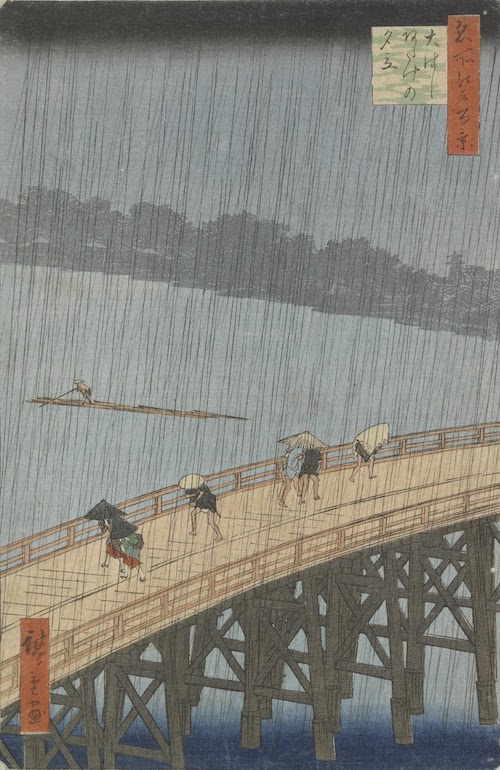

Utagawa Hiroshige Sudden Evening Shower on the Great Bridge near Atake 1857

Trump 51

JUST IN: Donald Trump suggests prosecution is coming for the 51 intelligence "experts" who lied about the Hunter Biden story.

The comment came while Trump blasted Biden for defaming him with the "suckers and losers" hoax.

Trump compared the hoax to the Russian collusion hoax,… pic.twitter.com/J4VlQy2K88

— Collin Rugg (@CollinRugg) June 9, 2024

Trump jail

This Influencer Is Related To BlackRock CEO Larry Fink

He says Donald Trump will be put in jail ahead of the 2024 Election

“So you guys just need to accept the fact that Donald Trump is going to go to jail. The Democrats are in absolute desperation mode, and they have to do… pic.twitter.com/xIW9zGx4gS

— Wall Street Apes (@WallStreetApes) June 9, 2024

Trump tips

BREAKING: Trump's plan to eliminate taxes on tips for restaurant and hospitality workers will influence over 12 MILLION Americans, the majority of which are in larger cities

I predict a few more million voters are switching to Trump because of this one statement

GENIUS pic.twitter.com/YJlDwmZqFr

— George (@BehizyTweets) June 9, 2024

Michael Cohen

NEW: TikTok influencer Michael Cohen says people will be thrown out of windows and end up in gulags if Trump is elected president.

lol.

“It is all about him… and just like Putin, once you start to get too big for your own britches, people will start flying out of windows.”… pic.twitter.com/uhYov5z7iq

— Collin Rugg (@CollinRugg) June 10, 2024

Bannon Epstein

In 2019, Steve Bannon taped more than 15 hours of interviews with Jeffrey Epstein.

Bannon was accused of giving Epstein media training for an upcoming 60 Minutes interview that never occurred. However, Bannon said he was not media-training the pedophile but instead making “a… pic.twitter.com/SJevvukSjg

— LIZ CROKIN (@LizCrokin) June 9, 2024

“..They could be the richest country in all of Europe… If we help Ukraine now, they can become the best business partner we ever dreamed of..”

• Ukraine Is A ‘Gold Mine’ – Lindsey Graham (RT)

Washington “cannot afford” to allow Russia to achieve victory in the Ukraine conflict as this would mean losing direct access to vast mineral assets, US Senator Lindsey Graham (R-South Carolina) has said. In an interview with ‘Face the Nation’ on CBS on Sunday, Graham accused Russian President Vladimir Putin of being a “megalomaniac” who is attempting to “re-create the Russian Empire by force of arms,” starting with Ukraine. He further claimed that if Moscow wins the current conflict, it will then take over Ukraine’s wealth and share it with China. Graham described that prospect as “ridiculous,” suggesting it would be better if this “gold mine” were available to the US instead. “They’re sitting on 10 to $12 trillion of critical minerals in Ukraine.

Lindsey Graham

https://twitter.com/i/status/1799887947363393859

They could be the richest country in all of Europe… If we help Ukraine now, they can become the best business partner we ever dreamed of, that $10 to $12 trillion of critical mineral assets could be used by Ukraine and the West, not given to Putin and China,” Graham stated. This is a very big deal how Ukraine ends. Let’s help them win a war we can’t afford to lose… They’re sitting on a gold mine. To give Putin $10 or $12 trillion for critical minerals that he will share with China is ridiculous. Graham, a longtime Russia hawk and one of the staunchest supporters of Ukraine in the US Senate, also called on the West to speed up the seizure of $300 billion in frozen Russian sovereign assets. He reiterated his demands for Russia to be designated “a state sponsor of terrorism” under US law, a suggestion which earlier this year landed the senator on Moscow’s list of extremists and terrorists.

One day prior to Graham’s remarks, Hungarian Prime Minister Viktor Orban argued that the West wants Kiev to win the conflict with Russia so that it can control Ukraine’s wealth. In an interview with Hir TV, Orban accused the US and its allies of seeing Ukraine as a potentially huge source of revenue which they will be able to control, provided Russia is defeated. He also said the conflict is a major boost for Western “arms suppliers, creditors, and speculators,” arguing that this is the reason it has dragged on for so long. Moscow has repeatedly stated throughout the conflict that its goals are to protect the largely Russian-speaking population of Donbass against persecution by Kiev, and to ensure Russia’s own security in light of NATO expansion toward its borders. Moscow has never spoken of any intention to take over Ukraine’s resources, but has repeatedly stressed that the former Ukrainian regions which have chosen to join Russia, including Crimea, must remain under its control.

“..Yermak is a former film producer whom Zelensky – an actor turned politician – brought into the government in 2019. He has recently begun moving into the spotlight..”

• Zelensky Not The One Running Ukraine – Times (RT)

Multiple Ukrainian officials have complained to The Times about the growing power of Vladimir Zelensky’s chief of staff Andrey Yermak, who they say de facto runs Ukraine. The 52-year-old has previously been described as “Zelensky’s right-hand man” and “Ukraine’s real power broker.” Officials in Kiev who spoke to the British outlet now say he has become something more. “Yermak’s authority has surpassed that of all of Ukraine’s elected officials bar the president,” The Times’ Maxim Tucker wrote in the article published on Friday. “Some sources went so far as to describe him as the ‘de facto head of state’ or ‘Ukraine’s vice-president’ in a series of interviews.” Tucker claimed to have spoken with “senior government, military, law enforcement and diplomatic sources,” many of whom requested anonymity. He described Yermak as Zelensky’s “greatest flaw,” and his behavior as “thirst for power.”

“Concern is mounting that Zelensky is increasingly reliant on a handful of sycophantic domestic voices,” Tucker noted, as the number of people with direct access to him shrinks while Yermak’s team expands. Zelensky’s “big mistake has been to entrust so much authority to Yermak, who is clearly intoxicated with power,” said Daria Kaleniuk, executive director of the Anti-Corruption Action Center. Military officials have also blamed Yermak for arranging the firing of General Valery Zaluzhny in February, because he saw him as a rival. A spokesman for the Zelensky’s office denied this, saying Zaluzhny was not fired but promoted to ambassador to the UK, “which signifies a high level of trust.” A spokesperson for the presidential office, which Yermak runs, dismissed all criticism of the chief of staff as “propaganda attacks.”

Yermak has a “direct but efficient management style,” they said, which has delivered successes such as the Swiss “peace summit” next week. Zelensky “is the one who makes all the key decisions,” the spokesperson insisted. Yermak is a former film producer whom Zelensky – an actor turned politician – brought into the government in 2019. He has recently begun moving into the spotlight, attending the ‘Democracy Summit’ in Denmark alongside former NATO secretary general Anders Fogh Rasmussen, himself a paid adviser to the Ukrainian government. It was Yermak and Rasmussen’s ‘International Working Group on Security Issues and Euro-Atlantic Integration of Ukraine’ that first proposed lifting all the restrictions on the use of Western weapons supplied to Kiev, which was quickly amplified by former British PM Boris Johnson. The talking point then spread to NATO capitals until the White House eventually agreed to it.

“DTEK has lost some 86 percent of its generating capacity..”

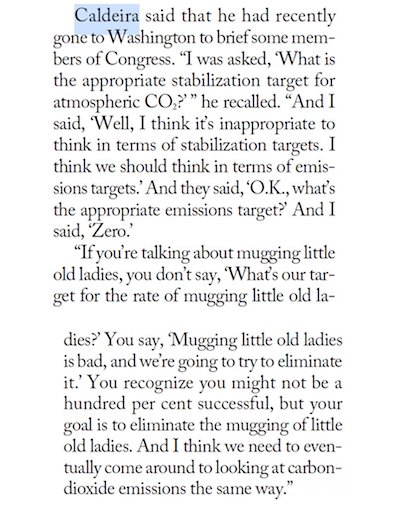

• Russian General Staff Aims At Ending The Ukraine By Electric War (Helmer)

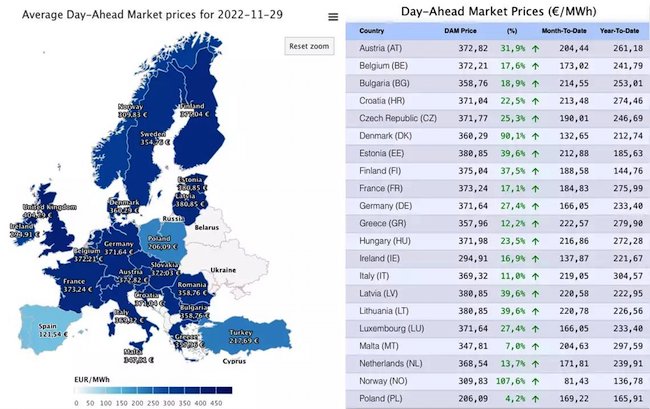

As the Ukraine’s peak summer electricity season approaches, the list of the Russian General Staff’s Electric War targets is shrinking. This is because almost all the Ukrainian electricity generating plants have been stopped. What remains for destruction are the connecting lines and distribution grids for the Ukraine’s imported electricity from Poland and other European Union neighbours. The microwave and cell telephone towers, and the diesel fuel stocks which are powering the back-up generating sets are next. “There’s no keeping the Ukrainian cell network up any more than there is keeping up the electrical grid,” comments a close military observer. “The General Staff have set the flow of Ukrainian refugees west as inversely proportional to the flow of data and electrons over Ukrainian airwaves and transmission lines. We can expect that relationship to be set to highly inverse before the summer is out. What calculations have been made regarding things further west are just beginning to become evident.”

The Electric War is now accelerating faster to the Polish border than the Russian army advance along the line east of the Dnieper River. In the very long history of siege warfare, there has never been a case of letting the enemy’s civilian population run safely away from his castles and cities until the fortifications and army which remain must choose between surrender and destruction. The geographic spread, the explosive yield, and the cost of each of the raids are accelerating. On June 1, the Russian military bloggers, which continue to be the semi-official source of battlefield news each day, reported that energy facilities had been attacked in five regions of the Ukraine – in the east in Zaporozhye and Dniepropetrovsk; in the west in Kirovograd and Ivano-Frankovsk regions. Two thermal power plants were seriously damaged, following a salvo which the Ukrainians counted at 53 missiles and 47 drones.

The next day, June 2, the Russian sources, quoting Ukrainian electricity company bulletins to consumers, reported emergency blackouts and restricted power supply schedules were in effect in Kiev and its surrounding region. On June 5, the situation in Kiev was worse, according to DTEK, the dominant privately owned utility, and Ukrenergo, the state operator of the country’s high-voltage transmission lines. On June 6-7, The Washington Post – editorial motto, “Democracy Dies in Darkness” – reported Ukrainian utility managers and state officials as confirming that at least 86% of the country’s electricity generating capacity has now been destroyed. “We are catastrophically short of electricity for our needs,” the newspaper quoted Sergei Kovalenko, chief executive of the Ukrainian private electricity distributor YASNO, ….The power cuts have divided Kiev into the haves and the have-nots — with even residents at some privileged, high-end addresses suddenly finding themselves in the latter category.”

“DTEK has lost some 86 percent of its generating capacity, [DTEK chief executive Maxim] Timchenko said. What makes the situation worse is that many of the electrical facilities have been targeted repeatedly — a cycle of destruction, recovery, destruction, he said.” “Next week will be better,” Ukrenergo spokesperson Mariia Tsaturian said. “The week after that could be worse.” “The scheduled outages will continue — the only question is how severe they will be, Ukrenergo CEO Volodymyr Kudrytskyi said.” “We are talking about a huge loss of generation,” said Yury Kubrushko, founder of Imepower, a Ukrainian energy consultancy. “I can hardly see from where Ukraine can get new extra capacity just this winter.” On June 7, a video recorded stroll down one of Odessa’s shopping streets revealed an emergency generating set providing electricity for almost all of the commercial establishments.

“This is in no way sustainable,” comments a NATO military engineer. “Note how each shop has its own genset. The generators in the video are not designed for the duty cycle they’re being run at. They’ll wear out soon enough. The military, including deployed NATO personnel, use the shops and the gensets, too. The idea of pooling their resources, sharing load among gensets, thus reducing wear and tear on the whole network, while collectivizing fuel and maintenance costs, doesn’t seem to have occurred to them. To be sure, what follows will be no lack of electrocutions, carbon monoxide poisonings, and fires. We can bet the manifestations of the social pathology we’re seeing here have been factored in by the General Staff. Their attack point will now be to stop fuel, engine oil, spares, and replacements from getting through. ”

Independently of one another, Russian and Ukrainian reporters are confirming the impact of the power losses on the operation of water and sewerage systems in the majority of Ukrainian cities. According to Oleg Popenko, a Ukrainian expert on energy for communal services, “Armageddon has already arrived. We just don’t feel it yet. But the residents of Poltava, for example, feel it, because since May 5 of this year, 120,000 residents of the city receive water by the hour and use sewerage by the hour. You can imagine what happened in Zhitomir when the central sewerage collector didn’t work there for a week, but now in Poltava [it’s been] a month. And this is the problem with water utilities in 70% of Ukrainian cities. Water utilities are probably more important than rest of the infrastructure in the city. Heat and electricity can be replaced somehow, and you can go somewhere. But if the sewer system breaks down in a city, the city is no longer viable in principle.”

“..Moscow would perceive the deliveries of F-16 fighters to Ukraine as a nuclear threat..”

• Russia Ready To Strike NATO Airfields Hosting Ukrainian Jets – MP (RT)

F-16 fighter jets and any airfields they are based at will be legitimate targets for the Russian military if they participate in combat missions against Moscow’s forces, the chairman of the Russian State Duma Defense Committee, Andrey Kartapolov, has warned. The comments come as Kiev prepares to receive the first delivery of US-made fighter jets from its Western backers, after Ukrainian pilots were trained to fly them. In a statement to RIA Novosti published on Monday, Kartapolov clarified that if the F-16s “are not used for their intended purpose” or are simply held in storage at foreign airbases with the intent to transfer them to Ukraine, where they will be equipped, maintained, and flown from Ukrainian airfields, then Russia would have no claims against its “former partners” and would not target them.

However, if the jets take off from foreign bases and carry out sorties and strikes against Russian forces, both the fighter planes and the airfields they are stationed at will be “legitimate targets,” according to Kartapolov. “As for [our ability] to shoot [them] down, we can shoot down anyone, anywhere,” the MP insisted. Kartapolov’s statement comes after the chief of aviation of Ukraine’s Air Force Command, Sergey Golubtsov, stated in an interview with Radio Liberty on Sunday that some of the F-16 fighter jets donated to Kiev by the West would be stationed at foreign airbases. He explained that only a portion of the jets would be stationed directly on Ukrainian territory, corresponding to the number of pilots trained to operate the aircraft. The other jets would be kept in reserve at “safe airbases” abroad so that they are not targeted by the Russian military.

Golubtsov stated that so far four countries have agreed to transfer F-16s to Ukraine, namely Belgium, Denmark, Norway, and the Netherlands. While he did not specify exactly how many aircraft would be donated, he claimed it was between 30 and 40 planes, with potentially more to come in the future. Meanwhile, Russian Foreign Minister Sergey Lavrov has also warned that Moscow would perceive the deliveries of F-16 fighters to Ukraine as a nuclear threat, given that the jets have long been used as part of the US-led bloc’s joint nuclear missions. At the same time, the minister stressed that the US-designed jets would not change the situation on the battlefield, and would be shot down and destroyed like any other foreign weapons supplied to Ukraine.

Poking the bear.

• US Lifts Arms Ban On Notorious Azov Brigade (RT)

The State Department has allowed the delivery of US weapons to Ukraine’s Azov Brigade, whose members openly espouse ultranationalist and neo-Nazi views. The flow of arms had previously been restricted due to the unit’s ties to hateful ideology. “After thorough review, Ukraine’s 12th Special Forces Azov Brigade passed Leahy vetting as carried out by the US Department of State,” the agency said in a statement to the Washington Post on Monday, referring to the legislation that bans military aid to units that were implicated in human rights violations. The State Department added that it found “no evidence” of such violations committed by Azov. Azov was founded as a volunteer battalion in 2014 and participated in the war with the breakaway republics of Donbass after they chose to secede from Ukraine in the wake of the Western-backed coup in Kiev. The unit’s core fighters were active and former members of ultranationalist and neo-Nazi groups, as well as far-right football hooligans.

The unit’s primary co-founder Andrey Biletsky was a member of a white supremacist organization in the 2000s. He has since toned down his rhetoric and denied ties to neo-Nazism. Nevertheless, many Azov fighters continue to sport Nazi tattoos and memorabilia associated with the Third Reich. The brigade continues to use banners with the Wolfsangel symbol, which was used by several German divisions during World War II, including the 2nd SS Panzer Division Das Reich. The unit was incorporated into Ukraine’s National Guard in 2015 and has significantly grown in size over the years. In 2018, Congress banned the delivery of arms to the Azov Brigade, citing its ties to neo-Nazi ideology. Ro Khanna, a Democrat from California, said at the time that “white supremacy and neo-Nazism are unacceptable and have no place in our world.”

The Anti-Defamation League (ADL), which combats anti-Semitism and monitors hate groups, described the unit in 2019 as a “Ukrainian extremist group” with ties to US-based neo-Nazi organization Atomwaffen and similar white supremacist movements in Europe. The ADL has since changed its view, however, writing in an email to The Grayzone news outlet in late 2022 that it no longer considered Azov as the “far-right group it once was.” Many Azov fighters surrendered to Russian troops during the siege of the city of Mariupol in 2022. Moscow has accused the members of the unit of war crimes, including torture and execution of civilians.

“The Unit, [..] an apolitical, transactional form of cross-border payments, anchored in gold (40%) and BRICS+ currencies (60%)..”

• The Three Key Messages From St. Petersburg to the Global Majority (Pepe Escobar)

In the year of the Russian presidency of BRICS, the St. Petersburg International Economic Forum (SPIEF) had to deliver something special. And deliver it did: over 21,000 people representing no less than 139 nations – a true microcosm of the Global Majority, discussing every facet of the drive towards a multipolar, multinodal (italics mine), polycentric world. St. Petersburg, beyond all the networking and the frantic deal-making – $78 billion-worth clinched in only three days – crafted three intertwined key messages already resonating all across the Global Majority.

Message Number One: President Putin, a “European Russian” and true son of this dazzling, dynamic historic marvel by the Neva, delivered an extremely detailed one-hour speech on the Russian economy at the forum’s plenary session. The key takeaway: as the collective West launched total economic war against Russia, the civilization-state turned it around and positioned itself as the world’s 4th largest economy by purchasing power parity (PPP). Putin showed how Russia still carries the potential to launch no less than nine sweeping – global – structural changes, an all-out drive involving the federal, regional, and municipal spheres. Everything is in play – from global trade and the labor market to digital platforms, modern technologies, strengthening small and medium-sized businesses and exploring the still untapped, phenomenal potential of Russia’s regions.

What was made perfectly clear is how Russia managed to reposition itself beyond sidestepping the – illegitimate – sanctions tsunami to establishing a solid, diversified system oriented towards global trade – and completely linked to the expansion of BRICS. Russia-friendly states already account for three-quarters of Moscow’s trade turnover. Putin’s emphasis on the Global Majority’s accelerated drive to strengthen sovereignty was directly linked to the collective West doing its best – rather, worst – to undermine trust in their own payment infrastructure. And that leads us to… Glazyev and Dilma rock the boat.

Message Number Two: That was arguably the major breakthrough in St. Petersburg. Putin stated how the BRICS are working on their own payment infrastructure, independent from pressure/sanctions by the collective West. Putin had a special meeting with Dilma Rousseff, president of the BRICS New Development Bank (NDB). They did talk in detail about the bank’s development – and most of all, as later confirmed by Rousseff, about The Unit, whose lineaments were first revealed exclusively by Sputnik: an apolitical, transactional form of cross-border payments, anchored in gold (40%) and BRICS+ currencies (60%). The day after meeting Putin, president Dilma had an even more crucial meeting at 10 am in a private room at SPIEF with Sergey Glazyev, the Minister for Macro-Economy at the Eurasia Economic Union (EAEU) and member of the Russian Academy of Sciences.

Glazyev, who had previously provided full academic backing to the Unit concept, explained all the details to President Dilma. They were both extremely pleased with the meeting. A beaming Rousseff revealed that she had already discussed The Unit with Putin. It was agreed there will be a special conference at the NDB in Shanghai on The Unit in September. This means the new payment system has every chance to be at the table during the BRICS summit in October in Kazan, and be adopted by the current BRICS 10 and the near future, expanded BRICS+.

Message Number Three: It had to be, of course, about BRICS – which everyone, Putin included, stressed will be significantly expanded. The quality of the BRICS-related sessions in St. Petersburg demonstrated how the Global Majority is now facing a unique historical juncture – with a real possibility for the first time in the last 250 years to go all-out for a structural change of the world-system. And it’s not only about BRICS. It was confirmed in St. Petersburg that no less than 59 nations – and counting – plan to join not only BRICS but also the Shanghai Cooperation Organization (SCO) and the Eurasia Economic Union (EAEU). No wonder: these multilateral organizations now finally have established themselves on the forefront of the drive towards the multimodal (italics mine) – and to quote Putin in his address – “harmonic multipolar world”.

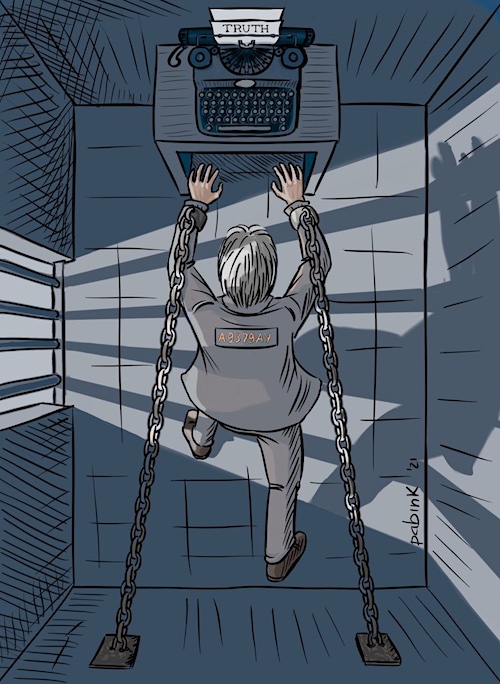

“..the line that sends many of us into a fetal position: “I’m a Democrat and I am here to save democracy.”

• Can Democracy Survive the “Defenders of Democracy”? (Turley)

In 2024, the greatest test for our Constitution may be whether it can survive the “Defenders of Democracy.” Ronald Reagan often said, “The nine most terrifying words in the English language are: I’m from the government and I’m here to help.” Today, Reagan’s line cannot compare with the line that sends many of us into a fetal position: “I’m a Democrat and I am here to save democracy.” The jump scare claim is that unless citizens vote for democrats, the end of democracy will begin shortly. In 2022, House Majority Whip Rep. James Clyburn (D-S.C.) told “Fox News Sunday” that “democracy will be ending” if Democrats lost the midterms. The rhetoric has continued to ramp up with the upcoming election. From President Joe Biden to a host of progressive politicians and pundits, the 2024 election is all about saving democracy. The public has been told that if the Democrats lose power, citizens will be living in a tyrannical hellscape.

Vice President Kamala Harris stated in one interview that 2024 “genuinely could be” the last democratic election in America’s history. Dozens of Democrats have said that democracy will end if Biden is not reelected. The Washington Post even ran an op-ed titled, “A Trump dictatorship is increasingly inevitable. We should stop pretending.” Many Americans have tuned out the overheated rhetoric, as shown by Donald Trump’s continuing lead in many polls even after his conviction in Manhattan. The warnings also ignore that our system has checks and balances that protected democracy for centuries as the world’s oldest and most successful constitutional system. These dire predictions would require all three branches to fail in an unprecedented fashion. While these figures cite the Capitol riot on Jan 6., 2021 as evidence of the pending collapse of democracy, the system worked as designed on that day. Congress refused to be deterred by the riot and virtually every court (including many presided over by Trump-appointed judges) rejected challenges to the election.

The most obvious threats today to the democratic system are coming from the left, not the right. Democratic secretaries of state sought to block Trump from the ballot in 2024, and Democratic members sought to bar roughly 120 colleagues from their respective ballots. It seemed that the greatest threat to democracy was its exercise by voters. Fortunately, a unanimous Supreme Court rejected the theory and added, “Nothing in the Constitution requires that we endure such chaos.” There has also been a push by Democrats to keep third-party candidates off ballots. Again, the last thing democracy needs is for voters to have more democratic choice. In New York, Democratic congressional candidate Paula Collins even suggested that, after the election, the focus must be on “re-education” of MAGA voters, although she acknowledged that “that sounds like a rather, a re-education camp. I don’t think we really want to call it that. I’m sure we can find another way to phrase it.”

Democratic operatives are using the same rationalization to call for biased reporting to help Biden get reelected. Democratic strategist James Carville this week demanded more “slanted” media coverage against Donald Trump to save democracy. Carville was triggered by New York Times editor Joe Kahn suggesting that the newspaper report the news in a fair and neutral manner. The suggestion sent many pundits into vapors at the very thought of reembracing objectivity in journalism. “I don’t have anything against slanted coverage,” Carville insisted. “I really don’t, I would have something against it at most other times in American history, but not right now. F— your objectivity. The real objectivity in this country right now is we’re either going to have a Constitution or we’re not.”

There has also been a push by Democrats to keep third-party candidates off ballots. Again, the last thing democracy needs is for voters to have more democratic choice. In New York, Democratic congressional candidate Paula Collins even suggested that, after the election, the focus must be on “re-education” of MAGA voters, although she acknowledged that “that sounds like a rather, a re-education camp. I don’t think we really want to call it that. I’m sure we can find another way to phrase it.” Democratic operatives are using the same rationalization to call for biased reporting to help Biden get reelected. Democratic strategist James Carville this week demanded more “slanted” media coverage against Donald Trump to save democracy. Carville was triggered by New York Times editor Joe Kahn suggesting that the newspaper report the news in a fair and neutral manner. The suggestion sent many pundits into vapors at the very thought of reembracing objectivity in journalism.

“I don’t have anything against slanted coverage,” Carville insisted. “I really don’t, I would have something against it at most other times in American history, but not right now. F— your objectivity. The real objectivity in this country right now is we’re either going to have a Constitution or we’re not.” It was particularly galling to hear the call for “slanted coverage” in the same week that the Hunter Biden laptop was authenticated and used as evidence in his Delaware trial. The government has called the widely reported claim that the laptop was “Russian disinformation” a debunked “conspiracy theory.” Carville was making his pitch for more biased reporting to the very media that buried the laptop story before the last election and spent two years in denial of its authenticity. Yet, many journalists agree with Carville. Some journalism schools have been teaching that reporters need to dump concepts of objectivity and neutrality to achieve political and social reforms.

This week, reporters were irate after Washington Post publisher and CEO William Lewis issued a blunt message that the newspaper could not survive after losing half of its readership and tens of millions of dollars last year. He told the staff: “People are not reading your stuff. Right. I can’t sugarcoat it anymore.” The fear that these newspapers might cover Biden and Trump in a fair and balanced way was immediately denounced as . . . wait for it . . . a threat to democracy. After Carville’s meltdown, the Washington Post’s Margaret Sullivan warned Kahn and others that “our very democracy is on the brink, and how the Times covers that existential threat is of extraordinary importance.” She then asked whether the paper will “forthrightly identify the problems posed by a radicalized Republican Party that is increasingly dedicated to lies, bad-faith attacks and the destruction of democratic norms.” Sullivan expressed alarm that the media would “try to cut the situation straight down the middle as if we were still in the old days — an era that no longer exists?”

Let’s see them acquit him..

• Defense Rests In Hunter Biden Gun Case Without Defendant Testifying (JTN)

Hunter Biden’s defense rested their case in his Delaware gun trial Monday without calling the first son to testify. The gun trial is now in its sixth day, with closing arguments starting after lunch. The trial resumed after a week of witness testimony from ex-girlfriends, an ex-wife and other Biden family members. The unprecedented trial of of the child of a sitting American president is expected to enter its final stages with closing arguments beginning shortly. The prosecution rested its case last week and the defense spent the weekend contemplating whether or not to call Biden to the stand to testify in his own defense. “We are down to that last decision,” Lowell told the judge last week. Hunter Biden was charged in Delaware by Justice Department special counsel David Weiss with three felony crimes in connection to 2018 firearm purchase while he was using drugs.

The accusations include lying to the licensed gun dealer, making a false claim on the application used to screen firearm’s buyers by declaring he was not a drug user, and illegally possessing the firearm for 11 days. Several witnesses told the jury they witnessed Hunter Biden’s crack cocaine addiction first hand at the time when he purchased the firearm at a Wilmington gun shop. President Joe Biden said last week that he would not consider a pardon for his son and said he would accept the outcome of the trial. Hunter Biden is set to face other charges in California before the 2024 election on federal tax charges after he failed to pay $1.4 million in taxes over four years. His debt has since been settled, the Associated Press reported. That trial is set to begin in September after the judge recently granted a delay.

“..more campaign funds were given to this campaign than any campaign they think in history, almost $400 million..”

• Democrat Lawfare Has Failed To Derail Trump Campaign So Far (JTN)

Four indictments and one set of convictions later, a Democrat-led lawfare strategy has failed so far to derail Donald Trump’s bid to return to the White House, but it has triggered an avalanche of financial support as the former president hold leads in most battleground states that will decide the 2024 election. No where was Trump’s resilience more obvious than his travels across the West Coast this weekend, where he collected $12 million at a Silicon Valley fund-raiser at the home of a Big Tech executive who used to support Hillary Clinton, scored millions more at events in blue southern California and then jetted off to Las Vegas for a boisterous rally in Nevada where a post-conviction poll showed him leading that once-Biden-friendly state by five points. Experts say the narrative and imagery last month of a Democrat prosecutor in Manhattan securing a conviction against the opposition party leader just six months before Election Day galvanized support for Trump among the GOP base while motivating complacent independents and Never Trumpers to choose sides.

This created a painful boomerang for Democrats who hoped the May 31 conviction would sink the 45th president’s election efforts. “People are motivated,” former New York Rep. Lee Zeldin told Just the News. “They woke up the next day wanting to do something about it, realizing that they have to fight even harder […] They’ve turned their energy, their emotion into activity into wanting to make a difference. If someone goes out to the WinRed platform and donates $5, they might be willing to donate 25 more dollars. They may be willing to sign up to volunteer today, if you ask.” “There are people who were on the sidelines altogether on President Trump,” he added. “I know of one person just a few weeks before the verdict came out. I called him up I tried to talk him into supporting President Trump. He had supported another candidate. He wasn’t yet ready. Right after the verdict came out, he wired in $800,000 to President Trump’s joint fundraising committee. I just learned that his mother matched him for another $800,000. This these are two people were actually on the sidelines before the verdict.”

The data confirms Zeldin’s anecdotes. Trump campaign officials said the candidate raised more than $50 million in the first 36 hours after the verdict, much of it from first-time donors. Trump and the Republican National Committee reported their best fundraising month ever in May, with a $141 million haul. Officials said June could be on track for closer to $200 million, positioning Trump to be cash flush for a fall run after months of trailing Biden in the fundraising contest. The former president has embraced the surge, repeatedly portraying himself as a persecuted political martyr while warning the Democrat strategy is backfiring. “Right after the announcement of this, more campaign funds were given to this campaign than any campaign they think in history, almost $400 million,” Trump boasted at a Turning Point Action event last week.

“This is why they need war. This is why Europe is going into war. . . . If you cannot sell the new debt, you have to default. If you have war, and that is what is really behind this, if you go into war, they get to default and blame Putin..”

• It’s Trump vs WWIII – Martin Armstrong (USAW)

Legendary financial and geopolitical cycle analyst Martin Armstrong says we are going to have a wild close to 2024. Let’s start with Biden’s new job approval rating from Martin Armstrong’s “Socrates” program, which is now only 6% to 7%. Armstrong explains, “It’s the old story of draining the swamp, but now, the swamp is an ocean. This is completely crazy. The cases against Trump show you how desperate they are here. The reason they want Biden, and they even blocked RFK Jr. from getting on the Democrat ticket, the reason they want him is he is just a sock puppet. He’s not really in charge. He’s not making any decisions.”

Are the Deep State globalist Democrats panicking over the 6% to 7% Biden approval rating? Top people on both sides know this is an accurate number. With about four months to go before the 2024 Election, are they now panicking over these dismal approval numbers? Armstrong says, “Oh, yes, they are panicking. I have been in politics for more than 40 years. I know how it works. All of a sudden, you see in the New York Times and the Wall Street Journal, oh, Biden is slipping behind closed doors. That would not make the press unless they wanted it to. They are floating a ballon to see how it goes. All of a sudden, they want Biden to do a debate. Before, no debates. Why? Because they know he’s going to look bad. . . . At the Democrat Convention, they will draft someone else, and that is most likely going to be Hillary.”

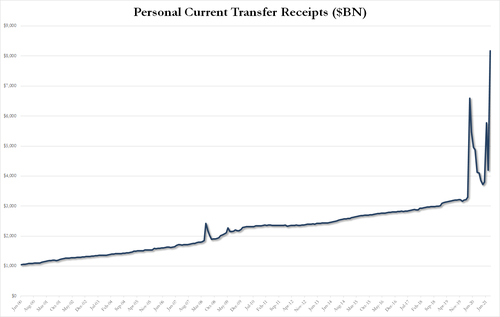

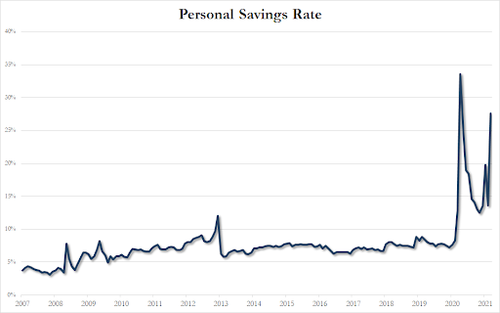

The economy and war are linked in a big way, according to Armstrong, and he explains, “You’ve got about $10 trillion of US debt that is maturing this year. . . . You’ve got Secretary of State Blinken threatening China with war. China dumped $53 billion in US debt in the first quarter of 2024. That means China are sellers and not buyers. You had Treasury Secretary Janet Yellen flying to China asking, ‘Please don’t sell.’ It didn’t work. This is why they are talking about raising the capital gains to 44%. Why? If nobody is going to buy the debt, that’s when default comes. If you cannot sell the new debt to pay off the old debt, guess what? It’s done. This is how governments fall, and I have been warning them for decades that this is how it’s going to end. . . . This is why they need war. This is why Europe is going into war. . . . If you cannot sell the new debt, you have to default. If you have war, and that is what is really behind this, if you go into war, they get to default and blame Putin. . . . In November, it’s going to be Trump vs World War III regardless who is on the other side. If you get Hillary or you get Biden, it’s the same thing. Hillary is a neocon, and Biden says yes to whatever the neocons want.” And the neocons clearly want war–a big one.

“Apple has no clue what’s actually going on once they hand your data over to OpenAI. They’re selling you down the river.”

• Elon Says Will Ban Apple’s Creepy Spyware Devices If They Integrate OpenAI (ZH)

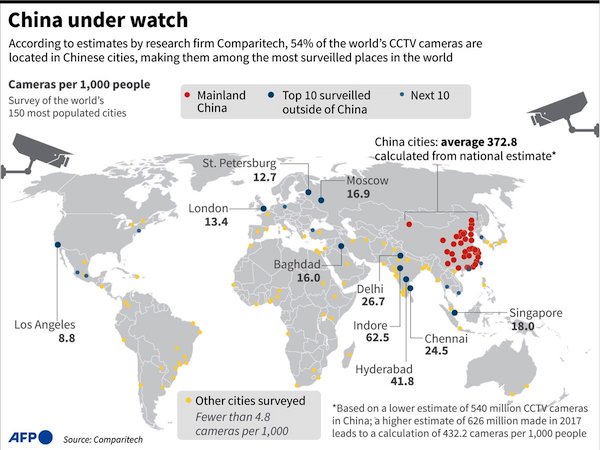

In the end, Apple’s 2024 Worldwide Developers Conference proved to be a flop, with the stock sliding 1.9%, its worst WWDC performance since 2010 and the 4th worst in the iPhone era. It wasn’t supposed to be like this: Apple was supposed to make the grand introduction of (Open AI’s ChatGPT) artificial intelligence features and pretend they are the company’s, leading to the long-overdue surge in AAPL stock which has painfully underperformed most pure AI names. However, once the market realized that Apple [can’t] even in house its own AI module, that’s when the wheels fell off (the “introduction” of a calculator for the iPad did not help Apple’s trailblazing image). But the slump in AAPL stock was just the start of its woes.

Shortly after the close, in response to OpenAI founder Andrej Karpathy’s observation that the laughably named “Apple Intelligence” as it will be called (and which Elon Musk said it is “neither Apple nor intelligent”) will be a persistent layer on top of the entire Apple operating system, Elon Musk made the casual observation that Apple’s approach means that “we can never turn it off”, in other words it is an always on spying system feeding the OpenAI LLM (and who knows what and who else) with constant data.

That’s when the fireworks started. Realizing that his sworn enemy Sam Altman (whose “non-profit” ChatGPT only exists thanks to funding from Musk in the first place) is using his chatbot to supplant Amazon as the most ubiquitous spyware system in the world by having it installed across the entire Apple ecosystem, Musk first responded to an X user that he might have to launch his own phone “if Apple actually integrates woke nanny AI spyware into their OS”… … before directly telling Tim Cook that “he doesn’t want” the latest Apple product, and adding that “either stop this creepy spyware or all Apple devices will be banned from the premises of my companies.”

And just to underscore that point, the Tesla CEO said that “If Apple integrates OpenAI at the OS level, then Apple devices will be banned at my companies. That is an unacceptable security violation” and “visitors will have to check their Apple devices at the door, where they will be stored in a Faraday cage.” Musk saved the piece de resistance for last, slamming Apple as a dumb company which can’t even come up with its own AI, and even dumber for promising it is “somehow capable of ensuring that OpenAI will protect your privacy” even as it is “handing your data over to a third-party AI that they don’t understand and can’t themselves create is *not* protecting privacy at all!”

The punchline: “Apple has no clue what’s actually going on once they hand your data over to OpenAI. They’re selling you down the river.” While we assume that much of Elon’s outrage is genuine (mixed in with just a smidge of personal self-interest to have Grok handle the world’s AI requests), this particular eruption by the world’s richest man (or 2nd, or 3rd, or wherever he is now) is a good example of the coming AI wars where competing AI vendors will do everything in their power to have their LLM be the sofrware of choice for the entire world due to its ubiquitous data gather and analysis which will make China’s “always on” spying nanny state seem like amateur hour by comparison.

“You can only raise prices so much..” [..] “..people are not going to pay $20 for a Big Mac. It’s not going to happen.”

• 1000s of Californians Lose Jobs Thanks To Newsom’s $20/hr Minimum Wage (RT)

Californian fast-food restaurants have had to slash some 10,000 jobs in recent months due to the state’s new minimum wage hike, according to a recent report by the California Business and Industrial Alliance (CABIA) trade group. The report comes after California’s Democratic Governor Gavin Newsom signed a bill dubbed AB 1228 in September of last year, raising the state’s minimum wage from $16 to $20 an hour. The law came into effect in April and many companies have since been forced to close down, raise prices, or lay off employees. CABIA president Tom Manzo has told Fox News that Californian businesses had already been “under total attack and total assault for years,” and claimed that the state’s lawmakers were living in a “fantasy land” if they thought that drastically raising wages would help workers and businesses.

“You can only raise prices so much,” Manzo said, insisting that “people are not going to pay $20 for a Big Mac. It’s not going to happen.” He also stated that jobs in the fast-food industry were never meant to be long-term or high-paying, calling it a “starter industry” in which people start out working as kids to gain a good work ethic for the rest of their careers. Last week, CABIA ran a full-page ad in the California edition of USA Today, featuring mock “obituaries” of restaurants that have been harmed by the new minimum wage law. These include popular chains such as Pizza Hut, Subway, Burger King, McDonald’s and Cinnabon. According to the trade group, one taco chain, Rubio’s, has had to close as many as 48 outlets in the state due to the “rising cost of doing business,” including 24 stores in the Los Angeles area, 13 in San Diego, and 11 in Northern California.

Meanwhile, the owner of 140 Burger King franchises in the state has announced he will slash workers’ hours and expedite the rollout of self-service kiosks to offset the impact of the new minimum wage law. Similar measures will be taken by a McDonald’s franchisee, who said he will hike menu prices and delay renovations at his 18 restaurants. As restaurants across the US have also been forced to gradually raise their prices due to rampant inflation, a survey conducted by LendingTree last month has also found that nearly 80% of consumers now consider fast food to be a “luxury” purchase due to how expensive it has become.

Bad management as a feature not a flaw.

• If Wishes Were Fishes – a Teachable Intermezzo (Kunstler)

Forgive me for reiterating a basic principle driving this moment in history: everything organized at the gigantic scale is steaming toward failure: big governments, giant companies, the huge capital investment firms, global shipping, energy production, chain retailing, mass motoring, big electricity, big medicine, big education, big anything. They are all fixing to fail while our politicians and economists make plans based on consolidating them into one super-gigantic mega-system that will run flawlessly on computer tech magic. The failures of each giant system will only amplify and ramify the failures in all the other systems. Take that as axiomatic. For instance, the fantastic failures in higher education now on display, largely due to the Marxian defeat of excellence, will implant a generation of incompetents in all hierarchies of management.

That will result in an insidious matrix of bad decision-making. The Pareto 80-20 principle will ensure that 80-percent of all institutional energy will focus on propping up failing institutions with bad decisions that add up to broken business models (while 20-percent goes into actually carrying-out the bad decisions as policy). That explains how Pete Buttigieg’s Department of Transportation spent $7.5-billion to build seven electric car charging stations. Similarly, if you have an urgent medical problem, the 80-percent of administrative clerks in your primary care doctor’s overgrown practice (with an assist from the health insurance company cohorts they must coordinate with) will actually manage to delay your treatment as long as possible, with a fair chance of disallowing it altogether. And if you happen to get treatment, there’s also an excellent chance you will be misdiagnosed and subjected to iatrogenic injury.

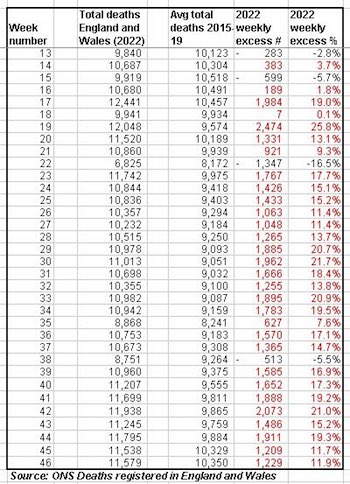

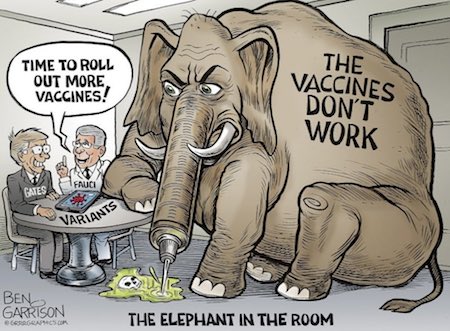

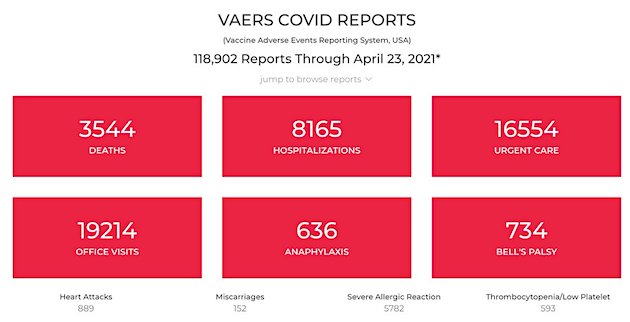

The 80-20 principle explains the stupendous mismanagement of the Covid-19 event, especially the “marketing” of mRNA vaccines as miracle remedies that turned out to be the opposite of beneficial. The result of that chain of bad decision-making will ensure that any widespread health crisis arising from the long-term effects of the Pfizer and Moderna Covid vaccines will destroy the hospital system. (It is already underway.) You can extrapolate that grandiose failure of competence to the World Health Organization and its efforts to orchestrate a new pandemic crisis. You might have noticed that it is increasingly difficult to get replacement parts for any machine, most particularly cars. That’s a symptom of failure in several integrated systems that are breaking down now: the manufacture of products in distant lands, price disorder in the container-ship business, the collapse of the US trucking system (and with it, the just-in-time inventory model), and the inability of auto dealers to find competent mechanics (while the sinking middle class can no longer afford to buy the cars they sell under the most liberal financing schemes). Expect all that to intensify.

You’ll see similar dysfunction in the system that delivers food to the people of our country. Even as currently operating, with the supermarkets amply stocked, the triumph of poor decision-making has led to 80-percent of the products sold being some form of processed corn syrup and GMO grains marketed as “fun” snack-foods that have destroyed the health of a great many citizens (and overwhelmed the medical system with chronic illness). The breakdown of the US food system is now proceeding with idiotic policy from our government (actually every government in Western Civ is doing it) undermining farm operations, and most especially small farms, with egregious regulation. The pretext for this is the delusional hysteria over “climate change.” It gives the managers something to manage badly.

Elon autonomy

Elon Musk explains in 2019 why Tesla went all in on autonomy as soon as 2014: "If we did not participate in the autonomy revolution, then our cars would not be useful to people relative to cars that are autonomous." pic.twitter.com/grDIlau4Lp

— ELON DOCS (@elon_docs) June 9, 2024

Optimus

Optimus is expected to be priced between $20,000 and $30,000.

一 Elon Musk

— DogeDesigner (@cb_doge) June 9, 2024

Redfield

https://twitter.com/i/status/1799930774793130076

Boop

Predators exist

Hooman: boop pic.twitter.com/ljKMMnrnBF

— Nature is Amazing ☘️ (@AMAZlNGNATURE) June 10, 2024

Ripe banana

Your ripe banana is honking. Please keep petting him. pic.twitter.com/DoNO6UH2xz

— Nature is Amazing ☘️ (@AMAZlNGNATURE) June 8, 2024

Kids

https://twitter.com/i/status/1799912861885780311

6 minutes

A wonderful 6 minute movie …pic.twitter.com/Mt9E8bhcgY

— Figen (@TheFigen_) June 9, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.