Salvador Dali Punta es Baluard de la Riba d’en Pitxot 1918-19

Assange

https://twitter.com/i/status/1583390688959307777

Christine Anderson

Why is this not on the news? The media is completely complicit in this – there’s no confusing that now. pic.twitter.com/3vvSOnxxUl

— Brandon Taylor Moore (@LetsGoBrando45) October 20, 2022

NBC

Very Disturbing Story

Tucker Carlson & @DarrenJBeattie Expose NBC Reporter Whose Job It Is To Harass & Intimidate Trump Supporters

Darren: "She will do everything she can to unearth anonymous Trump supporters, basically so she can ruin their lives." pic.twitter.com/tSxwMNL3E9

— The Columbia Bugle 🇺🇸 (@ColumbiaBugle) October 22, 2020

This is becoming a popular theme in the politically correct press.

“I think people are gonna be sitting in a recession and they’re not going to write a blank check to Ukraine. They just won’t do it..”

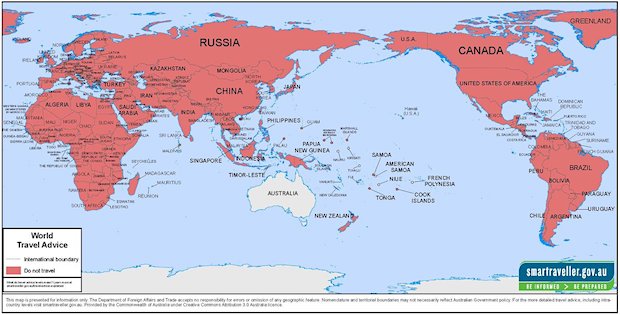

• US Election Outcome Threatens Ukraine Aid – Politico (RT)

EU nations should be prepared to provide more aid to Ukraine after the November 8 midterm elections in the US, Politico reported. If the Republican Party takes control of Congress, “NATO’s most generous donor to Ukraine’s war effort may suddenly seem much more parsimonious,” next year, the publication warned on Thursday. Similar predictions have been made by other outlets, such as Axios. Opinion polls have been showing dwindling support among American voters for supporting Ukraine. Members of the Republican Party have been increasingly criticizing President Joe Biden for asking Congress for tens of billions of dollars in aid to Kiev and not spending the money on domestic issues that the party finds important, like border protection.

“I think people are gonna be sitting in a recession and they’re not going to write a blank check to Ukraine. They just won’t do it,” House minority leader Kevin McCarthy told Punchbowl News this week. Republicans have long urged Europe to take a greater burden in supporting Ukraine, arguing that the crisis there is a bigger threat to Europeans than it is to the US. Politico predicted that with the party gaining a stronger grip on pursestrings, Washington’s approach to its allies may shift. The Biden administration is using “friendly encouragement … rather than haranguing its partners,” the news outlet noted. If the GOP takes over Congress, they would not use “such a convivial tone.”

But officials in Brussels don’t expect any serious changes in Washington’s generosity towards Ukraine due to an overall bipartisan consensus in favor of it. Estonian ambassador to the US, Kristjan Prikk, said he has “been assured by different members of Congress that there is a strong core support to continue the assistance to Ukraine as long as needed from both parties.” David McAllister, chair of the European Parliament’s Foreign Affairs Committee, told Politico that ultimately “the president maintains considerable control over foreign policy.” Meanwhile, European voters are feeling the pain of the trade breakup with Russia and the surge in energy prices it has caused. The EU leadership has been calling for unity and resolve in the face of economic hardships, stating that the bloc had to ensure Moscow’s defeat by Kiev.

Zelensky is fluent in Russian. They all are. “The Russian language is nothing but an “element of enemy propaganda and brainwashing of our people..”

• Russian Language Should Become Extinct In Ukraine – Security Chief (RT)

The Russian language should be eradicated in Ukraine as it is allegedly being used as a tool by Moscow to wield influence on Ukrainians, one of the country’s key security officials has claimed. The Russian language is nothing but an “element of enemy propaganda and brainwashing of our people,” Alexey Danilov, the head of Ukraine’s National Security and Defense Council, said on the ‘Big Lviv Talks’ show on Friday. The official also spoke in favor of Ukrainians learning English instead. According to Danilov, the very idea that Ukrainians have to understand the Russian tongue is a “dangerous narrative.” “Look, we don’t want anything from them [Russians]. Why don’t they leave us alone? Let them go to their swamps and croak in the Russian language,” he stated.

The senior official went on to criticize pundits and experts who speak Russian while appearing on Ukrainian TV. According to the 2001 census, approximately 14.3 million Ukrainians (29% of the population) speak Russian as their first language. Some other estimates put that number even higher. The language is particularly widespread in the eastern and southern regions of the country. Ever since the Maidan coup back in 2014, Moscow has been consistently accusing the Ukrainian government of systematically discriminating against Russian-speakers. The perceived violations of the linguistic minority’s rights were also cited by the secessionist movements in the Donetsk and Lugansk Regions, parts of which went on to become the Donetsk and Lugansk People’s Republics, respectively.

Russian President Vladimir Putin recently cautioned his country against taking cues from those who engage in ‘cancel culture’. Speaking at a media conference in Astana, Kazakhstan, he noted that around three million Ukrainians permanently reside in Russia. “How can we prohibit their language and culture? We don’t have anything of the kind on our minds,” Putin added. Commenting on reports about a man who had been fined in Moscow for listening to Ukrainian music in his car, the president said that attempts to ban the Ukrainian language in Russia were “illegal in themselves.”

Blinken.

• The Arms-Swapper (John Kiriakou)

The problem the Ukrainians are facing is that American weapons are difficult to use. They’re sophisticated and complicated. And there just isn’t any time for Americans to train Ukrainians in how to use them. A better idea, the administration thinks, is to just ask countries around the world that have Russian weapons to help. It wasn’t just these three South American countries that he asked. Blinken also asked South Africa, Finland, Cambodia, Rwanda, Mexico, the Democratic Republic of Congo and Cyprus. Would they send their Russian weapons to Ukraine and take American weapons in return? According to The New York Times, most of those countries said yes. Cyprus, though, said no. The Cyprus situation is what I was referring to at the start of this article. Greece and Turkey are both members of NATO. Cyprus is not.

Greece and Cyprus are members of the European Union. Turkey is not. In 1974, Turkey invaded Cyprus and has occupied the northern third of the island ever since. There are 33,000 Turkish occupation troops there right now. In 1974, Henry Kissinger, who was then both secretary of state and national security adviser, believed that the only way to stop the fighting was to impose an arms embargo on all three countries. Greece quit NATO in protest. The arms embargo didn’t last long. It was lifted on Greece and Turkey in 1979 and Greece rejoined NATO. But for reasons that have never been terribly clear, the arms embargo was maintained on Cyprus — until last month. [A commonly cited explanation for the embargo was to support U.N.-facilitated reunification efforts for Cyprus.]

In the intervening 48 years, Cyprus developed its economy, joined the European Union and bought French and Russian weapons. Now Tony Blinken wants them to send those Russian weapons to the Ukrainians. The Cypriot parliament asked rhetorically last week where the United States has been for the past 48 years, while some 1,510 Cypriots are still missing and presumed dead from the Turkish invasion. Even five American citizens are still missing from the conflict. They told Tony Blinken that they have more pressing problems than what the nationality of Ukraine’s weapons happens to be. They’re worried about 33,000 Turkish combat troops and daily Turkish statements that another invasion may be in the cards in the run-up to Turkish elections next year.

George Webb – Schiff

Schiff shifting blame of Yu to Trump? Didn’t he do the same thing with his Ukraine weapons deals with Hunter Biden with his encrypted Blackberrys? pic.twitter.com/0uBPTXXw4h

— George Webb – Investigative Journalist (@RealGeorgeWebb1) October 21, 2022

“..a unilateral decision of this kind is, of course, a violation of essential terms of the agreements which would lead to a termination of supplies.”

• EU Leaders Fail To Agree On Russian Gas Price Cap (RT)

EU leaders have failed to agree on a gas price cap following a summit in Brussels, but expressed their willingness to keep looking for bloc-wide solutions to the energy crisis. “There is a strong and unanimously shared determination to act together, as Europeans, to achieve three goals: lowering prices, ensuring security of supply, and continuing to work to reduce demand,” European Council President Charles Michel said after the meeting in the Belgian capital concluded late on Thursday. During a press conference on Friday morning, Michel insisted that the summit had sent “a clear signal to the market” and pledged that “there will be an effect very soon” from the EU’s moves to alleviate the energy crisis.

While they failed to find common ground on a gas price cap, the EU leaders asked the European Commission to come up with a “temporary dynamic price corridor on natural gas transactions to immediately limit episodes of excessive gas prices.” The participants of the summit also suggested that the EU’s joint purchasing power should be used as leverage in negotiations with global suppliers of gas. Joint purchasing would be voluntary for member states, but would require them to buy 15% of the volume needed to fill gas storage through the bloc’s mechanisms. EU energy ministers are expected to meet next week to discuss solutions to the crisis, which was exacerbated by the fallout from European sanctions on Moscow over the conflict in Ukraine and the subsequent drastic reduction of Russian gas supplies to the bloc. The situation deteriorated even further in late September when the Nord Stream pipelines, which deliver Russian gas to European customers through Germany, were damaged.

German Chancellor Olaf Scholz, who opposes radical interventions in the gas market, said after the summit that “there is a lot to do to make this concrete, but we need to find a concrete way to limit” the spikes in prices. Dutch Prime Minister Mark Rutte has pointed out that it was “very difficult to see” an agreement on the price cap being reached within the next few weeks. “We really have to assess all the pros and cons and the ramifications. If it would not fulfill the requirements, for example, could also lead to a higher base price or gas sailing away from Europe,” he pointed out. Earlier this month, Russian President Vladimir Putin warned that Moscow would cut off energy deliveries altogether if any price caps were imposed. The head of Russian gas giant Gazprom Alexey Miller also insisted last week that “a unilateral decision of this kind is, of course, a violation of essential terms of the agreements which would lead to a termination of supplies.”

How to make theft legal. And lose your own legality in the process.

• EU Wants To Use Frozen Russian Assets To Finance Ukraine (RT)

EU leaders have instructed the European Commission to prepare proposals on ways of using frozen Russian assets to rebuild Ukraine, Russian media reported on Friday. The statement comes as EU leaders wrapped up a two-day summit in Brussels. “We have to talk about the use of [frozen] assets that we have – Russian [frozen] assets. We have over €300 billion ($292 billion) of [frozen] assets and how we can use them in benefit of Ukraine,” Estonian Prime Minister Kaja Kallas said on Friday, as quoted by CNN. Legally, frozen funds still belong to Russia or its citizens. In order to spend those assets, the EU needs to find a way of confiscating them. According to media reports, EU leaders will discuss the possible confiscation of frozen Russian assets at a summit in Brussels in May.

European Commission President Ursula von der Leyen said the EU was looking to provide Ukraine with about €1.5 billion each month. The bloc’s finance ministers have been tasked with pulling together the money. The EU seized property belonging to Russian businessmen and companies, along with the assets of the Russian Central Bank, as part of sanctions against Moscow. The idea of using the funds in Ukraine was first put forward several months ago and was supported by politicians such as Ukrainian President Vladimir Zelensky, former UK prime minister Liz Truss, and president of the European Council Charles Michel. Top US officials including Treasury Secretary Janet Yellen warned that using those funds in Ukraine could be illegal and would discourage other countries from investing in the United States. Russia strongly criticized the seizure of its assets by the Western nations, with Foreign Minister Sergey Lavrov saying the asset freeze essentially constitutes theft.

“See you in Moscow on the Victory Day!”

• Musk Spars With Medvedev (RT)

US billionaire Elon Musk and former Russian president, Dmitry Medvedev have lashed out at each other on Twitter. The Tesla CEO asked about the situation on the frontline in Ukraine, to which Medvedev invited him to Moscow to celebrate Victory Day. The exchange came on Friday after Musk expressed appreciation for a tongue-in-cheek comment that Medvedev made about outgoing British Prime Minister Liz Truss. He followed up on the compliment by asking Medvedev: “Btw, how’s it going in Bakhmut?” He was referring to a frontline city in the Donetsk People’s Republic in Russia which is currently controlled by Ukrainian troops. “See you in Moscow on the Victory Day!” Medvedev responded.

The term “Victory Day” usually refers to the Russian national holiday on May 9, which marks the defeat of Nazi Germany, when the country holds large-scale military parades in Moscow and other major cities. The first part of the online conversation between Medvedev and Musk was about the former president’s comment on Truss’ short tenure as Britain’s prime minister, which the billionaire called “a good troll.” Medvedev reacted to Truss’ resignation this week by bidding her farewell and congratulating “lettuce,” alluding to a popular running joke in Britain. Last week, The Economist magazine said that in just seven days of being in control since the period of mourning for Queen Elizabeth II ended, Truss “blew up her own government.” The time is “roughly the shelf-life of a lettuce,” it added. The Daily Star tabloid responded last Friday by launching an online broadcast of a lettuce, wondering if it would last longer than the prime minister. Truss resigned on Thursday.

The Energy Charter Treaty lets companies, investors sue governments for perceived damage to their profits. God knows why it was ever signed.

• France To Leave Energy Charter Treaty (RT)

French President Emmanuel Macron announced Friday that France will leave the Energy Charter Treaty. Report informs, citing Politico, that the pact, which allows international companies and investors to sue governments over interventions that hit the profits of energy projects, is increasingly seen as a threat to national climate plans. “France has decided to withdraw from the Energy Charter Treaty,” Macron said at a press conference following an EU leaders’ summit in Brussels, adding that the move is “coherent” with the country’s climate ambitions and the Paris climate agreement. The decision follows announcements from Spain, the Netherlands and Poland that they will withdraw from the pact. Germany and Belgium have signaled they are considering their options. Earlier this week, France’s High Council on Climate said continued membership of the treaty posed a threat to the EU’s climate goals.

This committee is America at its worst. It beats even Mueller for that top spot.

They got Steve Bannon convicted yesterday, but he says he simply acted on his lawyers’ advice.

• Trump Officially Subpoenaed By Jan. 6 Committee (Axios)

The House select committee investigating the Jan. 6 attack on Friday formally issued a subpoena to former President Trump. Trump is the highest-ranking individual targeted for testimony by the panel, which has been building a case that the ex-president was the primary instigator of the deadly riot. Reps. Bennie Thompson (D-Miss.) and Liz Cheney (R-Wyo.), the chair and vice chair of the panel, are requesting Trump turn over documents by Nov. 4 and appear for a deposition on Nov. 14. “As demonstrated in our hearings, we have assembled overwhelming evidence … that you personally orchestrated and oversaw a multi-part effort to overturn the 2020 presidential election,” they wrote in a letter shared publicly Friday.

The committee seeks testimony about Trump’s dealings with associates who invoked the Fifth Amendment when questioned by the panel about their communications with him, including Michael Flynn, Roger Stone, John Eastman, Jeffrey Clark and Kelli Ward. It also says the testimony and documents will inform the committee’s planned legislative recommendations to ensure “no future President could succeed at anything even remotely similar to the unlawful steps you took to overturn the election.” The details: Among the documents listed in the subpoena are Trump’s communications on Jan. 6, 2021 and any photographs or videos taken on that day related to the Ellipse rally, the joint session of Congress or the Capitol riot. Also requested are:

Communications from Nov. 3, 2020 to Jan. 6, 2021 about efforts to press former Vice President Mike Pence, state legislators, the Justice Department and members of Congress to help overturn the election, as well as summoning supporters to D.C. on Jan. 6. Communications during that period between Trump and more than a dozen of his associates including Stone, Flynn, Eastman, Rudy Giuliani, Steve Bannon and Sidney Powell. Communications during that period about lawsuits and potential lawsuits that may have delayed or disrupted the joint session, and about fundraising off of claims of election fraud. Documents and communications from Sept. 1, 2020 to the present regarding the Oath Keepers, the Proud Boys, other militia groups and any individuals who attended the Ellipse rally or the Capitol riot. Communications from July, 2021 to the present about the select committee, as well as witnesses who testified to the panel and their lawyers.Documents about the destruction of any materials that would have been covered by the subpoena.

“For comparison, the entire Mueller Russiagate investigation cost $32 million.”

• Biden DOJ Wants $34 Million To Keep Targeting J6 Defendants (ZH)

The Biden administration’s weaponized Department of Justice (DOJ) has asked Congress for more than $34 million in new funding to continue its January 6th investigation, NBC News reports. The budget request for 2023 will fund 130 employees, including 80 federal prosecutors, to aid in the “extraordinary,” “unprecedented” and “complex” investigation. “We don’t have the manpower,” said one official told the outlet, noting that many J6 participants who will eventually be charged haven’t been arrested yet. Another official said that the cash crunch was a “culmination” of various factors – including the need to provide support for cases moving to trial. A third official called it a “work-in-progress” as prosecutors from US attorney’s offices around the country are recalled to their offices.

The request comes after federal officials have made around 850 arrests in the nearly 19 months since the incident – just a fraction of the 2,500 people who entered the Capitol, and the “hundreds more who committed serious crimes outside but haven’t yet been arrested.” The massive trove of evidence — be it body camera and surveillance video or damning content generated by suspects themselves — presents a tremendous challenge for an enormous bureaucracy working with technology that’s often a few years behind the times, at best. The U.S. Attorney’s Office for the District of Columbia, which is overseeing the Capitol siege investigation, is also running separate inquiries exploring the fake electors scheme and a conspiracy to obstruct the Jan. 6 electoral vote certification, both of which touch on Trump’s actions in the lead-up to Jan. 6, as well as on the day of the attack. -NBC News

The requested funding comes after it was slashed from the omnibus spending bill passed in March. In an interview earlier this week, Attorney General Merrick Garland told NBC News that he was “confident” the DOJ would be able to handle the workload regardless of what Congress does. “Of course, we’d like more resources, and if Congress wants to give that to us, that would be very nice,” Garland said on Tuesday. “But we have people — prosecutors and agents — from all over the country working on this matter, and I have every confidence in their ability, their professionalism, their dedication to this task.” Former US Attorney Joyce Vance told MSNBC: “People are concerned about the resources. It’s an enormous amount of cases, and that puts pressure not just on DOJ, but on the courts and probation. It puts pressure on the entire system.”

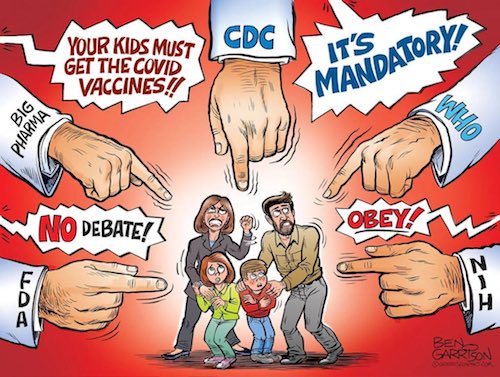

“..unlike the experts who sit on the CDC’s Vaccine Advisory Committee, many parents have actually read about the serious adverse reactions in young people who get the shots.”

• The Authorities Are Our Enemies (Kunstler)

Adding the mRNA shots to the official vaccine schedule will make permanent the liability shield their makers enjoy under the current emergency use authorization (EUA). Pfizer and Moderna are now off-the-hook for any responsibility, unless fraud over the vaxxes is proven in a court of law. Given the vast evidence of harms done by these products, will that be a difficult thing to do? Consider: cases for fraud can be brought in any jurisdiction of the USA, not just in the notoriously corrupt DC federal district court, which does not recognize crime for what it is (crime). This is the first time that a pharmaceutical under an EUA has been admitted to the childhood vaccine schedule.

The Vaccine Advisory Committee said it was okay because it consulted with the Department of Justice’s Office of General Counsel, and the lawyers there said it was okay. One might ask: is it within the purview of the DOJ’s Office of General Counsel to review the medical criteria for such a decision? The answer must be no. How are they qualified? You may be certain they did not parse the drug trial data on the mRNA products, or study the official reports of deaths and injuries. In short, they know nothing. Their authority in the matter is vacated. Since many states and localities go by the CDC’s vaccine guidelines, as well as pediatricians, then millions of children will be required to get the shots to attend school. So, the CDC has not only put an as-yet-untold number of kids on the road to disability, infertility, and death, but it may have coincidentally destroyed public schooling in America.

The so-called “uptake” on mRNA shots for children has been paltry. Parents do not want their kids to get the shots. Do you know why? I’ll tell you: Because, unlike the experts who sit on the CDC’s Vaccine Advisory Committee, many parents have actually read about the serious adverse reactions in young people who get the shots. And many more have heard enough horrifying rumors — despite the criminal delinquency of the major news media in ignoring any negative news about the vaxxes — prompting these parents to steer clear of vaxxing their children. Other countries have officially and altogether discontinued mRNA vaxxes for children. Do you think that’s for no reason?

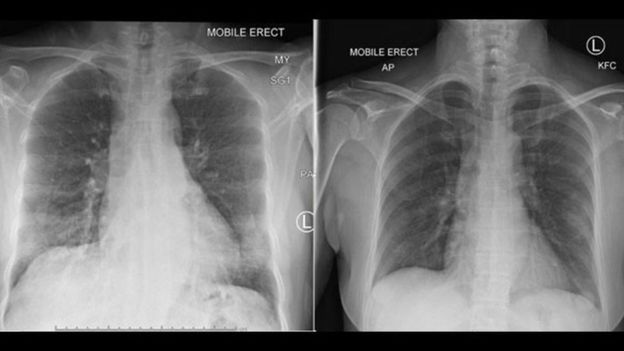

Reverse damage

Is it possible to reverse damage from spike proteins? The options for detox are both interesting and encouraging. Why are public health officials and the media not talking about this? pic.twitter.com/y3n4Dee3kN

— America's Frontline Doctors (@AFLDSorg) October 21, 2022

“This failure of due diligence has come at a huge price – to doctors and nurses as individuals and clinicians, to the medical profession as a body, and to the public as a whole.”

• Time for Doctors and Politicians to Stop Ignoring the Devastating Data (Evans)

Tragically, the vast majority of the medical profession and wider public were deceived by the powerful and incessant Government and media messaging that the vaccines would be our ‘only way out’ and that we should ‘trust the science’. It is now clear that most people, including doctors, did no independent research beyond listening to the Government press conferences, the pronouncements of health officials, the Today programme and reading the Times, Telegraph, Guardian, Mail and so on. This failure of due diligence has come at a huge price – to doctors and nurses as individuals and clinicians, to the medical profession as a body, and to the public as a whole.

Trust in the medical profession and health bodies has been seriously damaged, as evidence of unprecedented levels of vaccine injury mount and the extravagant claims of 95% or even 100% effectiveness have not been borne out in the real world. Indeed, real world data is repeatedly showing negative effectiveness of the Covid jabs in a matter of weeks – meaning that you are more likely to catch Covid if you are vaccinated than unvaccinated. These Covid jabs have certainly not lived up to the incessantly repeated marketing slogan of ‘safe and effective’. The UKMFA is calling now for the medical profession, politicians and decision-makers to actively engage with the huge amount of published science and real-world data, and to listen to the multitude of eminent scientists, doctors and independent journalists laying the facts out for easy independent research and understanding.

A good place to start would be the two part paper “Curing the pandemic of misinformation on COVID-19 mRNA vaccines through real evidence-based medicine”, published by Dr. Aseem Malhotra in the Journal of Insulin Resistance on September 26th 2022, and the press conference that he gave to explain his findings and to call for an immediate and “complete suspension” of mRNA COVID-19 Vaccines pending a full and independent investigation into the safety of these products. As a society, we now have an opportunity and responsibility to change course, to start to put things right and to hold accountable those people who failed in their duties and responsibilities to protect the public, so that this can never happen again. There is no shame in admitting that you were wrong or misled. Science, unlike the dogma of ‘The Science’, is all about constantly testing existing hypotheses and adapting and changing them when the facts change or new information comes to light. We have more than enough evidence to challenge the hypothesis that Covid vaccines are ‘safe and effective’.

Kolakusic EU deaths

https://twitter.com/i/status/1583377222152654848

“Plaintiffs move for the following government officials to be deposed as a part of their limited preliminary injunction discovery. These are: (1) NIAID Director and White House Chief Medical Advisor Dr. Anthony Fauci, (2) Deputy Assistant to the President and Director of White House Digital Strategy Rob Flaherty, (3) former White House Senior COVID-19 Advisory Andrew Slavitt, (4) former White House Press Secretary Jennifer Psaki, (5) FBI Supervisory Special Agent Elvis Chan, (6) CISA Director Jen Easterly, (7) CISA official Lauren Protentis, (8) Surgeon General Vivek Murthy, (9) CDC Chief of the Digital Media Branch Carol Crawford, and (10) Acting Coordinator of the State Department’s Global Engagement Center Daniel Kimmage. Defendants oppose Plaintiffs’ deposing of all of them”

• Fauci Forced To Testify On Social Media Censorship (RT)

The White House’s chief medical advisor, Anthony Fauci, and other senior officials are set to be deposed under oath as part of a lawsuit claiming the government worked alongside social media platforms to create a “massive censorship enterprise” throughout the Covid-19 outbreak. In a Friday ruling, Judge Terry Doughty granted a joint request from the attorneys general of Missouri and Louisiana to compel several current and former officials to testify in the suit, among them Fauci, ex-White House press secretary Jen Psaki, Director of White House Digital Strategy Rob Flaherty, Surgeon General Vivek Murthy and two high-level figures from the FBI and Department of Homeland Security (DHS).

“After finding documentation of a collusive relationship between the [Joe] Biden administration and social media companies to censor free speech, we immediately filed a motion to get these officials under oath,” Missouri AG Eric Schmitt said in a statement. “It is high time we shine a light on this censorship enterprise and force these officials to come clean to the American people, and this ruling will allow us to do just that. We’ll keep pressing for the truth.” While the defense insisted that senior officials can only be called to testify about their actions in office under “extraordinary circumstances,” Judge Doughty said the personnel in question met that standard. He added that the two GOP-led states “have proven that Dr. Fauci has personal knowledge about the issue concerning censorship across social media as it related to Covid-19,”ordering him to cooperate with a deposition.

Requests to depose the other officials were granted on similar grounds, as the judge concluded all either held direct meetings with social media firms about the purported censorship, or had close knowledge of those discussions. Jen Easterly, who heads up the DHS’s Cybersecurity and Infrastructure Security Agency (CISA) was also ordered to testify. She played a “central role” in “flagging misinformation to social-media companies for censorship,”the plaintiffs argued, describing the cyber agency the “nerve center” of “the federal government’s efforts to censor social media users.” The same official was said to be involved in the DHS’ now-defunct ‘Disinformation Governance Board’ – dubbed the ‘Ministry of Truth’ by critics – which would have created a new mechanism to facilitate cooperation between the White House and social media sites.

Initially filed last May by Schmitt and Louisiana Attorney General Jeff Landry, the lawsuit claims the federal government encouraged online platforms to censor, delete or ban certain speech about the pandemic, including discussion of the “lab leak theory of Covid-19’s origin,” as well as questions about the effectiveness of face masks, vaccines or lockdown policies, among other issues. The two AGs have largely relied on documents obtained through subpoenas of YouTube, Twitter and Facebook’s parent firm Meta, which detail regular communications between the government and social media sites. The White House, as well as the eight officials ordered to testify, have yet to comment on Friday’s ruling. The depositions must take place within 30 days of the order, though it remains unclear whether the defense intends to appeal the decision.

95%

Reminder… pic.twitter.com/UFZNVPp0ZY

— Wittgenstein (@backtolife_2023) October 21, 2022

”Everyone should be free to get numerous shots because that is freedom.

And everyone should be free to reject any unwanted shot because that, too, is freedom”

• We Will Be Challenging Any State’s Covid-19 School Vaccine Requirement (Siri)

The CDC’s vaccine advisory committee unanimously voted a few hours ago to add the Covid-19 vaccine to the CDC’s routine childhood vaccination schedule. Immediately following the vote, I received a call from Del Bigtree, ICAN’s founder and host of The HighWire, to tell me that ICAN will support a legal challenge to any state that imposes a Covid-19 vaccine mandate to attend school. We look forward to bringing those challenges to protect the individual right of every American, especially the youngest among us, as we successfully did when challenging the San Diego School District’s Covid-19 vaccine mandate. Everyone should be free to get numerous shots because that is freedom.

And everyone should be free to reject any unwanted shot because that, too, is freedom. While most post-March 2020 mandates have been successfully challenged or rescinded, we must never forget that the repressive arm of government is just behind a curtain, waiting to strangle our rights. That is why we must fight, always fight, to push back against that oppression. It is not a war that is won. It is an endless battle with one side pushing the needle toward eliminating individual rights and the other side that must never stop pushing back – because once it swings too far, we will not easily regain our rights. Power seized is rarely returned.

The next battle front is the body of every child in this country whose parents do not want them to receive a Covid-19 vaccine. A product for which you cannot sue the manufacturers for harm. A product whose clinical trial for children was underpowered, not properly controlled, and that did not review safety for a sufficient duration. But even in the absence of these issues, corrosive rights-crushing mandates should never exist. We look forward to, with ICAN’s support, challenging any state’s Covid-19 vaccine mandate for school.

P.S. Note that the CDC’s action of adding the Covid-19 vaccine to its routine childhood vaccine schedule does not automatically make it mandatory in all states for attending school. In most states, the state itself needs to take action to make it mandatory. The expectation is that some states will seek to do just that.

C19 injury

This healthcare worker followed mandates and now has chronic inflammatory demyelinating polyradiculoneuropathy. She gets monthly infusions now. Tiktok suspended her last account for speaking up about her injuries. pic.twitter.com/qYrfGiYADv

— Nashville Angela (@angelanashtn) October 21, 2022

I read this from Sotomayor earlier, and never mind the Turley setting. It’s beautiful, and almost poetic.

• I Try, But He Does It Better. He Cares About People. (Sotomayor)

Supreme Court Justice Sonia Sotomayor, one of the Court’s most strident liberals, praised her conservative colleague, Justice Clarence Thomas, in a lecture at Roosevelt University in Chicago on Thursday evening, noting his unique compassion for others. Sotomayor was quoted as saying: “I have disagreed with [Thomas] more than with any other justice. Which means we don’t come together on many cases. And yet I can tell you that I spend time with him, understanding that he is one of the few justices who knows practically everybody in our building. He knows their name, he knows the things about their life, what their family is suffering. He’ll tell me, you know that person’s wife is sick right now, or that person’s child is having difficulty.

There’s no other justice who does that. I try, but he does it better. He cares about people. Now, he cares on legal interests differently. And he sees those legal issues much differently than I do. I tell people, you know Clarence believes, just like him, because he grew up very, very poor, that everyone is capable of picking themselves up by their bootstraps. I understand that some people can’t reach their bootstraps. That’s a fundamental difference in how we view what the law can or should or does do for people. But I can appreciate him.”

Elephants

https://twitter.com/i/status/1583479100265463809

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.