Claude Monet Impression Sunrise 1872

Jabalya

Stop what you're doing and look at the destruction of the Jabalia Refugee Camp today.

Another huge Israeli massacre, with sources claiming hundreds of casualties. pic.twitter.com/5VdFlAqU3I

— Alan MacLeod (@AlanRMacLeod) October 31, 2023

https://t.co/WqnKDiaCMp pic.twitter.com/LYzaU200y7

— jordan (@JordanUhl) October 31, 2023

Ritter

Blitzer

CNN's Wolf Blitzer: You knew that there were innocent civilians in that refugee camp, right?

IDF spox: This is the tragedy of war. We told them to move south.

Blitzer: So you decided to drop the bomb anyway.

IDF spox: We’re doing everything we can to minimize civilian deaths. pic.twitter.com/oAtW7jV0pc

— Justin Baragona (@justinbaragona) October 31, 2023

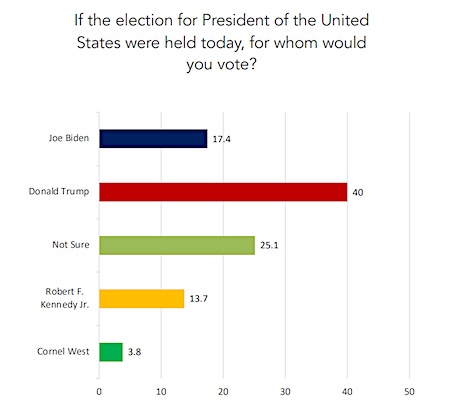

Arab American Institute poll

Malcolm X

A reporter asked Malcolm X to condemn the Mau Mau resistance to British colonialism in Kenya.

This was his response… pic.twitter.com/6vQTM7TLVC

— MintPress News (@MintPressNews) October 31, 2023

MaxAlex

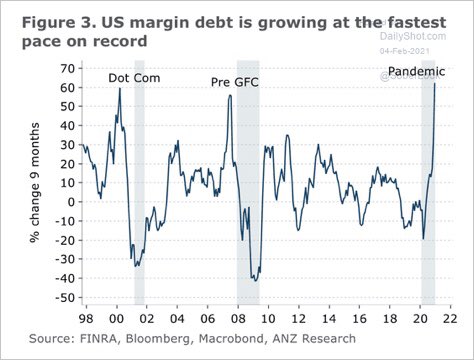

"Now that the debt is so high, there is no way to handle it other than to go to war."

Max Keiser on suicide bankers and the debt.

Alex Jones 10/30/23 pic.twitter.com/lPfmbDKXPb

— Saraphina99 (@Saraphina992) October 31, 2023

“When the fighting stops, the cost to children and their communities will be borne out for generations to come..”

• Gaza Now A ‘Graveyard’ For Children – UNICEF (RT)

The UN Children’s Fund (UNICEF) has reiterated its call for a humanitarian ceasefire in the Israel-Hamas war, saying the conflict is killing thousands of kids in Gaza and putting many more at risk from the violence and a water crisis. “Gaza has become a graveyard for thousands of children,” UNICEF spokesman James Elder told reporters on Tuesday in Geneva, “It’s a living hell for everyone else.” He noted that more than 3,450 children in the Palestinian enclave have already been killed, and the death toll rises significantly every day. Elder made his comments as Israel escalated its ground offensive in Gaza in response to the Hamas terrorist attacks that killed an estimated 1,400 people on October 7. Gaza’s water system also has been crippled by the conflict, contributing to an overall death toll of more than 8,000 in the territory.

“The threats to children go beyond bombs and mortars,” Elder said. He added that Gaza’s water production capacity has been cut to 5% of its normal level, putting more than 1 million children at risk of dying from dehydration. Many children have been sickened by drinking salty water out of desperation. Elder noted that even before the latest war between Israel and Hamas, more than three-fourths of Gaza’s children were identified as needing mental health support because of the trauma they had faced. “When the fighting stops, the cost to children and their communities will be borne out for generations to come,” he said. With Gaza’s children “living through a nightmare,” the UNICEF spokesman said, Israel must end its siege of the territory.

He called for all access crossings into Gaza to be open, allowing for the safe passage of food, water, fuel, medical supplies, and other humanitarian aid. “And if there is no ceasefire – no water, no medicine, and no release of abducted children – then we hurtle toward even greater horrors afflicting innocent children.” Israel’s government has blasted the UN, arguing that the body has not sufficiently condemned the atrocities committed by Hamas on October 7. West Jerusalem’s ambassador to the UN, Gilad Erdan, announced on Monday that members of his delegation would respond by donning yellow stars, alluding to the labels that Jews were forced to wear during the Holocaust. “From this day on, each time you look at me, you will remember what staying silent in the face of evil means,” he said in a speech to the UN Security Council.

"Gaza has become a graveyard for children. It's a living hell for everyone else.” – @UNICEF

"Fuel is vital for the water supply; for the ambulances; for the hospitals to operate." – @WHO

"Some of these buildings where people are sheltering are coming under attack." – @UNOCHA pic.twitter.com/YoU5AvRGT1

— United Nations Geneva (@UNGeneva) October 31, 2023

“.. fighting in urban areas, suicide bombings, air strikes, mines, IEDs and deliberate militant attacks on schools and hospitals.”

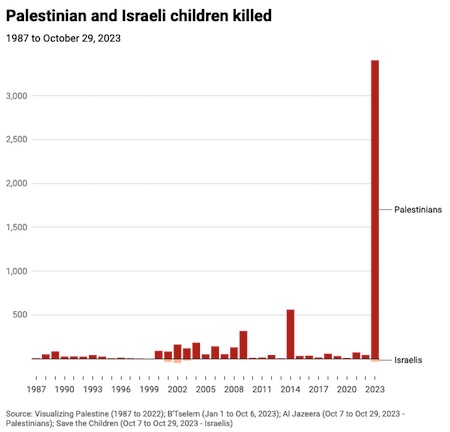

• More Children Killed in Gaza in 3 Weeks Than in Wars Worldwide Since 2019 (Sp.)

The escalation of the Palestinian-Israeli crisis has had a devastating impact on civilians. Commenting on the conflict earlier this month, Russian President Vladimir Putin urged that non-combatants be spared. “If men decide to fight amongst themselves, let them do it. But leave women and children alone,” Putin stressed. More children have now been killed in Gaza over the past three weeks than perished in conflicts across the globe during any year since 2019. That’s according to a report by Save the Children, a London-headquartered international children’s rights non-profit. Per the charity’s figures, based on data from the Gazan and Israeli health ministries, some 3,195 children were reported killed in Gaza since the October 7 escalation, with another 33 perishing in the West Bank, and 29 in Israel, for a total of 3,257. That’s far more than the number of children killed in any other armed conflict across some 20 nations throughout 2023, and the highest number since 2019, the charity says.

Indeed, according to annually published reports by the United Nations Secretary-General on Children and Armed Conflict, the ongoing Palestinian-Israeli crisis has been particularly devastating for the world’s youngest inhabitants. Comparatively, some 2,985 children died in conflicts in 2022, 2,515 in 2021, and 2,674 in 2020. In 2019, 4,019 children were confirmed killed, mostly in conflicts and insurgencies raging across Iraq, Afghanistan, Yemen, Syria, Myanmar, the Philippines, Palestine, Somalia, Mali, the Central African Republic, and South Sudan. 6,154 children were injured that year, with deaths and injuries attributed to fighting in urban areas, suicide bombings, air strikes, mines, IEDs and deliberate militant attacks on schools and hospitals.

Along with the fatalities, some 6,360 children in Gaza have now been maimed over the past three weeks, together with 180 in the West Bank, and 74 in Israel. Israeli media estimates that up to 30 children have been taken hostage by Hamas fighters and remain in captivity. Children are estimated to make up over 40 percent of deaths among the 7,700+ people killed in Gaza to date, and about 3 percent of the 1,033 fatalities reported in Israel since the start of hostilities this month. “One child’s death is one too many, but these are grave violations of epic proportions,” Save the Children Palestine director Jason Lee said in a statement of the Gaza fatalities. “A ceasefire is the only way to ensure their safety. The international community must put people before politics – every day spent debating is leaving children killed and injured. Children must be protected at all times, especially when they are seeking safety in schools and hospitals.”

“..it is still better than the wars that happened in the 20th century, but there is little joy.”

• World War III Has Already Started – Lukyanov (RT)

The Third World War is already underway, Fyodor Lukyanov, Russia’s leading foreign policy expert, has said. A world order that has been “unpleasant” but “manageable” is being broken down and currently there seems to be no mechanism for the resolution of conflicts, including the ongoing escalation between Israel and Hamas, he believes. Lukyanov, who is chairman of the presidium at think tank Council for Foreign and Defense Policy (SVOP) and editor-in-chief of magazine Russia in Global Affairs, made the remarks in an interview published last week by newspaper Komsomolskaya Pravda. Of late, the world has been seen old, frozen conflicts getting re-ignited, Lukyanov said, listing as examples the Nagorno-Karabakh hostilities, the Russia-Ukraine standoff and the new escalation in the Middle East.

The ongoing array of conflicts is effectively the new World War, which appears to significantly differ from the two global conflicts of the 20th century, Lukyanov, who is also a research director of the Valdai International Discussion Club, suggested. “There is a chain of conflicts affecting the whole world. In fact, World War III is already underway. In this sense, it is still better than the wars that happened in the 20th century, but there is little joy.” “We instinctively expect that the war will begin just like the Great War or the [Second World War]. But such wars probably won’t happen anymore – after all, there are nuclear weapons, which are still holding back many,” the expert said.

The escalation in the Middle East is not the last conflict to come, with more hostilities expected to break out worldwide soon – and no one seems to be capable now of stopping them, he also warned. “The international order is breaking down. It was an unpleasant one, based on the fear of mutual destruction, but manageable. Wars in the Middle East have erupted before, but the USSR and the USA intervened and extinguished them until the next conflict. And now I don’t see even a temporary settlement mechanism,” Lukyanov said. He noted that the Palestinian militant group Hamas has apparently picked the “right” moment to strike against Israel, given that the country has experienced “permanent internal chaos” for over a year already.

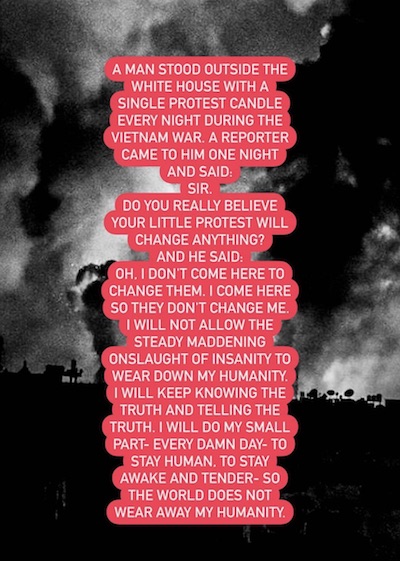

Just like with Ukraine, calling for peace is verboten.

• UK Official Fired For Urging “Permanent” Ceasefire In Gaza (RT)

UK Prime Minister Rishi Sunak has fired a ministerial aide for calling for a “permanent” ceasefire in Gaza. London has stopped short of urging for an end to the war, proposing only limited “pauses” to allow aid to reach the Palestinian enclave. Conservative Member of Parliament Paul Bristow was removed from his position as parliamentary private secretary (PPS) at the Department for Science on Monday, days after he penned a letter to Sunak pressing for a long-term truce between Israel and Palestinian militants in Gaza. “Paul Bristow has been asked to leave his post in government following comments that were not consistent with the principles of collective responsibility,” a spokesperson for 10 Downing Street said, referring to a rule requiring government officials to publicly support all cabinet policy decisions.

In his two-page letter to the prime minister, Bristow argued that a “permanent ceasefire” would “save lives and allow for a continued column of humanitarian aid [to] reach the people who need it the most.” Sunak, however, has vocally defended Israel’s military action against Hamas following the group’s deadly October 7 terrorist attack, and urged against a full-on truce, instead calling for brief humanitarian “pauses” that are “distinct from a ceasefire.” Following his firing, Bristow went on to tell Sky News that he “completely understand[s] the PM’s decision,” but that he can “now talk openly about an issue so many of my constituents care deeply about.” “I believe I can do this better from the backbenches rather than as part of the government payroll,” he continued. While the UN General Assembly passed a non-binding resolution calling for an immediate ceasefire in Gaza on Saturday, London abstained in the vote, along with 44 other member states.

Fourteen countries opposed the measure, including Israel and the US, though it appeared to have had little effect as Israeli forces continued the early phase of their ground assault on Gaza. Israeli Prime Minister Benjamin Netanyahu has rejected the idea of a ceasefire, telling reporters on Monday that “calls for a ceasefire are calls for Israel to surrender to Hamas.” Following weeks of heavy airstrikes, the Israel Defense Forces (IDF) have gradually expanded ground operations in the Palestinian enclave, with officials saying the mission will aim to eliminate Hamas entirely. Some 1,400 Israelis and more than 8,000 Palestinians have been killed in the latest bout of violence, in addition to thousands injured on both sides, according to local officials. The UN has warned of a dire humanitarian crisis in Gaza should the conflict continue, though only a slow trickle of aid has been allowed into the territory in recent weeks.

Define “Semite”.

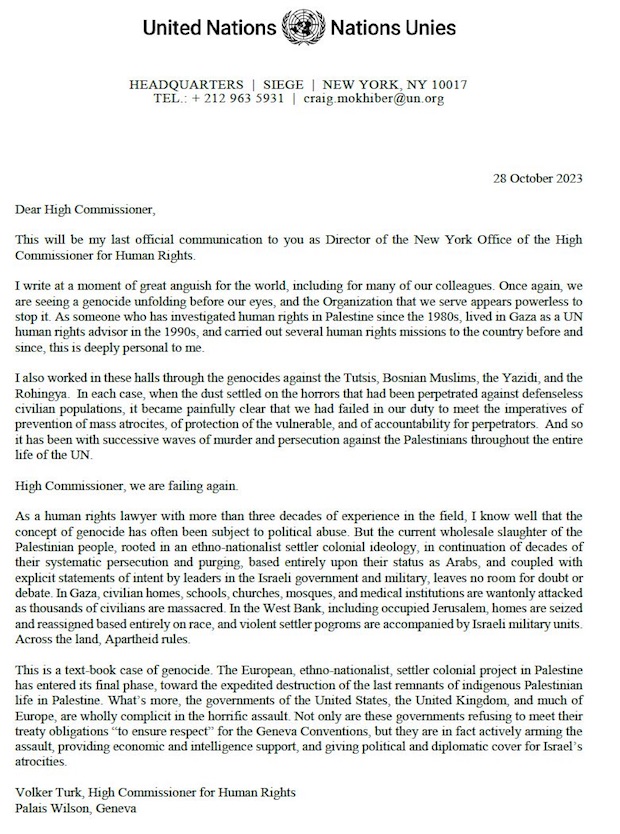

• Jewish Anti-Semitism Towards Arabs (Helmer)

The Semites, the Semitic peoples, and speakers of the Semitic languages started as a figment of the German imagination in the late 18th century and early 19th century. It quickly became a German racial epithet, used in contrast to Aryan. By the time Adolf Hitler came along, this was the pseudo-scientific doctrine in which the Germans lumped both the Jews and the Arabs into a single category – the inferiors of the Aryans. That is one of the reasons Hitler refused to listen to the advice of his general staff on aiding the Arab nationalist forces in Iraq, Syria and Palestine in the Wehrmacht’s war plans against the British and the Soviet Union. The pseudo-science of Semitism and Aryanism, and the idea of anti-Semitism which the Germans, together with the British and Americans, adopted in the run-up to World War II was spelled out at Harvard University by an anthropologist called Carleton Coon.

[..] he cribbed directly from German academics, turning out papers on the Berbers of Morocco and advancing his racial superiority-inferiority ideas between 1925 and 1939. When the war began, Coon joined the Office of Strategic Services (OSS) where he demonstrated his keenness for pistol shooting, hare-brained sabotage missions, and homicidal mania. Among his wartime schemes he proposed to remove the Arabs of the Maghreb (Morocco, Algeria, Tunisia) as unfit to rule; replace them with the restoration of the French empire; and kill those French officials whom Coon judged to get his way. He was one of the planners of the assassination of Admiral Francois Darlan, the French military commander, in Algiers on December 24, 1942; Coon’s pistol was the murder weapon.

American murderers of the Arabs like Coon then — like Israeli murderers of Arabs now — have succeeded in establishing their doctrine of exceptionalism and racial superiority in state policy as the successor to the doctrines of Aryanism and Nazism which were interrupted by Hitler’s suicide in 1945, then the Nuremberg trials concluding in 1946. The crime of racial and cultural genocide became international law in 1948. It was then modified by the new Israeli state doctrine of anti-Semitism: this decriminalised the genocide of the Palestinian people; and outlawed instead media criticism, political opposition, even science for threatening the legitimacy of Israel’s Basic Law of Arab exclusion, and Israeli military operations to enforce it.

In the present war between the Israel Defense Forces (IDF) and Hamas on the Gaza battlefield – “the American project”, as the Russian Foreign Ministry called it in a statement on October 29 *** – the doctrine of anti-Semitism as a race hatred crime is being applied to protect the race hatred crime being perpetrated against the other Semites, the Palestinians. This doctrine, however, has had a negative impact on the ability of the Israelis and the Americans to wage their war. A fresh Russian analysis of the military intelligence failures exposed by Hamas in its offensive of October 7, illustrates how and why the Israelis failed to anticipate because they underestimated their Arab adversary; and because they regarded him as a racial inferior.

“…Hassan Nasrallah, who is the secretary general of Hezbollah, will be making a significant statement on Friday. So that’s going to be something to listen to and see what direction Hezbollah will go in light of all this..”

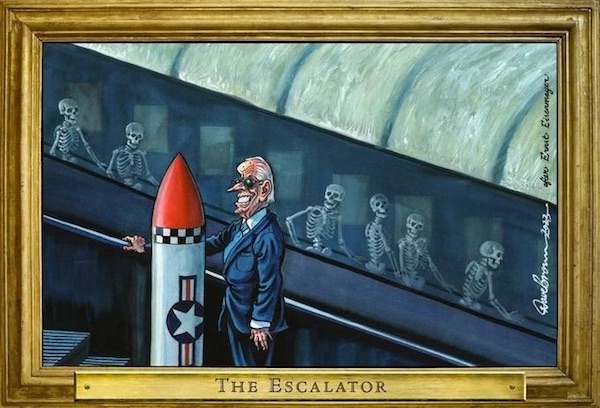

• US ‘Shooting Ourselves in the Foot’ By Provoking, Escalating Crises (Sp.)

The emergence of the latest crisis in the Middle East, which has started in Israel but threatens to draw in several other regional powers, is just the latest in which the US has forcefully asserted its interest in propping up a useful ally against its enemies there. However, it has come as the US is already deeply embroiled in the conflict between Ukraine and Russia, and has also committed significant resources and effort into a confrontation with China that has not yet exploded into open conflict. Retired senior security policy analyst Michael Maloof told Radio Sputnik’s The Critical Hour on Tuesday that the US was “shooting ourselves in the foot” by getting itself so deeply embroiled in crises of its own making around the globe, including in Eastern Europe, the Middle East, and the Asia-Pacific regions.

“In my opinion, these are all self-manufactured crises put upon by the neoconservatives within the Biden administration – not only internationally, but also domestically,” Maloof said. “And in three years, how we could deteriorate so far, so fast, is mind-boggling. And it has to be purposeful. And I’m seeing this accentuated in the policies that we have broadcast to the world internationally, in trying to contain and engineer regime change in Russia. That has failed miserably, Ukraine was just a pawn.” Now we have the Israeli situation. I think there’s evidence to show that Netanyahu knew what was happening, but I don’t think that he knew what the extent of the attack would be, the way it would be on the seventh of October. So I think that now he’s really into it and he has no other choice.

Meantime, he’s hearing increasing demands for him to step down, and the United States, of course, has moved in at least two carrier strike groups and Marines, and you wonder: what are they going to be used for?” Maloof added. “I think the whole idea is for deterrence so that Hezbollah doesn’t get into the fray. But what’s going to be happening this Friday, I’m now told, is that Hassan Nasrallah, who is the secretary general of Hezbollah, will be making a significant statement on Friday. So that’s going to be something to listen to and see what direction Hezbollah will go in light of all this. I know he has the support of the Lebanese people as well as the Lebanese army, and those are two significant factors to weigh in. And as Israel continues to do what it’s doing in Gaza, it’s intensifying the conflict, not diminishing,” Maloof said.

“And then the ultimate goal, of course, is to go after Iran. That has always been Israel’s goal, and now that they’ve got the United States sucked into it, I think that now Netanyahu feels emboldened, notwithstanding the domestic opposition he has.” “And on top of all that, we have crises that are still looming in the Asia-Pacific. And these, again, are all things that were precipitated by the Biden administration and the neoconservatives at the top, at the State Department. It’s been the State Department that has led all of these efforts. And of course, they have Victoria Nuland, [US Secretary of State Antony] Blinken – these are all neoconservatives that want to use that. They want to push the American version of democracy, of hegemony, around the world,” he said.

“And I think what they’re realizing is that it is being highly challenged as a result of Russia, China coming together, the role of the BRICS countries, the de-dollarization – again, all brought about by the Biden administration’s actions. If we sought to avoid having Russia and China become an alliance, and a military alliance at that, and draw closer together in a Eurasian approach, we perpetuated that with all of our actions. So it’s actually we’ve actually done this to ourselves. And not only did we shoot ourselves in the foot, but we’re shooting ourselves in the head. And now we’re on a slippery slope. How do you stop what’s now occurred? It’s going to be a real challenge, and we have no adult leadership in the world right now.”

“..Turkey’s recent initiative to set up an alternative mechanism to the United Nations.”

• UN a Global Mechanism For Which No Alternative Exists – Kremlin (TASS)

Russia continues to view the United Nations system as an irreplaceable international mechanism for which there is no viable alternative, despite certain inefficiencies in its work toward resolving a host of issues on the global agenda, Russian Presidential Spokesman Dmitry Peskov said on Tuesday. “We believe that the United Nations system, despite some degree of inefficiency and ineffectiveness as regards the most pressing issues on the global agenda, remains the singular international mechanism for which there is no alternative,” Peskov said, commenting on Turkey’s recent initiative to set up an alternative mechanism to the United Nations.

The presidential press secretary noted that the Turkish initiative would “require an international consensus at the very least.” “Only the future will tell whether it [reaching such a consensus] is possible during these difficult times, during this complex period of acute contradictions and conceptual changes [in worldviews],” Peskov added. Turkish Presidential Spokesman Fahrettin Altun stated earlier in the month that there was a need to establish new international organizations that would serve as an alternative to the United Nations Security Council because the latter was no longer capable of resolving global issues.

Short: there are no Jewish people living in Dagestan. None were on the plane either.

• Putin ‘Quick to Lay Down the Law’ on Dagestan Incident – Scott Ritter (Sp.)

At least 83 people have been detained over their involvement in mass riots at an airport in the city of Makhachkala, the capital of the Russian republic of Dagestan, located in the North Caucasus. Late last week, the airport was shut down for inbound and outbound flights after an angry mob stormed the facility and the tarmac after a passenger plane from Tel Aviv landed on October 29. The developments were spurred on by provocateurs on social media claiming that the plane was packed with “Jewish refugees” seeking to escape the Palestine-Israel conflict and to settle in Dagestan. Police quickly took the situation under control, with a criminal probe into the incident already underway. “This was very much an anti-Semitic mob, who wished to do harm to the Jewish passengers on the aircraft.

And they acted violently when Russian authorities came in to take control,” Ritter said, commenting on the October 29 incident. He recalled that Western media and “Western government sources” tried to use the incident “to cast Russia in a very negative light” as they alleged that Russia “is a hotbed of anti-Semitism and that this is the same as what took place during tsarist times.” “Russian President Vladimir Putin was quick to react to the situation, convening [the country’s] emergency council Security Council where he laid down the law about how Russia will respond to this or holding all of the perpetrators of this violence accountable and making it clear that there’s no room in Russia today for anti-Semitism,” Ritter said. The analyst stressed that Russia “has always maintained a neutral stance when it comes to Israel and Palestine,” and that Moscow “hopes to maintain that neutrality.”

However, he warned, this “would be marred if violence of this nature continued.” Ritter then described Russia as a country which has “a significant Muslim population,” adding, “globally the Muslim world is outraged at the behavior of the Israeli Defense Forces in Gaza, where they’ve laid siege to a city of over 2 million people and they’ve subjected these people to a bombardment that has killed many thousands of innocent civilians, many of whom are children under the age of 14.” According to the analyst, even though the Russian government has made it clear that “it’s right to be angry with the Israeli government, this anger cannot manifest itself into anti-Semitism and into blanket condemnation of Jewish people, [as well] the Jewish religion, [and] Jewish faith.”

Welcome to the freedom and democracy we are saving.

• Ukrainian Border Guards Using Drones To Catch ‘Fleeing’ Citizens (RT)

Ukraine’s border-guard service (DPSU) has released several videos showing surveillance drones helping officers catch people trying to leave the country illegally. National media have described those who’ve been caught as nationals “fleeing” Ukraine, amid an armed-forces mobilization as Kiev’s conflict with Russia continues. In the first clip published by DPSU on Saturday, a drone operator uses the aircraft’s thermal camera to guide a patrol towards a group of people hiding in bushes. The service claims the technique helped it catch 14 trespassers in four separate interceptions near the village of Okny near the border with Moldova. The next day the border guards released footage of a short chase, as seen from a drone via a night camera. The DPSU said the four would-be violators in this instance wanted to go to Moldova but were intercepted as they made their attempt.

Another video published by the service on Monday includes drone footage of a car moving down a battered road. Guards then stop the vehicle and apprehend the driver, who the DPSU claimed to be a people-smuggler. The suspect allegedly used his transport to sneak his clients to a part of the border with Moldova from where they would then cross illegally. Would-be violators in the first two cases reported by the DPSU had also used services of smugglers, who ask as much as $2,000 for help crossing the border, according to the service. The footage doesn’t go into what motivates people to embark their law-breaking trips. UNIAN, a major Ukrainian news outlet, described the official action as guards “keeping catching nationals fleeing across the border.” Kiev has banned men who are eligible to serve in the military from leaving the country unless they get a waiver.

It’s now reportedly ramping up efforts to draft additional troops, after suffering heavy casualties in attempts to breach Russian defensive lines over the months of the so-called summer counteroffensive. Ukrainian MP Sergey Rakhmanin, who sits on the parliamentary Committee for Security, Defense, and Intelligence, said in an interview last week that the country had long exhausted the reserve of persons who’d volunteered to go the front. Moscow has accused Kiev’s Western sponsors of using Ukrainians as “cannon fodder” in a proxy war against Russia. In a speech at a security forum in Beijing on Monday, Defense Minister Sergey Shoigu estimated Ukrainian casualties during the counteroffensive at over 90,000.

“Zelensky cannot stop, because peace for him is political death,” Oleynyk explained. “He understands that he will have to answer for everything to the Ukrainian military and to the families of the victims.”

“.. for the Ukrainian people, liberation from this Nazi occupation by the occupying power of the United States is not a defeat, but a hope for a new life in Ukraine.”

“The military may simply refuse to carry out [Zelensky’s] order because it is meaningless and absurd..”

• Tensions Between Zelensky and Top Brass Over Ukraine Counteroffensive (Sp.)

Valery Zaluzhny believes that the Ukrainian counteroffensive should be wrapped up and argues that the army needs to prepare for a new operation next year. For his part, Volodymyr Zelensky insists on the necessity to proceed with the military campaign, according to the British media. In September, the Ukrainian president vowed to carry out a counteroffensive in autumn and through winter while speaking to the US press, after a day of meetings on Capitol Hill and the White House. Zelensky claimed that Kiev made a mistake by taking a pause last year after making some territorial gains and pledged to take two or three cities in the near future. “Zelensky has no military experience, he sets political goals,” Volodymyr Oleynyk, a Ukrainian politician and former MP of the Verkhovna Rada (Ukrainian parliament), told Sputnik.

“The priority for him, for example, is an offensive at all costs, not sparing the soldiers, but getting results in the form of the liberation of cities. The West accepts him, praises him; in addition, [military] results bring money. And for Zaluzhny it is very important to preserve the army.” Per Oleynyk, tensions have been brewing between Zelensky and Zaluzhny for quite a while. Zaluzhny sees that the Ukrainian Army lacks air superiority, manpower, and equipment, but he is forced to advance nonetheless, the politician explained. “[Ukraine] has no means for an offensive – neither technical nor human – there is no advantage in the air, and so on,” Oleynyk said. “And [Zaluzhny] now professes the concept of defense. That is, we need to, following the example of Russia, dig in and remain on the defensive, not to carry out any offensives, because it would lead to a defeat.

But Zelensky insists on continuing the offensive. Why? It is clear that this is about the money that Western countries will or will not allocate. If there is an offensive, there will be money; if there is no offensive, there will be no money.” Americans view the Ukraine conflict as a proxy war and, of course, they want to defeat Russia at Ukraine’s expense, the politician continued. However, given that the well-advertised Ukraine counteroffensive has borne zero results, US politicians have started to express skepticism with regard to further funding. “US House [lawmakers] ask: ‘What are our goals in Ukraine, what’s behind our participation?’ And the second question: ‘How has our money been spent? About $80-90 billion have already been spent there. Where is this money? Please, answer these questions before you make your next step,'” Oleynyk said.

[..] “Zelensky cannot stop, because peace for him is political death,” Oleynyk explained. “He understands that he will have to answer for everything to the Ukrainian military and to the families of the victims. And for the Ukrainian people, liberation from this Nazi occupation by the occupying power of the United States is not a defeat, but a hope for a new life in Ukraine.” For his part, Zaluzhny understands that the whole blame for the potential defeat would be pinned on him, according to Oleynyk. What’s more, it’s not only Zaluzhny who is opposing Zelensky’s offensive push: most Ukrainian military servicemen share Zaluzhny’s concerns. The politician does not rule out that at some point the Ukrainian president may see his orders being sabotaged. “The military may simply refuse to carry out [Zelensky’s] order because it is meaningless and absurd,” he said.

Lloyd Austin still wants to add some sales for his employer, Raytheon.

• Russia Will Succeed In Ukraine Without US – Pentagon (RT)

If the US stops funding Ukraine, Russia will win, US Defense Secretary Lloyd Austin told the Senate Appropriations Committee on Monday, making the case for $44 billion more in military and other aid to the government in Kiev. “I can guarantee that, without our support, [Russian President Vladimir] Putin will be successful,” Austin told the senators. “If we pull the rug out from under them now, Putin will only get stronger and he will be successful in doing what he wants to do.” Austin and Secretary of State Antony Blinken were asking the lawmakers to approve President Joe Biden’s $106 billion supplemental funding request, which has bundled the Ukraine funding with aid to Israel and Taiwan, among other things.

Of the $44.4 billion in funding for Ukraine, $12 billion would go towards buying weapons and $18 billion would be spent on replacing weapons the US has already sent Kiev. Cybersecurity, “intelligence support” and “enhanced presence” of US troops in Europe would cost another $10.7 billion, while $3.7 billion would be spent to “expand production capacity in our industrial base,” according to Austin’s opening testimony. Both cabinet secretaries embraced the White House’s new talking points for Ukraine aid, portraying it as a way to support the US economy by expanding industrial production and creating new jobs for Americans, though it has done neither so far. The US has already spent $43.9 billion on “security assistance” to Kiev since February 2022, by the Pentagon’s own reckoning.

Austin’s argument echoed the one made by Ukrainian President Vladimir Zelensky to congressional Democrats last month, according to a feature published in Time Magazine on Monday. If the US does not send Ukraine more aid, “we will lose,” Zelensky reportedly said. The article also quoted Zelensky’s aides, who described him as delusional, unwilling to accept that Kiev is “out of options” and “not winning,” while issuing orders that some line commanders have begun to refuse. Meanwhile, according to Time, even if the US and its allies could somehow supply Kiev with all the weapons and ammunition it needs, Ukraine has run out of men to use them.

Biden can now claim it was the GOP that forced him to leave Ukraine alone. Well played?!

• Bills On Israel, Ukraine ‘Dead On Arrival’ In Both House And Senate (ZH)

As the nation celebrates Halloween, the House and Senate are engaged in some spooky late-stage Republic chaos over aid to Israel and Ukraine amid a backdrop of yet another government shutdown looming in two weeks. In short, • The government will run out of money (again) in roughly two weeks, requiring Congress to act (again). • According to Democrats and GOP Neocons such as Mitch McConnell and Lindsey Graham, America needs to send billions of taxpayer funds to both Israel and Ukraine, and won’t consider any legislation that doesn’t combine the two. ª House Republicans under newly minted Speaker Mike Johnson (R-LA), as well as a group of Senate Republicans, want Israel aid separated from Ukraine aid, while the Biden White House wants to jam a $105 billion foreign aid package ($14B to Israel, $60B to Ukraine) through Congress. • The House’s plan (if they can even pass it) to separate Israel aid from Ukraine aid is DOA in the Senate, while both the Senate’s combined package and the Biden admin’s package is DOA in the House. ª The House and the Senate also need to pass 12 appropriations measures for 2024, or face a 1% across-the-board cut on defense and nondefense spending, per the debt ceiling bill passed earlier this year.

While Johnson is hoping to push this through in a Thursday vote in the House (with no guarantee it’ll pass), Senate Republicans and Senate Majority Leader Chuck Schumer (D-NY) – who love war and defending foreign borders, are a no-go, with Schumer calling it “insulting.” As previously noted, while McConnell and other Senate neocons are in lockstep with Schumer and the Democrats over a massive funding package, a group of GOP Senators led by Roger Marshall (R-KS) have introduced legislation to provide a similar $14.3 billion in aid to Israel without Ukraine funding. “If Democrats want [Ukraine aid] so badly, then shouldn’t Republicans get one of our priorities in a trade?” said Sen. J.D. Vance (R-OH) in a statement to Punchbowl News. “We shouldn’t just roll over and give Democrats everything they want, especially when it divides our conference so starkly.”

More via Punchbowl: Vance said McConnell should force Democrats to accept policy changes at the southern border, before giving them enough GOP votes to pass a massive aid package for Israel, Ukraine and the Indo-Pacific. Many other Republicans agree with Vance. The White House’s request asks for more border security funding, but Republicans see this as a ruse. And Democrats say policy changes are a non-starter. Sen. Rand Paul (R-Ky.), who has long called to offset new federal spending, praised the House’s approach to Israel aid and said anything else is “dead on arrival” in the Senate. Paul also called out McConnell by name, saying his fellow Kentucky Republican should simply accede to the House’s proposal. “If Sen. McConnell thinks he’s going to pass a $100 billion conglomeration — what Biden wants — there’s no way it passes the House. Sen. McConnell’s not unaware of the way the House works,” Paul told us. “It’s a very precarious position the speaker is in. I think that’s all he can get through.” bThere are some practical challenges tied to what Vance and Paul are pushing for. For one, a standalone Israel bill with offsets is a no-go for the Democratic-led Senate.

“It is important to note that, while influence-peddling can be done legally, it is uniformly viewed as unethical or corrupt. For the Bidens, it also seems to be something of a family business.”

• The Biden Family’s Version of ‘It’s a Wonderful Life’ (Turley)

In the classic holiday film, It’s a Wonderful Life, the Bailey Brothers Building & Loan Association faced a run on the bank by customers spooked by rumors of theft and insolvency. George Bailey held back the crowd, explaining as he pointed to individual customers: “You’re thinking of this place all wrong. … The money’s not here. Well, your money’s in Joe’s house. That’s right next to yours.”

[..] In July, Sen. Chuck Grassley (R-Iowa) released an unclassified FBI record which included allegations to the agency of Biden and his son, Hunter, being paid $5 million each by a Ukrainian energy executive when the senior Biden was vice president. Most of the media has shown an utter lack of curiosity in following the money. However, the House Oversight and House Ways and Means committees have made strides in tracking millions of dollars which they allege were sent to Biden family members through a labyrinth of shell companies and accounts. The Bidens have been criticized for decades for influence-peddling. It is important to note that, while influence-peddling can be done legally, it is uniformly viewed as unethical or corrupt. For the Bidens, it also seems to be something of a family business.

While Biden’s brothers and son had few discernible business skills to market, they did have access — to him — to sell. The problem seems to be that they burned through the proceeds as fast as they acquired them. What is new now, according to House Republicans, is an emerging pattern of how the Bidens turned influence-peddling into the equivalent of the family’s personal savings & loan operation. Money moving between key family members was labeled as a “loan” in at least one instance, and Hunter has claimed other money as “loans” — a framing that not only offered plausible deniability but non-taxable income. Two IRS whistleblowers, who testified before House investigators in July, highlighted the use of a loan allegedly to evade public disclosure and taxation.

Hunter allegedly took large payments from dubious foreign sources and listed them as “loans,” despite no evidence of repayment or any standard loan agreement. This month, House investigators discovered that, in 2018, the president’s brother James received two loans totaling $600,000 from Americore Health, which they described as “a financially distressed and failing rural hospital operator.” According to the company’s bankruptcy proceedings, it made the loans “based upon representations that his last name, ‘Biden,’ could ‘open doors’” to new overseas investors. On the day he received the second loan transfer, James Biden sent a check for the same amount — $200,000 — to Joe Biden as a “loan reimbursement.”

Recently, the House Oversight Committee revealed that just after Joe Biden announced his 2020 presidential candidacy, Hunter Biden received a $250,000 loan from a Chinese businessman using the address of his father’s Delaware home. The generous transfer of funds was from Xiangsheng “Jonathan” Li, a Chinese businessman connected to the investment fund Bohai Harvest RST. (President Biden reportedly later wrote a college-admission recommendation for Li’s daughter). What happened next was vintage Biden family: A Hollywood lawyer, who had just met Hunter at a political gathering, reportedly suddenly took over the repayment of that loan, with no explanation, and later reportedly paid for some of Hunter’s tax bills and living expenses as well. So, it appears that $250,000 went to Hunter, but the loan obligation was shifted to a Democratic political donor.

It’s starting to add up.

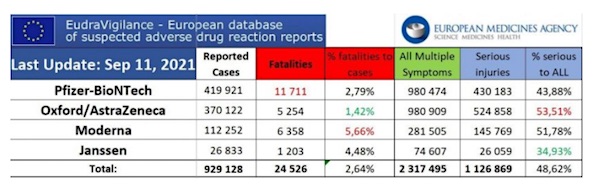

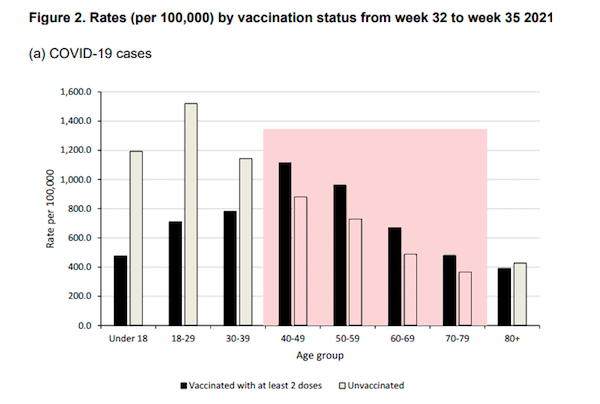

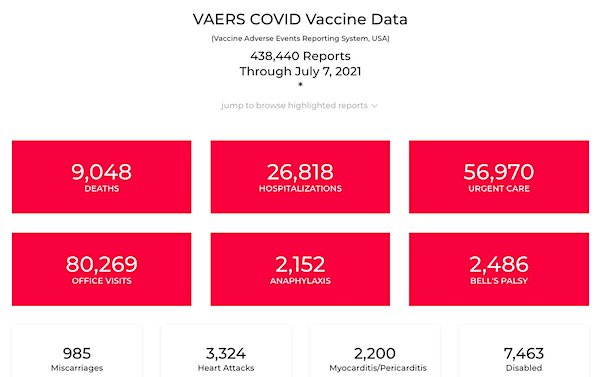

• 1 in 3 COVID-19 Vaccine Recipients Suffered Neurological Side Effects (ET)

Almost a third of individuals who received a COVID-19 vaccine suffered from neurological complications including tremors, insomnia, and muscle spasms, according to a recent study published in the journal Vaccines.

The study analyzed 19,096 people who received COVID-19 vaccines in Italy in July 2021, out of which 15,368 had taken the Pfizer vaccine, 2,077 had taken the Moderna version, and 1,651 took the AstraZeneca version. While both Pfizer and Moderna are mRNA vaccines, AstraZeneca, being an adenovirus vaccine, uses a different mechanism to trigger the immune response. The study found that about 31.2 percent of vaccinated individuals developed post-vaccination neurological complications, particularly among those injected with the AstraZeneca jab. Different vaccines had a different “neurological risk profile.”The neurological risk profile of the AstraZeneca vaccine included headaches, tremors, muscle spasms, insomnia, and tinnitus, while the risk profile of the Moderna vaccine included sleepiness, vertigo, diplopia (double vision), paresthesia (a feeling of numbness or itching on the skin), taste and smell alterations, and dysphonia (hoarseness or loss of normal voice). As to Pfizer vaccines, researchers found “an increased risk” of cognitive fog or difficulty in concentration. More than 53 percent of individuals who took an AstraZeneca shot suffered from headaches, which usually lasted for one day. Over 13 percent developed tremors, which typically reverted after a day as well. Insomnia was reported among 5.8 percent of AstraZeneca recipients. However, the study notes that researchers were unsure whether the individuals actually developed insomnia or had a “misperception of their sleep quality due to vaccination stress.”

Tinnitus was reported by 2.7 percent of the people who took AstraZeneca shots. Tinnitus is a condition in which an individual hears ringing or other noises which are not caused by an external sound. All these health complications had a higher risk of occurring after taking the first dose of the vaccine. The study speculated that complications related to the AstraZeneca vaccine are attributable to two factors. “Firstly, the nature of the vaccine, which is a modified adenovirus vector that results in significant and persistent systemic immune activation; secondly, individual vulnerability related to a predisposing biology.” Sleepiness was found in 39.7 percent of those who took Moderna jabs, with the condition usually lasting for a week. It suggested that there “could be a strict relationship between the development of sleepiness and immune responses to vaccine/infection.”

The study cited a “fascinating hypothesis” which suggests that influenza vaccines may lead to “the selective immune-mediated destruction of orexin-producing neurons, which is T-cell-mediated neuronal damage, thus triggering narcolepsy.”

“I’m never wearing a different costume,” he said. “Dressed as this Zelensky guy, I can get whatever I want!”

• Capitol Trick-Or-Treater Dressed As Zelensky Gets $40 Billion In Candy (BBee)

A lucky young boy who went trick-or-treating at the United States Capitol building came away with $40 billion in candy after dressing up as Ukrainian President Volodymyr Zelensky. “Jackpot! I knew this costume would pay off big time!” shouted young Tommy Billington after being notified of his candy haul. “All my friends thought I was stupid for dressing up like that Zelensky guy who is always on the news, but now they look like the stupid ones. I’ve got enough candy to last me 20 lifetimes!” Billington had arrived early for trick-or-treating in a cardboard mask depicting the Ukrainian President’s face. Believing him to be the actual Zelensky due to his short stature, Capitol Police ushered him directly into the corridors of the Capitol to meet with congressional leadership. Within an hour, Billington had been informed he would receive $40 billion worth of candy.

“He knows his stuff,” said one unnamed member of Congress. “He specifically asked that half of it be in Reese’s peanut butter cups, with the remainder being split evenly in Snickers, Twix, KitKat, and Jolly Ranchers. This was identical to a request we had received from President Zelensky last year.” Soon afterward, Billington watched excitedly as Capitol Police officers helped load pallets laden with candy-filled duffle bags onto several large trucks outside the Capitol building. “I’m never wearing a different costume,” he said. “Dressed as this Zelensky guy, I can get whatever I want!” At publishing time, Billington was believed to be on his way to the White House, where he was expected to ask President Biden to pledge an additional $25 billion in candy over the next six months.

https://twitter.com/witte_sergei/status/1719416354397389175

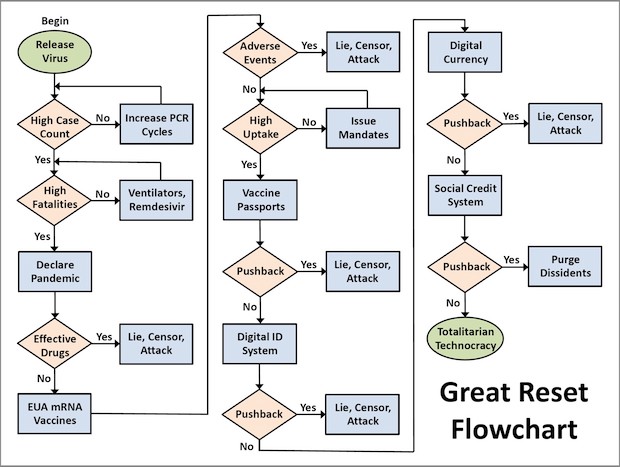

Canada DigID

Justin Trudeau has threatened Provincial Premiers that he will cut off healthcare funding unless they agree to Digital ID. This Digital ID system will allow government to control every aspect of your life.

— Pelham (@Resist_05) October 31, 2023

Rogan Musk

Podcast with the great and powerful @elonmusk #ad Full episode is 2 hours and 41 minutes, first 2 hours is available here on https://t.co/AIkGSaxVMA pic.twitter.com/DQh0GGNyaO

— Joe Rogan (@joerogan) October 31, 2023

Joe Rogan fires an arrow at the cybertruck while Elon smokes a cigar. It’s arrowproof. pic.twitter.com/Z49TZwr4lj

— Ian Miles Cheong (@stillgray) October 31, 2023

Baby monkeys

https://twitter.com/i/status/1719363379058417986

Cheater

He changed his mind.. 😂 pic.twitter.com/9jESMWfCsx

— Buitengebieden (@buitengebieden) October 31, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.