Jack Delano Troop train on the Atchison, Topeka & Santa Fe, Grants, New Mexico March 1943

On June 11, exactly – only – a week ago, I wrote, in Japan Enters Financial Nowhere, about a new phase in Japan’s downfall, the demise of its famous savings surplus which had kept the worst of the worries about its economic reality somewhat at bay until recently.

When its economy crashed early 1990s Japan made one fatefully horrible decision: to not cleanse its banks of their debts, to do basically no defaults or restructuring. And this is the price they’re going to be paying for that decision: once there are no buyers for their cheap debt anymore, the fall will be deep, steep and fast. The rapidly ageing population will see their pension provisions plummet in value, and everyone will see taxes rise more than they can presently imagine just to keep a semblance of a government in place.

PM Shinzo Abe was elected in December 2012 and launched what soon became known as Abenomics almost immediately, It consists of three “arrows”: a giant increase in the money supply (though there was never a shortage), a huge increase in government spending, and “reform” measures, in particular a corporate tax cut. More on the latter below, I’d like to keep a chronological oder here..

A last(?!) desperate move by Abe is to be a massive switch from bonds to riskier assets by the $1.26 trillion Japan public fund GPIF, the worst largest pension fund. A move seemingly destined for failure, because the Bank of Japan has already killed off the market for government bonds by buying up everything. As David Stockman wrote, also on June 11:

Japan Pension Fund Plans Massive Bond Dump Into Dead Market

So this is how it works. Japan has the most massive public debt in the world relative to national income, but the implicit aim of Abenomics is to destroy the government bond market. After all, if inflation goes to 2% or higher, government bonds yielding 0.6% will experience thumbing losses. Even the robotic Japanese fund managers no longer want to hold the JGB – as evidenced by another session when no future contracts on either the 10-year or 20-year bond changed hands. [..] In effect, the BOJ is the bond market – that is, the buyer of first, last and only resort. [..] The implicit assumption is that the BOJ can ultimately buy all the bonds ever issued and the massive outpouring of new bonds yet to come.

On June 12, the Wall Street Journal ran this:

Bank of Japan Raises Export Hopes

The Bank of Japan raised its view on overseas economies Friday, building up hopes for a future pickup in exports that the central bank hopes will make the country’s domestically driven recovery more balanced and sustainable. Speaking after the bank left its monetary policy unchanged earlier in the day, BOJ Gov. Haruhiko Kuroda said it was fair to expect a moderate increase in exports given improvements in the economic situation abroad. Touching on action taken by other banks, Mr. Kuroda also said he saw no reason for the yen to strengthen against the euro following the European Central Bank’s recent easing decision. Japan’s recovery has so far largely been driven by robust domestic demand, departing from the economy’s usual reliance on the nation’s strength as an export powerhouse.

But a brighter outlook for the global economy could raise hopes for exports finally gaining traction in the coming months, possibly mitigating a likely temporary downturn stemming from a sales tax increase in April. The economy grew at an annualized rate of 6.7% in the first quarter of the year, but private economists expect it to contract more than 4.0% in the current quarter as the higher tax takes its toll on consumption. While Mr. Kuroda said the pullback in consumption after the higher levy was “within the range of expectations,” he held out hopes for a rise in exports on the back of a gain in the global economy. “The U.S. economy will likely accelerate its growth and the Chinese economy is heading for stable growth as its downward shift comes to a halt ” Mr. Kuroda said at a news conference. Against this backdrop, “it is fair to expect Japan exports to increase moderately,” Mr. Kuroda added.

Clearly, Mr. Kuroda is either lying or dreaming. I’ll gladly leave the choice between the two to your discretion. But I think it would be good to note that Kuroda knows about China’s problems, and he knows US Q1 GDP growth was negative, so it’s not overly obvious what his reliance on growth elsewhere in the world is based on.

Then, Reuters reported on June 13 that:

Japan’s Abe Unveils Plan To Cut Corporate Tax Rate To Spur Growth

Japanese Prime Minister Shinzo Abe unveiled a plan on Friday to cut the corporate tax rate below 30% in stages to help pull the economy out of two decades of sluggish growth and deflation. Investors have been scrutinising whether Japan can substantially lower the corporate tax rate – among the highest in the world – to spur growth in the world’s third-largest economy. Abe also needs to strike a delicate balance between stimulating growth and reining in snowballing public debt, twice the size of its $5 trillion economy. The corporate tax cut is a major issue to be included in the government’s key fiscal and economic policy outline, which will be finalised around June 27 along with a detailed “growth strategy” of structural reforms. “Japan’s corporate tax rate will change into one that promotes growth,” Abe told reporters, adding that he hoped the lower burden on companies would lead to job creation and an improvement also for private citizens.

While it’s true that Japan’s corporate tax rate is high, it’s just as true that Japan has the by far highest national debt among richer economies, and that therefore lower tax revenues may not only be no panacea, they may be a really bad idea. Abe could try to offset that with higher taxes on the population, but here’s thinking even he wouldn’t be that thick; for his plans to succeed even a little bit, he needs his people to spend more into the real economy, not on taxes. The April sales tax hike from 5% to 8% has been bad enough in that regard, so much so that step two of the hike to 10% next year has already come under heavy fire.

Today, the next blow in a by now long series is delivered through falling exports and imports numbers. Together, they may result in a shrinking trade deficit, but if the ultra-low yen we’ve seen since Abenomics took off (it lost 20% vs the US$) can’t even raise exports, what will happen now the lows are behind us?

Japan Exports Disappoint, Risks Hitting Economy Hard

Japan’s annual exports declined for the first time in 15 months in May as shipments to Asia and the United States fell, threatening to knock the economy hard at a time when domestic consumption is being crimped by a national sales tax increase. The data backs expectations for additional stimulus from the Bank of Japan in coming months, particularly if market confidence takes a hit as external demand proves elusive. “If exports fail to pick up while domestic demand stagnates, that would heighten calls for the BOJ to act,” said Takeshi Minami, chief economist at Norinchukin Research Institute.

Total exports fell 2.7% in May on the year, Ministry of Finance data showed on Wednesday, compared with a 1.2% drop seen by economists and a 5.1% rise in April. On a seasonally adjusted basis, exports fell 1.2% in May from the prior month. The central bank is counting on exports growth to partially offset the impact of a sales tax hike to 8% from 5% in April, but the MOF data will be a worry for policy makers. Adding to the BOJ’s concerns over soft exports to Asia is the surprising weakness in shipments to the United States – Japan’s biggest export market – which suggests a recovery in advanced economies is slow to filter through to exporting firms.

This was underscored in Singapore’s exports for May, which unexpectedly fell on weak shipments to its key markets. The city-state’s non-oil domestic exports to the United States fell 8.8% in May from a year earlier, compared with 11.7% growth in April. In South Korea, exports to the U.S. rose 5.5% on-year, but that was much slower than April’s 19.3% jump. The MOF data showed Japan’s U.S.-bound exports fell 2.8%, the first drop in 17 months led by decline in car shipments, while exports to China rose 0.4% on-year. Exports to Asia, which account for more than half of Japan’s total exports, fell 3.4% in May from a year earlier, the first annual decline in 15 months.

Increases in exports are such a crucial part of Abenomics, it’s hard to overestimate their importance. Well, there are no increases, there are declines. To base one’s entire hopes and confidence of turning the world’s third largest economy around, on growth in the US, EU and China that doesn’t even exist, despite all the brouhaha about recovery that emanates from every media pore on a 24/7 basis, is a bet that the Japanese and their elected representatives should scrutinize until the entire onion has been peeled. Surely there are other options available, imaginable, than to recklessly add vastly more debt to an economy that’s already shouldering an until recently unthinkable load of it.

There comes a point when politicians basically put the lives and well being of their citizens on the line at a crap table in a dark and shady casino, pretending they’re still the ‘house’ while they’re not (they bet and lost the house). Japan and Abe are at that point. Savings rates have fallen through the bottom. Wages and spending have declined for years. Government bonds no longer trade, except when the Bank of Japan steps in. Today’s data make clear that exports won’t save the day, as other nations are mired in various stages of economic decline just as much and almost as deeply. In that light, and this is important to recognize, Japan is merely a step or two ahead of us other nations that live on debt and debt alone, and there’s no way it won’t schlepp us down all the more and all the more rapidly with it.

Great piece I overlooked on June 15.

• The Coming ‘Tsunami Of Debt’ And Financial Crisis In America (Guardian)

According to research, sectors of the American economy are building to a bubble of parallel and possibly larger scope than the conditions preceding the 2008 financial crisis. Photograph: Tony O’Brien/Action Images The US Congressional Budget Office is projecting a continued economic recovery. So why look down the road – say, to 2017 – and worry? Here’s why: because the debt held by American households is rising ominously. And unless our economic policies change, that debt balloon, powered by radical income inequality, is going to become the next bust. Our macro models at the Levy Economics Institute are showing that the US economy is about to face a repeat of pre-crisis-style, debt-led growth, based on increased borrowing. Falling government deficits are being replaced by rising debts on everyone else’s ledgers – well, almost everyone else’s.

What’s emerging is a new sort of speculative bubble, this time based on consumer and corporate credit. Right now, America is wrestling a three-headed monster of weak foreign demand, tight government budgets and high income inequality, with every sign that these conditions will continue. With that trio in place, the anticipated growth isn’t going to be propelled by an export bonanza, or by a government investment boom. It will have to be driven by spending. Even a limping recovery like the one we’re nursing along today depends on domestic demand – consumer spending not just by the wealthy, but by everyone else. We believe that Americans will keep consuming at the same ever-rising rates of past decades, during good times and bad. But for the vast majority, wages and wealth aren’t going up, so we’re anticipating that the majority of Americans – the 90% – will once again do what was done before: borrow, and then borrow more.

By early 2017, with growth likely to stall even according to CBO predictions, it should be apparent that we’re reliving an alarming history. Middle- and low-income households have been following a trajectory of an ever-higher ratio of debt to income. That same ratio has been decreasing for the most well-off 10%, who are continuing to see debt decline and wealth rise. Why is the relationship between the debt of the 90% and the gains of the 10% so significant? The evidence demonstrates that the de-leveraging of the very rich and the indebtedness of almost everyone else move in tandem; they follow the same trend line. In short, there’s a strong and continuous correlation between the rich getting richer, and the poor – make that the 90% – going deeper into debt. That the share of income and wealth to the richest has skyrocketed is certainly not a new revelation.

The more the top 10% has prospered, saved and invested, the more the bottom 90% has borrowed.

• US Housing Hit The Wall Of Wall Street In May (TPit)

It always starts with a toxic mix. Last fall when sales that had been predicted to continue their miraculous ascent were suddenly swooning, soothsayers dealt with it by developing a whole plethora of excuses. At each new disappointment, they dragged out new excuses. But in May, the toxic mix came to a boil, and now there are no more excuses: sales plunged and inventories jumped. The housing market is buckling under its own inflated weight. And what excuses they’d come up with! Last fall, the fiscal cliff, the threat of a government shutdown, the possibility of default that was belittled by everyone supposedly made home buyers uncertain. But these issues were swept under the rug, and sales continued to drop into the winter. Polar vortices were blamed, though in California, where the weather was gorgeous, sales dropped faster than elsewhere. Then the spring buying season came around when massive pent-up demand was supposed to sweep like a tsunami over the land.

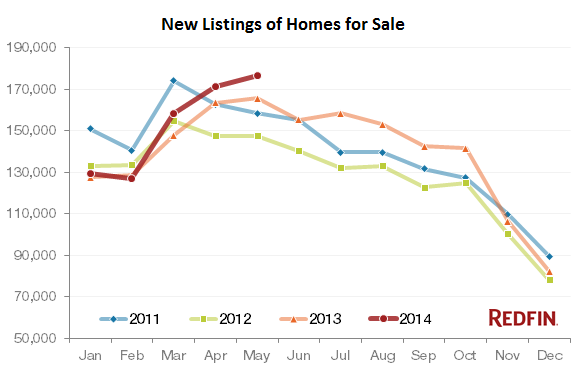

But sales continued to decline. So tight inventories were blamed. There simply weren’t enough homes for sale, it went. Alas, in May, new listings rose 6.5% from a year ago to a four-year high in the 30 markets that electronic real-estate broker Redfin tracks. People were dumping their homes on the market; new listings soared 25.5% in Ventura, CA, 15.8% in West Palm Beach, and 15.4% in Baltimore. This is what it looked like for all 30 markets combined. The onslaught of new listings added to the unsold inventory and pushed up the total number of homes for sale by 9.1% to the highest level since August 2012. And in this elegant manner, the final excuse of tight inventories causing the plunge in sales went up in smoke. This rise in inventory has been going on all year. Yet, as Redfin pointed out with a soupçon of irony, it was “surprising to some, given the speculation about extremely low inventory creating intense pent-up demand among buyers who have been waiting for months with low interest rates burning holes in their pockets.”

• Facing Extinction, Hedge Funds Go All In (Zero Hedge)

Several years ago we said that in the New centrally-planned normal, in which the Fed chairmanwoman is the Chief Risk Officer of the s0-called market, and where no selloffs are allowed because any major drop in a market artificially supported by trillions in artificial liquidity, would probably be its last (as it would crush the “credibility” of all-in central banks) that old “smartest money” concept, the 2 and 20 hedge fund, has become an anachronistic relic of the past (especially once Stevie Cohen ruined the game for everyone and took legal insider trading aka “expert network” out of the picture and forced hedge funds to make money the old fashioned way – legally).

Now, for the first time, we have empirical proof that hedge funds are indeed on the verge of extinction courtesy of the New artificial Normal. In its hedge fund quarterly note (which it clearly ripped off from Goldman), Bank of America has concluded what we said in the beginning of the decade: “Hedge Funds are less attractive post the financial crisis with lower alpha and less diversification benefits.” Or, in other words, hedge funds (for the most part: this excludes those extortionists also known as activists who successfully bully management teams into levering up in order to buyback record amounts of stock, in the process burying their companies and employers when the next downturn arrives) no longer provide a service commensurate to their astronomical fees. Or any service, for that matter, that one couldn’t get by simply buying the S&P500.

Here is the tombstone for hedge funds, from Bank of America, in two paragraphs:

Since the financial crisis, Hedge funds have generated positive alpha of 0.0999%, which is lower than the 0.7922% of positive alpha generated before the financial crisis. Additionally, hedge funds are more exposed to market risks than before the financial crisis. Since 2009 the CAPM model has explained 75% of HF returns, but pre-financial crisis CAPM explained only 2.96% of returns. In summary, although hedge funds still offer positive risk adjusted returns, the investment is becoming less attractive as an asset class due to the lower alpha and less diversification benefits.

The Fed too still pretends to be the House.

• Horror Show Called “Fed-Gate” May Come To Your Bond Fund Soon (Stockman)

The Financial Times is not exactly a rumor mill, so its recent headline amounts to a thunderbolt: “Fed Looks At Exit Fees On Bond Funds”. And so the shoes begin to fall. Owing to the Fed’s brutal financial repression since December 2008 (i.e. zero yield on short-term funds), there has been massive scramble for yield that has driven trillions into corporate and high yield bond funds. This means that liquid funds which would have normally been parked in bank deposits or money market funds have been artificially displaced. That is, they have been chased by the dictates of the monetary politburo into far more illiquid and risky investment vehicles owing to zero yields in their preferred financial venues. But now it is dawning on at least some of the more market savvy occupants of the Eccles Building that they have created a monumental financial log-jam waiting to happen. In their jargon, the migration of trillions into bond funds since the financial crisis has resulted in a sweeping “maturity transformation”. As former governor Jeremy Stein succinctly put it,

“It may be the essence of shadow banking is … giving people a liquid claim on illiquid assets.”

What Stein means is that the traditional money markets existed for a reason—even if returns were inferior to what could be obtained in longer duration fixed income securities or investments with equity-like features such as junk bonds. Corporations and individuals who invested in money market instruments, including bank CDs, were willing to absorb the yield penalty in return for the assurance of absolute daily liquidity that the funds in question required. But zero return is not a market driven liquidity penalty; it is an arbitrary prohibition imposed on the market by the monetary politburo. So now we have a giant anomaly. Trillions of daily liquidity demanding investments are potentially stuck in bond funds which could not provide it during a crisis. In effect, any attempt by bond funds managers to meet a surge of redemptions calls would make the crisis surrounding the Reserve Prime Fund’s “breaking the buck” in September 2008 seem like a Sunday School picnic.

… in its mindless drive to manipulate financial markets and generate artificial demand for credit, the Fed has created the potential for a massive run on bond funds should a new financial crisis be triggered by one black swan or another. And once again it is evident that the market’s natural process of “price discovery” has been destroyed in favor of ham-handed “price administration” by our monetary central planners. Yet the monster they have already created—-a massive log-jam at the bond fund exit gates—-would pale compared to the deformations and anomalies that would result from the imposition of a government dictated exist fee on unsuspecting investors. Even the announcement of a rule-making would potentially trigger the very kind of sell-off that it would be designed to prevent.

• Japan Exports Disappoint, Risks Hitting Economy Hard (Reuters)

Japan’s annual exports declined for the first time in 15 months in May as shipments to Asia and the United States fell, threatening to knock the economy hard at a time when domestic consumption is being crimped by a national sales tax increase. The data backs expectations for additional stimulus from the Bank of Japan in coming months, particularly if market confidence takes a hit as external demand proves elusive. “If exports fail to pick up while domestic demand stagnates, that would heighten calls for the BOJ to act,” said Takeshi Minami, chief economist at Norinchukin Research Institute.

Total exports fell 2.7% May on the year, Ministry of Finance data showed on Wednesday, compared with a 1.2% drop seen by economists and a 5.1% rise in April. On a seasonally adjusted basis, exports fell 1.2% in May from the prior month. The central bank is counting on exports growth to partially offset the impact of a sales tax hike to 8% from 5% in April, but the MOF data will be a worry for policy makers. Adding to the BOJ’s concerns over soft exports to Asia is the surprising weakness in shipments to the United States – Japan’s biggest export market – which suggests a recovery in advanced economies is slow to filter through to exporting firms.

This was underscored in Singapore’s exports for May, which unexpectedly fell on weak shipments to its key markets. The city-state’s non-oil domestic exports to the United States fell 8.8% in May from a year earlier, compared with 11.7% growth in April. In South Korea, exports to the U.S. rose 5.5% on-year, but that was much slower than April’s 19.3% jump. The MOF data showed Japan’s U.S.-bound exports fell 2.8%, the first drop in 17 months led by decline in car shipments, while exports to China rose 0.4% on-year. Exports to Asia, which account for more than half of Japan’s total exports, fell 3.4% in May from a year earlier, the first annual decline in 15 months.

• Bad Trade Data Casts A Cloud Over Japan (CNBC)

Japan’s exports and imports tumbled in May, data on Wednesday showed, raising concern about the outlook for the world’s third biggest economy as it weathers a rise in the country’s consumption tax. May exports fell 2.7% from a year earlier, the first annual decline in 15 months. That compared with a 5.1% jump in May and was much worse than analyst expectations in a Reuters poll for a 1.2% decline. Imports fell 3.6% on-year, compared with expectations for a 1.7% rise, bringing the trade balance to a deficit of 909 billion yen ($8.9 billion) in May. “In today’s world of very low-dollar value export growth, Abenomics could only count on export-led growth by taking market share. The easiest way to take market share is by depreciating the currency, which hasn’t been happening in Japan since the May 2013 taper tantrum,” said Tim Condon, the head of research of Asia at ING Financial Markets.

“It remains to be seen whether Abenomics can stimulate domestic spending sufficiently to offset weak export demand as only China and Singapore have managed to do this year,” he added. Abenomics is the term many analysts and commenters use to describe the economic policies of Japan’s Prime Minister Shinzo Abe, who came to power in late 2012 with a pledge to revive the country’s growth prospects. Part of that policy has been massive monetary stimulus to help weaken the yen and end deflation. Although the yen weakened about 22% against the dollar in 2013, its impact on exports has faded while the currency has strengthened almost 3% this year. The breakdown of the trade data showed that exports to Asia and the U.S. fell in May. “We see some sluggishness in exports to Asian countries such as China but exports to Europe picked up so that shows Japan is likely to be supported by the developed economies in the months ahead,” said Junko Nishioka, chief economist at RBS in Tokyo.

• Japan May Trade Deficit Shrinks As Energy Imports Fall (AFP)

Japan’s trade deficit narrowed in May as imports turned down for the first time in a year and a half, data showed Wednesday, but weaker shipments abroad helped keep the trade balance in the red. The figures – which suggested the world’s number three economy was slowing – reflected a fall-off in spending after sales taxes rose in April, a move seen as crucial to paying down a huge national debt but one that threatened to stall the nation’s budding economic recovery. The trade deficit has ballooned since the 2011 Fukushima atomic crisis forced the shutdown of nuclear reactors and a shift to pricey fossil-fuel imports to plug the energy gap. Nuclear once supplied more than a quarter of Japan’s power.“The weaker yen had contributed to the widening of the trade deficit last year, as it pushed up import prices by more than it raised the value of exports,” said Marcel Thieliant of Capital Economics. “However, the boost to trade values from the weak yen is now clearly over.” On Wednesday, the finance ministry said Japan’s May trade deficit narrowed 8.3% from a year ago to 909 billion yen ($8.9 billion), marking the 23rd consecutive monthly shortfall. Imports were down 3.6% to 6.5 trillion yen, the first on-year drop in 19 months as crude oil shipments fell by nearly 20% in volume terms. Domestic demand for gasoline and other products jumped in the months ahead of the consumption tax rising to 8.0% from 5.0%, as millions of shoppers dashed to stores before prices went up. May exports fell 2.7% to 5.6 trillion yen, the first downturn in over a year as demand for refined fuel and vehicles fell overseas.

• Japan’s Abe Unveils Corporate Tax Cut, Other Reforms (The Tell)

In a series of widely expected policy announcements yesterday, Japanese Prime Minister Shinzo Abe has pulled back his bow of state and let fly the “third arrow” of his trio of economic offensives, with a planned cut to the corporate tax serving as the pointy tip. Abe’s first arrow, readers might remember, was massive easing from a cooperative Bank of Japan, while the second arrow involved government spending. And now comes the reform arrow, with corporate tax relief as its highest-profile element. While details of the long-awaited tax cut and other reform proposals are expected later this month, Monday’s announcement made it clear that the current rates, which run as high as 35.64% for Tokyo-based companies, will be reduced drastically. How far it will go varies by source — Kyodo News says the base rate will fall “to below 30% within a few years from fiscal 2015,” while the Nikkei sees it at “the 20% level over the next several years.”

Either way, Capital Economics isn’t completely buying into the hype. In a note out Monday, CapEcon’s Marcel Thieliant notes that for starters, only about 30% of Japanese companies even pay the corporate tax. “It is not clear that corporate investment would strengthen significantly. The return on investment in Japan is lower than elsewhere as a result of a large capital stock, and capital spending is already higher than in other Group of 7 countries,” Thieliant writes, adding that boosting investment would need further tax reforms, including changes to loss carry-forwards and depreciation allowances. “Nonetheless, this is good news both for the equity markets and the economy as a whole,” Thieliant writes. “Japan’s corporate tax rate is among the highest in the Organization for Economic Cooperation and Development, and academic studies show that taxes on corporate profits are particularly detrimental to economic growth.”

Anyone surprised raise your hands. Both.

• Britain’s Poor Worse Off Than Ever (RT)

The poorest 20% of UK households earn just $9,530 annually, a dramatically lower rate than in other countries with a similar average income, according to new research. Few Britons would probably agree with the observation that “life is much worse (in the UK) than it is for the poorest fifth in virtually every other northwest European country,” but that is exactly the conclusion the High Pay Centre, an independent British think-tank, has made in a newly released study. Using figures from the OECD Better Life Index, the report shows that average UK household incomes of $53,785, which makes up the wealthiest 20% in the UK, ranked third in EU countries, lagging behind Germany and France. But that is where the economic similarities between the UK and the EU come to a screeching halt.

The OECD estimates the average income of the bottom 20% of UK households at just $9,530, which is significantly lower than the poorest 20% in France ($12,653), Germany ($13,381), Belgium ($12,350), the Netherlands ($11,274) and Denmark ($12,183). The report revealed Britain’s rapid decline from economic equality in just a few decades. “Since 1960, Britain has gone from being more economically equal than Sweden to being one of the most unequal countries in the developed world,” according to the High Pay Centre. “Of the 32 members of the Organization for Economic Co-operation and Development (OECD) only Portugal, Israel, the United States, Turkey, Mexico and Chile are more unequal than the UK.”

In fact, the think-tank said marginalized UK living standards are much closer to those of former Eastern bloc countries, such as Slovenia and the Czech Republic. The report noted that “inequality does not happen by chance,” but arises from deliberate political, social and cultural choices in areas like “taxation, public spending, industrial relations and public tolerance of high and low pay.” “These figures suggest we need to be more concerned about inequality and how prosperity is shared, as well as average incomes or aggregate measures like GDP,” as the Financial Times quotes Deborah Hargreaves, director of the High Pay Centre. “The fact that the rich are richer in the UK than many other countries hides the fact that the poor are poorer.”

“There are two other explanations. The first is that the governor knows something we don’t, although it would be nice to know what that is. The second is that he is not quite as smart as he thinks he is and is making it up as he goes along.”

• Does Mark Carney Know Something We Don’t? (Guardian)

Mark Carney surprised the financial markets last week when he said interest rates could be raised from their emergency level of 0.5% sooner than the City expects. Throughout his first year at Threadneedle Street the governor of the Bank of England has talked down the prospect of higher borrowing costs, using forward guidance to reassure businesses and households that the Bank was not keen on an early tightening of policy. So what changed between the governor’s doveish comments when he presented the Bank’s May inflation report and his Mansion House speech a month later? Not inflation as measured by the consumer price index, clearly. That fell to 1.5% in May is and still on a downward trend. Not the producer prices index, which measures inflationary pressure in the pipeline. This shows that despite annual growth of 3%, manufacturers’ factory gate prices are increasing by less than 1% a year. Not inflation expectations, a measure of where the public think the cost of living is heading.

And certainly not trends in wages, where whole-economy earnings growth is running at below 1% a year. All this makes Carney’s new hawkishness a bit hard to explain, particularly as he has been banging on for months about how the Bank’s new macro-prudential tools will enable it to cool down the property market – the one part of the economy where inflation is a looming problem. Forward guidance, his big policy initiative on taking over as governor from Mervyn King, appears to have been junked in favour of doing what his predecessor did – assessing the state of the economy on a month-by-month basis. If you want to be generous to the governor, you could argue that he is waving the interest-rate stick in the hope that he doesn’t have to use it. There are two other explanations. The first is that the governor knows something we don’t, although it would be nice to know what that is. The second is that he is not quite as smart as he thinks he is and is making it up as he goes along.

Lost shine. “We have seen the property market change rapidly this year”.

• China Home Prices Fall Month-On-Month, First TIme In 2 Years (CNBC)

China’s home prices rose at the slowest annual pace so far this year in May, official data showed on Wednesday. Average new home prices in China’s 70 major cities rose 5.6% from a year earlier, slowing from April’s 6.7% rise, according to Reuters’ calculations based on data released by the National Bureau of Statistics (NBS). In month-on-month terms, prices dropped 0.2% to register its first fall in two years. In Beijing, new home prices rose 7.7% in May from a year earlier compared with April’s 8.9% increase, while prices in Shanghai were up 9.6% versus 11.5% growth in April. Markets took the news in stride; real-estate developer stocks traded mostly higher with Gemdale, Poly Real Estate and China Merchants Property up 0.4% each. Shanghai and Hong Kong stocks opened flat.

After increasing at double-digit rates through most of last year, home prices started cooling in late 2013 as a sustained campaign to clamp down on speculative investment and easy credit took a bite. The softening real estate market helped drag annual economic growth to 7.4% in the first quarter, and a sustained fall would risk China missing its economic growth target for the first time in 15 years, analysts have warned China’s property sector is estimated to account for around 20% of the mainland’s gross domestic product (GDP); the segment is closely watched for cues about the direction of the world’s second-largest economy. “We have seen the property market change rapidly this year. I think this quarter and coming quarter till rest of the year, market will be under pressure which means transaction volume will be struggling there or go down, and price is definitely not going to go up nation-wide,” said Vincent Mo, executive chairman at SouFun Holdings, a leading real estate Internet portal in China.

‘They did it “for the family”‘.

• Relatives Shed Assets As China’s Leader Fights Graft (NY Times)

As President Xi Jinping of China prepares to tackle what may be the biggest cases of official corruption in more than six decades of Communist Party rule, new evidence suggests that he has been pushing his own family to sell hundreds of millions of dollars in investments, reducing his own political vulnerability. In January of last year, just after Mr. Xi took power, his older sister and brother-in-law finalized the sale of their 50% stake in a Beijing investment company they had set up in partnership with a state-owned bank. According to the billionaire financier Xiao Jianhua, who co-founded the company that bought the stake, the move was part of a continuing effort by the family to exit investments. They did it “for the family,” Mr. Xiao’s spokeswoman said. A review of Chinese records shows that there is evidence to back up Mr. Xiao’s claim. From 2012 until this year, Mr. Xi’s sister Qi Qiaoqiao and brother-in-law Deng Jiagui sold investments in at least 10 companies, mostly focused on mining and real estate.

In all, the companies the couple sold, liquidated or, in one case, transferred to a close business associate, are worth hundreds of millions of dollars, part of a fortune documented in a June 2012 report by Bloomberg News. No investment stakes have been tied directly to Mr. Xi or his wife and daughter. But the extensive business activities of his sister and brother-in-law are part of a widespread pattern among relatives of the Politburo elite, who have built up considerable fortunes by trading on their family’s political standing. After taking power, Mr. Xi vowed to do battle with the “tigers and flies” — senior and petty officials engaged in corrupt or unseemly business activities — to shore up the party’s credibility. But there are doubts that he could carry out a wholesale crackdown on financial dealings by ruling families, who are deeply enmeshed in the state-driven business culture of the country.

Printing presses?

• What Should China Buy With Its $3.9 Trillion Reserves? (Caixin)

China’s foreign exchange reserves rose to $3.948 trillion at the end of the first quarter. The figure in 1978 was $167 million, and in November 1996 it surpassed $100 billion for the first time. The change has been amazing. There have been many thoughts about how we in China can make use of the forex reserve, ranging from buying assets abroad to using it as leverage in diplomatic talks. What needs emphasizing is that the reserve is not a free buffet. It corresponds to the central bank’s debt in yuan and costs dearly to maintain. In a traditional sense, the forex reserve is meant to serve as a buffer in times of emergency and is to be used for repayment of external debt. The basic requirement for its investment is guaranteeing the safety of the principal rather than pursuing high yields. This is true for even the part of forex reserve in excess of the amount required for ensuring its traditional purposes are met. Also, it is important to know that 40% of the forex reserve came through operations under the capital account.

In other words, about $1.6 trillion of the reserve, be it hot money or foreign direct investment, flew into China because the investors were betting on the country’s positive outlook. If these investors want to take their investments out of the country, the government can take measures to slow the exit of capital, but there is no legal way to stop it. Granted, the odds are extremely low that all foreign investments would leave the country, especially if China sticks to the path of reform and opening up. The other 60% of the reserve, which resulted from operations under the current account, correspond to the debt owed to companies and individuals who sold their forex holdings to banks. The reason they did not hold the money in foreign currencies is that investing in yuan is currently more profitable. Also, there is a lack of channels for private investors to invest overseas. That is why China’s forex investments are primarily conducted by the forex administrator.

And nobody cares.

• One Quarter Of Public Company Deals Involve Insider Trading (RT)

An award-winning new study claims that more than a quarter of all public company deals involve transactions that could be consider examples of insider trading. The recently published report from Menachem Brenner and Marti G. Subrahmanyam at New York University and Patrick Augustin of McGill examined years of data concerning mergers and acquisitions, or M&As, to spot unusual trends in the 30 days preceding those announcement. According to their research, around one-in-four deals contained evidence of insider trading. “We became intrigued by reports of a number of illegal insider trading cases in options ahead of takeover announcements, in particular the leveraged buyout of Heinz by Warren Buffet and 3G Capital,” co-author Augustin said in a statement. “Hence, we set out to investigate whether instances of informed trading in options occur systematically or whether they were just random bets.”

“The statistical evidence we present is consistent with informed trading strategies, and is too strong to be dismissed as just random speculation. Our findings likely will be highly useful to regulators, firms and investors in understanding where and how informed investors trade,” Augustin added. Journalist Andrew Ross Sorkin called the group’s study “perhaps the most detailed and exhaustive of its kind” and said its results show that “the truth is worse than we imagine” when it comes down to just how commonplace insider trading really is. The results of their study, Sorkin wrote, “are persuasive and disturbing, suggesting that law enforcement is woefully behind — or perhaps is so overwhelmed that it simply looks for the most egregious examples of insider trading, or for prominent targets who can attract headlines.”

Indeed, the professors wrote that their research suggests that even though roughly a quarter of public deals involve insider trading, the United States Securities and Exchange Commission litigated only “about 4.7% of the 1,859 M&A deals included in our sample,” which was composed of hundreds of transactions made between 1996 and the end of 2012. When the SEC does intervene, they added, it takes “on average, 756 days to publicly announce its first litigation action in a given case. Thus, assuming that the litigation releases coincide approximately with the actual initiations of investigations, it takes the SEC a bit more than two years, on average, to prosecute a rogue trade,” which on average was worth about $1.6 million apiece, according to their study.

US courts will break this down too.

• Argentina Plans Debt Swap To Prevent Default (WSJ)

Argentina unveiled a plan to change the terms of its bonds that aims to prevent the country’s second default in 13 years, while continuing a long-running battle with a small group of creditors. The proposal would swap bonds governed by U.S. law for debt that falls under Argentina’s jurisdiction. Investors would give up the rights conferred by U.S. law and the security of having payments processed by a U.S. bank. But they would continue to receive income from Argentina’s bonds, which are among the world’s highest-yielding sovereign debt. The maneuver is an end run around a U.S. court ruling requiring Argentina to pay hedge funds that refused to go along with a debt restructuring after the country’s 2001 default.

On Monday, the U.S. Supreme Court declined to review the decision, leaving Argentina until the end of the month to reach a deal with the holdouts or default on more than $500 million in payments to holders of the restructured bonds. “What they’re going to attempt to do is very challenging,” said Jorge Mariscal, emerging-markets chief investment officer at UBS Wealth Management, which manages $1 trillion in assets. “It would be extremely unusual for Argentina to get away with something like this.” Mr. Mariscal has been recommending clients avoid Argentine bonds. No government has attempted this maneuver before, and it isn’t clear whether Argentina will be able to pull it off, analysts said. The plan to switch jurisdictions underscores how Argentina has become hemmed in by a string of defeats in U.S. courts and requires more desperate measures to avoid paying over $1.5 billion to holdout creditors, payments President Cristina Kirchner on Monday likened to “extortion.”

Argentina’s bond prices steadied Tuesday after falling sharply following Monday’s Supreme Court action, as investors waited for the Argentine government to announce its next move. However, the price of insuring Argentina’s debt rose, indicating fears of a default. The country’s main stock index rose 3.8%, with the market closing before the government’s announcement, after falling 10% a day earlier. On Tuesday, Standard & Poor’s Ratings Services downgraded Argentina’s debt to triple-C-minus with a negative outlook, three notches above default, from triple-C-plus. On Tuesday, the International Monetary Fund reiterated its warning that Argentina’s legal defeat could undermine future sovereign-debt restructurings by other governments. “We are concerned about possible broader systemic implications,” the IMF said.

As I said when this first was mentioned.

• Ukraine Seeks To Fill ‘Gas Gap’ With Reverse Flows. Is It Legal? (RT)

Reverse flows of Russian gas from some of the European countries like Slovakia and Poland are neither legal nor viable, experts tell RT. The comments follow Ukraine’s claims it’s going to use reverse schemes, after Gazprom cut its supplies. On Monday, Russia switched Ukraine to a prepayment system for gas supplies, saying it wouldn’t send gas directly unless it paid its $4.5 billion debt in full. Ukraine has responded by saying it could receive up to 20 billion cubic meters in reverse flow from neighboring Slovakia, Poland and Hungary, a practice Gazprom and RT experts doubt is legal. “It depends on the contracts between Gazprom and the European recipient. As far as we know, there is a non re-export clause that means gas received in Europe should actually be utilized in Europe for downstream purposes, it shouldn’t be re-exported, there is strong legal question there,” Marat Terterov, Executive Director of the Brussels Energy Club, told RT.

One of the main, and most simple stumbling blocks, is the contract itself, which doesn’t allow the importing countries to redistribute the supplies as they please. “A lot of this gas is Gazprom gas being delivered to the EU and it may be outside of the legal abilities of EU customers to de facto export that back to Ukraine,” Terterov said. The next big hurdle is Ukraine’s position as a non-EU member state, and the European Commission’s jurisdiction over it. At present, neither body has any official precedent in how to deal with the situation. “Oriented towards mitigating the energy security concerns of the East EU members, they are not intended to mitigate the concerns at the energy security level of a non-EU member such as Ukraine,” Terterov said. Brussels will therefore have no choice but to leave discussions between Gazprom and Naftogaz.

More Francis. Bless him.

• Pope Calls Out ‘Greedy’ Bankers Getting Rich On Financial Speculation (RT)

Pope Francis has called on “greedy” bankers to establish a stricter ethics code, and stop getting rich through financial market speculation. He attacked the practice of hedging as ‘intolerable’ equating it to stealing food from the poor. “It is increasingly intolerable that financial markets are shaping the destiny of peoples rather than serving their needs, or that the few derive immense wealth from financial speculation while the many are deeply burdened by the consequences,” Pope Francis said at an investors ethics’ seminar at the Vatican on Monday. Specifically, the pope denounced the practice of betting on the price of commodities such as corn, meat, and rice, which can drive up food prices and trigger periods of starvation in parts of the worlds.

“Speculation on food prices is a scandal which seriously compromises access to food on the part of the poorest members of our human family,” he said. This Pope called for an end to this “scandal” and said that finance institutions should serve the interests of all mankind, and not just wealthy and privileged individuals. Pope Francis has been more vocal than any other Pope on the modern superstructure of wealth, which in his first major published work as a Pope, The Joy of the Gospel, he slammed as a “new tyranny” and called on the rich to share their wealth. In the same speech he equated not sharing wealth with the poor to stealing.

There’s profit in misery.

• Bentley in Belgravia Shows Greece Is Good for Buyout CEO (Bloomberg)

Few financiers in London covet a job with a government-owned Greek bank. A glimpse of Pavlos Stellakis’s Bentley or his townhouse in Belgravia might have changed their minds. For more than a decade, Stellakis has presided over a private-equity business for Greece’s oldest and largest lender. While the bank and the country’s economy spiraled toward collapse, he prospered. National Bank of Greece received its first state rescue in 2009, the same year Stellakis was awarded a $3.8 million bonus. Since 2010, he has earned at least 60% more annually in salary than the bank’s chief executive officer, according to company documents. The funds he oversees have underperformed most peers and delivered few profits, the documents show.

Greek taxpayers, who own 57% of Athens-based National Bank after its $11.5 billion bailout last year, have no say in Stellakis’s compensation, according to two people with knowledge of the matter. Instead of being determined by the bank, it’s set by a three-person committee at NBGI Private Equity Ltd. that includes Stellakis himself, according to the company’s website. “At a time when people’s wages and pensions are being cut, for executives at banks that are being supported by public funds to be paid so much is wrong and it shouldn’t happen,” Louka Katseli, who was Greece’s economy minister when the nation received its first international bailout in 2010, said, speaking generally and not specifically about Stellakis.