John French Sloan A Woman’s Work 1912

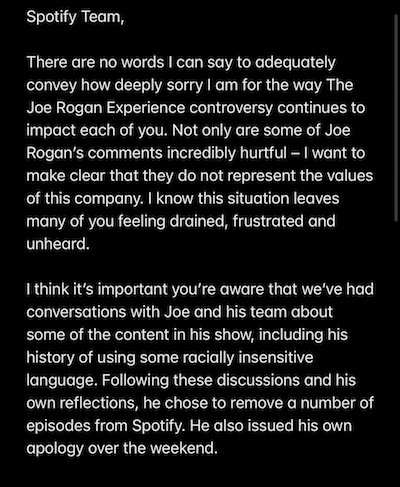

Seems a bit extreme.

Macgregor

One of the more notorious organizations in the Ukrainian military that uses all of these Nazi symbols that we're all familiar with is now apparently refusing to fight.pic.twitter.com/DEl1l1My14

— Douglas Macgregor (@DougAMacgregor) April 17, 2024

Barron

https://twitter.com/i/status/1780246703976632531

Watters jury

https://twitter.com/i/status/1780401543004426659

Tucker CIA

Tucker Carlson Asks “How Did The CIA React To Donald Trump's Presidency”

Pedro Israel Orta worked at The CIA during the Trump Administration, the response is telling

“They didn't even wanna recognize him as the president”

“Well, what I found interesting was every government… pic.twitter.com/D2TK1PHWrd

— Wall Street Apes (@WallStreetApes) April 17, 2024

Talking about testosterone…

Boeing

A Boeing quality engineer just testified to Josh Hawley that their planes are not safe and that he was threatened and silenced by the company when he tried to bring it up to them.

pic.twitter.com/OhNw4GFkK0— Greg Price (@greg_price11) April 17, 2024

Macgregor: “The United States has not commit to attacking Iran. This is unacceptable to Netanyahu, and he will work to alter Washington’s position.

Under the circumstances, Washington should expect Israel to employ whatever military power is at its disposal, including nuclear weapons, to destroy Iran’s strategic power.

Destroying Iran’s underground nuclear facilities has been a goal for a very long time. Both parties must realize Moscow will not tolerate a devastating attack on Iran.”

“They create felonies out of thin air by stretching the interpretation of law beyond its meaning..”

“.. that their country has been stolen from them and that the ruling elite are not going to permit Trump to give it back to them..”

• Prosecutors, Judges, Media Interfering in the November Election (PCR)

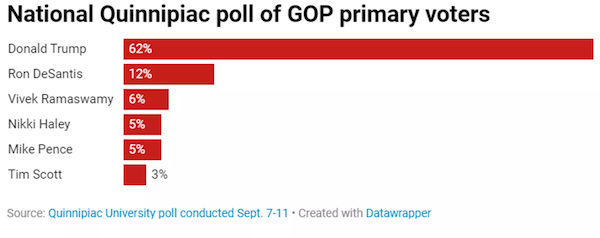

From the beginning it has been completely clear that the criminal and civil indictments of Trump have the purposes of using up his energy, money, and time so that he cannot campaign and of discrediting him with the insouciant part of the population that is stupid enough to have faith in the “justice system.” The trials themselves and the words of the prosecutors and judges prove it. The black Democrat New York District Attorney Alvin Bragg, put into office by anti-Trump billionaire George Soros, who Elon Musk says hates humanity (which means gentiles), has concocted a criminal case against President Trump for “falsifying business documents” that legal scholars dispute. Apparently, Bragg cares not a whit about his reputation, only about preventing Trump from campaigning. Bragg contends that Trump should have reported his $130,000 payment to porn star Stormy Daniels as a campaign contribution to himself and not as legal fees. But, of course, it would have been one of Trump’s lawyers or CPA who filled in the form.

A person of Trump’s wealth leaves such decisions to professionals and does not himself navigate complicated and risky forms. Regardless, there is nothing illegal whatsoever in making extortion or bribery payments to a porn star so that she doesn’t make harmful accusations. It is a much cheaper solution than suing for slander. You should understand that there is nothing illegal about Trump’s payment to the porn star. The payment is perfectly legal. Trump is not charged with making an illegal payment. He is charged with reporting it differently than a black quota hire, clearly incompetent, George Soros DA alleges Trump should have reported it. The whore media has not made this clear to the public. Instead the presstitutes have planted the idea that it is the payment that is the criminal action.

In law the charges against Trump are misdemeanors, not crimes. Trump’s black enemy has in an unspecified way elevated the charges to a felony. Increasingly prosecutors do this. They create felonies out of thin air by stretching the interpretation of law beyond its meaning. Prosecutors know that by the time a wrongly convicted defendant reaches the point that he can appeal the wrongful conviction to a higher court he will have run out of money and energy and will make a plea to a lessor charge. In Trump’s case, the black DA knows that given the slowness of the system Trump will be in court for years appealing wrongful decisions. As corrupt prosecutors suffer no punishment for their crimes against defendants, there is no barrier to their legal abuse of law–particularly when they are in court with a biased judge and have a biased jury. This first of 4 criminal trials began yesterday. Estimates are that the show trial will keep Trump in court for four days a week for the next six or more weeks. Clearly this is election interference and nothing else.

The other criminal trials are in various stages of disrepair. Fani Willis, the black Democrat Atlanta DA who has brought RICO charges against Trump and his attorneys is in trouble herself for paying her lover $700,000 of taxpayers’ money and using the money for vacations. She apparently is another George Soros plant and is shielded by the Democrat machine. She has had to remove her lover from Trump’s case, but is unlikely to suffer any consequences other than embarrassment. A New York civil case orchestrated by a black Democrat attorney general and a Trump-hating Democrat judge confiscated Trump’s NY real estate empire. In order to delay the confiscation until his higher court appeal is decided, the two required Trump to post a $500 million payment that would have depleted his cash for his political campaign. The payment was seen as a form of extortion, and the corrupt AG and judge had to reduce it to $175 million.

Clearly, these are not normal trials or normal charges. The law schools, bar associations, Congress and the whore media don’t even raise questions about the show trials that clearly constitute election interference. As I have said many times, the system will not permit Trump’s return to office. Americans need to understand that their country has been stolen from them and that the ruling elite are not going to permit Trump to give it back to them.

“Netanyahu is influenced by his [fundamentalist] political partners to go into an escalation so he can hold onto power and accelerate the coming of the Messiah.”

• Iran’s ‘New Equation’ Reaches Way Beyond West Asia (Pepe Escobar)

A Holy of the Holies was shattered in the Holy Land as Iran staged a quite measured, heavily choreographed response to the Israeli terror attack against its consulate/ambassador residence in Damascus, a de facto evisceration of the Vienna Convention on diplomatic immunity.This game-changer will directly interfere on how the Anglo-American system manages its simultaneous conflagration with Russia, China and Iran – three top BRICS members. The key problem is escalations are already built in – and will be hard to remove. The Total Cancel War against Russia; the genocide in Gaza – with its explicit policy masterfully decoded by Prof. Michael Hudson; and the decoupling/shaping the terrain against China won’t simply vanish – as all communication bridges with the Global Majority keep being torched.Yet the Iranian message indeed establishes a “New Equation” – as Tehran christened it, and prefigures many other surprises to come from West Asia.

Iran wanted to – and did send – a clear message. New equation: if the biblical psychopathic entity keeps attacking Iranian interests, from henceforth it will be counter-attacked inside Israel. All that in a matter of “seconds” – as the Security Council in Tehran has already cleared all the procedures. Escalation though seems inevitable. Former Israeli Prime Minister Ehud Barak: “Netanyahu is influenced by his [fundamentalist] political partners to go into an escalation so he can hold onto power and accelerate the coming of the Messiah.” Compare it to Iranian President Raisi: “The smallest act against Tehran’s interests will be met with a massive, extensive, and painful response against all its operations.” For Tehran, regulating the intensity of the clash in West Asia between Israel and the Axis of Resistance while simultaneously establishing strategic deterrence to replace “strategic patience” was a matter of launching a triple wave: a drone swarm opening the path for cruise missiles and ballistic missiles.

The performance of the much-vaunted Iron Dome, Arrow-3 and David’s Sling – aided by F-35 fighter jets and the US and the UK naval force – was not exactly stellar. There’s no video of the “outer-layer” Arrow-3 system shooting down anything in space. At least 9 ballistic missiles penetrated the dense Israeli defense network and hit the Nevatim and Ramon bases. Israel is absolutely mum on the fate of its Golan Heights intel installation – hit by cruise missiles. Amidst classic fog of war, it’s irrelevant whether Tehran launched hundreds or dozens of drones and missiles. Regardless of NATOstan media hype, what’s proven beyond the shadow of a doubt is that the supposedly “invincible” Israeli defense maze – ranging from US-made AD/ABM systems to Israeli knockoffs – is helpless in real war against a technologically advanced adversary.

What was accomplished by a single operation did raise quite a few professional eyebrows. Iran forced Israel to furiously deplete its stock of interceptors and spend at least $1.35 billion – while having its escalatory dominance and deterrence strategy completely shattered. The psychological blow was even fiercer. What if Iran had unleashed a series of strikes without a generous previous warning lasting several days? What if US, UK, France and – traitorous – Jordan were not ready for coordinated defense? (The – startling – fact they were all directly dispensing firepower on Tel Aviv’s behalf was not analyzed at all). What if Iran had hit serious industrial and infrastructural targets?

“..if Iran joins Russia and China and, as part of this troika, becomes an actor in the great world politics, the Middle East will face some big changes..”

• Iran’s Attack On Israel Signaled A Major Change In The Region (Ibragimov)

[..] the most intriguing question now is how the countries of the region, namely the Arab world, will react to Iran’s actions – after all, the attitude towards modern Tehran is quite mixed. Iran has been able to bolster its hand by using proxy organizations, which are now moving against Israel to defend the interests of Palestine. Judging by their neutral reactions – and quite unsurprisingly, in fact – none of the Arab leaders is interested in a strong Iran. They are interested in Iran existing as a moderate state allied with the West, with which they themselves cooperate. However, if Iran joins Russia and China and, as part of this troika, becomes an actor in the great world politics, the Middle East will face some big changes.

Despite the IRGC’s counterattacks, Iran continues to maintain its position that nobody needs a war, and it’s not interested in one by any means. As for its strikes so far, Iran considers them quite successful; they succeeded in making a point and delivering ‘a clear message’ to the entire West that Tehran is no longer confining itself to verbal statements and that, in general, things are going to get very real. Furthermore, any potential response from Israel will now justify similar operations by Iran, which may become harsher and harsher every time. Besides, the moral victory also belongs to Iran. Tehran had held the situation in suspense all along, and the world witnessed strikes on military bases in the north of Israel and saw them take damage. Iran’s strike, albeit a token one, has happened. The Islamic Republic is beginning to act like the flagship power in the region.

In this case, Israel hardly needs a direct war with the Islamic Republic, especially with the Hamas issue not settled yet, Gaza still not demilitarized, hostages yet to be rescued, and Western allies offering nothing in terms of support but nice statements and condemnations. In the meanwhile, there are rather serious reasons to believe that Israel may not be able to keep its temper and strike, just for self-consolation. Expecting a response strike from Iran, Israeli Foreign Minister Israel Katz said, several days prior to the counterattack, that if Iran strikes from its territory, then Israel will attack in response. That means the Israelis could go further and continue their attacks. Yes, Netanyahu has changed his tone somewhat and tries to show now that he doesn’t want a big war. He, however, may be under pressure from the security wing, members of which yearn for revenge and want to blow off steam on Iran, which they think created the situation Israel has been in since October 7, 2023. If Israel does strike back, attacking Iranian territories and killing people, the situation will spin out of control and there will be no stopping the Iranians.

The goal of Iran’s counterattack against Israel was not to unleash a big war. This action can be seen differently: as a PR effort, a propaganda schtick, or muscle-flexing. Some may say that Iran failed to retaliate fully, as its attack didn’t achieve anything equal to the two generals and 11 diplomats that Israel’s strike had killed. The message of the counterstrike, however, was not only to take revenge for Iran’s dead. Tehran deliberately didn’t strike targets in major Israeli cities. Its strikes on Israel were limited, mostly targeting the occupied Golani Heights, which legally belong to Syria, and military installations in Negev desert, in order to avoid escalation and prevent further provocations on Israel’s part. Besides, Iran has proved that it can penetrate Israel’s air defenses and that Israel is not that well protected.

Therefore, Iran’s goal was to change the rules of the game in the region and, by and large, it succeeded. Tehran’s counterattack put paid to any talk of Iran not putting its money where its mouth is and brought the conflict between the two countries to a whole new level. This half-measure cannot be seen as a defeat, but it’s not exactly a victory either. Besides, Israel is not going to sit idle. The Jewish state will start reviewing its actions and correcting mistakes; after all, matters of its own security are the utmost priority for Israel.

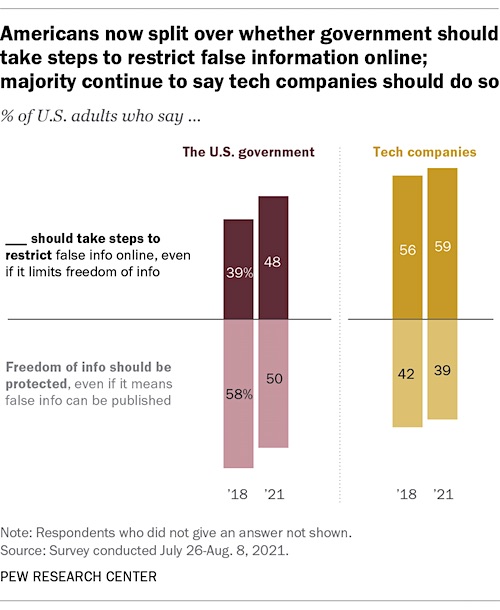

“These people that read various conspiracy-theory outlets that are just not accurate, and they actually model Russian propaganda.”

• Could the Russians Seize Congress? (Patrick Lawrence)

The Russians are coming — or coming back, better put. As the November elections draw near, let us brace for another barrage of preposterous propaganda to the effect Russians are poisoning our minds with “disinformation,” “false narratives,” and all the other misnomers deployed when facts contradict liberal authoritarian orthodoxies. We had a rich taste of this new round of lies and innuendo in late January, when Nancy Pelosi, the California Democrat who served as House speaker for far too long, asserted that the F.B.I. should investigate demonstrators demanding a ceasefire in Gaza for their ties, yes indeedy, to the Kremlin. Here is Pelosi on CNN’s State of the Union program Jan. 28: “For them to call for a cease-fire is Mr. Putin’s message. Make no mistake, this is directly connected to what he would like to see. Same thing with Ukraine…. I think some financing should be investigated. And I want to ask the F.B.I. to investigate that.”

O.K., we have the template: If you say something that coincides with the Russian position, you will be accused of hiding your “ties to Russia,” as the common phrase has it. Be careful not to mention some spring day that the sky is pleasantly blue: I am here to warn you—“make no mistake” — this is exactly what “Putin,” now stripped of a first name and a title, “would like to see.” There is invariably an ulterior point when those in power try on tomfoolery of this kind. In each case they have something they need to explain away. In 2016, it was Hillary Clinton’s defeat at the polls, so we suffered four years of Russiagate. Pelosi felt called upon to discredit those objecting to the Israeli–U.S. genocide in Gaza. Now we have a new ruse. Desperate to get Congress to authorize $60.1 billion in new aid to Ukraine, Capitol Hill warmongers charge that those objecting to this bad-money-after-bad allocation are… do I have to finish the sentence?

Two weeks ago Michael McCaul, a Republican representative who wants to see the long-blocked aid bill passed, asserted in an interview with Puck News that Russian propaganda has “infected a good chunk of my party’s base.” Here is the stupid-sounding congressman from Texas, as quoted in The Washington Post, elaborating on our now-familiar theme: “There are some more nighttime entertainment shows that seem to spin, like, I see the Russian propaganda in some of it — and it’s almost identical on our airwaves. These people that read various conspiracy-theory outlets that are just not accurate, and they actually model Russian propaganda.” I read in the Post that McCaul’s staff abruptly cut short the interview when Julia Ioffe, a professional Russophobe who has bounced around from one publication to another for years, asked him to name a few names.

So was this latest ball of baloney set in motion. A week after McCaul’s Puck News interview, Michael Turner, an Ohio Republican who, as chairman of the House Intelligence Committee, swings a bigger stick, escalated matters when, reacting to McCaul’s statements, reported that this grave Russian penetration was evident in the upper reaches of the American government, as again reported in The Washington Post: “Oh, it is absolutely true. We see directly coming from Russia attempts to mask communications that are anti–Ukraine and pro–Russia messages, some of which we even hear being uttered on the House floor.” Masked communications uttered on the House floor: Hold the thought, as I will shortly return to it.

House Speaker Mike Johnson is about to get ousted. It’s all RINOs all the way down.

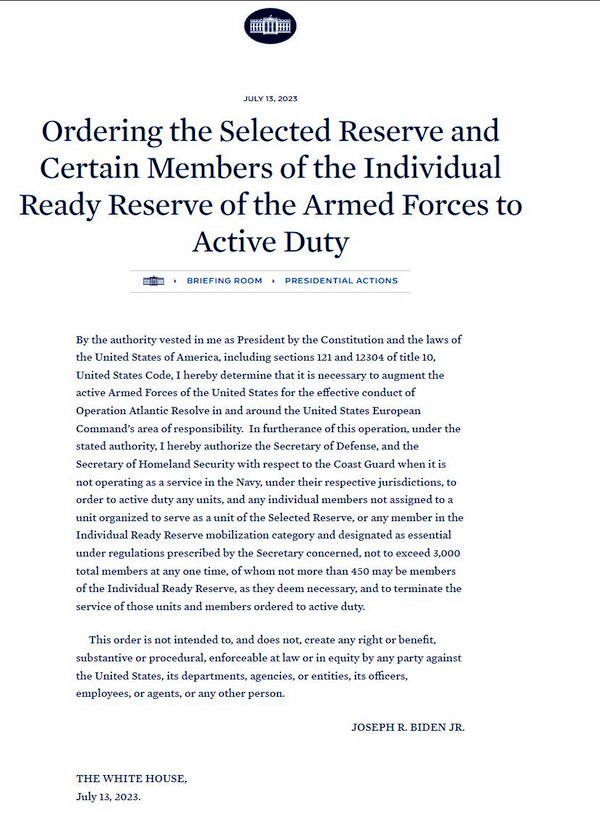

• White House Says It Opposes Standalone Israel Military Aid Bill (Antiwar)

The White House said on Monday that it opposes the idea of a bill that would give additional military aid to Israel without funding Ukraine and Taiwan. “We are opposed to a standalone bill that would just work on Israel, as we’ve seen proposed. We would oppose a standalone bill, yes,” said White House National Security Council spokesman John Kirby. Kirby’s comments came a day after House Speaker Mike Johnson (R-LA) said he would work on getting more military aid to Israel this week in the wake of Iran’s attack on Israeli territory, which came in retaliation for the bombing of Iran’s consulate in Damascus. Later on Monday, AP reported that Johnson told fellow GOP lawmakers that he plans to bring the package to the floor this week but will hold separate votes on funding for Ukraine, Israel, and Taiwan.

Back in February, the Senate passed a $95 billion foreign military aid bill that included $60 billion for the proxy war in Ukraine, $14 billion to support the Israeli slaughter of Palestinians, and a few billion for Taiwan and other spending in the Asia Pacific region. While Johnson wants to hold separate votes, his plan is expected to send about the same amount of money to each country, and each measure will likely pass. He has been under increasing pressure from the White House and congressional hawks in both parties to bring the $95 billion bill to the floor for a vote. “Time is not on anyone’s side here in either case, so they need to move quickly on this,” Kirby said. “And the best way to get that aid into the hands of the IDF and into the hands of the Ukrainian soldiers is to pass that bipartisan bill that the Senate passed.”

And Rand Paul.

• Rep. Massie Joins MTG In Calling For Speaker Johnson’s Ouster (ZH)

Kentucky Congressman Thomas Massie on Tuesday became the second representative to call for an end to Mike Johnson’s reign as Speaker of the House, joining Rep Marjorie Taylor Greene. He delivered that news directly to Johnson in a closed-door Republican conference meeting, telling the Louisianan “you’re not going to be the speaker much longer,” two representatives told Politico. Massie has criticized Johnson for backing aid packages for Ukraine and Israel, kick-the-can spending bills and the extension of warrantless NSA spying via the Foreign Intelligence Surveillance Act — while failing to bolster border security. In March, Greene — incensed at Johnson for collaborating with Democrats to push through a $1.2 trillion spending package over the objection of conservatives seeking spending cuts — filed a motion to “vacate the chair,” which would initiate a vote by House members on whether to fire Johnson from the job of speaker.

It’s unclear when Greene, Massie or someone else will call for a vote on the motion. Greene has said that she wants to allow time “for us to go through the process, take our time and find a new speaker of the House that will stand with Republicans and our Republican majority instead of standing with the Democrats.” She’s also expressed wariness over risking the GOP’s razor-thin House majority — which has withered in recent weeks as multiple Republicans announced they’re leaving Congress before finishing their terms. Massie says it’s only a matter of time before the House votes on Greene’s motion to vacate. “The motion is going to get called, OK? Does anybody doubt that? The motion will get called,” Massie told reporters after Tuesday’s meeting. “And then he’s gonna lose more votes than Kevin McCarthy. And I have told him this in private, like weeks ago.” Johnson’s predecessor, Kevin McCarthy, was himself dethroned in October via a motion to vacate the chair.

While Massie and Greene are far from alone in their disappointment in Johnson, many of their disgruntled colleagues are wary of a scenario in which Johnson is ousted and the House spends days or weeks struggling to settle on a successor. “We saw what happened last fall when this all went down — there’s not an alternative…You are not going to get a majority of votes for any new person,” Louisiana Rep. Garret Graves told Politico. Massie has asked Johnson to first allow the party to select a successor, and then voluntarily step down. On Tuesday, Johnson was defiant. “I am not resigning and it is in my view an absurd notion that someone would bring a vacate motion when we are simply trying to do our job,” he told reporters. Massie’s announcement in the closed-door meeting ruffled feathers. Ohio Rep. Jim Jordan voiced his discomfort with the idea, saying, “We don’t need that, no way. We don’t want that. We shouldn’t go through that again. That’s a bad idea.”

On Monday night, Johnson compounded conservatives’ anger when he announced he would bring four separate measures to a vote: aid to Ukraine, aid to Israel, aid to Taiwan and another bill with miscellaneous measures including a TikTok ban. As the New York Times explains, the goal is to cobble together legislation that would match what Democratic Senate Majority Leader Chuck Schumer is cooking up: If all four pieces passed the House, they would then be folded into a single bill for the Senate to take up, in an effort to ensure that senators could not cherry-pick pieces to approve or reject. “We’re steering toward everything Chuck Schumer wants,” said Massie. Decoupling the proposals also saps conservatives’ leverage to force more spending on border security. Greene called the plan “a scam” and added, “He’s definitely not going to be speaker next Congress if we’re lucky enough to have the majority.”

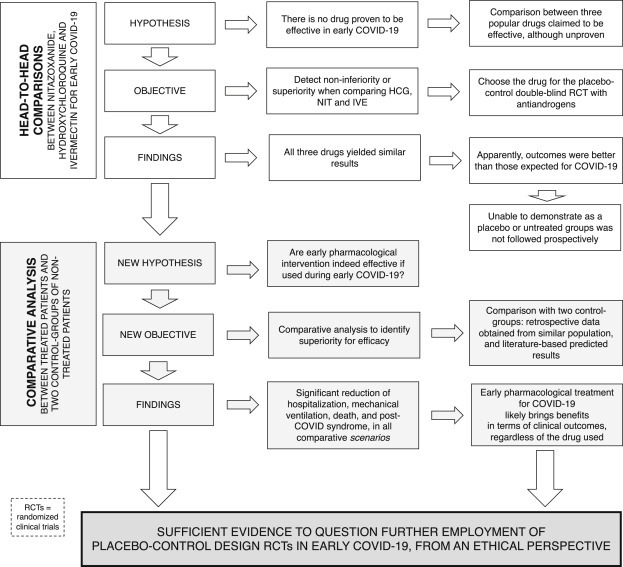

“..officials from 15 federal agencies “knew in 2018 that the Wuhan Institute of Virology was trying to create a coronavirus like COVID-19.”

• Rand Paul Drops COVID Bombshell: “We Have 15,000 Samples In Wuhan” (ZH)

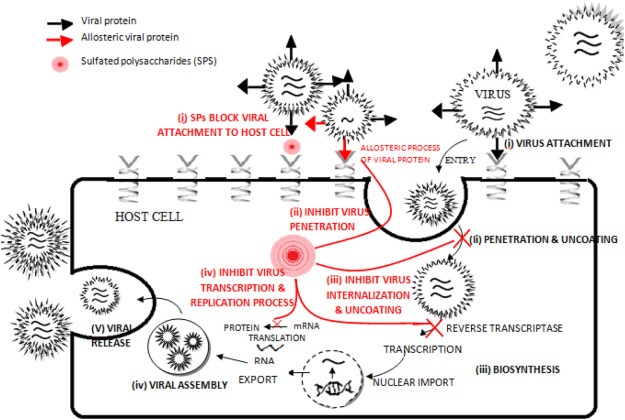

Last week Senator Rand Paul (R-KY) wrote in a Tuesday op-ed that officials from 15 federal agencies “knew in 2018 that the Wuhan Institute of Virology was trying to create a coronavirus like COVID-19.” “These officials knew that the Chinese lab was proposing to create a COVID 19-like virus and not one of these officials revealed this scheme to the public. In fact, 15 agencies with knowledge of this project have continuously refused to release any information concerning this alarming and dangerous research. Government officials representing at least 15 federal agencies were briefed on a project proposed by Peter Daszak’s EcoHealth Alliance and the Wuhan Institute of Virology.” -Rand Paul. Paul was referring to the DEFUSE project, which was revealed after DRASTIC Research uncovered documents showing that DARPA had been presented with a proposal by EcoHealth Alliance to perform gain-of-function research on bat coronavirus. New documents released by Drastic Research show Peter Daszak and the EcoHealth Alliance had applied for funds that would allow them to further modify coronavirus spike proteins and find potential furin cleavage sites.

Now, Paul points to an email between EcoHealth’s Daszak and “Fauci Flunky” David Morens from April 26, 2020 (noted days before by the House Select Subcommittee on the Coronavirus Pandemic), when the lab-leak hypothesis was gaining traction against Fauci – who funded EcoHealth research in Wuhan, and Daszak’s orchestrated denials and the forced “natural origin” narrative. In it, Daszak laments the “real and present danger that we are being targeted by extremists” (for pointing out that they were manipulating bat covid down the street from where a bat covid pandemic broke out), and called Donald Trump “shockingly ignorant.” He also told David that he would restrict communications “to gmail from now on,” and planned to mount a response to an NIH request which appears to suggest moving out of Wuhan – to which Daszak says “Even that would be a loss – we have 15,000 samples in freezers in Wuhan and could do the full genomes of 700+ Co Vs we’ve identified if we don’t cut this thread.”

In 2016 Peter Daszak (the man Fauci’s NIH was funding) openly talked about the gain of function research being done in China.

The research Fauci said never happened.

Daszak actually talked about creating a killer virus. pic.twitter.com/iYseialw6Z

— MAZE (@mazemoore) April 9, 2024

Which means Daszak, funded by Fauci, lied when he said “every single one of the SARSr-CoV sequences @EcoHealthNYC discovered in China is already published.” And Anthony Fauci concealed the ‘700 unknown coronaviruses’ in Wuhan. Meanwhile, an EcoHealth progress report referenced “two chimeric bat SARS-like CoVs constructed on a WIV-1 backbone.”

“..Musk was just paid too damn much for creating a $1.2 trillion company by Nov 2021..”

• Tesla Asks Shareholders To Approve Musk’s $56 Billion Comp… Again (ZH)

At his peak, Elon Musk was worth $340BN (Nov 2021) and stood alone as the world’s richest man/women/other. According to Bloomberg’s billionaires list, he is now worth mere $175BN… sliding to just the fourth-richest in the world as Tesla’s share price has declined and after a Delaware judge decided in January that Musk was just paid too damn much for creating a $1.2 trillion company by Nov 2021. But now, he may be about to climb that wealth ladder back to the top once more as Tesla has asked shareholders to vote again on the same $56 billion compensation package that was voided by a Delaware court early this year. Tesla Chair Robyn Denholm criticized the Delaware Chancery Court’s January decision, writing in the proxy that it amounted to second-guessing shareholders who had approved Musk’s performance-based award in 2018.

“Because the Delaware Court second-guessed your decision, Elon has not been paid for any of his work for Tesla for the past six years that has helped to generate significant growth and stockholder value,” Denholm wrote. The filing went on to say that negotiating a new pay package would take time and lead to incurring billions of dollars in additional compensation expense. Therefore, ratifying the 2018 package will be faster and “avoid a prolonged period of uncertainty regarding Tesla’s most important employee.” Additionally, the filing shows Tesla considered nine other states as alternatives to Delaware before narrowing its choice down to California, Nevada, New York or Texas.

Finally, Bloomberg reports that, according to the filing, dozens of institutional shareholders have contacted Tesla and expressed support for the 2018 compensation plan, including four of the top 10. The carmaker also said that thousands of retail investors have sent letters and emails to the board expressing the same sentiment. Of course, if this passes the shareholder vote, we assume the honorable Chief Judge Kathaleen St. J. McCormick – who described the company’s directors as “supine servants of an overweening master” – will have problems asserting that they hadn’t looked out for the best interests of investors… since it was the investors themselves, now fully informed, that democratically voted for Musk’s compensation plan. …or does democracy (and capitalism) die in Delaware?

When the 1st Amendment becomes a hindrance…

• NPR Editor Resigns After Suspension for Exposing Bias and Intolerance (Turley)

It appears that National Public Radio has solved the problem of the intolerance for opposing views, detailed in an article by award-winning editor Uri Berliner: he is now out of NPR. Berliner resigned after NPR suspended him and various other journalists and the CEO lashed out at his discussing their political bias. For those of us in higher education, it is a chillingly familiar pattern. Editors, journalists, and listeners at the public-supported outlet will now be able to return to the echo-chambered coverage without the distracting voice of a dissenter. After Berliner wrote his piece in the Free Press, NPR CEO Katherine Maher attacked Berliner and made clear that NPR had no intention to change its one-sided editorial staff or its coverage. Others at NPR also went public with their criticism of him and falsely portrayed his criticism as opposed to actual racial and other diversity of the staff.

In his article, NPR’s David Folkenflik acknowledges that the Berliner criticism “angered many of his colleagues.” Maher response was hardly surprising. After years of criticism over NPR’s political bias, the search for a new CEO was viewed as an opportunity to select someone without such partisan baggage. Instead, it selected Maher, who has been criticized for controversial postings on subjects ranging from looters to Trump. Those now-deleted postings included a 2018 declaration that “Donald Trump is a racist” and a variety of political commentary. Maher was unlikely to address the problem. She is the problem. Maher lashed out at Berliner, calling his criticism and call for greater diversity in the newsroom “profoundly disrespectful, hurtful, and demeaning.” So now Berliner has resigned rather than work at a media outlet where he was shunned and denounced. In social media post on Wednesday, Berliner published his resignation letter to NPR leadership and stated “I cannot work in a newsroom where I am disparaged by a new CEO whose divisive views confirm the very problems at NPR I cite in my Free Press essay.”

It is all-too-familiar to many of us in higher education where conservatives, libertarians, and republicans have been purged from most faculties. This is done through a mix of filling open slots with liberal academics while making life intolerable for those who remain. For years, a conservative North Carolina professor faced calls for termination over controversial tweets and was pushed to retire. Dr. Mike Adams, a professor of sociology and criminology, had long been a lightning rod of controversy. In 2014, we discussed his prevailing in a lawsuit that alleged discrimination due to his conservative views. He was then targeted again after an inflammatory tweet calling North Carolina a “slave state.” That led to his being pressured to resign with a settlement. He then committed suicide just days before his last day as a professor.

NPR’s CEO Katherine Maher on the truth:

“Our reverence for the truth might be a distraction that’s getting in the way of finding common ground and getting things done.”

Reposting this because the original poster deleted the video. pic.twitter.com/h9kqJWV3p3

— Ian Miles Cheong (@stillgray) April 17, 2024

Elon Musk: “The software running in her head is the anti-Grok – hates truth & humor”

“Orban said he intends “to come and take over Brussels,” reiterating his earlier warning to “occupy” the EU’s key institutions with his allies..”

• EU Leadership Must Go – Orban (RT)

The EU needs new leadership as the bloc’s current top officials have proven entirely unsuccessful, Hungarian Prime Minister Viktor Orban has claimed. Orban made the comments at the European Parliament on Tuesday as part of a public discussion with Former Polish Prime Minister Mateusz Morawiecki and the leader of the French National Rally party, Fabrice Leggeri. “Now we have a leadership in the EU with some major projects selected by themselves like green transition, RRF (Recovery and Resilience Facility) policy, migration, war [in Ukraine] and sanctions policy, and they all failed,” Orban said. “The present leadership of the European Union must go away. And we need new leaders,” the Hungarian prime minister insisted. Orban said he intends “to come and take over Brussels,” reiterating his earlier warning to “occupy” the EU’s key institutions with his allies in order to bring change to the bloc.

According to the Hungarian leader, the rule of law and conditionality system created by the current EU leadership has “proved to be… an instrument of political blackmailing. If you do not behave as we expect, you do not get the money.” Hungary has not received “a single penny” from the RRF because European Commission President Ursula von der Leyen has openly voiced dissatisfaction with Budapest’s reluctance to accept migrants and its opposition to the bloc’s gender policies, he said. The EU’s green transition “has failed because it has gone against [the] economic and industrial” interests of the bloc, Orban added. A switch towards climate neutrality should not be “politically motivated,” otherwise “it would destroy the competitiveness of the European economy. That is where we stand today,” he explained.

In contrast to many other EU members, the Hungarian leader has refused to provide arms to Ukraine and has consistently criticized the bloc’s sanctions against Russia over the conflict. According to Orban, the time has come for Brussels to define “what it should do with the issue of the war” in order to find a solution to the crisis and prevent similar ones in the future. Even goodwill gestures may “cause difficulties for the European economy,” such as the recent protests by farmers in Poland, France, Germany, and other nations partly caused by the preferences given by the EU to Ukrainian food suppliers, he explained. Orban also insisted that the issue of aid to Kiev should be “separated as much as possible from the issue of Ukraine’s accession to the EU,” formal negotiations for which were approved last year.

Smart guy. Runs the company himself, with a crew of 30. 900 million daily users. No ads.

• FBI Wanted Telegram Backdoor to Spy on Users – Founder (Sp.)

The former Fox News anchor and conservative media personality divulged that he had set up an official Telegram channel for his Tucker Carlson Network, encouraging the public to “keep an eye on the announcements there.” The channel has already attracted more than 150, 000 subscribers. Speaking with Tucker Carlson, Russian-born IT entrepreneur and co-founder of the Telegram social network Pavel Durov focused on a variety of topics, including his visit to the United States. The 39-year-old revealed that he was closely watched and monitored by the Federal Bureau of Investigation (FBI) during his time in the country. “We got too much attention from the FBI, [and] the security agencies, wherever we came to the US,” Durov said during the interview released on Wednesday.

In an interview with US journalist Tucker Carlson, Telegram founder Pavel Durov described his experience with ubiquitous FBI agents following him everywhere.

“Whenever I would go to the US I would have two FBI agents greeting me at the airport, asking questions. One time I was… pic.twitter.com/3hWoUHXYKV

— Sputnik (@SputnikInt) April 16, 2024

According to the businessman, one of his top employees once told him that he had been approached by the US government. “There was an attempt to secretly hire my engineer behind my back by [US] cybersecurity officers,” Durov claimed. He argued that those officers were trying to persuade the engineer to use “certain open-source tools,” which he would then integrate into Telegram’s code that, in Durov’s opinion, “would serve as backdoors” for hacking the platform. The entrepreneur stressed that he believes what the employee said was true, adding, “There is no reason for my engineer to make up [such] stories.” When asked if infiltrating Telegram’s systems would allow the US government to spy on its users, Durov stated that he did not dismiss the possibility, acknowledging that any government could potentially carry out such an action. “A backdoor is a backdoor, regardless of who uses it,” he underscored.

In an interview with US journalist Tucker Carlson, Telegram founder Pavel Durov complained about excessive attention from the FBI and other intelligence agencies “wherever we came to the US.”

Durov told Carlson how an intelligence agency attempted to convince his employee to… pic.twitter.com/IwwbABp5EH

— Sputnik (@SputnikInt) April 16, 2024

The 39-year-old tech tycoon noted that he had “personally experienced similar pressure” in the US, where law enforcement officials approached him on many occasions. “Whenever I would go to the US, I would have two FBI agents greeting me at the airport, asking questions. One time, I was having breakfast at 9 am and the FBI showed up at the house that I was renting,” the businessman asserted. According to him, FBI agents knew what he and his team were doing, but the agents wanted the details. “My understanding is that they [also] wanted to establish a relationship to in a way control Telegram better. I understand that they were doing their job. [But] for us running a privacy-focused social media platform, that probably wasn’t the best environment to be in. We want to be focused on what we do, not on government relations of that sort,” Durov pointed out.

The interview comes just a day after Carlson published the first post on his newly-created Telegram page, the Tucker Carlson Network, where users will “get all the latest updates, behind-the-scenes insights, and exclusive content.”

There are already more than 150,000 subscribers for the channel, and their number is growing with every passing second.

“Whatever we do, we'd be violating the US constitution” – Durov stunned by letters from Congress

In an interview with journalist Tucker Carlson, Telegram founder Pavel Durov explained how he was blackmailed by US lawmakers.

“After the events of January 6th, we received a letter… pic.twitter.com/LeKfjC6HOd

— Sputnik (@SputnikInt) April 17, 2024

“..When it comes to the freedom of speech, those two platforms could, basically, censor whatever you can read, access on your smartphone..”

• Apple and Google More Dangerous Than Governments – Telegram Founder (RT)

Apple and Google “could, basically, censor whatever you can read, access on your smartphone,” Pavel Durov, the co-founder of the popular messaging app Telegram has told Tucker Carlson in an interview; he lamented that the pressure coming from the tech giants is stronger than that exerted by governments. The entrepreneur has also said he received warnings from both the Democratic and Republican parties after the January 2021 riots in the US Capitol. The rare discussion took place at the Russian-born IT entrepreneur’s office in Dubai, and was released on Wednesday. Carlson asked Durov to give an example of a request to build backdoors into Telegram that crossed into censorship, and could be considered spying, or violating people’s privacy. The messaging app claims to have over 900 million active users.

“There was a funny story related to your home country,” the tech entrepreneur replied. “After the events of January 6, we received a letter from, I believe, a congressman from the Democratic side, and they requested that we share all the data that we have in relation to what they called ‘that uprising.” On January 6, 2021, a mob loyal to then-US President Donald Trump stormed the US Capitol and forced lawmakers into hiding in an attempt to prevent Congress from formalizing Joe Biden’s victory in the presidential election. Durov said his team checked the letter and it “seemed very serious,” essentially saying: “if you fail to comply with this request, you will be in violation with the US Constitution.” “Two weeks after that letter, we got another letter, a new letter, from the Republican side of the Congress, and there we read that, if we give out any data [to the Democrats], it would be in violation of the US Constitution.

So we got two letters that said: whatever we do, we would be violating the US Constitution.” However, the most pressure on Telegram, according to Durov, comes from tech giants Apple and Google, Durov stressed. “I would say that the largest pressure is not coming from governments. It is coming from Apple and Google. When it comes to the freedom of speech, those two platforms could, basically, censor whatever you can read, access on your smartphone,” he said. “They make very clear that if we fail to comply with their guidelines, as they call it, Telegram could be removed from the [app] stores.” Durov dismissed any suggestion of links between Telegram and the Russian government, suggesting that competitors could be stirring up such rumours to discredit the company.

https://twitter.com/i/status/1780401691268931685

“..through an “innocuous change” to the definition of “electronic communications surveillance provider” in the FISA 702 bill, the U.S. government could go far beyond its current scope..”

• NSA ’Just Days From Taking Over The Internet’ – Edward Snowden (Mitchelhill)

The United States National Security Agency (NSA) is only days away from “taking over the internet” with a massive expansion of its surveillance powers, according to NSA whistleblower Edward Snowden. In an April 16 post to X, Snowden drew attention to a thread originally posted by Elizabeth Goitein — the co-director of the Liberty and National Security Program at the Brennan Center for Justice — that warned of a new bill that could see the U.S. government surveillance powers amplified to new levels. The bill in question reforms and extends a part of the Foreign Intelligence Surveillance Act (FISA) known as Section 702. Currently, the NSA can force internet service providers such as Google and Verizon to hand over sensitive data concerning NSA targets. However, Goitein claims that through an “innocuous change” to the definition of “electronic communications surveillance provider” in the FISA 702 bill, the U.S. government could go far beyond its current scope and force nearly every company and individual that provides any internet-related service to assist with NSA surveillance.

“That sweeps in an enormous range of U.S. businesses that provide wifi to their customers and therefore have access to equipment on which communications transit. Barber shops, laundromats, fitness centers, hardware stores, dentist’s offices.” Additionally, the people forced to hand over data would be unable to discuss the information provided due to hefty gag order penalties and conditions outlined in the bill, added Goitein. The bill initially received heavy pushback from privacy-conscious Republicans but passed through the U.S. House of Representatives on April 13. Part of the pushback saw the bills’ proposed spying powers time-frame cut from five years to two years, as well as some minor amendments to the service providers included under the surveillance measures. However, according to Goitein, the amendment did very little to reduce the scope of surveillance granted to the NSA.

In her view, the amendment could even see service providers such as cleaners, plumbers and IT service providers that have access to laptops and routers inside people’s homes be forced to provide information and serve as “surrogate spies,” claimed Goitein. The bill has seen strong pushback from both sides of the political aisle, with several government representatives claiming the bill violates citizen’s constitutional rights. Democratic Senator Ron Wyden described the bill as “terrifying” and said he would do everything in his power to prevent it from being passed through the Senate. “This bill represents one of the most dramatic and terrifying expansions of government surveillance authority in history.” Republican Congressperson Anna Paulina Luna, who voted against the bill in the House of Representatives, said Section 702 was an “irresponsible extension” of the NSA’s powers. Luna added that if government agencies wanted access to data, they must be forced to apply for a warrant. The bill is slated for a vote on April 19 in the U.S. Senate.

“..we already do not own anything..”

• The Great Dispossession Part 2 (Paul Craig Roberts)

In Part 1 ( https://www.paulcraigroberts.org/2024/04/11/the-great-dispossession/ ), I reported that we already do not own anything. The immediate response from readers is: what can we do to avoid dispossession? Offhand, the answer might appear to be debt-free property and gold and silver in personal possession. However, if the goal is that we own nothing and are controlled under a digital currency regime, these assets will be taken as well. Webb says if the billionaires and large financial institutions can be made aware of the situation, they could make Congress aware of the regulatory changes and force Congress to use its law-making power to undo the regulatory changes. After all, if there is no private financial property, there is no one to contribute to Congressional elections. Billionaires’ campaign donations elect the politicians, and what the regulatory changes do to billionaires is to reduce them to the same poverty as a homeless person. What the changes mean for large financial institutions such as Merrill Lynch, Schwab, etc., is their existence ceases.

Webb’s hope is the combined influence can undo the regulatory changes. The question is whether awareness can be generated. The fate of Congress is also at stake. In the Great Reset there is no input from the people and no function for Congress. As in all of my writings, I am trying to bring awareness. Little doubt the messenger will be shot. The purpose of Part 2 is to outline the regulatory changes that have been made that have turned our property in financial assets into the property of “secured creditors.” Webb terms them legal changes, which they are, but as I read it from regulatory, not legislative, action. Webb says the changes are global, but he only describes how the US and EU effected the changes for themselves. I am unable to imagine that Russia, China, Iran and any parts of the world not captured in the Western financial system are parties to the dispossession, especially under the regime of sanctions. As I read it, the dispossession that awaits is limited to the Western world and its captive countries. By global, perhaps Webb means the global operations of Western world financial organizations.

First some definitions: an “account holder” is you, your IRA, your pension plan, your stock and bond investments held at an “account provider” or “intermediary” or “depository institution” such as Merrill Lynch, Schwab, Wells Fargo. An “entitlement holder” is the definition of you whose ownership claim to your financial assets has been subordinated to the claims of “secured creditors” of the institution where you have your accounts. Please do understand that the dispossession of which I write is your dispossession. As reported in Part 1, a country’s securities are pooled in a Central Security Depository (CSD). Each national CSD is linked to the International Security Depository (ICSD), which in the words of a 2013 report by the Bank for International Settlements Committee on the Global Financial System, makes available to “secured creditors” all available collateral (all of our stocks and bonds) and provides cross-border mobility of collateral from the “collateral giver” to the “collateral taker.” Yes, these terms are explicitly used, indicating recognition that theft is taking place.

“..stocks and real estate have been driven to unprecedented levels by years of zero interest rates. When this bubble pops, we will be dispossessed.”

• The Great Dispossession Part 3 (Paul Craig Roberts)

In Part 1, I explained that the next financial crisis will be bailed out not with central bank money creation but with our stocks, bonds and bank balances. In Part 2, I explained the multi-year quiet regulatory changes that dispossessed us of our property. In Part 3, I explain David Rogers Webb’s conclusion that a massive financial crisis is pending in which our financial assets are the collateral underwriting the derivative and financial bubble and will result in the loss of our assets but leave us with our debts as happened to those whose banks failed in the 1930s. Webb begins with the economic formula that the velocity of circulation of money times the money supply equals nominal Gross Domestic Product. V x MS = GDP. The velocity of circulation is a measure of how many times a dollar is spent during a given period of time, e.g., quarterly, annually. A high velocity means people quickly spend the money that comes into their hands. A low velocity means people tend to hold on to money.

Velocity impacts the Federal Reserve’s ability to manage economic growth with money supply changes. If the velocity of money is falling, an expansionist monetary policy will not result in rising GDP. In such a situation, the Federal Reserve is said to be “pushing on a string.” Instead of pushing up GDP, money supply increases push up the values of financial assets and real estate resulting in financial and real estate bubbles. Webb notes that falls in velocity are precursors of financial crises. A multi-year sharp fall in velocity preceded the stock market crash in 1929 and the Great Depression that gave birth to regulatory agencies. The 21st century is characterized by a long-term fall in velocity that has reached the lowest level on record, while stocks and real estate have been driven to unprecedented levels by years of zero interest rates. When this bubble pops, we will be dispossessed.

Will the bubble pop? Yes. The Fed suddenly and rapidly moved from zero to 5% interest rates, a reversal of the policy that drove up prices of stocks and bonds. The Fed raises rates by reducing money supply growth, thus removing the factor supporting high stock prices and collapsing the value of bonds. This results in a lowering of the value of stocks and bonds serving as collateral for loans, which, of course, means the loans and the financial institution behind them are in trouble. Bonds have already taken a hit. The stock market is holding because participants believe the Fed is about to reverse its interest rate policy and lower rates. Webb notes that the official data show that the velocity of money collapsed in the 21st century while the Fed introduced “quantitative easing.” He makes the correct point that when the velocity of money collapses, the Fed is pushing on a string. Instead of money creation fueling economic growth, it produces asset bubbles in real estate and financial instruments, which is what we have at the present time.

When after more than a decade of near zero interest rates, the Fed raises interest rates it collapses the values of financial portfolios and real estate and produces a financial crisis. As the authorities have set in place a system that bails out secured creditors with our bank deposits, stocks, and bonds, we will have no money and no financial assets to sell for money. People with mortgaged homes and businesses will lose them, as they did in the 1930s, when they lost their money due to bank failures. People with car payments will lose their transportation. The way the system works is you lose your money but not your debts. The secured creditors are the creditors of the troubled institutions. Ultimately, the secured creditors are the mega-banks defined as “privileged creditors.”

“We are being steered directly into a brick wall because the globalists can’t take over the world with the US standing.”

• Driving America into a Brick Wall – Bill Holter (USAW)

Back in February, when everyone was predicting a Fed rate cut, precious metals expert and financial writer Bill Holter said rates would be going up and not down. Since that call, the 10-Year Treasury is up more than 30 basis points. It closed today at 4.67%. Now, Holter is still calling for higher interest rates that will coincide with higher gold and silver prices. Why? It’s called inflation, and it’s not temporary. Holter explains, “Foreigners are backing away from buying Treasuries. That is the only thing that has kept the doors open, so to speak, is the fact we are able to borrow an unlimited amount of money because we are the world reserve currency. Foreigners backing away from our debt is going to lead the Federal Reserve to be the buyer of last, and then, only resort. So, you will have direct monetization between the Fed and the Treasury. What that will cause is a currency that declines in purchasing power. It will decline in a big way, and it will decline rapidly. So, what I am describing is inflation that turns into hyperinflation.”

But that is not the end of our problems. Holter points out, “I do think it is going to get worse, and that means interest rates will go higher, and that will put on much more pressure. We are at 4.65% on the 10-Year Treasury now. We went from 3.75% to 4.65% (in a short amount of time). We run through 5% on the 10-year Treasury, and everything blows up. . . . The bottom line here is we are at the end game of a fiat currency. Young people have never experienced high inflation. . . . Where we are this time around, Paul Volker (Fed Head in 1979) was able to raise rates to 16% or 17% and crush inflation. He was able to do that because there was not a ton of debt. The U.S. debt back in 1980 was 35% of GDP. Now, it is 125% plus debt to GDP. If you raise rates to 6% to 8%, you will blow up the entire system because much of this debt was put on during the 1% to 3% interest rate time. . . . The inflation is going to push rates higher no matter what the Fed says.”

Gold is hitting one new record high after another. It’s not greed, but fear, and Holter says, “Big money is buying gold because they are looking for protection.” The other wild card is war, and Holter says, “War is a way to keep the system propped up.” In closing, Holter contends, what you are seeing is not a series of mistakes by incompetent people. Holter says, “This is too stupid for it not to be the plan. . . .This is not a Republican or Democrat thing. We are being steered directly into a brick wall because the globalists can’t take over the world with the US standing. They have to take the US down, and if they take the US down, so will the western financial system fall. If that happens, the globalists can have their way.”

Brick wall right ahead.

• IMF Lambasts US Over Ballooning Debt (RT)

The International Monetary Fund (IMF) has raised concerns about overspending by the US government, warning it has been reigniting inflation risks and undermining financial stability around the world. The US federal budget deficit jumped from $1.4 trillion in fiscal 2022 to $1.7 trillion last year, according to the latest World Economic Outlook, issued by the IMF on Tuesday. “The exceptional recent performance of the United States is certainly impressive and a major driver of global growth,” the IMF said. However, the report explained that this “reflects strong demand factors as well, including a fiscal stance that is out of line with long-term fiscal sustainability.” The ballooning US national debt, which exceeded $34 trillion in December, and the fiscal deficit threatened to exacerbate sky-high levels of inflation while posing a long-term risk to the global economy, according to the report.

“Something will have to give,” the IMF warned. The US exceeded its debt ceiling, which was legally set at $31.4 trillion, in January 2023. After months of warnings of an imminent and economically disastrous default from the US Treasury, President Joe Biden in June 2023 signed a bipartisan debt bill that suspended the cap until January 2025. This effectively allowed the government to keep borrowing without limits through next year. Debt spiked to $32 trillion less than two weeks after the bill was approved, and has been piling up ever since. The debt held by the public could surge by $19 trillion over the next decade to surpass the $54 trillion mark, owing to the mounting costs of an aging population and higher interest expenses, according to recent projections by the Congressional Budget Office (CBO).

Since entering office, Biden has spent trillions on Covid relief as well as on infrastructure. The US has also spent billions on aid for Ukraine. The Biden administration, however, has been insisting that tax cuts signed into law by then-President Donald Trump were to blame for the ballooning national debt. Last month, Biden unveiled a $7.3-trillion budget plan for 2025 which would push US debt over 100% of GDP, as he laid out a fiscal agenda that boosts spending but plans to save $3 trillion through higher taxes over ten years. Republicans in the House of Representatives have described the proposed budget as a “roadmap to accelerate America’s decline,” accusing the Biden administration of “reckless spending” and of engaging in a “runaway spending spree” that disregards fiscal responsibility.

Dr Phil

https://twitter.com/i/status/1780432276536348760

Ladapo

https://twitter.com/i/status/1780338991906078826

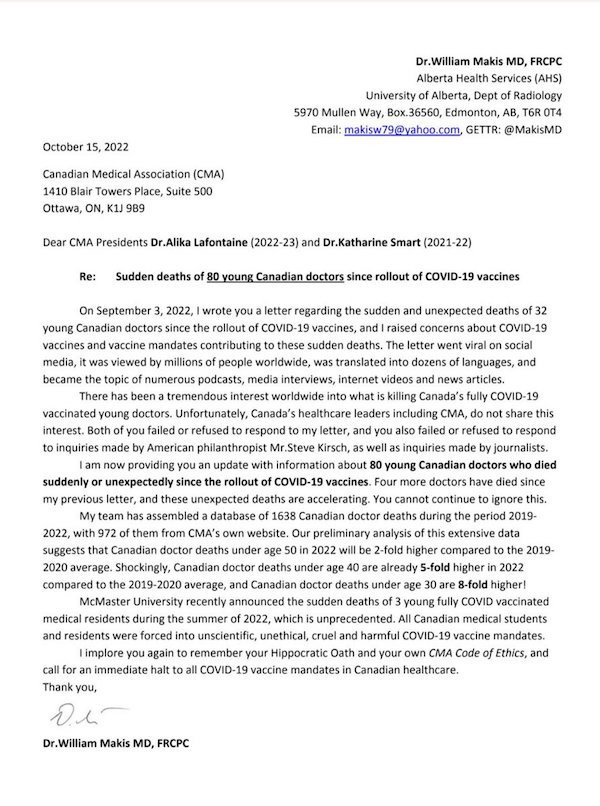

"The vaccines aren't appropriate for use in humans."

Florida's surgeon general, Dr. Joseph Ladapo, urges an immediate halt to mRNA-based Covid "vaccines", citing cancer and other health risks.

"Dr. Ladapo says he has safety concerns pertaining to the discovery of billions of… pic.twitter.com/Hrq5xJLKdK

— Wide Awake Media (@wideawake_media) April 17, 2024

https://twitter.com/i/status/1780336890639475072

Cloud seeding

https://twitter.com/i/status/1780546767232122903

https://twitter.com/i/status/1780631970667536551

Buster

https://twitter.com/i/status/1780260040672415826

Chickady’s Birdhouse

https://twitter.com/i/status/1780274925317574889

Bull dog

This dog stopped eating after they sent his bull friend away. ''The farmer gets the bull back after noticing this. ''After the reunion, & they're joyful. Many beings know love & loyalty, & they are worth a lot for every being. pic.twitter.com/Wpb5eUfO4d

— Hakan Kapucu (@1hakankapucu) April 17, 2024

Wolf

Be honest. If you saw a trapped wolf, would you try to help it? pic.twitter.com/EZQwY7pmfF

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 17, 2024

Puppy

https://twitter.com/i/status/1780651680528261376

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.