Wyland Stanley Pontiac coupe at San Francisco Palace of Fine Arts 1935

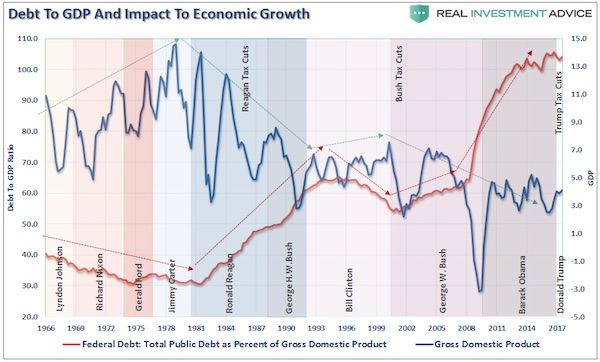

This is about much more than the Tax bill. It’s about how much growth you get per dollar in debt added. That is crucial.

• A Fiscal Disappointment – Tax Bill (Lebowitz)

The Committee For A Responsible Budget penned after the passage of the tax bill: “The House approved debt-financed tax cuts based on predictions of magical economic growth that defy history and all credible analyses. Tax reform should grow the economy and not add to the debt. Unfortunately, lawmakers are assuming faster economic growth will pay for that debt increase when there is no evidence it will cover more than a fraction of the tax bill’s costs. The last time Congress added 10-figures worth of tax cuts to the debt in 2001, it blew a hole in the budget and helped erase our surpluses — despite claims that economic growth would cover the cost.The growth fairy did not appear then, and it would be unwise to assume she will this time around.” Read that again. Despite claiming to be “fiscally conservative,” what is so amazing is that Republicans are considering doing this when debt is at the highest level in history and climbing.

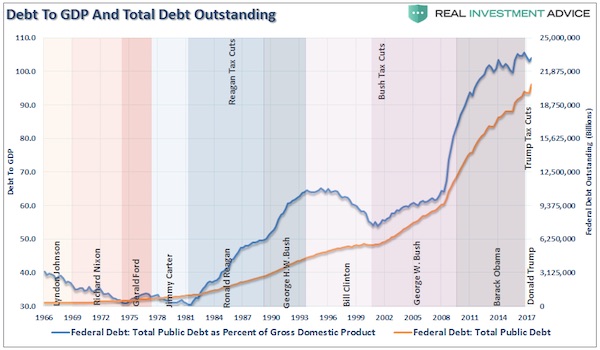

When the “Reagan” tax cuts of were passed, debt was less than 50% of GDP, inflation and interest rates were high and falling, and the economy was just recovering from back to back recessions. When the “Bush” tax cuts were passed, debt to GDP was only slightly higher than under Reagan but despite the tax cuts, the economy slid into a recession compounded by the “dot.com” bust. Currently, debt is 104% of GDP — higher than any time in history, the economy has been in a 9-year expansion at the lowest rate of growth on record, and interest rates and inflation are low with the Fed hiking rates and reducing monetary support. The situation currently is much more like Bush versus Reagan. Lastly, despite the continuing “talking points” that “tax cuts” spur economic growth and will pay for themselves over time….there is no evidence to support that claim.

A curious tale.

• Mt. Gox’s Bitcoin Customers Could Lose Again (R.)

When Mt. Gox, the world’s largest bitcoin trading exchange, collapsed in early 2014, more than 24,000 customers around the world lost access to hundreds of millions of dollars’ worth of cryptocurrency and cash. More than three years later, with the price of bitcoin skyrocketing to more than $7,000, not a single customer has recouped a single cent, crypto or otherwise. It’s not clear when they will. The failed exchange has become stuck in a morass of litigation – a Russian doll of bankruptcies in Japan and New Zealand, four in all, plus lawsuits in the United States and competing claims from creditors. And although the Mt. Gox bankruptcy trustee recovered digital currency now worth more than $1.6 billion, under Japanese law the exchange’s customers likely will recover only a fraction of that.

Kim Nilsson, a Swedish software developer who had more than a dozen bitcoins at Mt. Gox, isn’t optimistic of a payout soon. “It’s a legal twilight zone,” he says. “I wouldn’t be surprised if it took several years more.” There are few better examples of the dangers of investing in cryptocurrencies than Mt. Gox. As Reuters reported in September, cryptocurrency exchanges – where digital coins are bought, sold and stored – are largely unregulated and have become magnets for fraud and deception. At least 10 of them have closed, often after thefts, leaving customers without their funds. In all, more than 980,000 bitcoins have been stolen from exchanges since 2011 – two-thirds of those from Mt. Gox. Today, all of the stolen coins would be worth more than $6 billion, Reuters has calculated.

Mt. Gox is one of the few collapsed exchanges that ended up in bankruptcy court; some just vanished. But the problem for Mt. Gox’s thousands of creditors is that under Japanese bankruptcy law, their claims were valued at the market price of bitcoin in April 2014 just before the Tokyo District Court ordered the exchange be liquidated. At that time, one bitcoin was worth $483. On the basis of the April 2014 value, the claims ultimately approved were fixed at 45.6 billion Japanese yen, currently about $400 million. Based on the current price of bitcoin, Mt. Gox’s bankruptcy trustee is sitting on enough cash to repay creditors whose claims have been approved more than three times that amount, according to Reuters’ calculation. But that likely won’t happen, according to two Japanese bankruptcy attorneys.

In Japan, by law any funds left over in a bankrupt company’s estate after creditors have been paid go to shareholders. Mt. Gox is 88% owned by a Japanese company called Tibanne. And Mark Karpeles, a 32-year-old French software engineer and Mt. Gox’s former chief executive, owns 100% of Tibanne. Karpeles is currently on trial in Tokyo, accused of embezzling money from Mt. Gox and manipulating its data, as well as breach of trust. He has pleaded not guilty to the charges, some of which carry sentences of up to 10 years. He served nearly a year in jail following his arrest in August 2015.[..] In a three-hour interview, Karpeles told Reuters he doesn’t want the money. The main reason: He expects he would be inundated with lawsuits. He says he already is facing about a half dozen. “I don’t want to be the beneficiary of this,” he said. “I don’t really need money. I work, I get by.”

Bubbles all around.

• The Coming Economic Downturn In Canada (MN)

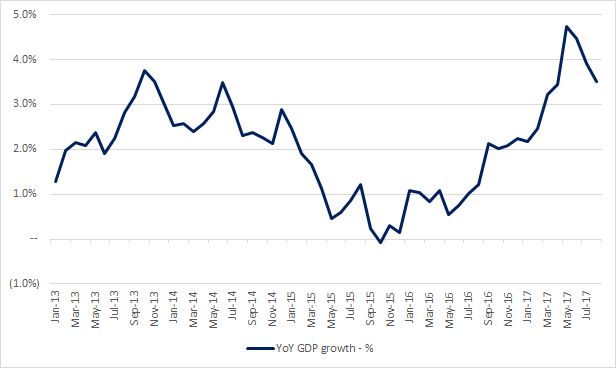

Given its natural resource-based economy, Canada is a boom and bust kind of place. This year, the country has enjoyed a significant boom. Thanks to a government stimulus program, rising corporate capital expenditures and consumer spending, Canada’s GDP growth has been nothing short of spectacular in 2017. According to Statistics Canada, the latest reading for year-over-year GDP growth is a healthy 3.5% (as of August 2017). While this is stronger than all major developed countries, growth is decelerating from its most recent peak in May 2017 (when GDP growth was an astounding 4.7%). A visual overview of historical GDP growth is shown below for reference:

Following the crude oil bust in the second quarter of 2014, Canadian growth rates cratered. While the country avoided a technical recession, the economic outlook was poor until early 2016. After crude oil returned to a bull market in the first quarter of 2016, the fortunes of the country turned. Given limited growth in 2015, the economy had no problem delivering 2%+ year-over-year growth rates in 2016. As a substantial stimulus program ramped up government spending in 2017, growth rates have continued to accelerate this year. While Canada has delivered exceptional growth in the last two years, the future outlook is much more challenging.

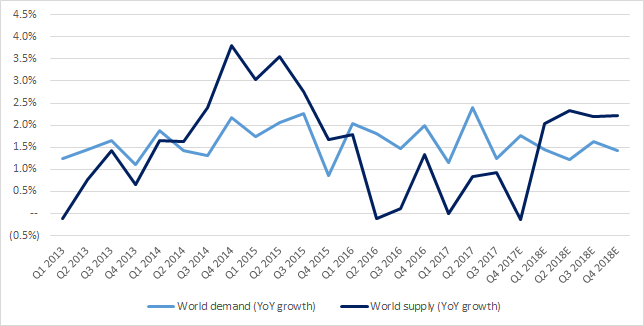

Beyond the issue of base effects (mathematically, year-over-year GDP growth will be much tougher next year), key sectors including the oil & gas industry and Canadian real estate look ripe for a downturn. As WTI crude strengthens beyond $55, crude oil is clearly in a bull market today. Looking at figures from the International Energy Agency, global demand growth continues to run ahead of supply growth. Thus the ongoing bull market is supported by fundamentals. Thanks to the impact of hurricanes and infrastructure bottlenecks in 2017, US shale hasn’t entirely fulfilled its role as the global ‘swing producer’ this year. The dynamics of supply growth versus demand growth are shown below:

It’s a good thing this is getting addressed. It may well be too late though.

• How a Half-Educated Tech Elite Delivered Us Into Chaos (Naughton)

One of the biggest puzzles about our current predicament with fake news and the weaponisation of social media is why the folks who built this technology are so taken aback by what has happened. Exhibit A is the founder of Facebook, Mark Zuckerberg, whose political education I recently chronicled. But he’s not alone. In fact I’d say he is quite representative of many of the biggest movers and shakers in the tech world. We have a burgeoning genre of “OMG, what have we done?” angst coming from former Facebook and Google employees who have begun to realise that the cool stuff they worked on might have had, well, antisocial consequences.

Put simply, what Google and Facebook have built is a pair of amazingly sophisticated, computer-driven engines for extracting users’ personal information and data trails, refining them for sale to advertisers in high-speed data-trading auctions that are entirely unregulated and opaque to everyone except the companies themselves. The purpose of this infrastructure was to enable companies to target people with carefully customised commercial messages and, as far as we know, they are pretty good at that. (Though some advertisers are beginning to wonder if these systems are quite as good as Google and Facebook claim.) And in doing this, Zuckerberg, Google co-founders Larry Page and Sergey Brin and co wrote themselves licences to print money and build insanely profitable companies.

It never seems to have occurred to them that their advertising engines could also be used to deliver precisely targeted ideological and political messages to voters. Hence the obvious question: how could such smart people be so stupid? The cynical answer is they knew about the potential dark side all along and didn’t care, because to acknowledge it might have undermined the aforementioned licences to print money. Which is another way of saying that most tech leaders are sociopaths. Personally I think that’s unlikely, although among their number are some very peculiar characters: one thinks, for example, of Paypal co-founder Peter Thiel – Trump’s favourite techie; and Travis Kalanick, the founder of Uber. So what else could explain the astonishing naivety of the tech crowd? My hunch is it has something to do with their educational backgrounds.

Take the Google co-founders. Sergey Brin studied mathematics and computer science. His partner, Larry Page, studied engineering and computer science. Zuckerberg dropped out of Harvard, where he was studying psychology and computer science, but seems to have been more interested in the latter. Now mathematics, engineering and computer science are wonderful disciplines – intellectually demanding and fulfilling. And they are economically vital for any advanced society. But mastering them teaches students very little about society or history – or indeed about human nature. As a consequence, the new masters of our universe are people who are essentially only half-educated. They have had no exposure to the humanities or the social sciences, the academic disciplines that aim to provide some understanding of how society works, of history and of the roles that beliefs, philosophies, laws, norms, religion and customs play in the evolution of human culture.

It’s as much about the companies as it is about Europe’s own tax havens. The latter should be easier to tackle.

• Europe Turns On Facebook, Google For Digital Tax Revamp (AFP)

They have revolutionised the way we live, but are US tech giants the new robber barons of the 21st century, banking billions in profit while short-changing the public by paying only a pittance in tax? With public coffers still strained years after the worst of the debt crisis, EU leaders have agreed to tackle the question, spurred on by French President Emmanuel Macron who has slammed the likes of Google, Facebook and Apple as the “freeloaders of the modern world”. As recently as March, five of the world’s top 10 valued companies were Silicon Valley behemoths: Apple, Google’s Alphabet, Microsoft, Amazon and Facebook. (Germany’s SAP was Europe’s biggest and 56th on the global list). But tax rules today are designed for yesterday’s economy when US multinationals -such as General Motors, IBM or McDonald’s- entered countries loudly, with new factories, jobs and more taxes for the taking.

These firms had what tax specialists call “permanent establishment”, when companies showed a clear physical presence measured and taxed through tangible, real world assets. But today in most EU nations, the US tech titans exist almost exclusively in the virtual world, their services piped through apps to smart phones and tablets from designers and data servers oceans away. Ghost-like, Silicon Valley has turned Europe’s economies upside down, but often with just a skeleton staff and some office space in markets with millions of users or customers. According to EU law, to operate across Europe, multinationals have almost total liberty to choose a home country of their choosing. Not surprisingly, they choose small, low tax nations such as Ireland, the Netherlands or Luxembourg. Thus, it is through Ireland that Facebook draws its wealth from millions of accounts across Europe.

There are 33 million accounts in France and 31 million in Germany, according to recent data. While users enjoy the platform, Facebook tracks likes, comments and page views and sells the data to companies who then target consumers. But unlike the economy of old, Facebook sells its data to French companies not from France but from a great, nation-less elsewhere, with no phone number, address or physical “presence” for a customer who probably cares little. It is in states like Ireland, whose official tax rate of 12.5% is the lowest in Europe, that the giants have parked their EU headquarters and book profits from revenues made across the bloc. Indeed, actual revenues from advertising are minimal in France and Germany, but at Facebook HQ Ireland they grew to 7.9 billion euros, even though the vast majority does not come from the tiny EU island-nation of a mere 2.5 million users.

A crazy world.

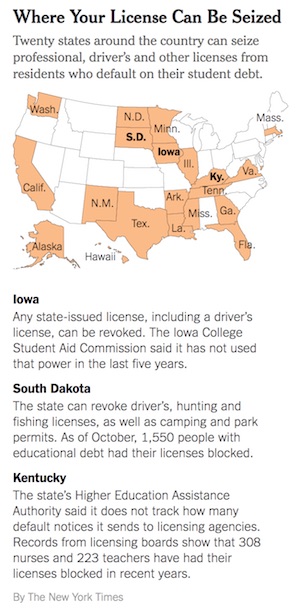

• When Unpaid Student Loan Bills Mean You Can No Longer Work (NYT)

Fall behind on your student loan payments, lose your job. Few people realize that the loans they take out to pay for their education could eventually derail their careers. But in 19 states, government agencies can seize state-issued professional licenses from residents who default on their educational debts. Another state, South Dakota, suspends driver’s licenses, making it nearly impossible for people to get to work. As debt levels rise, creditors are taking increasingly tough actions to chase people who fall behind on student loans. Going after professional licenses stands out as especially punitive. Firefighters, nurses, teachers, lawyers, massage therapists, barbers, psychologists and real estate brokers have all had their credentials suspended or revoked.

Determining the number of people who have lost their licenses is impossible because many state agencies and licensing boards don’t track the information. Public records requests by The New York Times identified at least 8,700 cases in which licenses were taken away or put at risk of suspension in recent years, although that tally almost certainly understates the true number. [..] With student debt levels soaring — the loans are now the largest source of household debt outside of mortgages — so are defaults. Lenders have always pursued delinquent borrowers: by filing lawsuits, garnishing their wages, putting liens on their property and seizing tax refunds. Blocking licenses is a more aggressive weapon, and states are using it on behalf of themselves and the federal government.

Proponents of the little-known state licensing laws say they are in taxpayers’ interest. Many student loans are backed by guarantees by the state or federal government, which foot the bills if borrowers default. Faced with losing their licenses, the reasoning goes, debtors will find the money. But critics from both parties say the laws shove some borrowers off a financial cliff.

Politicians everywhere dream of big and grandiose projects.

• Subways May Be the Latest Casualty of China’s Crackdown on Debt (BBG)

China’s frenzied construction of subway systems in cities all over the country may be easing, amid reports funding has been pulled for some projects as Beijing pushes to rein in debt levels. The National Development and Reform Commission, China’s top economic planning body, is revising a 2003 policy on subway development, Caixin reported on Saturday. The NDRC wants to “raise the bar” for approving local rail projects amid growing concern over a debt-driven infrastructure boom, the financial magazine said, citing sources that it didn’t identify. Population levels, as well as the economy and fiscal conditions of Chinese cities seeking permission for subway projects will be more closely scrutinized, Caixin said. Subway construction is a constant presence in China’s cities, with streets torn up to build the capacity needed to transport the swelling ranks of urban commuters.

Beijing alone has been testing three lines: a driverless subway, a maglev train, and a tram to be launched in the city’s western suburbs at the end of the year, the official Xinhua News Agency reported in September. But investment in the sector appears to be tapering off, just as China’s leaders make reining in financial risks a top priority. Fixed-asset investment in rail transportation has slowed almost to a standstill in 2017, increasing just 0.4% in January-October from a year earlier, statistics bureau data show. That’s down from 3.5% growth in the first four months of the year. Private rail transport investment – which makes up a tiny share of an industry that’s dominated by state-backed enterprises – slumped 58.6% January-October from a year earlier.

Rotation slowing by a millisecond per day.

• Upsurge In Big Earthquakes Predicted For 2018 As Earth Rotation Slows (G.)

Scientists have warned there could be a big increase in numbers of devastating earthquakes around the world next year. They believe variations in the speed of Earth’s rotation could trigger intense seismic activity, particularly in heavily populated tropical regions. Although such fluctuations in rotation are small – changing the length of the day by a millisecond – they could still be implicated in the release of vast amounts of underground energy, it is argued. The link between Earth’s rotation and seismic activity was highlighted last month in a paper by Roger Bilham of the University of Colorado in Boulder and Rebecca Bendick of the University of Montana in Missoula presented at the annual meeting of the Geological Society of America.

“The correlation between Earth’s rotation and earthquake activity is strong and suggests there is going to be an increase in numbers of intense earthquakes next year,” Bilham told the Observer last week. In their study, Bilham and Bendick looked at earthquakes of magnitude 7 and greater that had occurred since 1900. “Major earthquakes have been well recorded for more than a century and that gives us a good record to study,” said Bilham. They found five periods when there had been significantly higher numbers of large earthquakes compared with other times. “In these periods, there were between 25 to 30 intense earthquakes a year,” said Bilham. “The rest of the time the average figure was around 15 major earthquakes a year.”

The researchers searched to find correlations between these periods of intense seismic activity and other factors and discovered that when Earth’s rotation decreased slightly it was followed by periods of increased numbers of intense earthquakes. “The rotation of the Earth does change slightly – by a millisecond a day sometimes – and that can be measured very accurately by atomic clocks,” said Bilham. Bilham and Bendick found that there had been periods of around five years when Earth’s rotation slowed by such an amount several times over the past century and a half. Crucially, these periods were followed by periods when the numbers of intense earthquakes increased. “It is straightforward,” said Bilham. “The Earth is offering us a five-year heads-up on future earthquakes.”

Many will not.

• Will Puerto Ricans Return Home After Hurricane María? (Conv.)

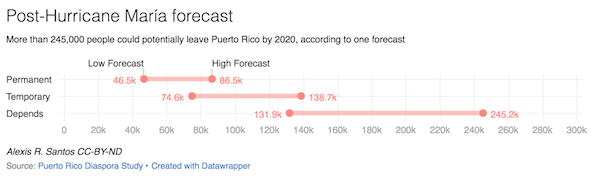

Even before this year’s devastating hurricane season, the team of demographers I work with at Penn State and the Puerto Rico Institute of Statistics had predicted that the population of Puerto Rico would decline over the next few decades. Have Hurricanes Irma and María accelerated this trend? Slowing population decline is central to the economic recovery plan drafted by the Puerto Rican government in March of this year. If migration off the island accelerates, it is likely that the government of Puerto Rico will face even greater challenges in meeting that plan’s milestones. Preliminary data from the Puerto Rican Diaspora Study, which I recently concluded, can help shed light on how many Puerto Ricans who have fled the island might return home – and how many are gone for good.

In the two months since María made landfall, Puerto Ricans have left the island in even higher numbers than before. Recent commercial flight passenger data indicate that between Sept. 20, the day Hurricane María made landfall, and Nov. 7, approximately 100,000 people left Puerto Rico. That number exceeds the 89,000 people who left island during all of 2015 and increases by the day. Lack of access to power, drinking water and health care are pushing people out. Recent forecasts of migration out of Puerto Rico from the Center for Puerto Rican Studies at CUNY suggest that, because of Hurricane María, the island may lose up to 470,335 residents, or 14% of its current population, by 2020. This would represent a doubling of migration off the island compared to previous years.

3,000 died this year.

• 600 African Migrants Rescued Near Spain (AFP)

Around 600 African migrants were rescued off the coast of Spain in 24 hours, a sea rescue patrol said Saturday. The Guardia Civil and Salvamento Maritimo rescue service added that operations to recover further migrants were still under way. Spain is the third busiest gateway for migrants arriving in Europe, but far behind Italy and Greece. However, the number of people arriving by sea in Spain has nearly tripled over the last year to 17,687. Many Africans undertaking the long route to Europe are choosing to avoid crossing danger-ridden Libya to get to Italy along the so-called central Mediterranean route, and choosing instead to get there via Morocco and Spain.

On Saturday, most of the migrants arrived in the south-eastern region of Murcia, where 431 people aboard 41 makeshift boats were discovered. Patrols found more than 110 people in the Alboran Sea, between Morocco and Spain’s Andalusian coast. Operations were also conducted in the Strait of Gibraltar, recovering 48 people on four makeshift boats. The rescues were carried out by the Navy, the Guardia Civil police and Salvamento Maritimo. According to the International Organization for Migration (IOM) close to 160,000 people have made the dangerous crossing to Europe this year and almost 3,000 more died or went missing while trying.

An irreversibly harmed child who has been waiting for a year for Britain to fulfill an already made pledge.

• First Child Refugee From Greek Camps Comes To UK (G.)

More than a year after the UK government pledged to transfer hundreds of child refugees from Greece, the first unaccompanied minor from the country will arrive in London this week. However the 15-year-old Syrian is described by experts as profoundly traumatised because of the delay and has recently attempted to take his own life. Fourteen months have elapsed since the boy was first identified by the Home Office as especially vulnerable and eligible for immediate transfer. It has also emerged that Hammersmith and Fulham council in west London told the Home Office a year ago that it had a place for the teenager, but officials did not act on the offer – a decision that charities say has caused “irreversible damage” to the child, who has lost contact with his family in Syria.

Giannoula Kefala, the council’s principal social worker, said: “From my perspective, the impasse and likely irreversible harm already caused to this extremely vulnerable child is unbearably disturbing.” Kefala said that last December she informed the Home Office of her intention to travel to Greece to assess the boy. “It is absolutely clear from my visit that the long delay has caused this child terrible harm, and that it has been apparent for a long time that the available resources in Greece cannot cater for this child’s needs. Recent hospital records make clear that the ongoing uncertainty is having a devastating impact.” The teenager is currently on heavy psychiatric medication, which worries his doctor but which is believed to be necessary to prevent a fatal outcome.

Until last Monday the youngster was being detained in a police cell with no access to medical professionals, and forced to sleep on a mattress on the floor. On 22 October, police said the boy, after repeated self-harming, had made a suicide attempt and was at “imminent risk of killing himself”. Kefala said she was concerned the boy could die.

They live in summer tents. It’s been pouring with rain for days. The UNHCR has many rolls of plastic sheeting just lying around.

• Lesvos Authorities Going On Strike Over Rising Migrant Population (K.)

With reception centers for migrants on the Aegean islands reaching breaking point, local authorities on Lesvos go on strike on Monday to draw attention to the problem. The island’s mayor, Spyros Galinos, called the general strike last week, noting that the rising migrant population “has fueled insecurity among citizens.” Authorities on Lesvos want the government to move migrants from seriously overcrowded facilities on the islands to the mainland. Around 16,000 migrants have been relocated to the mainland since October last year, but more transfers are needed as dozens continue to reach the islands daily even as the pace of returns to Turkey remains slow. Concerns are also growing about hundreds of migrants living in tents around the reception centers amid worsening weather conditions. The Interior Ministry has said that measures to deal with the winter months will be implemented in phases through the end of December.

Please stop.

• Over 50,000 Yemeni Children Expected To Die By The End Of 2017 (Ind.)

More than 50,000 children in Yemen are expected to die by the end of the year as a result of disease and starvation caused by the stalemated war in the country, Save the Children has warned. Seven million people are on the brink of famine in the country, which is in the grips of the largest cholera outbreak in modern history. An estimated 130 Yemeni children are dying every day and an estimated 400,000 children will need treatment for acute malnutrition this year, the charity said. “These deaths are as senseless as they are preventable,” said Tamer Kirolos, Save the Children’s country director for Yemen. “They mean more than a hundred mothers grieving for the death of a child, day after day.”

Eighteen-month-old Nadhira from the Bani Qais district of Hajja, northern Yemen, is suffering from severe acute malnutrition and respiratory diseases. Her mother saved the family’s income for three days to afford to take her to Hajja city for treatment, but her condition deteriorated once again after they were left unable to afford the medicine. “I worry about my family’s food and medicine when they get sick. I want my daughter to live: she’s my biggest concern now. I wish my daughter recovers from her sickness soon,” her mother Shaika said.

The charity has warned the death toll as a result of starvation and disease could be even higher, as the calculations were made before Saudi Arabia tightened a blockade on rebel-held parts of the country in response to a missile fired from rebel territory towards Riyadh international airport this month. The blockade has closed the major entry ports of Hodeidah and Saleef, as well as the airport in the capital Sanaa, which has severely hindered the access of food and aid.

Home › Forums › Debt Rattle November 19 2017