Gustave Courbet The bathers 1853

• South Korea has the world’s lowest birth rate and it has become a national emergency.

• China’s population drops for second year, with record low birth rate

• U.S. birth rate declined 30% in 15 years

• Canada’s fertility rate lowest on record

• France’s birth rates are the lowest since 1946

• Ukraine, Romania, Belarus and Moldova are among the top 10 countries in the world with the biggest population decline.

• Japan is also staring at a population crisis. Its birth rate declined for the seventh consecutive year.

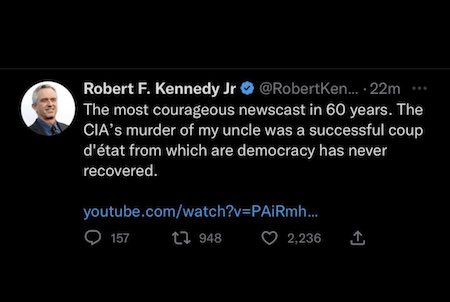

Dr. Drew

Dr. Drew Credits RFK Jr for a Large Part of His Personal Awakening: 'I Am Open to Everything Now'

"I've realized that everything in the news is BS. Everything. There is nothing I can consume on legacy media that I can trust and that is shocking…It makes you wonder how long… pic.twitter.com/OE7ZvoLqAy

— Chief Nerd (@TheChiefNerd) February 1, 2024

Ron Paul

What if our foreign policy was deeply flawed the entire time? pic.twitter.com/Df3RzopA3k

— Dave Benner, Nemesis of Neocons (@dbenner83) February 2, 2024

“MINUTE ORDER as to DONALD J. TRUMP:…the March 4, 2024 trial set by the court’s 39 Pretrial Order, as amended, is hereby VACATED. The court will set a new schedule if and when the mandate is returned. Signed by Judge Tanya S. Chutkan on 2/2/2024. (zjd) (Entered: 02/02/2024)”

SNL

President Trump's SNL Skit in 2015 is some NEXT LEVEL PREDICTION. #MAGA pic.twitter.com/mTa20EEAkL

— Russ Spacy (@RussSpacy) February 2, 2024

NYFlorida

WATCH: CNN's Erica Hill stunned speechless by report illegal migrants run crews that "operate in NY, do all their stealing, then go to Florida…"

"I’m like, ‘Why don’t they just stay and steal in Florida?’ They said, ‘Because there you go to jail.'"pic.twitter.com/ug9HyjqN9U

— Kyle Becker (@kylenabecker) February 2, 2024

Sheriff

American Sheriff Who Exposed Illegal Immigrants Receiving Cell Phones, Plane Tickets, Cash etc Says The Media Attacked Him & Accused Him Of Putting Out False Information

Now He’s Back With Receipts & PROOF The United Nations Is Funding The Illegal Immigrant Invasion & Providing… pic.twitter.com/qLrsP67YU7

— Wall Street Apes (@WallStreetApes) February 2, 2024

“..The U.S. seemingly aims to find a way to hurt Iranian and Resistance forces just enough to show that Biden is ‘very angry’..”

• The Three Strands to the ‘Swarming of Biden’ (Alastair Crooke)

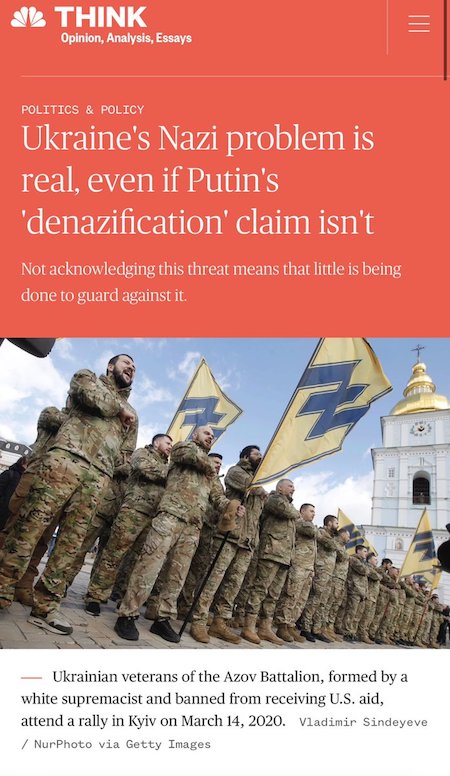

“The Iranians have a strategy, and we don’t”, a former senior U.S. Defence Department official told Al-Monitor: “We’re getting bogged down in tactical weeds – of whom to target and how – and nobody’s thinking strategically”. The former Indian diplomat MK Bhadrakumar has coined the term ‘swarming’ to describe this process of non-state actors miring the U.S. in the tactical attrition – from the Levant to the Persian Gulf. ‘Swarming’ has been associated more recently with a radical evolution in modern warfare (most evident in Ukraine), where the use of autonomous swarming drones, continuously communicating with each other via AI, select and direct the attack to targets identified by the swarm.In the Ukraine, Russia has pursued a patient, calibrated attrition to drive hard-Right ultranationalists from the field of battle (in central and eastern Ukraine), together with their western NATO facilitators.

NATO attempts at deterrence towards Russia (that recently have veered off into ‘terrorist’ attacks inside Russia – i.e. on Belgorod) notably have failed to produce results. Rather, Biden’s close embrace of Kiev has left him exposed politically, as U.S. and European zeal for the project implodes. The war has bogged down the U.S., without any electorally acceptable exit – and all can see it. Moscow drew-in Biden to an elaborate attritional web. He should ‘get out’ quick – but the 2024 campaign binds him.So, Iran has been setting a very similar strategy throughout the Gulf, maybe taking its cue from the Ukraine conflict.Less than a day after the attack on Tower 22, the military base ambiguously perched on the membrane between Jordan and the illegal U.S. al-Tanaf base in Syria, Biden promised that the U.S. would provide a quick and determined response to the attacks against it in Iraq and Syria (by what he calls ‘Iran-linked’ militia).

Simultaneously however, White House National Security spokesman John Kirby stated that the U.S. doesn’t want to expand military operations opposite Iran. Just as in Ukraine, where the White House has been loath to provoke Moscow into all-out war versus NATO, so too in the region, Biden is (rightly) wary of out-right war with Iran. Biden’s political considerations in this election-year will be uppermost. And that, at least partly, will depend on the fine calibration by the Pentagon of just how exposed to missile and drone attacks U.S. forces are in Iraq and Syria. The bases there are ‘sitting ducks’; a fact that would be an embarrassing admission. But a hurried evacuation (with overtones of the last flights from Kabul) would be worse; it could be electorally disastrous. The U.S. seemingly aims to find a way to hurt Iranian and Resistance forces just enough to show that Biden is ‘very angry’, yet without perhaps doing real damage – i.e. it is a form of ‘militarised psychotherapy’, rather than hard politics.

Risks remain: bomb too much, and the wider regional war will ignite to a new level. Bomb too little, and the swarm just rolls on, ‘swarming’ the U.S. on multiple fronts until it finally caves – and finally exits the Levant. Biden thus finds himself in an exhausting, ongoing secondary war with groups and militias rather than states (whom the Axis seeks to shield). In spite of its militia character, however the war has been causing major damage to the economies of states in the region. They have fathomed that American deterrence has not been showing results (i.e., with Ansarallah in the Red Sea). Some of those countries – including Egypt, Saudi Arabia and the United Arab Emirates – have initiated ‘private’ steps that were not coordinated with the U.S. They are not only speaking with these militia and movements, but also directly with Iran. The strategy to ‘swarm’ the U.S. on multiple fronts was plainly stated at the recent ‘Astana Format’ meeting between Russia, Iran, and Turkey on 24-25 January. The latter triumvirate are busy preparing the endgame in Syria (and ultimately, in the Region as a whole).

The joint statement after the Astana Format meeting in Kazakhstan, MK Bhadrakumar has noted: “is a remarkable document predicated almost entirely on an end to the U.S. occupation of Syria. It indirectly urges Washington to give up its support of terrorist groups and their affiliates “operating under different names in various parts of Syria” as part of attempts to create new realities on the ground, including illegitimate self-rule initiatives under the pretext of ‘combating terrorism.’ It demands an end to the U.S.’ illegal seizure and transfer of oil resources “that should belong to Syria””.

“..polls indicate that the European public – like the American public – is opposed to their governments supporting Ukraine..”

• EU Squanders Another €50 Billion on Kiev Regime… and Self-Destruction (SCF)

Finally, the European Union’s threats, blackmail, and arm-twisting have paid off to push through a giant €50 billion aid package to the hopelessly corrupt Kiev regime. This is while European farmers revolt against the EU leadership over higher energy costs and cheap imports from Ukraine that are putting them out of business and wiping out their livelihoods. The EU leaders are committing the entire bloc of 500 million people to political suicide. The reckless cavalier attitude is something to behold. Bring on the pitchforks, Merci! The 27 leaders of the European Union met in an emergency summit this week not to deal with the bloc’s mounting internal political, economic, and social problems but rather to lavish mountains of more aid on non-member Ukraine.

When the leaders held their last summit in December, it was a spectacle of back-biting and sordid wrangling. At that gathering, Hungary’s Prime Minister Viktor Orban vetoed the allocation of more funds to the Ukrainian regime amid bitter recrimination and bickering. This time around, however, Hungary caved in to the intense pressure to agree on the package. Days before the summit in Brussels this week, it was reported by the Financial Times that the European Council had drawn up plans to sabotage the Hungarian economy if Budapest persisted in not signing up for the massive aid plan. That speaks volumes about the perverse mindset at the apex of the EU bureaucracy. It demonstrates the undemocratic character of the bloc despite pretentious claims to the contrary.

Brussels had already frozen up to €10 billion in central funding for Hungary and there were reported threats to remove Budapest’s voting rights in the bloc’s decision-making which would have been a blatant violation of the EU’s declared principle of unanimity. The allocation of €50 billion to a non-member state is astounding. Even more bewildering is that the latest largesse is only a fraction of the total aid that the EU leadership has pumped into Ukraine since the proxy war against Russia erupted in February 2022. Over the past two years, the European Union has given the Kiev regime an estimated €100 billion.The United States and other Western allies have also plied Ukraine with another €100 billion. About half of this goes on weapons, while the other half pays for state financing.

As we have noted here previously, the cumulative funding by the West to Ukraine has far exceeded the historic Marshall Fund that the U.S. allocated to all of Europe for reconstruction following World War Two (about €170 billion in today’s money).There is simply no precedent or justifiable rationale for this mobilization of financial support for Ukraine. This has all been done as a fait accompli by an elite class with no democratic mandate. No referenda have been conducted to consult the public about the inordinate expenditure. Indeed, polls indicate that the European public – like the American public – is opposed to their governments supporting Ukraine.

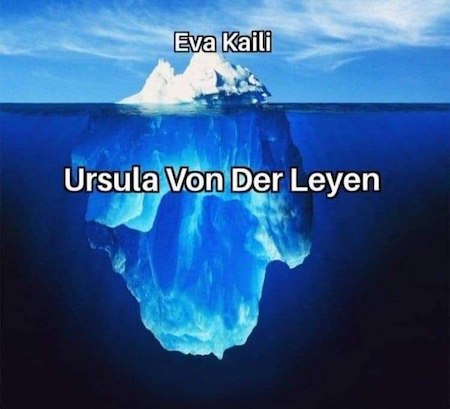

“..EU farmers “high-fived” her by throwing eggs, lighting fires and dumping manure in Brussels..”

• Von Der Leyen Celebrates A Great Day For Europe As Farmers Trash Brussels (RT)

“Agreement! The European Council delivered on our priorities. Supporting Ukraine…. A good day for Europe,” tweeted unelected European Commission President Ursula von der Leyen on Thursday, as EU farmers “high-fived” her by throwing eggs, lighting fires and dumping manure in Brussels, where a reported 1,300 tractors gathered in protest. Surely it must have been in anticipation of this “great day for Europe” that Brussels rolled out the barbed wire to keep the bloc’s own struggling farmers at bay while its leaders cut yet another check for Ukraine — after threatening the one anticipated holdout with national economic “blackmail,” as Hungarian Prime Minister Viktor Orban qualified it. It’s hard to believe that this meeting actually took place in Brussels. These officials are so disconnected from reality that it may as well have been held on a whole other planet.

Unlike the Ukrainian products making their way onto Western European dinner plates to stick it to Russian President Vladimir Putin (because turtlenecks and short, cold showers apparently failed to do the job), this crisis is certifiably EU-made. No one knows this better than the farmers, who also realize that it makes more sense to blockade the streets of Brussels than the national highways of their home countries, which they’ve been doing with overwhelming public support – from nine out of every ten citizens in the case of France, according to a recent Odoxa poll. It was the EU with its climate change obsession that imposed a Common Agricultural Policy on farmers across the entire bloc, managed by bureaucrats divorced from the reality on the ground. Pencil pushers use EU Copernicus satellite images to spy and crack down on farmers whose paperwork doesn’t match – even if any discrepancies can be chalked up to uncontrollable but temporary conditions like the weather.

It was also the EU that piled on regulations under the pretext of ensuring the quality of farm products, while at the same time flooding the bloc with grain, poultry, and other imports from Ukraine. Does “Chernobyl chicken” mass-produced by workers who are paid a pittance represent a threat to the physical health of citizens and economic health of farmers? If not, then why can’t Brussels take its jackboot off the necks of its own farmers so they can compete on a level playing field? The EU has also suddenly decided to ease up on some pesticide bans, angering greens. Paris is promoting the idea that ideologically-driven bans need to end, which seems like a tacit admission of their uselessness. So what should we be more worried about now – ideologically-driven authoritarianism under the guise of health consciousness, or an actual health threat?

And what about that Ukrainian grain that EU officials demanded Russia unblock to feed the poor in developing countries? It turns out that Turkey and Russia were right when they raised the alarm about it just being dumped right next door in Europe, and it sounds like Russian President Vladimir Putin was effectively a bigger defender of EU farmers’ interests than Brussels was. But who’s even surprised anymore by Brussels’ misplaced priorities, given the image that has now emerged of another €50 billion ($54 billion) going out the door to Kiev, in support of a country that’s undercutting the EU’s own farmers without even being in the EU itself?

“..over the past month the country has been beset by some of its largest strikes in decades: train drivers, local public transit workers, airport security personnel, doctors and retail workers, all demanding higher wages and better working conditions..”

• Flailing Germany Is The Future Of Europe (Fazi)

For much of the Merkel era, Germany stood as an island of economic and political stability amid Europe’s perennially stormy waters. Those days, however, seem like a distant memory. Europe is still in crisis — but now Germany is the epicentre. It is, once again, the sick man of Europe. Anti-government demonstrations are rare in Germany. So when hundreds of angry farmers and their tractors descended on Berlin in mid-December, to protest a planned cut to diesel subsidies and tax breaks for agricultural vehicles as part of a new wave of austerity measures, it was clear that something was afoot. The government, evidently concerned, immediately backtracked, announcing that the discount would remain in place, and that the diesel subsidy would be phased out over several years instead of being abolished immediately. The farmers, however, said it wasn’t enough — and threatened to step up the protests unless the government completely reserved its plans.

They were true to their word: in the weeks that followed, thousands of farmers staged massive protests, not just in Berlin but in several cities, even blocking the arterial autobahns, and effectively bringing the country to a standstill. The government, in turn, resorted to one of the oldest and most effective tricks in the political playbook: claiming the far-Right were behind the protests in an attempt to delegitimise the farmers and scare people away. Except that, this time, it didn’t work. Not only did the protests continue, they grew, and even attracted workers from other industries — fishing, logistics, hospitality, road transport, supermarkets — as well as ordinary citizens. As a result, what started as a protest over diesel subsidies has evolved into a much wider revolt against the German government. One of the most common slogans at the demonstrations is: “The traffic light must go!”, a reference to the governing coalition of the Social Democrats, the Free Democrats and Greens. And, much like the Gilets Jaunes in 2018, whose own protests were triggered by fuel prices, the farmers have given voice to a much greater pool of political anger.

As one told the Washington Post: “Originally, we had hoped that the cuts to the agriculture subsidies would be overturned. But… I think it’s clear that this protest is about a lot more. Not only us farmers are unhappy, but other areas, too. Because what’s coming out of Berlin is damaging our county — especially the economy.” Even this approaches euphemism: soaring living costs, plummeting real wages, massive layoffs and a burgeoning housing crisis have sent approval ratings for Scholz’s government to record lows — and Germans are getting restless. Aside from the farmers’ protests, over the past month the country has been beset by some of its largest strikes in decades: train drivers, local public transit workers, airport security personnel, doctors and retail workers, all demanding higher wages and better working conditions. Further industrial action is expected in the coming weeks. This is particularly astonishing considering that Germany has long prided itself on its non-conflictual model of industrial relations, which has historically emphasised co-operation between trade unions and employers’ federations.

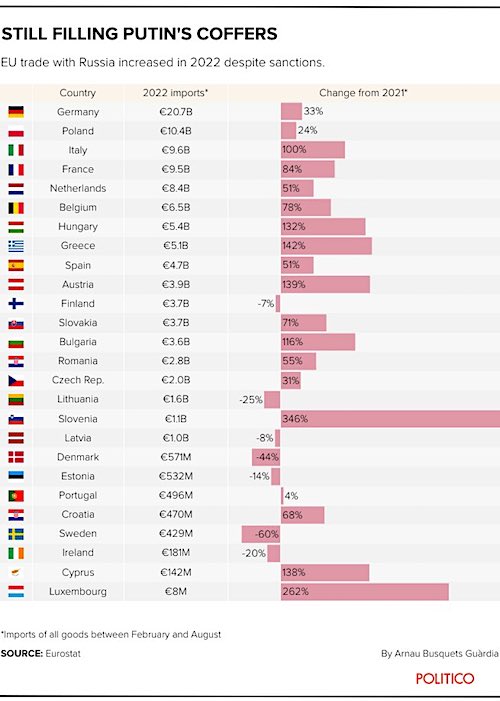

The problem is that Germany’s social peace was premised on an economic model — the once-hailed Modell Deutschland — that is all but bust. Its economic success in the 21st century was founded on two pillars: cheap imports of raw materials and energy (especially from Russia) and high demand in the rest of the world. Over the past few years, though, thanks to a global slowdown and the Ukraine war, both have been tumbled away. Germany was the worst-performing major economy in the world last year according to the IMF, and the country is now teetering on the brink of recession. Industrial production has fallen five months in a row: as Hans-Jürgen Völz (chief economist for the BVMV, which lobbies on behalf of small- and medium-sized businesses) said last July: “One sometimes hears about ‘creeping deindustrialisation’ — well, it’s not just creeping anymore.”

What’s striking is that the German leadership has largely brought this crisis on itself. First, it leapt on the anti-Russian bandwagon and decoupled from its main source of energy; and then it compounded the crisis via two of the German establishment’s favourite obsessions, green policies and austerity. The proposal to scrap fuel subsidies is a perfect case in point. It emerged from a court ruling that the government’s attempt to bypass its own fiscal rules by turning €60 billion originally earmarked for Covid aid towards measures aimed at combating climate change was unconstitutional. The decision to cut the subsidies was thus presented by the government as the only way to meet both its fiscal and climate targets. The message was one that we’ve become accustomed to: “es gibt keine Alternative [There is no alternative].” But of course, both of those targets are self-imposed. They are the result of political decisions, not laws of nature — something ordinary Germans are more than aware of.

“..Germany’s automobile industry is in decline and the country needs assistance to salvage it..”

• Germany Destroying Its Car Industry – Putin (RT)

Germany’s automobile industry is in decline and the country needs assistance to salvage it, Russian President Vladimir Putin said during a visit to the All-Russia Exhibition Center in Moscow on Thursday. “They are now destroying their auto industry. They need to be helped somehow,” Putin stated in response to reports about Russia’s contribution to the emergence of the automobile industry in Germany. When asked whether the current decline is related to Russian consumers increasingly opting for Chinese over German cars, Putin stated “not only that,” without elaborating further. German industry – and its automotive sector in particular – has been plagued by mounting problems over the past year and a half. The competitiveness of German manufacturers has been damaged by higher energy prices after the country lost cheap gas supplies from Russia.

Hildegard Muller, president of the German Automotive Industry Association (VDA), warned last year that soaring energy costs are contributing to a “dramatic loss in international competitiveness,” as many companies are considering relocating their businesses elsewhere. According to VDA data, while output from German automobile plants did manage to rise by 18% year-on-year to 4.1 million cars in 2023, this was still 12% below the pre-Covid year of 2019. Meanwhile, orders received by German manufacturers fell by 5%, with domestic orders plunging by 18%. In March 2022, amid Western sanctions on Moscow in light of the Ukraine conflict, many German car manufacturers, including Volkswagen and Daimler Truck, suspended trade with Russia and later exited the country, losing a lucrative market. The void left by German carmakers was quickly filled, however, by Chinese brands, which accounted for more than 90% of all Russian car imports in 2023.

In recent years, China has made a push to gain market share in the global automobile sector. It has now moved into second place behind Japan as the globe’s top car exporter and has been gradually either crowding out European carmakers or buying shares in their businesses. Geely, a major automotive brand based in China, acquired Swedish carmaker Volvo back in 2010, while in 2018 its founder, Li Shufu, became the largest shareholder of German automaker Daimler, the parent of Mercedes Benz. Maksim Oreshkin, Putin’s top economic adviser, earlier warned that “companies like Mercedes and BMW may fade into history in ten years” as they now have “neither the market nor the technological advantage that they had five to ten years ago.”

Legally, the Soviet occupation of Germany has stopped.

Legally, the US occupation of Germany is still in force.

The US and Germany just have agreed not to focus on it. pic.twitter.com/vIcI8sU513

— Make Peace Now; alternative news (@AlternatNews) February 2, 2024

“I asked him [ICC prosecutor] why he was able to issue an arrest warrant for Mr. Putin and is unable to do so for the prime minister of Israel. He did not answer that question..”

• Israel Ignoring UN Court Order – South Africa (RT)

South Africa has accused Israel of disregarding a ruling by the International Court of Justice (ICJ) ordering it to prevent civilian deaths in its war in Gaza against the Palestinian militant group Hamas. South African Foreign Minister Naledi Pandor told reporters in Pretoria on Wednesday that the Israeli government has killed hundreds more people in Gaza, just days after the UN’s top court ruling last week. The ICJ ruled on January 26 that Israel must take all necessary precautions to prevent genocide and destruction in the Palestinian territories. While the court stopped short of demanding a ceasefire, it did order West Jerusalem to punish members of its military who commit genocide, as well as government officials who advocate for massacre. In response, Israeli Prime Minister Benjamin Netanyahu described the World Court’s decision as “outrageous” and declared that no Israeli soldiers would be brought before the International Criminal Court (ICC).

According to the Gaza Health Ministry, Israeli forces continued to battle militants in the northern part of the enclave on Wednesday. The attacks killed over 150 people and injured 313 more. Nearly 27,000 people, mostly civilians, have been killed in Gaza since the war began in October, Palestinian health officials have said.The conflict started when Hamas fighters launched attacks against Israeli villages, killing more than 1,100 people and taking hundreds of hostages. The UN says around 85% of Gaza residents have been displaced from their homes, and 570,000 people there are starving.“I can’t be dishonest. I believe the rulings of the court have been ignored. Hundreds of people have been killed in the last three or four days. And clearly, Israel believes it has license to do as it wishes,” South Africa’s Foreign Minister said.

Pandor warned of the dangers of the world doing nothing to stop the civilian casualties in Gaza. She said that similar inaction contributed to Rwanda’s horrific death toll in 1994 when more than 800,000 people were slaughtered in an ethnically motivated genocide. South Africa filed a separate case against Netanyahu at the ICC last November, accusing him of war crimes and demanding his arrest.On Wednesday, Pandor stated that she had met with the ICC prosecutor to discuss the case and that it appeared to be handled differently than the allegations against Russian President Vladimir Putin over the Ukraine crisis. Last year, The Hague court issued an arrest warrant for Putin for alleged war crimes, including the removal of children from Ukraine.

“I asked him [ICC prosecutor] why he was able to issue an arrest warrant for Mr. Putin and is unable to do so for the prime minister of Israel. He did not answer that question. But I read into some of what he said that the investigations are still underway,” the South African official said. She said Pretoria would “look at proposing other measures to the global community” to stop Israel from killing civilians amid its war in Gaza.

Sure.

• Ukraine Seeks $1 Trillion From Russia – Zelensky Aide (RT)

Russia’s assets frozen by the West won’t be enough to cover the damage Ukraine has sustained due to Russia’s military operation, the Ukrainian president’s top economic adviser, Oleg Ustenko, said on Friday during a national telethon, as cited by RBK news outlet. “We are not talking about the figure of $300–350 billion of their gold and foreign exchange reserves. According to estimates made in Kiev, we are talking about $750 billion in direct losses. If we add indirect losses, this could raise the figure to $1 trillion,” Ustenko was cited as saying. In mid-2022, Ukrainian Prime Minister Denis Shmygal already named the amount that would be required to restore Ukraine, estimating it at $750 billion and saying at the time that the key source for the funds should come from the “confiscated assets that belong to Russia and Russian oligarchs.”

President Vladimir Zelensky later noted that the necessary reparations were estimated at $600–$800 billion. In late 2023, the Ukrainian Ministry of Justice ruled out the possibility of concluding a peace deal with Russia without receiving reparations for the damages sustained from the conflict. Kiev and its Western allies have long been mulling ways to use Russian assets blocked abroad to restore Ukraine. On January 30, EU member states reached an agreement allowing Brussels to transfer the income generated by Russia’s frozen central bank reserves to Kiev, but have so far stopped short of tapping the assets themselves. It’s estimated that Belgium’s Euroclear, the bloc’s central security depository, holds €196.6 billion (nearly $220 billion) worth of Russian assets, the vast majority of which belong to the country’s central bank.

In its financial results for 2023 published on Thursday, Euroclear revealed that it accrued almost $5 billion in profit from frozen Russian assets last year. It is assumed that Euroclear’s profits will not be paid to the owners of the assets but will later be transferred to a special EU fund to support Ukraine. In total, the EU has frozen €207 billion (just over $231 billion) of Russian assets and reserves since the beginning of the Ukraine conflict. Moscow has repeatedly warned that any actions related to its assets by the US and its allies would amount to “theft,” stressing that seizure of the funds or any similar move would violate international law and lead to a tit-for-tat response from Russia. Several Western officials, including European Central Bank President Christine Lagarde, have also warned that tapping frozen Russian funds would undermine trust in Western currencies and the economic system.

“..while some Russian military equipment designed and produced in the twilight of the Soviet era is often – but not always – inferior in some respects to NATO hardware, this is not true of modern Russian weaponry…”

• Russian Weapons Are Unrivaled – Putin (RT)

Russia’s modern weapons are more effective than the arms used by NATO countries, which have provided extensive military assistance to Ukraine, President Vladimir Putin has claimed. Speaking at the ‘Everything for Victory’ forum in the city of Tula not far from Moscow, Putin praised the country’s defense industry, saying it plays an important role in the conflict with Ukraine and in the country’s economy as it provides jobs for millions. The Russian leader acknowledged that while some Russian military equipment designed and produced in the twilight of the Soviet era is often – but not always – inferior in some respects to NATO hardware, this is not true of modern Russian weaponry.

It is clear that [these arms] are superior… I mean both missiles, armored vehicles, everything that is being used on the battlefield. He added that for the army to be successful, it should be able to swiftly react to the developments on the battlefield, suppressing the adversary’s artillery and reconnaissance assets. The military should also have its own such assets which should be more effective, Putin said. “Whoever does it faster will win,” he concluded. Last month, Russian Defense Minister Sergey Shoigu said that the country’s defense industry had significantly ramped up production of military hardware and materiel. This has also been true for the manufacturing of artillery shells which had been increased several times over, he said at the time.

Pilger Putin

John Pilger: Putin is popular because he restored Russia from chaos and won back its independence.

This is unacceptable to the Western elites

It mystifies many people in the West why Putin is so popular. He has a rating, apparently, of reaching up to 90%. Hardly anyone can… pic.twitter.com/xyYnZpla7B

— Ignorance, the root and stem of all evil (@ivan_8848) February 1, 2024

”What is called the Armed Forces of Ukraine has turned into a terrorist organization that attacks ambulances..”

• Ukrainian Military A Terrorist Organization – Putin (RT)

The Armed Forces of Ukraine have turned into a terrorist organization that intentionally attacks ambulances, Russian President Vladimir Putin said while speaking at the ‘Everything for Victory’ forum in Tula on Friday. He was commenting on attacks carried out by the Ukrainian military on residential areas of Russian cities in the Donetsk People’s Republic (DPR), which have led to a number of civilian casualties. In one such attack on January 20, a paramedic working in the city of Gorlovka was wounded while trying to provide assistance to victims following a previous round of shelling. On January 12, another paramedic was also killed during a Ukrainian attack on an ambulance brigade in the same city.

”What is called the Armed Forces of Ukraine has turned into a terrorist organization that attacks ambulances,” Putin said. The president recalled a story he heard last year about how Russian forces intercepted communications between two Ukrainian tank operators who were trying to enter Donetsk. One of the servicemen had just killed a man who had stepped out of his house, Putin said, when the other officer asked him “Why did you do that? He was just some guy wearing a tracksuit. He had a family, you can hear his children running around in the house.” The response, according to Putin, was “They’re all terrorists here.” “What is this if not neo-Nazism? That’s not to mention the rounds of applause for actual SS officers in the Canadian parliament and the blatant attacks on medical workers and ambulance vehicles,” added the president.

Russia knows of the tremendous strain put on medical personnel working in the territory of the DPR and other regions, he added, vowing to continue support for them. Work would be done to provide hazard pay to ambulance drivers, the president said. Earlier this week, Putin claimed there is a need to create a larger “demilitarized zone” in Ukraine that would ensure that peaceful Russian cities would no longer be targeted by Kiev’s foreign-made, long-range weapons.

“..China’s support for Russia “on the Ukrainian issue” will continue “despite the fact that the US and the EU continue to put pressure on the Chinese side.”

• China Issues ‘War Sponsor’ List Demand To Ukraine (RT)

Beijing has demanded that Ukraine immediately removes all 14 Chinese companies from a list of businesses that Kiev has branded “international sponsors of war,” Reuters has reported. The demand comes after Beijing’s ambassador to Kiev told senior Ukrainian government officials last month that the presence of Chinese firms on the list could hurt bilateral ties, according to the news agency. “China firmly opposes the inclusion of Chinese enterprises [on the list]… and demands that Ukraine immediately correct its mistakes and eliminate negative impacts,” a Chinese Foreign Ministry spokesperson told Reuters on Thursday.Of the 48 international companies on the Ukrainian blacklist, 14 are from China, the most of any other country.

“The ambassador said that [the blacklist] could have a negative impact on our relations,” a senior Ukrainian source told the news agency, adding that Beijing has not yet outlined any specific consequences.Kiev’s ‘International Sponsors of War’ project lists companies that still do business with Russia. While the list does not have legal implications, it aims to damage the reputation of businesses and push them into cutting ties with Russia, thus reducing Moscow’s “financial and technological ability.” In November, Kiev added Swiss food giant Nestle and German building materials giant Knauf to the blacklist for continuing to operate in Russia and pay taxes into the federal budget.

Last month, Lithuanian seafood company Viciunai Group was also included on the list. Alibaba and Chinese energy giants China National Petroleum Corporation (CNPC), China Petrochemical Corporation (Sinopec Group), and China National Offshore Oil Corporation (CNOOC) are some of the largest companies listed.China has not condemned Russia’s military operation against Ukraine, nor has it joined sanctions against Moscow. Beijing’s defense minister, Dong Jun, stated on Thursday that China’s support for Russia “on the Ukrainian issue” will continue “despite the fact that the US and the EU continue to put pressure on the Chinese side.” Russia and China consider themselves strategic partners, and two-way trade hit a record $240 billion in 2023 as economic ties continue to grow.

“..they fight for their “common good” to forestall the impoverishment of Polish families..”

• Polish Farmers: Full Blockade of Poland-Ukraine Border on February 9 (Sp.)

Polish farmers plan a complete blockade of the Poland-Ukraine border crossing, including highways, during an industrial action on February 9 to lambast the EU’s agricultural policy, according to the Solidarity trade union. “The position of Brussels from January 2024 cannot be accepted by our farming community. Moreover, the inaction of the Polish authorities and plans to cooperate with the European Commission and respect all its decisions regarding the import of agricultural products and food from Ukraine leave us no choice but to announce a general strike,” the protesters said in a statement.

The trade union has appealed to their fellow citizens to cooperate and show understanding regarding the ensuing situation as they fight for their “common good” to forestall the impoverishment of Polish families. The planned protests by farmers in Poland come on the heels of the escalating farmer protests in several European Union member countries. The agitating farmers list reasons like EU markets being flooded with cheap and tax-free agricultural products from Ukraine, agricultural subsidy cutbacks, etc. The EU’s deal with Kiev to extend the facilitated trade regime has triggered farmer fury within the bloc, especially in Brussels.

“FT has claimed that the farmers’ protests have been organized by a think tank chaired by a close aide of the prime minister..”

• Orban Linked To Farmers’ Protests – FT (RT)

Close associates of Hungarian Prime Minister Viktor Orban are reportedly responsible for organizing the farmers’ protests in Brussels over the past week, the Financial Times reported on Friday. The Hungarian leader personally met with protesters in the Belgian capital on Wednesday ahead of an EU summit on Ukraine aid, expressing support for what he described as “the voice of the people.” The farmers, thousands of whom have descended on Brussels, have been picketing the EU Parliament building, where they have burned pallets and piles of manure, and hurled eggs, stones and fireworks. They have also blockaded the Belgian capital using around 1,300 tractors. Similar demonstrations have also been seen in other EU states including France, Germany, Italy and Poland.

The farmers have been protesting against the EU’s agriculture policies, environmental standards, and rising fuel prices, and have highlighted the threat to their livelihoods posed by cheap Ukrainian imports. The Financial Times claims that Orban has been linked to a number of nationalist movements across the EU, as well as the recent farmers’ protests. The outlet claims that France’s National Rally party previously received a loan from a Hungarian bank run by Orban associates. Budapest also allegedly funded anti-immigration adverts on YouTube in Poland ahead of last year’s parliamentary elections in the country. FT has claimed that the farmers’ protests have been organized by a think tank chaired by a close aide of the prime minister, apparently referring to the Mathias Corvinus Collegium (MCC) – a Budapest-based college whose chairman is Balazs Orban (no relation) who has served as political director to the Hungarian prime minister.

The MCC has a Belgian-based offshoot, MCC Brussels, whose director Frank Furedi had previously claimed in an op-ed for Politico in 2022 that the purpose of the think tank was to “provide an alternative” for Europe’s “polarized cultural landscape.” Orban, who has repeatedly found himself at odds with other EU leaders, also stated in December that he did not wish for Hungary to leave the EU behind, but instead intends to “take Brussels” when Budapest assumes the rotating presidency of the EU Council from Belgium later this year. During the presidency, Orban said he hopes to convince as many member states as possible that Hungary’s insistence on standing by its ideals and values is the “right” way to do things. Nevertheless, on Thursday, the Hungarian leader lifted his veto on the EU’s €50 billion ($54 billion) package of economic aid to Ukraine, claiming that he had been “blackmailed” by Brussels into accepting the deal after months of resistance. Orban has described Ukraine as “one of the most corrupt countries in the world,” and opposed giving it any money out of the EU budget without oversight. Brussels, however, threatened to launch a financial blockade against Hungary if it did not back the deal, Orban explained.

“..Hunter’s other towering burden: being the son of one of the most powerful people on Earth..”

• Hunter Biden Compares Himself to Dead Romanovs and Ancient Greek Heroes (Turley)

Hunter Biden is comparable to children in Japanese internment camps, to undocumented immigrants, to the murdered descendants of the Tsar. At least that’s what he argues in a new court filing in his federal gun case, which presents Hunter as one of the most tragic figures since the fall of Troy. Literally. The brief starts by asking the court to ignore Hunter’s own admissions as to his use of drugs during the period of his gun ownership. As discussed in earlier columns, Hunter faces a serious problem in proving a prior defense by his counsel Abbe Lowell. Last October, Lowell argued that Hunter had not lied on ATF Form 4473 when he indicated he was not an unlawful user of, or addicted to, narcotics: “At the time that he purchased this gun, I don’t think there’s evidence that that’s when he was suffering.” The problem is that Hunter discussed his roaring addiction in his book, Beautiful Things: A Memoir, which he has used to excuse years of alleged influence peddling and an array of possible crimes from drug use to sex trafficking to tax offenses.

The narrative was pushed by his counsel and picked up by the media which showered him with praise for his courage. Now, however, counsel wants the Court to forget the admissions such as Hunter admitted that he was “drinking a quart of vodka a day by yourself in a room is absolutely, completely debilitating” as was “smoking crack around the clock.” He describes his addiction as running up to the announcement of his father for presidential election. The book is not his only problem. Recently, the government has revealed that, when it recovered the gun after its was discarded near a school, the gun pouch was coated in cocaine. Lowell expressed outrage that the government would cite his client’s own words or cite the fact that his gun pouch looked like it came from the desk of Tony Montana. Calling the use of his client’s words “despicable,” Lowell suggests that the prosecutors “should visit an Alcoholics or Narcotics Anonymous meeting.”

If that was not bizarre enough, he then describes Hunter’s other towering burden: being the son of one of the most powerful people on Earth. While Hunter repeatedly used that connection for appointments and influence peddling, it is also apparently his curse. Indeed, he suggests that it is a protected “immutable characteristic,” a term used often in cases protecting minorities from racial discrimination. Somehow his prosecution for a gun violation would raise constitutional concerns since “the First Amendment … protects the freedom of association among family members—particularly as the parent-child relationship is an immutable characteristic.” He shares how he carries the same burden as other accursed children. In a brief that borders on delusional, Biden’s lawyers say the son of the president who burned through millions from influence peddling is comparable to all those unfortunate and destitute souls.

While the media has endlessly covered how Donald Trump’s arguments are over-the-top in issues such as immunity, there appears to be comparably little interest in the president’s son’s self-aggrandizing demand for dismissal of his criminal charges. One of the filing’s main arguments is that Hunter Biden is being selectively prosecuted because of his father. Hunter profited massively from the Biden name, but now, his lawyer Abbe Lowell argues, he’s suffering from the “burden” of parentage.To back up this argument, Lowell cites Plyler v. Doe, a case involving the providing of free education to the children of illegal immigrants, to say that the Constitution, “prevents the government from inflicting harm on children for the conduct of their parents.” That’s right, Joe Biden is like an undocumented migrant father who carried his kid over the border for a better life. One can only imagine the press response to any comparison of the Trump children to migrant children.

“There is no concern for deterioration or death on the bench in Sotomayor’s case. It is simply a matter of swapping out justices like light bulbs before they burn out.”

• Justice Sotomayor Is the Left’s Latest Retirement-Target (Turley)

“I live in frustration … To be almost 70 years old, this isn’t what I expected.” Those words from Justice Sonia Sotomayor appear to resonate with some liberals, but not in the way intended by the jurist. Some activists and journalists are beginning to nudge Sotomayor to leave the Court in order to be replaced by a younger jurist, much as was done to Justice Stephen Breyer in 2021 and 2022. On CNN, journalist Josh Barro bluntly wondered why Sotomayor remains on the bench when younger jurists could be brought on to guarantee a liberal vote for years to come. He indicated that many liberals are frustrated with her for not stepping down: “I find it a little bit surprising, given what Justice Sotomayor describes there about the stakes of what is happening before the Supreme Court, that she’s not retired. She’s 69 years old, she’s been on the court for 15 years.”

Sotomayor gave her frank assessment of being “tired” and “frustrated” during an appearance at University of California’s, Berkeley. She suggested that the Supreme Court’s conservative majority contributes to her daily burden. It was a notable interview not only for its content but for its moderator, UC Berkeley Law Dean Erwin Chemerinsky. Chemerinsky previously shocked many in the legal community by denouncing Sotomayor’s six conservative colleagues as “partisan hacks.” In response to Chemerinsky’s probing, Sotomayor took an implied swipe at her colleagues and declared: “I live in frustration. Every loss truly traumatizes me in my stomach and in my heart. But I have to get up the next morning and keep on fighting.”She added that the workload is overwhelming: “There used to be a time when we had a good chunk of the summer break. Not anymore. The emergency calendar is busy almost on a weekly basis.”

Many clearly would like to see her lessen that load by following the pattern of former liberal colleague, Justice Breyer, who retired in 2022. Demand Justice, a liberal group that has pushed court–packing as a solution to the Court’s conservative majority, drove a billboard truck through the streets of Washington with slogans like “Breyer, retire. Don’t risk your legacy.” At 69, Sotomayor shows no signs of mental decline. She has been a highly effective justice, stepping into the vacuum created by the death in 2020 of Justice Ruth Bader Ginsburg. Of course, few ever questioned the “Notorious RBG” in her decision to stay on the Court, despite her much older age and longer tenure. While some of us noted that Ginsburg was taking a huge risk in not allowing then-President Barack Obama to pick a successor, she remained on the Court in spite of medical problems and ultimately was replaced by Justice Amy Coney Barrett. Ginsburg, however, was almost 20 years older than Sotomayor. There is no concern for deterioration or death on the bench in Sotomayor’s case. It is simply a matter of swapping out justices like light bulbs before they burn out.

“This will not stand, ya know, this aggression will not stand, man.” — Jeffrey (“the Dude”) Lebowski.

The world may be a disaster these days, but the White House is a bigger disaster. Can you name the White House chief of staff? Betcha can’t. Know why? He never, ever comes out and speaks to that mob in the press room. He might have to answer some difficult questions, such as: if the president’s brain is switched off more than half the time, who decides what to do with that ‘nuclear football’ they carry around with him. Is it. . . you? By the way, the chief of staff’s name is Jeff Zients. Ever heard of him? Of course not. [..] The question then: should “Joe Biden” just go ahead and nuke Texas? “JB” is thinking: What good is the place with that Putin wannabe running it? Buncha cattle and those ridiculous hats! The official head-gear of white supremacy! Probably millions of them down there, clutching their beloved guns! I’ve got news for you. Wanna play hardball? We’ve got F-16s.

Try shooting one of those Vipers down with your 30-ought-6 when it’s coming in low over Plano on after-burners at eleven hundred miles an hour, bristling with Sidewinder missiles. Anyway, for a nice strip steak, go to Kansas City. Fuggedabowt Texas. Kaboom! Not a joke! As for Iran. . . another $6-billion could keep them quiet for a while. Turns out that mullahs really like money. Do you know how many virgins you can buy for $6-billion here on Planet Earth? Why blow yourself up for them? Especially since you don’t know for a hundred percent sure that there is a place called heaven, or that it’s mainly a seraglio? By the way, why does our country (that’d be the USA) have all these little military outposts scattered around the desert wastelands of Jordan, Syria, and other lands of the Middle East? Did the one called Tower Two that got blown up a few days ago have a target painted on it?

Might as well have. You think the “other side” doesn’t have satellite imagery of the terrain? Kind of looks like we’re asking for trouble. And, also by the way, how come two of the three US soldiers killed there were girls? Is that how we do war these days? With a girlie army? Who actually thinks that’s going to work? Apparently, “Joe Biden.” Be advised: there is chatter coming out of this mysterious White House about bringing back the military draft. Remember what that is, Boomers? Remember Country Joe and the Fish singing: “Be the first one on your block to have your boy come home in a box.” That was back in the Vietnam days. Fifty-thousand-plus KIA. Only now we’ll be drafting girls (and probably some boys who want to be girls). I guess we’ll figure out now how gung-ho Gen Z really is.

You didn’t ask, but things are not going so well in our remote-control war in Ukraine against Russia (Putinland). Our Zelensky team (we own it) got completely rope-a-doped, punched itself out, its knees are buckling. Victoria Nuland, the renowned State Department girlie war-hawk, says she’s confident that Congress will pass the new $61 billion aid package for the Z-team, according to Radio Free Europe, the blob’s official propaganda outlet. The blob wants you to think that Putin wants to turn all of Europe into Putinland. I’m sure. Tori Nuland probably thinks we can save Ukraine with the fabulous girlie army and some snazzy new drones from McDonnell Douglas. Hey, it’s war, war, war. Bomb them all — Iran, Russia, Texas — and let God sort them out.

“Rather than counting on an exclusivity arrangement with Rogan’s podcast to help attract more subscribers, Spotify is betting on ad sales to generate more revenue..”

• Joe Rogan Scores Massive New Podcast Contract (RT)

US podcast king Joe Rogan has signed a contract renewal with Spotify that essentially allows him to have his cake and eat it, too – reportedly earning as much as $250 million from the streaming service and gaining the freedom to distribute his show on other platforms. Spotify confirmed the new multiyear agreement on Friday, saying it will continue to stream ‘The Joe Rogan Experience’ and will allow it to be carried by rival distributors. That means a show already rated as the most-watched podcast in the world while being streamed exclusively on Spotify will soon be opened up to listeners of such services as Apple Podcasts, Amazon Music and YouTube.

Rogan’s controversial show has ruffled feathers at Spotify since he joined the platform in 2020 in a deal valued at around $200 million. Elderly rock musician Neil Young removed his songs from the streaming service in 2022 and urged Spotify employees to quit after CEO Daniel Ek refused to cancel Rogan’s show for spreading “deadly misinformation” on Covid-19 vaccines. Angry Spotify staffers also accused Rogan of being “transphobic,” but his show was reportedly making the platform too much money to be torpedoed. The podcast boasts an audience estimated at about 11 million people per episode, and Rogan has credited media pearl-clutching over his controversial content for attracting about 2 million of his subscribers.

Rather than counting on an exclusivity arrangement with Rogan’s podcast to help attract more subscribers, Spotify is betting on ad sales to generate more revenue. Rogan’s compensation will include a base fee and a share of advertising revenue. Spotify said it will work with Rogan to “continue to maximize the audience of the show across platforms.” There was media speculation that Rogan would move to another platform when his Spotify contract expired. He turned down a $100 million, censorship-free offer to join Rumble in early 2022.

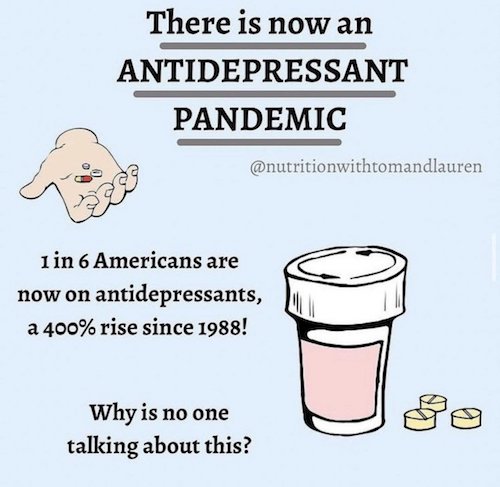

Tucker pharma

Holy smokes. Suspicions confirmed.

Former Pharma insider tells Tucker Carlson that the true goal of pharma ads on TV is not to sell drugs but to BUY OFF the news media.

This is described as an "open secret" within the pharmaceutical industry.

TUCKER: You're saying that pharma… pic.twitter.com/2YMMWIM5Hs

— The Vigilant Fox 🦊 (@VigilantFox) February 3, 2024

Elon net worth

Elon Musk’s net worth over the years. All his companies are philanthropy. pic.twitter.com/i7swLqrwfg

— Tesla Owners Silicon Valley (@teslaownersSV) February 1, 2024

Elon equity plan

Elon Musk’s comp plan was perceived as insane back in 2018. No one would have willingly signed up for that but Elon did.

He put the company first in this plan with no guarantees. pic.twitter.com/5sZk2eo78I

— Tesla Owners Silicon Valley (@teslaownersSV) February 1, 2024

Tesla

I don’t care what you think of Elon Musk or CEO pay. Any shareholder I know would die to bring on a CEO with the stipulations that Musk got in 2018.

If the company’s value increases by 1900% in 6 years, Musk would get approximately 9% of the company as a bonus.

Yes, those… pic.twitter.com/UMddvlXAep

— Brian Krassenstein (@krassenstein) February 1, 2024

Leopard in winter snow

📹 itseriksen

pic.twitter.com/XRpEMH0dF1— Science girl (@gunsnrosesgirl3) February 2, 2024

Black + Cat

Spectacular combination !! pic.twitter.com/MTRfuLPXeR— Figen (@TheFigen_) February 2, 2024

https://twitter.com/i/status/1753342498054058143

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.