Vasily Polenov Moscow courtyard 1878

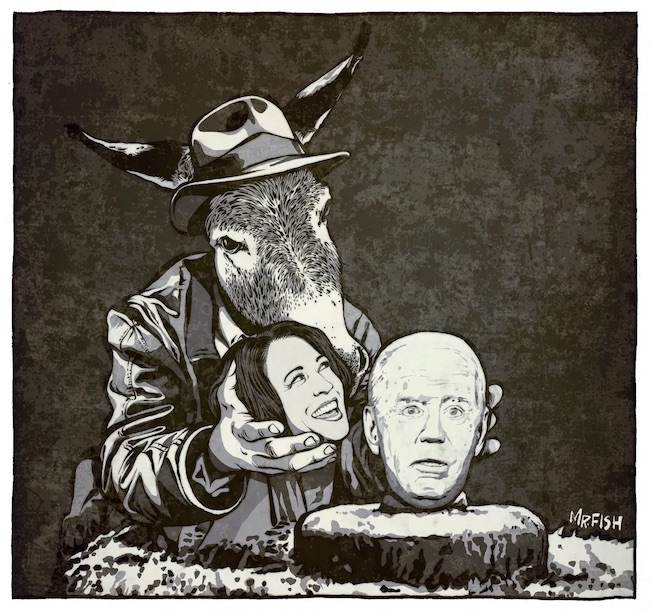

Word soup

Top-7 Kamala Harris cringe moments 🥴

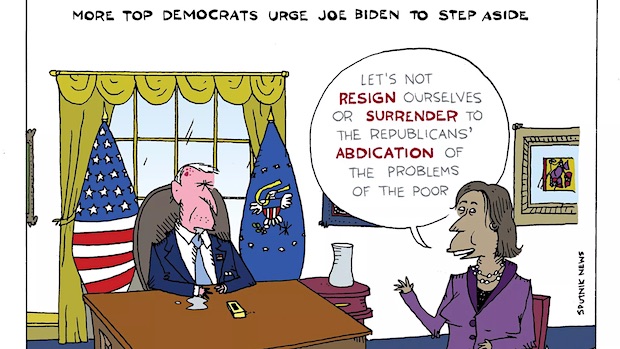

Does this candidate have a chance in the presidential race? pic.twitter.com/paxjpNkGTB

— Sputnik (@SputnikInt) July 21, 2024

Bella Hadid

Bella Hadid shares a video explaining the Israeli occupation of Palestine..🇮🇱🇵🇸 pic.twitter.com/9gHMnEgQMe

— Pelham (@Resist_05) July 23, 2024

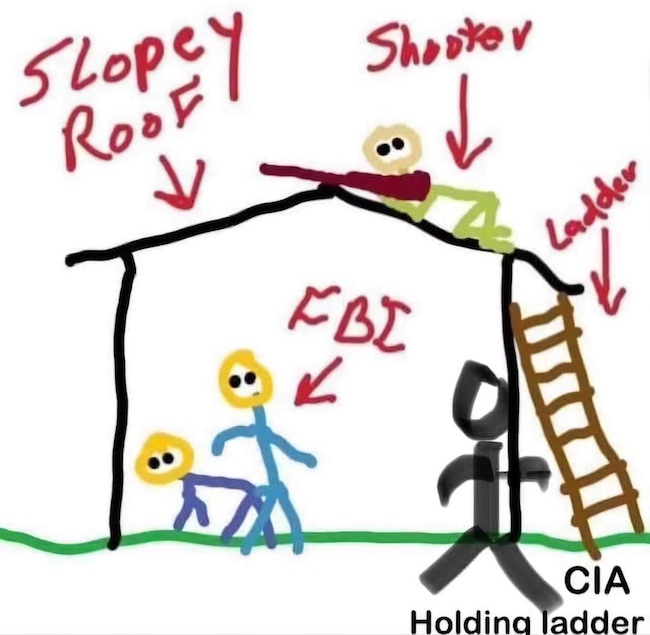

Chris M

Wray's testimony was insulting. His deliberate sloppiness in not knowing if the gun had a scope, or that no cartridges were recovered from the roof (they were cases), was a wink from the Matrix. A signal that says "We have no intention of getting to the truth." And ABC…FU. pic.twitter.com/xkP6udD3sO

— Chris Martenson, PhD (@chrismartenson) July 25, 2024

“So Khrushchev called for eliminating all conflicts between us that would cause another crisis. Well, that’s what we need today. That’s the spirit we need..”

• Biden’s Bitter Legacy Signals ‘Culmination of Betrayal’ (Sp.)

Beltway media, including the traditionally Biden-loyal Washington Post, dubbed the lame duck president an “anti-icon,” saying his “brief, targeted” address was “pragmatic, muted and self-effacing,” and “a little bit hard to watch.” Biden’s top 2024 challenger, former president Trump, took to Truth Social to lambast “Crooked Joe Biden’s Oval Office speech” as “barely understandable, and sooo bad.” “Crooked Joe Biden and lying Kamala Harris are a great embarrassment to America – there has never been a time like this,” Trump wrote in his traditional bombastic fashion. “I look at what’s happening today through the scope of what’s been happening since…the end of the Cold War, since 1991,” former NYT and Bloomberg contributor-turned independent foreign affairs observer John Varoli told Sputnik, commenting on the meaning of Joe Biden’s address beyond their immediate implications.

“It’s just been a horrifying time in American history,” Varoli said of this period of roughly 35 years. “It is the most disgraceful, wicked period in American history. And it’s just the feeling of betrayal…The Biden years are the culmination of this betrayal. You have to understand, we Americans, young Americans like myself…met [the end of the Cold War] with enthusiasm, with optimism. We were like ‘this is all great. It’s going to be peace in the world. No nuclear war. We’re going to get along with Russia.’ We were so full of optimism that we were going to build a better world.” Instead, the journalist recalled, the decades since 1991 have been filled with US wars, regime change operations and other aggression, from the Gulf War and the bombing of Yugoslavia, to NATO’s expansion, culminating with the Euromaidan coup in Ukraine, all in the interest of building and propping up the American unipolar moment.

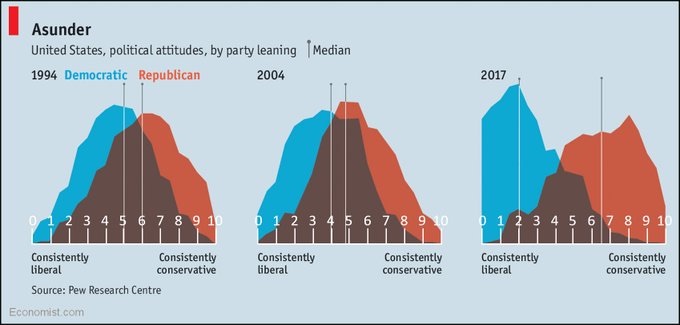

“What the hell’s wrong with these people?” was the natural reaction to these processes, Varoli said. “Then you realize, it was a plan. Professor Jeffrey Sachs said it. He saw it. He was there…This is nothing accidental…Biden is the culmination of this absolute insanity and madness. Imperial madness, imperial insanity, this bid for global domination.” mWhat’s taking place today in US politics is “basically the final chapter in [the] collapse” of “this whole imperial project,” according to the observer, with even mainstream outlets basically admitting, by reporting on Biden’s big donors pulling the plug on his reelection bid, that the US has turned into “an oligarchy.” “We are really now in uncharted territory, people just have no illusions. I did some research…[and] found a poll from 2022 that said 85% of Americans think there are serious problems with our political system. 85%! That was two years ago. Now it’s probably obviously like 100%. People say there could be a civil war. People just zone out. They become apathetic,” Varoli said.

“This is a crucial moment in American history,” Peter Kuznick, professor of history at the American University in Washington, DC and co-author of the book ‘Untold History of the United States’ together with film director Oliver Stone, told Sputnik. The historian pointed out that like Trump before him, Biden surrounded himself with neoconservative hawks, from Antony Blinken and Jake Sullivan to Victoria Nuland, bringing the world closer to a world-ending conflict between the superpowers. “I’m very concerned about what’s going on in the world now. The situation in Ukraine is very troubling. As I wrote in a recent article coauthored with Ivana Hughes, the Columbia professor who heads the Nuclear Age Peace Foundation, we are very concerned that the continued and increasing NATO militaristic policies in Ukraine, on top of the Russian invasion, putting the world on a glide path to World War Three and nuclear war. The fact that the Biden administration has effectively banned any discussion of diplomacy and simply doubles down on more advanced weaponry, and then gives Zelensky permission to use that weaponry to attack inside of Russia, has really made a bad situation even worse,” Kuznick said.

[..] “Whether it’s over Taiwan or it’s over the South China Sea, we’re heading for World War Three in the Pacific also. US Army General Minihan said he expects the US and China to be at war by 2025, and top Republicans in Congress said they agreed. Well, that’s horrifying also,” Kuznick stressed. Looking back to history, Kuznick recalled that “as Kennedy and Khrushchev learned” during the Cuban Missile Crisis, once an international crisis emerges, “there’s no way to control them.” “So Khrushchev called for eliminating all conflicts between us that would cause another crisis. Well, that’s what we need today. That’s the spirit we need,” Kuznick said.

“..the bosses’ replacement choice, Vice President Kamala Harris, had entered no primary. She never won a single delegate. Harris also never captured a single delegate in her first and only presidential run back in 2020.”

• Coup Upon Coup Upon Coup (Victor Davis Hanson)

In March 2020, all the major Democratic primary candidates abruptly, mysteriously, and in near unison withdrew from the presidential race, ceding the nomination to Joe Biden. Yet Biden had lost the first three races in Iowa, New Hampshire, and Nevada—and only won his first victory in South Carolina. Suddenly, on the eve of the Super Tuesday mega-primaries, the candidacies of front-runner Bernie Sanders, Pete Buttigieg, Elizabeth Warren, and others simply evaporated. The fear of a front-runner Sanders’ socialist victory and nomination—and thus an enviable landslide loss to incumbent Donald Trump in the general election—had prompted the donor class and shadowy political insiders to act. And they did so by choosing a perceived moderate, old Joe Biden from Scranton. That required the coerced departures of all his far-left rivals, who had hitherto performed much better than Biden in the primaries.

Now front-runner Biden still displayed obvious symptoms of serious cognitive decline that had only seemed to mount through the 2020 campaign. And his dementia continued to accelerate during his first three years as president. Biden had deceitfully promised to conduct a healing campaign and a unifying presidency. But once in the White House, his extreme agendas proved the most divisive and far-left in nearly a century. Rumors of that prior March 2020 Faustian bargain emerged. The Bidens got to serve as useful moderate veneers. So, they enjoyed the ceremonial functions of the presidency while outsourcing the real operations to former Obama officials, consultants, and advisors. Indeed, Obama did not, as most ex-presidents do, exit Washington upon leaving the White House. Instead, he bought a mansion and stayed close by.

Democrats demonized anyone critical of Biden’s obvious mental decline. Their smearing crested during Biden’s now-aborted 2024 reelection bid, even as Biden could no longer display even a veneer of mental and physical engagement. Polls revealed an impending Trump landslide victory in November—and a massive Democratic loss of Congress. So suddenly on a Sunday, July 21—just days left before state ballots were formalized with the names of the parties’ official nominees, and on the eve of the Democratic convention—party bosses, mega-donors, and Obama puppeteers went into action for yet a third time. They reportedly threatened candidate Biden with a complete loss of any further campaign funding and raised the specter of invoking the 25th Amendment to end his presidency—should he not suddenly withdraw from the race and endorse Vice President Kamala Harris as his surrogate on the ticket.

In one moment, the choices of nearly 15 million Biden primary voters were vitiated. No delegates were consulted. No other alternative Democrat candidates were even considered. Biden was dethroned; Harris was coronated—without much public input or even knowledge of how or why. Democrat grandees stopped smearing Biden’s conservative critics, who had worried over his dementia. Instead, they now trumped opposition criticism of Biden’s decline. Yet Biden most certainly did not resign his presidency. Instead, he promised to serve out his remaining six months in office. So Democrat insiders not only removed their leading candidate, who for the prior six months had won all the 2024 primaries and almost all the delegates, but insisted that Biden keep Democrats and himself in power—but only if he agreed to quit the race. In sum, at the 11th hour of a two-year reelection effort, a cabal arbitrarily decided that Joe Biden might well lose the Democrats the White House and the Congress.

So, they reversed course, now claiming his dementia was so acute as to destroy their November prospects. But mysteriously, his decline was not severe enough to imperil the American people, whom Biden must continue to lead until January 20, 2025. Furthermore, the bosses’ replacement choice, Vice President Kamala Harris, had entered no primary. She never won a single delegate. Harris also never captured a single delegate in her first and only presidential run back in 2020. She then dropped out of the race even before the first Iowa and New Hampshire balloting. We have now witnessed three left-wing veritable coups. In 2020, covert actors decided to ossify the Democratic primary races. Next, they conferred the nomination on a clearly cognitively challenged Joe Biden. He was now tasked with serving as a useful moderate vessel for a virtual, even more radical, Obama third term.

The same operators next assumed virtual control of Biden’s presidential agenda, given his accelerating cognitive decline. When that charade could no longer be sustained, for a third time, they circumvented the normal transparent democratic process. So, they removed the once useful but now a liability Biden—while insisting that he was still fit enough to keep the left in power—until the anticipated Harris victory in November. And all of this was the shadow work of those who sanctimoniously lectured America that “democracy dies in darkness.”

“She is a radical left lunatic who will destroy our country if she ever gets the chance to get into office. We’re not going to let that happen.”

• Trump Calls Kamala ‘Radical Left Lunatic’ Responsible for Biden Failures (Sp.)

Republican presidential candidate Donald Trump said presumptive Democratic nominee Kamala Harris is a “radical left lunatic” who is the driving force behind failed policies of the Biden administration. “Lying Kamala Harris has been the ultra-liberal driving force behind every single Biden catastrophe,” Trump said during a rally in North Carolina Wednesday evening. “She is a radical left lunatic who will destroy our country if she ever gets the chance to get into office. We’re not going to let that happen.” Trump claimed Harris is unfit to lead and would be worse than President Joe Biden. The Democratic National Committee (DNC) intends to nominate a presidential candidate by August 7. The election will take place November 5. An aggregation of national polls by RealClearPolitics shows Trump leads Harris 47.6% to 45.9% as of Wednesday afternoon.

“Crooked Joe Biden and Lyin’ Kamala Harris are a great embarrassment to America – there has never been a time like this!”

• Trump Comments On Biden’s Drop-out Speech (RT)

US President Joe Biden’s speech announcing his withdrawal from the presidential race was embarrassing for the country, according to his predecessor and current Republican candidate for president, Donald Trump. Biden gave a ten-minute speech from the White House on Wednesday evening in which he formally announced he was no longer seeking reelection this fall and endorsed his vice president, Kamala Harris, to replace him on the Democratic ticket. “Crooked Joe Biden’s Oval Office speech was barely understandable, and sooo bad!” Trump said on his Truth Social platform. “Crooked Joe Biden and Lyin’ Kamala Harris are a great embarrassment to America – there has never been a time like this!” His campaign later released a photo of Trump on board his private jet posing next to the TV screen showing a tired Biden struggling with his lines.

“I believe my record as president, my leadership in the world, my vision for America’s future, all merit a second term. But nothing can come in the way of saving our democracy. That includes personal ambition,” Biden said at one point. The video announcement came three days after a post on X (formerly Twitter), in which Biden announced his exit from the race – but not from the presidency – in favor of Harris. The 81-year-old had been under growing pressure from his party leaders, donors and the media to step down ever since the disastrous June 27 debate against Trump, but kept insisting he was still in the race. On July 13, just before the Republican convention, Trump survived an assassination attempt at a rally in Butler, Pennsylvania. Three days later, Biden’s staff announced that the president had caught Covid-19 and had to be flown to his Delaware home for recovery.

“It is not about his health. I can say no, that’s not the reason,” White House press secretary Karine Jean-Pierre told reporters on Wednesday, but would not say what the actual reason for Biden dropping out may have been. “If everyone acknowledges that he’s incapable of running a campaign, he’s clearly not capable of running the country,” House Speaker Mike Johnson, a Louisiana Republican, told reporters over the weekend. Harris has since taken over Biden’s war chest, printed signs and filmed a campaign video. She is yet to be officially nominated by the Democrats, but the party has said it would do so in a “virtual roll call” prior to the national convention, scheduled for August 19 in Chicago.

You can’t just “install” someone in a democratic system.

• Is US Democratic System Crumbling? (Sp.)

A new survey by Rasmussen Reports and the Heartland Institute has found that a staggering 62% of likely American voters fear this year’s election could be impacted by cheating, including 37% who are “very concerned.” 35% say they aren’t concerned about election cheating, including just 15% “not at all concerned.” “The fact that more than 60% of likely voters are concerned about election integrity should be a massive wake-up call to all those who refuse to admit that potential cheating in elections is a major problem,” Chris Talgo, editorial director of the Heartland Institute, said in an official statement. According to the survey, 18% of respondents said that in the 2020 election, they personally received more than one official ballot in the mail or received a ballot for someone who does not live at their address.

The pollsters pointed out that the number of those who received multiple mail-in ballots in 2020 is higher – reaching 20% – among voters of six battleground states, namely Arizona, Georgia, Michigan, Nevada, Pennsylvania, and Wisconsin. President Joe Biden won in 2020 by outpacing his rival, then-POTUS Donald Trump, in a number of swing states by a razor-thin margin, which prompted speculation that the election was rigged. Around two thirds of Republican voters still believe that the 2020 election was stolen from Trump, and that Biden did not win fair and square.The 2020 election fueled a crisis of democracy in the US, The Wall Street Journal reported last August, adding that many Republican voters had lost faith in the nation’s electoral system, while others were afraid that the 2024 election would exacerbate existing controversies.

Joe Biden’s mental health issues, his abrupt decision to quit the race, and the Democratic Party’s latest push for Kamala Harris’ nomination have added to debate about the fairness of the process. Republicans argue that Harris should not be given automatic access to Biden’s “war chest.” Team Trump has already filed a complaint with the Federal Election Commission (FEC) over Harris taking Biden’s campaign funds. Some activists argue that the abrupt replacement of Biden with Harris is “not democratic”. The left-wing Black Lives Matter (BLM) organization, in particular, lambasted the Democratic Party over “hypocrisy” for “installing” Harris as Joe’s successor.

“We do not live in a dictatorship. Delegates are not oligarchs. Installing Kamala Harris as the Democratic nominee and an unknown vice president without any public voting process would make the modern Democratic Party a party of hypocrites,” the group, which rose to prominence during the 2020 protests in the wake of African American George Floyd’s death, officially declared. Technically, Kamala is not yet the “nominee.” She could become the nominee after Democratic Party delegates vote for her. It is expected that the Democratic Party will have a virtual roll call vote to confirm their nominee between August 1 and 7, prior to the Democratic National Convention (DNC) scheduled to take place in Chicago on August 19-22.

She will not win.

• US’s Harris Vetting Dozen Potential Vice Presidential Candidates (Sp.)

US Vice President Kamala Harris’ camp is vetting around a dozen of potential running mates, CBS News reported on Thursday, citing a source familiar with the matter. The list reportedly features Commerce Secretary Gina Raimondo, Transportation Secretary Pete Buttigieg, Senator Mark Kelly, Kentucky Governor Andy Beshear, Illinois Governor Jay Pritzker, Michigan Governor Gretchen Whitmer, North Carolina Governor Roy Cooper, Pennsylvania Governor Josh Shapiro and Minnesota Governor Tim Walz. Some of the potential picks for vice president do not even hold elective office at the moment, a CBS correspondent said. On Sunday, President Joe Biden announced his withdrawal from the 2024 presidential race and endorsed Harris to be the Democratic Party’s nominee. Harris said on Tuesday that she had secured enough Democratic votes to become the party’s presidential nominee. If picked, Harris will take on Republican presidential nominee Donald Trump on November 5.

“..when [Anatoly] Antonov, the current Russian ambassador, leaves, that he will not be replaced. I think [Russia will] downgrade relations..”

• Harris to Uphold Russophobic US Dogma as World Seeks Multipolar Order (Sp.)

Much speculation has emerged over Vice President Kamala Harris’ approach to US foreign policy in the days since the former California Attorney General was announced as Joe Biden’s chosen successor Sunday. Harris, who served in the US Senate from 2017 until 2021, has taken on a relatively low profile. Observers have speculated she has been deliberately tasked with selling controversial policies to the public during her time as Biden’s second in command, as when she was dispatched to Guatemala in 2021 to warn prospective migrants against coming to the United States. “Frankly, we don’t know what she’s going to do on the international scene. There’s nothing that she has said or done that gives us any indication of what her stance is on anything,” claimed commentator Michael Maloof.

The former senior security analyst at the US Department of Defense joined Sputnik’s Fault Lines program Wednesday to contemplate the possible foreign policy of a Harris administration as much of the world seeks development independent of the United States and the Western liberal world order. Host Jamarl Thomas suggested Israeli Prime Minister Benjamin Netanyahu’s address before a joint session of Congress Wednesday could be an early indicator of Harris’ approach to the politics of international affairs, if not the substance. Harris has made headlines by refusing to attend Netanyahu’s speech as polling shows Democratic Party voters increasingly sympathize with Palestinians in the long running conflict between Israelis and the indigenous inhabitants of the Levant. But Harris has agreed to meet with the controversial Israeli leader during his time in Washington, leading Thomas to suggest her apparent dispute with Netanyahu is “an optics issue” rather than a difference of policy.

“I agree,” responded Maloof. “She doesn’t want to be associated with him publicly… That’s why she’s not showing up at the joint session.” The analyst claimed Harris, who is some 22 years younger than President Biden, may be naturally inclined toward younger Americans’ sympathy for the Palestinian cause but would be constrained by the actions of her predecessor. Maloof suggested it would be especially difficult for the politician to chart a new course on relations with Russia, which remains locked in a US-backed proxy war with Ukraine. “I’m afraid that if they continue the policy toward Russia, as they are right now, that when [Anatoly] Antonov, the current Russian ambassador, leaves, that he will not be replaced. I think [Russia will] downgrade relations,” said Maloof. “We’re making it much more difficult to renew any relations.”

“We’re almost on the verge of a war because of a hoax,” he added, referring to the conspiracy theory that Trump colluded with Russia during the 2016 US presidential election. “That’s basically what this amounts to and our relationships in the world are now complicated as a consequence.” “I’ve never seen within three and a half years how we have bungled things so poorly on the international scene when we have all these very smart, educated people at the helm, supposedly, and we’re going in the direction we’re going. It’s unbelievable.”

“..have decided to no longer share actionable, substantive information on criminal and other intelligence-related activity” with the Bureau..”

• US Police No Longer Trust FBI – Report (RT)

Many US state and local law enforcement agencies are refusing to share vital information with the Federal Bureau of Investigation due to concerns that it has become partisan and politicized, according to a whistleblower report submitted to Congress. The 230-page report was compiled by an alliance of retired and active-duty agents and analysts, who spoke to more than 30 “independent, highly credible” sources across the US. “They are not only reluctant to work with the FBI but reportedly have decided to no longer share actionable, substantive information on criminal and other intelligence-related activity” with the Bureau, because they believe it “has been operating as a partisan federal agency motivated by a political agenda” in recent years, the report’s authors said. The report’s existence was first reported on Wednesday in the New York Post. The document itself was sent to the House Judiciary and House Oversight committees and posted online.

The group described a “crisis of confidence” in FBI-led task forces and a “disturbing loss of trust” in the Bureau as a whole, even as Director Christopher Wray testified to Congress about a “complex threat environment” that is unprecedented in his career. Most sources pointed to the FBI’s response to the January 6, 2021 riot at the US Capitol and the August 2022 raid on former President Donald Trump’s Florida residence, Mar-a-Lago. One of the sources described the FBI’s behavior as “that of a Third World country” and argued it “should be dismantled and its personnel prosecuted and given long prison sentences.” Pressure to assist with “J6” cases has led to a belief that the Bureau is driven by a “partisan, political agenda.” One source said they could not understand why the FBI was not going after any other groups with the same fervor. Another said that local officers feared they could be targeted “because of their love for the US” and perceived as “domestic terrorists” based on how they vote.

Newer FBI agents “do not bother to conceal their distaste” for traditional political or religious views and openly identify themselves as “woke or liberal,” the head of a multi-agency task force said. Hired on the basis of “diversity, equity and inclusion” (DEI) guidelines, they are “completely worthless” and “the worst batch of people,” the whistleblowers said. The FBI academy at Quantico, Virginia at which new agents are trained “promotes a cult of narcissism” and arrogant superiority, while being intolerably politicized, the report claimed. Meanwhile, the Bureau’s Security Division has been abusing the security clearance process to purge conservative-leaning agents from its ranks. The whistleblowers urged Congress to force the resignation of Wray as “an extreme measure of last resort” and the only way to restore the Bureau’s reputation.

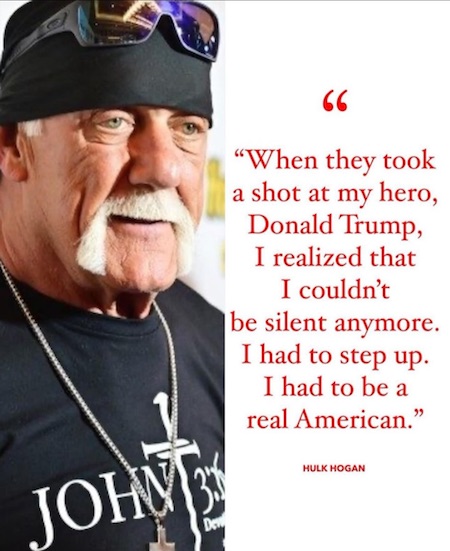

“Trump has money, a beautiful and intelligent wife, and he is giving the remainder of his life to fighting a corrupt establishment that hates him.”

• The Assassination Attempt & the US Election-PCR interviewed (PCR)

Since 2016 Trump has been regarded by the ruling establishment as a threat to the power and control exercised by the Republican establishment, Democrat establishment, the material interests that control both parties, the media, and especially the military/security complex whose enemy Trump threatened to take away by “normalizing relations with Russia. ” Trump took away from the Republican establishment the power to choose the Republican presidential nominee. Indeed, he took control of the Republican Party away from the establishment. Trump defeated the Democrat establishment and the media by defeating the preferred establishment candidate, Hillary Clinton, for president. Trump defeated the media by surviving their propaganda and by ridiculing the presstitutes.

His announcement that he was going to take the power away from the ruling establishment and give it back to the people enraged Washington and the material interests that control the government. His announced intent to normalize relations with Russia alarmed the armaments industry and security agencies, such as the CIA, FBI, NSA, that he was taking away the enemy that justified their power and their budgets. The establishment clearly perceives Trump as a threat.The establishment tried to deal with Trump with a plethora of concocted scandals: Russia-gate, two impeachments, porn star payoff which was turned into an indictment for “interfering with an election,” documents-gate, insurrection-gate, and criminal and civil indictments that have no basis in law and are falling apart, one being dismissed, two being put on hold while in one case the judges investigate the prosecutor for lying to the court and in another for allocating $700,000 in public funds to a lover.

The US Supreme Court has ruled that a charge on which 300 trump supporters were railroaded to prison is not a permissible charge. Given the failure of the establishment’s attempt to be rid of Trump, many expected an assassination attempt. The Secret Service’s total failure to protect Trump shows a lack of competence that is impossible to believe. The voids in the protection and the Secret Service director’s excuse for the shooter’s access are unbelievable. There might or might not be an investigation, but government investigations always clear the government. Remember the self-serving investigations of the assassinations of John F. Kennedy and Robert F. Kennedy, and the absurd official explanation of 9/11. There are likely to be more attempts on Trump’s life. If so, they will be explained as “copycat” attempts spurred by the “lone deranged shooter in Pennsylvania.”

In Europe, almost nobody had heard of J.D. Vance before Trump made him his running mate. How do you categorize Vance politically? Initially, J.D. Vance, influenced by the media’s demonization of Trump, was a Trump critic, but he came to the realization that the attack on Trump was an attack on America, particularly the Democrats and media’s open borders policy and normalization and legitimization of sexual perversity. Vance symbolizes a young generation which has zero confidence in the media and is beginning to think for itself. Vance opposes the transformation of the US into a Sodom & Gomorrah Tower of Babel.

Is Vance, who is half of Trump’s age, an indication of a generational change both in the Republican party and in US politics? That is Trump’s opinion, but only time will tell. It is difficult even for the sincere to resist the power and riches that the American establishment can bestow. Biden’s obvious mental decline has been progressing for some time. But why has his mental health and fitness for office only become an issue now and not much earlier? Biden’s performance in the first presidential debate and in the press conference were too shocking for the media to hide. Liberal media themselves confessed that they had “gaslighted” (deceived) the American public about Biden’s capability.

[..] In Europe, both Biden’s and Trump’s age is an issue: You were member of the Reagan administration, and Reagan became president at the age of 70. Why did Reagan become one of the most successful US presidents? Reagan achieved his two goals. One was to cure “stagflation,” which his supply-side economic policy did. The other was to end the Cold War, which he achieved with his rapprochement with Soviet leader Gorbachev. No presidents in modern times have such achievements. Additionally, Reagan radiated strength, humor, and a love for America. This made him likable and difficult for the liberal-left to successfully demonize.

Age is not a deterrent of effective leadership. Age brings wisdom. Not all people deteriorate with age at the same pace. I find it remarkable that the eight years of stress that Trump has been put through has not brought him a stroke or heart attack. I find it more remarkable that he is eager to undertake four more years of fighting for his country’s moral and economic renewal. Trump has money, a beautiful and intelligent wife, and he is giving the remainder of his life to fighting a corrupt establishment that hates him.

It’s there, bipartisan and all. Does anyone have faith in it?

• A Congressional investigation of the Assassination Attempt on Trump (PCR)

There is competent analysis on the Internet of acoustic evidence indicating more than one shooter involved in the attempt on Trump’s life. Obviously, what is needed is a credible, brave, credentialed acoustic expert to analyze the acoustic evidence. This should be arranged by committees of the US Congress, such as the committees headed by Jim Jordan and James Comer. It is completely clear that neither the FBI, which has been trying to destroy Trump and his supporters for eight years, nor the Secret Service or Homeland Security can be trusted with the investigation. These agencies have zero credibility.

The challenge for the committees of Rep Jordan and Rep Comer is to find an expert who does not hate Trump, who does not earn his living doing police work, and who is brave and solid enough to withstand the denunciation that will be his if he finds more shooters than Crooks. Are the Republicans up to their responsibility, or are the Republicans content with Kimberly Cheatle’s resignation and the exposure of the Biden regime’s DEI personnel policy? Are Republicans afraid of hurting America’s reputation by possibly revealing a state plot against a presidential candidate?

America cannot survive another assassination or another 9/11 swept under the rug. This time there must be a real investigation, not another coverup left in the hands of the executive branch. Any investigation by the FBI, Homeland Security, the Secret Service is worthless. These are not agencies capable of speaking truth. A real investigation is urgent. The official narrative is being formed. The attempt on Trump’s life is going to be blamed on “operational failure” resulting from DEI and an inadequately budgeted Secret Service, and the assassination attempt will disappear into performance and budgetary issues. If there was a deep state assassination attempt and all evidence is not professionally examined, the deep state will have again succeeded and will continue on its path of frustrating the will of the American people.

“..a year ago, the average daily number of Ukrainians killed in action (KIA) was 716. In the corresponding period of this month, the KIA level has jumped to an average of 1,948..”

• Zelensky Gets The Ukrainian Trains To Run On Time (Helmer)

Combat losses of the Ukrainian armed forces along the front have accelerated to a current average of almost two thousand men a day, according to the Russian Defense Ministry’s daily briefing and bulletin. The damage or loss of weapons is also growing fast. In the first week of July a year ago, the average daily number of Ukrainians killed in action (KIA) was 716. In the corresponding period of this month, the KIA level has jumped to an average of 1,948 — an increase of almost threefold. In the same week of 2023, the destruction or damage of US-made M777 artillery pieces was 8; in the first week of this month, the M77 loss number was 17. These loss rates for men and weapons have remained steady through this week.

The Ukrainians must assemble and deliver more fresh men and materiel to stave off defeat. The troops, artillery, tanks and other vehicles, plus ammunition, are delivered by train to railway stations along the front line. The Russian General Staff, headed by General Valery Gerasimov, knows the precise schedule of these trains, monitoring their departures and their speed in transit. They then prepare for their arrival at the front-line train stations where they are hit by a combination of missiles and glide bombs (FAB, Fugasnaya AviaBomba). This is the reality of the Russian summer offensive and Ukrainian counter-offensive without the political hype and propaganda.

In the Ukrainian version of the train war, the regime of Vladimir Zelensky is resisting effectively and increasing the cargo tonnage which Ukrainian Railways or Ukrzaliznytsia (UZ) is managing to pull to or from the country’s western and southern borders. This, UZ calls winning by not losing. For the ports of Poland and Romania the war windfall is profitable; for their road operators and cargo truckers, not so. The Ukrainian consultancy GMK Center and its director, Stanislas Zimchenko, reported earlier this month that the principal gateway for railway movement of cargo into and out of the Ukraine is Romania, followed by Poland. In the first five months of this year, rail movement through Romania accounted for 9.3 million tonnes; Poland 6 mt; Slovakia, 4.2 mt; Hungary, 1.1 mt; and Moldova, 0.5 mt. It is unclear from the GMK report whether these tonnages include military cargoes and whether military cargoes are being disguised as civilian cargoes.

“..Serbia, whose government is dead set on signing a Faustian bargain with Mephisto, in this case represented by Rio Tinto..”

• As The State “Withers Away”, Multinationals Go On A Rampage (Karganovic)

Rio Tinto is now adding lithium to its portfolio. In the Balkans it is positioning itself to become a major player in the global lithium trade. Some context might be illuminating. Less than a century ago, Anton Zischka lucidly suggested that a drop of oil is worth more than a drop of human blood.” That notion could be expanded nowadays to refer to a gram of copper, gold, cobalt, titanium, uranium, or lithium, among other commodities. “Ignoring lithium is a dangerous idea for a shrewd investor,” industry analysts advise. Goldman Sachs, which undoubtedly is well-qualified to judge in these matters, “has called lithium ‘the new gasoline’ which is surely a term not thrown about loosely by one of the world’s largest investment banks. After all, oil has been the most important commodity in the world for over a century. Could lithium be next,” market analysts are asking rhetorically.

As far as lithium specifically is concerned, the financial magazine Fortune, also reasonably well informed on the subject, recently asserted that “there is no dearth of companies that will claim a share of the expected lithium profits.” Why all the frenzy? What are the industrial uses of lithium that are generating such extraordinary excitement? Lithium and its compounds have several industrial applications, including heat-resistant glass and ceramics, lithium grease lubricants, flux additives for iron, steel and aluminium production, lithium metal batteries, and lithium-ion batteries. To this should be added rechargeable batteries for mobile phones, laptops, digital cameras and electric vehicles. These uses consume more than three-quarters of lithium production. In other words, lithium is not an ordinary commodity but a strategic asset since it is an indispensable component in products of enormous economic significance.

A major problem are the unavoidably catastrophic environmental and human health repercussions of lithium mining using currently available extraction technologies. That is not a problem that affects the life or health of Rio Tinto executives or stockholders, but it does impinge, and severely, on those directly involved in the mining process and the sustainability of the environment in which they live. That is because the lithium extraction process is dirty, literally and in the highest degree. We are told that “the extraction process, mainly through brine mining, poses significant risks, including water pollution and depletion, biodiversity loss, and carbon emissions. Every tonne of mined lithium results in 15 tonnes of CO2 emissions in the environment. In addition, it is estimated that about 500,000 litres of water are needed to mine approximately 2.2 million litres per tonne of lithium. This substantially impacts the environment, leading to water scarcity in already arid regions … soil degradation, and air contamination, raising concerns about the sustainability of this critical resource.”

The preceding comments are but a general and rather understated overview of the environmental consequences of lithium mining. For the grievous human health impact of the release into the ground, the water table, and the air of immense amounts of poisonous substances, which necessarily accompanies lithium mining, it might be helpful to consult some of Rio Tinto’s victims in the far corners of the world, such as villagers in Papua New Guinea and Madagascar, and the aborigines of Western Australia. These victims will soon be joined by more unfortunates in Serbia, whose government is dead set on signing a Faustian bargain with Mephisto, in this case represented by Rio Tinto. The classical definition of Faustian bargain is “a pact whereby a person trades something of supreme moral or spiritual importance, such as personal values or the soul, for some worldly or material benefit, such as knowledge, power, or riches”. That fits events unfolding in Serbia to perfection.

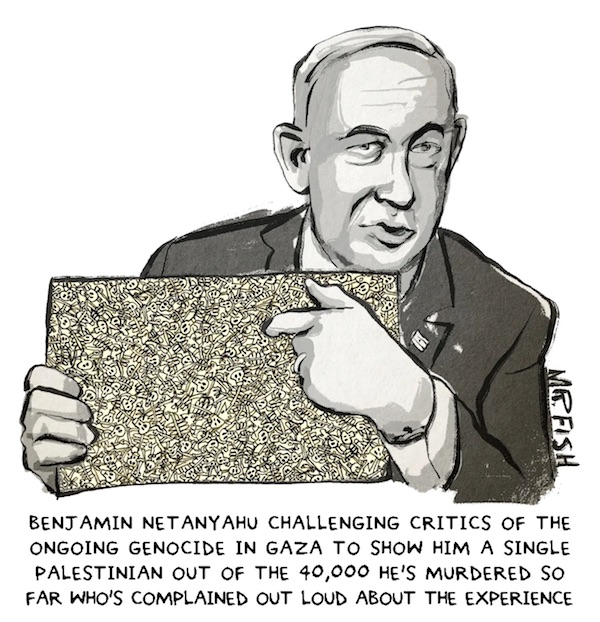

You can’t continue to defend and support killing 40,000 people because a few hundred on the other side got killed. Big blind spot for Trump.

• Israel Must End War In Gaza – Trump (RT)

Former US President Donald Trump has urged Israel to bring about a “fast” end to its war with Hamas, arguing that a drawn-out conflict is a “public relations” nightmare for the Jewish state. Speaking to Fox News on Thursday, Trump said the war should end quickly “because they are getting decimated with this publicity, and you know Israel is not very good at public relations.” Trump was a close ally of Israeli Prime Minister Benjamin Netanyahu during his term in the White House, and described himself as “history’s most pro-Israel US president.” He imposed sanctions on Iran at Netanyahu’s request, moved the US Embassy in Israel to West Jerusalem, and brokered the Abraham Accords, which saw Israel normalize relations with Bahrain, the United Arab Emirates, Morocco, and Sudan. In the months since Israel declared war on Hamas in October, however, Trump has repeatedly called on Netanyahu to bring the conflict with the Palestinian militant group to a rapid conclusion.

“You have to finish up your war,” he told the Israel Hayom news outlet back in March. “You gotta get it done. And, I am sure you will do that. And we gotta get to peace, we can’t have this going on.” The destruction of civilian homes in Gaza, he said at the time, is “a very bad picture for the world. The world is seeing this… every night, I would watch buildings pour down on people. Go and do what you have to do. But you don’t do that.” In his interview with Fox, Trump also condemned the Democrats who protested Netanyahu’s address to Congress on Wednesday, and called for jail sentences for the protesters who burned American flags outside the US Capitol. Netanyahu is set to meet with US President Joe Biden at the White House on Thursday afternoon, before traveling to Florida to meet with Trump at the former president’s Mar-a-Lago estate. Harris did not attend Netanyahu’s speech on Wednesday, but will meet with him on Thursday, after his one-on-one talk with Biden.

In a post to his Truth Social platform on Tuesday, Trump said he is “looking forward to welcoming Bibi Netanyahu” to Florida, referring to the Israeli leader by his commonly-used nickname. Trump promised a return to “peace and stability” in the Middle East, and in a later post, shared a letter he received from Palestinian Authority President Mahmoud Abbas, who wished Trump “strength and safety” after the attempt on his life earlier this month. “Thank you,” Trump replied to Abbas. “Everything will be good.”

Elon Bibi

10 months ago, Prime Minister of Israel Benjamin Netanyahu went to the Tesla factory and took a tour with Elon Musk pic.twitter.com/JYpKHLGLn2

— Dima Zeniuk (@DimaZeniuk) July 25, 2024

“That’s what total victory means. And we will settle for nothing less.”

• US Democrats Snub Netanyahu – Axios (RT)

Around half of House and Senate Democrats opted to stay away from a speech Israeli Prime Minister Benjamin Netanyahu delivered before a joint session of the US Congress on Wednesday, Axios has reported. The invitation to Netanyahu divided lawmakers, particularly Democrats. House Speaker Mike Johnson and Senate majority leader Chuck Schumer said in June the prime minister’s address would symbolize “the US and Israel’s enduring relationship” and “offer the opportunity to share the Israeli government’s vision for defending their democracy.” A number of prominent progressives, most notably Sen. Bernie Sanders, said at the time they would not attend the speech over Netanyahu’s handling of the war in Gaza following the October 7 attacks by Hamas, calling him a “war criminal.”

According to a headcount conducted by the news outlet, some 100 House Democrats and 28 Senate Democrats were in attendance, meaning that around half of both caucuses skipped the session. Former House Speaker Nancy Pelosi, former House Majority Whip Jim Clyburn, Alexandria Ocasio-Cortez, and Senate Foreign Relations Committee members Dick Durbin, Tim Kaine, Jeff Merkley and Brian Schatz were among the boycotters. Republican Thomas Massie also skipped the session. He said in a post on X (formerly Twitter) that he did not want to be a “prop” for Netanyahu, arguing the speech was an attempt to bolster the PM’s “domestic political standing in Israel and to quell int’l [international] opposition to his war.” Netanyahu said he sought to “present the truth about our just war” to Congress, during his first visit to Washington since the escalation of Israeli-Palestinian conflict.

Israel launched an invasion of Gaza following an October 7 surprise attack by the militant group Hamas, in which some 1,200 people were killed and another 250 were taken hostage. However, Israel has drawn widespread international criticism due to the mounting death toll and deepening humanitarian crisis in the Palestinian enclave. In early May, Washington put the delivery of weapons to Israel on hold amid calls for it to scale back its assault on Rafah, the city sheltering most of Gaza’s more than two million people. Netanyahu told US lawmakers that Israel will not stop until it has destroyed the military capabilities of Hamas, put an end to its rule in Gaza, and released all the hostages taken in the October attack, adding: “That’s what total victory means. And we will settle for nothing less.” More than 39,100 Palestinians have been killed and over 90,000 have been injured since the beginning of the Israeli campaign, according to Gaza health authorities.

You don’t support your members, you support a none-member. But of course.

• EU Won’t Support Hungary, Slovakia in Oil Transit Dispute With Ukraine (Sp.)

The European Union has denied its support to Hungary and Slovakia after they sought to force Ukraine to restore Russian oil transit to the bloc, the Financial Times reported citing sources familiar with the matter. EU Trade Commissioner Valdis Dombrovskis told the FT that Brussels would need more time to gather evidence and assess the legal situation. Eleven of the EU nations attending a meeting of trade officials on Wednesday backed his stance and none took the side of Budapest and Bratislava, diplomats told the FT. Hungarian Foreign Minister Peter Szijjarto said on Monday that Hungary and Slovakia had asked the European Commission to launch consultations with Ukraine after it stopped the transit of oil through the Druzhba pipeline. Szijjarto also said that Hungary would not approve the allocation of 6.5 billion euros ($7 billion) for arms sent to Ukraine through the European Peace Facility until the issue was resolved.

Ukraine’s trade agreement reportedly contains a clause that provides for the possibility of suspending oil transit. An EU diplomat was quoted as saying by FT that disruption in Russian oil supplies would have a “huge impact” on the central European nation. Last week, Szijjarto said that Ukraine stopped the transit of Lukoil’s oil. The Slovak Economy Ministry confirmed that the country was not longer receiving oil from the Russian oil giant, which was sanctioned by Ukraine. Slovakia’s Slovnaft refinery imports Russian crude from another supplier, but the country is discussing the current situation with Ukraine.

“Stephanopoulos referred to Trump as “liable for rape” 10 different times in the interview with Mace..”

• Judge Refuses to Dismiss Trump Defamation Lawsuit vs ABC, Stephanopoulos (AmG)

On Wednesday, a federal judge rejected a motion by ABC News and George Stephanopoulos to dismiss the defamation lawsuit filed against them by former President Donald Trump. As reported by The Hill, the lawsuit stems from an interview in March where Stephanopoulos, while talking to Congresswoman Nancy Mace (R-S.C.), repeatedly described President Trump as being “liable for rape” following the judgement in a civil lawsuit filed by disgraced former author E. Jean Carroll. The jury in that case technically found Trump liable for sexual assault, but not for rape. In her 21-page ruling, U.S. District Judge Cecilia Altonaga rejected ABC’s multiple claims to protection, including their assertion that they were not liable for defamation under the “fair reporting privilege.” The network pointed to a prior ruling by U.S. District Judge Lewis Kaplan, a Clinton appointee, who previously ruled that it did not constitute defamation when Carroll herself described Trump as guilty of rape, claiming that the legal distinction “is minimal.”

“Here, of course, New York has opted to separate out a crime of rape; and Stephanopoulos’s statements dealt not with the public’s usage of that term, but the jury’s consideration of it during a formal legal proceeding,” Judge Altonaga, an appointee of George W. Bush, said in her ruling, determining that the issue at hand was whether or not Stephanopoulos’ statements were substantially true. “Once again, the Court does not find that a reasonable jury must — or even is likely to — conclude Stephanopoulos’s statements were defamatory,” Altonaga continued. “A jury may, upon viewing the segment, find there was sufficient context. A jury may also conclude Plaintiff fails to establish other elements of his claim … But a reasonable jury could conclude Plaintiff was defamed and, as a result, dismissal is inappropriate.”

Stephanopoulos referred to Trump as “liable for rape” 10 different times in the interview with Mace, even as the congresswoman pushed back on his assertions. The lawsuit against ABC and Stephanopoulos, which was filed in Miami, is seeking an unspecified amount of money in compensation for damages. President Trump declared the ruling to be a “big win” for his case. In a post on his Truth Social website, Trump said that “before you know it, the fake news media will be forced by the courts to start telling the truth.”

“Principal Jesus Becerra at Viejo Elementary punished a seven-year-old girl named B.B. in the lawsuit for writing “any life” under a “Black Lives Matter” picture..”

• Federal Judge Rules Against Free Speech in Elementary Schools (Turley)

District Court Judge David Carter delivered a crushing blow against free speech rights in elementary schools in an outrageous case out of Orange County. Principal Jesus Becerra at Viejo Elementary punished a seven-year-old girl named B.B. in the lawsuit for writing “any life” under a “Black Lives Matter” picture. Judge Carter issued a sweeping decision that said that she has no free speech rights in the matter due to her age and that the school is allowed to engage in raw censorship. He is now being appealed. The message from the school seems to be that black lives matter but free speech does not. The school found a kindred spirit in Judge David Carter. After a lesson on Martin Luther King, B.B. gave her picture to a friend, believing the inclusive image of four shapes of different races and the words would be comforting to a friend. However, when that child showed the picture to a parent, a complaint was filed that B.B.’s pictures was insensitive and offensive. Becerra responded by disciplining the child for her inclusive picture.

Becerra should be fired, but his extreme views and lack of judgment is hardly unique in education. The far greater damage was created by Carter’s opinion. Judge Carter ruled that B.B. has no free speech to protect due to her age, but that “students have the right to be free from speech that denigrates their race while at school.” Judge Carter added that “an elementary school … is not a marketplace of ideas… Thus, the downsides of regulating speech there is not as significant as it is in high schools, where students are approaching voting age and controversial speech could spark conducive conversation.” The court leaves a vacuum of protected rights that he fills with what seems unchecked authority for the school: “a parent might second-guess (the principal’s) conclusion, but his decision to discipline B.B. belongs to him, not the federal courts.”

The Pacific Legal Foundation, has now filed a petition with the U.S. Ninth Circuit Court of Appeals on behalf of Chelsea Boyle and her child, B.B. In my view, Judge Carter is dead wrong, though I expect he will find support among some of the judges on the Ninth Circuit. The Court applies the famous ruling in Tinker v. Des Moines Indep. Cmty. Sch. Dist., 393 U.S. 503 (1969), as a license for sweeping censorship and discipline. Yet, the Court in Tinker that students have free speech rights and that any restrictions require evidence of “interference, actual or nascent, with the schools’ work or collision with the rights of other students to be secure and to be let alone.” It then imposes a high standard that it must “materially disrupt[] classwork or involves substantial disorder or invasion of the rights of others.” This disruption must be “caused by something more than a mere desire to avoid the discomfort and unpleasantness that always accompany an unpopular viewpoint.”

However, what is more disturbing is the disconnection of the right from anything but a narrow functionalist view of free speech. In my new book, “The Indispensable Right: Free Speech in an Age of Rage,” I criticize the functionalist approaches that tie the protection of free speech to its function in advancing a democracy. I argue for a return to the view of free speech as a natural or human right — a view that was popular at the beginning of our Republic but soon lost to functionalist rationales. Those rationales allow for the type of endless trade offs evident in the Carter decision. Carter’s functionalist or instrumentalist approach makes it easier to simply discard any free speech rights in elementary students. In my view, they have free speech rights as human beings as do their parents. Under Carter’s approach, schools can engage in a wide array of indoctrination by declaring opposing political and social views to be “disruptive.”

Ironically, my book criticizes Judge Carter in another case over his failure to consider free speech concerns. In his decision in the January 6th case involving John Eastman, Carter dismisses his arguments that he had a right to present his novel theory against certification of the election. While many of us disagreed with Eastman, there was a concern over efforts to strip lawyers of their bar licenses and even use criminal charges against such figures. However, what concerned me the most was sweeping language used by Carter in his decision. Carter’s narrow view of free speech and his expansive view of state authority is hardly unique. B.B. is devoid of free speech protections even in his outrageously abusive case. The reason is that she is not of an age where her speech is viewed as worthy of protection. It is an example of the distortive and corrosive effect of functionalism in free speech jurisprudence in my view.

Dog park

Puppy realizes he's at dog park, goes absolutely bonkers pic.twitter.com/qmjCrZ2Hlv

— B&S (@_B___S) July 25, 2024

Tetris

Magic of creativity. 😂pic.twitter.com/M03zEPG1dy

— Figen (@TheFigen_) July 24, 2024

Santorini

Incredible backyard transformation. pic.twitter.com/SAWVQjE4mo

— HOUSE PORN (@HOUSEPORN___) July 23, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.