Russell Lee Love Shack, South Side Chicago April 1941

I’m not going to argue here that a market collapse would be a positive thing no matter what, because the implications of a true collapse would be so deep and widespread that they’re too hard for anyone to oversee. But having said that, truth finding and price discovery are crucial for a functioning economy, and there is not a shred of truth left in the markets nor is it possible to discover anything about any price as a free market would have set it. And that means there’s no trust or confidence left in markets, there’s only a shaky trust in authorities propping them up. Neither of which can last forever.

What are stocks truly worth, what is a fair prices for a home, or a plot of land, an hour’s work, or a year’s crop? Is it what they were valued at in 2006, pre-crash, or in 2010, post-crash, or today in 2014? We can’t really answer that question (which is bad enough), but we can surmise that valuations have been distorted to an extensive degree by all sorts of government measures to stimulate economies and by central banks inserting freshly not-even-minted amounts of what some insist is money and others insist absolutely isn’t, into essentially broke banks, pretending they expect it to trickle down.

And that’s not all. The biggest banks in Japan, the US and Europe (and don’t get me started on China) have been declared “systemic” or too-big-to-fail, a status which absolves them from having to expose their debts to daylight. That means the shares in these banks are of necessity overvalued, and potentially by a lot, because if there were no such losses fermenting away in their vaults, they would be very eager to prove they have no foul smelling debt, since that would greatly boost their – perceived – trustworthiness. We know, therefore, that those bad debts, gambling losses, still exist, in all likelihood a lot of them, and all over the place. We’re talking many trillions of dollars.

And that’s not all either. Since stimulus measures on the one side and the refusal to uncover debts on the other have propped up asset prices to the extent they have, it’s not just the banks’ assets, but everybody else’s assets that are overvalued too. Yes, that includes yours. Not only the shares you may own in a bank or some other company, but also your home, and potentially even your job, it’s all overvalued. In other words, the perceived value of your assets is as distorted by government interference, executed with credit that uses your children’s labor as collateral, as a too-big-to-fail bank’s assets are.

The obvious reaction to realizing that your assets are overvalued, and possibly by a lot, is to think: let them keep going as they are, or I would risk losing my investments, the home my kids grow up in, and maybe my job. However, while running an economy on credit can be useful up to a point, when that credit becomes really zombie money, everyone starts paying a price, and the more there is of it, the higher that price becomes. The difference between credit and zombie money, as thin as the line between them may seem at times, is actually quite easy to discern: the former, if limited to productive purposes, allows for price discovery, while the latter makes it impossible.

Perverted markets give birth to perverted asset valuations. So who wants perversion? Well, the people who own the assets. People like Jamie Dimon, and you. Those who don’t like them – or shouldn’t if they were aware of what’s going on – are the young who can’t get a decent paying job, who can’t find a home to buy or even rent, who have a fortune in student debt hanging around their necks, and who therefore can’t start a family. Plus of course the weak, the needy and the old who rely on fixed income.

Governments and central banks shouldn’t interfere in markets in ways that make it impossible to know what anything is really worth. They should let banks that have too many debts go bankrupt and be restructured; that’s actually a very fine task for a government: to make sure that things are handled fairly, and with no negative impact on their people. But what we see is that this picture has been put upside down: governments seek to make sure that there’s no negative impact on their banks, and use their people’s present and future wealth to achieve that.

But why protect banks? What’s so important about them? Is it that they hold people’s money? That’s easy to get out first in case of a default, before anything else, and to guarantee. Granted, that might also lead to some price distortion, but not anywhere near what we see now. The secret ingredient here is of course that banks create credit/money every time they write a loan, but there’s no real reason why banks should do that, not governments, that set-up has no benefits for society, only for bankers and their shareholders.

I can write and think and philosophize about this for a very long time, and I do find it interesting, but eventually I always wind up at the same point, and that does sort of take the fun out. That is, the road we’re on now is not infinite, and there’s a cliff at the end of it. It always leads back to the value of real things that real people have produced with real work, and the fact that in today’s economy, that sounds almost like a – perhaps cruel – joke. The value of what you and I can produce with our own hands, guided by our own brains, is diminished to a huge extent by the zombie money that can place higher values on things that are achieved by flicking a switch, stroking a keyboard, or just let machines to the whole thing.

It’s one thing to make our work lighter, easier, or enhance our productivity. It’s another to replace it with something else altogether. And then pump central bank zombie money into raising the value of what has just replaced us. Even if we would all have access to all new technologies, you would have to seriously question their value, but once there’s only a select group that has that access, and on top of that it’s got access to public coffers, the only way for society itself is down. And the only way to restore a society’s core values, not as they are perceived today but as they truly are, is to cleanse the economy and the financial system of what distorts and perverts the ability to assess asset values. Which happens to be our own government and central bank’s interference in the financial system.

A collapse of the markets is going to come no matter what. They won’t be able to live forever on a diet of bad debt propped up by central bank zombie money, laid out on a bed of bad faith. And when it happens, sure, it’s going to hurt you, and probably a lot. But then, the sooner it happens, the less it will hurt your children. Isn’t that worth trying to understand why a market collape would be a good thing?

As long as you don’t recognize the influence of velocity of money on inflation, you’re, like Abe, lost in the woods.

• Abenomics Doomsday Machine Crushes Japan’s Middle Class (TPit)

The wonders of Prime Minister Shinzo Abe’s economic religion, touted with blinding exuberance around the world, are coming home to roost. And they’re whacking the hapless Japanese middle clareligion of Japanese Prime Minister Shinzo Abe and his ilk whose “bold” and “courageous” actions have been touted with blinding exuberance around the world, are coming home to roost. And they’re whacking the hapless Japanese middle class from all sides. Japan has two inflation measures: the nationwide index and an advance index for the 23 wards of Tokyo. The nationwide index, released today, was compiled based on prices in March, just before the April 1 consumption-tax hike from 5% to 8%.

And it bit into Japanese wallets: the “all-items index” rose 1.6% from a year ago, with services up 0.7% and goods up a stiff 2.6%. But the Tokyo index covers prices in the current month. It’s an indicator of things to come nationwide, as the consumption-tax hike began infiltrating prices in April. It wasn’t pretty. Businesses have been reluctant to add the additional three percentage points to prices of services and have been eating part of it. Service prices, such as haircuts, rose “only” 1.6% in April year over year. But the all-items index, which includes goods and services, rose 2.9%, the all items less imputed rent index 3.7%, and the goods index a red-hot 4.7%.

“All of this must seem counterintuitive to foreign audiences”, says he. Is it perhaps counterintuitive to Americans that it doesn’t?

• The American Dream Is Now Just That For Its Middle Class: A Dream (Observer)

While a majority of Americans tenaciously continue to hold dear to the American Dream – that long-standing American ideal that if you work hard anything is possible – more and more people are reporting that the opportunity for social advancement feels increasingly out of reach for them and their children. Indeed, it is hard to think of a more disquieting trend in American society than the fact that those in their 20s and 30s are less likely to have a high school diploma than those between the ages of 55 and 64. All of this must seem counterintuitive to foreign audiences. The US swaggers along on the world stage with a certainty and sense of moral purpose that no other country can match.

Blessed with practically limitless national resources, a dynamic and diverse population, a relatively stable political system and innovative technological capabilities that other nations can only dream of, how can so many Americans be falling behind – and how can the nation’s leaders allow it to happen? The answer is disconcertingly simple: we chose this path. Granted, no one actively set out to attack the middle class in America. There wasn’t some evil plan hatched behind closed doors to wreak socio-economic havoc. But the decline of the American middle class, the ostentatious wealth of the so-called 1% and the crushing economic anxiety of the growing number of poor Americans have happened in plain sight.

It is the direct result of a political system that has for more than four decades abdicated its responsibilities – and tilted the economic scales toward the most affluent and well-connected in American society. The idea that government has an obligation to create jobs, grow the economy, construct a social safety net or even put the interests of the most vulnerable in society above the most successful has gone the way of transistor radios, fax machines and VCRs. Today, America is paying the price for that indifference to this slow-motion economic collapse.

Wherever there’s a penny to be made …

• Speculators Short Small Caps Most Since 2004 Russell Drop (Bloomberg)

Money managers are turning on stocks that have delivered the best returns during the bull market: small caps. Large speculators such as hedge funds are betting $2.8 billion this month that the Russell 2000 Index will fall. That’s the most since 2012 and the highest versus average levels since 2004, according to data compiled by Bloomberg and Bank of America Corp. The about-face from a year of bullish wagers coincides with lackluster performance. The gauge of the smallest companies stands 7.1% below its 2014 high, trailing the recovery that has put the Standard & Poor’s 500 Index within 1.5% of a record.

Companies from KapStone Paper & Packaging Corp. to Cardtronics Inc. have climbed 20 times more than the S&P 500 since March 2009 amid faster sales and earnings growth. That’s also made them expensive. Valuations in the Russell 2000 rose above levels from the 1990s technology bubble. While small-cap shares are usually the first to benefit when economic growth picks up, the selloff reflects a loss of faith by professional investors in the five-year equity rally. “Small-cap stocks are the most expensive I’ve ever seen them, and I’ve been doing this for 20 years,” Eric Cinnamond, manager of the $724 million Aston/River Road Independent Value Fund, said in an interview from Louisville, Kentucky. “There’s a lot of junk in the Russell 2000. If you’re a hedge fund, you’re seeing people starting to sell things like Netflix and Facebook and the biotechs, and a nice way to sell risk is to sell the Russell 2000.”

Perverted markets give birth to perverted valuations.

• Treasuries Irresistible to America’s Banks Awash in Record Cash (Bloomberg)

America’s banks are regaining their appetite for U.S. government debt. After culling Treasuries and bonds issued by federal agencies last year for the first time since 2007, commercial lenders such as Bank of America have boosted their holdings every month this year, Federal Reserve data compiled by Bloomberg show. Banks now own $1.85 trillion of the debt, within 2% of the record amount held at the end of 2012. With a lackluster job recovery and higher mortgage rates damping loan growth, banks are tapping record deposits to plow more money into government debt as regulations designed to limit risk-taking take effect.

The demand helps explain why Treasuries are rising from the deepest losses since 2009, confounding forecasters who foresaw declines as a strengthening U.S. economy prompted the Fed to cut back its own bond buying. “The economic situation is still not fully bared out and they have to do something with their cash,” Jeffery Elswick, director of fixed-income at Frost Investment Advisors, which oversees about $5 billion in debt securities, said. “Banks have been big buyers of Treasuries. They need safe assets.” Treasuries have returned 2.2% this year, rebounding from a 3.4% loss in 2013. The longest-dated government debt has rallied the most, with 30-year bonds surging 10.8% in the best start to a year since at least 1988, index data compiled by Bank of America Merrill Lynch show.

Canada’s the land of frozen milk and honey.

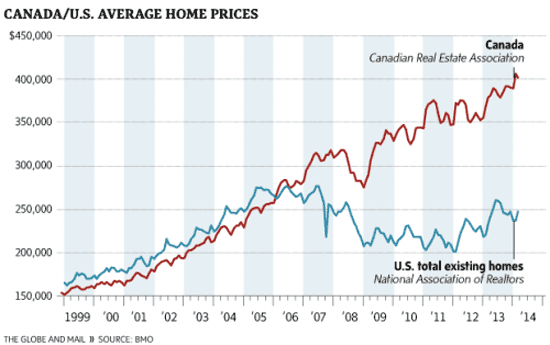

• The Canadian Housing Bubble Puts Even The US To Shame (Zero Hedge)

Since the bursting of the first US housing bubble in 2007, one of the primary explicit goals of the Fed has been to reflate the very same housing bubble (whose pop, together with the credit bubble, nearly wiped out the western financial system) as housing, far more than stocks, is instrumental to the “wealth effect” of the broader population (as opposed to just the 1%). Sadly for the Fed, instead of recovering previous highs, median housing prices (not to be confused with the ultraluxury high end where prices have never been higher) have stagnated and are now in the downward phase of the fourth consecutive dead cat bounce, curiously matching a like amount of Fed monetary injection episodes.

But while the Fed has clearly had a problem with reflating the broader housing bubble, one which would impact the middle class instead of just those who are already wealthier than ever before thanks to the Russel 200,000, one place which not only never suffered a housing bubble pop in the 2006-2008 years, but never looked back as it continued its diagonal ‘bottom left to top right’ trajectory is Canada. As the chart below shows, the Canadian housing bubble has put all attempts at listening to Krugman and reflating yet another bubble to shame.

Junk, zombie, and then nothing.

• Biggest Credit Bubble in History Runs Out Of Time (TPit)

It has been a feeding frenzy for junk debt. Yield-desperate investors, driven to near insanity by the Fed’s strenuous interest-rate repression, are holding their noses and closing their eyes, and they’re bending down deep into the barrel and scrape up even the crappiest and riskiest paper just to get that little extra yield. Last year, highly leveraged companies issued $1.1 trillion in junk-rated loans. It’s a white-hot market. Leveraged-loan mutual funds – dolled up in conservative-sounding names and nice charts to seduce retail investors – gorge on these loans. They saw 95 weeks in a row of inflows, week after week, without fail, adding over $70 billion to their heft, as Bloomberg reported, and only the sky seemed to be the limit. But suddenly, that endless flow of money reversed. “It’s going to be a disaster on the way out,” Mirko Mikelic, who helps manage $7 billion in assets at ClearArc Capital, told Bloomberg. “On the way in, there’s insatiable demand….”

Private equity firms have been ruthlessly taking advantage of that “insatiable demand.” And they have a special self-serving trick up their sleeve: Their junk-rated overleveraged portfolio companies issue new loans, but instead of using the funds for expansion projects or other productive uses, they hand them out through the back door as special dividends. It’s one of the simplest ways PE firms use to strip cash out of their portfolio companies. It loads even more debt on the already highly leveraged portfolio company without adding productive capacity. And those who end up holding this debt – for example, the mutual fund in your portfolio – have a good chance of losing it all. “It’s kind of like an epidemic,” explained Martin Fridson, a money manager at Lehmann, Livian, Fridson Advisors LLC, in an interview with Bloomberg. “Once an investment banker sees that, he’s going to go to his clients and say, ‘Here’s a window of opportunity, you can take a dividend and get away with it.’”

Letters of credit run the economy. Run them out of town and you have a very big problem.

• The Scarlet Absence Of A Letter Of Credit (Mark St.Cyr)

If there’s one thing we all know about banks and bankers: they love to tell tales in public of how much they value their customers. However, what you’ll never hear them profess in private: is how much they trust them. Although one may think that’s unseemly, believe it or not there is another entity banks hold at an even lower tier. Other banks. One of the known facts people remember about the melt down in 2008 (as opposed to general public) was when the banks no longer trusted each other, and what they earlier claimed was “collateral” wasn’t actually worth what it was stated to be.

Credit default spreads (CDS) were supposedly the insurance to negate valuation concerns. But when the banks felt CDS weren’t worth the paper they were written on, not only did they operate in a fashion reminiscent of cutting their noses off to spite their faces, but rather they began cutting visible ties (and/or appendages) to other banks. The blinding issue with all that took place during that period is the speed in which it all took place. Once it seemed one bank (regardless of size) was not going to be able to make good on a promise of clearing, near overnight the banks regarded any and all collateral at a discount.

This fed on itself to where even once valued pristine collateral such as hard materials let alone paper began to be not only discounted, but prices slashed at such discounts that would make a blue light special at K-Mart™ blush. So when I read the following article on Zero Hedge™: How China’s Commodity-Financing Bubble Becomes Globally Contagious. My blood ran cold. The implications of this development and the consequences it portends just might make it the proverbial “canary in a coal mine.” The underlying issue that makes this far more dangerous or different from times past is three-fold.

First: The idea of the need to send a perishable product overseas to another country that operates in a differing court system without the only document that gives one a chance of a “guarantee of payment” is not something to be taken lightly. As a matter of fact, it should be looked upon as a move of desperation. Second: If that commodity is both a readily needed or used product, the immediate resale by the receiving party (especially if they themselves are in trouble) may sell it off at a steep discount. And yes, I’m implying less than what they are being billed for.

For if the receiving party needs cash, and you don’t have anything backing payment, i.e., Letter of credit (LOC.), than it’s free money to do with as they please until you can get them into court – if you can at all. Why would one pay full price (or even think they should) when pennies on the dollar will now be the opening settlement offer in any negotiations? Third: The commodity itself is well-known, and has been publicly reported as being used as a collateral for cash strapped real estate developers in China. This last point is probably the most troubling of them all, and where the real issues might come about.

Yeah, sure.

• EU Stress Test Features Bond Rout, Eastern Europe Shock (Bloomberg)

The strength of Europe’s banking system is about to be tested against a fictional doomsday scenario that includes a global bond rout and a currency crisis in central and eastern Europe. The three-year outlook features “the most pertinent threats” to the stability of European Union banks and their potential impact on entire balance sheets, according to a draft European Banking Authority statement seen by Bloomberg News. The EBA is due to release the details tomorrow in coordination with the European Central Bank.

As the ECB prepares to take over supervision of about 130 euro-area lenders from BNP Paribas to National Bank of Greece starting in November, policy makers have chosen to reflect real-world developments like the tensions over Ukraine in a bid for more credibility in the toughest stress tests to date. Similar exercises in 2010 and 2011 were criticized for failing to uncover weaknesses at banks that later failed. “The negative impact of the shocks, which include also stress in the commercial real estate sector, as well as a foreign exchange shock in central and eastern Europe, is substantially global,” the draft statement said. “For most advanced economies, including Japan and the U.S., the scenario results in a negative response of GDP ranging between 5%-6% in cumulative terms compared to the baseline.”

Again: Yeah, sure.

• US Prosecutors Take Forex Probe To London (FT)

US criminal prosecutors have flown to London to question individuals as part of their probe into the alleged rigging of foreign exchange rates in a sign that the stakes are getting higher for the traders involved in the sprawling probe. The Department of Justice, in its first significant move since announcing in October that it would investigate alleged manipulation of the $5.3tn forex market, invited several UK-based currency traders “on the periphery” of the investigation to attend voluntary interviews in London rather than the US, according to three people familiar with the department’s tactics. The UK financial regulator also requested attending the interviews. The first wave of interviews took place in London at the beginning of the year but more are planned, the people said.

But in a move that underscores the complexity of co-ordinated international probes with both regulatory and criminal elements, the UK’s Financial Conduct Authority told the traders that for the FCA’s purposes, the proceedings would be under so-called compelled conditions, one of the people said. The FCA has powers to compel people to answer questions with no right to silence, while the US constitution includes a protection against self-incrimination. Evidence gathered by the FCA under compelled conditions then becomes problematic for US authorities to use. Material gleaned from FCA-compelled interviews cannot be used directly by UK criminal authorities either, unless individuals lied to the regulator during questioning.

Let’s see the true losses.

• Fannie-Freddie Fate Hangs on Senate Action This Week (Bloomberg)

A U.S. Senate plan for Fannie Mae and Freddie Mac, the most thorough yet for winding down the two mortgage financiers, faces a first test this week with its authors making last-minute changes to gather more support. The 22 members of the Senate Banking Committee will decide as early as tomorrow if the bill, the culmination of more than a year of delicate negotiations among Democrats and Republicans, gains momentum or fizzles. The legislation would replace the companies over five years with federal insurance for mortgage bonds that would kick in only after private investors were wiped out. Current shareholders of Fannie Mae and Freddie Mac would be in line behind the U.S. in getting any compensation from the wind-down.

To keep the bill from stalling, committee leaders are trying to win over at least a few of the half-dozen Democrats on the panel who haven’t publicly embraced it. They have proposed changes including ones that would prevent big banks from monopolizing the mortgage business and add stronger protections for lending in disadvantaged communities. An impasse would leave the two companies operating indefinitely under federal control without resolving the status of their privately owned shares. “This might be the only real chance this decade we have to achieve reform,” U.S. Housing and Urban Development Secretary Shaun Donovan said during a speech in New York last week. “Let’s not waste it.”

• Liars, Damned Liars, and Spanish Banks (TPit)

As Spain takes yet another giant step towards full recovery, its creditors and investors can rest assured that they’re backing the right horse, and Spanish businesses and families might finally begin getting the credit they need to get back on their feet. Well, at least that’s the official story. On the QT and off the record, it’s a bare-faced lie, a cynical deception masking a much bleaker reality — one consisting of the following four features:

1) A Deepening Credit Drought. Despite the quite literally countless billions of euros that have been ploughed into Spain’s financial sector, businesses are still not getting the credit they need. In fact, during 2013 total bank credit in Spain plunged more than 7%. What’s more, it’s a trend that continues to deepen, leaving in its wake a vast trail of defunct not-quite-too-big-to-fail businesses.

2) Total Dependence on Life-Support. To date, Spanish banks have received a total “official” bailout of more than €100 billion in transfers, guarantees, and credit lines – more than double the 40-or so billion-euro figure that is usually cited by authorities. Roughly two-thirds of that money has come from public accounts while the other third comes from Spain’s Deposit Guarantee Fund – that is, money that is ostensibly meant to protect customer deposits, not the banks that “hold” them.

According to more extreme estimates, the total bailout figure could be well in excess of €200 billion (roughly 20% of GDP). To cut a long story short, the banks have received anywhere between 100 and 220 billion euros in capital injections, asset swaps and government guarantees over the last few years. And thanks to the wonders of financial engineering, they can now declare a supposed €7 billion profit without making a single mention of ever returning the tens of billions of euros they “borrowed” from the public coffers in 2013.

3) Bad Bank, Really Bad Bank. Much of the so-called “cleansing” of Spain’s financial sector has involved lifting radioactive debt off the accounts of all of Spain’s banks – including the “good” ones – and burying it under the floorboards of Spain’s “bad bank”, the publicly owned Fund for Orderly Bank Restructuring (FROB). To begin with, taxpayers were sold the idea that they were going to make money from the “bad bank”. It turned out to be another lie and two years on, the FROB is bleeding money like a stuck piggy bank (€37 billion at last count). Indeed, as Mike “Mish” Shedlock recently reported on his blog, so grave is the situation that the Spanish government is even considering setting up a new “bad bank” for the sake of burying the overflowing toxic debt in its current “bad bank”.

A 3-part series from the Observer that leaves little to the rosy imagination.

• In Andalucía, The Poor And Jobless Have Little Faith In A Better Mañana (Observer)

As a destination it conjures images of beaches, whitewashed villas and endless olive groves. The sun shines as brightly as ever in Andalucía, but behind the brochure image lie poverty, soup kitchens and a growing sense of desperation. According to new data produced by Eurostat, the EU’s central statistics agency, the five worst unemployment black spots are all in Spain, and the blackest of them all is Andalucía, where one in three people are out of work. Back in 2007, Spain was building more homes than Germany, France and the UK combined, the majority of them on or near the coast.

When the property bubble burst in Andalucía – which stretches from the city of Almería in the east all the way to the Portuguese border and has a population of more than eight million – it was like a cluster bomb exploding: few escaped unscathed. Despite the seven million tourists who visit Andalucía every year – soaking up the sun on the Costa del Sol or culture and history in Seville, Granada or Córdoba – the combined effects of the end of the boom and a moribund national economy have hit the region hard. The extent of the jobs crisis is not as obvious here as it is in Madrid or Barcelona.

There are the beggars and assorted hawkers who have appeared in every Spanish town in recent years, but there are fewer people sleeping in doorways and the vestibules of banks. Many of the ancient city centres seem prosperous. The bars of Málaga are buzzing and the trade is mostly locals, not tourists. Yet last year the Catholic charity Caritas spent €2.6m on food for vulnerable families in Málaga alone, up nearly a quarter on the previous year, and the regional government has begun distributing breakfast and afternoon snacks to 50,000 schoolchildren.

• Spain’s Borrowing Costs Are Down, But Unemployment Rate Isn’t (Observer)

Unemployment is at crisis levels, but there are signs that Spain is turning a corner. After four torrid years characterised by soaring numbers without work and a crumbling banking system, demand for Spanish debt is suddenly buoyant. Last week Madrid borrowed €5.6bn on the international markets and the tranche that was lent for 10 years cost little more than 3%. This is less than half the cost of its borrowing at the height of the eurozone crisis – when international investors were shunning Spanish government bonds and yields soared over 7.5% – and only a fraction more than the 2.6% the UK pays on its debts.

Then there are the figures showing loan rates to small- and medium-sized businesses have fallen sharply. Lower loan rates could be connected to the improved situation in Spain’s banks, some of which reported last week that the number of distressed loans on their balance sheets had shrunk, especially mortgages on commercial property. Investors, toying with putting money into the country, are more confident that promised structural reforms are filtering into the real economy. Ratings agencies note Bank of Spain’s forecast for growth in the first quarter of this year – a solid 0.4%. Annual growth should top 1%. They are also confident the country can slowly close its large output gap, which will translate into falling unemployment and rising productivity.

And yet Mariano Rajoy’s administration, for all its vigour and business-friendly policies, is cited as one of the main reasons the European Central Bank (ECB) is expected to begin quantitative easing – in effect printing money – possibly within months. Like France and Italy, Spain is suffering from austerity. Combined with a vigorous campaign of wage cuts, this has reduced demand. While exports have become more competitive, workers have little spare cash to spend in the nation’s shops. Wages are expected to rise a little, but with plentiful labour and inflation at 0.5%, why would employers need to bargain?

• Foreign Buyers Delight In The Glut Of Spain’s Cheap Costa Properties (Observer)

Although hundreds of Spanish families are still being evicted every day for defaulting on their mortgages, foreign buyers have returned in force to the country’s depressed property market. New data from the Bank of Spain last week showed that foreign purchases in 2013 exceeded €6bn (£5bn) for the first time since 2004. According to Knight Frank’s Global Property Search, online searches for properties in Spain increased by 29% over the first three months of 2014 compared with the same period in 2013. More than a fifth of all Spanish residential sales – 55,187 transactions – were to foreign buyers.

“Foreigners are the only dynamic segment of the market today,” says Mark Stucklin of Spanish Property Insight. “These are people buying on the coast and in cities like Barcelona.” And it is not just private buyers, he says: institutional investors are also in the market. “The likes of Goldman Sachs, JP Morgan, Blackstone, George Soros and Bill Gates are all getting into Spanish real estate.” Some institutional investors are buying in bulk from Sareb, the so-called “bad bank” that has acquired thousands of unsold properties from failed Spanish banks and building societies. The bank controls about 200,000 property assets – homes and developments – and it is selling houses at a rate of 60 a day. Sareb is now implementing a new strategy for marketing and selling the €50bn in real estate under its control, which could create yet further opportunities for international investors, says Stucklin.

“HSH Nordbank reported €9 billion of bad shipping debt, or about 43% of its loans to the industry … ”

• German Shipping Swamped in Debt Underscores Bank Risk (Bloomberg)

As it tries to clean up the region’s banks, the ECB is taking a closer look at whether they need more capital to absorb possible losses on loans like Robrahn’s. Shipping loans are among the riskiest assets on banks’ balance sheets and among those most prone to misstatement, an ECB spokeswoman said. German lenders including Hamburg-based HSH Nordbank, Commerzbank and Norddeutsche Landesbank Girozentrale controlled about one-third of the $475 billion global ship-finance market at the end of 2012, according to Swen Metzler, an analyst at Moody’s Investors Service in Frankfurt.

The three lenders set aside more than €3.6 billion in provisions for bad shipping debt in the past three years after dozens of firms in Germany’s 1,543-container-ship market, the world’s biggest, were hurt as overcapacity and an economic slump pushed down cargo prices the most since the 1970s. [..] The ECB, which began auditing 128 banks in February and takes over as Europe-wide regulator in November, is investigating whether executives are fully reporting the riskiest loans and whether ships such as Robrahn’s Anna Sirkka, a 135-meter container vessel built in 2006, are still valuable enough to use as collateral.

“German shipping banks’ two biggest concerns at the moment are whether they get their money back and whether they need to boost capital to support their risk exposure,” Lars Heymann, partner at a unit of auditing and consulting firm PKF Fasselt Schlage, whose clients include shipping companies, said in an interview at his office in Hamburg. HSH Nordbank reported €9 billion of bad shipping debt, or about 43% of its loans to the industry, in fourth-quarter earnings published April 10. Nonperforming shipping loans at Commerzbank, Germany’s second-biggest bank, amounted to about €3.9 billion at the end of 2013, or 27% of its lending to the maritime industry, according to the company.

• US Failing To Push Economic Sanctions Against Russia Through EU Allies (RT)

The new round of sanctions against Russia, which the EU and the US plan to unveil Monday, will not target the Russian economy. Washington said it won’t use economic sanctions without the EU also signing up to them. G7 members agreed Friday to roll out a third round of anti-Russian sanctions over the Ukrainian crisis. But those would be an extension of the previous two rounds of sanctions, which targeted 33 individuals in Russia and Ukraine and a Russian bank, which the Western government deemed responsible for the crisis in Ukraine or close enough to President Vladimir Putin to have leverage on him.

“What we will hear about in the coming days, what we will agree … is an expansion of existing sanctions, measures against individuals or entities in Russia,” UK Foreign Secretary William Hague told Sky News on Sunday. The new round will slap travel bans and asset freezes on 15 more people, according to numerous insider reports. But it’s unlikely that they would have any greater effect on Russian policies than the sanctions already in effect. If anything, so far sanctions against the officials have only resulted in mocking calls from Russian MPs, politicians and ordinary citizens to add their names on the blacklists.

Imposing sanctions on some sectors of the Russian economy, which could actually hurt the country, remains an elusive goal for Washington. At the same time America, whose economic ties with Russia are mediocre at best compared to Europe’s, is unwilling to act alone. Otherwise, it would appear that there is conflict between Russia and the US, not Russia and the world, a narrative that Washington is struggling to promote.

• Living Behind The CNN Curtain (Max Keiser)

Good Bye, Lenin! is a 2003 German tragicomedy film. Directed by Wolfgang Becker, it captures the confusion inhabitants of East Germany (the GDR) had after the Berlin Wall came down and the West suddenly flooded in. What the East Berliners didn’t appreciate, to comic effect, was how incredibly behind the times they had become. Consumer culture and technology had leaped dramatically during the preceding Cold War years in ways that were unimaginable. I am reminded of this film whenever I hear Secretary of State John Kerry or presumptive Presidential candidate Hillary Clinton speak.

Their words appear to come from a time warp from a previous era before the US middle class fell behind Canada’s when measured in terms of standard of living; before America’s press freedom dropped to 46 on the Reporters Without Borders league table, and before the America’s prison population skyrocketed to over 2 million to swell the profits of private prison operators like Corrections Corp. of America. What those living behind what I call the ‘CNN Curtain’ in America, a population that represents 5% of the world’s population miss, is that the other 95% has been busy these past 15 years (post China entering the World Trade Organization) inventing a post-America future.

Many think that the past 15 years has been notable for an uptick in globalization but I would posit that the modern growth of financialization is more important; and the commensurate gapping of wealth and income that we’ve seen – resulting in the most extreme concentration of wealth amongst the new robber barons of Wall St. and the City of London in history. In many ways, since China joined the WTO, we’ve witnessed a de-globalization in terms of a breakaway from the dominant ideology of the 20th century that drove American soft power and global hegemony. Instead of a unipolar world, we’ve seen a fracturing and a move away from the ‘freedom and democracy’ meme emanating from Washington D.C. and the rise of the so-called BRIC nations of the East and ‘Global South’ who see the world quite differently and have the resources and capital to shape their own destinies.

Lovely!

• US Nuke Sites Still Controlled By Antique Computers With Floppy Disks (BI)

A major cheating scandal amongst Air Force nuclear missile launch officers has brought increased scrutiny on the U.S. nuclear arsenal, and an upcoming report from CBS “60 Minutes” gives a rare look inside the day-to-day military job plagued with low morale and weak management. In a report to air on Sunday, CBS Correspondent Lesley Stahl traveled to a missile field near an Air Force base in Cheyenne, Wyo., revealing a nondescript site — the silo is below ground — that looks like a fenced-in lot surrounded by farms.

But inside, she found technology still being used that was built in the 1960s, to include analog telephone systems that missileers complain makes communication difficult, and decades-old computer systems using floppy disks, which an Air Force general regards as good for security, as it is not connected to the internet. When asked of why she was given access to such a secure facility on CBS “This Morning,” Stahl speculated that the Air Force “wanted to assure people that while there was cheating, they’re dealing with it, and basically, the system is safe. And anytime they find it isn’t, they’re gonna pounce on it.”

How many trillions does the Vatican control? The world’s first multinational had first pickings wherever they came.

• John Paul II Canonization Sponsored By Banks, Oil Giant (CNBC)

He has railed against the “tyranny” of global capitalism and the “idolatry of money” but even Pope Francis needs a little corporate coin sometimes – as proven by the list of sponsors for Sunday’s canonizations. An oil and gas giant, several banks and Switzerland-based food megacorp Nestle are among more than a dozen financial backers of the Rome event. Hundreds of thousands of people are due to come to the Eternal City to see Pope John Paul II, who reigned from 1978 to 2005, and Pope John XXIII, who was pontiff from 1958 to 1963, canonized as saints. The list of sponsors is dominated by Italian corporations, including energy firms Eni and Enel, banking company Intesa SanPaolo and railway network Ferrovie Italiane.

It’s perhaps an unlikely roll call of names to be associated with a Vatican event, six months after Pope Francis launched an attack on the global economic system as part of his call for a greater focus on the needs of the world’s poor. The Catholic Church sits upon enormous assets – the Vatican Bank manages $8 billion worth of worldwide investments as well as 33,000 accounts for clergy and parishes – but its governing body, the Holy See, made a loss of $18.4 million in 2011. The presence of corporate sponsors might instead be explained by Rome’s perilous financial position. It faces a budget deficit of $1.17 billion and in February was turned down for a massive central government bailout to help it pay city employees and buy fuel for buses.

Who’s surprised?

• Developing World Exploitation Being Funded By Australian Banks (Guardian)

Australia’s biggest banking institutions have provided financial support to companies involved in illegal logging, forced evictions and child labour, according to a new report from Oxfam Australia. A new report released on Monday says ANZ, Westpac, National Australia Bank and the Commonwealth Bank have invested in a range of countries across the Asia Pacific that had been involved in land grabs that left locals homeless. “From PNG and Cambodia to Indonesia and Brazil, our banks have backed companies accused of forcing people from their land,” said Oxfam Australia’s chief executive, Dr Helen Szoke. “This involvement has also resulted in billions of dollars of exposure for everyday Australians who have their money in accounts with these banks, or who own bank shares directly or through their superannuation funds.”

According to the report, ANZ Bank provided financial support for a sugar plantation involving child labour and forced evictions, and Westpac is supporting a timber company logging rainforest in Papua New Guinea. NAB funds a palm oil company, Wilmar, which has been linked to land grabs in Indonesia and Malaysia, and the Commonwealth Bank has invested in an agricultural business which operates a Brazilian sugar mill that is accused of evicting indigenous communities from their land. “The banks need to say which companies they’re investing in, and where those companies have pushed people off the land, to work with those companies to change their practices and provide compensation to communities,” Szoke said.

• Giant Chinese 3D Printer Builds 10 Houses In Just 1 Day (RT)

A private company located in eastern China has printed ten full-size houses using a huge 3D printer in the space of a day. The process utilizes quick-drying cement, but the creators are being careful not to reveal the secrets of the technology. China’s WinSun company, used a system of four 10 meter wide by 6.6 meter high printers with multi-directional sprays to create the houses. Cement and construction waste was used to build the walls layer-by-layer, state news agency Xinhua reported.

“To obtain natural stone, we have to employ miners, dig up blocks of stone and saw them into pieces. This badly damages the environment,” stated Ma Yihe, the inventor of the printers. Yihe has been designing 3D printers for 12 years and believes his process to be both environmentally friendly and cost-effective. “But with the 3D printing, we recycle mine tailings into usable materials. And we can print buildings with any digital design our customers bring us. It’s fast and cheap,” Yihe said.

Zeitgeist. Bob Prechter says you can see a society’s mood in dress length and movie themes.

• How Disaster Movies Took Over Cinema (Guardian)

“There was extensive polling in the United States in the 1950s and 1960s,” says Kramer, “and people really believed that the end was nigh. There was a very widespread awareness of how much damage nuclear weaponry could do, and people truly expected that nuclear armageddon would happen soon. Another concern was the state of the environment. In polls that were taken in 1965, it didn’t register. But by 1970, a good percentage of the population felt that humanity was treating the planet so destructively that it threatened our existence. The Poseidon Adventure and Jaws tapped into those anxieties, but from Star Wars onwards they became an important reference point.”

\

Today, those concerns are more important than ever. The global-disaster movie (the mega-disaster movie? the disaster movie-plus?) has become so commonplace recently that we’re now expected to take the most horrific scenarios for granted. Just last year, a delightful children’s cartoon, The Croods, showed dozens of species being wiped out by shifting tectonic plates. Two bloke-ish comedies, This Is the End and The World’s End, invited us to chuckle as the human race was all but eradicated. Two family-friendly blockbusters obliterated London (thanks, GI Joe: Retaliation and Star Trek Into Darkness), and two monster movies (Pacific Rim and World War Z), obliterated pretty much everywhere else.And it’s not just mainstream movies that are in a genocidal mood. “It’s intriguing that arthouse cinema has got in on the act,” says Sanders. “Lars von Trier’s Melancholia and Jeff Nichols’ Take Shelter suggest that oblivion is just around the corner, and if the philosophising minds of von Trier and Nichols are interested, then perhaps it’s time to make an apocalypse-proof shelter.”

Home › Forums › Debt Rattle Apr 28 2014: Why A Market Collapse Would Be A Good Thing