Edward Hopper The Circle Theater, New York 1936

There goes the S&P 500.

• US Democrats Plan Crackdown On Booming Stock Buybacks (CNN)

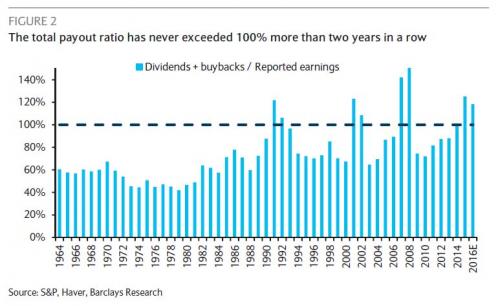

Democrats in Congress want to rain on Wall Street’s buyback parade. Senator Tammy Baldwin plans to introduce a bill on Thursday that would prohibit companies from repurchasing their shares on the open market, Baldwin told CNNMoney. While the legislation faces an uphill battle getting through Republican-controlled Congress, it demonstrates a growing backlash against companies using extra cash to reward shareholders instead of sharing it with workers. Buybacks, which boost stock prices by making shares scarcer, have exploded in 2018 thanks to the huge windfall created by President Trump’s new tax law. American companies like Pepsi and Cisco have announced a total of $229 billion of buybacks so far this year, according to research firm TrimTabs.

Companies are on track to buy back the largest number of shares in at least a decade. Critics say this trend is deepening the chasm between America’s rich and poor because affluent families own the vast majority of the stocks. They argue the money would be better spent by investing in the future, paying workers more or offering better benefits and retraining programs. “I fear that if we don’t act, the impact on our economy and growth is going to be horrendous,” Baldwin told CNNMoney Wednesday. “This very partisan corporate tax bill has fueled a surge in stock buybacks that is hurting economic growth and shared prosperity for workers.” The bill, which is co-sponsored by Democrats Elizabeth Warren and Brian Schatz, would explicitly “prohibit public companies from repurchasing their shares on the open market.”

It would also repeal a 1982 SEC rule that gave companies the green light to buy back vast amounts of their own stock. Since 2008, US companies have spent $5.1 trillion to buy back their own stock, according to Birinyi Associates. Between 2007 and 2016, companies in the S&P 500 devoted 54% of their profits to stock buybacks, according to research by University of Massachusetts Lowell professor William Lazonick, who advised Baldwin’s office on the legislation. “This was not good for the US economy,” said Lazonick. He called Baldwin’s proposed crackdown “hugely positive,” even for long-term shareholders who will benefit from companies investing in something “instead of simply propping up the stock price.”

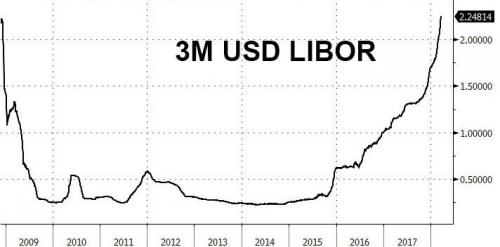

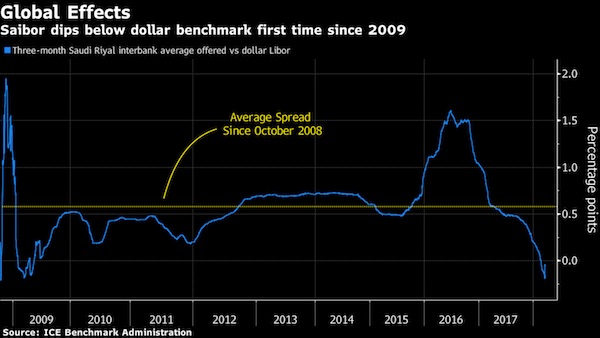

And Libor.

• ‘Mother Of All Yield Shocks’ Is About To Crush Stocks – Stockman (MW)

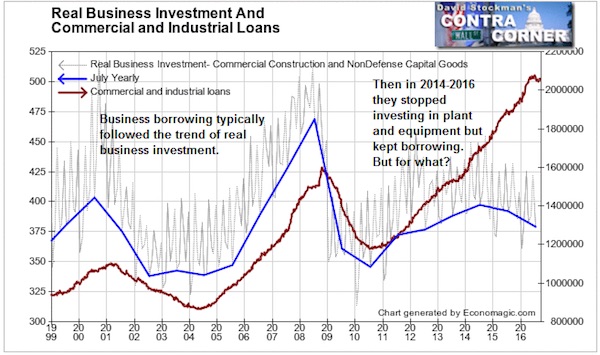

David Stockman, the so-called “Father of Reaganomics,” hasn’t been shy — or close to right — about his frantically bearish calls in recent years Just last summer, he warned of a “horrendous storm” that could take the S&P 500 index all the way down to 1,600. From there, he took it up a notch in September, saying stocks are headed for a retreat of up to 70%. Well, it’s still up at 2,700. But the market’s volatile behavior of late has emboldened some bears to refresh and even ramp up their doomsday scenarios. Stockman is one of them. “There is not a snowball’s chance in the hot place that the mother of all yield shocks can be avoided,” Stockman wrote on his blog this week.

He explains that we’re in a uniquely dangerous position, one that really couldn’t have even happened under previous administrations. “Had Lyndon Johnson, Tricky Dick, Jimmy Carter or even Ronald Reagan suggested that the Federal Reserve buy government debt at rates which exceeded annual issuance by the U.S. Treasury, as was the case during the peak years of QE, they would have been severely attacked — if not subjected to impeachment — for advocating rank financial fraud,” Stockman claimed. He said ever since former Federal Reserve Chairman Alan Greenspan “commenced the age of monetary central planning,” Wall Street has used deficits as a tool in Washington’s kit of “whatever it takes,” instead of something to be feared.

“Anything that could fuel even the appearance of short-term economic growth was embraced unthinkingly,” he said, “because ‘growth’ of any shape, form or quality became the predicate for endless increases in the stock market averages.” That’s a recipe for disaster, says Stockman.

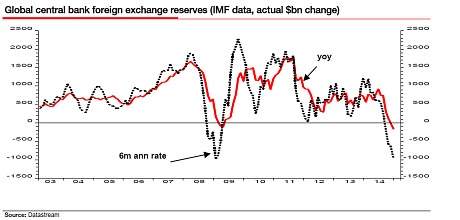

Whack-a-mole central bank style.

• Forget The Fed, Libor Is The Story Of The Year (ZH)

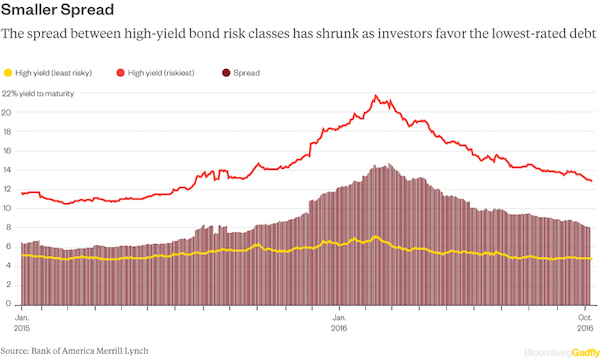

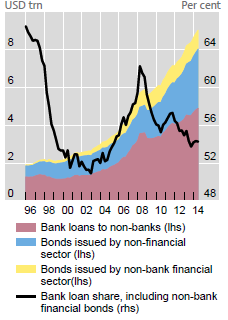

We’ve been saying it for over a month: the most important, if widely underappreciated, factor for risk assets has been the surge in Libor and the blow out in the Libor-OIS spread, or short-term funding costs, which impacts everything from bank lending costs to the marginal cost of trillions in floating rate debt. Yesterday, Citi’s Matt King confirmed as much in a lengthy note explaining why the blowing out Libor, and Libor-OIS spread, are sending increasingly ominous signals: LIBOR is still the reference point for the majority of leveraged loans, interest-rate swaps and some mortgages. In addition to that direct effect, higher money market rates and weakness in risk assets are the two conditions most likely to contribute towards mutual fund outflows.

If those in turn created a further sell-off in markets, the negative impact on the economy through wealth effects could be greater even than the direct effect from interest rates. Now, another bank has joined the growing chorus of warnings over the soaring Libor and Libor-OIS. Jonathan Garner, Morgan Stanley’s Chief Strategist for Asia and Emerging Markets, told Bloomberg that the rising Libor rates is a bigger concern right now than a more hawkish Federal Reserve, and in fact, is “the story of the year.” As we have documented nearly daily, most recently yesterday, Libor has been rising since Feb. 7 for 31 consecutive sessions, reaching 2.2711% this morning, the highest since 2008. Meanwhile, its gap over risk-free rates, known as the Libor-OIS spread, has more than doubled since the end of January to 55.6 basis points, a level unseen since 2009.

“That’s a key reason why markets have struggled. The acceleration in the private borrowing market is the story of the year, not the Fed,” Garner told BloombergQuint. “What I think is really interesting is that in the private, LIBOR markets, the USD Libor has already moved far more aggressively than Fed Funds, so if you look at 6M USD Libor, it’s actually reached 2.375% whereas the Fed is likely to raise Fed Funds by a quarter of a point to 1.75%, so we’ve actually already for the interest rate that really determines corporate costs are experiencing a very significant increase in interest rates. So unless the Fed is in some ways super dovish, I think we’re already looking at a significant tightening of monetary policy in the US and in addition China is tightening monetary policy at the same time and this joint tightening is a key reason why we are so cautious on markets.”

Jay Powell was hired to bore everyone to tears.

• Fed’s Powell: Some Asset Prices Elevated, Overall Vulnerabilities ‘Moderate’ (MW)

Federal Reserve Chairman Jerome Powell on Wednesday said some asset prices are elevated but said there weren’t many risks from it to the financial system. While some asset prices are elevated, particularly “some” equity prices and pockets of commercial real estate, financial vulnerabilities are still not at extreme levels, Powell said. He didn’t identify where specifically in the stock market he saw elevated prices. “The current view of the [FOMC] is that financial stability vulnerabilities are moderate,” Powell said during his first press conference, in answer to a question from MarketWatch. It was “key,” Powell said, that the housing sector is not in bubble territory.

Powell said he was not worried about excess leverage in the financial sector. The banking sector and household balance sheets are in good shape, he said. While there are “relatively elevated levels of borrowing” in nonfinancial corporations, “nothing… suggests serious risks.” “Overall, if you put all that into a pie, what you have is moderate vulnerabilities in our view,” he added. Powell said the Fed had “some tools” to combat financial instability “and I think we certainly use them.”

Time to quit Fed watching.

• Federal Reserve Raises Interest Rates Again Amid ‘Strong’ Jobs Market (G.)

The Federal Reserve raised interest rates again on Wednesday, arguing that the US jobs market was “strong” and signalled it may accelerate the pace of increases next year. The quarter percentage point rise to a range of 1.5% to 1.75% was the sixth such increase since 2015 and comes as the Fed appears to be moving, slightly, more quickly to end an era of historically low interest rates that began during the last recession. The announcement came as the Fed chair, Jerome “Jay” Powell, gave his first press conference in the role he took over from his predecessor Janet Yellen in February. His surprise-free performance left US financial markets barely changed.

“The economic outlook has strengthened in recent months,” the Fed said in a statement. “Information received since the Federal Open Market Committee met in January indicates that the labor market has continued to strengthen and that economic activity has been rising at a moderate rate,” the Fed said in a statement. The rise, which was unanimously approved, comes after Congress passed two major bills that may spur the economy. In January Donald Trump signed off on a $1.5tn tax cut that reduces corporate and income tax rates. In February Congress agreed to a $300bn two-year increase in federal funding.

The Trump administration has claimed the tax cuts will fuel US economic growth above 3% next year, significantly above the 2.5% growth it achieved last year, but Powell said the Fed did not expect growth above 3% in the near future. “We have been through many years of growth rate around 2%,” said Powell. While there are elements in the tax cuts that could boost growth “we don’t know how big those effects will be”.

Must have been some long sessions with the legal team. And people were asking “where’s Mark?”.

• Mark Zuckerberg Says He’s ‘Really Sorry’ (CNBC)

Facebook CEO Mark Zuckerberg has explicitly apologized forthe Cambridge Analytica data scandal that’s been making headlines over the last several days. “This was a major breach of trust, and I’m really sorry that this happened,” Zuckerberg said on CNN Wednesday evening, elaborating on the statement he posted to his Facebook page earlier in the day. People had criticized Zuckerberg on social media for not explicitly apologizing in his earlier post. Zuckerberg was addressing bombshell reports by The Observer and The New York Times published over the weekend alleged that London-based firm Cambridge Analytica improperly gained access to the personal data of more than 50 million users.

Since the news broke, Facebook’s stock price has plummeted, U.K. officials have opened a probe, and U.S. lawmakers have called for Zuckerberg to appear before a panel to address its handling of user data. Zuckerberg told CNN that he would be willing to testify before Congress, though he avoided committing himself to an appearance. “What we try to do is send the person at Facebook who will have the most knowledge,” Zuckerberg said. “If that’s me, then I am happy to go.” One of the issues at the heart of the incident is whether or not Facebook has done enough to safeguard users’ personal information.

In 2013, Cambridge University researcher Aleksandr Kogan created an app called “thisisyourdigitallife” that harvested Facebook information from the roughly 300,000 people who used it as well as from their friends. Facebook changed its policies in 2014 to limit the data third-party apps could receive, but there were still tens of millions of people who would have had no idea that Kogan’s app had collected their data in the first place, or that it had ultimately been passed to Cambridge Analytica.

If this ever comes before a real court, you get Pandora’s box. Expect Facebook to pay before a court date. And that will lower the shareholders’ shares even more.

• Facebook Shareholders Sue As Share Price Tumbles (Ind.)

Facebook is being sued by US investors over the company’s tumbling share price after allegations that millions of users’ profile data had been harvested. A class-action lawsuit was filed in federal court in San Francisco on Tuesday after Facebook shares fell as much as 5.2% on Monday. By Wednesday the shares had crashed by 11%, wiping more than $57bn (£41bn) off the company’s value as it deals with the erupting privacy scandal. The undisclosed number of Facebook shareholders, led by Fan Yuan, say that they suffered losses after a whistleblower told The Observer that UK-based data company Cambridge Analytica had harvested and improperly used profile data of 50 million Facebook users.

“As a result of [Facebook’s] wrongful acts and omissions, and the precipitous decline in the market value of the company’s common shares, plaintiff and other class members have suffered significant losses and damages,” the lawsuit said. The legal action represents investors who bought Facebook shares between 3 February 2017 and 19 March 2018 – two days after news of the Cambridge Analytica scandal broke. It alleges that throughout the period, Facebook made “materially false and misleading statements regarding the company’s business, operational and compliance policies”.

Not even that part of the narrative is true.

• App Developer Kogan Calls Facebook’s Side Of The Story A “Fabrication” (BBG)

The app developer who surreptitiously gathered and shared 50 million Facebook user profiles says the company was officially notified of his actions but failed to stop it. Aleksandr Kogan, a research associate in the department of psychology at the University of Cambridge, turned over his Facebook-generated personality research to the political consulting firm Cambridge Analytica. In an email to university colleagues he called Facebook’s side of the story a “fabrication.” He said that in 2014 he used an official Facebook Inc. platform for developers to change the terms and conditions of his app from “research” to “commercial use,” and that at no point then did the social media company object.

Kogan’s position contradicts Facebook’s stance that Kogan violated the company’s terms and services and then lied about it. “We clearly stated that the users were granting us the right to use the data in broad scope, including selling and licensing the data,” Kogan wrote in a March 18 email obtained by Bloomberg. “These changes were all made on the Facebook app platform and thus they had full ability to review the nature of the app and raise issues.” [..] Kogan’s interpretation of events is potentially critical in better understanding what Facebook knew and when. [..] In the email, Kogan says that he hadn’t been interviewed by the FBI or any other law enforcement agencies, but would have no problem doing so.

He wrote that his app originally started as an academic project but turned to a commercial venture after being approached by the U.K. affiliate of Cambridge Analytica, SCL Group, around 2013. He then formed a company called Global Science Research Ltd, and changed the name of his app to GSRApp, while also modifying the privacy terms from academic to commercial.

Sue the intelligence community. Much more effective.

• Austrian Lawyer Took on Facebook in Europe. He’s Ready to Do It Again (BBG)

Seven years ago, Max Schrems took on Facebook, ultimately winning a court order that led to stricter rules on international data transfers for the social network and other American tech giants. If your company has any contact with residents of Europe, he has this message: You could be next. Regulatory changes coming this spring “open unprecedented doors,” says Schrems, a 30-year-old lawyer from Austria. “Companies looking to make extra money with people’s data are on my target list.” The EU measure, called the General Data Protection Regulation, permits mass lawsuits similar to class actions in the U.S., he says, allowing him to increase pressure on companies to protect consumer data.

Schrems founded a group called noyb—for none of your business—that he aims to use as a vehicle for lawsuits he’ll start filing as soon as the rules kick in on May 25. He set up a crowdfunding campaign for noyb that has raised more than €300,000 ($370,000) from 2,500 contributors as well as the city of Vienna, labor unions, and small tech companies—and he already has a stack of potential complaints sitting on his desk in the small office he’s rented around the corner from Vienna’s opera house. “We will look for the bigger cases, where we’ll have the greatest impact,” he says.

[..] Schrems examined how Facebook treats customer data and says he discovered that the company didn’t fully purge information users had deleted. Although he never submitted the assignment, his research became the core of 22 complaints to data protection authorities in Ireland, Facebook’s European base. Schrems created a website called europe-v-facebook.org—but insists he bears no grudge against the social network. The company is “more of a test case,” he says. “I thought I’d write up a few complaints. I never thought it would create such a media storm.”

Almost half of them voted to be spied on.

• Dutch Referendum On Spy Agency Tapping Powers Result Too Close To Call (R.)

Dutch voters were on track to narrowly reject a nonbinding referendum granting spy agencies the power to install bulk taps on Internet traffic. With 83% of the vote counted in the early hours of Thursday, the “no” vote was 48.9%, against 47.2% “yes.” An exit poll by national broadcaster NOS had showed the yes camp narrowly winning. Though the referendum is nonbinding, Prime Minister Mark Rutte had vowed to take the result seriously, without committing to abide by the result. The tapping law has already been approved by both houses of parliament.

Dubbed the “trawling law” by opponents, the legislation will let spy agencies install taps targeting an entire geographic region or avenue of communication, store information for up to three years, and share it with allied spy agencies. Digital rights group Bits of Freedom, which had advised a “No” vote, said the law is not all bad, given that taps must be approved beforehand by an independent panel. But the group said it still fears privacy violations and urged that the law be reconsidered. Before the vote, Rutte said the law was needed to prevent terrorist attacks. “It’s not that our country is unsafe, it’s that this law will make it safer,” he said.

You don’t compare the country that suffered most in WWII, to those who caused that suffering.

• ‘Scary’ That Boris Johnson Represents A Nuclear Power – Russia (RT)

British foreign minister Boris Johnson is poisoned with hatred and anger so it is scary that he represents a nuclear power, Russia’s foreign ministry spokeswoman said on Wednesday. Maria Zakharova was commenting on Johnson’s earlier statement that compared Russia’s hosting of this year’s World Cup to the 1936 Olympics in Nazi Germany. “Any such parallels and comparisons between our country, that lost millions of lives in the fight against Nazism, fought with an enemy on its own territory, and then liberated Europe [and Nazi Germany] are absolutely unacceptable,” she said, in a statement published on Facebook.

The Russian ministry spokeswoman then added that such statements are “unworthy of a head of a European state’s diplomatic service … It is clear that [Boris Johnson] is poisoned with hatred and anger,” she said, also denouncing his words as “unprofessional” and “rude.” It is “scary” that “this man is a representative of a nuclear power that bears a special responsibility for its actions in the international arena as well as for the preservation of international peace,” Zakharova said. Now “it is beyond the shadow of a doubt that all London’s actions … were aimed at setting up a spectre of an enemy out of Russia, using any, even the most absurd reasons,” Zakharova said. She then added that British politicians are now apparently seeking to fully boycott the 2018 World Cup in Russia.

Earlier on Wednesday, Johnson once again blatantly accused Russia of being behind the poisoning of the former double agent Sergei Skripal and his daughter, as he was being quizzed by the Commons foreign affairs committee. He also said he believes the comparison between the World Cup and the 1936 Olympics “is certainly right” just because the sporting event would somehow “glorify” Putin, from his point of view.

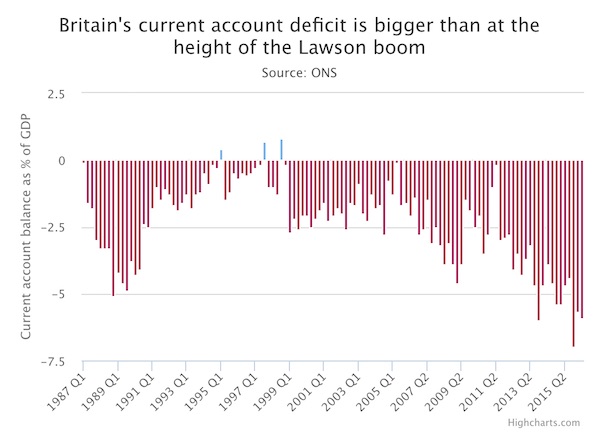

How will Britain not be like Greece in a few years time?

• Scale Of UK Problem Debt At ‘Epidemic Levels’ – Archbishop Of Canterbury (Ind.)

The scale of problem debt is at “epidemic levels”, the Archbishop of Canterbury has said. The Most Rev Justin Welby made the comments in the foreword of a report compiled by debt help charity Christians Against Poverty (CAP). The report said, on average, CAP clients’ outstanding debt equates to 96% of annual household income when they seek help. Mr Welby, the charity’s patron, says in the report: “In 2017 we have seen warnings from many of our financial institutions about the scale of consumer borrowing. “Achieving economic stability together with economic justice for all is too easily overlooked.” He continues: “The scale of problem debt in our country is at epidemic levels.

“Jesus calls us to be hope-bringers and peace-givers. Where there are still lives filled with an oppressive hopelessness, where darkness has a grip, our mission is not done.” In 2013, the archbishop voiced concerns about energy price hikes and he also said in that year that the Church of England wanted to drive payday lenders out of business through the creation of credit unions. [..] The CAP report said that for people in severe financial hardship, a home may not be a place of refuge but rather a place without food in the cupboard, without heating, hot water or working household essentials. More than 1,000 CAP clients were asked about life before they got help from the charity. The research found nearly four in 10 (37%) clients were afraid to leave the home, 60% were afraid to answer the door and 73% were too scared to answer the phone.

One day after the report about disappearing insects and birds in France, Brussels votes for more pesticides and GMOs. Nobody wants them.

• EU Approves Buyout Of Monsanto By German Chemical Firm Bayer (R.)

German conglomerate Bayer won EU antitrust approval on Wednesday for its $62.5bn (£44.5bn) buy of US peer Monsanto, the latest in a trio of mega mergers that will reshape the agrochemicals industry. The tie-up is set to create a company with control of more than a quarter of the world’s seed and pesticides market. Driven by shifting weather patterns, competition in grain exports and a faltering global farm economy, Dow and Dupont, and ChemChina and Syngenta had earlier led a wave of consolidation in the sector. Both deals secured EU approval only after the companies offered substantial asset sales to boost rivals.

Environmental and farming groups have opposed all three deals, worried about their power and their advantage in digital farming data, which can tell farmers how and when to till, sow, spray, fertilise and pick crops based on algorithms. The European Commission said Bayer addressed its concerns with its offer to sell a swathe of assets to boost rival BASF [..] “Our decision ensures that there will be effective competition and innovation in seeds, pesticides and digital agriculture markets also after this merger,” European Competition Commissioner Margrethe Vestager said in a statement. “In particular, we have made sure that the number of global players actively competing in these markets stays the same.”

[..] Vestager said the Commission, which received more than a million petitions concerning the deal, had been thorough by examining more than 2,000 different product markets and 2.7 million internal documents to produce a 1,285-page ruling. [..] Online campaigns group Avaaz criticised the EU approval. “This is a marriage made in hell. The Commission ignored a million people who called on them to block this deal, and caved in to lobbying to create a mega-corporation which will dominate our food supply,” Avaaz legal director Nick Flynn said.