Matson Aircraft refueling at Semakh, British Mandate Palestine 1931

It is truly great to see that over the past 10 days or so, millions of coronavirus experts worldwide have come out of hiding whose existence we knew nothing about beforehand. We at the Automatic Earth have been following the virus for well over 2 months, and not only do we still not understand as much as all these experts, we even contradict ourselves and each other from time to time. With all the new expert knowledge and -especially- opinions, no doubt the crisis will be solved real soon now.

When I started working very early this working, one of the first things I saw was this from Reuters. Which shows, while for instance Worldometer still had total deaths at 7,915, a 8,410+ number. Somehow it feels too specific for just a random mistake. Worldometer now says 8,010, so there is an increase, but not nearly as much.

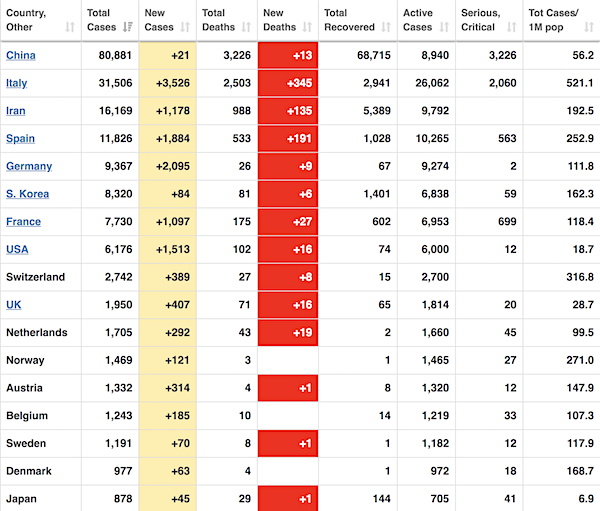

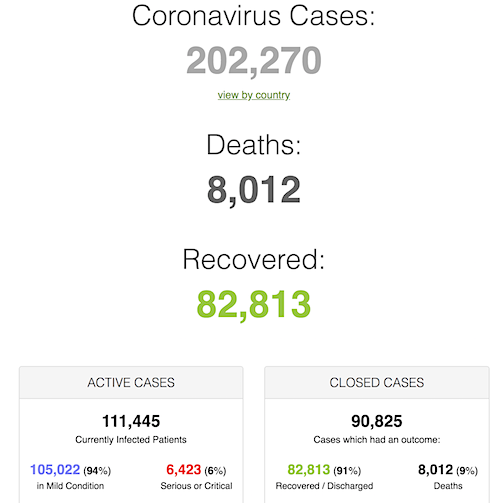

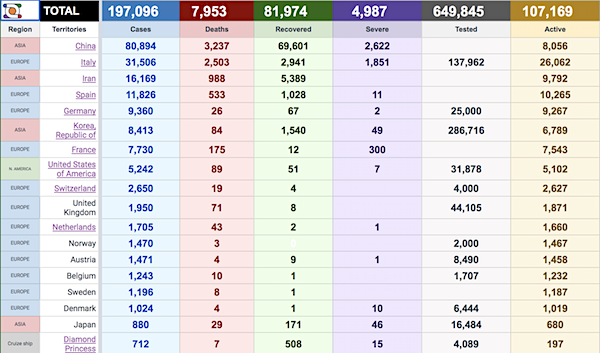

Do note, however, that both cases and deaths are up by much larger numbers in the past 24 hours than ever before…

• Cases 202,270 (+ 18,137 from yesterday’s 184,133)

• Deaths 8,012 (+ 830 from yesterday’s 7,182)

These numbers, too, are rising relentlessly.

From Worldometer yesterday evening (before their day’s close)

From Worldometer -NOTE: mortality rate is now at 9%!- (Note: some call this rate “misleading”, but that can by definition only be true if you don’t know the parameters. Worldometer is very clear: the death rate is part of Closed Cases, not All Cases. You may argue that Active Cases should be part of the equation, but that would only insert uncertainty into the number. Neither Worldometer nor I imply that 9% will be the ultimate fatality rate, just that at present it’s the rate among Closed Cases.)

From SCMP: (Note: the SCMP graph was useful when China was the focal point; they are falling behind now)

From COVID2019.app: (New format lacks new cases and deaths)

Somebody found a money tree. Or, rather, one in every country.

• Global Powers Unleash Trillions Of Dollars To Stem Coronavirus Crisis (R.)

The world’s richest nations prepared more costly measures on Tuesday to combat the global fallout of the coronavirus that has infected tens of thousands of people, triggered social restrictions unseen since World War Two and sent economies spinning toward recession. With the highly contagious respiratory disease that originated in China racing across the world to infect more than 196,000 people so far, governments on every continent have implemented draconian containment measures from halting travel to stopping sporting events and religious gatherings. While the main aim is to avoid deaths – currently at over 7,800 – global powers were also focusing on how to limit the inevitably devastating economic impact.

In the world’s biggest economy, U.S. President Donald Trump’s administration has proposed pumping $1 trillion into the market. Trump wants to send cash to Americans within two weeks as the country’s death toll approached 100 and more testing sent the number of coronavirus cases to over 5,700. Airlines are among the worst-hit sector, with U.S. carriers seeking at least $50 billion in grants and loans to stay afloat as passenger numbers evaporate. Britain, which has told people to avoid pubs, clubs, restaurants, cinemas and theaters, unveiled a 330 billion pounds ($400 billion) rescue package for businesses threatened with collapse. Budget forecasters said the scale of borrowing needed might resemble the vast amount of debt taken on during the 1939-1945 war against Nazi Germany.

“Now is not a time to be squeamish about public sector debt,” Robert Chote, head of the Office for Budget Responsibility, which provides independent analysis of the UK’s public finances, told lawmakers. France is to pump 45 billion euros ($50 billion) of crisis measures into its economy to help companies and workers, with output expected to contract 1% this year. “I have always defended financial rigor in peacetime so that France does not have to skimp on its budget in times of war,” Budget Minister Gerald Darmanin was quoted as saying by financial daily Les Echos. The European Union eased its rules to allow companies to receive state grants up to 500,000 euros ($551,000) or guarantees on bank loans to ensure liquidity.

But even with the promised cash splurges, world stock markets and oil prices were unable to shake off their coronavirus nightmare after Wall Street on Monday saw its worst rout since the Black Monday crash of 1987. The Philippines was the first country to close markets, while Europe – now the epicenter of the pandemic – saw airline and travel stocks plunge another 7%.

Central banks have run out of tools. Philippines the first to close markets altogether.

• We’re at a Real Risk of Financial Markets Being Closed – Bianco (NZZ)

Mr. Bianco, the Federal Reserve takes massive emergency actions. What does this mean for financial markets? The Central Banks went all in. They fired all of their ammunition and they’ve got only one goal in mind: They have to stop the decline in financial markets. This started late last week with the Fed’s giant repo operation. You can also throw in the announcements of the ECB and the Bank of Japan. Plus, we have the extraordinary actions taken by European governments to stem the effects of the pandemic. The government of Germany for instance is basically guaranteeing everybody’s job.

However, investors don’t seem convinced. What’s going to happen if markets drop further? Central Banks need to stop the stock market from falling through last week’s low. I believe if markets fall through those levels and keep going down, the so-called Fed Put is dead. It doesn’t work anymore, so quit trying to find new ways to exercise it. Just understand Einstein’s definition of insanity: Doing the same thing over and over again, and expecting different results.

What are the ramifications if the Fed Put doesn’t work anymore? Central Banks will need to move on. So if stocks make new lows we’re at a real risk of financial markets being closed. The Fed and other Central Banks have fired all their ammunition and if markets crash through last week’s lows, there’s nothing left. The Fed can’t buy equities outright without a change of the Federal Reserve Act. It would take weeks for Congress to do that. Even if Congress moves with lightning speed it will take them at least a week, and it will be over before that.

What would be the benefit of closing markets? It took the stock market sixteen trading days to drop by 27% from the all-time highs to Thursday’s lows. We have never seen anything close to that in history. The closest we’ve ever been in history was 1929, when it took 42 days to get from the all-time highs to a 20% correction. The speed in this decline is unprecedented.

Why is it so important to stop this crash? If it continues, you will get margin calls, involuntary liquidation. Markets will lose their ability to price securities, especially things like high yield bonds and emerging markets securities. Funds in those areas will be unavailable for people to redeem because they won’t have any prices. There will be trapped money. Also, you will get broken covenants in the corporate debt area, and that will force changes of control or restructurings. But the biggest damage will be that pensions will become underfunded. Companies will be forced to pony up billions of Dollars to get their pensions back into funding.

[..] You’re been in the investment business for a long time and have seen quite a few crashes. How do you experience this crisis personally? This is unlike anything we’ve seen in our lifetime. What’s going on in financial markets today exceeds the financial crisis of 2008, it exceeds 9/11, it exceeds the tech peak, and it exceeds the 1987 crash. Maybe 1929 is still bigger, but few of us were alive then. We’re writing a new chapter for American and world history textbooks. We’re only a few pages into it, and we’re not sure how it will end, but our grandchildren will one day learn school about the great pandemic of 2020 and what it meant for world history.

“What I’m opposed to is the hype, hypocrisy and excess that has preceded it. People got greedy, they piled into stocks at ungodly valuations. Companies that didn’t save or prepare for a crisis, instead were focused on short term market gains to juice up their stock prices. Companies such as Boeing that cut corners and blew money on buybacks for financial engineering purposes to enrich upper management and shareholders. I say screw them..”

The lesson of it all? The lesson is that lessons are not being learned. Of course the human species has an ingrained problem: We are all born with a blank sheet and have to learn everything from scratch. It would be helpful though if the elders could pass lessons from past mistakes on to the new generation. But no. So we keep making the same stupid mistakes. And here we are. Just four weeks after all time highs in markets America is again turning into bailout nation. Yes coronavirus is an unforeseen shock. So what? We’re supposed to handle a shock. We’re supposed to be prepared. We’re supposed to have savings and great balance sheets.

After an 11 year recovery and market bull run based on cheap and easy money shouldn’t things be great and shouldn’t we be well prepared for the next downturn? Is that really too much to ask? Apparently. We can’t even go 4 weeks without the Fed going apeshit on cutting rates to zero, launching $700B in QE, making discount windows available and launching $500B, even trillion dollar repos. We can’t even go 4 weeks without the government launching a proposed $850B stimulus package, tax cuts, free money checks of $1,000 to Americans and suggesting bailouts for $BA and $GE. That’s how fragile things are. They must be, otherwise the system would be able to handle a temporary shock. But it can’t. Why? Well for one our supposed great economy ever has the vast majority of Americans live paycheck to paycheck:

The consumer is doing great:

“78 percent of full-time workers said they live paycheck to paycheck, up from 75 percent last year.

Overall, 71 percent of all U.S. workers said they're now in debt, up from 68 percent a year ago.” https://t.co/iLgLYRrPYN— Sven Henrich (@NorthmanTrader) December 15, 2019

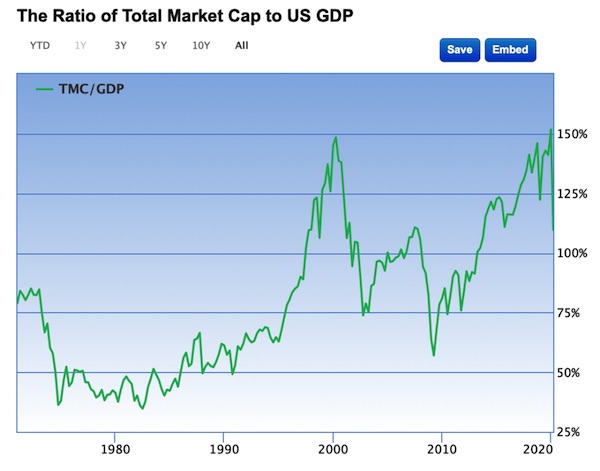

That’s a systemic problem. Sure you can blame people for living beyond their means, but in general most people just don’t have the income power to keep abreast with rising medial costs, home prices and all the other fun inflationary items that the Fed simply doesn’t count as inflation. How ignorant they are. PCE deflator. Please. And then of course the same lesson again not learned that keeps repeating ahead of every bust: Greed and more greed. When has it ever been a good idea to chase stocks to 150% market cap to GDP or even higher? The answer is never. Yet they convinced themselves and others that it’s different this time. New flash: It wasn’t. A lesson not learned and yet they did it. The chart was screaming unsutainability. And here we are 4 weeks later, yesterday closing at 109.5% market cap to GDP:

Reversion to the mean. And it could eventually get much worse. I showed this chart in Bull Cliff in February and I stated: “Investors keep piling money into this historically priced market….Central banks can deny all they want that they are not responsible for asset price inflation, but everybody knows better. The denials are not only hollow they are straight out lies. And having created the Pavlovian effect we now see in the investment community they are leading investors to abandon all sense of risk when risks are mounting ever more around us as valuations and earnings multiples keep expanding as a result of monetary policy. And hence it may be said that central bankers may be leading investors off the cliff.”

[..] I’m not opposed to the government stepping in to help in an emergency. That’s why we have government. What I’m opposed to is the hype, hypocrisy and excess that has preceded it. People got greedy, they piled into stocks at ungodly valuations. Companies that didn’t save or prepare for a crisis, instead were focused on short term market gains to juice up their stock prices. Companies such as Boeing that cut corners and blew money on buybacks for financial engineering purposes to enrich upper management and shareholders. I say screw them. If you don’t learn the lessons of the past then live with the consequences. And who pays ultimately for the consequences? We’ve seen this movie before

Still the greatest financial crisis explanation rant ever.

See if you note anything different 10 years later.#wankingbankers pic.twitter.com/FHutYeSJqD— Sven Henrich (@NorthmanTrader) January 24, 2019

Even Tyler Durden vehemently disagrees. But this is major military supplier Boeing.

• Boeing Seeks ‘Tens Of Billions’ In Bailouts (ZH)

In its latest 8K, the plunging planemaker has completely drawn down its $13.8 billion credit line that it entered in October 2018 as it “navigates current business challenges” exposing just how fast this company is burning through cash. [..] This comes just hours after sources told Reuters that Boeing is seeking a bailout of ‘tens of billions’ in US government loan guarantees amid the Covid-19 crisis.[..] As we raged previously, this bailout demand comes after the company blew nearly $100 billion on stock buybacks since 2013 helping push its stock to all-time highs not that long ago, and instead of selling stock to get liquidity, they’re asking the Trump administration for a massive bailout.

So, no, nobody in their right minds should give Boeing even one penny in “short term aid”. Instead, management and the board should be ordered to sell as much stock as they need – you know, the opposite of buying it back – to maintain the business, even it means sending the stock price crashing far lower. Because it’s called capitalism, and because there is no reason why taxpayers should foot the bill for a company which instead of saving cash when times were good, was handing it out to shareholders and a handful of executives, and which should now for some insane reason be eligible for a bailout when times suddenly go bad. No: force Boeing – and others like it that spent billions repurchasing its stock while incurring massive amounts of debt – to sell its stock.

After all that’s what a public company’s stock is – a currency – and just as Boeing could repurchase it when it had cash, and lifted its stock price to all time highs, it should now sell its stock and use the proceeds to fund itself, like any other corporation does when it needs funding. Last time we checked, Boeing’s market cap was $73 billion, and it certainly afford to drop much more as the company now does the buyback in reverse. This is also a warning to Congress and the White House: if chronic stock repurchasers such as Boeing, are bailed out instead of ordered to find their own sources of liquidity, there will be a mutiny in America and rightfully so, because it was Boeing’s shareholders that got rich on the way up, and now it is somehow up to taxpayers to make sure the company, loaded up with record amounts of debt used to fund buybacks, survives one more quarter. That, in a word, is bullshit.

We have this opportunity to get the rotten apples out, but are we going to use it?

• Hotel Industry To Ask Trump For $150 Billion In Aid (LAT)

Staggered by the coronavirus outbreak, the lodging industry requested $150 billion in aid from the Trump administration Tuesday as Marriott International announced plans to furlough tens of thousands of workers. After a White House meeting with President Trump and Vice President Mike Pence, hotel industry leaders said the virus outbreak is on pace to cause a bigger economic hit than the 2001 terrorist strikes and the 2008-09 recession combined. In addition to the $150 billion requested by the hotel industry, other sectors of the travel industry — such as convention centers, theme parks and tour companies — have requested $100 billion in funding to overcome the crisis, said Roger Dow, president of the U.S. Travel Assn., the trade group for the country’s travel industry.

That is on top of the $58 billion in aid requested Monday by the airline industry to overcome a surge in flight cancellations amid new travel restrictions. Without federal aid to the travel and lodging industries, the U.S. could lose as many as 4 million jobs in 2020, pushing the unemployment rate from 3.3% to 6.3% across the country, Dow said. Hotel occupancy rates were around 80% a few weeks ago but are now 10% to 20% in the busiest cities of the country, Chip Rogers, president of the American Hotel & Lodging Assn., said in a conference call with reporters. The federal aid, he said, has been requested in the form of grants to keep workers employed until the crisis subsides. Details about how the money would be disbursed had yet to be decided, Rogers said.

Should casinos be bailed out? Or only those owed by Native Americans?

• American Indian Casinos Close For Coronavirus, Seek $18 Billion Aid (R.)

The Native American gaming industry on Tuesday requested $18 billion in U.S. federal aid as it shut casinos that are the sole source of commercial revenue for dozens of tribes in a bid to slow the coronavirus epidemic. Tribal governments will be unable to provide health and education services and will default on loans unless they get federal support to make up for lost casino money, the National Indian Gaming Association said in a letter to members of the U.S. House of Representatives. “Providing the means for tribal governments to continue paying all employees’ salaries and benefits will immensely help this country recover,” according to the letter addressed to Representatives Deb Haaland and Tom Cole of the House Native American Caucus.

The United States’ roughly 460 Indian casinos are in the process of closing given the threat of coronavirus to tribal members and many non-Native American employees. Tribes are sovereign nations but are following advice from U.S. states and the federal government to slow the virus’ spread. That means shutting American Indian casinos which employ a combined 700,000-plus people directly and indirectly and generated over $37 billion in 2017, making them the largest segment of the U.S. gaming industry, according to the association.

Frances Coppola: “Demand is falling because of virus control measures. Giving people money to spend (above their normal income) while simultaneously making it impossible for them to spend it is absurd.”

• Mnuchin Warns Senators Of 20% US Unemployment Without Coronavirus Rescue (R.)

U.S. Treasury Secretary Steven Mnuchin warned Republican senators on Tuesday that the country’s unemployment rate could hit 20% if they failed to act on a proposed coronavirus rescue package and there was lasting economic damage, a person familiar with the closed-door meeting said. Mnuchin met with senators to persuade them to pass a $1 trillion stimulus package that would send cash to Americans within two weeks and backstop airlines and other companies. The Senate is majority-controlled by President Donald Trump’s fellow Republicans. A Treasury official said Mnuchin was not providing a forecast but trying to illustrate the potential risks of inaction.

“During the meeting with Senate Republicans today, Secretary Mnuchin used several mathematical examples for illustrative purposes, but he never implied this would be the case,” Treasury spokeswoman Monica Crowley said in an emailed statement. The warning was similar to one issued to U.S. lawmakers at the depths of the 2008 financial crisis, when Treasury Secretary Henry Paulson and Federal Reserve Chair Ben Bernanke went to Capitol Hill to urge passage of a $700 billion plan to buy toxic mortgage assets.

Amazingly nice comment from @DanaBashCNN.

President @realDonaldTrump “is being the kind of leader that people need.”

It is incredible that unity is the byproduct of this aweful virus. It is beautiful to see and this is a great start. Thanks Dana…

— Eric Trump (@EricTrump) March 18, 2020

“56% of Americans considered the coronavirus outbreak a “real threat,” while 38% said it was “blown out of proportion.”

• 18% Of US Workers Have Lost Jobs Or Hours Since Coronavirus Hit (LAT)

As fallout from the coronavirus pandemic hits the economy, it’s slamming the American workforce: Some 18% of adults reported that they had been laid off or that their work hours had been cut, a new poll found. The proportion affected grew for lower-income households, with 25% of those making less than $50,000 a year reporting that they had been let go or had their hours reduced, according to a survey released Tuesday by NPR, PBS NewsHour and Marist of 835 working adults in the contiguous United States. The poll was conducted Friday and Saturday, just after stocks began their steep plunge and normal life started grinding to a halt, with schools and places of worship closing, concerts and conferences being canceled and sports leagues suspending their seasons. The same poll found that about 56% of Americans considered the coronavirus outbreak a “real threat,” while 38% said it was “blown out of proportion.”

Couldn’t we all make this prediction? It depends on 1001 variables. Who needs an expert for this?

• COVID-19 Pandemic Could Continue For 2 YEARS – German Health Expert (RT)

A senior German disease control expert has warned that the coronavirus pandemic could continue for two years, depending on how long it takes for an effective vaccine to be developed and if people develop immunity after illness. Speaking on Tuesday, the Robert Kock Institut’s (RKI) president, Prof. Lothar Wieler, said pandemics tend to run their course in waves, and factors influencing how it unfolds from this point include how many people become immune to it after contracting the virus – and how quickly a vaccine is made. The RKI, a German federal agency responsible for disease control and prevention, on Tuesday raised the country’s threat level from the ongoing coronavirus pandemic from ‘moderate’ to ‘high’.

It said the revision comes in light of the continuing increase in new infections of the rapidly-spreading virus, which originated in China late last year and whose symptoms range from fever to serious respiratory illness. Germany has recorded over 7,900 cases of Covid-19 to date, with 20 deaths. New research from RKI scientists and the Helios clinic group also says that the novel coronavirus can more seriously afflict adults aged under 60 who have no underlying health conditions than similar patients suffering severe pneumonia in the regular flu season.

Although countries around the globe have largely stepped up measures to counter the spread of the virus, including border closures, shutting schools and limiting mass gatherings, Covid-19 cases outside of China recently surpassed the total figure recorded inside the country that had, until now, suffered the worst of the outbreak. Italy, in particular, is struggling with the pandemic and recorded a larger single-day number of deaths last weekend than China did at the worst of the peak there.

I thought we already knew that, but the article is dated the 17th.

• New Coronavirus Can Persist In Air For Hours And On Surfaces For Days (R.)

The highly contagious novel coronavirus that has exploded into a global pandemic can remain viable and infectious in droplets in the air for hours and on surfaces up to days, according to a new study that should offer guidance to help people avoid contracting the respiratory illness called COVID-19. Scientists from the National Institute of Allergy and Infectious Diseases (NIAID), part of the U.S. National Institutes of Health, attempted to mimic the virus deposited from an infected person onto everyday surfaces in a household or hospital setting, such as through coughing or touching objects. They used a device to dispense an aerosol that duplicated the microscopic droplets created in a cough or a sneeze.

The scientists then investigated how long SARS-CoV-2 remained infectious on these surfaces, according to the study that appeared online in the New England Journal of Medicine on Tuesday – a day in which U.S. COVID-19 cases surged past 5,200 and deaths approached 100. The tests show that when the virus is carried by the droplets released when someone coughs or sneezes, it remains viable, or able to still infect people, in aerosols for at least three hours. On plastic and stainless steel, viable virus could be detected after three days. On cardboard, the virus was not viable after 24 hours. On copper, it took 4 hours for the virus to become inactivated.= In terms of half-life, the research team found that it takes about 66 minutes for half the virus particles to lose function if they are in an aerosol droplet.

That means that after another hour and six minutes, three quarters of the virus particles will be essentially inactivated but 25% will still be viable. The amount of viable virus at the end of the third hour will be down to 12.5%, according to the research led by Neeltje van Doremalen of the NIAID’s Montana facility at Rocky Mountain Laboratories. On stainless steel, it takes 5 hours 38 minutes for half of the virus particles to become inactive. On plastic, the half-life is 6 hours 49 minutes, researchers found. On cardboard, the half-life was about three and a half hours, but the researchers said there was a lot of variability in those results “so we advise caution” interpreting that number.

Encouraging, but looks like a long time option.

• Australian Scientists Map How Immune System Fights Virus (BBC)

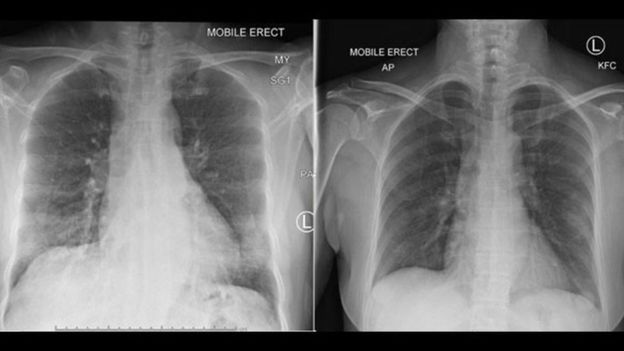

Scientists in Australia say they have identified how the body’s immune system fights the Covid-19 virus. Their research, published in Nature Medicine journal on Tuesday, shows people are recovering from the new virus like they would from the flu. Determining which immune cells are appearing should also help with vaccine development, experts say. “This [discovery] is important because it is the first time where we are really understanding how our immune system fights novel coronavirus,” said study co-author Prof Katherine Kedzierska. The research by Melbourne’s Peter Doherty Institute for Infection and Immunity has been praised by other experts, with one calling it “a breakthrough”.

Many people have recovered from Covid-19, meaning it was already known that the immune system can successfully fight the virus. But for the first time, the research identified four types of immune cells which presented to fight Covid-19. They were observed by tracking a patient who had a mild-to-moderate case of the virus and no previous health issues. The 47-year-old woman from Wuhan, China, had presented to hospital in Australia. She recovered within 14 days. Prof Kedzierska told the BBC her team had examined the “whole breadth of the immune response” in this patient. Three days before the woman began to improve, specific cells were spotted in her bloodstream. In influenza patients, these same cells also appear around this time before recovery, Prof Kedzierska said.

Chest scans showed the patient’s lungs clearing after immune cells appeared

Iran has released 54,000 + 85,000 prisoners “temporarily”.

• A Coronavirus Outbreak In Jails Or Prisons Could Turn Into A Nightmare (Vox)

The next site of a deadly coronavirus outbreak may not be a cruise ship, conference, or school. It could be one of America’s thousands of jails or prisons. Just about all the concerns about coronavirus’s spread in packed social settings apply as much, if not more, to correctional settings. In a prison, multiple people can be placed in one cell. Hallways and gathering places are often small and tight (often deliberately so, to make it easier to control inmates). There is literally no escape, with little to no space for social distancing or similar recommendations experts make to combat coronavirus. Hand sanitizer can be contraband.

Such an outbreak could not only infect and kill hundreds or thousands of people in prison, but potentially spread to nearby communities as well. Visitors and correctional staff could spread the disease when they go back home, and inmates could spread it when they’re released. Even an outbreak contained within a jail or prison could strain nearby health care systems, as hundreds or thousands of people suddenly need medical care that jails and prisons themselves can’t provide. So if you want to “flatten the curve” to spread out the illness and avoid overwhelming health care systems, experts say, you should worry about coronavirus in prisons and jails.

In the US, the concern is particularly acute because America puts so many people in jail or prison. The US locks up about 2.3 million people on any given day — the highest prison and jail population of any country in the world. With an incarceration rate of 655 per 100,000 people, the US locks up people at nearly twice the rate of Russia, more than five times that of China, more than six times Canada and France, nearly nine times Germany, and almost 17 times Japan. “We can learn what works in terms of mitigation from other countries who have seen spikes in coronavirus already, but none of those countries have the level of incarceration that we have in the United States,” Tyler Winkelman, a doctor and researcher at the University of Minnesota focused on health care and criminal justice, told me.

While France and Germany go out of their way to keep EU (Schengen) borders open, EU member Cyprus says no.

• Cyprus Bans Flights From 28 Countries From March 21 (R.)

Cyprus on Tuesday announced a two-week ban on flights from 28 countries, including Britain and Greece, to curb the coronavirus outbreak. The measure will come into effect from 0100 GMT on March 21 for a 14-day period, an official statement said. It does not affect cargo flights. The island has already enacted stringent entry requirements, effective from March 16, barring anyone into the island, including Cypriots, without a medical certificate that they are clear of coronavirus. Those who do arrive are placed in compulsory quarantine in a government-supervised facility for two weeks. The east Mediterranean island has reported 49 cases of coronavirus.

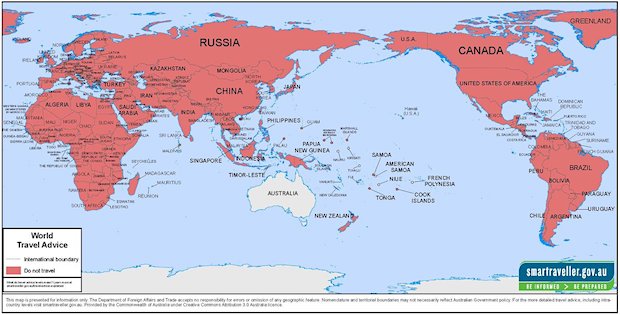

Australia’s DFAT travel advisory map has been updated. Every country in the world is labelled “Do Not Travel”, for the first time ever.

Best friends.

• Beijing Tells NYT, WSJ, WaPo Journalists To Hand In Credentials (RT)

China is pulling the press credentials of US journalists from outlets including the New York Times and the Washington Post whose passes expire in 2020, in the latest move of an ongoing tit-for-tat with America over media access. In a statement about China’s “countermeasures against US suppression of Chinese media organizations in the United States,” Beijing announced that American reporters working for the NYT, Wall Street Journal, Voice of America, Time and the Washington Post whose credentials are due to expire by the end of this year must hand them over within 10 days. These reporters will also not be allowed to work in China – including Hong Kong and Macau – in the future, and other US journalists will face new visa restrictions similar to those Washington recently introduced for Chinese reporters.

“In view of the US’ discriminatory restrictions on visas, administrative review, and interviews of Chinese journalists, China will take reciprocal measures against US journalists,” it added. The back-and-forth expulsions of journalists started in February, when Chinese authorities gave three Wall Street Journalists five days to leave the country after Beijing objected to an opinion piece in the outlet calling China the “real sick man of Asia.” The paper refused to apologize for the piece. Shortly afterwards, the US dramatically reduced the number of journalists it would permit to work for four Chinese state-owned media companies inside the US, cutting the number allowed from 160 to 100. They also reduced the length of time those permitted entry could remain in the US. Beijing condemned the move as reflecting a “Cold War mindset” and warned of retaliation.

Clean water in Venice for the first time in forever. The flipside of this: Free parking in Athens to limit use of public transportation.

https://twitter.com/ikaveri/status/1239660248207589383

If you read us, please support us. Help the Automatic Earth survive.