Vivien Leigh in Gone With The Wind, directed by Victor Fleming, 1939

Lots of retirement and pension scare stories today. I can only hope our readers have taken our warnings through the years to heart.

• Raising Pension Age Will Mean Many People Die Before Getting It (G.)

Further increases in the state pension age could push it to the point where many working people die before qualifying for it, MPs have warned, in a report that calls for the end of the “triple lock” guarantee on pensions. The Commons work and pensions select committee report on intergenerational fairness, published on Tuesday, claims that financing the triple lock in future will not be possible without increasing the state pension age to 70.5 years – leaving men in Manchester, Birmingham, Bradford and Blackpool dying on average before they receive their state pension. Under the triple lock, pensions have risen every year since 2010 by whichever is the higher figure out of the rate of inflation, average earnings or a minimum of 2.5%. This has lifted many pensioners out of poverty but the committee said it had resulted in the over-65s taking an “ever greater share of national income”.

In its November 2016 report, the committee recommended that the triple lock be replaced from 2020 by a smoothed earnings link. This would benchmark the state pension to a fixed proportion of average earnings in the long run, but would protect its purchasing power in times of inflation. Citing figures from the Institute of Fiscal Studies, the committee said the state pension age would need to rise to 70.5 years by 2060 to make the triple lock affordable, “meaning today’s young would face working lives of over 50 years before receiving a state pension”. It added: “Making the triple lock sustainable would mean pushing the state pension age over average life expectancy in poorer areas of the UK”. Current male life expectancy is lowest in Blackpool, at 67.5, while it is 68.7 in parts of Bradford and 70.2 in much of Manchester. Tower Hamlets in London’s East End has a male life expectancy of 69.1.

Dominoes.

• NY Teamsters Pension Fund Becomes First To Run Out Of Money (NYDN)

Chmil is one of roughly 4,000 retired Teamsters across New York State suffering a fate that could soon hit millions of working-class Americans — the loss of their union pensions. Teamsters Local 707’s pension fund is the first to officially bottom out financially — which happened this month. “I had a union job for 30 years,” Chmil said. “We had collectively bargained contracts that promised us a pension. I paid into it with every paycheck. Everyone told us, ‘Don’t worry, you have a union job, your pension is guaranteed.’ Well, so much for that.” Also on the brink of drying up are the pensions for two Teamster locals — 641 and 560 — in New Jersey, union officials said. Plus 35,000 Teamster members upstate who are part of the money-hemorrhaging New York State Teamsters Pension Fund.

Bigger than all of New York’s Teamster locals combined is the Central States Pension Fund — another looming financial disaster that could leave 407,000 retirees without pensions across the Midwest and South. And there’s still more beyond that, in various industries, officials say. “It’s a nightmare, it has just devastated all of our lives. I’ve gone from having $48,000 a year to less than half that,” said Chmil, one of five Local 707 retirees who agreed to share their stories with the Daily News last week. “I don’t want other people to have to go through this. We need everyone to wake up and do something; that’s why we’re talking,” said Ray Narvaez. Narvaez, 77, got a union certificate upon retirement in 2003 that guaranteed him a lifetime pension of $3,479 a month. The former short-haul trucker — who carried local freight around the city — started hearing talk in 2008 of sinking finances in his union’s pension fund.

But the monthly checks still came — including a bonus “13th check” mailed from the union without fail every Dec. 15. Then Narvaez, like 4,000 other retired Teamster truckers, got a letter from Local 707 in February of last year. It said monthly pensions had to be slashed by more than a third. It was an emergency move to try to keep the dying fund solvent. That dropped Narvaez from nearly $3,500 to about $2,000. “They said they were running out of money, that there could be no more in the pension fund, so we had to take the cut,” said Narvaez, whose wife was recently diagnosed with cancer. The stopgap measure didn’t work — and after years of dangling over the precipice, Local 707’s pension fund fell off the financial cliff this month.

With no money left, it turned to Pension Benefit Guaranty Corp., a government insurance company that covers pension. Pension Benefit Guaranty Corp. picked up Local 707’s retiree payouts — but the maximum benefit it gives a year is roughly $12,000, for workers who racked up at least 30 years. For those with less time on the job, the payouts are smaller.

“Americans who turn 70 1/2 have until April of the following calendar year to make withdrawals or face stiff penalties…”

• US Baby Boomers Forced By Law To Start Drawing From Retirement Funds (MW)

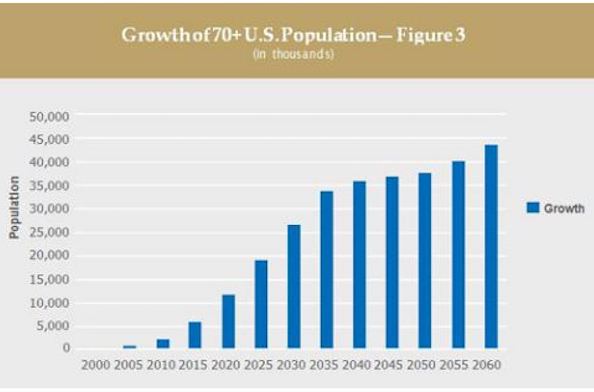

Robert Kiyosaki, author of the “Rich Dad” series of books, has for years predicted an epic market crash when baby boomers, forced by law, start drawing from retirement funds in large numbers. That meltdown was supposed to happen last year. Instead, the bull market raged on: It will be eight years old in March, if measured by the 2009 bottom. Kiyosaki has drawn some flak along the way. Kiyosaki hasn’t given up on the prediction, however, he told MarketWatch in a late-January interview and a series of follow-up emails. Baby boomers still need to start drawing money in 2017, he notes: They hold about $10 trillion in tax-deferred savings accounts, according to Bank of New York Mellon; Americans who turn 70 1/2 have until April of the following calendar year to make withdrawals or face stiff penalties. (There were nearly 75 million Boomers in 2015, according to Pew Research.)

“Every time I say that to people they scoff at me,” said Kiyosaki of his baby boomer meltdown theory. “The fact is, they’re pulling the money out…the thing that did happen that I never expected, was the market went up a lot due to the ‘Trump Bump.’” Early in 2016, when stocks posted their worst January since 2009, it looked like Kiyosaki might be right about the market. Stocks recovered only to slide on Brexit last summer and then fall briefly in an autumn pre-election dip. It’s been upward momentum ever since. The surprise election victory of President Donald Trump, who rallied investors with his promise to revamp the economy, further muddied the picture for Kiyosaki’s forecast. While stocks were already up about 4.3% before the election, its outcome boosted the S&P to finish 2016 with a 9.5% gain. The Dow industrials logged their best annual finish in 3 years, up 13.4%.

[..] Kiyosaki says 2016 brought about other, unexpected, crashes. “What has happened instead of a market crash was the crash in interest rates, which are adversely affecting millions of fixed-income retirees, pension plans, and savers — at the same time incentivizing people like me to become debtors, using debt to acquire income-producing real estate,” he said. Most retirement plans assume an 8% return, Kiyosaki said, but “when interest rates are a 1% or 0% or negative%, returns aren’t working.”

Lots of numbers, but none really matter much. The crux is that if there are Greek pensions that are too high, for instance compared to other European ones, cut them, fine. But don’t cut ones that are already below and and all minimal limits. That is not even worth being labeled policy, it’s simply inhumane.

• Greek Pensioners Brace For Latest Crisis Cuts (K.)

One group of Greeks that will look upon the return of creditors to Athens for talks aimed at completing the second review with some trepidation is the country’s 2.7 million pensioners. Since 2010, when Greece signed its first bailout with the eurozone and the IMF, the retirement age and social security contributions have increased, while pensions have come down. There is rarely a review that leaves pensions untouched and this one promises to be no different as lenders are targeting a reduction of annual pension spending by about 1.8 billion euros, or 1% of GDP. The IMF has been the most vociferous among Greece’s lenders regarding the need for a further overhaul of the country’s pension system to make it sustainable in the long run.

Between 2000 and 2010, pension spending in Greece climbed from 11 to 15% of GDP, mostly due to large increases in nominal pensions, generous benefits and options for early retirement. During this period, Greece’s figure was the second highest in the eurozone after that of Italy, according to the IMF. Despite two sets of reforms legislated in 2010 and 2012, pension expenditure continued rising and hit 17.7% in 2015, largely due to a GDP contracting by 25% while the average pension decreased by 8% between 2010 and 2015. The IMF believes the combination of low contribution revenues and high pension spending led to the pension deficit climbing from 7.3% of GDP in 2010 to 11% in 2015, making it by far the highest in the euro area.

It’s about access to the ECB’s QE program, where Draghi starts buying Greek bonds. And perhaps even the markets too. That would hugely limit Greece’s dependence on the Troika.

• Merkel Bypasses Schäuble To Push For Greek Review Conclusion (K.)

Kathimerini understands that German Chancellor Angela Merkel is prepared to do whatever it takes to conclude the second review of Greece’s third bailout so that it can join the ECB’s quantitative easing program (QE), on the condition that the government agrees to a package of pension cuts and a reduced tax threshold – amounting to roughly 2% of GDP. According to sources, Merkel has, to this end, already seized the initiative and met with ECB head Mario Draghi. The German chancellor is also expected to bypass any objections that may be raised by her finance minister, Wolfgang Schaeuble, and will push for a specific outline of what midterm measures for debt relief will look like – once Greece agrees to measures demanded by the IMF.

Draghi, as well as ECB executive board member Benoit Coeure, have already made it clear that Greece can only join the QE mechanism if it concludes the review, and midterm measures for debt relief are in place – which is something that, so far, Schaeuble has opposed. Merkel’s plan stipulates that after a staff level agreement is reached, the Greek Parliament will vote through the measures. When this is done, the specifics of the debt relief measures will be presented as a carrot to Athens. This will open the way for it to join the QE scheme and the IMF to rejoin the Greek program.

if this is true, it’s massive.

• US Stepping In To Ease Greece, Turkey Tensions (K.)

Washington appears to have activated a channel of communication with Ankara in a bid to reduce the recent spike in tensions with Greece in the Aegean Sea. According to sources, the US recently asked Ankara to tone down its aggressive stance in the Aegean. It is not known how Ankara has taken the American initiative, but it is clear that Washington fears a possible incident in the Aegean between the two NATO allies, which could destabilize the alliance’s southeast wing. Meanwhile, the incendiary rhetoric emanating from Ankara, albeit from nongoverment politicians, continued Tuesday with the leader of the ultra-right MHP party Devlet Bahceli speaking of Greek islands that remained “under occupation.” Bahceli is an ally of Recep Tayyip Erdogan and supports the bid by the Turkish president to expand his executive powers in the referendum that will take place in Turkey on April 16.

Citing what he described as international law, Bahceli called for the “unconditional end to the occupation of the islands,” referring to a string of islands and islets in the eastern Aegean. He went even further, referring to the Greek-Turkish war in 1922 and the way the Greek army was defeated by Turkish forces in Asia Minor – without, however, mentioning the Greek population of Turkey which was uprooted as a result of the war. “If [the Greeks] want to fall back into the sea [referring to how the Greek army was pushed out of Asia Minor] and if they are up to it, they are welcome to do it. The Turkish army is ready,” he said. The MHP leader also said the divided island of Cyprus is Turkish. Since the recent escalation of tension between Greece and Turkey, progress in the UN-backed peace talks between Greek and Turkish Cypriots has stalled.

Most remarkable thing must be that Trump has learned to read from a teleprompter, and was told to stick with only that.

• Trump Touts Unity Strength In Speech To Congress (R.)

President Donald Trump told Congress on Tuesday he was open to immigration reform, shifting from his harsh rhetoric on illegal immigration in a speech that offered a more restrained tone than his election campaign and first month in the White House. Trump, in a prime-time address to a country that remains divided over his leadership, set aside disputes with Democrats and the news media to deliver his most presidential performance to date, seeking to regain the confidence of Americans rattled by his leadership thus far. The president’s speech was long on promises but short on specifics on how to achieve a challenging legislative agenda that could add dramatically to budget deficits. He wants a healthcare overhaul, broad tax cuts and a $1 trillion public-private initiative to rebuild degraded roads and bridges.

Trump built a base of support behind his presidential campaign by vowing to fight illegal immigration. In his speech, he took a more moderate tone, appealing to Republicans and Democrats to work together on immigration reform. He said it was possible if both Republicans and Democrats in Congress were willing to compromise, although he also said U.S. immigration should be based on a merit-based system, rather than relying on lower-skilled immigrants. Comprehensive immigration reform eluded his two predecessors, Democrat Barack Obama and Republican George W. Bush, because of deep divisions within Congress and among Americans over the issue. Trump said reform would raise wages and help more struggling families enter the middle class. “I believe that real and positive immigration reform is possible, as long as we focus on the following goals: to improve jobs and wages for Americans, to strengthen our nation’s security, and to restore respect for our laws,” said the Republican president.

Dean Baker corrects the NYT.

• Donald Trump and Paul Ryan are Not Political Philosophers (Baker)

Apparently the paper is confused on this issue since it headlined a front page piece on the budget, “Trump budget sets up clash over ideology within G.O.P.” The article lays out this case in the fourth paragraph: “He [Trump] also set up a battle for control of Republican Party ideology with House Speaker Paul D. Ryan, who for years has staked his policy-making reputation on the argument that taming the budget deficit without tax increases would require that Congress change, and cut, the programs that swallow the bulk of the government’s spending — Social Security, Medicare and Medicaid.” Most of us recognize Donald Trump and Paul Ryan as politicians who hold their jobs as a result of being able to gain the support of important interest groups. It really doesn’t make much difference what their political philosophy is.

Contrary to what the NYT might lead us to believe, this is not a battle of political philosophy, it is a battle over money. On this score, the NYT also gets matters seriously confused. First of all, it is wrong to describe Social Security, Medicare, and Medicaid as “the programs that swallow the bulk of government spending.” Under the law, Social Security can only spend money raised through its designated taxes, either currently or in the past. For this reason, it is not a drain on the rest of the budget unless Congress changes the law. Medicaid would also not rank among the three largest programs. The government is projected to spend $592 billion this year on the military compared to $401 billion on Medicaid.

The claim that Paul Ryan is concerned that these programs would “swallow the bulk of government spending” directly contradicts everything Paul Ryan has been explicitly advocating for years. Ryan has repeatedly put forward budgets that would reduce the size of the federal government to zero outside of the military, Social Security, Medicare, and Medicaid. It is difficult to understand how a major newspaper can so completely misrepresent a strongly and repeatedly stated view of one of the country’s most important political figures.

Full blown insanity.

• This Chart Signals China’s Housing Bubble May Burst Soon (ME)

The probability that a real estate bubble may burst in China is rising. The financial sector heavily depends on real estate, which in turn exposes the entire Chinese economy to systemic risk. This link means that a downturn in real estate could soon spread to other areas of the Chinese economy if banks face liquidity shortfalls. Also, falling housing prices could result in more non-performing loans (NPLs). While NPLs officially account for only 1.75% of all Chinese loans, the government is likely understating the figure. BMI Research, a financial consulting firm, estimated in a 2016 report that NPLs could be close to 20% of loans.

As banks gave more credit to real estate developers and buyers, their profitability stalled. In theory, China’s economy is not based on capitalism and thus doesn’t revolve around profitability; but in practice, money needs to come from somewhere. A company that doesn’t make a profit can’t survive in the long run. The Chinese government can’t afford to let banks fail since it would threaten both the financial system’s health and the key lifeline to state-owned enterprises that provide jobs. This surge in China’s real estate prices, fueled by ongoing credit expansion, are forcing the government to choose between deflating the housing market and slowing growth.

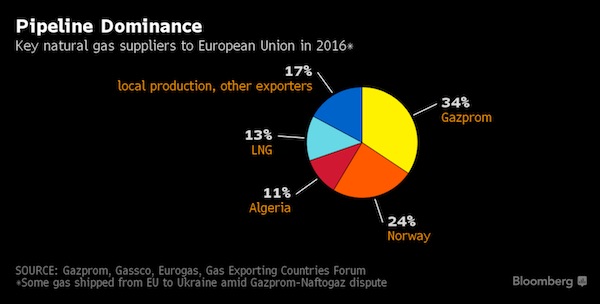

Pipelines vs pipedreams.

• Russia Seen Dominating European Energy for Two Decades (BBG)

Europe has wanted to wean itself from Russian natural gas ever since supplies from its eastern neighbor dropped during freezing weather in 2009. Almost a decade later, the region has never been more dependent. Gazprom, Russia’s state-run export monopoly, shipped a record amount of gas to the European Union last year and accounts for about 34% of the trading bloc’s use of the fuel. Russia will remain the biggest source of supply through 2035, Shell said last week, echoing comments by BP in January. EU lawmakers have had their hearts set on diversifying supplies with liquefied natural gas delivered by tanker from the U.S., where production of the fuel skyrocketed last year. So far, those shipments have failed to materialize amid a lack of firm contracts and higher prices outside Europe. Overall, LNG shipments to the region, led by Qatar, were stagnant last year. “Russia will for sure remain Europe’s largest gas supplier for at least two more decades,” even if most of the incremental gains in EU imports are met by LNG from somewhere else, said Vladimir Drebentsov, chief economist for Russia and CIS at BP in Moscow.

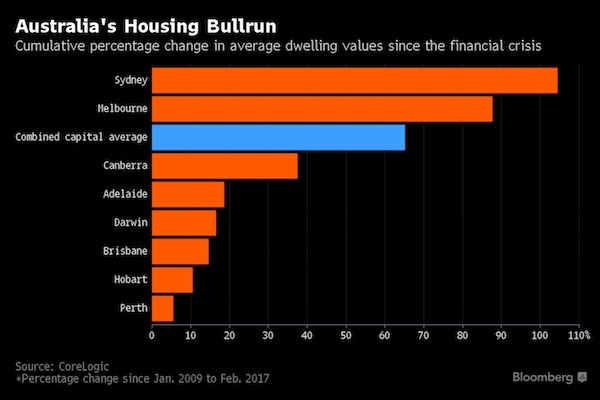

It was once a good place to live.

• Sydney Home Prices Surge 14.8%, Fastest Annual Pace Since 2002 (BBG)

Dwelling values in Australia’s largest city rose at the fastest annual pace in 14-years in February as record-low interest rates outweighed regulatory efforts to avert a housing bubble. Average values in Sydney surged by 18.4%, the biggest jump since December 2002 when the nation was at the tail-end of the early 2000’s housing boom, according to data provider CoreLogic Inc. Across the state capitals combined, values rose by 11.7%. Despite tighter lending restrictions aimed at discouraging speculative buying by landlords, the runaway housing market shows few signs of easing amid strong economic growth, historically low borrowing costs and a tax system that offers perks for property investors. Housing affordability has become a hot-button political issue, with New South Wales premier Gladys Berejiklian promising to make it one of her top priorities.

Last month, she appointed former Reserve Bank of Australia governor Glenn Stevens to advise on the options. Central bank Governor Philip Lowe has signaled he’d prefer not to ease interest rates as it would further inflate Sydney house prices and drive already record household debt even higher, threatening financial stability. “The strong growth conditions across Sydney have provided a substantial wealth boost for home owners,” said Tim Lawless, head of research at CoreLogic. “However, the flipside is that housing costs are becoming increasingly out of reach.” Prices are now almost 8.5 times higher than household incomes in Sydney, according to CoreLogic. There are, however, considerable regional variations. Perth, in the mining heartland of Western Australia that’s suffering as a decade-long investment boom winds down, saw values fall by 4.5% in the year to February.

You can’t easily tweak internation law on nuclear. For good reasons.

• UK Nuclear Power Stations ‘Could Be Forced To Close’ After Brexit (G.)

Nuclear power stations would be forced to shut down if a new measures are not in place when Britain quits a European atomic power treaty in 2019, an expert has warned. Rupert Cowen, a senior nuclear energy lawyer at Prospect Law, told MPs on Tuesday that leaving the Euratom treaty as the government has promised could see trade in nuclear fuel grind to a halt. The UK government has said it will exit Euratom when article 50 is triggered. The treaty promotes cooperation and research into nuclear power, and uniform safety standards. “Unlike other arrangements, if we don’t get this right, business stops. There will be no trade. If we can’t arrive at safeguards and other principles that allow compliance [with international nuclear standards] to be demonstrated, no nuclear trade will be able to continue.”

Asked by the chair of the Commons business, energy and industrial strategy select committee if that would see reactors switching off, he said: “Ultimately, when their fuels runs out, yes.” Cowen said that in his view there was no legal requirement for the UK to leave Euratom because of Brexit: “It’s a political issue, not a legal issue.” The UK nuclear industry would be crippled if new nuclear cooperation deals are not agreed within two years, a former government adviser told the committee. “There is a plethora of international agreements that would have to be struck that almost mirror those in place with Euratom, before we moved not just material but intellectual property, services, anything in the nuclear sector. We would be crippled without other things in place,” said Dame Sue Ion, chair of the Nuclear Innovation and Research Advisory Board, which was established by the government in 2013.

Bur perhaps none of this matters in the long run, perhaps waste is the inevitable consequence of the need to feel rich, be rich. As Ken Latta put it in his February 23 article here at the Automatic Earth: “wealth is best measured by the capacity to be utterly wasteful”.

• Denmark Reduces Food Waste By 25% In 5 Years With Help Of One Woman (Ind.)

Never underestimate the power of one dedicated individual. A woman has been credited by the Danish Government for single-handedly helping the country reduce its food waste by 25% in just five years. Selina Juul, who moved from Russian to Denmark when she was 13 years old, was shocked by the amount of food available and wasted at supermarkets. She told the BBC: “I come from a country where there were food shortages, we had the collapse of infrastructure, communism collapsed, we were not sure we could get food on the table”. Her organisation, Stop Spild Af Mad – which translates as Stop Wasting Food – made all the difference and is recognised as one of the key drivers behind the government’s focus to tackle food waste.

“She was this crazy Russian woman that walked in the door, with a crazy idea about stop wasting food and she has come really far since,” Maria Noel, communication officer of Dagrofa, a Danish retail company, told the BBC. “She basically changed the entire mentality in Danemark,” she added. Ms Juul convinced Rema 1000, the country’s biggest low-cost supermarket chain, to replace all its quantity discounts with single item discounts to minimise food waste. Max Skov Hanser, a grocer at Rema 1000, said the retailer wasted about 80 to 100 bananas every day. However, after the supermarket put up a sign saying “take me I’m single”, it reduced the waste on bananas by 90%. In the past five years Denmark has become one of the leading European countries in the fight against food waste. Last year, a charity in Copenhagen opened Denmark’s first ever food surplus supermarket, which sells products at prices 30 to 50% cheaper than usual retailers.

On Wendell Berry.

• The World-Ending Fire – How America’s Farmers Betrayed The Land (G.)

Berry’s essays roam widely over such topics as “Writer and Region” (an A-grade discussion of The Adventures of Huckleberry Finn), “The Work of Local Culture” and his high-minded disinclination to swap his ancient typewriter for a computer (complete with several shocked technophile responses). But the majority of them return, out of a kind of disgust, to the idea of betrayal, and the way in which the US farming industry has abandoned its responsibility to the terrain it has been cultivating for the last century and a half. The startling aspect of this charge sheet is its proxy villain, which is neither the cereal companies nor the burger chains but the American dream. Ronald Reagan once named his favourite children’s books as Laura Ingalls Wilder’s Little House series, in which the resourceful Ingalls family head west across the newly available prairie states.

Pa chops trees, builds shacks and plants corn while Ma keeps house and thinks the native population “dirty”. To Berry, by contrast, the Pa Ingallses of the 1870s midwest are simply opportunists casting aside the old ways without bothering to reflect on their value, exploiters whose hard work and high moral tone obscure the absence of any real relationship with the land they are bent on despoiling. “A Native Hill”, a series of pointed reflections on the landscape of Henry County, Kentucky, notes that the original inhabitants had managed to preserve its integrity for thousands of years. The pioneers “in a century and half plundered the area of at least half its topsoil and virtually all its forest”, and constructed a road they may not have needed in the first place.

On the one hand, Berry is placing the Native American Indians and Pa Ingalls in false opposition: the effervescing Ingalls brood were different kinds of people – most obviously, nomads and settlers – wanting different things from the world they inhabited. On the other hand, Berry’s agrarian arguments are persuasive. To produce five feet of topsoil, he suggests in “The Making of a Marginal Farm”, takes 50,000 to 60,000 years. Meanwhile, the rallying cries are mounting up: think small; distrust the combines; a family can live for a year off a 60 sq ft vegetable plot; nobody ever did themselves any good by living in a city (he derides “the assumption that the life of the metropolis is the experience, the modern experience … ”).

As for The World-Ending Fire’s implications, you can just about envisage a future in which, once the fossil fuels have run out, necessity forces us all to live in smaller, self-sustaining societies without the benefit of the internal combustion engine. So perhaps Berry will have the last laugh. Whether by that stage in human evolution it will be worth having is another matter.

Home › Forums › Debt Rattle March 1 2017