Francesco Hayez The Death of the Doge Marin Faliero 1867

We’re ruled by fear. There’s simply painfully little common sense left. But here’s some…

“..lockdown measures have caused 282 times more harm than benefit to Canadian society over the long term ..”

• Flaw In Many Models Used For COVID-19 Lockdown Policies (ET)

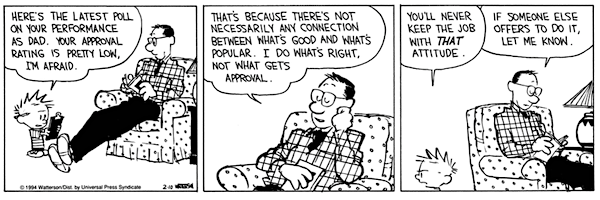

Economics professor Doug Allen wanted to know why so many early models used to create COVID-19 lockdown policies turned out to be highly incorrect. What he found was that a great majority were based on false assumptions and “tended to over-estimate the benefits and under-estimate the costs.” He found it troubling that policies such as total lockdowns were based on those models. “They were built on a set of assumptions. Those assumptions turned out to be really important, and the models are very sensitive to them, and they turn out to be false,” said Allen, the Burnaby Mountain Professor of Economics at Simon Fraser University, in an interview.

Allen says most of the early cost-benefit studies that he reviewed didn’t try to distinguish between mandated and voluntary changes in people’s behaviour in the face of a pandemic. Rather, they just assumed an exponential growth of cases of infection day after day until herd immunity is reached. In a paper he published in April, in which he compiled his findings based on a review of over 80 papers on the effects of lockdowns around the world, Allen concluded that lockdowns may be one of “the greatest peacetime policy failures in Canada’s history.” He says many of the studies early in the pandemic assumed that human behaviour changes only as a result of state-mandated intervention, such as the closing of schools and non-essential businesses, mask and social distancing orders, and restrictions on private social gatherings.

However, they didn’t take into consideration people’s voluntary behavioural changes in response to the virus threat, which have a major impact on evaluating the merits of a lockdown policy. “Human beings make choices, and we respond to the environment that we’re in, [but] these early models did not take this into account,” Allen said. “If there’s a virus around, I don’t go to stores often. If I go to a store, I go to a store that doesn’t have me meeting so many people. If I do meet people, I tend to still stand my distance from them. You don’t need lockdowns to induce people to behave that way.”

Allen’s own cost-benefit analysis is based on the calculation of “life-years saved,” which determines “how many years of lost life will have been caused by the various harms of lockdowns versus how many years of lost life were saved by lockdowns.” Based on his lost-life calculation, lockdown measures have caused 282 times more harm than benefit to Canadian society over the long term, or 282 times more life years lost than saved.

More common sense. Google translate from France Soir.

• French Parliament Wakes Up And Says No To The Health Pass (FS)

Article 1 of the bill proposed by the government on the issue of ending the health crisis was rejected by the National Assembly. It was the one that specified the operating methods of the health pass. On April 28, the government proposed its bill relating to the management of the exit from the health crisis. Article 1 of this project made the famous “sanitary pass” appear in black and white, which was to be implemented little by little over the summer, in particular for events welcoming more than 1,000 people. First, this bill went through the committee, then was admitted at first reading in the National Assembly yesterday, Monday, May 10, with 234 amendments to be studied. During more than six hours of debate, these amendments were swept away one by one, whether they were a deletion of an article, a rewrite or even a simple clarification.

As a result, this Tuesday morning, the newspapers overwhelmingly headlined that the “green light for the health pass” had been given by the National Assembly. That was indeed how things were shaping up. Roland Lescure, LREM deputy, to describe these measures as “a condition of regained freedoms”. Only, as Philippe Gosselin, LR deputy rightly and ardently pointed out, the opposition and the majority converged yesterday, in places, to say that the project had errors and inconsistencies. Martine Wonner, MP for Freedom and Territories, asked the question even more clearly: “In peacetime, the Republic has never known such restriction of freedoms. So who is the government at war with?”

Yesterday evening, the deputies were only 143 to be present in the hemicycle. Today, there were 213. Finally, at the end of the study of the amendments to article 1, the vote proved the opposition right! As a result, article 1, on which the majority of the bill is based, is not adopted: 211 voters: 103 FOR / 108 AGAINST For good reason, while it has been four years since it happened, the MoDem has dissociated itself from the majority. They who quoted Victor Hugo yesterday: “in the storm and the noise, clarity reappears, increased”. Philippe Latombe thus underlined the will of the people, namely to have a “coherent and clear political voice”. In fact, the MoDem deputies were demanding regarding the adoption of this bill and the characteristics of the health pass. While for 14 months the power of Parliament had at least been reduced, the deputies were able to be heard this evening.

The opposite of common sense.

• NHS App Ready To Become Vaccine Passport Next Week (BBC)

England’s NHS app will be available to use as a vaccine passport from Monday, the government has said – but only for those who have had both doses of the jab. A paper version will also be available – by calling 119 but not through a GP. Both will be available from Monday, 17 May, when the ban on foreign travel is eased. The NHS app is separate to the NHS Covid-19 app, which is used for contact tracing. People can already use the NHS app to: • request repeat prescriptions • arrange appointments to see their doctor • view medical records • It can also show vaccine statuses, including for coronavirus, but currently this feature must be enabled by a GP before it appears on the app.

The new update will contain a separate feature to display coronavirus vaccine records, so the government said there should be no need to contact GPs. The app will not show coronavirus test results, but the NHS plans to incorporate this in the future, the government website said. It advised people to register to use the app at least two weeks before travelling. A paper letter can be requested only at least five days after a second vaccine dose and can take five days to arrive. “There are not many countries that currently accept proof of vaccination,” the government advice warns. “So for the time being, most people will still need to follow other rules when travelling abroad – like getting a negative pre-departure test.”

The government has announced 12 countries people in England can travel to, without having to quarantine when they return. But not all of these destinations allow UK tourists. For example, travel to mainland Portugal and the Azores is currently for essential purposes only. The list will be reviewed every three weeks. Countries can be added or removed at short notice.

Will we see this in more places?

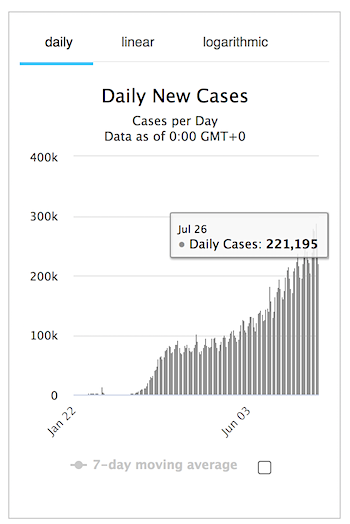

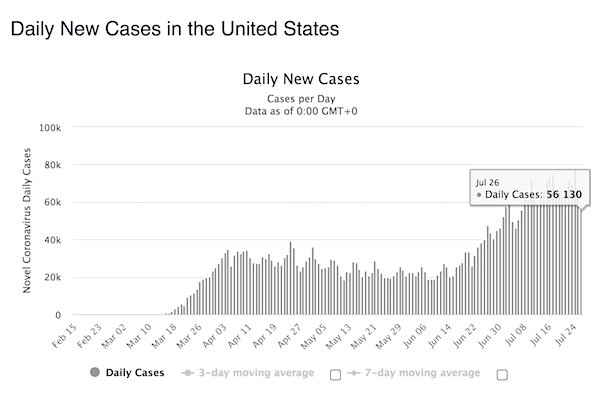

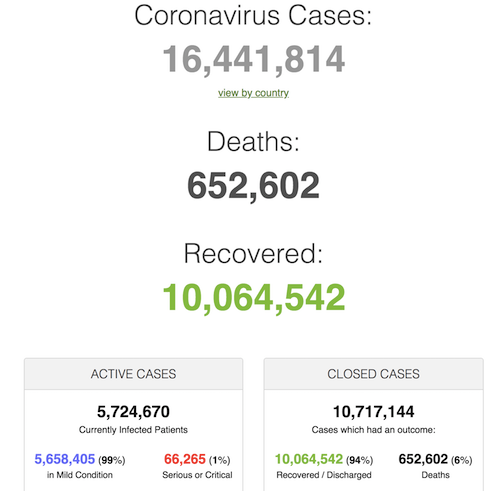

• World’s Most Vaccinated Nation Sees Active COVID Cases Double In A Week (ZH)

The situation in the Seychelles, an island nation that has suffered from a recent surge in COVID-19 cases despite boasting the world’s highest vaccination rate, is going from bad to worse. Since we last reported on the Seychelles one week ago, the island nation has faced a fresh surge in COVID cases. The vaccine failure cannot be determined without a detailed assessment, said the WHO. The hike in coronavirus cases has stoked concerns that the jabs might not be helping to suppress the island nation’s COVID-19 outbreak. A vaccine failure can’t be determined without a detailed study by the WHO, however. Presently, the health body is in direct communication with Seychelles and working on evaluating the situation, said Kate O’Brien, director of the WHO’s department of immunization, vaccines and biologicals at a briefing on May 10.

The Indian Ocean archipelago nation started vaccinations in January when it introduced the Chinese-developed Sinopharm vaccine. It administered Chinese vaccine shots to 57% of those who were fully inoculated and the rest received vaccines that were made in India. Since last week, the number of active coronavirus cases has more than doubled to 2,486 people. Of these, 37 percent of the population have received both the vaccine doses, as per the report. Due to the surge in COVID-19 cases, Seychelles re-imposed curbs last week, including closing schools, canceling sports events and banning mingling of households.

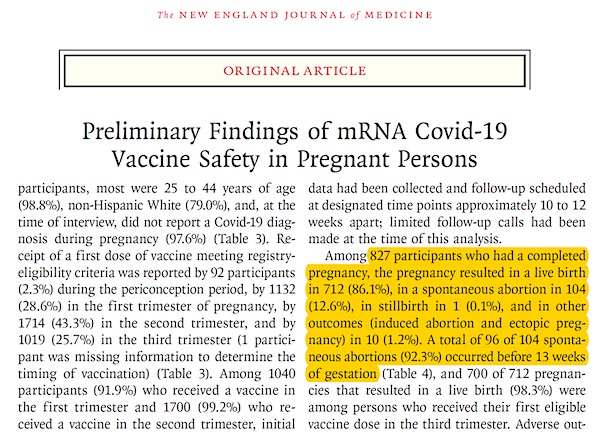

Imagine taking an mRNA injection when you’re pregnant. “Pregnant Persons” sounds like a sign of our times. I will not get used to it.

• mRNA Covid-19 Vaccine Safety in Pregnant Persons (NEJM)

BACKGROUND Many pregnant persons in the United States are receiving messenger RNA (mRNA) coronavirus disease 2019 (Covid-19) vaccines, but data are limited on their safety in pregnancy.

METHODS From December 14, 2020, to February 28, 2021, we used data from the “v-safe after vaccination health checker” surveillance system, the v-safe pregnancy registry, and the Vaccine Adverse Event Reporting System (VAERS) to characterize the initial safety of mRNA Covid-19 vaccines in pregnant persons.

RESULTS A total of 35,691 v-safe participants 16 to 54 years of age identified as pregnant. Injection-site pain was reported more frequently among pregnant persons than among nonpregnant women, whereas headache, myalgia, chills, and fever were reported less frequently. Among 3958 participants enrolled in the v-safe pregnancy registry, 827 had a completed pregnancy, of which 115 (13.9%) resulted in a pregnancy loss and 712 (86.1%) resulted in a live birth (mostly among participants with vaccination in the third trimester). Adverse neonatal outcomes included preterm birth (in 9.4%) and small size for gestational age (in 3.2%); no neonatal deaths were reported. Although not directly comparable, calculated proportions of adverse pregnancy and neonatal outcomes in persons vaccinated against Covid-19 who had a completed pregnancy were similar to incidences reported in studies involving pregnant women that were conducted before the Covid-19 pandemic. Among 221 pregnancy-related adverse events reported to the VAERS, the most frequently reported event was spontaneous abortion (46 cases).

CONCLUSIONS Preliminary findings did not show obvious safety signals among pregnant persons who received mRNA Covid-19 vaccines. However, more longitudinal follow-up, including follow-up of large numbers of women vaccinated earlier in pregnancy, is necessary to inform maternal, pregnancy, and infant outcomes.

Bit of PR from SCMP. What it depicts mostly is the difficulty in having the “poor” vacccinated.

• Sinovac Shot Causes ‘Drastic Drop’ In Deaths, Infections (SCMP)

Sinovac Biotech Ltd’s vaccine is wiping out Covid-19 among health workers in Indonesia, an encouraging sign for the dozens of developing countries reliant on the controversial Chinese shot, which performed far worse than Western vaccines in clinical trials. Indonesia tracked 25,374 health workers in capital city Jakarta for 28 days after they received their second dose and found that the vaccine protected 100 per cent of them from death and 96 per cent from hospitalisation as soon as seven days after, said Health Minister Budi Gunadi Sadikin in an interview on Tuesday. The workers were tracked until late February.

Sadikin also said that 94 per cent of the workers had been protected against infection – an extraordinary result that goes beyond what was measured in the shot’s numerous clinical trials – though it is unclear if the workers were uniformly screened to detect asymptomatic carriers. “We see a very, very drastic drop,” in hospitalisation and deaths among medical workers, Sadikin said. It is not known what strain of the coronavirus Sinovac’s shot worked against in Indonesia, but the country has not flagged any major outbreaks driven by variants of concern. The data adds to signs out of Brazil that the Sinovac shot is more effective than it proved in the testing phase, which was beset by divergent efficacy rates and questions over data transparency. Results from its biggest Phase III trial in Brazil put the shot known as CoronaVac’s efficacy at just above 50 per cent, the lowest among all first-generation Covid-19 vaccines.

In a separate interview with Bloomberg on Tuesday, Sinovac’s CEO Yin Weidong defended the disparity in clinical data around the shot, and said there was growing evidence CoronaVac is performing better when applied in the real world. But the real-world examples also show that the Sinovac shot’s ability to quell outbreaks requires the vast majority of people to be vaccinated, a scenario that developing countries with poor health infrastructure and limited access to shots cannot reach quickly. In the Indonesian health worker study, and another in a Brazilian town of 45,000 people called Serrana, nearly 100 per cent of people studied were fully vaccinated, with serious illness and deaths dropping after they were inoculated.

Time for the NIH to come clean.

• Rand Paul Clashes With Fauci Over Coronavirus Origins (Hill)

Anthony Fauci on Tuesday clashed with Sen. Rand Paul (R-Ky.) over the role of the Wuhan, China, virology lab in the origins of COVID-19. During a Senate hearing on the pandemic response, Paul alleged that the National Institutes of Health (NIH) had been sending funding to the Wuhan lab, which then “juiced up” a virus that was originally found in bats to create a supervirus that can infect human cells. Paul pressed Fauci on the theory that the novel coronavirus was created in the Wuhan lab, and then somehow escaped, either because of an accident or because it was deliberately released. “Sen. Paul, with all due respect, you are entirely, entirely and completely incorrect,” Fauci said. “The NIH has not ever, and does not now, fund ‘gain of function research’ in the Wuhan Institute.”

Paul continued to argue with Fauci, who is the director of the NIH’s National Institute of Allergy and Infectious Diseases (NIAID), accusing him of cooperating with the Chinese government, and supporting the laboratory that bioengineered a deadly virus. Fauci noted that although the NIH did fund a project at the Wuhan lab, it was not meant for “gain of function” research into human-made superviruses. The NIH gave a grant to a group called EcoHealth Alliance, which hired the virology lab in Wuhan to conduct genetic analyses of bat coronaviruses and examine how they spread to humans. The Trump administration last year forced the NIH to terminate the grant. The false link between Fauci, the NIH and the Wuhan lab has been circulating among right-wing media and politicians like Paul and Sen. Ron Johnson (R-Wis.) for months.

“Let me explain to you why that was done, the SARS COV-1 originated in bats in China. It would have been irresponsible of us if we did not investigate the bat viruses and the serology to see who might have been infected,” Fauci said. Gain of function research is a controversial form of study that involves boosting the infectivity and lethality of a pathogen. Fauci has advocated for the research in the past, but he denied that the NIH was funding it in China. But Paul interrupted him, and hinted that not only was the virus introduced to the world because of a lab accident, it was also biologically engineered. “Government scientists like yourself who favor gain function … ” Paul said. “I don’t favor gain of function research in China and you are saying things that are not correct,” Fauci interrupted.

Fauci Rand Paul

https://twitter.com/i/status/1392137203925622790

“Taking down the grid would be, effectively, the end of civilization, at least for a while, maybe a long while, maybe for good.”

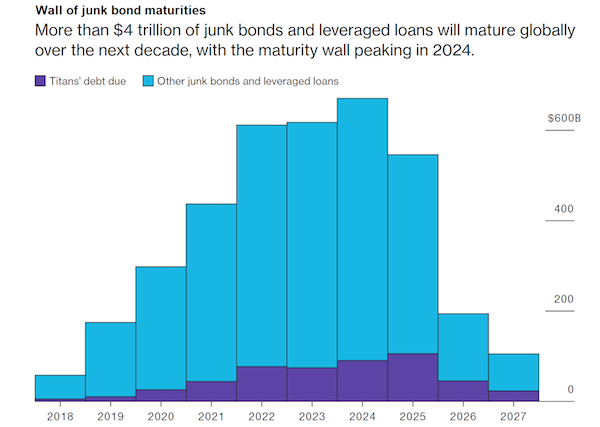

• The Raptures of Hyper-Complexity (Kunstler)

I think you get the picture. That whole kit of industrial production is long gone, and we’re left in an economic slum of Chinese product “welfare” (stuff for treasury bonds) juiced on computer-driven hyper-complexity, decorated with junk enterprise like social media, streaming pornography, crypto-currency mining, and chicken nuggets — with a lot of deceptive and useless motion in the form of mass motoring to provide the illusion that this country is actually going somewhere… all with a poison Chinese Covid-19 cherry-on-top. This is the outfit that Joe Biden is ostensibly the president of. Now along comes the curious case of the Colonial Pipeline shutdown. It’s especially interesting because the pipeline itself, while big (5,500 miles long, from refineries in Texas clear up to gas stations in New York), is itself not that complicated.

It’s a tube that a few volatile liquids move through: gasoline, aviation fuel, diesel oil. It has a bunch of valves to regulate the flows of these liquids. Plus, some storage tank-farms. The valves are computerized. That seems to be the problem. There was no physical damage to the pipeline and its components. The software that runs it got hacked, reportedly a “ransom-ware” sting, where unknown actors get control of the software and won’t relinquish it unless a whole lot of cash gets forked over by some non-traceable electronic means of transfer. I imagine it’s this last point that Colonial and its hackers are haggling over now, which explains the failure to restart the otherwise undamaged pipeline. I also imagine, meanwhile, all kinds of private and government computer savants are trying like hell to hack the hack behind the scenes.

The Colonial Pipeline is easy-peasy compared to the financial system and the electric grid. If the first one gets hacked, the nation’s nominal wealth might disappear (yours included), and, anyway, the financial system itself is not just enormous and hyper-complex, but much of its complexity conceals the massive misrepresentation of vaporous entities for “money” and any stoppage of the flows of that “money,” and things purporting to derive from it, will reveal the black hole at the center of all that activity. Hear that giant sucking sound? That was your livelihood, your pension, and your legacy rushing by en route to zero.

The electric grid is sometimes referred to as “the biggest machine in the world.” Unlike the financial system, it’s not largely stoked on hyper-complex dishonesty, it’s just really old, and jerry-rigged, and held together with duct-tape and baling wire. Probably a few kids in a basement somewhere — not even enemies of the republic, necessarily — could initiate a software attack that causes a whole lot of damage to transformers and other vital components and starts a process that wrecks the whole darn thing. Taking down the grid would be, effectively, the end of civilization, at least for a while, maybe a long while, maybe for good.

The mega Colonial spill last year would seem to be connected to this.

• Stop The Crap On Colonial (Denninger)

Let’s start with the stupid: Yes, what they did, assuming the reports are accurate, was stupid. You do not connect anything that has access to SCADA, that is, control systems, to the Internet. Period. I don’t care how. I don’t why. I don’t care what. You don’t do it. End of discussion. Oh, but that means the employees can’t work from home! Correct. Sit in office, work on machine, machine has zero external connectivity, no USB ports or instantly alarms if you plug something into one, etc. Connections between facilities are encrypted over centrally-controlled infrastructure with regular audits. Nothing beyond the orbit of those devices connects to the sane and sanitary systems. Period, end of discussion, no exceptions. Next, there are rumors that Colonial had a leak in their line and it was spewing fuel into the environment.

It was allegedly supposed to be fixed by a given date. More than one million gallons of gas spewed out of it. Eight months later it was still not corrected. That was on April 19th of this year. So what’s going on here? I get it. Things break. We rely on “things” for our daily lives. A certain amount of human error and trouble is expected. I’m ok with this; many are not, but I am because I like to have fuel in my car and groceries on the shelves, and without said technology, which comes with risk, we won’t have those things. There are people who think we can avoid all that. They’re wrong.

But how many articles have I written over the last 13 years talking about cybersecurity and proper control over one’s infrastructure when it comes to critical items. You know, like pipeline pressures, delivery quantities, etc? How is it that this sort of volume of gasoline managed to get out? Is there not a set of flow meters on the inlet and outlet, and do they not match? Are there not pressure transducers that detect a violation of the pipe’s integrity? Is not the characterization of the flow known; the pipe is “X” length, the pressure is “Y”, the flow is “Z” and we know what it’s made of so we should be able to reasonably compute what the frictional loss is over a given distance. Further, as should be obvious, if 1,000 gallons go in one end then exactly 1,000 gallons have to come out the other end, right? This isn’t a damned garden spray-nozzle!

“Granholm said that there was not a supply shortage, but rather a “crunch”..”

• US States Declare Emergency Over Gas Shortage Fears (DW)

Several east coast US states declared a state of emergency on Tuesday as gas stations began to run out of gasoline, five days after a cyberattack brought down the key Colonial pipeline. Despite assurances from President Joe Biden’s administration that the pipeline, which provides almost half the gas to the eastern seaboard, would be up and running within days, panicked drivers continued to top up their tanks. “We are asking people not to hoard,” US Energy Secretary Jennifer Granholm told reporters at the White House. “Things will be back to normal soon.” State governors in Florida, Georgia, North Carolina and Virginia implemented states of emergency to deal with the growing number of gas stations that were running out of fuel.

Declaring a state of emergency allows state governments to activate the National Guard as needed, and helps streamline cooperation between state and local officials. In the Georgia metropolis of Atlanta, some 30% of gas stations had run dry, with a similar number in Raleigh, North Carolina, according to the tracking firm GasBuddy. By 4 p.m. EST (20:00 UTC) almost 8% of gas stations throughout the state of Virginia had run out of gas, while in Florida close to 3% were empty, CNN reported. Granholm said that there was not a supply shortage, but rather a “crunch” in some states that are particularly reliant on the Colonial pipeline. Georgia lifted sales tax on gas until Saturday to help consumers while the federal government temporarily loosened certain environmental and working hours regulations to smooth out the problems.

End the Fed.

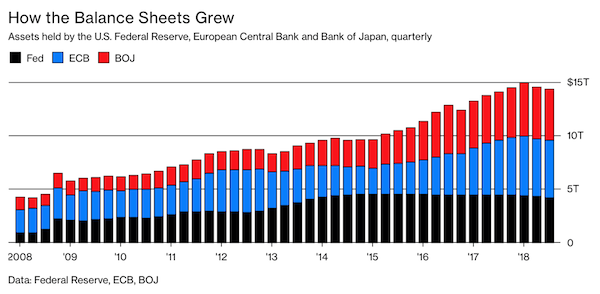

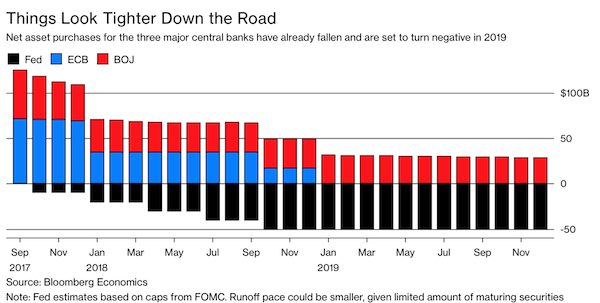

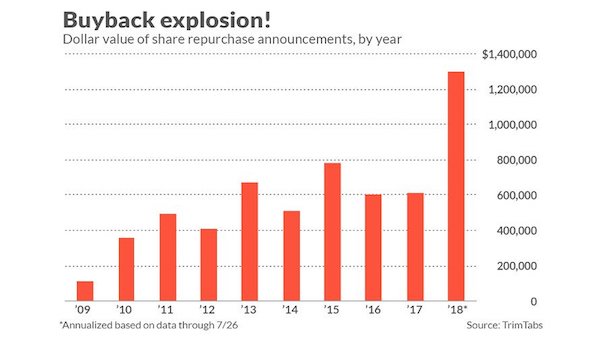

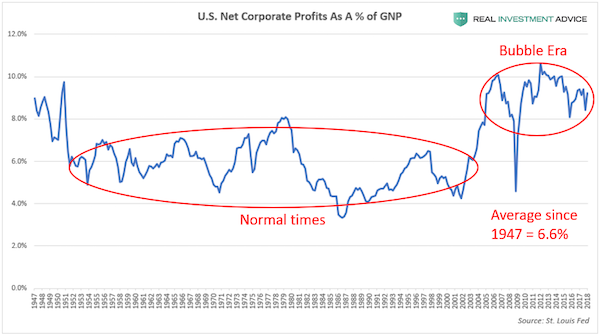

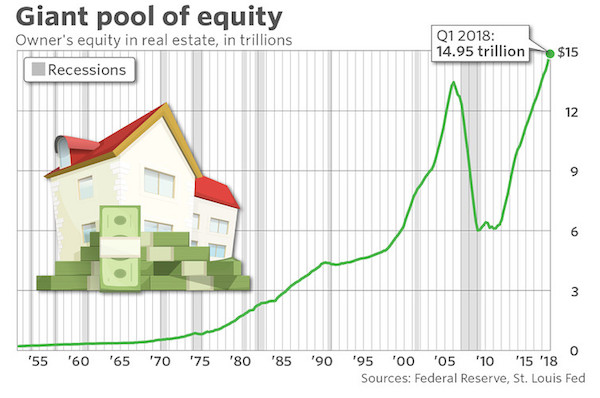

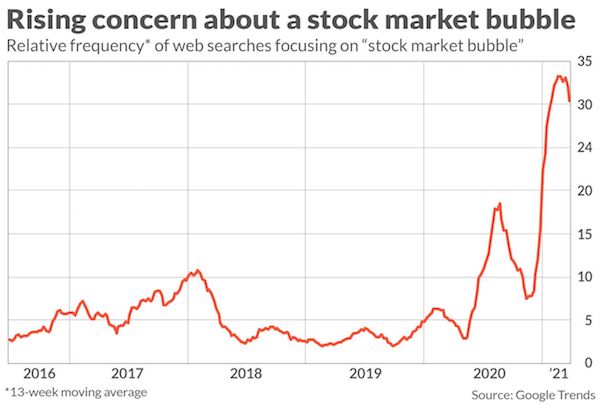

• If Everyone Sees It, Is It Still A Bubble? (RIA)

“If everyone sees it, is it still a bubble?” That was a great question I got over the weekend. As a “contrarian” investor, it is usually when “everyone” is talking about an event; it doesn’t happen. As Mark Hulbert noted recently, “everyone” is worrying about a “bubble” in the stock market. To wit: “To appreciate how widespread current concern about a bubble is, consider the accompanying chart of data from Google Trends. It plots the relative frequency of Google searches based on the term ‘stock market bubble.’ Notice that this frequency has recently jumped to a far-higher level than at any other point over the last five years.”

What Is A Bubble? “My confidence is rising quite rapidly that this is, in fact, becoming the fourth ‘real McCoy’ bubble of my investment career. The great bubbles can go on a long time and inflict a lot of pain, but at least I think we know now that we’re in one.” – Jeremy Grantham What is the definition of a bubble? According to Investopedia: “A bubble is a market cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. Typically, what creates a bubble is a surge in asset prices driven by exuberant market behavior. During a bubble, assets typically trade at a price that greatly exceeds the asset’s intrinsic value. Rather, the price does not align with the fundamentals of the asset.“

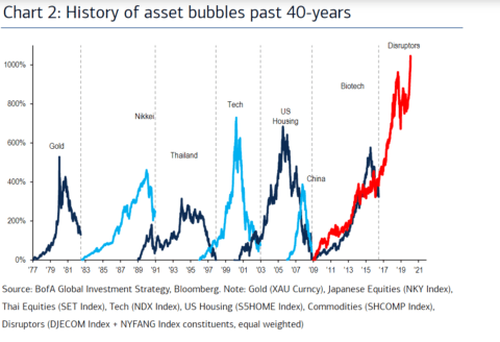

This definition is suitable for our discussion; there are three components of a “bubble.” The first two, price and valuation, are readily dismissed during the inflation phase. Jeremy Grantham once produced the following chart of 40-years of price bubbles in the markets. During the inflation phase, each was readily dismissed under the guise “this time is different.” As Howard Marks previously noted: “It’s the swings of psychology that get people into the biggest trouble. Especially since investors’ emotions invariably swing in the wrong direction at the wrong time. When things are going well people become greedy and enthusiastic. When times are troubled, people become fearful and reticent. That’s just the wrong thing to do. It’s important to control fear and greed.”

He was sentenced because of “jigsaw identification”, but no-one was identified.

“..the women who are meant to be threatened with jigsaw ID all remained anonymous, Alex Salmond’s life was destroyed, and Craig Murray’s life is about to be destroyed too.”

• Whistleblower Craig Murray Sentenced To 8 Months In Prison (Elmaazi)

Former UK diplomat-turned whistleblower Craig Murray was sentenced to eight months in prison at the High Court in Edinburgh for contempt of court resulting from his coverage of the trial of former Scottish First Minister Alex Salmond. A three-judge panel determined on March 25, 2021—following a two-hour trial in January—that information published by Murray in a number of his blog posts was likely to lead indirectly to people being able to identify witnesses in Salmond’s sexual assault trial. This process, known as “jigsaw identification,” refers to the possibility that a person may piece together information from various sources to arrive at the identification of a protected witness.

In doing so, the judge ruled that Murray violated a court order prohibiting the publication of information that could likely lead to the identification of the alleged victims in Salmond’s case. Murray is a broadcaster, human rights advocate and journalist, who has extensively covered the prosecution of WikiLeaks founder Julian Assange and is known to support other whistleblowers. He also strongly supported Salmond and the Scottish campaign for independence. He denied the charges, arguing he went to great pains to cover the prosecution without identifying the witnesses. The trial and eight-month prison sentence was heavily criticized by a number of veteran Scottish journalists and lawyers.

Hugh Kerr, a former vice chair of the National Union of Journalists who was once a Labour Party Member of the European Parliament before he joined the SNP, told The Dissenter that he considered both the verdict and the sentence in Murray’s case to be “disgraceful.” “[This decision represents] a real threat to civil liberties,” Kerr argued. “A key point, of course, the women who are meant to be threatened with jigsaw ID all remained anonymous, Alex Salmond’s life was destroyed, and Craig Murray’s life is about to be destroyed too.” “I know that Craig shall appeal not only to the Supreme Court but also to the European Court of Human Rights. He will do so with the support of many people in Scotland and many people around the world,” Kerr added.

“It is believed to be the first instance in Scottish legal history where ‘jigsaw identification’ has led to an individual being imprisoned,” a statement released on behalf of Murray’s family declared. Award-winning investigative journalist John Pilger said, “In these dark times, Craig Murray’s truth-telling is a beacon. He is owed our debt of gratitude, not the travesty of a prison sentence which, like the prosecution of Julian Assange, is a universal warning.” “Craig Murray has compiled a remarkable record of courage and integrity in exposing crimes of state and working to bring them to an end,” Professor Noam Chomsky stated, contending Murray “fully merits our deep respect and support for his achievements.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

On this day in 330, Constantine The Great dedicated the ancient Greek city of Byzantium as the new capital of the Eastern Roman Empire and renamed it Constantinople.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.