gurusid

Forum Replies Created

-

AuthorPosts

-

gurusid

ParticipantHi Illarghi,

Actually the situation in Cyprus plays nicely in to the hands of those who want to quash doubts over the efficacy of austerity; that and the fact the UK budget is coming up:

Chancellor George Osborne has insisted that ditching his plan to restore the nation’s finances could leave the UK facing an economic disaster like Cyprus.

The bleak assessment came as Mr Osborne rejected calls for a change in approach ahead of Wednesday’s Budget, saying there was no “miracle cure” to the country’s troubles.

The Chancellor said the crisis in Cyprus was an example of “what happens if you don’t show the world you can pay your way”. He told BBC1’s Andrew Marr Show: “That is why in Britain we have got to retain the confidence of world markets.”

The Cypriot parliament is set to consider a European Union and International Monetary Fund bailout, with the possibility of a levy on bank deposits of up to 10%.

Mr Osborne, who has promised to protect British military personnel and Government personnel from the levy, added: “It is an extraordinary situation. I remember coming on this show a couple of years ago and we were talking about Greece then. Since then we have had Ireland and Portugal, problems in Spain, problems in Italy, now in Cyprus.

“Anyone who thinks Britain is alone in having these challenges should look on their TV screens, look at tonight’s news and realise that it’s a very tough economic situation out there. Unless we in Britain front up to our own problems, the problems in our banking system, the problems that we are borrowing so much money, the problems that actually our businesses need more help to create jobs. If we don’t do those things then the difficult economic situation in Britain will get very much worse.”

…

Shadow chancellor Ed Balls, appearing on the same programme, called for a stimulus package funded by increased borrowing. “Vince Cable, the International Monetary Fund, myself, many others are all saying unless you get the economy moving, unless you get some growth back, the deficit will stay high. Whereas if you act now with some stimulus to kickstart the economy, that’s the way to get growth moving.”He accused Mr Osborne and Prime Minister David Cameron of refusing to consider a change in approach because of the political fallout. “The only reason why they won’t now change course is to avoid their own political humiliation. That is no reason to stick to a failing plan. Stimulus now, kickstart the economy, get growth moving, that’s the only way to get the deficit down.” He added it was the “economics of the lunatic farm” to call for more spending cuts and tax rises when those were the policies which had choked off the recovery.

They will of course bail out British military personnel (don’t want any mutiny in the ranks!) its a handy base to have to have in the region (for the geographically challenged like me, its next to Syria) but plain old UK citizens will have to take the hit unless their branch is in the UK:

“What I’d say specifically about the Cyprus situation – first of all, we are not part of the bailout because David Cameron got us out of these euro bailouts when he became Prime Minister.

“Second, I’d say that the Cypriot banks in Britain – this is important because there are many thousands of people who bank with Cypriot banks in Britain – those banks are not going to be included in this bank tax.”

There are several more reports on the ‘crisis’; given that propaganda is always proportional to policy:

And of course like any system:

…To Those Within A System, The Outside Reality Tends To Pale And Disappear.

This effect has been studied in some detail by a small group of dedicated General Systemanticists. In an effort to introduce quantitative methodology into this important area of research, they have paid particular attention to the amount of information that reaches, or fails to reach, the attention of the relevant administrative officer. The crucial variable, they have found, is the fraction:

Ro/Rs

where

Ro equals the amount of reality which fails to reach the relevant administrative officer

and

Rs equals the total amount of reality presented to the system.

The fraction Ro/Rs varies from zero (full awareness of outside reality) to unity (no reality getting through).Of course from a deflationary point of view, this ‘tax’ could also be seen as the ‘correct rate’ of interest, nobody complained when they got 10% or more back in 2008:

Just how do bubble realities burst? Maybe its a case of ‘green bottles’ rather than dominoes:

https://www.youtube.com/watch?v=99XPHwuGjMIL,

Sid.gurusid

ParticipantHi Dave,

Your reply summed up nicely the whole conundrum. Practically speaking, i.e. in the real world it doesn’t work; but in the fantasy worlds inside the deluded minds of many people on the planet today, and especially the ‘financial world’ it does.

if you ignore the logistics and storage aspect, its a no-lose trade

When humanities little bubble bursts and they find themselves in the Real world – what’s left of it – they will find out how much they truly have ‘lost’. That time is fast approaching… :ohmy:

L,

Sid.gurusid

ParticipantClown or comedian,

They just elected a bigger one:

👿

:woohoo:

‘New pope, lets party!’:cheer:

Where as most people (a Billion hits)would rather do the Harlem Shake:

Harlem Shakers Surprised By Dance Craze

Welcome to the Idiocracy:

https://www.youtube.com/watch?v=BBvIweCIgwkL,

Sid.gurusid

ParticipantHi Alan,

So, prices are being driven UP artificially, but are also being held DOWN artificially. Maybe you could explain in more detail.

I just did. Its down to a distorted value system which assigns an arbitrary monetary value to everything, even when a ‘price’ cannot be put on it to start with. How can you put a monetary value fresh clean water to drink? How can you put a monetary value fresh clean air to breath? How can you put a monetary value on good soil and fertile seeds that provide food? How can you put a monetary value on an energy source that gives you the equivalent of one to seven years of constant human toil (twelve if you give them a break now and again)?

It is the ‘wetiko psychosis:

The wétiko psychosis, and the problems it creates, have inspired many resistance movements and efforts at reform or revolution. Unfortunately, most of these efforts have failed because they have never diagnosed the wétiko as an insane person whose disease is extremely contagious.

Jack D. Forbes (Derrick Jenson quoting Jack D Forbes on the ‘insanity’ of it all)

If your value system is corrupted or worse your value system is not based in reality at all, then it is quite easy to assign arbitrary* notions of value to anything, including court judgements on the very sanctity of life.

Dictionary ref: arbitrary. adj. 1 based on or derived from uniformed opinion or random choice; capricious. 2 despotic. (Concise Oxford, 9th Ed. 1995)

On conflating the measure with the thing being measured, well it kind of goes to eleven…

https://www.youtube.com/watch?v=EbVKWCpNFhY

😆

L,

Sid.gurusid

ParticipantHi Folks,

Forgive me but this is critical:

Alan: Right. Synonyms: PRICE RISES. PRICE INCREASES. Those phrases, in common parlance, are SYNONYMOUS with inflation.

And that is the problem, because most synonyms are context dependant and the context has changed so that this ‘synonym’ is no longer (if it ever was) valid.

Nassim: Why not just say “price inflation” so that everyone is happy.

Because it is incorrect.

Why? Because it’s a category error . Price is a measure of value. It’s not the measurement that inflates but the thing being measured. In this case it is the relative value of the currency, which can be valued relatively to many things. When you ‘inflate’ a balloon, its not the ruler that gets bigger, but the balloon that gets bigger regarding the measure of the ruler. Price is a measure of many things, from expectation and to some extent demand, but also of affordability and notions of value. By conflating inflation and price, one distorts the very notions of value. Its not the ‘value’ that is increasing, but means to acquire that value that is inflating. That can happen if there is more of the means available, or if that means itself loses relative value so that you need more of it. Whether that means is money, goats or pink elephants, does not matter, it is the means that inflates or deflates, not the price which is a measure of relative value. At the moment the means (money, debt/credit) is disappearing. Wages unlike the previous inflationary eras are falling not rising, except for the very rich elite such as CEOs and bankers: the ‘FED’ and for that matter all the other ‘banks’ are not handing out free cash to people in the street. However, the prices of many ‘goods’ are being bet upon by the stock market system that is assigning arbitrary(1) prices and hence arbitrary value irrespective of what the true value is worth. As TAE have said, these stocks (and derivatives and financial products) have yet to be ‘marked to market’ to discover their true ‘price’ or value. What the ‘measure’ of their true worth is. Thus currently we have a situation in which price has become divorced from the money supply; it’s a bit like an authoritarian government ‘fixing’ the state price of bread, regardless of what is affordable or what the bread is actually worth, only here its called the ‘free’ market, and instead of party officials fixing the price, we have stock brokers and computerised algorithms. These are price rises driven by speculation on value (virtual digital value at that) NOT inflation of the money supply. The irony here as regards ‘energy’ prices such as oil is that they would go through the roof, as their value has been held down as regards their true worth, say when compared to the equivalent in human labour energy. As regards ‘price inflation’ – good luck with trying to measure anything with an inflatable ruler… 🙁The boys and girls in the Bubble? Damn right:

“”Reality” is what we take to be true. What we take to be true is what we believe. What we believe is based upon our perceptions. What we perceive depends upon what we look for. What we look for depends upon what we think. What we think depends upon what we perceive. What we perceive determines what we believe. What we believe determines what we take to be true. What we take to be true is our reality.”

(2)

2 This is attributed by many to a David Bohm lecture at Berkely, 1977, however in Gary Zukav’s “The Dancing Wu Li Masters”, (1980, p.310) he writes this phrase without reference to Bohm with the opening word “Reality” in inverted commas, and this gives me reason to think he is the originator – perhaps inspired by Bohm..

gurusid

ParticipantHi alan,

alan: I am going by the dictionary definition of inflation — universally accepted, though rejected by TAE — of higher prices

No they don’t ‘reject’ it:

Alan’s dictionary ref:

http://www.bing.com/Dictionary in·fla·tion [ in fláysh’n ] — higher prices: an increase in the supply of currency or credit relative to the availability of goods and services, resulting in higher prices and a decrease in the purchasing power of money. Synonyms: price rises, increase, price increases, rise.Also I suspect that your view is incommensurate with that of the TAE:

Further:

Also:

Inflation is an increase in the supply of money relative to goods and services. Deflation is a decrease in supply of money relative to goods and services. ‘Stagflation’, is ‘Inflation’ (money supply increase) without any concomitant growth in GDP, and a relatively high unemployment rate. It resulted when banks increased the money supply to counter the recession bought on by the 1970s oil crisis. Most neo-classical economists cannot explain what happened because their theories do not work – read Steven Keen’s “Debunking Economics” to see why.

As Stoneleigh says:IMHO price ‘inflation’/‘deflation’ is a non-sense term used by the media to obfuscate and dumb down the reality of what is actually happening (and I have been guilty of thinking this way myself before I clearly understood what the concepts meant). It’s a version of Orwellian double speak, and more ominously of ‘double think’ “the act of simultaneously accepting two mutually contradictory beliefs as correct”:

‘Prices’ go up and they go down, dependant upon what people will ‘pay’ or what the seller thinks they will pay. They do not inflate or deflate, they are results not causes.

Don’t get me wrong, I am learning about all this stuff too, but it is important to hammer out the key concepts clearly and concisely. Other wise its double think and speak time… :dry:

L,

Sid.gurusid

ParticipantHi Jal,

Somehow, the saying

“KNOWLEDGE IS POWER”

does not seem to apply to this choir or to any other ancient choir.

IMHO, that’s because the term ‘Knowledge is Power’, depending upon the context, is both an oxymoron and a category error… 😆

L,

Sid.gurusid

ParticipantHi Dave,

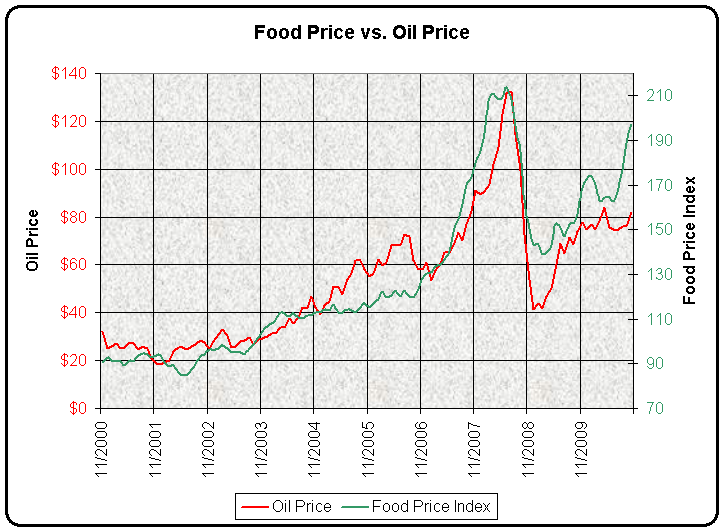

Ahh, food and ‘oil’:

The thing that stunned me was the closeness of the correlation. For you math geeks, the correlation coefficient of the two data sets is 0.93!

The next thing that’s fascinating is that changes in the Food Price Index appear to lead changes in the price of oil by a few months. Since food prices don’t drive oil prices as far as I know, this implies that they are both responding to the same underlying situation, but that food prices are a more sensitive indicator.

The last thing that I noticed is the behaviour of food and oil prices in the last six months. The sharp rise in food prices is being noticed in the media now, but the graph hints that the story is just beginning.

The key could be here: “Since food prices don’t drive oil prices as far as I know” actually with the rise of bio-fuels in the form of corn ethanol, there is an even greater link perhaps – oil price goes up, food price goes up so does the ‘bio’fuel price leading to higher fuel price (not ‘oil’ price) – but I’ll bet any correlation is down to speculators hedging their bets. It might be that oil inventories have longer lead times than food inventories and so betting on prices feeds through quicker – who knows? Definitely ‘some’ sort of correlation. :woohoo:

Wait until there’s real scarcity, then we’ll see some ‘price shocks:

Energy used to produce food:

…or oil! :sick:

Though in the search for ‘truth’ I prefer perhaps the ‘original’ (?) version:

A chapter called “Conversations with North American Indians” contained comments made by Alanis Obomsawin who was described as “an Abenaki from the Odanak reserve, seventy odd miles northeast of Montreal.” (The book uses the spelling Obomosawin.) Obomsawin employed a version of the saying while speaking with the chapter author Ted Poole. [AOTP]:

Canada, the most affluent of countries, operates on a depletion economy which leaves destruction in its wake. Your people are driven by a terrible sense of deficiency. When the last tree is cut, the last fish is caught, and the last river is polluted; when to breathe the air is sickening, you will realize, too late, that wealth is not in bank accounts and that you can’t eat money.

In later years Obomsawin became famous as an award-winning documentary filmmaker based in Canada.

:whistle:

L,

Sid.gurusid

ParticipantHi illarghi

the lazy sloppy “journalism” in the international press

Just as I thought, the propaganda machine has gone into overdrive… Pizza spring and Grillo warfare here we come…

L,

Sid.gurusid

ParticipantHi Trivium,

Careful of preaching to the choir, the choir is well aware of the score…

As for functional illiteracy:

Ed West in the Telegraph:

One in five Brits is functionally illiterate – and public schoolboys like Nick Clegg will keep it that way

Back in the days when I used to work at Nuts magazine, the bosses brought in a sort of marketing guru during the first few weeks to help with struggling sales.After presenting us with the amazing revelation that “men like breasts” (for which IPC paid him a handsome amount of money) he also told us to reduce our typical story length from 400 to 150 words because, as he explained, “a quarter of British men are functionally illiterate”.

Within weeks we were selling hundreds of thousands.

As John Taylor Gatto says:

“It’s absurd and anti-life to be part of a system that compels you to sit in confinement with people of exactly the same age and social class. That system effectively cuts you off from the immense diversity of life and the synergy of variety; indeed it cuts you off from your own past and future, sealing you in a continuous present much the same way television does…”

“Whatever an education is, it should make you a unique individual, not a conformist; it should furnish you with an original spirit with which to tackle the big challenges; it should allow you to find values which will be your road map through life; it should make you spiritually rich, a person who loves whatever you are doing, wherever you are, whomever you are with; it should teach you what is important, how to live and how to die.”

– John Taylor Gatto

Here’s Derrick Jenson quoting Jack D Forbes on the ‘insanity’ of it all:

The wétiko psychosis, and the problems it creates, have inspired many resistance movements and efforts at reform or revolution. Unfortunately, most of these efforts have failed because they have never diagnosed the wétiko as an insane person whose disease is extremely contagious.

Jack D. Forbes

Unfortunately most of the infecting takes place in the schools…

L,

Sid.gurusid

ParticipantHi Folks,

I posted this elsewhere a while back, but thought it pertinent in the current discussion about politics:

John Taylor Gatto on trust, competence and ancient Athens:

For a long time, for instance, classical Athens distributed its most responsible public positions by lottery: army generalships, water supply, everything. The implications are awesome— trust in everyone’s competence was assumed; it was their version of universal driving. Professionals existed but did not make key decisions; they were only technicians, never well regarded because prevailing opinion held that technicians had enslaved their own minds. Anyone worthy of citizenship was expected to be able to think clearly and to welcome great responsibility. As you reflect on this, remember our own unvoiced assumption that anyone can guide a ton of metal travelling at high speed with three sticks of dynamite sloshing around in its tanks.

When we ask what kind of schooling was behind this brilliant society which has enchanted the centuries ever since, any honest reply can be carried in one word: None. After writing a book searching for the hidden genius of Greece in its schools, Kenneth Freeman concluded his unique study The Schools of Hellas in 1907 with this summary, “There were no schools in Hellas.” No place boys and girls spent their youth attending continuous instruction under command of strangers. Indeed, nobody did homework in the modern sense; none could be located on standardized tests. The tests that mattered came in living, striving to meet ideals that local tradition imposed. The word sköle itself means leisure, leisure in a formal garden to think and reflect. Plato in The Laws is the first to refer to school as learned discussion.

Of course one thing that would change the whole shebang is to decentralise the whole political process creating a network/nodal structure rather than hierarchical pyramid. This helps to build a more sustainable community structure as well as giving back autonomy to local regions to do what is most suitable in that region and to local needs. Its similar in some respects to the polycentrism being developed in Finland. These structures tend to be inherently more resilient, and have existed traditionally all over the world such as the Haudenosaunee (Six Nations Confederacy) was founded over 1,000 years ago, and ironically the ‘Mafia’ which has its root in feudalism prior to the annex of Sicily in 1860:

The ‘mafia’ is generally thought of as an Italian secret crime society, but the origins of the Mafia start way before the onset of automatic guns and cocaine. The Mafia began as a way of life: a way to protect one’s family and loved ones from the injustice of the government.

.

Social entrepreneur and Chiarman of the Schumacher society, Herbert Girardet talks about sustainable cities and the democratic process:

Herbert Girardet: The self-sufficient city

The characteristic of a truly sustainable city is, first and foremost, that it powers itself entirely by means of renewable energy systems. Herbert Girardet encourages us to make a quick switch to renewable energy to power our houses, our urban transport systems and our daily way of life.

…

Another important issue is not just the economics and the environmental aspects of sustainability but also what one might call cultural sustainability. It is critically important to have the flow of ideas and to include the way people think into city planning. Decisions affect our daily lives.One of the big problems in modern democracies is that we are only asked to manifest our views every four-five years when an election takes place. But, in a world where sustainability and concern about damaging the world fatally is becoming such a big issue, it is of critical importance to voice our views much more actively today and to use them in decision-making.

For instance, in the Brazilian city of Porto Alegre the city government decided to involve the general public in the budget setting process. People started considering what the money should be spent on. On better schools, better transport systems, playgrounds and so on. This was a creative process where everyone was asked to participate with their views and ideas on how to do this. By way of process Porto Alegre has become a dynamic city. Suddenly people think about these issues on a daily basis.

…

In our present world, particularly in Europe, we take the unlimited access to food for granted. But food supply is becoming a big problem.One example of a remarkable development is the urban agriculture of Havana in Cuba. When the Soviet Union collapsed in ’89, trade stopped and they had to come up with new ways of feeding their cities. They turned unused land within the city into little farms. A response to a crisis situation turned into new opportunities to create a high degree of food self-sufficiency. When you go to Havana today the whole city is covered with small cooperative farms that are cultivated by people from surrounding apartment buildings. Tens of thousands of hectares of land within the city are now turned over to growing crops for the local people.

You can find similar things in Dar Es Salaam in Tanzania, which has similar urban agriculture projects, but also Accra in Ghana and in many Chinese cities. Urban agriculture is a very important part of the future of cities.

After all what do people really need:

A ‘sustainable city’ is organized so as to enable all its citizens to meet their own needs and to enhance their well-being without damaging the natural world or endangering the living conditions of other people, now or in the future. (Girardet 1999: 13)

This definition has a number of things going for it. It places people and their long term needs at the centre. These include:

Good quality air and water, health food and good housing.

Good quality education, a vibrant culture, good health care, satisfying employment or occupations and a sharing of wealth.

Safety in public places, equal opportunities, freedom of expression and catering for the needs of the young, the old and the disabled. (op. cit.)

This is clearly a greener, and more inclusive approach to sustainability than exists within the current policies of most countries (see below). It looks to the environment and to economics and to social relationships and social justice. As such it is a more hopeful vision – and this, we believe, is vital to education and community development.

The only ‘national’ policy you need is to let the locals get on with it, but of course that would mean the death of the beast*, and I doubt it will go without a fight…

L,

Sid.

* corrupt system of governancegurusid

ParticipantHi Oilobserver,

It depends what sort of biology you are studying. Definitely do what Illarghi suggests; this site is one of the best in terms of ‘big picture’ analysis. The recent primer guide is probably a good place to start.

What do young people (like me) have to do in order to ease the transition from our current system into a sustainable one?

Well that really is a tough one. As you don’t (I assume) have much wealth yet, it is going to be a case of investing in yourself. Your biology background is a good start as this can be useful in many area such as medicine, but especially as the sustainable growing of food is going to be a key issue going forward. Check out these links:

Masanobu Fukuoka link:

https://www.onestrawrevolution.net/One_Straw_Revolution/One-Straw_Revolution.htmlIf you can get a copy of his “One Straw Revolution”; get it and read it, also his “Natural Farming” though this one is harder to get. This man was a ‘scientist’ with the Japanese agricultural bureau before abandoning this approach to discover how to truly ‘work with nature’. His approach of ‘do nothing’ farming is truly remarkable in both its simplicity and the yields which were more than modern practices with machinery and fertilizers and pesticides could produce.

Sepp Holzer:

https://www.krameterhof.at/en/

Another remarkable pioneer, his book “Rebel Farmer” and his ‘Permaculture’ book are highly recommended.Robert Hart:

https://www.naturewise.org.uk/page.cfm?pageid=nw-forest

&

https://www.pfaf.org/user/cmspage.aspx?pageid=93

Again his book “Forest Gardening”, and the pamphlet “The Forest Garden” describe a sustainable perennial garden of fruit and vegetables that can provide for a very large part of ones diet.The ‘Soil Food Web’ is something that should interest any biologist interested in sustainability and growing food, there is lots on the internet though you will have to dig for it (or not – digging is very destructive to this ‘web of life’):

https://www.ecoversity.org/archives/soil_ecology.pdfAlong these lines the book “Teaming with Microbes” is also an eye opener:

https://teamingwithmicrobes.com/home/And Paul Stamets’ “Mycelium Running” is also a must:

https://www.fungi.com/about-paul-stamets.htmlThe key thing to realise is how much has been discovered on the way that nature really works, and also how much more there is needed to be discovered as we move away from the dogmatic mechanistic reductionist paradigm towards a more wholistic symbiotic one.

Finally on ‘education’ in general, check out John Taylor Gatto:

https://www.johntaylorgatto.com/Morpheus: I’m trying to free your mind, Neo. But I can only show you the door. You’re the one that has to walk through it.

L,

Sid.gurusid

ParticipantHi Illarghi,

On the depression and child poverty in America, for those that can get it, check out this film: This World – America’s Poor Kids

It supports your reduction of per capita square footage of living space (families crammed into one room having previously lived in a house), and accommodation based upon what people can afford, from low rent to no rent and the social consequences for all concerned, especially the children. Heart wrenching in places…

The Director Jezza Neuman’s blog is very insightful too.

Over half a million more kids in poverty since 2007 and its getting worse. Says a lot about the true ‘state of the Nation’…

L,

Sid.gurusid

ParticipantHi folks,

Pipefit:

So with such a low fertility rate, once emigration gets going, population is going to tank hard, and the remnants of the economy tank harder.

In the UK net immigration is boosting population as this report by Rosamund McDougall, Co-chair of the Optimum Population Trust 2002-2005 and joint Policy Director 2006-2009:

Britons are marrying later in life, having children later in life, and dying later too – affecting the number of deaths each year. With expected increasing life expectancy, boys born in 2005-7 could expect to live to the age of 88.1 years and girls

to 91.5 years. Men aged 65 in 2004-6 could expect to live another 16.9 years and women 19.9 years, which contributes to the Ageing of the UK population. Births have exceeded deaths every year since 1901, except in 1976. But uncomfortable though it has been to say so, the main cause of UK population growth remains high net inward migration flows and the effects of this on the number of births. “Of the 5.6 million natural increase projected between 2008 and 2033,” reported the ONS in its 2008-based Population Projections, “only 3.3 million would occur if net migration were zero (at each and every age)…Thus just over two-thirds of the projected increase in the population over the period 2008 to 2033 is either directly or indirectly due to migration.” Of this, 45 per cent is directly attributable and 23 per cent indirectly.Annual population growth has quadrupled since the 1970s. Continued growth at the officially projected rate would involve adding a population of nearly 10 million – more than London’s – to the UK by 2033, with all its needs for additional housing,

energy and power supplies, reservoirs, schools, hospitals, transport, shops, waste disposal, prisons – and all its impacts in the form of waste and emissions. Those who argue for population growth will not answer the question of what they think is an environmentally sustainable level, nor at what level they believe growth should stop. Our numbers cannot grow for ever.Also Nassim:

It has always been my contention that when women have few babies – let’s face it, they make the decision – it is a sign of declining expectations. The fact that this decline – in native European women – has been so great over the past few decades is highly significant, IMHO.

In the UK, the fertility of native-born women is significantly less than that of other women (1.89 versus 2.28)

Women only have that choice when the culture allows it, and also where they are educated and have control over their lives. While the social support for having children has been blamed for the high level of teenage unmarried mothers for instance (recent data shows a decline), there are many other factors such as social deprivation/isolation, peer pressure, male sexual dominance in those communities and low levels of education (education that has excluded and dumbed them down). Also the religious/cultural is probably still the biggest influence; the secularity of ‘western women’ means they have access to contraception, which combined with education and sexual equality suggests that they have the most choice over having children. While Catholicism still preaches abstinence from contraception, their birth numbers are not as high as they used to be, and the scares over the birth rate of Islamic families in the UK are down to demographics: these imigrants tend to come from Pakistan and Bangladesh, which have traditions of large families (as seen in Nassim’s link above), and first generation immigrants tend to keep this tradition, so boosting migrant community numbers, though second and further generations tend to become more secularised and adopt the ways of the country they were born into. Coupled with shifting demographics of people living longer, and one can see that population dynamics is a complex thing.

Also, population growth has always been linked to the economic ideal of a never ending ‘growth economy’ which expresses itself in extreme exploitation of both the planet and its inhabitants of all species.

However if humans are to live sustainably upon the planet, then a smaller (much smaller) population needs to be aimed for over the coming centuries, other wise long-term depletion of soil, water and mineral resources will do it for us, and in the process probably kill off most of the other life on the planet too… Either that or we all learn to live on the same resources as the average Indian, and somehow I don’t see that happening in a hurry:

L,

Sid.gurusid

ParticipantHi Dave,

Interesting point about the stage of pay down/bailout of Irish debt (posted here about it yesterday), especially in the commercial sector, that further explains why they have cancelled the ‘state guarantee’ for deposits over €100,000:

Ireland to remove bank deposit guarantee from end-March

DUBLIN (Reuters) – Ireland (OTC BB: IRLD – news) will remove a state guarantee on bank deposits next month to help ease pressure on loss-making lenders and move the country further towards exiting its EU/IMF bailout, finance minister Michael Noonan said.Ireland’s almost fully state-owned banks, whose rescue cost the equivalent of 40 percent of annual economic output, have had widening losses partly because of fees they had to pay for the guarantee, and they have been clamouring for its removal for months.

…

The removal of the guarantee will not impact the vast majority of bank customers because deposits over 100,000 euros are covered by a separate guarantee which has been in operation in Ireland since 1995.The Eligible Liabilities Guarantee (ELG) scheme guaranteed deposits over 100,000 euros in case banks got into trouble. Lenders had to pay a fee to the government for the guarantee, which cost the country’s three remaining domestic banks 1.1 billion euros last year.

And it also points to a ‘get it while you can’ attitude on mortgage repayments:

Trackers don’t track and fixes move: The truth about mortgage deals

The Bank of Ireland is about to increase the cost of its tracker mortgages, despite the base rate not increasing, but is your mortgage rate safe?

Thousands of Bank of Ireland mortgage customers are to be hit with higher repayment costs on their tracker mortgages, whether the Bank of England Base rate changes or not.The lender has announced rate hikes to take effect from May, seeing rates for 13,500 customers on base rate tracker deals double.

The changes mean that a buy-to-let mortgage customer on a typical interest rate of 2.25% will see their rate climb to 4.99% from May 1.

Residential customers will see increases introduced in two stages: 2.49% plus base rate will take effect from May 1, changing again to base rate plus 3.99% on October 1, jumping to an overall rate of 4.49% if the base rate stays at 0.5%.

That is they seek to reap as much flesh from the loans before they are paid off or defaulted upon, though the rate rise might prove very counter productive if many start to default earlier on those mortgages…

L,

Sid.gurusid

ParticipantHi Skip,

The same goes for the UK:

Where in some places you can’t sell property at all.Going forward there is likely to be an increase in this very ‘localised’ type of situation, especially as benefits are cut, and work remains non-existent.

The same for the US, Canada, and the UK, only here we turn it into a business…

L,

Sid.gurusid

ParticipantHi Nassim,

Well, after all said and done, an “Englishman’s home is his castle” n’est pas? Such is the power of propaganda and social norms. That and the fact that decent affordable housing for rent has always been problematic in the UK due to the feudal class system of serfs and lords and the dehumanisation by each party by the other. So the serfs (latterly working class) saw the upper class as greedy morons; the upper class saw the poor as ignorant wretches. (Noblesse Oblige, if it ever existed was killed off with the French revolution.) Thus the rise of the slum landlord, both then and now. It was only with the rise of socialism in the twentieth century that saw a brief respite with the ‘homes for heroes’ and slum clearances, which worked for a while (in the inter war years) till the elite saw again a way to make a quick buck with cheap poor quality development rolled out across the land in the sixties and seventies. Couple with bad government planning and the destruction of existing communities it was a recipe for disaster. Then came neo-liberalism in the 1980’s and the buy your own council house bonanza (though that right had in fact existed for quite a while already), which saw lucrative gains for those fortunate enough to live in a ‘nice’ area, and total loses for those on sink estates.

The British model of renting and the whole attitude is summed up in that FT article:

By Ed Hammond, FT. March 1, 2013 7:16 pm

“Britain’s inability to wean itself off home ownership is perplexing. Every other large European nation has managed to foster a sensible market for rented housing alongside traditional owner-occupation. From the sprawling ex-industrial workers’ estates of West Germany, now leased out on 30-year terms, to Switzerland’s luxury housing complexes, renting is a professionalised mass-market phenomenon. In those two countries, half and two-thirds, respectively, of all households rent. In the US, too, renting, both short- and long-term, is – certainly within the country’s metropolises – the norm.In contrast, renting has never been considered a “grown-up” option in Britain. Rather, it is still seen, predominantly, as a stopgap between parental nest and home ownership. This view of renting as a dissolute middle ground has stunted the growth of a functional market. The country is the poorer for it. Where continental Europeans have an efficient rental market stewarded by responsible and, crucially, accountable institutional landlords, Britons have buy-to-let: the opportunistic love child of Dickensian skulduggery and pointy-shoed speculation.

The British rental model, if it can rightfully be called that, is primarily a way for the landlord to siphon some cash from his investment while waiting for the market to inflate enough to flip it. In this lies a big part of the problem. If the homeowner is renting only as a passing measure, the uncertainty inherent for any tenant makes it impossible to consider it as a realistic long-term option any more than they might a friendship with a lion.”

Thus status in the caste/class system is paramount:

A firm demonstration of one’s importance in the world, as my poker companions showed, often matters more than quietly playing the hand that makes most financial sense.

Of course that doesn’t mean that they are actually that ‘sharp’:

Mortgage borrowers crippled by foreign currency loans

By Jessica Winch | Telegraph – Mon, Feb 25, 2013 09:40 GMTBritish home owners who took out foreign currency mortgages have been badly hit by the strong appreciation of the Japanese yen and now face crippling debts.

…

“The key reason to take out a foreign currency mortgage should be to take a view on exchange rates, in particular if one expects sterling to improve against the currency in which the mortgage is denominated. Too many people took out these loans simply because the interest rate was lower.”

In 2004, yen mortgage rates were around 1pc, while UK rates were around 5pc.

…

However, the risk with a foreign currency mortgage is that if sterling falls in value against the foreign currency, the monthly repayments go up in sterling terms and more importantly the total amount of the debt in sterling also rises.

…

The rising level of debt meant that borrowers had to stump up more collateral, such as cash or savings, or the bank could switch their mortgage back into sterling to avoid further losses.

Some of the affected borrowers said they were not fully warned of the risks. Others also discovered they were not covered by UK financial services jurisdiction.

“If individuals do not understand the risks associated with borrowing in foreign currency, then it’s incredibly dangerous to do so.”

The Sunday Telegraph was initially contacted by Paul Coates, 51, an ex-financial agent who works in Singapore as a property agent. He had a yen mortgage with RBS (LSE: RBS.L – news) switched back to sterling in December 2008, which increased the size of his loan by 50pc to £302,688.

Four years later, he is facing legal action in the UK to repossess the property in north Wales, which Mr Coates had bought for his mother.

He said: “I have been very stressed about this for four years and it’s very likely I’ll lose my home in the UK.

“I expected currency risks but what I did not understand and what wasn’t made clear to me was that the bank would switch the mortgage the way it did.

“I think they should have had a stop-loss arrangement to convert the loan at an earlier stage.”

He had fallen behind with his mortgage repayments as he was out of work for a year when the financial crisis hit.

An RBS International spokesman said: “Due to client confidentiality, we are not able to comment on the specifics of this matter.”

David Lewnes, a retired advertising executive, went to live in Singapore nine years ago, after working in east Asia since 1985. He bought a two-bedroom property in east London in 2004 as an investment and was advised to take out a yen mortgage to help reduce the payments on the property.

He took out a mortgage of £345,000 with RBS’s Singapore office following advice from an adviser.

However, the rapid appreciation of the yen from 2007 onwards led to RBS forcing Mr Lewnes to switch his loan back to sterling as the loan exceeded the maximum loan-to-value of 75pc. As a result, his debt increased by 50pc and the total debt of £525,000 exceeded the value of the property.

“While everybody appreciated there was some currency risk, they had no idea of the magnitude of that risk,” Mr Lewnes said. “When the exchange rates started to move the bank should have warned their clients, but they didn’t. They waited until it was a disaster.”

Mr Lewnes has paid down the debt to £450,000 and intends to continue with interest repayments until the loan expires in 2021. He plans to sell the house and use the proceeds to service the debt.

An RBS International spokesman said the bank did provide foreign currency mortgages to clients who requested them in Singapore from 2004 to 2011.Again hindsight is always 20×20, but as for being a sharpie, I think this shows their edge is somewhat blunted.

But ““When the exchange rates started to move the bank should have warned their clients, but they didn’t.” I mean, didn’t they think to check the exchange rate and set a bail out point themselves? Didn’t they bother to check their mortgage repayments? Seems to me they were perhaps too attached to their ideas of who they were in the world and about how things work. Attachment truly is the source of suffering…

Shed with a bed anyone? Somewhere to store your tulip bulbs I suppose…

L,

Sid.gurusid

ParticipantHi folks,

Sorry just couldn’t resist:

‘Super zombie’ households face disaster – even without an increase in loan rates

On top of fears that one million or more ‘zombie households’ face instant insolvency the moment interest rates return to normal comes new research today uncovering a sub-category of ‘super-zombies’.

These specimens of the financially undead are households unable to pay what they owe, even if interest rates stay where they are.

Zombie households: These specimens of the financially undead are unable to pay what they owe, even if interest rates stay where they are.

More than one million households have interest-only mortgage debt totalling £120 billion on which they are currently on course to default.

Some have no investment plan of any sort to pay off the capital sum. About 700,000 mortgages are in this position, with a value owed of about £75 billion.

Some have a plan that on current form will be unable to clear the debt. About 400,000 mortgages fit this description, with a total owed of £45 billion.

The message from today’s report, by research consultancy BDRC Continental and published exclusively by Financial Mail, is that 1.1 million households are in effect hoping for the best.

Not only that, but the option of simply selling the property for a big capital gain is not the tried and trusted solution that it once was, given the subdued state of the UK housing market.

Zombie households are made up of those individuals and families who are barely keeping afloat financially and who would slip beneath the waves were the current level of interest rates – the lowest in more than 300 years – to return to anything like normal.

There are about one million such households, the influential National Institute of Economic and Social Research estimated last year.

Now BDRC’s findings have exposed another, more frightening aspect of the phenomenon.

…

Its survey found only 31 per cent had an investment plan that was on course to clear their debt, while eight per cent of the total either did not know or answer.

Wornell added: ‘Many interest-only borrowers are not engaged with the end-game – what happens when their mortgage term finishes and they have to repay the capital? Everyone with such a mortgage needs a credible repayment plan.’

Elsewhere in the financial graveyard, new figures from R3, the body representing insolvency professionals, has found a rise in the number of people who are paying only the interest on their credit card statements – to 3.4 million against 2.9 million a year ago.

One ray of light is that the total number who are paying only interest on their overdrafts has declined over the same period, from 2.4 million to 2.2 million.

But figures last month from the Office for National Statistics showed the proportion of people who said they would be unable to meet an unexpected but unavoidable expense had risen from one in four in 2007 – at the start of the economic downturn – to two in five today. And a detailed Business Department report from 2011 found 23 per cent of the adult population either ‘constantly struggling’ or ‘falling behind with bills and commitments’.

The Bank of England has expressed concern about the effect of large household debts on consumers’ willingness to spend, and City regulator Martin Wheatley, head of the new Financial Conduct Authority, described the £120 billion of unfunded interest-only mortgages as ‘a ticking time-bomb’.As I just posted elsewhere, and Stoneleigh and Illarghi have been saying, things are about to get very interesting… as in historically interesting – like 300 years since interest rates were this low, oh and the South Sea Bubble burst about then as well, oh and the Mississippi bubble…

L,

Sid.gurusid

ParticipantHi Folks,

Stoneleigh wrote:

Europe is indeed tipping over the edge again, into phase II of the credit crunch. For those minded to gamble with something they can afford to lose, shorting would be the way to go at this point IMO (bearing in mind that all gambling is risky, that governments can change the rules so that you may not be able collect on having been right, and that there will be far more ways to lose your shirt than to make a lot of money, even if you’re right about the trend).The unnaturally low level of volatility, combined with strong insider selling against a backdrop of optimism verging on euphoria, is a strong red flag warning. deflation is a very powerful force, and can take hold very quickly. When it does it very rapidly becomes a self-fulfilling prophecy.

Watch Europe as it’s in the vanguard of deflation, and in some countries acute liquidity crunch already. This is where the rest of us are headed.

And so it begins (again and in earnest this time):

Bank of England mulls negative interest rates

Paul Tucker, deputy governor for financial stability, raised the possibility in front of MPs after saying the Bank could be doing more to help the economy, including measures to boost lending to small businesses.

Negative interest rates would mean high street lenders paying the central bank to place their money with it. The move would be intended to encourage more lending to businesses and households. But it could also lead to a reduction in the interest paid on individual savers’ accounts held with high street banks.

The Bank has considered cutting rates from their record low of 0.5pc in the past but decided against doing so for fear of bankrupting a number of smaller building societies. To get round the problem, the Bank is reviewing a possible change to its remit so it can set a separate interest rate specifically for excess deposits placed by financial institutions at the central bank.

…

Other central banks, such as the European Central Bank, have two rates – a base rate and a deposit rate. In the UK, Bank sources said, a new so-called deposit rate could be charged on funds placed with the central bank above a certain level. For example, the first £1bn of banks’ money held could be charged at the existing base rate, and the rest at the new ‘deposit rate’.So in other words the banks can no longer get ‘cash on their cash’, albeit at the paltry 0.5%, but rather are effectively paying the BoE to hold their money for them so forcing out into the ‘market’.

But maybe they don’t want to lend due to all the ‘risk’ that they suddenly see out there, and so will find other ways to get their pound of flesh:

Couple unable to pay its interest-only mortgage ‘bullied and intimidated’ by government agency

By August 2012, with under two years to run, UKAR said that monthly payments of £2,982 were due – and these were now being added to the Jacksons’ total mortgage in the form of arrears.

Arrears on their account today are £15,000 and increasing at the rate of £2,700 a month. When the property is eventually sold, UKAR will claim these arrears along with the original mortgage balance.

The arrears could, within less than a year, wipe out all the equity in the property. The Jacksons say UKAR is effectively enforcing a brutal mortgage arrears policy to obtain a far greater part of the property’s eventual sale value.

‘We are sick with worry over these arrears,’ the Jacksons say. ‘We accept the house will have to be sold to pay the outstanding mortgage but all we ask is that we are allowed to pay interest only for the rest of the term, which we can afford to do.’

UKAR admits that its handling of the Jacksons’ case has been poor in some minor respects, but maintains it is right to demand full monthly repayments and, if these are not met, to add them to the total owed.And even if you can pay the mortgage now, you may not be able to for much longer:

Trackers don’t track and fixes move: The truth about mortgage deals

The Bank of Ireland is about to increase the cost of its tracker mortgages, despite the base rate not increasing, but is your mortgage rate safe?

Thousands of Bank of Ireland mortgage customers are to be hit with higher repayment costs on their tracker mortgages, whether the Bank of England Base rate changes or not.The lender has announced rate hikes to take effect from May, seeing rates for 13,500 customers on base rate tracker deals double.

The changes mean that a buy-to-let mortgage customer on a typical interest rate of 2.25% will see their rate climb to 4.99% from May 1.

Residential customers will see increases introduced in two stages: 2.49% plus base rate will take effect from May 1, changing again to base rate plus 3.99% on October 1, jumping to an overall rate of 4.49% if the base rate stays at 0.5%.

I guess they must think that the ’greedy landlords’ are putting up their rents deliberately to cash in a make money, but while there are many who are profiteering – usually those with little in the way of debt and or who bought before the boom, the fact is being a landlord does still (just) have its obligations, such as providing appliance and services safety certificates and maintaining the property to a reasonable standard. That costs money, and those costs are also going up. Also given that many bought on ‘interest only’ mortgages, at some stage they might find themselves in negative equity. As TAE have often said, and even despite increasing rents, the risk to the landlord is still greater.

Maybe that is why the FSA are targeting Banks who ‘game’ their liabilities:

* Bankers see risk to economy and models from standardisation

By Steve Slater

LONDON, Feb 25 (Reuters) – Britain’s banks could need tens of billions of pounds more capital as part of a crackdown on internal risk models that are deterring investors and undermining efforts to shield the global financial system from future shocks.The Financial Services Authority has been assessing how lenders calculate the riskiness of their mortgages and other loans to make sure they are setting aside enough money to cover potential losses.

The FSA has stepped up that scrutiny in the past two months, banking sources said, as part of a wider trend in Europe towards standardising guidelines on how banks should calculate the riskiness of loans amid concern some are gaming their internal models to flatter their financial health.

…

To meet the new rules, lenders are cutting their risk-weighted assets (RWAs) through disposals, by cutting risky businesses, and hedging. They are also tinkering with their internal models to make their holdings appear less risky, undermining the credibility of Basel III.

…

A DELICATE ISSUEThe Bank of England’s Financial Policy Committee (FPC), which looks out for trouble spots in the financial system, said in November the way that banks calculated RWAs was too “complex and opaque” and needed fixing. The FSA was told to assess the problem and report back for a March 19 FPC meeting.

No wonder then that some have started to remove ‘insurance’ cover for certain ‘liabilities’:

Ireland to remove bank deposit guarantee from end-March

DUBLIN (Reuters) – Ireland (OTC BB: IRLD – news) will remove a state guarantee on bank deposits next month to help ease pressure on loss-making lenders and move the country further towards exiting its EU/IMF bailout, finance minister Michael Noonan said.Ireland’s almost fully state-owned banks, whose rescue cost the equivalent of 40 percent of annual economic output, have had widening losses partly because of fees they had to pay for the guarantee, and they have been clamouring for its removal for months.

…

The removal of the guarantee will not impact the vast majority of bank customers because deposits over 100,000 euros are covered by a separate guarantee which has been in operation in Ireland since 1995.The Eligible Liabilities Guarantee (ELG) scheme guaranteed deposits over 100,000 euros in case banks got into trouble. Lenders had to pay a fee to the government for the guarantee, which cost the country’s three remaining domestic banks 1.1 billion euros last year.

So between the hard place (negative interest on their capital) and the rock (inherent risk re-emerging and no way to cover it up) it looks like the future of lending is getting decidedly Hobsonian…

and deflationary. Has the FIRE finally gone out?

L,

Sid.gurusid

ParticipantHi again,

And here is a taste of that hell:

How GMOs Unleashed a Pesticide Gusher

GMOs have added more than four pounds of herbicides to US farm fields for every pound of insecticide they’ve taken away.

The chemical war against pests will likely get yet another boost from the failure of Roundup. As I’ve reported before, GMO seed giants Monsanto and Dow are preparing to roll out seeds designed to resist both Roundup and older herbicides including 2,4-D, the less toxic half of the formulation that made up the infamous Vietnam War defoliant Agent Orange. The industry insists that weeds won’t develop resistance to the new products. But last year, a group of Penn State weed scientists published a paper warning that the new products are “likely to increase the severity of resistant weeds.” Indeed, 2,4-D-resistant weeds have already been documented in Nebraska.In his paper, Benbrook created a model for how a 2,4-D-resistant corn product, if released in 2013, would affect 2,4-D use. One of the actual benefits of Roundup Ready technology is that it has until recently made 2,4-D almost obsolete—its use on corn crops went from 4.4 million pounds in 1995 to 2.4 million in 2000. It hovered at that level for a while before jumping to 3.3 million pounds in 2010, as farmers increasingly resorted to it to attack Roundup-resistant weeds. If 2,4-D resistant corn is widely adopted, Benbrook projects, making what he calls “conservative” assumptions, 2,4-D use will hit 103.4 million pounds on corn fields per year by 2019. Overall, Benbrook projects a 30-fold increase in 2,4-D applied between 2000 and 2019. Because 2,4-D is so toxic, the result will not be pretty. Here’s Benbrook’s study:

Such a dramatic increase could pose heightened risk of birth defects and other reproductive problems, more severe impacts on aquatic ecosystems, and more frequent instances of off-target movement and damage to nearby crops and plants.

The only question on GMOs and pesticide use Benbrook’s paper leaves open is: When will Monsanto correct the absurd claim on its website that its highly lucrative technology has allowed farmers to cut back on herbicides?”

The answer is never as that is the real business of Monsanto and companies like it, selling toxic chemicals. The bigger the lie, the bigger the profits… :dry:

L,

Sid.gurusid

ParticipantHi Illarghi,

Unfortunately I have found that it is very difficult to explain to people just how nefarious this technology is. Aside from the profiteering and law breaking there are some serious unanswered questions regarding the health implications of GMO, and the scientific basis for their ‘technology’:

Although the body of safety studies on GM foods is quite small, it has verified the concerns expressed by FDA scientists and others.

– The gene inserted into plant DNA may produce a protein that is inherently unhealthy.

– The inserted gene has been found to transfer into human gut bacteria and may even end up in human cellular DNA, where it might produce its protein over the long-term.

– Toxic substances in GM animal feed might bioaccumulate into milk and meat products.

– Farmer and medical reports link GM feed to thousands of sick, sterile, and dead animals.But there is not a single government safety assessment program in the world that is competent to even identify most of these potential health problems, let alone protect its citizens from the effects.

(that last bit is the ‘missing’ science bit)

Also people have no idea just how crude the current commercial gene modification techniques are as this 2009 report states:

Research led by scientists at Iowa State University’s Plant Sciences Institute has resulted in a process that will make genetic changes in plant genes much more efficient, practical and safe.

…

The breakthrough was developed by David Wright, an associate scientist, and Jeffery Townsend, an assistant scientist, and allows targeted genetic manipulations in plant DNA, which could have a huge impact on plant genetic work in the future.

Until now, when scientists introduced DNA into plants, they would randomly inject that DNA into the plant cell. There was no way of knowing if it was in the right place or if it would work until many resulting plants were tested.I mean, c’mon, “they would randomly inject that DNA into the plant cell… no way of knowing if it was in the right place or if it would work” and their feeding this sh*t to people I hear you say?

It reminds me of the Radium toothpaste days:

That’s right, radioactive elements were used in all manner of things for due to ‘their curative powers’ – yeah your teeth fell out so it ‘cured’ you of having to brush the damn things!

I guess this one would alleviate the need for a face lift. You’d just peel your skin off yourself.

Ok, ok hindsight is always 20×20, but don’t forget those guys saying it was ‘safe’ and ‘curative’ were some of the top ‘scientists’ of their day:

Marie Currie and her tragic but real scientific experiments that cost her her life.So is it no wonder that today’s top ‘scientists’ think they are doing ‘gods work’:

The new technique harnesses a natural process called homologous recombination to precisely introduce DNA at a predetermined location in the plant genome through targeted DNA breaks generated by zinc finger nucleases.

This occurs about 1 in 50 attempts and is very efficient compared to unassisted methods that allow the same changes at a rate as low as 1 in 10 million.

“I’ve been working in this field for 29 years, just when we started learning how to modify genes,” said Townsend. “From that day, this was the goal — to actually get the research to the point where you can have homologous recombination. Now, we’ve done it.”

Using this process, a specific gene is located in a living cell, then a break is made in the DNA of that gene. When the cell begins to heal itself, existing DNA can be deleted or modified, or new DNA can be added near the break site. Afterward, the cell carries the genetic change and passes the change on to its offspring.

“It’s like surgery, only on the molecular level,” said Wright. “It’s been known for a long time that you if you make a break in a cell, you can get some DNA into that spot,” said Wright. “It’s just that you have three meters of DNA in a cell if you unwound it. Putting the break where you want it has always been the problem.”Ok the guy’s good at what he does, but don’t you get the impression he might have been in the lab a bit too long…

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

– Upton SinclairAnd this was just one random sample of the attitude of technicians, sorry scientists in this field. Actually most so called ‘science’ today is in fact a manipulation of technique and is therefore a technical endeavour done by technicians. Real science involves hypothesising and doing real (i.e. double blind) experiments to check and discover whether the theory is correct, not fudging some data to get a technique approved for commercial use. And this god like hubris has to be seen in the flesh to be believed, and I’ve seen it up close and personal. :ohmy:

But the real crux comes with this:In addition to the difficulty introducing changes where researchers want them using current methods, government regulations often slow the movement of research from the lab to the field.

Wright and Townsend hope the precision of this technique will speed the regulatory process.

“In the random process, regulators would say, ‘You really don’t know what you’re doing,'” said Townsend. “With this new technology, we can tell them, ‘The genome looks like this, this is exactly the change we want to make.’

“That’s the power of this technology. It makes it (genetic engineering) practical and much safer. It was impractical, and now it is practical.”“…government regulations often slow the movement of research from the lab to the field.” If only! Of course there is no mention of what happens when these totally untested gene combination get out into the broader environment, yet alone their effects when fed to animals and humans. But then doing ‘gods work’ has so many potential benefits:

There are many applications for this that could allow stunning advances for many crops, according to Wright and Townsend.

For instance, canola is a commodity grown for its oil, just as soybeans. However, after the oils are extracted, soybean meal is sold as feed. Once oils are extracted from canola, the meal has a much lower value as a livestock feed due to several factors, including the presence of the chemical sinapoylcholine, also called sinapine.

The new technique could allow scientists to remove the genes that make sinapine. The result would be a more versatile canola product.

Farmers, especially in the upper Midwest and Canada, would benefit from this new market for canola meal.

plants could benefit as well.

Removing the genes that are responsible for peanut allergies, or removing genes that produce harmful chemicals or anti-nutritionals in other crops are just a few of the immediate crop improvements that Wright and Townsend envision for this technology.No-one asks whether livestock should be eating canola in the first place, or what might happen if that gene got into other closely related species such as “Turnip, rutabaga, cabbage, Brussels sprouts, mustard, and many other vegetables are related to the two natural canola varieties commonly grown, which are cultivars of Brassica napus and Brassica rapa.” So a good excuse not to eat your broccoli I suppose. :whistle:

Oh and if you want GMO free honey, forget about it! Proof positive this stuff is everywhere… :blink:

Still, look on the bright side, unlike Radium, at least your face won’t fall off…

Byers began taking enormous doses of Radithor, which he believed had greatly improved his health, drinking nearly 1400 bottles. By 1930, when Byers stopped taking the remedy, he had accumulated significant amounts of radium in his bones resulting in the loss of most of his jaw. Byers’ brain was also abscessed and holes were forming in his skull. His death on March 31, 1932 was attributed to “radiation poisoning” using the terminology of the time, but it was due to cancers, not acute radiation syndrome. He is buried in Allegheny Cemetery in Pittsburgh, Pennsylvania, in a lead-lined coffin.

Due to Byers’ prominence, his death received much publicity. The Wall Street Journal ran a headline reading “The Radium Water Worked Fine until His Jaw Came Off” after his death. His illness and eventual death also led to a heightened awareness of the dangers of ingesting radioactive materials, and to the adoption of laws that increased the powers of the FDA.

William Bailey was never tried for Byers’ death, although the Federal Trade Commission issued an order against his business. However this did not stop Bailey from trading in radioactive products. He later founded a new company – “Radium Institute”, in New York – and marketed a radioactive belt-clip, a radioactive paperweight, and a mechanism which made water radioactive.

:sick:

Yes we’ve been here before, many times… Ignorance, corruption, law breaking and the hubris of ‘doing gods work’ are all too human traits as history shows, but the consequences of uncontrolled use of GMOs could lie not in the realm of the gods but those of the damned hellish. 👿

L,

Sid.gurusid

ParticipantHi Folks,

He won! (sortof…):

(Reuters) – The outcome of Italy’s national election is still uncertain but what is already clear is that the massive winner is Beppe Grillo, a shaggy haired comedian whose anti-establishment 5-Star movement could well become the country’s largest party.

Markets don’t like it though:

(Reuters) – The Italian stock market fell and state borrowing costs rose on Tuesday as investors took fright at political deadlock after a stunning election that saw a comedian’s protest party lead the poll and no group secure a clear majority in parliament.

The markets ‘no-likey’ and the press isn’t that enamoured:

(Reuters) RECESSION

“It’s a classic result. Typically Italian,” said Roberta Federica, a 36-year-old office worker in Rome. “It means the country is not united. It is an expression of a country that does not work. I knew this would happen.”

Italy’s borrowing costs have come down in recent months, helped by the promise of European Central Bank support but the election result confirmed fears of many European countries that it would not produce a government strong enough to implement effective reforms.

Rather than focus on the possibility of real change, the system just chokes. It remains to be seen how this pans out, will this be the straw that (finally…) breaks the Euro’s back?

(Reuters) – Spain said it was extremely worried about the impact of Italy’s deadlocked election result, warning on Tuesday the deadlock could affect the entire euro zone.

Foreign Minister Jose Manuel Garcia-Margallo said there was a feeling of “extreme concern” over possible movements in bond spreads as a reaction to the results.

“This is a jump to nowhere that does not bode well either for Italy or for Europe,” Garcia-Margallo told journalists on the sidelines of a conference in Madrid.

The Spanish government said it was monitoring the situation, especially the fallout on financial markets as the premium investors demand to hold Spanish 10-year debt rather than the German benchmark jumped to 393 basis points, a level not seen in several weeks, when it emerged a cabinet could be hard to form.Are we going to see Grillo warfare and a pizza spring? 😆

I expect the propaganda machine to go into overload…

L,

Sid.gurusid

ParticipantHi Folks,

Insurers may deny, or seek to reduce, a claim if they can place some, or all, of the responsibility for an accident on to the victim

Unless you’re a wealthy celebrity!

Atkinson, worth a reported £71 million, hit a slippery patch of road near Peterborough in August 2011, he lost control of the F1 and hit a tree – leaving the car’s 6.1-litre engine 20-yards away from the rest of the vehicle. It was the second time Atkinson had crashed his F1, with the actor front-ending it into a Rover Metro in 1999.

Maybe his insurers will sue the tree! I’d love to see his ‘revised’ premium…

Meanwhile the UK gov’t tries to persuade insurers to continue insuring flood prone properties:

Floods Insurance Payouts Top £1bn For 2012.

Nick Starling, ABI’s Director of General Insurance, said: “2012 may have been a record-breaking wet one, but it was business as usual for insurers, who helped thousands of customers recover from the trauma of flooding.

“Flooding is the greatest natural threat facing the UK and the risk is rising so political consensus and commitment on investment in flood defences, sensible planning decisions and working with the insurance industry is essential.”

The figures comes as an agreement between the Government and insurers to ensure cover for high-risk homes is due to expire at the end of June.

The ABI said talks with the Government are ongoing about how affordable premiums in high-risk areas can continue.

But the insurers are set to claw back all those payouts in the form of big premium hikes:

Mohammad Khan, a partner at PricewaterhouseCoopers (PwC), said: “The weather events of 2012 have dented insurers’ profits and will probably lead to renewal premiums rising by up to 5% for those unaffected by the floods and by up to 50% for those flooded.

“The UK floods therefore, have also brought into sharp focus the current standoff between the insurance industry and the Government on the renewal of the Flood Principles – agreement needs to be reached in 2013.”

More like no insurance for those flooded and 50% or more premium hikes on everyone else…

L,

Sid.gurusid

ParticipantHi Dave,

For instance, if the political class thought that oil prices were rising for monetary reasons, they might consider tightening credit, which wouldn’t really help the situation if oil prices were actually rising because of scarcity and/or resource depletion.

IMHO I see it as differing ‘systems’ reacting. The ‘political’ system which in the UK tends to be very ‘policy’ reactive compared to the say Germany’s more ‘precautionary’ approach, though more recently the Germans have been forced down the reactionary path due to the shear force of circumstance, something which will be much more prevalent as things really start to kick off. Thus in terms of energy, the Germans tended to have a more forward looking precautionary approach with plenty of structured planning, the UK on the other hand with its ridiculous ‘laissez fair’ leave it all to the market approach has only a reactionary response. Thus, instead of doing something about the problem which they knew about years ago which has led to the current looming crisis with fuel bills and supply constraints:

– By 2015 the Energy Demand in the UK Could Exceed Supply by 23% at Peak Times

– The Impact of the ‘Real’ Energy Gap on GDP Will be Equivalent to GBP108bn a Year

– GBP3.7k a Year Cost for Every Working Adult In The Country

– Powercuts are Now Just as Likely in the Summer as the Winter

The UK energy gap is much larger and closer than currently being reported, according to a new white paper issued by LogicaCMG, a leading provider of business services to the energy sector. Within ten years the gap could cost UK businesses over GBP108 billion a year.It’s a good job the Prime Minister is in India he can get to see how a country manages with constant blackouts and power shortages, as that is soon to start happening here in the UK.

The chance of large power cuts – those that hit more than a million homes – will be 300 times more likely by 2015.

The only upside would be if the UK gov’t pushed some of the ‘quantitative easing’ into the power industry to renew the infrastructure. Who knows that might even boost GDP and ‘Growth’.

However the other system of Finance and Investment will put paid to all that by betting, sorry ‘speculating’ on fuel and energy prices, regardless of the actual costs of production. Fuel prices in the UK are set to hit record highs due in part to a falling sterling but also to speculation.

L,

Sid.gurusid

ParticipantHi Dave,

One of the very confusing things about this pop is that absolute prices of many things are rising. I believe resource constraints (declining ore grades, oil finds, etc) are a big reason why some prices are increasing. Government support of particular sectors is another reason. It is important to be clear about which prices are going up, which ones are going down, and why. But I believe that over time, the level of credit money in the economy will eventually have a strong influence in the general direction of prices, so that’s the thing to watch.

History rhymes but never repeats? Unlike the 1930s when oil was in a glut due in part to the Texas wildcat strike, today we have an increasing ‘difficulty’ increasing oil and other energy supplies without incurring huge fiscal costs too, yet alone the extra energy needed to find the ‘extra energy’ which decreases the EROEI. And as Ayres and Warr have shown, energy or more specifically ‘work’ (exergy services) is a key (if not the key) driver of economic expansion.

Our understandings and expectations of the world have been shaped by our experience of economic growth. The dynamic stability of that growth has habituated us to what is ‘normal.’ That normal must soon shatter. – David Korowicz

…Since crude oil production has been on an undulating plateau since 2005 while demand has increased (Hirsch et al, 2010), this has put huge upward pressure on the price of oil, and several commentators have drawn the conclusion that these high oil prices signify the end (Heinberg, 2011; Rubin, 2012) or at least the twilight (Alexander, 2011a; 2012a) of economic growth globally. If this is true, we are living at the dawn of a new age, and should be bracing for impact.

We are in a new paradigm: not only has the rug been pulled out from under all the old world theories of perpetual economic growth, but the ground beneath is not there, but way back yonder at the cliff edge we passed over a while back, having been hidden by said rug. All 7 billion of us and counting…

One thing on the three ‘Es’ of Economy, Energy and Environment, is that I suspect we will not get one after the other, but rather one feeding into the others, thus while we currently have an economic crisis, energy is now feeding into that crisis and causing greater disruption. So too as we go further down the road the environmental crisis (here I am referring to things like ocean depletion and pollution, soil erosion, groundwater and aquifer depletion amongst many others never talked about) will feed into the other two and together will form a maelstrom of consequences.

And as Dave said (which could be said of most neo-classical economists):

Honestly it felt like I was listening to a pair of virgin psych grad students having a long and detailed discussion about sex.

Ain’t that the truth! :whistle:

L,

Sid.gurusid

ParticipantHi Dave,

Is that a head and shoulders forming in that EU Total credit chart?

Also, on Prof’s Zero Hedge link:

Conclusion

The deflation death spiral is a theoretical description of a situation but it does not describe the reality of human action, for any number of reasons:

1. There is in reality always a diversity of expectations among the public. While some people will expect prices to continue in the same direction, others will form the opposite view. Everyone’s expectations will change not only in response to changes in the data, but taking into account their entire life experience, their own ideas, and their situation.

2. Expectations are not entirely driven by prices. A broad range of things influences our expectations about price.

3. Lower prices are not always sufficient motivation to delay purchases because everyone prefers to have what they want now, rather than later.

4. Expectations of buyers tend to be met by sellers, if not at first, then fairly soon. In some cases, buyers can hold onto their cash for a bit longer, but most businesses have no choice but to sell their inventories at what the buyer will pay. In other cases, buyers may not be able to delay purchases, or may not wish to, and will pay what they must in order to buy.

5. Everyone—buyers and sellers (and every one of us acts in both of these roles at different times)—has expectations not only about consumer prices, but about wages, employment prospects, even asset prices, the economy in general, the progress of our own life, and the future of our family. A coherent plan of saving and spending takes all of these things into account.