Eugène Delacroix Pietà 1837

Pepe Press Project

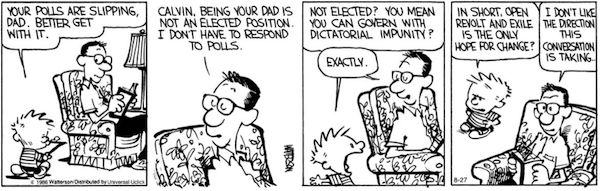

Twitter thread by “sundance”. The swamp is deep and smelly.

• Want To See The Scale Of DC Corruption? (CTH)

Want to see the scale of DC corruption?… Start with this question: Why did Andrew Weissman release the Carter Page FISA application in July of 2018? At the apex of the special counsel cover-up operation, Andrew Weissman released the Carter Page FISA application, using the ridiculous justification of a FOIA request. No one asked “why”? Everyone was so intoxicated by the first ever release of a TSCI FISA, they never paused to ask the question. However, the answer reveals just how brutally corrupt the special counsel cover up operation was. The FISA application was released, because it was the central focus of the James Wolfe criminal indictment. Senate Intel Committee Security Director James Wolfe was busted leaking material from SSCI SCIF. Wolfe leaked the FISA application to journalist Ali Watkins.

The Wolfe leak of the FISA application was a very serious problem for both the special counsel and the SSCI. So, before the DC US Attorney could put those charges into the official court record, Weissman found out and publicly released it. Thereby the special counsel proactively undermined any criminal charge that would be levied against Mr. Wolfe, and subsequently, importantly, protected the Senate Select Committee on Intelligence. Why did the Special Counsel need to protect James Wolfe from the consequences of his leaking the Carter Page FISA application? Because James Wolfe was told to leak the Top Secret Classified FISA application by Senate Committee Vice-Chairman, Senator Mark Warner. Why did Senator Mark Warner originally tell James Wolfe to leak the Carter Page FISA application to Ali Watkins? ANSWER: Because SSCI Vice-Chairman Warner was trying desperately to get enough pressure in DC to appoint a special counsel.

The leak took place on March 17, 2017, amid the DC furor to get a Trump-Russia special counsel at all costs. The special counsel was appointed, in part, due to the public pressure created by the open admission of an internal FBI investigation of President Trump, which *importantly* at the time of the leak (3/17/17), was still being denied. It wasn’t until (conveniently & not coincidentally) three days later on March 20, 2017, when FBI Director James Comey admitted before congress that yes, President Trump was actually under an open FBI investigation. Fast forward to late 2017, early 2018, and the Wolfe FISA leak is now part of a criminal investigation and criminal indictment (unsealed June 7, 2018)

As soon as the Wolfe indictment was unsealed, the special counsel jumped into action to remove the most explosive element, the FISA leak, from any potential courtroom. The fear was Wolfe wasn’t about to go to prison for leaking a document he was told to leak. The ramifications were tremendous for everyone, including the special counsel. The revelation of a coordinated multi-branch effort to target Trump would crush the Weissman agenda. Wolfe’s lawyers knew how to leverage the fear within DC to get the best outcome for their client. Cunning Weissman knew by publicly releasing the FISA application, using the goofy and easily dismissible justification of a FOIA request, he could remove that element from the criminal case. Which is exactly what happened.

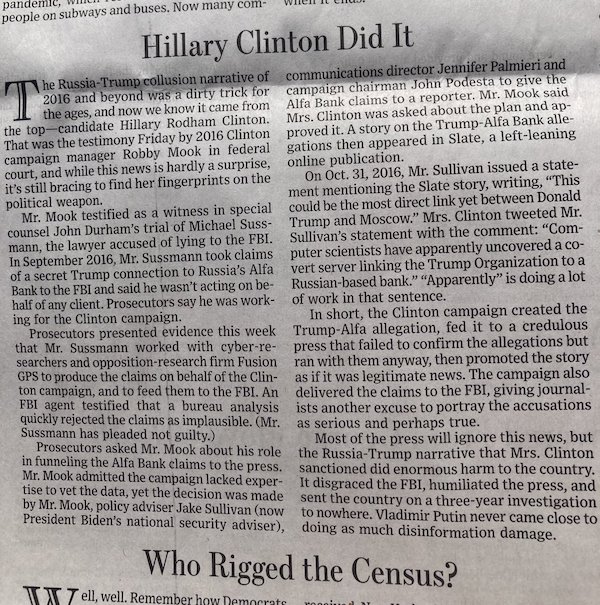

WSJ op-ed (see below): “The Russia-Trump narrative that Clinton sanctioned did enormous harm to the country. It disgraced the FBI, humiliated the press, and sent the country on a three-year investigation to nowhere. Putin never came close to doing as much disinformation damage.”

• Apparently Mueller and Weissmann Never Interviewed Robby Mook (CTH)

Special Prosecutor John Durham found the truth behind the creation of the Trump-Russia hoax, and through the trial of Sussmann is now diligently passing out the bitter pill ‘I toldyaso’s’ to the small group of rebellious researchers who found this exact trail of evidence years ago. The Clinton campaign lying is politics. The Clinton campaign selling lies to the media is slimy, but nonetheless politics. The media pushing those lies only showcases how corrupt they are in supporting their political allies. However, the Clinton campaign selling those lies to the FBI is a bit more problematic; thus, the trial of Sussmann. Having said all that; while also accepting this grand game of pretense; there’s an 800lb gorilla in the room that no one seems bothered by.

How did Robert Mueller and Andrew Weissmann spend 2 years investigating Trump-Russia; with a team of 19 lawyers, $40 million in resources, 40 FBI agents, 2,800 subpoenas, 500 search warrants and 500 witnesses; and not find out that Hillary Clinton created the hoax they were investigating? [..] The 2017, 2018 and 2019 special counsel probe, led by the nameplate of Robert Mueller, was a DC cover-up operation for FBI and DOJ misconduct. The best defense is a good offense, so they attacked President Trump by maintaining the hoax.

Media people often forget, or perhaps -again- need to pretend not to know; however, the exact same group of FBI and DOJ staff level investigative officials that originated the Trump investigation in 2016, transferred into the Robert Mueller investigation in May 2017. It was the same people, doing the same investigation, under a different title. The Mueller team originally consisted of the same FBI officials who received the Alfa-Bank hoax material from Michael Sussmann. Andrew Weissmann and a group of 19 lawyers joined the effort and pulled in more resources. Yet if we are to believe the current narrative, you would have to believe those same investigators never talked to any Clinton campaign people, or Fusion GPS, or Rodney Joffe, or Marc Elias, or Michael Sussmann?… but wait, I mean, they did.. talk to Sussmann… because….. that’s what this trial is about….

WSJ op-ed

They wanted a special counsel.

• Sussmann Peddled Anti-Trump Claims To CIA After The Election (WT)

Hillary Clinton campaign lawyer Michael Sussmann peddled his false theories about former President Donald Trump to the CIA in the early days of the Trump administration, two former CIA officials testified Friday. Retired CIA officer Mark Chadason told jurors that he met with Mr. Sussmann for breakfast at a Northern Virginia hotel on Jan. 31, 2017, roughly two weeks after Mr. Trump had been sworn in as president. Mr. Chadason and another retired CIA officer known only as Kevin P. testified in the trial of Mr. Sussmann, who is charged with one count of lying to the FBI when seeking to spur investigations of Trump-Russia conspiracy theories. From the witness stand in a federal courtroom in Washington, Mr. Chadason testified that Mr. Sussmann said he was representing “an engineer with a number of patents” and “a Republican” who had some anti-Trump allegations.

He also described Mr. Sussmann as appearing “frustrated,” and threatened to take his claims to The New York Times if the CIA wasn’t interested. Prosecutors say Mr. Sussmann lied to the FBI in September 2016 when he told bureau lawyer James Baker that he was not representing any client as he turned over documents promoting a false story about Mr. Trump’s link to Russia’s Alfa Bank. The prosecutors accuse Mr. Sussmann of working on behalf of the Clinton campaign, saying he later billed the campaign for his time at the bureau. It is the first trial stemming from special counsel John Durham’s probe of the origins of the FBI’s investigation of Trump-Russia collusion to sway the 2016 presidential election. Defense attorneys say Mr. Sussmann didn’t lie and his connections to the Clinton campaign and the Democratic party were well known to the FBI and Mr. Baker.

After the FBI concluded the allegations were meritless, Mr. Sussmann then turned to the CIA, the officers said. Kevin P. testified that Mr. Sussmann met with him and another CIA officer, known as Steve M. in February 2017. He said that Mr. Sussmann said the Alfa Bank allegations came from “contacts,” not a client. Kevin P. told jurors that during the meeting, Mr. Sussmann noted his contacts with the Democratic National Committee, but made it clear they weren’t involved in the allegations. Mr. Chadason also said that Mr. Sussmann didn’t try to hide his ties to the Clinton campaign and DNC. He later wrote in an email to the CIA that Mr. Sussmann was a “partisan lawyer” and he wasn’t sure what “the real story is here.”

And there are Comey and McCabe…

• Baker Says FBI Investigated Sussmann Alfa Bank Claims: Nothing There (Fox)

The FBI found that “there was nothing there” after investigating the information brought to the bureau in September 2016 by Clinton campaign lawyer Michael Sussmann alleging a covert communications channel between the Trump Organization and a Russian bank, former FBI General Counsel James Baker testified Thursday. Baker’s testimony came on day four of the Sussmann trial – the first criminal trial stemming from Special Counsel John Durham’s years-long investigation into the origins of the Trump-Russia probe. Sussmann has been charged with making a false statement to the FBI when he told Baker in September 2016, less than two months before the presidential election, that he was not doing work “for any client” when he requested and attended a meeting where he presented “purported data and ‘white papers’ that allegedly demonstrated a covert communicates channel” between the Trump Organization and Alfa Bank, which has ties to the Kremlin.

Durham’s team alleges Sussmann was, in fact, doing work for two clients: the Hillary Clinton campaign and a technology executive, Rodney Joffe. Following the meeting with Baker, Sussmann billed the Hillary Clinton campaign for his work. Sussmann has pleaded not guilty to the charge. Baker testified Thursday that the FBI began an investigation into the Trump-Alfa Bank allegations, which lasted “several weeks, maybe a month, maybe a month and a half.” “We concluded there was no substance,” Baker testified. “We couldn’t confirm it. We could not confirm there was a surreptitious communications channel.” Baker added: “There was nothing there.” In testimony on Tuesday afternoon, FBI Special Agent Scott Hellman also said the data revealing the alleged covert communications channel between Trump and Russia that Sussmann brought to the FBI turned out to be untrue, and said he did not agree with the narrative.

Hellman testified that whoever drafted the narrative describing the DNS data was “5150,” and clarified on the stand that meant he believed the individual who came to the conclusions “was suffering from some mental disability.” Baker on Thursday did testify, however, that when Sussmann brought the allegations to him on Sept. 19, 2016, the FBI “was already conducting an investigation into alleged connections between the Trump campaign and Russians at this point in time.” Baker said he briefed then-FBI Director James Comey and then-FBI Deputy Director Andy McCabe on the Sussmann allegations shortly after they were brought to him. “Here was another type of information between Trump and Russia that had come to me,” Baker said. “It seemed to me of great urgency and great seriousness that I would want to make my bosses aware of this information.” He added: “I think they were quite concerned about it.”

“..the fact that the best Ukrainian troops surrendered to the Russian army represents a strong psychological blow to the entire Ukrainian army..”

• Azov Surrenders. Who Will Be The Sacred Martyr Now? (Milacic)

On the night of May 17, after brief negotiations, Ukrainian army units, blocked by Russian troops at Azovstal in Mariupol, began to surrender. Initially, it was announced that the Ukrainian military wanted to hand over to Russia their wounded whose condition in the cellars of a huge factory was hopeless. However, it soon became clear that the entire “Mariupol garrison” as the remnants of the nationalist volunteer regiment “Azov” and the units of the Ukrainian army that had joined it were called by the Kiev-controlled media, were laying down their arms. So, on the morning of May 17, 90 wounded soldiers were pulled out of the basements and were joined by more than 250 healthy, albeit exhausted and filthy fighters. In a few days, that number reached 2,500 Ukrainian soldiers.

That’s why we wonder, what fate awaits them and other members of the Ukrainian army who surrender to Russian troops? For President Zelensky and his team, Azovstal was a kind of a sacred symbol of Mariupol’s resistance. Many hopes were pinned on the Azov Regiment, considered a terrorist organization in Russia. First of all, those in Kiev believed that the nationalists would hold out to the end and die as heroes, especially since in Russia they face a trial. And they will be lucky if it is in Russia, because in the DPR, unlike in the Russian Federation, they have the death penalty. And still, the Azov fighters began to surrender. In the morning, Russian social networks exploded with indignation after it became known that the militants leaving Azovstal had negotiated a bunch of conditions.

No prosecution, priority exchange, no video footage and respectful treatment. The fuming Russian patriots soon calmed down though. First, because the video with the prisoners almost instantly appeared on TV channels, and second, the State Duma adopted an appeal demanding that new prisoners be carefully filtered out and all those involved in war crimes be brought to justice. In addition, the surrender negotiations went too quickly to discuss exchange conditions and other terms at the highest level. The heroes of “Azov” are also human and just want to live. Even behind bars. This creates very big problems for Kiev, though. The commanders of the Azov Regiment, Svyatoslav Palamar and Denis Prokopenko, two leaders of Ukrainian ultranationalists, also surrendered to the Russian army. In this way, they publicly humiliated all Ukrainian ideology.

Until yesterday, they were celebrated as immortal heroes, who swore that they would lay down their lives for Ukraine in the fight against the Russian occupiers. And despite all that – they surrendered to the Russian army. For official Kiev, only two options were acceptable. The first to liberate Palmar and Prokopenko, along with other Ukrainian soldiers. While the other option was “glorious death”. That is, Palmar and Prokopenko would die in the fight with the Russian army. That would enable Kiev to make Ukrainian anti-Russian heroes out of them. Thus, the fact that the best Ukrainian troops surrendered to the Russian army represents a strong psychological blow to the entire Ukrainian army, especially to the Ukrainian forces in Donbas.

Azov tattoos

Doohickey.

• Operation Z – Dumb Bombs Go To School (Sonar21)

Suppose you knew – to a really high degree of precision – what your altitude was, what your ground speed was, precisely where you were and where the target was. Imagine if you had a set of satellites up there that could tell you all these things. And you also knew a lot of other esoteric things (like the glide characteristics of your bombs) and you had the best possible weather information over your target. All this and every other scrap of information you needed. If you knew all this, and had a computer to work it out, then you could just drop your dumb bomb when the computer told you to and it would passively glide to the target. And that is what the Russians have done. Explained here with more detail but by now you have the idea. The Russian global positioning system – GLONASS – gives them the necessary data, the computer doohickey in the plane calculates and drops the dumb bomb at exactly the right time.

All the data inputs are known to a very high degree of accuracy. The bomb is just as dumb as it ever was but the doohickey on the plane makes it fall at precisely the moment when its dumbness doesn’t matter. For the American solution communication has to be continuous – break the link and Mr Smart Bomb’s IQ drops into single digits. For the Russians, it doesn’t matter – gravity and inertia will get Mr Dumbo to the target – fly in the general direction, push the button, let the computer do the work and forget it. Therefore, Russia doesn’t have any more dumb bombs because it’s figured out a way to make them all smart; and one thing Russia has learned from the World War 2 experience is that you can’t have too much ammunition – there are lots of bombs. But, maybe this is too complicated for our generals – computer game, whatever.

“Europe and Germany have been forewarned. They better know what they are doing.”

• Germans ‘Schwedt’ Hard For Russian Oil (Vilches)

Some may think that refinery feedstocks are like dog food, even interchangeable. Not true. Refineries are very closely matched and subtly calibrated/configured to very specific feedstocks difficult and time-consuming to substitute. Changes can and have been made but it requires lots of effort, money, dedicated facilities, experimentation, mistakes, trial & error, specific expertise, risk, and most importantly fixed, unchanging new feedstocks always complying with specs. Substituting the quality and humongous quantity of Russian oil feeds has never ever been attempted. This means that Russia today supplies Europe with exclusive Urals grades of very precise and constant homogenous physical & chemical characterization that would be impossible to get from third parties fast enough and cheap enough in continuous enormously large quantities from different reservoirs wherever. So it´s a very delicate and tight matching already achieved between Schwedt and the Russian Urals blend, that most probably cannot be substituted.

Banning Russian oil means many things. Some are known to require — among other things — time, money, expertise, human resources, etc.etc. But some others are unknown and very complex. For example, finding many new different oils – from many new unproven vendors – that collectively and in a coordinated fashion ( ?? ) would constantly offer into the future — rain or shine, come hell or highwater — the very same homogenized profile of delivery, quality, quantity, price, service and enlargeability of feedstocks that Russia has reliably provided Europe for decades at low cost. Anything less and Europe will no longer be or perform or deliver as we know it. Skeptics please easily find the 6 (six) criteria that such oil feedstocks mandatorily need to meet at Ref #11. Europe and Germany have been forewarned. They better know what they are doing.

“..that’s how Pfizer made cases of myocarditis and pericarditis disappear, by sweeping them under the rug of COVID-19..”

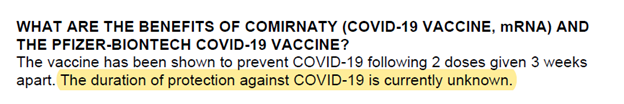

• Is Subject #12312982 the Key to Proving Pfizer Vaccine Trial Fraud? (JJ)

Subject # 12312982 in Pfizer study C4591001 is Augusto Roux, a 35-year old lawyer from Buenos Aires, Argentina who volunteered for Pfizer’s stage 3 trial of its COVID-19 vaccine (or whatever you want to call it) in order to protect his mother with emphysema. His story and some of the shenanigans surrounding the Argentinian trial site have been amply covered by Dr. David Healy in three sprawling but extremely important blog posts. The first one was published March 1st, but it was only last week that I caught on to this story, so I’m assuming most of you probably aren’t familiar with it. So please share this — we’ve got to get the word out, because Augusto Roux may very well hold the key to bringing down the Pfizer vaccine trial, or a least proving fraud at the largest trial site that was home to over 10% of the participants in the trial.

[..] On the way home after his second dose on Sept. 9, 2020, he began feeling unwell, developed a high fever and felt terribly ill until he fainted on Sept. 11 and finally went to the hospital on Sept. 12 (not the one where the trial was being run). They did a thorough work-up, including a CAT scan of his chest that showed an abnormal collection of fluid around the outside of the heart. Basically he had pericarditis. On Sept. 14, he was discharged. The doctor wrote in his chart that he had suffered an adverse reaction to the vaccine. Augusto was told by hospital staff they there had been a huge influx of people from the clinical trial coming to the hospital (there were 2,981 subjects enrolled in the trial before Augusto), so his experience was not new to them. (The trial site managed to enlist several thousand subjects in just a few weeks.) One nurse estimated they had seen around 300 people.

Now here’s where it gets really interesting, and we know all of this because Augusto, a lawyer, successfully sued to get his medical and trial clinical records, even though it took him over a year. Even though Augusto had a negative PCR test at the hospital, and even though the doctor at the hospital wrote that his condition was due to the vaccine, when Augusto called the trial site on Sept. 14 to notify them he was in the hospital, they wrote down in his clinical trial record that he had been admitted for a bilateral pneumonia that had nothing to do with the “investigational product” — even though that was not what he told them.

On October 7, the clinical trial notes that “at the request of the sponsor” (AKA Pfizer), the adverse event code was update to COVID-19 disease. And that’s how Pfizer made cases of myocarditis and pericarditis disappear, by sweeping them under the rug of COVID-19. Moreover, the diagnosis of COVID-19 would not count against the efficacy calculations, since those required a positive PCR test to confirm diagnosis.

No love lost for Rubio, but still insane.

• Rubio Accuses Google of Election Bias, Censoring Campaign Emails (ET)

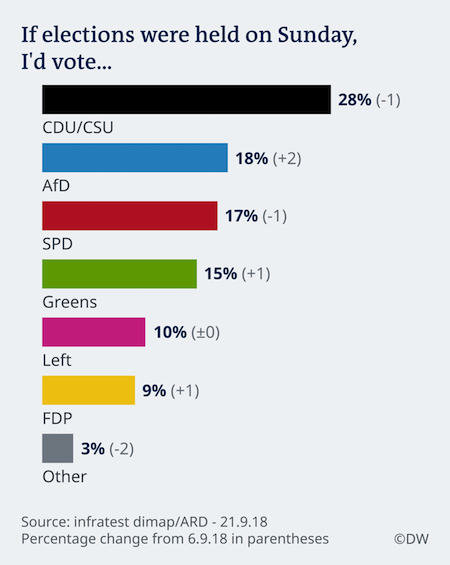

Sen. Marco Rubio (R-Fla.) is accusing Google of filtering his emails to supporters in the run-up to the midterm election this fall, describing on May 21 his current situation as being in “purgatory.” The Florida Republican said in a tweet that up to 90 percent of his campaign emails to supporters with a registered Gmail address never reach their inboxes but go to their spam folder. He said that has occurred since his likely Democratic opponent in the November general election, Rep. Val Demings (D-Fla.), announced a year ago she would run against him. “Marco Rubio for Senate is in @Google purgatory. Since a Pelosi puppet announced she was running against me, they have sent 66% of my emails to REGISTERED SUPPORTERS with @gmail to spam,” Rubio wrote on Twitter on May 21.

“And during the final weeks of finance quarters, it climbs to over 90%,” the post reads. Rubio, who is running for a third term in the U.S. Senate, is likely to face off against Demings, a former Orlando police chief, in Florida’s 2022 general election on Nov. 8. Ahead of the Sunshine State’s primaries on Aug. 23, the Republican senator holds a lead of 9 points over Demings in an average of polls among registered voters. Republicans filed a joint complaint on April 27 with the Federal Election Commission to investigate Gmail’s algorithm—which “makes it much harder for Republicans to reach their supporters” than Democrats and stifles GOP fundraising efforts—as claimed by researchers at North Carolina State University (NCSU).

Too much inventory?!

• Bullwhip Effect: Why Prices Are About To Fall Off A Cliff (ZH)

It was exactly a year ago, when Deutsche Bank strategist Luke Templeman said that amid the panicked scramble by US wholesalers to stock up on scarce inventory as a result of snarled supply chains, it was only a matter of time before the US economy was roiled by a “bullwhip” (or whiplash) effect. Some details for those unfamiliar with this concept: the bullwhip effect occurs when a drop in customer demand causes retailers to under stock. In turn, wholesalers respond to a lack of retail orders by understocking themselves. That then causes manufacturers to slow production. Eventually the reverse occurs. As customer demand comes back, retailers quickly order more goods, often too much, and wholesalers and factories are caught short. Shortages occur, prices increase. Eventually production ramps up at levels that are far beyond equilibrium levels and this cascades down the chain. These violent swings in availability of goods then continue back and forth until an equilibrium is eventually established.

Last May, the beginning of the bullwhip effect was seen in the way retailers and wholesalers managed their inventory levels since the outbreak of covid. Specifically, retailers kept a supply of inventory at a relatively constant level, above that of wholesalers. As covid hit, supply chains from Asia were cut which caused a fright amongst retailers in the West who immediately began to put in orders for more inventory. A whole lot more of it. Subsequent lockdowns saw demand plummet and inventories along with it. In both cases, the actions of wholesalers followed those of retailers by a month or so. In the context of a starting bullwhip effect, Templeman’s conclusion was accurate: “As inventory levels have fallen to multi-decade lows at retailers, there are likely many businesses that will not have enough inventory to satisfy customers as economies recover and pent-up demand is unleashed. This is particularly the case as retailers are far more reliant on just-in-time supply chains than they were in decades past.”

Gold.

• How the United States Conquered Inflation Following the Civil War (FEE)

According to the most recent polling data, the American public’s approval of Congress stands at a dismal 21 percent. Almost four times as many people disapprove of the job it’s doing.That’s par for the course in recent decades. It’s the major reason the Washington sausage grinder earns so little praise. To be fair, though, let’s review an occasion when lawmakers got something right. I’m prompted to share this story now because its lessons are especially relevant considering today’s concerns about rising price inflation. The year was 1875. The Civil War (1861-65) produced a disastrous hyperinflation in the Confederacy and considerable currency depreciation of paper greenbacks in the North as well.

A decade after Appomattox, Congress still had not made good on its promise to make its paper money redeemable in gold. But in January 1875, alarmed by the rise of pro-inflation agitators (the “greenbackers,” later to become “silverites”), Congress passed the Specie Payment Resumption Act, which President Ulysses S. Grant later signed into law. Politicians often break their promises, and this was yet another opportunity to do so. Congress could have declared, “We don’t have the gold necessary to honor our pledge, so we’ll pay gold for greenbacks at 50 cents on the dollar.” But lawmakers chose to be honest for once, and to meet their obligations fully. The Act provided that all paper greenbacks would be redeemable on demand “at par” (100 percent of the earlier promise), beginning on January 1, 1879.

When Rutherford B. Hayes succeeded Grant as President in March 1877, he knew his administration had less than two years to prepare the Treasury and the nation’s banks for redemption. He and his Treasury officials believed the best way to avoid a run on the banks in January 1879 was to shore up the country’s gold reserves. They did so largely by selling bonds to Europeans in exchange for gold. Redemption Day came amid rumors that people would flood the banks with their paper greenbacks and demand the promised gold, but just the opposite happened. Hardly anybody showed up at bank teller windows asking for the yellow metal. Why? Because the Treasury had accumulated more than enough gold to take care of convertibility, and the public knew it. The lesson? When people have good reason to believe their paper money is “as good as gold,” they prefer the convenience of paper.

Former United States Circuit Judge Randall R. Rader writes, “The year 1879 brought the resumption of the redeemable currency. The consumer price index stabilized at 28 in that year. For more than three decades thereafter (World War I interrupted the price tranquility), the index never rose above 29 or dipped below 25. The index remained at 27 for a decade. Never did it rise or fall more than a single point in a year. The gold standard worked throughout that entire period to keep prices remarkably stable.”

There will be more court hearings.

• Pressure Mounts on Patel Over Assange Decision (Lauria)

At some point during the next nine days, British Home Secretary Priti Patel will decide whether or not to extradite imprisoned WikiLeaks publisher Julian Assange to the United States to face espionage charges for publishing accurate information revealing U.S. war crimes. Pressure is building from both sides on the home secretary. Press freedom and human rights organizations, a Nobel laureate, the Council of Europe’s human rights commissioner, journalists and Assange supporters have appealed to Patel to let Assange go. While it would be deemed improper for outside influence to be brought on judges, it would not be fanciful to imagine that behind the scenes Patel is getting the message from the U.S. Department of Justice and possibly from U.S. and U.K. intelligence services about what is expected of her.

The home secretary should know without prodding what the U.S. and British governments want her to do. Patel is a highly-ambitious politician who no doubt will calculate how her decision will impact her career. “Politicians think about their next election, they think about their voters … that’s what makes them tick,” Kristinn Hrafnnson, WikiLeaks editor-in-chief, told Consortium News at a protest outside the Home Office in London last Wednesday. “For the first time it’s in the hands of a politician, and Priti Patel, if she wants to think about her legacy … she should do the right thing.” “Politics is a strange beast,” Hrafnsson said. “Anything can happen. I’m hoping this is something that will be taken up in the Cabinet here. Let’s not forget that Boris Johnson was a journalist. He was part of the media community and should have better understanding of this case than many others.”

Patel is acting after the U.K. Supreme Court refused to hear Assange’s appeal of a High Court decision to overturn a lower court ruling barring Assange’s extradition on health grounds and the danger of U.S. prisons. The High Court decided solely on conditional U.S. promises that Assange would be well treated in custody. With the courts no longer involved and the decision solely in Patel’s hands, the case now is purely political, meaning political pressure can be brought to bear on the home secretary. “The home secretary has the discretion to block this extradition, and there is a lot of pressure from civil society and press freedom groups for her to do so,” said Stella Assange at film screening on Thursday.

If Patel decides to extradite Assange it’s not the end of the legal road for Assange. He has the option of launching a “cross” appeal to the High Court. Though he won in magistrate’s court on health grounds and the condition of U.S. prisons, the judge ruled on every other point of law in Washington’s favor.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.