Arthur Rothstein Planting beans near Belle Glade, Florida January 1937

QE Is A Fraud Perpetrated By Made Men

A lot of words are being spent again these days on deflation and the QE measures that are supposed to “cure” it. Paul Krugman, who when it comes to stimulus is a hammer seeing nails only, now has it in for Sweden’s central bank, which he labels monetary sadists for not opening the spigots. But it’s all a hugely deceptive false flag; it’s not an issue of whether you launch QE or not. There’s a third, and much more valid, way of looking at this.

First of all, one should wonder if QE is the right kind of stimulus, if growth and recovery in the real economy is the objective. Which in present circumstances is a very big IF ,that is surprisingly, hardly ever questioned. But if the real economy is the target area, it’s highly likely that something like Steve Keen’s version of a debt jubilee, where every citizen receives an X amount, first to be used to pay off any debts, would be far more effective. Or the Positive Money ideal, in which central banks, not commercial banks, have the ability to create fresh credit.

However that may be, what everybody should realize is that QE or another form of stimulus MIGHT work, but only if they’re executed in the proper fashion, that is, if debts are restructured at the same time stimulus is unleashed, i.e. the financial system is purged, which is the only way to restore trust and confidence. Debt restructuring must be a core element of any stimulus, and if it’s not, wherever you live, you know you’re being screwed.

In essence, what central banks have done so far, first in Japan, then in the US and EU, is to cordon off the debts residing in their banks (e.g. in the form of swaps and not-so-securities), and then flood these same banks with money/credit, in order to make them look healthy. Since all these nations’ banks have the same debt issues, they all agreed to ignore each other’s obvious sleight of hand. And anyone can understand that if these banks are still sitting on huge amounts of debt, any and all stimulus must and will at some point disappear into a bottomless black hole, albeit only after first having pumped up asset markets to new bubble heights and creating a temporary and entirely false impression of growth and recovery, with one more round of fat profits for the zombified financial system, and eventually leaving behind an economic landscape for which the term scorched earth would be sheer flattery.

If one thing should be clear, it’s that this does nothing to either fight deflation, induce growth or launch a recovery. It paints rosy pictures on a shiny and alluring screen, behind which present and future generations are being robbed blind. And even if it might be too much to ask, it would be good if it also became clear that QE has never been intended to heal the real economy, other than perhaps as a secondary side-effect. The purpose of QE is, and always has been, to keep banking systems standing as long as is deemed desirable, after which point the insiders clear out with their gains and the public at large will be left with the losses. QE is merely another way to transfer losses from “them” to you.

A stinging rebuttal of Krugman and his ilk comes, via Tyler Durden, from Phoenix Capital Research, where Kool-Aid is not a favorite in the vending machine.

Japan Has Proven That Central Banks Cannot Generate Growth With QE

The Keynesian economists managing or advising the world’s Central Banks have always averred that they could pull us out of the weakest recovery in the post-WWII era if they were allowed to have their way. Their “way” involves rampant debt monetization, also called Quantitative Easing or QE. Indeed, the primary argument from the Keynesians as to why QE has thus far failed to generate a rip-roaring recovery is that none of the QE programs in place were large enough. Japan is where the Keynesian economic model rubber hit the road. In April 2013, the Bank of Japan announced a staggering $1.4 trillion QE program. In today’s world of Central Banking madness, $1.4 trillion no longer sounds like an insane amount. So let me put this number into perspective… $1.4 trillion is…

- The equivalent of 24% of Japan’s total annual economic output.

- Enough to fly every human being in Japan to California for a 2-week vacation.

- The equivalent of writing a check for $11,200 to every man, woman, and child in Japan.

Moreover, with $1.4 trillion, you could…

- Buy Australia’s entire economy for a year.

- Fund NASA for the next 82 years.

- Treat every person on the planet to a $200 five star dinner at one of New York’s top restaurants.

For the US to engage in an equivalent amount of QE, it would have to announce a $3.7 trillion QE program. If Europe engaged in a QE program of this magnitude, it could buy back ALL of Spain and Greece’s debt outstanding. Suffice to say, Japan’s QE was large enough that no one, not even the most stark raving mad Keynesian on the planet, could argue that it wasn’t big enough. Which is why the results are extremely disconcerting for Central Bankers at large.

[..] Abenomics has failed to revitalize Japan. Just as importantly, this failure [..] is costing Abe his popularity (his ratings have fallen from 75% at re-election to roughly 50% now). Thus, the Bank of Japan’s massive QE campaign has revealed:

- That QE does not generate economic growth

- There will be political consequences for its failure

As much as I appreciate Phoenix Capital’s input, I also find some crucial points missing in this analysis. While I’m no fan of either Krugman or his Keynesianism on steroids, I don’t think they irrevocably refute the potential of QE as a ways to stimulate an economy. I’ve already said that I don’t think QE is the best way to accomplish that, but I think it’s more important to note that QE without debt restructuring cannot possibly work, because A) the debt is likely to swallow up all QE and more, and B) no confidence is restored. And what I find yet more important than that is that QE as it has been executed thus far is not a failure, as Phoenix contends, but a multi-trillion dollar fraud. Because central bankers are very aware of both points A) and B).

Racking up deficits and balance sheets for governments and central banks in order to prop up the zombified corpses of financial institutions that have wagered big and lost bigger, without making sure the debts and losses are purged that made them need the stimulus in the first place, is nothing but the biggest heist in human history. Moreover, if you could fight deflation with stimulus, this certainly wouldn’t be the way to go. If Japan, instead of handing it to its banks, would simply actually have given $11,200 to every man, woman, and child in Japan, the chances of raising the velocity of money, a crucial element of in/deflation, would have been much higher.

And I’m supposed to think that central bankers don’t understand this? I’m sorry, but that’s something I can’t get through my head. From where I’m sitting, people like Greenspan and Bernanke and Kuroda look far more like wise guys or made men than they look like oracles or wise old academic types who unfortunately got things wrong on occasion.

And before I forget, the fact that QE has been implemented as it has doesn’t only tell us something about the political power of the financial system, which can do this simply because they can, it also gives an indication of how vast the losses truly are, how foul the smell emanating from the paper hidden in the bank vaults truly is by now, 7-odd years into this Kabuki meets ancient tragedy performance for which ticket prices keep rising exponentially.

Yeah, the US economy is doing oh so great, isn’t it?

• America’s Consumers Are Dropping, Not Shopping (Alhambra)

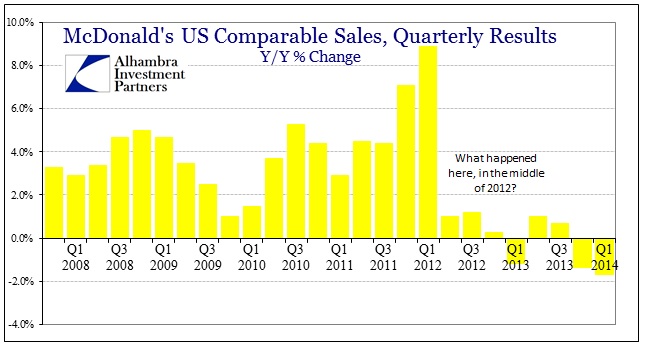

McDonald’s latest results confirm that something is very much amiss on the consumer side. Total global revenue grew only 1% Y/Y, including new store launches and acquisitions. However, as has been the pattern since 2012, US comparable store sales lagged markedly. The rate of contraction in Q1 was actually the worst in more than a decade.

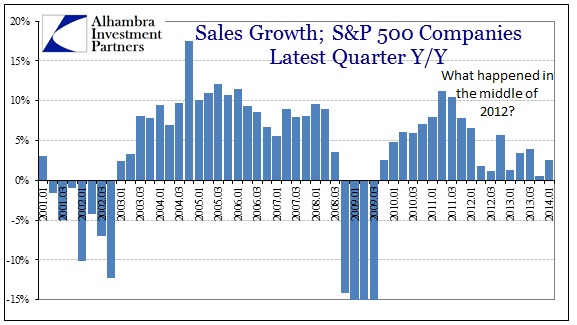

Even if you believe that the cold and snow of January and February played a role, it could not have explained that comparison. There is simply no way that anything other than consumer exhaustion can create the chart above. One need only glance at the revenue history of companies in the S&P 500 to see that in full effect. If McDonald s persistent travails are limited to the company, or even the fast food industry, there is no way that the revenue pattern for MCD would so match closely that of the entire S&P 500. The commonality screams macro.

Current projections for the first quarter add up to about 2.5% revenue expansion across S&P 500 companies, but, as last quarter showed, that is likely overly optimistic (fourth quarter revenue was believed to be expanding at near 3% at the outset of earnings season in January 2014, only to be revised lower to almost 0%).

I think they already figured that out.

• The American Middle Class Is No Longer the World’s Richest (NY Times)

The American middle class, long the most affluent in the world, has lost that distinction. While the wealthiest Americans are outpacing many of their global peers, a New York Times analysis shows that across the lower- and middle-income tiers, citizens of other advanced countries have received considerably larger raises over the last three decades. After-tax middle-class incomes in Canada — substantially behind in 2000 — now appear to be higher than in the United States. The poor in much of Europe earn more than poor Americans. The numbers, based on surveys conducted over the past 35 years, offer some of the most detailed publicly available comparisonsfor different income groups in different countries over time.

They suggest that most American families are paying a steep price for high and rising income inequality. Although economic growth in the United States continues to be as strong as in many other countries, or stronger, a small percentage of American households is fully benefiting from it. Median income in Canada pulled into a tie with median United States income in 2010 and has most likely surpassed it since then. Median incomes in Western European countries still trail those in the United States, but the gap in several — including Britain, the Netherlands and Sweden — is much smaller than it was a decade ago.

The weather?

• Sales of Existing U.S. Homes Fall for a Third Month (Bloomberg)

Sales of previously owned homes fell in March for a third consecutive month as rising prices and a lack of inventory discouraged would-be buyers. Closings, which usually take place a month or two after a contract is signed, fell 0.2% to a 4.59 million annual rate, the lowest level since July 2012, the National Association of Realtors reported today in Washington. Purchases were down 8.5% compared with the same month last year before adjusting for seasonal patterns. Property values have climbed faster than wages, putting ownership out of reach for some Americans. Harsh winter weather in January and February also probably kept some properties off the market, contributing to a lack of supply that has further stoked price increases.

David Stockman is on the right track.

• America’s Housing Fiasco Is On You, Alan Greenspan (Stockman)

In truth, America’s baby-boom generation was robbing its own future retirement years, but the Maestro was oblivious. Instead, he was busy tracking the quarterly rate of MEW (“mortgage equity withdrawal”) and crowing about how it was contributing to unprecedented prosperity on Main Street. It ended up in a conflagration of exploitive lending, fraud, default and trillions of financial losses, of course, but not until $5 trillion of cumulative MEW during the decade through 2007 had ruined the financial well-being of America’s middle class for a generation to come.

Under a regime of free market interest rates $5 trillion of MEW—that is, robbing from the future to party today—could not have happened. Long before the 2003-2006 blow-off top, mortgage interest rates would have soared to double digit levels, causing monthly debt service requirements to double or triple. Moreover, in an environment of market-set interest rates there would have been no Greenspan Put or ultra cheap wholesale financing that enabled Wall Street to fund mortgage boiler shops with warehouse credit lines and buyers of its toxic securitization products with cheap repo.

In short, free market interest rates are the vital check and balance mechanism which prevents runaway spirals of debt issuance and frenzied bidding-up of asset prices. Yet it was Greenspan’s “wealth effects” doctrine that destroyed the mechanism of honest price discovery once and for all. The carnage that has ensued in the nation’s credit and housing markets, therefore, is on you, Alan Greenspan.

“More Policy” is needed?

• China Factory Activity Shrinks For Fourth Month

China’s factory activity shrank for the fourth straight month in April, signaling economic weakness into the second quarter, a preliminary survey showed on Wednesday, although the pace of decline eased helped by policy steps to arrest the slowdown. Analysts see initial signs of stabilization in the economy due to the government’s targeted measures to underpin growth, but believe more policy support may be needed as structural reforms put additional pressure on activity. The HSBC/Markit flash Purchasing Managers Index (PMI) for April rose to 48.3 from March’s final reading of 48.0, but was still below the 50 line separating expansion from contraction.

Wham! Don’t miss the video.

• China ‘A Ticking Time Bomb And A Big Shock’s Coming’ (Saxo Bank)

(Roll over for video)

Markets are massively underestimating the deflationary fallout that’s going to come from a big decline in China and other emerging markets. That’s according to Michael Ingram, Market Strategist at BGC Partners. China’s manufacturing sector continues to shrink. On Tuesday, the HSBC PMI index for April came in at 48.3. Anything below 50 shows a contraction. China’s yuan hit a 16-month low on the news. Michael says China’s efforts to re-balance its economy is taking its toll and he’s not sure it can be managed effectively. He says that we’re not seeing “risk off” right now, we’re seeing “growth off”. Any suggestion that emerging markets have decoupled from developed economies is “nonsense”, according to Michael and China’s a “ticking time bomb” that’s about to explode.

I like Shilling, but seeing him quote Lagarde to get his point across makes me queasy.

• Deflation Is About to Wallop Europe (A. Gary Shilling)

The euro has been defying gravity for years. Europe’s Teutonic North and Club Med South were joined under one monetary policy. But the 18-member euro area has no common fiscal policy and probably never will, given its vast cultural and economic differences. This hardly makes the euro a safe-haven currency. After dropping from 1.60 per U.S. dollar to 1.20 during the global recession, the euro has risen to 1.38. And that’s despite Europe’s follow-on recession, which began in the fourth quarter of 2011 and lasted six quarters. Real gross domestic product growth since then has averaged only 0.9% annually, well below the 2.3% in the U.S. Does the euro really deserve to be strong against the greenback?

It is true that the financial crisis has abated since European Central Bank President Mario Draghi said in July 2012 that the central bank was “ready to do whatever it takes” to preserve the euro. Since then, the yield on 10-year Spanish government issues dropped from a junk-bond level of 7.6% to 3.1%, close to the 2.6% yield on the 10-year U.S. Treasury note. Italian sovereigns, meanwhile, have fallen from a 6.6% yield to 3.1%. The days of euro strength may be numbered, however, because of mushrooming fears of deflation in Europe.

Average house prices in the euro area have dropped 5% since the second quarter of 2011. More important, inflation increased a mere 0.5% in March from a year earlier. Since January 2013, inflation has been below the ECB’s target of “just under 2.0%.” In the 28-country European Union, inflation was just 0.6% in March versus a year earlier. Bankers and policy makers worldwide are deeply worried about trivial inflation in the euro area turning into chronic deflation. Christine Lagarde, the chairman of the International Monetary Fund, said in a January speech: “We see rising risks of deflation, which could prove disastrous for the recovery. If inflation is the genie, then deflation is the ogre that must be fought decisively.”

All roads lead to ruin.

• QE From ECB? May Not Be The Panacea Many Hope (CNBC)

Amid hopes that the ECB will undertake a move to stimulate the economy that will revive sluggish growth and low inflation levels, while simultaneously easing the euro’s stubborn strength and boosting equity and bond prices, Capital Economics said there are potential routes it could take if easing takes on the form of QE. “If the main concern is that the weakness of the banking sector is holding back economic growth, it would make sense to focus additional purchases on private sector assets,” said Jessop. This option, the economist said, would have the largest positive impact on the euro zone equity and corporate debt prices. However, it could have the undesirable impact of strengthening the euro as the relative strength of the region’s riskier financial assets increase, which would be negative for core government debt.

A second option would involve the ECB specifically targeting the risk of deflation by boosting the money supply. This could prompt the ECB to focus on the purchase of government bonds. However, this could have the adverse effect of strengthening the euro if it undermines the fiscal discipline of the Southern European countries where yields have already fallen to levels hard to justify in terms of the outlook for public finances, Jessop pointed out. The third scenario would involve the purchases of higher-rated German or French bonds, which Jessop said might go furthest in weakening the euro. But the impact could be limited as yields on these instruments are already very low as investors have priced in the risk of deflation.

• Krugman Slamming Riksbank Fuels Deflation Anxiety (Bloomberg)

The Riksbank, the world’s oldest central bank, has become a sadist in its use of monetary policy, according to Nobel Laureate Paul Krugman. He says the Stockholm-based central bank’s bias toward tight policy during the financial crisis was a “terrible mistake” that now risks creating a Japan-style deflationary spiral. The criticism has the potential to weaken the exchange rate as international investors “question the Swedish economic development,” according to SEB AB, the Nordic region’s biggest currency trader. Krugman’s comments go to the heart of a debate that’s splitting policy makers at Sweden’s central bank.

Governor Stefan Ingves has consistently warned that low rates risk fueling a credit bubble. The bank’s pro-easing lobby – two of its six board members – argue too-tight policy is keeping people out of work and making the 2% inflation target harder to reach. Some economists even warn that Ingves risks undermining his debt fight if prices continue to fall. “The closer you get to deflation, the worse the debt problems get, unless you lower rates,” Par Magnusson, an economist at Royal Bank of Scotland Group Plc in Stockholm, said in a phone interview. “That is fatal. Then you have to do everything in your power to get inflation going, because that’s the only thing that can hollow out the debt and help households pay off their loans.”

Ingves, who is also chairman of the Basel Committee on Banking Supervision that Krugman describes as a “sadomonetarist stronghold,” said in an interview this month he expects inflation to return. Yet he was soon wrong-footed by a report that showed prices fell 0.6% in March from a year earlier, twice as much as the bank had predicted. “Whatever their motives, sadomonetarists have already done a lot of damage,” Krugman wrote in his April 21 New York Times column. “In Sweden they have extracted defeat from the jaws of victory, turning an economic success story into a tale of stagnation and deflation as far as the eye can see.”

Leave it to the Telegraph to miss already in the headline.

• Swedish Lessons Show Even Deflation Can’t Cure The Housing Bubble (Guardian)

Last week Sweden became the first northern European country to report that it had fallen into outright price deflation, a state of affairs that worries economists because if consumers and companies expect falling prices, they tend to postpone purchases, investment and hiring, potentially leading to a downward spiral in demand. The reason Stockholm’s plight is attracting more attention than the rest of Europe, where eight countries are now in price deflation, is because Sweden came through the financial crisis relatively unscathed. Unlike others, it also still has its own currency and therefore retains control over monetary policy.

Yet, despite these apparent advantages, Sweden now finds itself in much the same boat as the depressed periphery countries of the eurozone, at least in terms of price inflation. How did this come about and what lessons does it hold for Britain, where some of the pressures on monetary policy – including fast inflating house prices and relatively high levels of household indebtedness – look remarkably similar to those of Sweden? The standard script goes something like this. Having had its own very deep banking and economic crisis back in the early 1990s, Sweden was much better prepared for the latest one than most other European countries. In the early stages of the crisis, it also did many of the right things.

• Draghi Gauges Ukraine Effect as ECB Tackles Low Inflation (Bloomberg)

Mario Draghi can look for clues from euro-area companies this week on whether the region needs more stimulus to counter economic risks from low inflation to geopolitical tension. Purchasing managers’ indexes tomorrow are forecast to show growth in manufacturing activity holding at the weakest pace this year. Figures the following day may show declining business confidence in Germany, the region’s biggest economy, in a survey published shortly before the European Central Bank president speaks in Amsterdam.

A territorial dispute between Russia and Ukraine, which supply much of Europe’s energy, is undermining confidence in a recovery already threatened by a strengthening currency and subdued pricing power. That raises the prospect of ECB officials being called on their promise to ease monetary policy if needed, including with unconventional tools such as quantitative easing. Tension in eastern Europe “could easily spark turbulences big enough to temporarily halt the euro-zone recovery,” said Christian Schulz, senior economist at Berenberg Bank in London. “It is the biggest risk to our optimistic growth forecasts for the euro zone at the moment.”

• Japan Has Proven That Central Banks Cannot Generate Growth With QE (Phoenix)

The Keynesian economists managing or advising the world’s Central Banks have always averred that they could pull us out of the weakest recovery in the post-WWII era if they were allowed to have their way. Their “way” involves rampant debt monetization, also called Quantitative Easing or QE. Indeed, the primary argument from the Keynesians as to why QE has thus far failed to generate a rip-roaring recovery is that none of the QE programs in place were large enough.

Japan is where the Keynesian economic model rubber hit the road. In April 2013, the Bank of Japan announced a staggering $1.4 trillion QE program. In today’s world of Central Banking madness, $1.4 trillion no longer sounds like an insane amount. So let me put this number into perspective… $1.4 trillion is…

1) The equivalent of 24% of Japan’s total annual economic output.

2) Enough to fly every human being in Japan to California for a 2-week vacation.

3) The equivalent of writing a check for $11,200 to every man, woman, and child in Japan.Moreover, with $1.4 trillion, you could…

1) Buy Australia’s entire economy for a year.

2) Fund NASA for the next 82 years.

3) Treat every person on the planet to a $200 five star dinner at one of New York’s top restaurants.For the US to engage in an equivalent amount of QE, it would have to announce a $3.7 trillion QE program. If Europe engaged in a QE program of this magnitude, it could buy back ALL of Spain and Greece’s debt outstanding. Suffice to say, Japan’s QE was large enough that no one, not even the most stark raving mad Keynesian on the planet, could argue that it wasn’t big enough. Which is why the results are extremely disconcerting for Central Bankers at large. To whit, since announcing this program Japan has seen:

1) GDP growth accelerate for only two quarters before turning down again.

2) Prices rise for nine straight months… pushing Japan’s cost of living to a five year high.

3) Household spending crater 2.5% year over year in real terms.

4) The Yen lose an astounding 25% of its purchasing power.

5) Multiple new record trade deficits, with January being the worst ever January on record… ditto for October, November and December last year.

6) Over 77% of Japanese citizens not feeling as though Japan’s economy is improving.In simple terms, Abenomics has failed to revitalize Japan. Just as importantly, this failure is being noticed by the press (articles regarding the failure of Abenomics have emerged in Forbes, the Financial Times, and CNBC) and is costing Abe his popularity (his ratings have fallen from 75% at re-election to roughly 50% now). Thus, the Bank of Japan’s massive QE campaign has revealed:

1) That QE does not generate economic growth

2) There will be political consequences for its failureNow, Central Bankers will never openly admit that they or their policies have failed. But Japan has proved that they have. It’s only a matter of time before the world catches on.

Hussman’s a good analyst but he sees the Fed as a charity organization.

• The Federal Reserve’s Two Legged Stool (John Hussman)

In her first public speech on monetary policy, Janet Yellen made it clear that the Fed intends to pursue a more rules-based, less discretionary policy. This is good news. The bad news, however, is that Yellen focused only on employment and inflation. In that same speech, not a single word was said about attending to speculative risks or financial instability (which are inherent in Fed-induced, yield-seeking speculation). Without attending to that third leg, the Fed is resting the fate of the U.S. economy on a two-legged stool.

The problem is this. In viewing the Fed’s mandate as a tradeoff only between inflation and unemployment, Chair Yellen seems to overlook the feature of economic dynamics that has been most punishing for the U.S. economy over the past decade. That feature is repeated malinvestment, yield-seeking speculation, and ultimately financial instability, largely enabled by the Federal Reserve’s own actions. To overlook yield-seeking speculation as a central element connected to the Federal Reserve’s mandate is to invite a repeat of dismal economic consequences over and over again.

The Fed’s mandate need not explicitly refer to financial stability – it is enough to recognize that the failure to take speculation, malinvestment, and financial stability seriously has been one of the primary causes of economic and financial crises that prevent the Fed from achieving that mandate. Indeed, the Fed has again baked such consequences into the cake as a result of its policy of quantitative easing, and an associated lack of appreciation for how equity valuations work (particularly the need to consider valuation multiples and profit margins jointly, whenever one uses earnings-based measures). Nearly every argument that stocks are not in a “bubble” begin with an appeal to 2000, as if the most extreme valuations in history should be a upside objective, below which anything else is acceptable. As long as conditions are not as extreme as 2000, the word “bubble” presumably cannot be applied.

Thing is, Bill, will the US be first to blow up? If not, how will that change outstanding bets?

• America’s Empire And Credit Bubble Are Reaching Their “Sell-By” Date (Bonner)

We made an observation last week: The US empire and its credit bubble will probably come to an end at the same time. Each depends on the other. If the US were not so big and powerful, it could not impose its money as the world’s reserve currency. Without its position as the issuer of the world’s reserve currency (dollars instead of gold), the US wouldn’t be able to flood the world with its cash. Without the rest of the world’s need for dollars, the credit bubble couldn’t continue growing. And without the credit growth there would be no way to pay the expense of maintaining a worldwide empire. This does not explain the miracle of “growth without savings” we discussed last week, but it gives us a hint as to what will happen when the trick no longer works.

All bubbles… and all empires… eventually blow up. An empire that depends on a credit bubble is doubly explosive. All it takes is a turn in the credit cycle, and the fuse is lit. We wrote a book on the subject, along with co-author Addison Wiggin, in 2006. From the invasion of the Philippines to the Vietnam War… the US empire was financed by the rich, productive power of the US economy. But as the war in Vietnam was winding down, the source of imperial finance changed from current output to future output. The US switched to a purely paper money system… and turned to borrowing to finance its military adventures.

Today’s blockhead puffs out his chest and enjoys feeling like a big shot. He passes the bill on to tomorrow’s taxpayer. The argument for heavy security spending collapsed between 1979 (when China took the capitalist road) and 1989 (when Russia abandoned communism). But by then, the “military-industrial complex” (or the military-industrial-congressional complex) President Eisenhower warned us about was already firmly in control of Washington. Presidents – Democrat and Republican – came and went. Nothing nor nobody could keep resources from the security industry.

“Enrollment in the plans – which allow students to rack up big debts and then forgive the unpaid balance after a set period – has surged nearly 40% in just six months”. Wow.

• US Student-Debt Forgiveness Plans, Costs, Skyrocket (WSJ)

Government officials are trying to rein in increasingly popular federal programs that forgive some student debt, amid rising concerns over the plans’ costs and the possibility they could encourage colleges to push tuition even higher. Enrollment in the plans—which allow students to rack up big debts and then forgive the unpaid balance after a set period—has surged nearly 40% in just six months, to include at least 1.3 million Americans owing around $72 billion, U.S. Education Department records show. The popularity of the programs comes as top law schools are now advertising their own plans that offer to cover a graduate’s federal loan repayments until outstanding debt is forgiven.

The school aid opens the way for free or greatly subsidized degrees at taxpayer expense. At issue are two federal loan repayment plans created by Congress, originally to help students with big debt loads and to promote work in lower-paying jobs outside the private sector. The fastest-growing plan, revamped by President Barack Obama in 2011, requires borrowers to pay 10% a year of their discretionary income—annual income above 150% of the poverty level—in monthly installments. Under the plan, the unpaid balances for those working in the public sector or for nonprofits are then forgiven after 10 years.

Private-sector workers also see their debts wiped clean—after a longer period of 20 years—reflecting a government aim to have no one, wherever they work, paying down student debt their entire working life. An independent study estimates the future cost of the 2011 program, known as Pay As You Earn, could hit $14 billion a year. The Obama administration has proposed in its latest budget released last month to cap debt eligible for forgiveness at $57,500 per student. There is currently no limit on such debt.

In California, this is truly sad. In Guatemala, it’s life.

• Number Of Middle Age Californians Living With Their Parents Soars (LA Times)

At a time when the still sluggish economy has sent a flood of jobless young adults back home, older people are quietly moving in with their parents at twice the rate of their younger counterparts. For seven years through 2012, the number of Californians aged 50 to 64 who live in their parents’ homes swelled 67.6% to about 194,000, according to the UCLA Center for Health Policy Research and the Insight Center for Community Economic Development. The jump is almost exclusively the result of financial hardship caused by the recession rather than for other reasons, such as the need to care for aging parents, said Steven P. Wallace, a UCLA professor of public health who crunched the data.

“The numbers are pretty amazing,” Wallace said. “It’s an age group that you normally think of as pretty financially stable. They’re mid-career. They may be thinking ahead toward retirement. They’ve got a nest egg going. And then all of a sudden you see this huge push back into their parents’ homes.” Many more young adults live with their parents than those in their 50s and early 60s live with theirs. Among 18- to 29-year-olds, 1.6 million Californians have taken up residence in their childhood bedrooms, according to the data. Though that’s a 33% jump from 2006, the pace is half that of the 50 to 64 age group. The surge in middle-aged people moving in with parents reflects the grim economic reality that has taken hold in the aftermath of the Great Recession.

That only voice in America that goes against the grain. What if he’s no longer there?

• Ron Paul 2008 Speech On Disbanding NATO (Ron Paul)

Mr. Speaker, I rise in opposition to this resolution calling for the further expansion of NATO to the borders of Russia. NATO is an organization whose purpose ended with the end of its Warsaw Pact adversary. When NATO struggled to define its future after the Cold War, it settled on attacking a sovereign state, Yugoslavia, which had neither invaded nor threatened any NATO member state. This current round of NATO expansion is a political reward to governments in Georgia and Ukraine that came to power as a result of US-supported revolutions, the so-called Orange Revolution and Rose Revolution.

The governments that arose from these street protests were eager to please their US sponsor and the US, in turn, turned a blind eye to the numerous political and human rights abuses that took place under the new regimes. Thus the US policy of “exporting democracy” has only succeeding in exporting more misery to the countries it has targeted. NATO expansion only benefits the US military industrial complex, which stands to profit from expanded arms sales to new NATO members. The “modernization” of former Soviet militaries in Ukraine and Georgia will mean tens of millions in sales to US and European military contractors.

The US taxpayer will be left holding the bill, as the US government will subsidize most of the transactions. Providing US military guarantees to Ukraine and Georgia can only further strain our military. This NATO expansion may well involve the US military in conflicts as unrelated to our national interest as the breakaway regions of South Ossetia and Abkhazia in Georgia. The idea that American troops might be forced to fight and die to prevent a small section of Georgia from seceding is absurd and disturbing. Mr. Speaker, NATO should be disbanded, not expanded.

Sort of good, but …

• Russia Postpones Planting Of GMO Seeds By 3 Years (RT)

Russia will not start certifying GM seeds for at least three more years due to delays in creating the necessary infrastructure, Prime Minister Dmitry Medvedev told MPs. Earlier Russia had expected to allow planting such seeds from June. The delay comes amid the general GMO-skeptic mood that the Russian government adopted recently. The country may even ban the cultivation and import of genetically modified foodstuffs. Last year, the government allowed the planting of GM seeds starting July 2014 as part of Russia’s accession to the World Trade Organization. Now the deadline will have to change, Medvedev told Russian MPs.

“The government decree will be amended. Not because it was wrong, but because the deadline stipulated in it was too optimistic,” he said, explaining that at the moment there are not enough gene laboratories to meet the demand for certification in Russia. “But even if the certification starts in three years or after some time, it doesn’t mean that we will allow the use of genetically modified material,” Medvedev said. He added that the labs and the entire system of certification will still be needed, considering that even with strict regulation of the sale of GM seeds, some of them have found their way into Russia. “The problem is that GM material is already everywhere,” Medvedev said. “We need to know where and how it is being used. The labs’ task would be to do that. That’s what we are planning to invest in.”

China’s undoubtedly the worst environmental nightmare in history. We ain’t seen nothing yet.

• Even China’s Dirt Is Dirty (Bloomberg)

Even the most choking of Beijing smogs eventually gives way to blue skies. The very impermanence of air pollution encourages optimism that it can be solved one day. The poisoning of China’s land and water is another matter altogether. Unlike smog, which can be seen the moment it leaves a smokestack, chemicals leaking from pipes into China’s soil and rivers may not be discovered for years or decades. By then, the damage may be incalculable and permanent. Last week’s release of data collected during a nearly nine-year national soil survey finally gave Chinese a chance to evaluate the devastating toll that 30 years of rapid industrial development has had on them, their food supply, and their country.

The numbers are astonishing. More than 16% of China’s 3.7 million square miles of soil is contaminated. Even worse, nearly a fifth of the country’s arable land is polluted. While the report doesn’t specify how badly, hints exist. In December, a senior Chinese official conceded that 2% of China’s arable land – an area the size of Belgium – had become too polluted to grow crops at all. According to the report, the most common soil pollutants are inorganic in nature. They include nickel, arsenic, and highly toxic cadmium – all metals associated with industrial activity. Unfortunately, the report doesn’t reveal the benchmarks used to decide whether a soil sample qualifies as “polluted,” so it’s impossible to perform a comparative analysis with soil contamination in other countries.

Nonetheless, the fact that the Chinese government was willing to publicize these numbers is significant. As recently as last spring the Ministry of Environmental Protection denied a request to release the very same data to the public. No doubt authorities were concerned about how ordinary Chinese might react to the data, given already rampant fears about the safety of Chinese crops. They may also have feared that the real situation could be worse than that documented in the survey, which built its data set by taking one sample per every 6,400 hectares of land. Needless to say, it’s easy to miss contamination hot spots using such a methodology (likewise, it’s possible to oversample).

Unfortunately, the government’s change of heart only has only gone so far. The report does not reveal the specific locations of the many thousands of pollution hotspots identified over the last eight-and-a-half years. That’s the kind of information that can help an individual or community make life-extending decisions. Instead authorities have only offered broad stroke data that starts a conversation about soil pollution, but doesn’t offer any immediate benefit to anyone except local bureaucrats, who might otherwise be vilified for having allowed their districts to be polluted.

You need 100,000 of these guys.

• Spain’s ‘Robin Hood’ Swindled Banks To Help Fight Capitalism (Guardian)

They call him the Robin Hood of the banks, a man who took out dozens of loans worth almost half a million euros with no intention of ever paying them back. Instead, Enric Duran farmed the money out to projects that created and promoted alternatives to capitalism. After 14 months in hiding, Duran is unapologetic even though his activities could land him in jail. “I’m proud of this action,” he said in an interview by Skype from an undisclosed location. The money, he said, had created opportunities. “It generated a movement that allowed us to push forward with the construction of alternatives. And it allowed us to build a powerful network that groups together these initiatives.”

From 2006 to 2008, Duran took out 68 commercial and personal loans from 39 banks in Spain. He farmed the money out to social activists, funding speaking tours against capitalism and TV cameras for a media network. “I saw that on one side, these social movements were building alternatives but that they lacked resources and communication capacities,” he said. “Meanwhile, our reliance on perpetual growth was creating a system that created money out of nothing.” The loans he swindled from banks were his way of regulating and denouncing this situation, he said. He started slowly. “I filled out a few credit applications with my real details. They denied me, but I just wanted to get a feel for what they were asking for.”

From there, the former table tennis coach began to weave an intricate web of accounts, payments and transfers. “I was learning constantly.” By the summer of 2007, he had discovered how to make the system work, applying for loans under the name of a false television production company. “Then I managed to get a lot.” €492,000 (£407,000), to be exact. [..] His actions, he said, were at the vanguard of a worldwide debate on the economic crisis. The timing pushed the anti-capitalist movement into the light, just as many Spaniards were seeking alternatives to a system that had wreaked havoc on their lives.

When David Hughes and Art Berman pop up at Bloomberg, you know something is moving.

• Is the U.S. Shale Boom Going Bust? (Bloomberg)

It’s not surprising that a survey of energy professionals attending the 2014 North American Prospect Expo overwhelmingly identified “U.S. energy independence” as the trend most likely to gain momentum this year. Like any number of politicians and pundits, these experts are riding high on the shale boom — that catch-all colloquialism for the rise of hydraulic fracturing and horizontal drilling that have unleashed a torrent of hydrocarbons from previously inaccessible layers of rock. But this optimism belies an increasingly important question: How long will it all last?

Among drilling critics and the press, contentious talk of a “shale bubble” and the threat of a sudden collapse of America’s oil and gas boom have been percolating for some time. While the most dire of these warnings are probably overstated, a host of geological and economic realitiesincreasingly suggest that the party might not last as long as most Americans think. For the better part of two centuries, the American oil and gas industry drew its treasure from porous underground formations where hydrocarbons moved comparatively easily to the surface. The best of those resources began to dry up in the 1970’s and imports began to rise. Enter hydraulic fracturing and horizontal drilling, technologies that allow developers to extract oil and gas from much deeper, tighter and far-less-porous rock formations, including shale.

The problems arise when you look at how quickly production from these new, unconventional wells dries up. David Hughes — a 32-year veteran with the Geological Survey of Canada and a now research fellow with the Post Carbon Institute, a sustainability think-tank in California — notes that the average decline of the world’s conventional oil fields is about 5% per year. By comparison, the average decline of oil wells in North Dakota’s booming Bakken shale oil field is 44% per year. Individual wells can see production declines of 70% or more in the first year.

Shale gas wells face similarly swift depletion rates, so drillers need to keep plumbing new wells to make up for the shortfall at those that have gone anemic. This creates what Hughes and other critics consider an unsustainable treadmill of ever-higher, billion-dollar capital expenditures chasing a shifting equilibrium. “The best locations are usually drilled first,” Hughes said, “so as time goes by, drilling must move into areas of lower quality rock. The wells cost the same, but they produce less, so you need more of them just to offset decline.”

Canada’s native peoples have views that are so different from predatory capitalism you need to fear for their safety and their futures.

• Canadian Aboriginals See No Compromise On Oil Sands Pipeline (Reuters)

Just a few miles from the spot where Enbridge Inc plans to build a massive marine terminal for its Northern Gateway oil pipeline, Gerald Amos checks crab traps and explains why no concession from the company could win his support for the project. Amos, the former chief of the Haisla Nation on the northern coast of British Columbia and a community leader, has argued for years that the risk – no matter how small – of an oil spill in these waters outweighs any reward the controversial project might offer. That resolve is shared by many in the aboriginal communities along the proposed pipeline and marine shipping route who see the streams, rivers and oceans in their traditional territories as the lifeblood of their culture.

“Our connection to this place that we call home is really important,” says Amos as he pulls three Dungeness crabs from his trap, tossing two in a bucket and holding the third up for his two young granddaughters, who shriek and giggle as the crustacean wriggles its legs. “If these little ones can’t witness us doing what we’ve done for generations now, if we sever that tie to the land and the ocean, we’re no longer Haisla.” The Northern Gateway pipeline would carry diluted bitumen 1,177 kilometers (731 miles) from Alberta’s oil sands to the deepwater port in Kitimat, in northwest British Columbia, where it would be loaded on supertankers and shipped to Asia. It is expected to cost C$7.9 billion ($7.17 billion).

Home › Forums › Debt Rattle Apr 23 2014: QE Is A Fraud Perpetrated By Made Men