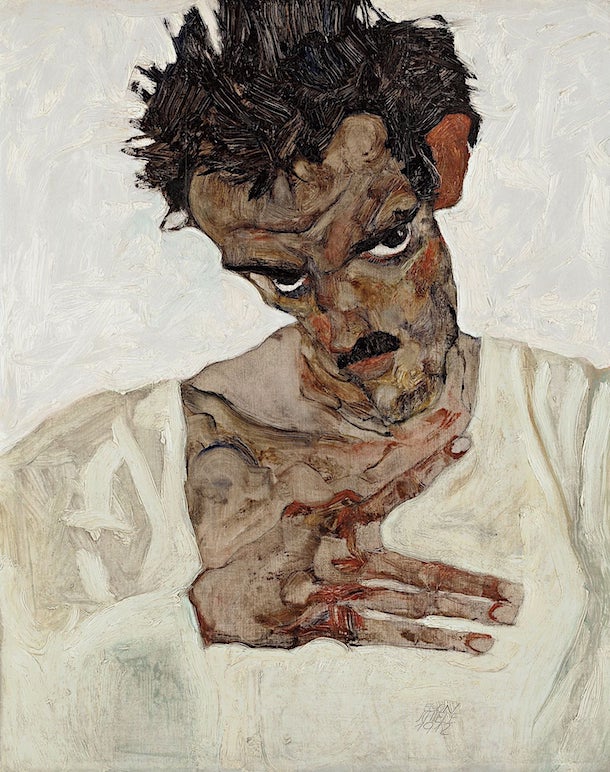

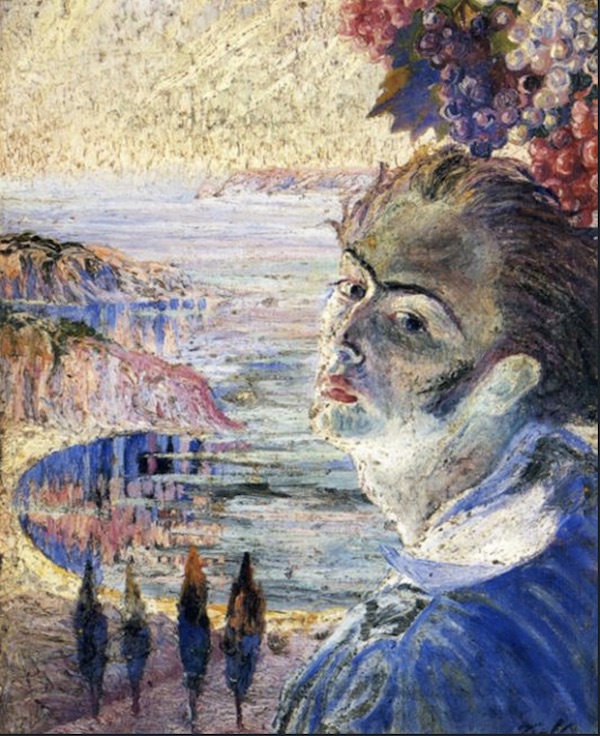

Willem de Kooning Police Gazette 1955

Two weeks ago, I wrote about Benjamin -Bibi- Netanyahu, Israel PM:

Benjamin -Bibi- Netanyahu has always been a warmonger. He thinks he, and his people, are superior to the Palestinians, and come to think of it, to Muslims in general. And when he first appeared on the scene some 30 years ago, he might have had a point, at least from a military point of view. But he does not today, and that is very dangerous for his people. Bibi lives in the past, because he liked that past – he could feel superior. He does not recognize to what extent the world, including his, has changed. But change it did, while he was dreaming of winning warfare.

But that didn’t cover everything I think should be covered. So here’s some more. Let’s do a few quotes. First, Scott Ritter a few days ago:

Israel Failing in Global PR Campaign to Demonize Hamas

“Remember, Benjamin Netanyahu, the prime minister of Israel, was teetering on the brink of political collapse prior to the Hamas action of October 7,” Ritter recalled. “He is a man who is under the shadow of some very serious corruption charges, charges which, again, you’re innocent until proven guilty in a court of law, but if there was a court of law of relevant jurisdiction who heard the case, he probably be found guilty – and he knows it, which is why he is collaborating with his party in the Knesset, the Israeli parliament, to change the Israeli Basic Law so that there is no longer a separate-but-equal branch of government called the judiciary, but rather a judiciary that is subordinated to the Israeli parliament. And the Israeli parliament can basically veto any judge that they disagree with. They can impeach at will. So any judge who heard a corruption case against Ben Netanyahu, who allowed it to go forward would be subjected to impeachment, removal. It makes Benjamin Netanyahu literally above the law.”

Bibi would have been in jail if he wasn’t PM. How did he make it to PM again? He formed a coalition with extreme right, or whatever you call it. People like present-day Minister of National Security Itamar Ben-Gvir. Who is so extreme that the EU cancelled a reception in May 2023 because he was supposed to attend. The same EU who now supports Israel no matter what. Israel’s Opposition Leader Yair Lapid said: “Ben-Gvir is not a legitimate person in the international community (and not really in Israel either), and sometimes you have to be both wise and just and simply send someone else”. And Bibi’s cabinet – and wider government- holds many more people like that. Bibi sold his soul to the devil to stay in power, lest he’d be in shackles.

James Tweedie 4 days ago:

Netanyahu Dragging US Into War With Iran to Save His Political Career

And now we’re reaching a point where Israel, as we now know, could be extinguished if the Sunnis and the Shia unite and take on Israel all at once in a swarm approach from all directions.” He said Netanyahu had good reason to allow the situation to erupt on October 7 and to escalate it further, as he was “not in control” of the more extreme members of his coalition government while also facing criminal charges when he leaves office. “Netanyahu could make this an endless war just to stay in office and to protect himself personally.” Maloof argued. “There’s clear evidence now that he knew, he had information and intelligence that Hamas […] was planning an action. He was warned, but he let it happen.”

Ergo, Bibi’s not in charge. The right wing appears to be -as if he’s not right wing enough. If he doesn’t do what they want, they can cancel their support, and he will be locked up. I know, simplified, but still.

So it’s kind of puzzling when he doesn’t do what they desire. And you can be sure they desire bloodshed. These people are Old Testament, an eye for an eye, not turn the other cheek.

Netanyahu Refuses To Order Wide-Scale Ground Operation In Gaza – NYT

Israeli Prime Minister Benjamin Netanyahu refused to sign the order on beginning of a wide-scale ground operation in the Gaza Strip out of fear of losing trust of the people, should the operation fail, the New York Times reported citing sources in the Israeli government. According to two sources, who were present during meetings of the emergency cabinet, Netanyahu “outraged senior officers by refusing to sign the plan” of the. His refusal, the sources note, was partially motivated by the Prime Minister’s desire to obtain a unanimous approval of this step from the emergency cabinet, established jointly with the opposition after the October 7 attacks.

The NYT claims that Netanyahu’s refusal indicates disagreements within the cabinet, with some ministers considering a less ambitious invasion plan, which includes several operations covering a small portion of the enclave instead of a single wide-scale one. Analysts say that the Prime Minister is unwilling to approve the action plan out of concerns that he will be blamed for the operation’s potential failure amid the falling public trust. On October 25, Axios reported citing US officials that Netanyahu is skeptical about the armed forces’ command plans and intends to postpone the beginning of the ground operation in the Gaza Strip.

There’s Bibi, there’s the right wing that controls him, but there is a still bigger force that neither of them dares contradict. Turns out, it’s the US. Who claim they merely “advise” Israel, but who in actual fact call the shots regardless.

Bibi’s right wing pals would have gone in right away 3 weeks ago, he himself might have waited a week or so longer, but it’s not their decision. They have to sit tight until they get their orders.

Israel Scaled Back Gaza Ground Campaign After US Intervention – NYT

The Israeli military has limited the scope of its “expanded” ground operation against the Palestinian armed group Hamas in Gaza following consultations with senior White House officials, the New York Times reported on Saturday, citing sources. According to the paper, the initial plans “alarmed” officials in Washington, who voiced concern that they “lacked achievable military objectives,” with fears that the IDF was not yet prepared for a full-scale ground assault. However, an unnamed US government source told NYT that after discussions with Defense Secretary Lloyd Austin and other officials “the Israelis improved and refined their plan” for the offensive. As a result, the report said, the IDF’s actions in Gaza have so far been “smaller and more narrowly focused” than Israeli officials initially proposed to their US counterparts.

What’s the US afraid of? Well, plenty. First of all, a repeat of the humiliation they’re suffering in Ukraine. Then, Israel not being able to defeat Hamas. After that, Hezbollah. Then Iran. And at the end, if it would come to that, confronting the entire Muslim world. Russia would choose the Muslim side. China would pick Russia’s side. OPEC countries would cut the oil supply.

The US tries to make you believe that Israel conducts its own actions. They do not. Everything Israel did do so far has required US permission. Which also means that the US is ultimately responsible for a campaign that has killed some 4,000 Palestinian children, and many more to come. That’s on Joe Biden’s head. And ultimately yours, if you’re American or European. Something’s off. That’s not what you want, you don’t want 1000s of children dying in your name. So why do you let it happen?

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.