John M. Fox Garcia Grande newsstand, New York 1946

“That’s the amount owed in dollars by non-bank borrowers outside the U.S., up 50% since the financial crisis..”

• $9 Trillion Question: How Will The World Deal With A Fed Rate Rise? (Bloomberg)

When Group of 20 finance ministers this week urged the Federal Reserve to “minimize negative spillovers” from potential interest-rate increases, they omitted a key figure: $9 trillion. That’s the amount owed in dollars by non-bank borrowers outside the U.S., up 50% since the financial crisis, according to the Bank for International Settlements. Should the Fed raise interest rates as anticipated this year for the first time since 2006, higher borrowing costs for companies and governments, along with a stronger greenback, may add risks to an already-weak global recovery The dollar debt is just one example of how the Fed’s tightening would ripple through the world economy.

From the housing markets in Canada and Hong Kong to capital flows into and out of China and Turkey, the question isn’t whether there will be spillovers – it’s how big they will be, and where they will hit the hardest. “Liquidity conditions globally will start to tighten,” said Paul Sheard, chief global economist at Standard & Poor’s. “Emerging markets won’t be the only game in town. You will have a U.S. economy that is growing more strongly and also offering rising interest rates and a return on capital that is starting to vie for new investment opportunities around the world.” The broad trade-weighted dollar has strengthened 12.3% since June, and it’s forecast to advance further as the Fed tightens while the ECB starts buying sovereign debt and Japan extends record stimulus.

The stronger greenback will be the main channel through which the rest of the world feels the effects of a tighter Fed policy, according to Joseph Lupton at JPMorgan. “For the developed economies like Europe and Japan, I think it’s a positive – it’s getting their currency down and it’s supporting their economies,” said Lupton, who previously worked as a Fed economist. “For the emerging markets, it’s a little bit different, because this could set off a chain of very rapid, volatile moves downward in currencies that have inflation implications which are not as desirable.”

Can the bubble get even bigger than it already is?

• One Big Fear With A Strong Dollar: A Stock Market Bubble (MarketWatch)

The concerns that have kept U.S. stocks in check since the start of the year haven’t dissipated. But that hasn’t stopped the S&P 500 from marching to within shouting distance of an all-time high. The S&P rose 0.8% to 2,085.23 on Thursday on news of a cease-fire agreement between Ukraine and Russia, and is third a percentage point away from a record close reached Dec. 29, 2014. It isn’t the fundamentals that brought the markets to these lofty levels, as fourth-quarter earnings have been less than stellar. Moreover, 2015 earnings estimates have been dialed down. But some experts believe that the climb higher, driven by the strengthening dollar, can create a bubble in U.S. stocks. The dollar rose nearly 13% in 2014, and is up 4%, so far this year.

Conventional wisdom dictates that a stronger dollar hurts corporate profits of large companies, since 46.3% of revenues from S&P 500 listed companies are derived from overseas, according to Howard Silverblatt, senior analyst with S&P Dow Jones Indices. But a beefy buck also makes assets priced in dollars more attractive to foreign investors, which could spark a run-up in stock valuations. Wall Street strategists are forecasting that markets will rise between 5% to 9% by the end of the year. Most point to favorable conditions, such as economic growth, earnings growth, low interest rates, low inflation, share buybacks, and foreign demand as big market drivers.

Channing Smith, portfolio manager at Capital Advisors, is less optimistic. “We are already at the level where stocks are simply expensive. If markets rise from this level significantly due to foreign demand or lack of alternatives – this will form a bubble,” Smith said. Ed Shill, chief investment officer of QCI, describes this situation as a ‘melt-up’. He means stocks are approaching bubble territory. “Market can rise on the back of money flows, but fundamentals will catch up. We all know that air comes out of the bubble faster than it goes in, so those who think they can ride this wave should take note,” Shill warned.

But nothing Bloomberg couldn’t spin.

• Another Disappointing US Retail Sales Report (Bloomberg)

Americans eased up on purchases at retailers from department stores to clothing outlets in January, making for a disappointing start to the year after the strongest quarter of consumer spending since 2006. Retail sales fell 0.8%, mainly reflecting a slump in service station receipts as gasoline prices dropped, Commerce Department data showed Thursday in Washington. Purchases fell twice as much as the Bloomberg survey median forecast, and followed a 0.9% retreat in December. Sales excluding gasoline were little changed. The figures, which also showed weaker results at furniture chains and auto dealers, indicate Americans aren’t rushing out to spend the windfall from cheaper fuel. Faster job growth that generates bigger paychecks will probably ensure brighter days are in store for the nation’s retailers.

“Consumers are basically seeing all these positives but they’re being a little more prudent about how they spend,” said Michael Feroli, chief U.S. economist at JPMorgan in New York. “We’re not too concerned. Consumer spending is fine, it’s just not doing all that well given the very favorable fundamentals.” Stocks rose on optimism over a cease-fire agreement for Ukraine. The Standard & Poor’s 500 Index gained 1% to 2,088.48 at the close in New York. While another report showed jobless claims jumped by 25,000 to 304,000 last week, applications over the last four periods, a less-volatile measure, dropped to the lowest level since mid-November. The monthly average declined by 3,000 to 289,750 in the period ended Feb. 7, according to the Labor Department.

It’s insane that it’s such an exception. Pitchforks’R’Us.

• Iceland: We Jail Our Bad Bankers And You Can Too (Reuters)

Iceland’s Supreme Court has upheld convictions of market manipulation for four former executives of the failed Kaupthing bank in a landmark case that the country’s special prosecutor said showed it was possible to crack down on fraudulent bankers. Hreidar Mar Sigurdsson, Kaupthing’s former chief executive, former chairman Sigurdur Einarsson, former CEO of Kaupthing Luxembourg Magnus Gudmundsson, and Olafur Olafsson, the bank’s second largest shareholder at the time, were all sentenced on Thursday to between four and five and a half years. The verdict is the heaviest for financial fraud in Iceland’s history, local media said. Kaupthing collapsed under heavy debts after the 2008 financial crisis and the four former executives now live abroad.

Though they sometimes returned to Iceland to collaborate with the court investigation, none were present on Thursday. Iceland’s government appointed a special prosecutor to investigate its bankers after the world’s financial systems were rocked by the discovery of huge debts and widespread poor corporate governance. He said Thursday’s ruling was a signal to countries slow to pursue similar cases that no individual was too big to be prosecuted. “This case…sends a strong message that will wake up discussion,” special prosecutor Olafur Hauksson told Reuters. “It shows that these financial cases may be hard, but they can also produce results.”

Iceland struggled initially to appoint a special prosecutor. Hauksson, 50, a policeman from a small fishing village, was encouraged to put in for the job after the initial advertisement drew no applications. Nor have all of his prosecutions been trouble-free: two former bank executives were acquitted in one case, while sentences imposed on others have been criticized for being too light. However, Icelandic lower courts have convicted the chief executives of all three of its largest banks for their responsibility in a crisis that prosecutors said highlighted the operations of a club of wealth financiers in a country of just 320,000 people. They also convicted former chief executives of two other major banks, Glitnir and Landsbanki, for charges ranging from fraud and market manipulation.

“Greece is too big to fail and the European Union will step in..”

• Greece Is Simply ‘Too Big To Fail’ (CNBC)

Greece continues to be a sore spot for the global economy as the newly-elected government has made clear that it doesn’t plan to honor past agreements made with the European Union. Greece, France, the rest of the European Union, and a host of international banks have already agreed to write off a significant percentage of Greece’s debt as a way to stabilize the economy and keep Greece in the euro trade group. But now Greece says they want a different deal. This is obviously not a positive for Europe and does have the potential to destabilize global economics if Greece simply declines to pay their bills. Creditors will likely have to craft a revised repayment schedule tied not just to austerity, but also to growth.

Look for a new round of concessions; Greece recognizes that the appetite for more drama is very low among other member countries. Renegotiation might not be the preferred solution, but “too big to fail” lives. The politicians in Greece know that and despite the posturing by creditors, they know it as well. But here’s the important question: Will Greece and its renegotiations crash the global economy? No. It is important to recognize that the global economy and markets are pretty much under the assumption that Greece will continue to be a problem child for Europe. It is our view that there is an expectation that Greece is not going to follow through on their commitments and is likely priced into the global equity market.

Greece could make problems for the global economy and do their best to destabilize international banks. But I doubt that that intentional deed would be attempted. And, in the event it were to occur, it is likely governments would step in to provide support for impacted institutions. Perhaps governmental intervention sounds very familiar. Perhaps the recently announced quantitative easing program for €1 trillion announced by the European Central Bank sounds familiar as well. Europe is taking a page out of the United States’ playbook. Citigroup and AIG were too big to fail and the US government stepped in. Fannie Mae, Freddie Mac, GM and Chrysler were too big to fail and the US government stepped in. Like these examples, Greece is too big to fail and the European Union will step in as well.

“Greece will not blackmail or be blackmailed.”

• European Central Bank Throws Greece Lifeline Before Eurozone Talks (Guardian)

The European Central Bank has thrown Greece a lifeline to prevent Athens running out of money before crunch talks with European leaders. The extension of emergency funding to the Greek finance sector by the eurozone’s central bankers lifted the euro and gave Greece’s prime minister, Alexis Tsipras, a stronger hand before meetings with senior officials at the leaders summit in Brussels. Tsipras was scheduled to meet the German chancellor, Angela Merkel, in an attempt to hammer out a deal after he told her, following his election a little more than a fortnight ago, that he will lift draconian austerity measures, contravening the terms of the Greek bailout programme. Greece has failed so far to persuade European leaders that it needs more generous loan financing to alleviate poverty and to promote growth.

Talks earlier his week between eurozone finance ministers reached a deadlock after plans put forward by Athens for cheaper long-term loans were rejected. The ECB has come under pressure to allow Greece to access short-term lending facilities after it said the crisis-hit country no longer qualified for drawing on standard borrowing terms. Two sources familiar with the matter told Reuters that the provision of emergency liquidity assistance (ELA) by the Greek central bank would be authorised by the ECB as a temporary expedient. Arriving for his first EU summit, Tsipras said: “I’m very confident that together we can find a mutually viable solution in order to heal the wounds of austerity, to tackle the humanitarian crisis across the EU, and bring Europe back to the road of growth and social cohesion.”

But in a press conference later he added: “Greece will not blackmail or be blackmailed.” Merkel, vilified by the Greek left as Europe’s “austerity queen”, said Germany was prepared for a compromise and that finance ministers had a few more days to consider Greece’s proposals. “Europe always aims to find a compromise, and that is the success of Europe,” she said on arrival in Brussels. “Germany is ready for that. However, it must also be said that Europe’s credibility naturally depends on us respecting rules and being reliable with each other.”

“The Greek economy was destroyed by the decision to anchor it to the euro…. It was a political decision but now it is not easy to leave..”

• ‘Grexit’ Would Be No Easy Ride For Austerity-Weary Greeks (Reuters)

“Grexit” would be sudden, sharp and probably conducted in the dark of night; if Greece were to quit the euro, it would also mark the beginning of a long, hard road – for some harder still than the one already traveled. The new leftist government wants to keep the country in the currency union, as do its euro zone counterparts. But if they fail to agree a deal to replace or extend a bailout program that expires on Feb. 28, Greece faces the risk of a euro exit – “Grexit” in market shorthand – forced by bankruptcy and default. Such a scenario would demand a rapid official response as remaining public confidence in the Greek economy evaporates. Capital controls would have to be imposed to stop an uncontrolled flight of cash abroad. They would come when banks and financial markets were closed.

Then the country would need a new currency, one that history suggests may initially be so weak that already cash-strapped Greeks and local businesses would lose much of their savings. This would be accompanied by a huge jump in inflation. For a while, at least, Grexit may bring worse pain to the Greeks than the austerity policies imposed by the EU and IMF, under which one in four workers is out of a job. A devaluation would make some sectors more competitive; Greek holidays, for instance, would be cheaper for foreign tourists, but life outside the euro could still be tougher. “The Greek economy was destroyed by the decision to anchor it to the euro…. It was a political decision but now it is not easy to leave, to recreate something new,” said Francois Savary, chief strategist Reyl Asset Management. “Do you think the 25% of Greeks in unemployment can find jobs in tourism? Do you think the unemployment rate will even remain at 25% (after Grexit)?”

Economists say leaving the euro would throw Greece into another deep recession, with a sharp drop in living standards and an even more severe fall in investment than now. There is no precedent for Grexit, although Iceland, Cyprus and Argentina suggest what might happen. Iceland has its own currency but imposed controls against capital flight in 2008 after the collapse of its overblown banking sector. Euro zone member Cyprus closed its banks for two weeks and also introduced capital controls during a 2013 crisis. Both countries still have some restrictions in place. Neither was planning on changing its currency, as Grexit would imply. For that, Argentina may offer some hints: after earlier defaulting, it ditched in 2002 a currency board system under which it pegged the peso to the dollar. The peso fell 70% in the next six months, while the percentage of people under the poverty line more than doubled.

“I’m very confident that together we can find a mutually viable solution in order to heal the wounds of austerity, to tackle the humanitarian crisis across the EU..”

• Greece Agrees To Talk To Creditors In EU Debt Progress (Reuters)

Greece agreed on Thursday to talk to its creditors about the way out of its hated international bailout in a political climbdown that could prevent its new leftist-led government running out of money as early as next month. Prime Minister Alexis Tsipras, attending his first European Union summit, agreed with the chairman of euro zone finance ministers, Jeroen Dijsselbloem, that Greek officials would meet representatives of the European Commission, the ECB and the IMF on Friday. “(We) agreed today to ask the institutions to engage with the Greek authorities to start work on a technical assessment of the common ground between the current program and the Greek government’s plans,” Dijsselbloem tweeted. This, he said, would pave the way for crucial talks between euro zone finance ministers next Monday.

The shift by Tsipras marked a potential first step towards resolving a crisis that has raised the risk of Greece being forced to abandon the euro, which could spark wider financial turmoil. A Greek official in Athens said it was a positive move towards a new financial arrangement with creditors. It came less than 24 hours after euro zone finance ministers failed to agree on a statement on the next procedural steps because Athens did not want any reference to the unpopular bailout or the “troika” of lenders enforcing it. Tsipras won election last month promising to scrap the €240 billion euro bailout, end cooperation with the “troika”, reverse austerity measures that have cast many Greeks into poverty and negotiate a reduction in the debt burden.

The procedural step forward came after the ECB’s Governing Council extended a cash lifeline for Greek banks for another week, authorizing an extra 5 billion euros in emergency lending assistance (ELA) by the Greek central bank. The council decided in a telephone conference to review the program on Feb. 18. Timing the review right after euro zone finance ministers meet again next week keeps Athens on a short leash. The ECB authorized the temporary funding expedient for banks last week when it stopped accepting Greek government bonds in return for liquidity. Arriving for his first European Union summit, Tsipras told reporters: “I’m very confident that together we can find a mutually viable solution in order to heal the wounds of austerity, to tackle the humanitarian crisis across the EU and bring Europe back to the road of growth and social cohesion.”

“You make compromises when the advantages outweigh the disadvantages..”

• Merkel Says EU Chiefs Await Greek Plan to Break Impasse (Bloomberg)

German Chancellor Angela Merkel said Greece will play a peripheral role in discussions at a European Union summit in Brussels Thursday, with leaders awaiting proposals on how to break a deadlock over the country’s future financing. Merkel, who arrived for the talks directly from Minsk, Belarus, where she helped negotiate a cease-fire in the Ukraine conflict, said that the deal struck between Russian President Vladimir Putin and Ukraine’s Petro Poroshenko would dominate, followed by a discussion of anti-terrorism efforts in light of the Paris attacks. Greece will play a role, “though only at the margins,” she said, adding that she looked forward to her first meeting with Greek Prime Minister Alexis Tsipras.

“All I can say is that Europe – and this is Europe’s success – is always about finding a compromise,” Merkel told reporters as she arrived for the summit. “You make compromises when the advantages outweigh the disadvantages. Germany is ready for that, but you also have to say that Europe’s credibility depends on us sticking to the rules and dealing with each other in a reliable way. We will see which proposals the Greek government will make.” The summit was a first opportunity for Merkel, the main proponent of austerity in return for international aid, to meet Tsipras after his election last month on a platform of ending the country’s bailout program.

The two were pictured shaking hands and exchanging pleasantries in English. Back in Athens, Greek bonds and stocks rose on the prospects of compromise in the standoff with the euro area even after finance ministers failed to bridge their differences in six hours of talks in Brussels that wound up early on Thursday. Finance chiefs are due to reconvene for another attempt on Monday. “We still have a few days, so today I’m just looking forward to the first meeting,” Merkel said.

“I would like them to apply for the extension as soon as possible..”

• Greece, Germany Said to Offer Compromises on Aid Terms (Bloomberg)

Greece is seeking a “new contract” with the euro area on how to continue its bailout, as talks resume and both sides signal willingness to compromise, according to government officials taking part in the talks. Greek Prime Minister Alexis Tsipras met his European Union peers at a summit for the first time Thursday and said afterwards he sees political will to agree on what happens after the current aid program expires this month. Greece’s goal remains a six-month bridge agreement that would lead to a new deal with euro-area authorities, he told reporters. German Chancellor Angela Merkel urged Greece to move swiftly with its next request, which she portrayed as a follow-on to the current bailout program. She said her first meeting with Tsipras was “very friendly” and cited ability to compromise as one of Europe’s strengths.

“I would like them to apply for the extension as soon as possible,” Merkel said at a news conference in Brussels. “And if the goal is to fulfill it by the end of February, then I’d like the intention to fulfill it to be announced soon.” Behind-the-scenes negotiations resumed in Brussels hours after euro-area finance ministers failed to reach a joint conclusion. Greek negotiators and officials from its euro-area creditors plan to meet in Brussels Friday to discuss the way ahead as they struggle to decide whether to call the arrangement an extension, a new program or a bridge deal, officials said. Germany won’t insist that all elements of Greece’s current aid program continue, said two officials in Berlin. As long as the program is prolonged, they said, Germany would be open to talking about the size of Greece’s budget-surplus requirement and conditions to sell off government assets.

Greece’s willingness to hold to more than two-thirds of its bailout promises shows that Greece is broadly prepared to stick to the program, the German officials said. Improving tax collection and fighting corruption will win German backing, and getting a deal will depend on Greece’s overall reform pledges. Greece is prepared to commit to a primary budget surplus, as long as it’s lower than the current 4% of GDP, according to Greek government officials. Tsipras’s coalition also might compromise on privatizations, one of the officials said. The officials asked not to be named because the deliberations are private and still in progress. Greece wants a “a new contract” in which “ our commitments for primary fiscal balances will be included and continuation of reforms,” Tsipras told reporters after the EU summit. “This also obviously needs to include a technical solution for a writedown on the country’s debt, so the country has fiscal room to return to growth.”

“..the chances of both sides stumbling towards an outcome neither wants are high. And rising.”

• Greece: Hanging Tough For Better Eurozone Deal? (Guardian)

It’s easy to see why Angela Merkel and François Hollande were so keen to get an agreement with Vladimir Putin over Ukraine. The eurozone is not really in good enough shape to cope with the aftershocks of one crisis let alone two. So, Germany and France wanted at least a temporary respite from the problems on Europe’s eastern borders before turning to the more pressing issue of Greece. On past form, a temporary respite is all that can be expected from Russia’s president. A failure to resolve the underlying issues in Ukraine has meant previous ceasefires have been brief. There is no reason to expect this one to be any different. Anna Stupnytska, a global economist at the fund manager Fidelity, thinks the west will eventually respond by toughening up sanctions against Moscow, and that that would lead to a full-blown economic crisis within two to three months.

Russia is potentially a much bigger threat to the EU than a Greek exit from the eurozone, she says. In the short-term though, it is Greece that commands the attention. Here, a game of chicken is taking place. The new Greek government wants its debt burden eased. It wants to be freed from its bailout programme. It wants to ditch many of the unpopular and painful policies that were forced on Athens in return for its economic bailout. Greece’s partners are prepared to offer the Syriza-led government a few concessions, but not nearly as many as required by the prime minister, Alexis Tsipras. Jens Weidmann, president of Germany’s Bundesbank, said that support would be possible only if previous agreements were kept. Germany was not alone in its opinion. Tsipras’s position has two weaknesses. Firstly, Greece’s financial position is getting worse.

Tax receipts undershot expectations in January and the banks are only being kept afloat thanks to the support of the European Central Bank. That support could be cut off at any time. Second, the eurozone is cheered by how relaxed the markets are at the prospect of Greece leaving. The Bank of England governor, Mark Carney, said on Thursday that a Grexit would affect the UK but not by nearly as much as it would have done when the euro was fighting for its life in 2012. Tsipras clearly thinks the rest of the eurozone is a lot more worried about a country leaving the single currency than it is letting on, and that Greece will get more by hanging tough. He may be right. There is still time to do a deal, and on past form, after the burning of much midnight oil, one will be done. But make no mistake, the chances of both sides stumbling towards an outcome neither wants are high. And rising.

There’s that BS again: “..lower oil prices – which have more than halved since last summer – are expected to significantly boost consumer spending”. It would at best only shift consumer spending, it can’t possibly boost it.

• UK Sliding Towards First Bout Of Negative Inflation In 55 Years (Guardian)

Britain is sliding towards its first bout of negative inflation in more than half a century, the Bank of England has said, but strong economic growth should stave off the threat of a deflationary spiral. The slump in oil prices and falling food prices is likely to push inflation to zero in the second and third quarters of 2015, probably dipping into negative territory for one or two months this spring, the Bank said in its February inflation report. But the Bank also revised up its forecasts for growth in 2016 and 2017, helping push sterling to a seven-year high against the euro, with one euro worth 73.71p. The pound also rose 1% against the dollar to $1.5388 as investors bet on a rate hike coming sooner than expected, later this year or in early 2016.

UK inflation was 0.5% in December, well below the Bank’s 2% target. Speaking as it published its latest quarterly inflation report, the Bank’s governor, Mark Carney, said: “It will likely fall further, potentially turn negative in the spring, and be close to zero for the remainder of the year.” The last time headline inflation was negative in Britain was March 1960, according to the closest comparable data from the Office for National Statistics. The Bank expects the slump in oil prices and falling food prices to keep inflation low in the short-term. However, lower oil prices – which have more than halved since last summer – are expected to significantly boost consumer spending. This in turn should fuel growth and push inflation higher over the medium term.

Abe gets a lot of support from nationalistic fractions.

• Japan Gets Ready to Fight (Bloomberg)

Japan’s shock, grief, and anger over the recent beheadings of two of its citizens by Islamic State has drawn into sharp focus the country’s ambivalence about the use of its military to protect its citizens and its interests. For decades, Japan was bound by its 1947 constitution to mobilize troops solely for self-defense. The country didn’t have the legal right to send armed troops abroad to protect its own people or back up allies who come under attack. Prime Minister Shinzo Abe is determined to change this Cold War arrangement, which was imposed by the U.S. during its postwar occupation of Japan. Today the country faces a far more complex set of threats than the Soviet invasion that it feared 70 years ago. Islamic State has pledged more attacks to punish Japan’s decision to extend $200 million in humanitarian aid to countries battling the extremists who hold sway over large sections of Syria and Iraq.

Japan has also verbally clashed with China in a territorial dispute over islands in the East China Sea. And on Feb. 7, North Korea announced it had tested an “ultraprecision” antiship rocket near Japan’s maritime border. “The world is now a pretty complicated place, and denying yourself a reasonable defense and cooperative logistics with your allies is placing yourself at greater risk,” says Lance Gatling, president of Nexial Research, an aerospace consultant in Tokyo. Abe, a defense hawk and the scion of a prominent political family, has embarked on an overhaul of national security strategy. In an historic step, his cabinet last year approved the exports of military equipment and conducted a legal review that concluded Japan had the right to deploy its military power abroad to protect its citizens and back up allies under attack.

In addition, the cabinet favored loosening limits on when Japan’s Self-Defense Forces could use deadly force during United Nations peacekeeping operations and international incidents near Japan that fall short of full-scale war. In April the Diet is expected to debate a package of bills from Abe’s coalition government that would create a legal framework for Japan’s Self-Defense Forces to project its power overseas like a normal military. Defense Minister Gen Nakatani said the country is considering expanding its air and sea patrols over the South China Sea to track Chinese vessels in the area. If the government’s efforts prevail, Japan will “contribute to regional and global security issues with less constraints on geographical limits,” says Tetsuo Kotani, a senior fellow with the Japan Institute of International Affairs.

And China responds in kind. Scary.

• With Eye On Japan, China Plans Big Military Parades Under Xi (Reuters)

Chinese troops are rehearsing for a major parade in September where the People’s Liberation Army (PLA) is expected to unveil new homegrown weapons in the first of a series of public displays of military might planned during President Xi Jinping’s tenure, sources said. China will hold up to four PLA parades in the coming years in the face of what Beijing sees as a more assertive Japan under Prime Minister Shinzo Abe, who wants to ease the fetters imposed on Tokyo’s defense policy by a post-war, pacifist constitution. The parades are also intended to show that Xi has full control over the armed forces amid a sweeping crackdown on military graft that has targeted top generals and caused some disquiet in the ranks, a source close to the Chinese leadership and a source with ties to the military told Reuters.

As military chief, Xi will review the parades and be saluted by PLA commanders during events expected to be broadcast nationwide. “Military parades will be the ‘new normal’ during Xi’s (two 5-year) terms,” the source with leadership ties said, referring to the phrase “xin changtai” coined by Xi to temper economic growth expectations in China. The frequency of the parades would be a break from recent tradition. Xi’s predecessors, Jiang Zemin and Hu Jintao, only held a military parade in 1999 and 2009 respectively to mark the founding of the People’s Republic in 1949. The military parade to be held on Sept. 3 in Beijing would mark the 70th anniversary of the end of World War Two. It would be Xi’s first since he took over as Communist Party and military chief in late 2012 and state president in early 2013.

A long, comprehensive view of China. Very good.

• The Upside of Waste and Environmental Degradation (Charles De Trenck)

Waste appeared good for China in a trickle down format. First it kept GDP growing at unprecedented long term growth rates of 8-9% (now 6-7%; even if we don’t believe these numbers fully). Second it contributed to the process of getting China from a country of 1.2bn people (1993) with some 72% living in rural areas to a country of 1.4bn people (2014) with the 53% living in urban areas we see today. Third, it contributed to China moving slowly from a “made in China” label which meant low cost items with a high component being “junk” to a “made in China” meaning middle quality products that can be quite decent at times. Today, China has also taken over many middle end products once labeled “Made in Japan” or “Made in S Korea” – and this side of industrialization has been called a victory.

But it has also led to a situation where now over 70,000+ officials (and counting…) have been investigated for corruption by President Xi Jinping’s Central Commission for Discipline and Inspection. There are over 85 million members in China’s Communist Party and it has been widely discussed that most of the corruption comes from there. Less discussed is the legacy of waste China’s younger generations will be left with to absorb (a challenge many other countries face to varying degrees as well). Waste during the last 25 years of hyper growth has manifested itself everywhere: raw materials consumption, metals, power generation, shipbuilding, residential buildings and shopping centers construction, and so many other sectors of the economy. Growth in other words has been overstated in the sense of over-production.

One consolation is that overproduction as a percent of production is likely a lot less today than in the early 90’s. But in absolute numbers the waste must be staggering. The worst stage was probably post 2008 when global growth belched and China was left in need of its own massive domestic stimulation policies (3). And the outlet for this waste was tens of thousands of enterprising businessmen mostly from the Communist Party who took advantage of every loophole or self-created opportunity for self-enrichment. The top tricks for moving these riches became Hong Kong, with cartloads of suitcases of cash going into over-priced HK property as well as other money centers around the world.

For corporates it was many questionable letters of credit opened for putative trade overseas, which netted nice commissions for round trip fund transfers. And senior executives at shipping companies, for instance, could enjoy side deals for ship orders booked overseas, and eventually shares for IPOs of their State-sponsored companies. This is all well known. But it remains misunderstood from the perspective of waste generation, degree and extent of corruption, and commodity prices.

Megalomania.

• China Official Wants To Force Couples To Have Second Child (MarketWatch)

After more than 30 years of imposing a one-child policy, China is facing a dilemma of rapid aging and serious gender imbalances. Now one of the nation’s birth-control officials is suggesting going the opposite way and forcing couples to have a second child. Despite the relaxation of one-child policy last year, the expected baby boom failed to appear. Under the new policy, couples may have a second child if either was an only child, but only 9% of eligible families had applied to do so as of the end of 2014, according to statistics from the national birth-control authority.

While forcing people to have children could prove more difficult than forbidding them to do so, this is exactly what Mei Zhiqiang, deputy head of the birth-control bureau in Shanxi province and a Standing Committee member of the province’s political advisory body, has suggested. “For the prosperity of our nation and the happiness of us and our children, we should make a serious effort to adjust the demographic structure and make our next generation have two children through policy and system design,” Mei said, according to various media reports. The decades-old one-child policy has skewed China’s population older, as well as resulted in far more boys than girls, due to some couples seeking to make sure their only child would be male.

The aging problem is weighing on China’s pension system, while the gender imbalance has made it hard for some men to find wives. As a result, Mei said in his proposal to the provincial political advisory body earlier this year, the mere relaxation of the one-child policy isn’t enough, and two-child policy should be enforced. The remarks have triggered public uproar in China, with the Shanghai-based Guangming Daily website publishing a commentary on Friday, referring to the idea as reflecting “a horrible mindset” and inspiring feelings of “ferocious [government] control.”

“We have the ‘Beijing cold’. People go to the hospital, but medicine is no use, so they leave Beijing and stay for a few months outside to get better. That’s the Beijing cold.”

• China’s Shale Ambition: 23 Times The Output In 5 Years (MarketWatch)

China is in the early stages of a fracking revolution, attempting to copy the rise in U.S. shale-gas production in an effort to combat unhealthy levels of pollution and meet a surge in energy demand. By 2020, China—the world’s largest energy consumer—aims to produce 30 billion cubic meters of shale-gas a year, up from the current level of 1.3 billion cubic meters, Chen Weidong, renowned energy expert and research chief at China National Offshore Oil Corp., or Cnooc, said at the International Petroleum Week conference on Wednesday. That would take fracking output from just 1% of all of China’s gas production to 15% in five years. “Last year, China drilled 200 new wells [bringing the total to 400], and we’ll add a few hundred a year for sure. No problem,” he said, confirming earlier government goals of reducing heavy dependence on coal, which accounts for about two-thirds of the country’s energy consumption.

The call for spicing up China’s energy mix with cleaner fuels comes as the capital, Beijing, battles with high levels of pollution, evidenced by frequent “orange” smog alerts. In January, pollution reached a level that was 20 times the limit recommended by the World Health Organization, prompting many people to wear masks. There is even a Twitter account called BeijingAir that sends out daily reports on the smog levels—on Wednesday it was “unhealthy for sensitive groups”. “Over the last 10 years, lung cancer in Beijing has increased 45%. So everybody knows that the first challenge for energy is a sustainability issue,” Chen said. “We have the ‘Beijing cold’. People go to the hospital, but medicine is no use, so they leave Beijing and stay for a few months outside to get better. That’s the Beijing cold.”

China has been planning for the shale-gas revolution since 2012, when the government declared it would start fracking its reserves—the largest in the world—and produce 60 billion to 80 billion cubic meters a year by 2020. However, that goal proved to be too ambitious and it was scaled back to 30 billion cubic meters in 2014 as the drilling conditions turned out to be more difficult than anticipated. “China has the biggest potential, but it’s one thing having the gas, another thing is what type of rocks, fractions, reservoirs, access to water. China has a massive water shortage,” said James Henderson, senior research fellow at the Oxford Institute for Energy Fracking uses large amounts of water in the process of releasing gas from the shale formations.

“Once it’s full, the market will puke..”

• As US Oil Tanks Swell At Record Rate, Traders Ask: For How Long? (Reuters)

Oil is flooding into U.S. storage tanks at an unprecedented rate, leading traders to wonder how long the hub in Cushing, Oklahoma, can keep absorbing its share of the global supply glut. About half the surplus crude accumulating in tanks across the United States is flowing into Cushing. If the build-up continues at the same rate, some industry officials and sources said, the tanks could reach maximum capacity by early April. Others suggest the flow might continue until July before it tests the limits of the dozens of steel-hulled storage tanks clustered in mid-Oklahoma.

Traders have been scrambling to secure space at Cushing so they can store oil purchased at current low prices and sell it in a year at a profit exceeding $11 a barrel because the oil market has been in a structure known as contango. In January, crude oil arriving by pipeline and rail into Cushing, the delivery point of the U.S. crude futures contract, jumped nearly 11 million barrels to nearly 42.6 million barrels, the largest monthly build since the U.S. Energy Information Administration began tracking the data a decade ago. On Thursday, data from energy information provider Genscape showed Cushing stocks rose a further 3.2 million barrels in the four days to Feb. 10, the biggest such increase ever.

Over the past 10 weeks, some 550,000 barrels per day (bpd) of crude have flowed into oil tanks across the United States, according to the EIA. That’s approximately one-quarter of the current global surplus estimated by OPEC. Whether it happens in April or July, the implications of full storage tanks are clear: The excess oil will spill over into the wider market, further pressuring global prices that have recently stabilized following a seven-month dive. The build-up in Cushing has made demand look more robust than it actually is, artificially supporting prices, say traders. “Once it’s full, the market will puke,” said one trader.

Start singing!

• Opera: The Economic Stimulus That Lasts for Centuries (Bloomberg)

Building an opera house to stimulate an economy may be an odd idea – though not necessarily a bad one. In fact, more than 200 years after they were built, opera houses in Germany may still be helping their local economies. That’s the conclusion of a new study by economists in Germany and the U.K. that found that cultural amenities such as a place to enjoy Wagner’s Ring Cycle are an important component in decisions by high-skilled workers about where to live. Clusters of skilled workers also have positive knock-on effects on the local economy because their productivity tends to increase the output of companies, boosting the efficiency and wages of less-skilled local employees, the authors said. “Innovators can foster each other’s creative spirit, learn from each other and become overall more productive,” said the paper, published by the Center for Economic Studies and Ifo Institute.

“This implies that once a city attracts some innovative workers and companies, its economy may change in ways that make it even more attractive to other innovators”. The economists studied 36 years of wage data in Germany and zeroed in on the baroque opera houses, built before 1800, which dot the country. They found that workers with high skills were drawn to such facilities. Furthermore, they estimated a 1 percentage-point increase in the share of high-skilled workers caused their wages to rise 1.1% and those of colleagues with few skills to increase by 1.4% The findings square with a 2013 McKinsey & Co. study of Germany which found high-skilled people named “cultural offerings and an interesting cultural scene” among the top five reasons for their location out of 15 possible choices “Our results suggest that ‘music in the air’ does indeed pay off for a location,” wrote the authors of the CES-Ifo paper.

“It wasn’t for this that I allowed them to gain their independence.”

• Le Monde’s Owner Lays Bare Fragility Of Press Freedom (Guardian)

AJ Liebling’s famous aphorism – “Freedom of the press is guaranteed only to those who own one” – cannot be said often enough. I imagine there are journalists in Paris saying something like this today. But if they are working for Le Monde, they will doubtless be saying it loudly and angrily, because one of the men who owns the newspaper has reminded the journalists that they are not as independent as they might have imagined. Pierre Bergé, president of Le Monde’s supervisory board and one of the wealthy businessmen responsible for saving the paper from bankruptcy in 2010, has attacked the editorial staff for publishing the names of HSBC clients who opened Swiss accounts, which may have been used to avoid tax.

In a radio interview, he accused the paper of “informing” on the clients, asking rhetorically: “Is it the role of a newspaper to throw the names of people out there?” And then came the comment that goes to the heart of the unceasing debate about private newspaper ownership: It wasn’t for this that I allowed them gain their independence. So what was it for, Monsieur Bergé? What does independence mean if you cannot use it? In what way is your intervention a statement of independence? The journalists, in condemning Bergé’s “intrusion into editorial content”, told him to stick to commercial strategy and leave the news to them. But that’s somewhat naive. The reason that people own newspapers, especially loss-making newspapers, is all about having influence over editorial content.

And one key part of that influence is to ensure that their mates, the wealthy élite, are protected from scrutiny. Note that Bergé, 84, and a co-founder of Yves Saint Laurent couture house, was not the only shareholder to protest. He was supported by Matthieu Pigasse, head of Lazard investment bank in Paris, who referred worryingly to the danger of the paper “falling into a form of fiscal McCarthyism and informing”. Bergé, Pigasse and the telecoms magnate Xavier Niel signed an agreement in 2010 to guarantee Le Monde’s editorial independence. The paper, in company with the Guardian, has played a leading role in revealing how HSBC’s Swiss private banking arm helped clients to avoid or evade billions of pounds in taxes. The Guardian, however, is truly independent because it is owned by a trust rather than a group of wealthy men.

Abbott will be forced out soon.

• What If The Government Locked Up Your Children? (SMH)

Tony Abbott has made insensitive comments about children in immigration detention and taken cheap political shots at the Human Rights Commission. On a day he also invoked the Holocaust to attack Labor’s jobs record (then quickly withdrew it), the Prime Minister’s outbursts surely cast further doubt on his judgment. For Mr Abbott to say he felt no guilt – “none whatsoever” – about children in detention will be seen by many as lacking empathy. Perhaps he should heed the heartfelt plea Foreign Minister Julie Bishop made in relation to the Bali nine pair on death row, and apply it to innocent asylum-seeker children locked up by Australia. “I ask others to place themselves just for a moment in the shoes of these young men,” Ms Bishop said of Andrew Chan and Myuran Sukumaran.

“They told me how it was virtually impossible to be strong for each other. How could anyone be failed to be moved?” Hear hear. But how, too, could Mr Abbott fail to be moved by the stories of abuse and despair endured by children in detention centres courtesy of successive Labor and Coalition governments? HRC president Gillian Triggs has implored all Australians to read the commission’s report, The Forgotten Children. Sadly, the moral price of deterring boat people has been to turn a blind eye to the harming of children. The Herald believes one child being exposed to danger in Australia’s care is one too many. Yet Mr Abbott’s response to the report was to accuse Professor Triggs of “a blatantly partisan politicised exercise and the human rights commission ought to be ashamed of itself”.

Later, he accused the HRC of a “transparent stitch-up”. Such vitriol is unbecoming of a prime minister and belittles the importance of protecting children. Given the boat people issue has been divisive for at least 15 years, the HRC report was always going to be politically sensitive. Nonetheless, the Herald believes Professor Triggs could have been more restrained as well. Her approach and language will hardly help attempts at a bipartisan solution. The number of children in detention has dropped sharply under the Abbott government and it deserves credit for that. What’s more, the commission should have acted sooner to investigate fully Labor’s policy.

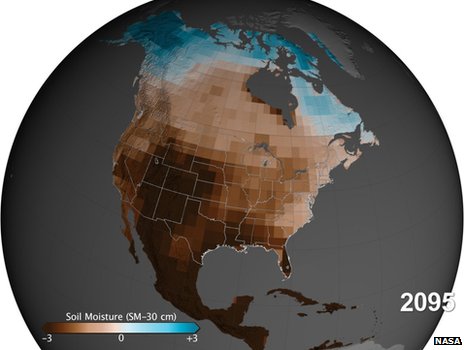

“The study suggests events unprecedented in the last millennium may lie ahead.”

• US ‘At Risk Of Mega-Drought Future’ (BBC)

The American south-west and central plains could be on course for super-droughts the like of which they have not witnessed in over a 1,000 years. Places like California are already facing very dry conditions, but these are quite gentle compared with some periods in the 12th and 13th Centuries. Scientists have now compared these earlier droughts with climate simulations for the coming decades. The study suggests events unprecedented in the last millennium may lie ahead. “These mega-droughts during the 1100s and 1200s persisted for 20, 30, 40, 50 years at a time, and they were droughts that no-one in the history of the United States has ever experienced,” said Ben Cook from Nasa’s Goddard Institute for Space Studies.

“The droughts that people do know about like the 1930s ‘dustbowl’ or the 1950s drought or even the ongoing drought in California and the Southwest today – these are all naturally occurring droughts that are expected to last only a few years or perhaps a decade. Imagine instead the current California drought going on for another 20 years.” Dr Cook’s new study is published in the journal Science Advances, and it has been discussed also at the annual meeting of the American Association for the Advancement of Science.

There is already broad agreement that the American Southwest and the Central Plains (a broad swathe of land from North Texas to the Dakotas) will dry as a consequence of increasing greenhouse gases in the atmosphere. But Dr Cook’s research has tried to focus specifically on the implications for drought. His team took reconstructions of past climate conditions based on tree ring data – the rings are wider in wetter years – and compared these with 17 climate models, together with different indices used to describe the amount of moisture held in the soils.