Claude Monet The pond at Montgeron 1876

Tick tick tick…

Cruz on Warren

You know, there are decaffeinated brands on the market that are just as tasty. https://t.co/W5r0Fzy6oK

— Ted Cruz (@tedcruz) September 27, 2020

A lot of Amy Coney Barrett of course today.

• Amy Coney Barrett Senate Confirmation Hearing Set To Start Oct. 12 (NBC)

While President Donald Trump officially announced his nominee for the Supreme Court on Saturday afternoon, an expeditious timeline had already started to take shape that could kick off confirmation hearings as early as mid-October. Senate hearings, which for the last three Supreme Court justices began nearly two months after they were nominated, could start as soon as Oct. 12, a Republican aide familiar with the matter told NBC News before Judge Amy Coney Barrett was officially announced as the nominee. Hours after Trump nominated Barrett to replace the late Ruth Bader Ginsburg, the aggressive timeline was made official by Senate Judiciary Chairman Lindsey Graham, who said on Fox News that confirmation hearings will start on Oct. 12, less than one month before the Nov. 3 election.

Graham said hearings will start with an introduction to Barrett, opening statements, and a statement by the nominee. Tuesday and Wednesday of that week will be dedicated to questions and answers and then the markup process would start on Thursday. Per committee rules, the nomination can be held by Democrats for one week because it is the first time the nomination is on the agenda, said Graham, who hopes to have the nominee out of committee by Oct. 26 and then it’s up to Senate Majority Leader Mitch McConnell, R-Ky, to set the floor schedule. “If they treat her as bad as they treated [Justice Brett Kavanaugh], it’s going to blow up in their face,” Graham said of Democrats on Fox News.

“If they continue this pattern of trying to demean this nominee, I think the American people will push back and push back hard.” Both Barrett and Trump acknowledged that her confirmation hearings could get ugly as Democrats attempt to block a vote until after the election. One Judiciary Committee member, Sen. Richard Blumenthal, D-Conn., said he would not meet with Barrett, which is customary for committee members, in protest of Trump’s decision to rush ahead with the nomination with the election only 38 days away. “I refuse to treat this process as legitimate and will not meet with Judge Barrett,” Blumenthal said in a statement. Barrett said on Saturday that she has “no illusions that the road ahead of me will be easy, either for the short term or the long haul.”

Balding

I for one welcome a SCOTUS nomination at this point in history. It will allow America to show to the world our calm rational analytical approach to thorny questions of legal philosophies that challenge fundamental questions of democracies but draw us together respectfully

— CCP Collaborator Balding 大老板 (@BaldingsWorld) September 26, 2020

As seen through the eyes of a man?!

• Supreme Court Nomination Is A Testament To The Values Of Feminism (Turley)

In her book, “In My Own Words,” Justice Ruth Bader Ginsburg wrote how feminism is a concept best captured in the song “Free to Be You and Me” by Marlo Thomas. That definition defined feminism as allowing women to decide their values without societal dictates or limits. This view sharply contrasts with some who think feminism is adhering to liberal orthodoxy. Ginsburg never believed feminism meant removing the “feet off our necks” by her brothers just to have them replaced by the feet of her sisters. Indeed, true feminism meant allowing women the freedom of choice to find their own voices and values in society. That is why this nomination of a Supreme Court justice is a testament not just to feminism but to Ginsburg.

The women on the short list of President Trump bear striking resemblance to her in their independence and clarity of thought. Most of them, like Ginsburg, balanced family obligations with their career ascensions. The difference is these women reached different conclusions on how the law is read and applied. Many do have legitimate objections for issues like abortion as inimical to the rights of women, but these women are part of the legacy of Ginsburg and her generation in an empowerment of women to reach their own conclusions. The nominee most like Ginsburg is Judge Amy Coney Barrett. They both finished law school at the top of their classes. Both went on to teach at leading law schools and both started their careers with an emphasis on procreational rights and constitutional interpretation. Deeply religious, both cited the role of faith in their careers and convictions.

Like Ginsburg, Barrett refused to yield to the choice of family over career. Barrett has raised seven children, including two adopted from Haiti, while rising to national recognition as a brilliant lawyer and jurist. Both women earned a reputation for civility and what Ginsburg described as showing us that “you can disagree without being disagreeable.”

Two pieces from USA Today.

• If Democrats Attack Her Over ‘People Of Praise’, They’ll Regret It (USAT)

All faiths are at least a little bit weird to those outside of them. Imagine telling someone unfamiliar with Catholicism, “Every chance I get, I eat some bread that I believe is the body of God’s only son, who was executed in Jerusalem under Tiberius.” Totally normal, right? So to all of my friends who think that the religious practice of Donald Trump’s Supreme Court nominee, Amy Coney Barrett, who is a member of a charismatic ecumenical community called the People of Praise, ought to bring out the bulldog in Kamala Harris and other Democrats on the Senate Judiciary Committee, I say dear God, no. First, you cannot fight bigotry with bigotry; religious intolerance is just as wrong as any other kind of othering. Indulging it won’t get us a more tolerant America.

And Senators, treating her like the kook that she is not is just what the president is counting on you to do. Unless you want to star in Trump campaign commercials that he’ll say prove Joe Biden is “against God,” don’t even think about it. Yes, women leaders in the People of Praise were until recently referred to as ‘handmaids’ — a biblical reference to Mary, the mother of Jesus. In the Gospel of Luke, when the angel tells her, “You will conceive in your womb and bear a son, and you shall name him Jesus,” she responds, “Behold, I am the handmaid of the Lord. May it be done to me according to your word.” But the group was not the inspiration for Margaret Atwood’s dystopian novel ‘The Handmaid’s Tale.’ “What the people in that book are going through is horrible,” says Joannah Clark, who runs a People of Praise school in Portland, Oregon and has known Barrett since college.

The group does not require a “loyalty oath” or arrange marriages or force women to keep having children. It puts a premium on intellectual life and values education for men, women and children. Its well regarded schools are attended by many non-members. It does have a view of marriage that I don’t share and you might not, either, but that St. Paul certainly did. (As the Church is subordinate to Christ,” says his letter to the Ephesians, “so wives should be subordinate to their husbands in everything.”) You know that favorite pro-choice rejoinder, ‘If you don’t like abortion, don’t have one?’ If deferring to your husband at home and speaking in tongues in prayer is not your brand of theological vodka, then don’t join the People of Praise, or any Pentecostal church in the world.

But don’t be the kind of hypocrite who embraces only those differences that line up with your own cultural views. Just as Biden is not coming for your guns or your suburbs, neither is he coming for your religious liberty. But could we please make sure Dianne Feinstein is aware, so she doesn’t repeat the folly of her 2017 “dogma lives loudly within you” gift to Republicans at Barrett’s confirmation hearing for her appointment to the U.S. Court of Appeals for the Seventh Circuit?

Kellyanne Conway on Barrett 7th CIrcuit vote

Fact-check: Barrett's confirmation to the 7th circuit was not a party-line vote. Three Democrats – Manchin, Donnelly and Kaine (Democrat VP nominee the year before) – voted for her. https://t.co/EC3NvhISsn

— Kellyanne Conway (@KellyannePolls) September 27, 2020

Nicole Garnett is the John P. Murphy Foundation professor of law at University of Notre Dame.

“Yes, she is brilliant. And, yes, she is a principled, careful judge. But she also is one of the most generous people whom I have ever met.”

• Amy Coney Barrett’s Intellect And Heart Are Unrivaled (USAT)

I first met Amy Coney at a Washington, D.C., coffee shop in the spring of 1998. A mutual friend had connected us because we were about to begin clerking together on the Supreme Court (me for Justice Clarence Thomas, her for Justice Antonin Scalia). I don’t remember the details, but I do remember that I walked away thinking I had just met a remarkable woman. We could not have known then that over the next 22 years, our lives would become completely intertwined: That, three years later, she would become my colleague at Notre Dame Law School, that she and her husband would move around the corner from us in South Bend, Indiana, and that we would raise our children together. We could not have known that, in a sense, we would grow up together — as lawyers, teachers, scholars, mothers, friends.

And we certainly could not have imagined that, 22 years later, she would be nominated to serve on the United States Supreme Court. But looking back, everything has changed, except Amy Coney Barrett. The very same qualities that struck me as remarkable on that spring afternoon are the qualities that make her an exceptional judge, award-winning teacher, generous colleague, loyal friend and loving mother. And the obvious pick to serve on the Supreme Court. She is brilliant, to be sure, but also humble, generous, loving, kind. She accepts each new challenge with grace and gives all she has to give (and sometimes it seems more) to all she is called to do. She will bring all those qualities to the Supreme Court, and our nation will be blessed by her years of service as Justice Barrett.

As Harvard Law School professor Noah Feldman, who clerked with us and disagrees with much of her judicial philosophy, recently observed, she stood out as one of the two finest legal minds among the almost 40 clerks. He concludes, “I’m going to be confident that Barrett is going to be a good justice, maybe even a great one — even if I disagree with her all the way.” [..] Yes, she is brilliant. And, yes, she is a principled, careful judge, admired legal scholar and amazing teacher. Her respect among her colleagues and students is reflected in the fact that she has been elected professor of the year three times by the law school’s graduating class and in letters of support for her nomination to the 7th Circuit, including ones signed by all of her full-time faculty colleagues at Notre Dame, all of her fellow Supreme Court clerks, hundreds of former students and dozens of prominent law professors from around the country.

But she also is one of the most generous people I have ever met. The Barrett home is a wellspring of hospitality. It is the kind of place where families gather to share life, where the kids are served hot dogs on a backyard picnic table while the parents are treated to Judge Barrett’s amazing crawfish etouffee. It is where she has prepared countless meals for families welcoming new babies or recovering from surgeries, comforted friends who know that they can always turn to her for support in times of crisis, and served as a sounding board for personal challenges both large (career advice) and small (potty-training advice).

“..there has never been a more serious crime in American history…”

• Betrayal, Infuriating Betrayal (Whitney)

Here’s your political puzzler for the day: Which of these two things poses a greater threat to the country:

1) An incompetent and boastful president who has no previous government experience and who is rash and impulsive in his dealings with the media, foreign leaders and his critics?

2) Or a political party that collaborates with senior-level officials in the Intel agencies, the FBI, the DOJ, the media, and former members of the White House to spy on the new administration with the intention of gathering damaging information that can be used to overthrow the elected government?

The answer is “2”, the greater threat to the country is a political party that engages in subversive activity aimed at toppling the government and seizing power. In fact, that’s the greatest danger that any country can face, an enemy from within. Foreign adversaries can be countered by diplomatic engagement and shoring up the nation’s military defenses, but traitors–who conduct their activities below the radar using a secret network of contacts and connections to inflict maximum damage on the government– are nearly unstoppable. What the Russiagate investigation shows, is that high-ranking members of the Democrat party participated in the type of activities that are described above, they were part of an illicit coup d’etat aimed at removing Donald Trump from office and rolling back the results of the 2016 elections.

It is a vast understatement to say that the operation was merely an attack on Donald Trump when, in fact, it was an attack on the system itself, a full-blown assault on the right of ordinary people to choose their own leaders. That’s what Russiagate is really all about; it was an attempt to torpedo democracy by invoking the flimsy and unverifiable claim that Trump was an agent of the Kremlin. None of this, of course, has been discussed in a public forum because those platforms are all privately-owned media that are linked to the people who executed the junta. But for those who followed events closely, and who know what actually happened, there has never been a more serious crime in American history.

Obama pressure

What did Obama know & when did he know it?

@SidneyPowell1 points out new texts on how Obama’s briefing went on 1/5 & Comey/Rice memos show he knew of effort to get @GenFlynn

Obama Admn exerted “significant pressure on Comey & McCabe to keep investigation going” pic.twitter.com/tAhkV9gFIe

— Anne #StopYulin ⭐️⭐️⭐️ (@CrazyCatRescuer) September 26, 2020

More text messages

POTUS says more text messages are coming out over the next few days… pic.twitter.com/Iaf7foarE4

— M3thods (@M2Madness) September 27, 2020

Moon of Alabama rips an Off Guardain piece to shreds. Good.

• In Which We Debunk A Coividiot Pamphlet (MoA)

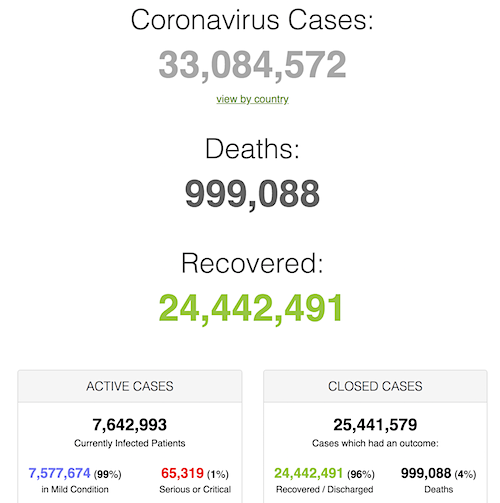

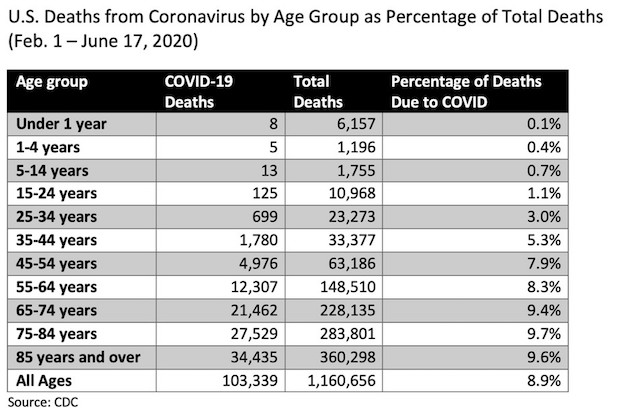

The next claim in the Off-Guardian nonsense: 3. An immense majority (95%) of fatal evolutions happen in old and frail individuals with premorbidities, with an average age of death at or above 80 years old. That claim is again an outright lie:Of the roughly 1.2 million American deaths that occurred between February 1 and June 17, almost 9% were due to coronavirus. The proportion of deaths due to coronavirus were about the same for each age group above 45 years. Below that, the proportion of deaths due to coronavirus fell dramatically.

The numbers in the second column of the table show that only about half of the total Covid-19 fatalities, not 95%, were “at or above 80 years old”. As for “premorbidities” (being alive is btw one). Hypertension and obesity are named as co-morbidities for Covid-19 cases. The CDC says that 42% of all U.S. inhabitants are obese while some 45% have hypertension. But today these people are alive and reasonably well. Most of them have still several decades of life before them. Would they get infected with SARS-CoV-2 and die, the virus, not their co-morbidities, would have caused their death. On to the next Off-Guardian blooper:

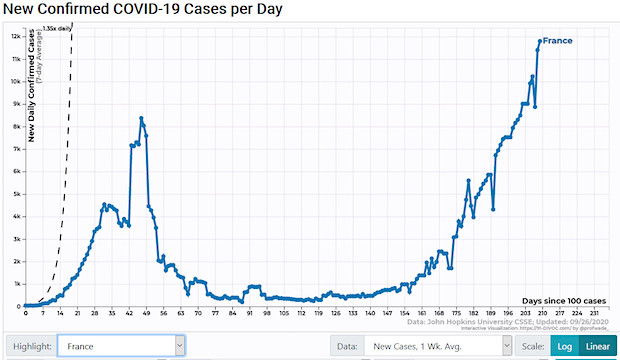

4. Antibody studies, cross immunization with other corona strains and the completion of the death toll curve in many countries are strong evidence that the human population is developing herd immunity against SARS-CoV-2. In this context, a severe “second wave” for SARS-CoV-2 is improbable. We may rather expect a new cold episode from it just like every year, but of regular or even weak intensity thanks to the gained herd immunity.

Antibody prevalence even in hard hit place like New York City is way below the 80% or so that would be needed for some kind of “herd immunity”. In the U.S. and Europe antibody prevalence is in total way less than 10%. The bay area for example has only some 2%. Is the U.S. ready to give 10 times more lives than the 266,000 who have already died of Covid-19 to achieve a potentially only temporary herd immunity?

Cross immunization with other corona viruses is a conjecture. We have so far no data that shows that there is cross immunity from other viruses that works against SARS-CoV-2. (Recent data points in the other direction. Children have an innate immune response to SARS-CoV-2 and it protects them well. Every adult has been infected with dozens of different viruses while growing up. We adults have developed and show an adaptive immune response to SARS-CoV-2. This seems to work less well than the children’s response. Instead of developing cross immunity through other infections our bodies seem to have learned something from previous infections that makes it more difficult to counter SARS-CoV-2.) The “improbable” second wave of Covid 19 is already developing in several European countries. Just take a look at France. And don’t worry. The rise in the still low death toll WILL follow the infection curve with a four weeks lag.

Everything about testing is in question.

• ‘A One-Off Test Is A Folly’: The Truth Behind False Negative Covid Tests (HuPo)

When Sarah found herself suffering sudden bouts of breathlessness in May, she took herself to hospital. But after her Covid-19 swab test came back negative, doctors said she was probably anxious, and sent her home. Despite this, Sarah’s symptoms continued to worsen. A week later, she was rushed to hospital in an ambulance. Paramedics told her that based on her clinic observations, she should be in a coma. Then came more surprising news: She had tested positive for coronavirus. A doctor explained her first test had been a false negative – a result that comes up despite the patient having the virus, and possibly being contagious.

As a clinically vulnerable Covid-19 patient with a chronic illness, I have had frequent contact with hospitals and healthcare systems during this pandemic. I have also been told by doctors that the potential for false negative results is high, so I decided to find out if this was true. The answer, according to the experts I spoke to for this article, is a resounding yes. Sarah’s story – given to a patient safety charity under a pseudonym – is one that resonates with Dr Claudia Paoloni. Paoloni, president of the Hospital Consultants and Specialists Association, detailed another case in which a patient tested negative twice: once when she was first admitted to hospital and once later in her hospital stay. She finally tested positive on her third test – by which time she was on a ventilator in intensive care.

Paolini believes Covid-19 swab tests produce a troublingly high rate of false negative results, and the problem lies in the reliance on a single test. “To use as a one-off test in any capacity to exclude someone from having Covid-19 is a folly.” If you want to exclude someone from having the virus, Paoloni said, you must do multiple tests and collect multiple negative results. “If the test and tracing system is not working, which is the case here, transmission will continue unabated in the community.” Paoloni also warns this could get worse as the government tries to introduce rapid testing.

A study from Imperial College London published earlier in September put the sensitivity rate of rapid testing between 94% and 100%. That’s one in 20 people with Covid-19 who will almost definitely get a negative result. The current rate of false negatives in the UK was originally estimated at 30%, she explained. Things have improved since then, but it’s still around 8%, she said, which is almost two in 20. The most recent data published by the Office for National Statistics says the test’s sensitivity – which it says can tell us how likely it is to return a false-negative result, may be somewhere between 85% and 98%.

Experiment.

• DeSantis Drops All Florida COVID Restrictions, Promises No More Closures (JTN)

Florida Gov. Ron DeSantis this week formally lifted all statewide COVID-19 restrictions in the Sunshine State, promising residents that his office would pursue no lockdowns as it moves forward in managing the coronavirus pandemic there. DeSantis’s announcement ended all restrictions on restaurants and bars; it also forbids local governments from closing businesses. Local authorities are further forbidden from imposing restaurant capacity limits below 50%. “We’re … saying in the state of Florida everybody has a right to work,” DeSantis said at a Friday press conference. Local authorities, he said, “can do reasonable regulations, but they can’t just say no.”

Additionally, local governments may not collect fines on pandemic-related regulations such as mask mandates. Private businesses will still be permitted to set their own capacity limits and mask rules under the state’s reopening. Democratic state Senator Linda Stewart criticized the move on Friday, saying she was “not terribly convinced that we’re ready for this right now” and claiming that the state “will find out in three weeks if we’re ready.” Coronavirus cases in Florida peaked in mid-July and have been declining ever since; daily deaths, meanwhile, have declined more slowly, though they appear to have peaked in early August.

The Guardian produces smear and slander. FIle a complaint against them.

• Guardian’s Deceit-Riddled New Statement Betrays Assange And Journalism (Cook)

A decade ago, remember, the newspaper worked closely in collaboration with Assange and Wikileaks to publish the Iraq and Afghan war diaries, which are now the grounds on which the US is basing its case to lock Assange behind bars in a super-max jail. My first criticism was that the paper had barely bothered to cover the hearing, even though it is the most concerted attack on press freedom in living memory. That position is unconscionably irresponsible, given its own role in publishing the war diaries. But sadly it is not inexplicable. In fact, it is all too easily explained by my second criticism. That criticism was chiefly levelled at two leading journalists at the Guardian, former investigations editor David Leigh and reporter Luke Harding, who together wrote a book in 2011 that was the earliest example of what would rapidly become a genre among a section of the liberal media elite, most especially at the Guardian, of vilifying Assange.

In my earlier post I set out Leigh and Harding’s well-known animosity towards Assange – the reason why one senior investigative journalist, Nicky Hager, told the Old Bailey courtroom the pair’s 2011 book was “not a reliable source”. That was, in part, because Assange had refused to let them write his official biography, a likely big moneymaker. The hostility had intensified and grown mutual when Assange discovered that behind his back they were writing an unauthorised biography while working alongside him. But the bad blood extended more generally to the Guardian, which, like Leigh and Harding, repeatedly betrayed confidences and manoeuvred against Wikileaks rather the cooperating with it. Assange was particularly incensed to discover that the paper had broken the terms of its written contract with Wikileaks by secretly sharing confidential documents with outsiders, including the New York Times.

Leigh and Harding’s book now lies at the heart of the US case for Assange’s extradition to the US on so-called “espionage” charges. The charges are based on Wikileaks’ publication of leaks provided by Chelsea Manning, then an army private, that revealed systematic war crimes committed by the US military. Lawyers for the US have mined from the Guardian book claims by Leigh that Assange was recklessly indifferent to the safety of US informants named in leaked files published by Wikileaks. Assange’s defence team have produced a raft of renowned journalists, and others who worked with Wikileaks, to counter Leigh’s claim and argue that this is actually an inversion of the truth. Assange was meticulous about redacting names in the documents. It was they – the journalists, including Leigh – who were pressuring Assange to publish without taking full precautions.

Making a connection between COVID and climate change is contentious. And unnecessary.

• Avoiding a Climate Lockdown (Mariana Mazzucato)

As COVID-19 spread earlier this year, governments introduced lockdowns in order to prevent a public-health emergency from spinning out of control. In the near future, the world may need to resort to lockdowns again – this time to tackle a climate emergency. Shifting Arctic ice, raging wildfires in western US states and elsewhere, and methane leaks in the North Sea are all warning signs that we are approaching a tipping point on climate change, when protecting the future of civilization will require dramatic interventions. Under a “climate lockdown,” governments would limit private-vehicle use, ban consumption of red meat, and impose extreme energy-saving measures, while fossil-fuel companies would have to stop drilling. To avoid such a scenario, we must overhaul our economic structures and do capitalism differently.

Many think of the climate crisis as distinct from the health and economic crises caused by the pandemic. But the three crises – and their solutions – are interconnected. COVID-19 is itself a consequence of environmental degradation: one recent study dubbed it “the disease of the Anthropocene.” Moreover, climate change will exacerbate the social and economic problems highlighted by the pandemic. These include governments’ diminishing capacity to address public-health crises, the private sector’s limited ability to withstand sustained economic disruption, and pervasive social inequality. These shortcomings reflect the distorted values underlying our priorities. For example, we demand the most from “essential workers” (including nurses, supermarket workers, and delivery drivers) while paying them the least. Without fundamental change, climate change will worsen such problems.

The climate crisis is also a public-health crisis. Global warming will cause drinking water to degrade and enable pollution-linked respiratory diseases to thrive. According to some projections, 3.5 billion people globally will live in unbearable heat by 2070. Addressing this triple crisis requires reorienting corporate governance, finance, policy, and energy systems toward a green economic transformation. To achieve this, three obstacles must be removed: business that is shareholder-driven instead of stakeholder-driven, finance that is used in inadequate and inappropriate ways, and government that is based on outdated economic thinking and faulty assumptions.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Few people have the imagination for reality.

– Johann Wolfgang von Goethe

Support the Automatic Earth in virustime.