Paul Gauguin Fatata te Miti (By the sea) 1892

Fauci Fail

Fauci and mass casualties in return for poor vaccines: for AIDS and C19 pic.twitter.com/55nGsDfHwY

— George Fareed (@GeorgeFareed2) October 19, 2021

Brought to you by..

Well, this is totally normal and not at all a conflict of interest pic.twitter.com/4MKm0VozBC

— Whitney Webb (@_whitneywebb) October 19, 2021

Seattle

https://twitter.com/i/status/1450516369984819200

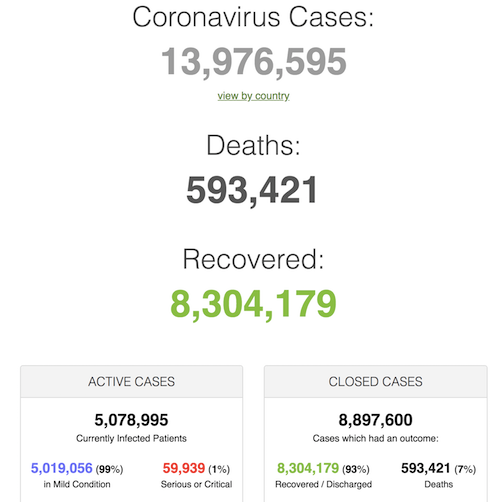

“If you’re under 45, your chances of dying are almost nonexistent, and then it increases exponentially.”

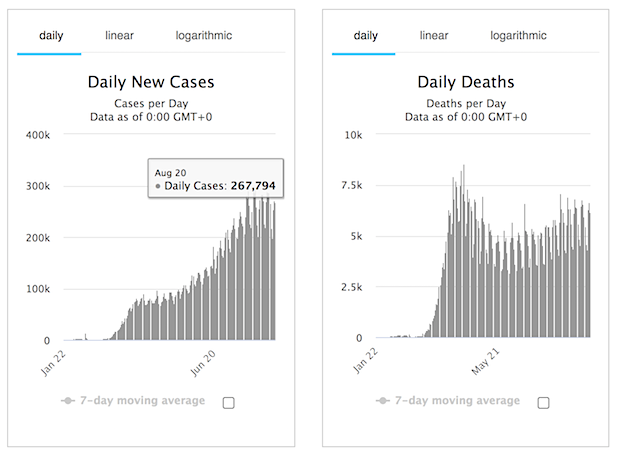

• Even Fully Vaccinated Older People Are At High Risk For Severe Covid (NatGeo)

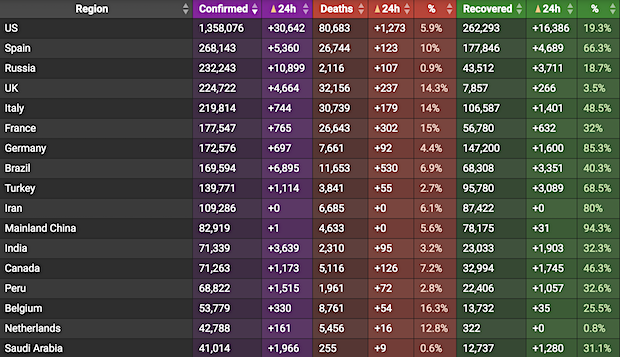

Mounting data suggest that older people are at higher risk of severe disease from a breakthrough infection of COVID-19—and scientists say that should come as no surprise. After all, older age brackets have been disproportionately at risk throughout the pandemic, and that continues to be true even once someone is fully vaccinated. Concerns about breakthrough infections bubbled up again this week when news broke on October 18 that former Secretary of State Colin Powell had died after contracting COVID-19. Powell was 84, but his cause of death was more complex: The former statesman suffered from multiple myeloma, a cancer of white blood cells. People with this form of cancer tend not to respond well to vaccines.

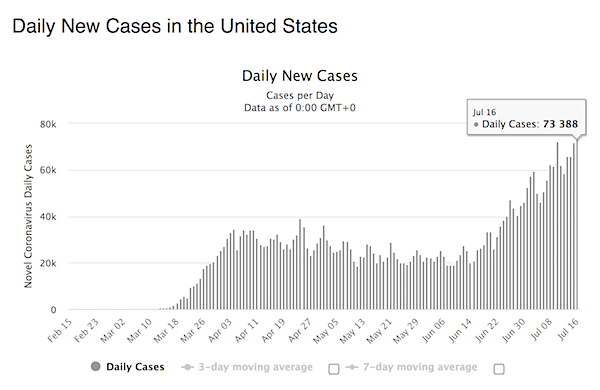

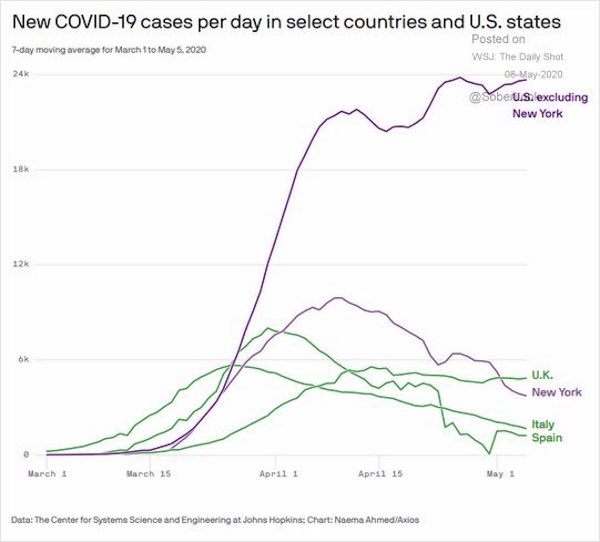

But in addition to the immunocompromised, health officials are seeing worrying evidence that older age groups continue to be at higher risk from the pandemic. According to the latest data from the Centers for Disease Control and Prevention, people over 65 account for 67 percent of hospitalizations and 85 percent of deaths from breakthrough cases. And recent media reports citing data from Seattle, Washington, and the United Kingdom show that older vaccinated people face similar—and, in some cases, greater—risks of severe disease than unvaccinated children. “The huge risk factor is age,” says William Petri, an immunologist at the University of Virginia. That’s why the U.S. prioritized vaccinating older people and those in long-term care facilities when it first rolled out the vaccines, he explains.

“If you’re under 45, your chances of dying are almost nonexistent, and then it increases exponentially.” [..] Experts say they still don’t have an adequate explanation for why older people were more susceptible to COVID-19 even before vaccines were available. “It’s just one of the great mysteries of the virus,” says Deepta Bhattacharya, an immunologist at the University of Arizona. Scientists who study aging say it likely has to do with some of the hallmarks of getting older. For example, the human body normally clears away cells that have become damaged due to disease, injury, or stress. But as the body ages, this process becomes less efficient, and it starts to accumulate so-called senescent cells, which are damaged but won’t die. These cells secrete chemicals that damage neighboring healthy cells and trigger inflammation. Senescent cells thus weaken the body and make it harder to fight off infections.

Ryan Cole.

• Even Doctors In Red States Are Punished For Saving People From Covid (Blaze)

You are not allowed to treat COVID outpatient. It’s not about any one drug. You will be punished if you dare treat patients with anything that works. What began as 15 days to flatten the hospital curve has grown into a ban on all treatment outside the hospital to ensure everyone sick with moderate disease lands in the ER. No, they will not prosecute a doctor, they will just threaten to pull his license, which is why doctors won’t even prescribe azithromycin or prednisone, much less ivermectin and other proven antiinflammatories. What if you are part of the 1% of doctors who actually save lives — who run toward the fire rather than away from it? Instead of getting a medal of honor, these national heroes are now losing their licenses.

Idaho is not California. In fact, many Californians are fleeing to Idaho to escape the progressive persecution of the once Golden State. Yet now, with their investigation of Dr. Ryan Cole, the Idaho Medical Board wants to ensure that no doctor will ever treat you for this virus. If you contract this virus, there is probably nobody in the world you’d want access to more than Dr. Cole. A Mayo Clinic-trained anatomic and clinical pathologist who is licensed in 12 states, Cole knows the mechanisms of pathogens and various medicines as well as you know the streets of your neighborhood. He has lived the COVID pandemic in his Idaho lab since last March, diagnosing over 100,000 cases, and has given up much of his regular work to treat patients on his own time and own dime for months. His record is remarkable, and I have many friends and listeners of my podcast who are alive today because of his brilliance and kindness.

So there will be a ceremony in the Oval Office next week to present Dr. Cole with a medal for treating people in a pandemic while others let their patients die, right? At least the Idaho governor, Brad Little, will offer him some state reward? Nope. Instead, they are threatening to yank his license. Steven Kohtz, MD, president of the Idaho Medical Association’s board of trustees, and Susie Keller, CEO of the association, wrote a letter to the state’s board of medicine on Oct. 7, lamenting that “he has treated patients ‘from Florida to California'” with ivermectin. The horror! He should have let them die and not treated them at all, like Kohtz and his colleagues have done since last March.

In the letter, they claim Cole’s statements have killed people. “Many of those statements have advocated that people not be treated appropriately and undoubtedly have led to and will continue to lead to poor health outcomes as people are encouraged not to be vaccinated against COVID-19 or obtain appropriate treatment for it when such treatment could improve their health.” Well, how could treating pulmonary symptoms with steroids and antiinflammatories be worse than not treating them at all? This is the ultimate exercise in projection. They assuage their own guilt of letting patients die by preventing others from treating people in the critical early days of the virus.

ADE

Antibody-dependent enhancement pic.twitter.com/rrWhlM8xvv

— Wittgenstein (@Kukicat7) October 19, 2021

Oops.. There’s a reason your medical data are private.

• ‘Terrible Mistake’ Could Send Execs To Jail Over Vaccine Certificates (AFR)

Collecting COVID-19 vaccination certificates from customers or employees poses a serious legal and cyber security risk to businesses that exposes them to lawsuits, hefty fines and even executive jail sentences if the data isn’t handled properly, experts warn. The risk is so grave that businesses that have already stored images of government-issued vaccination certificates from employees or customers are advised to scour their email or human resource systems and delete the images, or at the very least remove a sensitive piece of information prominent on the certificate that exposes businesses to a “world of data security pain”, one expert says. As part of state and federal requirements for emerging out of the pandemic lockdown, businesses are asked to check whether customers and employees are vaccinated before allowing them to enter their premises.

Businesses storing information about whether someone has been vaccinated are therefore storing health information, quite possibly for the first time, exposing them to the Privacy Act, which requires they take “reasonable steps” to secure that information, said Anna Johnston, a former NSW deputy privacy commissioner who runs her own data privacy consultancy, Salinger Privacy. Worse than that, the federal government certificates contain a unique identifier, known as the Individual Health Identifier (IHI), that is covered by its own law, with much stricter data security requirements and with punishments that could include jail if that one piece of data is mishandled, Ms Johnston told The Australian Financial Review.

Together with the Tax File Number, the IHI is the most sensitive piece of data used by government, she said. It uniquely identifies Australians for healthcare purposes, far more so than a Medicare number, which can be shared by family members. It’s so sensitive that, when it was brought in 2010, it came with its own privacy legislation, the Healthcare Identifiers Act. “Including the IHI on the vaccination certificate, which is a document we’re supposed to be showing to our gyms, hairdressers and restaurants, as well as to our employers and customers, was a terrible mistake by the federal government,” she said. “It’s a bad data-security problem that the government has created.

“I really feel for small businesses in particular. They don’t have an in-house compliance officer telling them what to do. They don’t have an information security officer telling them how to secure these records. They probably don’t have the foggiest clue that there are special rules for the use and disclosure of the IHI that, if they breach those rules, expose them to both a civil penalty and a criminal penalty. “You face up to two years imprisonment for use or disclosure of the IHI for any purposes outside of supporting healthcare. And now that number is on a PDF that is being emailed around willy nilly.”

Australia’s vaccination certificate has a piece of data experts warn shouldn’t be there.

Kimberley Strassel: “Here we go. Some of us wondered how long it would take for the liberal/media establishment to argue that we needed to keep pandemic measures going forever–even for things that we previously lived with, like the flu. It didn’t take long..”

• We Accidentally Solved the Flu. Now What? (Atl.)

Perhaps the oddest consolation prize of America’s crushing, protracted battle with the coronavirus is the knowledge that flu season, as we’ve long known it, does not have to exist. It’s easy to think of the flu as an immutable fact of winter life, more inconvenience than calamity. But each year, on average, it sickens roughly 30 million Americans and kills more than 30,000 (though the numbers vary widely season to season). The elderly, the poor, and people of color are all overrepresented among the casualties. By some estimates, the disease’s annual economic cost amounts to nearly $90 billion. We accept this, when we think about it at all, as the way things are.

Except that this past year, things were different: During the 2020–21 flu season, the United States recorded only about 2,000 cases, 17,000 times fewer than the 35 million it recorded the season before. That season, the flu killed 199 children; this past season, as far as we know, it killed one. “We’ve looked for flu in communities and doctors’ offices and hospitals, and we’ve gotten almost zero,” says Emily Martin, a University of Michigan epidemiologist who’s part of the CDC’s flu-monitoring network. The same was true of other seasonal respiratory viruses last winter, says Saskia Popescu, an epidemiologist at George Mason University in Virginia, though some have since rebounded. RSV, parainfluenza, rhinovirus, adenovirus—for a while, they all but vanished.

For this, perversely, we can thank the pandemic. The coronavirus itself may have played some role—infection could produce a general immune response that would also confer protection against the flu—but most of the epidemiologists I spoke with instead emphasized the importance of the behavioral changes adopted to slow the spread of the coronavirus: masking, distancing, remote learning, working from home, limiting indoor social gatherings. Despite the inconsistency with which America deployed them, these measures helped tamp down the spread of the virus, but they completely crushed influenza, a less transmissible foe to which the population has considerable preexisting immunity. We set out to flatten the curve, and we ended up stamping out the flu.

This was one of the few blessings in an otherwise abysmal winter, in which COVID cases and deaths surged to their highest levels ever in the U.S. At least we didn’t face the dreaded “twindemic.” But our triumph over the flu also poses a dilemma, as much ethical as epidemiological. We’ve demonstrated conclusively that saving nearly everyone who dies of the flu is within our power. To do nothing now—to return to the roughly 30,000-deaths-a-year status quo without even trying to save some of those lives—would seem irresponsible. So what do we do? Which measures do we maintain and which do we let go?

You mean there was ever any justification?

• Study Destroys Justification for Vaccine Mandates (Siri)

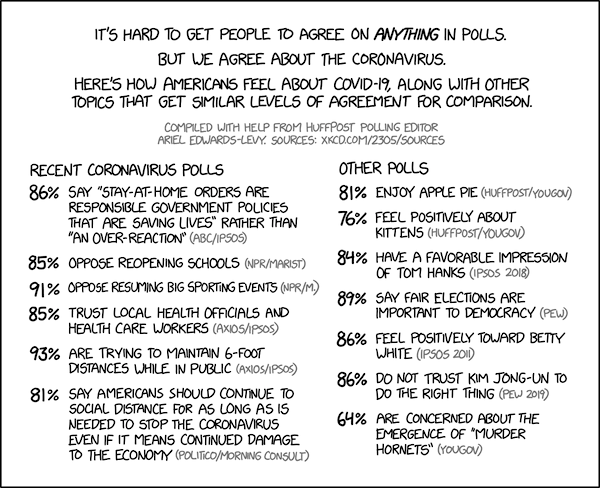

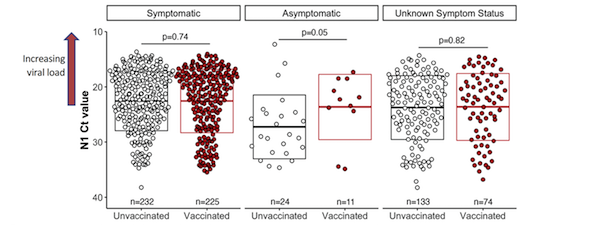

Civil and individual rights are only meaningful if they continue to protect individuals during difficult situations. It is why the U.S. Supreme Court upheld the right of neo-Nazis to march through Jewish neighborhoods. It is why it upheld the right to burn the American flag. Protecting these rights when it is difficult protects us all. It assures that government will not erode these civil and individual rights, including during a pandemic. The CDC and State Health Department scientists just released a study that again reflects the dangers of making civil and individual rights contingent on a medical procedure. This study, titled Shedding of Infectious SARS-CoV-2 Despite Vaccination, reviewed swab specimens from 36 counties in Wisconsin from the end of June to the end of July 2021. They then checked the viral load of SARS-CoV-2 in each swab.

What did they find? High viral load in “158 of 232 unvaccinated (68%…) and 156 of 225 fully vaccinated (69%…) symptomatic individuals.” Meaning there was effectively no difference between the symptomatic vaccinated and unvaccinated in terms of who was carrying, and therefore spreading, the virus. But the study does not end there. It also found high viral loads in “7 of 24 unvaccinated (29%…) and 9 of 11 fully vaccinated asymptomatic individuals (82%…).” Meaning, among asymptomatic individuals, the vaccinated had a higher percentage with a high viral load. As I explained in an interview with Shannon Bream, this reflects that the unvaccinated that catch the virus are more likely to be at home in bed with symptoms, while the vaccinated that catch the virus are more likely to have no symptoms and hence continue their daily routine unknowingly spreading the virus.

These findings are depicted in the following chart. Note that the lower the “N1 Ct value” the higher the viral load (and that a team at Oxford concluded that an N1 Ct value over 24 should not be taken to indicate the presence of any actual virus):

Make In-N-Out your destination.

“We refuse to become the vaccination police for any government..”

• SF’s Only In-N-Out Refuses to Enforce the City’s Vaccination Mandate (SFE)

The only San Francisco location of wildly popular California-based fast food chain In-N-Out Burger was temporarily shut down and remains closed for indoor dining after the SF Department of Public Health found the restaurant was not properly enforcing the city’s vaccination mandate for indoor dining, KRON4 reported first. The city shut down the restaurant at 333 Jefferson Street on Thursday, October 14, after learning staff weren’t checking diners’ proof of vaccination or preventing customers without proof of vaccination from entering. The restaurant has since resumed takeout and outdoor dining, but the company seems to be digging its heels on the vaccination mandate.

In a statement provided to Eater SF, In-N-Out Chief Legal & Business Officer Arnie Wensinger says the company believes requiring its staff to enforce a vaccination mandate constitutes government “overreach” and is refusing to do so. “We fiercely disagree with any government dictate that forces a private company to discriminate against customers who choose to patronize their business,” Wensinger’s statement reads. “This is clear governmental overreach and is intrusive, improper, and offensive.” In an email to Eater SF the San Francisco Department of Public Health says it’s been trying to get In-N-Out to adhere to the city’s vaccination order for weeks.

The city’s Joint Information Center Outreach Team first visited the restaurant on September 24 after receiving a complaint to the 311 non-emergency service line. Inspectors from the Environmental Health division who followed up on October 6, found the restaurant was still in violation of the health order and issued a Notice to Comply. The department finally issued a Notice of Closure on October 14, at which point the restaurant was “instructed to cease all operations on site immediately because of the threat it poses to public health,” according to the Department of Public Health. The owner of the property, Anchorage Holdings LP, which is based in Addison, Texas, was also issued a Notice of Violation.

The company says it has “properly and clearly posted signage to communicate local vaccination requirements.” But In-N-Out also admits employees were not checking customers’ vaccinations cards and IDs, nor were they preventing customers who are not able to prove they’ve been vaccinated from entering the restaurant, which the health department told the company that staff must do. “As a Company, In-N-Out Burger strongly believes in the highest form of customer service and to us that means serving all Customers who visit us and making all Customers feel welcome,” the statement continues. “We refuse to become the vaccination police for any government. It is unreasonable, invasive, and unsafe to force our restaurant Associates to segregate Customers into those who may be served and those who may not, whether based on the documentation they carry, or any other reason.”

“It will be interesting to see if, and how quickly, a parallel economy with a vaccination option workforce, will take root.”

• 9 In 10 Large Employers Worry About Losing Employees Over Vaccine Mandate (CTH)

In an unusual twist to the strength of the multinationals, many large corporations are worried they will lose critical employees to smaller organizations with less than 100 employees who do not have to enforce the national worker vaccine mandate. By itself the 100 worker rule, in combination with the exemptions being provided by the federal government for some politically connected union organizations, would seem to undercut the premise of the “national health emergency.” If the COVID pandemic is such a national threat, why would any groups be excluded from the mandate? However, until the Dept of Labor rule is officially registered, court cases to hear such arguments are not possible. A recent survey by The Society for Human Resource Management, as shared by The Hill, indicates that 9 out of 10 large employers are concerned about losing significant amounts of workers due to the federal mandate:

The Hill – […] “The survey reveals uneasiness among employers over the impending workplace rule, which will require employers with 100 or more employees to mandate COVID-19 vaccinations or frequent testing. They’re most concerned about losing workers amid an extremely tight labor market. Another two-thirds of employers surveyed said that they cannot afford to pay for weekly COVID-19 testing for unvaccinated workers. […] Others are worried that they could lose unvaccinated workers to rival firms with fewer than 100 employees or to independent contracting companies that aren’t subject to the rule.”

It will be interesting to see if, and how quickly, a parallel economy with a vaccination option workforce, will take root.

Well, not really.

• Southwest Drops Plan To Put Unvaccinated Staff On Unpaid Leave (CNBC)

Southwest Airlines has scrapped a plan to put unvaccinated employees who have applied for but haven’t received a religious or medical exemption on unpaid leave as of a federal deadline in December. Southwest Airlines and American Airlines are among the carriers that are federal contractors and subject to a Biden administration requirement that their employees are vaccinated against Covid-19 by Dec. 8 unless they are exempt for medical or religious reasons. Rules for federal contractors are stricter than those expected from the Biden administration for large companies, which will allow for regular Covid testing as an alternative to a vaccination.

Executives at both carriers in recent days have tried to reassure employees about job security under the mandate, urging them to apply for exemptions if they can’t get vaccinated for a medical reason or for a sincerely held religious belief. The airlines are expected to face more questions about the mandate when they report quarterly results Thursday morning. Pilots’ labor unions have sought to block the mandates or sought alternatives such as regular testing. Southwest’s senior vice president of operations and hospitality, Steve Goldberg, and Julie Weber, vice president and chief people officer, wrote to staff on Friday that if employees’ requests for an exemption haven’t been approved by Dec. 8, they could continue to work while following mask and distancing guidelines until the request has been reviewed.

The company is giving employees until Nov. 24 to finish their vaccinations or apply for an exemption. It will continue paying them while the company reviews their requests and said it will allow those who are rejected to continue working “as we coordinate with them on meeting the requirements (vaccine or valid accommodation).” “This is a change from what was previously communicated. Initially, we communicated that these Employees would be put on unpaid leave and that is no longer the case,” they wrote in the note, which was reviewed by CNBC. Southwest confirmed the policy change, which comes just weeks before the deadline.

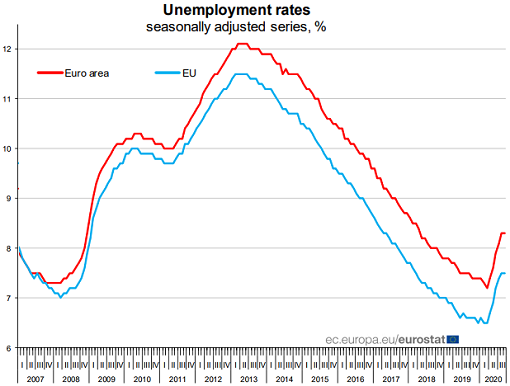

“..if none of the unvaccinated workers were to cave in to the government’s demands — some will, of course, we just don’t know how many — the number of people without work in Italy would increase by well over 150% — in the space of just one week!”

• Things Are Getting Messy In Draghi’s Italy (NC)

As of last Friday all residents of Italy need a covid passport, or Green Pass, to access not only public spaces but also public and private workplaces. The pass proves that they have either been vaccinated against Covid-19, have recovered from the disease in the past six months or have recently tested negative. And now they need it to make a living, to feed their families. The “no jab, no job” rule applies to workers of all kinds, including the self employed, domestic staff and even people working remotely. If you’d still rather not get vaccinated, you have the option of showing proof of a negative test every two days. That can cost anywhere between €15 and €50 each time — far beyond the means of most low-paid workers. If you still refuse to get vaccinated or present proof of negative tests, you face unpaid suspension as well as a fine of up to €1,500. Public sector workers have five days to present the green pass before being suspended. Private sector workers without a green pass face suspension from the first day.

Here’s more from Politico: “By law, all workers must be able to show a so-called Green Pass, proving they are vaccinated against COVID-19 or have tested negative in the past 48 hours. Roughly 81 percent of Italians over 12 are fully vaccinated. While polls suggest the majority of Italians are in favor of vaccine passes (just as the majority of people in all countries are in favour of vaccine passes, according to polls), there are still 3.8 million unvaccinated workers, many in strategic sectors and public services such as ports, trucking, health care and law enforcement, who will be unable to work.”

This is by any measure a massive cull of workers. Three point eight million is more than 5% of Italy’s entire population and over 16% of the country’s officially employed workforce (22.7 million). The total number of people currently unemployed in Italy is 2.3 million. In other words, if none of the unvaccinated workers were to cave in to the government’s demands — some will, of course, we just don’t know how many — the number of people without work in Italy would increase by well over 150% — in the space of just one week! And as the Politico article mentions, many of these workers are in strategic sectors and public services.

This is all happening as Europe — and the world at large — faces the worst supply chain crisis in decades as well as acute energy and labor shortages. The move also risks giving a huge boost to Italy’s already quite large informal economy. Given as much, this is a huge, high-stakes bluff on the part of Draghi’s technocratic government, which was formed eighth months ago. If it pays off, the vast majority of Italy’s vaccine holdouts will fall into line and go back to work, and other governments across Europe will follow suit with similar mandates. If it doesn’t, Italy’s economy could be plunged into chaos.

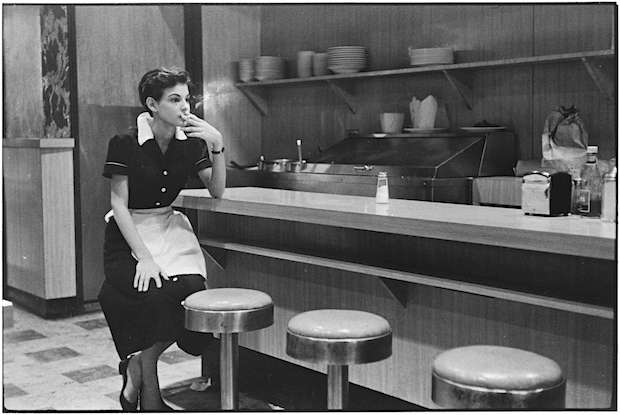

Laptoppers.

• The Frightened Class (Harrington)

They’re all around us, especially those of us who live in relatively prosperous metropolitan neighborhoods in the US or Western Europe. Despite being—at least in material terms—among the most fortunate people who have ever walked the earth, they are very scared. And they want you to be very frightened too. Indeed, many of them see your refusal to be as frightened as they are about life’s inevitable risks as a grave problem which entitles them and their often powerful and influential fellow travelers to recur to all manner of authoritarian practices to insure that you adhere to their increasingly neurotic view of reality.

This tendency has been in full bloom lately as the people who have sat safely behind their laptops during the last 20 months have harangued and threatened those who have been out on job sites and meatpacking plants mixing freely with others and the virus, to internalize their own obsessions. And when these supposedly ignorant others—whose storehouse of empirical evidence about the dangers of the virus easily outstrips that of the laptoppers—refuse to buckle to the demand to be scared, they are met with all sorts of opprobrium. Viewed in historical terms, it’s an odd phenomenon.

For most of recorded time prosperity and education have been the gateway to a life of relative freedom from worry. But now, the people who most enjoy these benefits are, it seems, wracked with anxiety and, in the not infrequent way of many people suffering that plague, and hellbent on sharing their misery with others. The point here is not to belittle the very real costs of anxiety in the lives of many people, nor to dismiss it as a real public health concern. Rather, it is to ask how and why it is proliferating so rapidly among those who, at least on the surface, have less reason than the vast majority of their fellow human beings to suffer from it.

“.. the inspector general’s public report states that McCabe lied to investigators on four occasions, three of them while under oath. His firing followed the standards consistently applied to all other FBI agents.”

• Andrew McCabe’s Settlement With The DOJ Is A Signal To John Durham (Brock)

Former FBI Deputy Director Andrew McCabe was un-fired when the Department of Justice (DOJ) — now firmly under a Democratic administration — agreed to settle with McCabe by fully restoring his FBI pension and removing all records from his FBI personnel file that indicate he was fired for cause. It wasn’t really a settlement. McCabe sued the government, and the DOJ said, “Okay, we’ll give you what you want.” The agreement does not change the findings of DOJ Inspector General Michael Horowitz that McCabe lied under oath to investigators on three occasions; it simply eliminates all consequences for doing so. Oh, and it also forks over half a million dollars of taxpayer money to cover McCabe’s attorney’s fees. That’ll teach him a lesson for lying after raising his right hand three times and swearing not to.

DOJ’s magnanimity comes as special prosecutor John Durham has begun noose-tightening indictments in his probe of individuals involved in creating and furthering the discredited “Crossfire Hurricane” investigation. The DOJ cannot prevent Durham from pursuing indictments of any former FBI executives, including McCabe, should the evidence lead to that. However, if he does, McCabe’s stunning absolution by a DOJ now controlled by the Democrats strongly indicates that a presidential pardon is likely in play for anyone who so vigorously investigated Republicans without an adequate basis to do so. In other words, it looks like these former FBI executives now have an “insurance policy” — to borrow an infamous phrase from former FBI special agent Peter Strzok.

McCabe’s re-polishing also has the secondary salutary effect of perpetuating the longstanding Washington tradition of pushing blame as far down the hierarchy stack as possible, in order to leave unsullied the elite command staff who set the tone and lead the charge. [..] McCabe was hurriedly fired on the one-yard line just short of retirement eligibility, which affected his access to a full FBI pension. His beef with that action has some merit as inordinately punitive. Restoration of his retirement benefits is not something that most FBI agents are going to begrudge him, given his otherwise long career in the FBI. However, the inspector general’s public report states that McCabe lied to investigators on four occasions, three of them while under oath. His firing followed the standards consistently applied to all other FBI agents.

“Committee Chairman Adam Schiff assured that public that “this whole smear on Joe Biden comes from the Kremlin.”

• Joe Biden and the Disappearing Elephant (Turley)

How Houdini made his 10,000 pound elephant Jennie disappear every night in New York’s Hippodrome remains a matter of some debate. There are no good pictures of his famous cabinet and Houdini later threatened to sue those claiming “disappearing elephants.” What is clear is that the sheer size and the audacity of the act (like that of the Bidens) contributed to the trick. The fact is that Jennie never left the large cabinet, people just didn’t see it. The Bidens achieved the same effect. They made a full-sized scandal disappear with the help of media and members who did not want the public to see it. Twitter banned postings about the laptop until after Biden was elected. The media dismissed the story as a conspiracy theory with some mocking the “New York Post and everyone else who got suckered into the ridiculous Hunter Biden Laptop story. Take a bow.”

Committee Chairman Adam Schiff assured that public that “this whole smear on Joe Biden comes from the Kremlin.” Some 50 former intelligence officials, including Obama’s CIA directors John Brennan and Leon Panetta, also insisted the laptop story was likely the work of Russian intelligence. The laptop is, of course, now recognized as genuine even by some of the early deniers. Hunter remains under criminal investigation for possible tax and money laundering violations. But the greatest “reveal” is the person referred to as “the Big Guy” and “Celtic” in these emails: President Biden.

Recently released emails reference payments to President Biden from son’s accounts and indicate the possible commingling of funds. Even more embarrassing, the shared account may have been used to pay a Russian prostitute named “Yanna.” In one text, a former secret service agent warns Hunter (who was holed up with a prostitute in an expensive hotel) “Come on H this is linked to Celtic’s account.” The question is whether prosecutors will continue to act like they do not see the elephant.

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.