Lewis Wickes Hine Night scene in Cumberland Glass Works, Bridgeton, NJ 1909

“Every time someone says, ‘There is a lot of cash on the sidelines,’ a tiny part of my soul dies.”

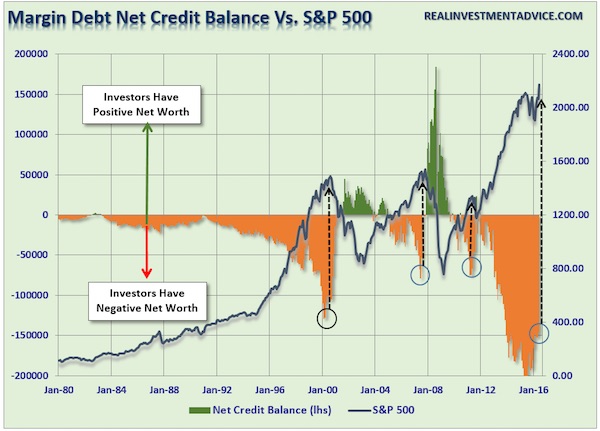

Scary graph.

• (There’s No) Money In The Mattress (Roberts)

Here is a myth that just won’t seem to die: “Cash On The Sidelines.” This is the age old excuse why the current “bull market” rally is set to continue into the indefinite future. The ongoing belief is that at any moment investors are suddenly going to empty bank accounts and pour it into the markets. However, the reality is if they haven’t done it by now after 3-consecutive rounds of Q.E. in the U.S., a 200% advance in the markets, and now global Q.E., exactly what will that catalyst be? However, Clifford Asness summed up the problem with this myth the best and is worth repeating:

“Every time someone says, ‘There is a lot of cash on the sidelines,’ a tiny part of my soul dies. There are no sidelines. Those saying this seem to envision a seller of stocks moving her money to cash and awaiting a chance to return. But they always ignore that this seller sold to somebody, who presumably moved a precisely equal amount of cash off the sidelines. If you want to save those who say this, I can think of two ways. First, they really just mean that sentiment is negative but people are waiting to buy. If sentiment turns, it won’t move any cash off the sidelines because, again, that just can’t happen, but it can mean prices will rise because more people will be trying to get off the nonexistent sidelines than on.

Second, over the long term, there really are sidelines in the sense that new shares can be created or destroyed (net issuance), and that may well be a function of investor sentiment. But even though I’ve thrown people who use this phrase a lifeline, I believe that they really do think there are sidelines. There aren’t. Like any equilibrium concept (a powerful way of thinking that is amazingly underused), there can be a sideline for any subset of investors, but someone else has to be doing the opposite. Add us all up and there are no sidelines.”

Margin debt levels, negative cash balances, also suggest the same. Cash on the sidelines? Not really.

And there are plenty plans to ‘do more’.

• Sub-Zero Government Bonds Turn the Hunt For Yield Upside Down (BBG)

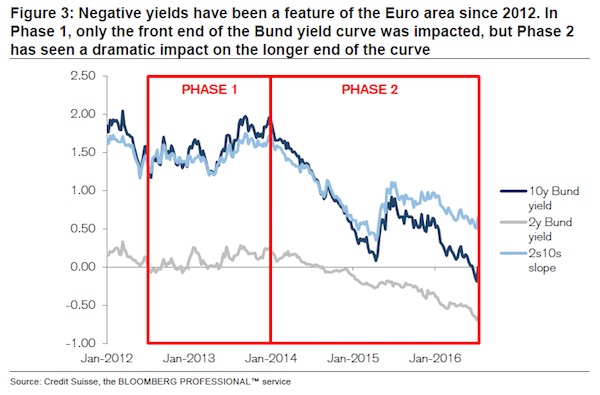

The erosion of yields on government debt is generally thought to push investors into riskier assets as they seek out higher returns. That’s true, argue Credit Suisse analysts in a new note, but only in the ‘first phase’ of a negative yield world. That is, when yields on government bonds with shorter-durations dip below zero, total returns on riskier assets such as junk-rated corporate debt do trump returns on German bunds. That tendency disappeared, however, as yields on longer-dated government debt also fell into negative territory — at least in Europe.

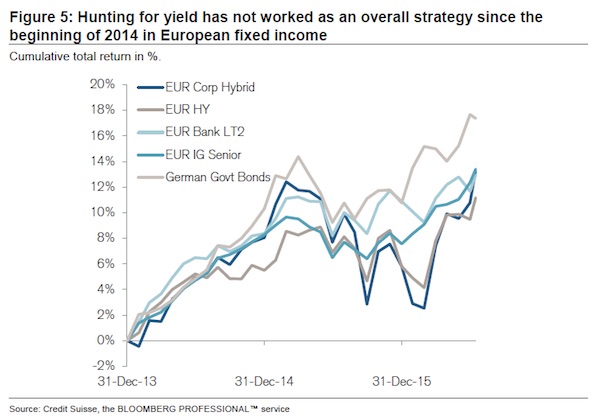

“The defining characteristic of Phase One is a strong outperformance of high-yielding credit assets versus low-yielding credit assets and government bonds, i.e. a strong hunt for yield trend. Nothing unusual so far,” write Credit Suisse’s William Porter and Chiraag Somaia. “However, more interestingly, Phase Two, still characterized by negative yields, actually sees an outperformance of government bonds versus both low- and high-yielding credit assets, i.e. any hunt for yield over the past 2.5 years as a whole has been an unsuccessful strategy.” The trend is shown in the below chart, where total returns on German government bonds have bested high-yield and investment-grade corporate debt.

“For now, we think ever-falling yields represent an overall risk aversion and/or verdict on economic policies that is not overly friendly to yieldier assets despite the obvious incentives they carry in this environment,” conclude the analysts. “So yield-hunting behavior is not always and everywhere wrong – this summer may treat it favorably – but any outperformance has subsequently been counter-trend in the past 2.5 years.”

Quick! Find me a carpet to sweep this under!

• US Sides With HSBC To Block Release Of Money Laundering Report (R.)

The U.S. government asked a federal appeals court on Thursday to block the release of a report detailing how HSBC is working to improve its money laundering controls after the British bank was fined $1.92 billion. In a brief filed with the 2nd U.S. Circuit Court of Appeals, the U.S. Department of Justice sought to overturn an order issued earlier this year by U.S. District Judge John Gleeson to make public a report by the bank’s outside monitor. “Public disclosure of the monitor’s report, even in redacted form, would hinder the monitor’s ability to supervise HSBC,” the government’s court filing said, adding that bank employees would be less likely to cooperate with the monitor if they knew their interactions could be released.

HSBC concurred with the court’s finding. “HSBC also argues that the Monitor’s report should remain confidential, as have the Monitor, the UK Financial Conduct Authority, the US Federal Reserve and other HSBC regulators,” HSBC said in a statement. “The effectiveness of the monitorship is dependent on confidentiality.” The filing comes a week after U.S. congressional investigators criticized senior officials at the Department of Justice for overruling internal recommendations to criminally prosecute HSBC for money-laundering violations. Instead, the government in 2012 fined HSBC and entered into a five-year deferred prosecution agreement that stipulated all charges would be dropped if the bank agreed to install an independent monitor to help improve compliance. In the 2012 settlement, HSBC admitted to violating U.S. sanctions laws and failing to stop Mexican and Colombian cartels from laundering hundreds of millions of dollars in drug proceeds through the bank.

Martens & Martens. Strong.

• Are Wall Street Banks in Trouble? You’d Never Know from the Headlines (WSoP)

On July 14, when America’s biggest bank by assets reported its second quarter earnings, this headline ran at the New York Times: “JPMorgan Chase Has Strong Quarter as Earnings Top Estimates.” CNBC, a unit of NBCUniversal, used the same criteria in its headlines to report the earnings of Citigroup, Bank of America and Morgan Stanley — putting a positive spin in the headline because the earnings had topped what analysts were expecting – rather than the far more meaningful, and traditional, measure of whether earnings had beaten the same quarter a year earlier. CNBC’s headlines read: Citigroup earnings handily top Wall Street expectations: CNBC-July 15, 2016 Bank of America earnings top expectations: CNBC-July 18, 2016 Morgan Stanley solidly beats earnings expectations: CNBC-July 20, 2016.

This is hubris of the highest order. Publicly traded companies simply guide research analysts toward lowered expectations on their upcoming quarterly earnings so that the companies can surprise on the upside and get these kinds of misleading headlines in the all-to-willing New York media – which has a vested interest in making everything appear rosy in the Big Apple. (New York media is dependent on fat Wall Street profits to boost the price of their own publicly traded shares since ad revenue in New York is linked to the health of Wall Street.) One would never know by these headlines that big bank earnings were actually down year over year – and in some cases, down dramatically. JPMorgan Chase earned $6.2 billion in the second quarter of 2016 versus $6.29 billion in the second quarter of 2015.

The news was far worse at Citigroup, despite the rosy headline at CNBC. Citigroup’s second quarter profit fell 17.5% year over year, to $4 billion from $4.85 billion in the second quarter of 2015. Its revenues were the lowest in 14 years according to S&P Capital IQ. At Bank of America, profit fell to $4.23 billion from $5.3 billion in the second quarter of 2015, a sharp decline of 20%. Morgan Stanley reported a year over year decline of 8%, with profits in the second quarter of 2016 falling to $1.67 billion from $1.82 billion in the second quarter of 2015. Now news of jobs cuts is spilling out with the Wall Street Journal reporting that Bank of America will make “$5 billion in annual cost cuts by 2018 as part of its strategy to deal with persistently low interest rates that are eating away at lenders’ profitability.”

The New York Post is calling job cuts at Goldman Sachs the worst since the financial crisis in 2008. Fortune’s Stephen Gandel reported two days ago that Goldman had slashed a whopping “1,700 positions in the past three months.” Something else one won’t find in those smiley-face headlines is the fact that Wall Street is not only bleeding profits and jobs but it’s also bleeding equity capital – the only thing that separates the word “bank” from the word “bankruptcy.” While the Dow Jones Industrial Average and Standard and Poor’s 500 Indices may be setting new highs, the big Wall Street banks are decidedly not.

Over the past 52 weeks, Goldman is down from a share price of $214.61 to an open this morning of $162.55 – a decline of 24%. Bank of America is off 22% from its 52-week high, based on today’s open. Morgan Stanley and Citigroup are in decidedly worse shape with declines of 28% and 27%, respectively, from their 52 week highs versus their share price at the open of the New York Stock Exchange this morning. Add this all up and you’re talking about tens of billions of dollars in equity capital vaporizing.

Denmark is in the same position as dozens of other countries: “..there’s a real risk that housing prices can see a dramatic fall, even though we’re not seeing a bubble in the classical definition of the term..”

• Denmark Faces ‘Out of Control’ Housing Market in Negative Spiral (BBG)

Denmark’s biggest mortgage bank is warning there’s a risk the housing market may get “out of control,” especially around cities, as long-term negative interest rates make borrowers complacent. “To be concrete, there is a danger that Danes go blind to the risk of rates ever rising again,” Tore Stramer, chief analyst at Nykredit in Copenhagen, said in an e-mail. “That raises the risk of a major housing price decline, when rates at some point or other start to rise again.” Denmark’s central bank has had negative interest rates for the better part of four years. Thomas F. Borgen, CEO of Danske Bank, says his managers are operating under the assumption that rates won’t go positive until “at least” 2018, with Britain’s departure from the EU adding to the risk of an even longer period below zero.

With no other country on the planet having experienced negative rates longer than Denmark, the distortions the policy is wreaking may provide a preview of what other economies face should they go down a similar path. Danes can get short-term mortgages at negative interest rates, and pay less to borrow for 30 years than the U.S. government. Apartment prices in Denmark are now about 5% above their 2006 peak. Back then, the country’s bubble burst and apartment prices slumped about 30% through 2009. “It’s worth remembering that there’s a real risk that housing prices can see a dramatic fall, even though we’re not seeing a bubble in the classical definition of the term,” Stramer said. Denmark’s negative rates are a product of the central bank’s policy of defending the krone’s peg to the euro. Its main rate was minus 0.75% for most of last year, though the bank raised it by 10 basis points in January in an effort to normalize policy.

Reality kicks in. What’s going to happen to the lenders who made it all possible?

• Fracklog in Biggest US Oil Field May All But Disappear (BBG)

The number of dormant crude and natural gas wells in the U.S. stopped growing in the first quarter – and may all but disappear in the nation’s biggest oil field should prices hold steady. As of April 1, there were 4,230 wells left idle after being drilled, a figure little changed from January, according to an analysis by Bloomberg Intelligence. While some explorers have continued to grow their fracklog of drilled but not yet hydraulically fractured wells, others began tapping them in February as oil prices rose, the report showed.

Crude in the $40- to $50-a-barrel range may wipe out most of the fracklog in Texas’s Permian Basin and as much as 70% of the inventory in its Eagle Ford play by the end of 2017, according to Bloomberg Intelligence analyst Andrew Cosgrove. While bringing them online is the cheapest way of taking advantage of higher prices, the wave of new supply also threatens to kill the fragile recovery that oil and gas markets have seen so far this year. “We think that by the end of the third quarter, beginning of the fourth quarter, the bullish catalyst of falling U.S. production will be all but gone,” Cosgrove said in an interview Thursday. “You’ll start to see U.S. production flat lining.”

It’s the same as oil producers. In China’s steel industry, a return to reality would mean too many jobs lost to bear.

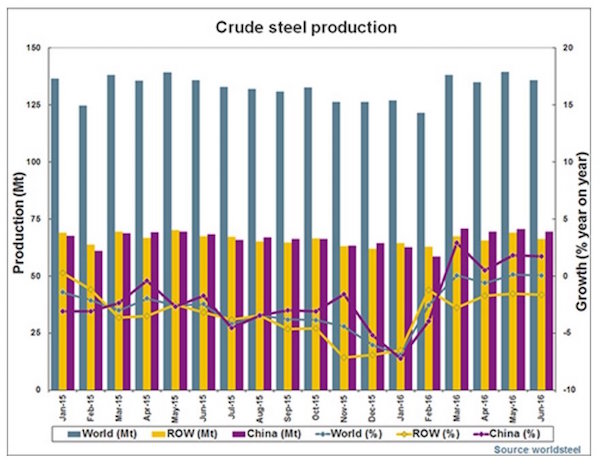

• China Continues To Produce More Steel Than The Rest Of The World Combined (BI)

For the fourth month in a row, China produced more steel than all other nations combined in June. According to data released by the WorldSteel Association on Wednesday, a group that accounts for approximately 85% of the world’s steel production, China produced 69.5 million of crude steel in June, dwarfing production in all other nations which came in at 66.5 million tonnes. At 136 million tonnes, total global output in June was unchanged from the levels of a year earlier.

While down 1.4% on the 70.5 million tonnes produced in May, Chinese crude steel production is now 1.7% higher than the levels of June 2015, fitting with the splurge in state-backed infrastructure investment seen in recent months. Despite the recent uplift in steel production, shown in the chart below supplied by WorldSteel, global steel production came in at 794.8 million tonnes in the first half of the year, down 1.9% on the same corresponding period in 2015.

They fix it daily, but that’s not manipulation nor devaluation…. That’s just fixing.

• China’s Vice FinMin: We’ve Got No Reason To Devalue The Yuan (CNBC)

China has no reason to devalue the yuan, as economic fundamentals remained strong, with growth at 6.7% in the first half, the country’s Vice Finance Minister Zhu Guangyao told CNBC. Zhu’s comments came shortly before Republican presidential candidate Donald Trump lambasted China again, this time for what he said was “devastating currency manipulation. [..] “The yuan has been trading around five-year lows recently, as concerns over the state of the economy fueled capital outflows. Investors have also expressed concerns over the level of debt built up in the economy. China suffered almost $700 billion worth of capital flight in 2015. The surge in outflows late in 2015 sparked market concerns that China’s foreign reserves weren’t sufficient to stabilize the currency by buying yuan over the long term.

Meanwhile, the greenback has strengthened against most major currencies as investors reacted to negative interest rates in Japan and Europe, as well as the possibility the Federal Reserve would continue on its rate-hiking path. On Friday the dollar/yuan traded at 6.6683 on-shore and 6.6754 off-shore. China fixes its currency against the dollar every day. In August, China shifted the market mechanism for setting the daily fix, saying it would set the spot rate based on the previous day’s close, theoretically allowing market forces to play a greater role in its direction. That resulted in an effective 2% devaluation in the currency, a move that sparked fears of a “currency war” to make Chinese exports more competitive.

What’s that going to do to the share price?

• Apple’s Q2 China Revenues Could Fall 20%: Baidu (CNBC)

Apple’s revenues in China could be down 20% in China in its quarterly earnings report, according to research by Baidu, the so-called “Chinese Google.” As part of its online suite of products Baidu offers mapping software and a search platform. It has about a 70 to 80% market share in search in China and logs billions of location requests on Baidu Maps. Using this so called “big data” from the use of its map and search products, which is all anonymized, Baidu said it could predict employment and consumer trends and their impact on a company’s revenues. It used these tools on Apple’s retail sales in China, selecting a list of flagship Apple stores in mainland China and the counting the volume of map queries of all the stores.

Baidu found that in the last quarter of 2015, map query volumes were up 15.4% year-on-year, which corresponded with a 14% rise in Apple’s China revenue in that same period. But in the first quarter of 2016, map queries declined 24.5% year-on-year, which was parallel with a 26% decline in Apple’s China revenue. “The impressively strong correlation indicates that map query data provides possibilities for us to ‘nowcast’ the company’s revenues and reveal the future trends. Based on our analysis of latest data, we project that the Apple’s revenue in China of second quarter of 2016 may be down around 20% on a year-over-year basis,” Baidu concluded. The “second-quarter” that Baidu references is Apple’s fiscal third-quarter and will be announced on July 26.

Pensions. A word your children will know only from history books.

• Pension Funds Are Underwater – And Taking Us With Them (VW)

The California Public Employees’ Retirement System (CalPERS) has announced its worst performance in seven years. Its meager rate of return for the fiscal year ending June 30 just managed to squeak by .6%, not even beating our current meager rate of inflation. After two successive years of tepid returns, long-term fund averages have sunk far below the critical 7.5% benchmark. It’s bad news for California taxpayers, because if returns don’t soon show a long-term average of 7.5%, they’ll be the ones who will have to make up the difference. Ted Eliopoulos, the fund’s chief investment officer, admits the massive pension fund’s long-term returns are well below anticipated levels, telling the Los Angeles Times, “We’re moving into a much more challenging, low-return environment.”

Yeah. Average returns are now barely over seven% for a twenty-year period, and returns over ten and fifteen years now average less than 6%. These changes are not just a blip on the investment horizon, as we assume bond yields and stock dividends will improve. According to the Milliman pension consulting firm, many public pension funds have had to adjust their expectations to accommodate lower returns overall. CalPERS needs to adjust its own expectations accordingly, even though doing so would drive up costs for state and local government agencies covered by the big pension firm. “We quite clearly have a lower return expectation than we had just two years ago,” Eliopoulos said. “That will be reflected in our next cycle. We are cognizant that this is a challenging environment for institutional investors.”

Thus, while the Times reports this dismal turn of events as a new development, it’s apparent Eliopoulos and CalPERS have been struggling for a while. What’s more, financial observers have been voicing concerns about pension fund depletion for at least as long as bond yields and stock dividends have been anemic. [..] The bad news is: If you’re a California public employee, you’re going to take a hit. But even if you’re not a public employee, but merely a California taxpayer, you’ll also take a hit. In addition, while private employee pension funds don’t pose the same financial risk to non-participants, their members run a similar risk; after all, they’re toiling in the same universe of stocks and bonds.

The Guardian gets the headline right, but shows no understanding of what it means.

• Once-Expanding EU Prepares To Contract For The First Time In Its History (G.)

Johannes Hahn’s job title sounds a little incongruous these days: he’s the EU commissioner for European neighbourhood policy and enlargement negotiations. The job title was created in the late 1990s during a period of optimism and expansion. But now, thanks to the will of 52% of British voters, the EU looks set to contract rather than enlarge for the first time in its history. There are still six candidate countries for EU membership, in the process of making formal applications to join the bloc, as well as a number of other countries with various levels of association. But with many in the EU wary and sceptical of further expansion, the only enlargement negotiations going on at the moment are about managing the expectations of countries that want to join.

Hahn was in Kiev last week, meeting Ukrainian government officials and chairing ministerial meetings of the EU’s Eastern Partnership, a programme linking the EU with six former Soviet countries, which was launched as a response to the Russian war with Georgia in 2008 and was implicitly meant as the first step towards EU membership for the nations. “Don’t believe that the unfortunate decision of Brexit will have any influence on our relationship – quite the opposite,” he told a meeting of the group’s foreign ministers.

But in reality, the initial Eastern Partnership plans are in tatters, as both enlargement fatigue inside the EU and a stick-carrot combination from Russia has pushed a number of the countries away from wanting further integration with the EU. Two of them, Belarus and Armenia, have joined Russia’s Eurasian Economic Union, an explicit challenge to the EU, while nobody seriously speaks about Ukraine or Georgia as members any more.

Surprise? What surprise?

• Earth On Track For Hottest Year Ever As Warming Speeds Up (R.)

The earth is on track for its hottest year on record and warming at a faster rate than expected, the World Meteorological Organization (WMO) said on Thursday. Temperatures recorded mainly in the northern hemisphere in the first six months of the year, coupled with an early and fast Arctic sea ice melt and “new highs” in heat-trapping carbon dioxide levels, point to quickening climate change, it said. June marked the 14th straight month of record heat, the United Nations agency said. It called for speedy implementation of a global pact reached in Paris last December to limit climate change by shifting from fossil fuels to green energy by 2100.

“What we’ve seen so far for the first six months of 2016 is really quite alarming,” David Carlson, director of the WMO’s Climate Research Program, told a news briefing. “This year suggests that the planet can warm up faster than we expected in a much shorter time… We don’t have as much time as we thought.” The average temperature in the first six months of 2016 was 1.3° Celsius (2.4° Fahrenheit) warmer than the pre-industrial era of the late 19th Century, according to space agency NASA. [..] “There’s almost no plausible scenario at this point that is going to get us anything other than an extraordinary year in terms of ice (melt), CO2, temperature – all the things that we track,” Carlson said. “If we got this much surprise this year, how many more surprises are ahead of us?”

Hard to gauge what’s going to happen with this.

• Fighting the Most Dangerous Animal in the World (Spiegel)

[..] Aedes aegypti presents a threat to some 4 billion people across the globe. The world long approached the Aedes agypti plague as though it were a storm that would soon blow over, but it has now become a fixture in large cities in the tropics. If nothing is done, experts say, more and more people will die as a result. And it has also become clear that some of the tropical diseases carried by this insect are coming to Europe. Partly, that is the result of rising temperatures on the European continent. In the southwestern German city of Freiburg, for example, scientists have determined that a population of Aedes mosquitoes survived the German winter for the first time. It used to be that only those who traveled to the tropics were at risk of becoming infected with tropical illnesses.

But now, many in Europe must face the prospect of the tropics coming to them. It was images from Brazil that sent a jolt of fear around the world at the beginning of this year. Across the country, babies were suddenly being born with heads that were misshapen and too small. When indications mounted that this curious increase in cases of so-called microcephaly was connected to the Zika epidemic that had stormed across Brazil in the previous months, the WHO declared an international emergency. Brazil mobilized 220,000 soldiers for the battle, sending them through bathrooms, yards and garages to eliminate standing water where female Aedes mosquitoes lay their eggs. But the campaign did little to reduce the threat. In the first four months of this year, officials registered 100,000 additional cases thought to be Zika.

In addition, almost a million people were infected with dengue fever, more than ever before in such a short span of time. There is no vaccine against the Zika virus and there is no medicine that can prevent people from becoming infected. In March, medical researchers said that Zika can also be transmitted via sexual intercourse and, as if that weren’t enough, 151 health experts wrote an open letter in May demanding that the Olympic Games – set to kick off in Rio in two weeks – be postponed or moved. Taking the risk of holding the games as planned, they said, would be irresponsible. The city is expecting a half-million visitors. If only a tiny fraction of them become infected by the virus, these games – intended to crown Brazil’s climb to economic power status – could mark the beginnings of a catastrophe.