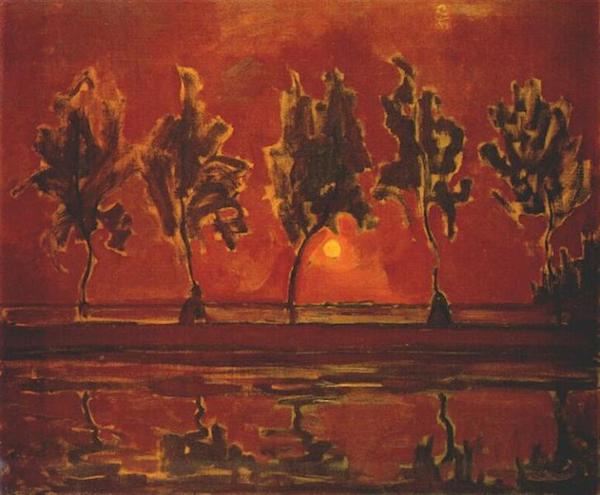

Piet Mondriaan Trees by the Gein at Moonrise 1908

NOTE: I know there are a lot of RT articles here lately. But it is simply the best source for Ukraine news. And rather than being Russian propaganda, it’s the only English-language source that is not rabidly anti-Russian.

The French with photos of relatives who have died from the vaccine !!

The French with photos of relatives who have died from the vaccine !! pic.twitter.com/7LnAfbAjgF

— Glynis Payne (@GlynisPayne17) August 7, 2022

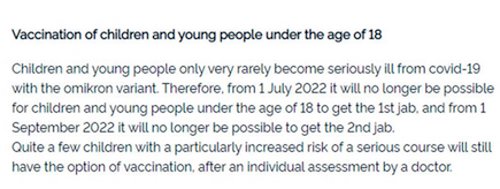

Denmark.

DMED database

Army veteran Pam Long lists alarming numbers from the DMED data base. This is disturbing and we all deserve the truth. pic.twitter.com/1dXPKoLblz

— Jamie Sale (@JamieSale) August 8, 2022

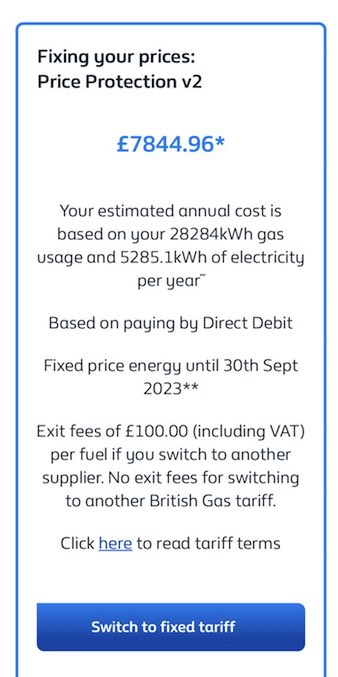

A typical UK gas and power bill this winter.

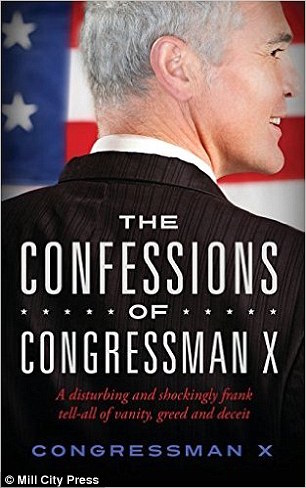

“..the criminalization of politics..”

• The FBI has Raided President Trump’s Home (Techno Fog)

Breaking news for a Monday night: President Trump announced his home in Palm Beach – Mar-A-Lago – “is currently under siege, raided, and occupied by a large group of FBI agents.” [..] According to the New York Times, the search has to do with materials taken home by President Trump after he left the White House: “The search, according to two people familiar with the investigation, appeared to be focused on material that Mr. Trump had brought with him to Mar-a-Lago, his private club and residence, after he left the White House. Those boxes contained many pages of classified documents, according to a person familiar with their contents. Mr. Trump delayed returning 15 boxes of material requested by officials with the National Archives for many months, only doing so when there became a threat of action being taken to retrieve them.”

The politics of the search can’t be ignored. If the New York Times is to be believed, Trump’s purported crime – the delay of returning materials that may be classified – could have been resolved in another manner that didn’t involve raiding his home and breaking open a personal safe. No doubt the search is an escalation by a desperate Regime confronted by their own failures at home and abroad. What about the relation of the search to January 6? I’ve gone back and forth as I’ve written this, but it’s certainly possible they were also after documents related to January 6. There are no guarantees, considering the politicization of Biden’s DOJ, which has thus far protected friends in politics, the killer of Ashley Babbitt, supporters in academia, and the President Biden’s own corrupt son.

One can be certain, however, that if the Biden Administration will carry out this raid, then it will also be aggressive to pursue charges against Trump related to January 6. As if there were any doubt. After all, last week there was reporting that a federal grand jury investigating January 6 had issued subpoenas to the Trump White House Counsel, Pat Cipollone, and his top deputy, Patrick Philbin. Perhaps the roadmap for the DOJ comes from the January 6 Committee, which has poured out the thin gruel of purported criminal charges against Trump, alleging he and others, including attorney John Eastman, could be charged with: • Obstruction of an Official Proceeding (18 USC 1512(c)(2)); and • Conspiracy to Defraud the United States (18 USC 371). Each of these counts, and really the DOJ’s pursuit of Trump and his attorneys and advisors, amounts to the criminalization of politics.

“My personal theory is that the Covid-19 release was wholly and entirely about getting rid of Donald Trump and nothing else..”

• The Sickening Quickening (Kunstler)

Do you still doubt that the federal bureaucracy and the elected government parasitically attached to it seek to harm the people they rule (i.e., us) by any means necessary? They’re still pushing Covid “vaccines” in a futile effort to eliminate the control group of their massive eugenics experiment — that is, the unvaccinated, who are not getting the many vaccine-induced diseases behind the rise of all-causes mortality in people under 65. But the vaxx scam isn’t working anymore. Too many people have already been hurt, or killed, or seen friends and relatives go down mysteriously and they’re taking a pass on any more shots. Parents have evidently seen enough to not bring their little children in for the life-altering mRNA treatments. The CDC, the FDA, and their cohorts hide their information, lie when pressed, and pretend that they are acting scientifically.

But really, at this point, many public health officials must be secretly wondering how they will evade prosecution. They won’t when fraud is proven in a court of law. Even with all the lies and redactions issued by the CDC and the FDA, the evidence is piling miles high that the Pfizer and Moderna drug trials were covered-up botches and the entire administration of the vaccine program has been an unnecessary disaster. Fraud vitiates immunity from liability. The pharma companies will go out of business and their profits will be clawed back in countless lawsuits. The drug company executives will go to prison along with Rochelle Walensky, Anthony Fauci, Dr. Scott Gottlieb, and many of their lieutenants.

My personal theory is that the Covid-19 release was wholly and entirely about getting rid of Donald Trump and nothing else, in order to protect the permanent bureaucracy, a.k.a. the deep state, which was faltering in its countless turpitudes against the people, including the FBI and DOJ’s complicity in the criminal frauds and seditions of RussiaGate, and the CIA’s complicity in the “whistleblower” shenanigans behind Trump impeachment No. 1. The “long game” in the Covid-19 scam of 2020 was obviously to set-up the loosest mail-in voting apparatus possible to enable maximum ballot fraud in that year’s elections. The catch is, the Covid-19 play did not protect the deep state; it only further demonstrated its malevolence.

It’s a big club… In a small world.

• Liz Cheney’s Husband Is Partner At Law Firm Representing Hunter Biden (Fed.)

Philip Perry, who is married to Wyoming Rep. Liz Cheney, is a partner at the same law firm representing President Joe Biden’s scandal-ridden son, Hunter. Last week, the Daily Mail reached out to Hunter Biden’s attorney for comment on a story unearthing new details to the extent the younger Biden leveraged the family name for lucrative overseas business ventures. In 2014, the paper reported, then-Vice President Biden met with a pair of Chinese energy executives connected to Hunter Biden’s foreign business deals. An attorney named Christopher Clark, who is listed with the firm Latham & Watkins as partner, responded to the Daily Mail’s request for comment calling the reporter a “parasite” in an otherwise nonsensical email full of typos.

The vice president’s 2014 encounter with Chinese energy tycoons marks the fifteenth such meeting with businessmen tied to Hunter Biden’s financial interests, and contradicts Biden’s repeated claims of never discussing business with his son, “or with anyone else.” The first son is currently under federal investigation for money laundering and foreign lobbying. Perry is also listed as a partner with Lathan & Watkins on the firm’s website while his wife runs for re-election on an anti-Trump platform ahead of the Wyoming primary next week. Cheney faces an uphill contest from Trump-endorsed attorney Harriet Hageman in a state that voted for former President Donald Trump two years ago by a wider margin than anywhere else in the country.

A poll sponsored by the Casper-Star Tribune last month shows Hageman up by 22 points as Cheney tries to clinch a fourth term by appealing to Democrats. Even if every Democrat in the state were to change their registration to back Cheney in the primary, however, Cheney’s Trump-backed opponent remains likely to prevail where Republicans outnumber Democrats more than 200,000 to 43,000. On Sunday, the New York Times published a profile of the race ahead of next week’s contest chronicling Cheney’s failing campaign. “She no longer provides advance notice about her Wyoming travel and, not welcome at most county and state Republican events, has turned her campaign into a series of invite-only House parties,” the Times reported.

“What’s more puzzling than her schedule is why Ms. Cheney, who has raised over $13 million, has not poured more money into the race, especially early on when she had an opportunity to define Ms. Hageman,” the paper added. “Ms. Cheney had spent roughly half her war chest as of the start of July, spurring speculation that she was saving money for future efforts against Mr. Trump.”The Wyoming congresswoman likely to lose her seat in the next Congress has been laying the foundation for a presidential run in 2024. “If I have to choose between maintaining a seat in the House of Representatives or protecting the constitutional republic and ensuring the American people know the truth about Donald Trump, I’m going to choose the Constitution and the truth every single day,” Cheney said on CNN last month.

“..neither Kiev nor Tbilisi will ever become members of NATO or the EU, and that “even the unshaven guy in a green T-shirt from Kiev” understands this.”

• West Wants To Destroy Russia – Medvedev (RT)

The West has launched an aggressive “geopolitical process” aimed at destroying Russia, former President Dmitry Medvedev claimed in an interview with TASS published on Monday. Asked if the hostilities between Russia and Georgia in 2008 and the current conflict in Ukraine are “links in the same chain,” Medvedev said they are without a doubt part of the same scheme orchestrated by the West. “This is a single process and a common plan directed against Russia. It consists of the desire of the West, primarily the United States and other Anglo-Saxon countries, to rock the situation in our country. How? Through neighbors in close proximity to the borders of Russia,” Medvedev, the deputy head of the National Security Council, and president of Russia from 2008 to 2012, explained.

He noted that before the conflict with Georgia began in 2008, when Tbilisi’s forces began shelling the disputed region of South Ossetia and killed a number of Russian peacekeepers and civilians, the US was “cynically engaged” in the training, funding, and arming of the Georgian Army, and Washington was actively encouraging then-Georgian President Mikhail Saakashvili to launch an attack against the civilian population in the area. The same “provocative and, let’s face it, criminal policy of the US” is currently being aggressively pursued in Ukraine, Medvedev said, adding that this time, the process is receiving more active support from the EU, which he says has “finally lost its independence.” “But the end goal remains the same,” he claimed, “to destroy Russia,” arguing that this goal is the root cause of the “extremely aggressive, Russophobic geopolitical process initiated by the West.”

The former president went on to say that despite NATO’s attempts to expand along Russia’s borders, which has become “a global problem that makes all reasonable people sick,”the US-led bloc has no intention of allowing either Ukraine or Georgia to become members. “They understand that anything they undertake in beleaguered countries such as Ukraine or Georgia, which are in territorial disputes with Russia, will be more expensive for themselves. The costs will be enormous,” Medvedev noted, adding that neither Kiev nor Tbilisi will ever become members of NATO or the EU, and that “even the unshaven guy in a green T-shirt from Kiev” understands this.

On top of this, they announced a new fuel tax last week.

• ‘Millions’ In Germany Won’t Be Able To Pay For Heating – Union (RT)

At least a third of Germans on low incomes may not be able to pay increasingly high energy bills, the German Tenants’ Association (DMB) has warned, urging the government to make changes to housing programs. “That’s a hell of a lot of people,” Lukas Siebenkotten, the DMB’s chief, told newspaper Der Tagesspiegel on Sunday. “We’re talking about millions here.” Siebenkotten urged the government to allow more people to claim housing benefits in the wake of rising energy prices. “Tenants must also be protected from the termination of contracts if they cannot make increased advance payments,” he said. The remarks came after Klaus Mueller, the head of the Federal Network Agency, Germany’s gas regulator, warned that consumers should conserve at least 20% of gas in order to avoid shortages during the winter.

“In all other scenarios, we either face the threat of a gas shortage as early as December, or have low-level shortages at the end of the upcoming heating season,” Mueller said, describing current gas prices as “astronomically high.” High inflation and increased energy costs in Germany have been exacerbated by fears that Russia might completely cut off supplies of natural gas to the country. Germany and other EU states imposed sweeping sanctions on Moscow in response to its military campaign in Ukraine and unveiled a plan to phase out Russian gas. However, the German government has repeatedly warned that an immediate end of supplies from Moscow would badly damage the economy, increase unemployment and lower living standards.

Russian gas company Gazprom decreased the flow to Germany through the Nord Stream 1 Baltic Sea pipeline and then suspended deliveries altogether for 10 days last month for maintenance work. According to Gazprom, the routine maintenance process had been disrupted by the hold-up of a repaired turbine in Canada, which Ottawa initially refused to return to Germany due to sanctions. Berlin rolled out a gas-saving plan late last month, which includes boosting reserves in gas storage facilities and using more coal power plants.

How will these governments survive the cold? People will discover that the only reason their kids are freezing is an ideological one.

• Germany Rules Out Emergency Use Of Nord Stream 2 Gas Pipeline (RT)

Germany is not going to put Russia’s Nord Stream 2 gas pipeline into operation even if the situation with energy supplies deteriorates in the coming months, government spokesman Steffen Hebestreit said on Monday. “What is clear is that we stand firmly on the side of Ukraine, that we support the sanctions that we jointly adopted in the EU and in consultations with the international community… What is also clear is that Nord Stream 2 is not certified and is not currently going through the certification process and thus is not available [for operation],” the spokesman said at a press briefing. When asked specifically if German Chancellor Olaf Scholz rules out using the pipeline in the coming fall and winter if the situation with gas supplies in the region becomes more complicated, Hebestreit said “yes, he rules it out.”

The government representative agreed that the upcoming heating season may be difficult for Germany, but noted that the government is taking the necessary steps to ease the situation. The construction of the Nord Stream 2 pipeline, aimed at boosting Russian natural gas supplies to the EU, was completed last year. However, Berlin halted its certification shortly before Russia launched a military operation in Ukraine in late February. Hebestreit’s comments echo those of German Economy Minister Robert Habeck, who said last month that Germany does not plan to revive the Nord Stream 2 certification process despite fears of supply disruptions, and urged his country to conserve natural gas and continue decreasing its dependence on supplies from Russia.

“..1/5 of all farms will be forced to shut down and almost 1/3 of farms forced to scale down and reduce livestock..”

• Netherlands To Shut Down 11,200 Farms To Meet Climate Goals (Sweden)

If you have followed my reporting you probably know about the protests happening in the Netherlands. Tens of thousands of farmers have taken to the streets to protest against new climate goals which will force farmers to shut down their farms. They have set hay bales on fire on motorways and dumped manure and even blocked supermarket distribution centers. According to calculations done by the Finance ministry, a whopping 11 200 livestock farmers will be forced to shut down by the government to reduce nitrogen emissions in order to meet European environmental rules. Another 17 600 farmers would need to reduce the amount of animals they keep to meet these climate goals.

And this is bad. Because there are about 54 000 farms in the Netherlands, meaning that around 1/5 of all farms will be forced to shut down and almost 1/3 of farms forced to scale down and reduce livestock. Meaning that thousands and thousands of farmers will be losing their livelihoods in order to meet government climate goals. They are literally going to make people loose their livelihoods in order to meet climate goals. That is crazy. Not only that, think about all the food that will be lost as a result of this. We are already facing a food crisis due to sky high fertilizer prices and grain shortages due to the war in Ukraine. We need more food now, not less! The climate change fanatics are trying to bring us back to the middle ages.

The state is planning on forcing farmers to sell their farms to the state (buying them out). State sanctioned appropriation of farms and land. Now where have I heard about that kind of thing before…? Oh yes, under Communism. I told you that this is Climate Communism and that The Great Reset is just another word for Global Communism. And it seems like people in the Netherlands are not happy with these government plans, as the political party of the Prime Minister in the Netherlands, VVD, has reached a new all-time low in the polls. If there was an election now, they would lose 13 of their 34 seats in parliament. A whopping 7 out of 10 voters say that they are dissatisfied with the Cabinet of the Prime Minister. Meanwhile the new party called Farmer-Citizen Movement is now polling in second place.

WIth the recent revelations about the Great Barrier Reef, maybe take it easy with the term “Climate-Driven”.

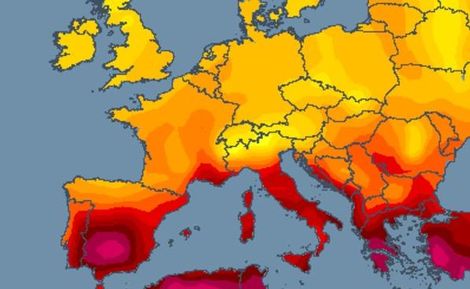

• Europe Is Being Hit By A Climate-Driven Drought Crisis (G.)

Europe’s most severe drought in decades is hitting homes, factories, farmers and freight across the continent, as experts warn drier winters and searing summers fuelled by global heating mean water shortages will become “the new normal”. The EU European Drought Observatory has calculated that 45% of the bloc’s territory was under drought warning by mid-July, with 13% already on red alert, prompting the European Commission to warn of a “critical” situation in multiple regions. Conditions have deteriorated since as repeated heatwaves roll across the continent. In France, the prime minister, Élisabeth Borne, last week activated a crisis unit to tackle a drought Météo-France described as the country’s worst since records began in 1958.

More than 100 French municipalities have no running drinking water and are being supplied by truck, green transition minister Christophe Béchu said, adding: “We are going to have to get used to episodes of this type. Adaptation is no longer an option, it’s an obligation.” With surface soil humidity the lowest ever recorded and July rainfall 85% lower than usual, water restrictions including hosepipe and irrigation bans are in place in 93 of the country’s 96 mainland départements, with 62 classified as “in crisis”. Amid rising food prices following Russia’s invasion of Ukraine, France’s agriculture minister warned the corn harvest is likely to be more than 18% lower than last year, while farmers’ unions say a shortage of cattle fodder as a result of the drought could lead to significant milk shortages in the autumn and winter.

The electricity utility EDF was last week forced to reduce output from one of its nuclear reactors in south-western France because of high water temperatures in the Garonne River, and has issued multiple similar warnings for reactors along the Rhône. Spain’s water reserves are at all-time low of 40% and have been falling at a rate of 1.5% a week through a combination of increased consumption and evaporation, according to the government, in what is likely to be the driest of the past 60 years. The country has received less than half its expected rainfall for the time of year for the past three months, with restrictions in place from Catalonia in the north-east to Galicia in the north-west as well as western Extremadura and Andalucía in the south. Most water restrictions have been imposed on domestic users, with rural authorities often reluctant to rein in farmers’ frequently illegal exploitation of an increasingly scant resource despite agriculture accounting for nine-tenths of Spain’s water consumption.

“..cutting-edge technologies developed by China, including advancements in quantum science, artificial intelligence and other areas “that are likely to disrupt how future wars are fought and economies are structured.”

• CIA’s Strategy Towards China Revealed (RT)

The CIA’s shift of focus to “great power competition” with China means that “money and resources would be increasingly shifted”away from counterterrorism (CT), the spy agency’s second-highest ranking officer reportedly told leaders of its CT branch. The meeting was held some weeks ago behind closed doors, the Associated Press reported on Monday, citing anonymous sources. Deputy Director David Cohen assured officials during the meeting that fighting terrorists would remain a priority for the agency to a significant degree, the report said. The entire US intelligence community has been pivoting towards China under the current administration, with hundreds of officers reassigned, including from counterterrorism, according to the news agency.

The CIA is also moving in that direction, hiring new officers fluent in Chinese and teaching the language to current employees, the AP said. The realignment, which is being done under pressure from Congress, means inevitable cuts of funding and manpower in other areas, the news agency said. Lawmakers are particularly interested in cutting-edge technologies developed by China, including advancements in quantum science, artificial intelligence and other areas “that are likely to disrupt how future wars are fought and economies are structured.” Last October, the CIA announced a major structural reform, which included the creation of two so-called mission centers. One is dedicated to China and the other to emerging technologies.

The AP’s report comes on the back of last week’s announcement of the CIA-led assassination of al-Qaeda leader Ayman al-Zawahiri, who was killed by a drone strike in Kabul, US President Joe Biden announced last Monday. The agency noted that supporters of the White House say the strike showed the US can deal with terrorist threats despite pulling out from Afghanistan last year. Critics, meanwhile, have suggested that Zawahiri’s presence in the country indicated a resurgence of terrorism after the Taliban takeover. Afghanistan’s new authorities rejected US claims that the al-Qaeda leader had been granted protection and the green light to live in the capital.

“..Zelensky on Sunday reiterated a warning that if the two regions go through with their plans, Kiev will break off all talks with Russia..”

What talks?

• Ukrainian Region Announces Vote On Joining Russia (RT)

aporozhye Region will hold a referendum on whether to secede from Ukraine and request joining Russia, the head of its administration announced on Monday. Evgeny Balitskiy said that he had signed an order to organize the plebiscite during a regional forum held in the city of Melitopol. Over 700 representatives from various parts of the Ukrainian region approved the idea, according to RIA Novosti. Earlier comments by administration officials indicated the referendum may be held as soon as mid-September. Russian forces took partial control of the region during the initial offensive against Ukraine launched in late February. The eponymous city located in the north of the region on the Dnepr River remains under Ukrainian control.

Officials in Kherson Region, another Russia-controlled part of Ukraine, voiced similar plans to put to a vote the proposal of breaking away from Kiev and seeking to join Russia. Ukrainian President Vladimir Zelensky on Sunday reiterated a warning that if the two regions go through with their plans, Kiev will break off all talks with Russia. Moscow in response suggested that the Ukrainian president should address the citizens of those regions. “The thing is, this is what the residents of the region plan. It’s not like we [Russia] are holding a referendum. Here, apparently, it is necessary to understand to whom Zelensky is addressing this statement – to the citizens of Ukraine of the mentioned regions or to the citizens of Russia? If it’s to the citizens and leadership of Russia, then we are the wrong address,” Kremlin spokesman Dmitry Peskov commented on Monday.

There have been no peace talks between Russia and Ukraine for months, as Kiev rejected such contacts and claimed it would only negotiate after defeating Russian on the battlefield with the help of Western military aid. Before the talks broke off, the two nations appeared to have made progress in resolving their differences. During a meeting in Istanbul in late March, Kiev had pledged to become a neutral country and accept restrictions on its military. Moscow said it prepared a draft peace agreement based on those proposals, but Ukraine never responded. An indirect Russian-Ukrainian deal was mediated last month by the UN and Turkey to allow grain exports from three Ukrainian ports to resume via the Black Sea. The scheme was formalized in two separate agreements that were signed by Russia and Ukraine with the other two parties.

“..our forces have been victorious everywhere, constantly boldly retreating..”

• Austrian Barbarians Go Home! (Batiushka)

(With apologies to the peoples of Austria and France) As we write, the wicked Austrian terrorist State under its manic leader Putzin continues its completely unprovoked invasion of East France. President Putzin is well-known, as he is very short (not that we wish to belittle him) and has only one testicle, as everybody knows. His invasion and occupation of East France have been going on for nearly six months now and our forces have been victorious everywhere, constantly boldly retreating. However, as the younger among you may need a reminder to the facts of the background of this evil invasion, we give this below.

In 1945 France liberated defeated Nazi Germany and set about looking after it. As the word ‘Germany’ is such an ugly word, it was replaced by ‘East France’. Here hordes of workers made products for the Paris government which for nearly three generations very generously allowed the East France people to speak their German dialect. However, enough was enough and the time came when in 2014 Paris declared that all education would in the future be in French and that the German dialect would be banned in public places. If any East French were dissatisfied, too bad for them, they would just have to go and live in another country. Another huge act of generosity on the part of our glorious Paris government. Almost immediately, and in a quite unprovoked and totally unexpected manner, the evil Austrian regime annexed Bavaria.

(They called it an ‘Anschluss’, though how you pronounce such a long, complicated and ugly word, we have no idea). True, they held a referendum, in which over 90% of Bavarians voted to join Austria, but obviously nobody believes those results. Quite typically Putzin probably threatened to shoot anyone who did not vote for him. Then, on top of that, Austrian-backed, German-speaking separatists began to fight against Paris forces in Saxony. Leipzig was reduced to rubble by our brilliant artillerymen and over 10,000 separatist civilians, including over 400 children, were eliminated. However, on 24 February 2022, the Putzin regime invaded Saxony, murdering civilians and raping tens of millions of women and children, throwing babies out of incubators and bayoneting them. These are well-known facts.

“..President Andrzej Duda has expressed hope that there will be no border between Poland and Ukraine in the future, calling the two nations “fraternal.”

As Zelensky shouts about defending Ukraine, he’s selling it off at large discounts. And if Poland get their share, Hungary will demand theirs.

As for deploying Polish “peacekeeping” forces in Ukraine, beware.

• Poland Proceeding With Its Plans For Ukraine – Moscow (RT)

Warsaw is looking to send “peacekeeping” forces into Western Ukraine and take over sectors of the economy, Russia’s Foreign Intelligence Service claims Warsaw continues to carry out an apparent attempt to “reclaim” parts of Ukraine in accordance with its “far-reaching plans” for the country, Russia’s Foreign Intelligence Service (SVR) said in a statement posted on Monday. According to Russian intelligence, Poland is not only setting up a scenario to deploy its “peacekeeping” forces to the western parts of Ukraine, but is also trying to establish control over promising sectors of the Ukrainian economy, first and foremost – agriculture. The SVR claims that Polish companies have taken advantage of the difficult condition Ukrainian farmers are in by arranging to purchase their goods at reduced prices, which is allegedly pushing some Ukrainian agriculture enterprises toward bankruptcy.

The intelligence agency claims that Polish entities will then buy up these assets and lands at bargain prices. “This can be illustrated, for example, by the purchase of new barley crop at $30 per ton, which is almost 5 times cheaper than the real cost of this product,” the SVR noted in its report. The agency goes on to claim that Poland is investing in the creation of transport infrastructure and other logistics for the unimpeded export of Ukrainian food to Europe and other markets where prices are much higher. All of this is being done under the new legal framework created by Kiev, the SVR explains, referring to a law on special guarantees for Polish citizens introduced in late July, and also one that allows Ukrainian industrial enterprises to be sold at a 50% discount.

Thus, the current Kiev authorities have essentially already started selling off the country, giving priority in this ‘business project’ to their Polish neighbors. In April, SVR chief Sergey Naryshkin claimed that intelligence obtained by Moscow suggested that Poland and the US were working on a plan for Warsaw to regain control of Ukrainian areas that they consider as “historically belonging” to it. He also suggested that the first phase of this “reunification” project would see Polish troops deployed to parts of Ukraine as “peacekeepers” under the pretext of protecting Ukraine from “Russian aggression.” Poland has categorically denied these claims, although President Andrzej Duda has expressed hope that there will be no border between Poland and Ukraine in the future, calling the two nations “fraternal.”

Amnesty did thorough research. Just like CBS.

• An Unpleasant Truth For Ukrainians Is Coming To Light (Milacic)

Amnesty says survivors and eyewitnesses of Russian attacks in Donbass, Kharkiv and the Mykolaiv region told researchers that the Ukrainian military was conducting operations near their homes at the time of the attacks, exposing the areas to counterfire from Russian forces. Amnesty International researchers have witnessed such behavior in numerous locations. International humanitarian law requires all parties to a conflict to avoid locating, to the greatest extent possible, military targets within or near densely populated areas. Other obligations to protect civilians from the effects of attacks include removing civilians from the vicinity of military targets and providing effective warning of attacks that may affect the civilian population.

– The army was stationed in the house next to ours and my son often brought food to the soldiers. I begged him several times to stay away, because I feared for his safety. That afternoon, when the attack happened, my son was in our yard and I was in the house. He died on the spot. His body was mutilated. Our house was partially destroyed – said the mother of a man (50), who was killed in a rocket attack on June 10 in a village south of Nikolaev. Amnesty International found military equipment and uniforms in the house next to hers. Nikola, who lives in the block in Lisichansk in Donbass, which the Russians regularly targeted and killed at least one person, said that it is not clear to him “why our army fires from the cities and not from the fields”.

Another resident said that “there is definitely military activity in the neighborhood.” – We hear “outgoing” and then “incoming” fire” – he said. Amnesty International teams saw soldiers using residential buildings located 20 meters from the entrance to the underground shelter, which was used by residents and where an elderly man was killed. In one Donbas town on May 6, Russian forces used cluster munitions over a neighborhood of mostly one- or two-story houses where Ukrainian forces were manning artillery. Shrapnel damaged the walls of the house where Ana (70) lives with her son and 95-year-old mother.

In early July, a farm worker was injured when Russian forces attacked an agricultural warehouse in the Nikolayev area. Hours after the attack, Amnesty International researchers witnessed the presence of Ukrainian military personnel and vehicles in the grain storage area, and witnesses confirmed that the military was using the warehouse, which is located across from a farm where civilians live and work. As researchers surveyed damage to residential and public buildings in Kharkiv and villages in the Donbass and east of Mykolaiv, they heard gunfire from nearby Ukrainian military positions. In Bakhmut, several residents said the Ukrainian military was using a building barely 20 meters across the street from the high-rise. On May 18, a Russian rocket hit the front of the building, partially destroying five apartments and damaging nearby buildings.

“..saying there is “no proof” that weapons entering his country are unaccounted for, despite similar warnings from the Russian government, Europol, Canada, the CIA and a number of US Republicans..”

• CBS Caves Into Ukrainian Pressure On Weapons Revelations (RT)

CBS News has pulled a documentary and amended a story featuring claims that 70% of foreign weapons never make it to the front lines in Ukraine. The changes were made amid an outcry from the Ukrainian government and its supporters. The documentary originally featured an interview with Jonas Ohman, the founder of a Lithuania-based organization supplying the Ukrainian military. Ohman told CBS that getting foreign weapons to Ukrainian troops involves navigating a network of “power lords, oligarchs [and] political players,” and that of all the aid arriving at the border in Poland, “kind of like 30% of it reaches its final destination.” Amnesty International’s Donatella Rovera also appeared in the film, saying that “there is really no information as to where [the weapons are] going at all.”

The documentary was released online on Thursday, and was set to air on CBS on Sunday evening. Pro-Ukrainian social media accounts hounded CBS over the weekend, accusing the American network of spreading “Russian propaganda. ”Ukrainian presidential adviser Mikhail Podoliak waded in, saying there is “no proof” that weapons entering his country are unaccounted for, despite similar warnings from the Russian government, Europol, Canada, the CIA and a number of US Republicans. The documentary was pulled from CBS’ website on Sunday night, and Ohman’s quote removed from a text version of the story. Atop this story, CBS placed a note saying that arms deliveries have “significantly improved” since its filming in April, and that the US sent a senior military official to Kiev in recent days “for arms control and monitoring.”

Ohman’s organization issued a statementsaying that the documentary took his words “out of context,” but did not deny that 70% of incoming military aid was going missing in April. Weapons were not being “stolen” or “sold on the black market,” the organization explained, but ending up in the hands of “different power players” attempting to “solidify their positions.”Who these players were was left unexplained. CBS said that it is “updating” its documentary and will air the edited version at a later date. Rovera, already slated by the Ukrainian government and its supporters over a recent Amnesty report accusing Kiev of placing weapons in civilian areas in violation of humanitarian law, also attempted to backpedal.

In a Twitter post on Sunday, she claimed that the responsibility for tracking arms shipments lies with the states providing the weapons, not with Ukraine. The Ukrainian government welcomed the CBS retraction. Foreign Minister Dmitry Kuleba nevertheless declared that the US network had “misled a huge audience by sharing unsubstantiated claims and damaging trust in supplies of vital military aid to a nation resisting aggression and genocide.” “There should be an internal investigation into who enabled this and why,” he concluded. Others criticized the changes, which journalist Max Blumenthal said were made following “a coordinated freakout by the Ukraine lobby.”

As Ukraine accuses Russia of targeting a plant they already control, with missiles. Easier to just pull a switch or two?!

• Russia Accuses Ukraine Of ‘Nuclear Terrorism’ (RT)

Ukrainian troops have committed “a new act of nuclear terrorism” by continuing to shell the Zaporozhye Nuclear Power Plant, the Russian Defense Ministry said on Monday. The nuclear plant, Europe’s largest, in southern Ukraine was seized by Russian forces in late February, when Moscow launched its military operation in the neighboring state. The facility continues to operate under Russian control with Ukrainian personnel. In a daily briefing, Russian Defense Ministry spokesman Lieutenant General Igor Konashenkov said that Ukraine’s 44th Artillery Brigade fired at the plant on Sunday from the village of Marganets on the opposite side of the large Kakhovka water reservoir.

The shelling damaged a high-voltage power line, causing a short circuit at the plant, Konashenkov said. He added that a fire broke out at the facility, which was then put out. According to the Russian Defense Ministry, it was the second time Ukrainian shelling has caused a fire and a partial power outage at the plant since Friday. Kremlin spokesman Dmitry Peskov told reporters that the attacks on the nuclear facility could have “catastrophic consequences for a huge territory, including the territory of Europe.” “We hope that countries which have an absolute influence on the Ukrainian leadership will use this influence to rule out such shelling,” Peskov said.

Ukrainian President Vladimir Zelensky accused Russia of shelling the Zaporozhye plant on Friday. “Russian nuclear terror requires a stronger response from the international community,” he tweeted, also warning about a potential nuclear disaster. Ukraine and the US previously accused Russian soldiers of using the plant as cover in the fight against Ukrainian troops. Russia has rejected these claims. UN Secretary General Antonio Guterres condemned the “suicidal” attacks on the plant, expressing hope that international inspectors will be able to access the facility soon.

Blue states start boycotting red states. Civil War here we come.

• Time for a Red-State NATO-like Alliance on Boycotts (Turley)

“An attack on one is an attack on all.” That reference to Article 5 of the NATO treaty is a virtual mantra in Washington these days as “the bedrock of peace and security in Europe for over half a century.” But the benefits of such deterrence should not be lost on another group under increasing threat for their political alliances: America’s red states. From California to Illinois, legislators are moving to boycott any state contracts with businesses in states with anti-LGBTQ legislation or restrictive abortion laws. At the same time, many Democratic leaders are pressuring companies to boycott red states too. This past week, California Gov. Gavin Newsom (D) called upon Hollywood production companies to stop filming in states such as Georgia or Oklahoma with strict anti-abortion laws.

In Georgia, Democratic gubernatorial candidate Stacey Abrams has warned that companies will cut off ties with such states, including her own, if they do not change their laws. (Abrams previously was criticized by conservatives for fueling the boycott of her own state which led to the withdrawal of the All-Star Game from Atlanta over election reform laws.) Such campaigns have succeeded, particularly with private companies. Indeed, in both restricting speech and boycotting states, the left has found greater success with private companies than with voters in pushing their agenda. The New York Times warned pro-life states that they risk their “competitive edge” in the market if they do not change their laws to conform with blue-state views. The boycott threats have been growing since 2016, when North Carolina was targeted for passing a bill limiting bathroom access by biological gender.

The point of these campaigns is to pressure state officials to ignore the will of a majority of their citizens and pass laws to appeal to corporations and other states in a competitive market. Such boycotts by private citizens or groups are an important form of political speech; various state laws barring state contracts with those who support boycotts of Israel, for example, have been struck down as unconstitutional, although an appellate court recently upheld an Arkansas law. However, states or companies engaging in such boycotts is a different matter. Many consumers do not want companies like Disney to engage in political debates over issues like transgender rights. One poll showed 67 percent opposed corporate opposition to an “anti-grooming” law, a view that appears to be impacting Disney.

Bunch of cowards.

• Australian Labor Party & Assange: Burying the Politics (Tranter)

The difficulty for the Australian Labor government in deciding how to respond to the Julian Assange case is that once a prosecution is characterised as a political prosecution then, by its nature, there can be no expectation of due process. The U.S.-U.K. Extradition Treaty forbids extradition in the case of “political offences.” Former Australian High Commissioner to the U.K. George Brandis — who was commissioner for almost the entirety of Assange’s Belmarsh imprisonment since 2019 — doesn’t agree that Assange is a political prisoner. The Department of Foreign Affairs and Trade (DFAT) and its new Minister Penny Wong have consistently stated a view that the case is not political but purely a legal matter: “Australia is not a party to Julian Assange’s case, nor can the Australian government intervene in the legal matters of another country.”

However, the most vocally outspoken Labor MP on the Assange case has now thrown that position on its head. “This is a political case, Labor MP Julian Hill told Consortium News in a video interview on July 28. “It is a political decision to extradite. And we’ve conveyed our view to the U.K. government regarding that. And it’s also a political decision in the U.S.” The government suggesting its hands are tied as Australia is “not a party” to the Assange case and they can’t intervene in “legal matters,” ignores the evident truths that the Assange case is indeed political, that its result will have global political consequences and that a pathway exists for a political intervention towards a political resolution.

Labor also strains to maintain credibility in its stated expectations of Assange receiving fair and humane treatment, on the one hand, and on the other remaining silent on the findings of Nils Melzer, the then-U.N. special rapporteur on torture, who had found Assange had suffered both psychological torture and political persecution. There has also been a silence on the extraordinary acts of the U.S. intelligence agencies, in particular the fact that Assange’s legally privileged conversations and papers were recorded and handed to U.S. intelligence agencies, and also on the C.I.A.’s plans to kidnap or assassinate Assange.

Ukrainians migrating from Zelensky controlled areas to Russian controlled #Kherson

Here's some TRUTH coming from #CNN first time

CNN showing Ukrainians migrating from Zelensky controlled areas to Russian controlled #Kherson with family cats dogs trunks.

They have chosen freedom and real democracy#Ukraine #UkraineRussiaWar #Zaporizhzhia #UkraineWar #Bakhmut pic.twitter.com/94tTN8kXdR— UkraineNews (@Ukraine66251776) August 8, 2022

The Himalayan Vulture

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.