Unknown The Peninsula, Virginia, Lt. George A. Custer with dog 1862

That’s always a hard question to answer. At what point does government policy become criminal? Since governments make the laws, perhaps never. But then again, countries tend to have constitutions, and government actions can violate those. Still, before you know it, you get trapped and stuck in lawyer lingo limbo, and that’s not what I’m looking for. I’m wondering to what depths a government can go in its actions vis à vis it own people. So maybe I should rephrase this, maybe a more relevant question would be when government policy becomes morally repugnant. There I sure have a few candidates.

The Guardian reports on a study published this week, entitled Wars in Peace, and published by the Royal United Services Institute (RUSI), which states that Britain’s post-cold war peacetime war efforts will cost more than $100 billion (I guarantee you that’s still a conservative number). Almost half of that is needed to treat the veterans of the wars in Iraq and Afghanistan. Why have these wars been fought? Who knows. Have they been useful in any way? I would have to say I think not, because the study says “the bulk of the money has been spent on interventions judged to have been “strategic failures”. And “there is no longer any serious disagreement” over how the UK’s role in the Iraq war helped to increase the radicalisation of young Muslims in Britain. “Far from reducing international terrorism … the 2003 invasion [of Iraq] had the effect of promoting it … ”

To get there, the British and American troops, plus a ragtag small band of others present only to give the efforts an air of legitimacy, killed 100,000 Iraqis and sent 2 million fleeing from their homes. And now almost $50 billion will be needed to supply long-term care to the wounded and traumatized British veterans who killed and maimed them. I find it easier to understand why American society doesn’t go after Bush, Rumsfeld and Cheney (though I think it’s ludicrous) than why Britain doesn’t go after Tony Blair. The only plausible reason is that many of those who supported Blair when he sent Britain’s young and promising, the future of the nation, into desert hell-holes to go and kill the foreign man, only to return as mental if not physical cripples, are still in power today. In both countries, it’s been more than sufficiently established that both people and parliaments were served blatant lies. That fact that even parliaments don’t dare fight back tell you all you need to know about the level and extent of democracy in the Angle-Saxon world.

In this same vein, there is something else I read this morning that first made me wonder about governments and criminal behavior. Bloomberg:

UK Return To Loans for 95% of Home Value Seen as Risky

With U.K. home prices rising at the fastest pace since 2010, banks are making more high loan-to-value mortgages. The number of loan products available to borrowers with a 5% deposit has tripled to 132 since the government in October extended its Help-to-Buy program, which assists buyers with down payments on new homes [..] These higher risk loans are similar to those that spurred the U.K.’s property crash in 2008, when [..] home prices fell 17%. Today, with just 5% down, borrowers may later find themselves underwater, owing more on their properties than they are worth, said Rob Wood, a former BOE economist. “Small falls in house prices can push them into negative equity,” said Wood.

Prime Minister David Cameron’s support for homebuyers is boosting the economy before next year’s national elections. Help to Buy allows purchasers to take out a mortgage with a down payment of as little as 5% for a home costing as much as 600,000 pounds. Willem Buiter, an external member of the BOE’s rate-setting committee from 1997 to 2000, said earlier this month that encouraging people to take out higher loan-to-value mortgages is bad policy and the market is overheating. “If it’s a bubble, we’ll be able to tell after it pops,” he said at a briefing in London. “If it isn’t one, it sure looks like one.”

Seen as risky, says the headline. Yeah. Well, I see a government returning to subprime loans mere years after many people lost their shirt on their homes as criminal. Or make that “morally repugnant” if you will. Help to Buy is not helping the British people, other than to put their heads in a noose. Cameron is very aware of this, just as Blair and Bush knew many of their young soldiers would never return in one piece. Same difference.

As for Buiter’s “If it isn’t a [bubble], it sure looks like one,” we already have the answer to that. It’s what David Stockman has aptly christened “Canary-On-Thames”. Stockman cites Brett Arends at Marketwatch, who in “Ominous Signs For London Real Estate” notices that while house prices are still rising in London, rents are falling. Stockman writes:

In the attached survey of soaring real estate prices in Prime Central London [Brett Arends] does not bother to marvel at their near vertical ascent – up two-thirds in the past five years and 2X in the last decade – or enumerate the various sheiks, oligarchs, moguls and potentates who have converged on the posh precincts along the River Thames. Instead, he goes straight to an apparent anomaly: While property prices are soaring, rents are falling. During the past year, for example, property prices in Mayfair are up 5%, but rents are down 8%. Likewise, in the area north of Hyde Park, prices have risen 10%, while rents have fallen by 8%. Overall, rents peaked in 2011 in Prime Central London, and have been slowly falling ever since.

Needless to say, falling rents are not a sign of scarcity – even in the toniest sanctuaries of one of the planet’s hottest urban centers. Nor are they an endorsement for the real estate brokers’ pitch that central London is different – an irreplaceable treasure of civilization that is immune to the normal laws of economics. What the rent/price anomaly really means is that “yields” or cap rates in central London have been falling drastically. In fact, they are at an all-time low according to Frank Knight – the acknowledged authority on London real estate. From a 10% yield in the mid-1990s, cap rates had fallen to 4% by March 2009, and now stand at just 2.8%.

Check any prior property bubble peak – say the Miami condo market in 2006-07 – and what you will find is plummeting cap rates, pushing down into the 2-4% zone. And what you will also find not far behind is a central bank running its printing presses overtime. In short, the economic deformation spotted by Arends is a monetary phenomenon, not a reflection of physical supply and demand or simply the mechanics of the free market at work. The add factor is cheap credit – the marginal source of the “bid” that can keep apartment and townhouse prices soaring even when the units are empty.

What is unique about London is English Law and open borders. So that makes central London not only a haven for so-called “flight capital”, but also the virtual epi-center of a global financial bubble that has been created by the combined money printing exertions of all the world’s major central banks. Stated differently, the monumental global expansion of cheap credit since the turn of the century – up from $1 trillion to $25 trillion in China alone – has caused a huge inflation of real estate and resource values all around the planet.

Yes, this means that the Cameron/Osborne Help-to-Buy bubble is already well past its best-before date. Even if thousands more foreign buyers high on cheap credit and shady deals may flock in before this city-of-cards comes tumbling down. What Downing Street 10 will have done is to dislocate huge numbers of Londoners unable to keep up with rising prices, and fool many many gullible thousands more into signing up for the property ladder only to to be unceremoniously kicked off with huge debts tied around their necks.

There are those who would argue that in financial systems and “free” markets, those who don’t pay attention get fleeced, and that this has a function. But for a government and central bank to push and advocate this sort of development, just to look better for a short time, is a whole different story. Not a day goes by that I don’t hear and read yet more about the miraculous recovery Britain has accomplished for itself. Hail Cameron! Well, reading the above, you, like me, may have an pretty clear idea where this is going. My advice to the British people: take ’em to court, let them explain how the upcoming disaster came to be, and even if the law says it doesn’t constitute criminal behavior, make sure to let ’em sweat. So the next set of doofuses will think twice before trying it again.

Obviously, there are very similar “miraculous recovery” stories doing the rounds about the US. And for very similar reasons. Try New York real estate prices. Nevertheless, both existing and new home sales numbers that came out this week spell it out as clear as you can wish it to be: the US housing recovery is dead. Falling sales, construction dead in the water, the works.

I read something toady to the extent that “100% of experts polled agreed that US interest rates would start rising significantly this year”. I’ve said it many times before, and I’ll say it again: GET OUT! You’re not all going to be among the 1% of people who beat the markets. Go find something more useful to do with your time and your money and your life than to spend it all in this cheap credit casino that was constructed specifically to take it all away from you.

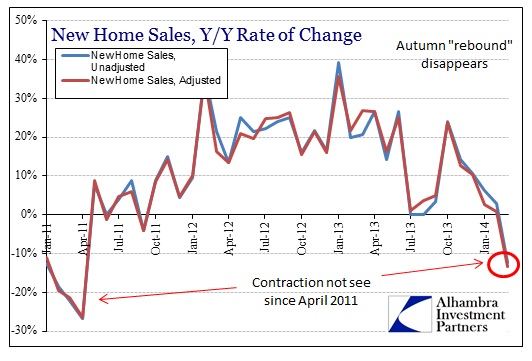

• US New Home Sales Drop 14.5% In March (AP)

The number of Americans buying new homes plummeted in March to the slowest pace in eight months, a sign that real estate’s spring buying season is off to a weak start. The Commerce Department said Wednesday that sales of new homes declined 14.5% last month to a seasonally adjusted annual rate of 384,000. That was the second straight monthly decline and the lowest rate since July 2013. Sales plunged in the Midwest, South and West in March. But they rebounded in the Northeast, where snowstorms in previous months curtailed purchases. New-home sales have declined 13.3% over the past 12 months. “Our core view is that the housing market has stalled and won’t contribute” to overall economic growth this year, said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Rising home prices have caused some buyers to back off at the lower end of the market, while new-home buyers at the top continue to buy. As a result, median sales prices jumped 12.6% during the past month to $290,000. Home sales usually improve with the start of the spring. More would-be buyers venture to open houses. Families with children often begin to look for homes so that they can move once the school year ends. Builders anticipated a snap back with the warmer weather. There were 193,000 new homes for sale at the end of the month, about 39,000 more than the same period last month.

The avearge American should fear rising rates more then the Fed.

• Why The Fed Fears Honest Interest Rates (Alhambra)

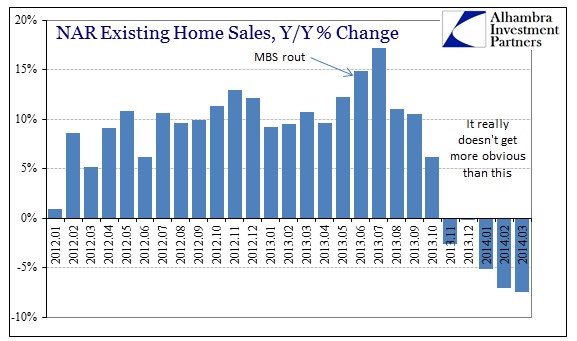

I mentioned earlier today that pretty much the only sector of the economy (outside of government run lending for university waste) acting favorably toward interest rate stimulus was autos. Prior to the historic credit selloff and MBS rout in the middle of last year, you could add housing to the list. The latest figures for March 2014 from the National Association of Realtors leave no doubt that housing has disengaged over the interim.

The obsession with temperature continues, even though March was free and clear of the kind of unusual storms plaguing January and February. Again, such pandering is indicative of the kind of groping and pleading for something that can explain what is otherwise obvious while still preserving the monetarist view and paradigm. To accept what is obvious means either total refutation or more experimentation with the limits of rational expectations theory.

The change in trend clearly predated the change in season, but aligns exactly with the inflection in mortgage finance and credit. This should be much more alarming to mainstream observers, as I have noted repeatedly that a relatively minor increase in interest rates should not have provoked something so dazzling in its contrast. How can 80 or so basis points lead to these results, absent any artificial market factors? Once more, the tide of asset inflation.

TEXT

• Explaining The Horrendous US Home Sales Report (Zero Hedge)

This is our best attempt at playing clueless propaganda cheerleaders also known as economists:

Q. Why did new home sales crash in all regions except the traditionally coldest, wettest, and snowiest Northeast, where sales rose?

A. Uhm, because it obviously snowed everywhere except in the Northeast.

And there you have it: spin 101 for braindead zombies and vacuum tubes.

And for those confused about the current state of the “housing recovery”, here is a longer-term chat:

Source: Bullshit Bureau

TEXT

• Fed Money Printers At Work: March Y/Y New Home Sales Down 12% (Alhambra)

Economists blaming weather for the real estate/housing pause were cautiously optimistic for March ahead of this week s housing data windfall.

Economists expect that sales rose 2.3 percent to a seasonally adjusted annual rate of 450,000 last month, according to a survey by FactSet. New-home buying dipped 3.3 percent in February. Harsh winter storms that month curtailed purchases in the Northeast, while buying also fell in Western states where prices increases during 2013 have hurt affordability.

According to the Commerce Department, March was actually far worse than February, and, depending on your view of bubbles, far better. The seasonally adjusted estimated level of new home sales fell to 384k in March from 449k in February. That was 18% below January s pace. Unadjusted, sales in March 2014 were 12% below March 2013.

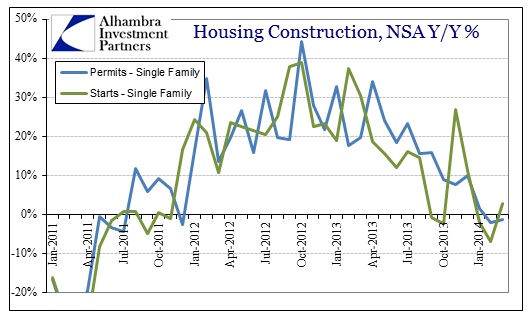

Now that winter is fading into spring, a lack of supply is forming as the new narrative excuse. That would be one way to explain this:

But if there was surging demand not being met by existing supply, basic, common sense economics (not orthodox) posits that we should be seeing a housing construction boom right now. After all, rising prices via a shortage screams for an increase in production, yet we have been observing the exact opposite.

Those with direct access are bidding far past what fundamental buyers (those that actually want to live in a dwelling) are able to obtain. That is not a supply problem, nor is this a market; it is the tide of intentional asset inflation.

• UK Return To Loans for 95% of Home Value Seen as Risky (Bloomberg)

When James Seabury found his first home in northeast England in November, he had to borrow almost all of the 140,500-pound ($236,000) purchase price. “Seven thousand pounds was all we had for a deposit,” said Seabury, 30, a town planner whose loan covered 95% of the purchase price. “We managed to get the mortgage sorted and move in within four or five months. It was really quick.” With U.K. home prices rising at the fastest pace since 2010, banks are making more high loan-to-value mortgages.

The number of loan products available to borrowers with a 5% deposit has tripled to 132 since the government in October extended its Help-to-Buy program, which assists buyers with down payments on new homes, according to Genworth Financial Inc. These higher risk loans are similar to those that spurred the U.K.’s property crash in 2008, when the country’s biggest mortgage lender, Northern Rock Plc, collapsed, and home prices fell 17%. Today, with just 5% down, borrowers may later find themselves underwater, owing more on their properties than they are worth, said Rob Wood, a former Bank of England economist. “Small falls in house prices can push them into negative equity,” said Wood, who works at Berenberg Bank in London.

Prime Minister David Cameron’s support for homebuyers is boosting the economy before next year’s national elections. Help to Buy allows purchasers to take out a mortgage with a down payment of as little as 5% for a home costing as much as 600,000 pounds. Willem Buiter, an external member of the BOE’s rate-setting committee from 1997 to 2000, said earlier this month that encouraging people to take out higher loan-to-value mortgages is bad policy and the market is overheating. “If it’s a bubble, we’ll be able to tell after it pops,” he said at a briefing in London. “If it isn’t one, it sure looks like one.”

• Canary-On-Thames: Soaring Property Prices And Falling Rents (Stockman)

Brett Arends is one member of the financial commentariat who can see through the outward manifestations of bubble finance. In the attached survey of soaring real estate prices in Prime Central London he does not bother to marvel at their near vertical ascent – up two-thirds in the past five years and 2X in the last decade – or enumerate the various sheiks, oligarchs, moguls and potentates who have converged on the posh precincts along the River Thames. Instead, he goes straight to an apparent anomaly: While property prices are soaring, rents are falling. During the past year, for example, property prices in Mayfair are up 5%, but rents are down 8%. Likewise, in the area north of Hyde Park, prices have risen 10%, while rents have fallen by 8%. Overall, rents peaked in 2011 in Prime Central London, and have been slowly falling ever since.

Needless to say, falling rents are not a sign of scarcity – even in the toniest sanctuaries of one of the planet’s hottest urban centers. Nor are they an endorsement for the real estate brokers’ pitch that central London is different – an irreplaceable treasure of civilization that is immune to the normal laws of economics. What the rent/price anomaly really means is that “yields” or cap rates in central London have been falling drastically. In fact, they are at an all-time low according to Frank Knight – the acknowledged authority on London real estate. From a 10% yield in the mid-1990s, cap rates had fallen to 4% by March 2009, and now stand at just 2.8%.

Check any prior property bubble peak – say the Miami condo market in 2006-07 – and what you will find is plummeting cap rates, pushing down into the 2-4% zone. And what you will also find not far behind is a central bank running its printing presses overtime. In short, the economic deformation spotted by Arends is a monetary phenomenon, not a reflection of physical supply and demand or simply the mechanics of the free market at work. The add factor is cheap credit—the marginal source of the “bid” that can keep apartment and townhouse prices soaring even when the units are empty.

What is unique about London is English Law and open borders. So that makes central London not only a haven for so-called “flight capital”, but also the virtual epi-center of a global financial bubble that has been created by the combined money printing exertions of all the world’s major central banks. Stated differently, the monumental global expansion of cheap credit since the turn of the century – up from $1 trillion to $25 trillion in China alone – has caused a huge inflation of real estate and resource values all around the planet. As the global bubble inflated, the developers, builders, miners, shippers and material processors made fortunes far beyond ordinary measures of return on the tangible and intellectual capital involved in these enterprises.

• Ominous Signs For London Real Estate (MarketWatch)

Uh-oh. Is the biggest bubble in the western world about to pop? I’ve learned from long experience that one can never tell for certain. But the signs are ominous. I’m in London, where real estate is just entering the sixth year of a mania that seems to be putting all others in the shade. London’s property market today makes Las Vegas in 2005 look like penny ante poker in an old people’s home. It makes you think of Tokyo in the late ‘80s. This mania is massive. Everyone here is rich — on paper. Every piece of real estate is worth gazillions. My old one-bedroom, fourth-floor walk-up would apparently now sell for nearly $1 million. It measured 450 square feet. Did I mention there was no elevator?

Everyone is talking about how much money they have made on their home in the last year and how much more they are going to make in the next. Prices are up every month. Values are way, way past the levels seen even in 2007. Conversations here go like this: “Did you hear? A flat just like mine over on Thingummy Avenue just sold for $2.2 million. I think it was about the same size as mine, but it didn’t have a third bathroom, and the view wasn’t as good. I think my place is now worth $2.5 million.” “Well, the flat two floors below us sold for $3 million. They’d only been there a year. It needs a new bathroom. And it’s on the other side of the building, so the view isn’t so good…” But there’s just one problem. While the nominal value of property is still going up, the cost of renting one of those properties isn’t keeping pace. In fact, it’s going down. No, really.

• Cost Of British Military Actions Since Cold War Tops $100 Billion (Guardian)

Britain’s military operations since the end of the cold war have cost £34.7bn and a further £30bn may have to be spent on long-term veteran care, according to an authoritative study. The bulk of the money has been spent on interventions in Iraq and Afghanistan judged to have been “strategic failures”, says the study, Wars in Peace, published by the Royal United Services Institute (RUSI). In comments with particular resonance in the light of Tony Blair’s speech on Wednesday exhorting the west to do more to defeat Islamic extremism, the RUSI study concludes that “there is no longer any serious disagreement” that Britain’s role in the Iraq war served to channel and increase the radicalisation of young Muslims in the UK.

The RUSI study refers to estimates of 100,000 Iraqis killed, with 2 million refugees fleeing to neighbouring countries. Most of the study’s figures have been collated for the first time from responses to freedom of information requests to the Ministry of Defence. If the material cost of British deaths and injuries in subsequent compensation payments is included, the cost to Britain of military conflicts since 1990 could total as much as £42bn – excluding the cost of caring for veterans. What the study describes as “largely discretionary” operations – the failed interventions in Iraq from 2003, and in Afghanistan after 2005 – accounted for 84% of the total cost of British military interventions since 1990. The figures are net additional costs of the operations – that is, on top of what the armed forces would have been spending in any case, on running costs such as fuel, training exercises, and salaries.

• 7 Million GM Recalls Seen Eroding Profit Under CEO Barra (Bloomberg)

This was supposed to be the year when General Motors made a record $10 billion in profit. Now, new Chief Executive Officer Mary Barra will be hard pressed to avoid posting a loss when GM announces its first-quarter earnings tomorrow. The cost of recalling 2.59 million vehicles linked to the deaths of at least 13 people – combined with continued losses in Europe and new challenges in Russia, Australia, Asia and South America — have prompted analysts to downgrade their earnings estimates.

“It’s certainly been a trying 100 days” since Barra started on Jan. 15, said Brian Johnson, an industry analyst with Barclays Plc. This week, Johnson lowered his earnings estimate to a penny-per-share loss from a 20-cent profit. He predicted that the company would have its worst results since the fourth quarter of 2009, when GM was fresh from its U.S. government-backed bankruptcy reorganization.

Over the past four weeks, 12 of 14 analysts surveyed by Bloomberg lowered their estimates for GM’s first-quarter adjusted EPS, bringing the consensus estimate down 88%, to 6 cents a share. Detroit-based GM reported an adjusted 67 cent per share profit a year ago. A year ago, GM reported a net first-quarter profit of $1.18 billion. This quarter, it has forecast taking a $1.3 billion loss for costs related to recalling 7 million vehicles, including those with faulty ignition switches. It has also said it will take a $400 million pretax charge for changes in Venezuela’s currency. That will come on top of any losses in Europe, which have totaled more than $18 billion since 1999.

• GM Car Owners Claim Bankruptcy Fraud to Keep Recall Lawsuits Alive (Bloomberg)

General Motors’s request for court protection from 50 car-owner lawsuits seeking compensation for millions of recalled autos with defective ignition switches was attacked as legally “unsupportable.”Car owners challenged GM’s position that it may compensate accident victims but not them, claiming in a court filing yesterday that GM committed fraud by not revealing the defects, allegedly known since 2001, or listing either group as creditors in its 2009 bankruptcy. In the reorganization, U.S. Bankruptcy Judge Robert Gerber freed GM from most of its liabilities, leaving intact only some warranty obligations and responsibility for accidents.

To stop Gerber from protecting GM from new suits, the ignition switch car owners must prove their fraud allegation, bankruptcy attorney Chip Bowles of Bingham Greenebaum Doll LLP said. “This is very difficult,” Bowles said. “However there is a middle ground and that would be the parties requesting discovery,” or pre-trial evidence from GM, to prove fraud. “There is a decent chance that Gerber would allow discovery.” GM, which has said it isn’t seeking to block lawsuits over accidents that caused injury, loss of life or property, told the judge he must rule on the issue before other ignition lawsuits against the company may proceed. A conference on GM’s request is set for May 2 in U.S Bankruptcy Court in Manhattan.

Part 2 of Shilling’s series.

• The Economic Monster Called Deflation (A. Gary Shilling)

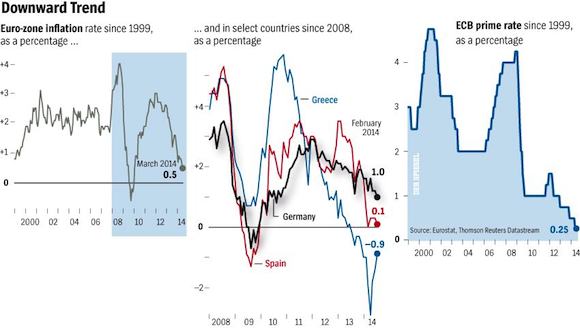

In part one of this series, I wrote about the deflation specter that is haunting Europe. Central bankers are so fearful of deflation that they want an inflationary cushion to prevent an economic shock or geopolitical crisis from sending low inflation into negative territory. The Federal Reserve, European Central Bank, Bank of England and Bank of Japan have inflation targets of 2%. Why is deflation so troubling to central bankers? First, with chronic deflation, debts rise in real terms. Their nominal value remains fixed, yet nominal incomes and profits — the wherewithal to service those debts — tend to fall. So bankruptcies leap, and lending, the driver of much economic growth, atrophies.

Second, when deflation occurs, economies weaken and central banks lose much of their power. Interest rates fall to zero, and monetary policy becomes asymmetrical (because rates can only be raised, not lowered). Third, real interest rates are always positive, even with zero nominal rates. That’s been the case in Japan for two decades. This means that central banks can’t create the negative real rates they desire to encourage borrowing. To be effective, they need to pay borrowers, in real terms, to take money. Finally, deflation breeds deflationary expectations, which results in a sluggish economy. That’s been the case in Japan since the early 1990s. Buyers wait for lower prices before purchasing, so excess capacity and inventories mount, pushing prices down.

That confirms prospective buyers’ expectations, so they hold off further, creating a self-feeding cycle of buyer hesitation, which spawns excess inventories and capacity that depresses prices and encourages further restraint by purchasers, and so on. To make matters worse, global financial deleveraging, which also depresses growth, will probably persist for four more years or so, given that it normally takes a decade to unwind excessive debt after a major financial crisis (as happened in 2008). Deleveraging has been so profound that it has largely offset the huge fiscal stimulus and monetary easing in the U.S. and elsewhere.

• ECB Prepares Measures To Combat Possible Deflation (Spiegel)

One of European Central Bank President Mario Draghi’s most important duties is watching his mouth. One ill-considered utterance is enough to sow panic on the financial markets. But during a press conference earlier this month, Draghi allowed himself a telling slip. Speaking to gathered journalists at the Spring Meetings of the International Monetary Fund and the World Bank, Draghi twice almost uttered a word he has been at pains to avoid. “Defla…”, Draghi began, before stopping himself and continuing with the term “low inflation.”

Yet despite Draghi’s efforts, the specter of deflation was omnipresent in Washington during the meetings. And it is one that is making central bank heads and government officials nervous across the globe. The IMF in particular is alarmed, with Fund economists warning that there is currently up to a 20% risk of a euro zone-wide deflation. IMF head Christine Lagarde has called on European central bankers to “further loosen monetary policy” to address the danger. The reason for concern is clear: Ever since the Great Depression at the beginning of the 1930s, deflation has been seen as one of the most dangerous illnesses that can befall an economy.

Several countries at the time fell victim to a downward spiral consisting of falling prices, rapidly rising unemployment and shrinking economic output — a morass that took years to escape. Because prices were falling, people stopped spending in the hope that everything would become even cheaper. Companies were unable to sell their products and many went broke, which led to millions of people losing their jobs and a further squeeze on consumption. Japan provides a more recent example, where the economy has been largely stagnant for years amid falling prices. Is the euro zone now facing a similar nightmare? The inflation rate in the common currency zone sank to 0.5% in March, dangerously close to zero and far away from the ECB’s target of 2%.

Yes, kiddo’s, this too is presented as serious news. I’s say if it takes Greece and Portugal to boost the Eurozone, it’s women and children first.

• Greece And Portugal Boost Eurozone (Guardian)

Europe’s recovery from its debt crisis took two significant steps forward on Wednesday as Greece posted a primary budget surplus and Portugal made a successful return to the bond markets for the first time in three years. The European commission paved the way for Greece to begin debt relief talks with its creditors by announcing that the country had been left with a surplus of about €1.5bn (£1.2bn) last year, or 0.8% of national output,once its hefty debt payments and the cost of recapitalising its banks had been stripped out. The EU’s executive arm said Greece’s finances were ahead of the targets agreed with its lenders, describing it as a “reflection of the remarkable progress that Greece has made in repairing its public finances since 2010”.

The commission, a member of the troika that bailed out Greece alongside the International Monetary Fund and the European Central Bank with packages worth more than €200bn, said it believed the country’s debts were sustainable. Greek government ministers said the country’s long years of sacrifices since accepting a bailout in 2010 were paying off. “After these years that were very tough on households and businesses, the country and its economy are in a definitely better position,” said the deputy finance minister Christos Staikouras.

The primary surplus means that, technically, Greek government revenues now exceed expenditure. However, it was only reached by ignoring the interest payments on Greece’s borrowings, the cost of recapitalising its banks, and other one-off measures. Greece’s total national debt actually rose to 175% of national output in 2013, up from 157% of GDP the previous year. Much is held by other eurozone governments, which must decide whether to help Athens by cutting the interest rates on its bonds or extending the maturities on those debts.

No kidding, Mo.

• Europe Still Has a Mountain of Debt (El-Erian)

There was a time not so long ago when the vast majority of experts agreed that a country could not emerge decisively from a financial crisis unless it solved problems of both “stocks” and “flows” — that is, secured a flow of money to cover its immediate needs and found a way to manage its stock of outstanding debt over time. In Europe today, this conventional wisdom appears to be fading. The temptation there is to declare victory having solved only the flow, not the stock, challenge. The flow/stock intuition is quite straightforward. In the first instance, a crisis-ridden country must generate enough resources to meet its pressing funding needs, and do so in a manner that does not erode its growth potential.

Soon thereafter – or, even better, simultaneously – the country needs to realign its longer-term payment obligations in a manner that is consistent with both its ability and willingness to pay. Unless a country does both, the productive commitment of its own people and companies will be too tentative to drive a full and proper recovery. It will also be a lot harder to attract the scale and scope of long-term foreign direct investment that is so helpful for enhancing growth, jobs and national prosperity.

The need for a comprehensive approach was most vividly illustrated during the Latin American debt crises. Having secured sufficient emergency financing and embarked on serious economic reform efforts, the successful countries devoted lots of effort to improving their debt maturity profiles, better aligning the currency composition of their debt and, most important, reducing the size of their contractual obligations. These efforts were instrumental in productively re-engaging the domestic private sector and in attracting sizable foreign investment.

A currency war has been building for years.

• A Currency War Is Coming (MarketWatch)

While most investors like to believe that things like earnings and the economic data drive the market’s ups and downs, lately it’s been all about moves in the currency market. Since stocks started surging higher in late 2012, they’ve been marching in lockstep with the Japanese yen. Specifically, whenever the yen goes down, stocks rise. And when the yen strengthens, stocks weaken. (The relationship is so close that since the beginning of 2013, the yen’s movement explains 60% of the changes in the S&P 500.) But now, amid some signs of stalling in the global economy and turmoil in the stock market (with the Nasdaq threatening its 200-day moving average for the first time since 2012), the currency market assumptions that have pushed the market higher over the last three years are under threat.

We’re on the cusp of an outright currency war — something that the Brazilians first warned about in 2010 — as central banks in all the major economies actively work to weaken their currencies to boost exports, their economies, and keep pushing inflation higher. While headlines remain focused on the simmering conflict in Ukraine, the real battle is about to break out in the foreign-exchange market as countries battle, not for supremacy, but in a race to the bottom. What has changed is that both China and Europe are quickly moving to weaken their currencies in an effort to support growth.

China’s actions have already attracted the ire of the U.S. Treasury, which in a recent semi-annual currency-market report singled out China as keeping its currency significantly undervalued after “unprecedented” decline earlier this year. And in a first, the European Central Bank, after watching the euro zone’s overall inflation rate drop dangerously low amid stagnant credit creation, is now openly discussing launching a quantitative-easing bond-buying stimulus. In a preview of the potential market turmoil that could be unleashed by ECB action to weaken the euro against the yen, just remember what happened on April 4 when stocks suffered an epic midday reversal from all-time highs on reports in the German press that ECB analysts were beginning computer simulations on what the impact of a bond-buying stimulus would be on inflation and growth.

Great Durden exposé.

• The Chinese Ponzi: An Orgy Of Borrowing, Building and Speculating (Zero Hedge)

Much has been said here and elsewhere about not only China’s ghost cities – that final resting place where trillions in Chinese GDP “fixed investment” goes to quietly die but no before contributing to over half of China’s GPD – over the past five years, but also about the bursting of the Chinese housing bubble in the past several months now that the Beijing Politburo has drastically slowed down the pace of loan creation and the country has shocked its bond investors by admitting failure is an all too real possibility.

This post will therefore hardly reveal anything new, however it will provide some perspective on how from one of the most important industries for China’s suddenly cooling economy, housing has becoming nothing more (or less) than one giant Ponzi scheme. Here are some of the soundbites of a recent Bloomberg piece showing how “Xi’s Squeeze Leaves China’s Heartland Missing Boom” covering such exciting topics as:

… Bubbles:

“Cities in China are facing some serious real estate bubbles, and the bubbles in third-, fourth-tier cities have the risks of total collapse,” said Tao Ran, director of the China Center for Public Economics and Governance at Renmin University in Beijing, in a phone interview on March 31. “The central government and banks tightened credit in the property market because they realized the risks.”

… Collateral

That makes it harder for Zhu Houlun, 43, who took over as Laohekou party secretary in August 2012 with plans to merge with neighboring Gucheng by building a new urban center on 70 square kilometers (27 square miles) of farming communities between the two. The project would create a city of 700,000 by 2020, more than double Laohekou’s existing urban population, according to a Xiangyang government report.

Zhu must rely on private developers like Liu Pingfeng, from neighboring Hunan province, who is building a 5 billion yuan project north of Laohekou called the Red River Valley Eco-Tourism Resort that includes apartments, a five-star hotel, a theme park and a polo club. “Raising funds is very difficult,” said Liu, 47, who has been building in Hunan for a decade. “I used to use land as collateral — as long as I got the land certificate I could get the loan. Now it’s almost impossible.”

… Social problems:

“Local government officials are still very fixated on economic growth,” said Lynette Ong, an associate professor at the University of Toronto who wrote the 2012 book “Prosper or Perish: The Political Economy of Credit and Fiscal Systems in Rural China.” “Without growth, a lot of social problems like unemployment will surface.”

… from ashes to ashes, from ghost town to ghost town:

The expansion on the coast was largely fed by immigrants from provinces like Hubei that are now struggling to lure them back. On a February morning in Laohekou’s cavernous and unheated labor exchange, a single jobseeker scans the vacancies posted on the back wall, while five female staff clutch thermoses of hot drinks to keep warm. “It’s hard to hire people here,” said Zhang Hongju, one of the staff. “The young people have all gone to Guangdong and those who haven’t need to stay home to take care of elderly family or kids.”

In Chen Genxin’s village, slated to be demolished to make way for China Dreamland, he says everyone is over 50. His sons left during the boom to get jobs in other cities. “If the country wants us to tear it down, we’ll tear it down,” said Chen, 71, as he harvests spinach from his small plot with his wife in the afternoon sun. “The earth will bury me wherever I go.”

… and, of course, the fact that it is all one massive Ponzi scheme:

In Red River’s muddy construction site by the river, there are clusters of concrete skeletons that Liu says are due to open in October as shops, cafes, bars and a fitness center. Nearby is a hole in the ground the size of a football field that will be a musical fountain. The soaring cost of loans means Liu will build and sell Red River in stages. “As we sell our first batch of apartments, we’ll have cash flow to build the next stage,” he said in an interview in February in Laohekou.

Stop using plastic. Use cash where you can.

• The Growing Perils of the Cashless Future (Fiscal Times)

We’re finally on the brink of the cashless society that futurists and other have been forecasting for years. The average consumer owns at least two credit cards and early adopters have begun ditching plastic for virtual wallets. Even businesses that used to rely heavily on cash — think taxis, food trucks or even craft fairs — can now go cashless, thanks to new technology like Square. Yet, the more we abandon paper bills for plastic, smartphone payments and even cryptocurrencies like Bitcoin, the perils of the new, cashless economy are becoming more apparent. Recent security breaches at Target, Neiman Marcus and other retailers illustrate the vulnerability of electronic payments to hacking attacks.

There were 2,164 reported security incidents exposing 822 million records last year, nearly doubling the previous highest year, 2011, according to Risk Based Security, a data security firm. The pace seems to be continuing this year. Chip-and-pin cards, in use in Europe for years, would remove some of the threat. Computer chips embedded on the cards verify unique personal identification numbers consumers punch into terminals. The cards would help reduce fraud, but it’s not clear how much. For instance, they don’t help prevent online fraud.The problem is cost. Making the cards and installing the new terminals needed to read them is expensive. Consumer advocates want Congress to press retailers and banks for fast adoption of chip-and-pin technology.

“Some institutions in the U.S. say they will switch to this technology in the next few years, but we need a stronger commitment from all stakeholders,” stated Delara Derakhshani, policy counsel for Consumers Union, in testimony to Congress. “Policymakers must also take action to encourage investments in technology to tighten up the security of our financial institutions.” Data breaches aren’t the only downside. Going cashless in a world of Big Data means all your purchases — and therefore your privacy — is up for grabs. Did you hear the one about the woman who wanted to surprise her husband and tell him that after three years of trying, she was finally pregnant? Too late. While on line one night on their home computer, he noticed all these products geared to pregnancy and childbirth.

My, what a hard choice. Lung disease or the Putin bogeyman.

• Poland Pushes Coal on Europe as Putin Wields Gas Weapon (Bloomberg)

Polish Prime Minister Donald Tusk says the country’s giant coal fields should become a cornerstone in Europe’s defense against a newly aggressive Russia. Because the fossil fuel supplies 90% of Poland’s power it has less need of Russian natural gas than other Eastern European nations, burning half as much per capita as the neighboring Czech Republic, for example. As politicians wrestle with how to respond to the crisis in Ukraine, Tusk argues Europe needs to “rehabilitate” coal’s dirty image and use it to break Russia’s grip on energy supply. “In the context of the Russian-Ukrainian conflict, the overriding objective is to lessen the dependence on Russia,” said Mujtaba Rahman, an analyst at Eurasia Group in London.

“Climate objectives will be absolutely secondary to that.” Coal, a cheaper source of power than gas, nuclear, wind or solar at today’s prices, is already a key part of Poland’s economy, keeping factories competitive and guaranteeing hundreds of thousands of manufacturing jobs. It’s even a tourist attraction. Poland burns over 50 million tons of coal a year, more than any European nation other than Germany, while having the lowest reliance on natural gas among the EU’s 10 largest economies, according to International Energy Agency data. That’s a popular position in a nation where Soviet troops were stationed for four decades until the early 1990s.

• Russian FM Lavrov: Americans Are ‘Running The Show’ In Ukraine (RT)

Sophie Shevardnadze: Sergey Lavrov, Russia’s Foreign minister, it’s great to have you on our show today. So, just the other day Joe Biden on his visit to Kiev said that time is short for Russia to make progress on its commitments made in Geneva. What is expected of Russia?

Sergey Lavrov: Well, it’s difficult to say because I discuss this almost daily with John Kerry. And frankly the American colleagues chose to put all the blame on Russia, including the origin of the conflict and including the steps which must be taken. They accuse us of having Russian troops, Russian agents in the east and South of Ukraine. They say that it is for the Russians only to give orders and the buildings illegally occupied would be liberated and that it is for the Russians to make sure that the East and South of Ukraine stops putting forward the demands for the federalization and the referendum and so on and so forth. This is absolute…you know…switching the goal post if you wish.

In Geneva we all agreed that there must be reciprocal approach to any illegitimate action in Ukraine, be it in Kiev, be it in the West, be it in the East, be it in the South. And the people who started the process of illegitimate actions must step back first. It is absolutely abnormal due to any norms in a European city that Maidan is still occupied, that the buildings in Kiev are still occupied and in some other cities, that those who put on fire the buildings belonging to Communist party headquarters in Kiev, the buildings belonging to the Trade Union headquarters are not even under investigation. I don’t even want to mention the sniper cases because everyone forgot about those snipers. And we only hear that “Let’s concentrate on eliminating terrorist threats in the East and in the South”.

Kerry offered $50 million. He can pay that from his own pocket without lifting his a hairdo.

• Ukraine’s Unpaid Russian Gas Bills Dwarf US Aid Offer (Bloomberg)

Ukraine’s best hope for keeping furnaces and factories running through next winter is to store as much natural gas as it can after a U.S. aid pledge fell far short of the nation’s needs. Energy supplies have given Russian leader Vladimir Putin powerful economic leverage in his battle with Ukraine. The former Soviet republic gets half its gas from Russia, and it’s the transit route for 50% to 60% of the gas Russia sells to other European nations. U.S. Vice President Joe Biden told Ukrainian leaders this week that the U.S. would provide help so that “Russia can no longer use energy as a weapon.”

Biden announced $50 million in aid, an unspecified part of which would go to develop the country’s gas reserves, explore alternative energy and improve efficiency. Russia responded yesterday, when Prime Minister Dmitry Medvedev said Ukraine would have to prepay for gas shipments unless it starts paying down the $2.2 billion debt it’s accumulated through March. The immediate danger facing Ukraine is a cutoff of Russian gas shipments for nonpayment of its debt. Medvedev told the Duma, the lower house of Russia’s parliament, yesterday that Ukraine’s only option is, “Gas for cash.”

“The near-term options are limited, so if supplies were cut off tomorrow, they’d be in a pretty difficult spot,” Jason Bordoff, who heads Columbia University’s Center on Global Energy Policy and is a former energy and climate adviser to the Obama administration, said in an interview yesterday. “Before next winter, they really want to be building up as much storage as possible.” Saddled with aging electric generators, leaky furnaces and drafty apartment blocks that date back to the Soviet era, Ukraine lacks the infrastructure to curb energy demand enough to make a significant dent in its dependence on Russia. Exploiting new petroleum discoveries beneath the Black Sea will take years of drilling and pipeline construction to bear fruit.

Modernizing Ukraine’s energy infrastructure and attaining supply independence would take 16 years and require $170 billion euros ($234 billion) in investment, a figure that dwarfs its annual economic output, the Paris-based International Energy Agency said in an October 2012 report.

This is going to turn sooo bad.

• 60% Of China’s Water Too Polluted To Drink (RT)

At least 60% of China’s underground water resources have “very poor” or “relatively poor” quality, which means these water can’t be used for drinking directly, says a new report, showing a deep environmental crisis in the country. China’s Ministry of Land and Resources has been monitoring at least 4,778 areas in 203 Chinese cities in 2013, the official Xinhua news agency said. According an annual report unveiled by the ministry, in at least 43.9% of the monitored sites the underground water was ranked as “relatively poor” and in 15.7% of cases as “very poor.” This means that about 59.6% of underground water can’t be used directly for drinking.

The recent results show a decrease in the amount of drinkable underground water in China by 2% compared to 57.4% in 2012. If the quality of water is considered “poor,” it can’t be used at all as a source for drinking water, say China’s underground water standards, while water of “relatively poor” quality may be used for drinking only after special treatment. According to the report, water quality became worse in 754 areas monitored by the ministry and improved only in 647 sites. Deterioration of drinking water quality is still one of the country’s major problems. The pollution is caused by an increasing population and rapid economic growth as well as lax environmental oversight.

In April, cancer-inducing benzene was found in water supply in the city of Lanzhou, which is considered one of the most polluted in the country. Citizens stockpiled crates of water as the government warned them not to consume any of the tap water for the next 24 hours. The water supply was switched off in one district. China blamed Veolia Water, the sole water supplier for more than 2 million people in the city, for failing to maintain water quality. The company, however, stated that the pollution was because of industrial contamination.

Go for it, VT!

• Vermont Poised To Enact Toughest US GMO-Labeling Law Yet (RT)

Vermont lawmakers have passed legislation that requires food made with genetically modified organisms, or GMOs, to be labeled as such. The law, the first of its kind in the US, must now get approval from Gov. Peter Shumlin, who has supported the bill. The state House of Representatives approved the bill on Wednesday by a vote of 114-30. The state Senate passed the legislation last week by a vote of 28-2. The bill would require any foods containing GMOs sold at retail outlets to be labeled as having been produced or partially produced with “genetic engineering.” The law would go into effect on July 1, 2016. Gov. Shumlin must now sign the bill to cap the process. He again expressed support for the measure on Wednesday.

“I am proud of Vermont for being the first state in the nation to ensure that Vermonters will know what is in their food. The Legislature has spoken loud and clear through its passage of this bill,” Shumlin said. “I wholeheartedly agree with them and look forward to signing this bill into law.” Anticipating lawsuits from industry, legislators established a fund of up to $1.5 million to help the state pay for defense against any legal action. People can contribute voluntarily to the fund, and settlements won in other court cases can be added to the fund by the state attorney general, the Burlington Free Press reported. The bill also makes it illegal to call any food that contains GMO ingredients “natural” or “all natural.”

Maine and Connecticut are the only US states that have passed GMO labeling laws, though their proposals would only go into effect if and when surrounding states also pass similar laws. GMO labeling is required in 64 countries, including the European Union. The Center for Food Safety says dozens of states are considering GMO labeling laws on some level, as there is no federal labeling standard. Polling suggests over 90%of Americans would prefer GMO ingredients in consumables to be labeled to some extent.

Home › Forums › Debt Rattle Apr 24 2014: When Does Government Policy Become Criminal Behavior?