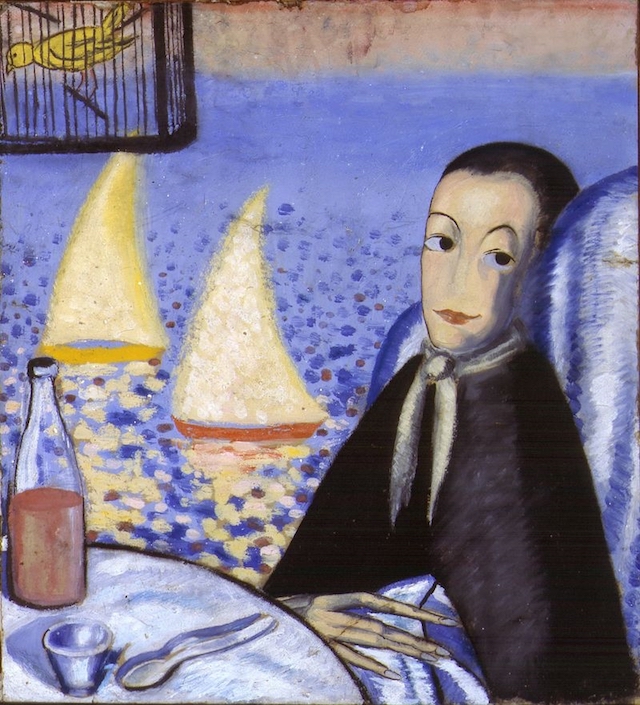

Salvador Dali The Sick Child. Self-Portrait in Cadaqués 1921

Trump cheated

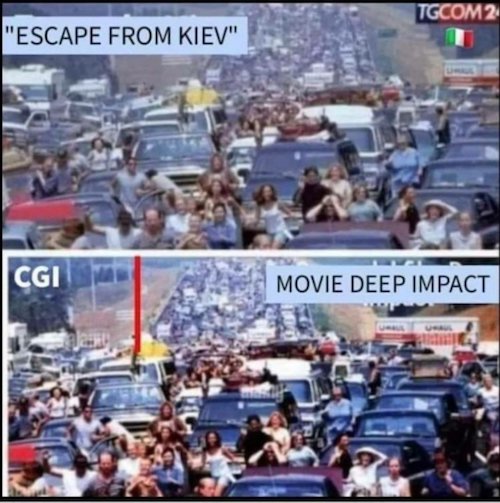

The original #StopTheSteal pic.twitter.com/5Ox4VkdPIp

— Matt Orfalea (@0rf) September 14, 2023

Pepe/Hudson

Nap Mcgregor

Ritter

gato malo

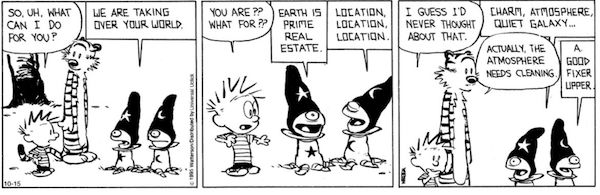

here's a fun idea:

instead of making it a glamour post in NYC where delegates can live high on the hog with nightlife and restaurants, let's make the UN a hardship post.

every 5 years it moves to whatever the world's awful spot is. sudan. syria. mozambique. haiti.

you want… https://t.co/hsbryP8EOI pic.twitter.com/ncoDeOfsyK

— el gato malo (@boriquagato) November 28, 2023

“..The Heart of Darkness is being constructed by “the only democracy” in West Asia in the name of “our values”..”

“..The haunting cries from the jungle don’t come anymore from an “exotic” hemisphere. The jungle is here – creeping inside all of us…”

• ‘The Horror! The Horror!’, Revisited in Palestine (Pepe Escobar)

Joseph Conrad once said that before he had been to the Congo he was a simple animal. It was in one of those lands partially mapped out by the cruelty and hypocrisy of the imperial ethos that Conrad discovered European colonialism in its undiluted, most terrible incarnation, duly depicted in Heart of Darkness – one of the great consciousness-raising epics in the history of literature. It was in the Congo that Conrad, an ethnic Pole born in what is still known today as “Ukraine”, then controlled by Poland, and who only started to write in English when he was 23, forever lost any illusion over the civilizing mission of his race. Other eminent Europeans of his time seamlessly experienced the same horror – participating in Conquest Atrocity Spectaculars; helping the Metropolis to hack and plunder Africa; using the continent as backdrop to their – murderous – juvenile adventures and rites of passage; or only testing their mettle while “saving” the souls of the natives.

They went through the savage heart of the world and made their fortune, their reputation or their penitence just to come back to the sweet comfort of unconsciousness – when they were not shipped back in a coffin, of course. To dominate assorted “primitive” peoples, Britannia replaced the iron and the sword with trade. Like any monotheistic faith, they believed there was only one way to be; one way to drink your tea; one way to play the game – any game. Everything else was non-civilized, savage, brute, at best providing raw materials and acute headaches. For the European sensibility, the sub-equatorial world, actually the whole Global South, was where the White Man went for personal triumph or for dissolution, becoming somewhat “equal” to the natives.

Literature, from the Victorian era onwards, is full of heroes traveling to “exotic” latitudes where passions – like tropical fruit – are bigger than in Europe, and perverted forms of self-knowledge can be experienced to oblivion. Conrad himself placed his tortured heroes on Earth’s “obscure” places to expiate their shadows alongside the shadows of the world, far away from “civilization” and its conventional punishments. And that brings to Kurtz in Heart of Darkness: he’s in a class by himself because he arrives at an extreme of self-knowledge virtually unheard of in European literature, facing the full revelation of the malignity of his mission and his species. In the Congo, Conrad lost his innocence. And his main character lost reason. When Kurtz migrated into the movies in Coppola’s Apocalypse Now, and Cambodia replaced the Congo as the Heart of Darkness, he was denigrating the image of the Empire.

So the Pentagon sent a warrior-intellectual to kill him, Captain Willard. Coppola depicted the passive spectator Willard as even more insane than Kurtz: and that’s how he pulled off the psychedelic unmasking of the whole farce of civilizing colonialism. Today, we don’t need to set sail or embark on a caravan looking for the source of misty rivers to live the neo-imperial adventure. We just need to turn on the smartphone to follow a genocide, live, 24/7, even in HD. Our meeting with the horror… the horror – as immortalized in Kurtz’s words in Heart of Darkness – can be experienced while shaving in the morning, doing Pilates or dining with friends. And just as Coppola in Apocalypse Now, we are free to express a humanist moral stupor when facing a “war”, actually a massacre, that is already lost – impossible to be ethically sustained.

Today we are all Conradian characters, just glimpsing fragments, shadows, mixed with the stupor of living in a gruesomely memorable time. There is no possibility of grasping the totality of facts – especially when “facts” are fabricated and artificially reproduced or bolstered. We are like ghosts, this time not facing the grandeur of nature, or traversing the thick, irreversible jungle; but plugged to a devastated urbanity as in a video game, co-authors of the non-stop suffering. The Heart of Darkness is being constructed by “the only democracy” in West Asia in the name of “our values”. There are so many invisible horrors enacted behind the fog, in the heart of a jungle now replicated as an urban cage. Helplessly watching the wanton killing of women and children, the carpet bombing of hospitals, schools and mosques, it’s as if we are all passengers in a drunken ship plunging into a whirlpool, admiring the powerful majesty of the whole scenery. And we are already dying even before we glimpse death. We are the epigones of T.S. Eliot’s Hollow Men. The haunting cries from the jungle don’t come anymore from an “exotic” hemisphere. The jungle is here – creeping inside all of us.

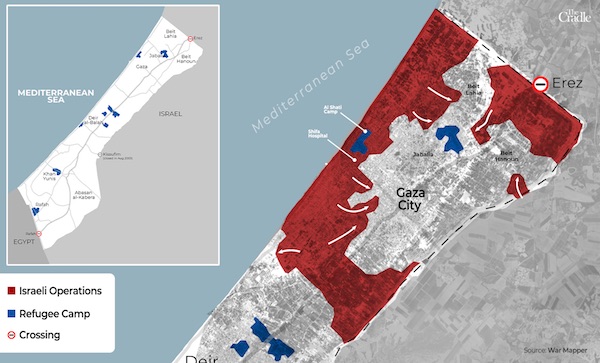

“..civilian massacres and infrastructural destruction galore, but with little damage to the military structure of the Palestinian resistance..”

• Israel’s Ground War Conundrum (Illaik)

Before dusk on 26 November, fighters from Hamas’ military wing, Al-Qassam Brigades, began the process of handing over to the International Red Cross a number of Israeli captives taken during the 7 October Al-Aqsa Flood operation. The transfer of these women and children took place in the Gaza Strip amid what appeared to be a security parade. Al-Qassam fighters arrived in four-wheel-drive vehicles and deployed themselves around the site, wearing full uniforms and bearing arms. Surrounded by civilians cheering on the resistance, the transfer of the Israeli captives was completed smoothly and quietly. This event took place in Palestine Square in Gaza City on the third day of the truce that followed a 49-day war. Throughout the war, Gaza City has been subjected to a suffocating siege and an unprecedented Israeli air and artillery assault, not seen since at least 1982.

The handover process in Palestine Square also took place more than a month after the Israeli army began its ground operation, in which it aims to occupy Gaza City and all areas north of the Strip, destroy them, and displace their population permanently. But the visual of Al-Qassam fighters confidently standing guard in Palestine Square on 26 November, suggested to all present that they remained unharmed by Israel’s war. The fighters transported the Israeli prisoners from their various hideouts and agreed-upon pickup sites to the square, while ensuring that these safe houses would not be discovered. Somebody issued the order, and others carried it out seamlessly, in a highly visible geographical area of less than 150 square kilometers. Keep in mind that Israel and the US have allocated enormous intelligence resources over the past six weeks to unearth the vast network of Hamas tunnels, and to discover the whereabouts of the prisoners.

This picture reveals, to a large extent, the results of Israel’s ground operation: civilian massacres and infrastructural destruction galore, but with little damage to the military structure of the Palestinian resistance. A number of its leaders have indeed been killed – most recently Al-Qassam’s northern commander and military council member Ahmed al-Ghandour – but its command and control system still ticks on effectively. Further evidence of this lies in the inability of the occupation army to penetrate, unimpeded, all of northern Gaza. Israel precedes its ground movements with intense air strikes, then artillery shelling. After destroying everything in its path, its tanks begin advancing. It is almost impossible to confront tanks as they enter, because air fire clears spaces 500 meters ahead, while artillery shells pave the path 150 meters in front of the ground units.

However, whenever possible, the resistance fighters launch anti-armor missiles – Cornet, Conkurs, or similar types – with ranges exceeding one thousand metres. After the tanks reach their designated target, the resistance fighters emerge like ghosts from under the ground or rubble and fire anti-armor shells at them, usually Al-Yassin homemade shells, with a range of fewer than 150 meters. Or, alternatively, a fighter physically approaches the Israeli tanks and plants a sticky bomb that explodes in much the same way as a hand grenade. The work of resistance does not end there. If the tanks do not retreat, and the occupation soldiers settle in, they will be attacked with machine gun fire or explosive devices. The Palestinian fighters film many of these operations, and the footage is delivered to the operations room, which decides what to publish. It is clear that the resistance’s command and control system is still operating effectively.

“..Ursula von der Leyen, visited Egypt and Israel to present them with financial offers ($10bn for Egypt and $5bn for Jordan), in exchange for the dispersal of the inhabitants of the Gaza Strip elsewhere..”

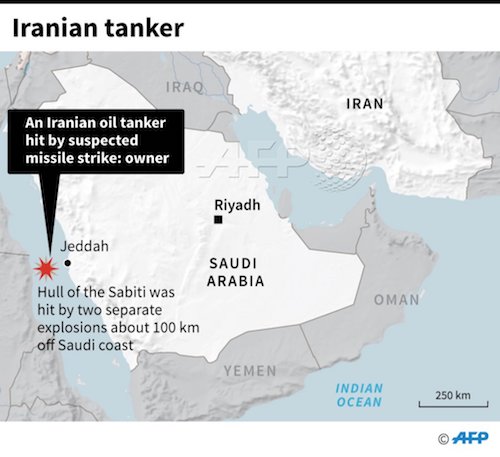

• The Magician’s Hat (Alastair Crooke)

The Magician steps onto the stage, his black cloak swirling about him. Centre stage, he flourishes his hat: It is empty. He punches it lightly to demonstrate its solidity. The Magician then picks up certain objects and places them into his hat. Into it goes AnsarAllah’s seizure of an Israeli-owned vessel (the situation is being ‘monitored’); into it goes the Iraqi strikes on U.S. bases (barely noticed by the main-stream media); into it too go the 1,000 missiles fired into northern Israel by Hizbullah; into it goes the hot war in the West Bank. The Magician turns to the audience – the hat is empty. But the audience knows those objects have a physical reality, but somehow they are magically obfuscated.

It is in this way that the western main-stream media maintains deterrence by playing down the state of war through what Malcom Kyeyune describes as “a simulacrum of peace” – of a gently subsiding conflict and the quieting deployment of (paraphrasing Kyeyune) a very “post-modern question”: What exactly is the meaning of civilian ‘non-combatant’ anyway? One aspect to the image of easing conflict is the hostage exchange that has been agreed. It is both real, and at the same time it underpins the simulacrum that once Hamas is annihilated, and the hostages released, then the problem of 2.3 million Palestinians can go into the magician’s hat, and be eased from sight. For some, the hope is sincere and well intentioned – that once the fighting ceases, it will stay ceased, and that an end to the bombardment in Gaza might open a window to some political ‘solution’ – if it can be extended sine dei.

‘Solution’ being here but a polite word for the EU’s attempted bribery of Egypt and Jordan. Reportedly, the EU President, Ursula von der Leyen, visited Egypt and Israel to present them with financial offers ($10bn for Egypt and $5bn for Jordan), in exchange for the dispersal of the inhabitants of the Gaza Strip elsewhere – effectively to facilitate the evacuation of the Palestinian population from the Strip in line with Israel’s aims of ethnically-cleansing Gaza. However, former minister Ayalet Shaked’s tweet – “After we turn Khan Yunis into a soccer field, we need to tell the countries that each of them take a quota: We need all 2 million to leave. That’s the solution to Gaza” – is but one by senior Israeli political and security figures extoling what Israel increasingly sees as the “solution” for Gaza.

But by being so explicit, Shaked likely has torpedoed Von der Leyen’s initiative – for no Arab state wants to be complicit in a new Nakba. A Hudna or ‘time out’ inevitably is highly precarious. In the 2014 fighting, when IDF forces initiated military sweeps in Gaza after a ceasefire had begun, it led to a fire-fight and the collapse of the cease-fire. The fighting continued for another full month. Two key lessons that I learnt from trying to initiate truces on behalf of the EU during the Second Intifada were that a ‘truce is a truce’ and only that – both sides use it to reposition themselves for the next round of fighting. And secondly, that ‘quiet’ in one confined locality does not spread de-escalation to another geographically separate locality; but rather, that one outbreak of egregious violence is virally contagious, and spreads geographically instantly.

The present hostage exchange is centred on Gaza. However, Israel has three fronts of hot conflict open (Gaza, its northern border with Lebanon, and in the West Bank). An incident occurring in any one of the three fronts may be enough to collapse confidence in the Gaza understandings and re-launch Israel’s assault on Gaza. On the eve of the truce, by way of example, Israeli forces heavily bombed both Syria and Lebanon. Seven Hizbullah fighters were killed. The point here, plainly said, is that the historical precedents of Hudnas leading to political openings are not that great. A hostage release, per se, resolves nothing. The issue in the present crisis runs far deeper. When, ‘once upon a time’, Britain promised the Jews a homeland, western powers also (in 1947) promised Palestinians a state, but never took it to implementation. This lacuna ultimately is culminating in a head-on train crash.

“..Netanyahu’s troubles have deep roots, entwined with his relentless efforts to avoid corruption charges and possible imprisonment..”

• Netanyahu’s End Game In Gaza Is His Own Political Survival (Cradle)

Regardless of how Israel’s brutal war on the Gaza Strip ends, one undeniable outcome seems to be emerging – the potential demise of Prime Minister Benjamin Netanyahu’s political career. Beyond the immediate repercussions of the Hamas-led Al-Aqsa Flood Operation, Netanyahu’s troubles have deep roots, entwined with his relentless efforts to avoid corruption charges and possible imprisonment. This led him to form the most extreme, far-right government in Israel’s history, indirectly setting the stage for the historic operation launched by the Palestinian resistance on 7 October. The occupation state’s military and security establishment, while thought to have been caught off guard by the scale of events on 7 October, had sensed the impending volatility in besieged Gaza, the occupied West Bank, and even the territories occupied in 1948.

The actions of extremist ministers like Finance Minister Bezalel Somotrich and National Security Minister Itamar Ben-Gvir, whom Netanyahu shielded to maintain the unity of his fragile coalition government, have inarguably contributed to the brewing crisis. Amidst the carnage and devastation of the ongoing Israeli assault on Gaza, Tel Aviv’s internal political crisis is seeping into the mini-war cabinet assembled to direct the war. The divergence between Netanyahu and military officials, coupled with his initial refusal to pursue a humanitarian truce and prisoner release initiatives, hints at a crisis rooted in the premier himself. The prime minister’s desperation to cling to his political immunity and avoid imprisonment has him eager to prolong the war on Gaza.

He believes it will give him time to strike an exit settlement—likely under US sponsorship—to avert a fate similar to former Prime Minister Ehud Olmert’s post-Lebanon aggression in 2006. This, despite the thousands of Israeli troop deaths and injuries the conflict has borne. Netanyahu, fully cognizant that eliminating Hamas is an impossible goal, is nonetheless publicly employing this war objective as cover for other strategically beneficial outcomes he is chasing: control over Gaza’s gas, Palestinian displacement projects to Sinai and Jordan, pushing for direct US-Iran confrontations, and the shedding of his extremist allies. Banking on Washington’s support amidst President Joe Biden’s preoccupation with the 2024 presidential elections, European sympathy intertwined with Israeli gas needs, and Arab expressions of concern without substantive action, Netanyahu is engaged in a high-stakes gamble.

The potential reoccupation of the Gaza coast, with its gas wealth and strategic location – increasingly perceived by some observers to be Israel’s end game in the war – stands as an additional prize for Netanyahu, whose political standing is increasingly fragile. Beyond the immediate gains, a resurrection of an old Israeli project – the Ben Gurion Canal from northern Gaza to Eilat – could reshape regional geopolitical and geoeconomic dynamics by bypassing Egypt’s Suez Canal. However, Netanyahu’s paramount concern isn’t just the war’s outcome or a decline in international support. It is the impending split within his party. The Likud Party recognizes Netanyahu as the source of years-long political crises, marked by five unproductive elections since 2019 and deepening political divisions in Israel.

“It is in this (the creation of a sovereign Palestinian state within the 1967 borders) that we see the key condition for achieving a comprehensive, long-term and just Palestinian-Israeli settlement..”

• Putin Notes Importance of Establishing Palestine Within 1967 Borders (Sp.)

Russian President Vladimir Putin said in a message to Palestinian President Mahmoud Abbas that the key to resolving the Palestinian-Israeli conflict is the creation of a Palestinian state within the 1967 borders. “It is in this (the creation of a sovereign Palestinian state within the 1967 borders) that we see the key condition for achieving a comprehensive, long-term and just Palestinian-Israeli settlement,” Russian Deputy Foreign Minister Mikhail Bogdanov read out the Russian president’s message to Abbas at an event marking the Day of Solidarity with the Palestinian People at the Palestinian Embassy in Russia.

In the text of the telegram published on the Kremlin’s website, Putin stressed that “now, when the bloody conflict is bringing untold suffering to the peaceful population of Palestine, I consider it particularly important to reaffirm Russia’s consistent position in favor of the realization of the legitimate rights of your people to establish their own sovereign state within the 1967 borders with East Jerusalem as its capital.” “This undoubtedly corresponds to our common interests and is in line with the consolidation of regional security and stability. I wish you, Mr. President, good health and success, and I wish all Palestinians peace, well-being and prosperity in their homeland,” the Russian leader concluded.

The Palestinians won’t move voluntarilty.

• New Jerusalem: US and Israeli Solution To The Palestine Problem (RT)

Egypt’s reaction to the events in the Gaza Strip has drawn renewed attention to the US-Israeli plan of relocating the Palestinian population living in Gaza to the Sinai Peninsula, which is now a part of Egypt. In former times, this question was repeatedly raised during negotiations with Cairo. Now, it looks like Egyptian President Abdel Fattah el-Sisi will have to deal with the issue once again and find an optimal solution. The idea of pushing the Palestinians out of Gaza first appeared back in the 1960s. After the establishment of the State of Israel in 1948 and the mass exodus of Palestinian Arabs as a result of the Arab-Israeli War in 1948-1949 and the Six-Day War in 1967, various Israeli institutions proposed solutions to this issue.

In 1968, the Israeli Foreign Ministry presented a project that would encourage Palestinians living in Gaza to move to the West Bank and then to Jordan and other Arab countries. In the same year, a US Congressional committee discussed a plan for the voluntary relocation of 200,000 Palestinians from Gaza to other countries, such as West Germany, Argentina, Paraguay, New Zealand, Brazil, Australia, Canada, and the USA. This plan failed, however, since many nations refused to accept the Palestinians. In 2000, Reserve Major General Giora Eiland, who headed the Israeli National Security Council, presented a project known as ‘Regional Alternatives to the Two-State Solution.’

Published by the Begin-Sadat Center for Strategic Studies, this document assumed that Egypt would cede a 720 square km rectangle on the territory of the Sinai Peninsula, including coastal areas and the city of el-Arish, in favor of a potential Palestinian state. In return, the Palestinians would give Gaza and a part of the West Bank over to Israel, while Egypt would receive equivalent territory in the southwestern part of the Negev Desert (the Wadi Feiran region), certain economic privileges, international support, and security concessions. However, the plan was proposed at an inopportune moment – shortly after the failed negotiations at Camp David between Palestinian National Authority President Yasser Arafat and Israeli Prime Minister Ehud Barak and at the time of the Al-Aqsa Intifada in September 2000.

As a result, the settlement of the Palestinian-Israeli conflict was frozen for several years, and the Giora Eiland project fell through. Similar initiatives were put forward in later years. Most of them were based on Eiland’s document. The so-called ‘Deal of the Century’ proposed by former US President Donald Trump in 2020 and officially titled Peace to Prosperity, was the most recent initiative to resolve the Gaza issue. Trump’s peace plan was not that different from the previous ones and included the same key points – Egypt would cede land in the Sinai Peninsula to build airports, factories, and business centers, and encourage agricultural and industrial projects that would help employ hundreds of thousands of people. According to the document, the new Palestinian State was supposed to grow and develop on this territory.

“..how could you possibly be an Irish Catholic and a Zionist at the same time? Sinn Féin, which is on course to top Ireland’s next election, is embracing Palestinians and condemning Israel..”

• The Middle East At An Inflection Point (Bhadrakumar)

It has been a perennial hope and expectation that Israel would abandon the path of repression, colonisation and apartheid as state policies and instead accept a negotiated settlement of the Palestine problem under pressure from its patron, mentor, guide and guardian — the United States. But that proved delusional and the remains of the day is a chronicle of dashed hopes and hypocrisy. The big question today is whether a paradigm shift is possible. That is also the dilemma facing US President Joe Biden at 80. History shows that while catastrophic events have myriad negative effects, positive effects are also possible, especially in the long term. The French-German reconciliation after two world wars is, perhaps, the finest example in modern history, and it planted the germane seeds of European integration project. Certainly, the collapse of the Soviet Union gave impetus to the Sino-Russian rapprochement, which morphed into a “no limit” partnership.

However, for such miracles to happen, visionary leadership is needed. Jean Monnet and Konrad Adenauer were indeed political visionaries — and, in a different sort of way, the two consummate pragmatists Boris Yeltsin and Jiang Zemin too were. Does it look as if Biden and Benjamin Netanyahu belong to that pantheon? When Biden met with Netanyahu and his war cabinet in Tel Aviv on October 18, he assured them: “I don’t believe you have to be a Jew to be a Zionist, and I am a Zionist.” Therein lies the paradox. For, how could you possibly be an Irish Catholic and a Zionist at the same time? Sinn Féin, which is on course to top Ireland’s next election, is embracing Palestinians and condemning Israel. Of course, there are no surprises here.

Biden is torn between conflicting faiths. Suffice to say, when Biden speaks about a two-state solution, it becomes hard to believe him. On Netanyahu’s part, at least, he doesn’t even feel the need to pay lip service to a two-state solution, after having systematically buried the Oslo Accord and embarked on the journey towards a Jewish theocracy in what was once the state of Israel. Make no mistake, Greater Israel is here to stay and the world opinion regards it as an apartheid state. There is a great misconception that Biden is under pressure from the American opinion on the conflict in Gaza. But the fact of the matter is that support for Israel has all along been rather thin in America and had it not been for the Israel Lobby, it would have probably asserted a long time ago. Curiously, something like one third of American Jews, especially the youth, don’t even care for the Israel Lobby.

That said, it is also a fact that Americans have generally a favourable opinion about Israel. Their problem is really about Israel’s aggressive policies — this is despite the absence of any open media or academic discussion in the US regarding the state repression of Palestinians or the colonisation of West Bank. A defining moment came when Netanyahu taunted and humiliated President Barack Obama on the Iran nuclear deal by consorting with the Congress against the presidency in an audacious attempt to derail the negotiations with Tehran. In the recent years, Israel’s image has been tarnished in the liberal opinion following the ascendance of right-wing forces and the overtones of racist attitudes including among Israeli youth. Indeed, Israel has been an increasingly illiberal country even toward its own citizens. Due to such factors, Americans no longer take an idealised view of Israel as a morally upright country battling for existence.

“Zaluzny has no plans for 2024 because there is nothing he can do about the upcoming defeat of the Ukrainian army.”

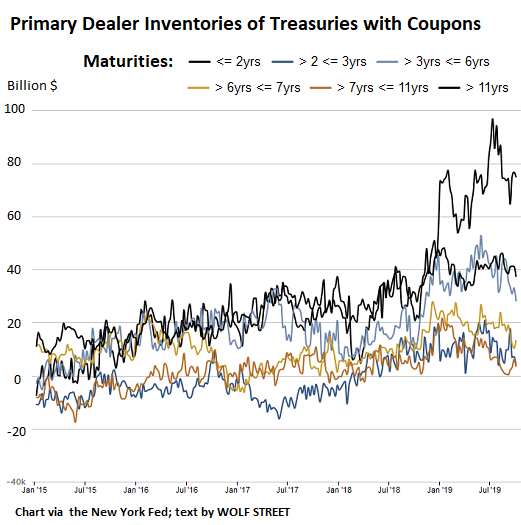

• Ukraine SitRep: High Losses, Political Infighting, Blocked Borders (MoA)

How many losses did the Ukrainian army have in its war against Russia. We, so far, did not have any answer to that. The Ukrainian military has given no realistic account of its own losses while its claims of Russian losses are obviously exaggerated. The Russia military is likewise giving no numbers for its own losses. But its daily reports give estimates of Ukrainian ones. These are currently around 650 per day plus/minus 200 depending on the intensity of the fighting. Some western observers, foremost retired Colonel Macgregor, say that Ukraine’s unrecoverable losses have exceeded 400,000 men. But he does not name his sources. Now a new chapter in the war between the Ukrainian president Zelenski and the Commander in Chief of the Ukrainian army, General Zaluzny, may have given us an answer. Yesterday this news item found its way to the Strana news site (machine translation):

Zaluzhny Didn’t Provide The Plan Of War-2024 And Has To Leave-the People’s Deputy From “Servants Of The People”. The commander-in-Chief of the Armed Forces of Ukraine, Valery Zaluzhny, does not have a war plan for 2024, and therefore must resign. This was stated by Deputy head of the Verkhovna Rada Committee on National Security and Defense, MP from Servant of the People Mariana Bezuglaya on her Facebook page, referring to a “non-public discussion” with the military. “Yes, the Commander-in-Chief of the Armed Forces of Ukraine could not provide a plan for 2024. Neither big nor small, neither asymmetrical nor symmetrical. The military simply said that they need to take at least 20 thousand citizens a month, ” she writes.

Zaluzny has no plans for 2024 because there is nothing he can do about the upcoming defeat of the Ukrainian army. Every time he urges to stop defending positions that can not be held, like Bakhmut and Avdeevka, the political leadership tells him use all reserves and to keep holding. Every time he urges to build strong defense lines and to retreat to them he gets overruled. There is thereby nothing, except one number, that he can plan for. That number is the one of the irretrievable losses of the Ukrainian army is experiencing. Zaluzny needs 20,000 new men per month to replace the losses and to keep his army going.

“.. the alliance has not abandoned its plans to contain Russia and slaughter the Ukrainian people as ritual victims in the fight against Russia..”

• NATO ‘Slaughtering’ Ukrainians To Fight Russia – Kremlin (RT)

NATO is sticking to its plan to contain Russia by sacrificing countless Ukrainian lives, Kremlin spokesman Dmitry Peskov has said. His comments came after the bloc’s Secretary General Jens Stoltenberg argued that the alliance was trying to prevent further escalation of tensions with Russia. Speaking to reporters on Tuesday, Peskov pointed out that, no matter what statements come out of NATO, the bloc was originally conceived and structured in a way that “essentially make it an instrument of confrontation with Russia and a means of containing it.” “So far, the alliance has not abandoned its plans to contain Russia and slaughter the Ukrainian people as ritual victims in the fight against Russia,” Peskov said, noting that Moscow was planning its course of action taking these realities into account.

During a press conference ahead of the meetings of NATO foreign ministers on Monday, Stoltenberg said the two main goals of the organization were the continued support of Kiev and preventing an escalation of the conflict that could lead to “a full-fledged war between Russia and NATO.” One way the US-led bloc is preventing this from happening, according to Stoltenberg, is by sending a “clear signal” to Moscow that the alliance is ready to defend its territory by building up its armed forces on its eastern borders. “We are doing this not to provoke a conflict, but to prevent it,” the NATO secretary general claimed. Meanwhile, he also noted that the failure of Ukraine’s army to move the front line during its much-touted counteroffensive, despite “unprecedented” Western support, has shown that the bloc must “never underestimate Russia.”

So far, Kiev is believed to have lost as many as 103,000 troops since launching the ill-fated counteroffensive, according to the latest estimates by Russia’s Defense Ministry. With Ukraine’s forces seemingly unable to reclaim lost territories, a growing number of Western officials have suggested that Kiev may have to seek a peace deal with Russia and concede its former territories. Ukrainian President Vladimir Zelensky has also suggested in an interview with Fox News that the conflict with Russia could be stopped if Kiev conceded Donbass and Crimea, but claimed that the country was “not ready” for such a peace deal.

“Our diversity and unity of cultures, traditions, languages and ethnic groups simply does not fit the logic of Western racists and colonialists,,”

• Strong, Stable World Order Impossible Without a Sovereign Russia: Putin (Sp.)

Russia is at the forefront of the effort to build a more fair, stable world order, and the latter’s creation will be impossible without sovereignty, President Vladimir Putin has said. “I would like to emphasize that without a sovereign, strong Russia, no lasting, stable world order is possible,” Putin said in a video address before the World Russian People’s Council on Tuesday. “It is our country specifically that is at the forefront of creating a more equitable world order,” Putin said. “As has happened more than once in history, it has fallen to our country today, to the Russian World, to block the path of those who claim world domination and ‘exceptionalism.’ We are fighting for the freedom of not only Russia, but the entire world.” “Today, Russophobia and other forms of racism and neo-Nazism have become practically the official ideology of Western ruling elites,” Putin said.

“They are directed not only against ethnic Russians, but also against all the peoples of Russia – Tatars, Chechens, Avars, Tuvinians, Bashkirs, Buryats, Yakuts, Ossetians, Jews, the Ingush, the Mari, and the Altai people. There are many of us, I won’t name everyone now, but I will repeat that this is directed against all the peoples of Russia.” “The West, in principle, does not need such a large and multinational country as Russia. Our diversity and unity of cultures, traditions, languages and ethnic groups simply does not fit the logic of Western racists and colonialists, their cruel system of total depersonalization, dissociation, suppression and exploitation. It is for this reason that they’ve started playing their old tune about Russia being a ‘prison of nations,’ about Russians themselves being a slavish nation. We have heard this many times over the centuries,” he said.

Pointing to the failure of the West’s sanctions “blitzkrieg,” Putin stressed that Russia’s adversaries have often sought to “dismember and plunder Russia, if not by force, then through chaos.” “We have become stronger. Our historic regions have returned to Russia. Society is abandoning the superficial and turning to its true, authentic values,” Putin suggested. Sovereignty is a precondition for true freedom, for Russia, its people and each individual, Putin said. “Because in our tradition, a person cannot feel free if his loved ones, children and homeland are not free. And it is precisely this true freedom that our boys, men, soldiers officers and daughters of the fatherland are now defending. A free people who understand their responsibility for today and for future generations.” Russia, without any exaggeration, is engaged in a struggle for “national liberation,” Putin said, suggesting that the country is “defending the safety and well-being of our people, the highest historical right to be Russia – a strong, independent power, a nation civilization.”

“For years, he has been able to manipulate the media and create ever changing rationales for his role in the alleged corruption scheme from expert to addict to victim..”

• Hunter Has a Hearing Date But He Has Demands (Turley)

We previously discussed how Hunter Biden was gracious enough to say that he might appear before Congress after receiving a subpoena from the House Oversight Committee when “the time is right.” As I noted at the time, that is not quite how subpoenas work. It is really not an invitation. Now a date has been set for December 13th, but Hunter’s lawyer, Abbe Lowell, is suggesting that he will not appear in private but only in a public hearing. Again, Hunter fundamentally misses the point of a congressional subpoena. House Oversight Committee Chairman James Comer, R-Ky., quickly disabused Hunter of the point of the subpoena and said that he will indeed appear in a private session before a public hearing. That is precisely what the Democrats have done, including with dozens of witnesses in the January 6th committee.

This is a bad start for Hunter, who is a lawyer. For years, he has been able to manipulate the media and create ever changing rationales for his role in the alleged corruption scheme from expert to addict to victim. Those spins could now come at a cost. While the Justice Department slow walked his investigation and allowed the statute of limitations to run, any misrepresentation could be charged as a new felony with a new statute of limitations. Hunter will appear in the place set by the Committee. He can choose his answers, but not his forum. Putting the bravado of the letter aside, he now has a date with Congress and he will no longer be able to orchestrate how he will appear in public.

X thread.

“..the reason the media and politicians are terrified is that they are convinced Trump would do exactly what they would do in his place—and what they would do utterly suddenly horrifies them..”

• Don’t Do Unto Others What We Would Have Done to Them? (Victor David Hanson)

Once more, it gets even creepier how the projectionist Left is daily still shrieking about impending Trump “revenge” and “rage”, or about Trump’s purported enemies lists to come, or about his planned weaponization of the bureaucracies. The fear is in direct proportion to Biden cognitive decline, sinking polls, and walls-are-closing-in family corruption. Should we laugh or cry about the transparent hypocrisy? After all, who tried to wreck an administration with a 22-month-long Russian “collusion” fraud, suppressed a laptop with the lie it was Russian “disinformation”, or impeached a president for a phone call correctly identifying the Biden family’s operation in Ukraine as utterly corrupt and at the expense of U.S. interests?

Do we recall that the Obama-Biden nexus—from 2009-17, and from 2021 until now—cemented the reputation of FBI as a partisan operation, rebooted the Pentagon as an agent of woke change ferreting out “white rage” and “white privilege”, reinvented the DOJ as a Biden family protection service, politicized the CIA so that it, along with the FBI, interfered in the 2016 and 2020 elections, and warped the IRS by suppressing evidence of Biden family tax fraud? What Lois Lerner, Eric Holder (self-identified as Obama’s “wingman”), and Loretta Lynch left undone was taken up by Merrick Garland.

Does the New York Times, or Joe Scarborough or any of these strange pundits raging about Trump rage to come remember how the “Logan Act” farce was used to destroy Michael Flynn? Or the Foreign Policy essay of Rosa Brooks, a former Obama-era Pentagon lawyer, about how to drive out Trump without waiting for the 2020 election, by either impeachment, the 25th Amendment—or a military coup? How about the “kill Trump” porn that saw celebrities, actors, and academics envisioning decapitating, stabbing, shooting, exploding, or incinerating the orange man? How about Anonymous’s confessions about how fellow bureaucrats were trying to undermine and sabotage the operations of the Trump administration from within? Or the Pentagon’s retired 4-stars calling for Trump to be removed the “sooner the better”, or labeling him a Mussolini or Nazi-like figure?

Who paid Twitter millions to censor the news of political opponents? Who paid foreign national Christopher Steele to peddle a fake dossier to destroy the 2016 Republican candidate? Do we remember Biden’s Phantom-of-the-Opera harangue about his “ultra-MAGA” and “semi-fascists” political enemies? Were not the twin pillars of Biden’s current foreign policy team, National Security Advisor Jake Sullivan, and Secretary of State Antony Blinken, once respectively knee-deep in the anti-Trump Alfa Bank-ping hoax and the “51 Intelligence Authorities” laptop scam? Again, the reason the media and politicians are terrified is that they are convinced Trump would do exactly what they would do in his place—and what they would do utterly suddenly horrifies them.

“..Trump also argued that his name, and the potential for future development, was a factor in the previous valuations..”

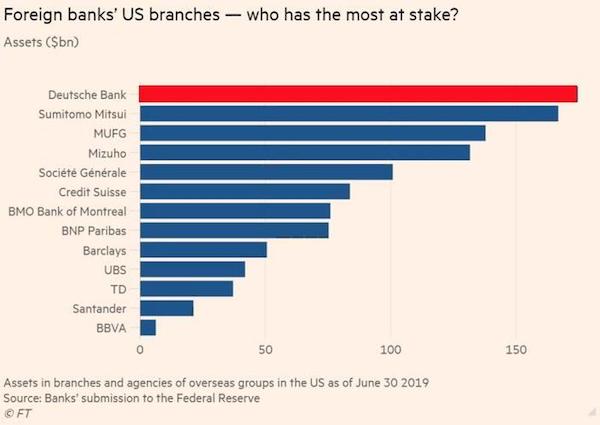

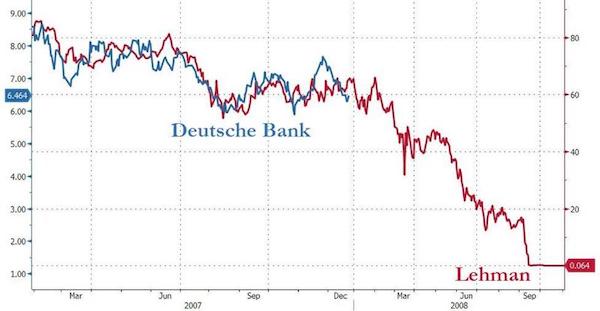

• Did Deutsche Bank Just Destroy New York AG’s Case Against Trump? (ZH)

A Deutsche Bank executive may have just tanked New York Attorney General Letitia James’ lawsuit against former President Donal Drump – which revolved around portraying the German lender as Trump’s biggest victim in an alleged scheme to inflate his assets in order to obtain favorable terms from banks and insurers. David Williams, who directly worked on at least one of several loans obtained by Trump over several decades, testified on Tuesday in Manhattan that it’s “atypical, but not entirely unusual” for a bank to internally slash a client’s stated asset values by 50% and approve a loan anyway, as they did with Trump, Bloomberg reports. “It just depends on the circumstances,” said Williams, a managing director at the bank.

“Deutsche Bank, which loaned hundreds of millions of dollars to Trump for properties in Miami, Chicago and Washington, cut his stated net worth in 2011 and 2012 from about $4.2 billion to $2.3 billion, according to internal bank credit memos. The same documents indicated the bank approved the loans anyway because it expected them to generate a profit based on Trump’s history of successful developments and other criteria. Trump, who denies wrongdoing and claims the case is politically motivated, is calling to the stand this week four current and former Deutsche Bank employees — including the family’s former private banker Rosemary Vrablic — as part of his defense case, seeking to flip the script on the state’s version of events”. -Bloomberg.

The testimony completely undermines AG James’ premise, that Trump defrauded the German bank. “As part of our due diligence, we subject a client’s asset value to adjustments,” said Williams. “It’s part of our underwriting process we apply it to every client regardless of what’s reported.” “Is a difference of opinion in asset values between the client and the bank a disqualifying factor to extend credit?” Trump attorney Jesus Suarez asked Williams. “No,” he replied. “Why not?” “It’s just a difference of opinion,” Williams continued. “I think we expect clients to provide information to be accurate.” Trump and two of his sons, Donald Trump Jr. and Eric Trump, testified earlier in the trial that no banks had been victimized by the alleged inflated valuation, and that various lenders had made millions of dollars in interest on the loans. Trump also argued that his name, and the potential for future development, was a factor in the previous valuations.

James, an activist Democrat AG, says that Trump and his company falsified documents to banks and insurers. The judge in the case, Arthur Engoron, has similarly proven himself to be a partisan operative and not a neutral arbiter. “Justice Aurthur Engoron, who is overseeing the case, held Trump liable for fraud on the eve of trial, resolving the biggest claim in the case and putting Trump’s control of his assets at risk. The trial is focusing on six remaining claims, as well as penalties. The state is seeking the return of $250 million in “illegal profit” and a ban on Trump and his sons from serving as directors or officers of any New York-based company.” -Bloomberg

“..On the same day that Judge Chutkan denied his subpoena request, Mr Trump filed a new, 34-page motion to compel the prosecution to give him information from the Justice Department and Homeland Security..”

• Judge Denies Trump’s Jan 6 Committee Request In Election Fraud Case (BBC)

A judge has blocked former President Donald Trump’s attempt to obtain records related to the congressional investigation into 6 January. Judge Tanya Chutkan denied a motion from his team to issue subpoenas to members of the committee that looked into the Capitol attack in 2021. In an opinion filed on Monday, she cast the motion as a “fishing expedition”. This is the latest courtroom defeat for Mr Trump in the case alleging he plotted to overturn the 2020 election. Judge Chutkan has already issued a gag order and denied Mr Trump’s request to remove language from the indictment that he said could prejudice a jury against him.

In the motion, filed in October, Mr Trump had sought to issue subpoenas to Representative Bennie Thompson, chairman of the 6 January committee, White House Counsel Richard Sauber, the Department of Homeland Security’s general counsel, the national archivist, the House clerk, the committee on House administration, and Representative Barry Loudermilk. The subpoenas were for what Mr Trump called “missing materials” and communications about how those materials were handled. Judge Chutkan said that Mr Trump had not specified what information he was seeking in the materials and only gave a “vague description of their potential relevance”. She focused on his requests for the committee’s video recordings and transcripts of witness interviews.

Noting that the transcripts had already been provided to Mr Trump, she said he had not articulated how the videos could help his case. Altogether, he had not “sufficiently justified” his request, she wrote. In a series of primetime televised hearings last year, the bipartisan committee presented its own case. The bipartisan committee argued that Mr Trump sought to stay in the White House by contesting the results of the 2020 election and that he rallied supporters to try to stop Congress from certifying President Joe Biden as the rightful winner. It often showed videos of depositions from Mr Trump’s closest aides and confidants, including his daughter Ivanka Trump and former Attorney General Bill Barr.

Mr Trump is the current front-runner for the Republican nomination in next year’s election, and juggling four criminal court cases with his busy campaign schedule. The former president, though, is not slowing down on either side. On the same day that Judge Chutkan denied his subpoena request, Mr Trump filed a new, 34-page motion to compel the prosecution to give him information from the Justice Department and Homeland Security, mostly on supposed threats to the integrity of the 2020 election.

“..Future Forward USA Action siphoned $77 million worth of dark funds into the Future Forward PAC since the 2020 election. This represents over 40% of the total funds raised by the Biden super PAC..”

• Soros Poured $15M in ‘Dark Money’ Into Biden-Linked Non-Profit (Sp.)

A hefty chunk of ‘dark money’ from a group bankrolled by George Soros – the ‘face’ of Western soft power campaigns for decades – was shelled out last year as part of an effort to get Joe Biden reelected in 2024, Fox News reported. A nonprofit called the Open Society Policy Center lodged within the web of the Soros-funded Open Society Foundations network forked out $15.18 million to the 81-year-old Democrat’s nonprofit – Future Forward USA Action – to cover the costs of research and “content testing on critical policy issues,” according to tax documents seen by the outlet. For those wondering what Future Forward USA Action is, the organization is an affiliate of the Future Forward USA political action committee (PAC), also known as “FF PAC.”

The latter is a Democratic Party-aligned super PAC based in California. As for the Future Forward USA Action nonprofit, which shrouds its donors in secrecy, it is a crucial fundraising vehicle, tasked with raking in dark money to try to propel Biden, whose dismal approval rating has been hovering at around 40% in the latest polls, to another term in the White House. According to records from the Federal Election Commission, Future Forward USA Action siphoned $77 million worth of dark funds into the Future Forward PAC since the 2020 election. This represents over 40% of the total funds raised by the Biden super PAC, which reached approximately $181 million. The findings indicate that a significant portion of the funds supporting Biden originated from this affiliated ‘dark money’ nonprofit.

“For someone who claims to disdain dark money, President Biden seems quite comfortable with the kind of dark money propping up an outside group spending big to push his agenda,” Caitlin Sutherland, executive director of Americans for Public Trust, was cited by the outlet as saying, adding: “George Soros’ projects are notorious for pushing policies that undermine safety, democracy and the rule of law. By funneling money through this Biden-tied group, Soros is signaling that he and Biden are birds of a feather.” The fact that Soros’ money is being channeled towards giving the octogenarian currently in the White House a leg up in the 2024 elections is hardly newsworthy, though.

The Hungarian-born self-styled liberal philanthropist along with his Open Society Foundations (OSF) has played a significant role as a primary soft power tool used by US and European foreign policy from around the mid-1980s. Billions of dollars have been flooded into supporting Democratic political campaigns, with activities ranging from providing generous grants to political parties pushing liberal, pro-Western politics, to bankrolling media outlets, think tanks, academia, and publishing houses. More recently, in the run-up to the 2024 elections in the US, OSF and Soros have been pouring scathing criticism upon Donald Trump, and linked to financing of the election campaigns of judges, including some of those currently seeking to prosecute the 45th President.

Beau

JIMMY STEWART reads a Poem about his dog ‘Beau’ to a visibly moved Johnny Carson on The Tonight Show in 1981.

Just beautiful.

— Michael Warburton (@MichaelWarbur17) November 28, 2023

Hug

We all need a hug sometimes.. 😊 pic.twitter.com/1dzjg7wNVZ

— Buitengebieden (@buitengebieden) November 28, 2023

Wood pigeon

The New Zealand Kereru (wood pigeons) eat so much fruit that it ferments inside them, as they get drunk, they fall from trees pic.twitter.com/ufjwEuzmqS

— Science girl (@gunsnrosesgirl3) November 28, 2023

Washing machine

‼️NEWSFLASH: Russians are forced to get creative with the use of Ukrainian washing machines because of the large supply surplus. pic.twitter.com/wt6rsDuBdz

— Olga Bazova (@OlgaBazova) November 28, 2023

Leash

https://twitter.com/i/status/1729589251023524083

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.