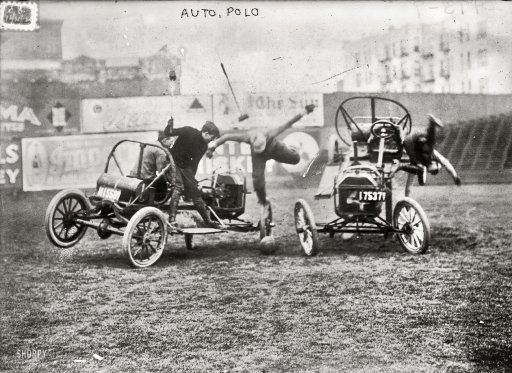

G.G. Bain Auto polo, somewhere in New York 1912

There’s a Reuters article by Paul Taylor today that’s thought provoking, but not along the same line of thought that the writer follows (or the twist he gives to it). Taylor concludes that the IMF would love to wash its hands off Greece, but can’t because it’s subservient to German and Brussels interests (a junior partner). However, he also describes, without realizing it, why and how the Fund can rectify that.

Not that we’re not under the illusion the IMF is prone to latch on to the following, but that it would nevertheless be an extremely wise move for the Fund, and especially for its reputation. Which, no matter how you see it, is under threat from its Asian ‘competitor’, the Asian Infrastructure Investment Bank (AIIB), not in the least because the non-western world has long found that the west has far too much power in the IMF, which after all is a global organization.

In that vein, let’s start off with an article the FT published in April 2013, by Ousmène Mandeng, who also features in Taylor’s piece. This former IMF deputy division chief pointed out what unease the IMF role in Greece caused, and how that role undermined its role as an international institution. Today, nothing has changed.

The IMF Must Quit The Troika To Survive

There are many victims of the eurozone crisis but one loser is seldom mentioned: the IMF has suffered considerable collateral damage. It has been dragged along in an unprecedented set-up as a junior partner within Europe, used as a cover for the continent’s policy makers and its independence lost. The monetary fund was set up as a technocratic institution. That, indeed, is why it was brought into Europe: it was felt that a neutral broker was needed to fix the eurozone’s problems.

It is an outsider that would seem less biased in its assessments of peripheral eurozone countries than, say, the chancellor of Germany or the president of the European Commission. While the distribution of voting power within the IMF has been controversial for some time, it is a consensus-driven body. Its independence from any one region or power has provided the basis for efficient decision-making – and is essential to it.

That last sentence sounds more like wishful dreaming than an assessment of reality.

So the fact that decisions about IMF-supported adjustment programmes are seemingly being taken in Berlin, Frankfurt and Brussels should horrify its members.

The commission and the ECB are not even members of the IMF yet they seem to be running the show.

Together with the IMF, they are the troika running the continent’s rescues. Being part of this approach means political meddling has been institutionalised. The approach to the eurozone crisis also undermines the long-running efforts to reform the governance of the IMF, which were, after all, intended to reduce the disproportionate influence of western European governments.

The interests of other eurozone countries or institutions dominate proceedings unduly, so it is often unclear whether the interests of the IMF, the global economy, the eurozone or individual countries are being protected by its work.

For the neutral observer, it seems very clear whose interests the IMF ‘protects’.

[..] troika adjustment programmes have been guided often by the needs of neighbouring European governments rather than global economic considerations. It would surely already have walked away from Greece had it not been held back by political inconvenience. The eurozone has further undermined the IMF by setting up its own crisis resolution institution. The European Stability Mechanism is for all practical purposes a European monetary fund.

Proposals for an Asian monetary fund during the Asian crisis were attacked with good reason: there was real concern that a regional fund would reduce the effectiveness of multilateral co-operation. These concerns seem to have been forgotten.

Well, those concerns are back.

It is not hard to imagine a scenario where a country has suffered a considerable economic shock and requires significant financial resources to avoid a painful and disruptive adjustment – say a large debt restructuring. In such circumstances, the interests of that nation, the world and neighbouring countries might not be aligned.

The fund cannot be seen as neutral and at the same time serve the immediate interests of the eurozone. [..] the eurozone debacle risks destroying the credibility of the IMF – and therefore the foundations for multilateral economic co-operation.

The IMF’s potential effectiveness has suffered and countries may be less willing to seek assistance from the fund, possibly prolonging future economic pain. This will come to matter a great deal if a larger eurozone country should come to require its help. To save itself, the IMF needs to leave the troika.

The main take-away from this should perhaps be that the IMF has not even so much served the interests of the eurozone, but exclusively those of its richest members, Germany, Britain and France. That this can be damaging in the long term is obvious. But there may be a way it can redeem itself, as we will argue. First, though, let’s go to Taylor’s article today:

IMF’s ‘Never Again’ Experience In Greece May Get Worse

For the IMF, five years of playing junior partner in European bailouts for Greece has been a “never again” experience, and the worst may be yet to come. The global lender has lent far more to Athens than to any other borrower, contributing nearly one-third of the total €240 billion.

But it has sat uncomfortably in the side-car of the Greek rescue. Called in by EU paymaster Germany to try to keep the European institutions and the Greeks honest, the IMF has never had control of the program.

Critics say the IMF has damaged its credibility by going along with political fudges to keep Greece in the euro zone rather than insisting on write-offs, first by private creditors and now by European governments..

Keep that in mind: uncharacteristically, the IMF has not made restructuring debts a priority for Greece. Or, one could argue, debts were restructured, but too late and in the wrong way. That, too, may prove very damaging for the Fund.

“One of the most important lessons for the IMF from the Greek program should be that a multilateral institution should not institutionalize special interests of a subset of its membership,” said Ousmene Mandeng, a former IMF official.. “The interest of the IMF is not necessarily aligned with the EU/ECB,” he said.

In 2013, the IMF published a critical evaluation of its own role in the first Greek bailout in 2010, arguing that it should have insisted on a “haircut” on Greece’s debt to private creditors from the outset. Instead it went along with European governments frightened of a Lehman-style market meltdown and keen to shield their banks from losses.

A 2010 IMF staff position note described default on any debt in advanced economies as “unnecessary, undesirable and unlikely”, yet 18 months later the IMF advocated a 70% “haircut” on Greek government debt as a condition for continued involvement in lending to Athens.

Now IMF chief Christine Lagarde is hinting that European governments need to give Greece debt relief to make the numbers add up, but since this is politically unacceptable in Germany, she has had to talk in code in public. “Clearly, if there were to be slippages from those (fiscal) targets, for the whole program to add up, then financing has to be considered,” Lagarde told a news conference last week.

In other words, politically unacceptable in Germany trumps politically unacceptable in Greece by seven leagues and a boot and a half. That is not just damning for the IMF’s image, it damages that of the EU just as much. The leaders of neither seem to care much. But internally in the IMF, the discussions have always been there, and always provided the right approaches. It’s just that third-party considerations prevailed.

Behind closed doors, IMF officials are telling the Europeans that Greece will not survive without a third bailout program, which will require debt restructuring by European governments. The IMF insists on being repaid in full and is not expected to lend any more to Athens. But Berlin and its allies want the Fund to remain involved..

[..]The Fund prefers to see its role as that of a truth-teller, making an objective assessment of a country’s ability to sustain its debt based on economic criteria such as interest rates and loan maturities, growth, productivity and the fiscal balance. Insiders say privately it would love to get out of the Greek program for good, but the Europeans may not let it.

Summarized: the IMF is a political tool. Nothing new there. But it’s being a tool that threatens for the Fund to become a bit-player in the global scene. China and Russia have seen enough, as, obviously, has Greece. Though Athens whould have been justified in venting a lot more anger about what happened to it than it has, even to this -Syriza- day.

In its various ‘critical evaluations’, the IMF will probably use a term like ‘mistake’. But there is a large difference between ‘mistake’ and fault’ or ‘blunder’ or even ‘criminal neglicence’. And the IMF needs to admit that it has been at fault, and seek to retroactively rectify that fault. If it wants to undo the damage to its reputation, that is.

The 2010 -first- Greek bailout, worth €110 billion, happened without any debt restructuring. Of course that should never have been accepted inside the IMF offices. It was a gross departure from established policy.

But the reason why is crystal clear: 90% of the money didn’t go to Greece, it went to save German, Dutch and French banks who had gambled and lost big-time, largely with loans to an Athens government serving the interests of the country’s existing oligarchic elite. The proper term is ‘collusion’.

After the troika had bailed out the European banks and thus further indebted the Greek people to the tune of another €100 billion, obviously a second bailout became necessary. After all, Greek debt had neither been relieved not restructured. It took just 18 months for that second bailout to enter the scene, stage left.

Meanwhile, those same European banks, handily helped along by the €100 billion they received courtesy of the Greek people, had reduced their exposure to Greek debt from €122 billion to €66 billion. Which put a further € 56 billion pressure on Athens.

In July 2011, Dominique Strauss-Kahn, who had overseen the first bailout, was forced out of the IMF governor role through some ‘bizarre incidents’, and in came Wall Street darling Christine Lagarde. A second bailout package for € 100 billion was agreed, but Greek PM Papandreou didn’t feel secure enough politically to accept its terms without calling a referendum. The EU, though, doesn’t like referendums (it tends to lose out in those).

In short order, Berlin/Paris/London had Papandreou replaced by Yale and Federal Reserve clone Lucas Papademos as Greek PM on November 10 2011. Just 6 days later, they also toppled Silvio Berlusconi as Italian PM, and replaced him with another banking technocrat, Mario Monti. Europe and democracy, it’s a strange-bed-fellows relationship.

That second bailout, agreed to in October 2011, but ratified only in February 2012, included a 53.5% face value loss for bondholders. But since the big ‘foreign’ banks had pulled out, that loss was mainly forced upon Greek banks and funds. Dragging the country’s economy even further down. The pattern is deceptively simple and even almost elegant in its destructiveness.

And that is why we find ourselves where we are today.

The whole point of this long history lesson is that what the IMF can do today to restore its reputation, its independence and indeed its very relevance, is to go back to the first Greek bailout of 2010 – it can simply claim that any deals agreed to under Strauss-Kahn were illegal for, by lack of a better term, pimping reasons-, and to retroactively undo the damage done by any and all deals under the troika umbrella.

That is to say, since the IMF is on the hook for €80 billion, a third of the €240 billion Greece ‘owes’, it can go to the ‘systemic’ European banks that were the recipients of this unjustified largesse, and demand its money back from them, instead of from the Greek people.

That would instantly solve the whole Greek debt issue everyone’s been talking about for forever and a day, the Athens government could go to work on reforms aimed at alleviating the misery forced upon its people instead of having to focus on troika talks 24/7, and all the false narratives about lazy Greeks living above their means could be thrown out the window in one fell swoop.

And the IMF could, make that would, regain its reputation, its credibility and its -global- relevance. Just like that. Overnight.

Like stated at the beginning, we don’t expect it to happen. But the opportunity is there. And it makes a lot more sense than just about anyone in the west will be willing to admit. The IMF can’t just serve only the EU and US and their banking sectors, or its days are numbered. It can either try and restore its reputation by doing what’s right or it can become yet another ingredient in history’s long gone and forgotten alphabet pea soup.