo was completely brought back under control of the Syrian government. The population began to return to its homes, many of which were abandoned when al-Qaeda-linked rebels took over in 2012. As far as I know, the western mainstream media did not have a single reporter on the ground in Aleppo, but relied on “activists” to inform us that the Syrian army was massacring the civilian population. It hardly makes sense for an army to fight and defeat armed rebels just so it can go in and murder unarmed civilians, but then again not much mainstream reporting on the tragedy in Syria has made sense. I spoke to one western journalist last week who actually did report from Aleppo and she painted a very different picture of what was going on there.

She conducted video interviews with dozens of local residents and they told of being held hostage and starved by the “rebels,” many of whom were using US-supplied weapons supposed to go to “moderates.” We cannot be sure what exactly is happening in Aleppo, but we do know a few things about what happened in Syria over the past five years. This was no popular uprising to overthrow a dictator and bring in democracy. From the moment President Obama declared “Assad must go” and approved sending in weapons, it was obvious this was a foreign-sponsored regime change operation that used foreign fighters against Syrian government forces. If the Syrian people really opposed Assad, there is no way he could have survived five years of attack from foreigners and his own people.

Recently we heard that the CIA and Hillary Clinton believe that the Russians are behind leaked Democratic National Committee documents, and that the leaks were meant to influence the US presidential election in Donald Trump’s favor. These are the same people who for the past five years have been behind the violent overthrow of the Syrian government, which has cost the lives of hundreds of thousands. Isn’t supporting violent overthrow to influence who runs a country even worse than leaking documents? Is it OK when we do it? Why? Because we are the most powerful country? We are a country sitting on $20 trillion in debt, living far beyond our means. Power can oftentimes be an illusion, and in any case it doesn’t last forever. We can be sure that the example we set while we are the most powerful country will be followed by those who may one day take our place. The hypocrisy of our political leaders who say one thing and do another does not go unnoticed.

Still not over. TISA is another one that keeps lurking.

• We’re About To Sign A Deal With Canada That’s Just As Bad As TTIP (Ind.)

CETA is an EU-Canada trade deal just like the controversial EU-US deal TTIP. It was secretly negotiated over five years, locks in the privatisation of public services and will permit corporations across the North America to sue European governments in a private justice system. Brexit may not happen for at least two years, but CETA will be voted on in February – if it passes, it will immediately apply to the UK. Inequality is grist to the mill for far-right populists, yet the European Commission and members of the European Parliament (MEPs) are failing to learn the lessons of Brexit and the rise of Nigel Farage and Donald Trump. Instead, it’s big business as usual, and continued support for policies that generate inequality and, in turn, fuel the xenophobic right.

This week there has been a clear demarcation of the crucial choice faced by the EU and UK, which may help determine the future rise of the far right in Europe – and, set against it, the decline of out-of-touch, centre-left parties. On Friday, the International Labour Organisation reported that the top 10% of highest paid workers in Europe together earn almost as much as the bottom 50%. Last week, the European Parliament’s Employment and Social Affairs Committee found that the EU-Canada trade deal CETA will only make this situation worse, “widening the income gap between unskilled and skilled workers thus increasing inequalities and social tensions.” The cross-party committee points to CETA triggering potential job losses of more than 200,000 across the EU.

It goes on to point out what campaigners across Europe have long been saying about accords like CETA, TTIP, and the Donald Trump-opposed TPP: “There is a clear disparity between the levels of protection envisaged for investors and for labour interests and rights.” These investors are not the small businesses that CETA and TTIP’s supporters repeatedly cite. As the report makes clear, CETA has no chapter with specific measures to help small business. The clear disparity between workers and investor interests is perhaps best captured in one key element found across all these deals: the widely opposed “corporate court” private justice system that grants big business the power to sue states for policies that affect their profits. Put more simply, it’s a taxpayer-funded risk insurance scheme for corporations that would swing into play were a government to decide to ban nuclear power, oppose fracking or re-nationalise public services like the railways.

Despite voting to leave the EU, CETA can still affect the UK: the deal could be passed within the next two months, with large swathes of it immediately put in place. After that happens, those already struggling in the UK’s brittle Brexit economy will feel the squeeze of yet more anti-worker policy-making. Yet despite the clear dangers posed by CETA, Liam “Take Back Control” Fox has already signed the UK up to the deal, willfully bypassing UK parliamentary scrutiny along the way.

“.. over 170,000 Londoners are homeless..”

• Britain’s Shame: The People Who Are Homeless, Even Though They’re In Work (G.)

Illustration: Eva Bee

The former Tory minister George Young described the homeless as “what you step over when you come out of the opera”. No, Sir George: today’s homeless deliver your takeaways and pull pints at the local. Then they kip on park benches. Martin, who works for Islington council taking disabled children to school, told me how he’d spent a month sleeping either in Hampstead Heath or by the canal near London Zoo. “I was exhausted all the time,” he said. Some mornings, he’d knock for the children still clutching the bag that held all his belongings. This month, the charity Shelter calculated that over 170,000 Londoners are homeless. Its researchers pieced together the data for how many were both in a job and in temporary accommodation: it amounts to nearly half (47%) of all homeless households in the capital.

Figures like these, and shelters like Scott’s, neatly puncture many of the official boasts about work in post-crash Britain. The ministerial bragging about record employment? That economic miracle would include a third of the people dossing down at Scott’s place. The smugness with which David Cameron talked about the high-tech sharing economy? The Uber driver in that bunk over there might put him right on a few things. All the blether about how strong unions will destroy the economy? The casualised workforce in these improvised dormitories make a good argument for labour protection. Most of all, it proves that two of the hardiest orthodoxies in British politics are now a lie. First, the notion that work pays.

That is why Norman Tebbit told men to get on their bikes, why Gordon Brown fiddled about with tax credits, why George Osborne could get away with attacking “skivers”. But minimum wages, zero-hours contracts and a couple of shifts through a temping agency don’t pay. They certainly don’t pay enough to get you decent accommodation in one of the most expensive housing markets on the planet. When that belief dies, so too must its corollary: that the homeless are always unemployed. “Why are beggars despised? For they are despised universally,” asked George Orwell in Down and Out in Paris and London. “It is for the simple reason that they fail to earn a decent living.” None of the people I met were begging, but each lived within the shadow of the idea that by being homeless, they had become despicable.

Britain is bad, Greece is worse. “350,000 families without a single employed person..”

• Nine In 10 Jobless Greeks Receive No Unemployment Benefit (Kath.)

Nine in 10 jobless Greeks do not receive unemployment benefits, according to a study by the country’s statistical authority (ELSTAT) and the Labor Institute of the General Confederation of Greek Labor (INE/GSEE). The same study found that nearly 74 percent of the unemployed population have been without work for more than 12 months. Meanwhile, there are 350,000 families without a single employed person, while about 300,000 high-skilled workers have left the country in the past six years in search of better prospects, the study showed.

Why is the entire Eurogroup of finance ministers silent on the feact that Dijsselbloem makes decisions behind their backs?

• Moody’s Voices Concern At ‘Material Delay’ In Greece Debt Relief Talks (G.)

Fears that Greece’s seven-year debt crisis is about to enter a troubling new phase have been voiced by one of the world’s leading rating agencies. Moody’s said it was worried by the decision by the European authorities to suspend a debt-relief deal for Greece after the government in Athens gave a Christmas bonus to pensioners, promised free school meals for the poorest children and cancelled a VAT increase. The rating agency said any “material delay” in concluding talks between Greece and its European creditors would make it harder for the troubled country to meet next year’s onerous financial commitments and would increase the risks of bondholders not being paid. After months of negotiations, Europe agreed to limited debt relief to Greece earlier this month by giving Athens longer to pay and reducing the interest rate payable on its loans.

But within days the decision was put on hold by the European Stability Mechanism (ESM) – the Luxembourg-based body that provides help to countries and banks facing financial difficulties – after Alexis Tsipras’s coalition government decided to provide help to pensioners, schoolchildren and VAT payers on the Greek islands. The plans involved spending amounting to €617m – less than 0.5% of Greece’s GDP – but were made without consultation with the country’s creditors. Hardliners in Brussels and in Berlin were outraged by Tsipras’s decision, seen as evidence of backsliding on a commitment made in August 2015 to keep to a tough programme of economic reforms in return for an €86bn bailout. Tsipras says that Greece has overachieved on the budget targets set by Europe and that the money will be going to those hardest hit by austerity. Greece has seen its economy shrink by 30% since its financial crisis began in 2009.

[..] “.. a material delay in the negotiations would raise the credit risk to bondholders. Greece has large upcoming maturities in July 2017, with €2.3bn owed to private-sector bondholders and €3.9bn to the ECB. Greece will be highly challenged to meet these redemptions without completion of the programme’s second review and without the disbursement of €6.1bn of ESM funding by the summer.”

Troubling, but do be careful about where to lay the blame.

• Greek Hospitals Deepen Trauma For Refugee Women Giving Birth (Gill)

Dr Konstantinos Spiriounis, an obstetrician-gynecologist, is a member of the department of municipal clinics and public health in Athens and until June this year worked at one of the city’s main public maternity hospitals, Elena. He says that the country’s economic problems have led to a recruitment crisis, putting hospitals under pressure, but that doctors do their best in difficult circumstances. “There are no new hires happening in the hospitals, so us doctors in Greece in public hospitals have learnt to do the work of two or three people. “Many times the doctors and nurses stay on when their shift ends because there isn’t anyone else to do it. You are always concerned in that you will make a mistake or miss something important, because you are so exhausted. Sometimes we find we’re out of things like gauze or medical tape, and we go buy it ourselves from the pharmacy.”

He says that all women are offered the same service, the best the doctors can provide. “We offer the same to everyone, whether you are Greek or a foreigner. For us, the cry of a baby and the joy of the mother is the same no matter where they are from.” But human rights lawyer Electra Leda Koutra, who worked on the research into birth experiences of refugee mothers, says vulnerable refugees need specific support. “A Greek woman will go home after birth. A refugee woman will be thrown back in a refugee camp or out on the streets [to] incredibly harsh, dangerous, unsanitary conditions.

“Treating refugee women ‘the same as Greeks’ means speaking to them in Greek, giving them no option but male obstetricians, not translating for their medical instructions upon exit from hospital, and not taking into account the conditions they will face right afterwards. All this so-called equal treatment constitutes blatant gender-based violence and discrimination.” The difficulties faced by the women in pregnancy and birth are part of a wider challenge for all refugee families in Greece, that of surviving day to day with no idea of what the future will bring. Since borders closed further west within Europe earlier in 2016, tens of thousands of refugees have been stuck in overstretched Greece and Italy. The EU has promised to disperse 160,000 to other EU countries, only 8,162 people have been found a new home, figures from the European commission show.

Count me not surprised.

• Thousands Of US Locales Have Lead Poisoning Worse Than Flint (R.)

On a sunny November afternoon in this historic city, birthplace of the Pony Express and death spot of Jesse James, Lauranda Mignery watched her son Kadin, 2, dig in their front yard. As he played, she scolded him for putting his fingers in his mouth. In explanation, she pointed to the peeling paint on her old house. Kadin, she said, has been diagnosed with lead poisoning. He has lots of company: Within 15 blocks of his house, at least 120 small children have been poisoned since 2010, making the neighborhood among the most toxic in Missouri, Reuters found as part of an analysis of childhood lead testing results across the country. In St. Joseph, even a local pediatrician’s children were poisoned.

Last year, the city of Flint, Michigan, burst into the world spotlight after its children were exposed to lead in drinking water and some were poisoned. In the year after Flint switched to corrosive river water that leached lead from old pipes, 5 percent of the children screened there had high blood lead levels. Flint is no aberration. In fact, it doesn’t even rank among the most dangerous lead hotspots in America. In all, Reuters found nearly 3,000 areas with recently recorded lead poisoning rates at least double those in Flint during the peak of that city’s contamination crisis. And more than 1,100 of these communities had a rate of elevated blood tests at least four times higher.

Growth at all costs.

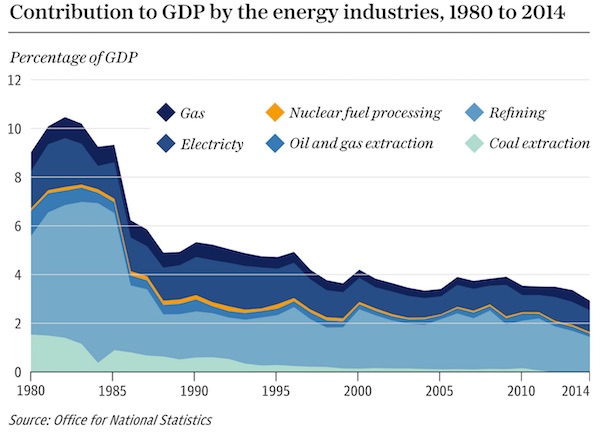

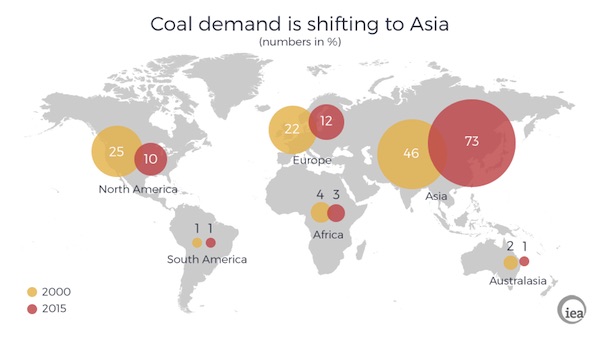

• Coal Continues Its March Towards Asia (IEA)

Growth in global coal demand will stall over the next five years as the appetite for the fuel wanes and other energy sources gain ground, according to the latest coal forecast from the International Energy Agency. The share of coal in the power generation mix will drop to 36% by 2021, down from 41% in 2014, the IEA said in the latest Medium-Term Coal Market Report, driven by lower demand from China and the United States, along with fast growth of renewables and strong focus on energy efficiency. But in a sign of coal’s paradoxical position, the world is still highly dependent on coal. While coal demand dropped in 2015 for the first time this century, the IEA forecasts that demand will not reach 2014 levels again until 2021.

However such a path would depend greatly on the trajectory of China’s demand, which accounts for 50% of global coal demand – and almost half of coal production – and more than any other country influences global coal prices. The new report highlights the continuation of a major geographic shift in the global coal market towards Asia. In 2000, about half of coal demand was in Europe and North America, while Asia accounted for less than half. By 2015, Asia accounted for almost three-quarters of coal demand, while coal consumption in Europe and North America had declined sharply below one quarter. This shift will accelerate in the next years, according to the IEA.

All costs, including that of human lives.

• Air Pollution In Northern Chinese City Surpasses WHO Guideline By 100 Times (R.)

Concentrations of airborne pollutants in a major northern Chinese city exceeded a World Health Organisation (WHO) guideline by 100 times on Monday as north China battled with poor air quality for the third straight day. In Shijiazhuang, capital of northern Hebei province, levels of PM 2.5, fine particulate matter, soared to 1,000 micrograms per cubic meter, state-run Xinhua News Agency reported on Monday. That compares with a WHO guideline of an annual average of no more than 10 micrograms. In nearby Tianjin city, authorities grounded dozens of flights for the second day and closed all highways after severe smog blanketed the port city, one of more than 40 in China’s northeast to issue pollution warnings.

PM 2.5 levels hit 334 micrograms per cubic meter in Tianjin as of 4 p.m. local time, according to local environmental protection authorities. In Beijing, PM 2.5 levels were at 212 micrograms per cubic meter. On Saturday, 22 cities issued red alerts, including top steelmaking city Tangshan city in Hebei and Jinan in coal-rich Shandong province. A red alert is the highest possible air pollution warning. Red alerts are issued when the Air Quality Index (AQI) is forecast to exceed 200 for more than four days in succession, 300 for more than two days or 500 for at least 24 hours. The AQI is a different measure from the PM 2.5 gauge.

After all the fast breeder hype this is what you end up with. But I’m sure there’ll be lots more talk. Coal it is then.

• Japan Pulls Plug On Troubled Fast Breeder Reactor (AFP)

Japan has scrapped plans to generate electricity at a multi-billion dollar experimental nuclear reactor, the government said Monday, giving up on the decades-old project due to spiralling costs. Once touted as a “dream reactor,” the Monju facility was designed to generate more fuel than it consumes via nuclear chain reaction, an attractive alternative in a country with few natural resources. But its complex fast breeder reactor technology has been plagued with problems that have left it idle for more than a decade. It has also been a financial black hole since construction began in 1986, given its initial 1 trillion yen ($8.5 billion) construction cost and daily operating costs of 50 million yen, even while shut down. The government “will not restart (Monju) as a nuclear reactor and will take steps to decommission it,” science minister Hirokazu Matsuno told the governor of western Japan’s Fukui prefecture where it is located.

Wave bye bye.

• This Is The Polar Bear Capital Of The World, But The Snow Has Gone (G.)

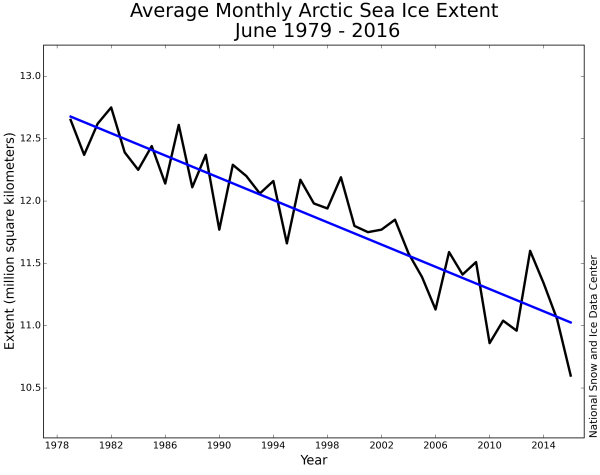

Churchill, on the banks of the Hudson Bay in Canada, is known as the polar bear capital of the world. Hundreds of bears gather there each year before the sea freezes over in October and November so they can hunt seals again from the ice for the first time since the summer. I first went there 12 years ago at this time of year. The place was white, the temperature was -20C, and the bears were out feeding. This year I came back to make a film for Danish TV and set up live feeds of the bears. It was so different. In mid-November there was no snow or sea ice or ice; the land was green or brown and the temperature was 2C. The bears were walking around on the land waiting for the ice to form. It was like summer.

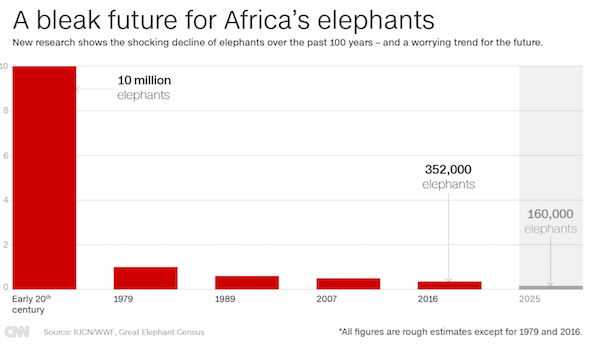

October had seen unprecedented temperatures all around the Arctic leading to a record-breaking slowdown of sea ice formation. Local people told me they had never seen it like this before. With Geoff York, director of conservation at Polar Bears International, we pored over satellite maps every day. It was shocking. The whole 470,000 sq mile bay was completely ice-free. This is the southernmost colony of polar bears in the world and in the past about 1,000 bears would be there. But studies have shown that in the last 20 years the surface temperature of Hudson Bay has warmed by about 3C. This has had a massive effect on the bear. The western Hudson Bay population has declined by more than 20% in 30 years. It’s the same elsewhere. New analysis of data from the southern Beaufort Sea in north-west Canada and Alaska suggest even greater population declines there.

We saw about 20 bears around Churchill in the 10 days I was there. That’s actually a few more than I saw last time, when I was there 12 years ago, but that was because most of the bears were out on the ice then. The ones we did see this year appeared thin, restless and hungry, and were starting to be more aggressive. There was a mum and a cub and it was very emotional because it looked pretty certain that the cub would not survive much longer. The days of bears in this region having triplets seem to be over. The declining sea ice has decreased hunting opportunities, so the bears are smaller and fewer cubs are being born in this area.