Rembrandt van Rijn The Adoration of the Magi 1634

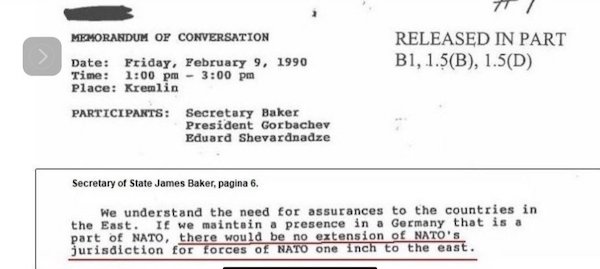

Miller

Stephen Miller: “The moment President Trump puts his hand on that bible and takes the Oath of Office, he will sign an executive order sealing the border shut and begin the largest deportation in history.”

BAM!! HALLELUJAH!! pic.twitter.com/kcY57Y86qZ

— Juanita Broaddrick (@atensnut) November 29, 2024

Hammer

https://twitter.com/i/status/1862319620511711653

Elon

"I'm the largest individual taxpayer in history, so I paid $10 billion in tax. I sort of thought maybe the IRS would send me a little trophy or something but I didn't get anything. Not even a cookie."

— DogeDesigner (@cb_doge) November 29, 2024

RFK

Robert F. Kennedy Jr.: "Today, we have the worst healthcare, we have the most expensive, we pay two to three times what people pay in European countries, we pay almost five times what Italians pay, and they have a lifespan seven years longer than us."

"Our lifespan has dropped… pic.twitter.com/SMOQDqR8z0

— Camus (@newstart_2024) November 29, 2024

Hillary

ROGAN: "What you're seeing with Trump, regardless of flaws, is a massive concentrated PsyOp. They've distorted who he is … It's all a f*cking illusion."

Full Episode (#2236): @joerogan pic.twitter.com/dF4zCTWNkM

— Chief Nerd (@TheChiefNerd) November 29, 2024

Hazel

Russia's new hypersonic missile, Oreshnik, comes equipped with an extremely powerful thermal warhead that burns at 4,000°C

That's hot enough to vaporize concrete, destroy even the most hardened military hardware, and even melt steel beams pic.twitter.com/zgSOBN13Ee

— BRICS News (@BRICSinfo) November 29, 2024

Saylor

https://twitter.com/i/status/1862180941319610644

“This version of Trump knows what buttons to press, he knows where the bodies are buried, he’s absorbed their worst and now he is about to throw it right back at them.” — Jeff Childers

• What Part of Mandate Don’t You Understand? (James Howard Kunstler)

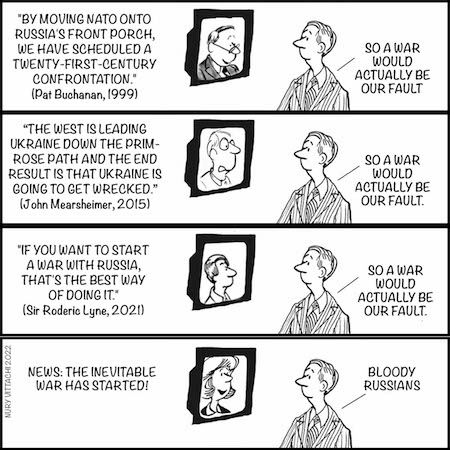

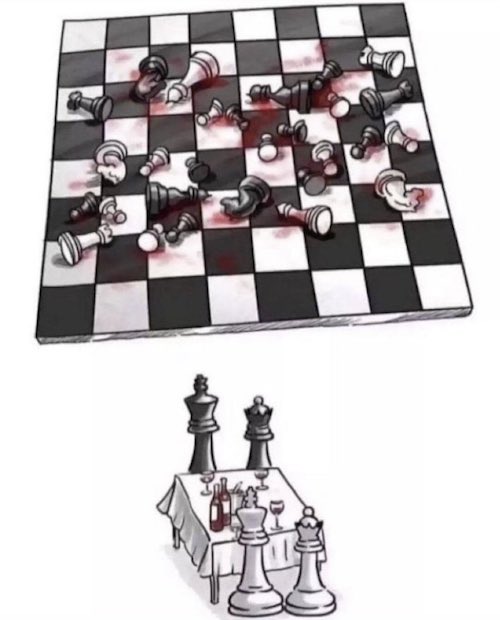

You have every reason to believe that this arrogant, malicious, leviathan government, and the vicious intel / lawfare blob at its vanguard, is about to be turned upside-down, inside-out, and sideways. Every appointment by Mr. Trump is a dose of chemotherapy to this malignant beast, aimed at all its diseased organs. The rogue cells within are going to die hard, struggle against their extinction, shriek and thrash as the treatment proceeds. That is, if it is allowed to proceed. And so: rumors arise of a coup to prevent it from happening. The benchmark version goes like this: “Joe Biden” keeps up his stupid provocation of Russia with those medium-range ATACMS missiles until Mr. Putin is forced to respond with a strike against a NATO member, say, a military base in Poland used to stage and target the ATACMS. Under NATO’s Article Five — an attack against one is an attack against all — Europe and the US must go to war against Russia.

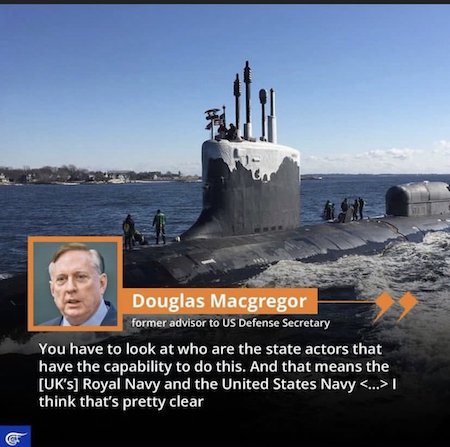

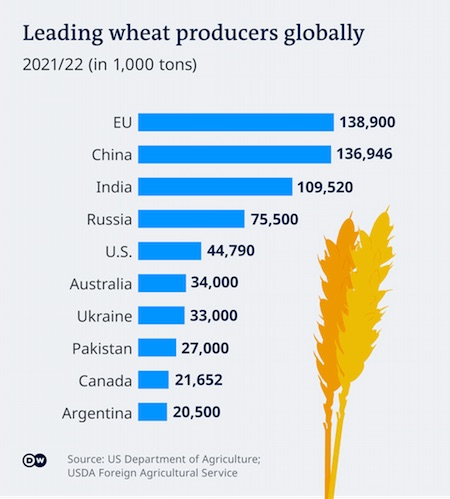

This becomes the pretext for “Joe Biden” to declare an extraordinary emergency (or Kamala Harris, if “JB” can be shoved out under the 25th Amendment). The inauguration of the newly-elected government must needs be postponed. . . . Such a move would surely provoke a domestic insurrection against the leviathan and Civil War Two would be on. Or else you might expect a swift counter-coup out of the US military not playing along. Mr. Putin, too, could demur from playing the game, that is, just not go for the bait, refrain from striking any NATO territory. After all, his beef is officially with Mr. Zelensky’s Kiev government. Russia could just pound Kiev until that government ceases to exist. So far Mr. Putin has carefully refrained from destroying the historic city center, mainly hitting power plants to turn off the heat and light to make life extremely uncomfortable in the Ukraine capital with winter coming on. But he could level the city.

The choice is Mr. Zelensky’s, and has been for months as his forces, armaments, and prospects dwindle. He could suspend hostilities, go to talks, even raise a white flag and put an end to the needless suffering. Under no circumstances will he get the Donbas or Crimea back. I doubt that Russia wants to take over the rest of Ukraine, considering the cost of having to support it indefinitely. Better that it should remain a sovereign state and look after itself — but neutral, demilitarized, and, if you like, de-Nazified. You understand that these will be Russia’s final terms? And that there is nothing unreasonable about them? In short, the hypothetical coup would fail, and the Ukraine war will end, and Mr. Trump will get inaugurated if he is careful to avoid the blob’s assassins until January 20.

As for Rep. Jamie Raskin’s scheme to prevent a Trump swearing-in on account of him being “an insurrectionist,” you can file that under “dumb-shit grandstanding.” So, the new government will come in, the new department chiefs will get into office, and the leviathan will get the therapeutic treatment it deserves. Outside of these criminal proceedings, the rest is executive process — just firing a lot of dead-weight and bureaucrat officials who contribute nothing but inertia and impediment to the normal functioning of a society. And deconstructing whole agencies. The blob will likely attempt to block that effort by marshaling its own allied lawyer army to bombard the courts with suits and writs. If the Trump team does its work carefully, with scrupulous attention to correct process, that offensive can be overcome and worked-around.

After a while, we’ll discover just how much government is really necessary, sort of like Twitter did, after Elon Musk fired 80-percent of the loafers on his payroll. Since so much of the US economy has shifted insidiously into government, this downscaling is apt to be painful, but especially for the local economy of Washington DC, which is to say, a grift economy of overlapping rackets. Upgrade a few laws and whole industries — such as lobbying by military contractors — might be wiped out. But you have to ask: how was that ever a good thing? For now, we give thanks that important changes are probably underway. Stolen liberties will be returned. You will be free to succeed or fail in a society of voluntary transactions. That was always the essence of being an American, not being a client of a fake therapeutic state, savior of all, but really just protector of its own.

You would get full NATO troops right next to Russian troops. Bad idea.

• West Plotting To ‘Occupy’ Ukraine – Russian Intel (RT)

The West is secretly planning to occupy Ukraine and freeze the conflict with Russia by deploying tens of thousands of supposed peacekeepers to the country, the Russian Foreign Intelligence Service (SVR) has said. In a statement on Friday, the spy agency cited intelligence sources as saying that NATO is increasingly in favor of halting the hostilities along the current front line, as the US-led military bloc and Ukraine have come to realize that they are failing to inflict a “strategic defeat” on Russia. Freezing the conflict would allow the West to rebuild the shattered Ukrainian military and “prepare it for an attempt at revenge,” the SVR stated. It further claimed that NATO is already setting up training centers to process at least one million Ukrainian conscripts. A possible respite would also help the West restore Kiev’s military industry, which has been regularly battered by Russian missile and drone strikes, the SVR added.

“To solve these tasks, the West will need to essentially occupy Ukraine. Naturally, this will be done under the guise of deploying a ‘peacekeeping contingent’ in the country… According to the plan, a total of 100,000 so-called peacekeepers will be deployed in Ukraine.” According to the SVR, the plan would also involve Ukraine being partitioned into four large occupation zones. Romania would take the Black Sea coast, Poland would control Western Ukraine, and the UK would occupy the north, including Kiev. The central and eastern parts of the country would be taken by Germany, the agency claimed. The SVR also alleged that Germany plans to revive practices implemented by the Nazi regime during World War II to “police” Ukraine. In particular, Berlin wants to create special “death squads” made up of Ukrainian nationalists to maintain order in the occupied territory, the statement read.

“Does Russia need such a peaceful settlement option? The answer is obvious,” the SVR said. The statement comes after French newspaper Le Monde reported earlier this week that France and the UK have “reactivated” a discussion on a potential troop deployment in Ukraine. Earlier this year, French President Emmanuel Macron insisted that the West should not rule out this option to keep Russia in check, despite strong pushback from numerous NATO allies. Moscow has repeatedly signaled its opposition to freezing the conflict, insisting that all the goals of its military operation, including Ukraine’s neutrality, demilitarization, and denazification, must be met. Kremlin spokesman Dmitry Peskov has stressed that while there is no consensus in the EU on sending troops to Ukraine, “there are some hotheads.”

“..the career military experience Kellogg brings to his new job is “losing, not winning on the battlefield..”

• Lights Out In The Ukraine, In General Kellogg’s Brain Too (Helmer)

The damage assessments of yesterday’s November 28 electric war strikes against targets across the Ukraine spell the countrywide collapse of electricity supply before January 20, when the new Trump Administration will take office. By then, the Russian General Staff will have deprived Keith Kellogg, the retired US Army general newly appointed to serve as Trump’s negotiator for end-of-war terms, of the options he has publicly declared for himself, and also for Trump, in their war to make America great again in Europe. “The Mayor of Kiev told us this is genocide,” Kellogg said in interview with Fox News.“Now we are right on the cusp…This is going to be a fight to the end… Again, as I said, I think it’s a fight to the finish…Why this is important geo-strategically is that if we [US] can — if the Ukrainians can defeat Russia in the field, and evict them from the Donbass or the Crimea, Putin falls. It changes Europe for a generation to come…So one of these two sides is going to win. I don’t think there’s going to be anything to negotiate.”

Kellogg said this in February 2023, after he had returned from a sponsored trip to Kiev and to the eastern region of the country. Subsequently, he was paid to write an end-of-war strategy paper for Trump to use during the last months of the election campaign this year. This focused on attacking the Biden Administration for weakening the US and the NATO allies on the battlefield, and also in Europe. Trump’s “geo-strategic” priority remained, Kellogg wrote, to prevent “Ukraine fatigue among the Europeans, threatening to leave the United States, once again, as the primary defence contributor to Europe and further straining America’s ability to maintain its own critical defence stockpiles.” Negotiating to prevent the US from losing its military dominance in Europe, and to conserve the forces and weapon supplies “needed in other conflicts, especially if China invades Taiwan” are Kellogg’s running orders from Trump.

Russian sources say that reviving the Reagan Administration’s “Star Wars” weapons systems to combat Russia’s Kinzhal and Oreshnik missile advantage is the unstated “geo-strategic” priority, not only of Kellogg but of others in the Trump administration. They believe Elon Musk will lobby the president to make himself “chief US rocketeer to get a trillion-dollar contract to build missiles to counter us. But if they want a new arms race, they are already trailing. They will lose in space what they’ve already lost on the ground.”

According to a US veteran of the Afghanistan War, the career military experience Kellogg brings to his new job is “losing, not winning on the battlefield. He’s a typical empire enforcer. The last time Kellogg fought a competent military force, it was the Vietnamese, and Kellogg lost. For Trump to pick a man whose military victories are the invasion of Panama, the defeat of Iraq in Gulf War-1, and running a nuclear war bunker with Paul Wolfowitz during 9/11, tells you that it’s lights-out in the minds of both the soldier and his commander.”

He’s supposed to negotiate with Russia. But this is a negotiation with NATO.

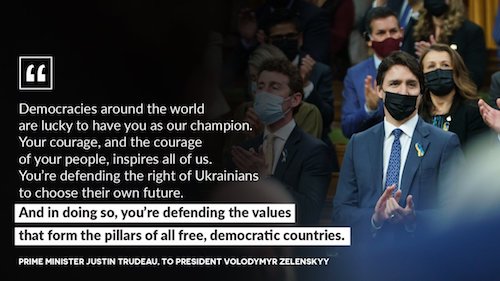

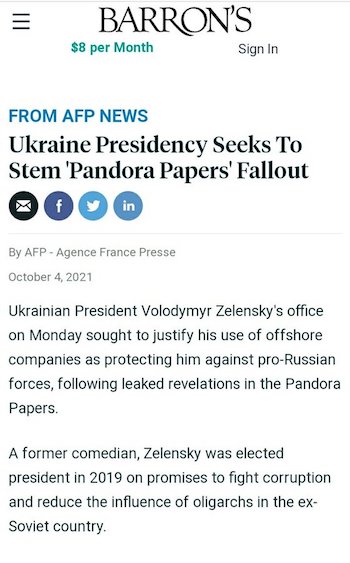

• Zelensky Offers To End ‘Hot Phase’ Of War In Exchange For NATO Membership (ZH)

Ukrainian President Volodymyr Zelenskyy says he’s willing to end the “hot phase of the war” with Russia – including ceding captured territory – in exchange for NATO membership that includes Ukraine’s internationally recognized borders. “If we want to stop the hot phase of the war, we need to take under the Nato umbrella the territory of Ukraine that we have under our control,” he told Sky News, adding “We need to do it fast. And then, on the occupied territory of Ukraine, Ukraine can get them back in a diplomatic way.” Zelenskyy said that a ceasefire was needed to “guarantee that [Russian President Vladimir] Putin will not come back” to take more Ukrainian territory,” or that “he [Putin] will come back.” In short, to end the war, Zelenskyy wants the thing that started the war.

The comments are a drastic departure from previous statements – as Zelenskyy has long-asserted that Ukraine’s sovereignty is non-negotiable, including over Crimea. Putting things in recent perspective, Zelenskyy’s comments come as NATO Secretary-General Mark Rutte admitted to Fox News that Ukraine is not in a strong enough position to negotiate an end to the war, explaining that there is not enough battlefield leverage to “prevent the Russians from getting what they want.” “I think that’s crucial that we have a good deal because the whole world will be watching what type of deal will be struck between Russia and Ukraine when it comes to it,” Rutte said. “We have to make sure that Ukraine is in a position of more strength than they are at the moment,” Rutte continued, “so that a deal can be struck which is favorable not to the Russians — and therefore to China, North Korea and Iran — because they all will be watching.”

It also comes amid pressure from the Biden administration to lower the draft age in Ukraine to 18 so it has enough troops to continue fighting Russia, aka more meat for the grinder. Former British PM Boris Johnson – who allegedly scuttled early peace talks in Turkey that might have ended the Ukraine war – has called for NATO troops on the ground in Ukraine, again. Johnson also asserted that if Russia gets the upper hand in the conflict then Britain may deploy it’s forces regardless in order to “defend Europe.” Ukraine’s eastern defenses are currently being overrun by ongoing Russian attrition tactics. This reality in combination with Trump’s avalanche election win seems to have triggered establishment ghouls into a frenzy of escalation with Joe Biden giving the greenlight on long range missile strikes coordinated directly by NATO forces.

They’re offering up their troops to initiate a war.

• Deaths of Western Fighters In Ukraine Is ‘Dangerous Escalation’ – Orban (RT)

The reported presence of Western soldiers among the casualties in Ukraine marks a dangerous escalation and risk of an “expansion of the war,” Hungarian Prime Minister Viktor Orban has said. In an interview with Kossuth radio on Friday, Orban described the current state of affairs as paradoxical, stating that while peace appears closer than ever, the situation has never been as dangerous. “According to Russian reports, American and French soldiers died in airstrikes carried out by the Russians on the territory of Ukraine. That means there are Western soldiers there,” he said. Earlier this week, Moscow launched a series of retaliatory strikes in response to Kiev using Western-supplied long-range weapons for attacks inside Russia’s internationally recognized borders.

This came after Washington removed restrictions on Ukraine’s use of ATACMS for such strikes. Russian forces hit the positions of US-made missile launchers and facilities hosting foreign instructors and mercenaries, the defence ministry said. Moscow has repeatedly said that foreign military personnel are fighting alongside Ukraine’s regular army and participating in cross-border raids. According to the foreign ministry, a group of fighters eliminated during an incursion into Bryansk Region last month included US, Polish, and Canadian citizens. In Orban’s view, the presence of Western troops “clearly shows the danger of escalation, and thus the expansion of the war.” Russian officials have repeatedly described foreign mercenaries operating in the conflict zone as a “legitimate target” for the military, while accusing NATO of direct involvement in the hostilities.

During the interview, Orban also criticized the EU for prolonging the conflict, referring to a resolution adopted by the European Parliament on Thursday to expand military aid to Kiev. This included additional supplies of long-range missiles. He called the move “depressing,” as it indicates that many EU leaders “want to continue the war and even increase its intensity.” He also highlighted a lack of an immediate impact on the Ukraine crisis from the election victory of Donald Trump in the US, who promised to end the conflict in 24 hours, and noted that the outgoing administration of President Joe Biden maintains its pro-war stance. Moscow considers the Ukraine conflict to be a US-driven proxy war against Russia, which has escalated into a de facto global confrontation, after Western nations authorized Kiev to launch long-range attacks deep inside the country using donated weapons.

“The majority of the US and European public have confirmed time and time again that they will not support direct conflict with Russia.”

• Boris Johnson Calls For NATO Troops On The Ground In Ukraine Yet Again (ZH)

After months of rumors surrounding possible peace talks in Turkey that might have ended the war in Ukraine not long after it reignited in 2022, multiple sources confirmed that British Politician and former PM Boris Johnson showed up in Kyiv to dismiss the negotiations and told the Ukrainians “let’s just fight”. These sources include David Arahamiya, the leader of Ukraine’s ruling party, Tory MP Nadine Dorries and Vladimir Putin himself. Johnson continues to deny the peace deal claims and “fact checkers” engage in extensive mental gymnastics to argue that there was no “official deal” put to paper, therefore Johnson didn’t sabotage anything. In other words, if a politician ruins a peace deal in its infancy before it is drafted then he’s not culpable for the war that follows. The bottom line? Johnson, a prominent British official with ties to NATO, showed up in the middle of early negotiations and told the Ukrainians to fight instead of pursuing peace.

This alone would have given the Ukrainians a false sense of security that NATO forces would intervene and fight for them. Boris Johnson would go on to promote a surge in military recruitment in the UK, and supported calls for conscription from military officials. He has also suggested NATO boots on the ground in the region on multiple occasions – A move that would immediately be seen by Russia as an escalation to world war. In a recent interview with the Daily Telegraph, the former British PM promoted the idea of British forces entering Ukraine as a part of a “peacekeeping plan.” The presence of any NATO country’s troops in Ukraine, even those not on the front line, would be seen as a tip-toe towards direct confrontation by the Kremlin. In early November, Johnson argued that if Donald Trump pulled US support for Ukraine in order to force a peace deal, Britain might send troops into the fray.

The argument sounds like a thinly veiled threat: If the US tries to force a peace deal, then Britain will send troops, escalate the war and ensure that no peace is possible. Johnson also asserted that if Russia gets the upper hand in the conflict then Britain may deploy it’s forces regardless in order to “defend Europe.” Ukraine’s eastern defenses are currently being overrun by ongoing Russian attrition tactics. This reality in combination with Trump’s avalanche election win seems to have triggered establishment ghouls into a frenzy of escalation with Joe Biden giving the greenlight on long range missile strikes coordinated directly by NATO forces. To be clear, Ukraine is not part of the EU nor is it a member of NATO. NATO warhawks like Johnson have consistently claimed that Russia’s intent is to invade greater Europe (domino effect propaganda similar to the Vietnam War), yet there is still no evidence to support this.

The western media has spent the better part of the conflagration claiming that Russian forces have been chewed up beyond repair in Ukraine; at the same time they suggest Russia somehow has the strength to invade the EU. The majority of the US and European public have confirmed time and time again that they will not support direct conflict with Russia. They will not volunteer to fight in such a war and will not submit to military conscription. Around 70% of Americans say they prefer negotiations to end the war. Only 10% of Europeans believe Ukraine can win and 52% of Ukrainians say they want negotiations and a quick end to the war. Despite this, establishment politicians continue to ignore the overwhelming calls for peace in Ukraine.

We can not be sure.

• Donald Trump Won’t Be Able To Quickly End The Ukraine Conflict (Poletaev)

Nuclear deterrence is often viewed as an impenetrable barrier, akin to a fortress that, once breached, will lead to catastrophic destruction. However, the Ukraine conflict illustrates that it works more like an immune system: while threats may penetrate, a strong system can still deal with the infection without collapse. Russia’s nuclear deterrence has been effective in keeping the West at bay, ensuring that military aid to Ukraine stays at levels that do not provoke Moscow’s direct retaliation. As Russia’s “nuclear immunity” holds, the West continues to try to find weaknesses in the system, but the Kremlin’s resolve remains firm. Yes, the globalist West continuously searches for a weak spot in Russia’s “immune system.”

And yes, the “infection” is spreading: battles rage in Kursk Region, drones fly thousands of kilometers into Russian territory, and now there are also long-range missiles. However, none of this poses an existential threat, and Moscow is successfully battling this infection. For example, two years ago, there were neither missiles nor drones striking Russia, yet the country was much closer to military defeat than it is today. Putin’s demonstration of the Oreshnik missile system, including its hypersonic capabilities, should not be viewed as a final warning. It is, rather, another indication that Russia is ready to defend its interests. The Oreshnik missile serves as a powerful reminder of Moscow’s military capabilities, but its true purpose is to maintain deterrence and remind Western leaders of the limits of their involvement.

The most ambitious scenario would be to sign a comprehensive agreement with the West, dividing spheres of influence and addressing the issues outlined in Putin’s December 2021 ultimatum. This would mean creating a new security architecture in Europe that acknowledges Russian interests and reassesses the outcomes of the Cold War. However, this goal is hardly attainable under current conditions. A more realistic scenario involves a limited agreement with the West regarding Ukraine. While this seemed improbable six months ago, it is now being seriously considered. Talks began even before the US elections. Leaked information suggests that the West may propose a ceasefire along the front lines and a 20-year moratorium on Ukraine’s NATO membership.

Moscow, however, demands Kiev’s disarmament and political neutrality. The fighting will likely continue until these contradictions are resolved. The final choice is one without any significant agreement, similar to the post-2008 events in Georgia. Ukraine’s military defeat would become a political victory. If Kiev’s reliance on the West wanes, Ukraine, like Tbilisi, would abandon its hostile stance toward Moscow to avoid further military losses and recover its economy. This third scenario has become more likely as Ukraine faces growing challenges on the battlefield and the West reduces support. The reality is that a relatively stable agreement with the West regarding Ukraine can only happen if Kiev renounces its antagonistic policy toward Russia.

For this solution to unfold, the West must avoid direct intervention and refrain from increasing military aid to Ukraine. This is Putin’s strategy – as he holds no illusions about Trump or the possibility of a diplomatic resolution. Why? Because an agreement is only possible when contradictions are resolved, but the fundamental issue between Russia and the West remains unresolved: neither side is ready to accept Ukraine as part of their opponent’s sphere of influence.

Canada, Mexico and China.

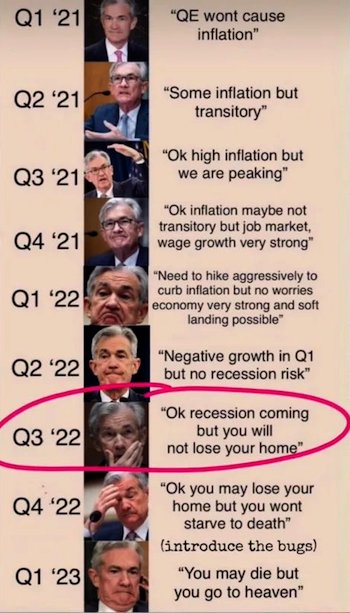

• “This Week, The Second Trump Trade War Started” (Philip Marey)

This week, the second Trump trade war started. On Monday, there was some market relief after Trump’s announcement on Friday that he would nominate Scott Bessent as Treasury Secretary. However, that changed on Tuesday after Trump made his tariff threats to Canada, Mexico and China. Mexican President Claudia Sheinbaum did not take long to make her own threat of retaliatory tariffs against the US. On Tuesday she said “if there’s a tariff, another one will come in response.” However, on Wednesday, Sheinbaum and Trump had a telephone conversation that she called “excellent” and he “very productive.” Sheinbaum had assured Trump that migrant caravans are no longer reaching the US-Mexican border and she also said that they had discussed increased security cooperation. US-Mexican security relationships had soured after the US had lured a Mexican drug lord out of the country into US custody, without informing Mexican authorities. This led to a split in the Sinaloa cartel and an internal battle of several months that has left more than 400 people dead.

In contrast, Canadian Prime Minister Justin Trudeau avoided confrontation and on Tuesday he said he had held a “good” conversation with Trump on Monday night shortly after the Truth Social post and that “we talked about some of the challenges that we can work on together.” On Wednesday, Trudeau met virtually with the provincial premiers to discuss a “Team Canada” approach to Trump’s tariff threat and to stress the importance of unity in Canadian reactions to Trump’s tariff threats. To get Michael Moore’s take on an escalating US-Canada conflict, I would suggest his 1995 film Canadian Bacon. China, which is blamed for not doing enough to stem the outflow of precursors to fentanyl, reacted calmly. On Tuesday, the Foreign Ministry said that the US should “cherish” China’s goodwill over the issue and added that China was willing to continue working together.

Of course, the Chinese reaction is likely to be more forceful if the tariffs are actually implemented. Trump’s beef with Canada, Mexico and China is about fentanyl trafficking and illegal immigration. In his first term, Chinese companies did not only supply the precursors, but also fentanyl itself. Trump was successful in getting the Chinese to regulate the production and sale of fentanyl in China. However, production shifted to Mexico, with Chinese companies providing the chemicals needed to make fentanyl. In 2019, Trump also threatened Mexico with tariffs unless migration was reduced. Mexican President Andres Manuel Lopez Obrador succumbed to US pressure and deployed the Mexican military to the borders.

Immigration was a major campaign theme during the US presidential election and the tariff threat is only the beginning of a likely ambitious effort to stem the flow of illegal aliens into the US. While the President-Elect arguably has a strong mandate from US voters to enhance border security and deport undocumented immigrants, these policies will pose challenges to many US businesses. As we showed in Trump border policy and immigrant labor supply, food & agriculture and construction are especially vulnerable given the high dependency on undocumented immigrant labor. While there are still many unemployed US citizens who could do the work, most of them do not find the jobs that undocumented immigrants do very attractive. Therefore US businesses that depend on immigrant labor should prepare for possible labor shortages.

“Delivering on Government Efficiency..”

Don’t get in Elon and Vivek’s way.

• Trump Admin’s DOGE Efficiency Push Now Reaching State Level (JTN)

A Wisconsin group is asking its state government to undergo spending and staffing reviews similar to those the incoming Trump administration intends to conduct with a newly created agency that will be led by successful entrepreneurs Elon Musk and Vivek Ramaswamy. The Trump agency is named the Department of Government Efficiency, or DOGE. Musk, a billionaire, owns Tesla, Twitter and SpaceX. Ramaswamy is also an entrepreneur and reportedly worth hundreds of millions. The request from the Wisconsin’s Institute for Reforming Government is not entirely new. It was conceived last year but revived as Republican Donald Trump campaigned, then won the presidency on such promises as cutting jobs, replacing career civil servants with federal appointees and relocating government offices.

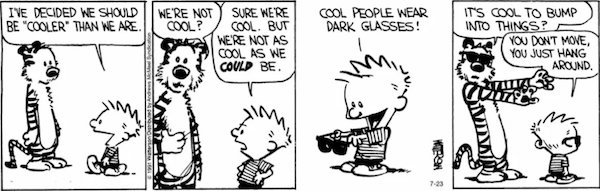

The institute’s plan focuses on reducing the number of full-time state employees by finding redundancies and contracting for professional services and The group has also proposed scaling back state agencies in the Wisconsin capital of Madison and moving state workers into the communities their department serves, creating less office space while making remote work more accountable. “With renewed attention on right-sizing government and reducing unnecessary bureaucracy at the federal level, it’s time for state lawmakers to seriously rethink how state agencies operate as well,” said Chris Reader, the institute’s executive vice president.

“We released a plan to rethink, reorganize, and modernize state agencies in 2023. It was DOGE before DOGE was cool. With voters distrusting the bureaucracy, [Democrat] Governor [Tony] Evers and lawmakers have a great opportunity in 2025 to listen to voters and reimagine state government.” Unlike the federal effort, whose leaders say they won’t be working with Congress to reduce the federal spending and staffing levels, IRG is calling for state representatives to lead the effort to reduce government spending.

However, within days of Trump winning the presidency on Nov. 5, then naming acolytes Musk and Ramaswamy to lead DOGE, the GOP-led House announced it had created the Delivering on Government Efficiency, or DOGE, subcommittee for the next Congress and that another Trump loyalist, Georgia Republican Rep. Majorie Taylor Greene, would lead it. The Wisconsin group said that its polling shows that 73% of residents agree that state agencies should review new regulations before they are enacted and that 67% favor having regulations expire after seven years unless they are re-approved by the legislature. The group is also calling for Wisconsin to create one-stop shops with a single digital portal for government services.

They did it in 2018-19, so it would be no surprise.

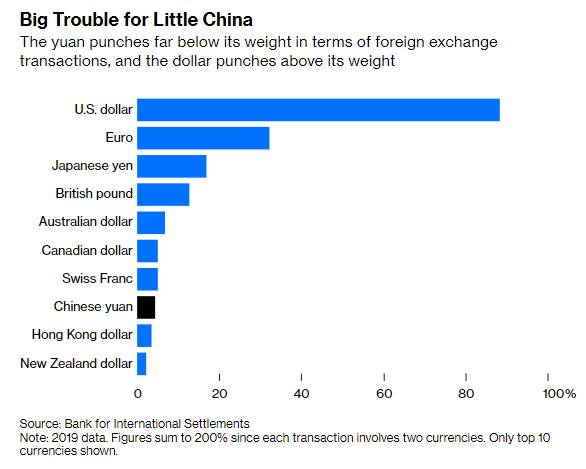

• China Could Devalue Yuan To Spite Trump – JP Morgan (RT)

An anticipated shift in trade policy during Donald Trump’s second term as US president, including a drastic hike in tariffs on Chinese products, could see the yuan depreciate by up to 15%, according to JPMorgan Chase, as cited by Bloomberg. In a note dubbed “Bracing for a storm” seen by the outlet, the analysts projected US import taxes on Chinese goods to be raised to 60% from the current 20% mark, with fresh levies to also hit imports from Malaysia and Vietnam. The Chinese government could devalue the yuan in response, and impose retaliatory tariffs to support the national economy, the strategists suggested , forecasting that China’s GDP growth next year could slip nearly one point to 3.9%, in spite of the possible measures.

JPMorgan highlighted that a potential devaluation of the yuan by 10-15% is “significantly less than the 28-30% that could be expected if China’s central bank were to rehearse the 2018-19 playbook, when it allowed currency depreciation to offset 70% of the rise in US tariffs.” In 2018, Trump raised tariffs on Chinese goods to 20% from 3%. Earlier this month, the yuan fell to its weakest level against the dollar since late 2023 amid uncertainty over Trump’s victory in the US presidential election. On Thursday, the Chinese currency traded at nearly 7.25 yuan to the greenback.

Earlier this week, Trump – who will take office on January 20 – pledged to introduce 25% import duties on all products from Canada and Mexico, along with increasing tariffs on Chinese imports to 30%. JPMorgan expects emerging economies, particularly manufacturing exporters such as Malaysia, Vietnam and Mexico, to be the hardest-hit by a US-China trade war. The analysts stressed that the affected states are likely to lose global market share, as Beijing would redirect exports toward other emerging markets. India would feel the least impact, the economists predict.

“..a 30% reduction in energy demand. After 2030, consider that all beef, lamb and dairy will be banned and “replaced by new diets”. Then there is a massive 45% cut in most common building materials..”

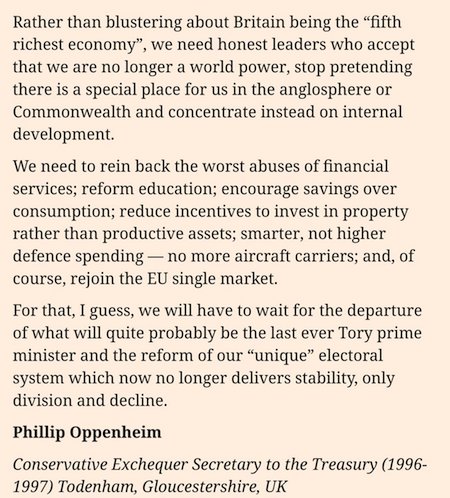

• Time for Starmer to Be Honest About What Net Zero Means (Morrison)

Earlier this week the Labour backbencher and Chairman of the U.K. Parliament’s Energy Committee Bill Esterson noted that people will have to adjust their habits to meet Net Zero emission goals for 2030. Such honesty, emerging as it does from the Parliament of Net Zero nodding donkeys, is to be applauded. As far as it goes. Try a 30% reduction in energy demand. After 2030, consider that all beef, lamb and dairy will be banned and “replaced by new diets”. Then there is a massive 45% cut in most common building materials such as cement, along with a similar reduction in road freight traffic. The attack on farming will be remorseless with fertiliser restriction halving “direct emission” from the soil. To sum up: widespread rationing and blackouts along with food, holiday and travel restrictions, all within about 60 months.

Look at what they fund and write and whom they consult, not what they say, is the best advice to counter all the whoppers that are being told about Net Zero. Sir Keir Starmer’s statement at the recent COP29 that he didn’t want to tell people how to live their lives can only be explained by noting it came from a British Prime Minister who has difficulty telling a woman from a man. Thankfully we have the Government-funded U.K. FIRES project to give us an honest heads-up on the near-term implications of Net Zero. All of the substantial reductions in energy, food and industrial materials mentioned above arise from its “pragmatic approach”. Its evidence-based conclusions rely on technologies that are available today. It excludes processes such as carbon capture and hydrogen that have yet to be proven at meaningful scale.

Its conclusions warm the hearts of the most committed green ideologues. Its reports also happen to be the most honest representation of the horrors that await if the Net Zero fantasy ever becomes a reality. By 2028 a total of seven million heat pumps will need to be installed and massive retrofits undertaken in domestic homes. Meanwhile, all rented and non-domestic properties will need to be EPC A rated by 2030. The desire to “manage land use for Net Zero emissions” means a massive cut in chemical fertilisers, so expect food supply to fall off a cliff. U.K. FIRES notes, correctly, that there is “insufficient time for the planning, development and construction of new large-scale infrastructure to contribute to the 2030 target”.

Again correctly, it is observed that increased use of wind and solar power creates a problem with intermittency. “Eventually, this must be addressed by either demand-shifting or storage,” it states. Storage at scale is more or less impossible with current technology, and another word for “demand-shifting” is rationing. To enforce these consumption restraints across the broad range of modern industrial lifestyles, a “whole society” approach must be mobilised. U.K. FIRES received a £5 million grant from the British Government and its warnings – or should that be wishes – about 2030 are contained in a report called ‘Minus 45’ prepared ahead of the Glasgow COP26 in 2021. It is based on a U.K. Government promise to reduce carbon emissions by 45% from 2018 to 2030. Its recommendations are relevant today, not least because Starmer tried to curry favour at the recent COP29 in Baku by promising to reduce emissions further.

His wife is upset?!

• Epps Loses Defamation Case Against Fox News (Turley)

Just months after a judge dismissed Nina Jankowicz’s much-hyped defamation lawsuit against Fox, a federal district court judge in Delaware, Judge Jennifer L. Hall, has dismissed Ray Epps’s defamation lawsuit. The Jan. 6 rioter said the network falsely identified him as an FBI informant. U.S. District Court Judge Jennifer L. Hall granted Fox News’ motion to dismiss the suit. In the original complaint, Epps made a defamation per se claim and a false light claim. Epps and his wife have clearly been through a nightmare of threats and innuendo. However, this public controversy was discussed by various networks and the Jan. 6th Committee. It was also a matter of legitimate public debate and commentary, with people on both sides expressing their views on the evidence and underlying allegations.The problem for the court was trying to draw a line when coverage and commentary becomes defamation on such subjects.

The chilling effect on free speech can be immense. The Supreme Court has repeatedly ruled that tort law could not be used to overcome First Amendment protections for free speech or the free press. The Court sought to create “breathing space” for the media by articulating that standard that now applies to both public officials and public figures. The status imposes the higher standard first imposed in New York Times v. Sullivan for public officials, requiring a showing of “actual malice” where media had actual knowledge of the falsity of a statement or showed reckless disregard whether it was true or false.Now based in Utah, Epps alleged his life was upended after former Fox host Tucker Carlson repeatedly described him as a federal agent who helped instigate the attack on the Capitol, which was an attempt to stop the certification of the election of Joe Biden.

The breathing space cuts both ways. In reporting on the dismissal of the Epps lawsuit, it is notable that the Associated Press is still referring to Jan. 6 as an “insurrection” rather than a riot. Curiously, when you hit the link on “insurrection,” it goes to an article on the dropping of the Smith case, which notably did not charge Trump or anyone else with insurrection or even incitement. Yet, the AP is still reporting “the insurrection” as a fact. The dismissal of Jankowicz directly addressed the dangers of using the courts to try to silence your critics. The case backfired on Jankowicz in prompting a court to expressly state that what she has been advocating is censorship. After holding that people are allowed to criticize Jankowicz as protected opinion, the court added:

“I agree that Jankowicz has not pleaded facts from which it could plausibly be inferred that the challenged statements regarding intended censorship by Jankowicz are not substantially true. On the contrary … censorship is commonly understood to encompass efforts to scrutinize and examine speech in order to suppress certain communications. “The Disinformation Governance Board was formed precisely to examine citizens’ speech and, in coordination with the private sector, identify ‘misinformation,’ ‘disinformation,’ and ‘malinformation.’ … that objective is fairly characterized as a form of censorship.” Jankowicz previously solicited significant contributions on the promise of this ill-conceived lawsuit. Nevertheless, Jankowicz is still being touted as a hero and enlisted to explain how to combat “disinformation.” The calls for greater censorship are likely to only increase after the election. However, we have seen figures like Hillary Clinton call on Europeans to force the censorship of Americans.

BREAKING: A federal judge just ruled to dismiss the lawsuit filed by January 6th operative Ray Epps against Tucker Carlson & Fox for defamation.

The judge dismissed it without comment. She might've felt there was validity to the claims that Epps was a Fed.

Anyone with a brain… pic.twitter.com/vOLK9T4AYj

— George (@BehizyTweets) November 27, 2024

“Israel says ‘suspects’ in vehicles violate ceasefire by trying to return home..”

• Ceasefire Falters as Israel Launches Airstrikes on Southern Lebanon (Antiwar)

The Israel-Lebanon ceasefire began Wednesday morning. Less than two days later, it seems to be faltering, with multiple reports of Israeli attacks across southern Lebanon, and claims of violations by both sides. Israel carried out an airstrike against the outskirts of Baysariyeh, which is near Tyre. They confirmed the attack, saying they were targeting a Hezbollah storage facility after seeing “terrorist activity.” They added in their statement that they were “acting to enforce violations of the ceasefire.” Though the claims of violations are coming from both sides, so far it is only Israeli forces whose violations actually involve firing. Lebanese people continue to try to return to their homes in the south, despite Israel’s military forbidding them to do so. There are multiple reports of Israel carrying out artillery shelling against towns and villages across southern Lebanon this afternoon.

Strikes were reported against the towns of Halta, Taybeh, Khiam, and Rmeish. In Rmeish the attack damaged a supermarket and a home. Three were injured in Taybeh. There were also reported Israeli tank shellings in several places, including the village of Markaba. In that incident, a car was attacked and multiple civilians were wounded. Israeli ground troops also opened fire on vehicles multiple times across southern Lebanon, incidents which happened both on Wednesday and Thursday. Israel presented the people they were shooting at as a “number of suspects,” and said that any vehicles in southern Lebanon amount to a ceasefire violation. There is no indication vehicles are actually forbidden by the terms of the ceasefire. Shooting at people, as Israel has been throughout the day, is plainly a violation, however.

“I felt that the United States was mobilizing its formidable economic and financial resources to prevent the business ventures of other countries, even their allies..”

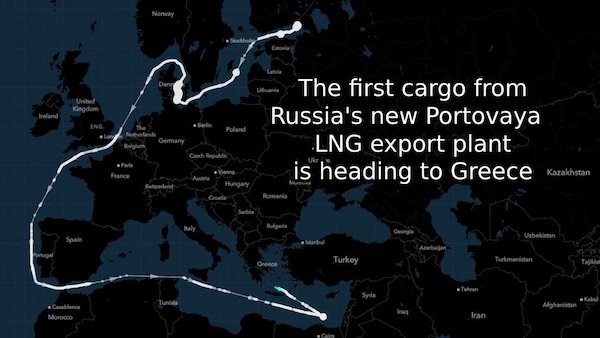

• Merkel Blows A Hole In Washington’s Nord Stream Narrative (Marsden)

Angela Merkel has just dropped a smoking gun into the pages of her new book. According to ‘Freedom: Memoirs 1954-2021’, published on November 26, Berlin was fully aware that Washington wanted to kill off Nord Stream. And that it was just using Russia as a scapegoat to steal a massive new energy market for itself. “The United States argued that its security interests were affected by the building of the pipeline because its ally Germany would make itself too dependent on Russia. In truth, I felt that the United States was mobilizing its formidable economic and financial resources to prevent the business ventures of other countries, even their allies,” Merkel writes. “The United States was chiefly interested in its own economic interests, as it wanted to export to Europe LNG obtained through fracking.”

This pretty much establishes that it was by premeditated design that Washington leveraged the Russian military operation in Ukraine as a convenient pretext to turn economic competitor Germany – and the EU more generally – into a vassal. But Merkel’s successor, Chancellor Olaf Scholz, and the rest of the German and European establishment, acted like Joe Biden was just coming to their rescue out of benevolence when he offered to sell them LNG to replace Russian gas – which turned out to cost several times the price, to the ongoing detriment of German and European industry and citizenry. Biden had stood beside Scholz at a White House podium in February 2022, talking like a mafia boss, saying that “there will no longer be a Nord Stream 2” if Russia enters Ukraine. Then the pipeline just mysteriously blew up in September 2022. Germany still hasn’t found those responsible, though.

Hey, how about this guy who was standing right next to your chancellor? German President Frank-Walter Steinmeier awarded Biden the Order of Merit in October, citing Germany’s “friendship” with the US, and telling Biden that “under your leadership, the transatlantic alliance is stronger and our partnership is closer than ever.” Yeah, close. Like family. Where you can help yourself to stuff that isn’t yours and wreck it – like an entire German car industry or a pipeline. Or where you can disapprove of a relationship – like the one that Germany had with Russia. Or maybe one can even do both of these things at the same time, like Miami-based American businessman, Stephen Lynch, seems to be attempting to achieve by asking for the US government’s approval in bidding on Nord Stream 2, majority-owned by a subsidiary of Russia’s Gazprom, according to the Wall Street Journal.

Now that Washington’s meddling has bankrupted the pipeline project and it’s set for the auction block, guess Lynch figures that maybe he can squeeze in between Russian gas and Germany’s desperation for cheap supply, with Uncle Sam’s blessing. This is a once-in-a-generation opportunity for American and European control over European energy supply for the rest of the fossil-fuel era,” Lynch told the WSJ. It’s also a chance for US interests to profit from, and exert control over, both the EU and Russia, by wedging themselves between the two like they’re a chaperone on a teenage movie date. “I haven’t heard of Gazprom wanting to put gas transportation infrastructure in the hands of the USA,” the Kremlin has said, putting a damper on Lynch’s ambitions, which are perfectly aligned with what Merkel now says has been America’s objective all along.

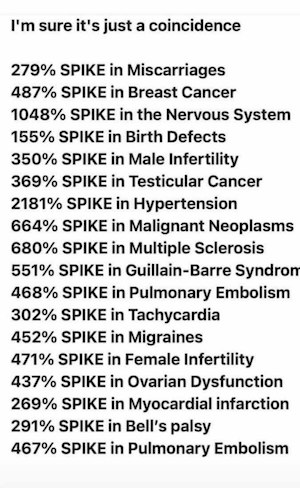

Detox

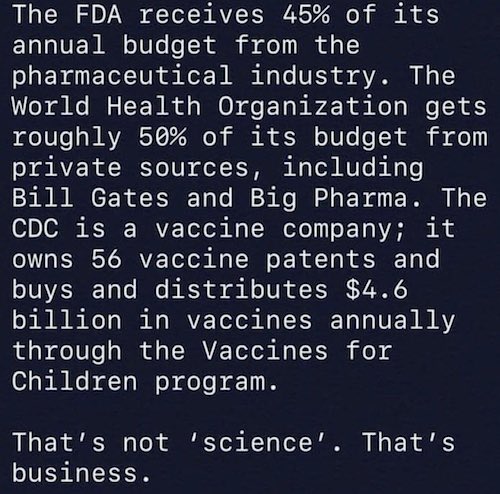

"They don't want us to prove that the vaccine is in these tumours and that it's driving it."

"..If we could do that simple test in the blood on everybody, and show they had the spike protein, we could then rapidly devise effective detox programs. And then confirm it, because you… pic.twitter.com/VehgpnqTUz— RefugeOfSinners (ROS) (@RefugeOfSinner5) November 28, 2024

Nerves

Nerves of stainless steelpic.twitter.com/uIXpHKxXis

— Massimo (@Rainmaker1973) November 29, 2024

Antlers

Each year, male antlers shed and are renewed each spring.

Their annual exchange is a very intriguing part of its biology. pic.twitter.com/JyaSyQsvM2

— Figen (@TheFigen_) November 28, 2024

Siblings

https://twitter.com/i/status/1862557640880239046

Hoover Dam

How the Hover Dam was built – The Scariest Dam in the world.

pic.twitter.com/gfVf5S6xvz— Interesting STEM (@InterestingSTEM) November 28, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.