Rembrandt van Rijn Student at a table by candlelight c.1642

Chansley

https://twitter.com/FreeStateWill/status/1635011407434641408

O’Keefe

TOO SHOCKING TO BELIEVE!

James O'Keefe Exposes Government Conspiracy to Frame Citizens at January 6th Protest.This is what @Project_Veritas didn't want you to see when they ousted me. #January6th was a setup. A frame job. #QAnonShaman #whistleblower #FirstAmendment pic.twitter.com/nANTVWumvh

— O'Keefe Reborn (@okeefe_reborn) March 11, 2023

Iran Saudi

Iranian insider reveals how Iran-Saudi Arabia rapprochement happenedpic.twitter.com/ngNWvVVCi2

— Zhang Meifang张美芳 (@CGMeifangZhang) March 12, 2023

Stone Putin

https://twitter.com/i/status/1634557724619943939

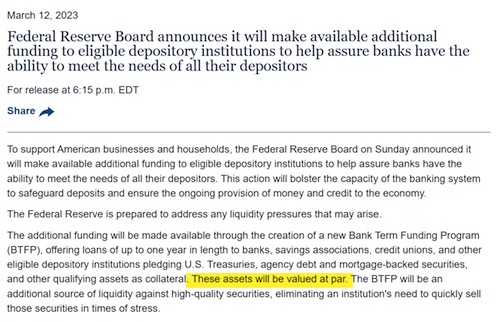

Zakharova: “Every child can explain how the US authorities will ‘support the stability of the banking system’ – with paper and paint. They will print even more unsecured dollars then they will cause even more problems in the world.”

“..pledge collateral at par, not at market value, thus giving banks credit for all those hundreds of billions in unrealized net losses, and allowing banks to “unlock liquidity” based on losses which the Fed and TSY now backstop!”

• Fed, TSY, FDIC Announce New Banking System Bailout, Signature Bank Closed (ZH)

On Friday, we said that the Fed will have to make an announcement before the Monday open, and we didn’t have to wait that long: in fact, the Fed waited just 15 minutes after futures opened for trading to announce the new bailout, alongside even more shocking news: the Treasury announced that New York State regulators are shuttering Signature Bank – a major New York bank – adding that all depositors both at Signature Bank, and also the now insolvent Silicon Valley Bank, will have access to their money on Monday. And as we process the shock of yet another small bank failure (which makes JPMorgan even bigger), the Fed just issued a statement saying that “to support American businesses and households, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

This action will bolster the capacity of the banking system to safeguard deposits and ensure the ongoing provision of money and credit to the economy.” The Fed also said that it is prepared to address any liquidity pressures that may arise, which in turn has just unveiled the first bailout acronym of the new crisis: the Bank Term Funding Program, or BTFP. Some more details: The financing will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

The Fed explains that the Department of the Treasury will make available “up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP.” And while the Federal Reserve – which was completely clueless about this banking crisis until Thursday – does not anticipate that it will be necessary to draw on these backstop funds, we anticipate that the final number of needed backstop liquidity be somewhere north of $2 trillion. What is more notable is that the BTFP – or Buy The Fucking Pivot – facility, will pledge collateral at par, not at market value, thus giving banks credit for all those hundreds of billions in unrealized net losses, and allowing banks to “unlock liquidity” based on losses which the Fed and TSY now backstop!

And they did…

• Bill Ackman To US Gov’t: Fix Mistake In ‘48 Hours’ Or Face ‘Destruction’ (CT)

Billionaire Bill Ackman has urged the United States government to “guarantee” all deposits held by Silicon Valley Bank (SVB) within the next “48 hours,” or it risks the “destruction” of many financial institutions. In a March 11 tweet, Bill Ackman, CEO of hedge fund management firm Pershing Square Capital Management, said a “giant sucking sound” will be heard from the ”withdrawal of substantially all uninsured deposits” from all banks, not just the “systemically important banks (SIBs),” should the government fail to “guarantee all” of SVB’s deposits before the “open on Monday.”Ackman suggested that this would be the result of “the world” realizing what an uninsured deposit is — “an unsecured illiquid claim on a failed bank.”

https://twitter.com/CaitlinLong_/status/1635047789376974848

He warned that these withdrawals would “drain liquidity” from the community, regional and other banks and “begin the destruction” of these crucial institutions if the United States government fails to protect “all depositors.” Ackman said the only other way to prevent this was in the “unlikely” event that major financial institutions, such as JPMorgan Chase, Citibank or Bank of America, acquire SVB before Monday. He argued that this could have been “avoided” if the U.S. government had “stepped in on Friday” to guarantee SVB’s deposits, adding that the long-standing bank’s “franchise value” could have been safeguarded and “transferred” to a new owner in return for an “equity injection.”

Ackman suggested that SVB’s senior management “made a basic mistake” and should be fired. He noted: “They invested short-term deposits in longer-term, fixed-rate assets. Thereafter short-term rates went up and a bank run ensued. Senior management screwed up and they should lose their jobs. After conducting a “back-of-the-envelope review” of SVB’s balance sheet, Ackman believes that even “in a liquidation,” depositors “should eventually” get back approximately “98% of their deposits”. However, he argued that “eventually” is “too long” when you have “payroll to meet next week.”

A new meaning for “bailout”.

“No bailout for shareholders and bondholders of SVB. Depositors will be protected.”

“the Fed itself is insolvent. It has exactly the same problem as SVB — it paid top dollar for bonds whose prices have fallen, driving the Fed deep into neg equity (along with BoJ, ECB…)”

• Yellen Says Government Will Help SVB Depositors But “No Bailout” (ZH)

With just hours left until futures open for trading late on Sunday afternoon, the situation remains extremely fluid and for now it appears that regulators, central bankers and treasury officials (we won’t mention the White House where the most competent financial advisor is Hunter Biden) still don’t have a clear idea of how they will coordinate or respond. Take Janet Yellen, who said on Sunday morning that the US government was working closely with banking regulators to help depositors at Silicon Valley Bank but dismissed the idea of a bailout. Speaking with CBS on Sunday, the treasury secretary sought to assure US customers of the failed tech lender that policies were being discussed to stem the fallout from the sudden collapse this week. The Federal Deposit Insurance Corporate (FDIC) took control of the bank on Friday morning.

“Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again,” Yellen said (oh but you will, you just don’t know it yet). “But we are concerned about depositors, and we’re focused on trying to meet their needs.” It wasn’t clear which depositors she meant: as we first pointed out on Friday, out of SIVB’s $173 billion of customer deposits at the end of 2022, $152 billion were uninsured (i.e., over the $250,000 FDIC insurance threshold) and only $4.8 billion were fully insured. As we also noted last week, a further look at SIVB funding (pie charts) shows unusually high reliance on corporate/VC funding; only the small red private bank slice looks like traditional retail deposits to us.

As a result, as JPM’s Michael Cembalest says “It’s fair to ask about the underwriting discipline of VC firms that put most of their liquidity in a single bank with this kind of risk profile. At the end of 2022, SIVB only offered 0.60% more on deposits than its peers as compensation for the risks illustrated below; in 2021 this premium was 0.04%”.

Tech start-ups are sexy.

• HSBC To Buy Silicon Valley Bank’s UK Operations (G.)

The government has struck a last-minute deal for HSBC to buy Silicon Valley Bank’s UK operations, saving thousands of British tech startups and investors from big losses after the biggest bank failure since 2008. The takeover will override the Bank of England’s initial decision to place SVB UK into insolvency, after a run on the lender that was originally sparked by fears over the a multibillion-pound shortfall on the US parent company’s balance sheet. The US bank was closed and its assets seized by authorities on Friday. “This morning, the government and the Bank of England facilitated a private sale of Silicon Valley Bank UK to HSBC. Deposits will be protected, with no taxpayer support. I said yesterday that we would look after our tech sector, and we have worked urgently to deliver that promise,” the chancellor, Jeremy Hunt, said on Twitter.

HSBC’s takeover is expected to protect the finances of SVB UK’s 3,500 customers, including hundreds of tech startups that feared they would go bust if their deposits were wiped out. Authorities had been considering a range of options to help SVB UK customers pay wages and suppliers, including an emergency fund that could provide a cash lifeline to support startups, as well as government-guaranteed loans for the sector, similar to those offered to businesses during the Covid crisis. It follows a tense 72 hours, with Rishi Sunak having been locked in weekend talks with the Bank of England governor, Andrew Bailey, and Hunt, who warned that tech and life sciences sector were at “serious risk” as a result of the bank’s collapse.

While analysts said there was little chance of contagion across the banking sector – given that the biggest banks serve a wider range of customers and have plenty of capital – tech startups and investors were worried about the ripple effects for the sector. A group of more than 200 tech executives warned in an open letter to Hunt over the weekend that the loss of deposits had the potential to cripple the industry, with many businesses at risk of falling into insolvency overnight.

“They make it personal. They don’t make it professional.”

• Hatred of Putin Makes Washington ‘Do Dumb Things’ – Seymour Hersh (RT)

Legendary investigative journalist Seymour Hersh on Sunday offered a theory for what he sees as the foreign policy “complete idiocy” displayed by US officials, saying they’re so consumed by hatred of Russian President Vladimir Putin that they stumble into bad decisions. Hersh, the Pulitzer Prize-winning journalist who reported last month that US President Joe Biden ordered last fall’s sabotage of the Nord Stream natural gas pipelines, has called the alleged plot one of Washington’s “dumbest” decisions in years. However, the blunder didn’t reflect a lack of intelligence among top officials in Biden’s administration, including Secretary of State Antony Blinken and National Security Adviser Jake Sullivan, Hersh said in an interview with China’s CGTN.

Top administration officials “all have high degrees of, plenty of, intelligence,” Hersh said. “It’s just what they’re so driven by, I think, hatred of all things particularly Putin, and also communism per se. They’re so cold warriors, they’re really out of sorts. It makes them do dumb things.” The White House dismissed Hersh’s bombshell report on the Nord Stream blast as “complete fiction.” The New York Times, where Hersh did award-winning work on the Watergate scandal and other stories as a star reporter in the 1970s, claimed earlier this month that a “pro-Ukraine group” was behind the Nord Stream attack. The story cited unidentified US officials. Hersh told CGTN that neither the Ukrainian navy nor a non-state actor had the resources to carry out the sabotage, which involved planting C4 explosives on four concrete-encased steel pipelines at the bottom of the Baltic Sea. He said the false claim was made to distract from the fact that US Navy divers planted the remotely detonated explosives under cover of a NATO exercise in the Baltic.

“They’re trying to divert attention from the story that I wrote, which included enormous specifics,” Hersh said. “I was describing a process that began before Christmas of 2021. . . . They had a series of meetings at a secret room in the White House, that I gave clues I know the title of the room.” The veteran journalist argued that being “antagonistic” with China and Russia is counterproductive for Washington. “They make it personal. They don’t make it professional.” He added that Biden’s foreign policy has alienated governments around the world since Russia’s military operation in Ukraine began last year. “Russia has made more friends in the Third World since this began than anybody in this administration seems to appreciate,” Hersh said. “This notion of American hegemony, if you will, just doesn’t work anymore.”

Nordstream attack vessel

US release footage of Nordstream attack vessel and dive team…. pic.twitter.com/5DK7tOBdUf

— Lingo Rennon (@lingo_rennon) March 12, 2023

The interview.

• Liu Xin’s Interview With Seymour Hersh (CGTN)

As the NYT reports new allegations on the Nord Stream sabotage, Seymour Hersh takes the “pro-Ukrainian group” intel with a pinch of salt. Here’s the reason. Liu Xin: But you think it’s not possible for a “pro Ukrainian group” to carry out this explosion? Seymour Hersh: I know that the few things I know about the Ukrainian navy is they are capable of dropping mines. I’m not an expert on it. I just happen to ask questions after that story came out. They don’t have a working decompression chamber. We’re talking about four pipelines, Nord Stream 1 and 2, each has two. They’re steel tubes covered by a concrete cover to protect themselves from the salinity, the salt in the water. So, you have to have people that know, that are the experts in underwater diving and experts in using the most, the plastic C4, the most volatile stuff there is.And also, they have to be able to go quick. They have to be sure they get the bomb, their weapon and the bomb in the right place that triggers, destroys everything. They have to practice like, they practice for weeks and months on this, I would say, in the waters of the Baltic Sea. “The U.S. is trying to divert attention away from my story,” says Seymour Hersh, after the NTY reported intel pointed at a “pro-Ukrainian group” on the Nord Stream sabotage.

Liu Xin: The fact that the U.S. government officials leaked this intelligence to the New York Times at this particular moment. What do you think they are trying to send as a message? Seymour Hersh: They are trying to divert attention from the story that I wrote, which included enormous specifics. I was describing a process that began before Christmas of 2021. It involved the National Security Advisor Jake Sullivan of the White House for the President. They had a series of meetings at a secret room in the White House. They gave clues, I know the title of the room. They were asked to come up with both reversible and irreversible concepts, ideas. A reversible concept would have been more sanctions. Something irreversible would have been kinetic, a bomb. And then eventually it turned out what they really wanted was a hit on the pipelines. And in this government, the concern has always been that Germany has been getting so much gas at such a cheap price from Russia that it would be very hard to wean them away from Russia. Slamming U.S. foreign policy as “complete idiocy,” Seymour Hersh told Liu Xin he believes American hegemony and the hatred of “all things Putin & communism” are driving the Biden Administration to do dumb things.

Liu Xin: You have also called a part of the called this planning “stupidity.” And you on several occasions you laughed at the intelligence level of the Biden. Seymour Hersh: I was not questioning their intelligence. These are all people, Tony Blinken, the Secretary of State, the one who didn’t go to China to meet his counterpart because of a balloon and Jake Sullivan, who’s the National Security Advisor, and the Undersecretary of State, all have high degrees of, plenty of intelligence. It’s just what they’re so driven by, I think, hatred of all things particularly Putin, and also communism per se. They’re so cold warriors. They’re really out of sorts. It makes them do dumb things. I just think his foreign policy is too complete idiocy, alienating a lot of people around the world. This notion of American hegemony, if you will, it just doesn’t work anymore. That’s what I object to.

“..this point of view is nothing but a wish of defeat to his country and its non-existence..”

• Zakharova: Ukraine Allegations Russia’s Reluctant To Talk A Colossal Lie (TASS)

Russian Foreign Ministry Spokeswoman Maria Zakharova has slammed her Ukrainian counterpart Dmitry Kuleba’s statement that Moscow is reluctant to negotiate the crisis settlement with Kiev as a “colossal lie”. “These days, Kuleba was once again ranting and raving in interview with the Italian newspapers Repubblica and Stampa. He called those Italians who are standing for settling the conflict with Russia through talks rather than in the battlefield hypocrites. In his interpretation, this point of view is nothing but a wish of defeat to his country and its non-existence – “Not peace but ‘rest in peace’ on Ukraine’s grave,” she wrote on her Telegram channel.

“However, he seems to share the opinion that ‘there is always room’ for talks but says he sees no willingness for them in Russia. A colossal lie, bearing in mind the fact that it is the regime he represents that has banned such talks with Russia in its laws”. Moreover, in he words, Kuleba forecasted “the end of Europe if Ukraine is defeated”. “An optimist. In its current shape, Europe ended right when the European Union let Washington govern its political institutions and ultimately surrendered to NATO,” she added.

Ukraine Inc.

https://twitter.com/i/status/1634810341682036738

“We sat down with Ukrainian representatives and the German armaments industry … and German industry, in my presence, asked the German government for one thing: signed contracts..”

• Ukraine Won’t Get Western Jets ‘Anytime Soon’ – FM (RT)

Kiev will not get Western-made fighter jets “anytime soon,” Ukrainian Foreign Minister Dmitry Kuleba admitted during an interview with the German newspaper Bild am Sonntag published late on Saturday. The potential delivery of fighter jets to Kiev to prop it up in its ongoing conflict with Moscow is hindered by assorted technical and logistical issues, Kuleba said. However, he urged that Ukrainian pilots, who are only familiar with Soviet-made aircraft, begin training on the Western planes as soon as possible. “I don’t expect the delivery of fighter jets to happen anytime soon because it’s a very difficult task logistically and technically. Therefore, we advise that the training of Ukrainian pilots on Western jets should start now, so that when the decision to provide aircraft is made, we do not waste time or many months on training,” he said.

The diplomat also urged Berlin to ramp up deliveries of ammunition to Ukraine, namely artillery shells, claiming that while German industry had already expressed a readiness to provide them, the issue lies with the country’s government. “We sat down with Ukrainian representatives and the German armaments industry … and German industry, in my presence, asked the German government for one thing: signed contracts,” he stated. Over the course of the conflict, Ukraine has increasingly demanded more and more sophisticated weapon systems from its Western backers. Kiev has intensified calls for NATO to supply it with fighter jets – namely the US-made F-16 – in recent months after securing a pledge for dozens of Leopard 2 and Leopard 1, M1 Abrams, and Challenger 2 main battle tanks from multiple EU countries, the US, and UK, respectively.

So far, however, the West has been reluctant to provide Ukraine with modern aircraft. Late in February, US President Joe Biden said he was “ruling it out for now.” His Ukrainian counterpart Vladimir Zelensky “doesn’t need F-16s now. There is no basis upon which there is a rationale, according to our military, now, to provide F-16s,” Biden told ABC at the time. Still, American media reported that the Pentagon has already invited Ukrainian pilots to a military base in Arizona to determine how long it would take to train them to fly the F-16. Last week, unnamed officials told NBC that two Ukrainian airmen had already arrived on American soil and more were likely to follow. Russia has repeatedly warned the West against “pumping” Ukraine with assorted weaponry, maintaining it would only prolong the hostilities rather than change the ultimate outcome.

By Petr Lavrenin, Odessa-born political journalist and expert on Ukraine and the former Soviet Union

• Growing Backlash Against Methods To Conscript Ukrainian Men For War (Lavrenin)

Last year, military conscription became an issue in both Russia and Ukraine. However, the extent has been completely different in the two countries. While in Russia the mobilization was partial, lasting barely more than a month and affecting around 300,000 people, according to official figures – a significant part of whom already had military experience – a completely different picture has developed in Ukraine. Kiev instituted a general conscription drive which has been in force for more than a year. The exact number of those taken to the armed forces during this time is not known for certain and the process has been accompanied by numerous scandals. Cases where law enforcement officers have applied force when handing out conscription notices and illegally delivered men to enlistment offices have given rise to public discontent.

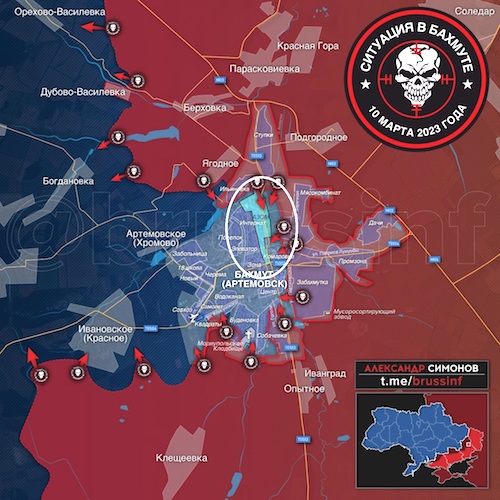

However, the Ukrainian authorities clearly have no intention of pausing enlistment because the situation remains critical at some sections of the front. The Armed Forces of Ukraine (AFU) are losing their grip on fortified areas around Artyomovsk (Bakhmut), and taking huge numbers of casualties, according to the Guardian and other media outlets. Meanwhile, Kiev continues to issue mobilization summonses and is sending people without proper training. According to the country’s legislation, a summons for military duty can only be issued on the street if it specifies the personal data of the person to whom it is given. It is also illegal for military commissars to detain citizens, as they are not the police, and conscripts are not criminals. Yet, that’s exactly how conscription is currently being conducted in Ukraine. Men of military age are being hunted down, and videos showing military commissars going to extreme lengths to hand out summonses, including by force, constantly circulate on social media.

Odessa, in particular, stands out in this respect. For example, military commissars were caught driving around the city in ambulances. When they came across men of the appropriate age, they stopped, handed over summonses and drove on. After videos emerged on social networks, local military commissars had to explain themselves and claimed that they were given the ambulance to use for their work. There were also cases when men in Odessa were detained on the street and forcibly taken to military enlistment offices, even without being handed a mobilization summons. For quite a long time, the AFU’s Operational Command South tried to ignore the illegal, forceful methods used by its military commissars. However, on February 14, a video was released showing military enlistment office staff detaining a man by force. In order to avoid a scandal, the military quickly assured the public that the staff responsible would be disciplined for “incorrect” behavior and the incident investigated.

Too many tunnels?!

• Prigozhin Describes Situation In Bakhmut As Very Difficult (TASS)

The situation is Artyomovsk (known as Bakhmut in Ukraine) is very difficult, with the Ukrainian army receiving “endless reserves,” Wagner PMC founder Yevgeny Prigozhin said on Sunday. “The situation in Bakhmut is difficult, very difficult, with the enemy fighting for each meter. And the closer we are approaching the city center the fiercer fighting is growing, the more artillery and tank being used against us. Ukrainians keep on supplying endless reserves. But we are moving forward and will continue to move forward and we will not cover the glory of Russian arms with shame,” his press service quoted him as saying on its Telegram channel.

Artyomovsk is located in the Kiev-controlled part of the Donetsk People’s Republic (DPR). Fierce fighting for control of the city is underway. According to the latest data, Russian forces have blocked or taken control of all paved roads to the city while the nascent spring mud season is complicating the logistics of supplying the Ukrainian army with fresh ammunition and personnel. Prigozhin said on Saturday that Russia forces were some 1.2 kilometers from the city’s administrative center.

Prigozhin

https://twitter.com/i/status/1634598452666544128

“Wagner” began storming the underground part of the “Bakhmut Azovstal”. Right now,”Wagner” are making their way into the mine. The battles take place at a depth of up to 320 meters.

You lost. You were staring blind.

• US ‘Sitting Still’ Amid Growing China-Russia Influence – Bolton (RT)

President Joe Biden’s administration is doing nothing to counteract steps by China, Russia, and their allies to work more closely together, jeopardizing US interests and undermining its global influence, former White House National Security Adviser John Bolton has claimed. “We’re sitting still, and the Chinese, the Russians, Iran, North Korea and several others are moving to shore up their relations and threaten us in a lot of different places,” Bolton said on Sunday in a WABC 770 radio interview. He added that while Beijing follows a clear strategy, “we kind of wander around from day to day.”

Bolton, a longtime war hawk who has called for regime changes in Moscow and Tehran, made his comments in the wake of Friday’s announcement that Saudi Arabia and Iran had agreed to re-establish diplomatic ties under a deal brokered by China. He lamented that the agreement reflected diminishing US influence around the world. “It’s an indication that the Saudis and others are trying to hedge their bets with China and Russia, because they don’t think the United States has the resolve and the fortitude necessary to do what they need to do to protect the world against Iran and its intentions,” Bolton said.

The 74-year-old Bolton has worked in the administrations of former Presidents Donald Trump, George W. Bush, George H.W. Bush and Ronald Reagan. Chinese officials have bristled at Washington’s threat claims, arguing that the US and its NATO allies behave as if they’re still fighting the Cold War. Beijing has maintained neutrality on the Ukraine crisis, resisting US pressure to condemn Russia over the conflict, and proposed a 12-point blueprint to end the fighting late last month. Biden dismissed the peace plan, saying it would benefit only Russia.

Maybe he should name the journal…

• ‘Rigorous’ Maidan Massacre Exposé Suppressed By Top Academic Journal (GZ)

A peer-reviewed paper initially approved and praised by a prestigious academic journal was suddenly rescinded without explanation. Its author, one of the world’s top scholars on Ukraine-related issues, had marshaled overwhelming evidence to conclude Maidan protesters were killed by pro-coup snipers. The massacre by snipers of anti-government activists and police officers in Kiev’s Maidan Square in late February 2014 was a defining moment in the US-orchestrated overthrow of Ukraine’s elected government. The death of 70 protesters triggered an avalanche of international outrage that made President Viktor Yanukovych’s downfall a fait accompli. Yet today these killings remain unsolved.

Enter Ivan Katchanovski, a Ukrainian-Canadian political scientist at the University of Ottawa. For years, he marshaled overwhelming evidence demonstrating that the snipers were not affiliated with Yanukovych’s government, but pro-Maidan operatives firing from protester-occupied buildings. Though Katchanovski’s groundbreaking has been studiously ignored by the mainstream media, a scrupulous study he presented on the slaughter in September 2015 and August 2021 and published in 2016 and in 2020 has been cited on over 100 occasions by scholars and experts. As a result of this paper and other pieces of research, he has among the world’s most-referenced political scientists specializing in Ukrainian matters.

In the final months of 2022, Katchanovski submitted a new investigation on the Maidan massacre to a prominent social sciences journal. Initially accepted with minor revisions after extensive peer review, the publication’s editor effusively praised the work in a lengthy private note. They said the paper was “exceptional in many ways,” and offered “solid” evidence in support of its conclusions. The reviewers concurred with this judgment. However, the paper was not published, a decision Katchanovski firmly believes to have been “political.” He filed an appeal, but to no avail. Among those fervently supporting Katchanovski’s appeal was renowned US academic Jeffrey Sachs. “You have written a very important, rigorous, and substantial article. It is thoroughly documented. It is on a topic of great significance,” Sachs wrote to the scholar.

“Your paper should be published for reasons of its excellence…The journal will only benefit from publishing such a work of importance and excellence, which will further the scholarly understanding and debate regarding a very important moment of modern history.” Katchanovski declined to name the journal in question, but described it as “top-tier” in the field of social sciences. He believes its refusal to publish his study is “extraordinary,” but nonetheless emblematic of a “far bigger problem in academic publishing and academia.” “The editor who accepted my article only learned it would not be published from my tweets on the subject. This reversal was highly irregular and political. There is growing political censorship concerning Ukraine in academia, and also self-censorship..”

Let’s see them.

• Comer: We Have Documents That Show Biden Family Was Getting Money from CCP (GP)

House Oversight Chairman James Comer (R-KY) joined Maria Bartiromo on Sunday Morning Futures this morning. This was an explosive interview. Comer dropped several bombs on the Biden Crime Family. According to Comer the House Oversight Committee is working with four individuals with close ties to the Bidens. Comer says the committee now has documents that tie the Bidens to the Chinese Communist Party. Biden is finished. James Comer: “It’s as bad as we thought… Since we’ve last spoken we have bank records in hand. We have individuals who are working with our committee. In the last two weeks we’ve met with either these individuals personally or with their attorneys. And that would be four individuals who had ties in with the Biden family in their various schemes around the world. So now we have in hand documents We have in hand documents in hand that show just how the Biden family was getting money from the Chinese Communist Party.”

Comer’s got the goods! This is a pivotal moment in American history. They finally have the goods on the Biden Crime Family.How will Democrats deal with this? With more phony charges against President Trump? Or maybe Old Joe will suffer a slip and fall?

“They did not want to have a discussion about anything. It was completely opposite to what the party was even ten years ago..”

• The Democrats Have Lost the Plot (Taibbi)

One of the crazier parts came at the end of the examination by Garcia, when I ended up becoming just a bystander to a heated and apparently sincerely unfriendly blowup between chairman Jim Jordan and Plaskett: GARCIA: So you’re not gonna tell us when Musk first approached you. TAIBBI: Again, Congresswoman, you’re asking me to, you’re asking your journalist to reveal a source. GARCIA: So then you consider Mr. Musk to be the direct source of all this? TAIBBI: Now you’re, you’re trying to get me to say that he is the source. GARCIA: Well, he isn’t, if you’re telling me you can’t answer because it’s your source, the only logical conclusion is that he is in fact your source. TAIBBI: Well, you’re free to conclude that. GARCIA: Well, sir, I just don’t understand. You can’t have it both ways, but let’s move on, because — JORDAN: Well, no, he can. He’s a journalist. PLASKETT: He can, because either Musk is the source and he can’t talk about it, or Musk is not the source. And if Musk is not the source, then he can discuss.

Did these people really not understand that identifying who is not a source crosses the same line as identifying who is one? You just can’t go into these questions. I started to interject to point this out, then realized that Garcia and Plaskett legitimately didn’t even know the basics of the civil liberties landscape. This was much the same as when Vijaya Gadde acted completely at a loss when Ro Khanna wrote to her in the middle of the Hunter Biden laptop affair, to express concerns about speech rights. Khanna mentioned the New York Times v. Sullivan case and other principles to Gadde, and she seemed to have no idea what he was talking about. This was like that. Garcia also made it clear she didn’t know what Twitter was. At one point she said, regarding yesterday’s Twitter Files thread, that I had said “I had to attribute all the sources to Twitter first.”

I was so confused by this that I paused, worried that I was misunderstanding (my hearing is not so great). She then asked if I “sent it to Twitter first.” As I was replying no, that I’d posted the thread on Twitter, I heard an aide whispering something about “putting it on Twitter.” Garcia seemed to think that Twitter was an editorial body to which I was sending text, maybe for review. It’s understandable, not knowing that the platform doesn’t work that way — not everyone has to be on Twitter obviously — but then why the hostility? Instead of simply asking me in a friendly way about this process, which I would have been glad to explain, she kept blasting away. “First, sir. Yes or no?” The Democrats were angry that Michael and I were there at all. They did not want to have a discussion about anything. It was completely opposite to what the party was even ten years ago, when expression rights were an issue they wanted to own.

Scott Ritter’s wife is Georgian. He knows the country. This is a harrowing story.

• Georgian Protesters Unwittingly Imperil Their Nation’s Survival (Scott Ritter)

In many ways, the critics were correct—the practical outcome of the foreign agents bill would have been to expose the extent to which Georgian politics and governance had become overrun with foreign money and influence. The threat, however, didn’t come from Russia, but rather the United States, which uses the $40 million in aid funneled through the United States Agency for International Development (USAID) every year to conduct what amounts to a “soft coup” in Georgia designed to displace the current government with one that will be compliant to American—not Georgian—goals and objectives—including the establishment of a “second front” against Russia. All of this is done, according to Samantha Power, the Director of USID, to build “a country with free expression, a free press, & a path to Euro-Atlantic integration.”

But what she really means is a country that suppresses any dissent as “disinformation,” uses the media as state-sponsored propaganda, and removes from power any politician or political party that dares impede Georgia’s absorption into the US-led NATO sphere of influence. Georgia’s Prime Minister, Irakli Garibashvili, does not want an expanded war with Russia—especially one that drags Georgia into the conflict. As such, Samantha Power and her minions at USAID believe the prime minister of Georgia must now be removed and replaced with an anti-Russian (i.e., pro-war) leader cut from the same pro-American cloth as Georgia’s US-backed President, Salome Zurabishvili.

To accomplish this, USAID funds programs designed to foment a “bottom-up” transformation of Georgian society and politics by empowering “diversity” at the grass-roots level, suppressing opposing points of view in the name of building “societal resilience to disinformation,” and seizing control of the electoral process so that the US-controlled “diversity” movements can prevail in local elections and, by extension, national elections. The Georgian foreign agents bill would have exposed the level to which these USAID-funded programs, and other related US and EU-funded activities, had infiltrated Georgian society. For that reason, the US mobilized its paid activists to take to the streets, forcing the Georgian Prime Minster to pull the plug on the legislation in the interests of public safety.

This is about suicides, not covid. Why only suicides among veterans? Isn’t it time to widen and broaden this discussion?

• Could Vitamin D Help Save Our Veterans? (ET)

Findings from a new study have shown that vitamin D may lower the risk of suicide and suicide attempts in U.S. veterans with low vitamin D levels. The study found that veterans who received vitamin D had a 64 percent lower risk of suicide than those who did not receive supplementation. The study was published in February 2023 in the journal Plos One. Suicide is a serious public health issue and the 12th leading cause of death in the United States. In 2020, 45,979 Americans died by suicide and there were an estimated 1.2 million suicide attempts. According to the CDC, suicide rates increased 36 percent between 2000-2018, and Suicide Awareness Voices of Education states that from 2020 to 2021 there was a 3.6 percent increase in suicides, bumping it up to the 11th leading cause of death in the United States. This is one death every eleven minutes.

When it comes to veterans, however, the statistics change. Veterans are at a 57 percent higher risk of suicide than those who haven’t served, which is more than 1.5 times the national average. Suicide is the second leading cause of death of veterans under the age of 45. Some other notable statistics: • 125,000 veterans have died by suicide since 2001. • There were 6,146 veteran suicides in 2020. • There have been 20 consecutive years with 6,000-plus veteran suicides. The study aimed to determine the association between vitamin D supplementation, vitamin D blood serum levels, suicide attempts, and intentional self-harm in a group of veterans in the Department of Veterans Affairs.

The retrospective cohort study looked at veterans who had filled either a vitamin D3 or vitamin D2 prescription between 2010 and 2018. A cohort of 169,241 vitamin D2-treated veterans and 490,885 vitamin D3-treated veterans were each matched to an equal number of controls that had similar demographics and medical histories. The results of the study showed that vitamin D3 and D2 supplementation was associated with a 45 percent and 48 percent reduced risk of suicide attempt and self-harm. This was an almost 44 percent difference between the groups receiving supplementation and the control group. Additionally, the study found that vitamin D supplementation among black veterans was associated with a 60 percent decline in suicide attempts, and in veterans with vitamin D deficiency, which the study defined as being below 20 nanograms per milliliter (ng/mL), there was a more than 64 percent reduction in potential suicide attempts.

“..in exceptional circumstances of unjust laws, ethical responsibilities should supersede legal duties.”

• The Doctor Indicted For Not Killing His Patients (Horowitz)

All the government officials, pharmaceutical executives, and doctors involved in defrauding the public with taxpayer funding and violating the consent of humanity to mandate dangerous shots are absolved of liability. Meanwhile, a doctor who took his Hippocratic Oath seriously and allegedly saved nearly 2,000 patients (with FULL CONSENT) from the shots, is facing serious federal charges for conspiracy to defraud the government defrauders. We’re all big talkers. We’d like to believe that if we were there in Germany during the late 1930s, we would have protested the budding genocide, which was first rooted in medical experimentation and coerced sterilization. But just like most doctors and scientists went along with the Third Reich, nearly every doctor went along with the Fourth Reich in coercing patients into taking a known dangerous shot because they were “just following orders” and “following the science.”

Dr. Kirk Moore, an experienced plastic surgeon from Utah, on the other hand, has risked his life and career to actually follow the dictates of the Nuremberg Code. Yet despite everything we now know about the shots, which should win him the Presidential Medal of Freedom for his alleged actions, he is the one facing prosecution for a disposing of a shot that is only on the market because of government fraud. In January, Dr. Moore, along with two members of his clinic’s staff and a neighbor, were indicted on conspiracy to defraud the federal government by allegedly offering nearly 2,000 patients saline injections along with vaccine documentation while disposing of the real shots into the sink. To be clear, he is not being accused of tricking patients. He never offered unsuspecting patients fake shots. These were all people (or parents of minors) who desperately sought him out to bypass the genocidal, unconstitutional, inhumane, and immoral jab mandates, so they could go on with their lives unharmed by this terrible technology.

Prosecutors accuse Dr. Moore and staff at the Plastic Surgery Institute of Utah of pretending to administer 391 children shots, 524 adult Pfizer shots, 64 Moderna shots, and 958 J&J shots between October 2021 and Sept. 2022 just based on the inventory of shots that went to that office. That was long after it was known these shots were dangerous, yet Moore, not the Pfizer executives, faces up to five years in federal prison. According to the AMA Medical Code, “When physicians believe a law violates ethical values or is unjust, they should work to change in law.” However, it adds that “in exceptional circumstances of unjust laws, ethical responsibilities should supersede legal duties.”That is clearly going to be part of Moore’s defense if he is indeed shown to have given people saline at their request. Ironically, Moore is being accused of grifting and running a fake vaccine card ring and earning $98,000 off it. Dr. Moore, though, rigorously disputed this fact in an interview on my podcast and notes that when people asked him for his fee for COVID treatment, he told them to donate it to a 501(c)(3) medical freedom group.

Earth music

https://twitter.com/i/status/1634947463487574018

Owl

https://twitter.com/i/status/1634644161239437318

God made a farmer

https://twitter.com/i/status/1634879637527445504

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.