Marjory Collins Gasoline rationing in Mechanicsville, Maryland Jul 1942

When first we practise to deceive!

The upper echelons in and behind various governments have had on their radar far longer than the media that serve them, and I also realize that Washington wants a leading role in that battle, but even then I still don’t really get what is going on these days.

I think perhaps that’s because I tend to give the American political machine too much credit when it comes to intelligence and insight and other qualities its managerial staff doesn’t exactly seem to be drowning in. But still. I get the idea that most of what Washington does is based on what someone I read today calls ‘solution selling’, and what I know as ‘the completion backward principle’.

Both marketing terms mean you create a problem – a.k.a. a market – first, and then sell your products into the hole you just created. Perhaps that comes closest to what I see America doing these days, and if I’m right in that assessment, I can guarantee massive failure. Or maybe I should say massive warfare, which for me would be a failure, but not necessarily for the Pennsylvania Avenue apparatchiks.

The result is that stock markets keep rising, and oil prices keep falling, while the US actively involves itself in various hornets nests directly linked to various energy resources, involvements it doesn’t exactly have a stellar record in over the past 25 years- if not much longer -. Stocks are up only on central bank largesse, and oil is down only because people have faith in US military might. The latter is a big mistake all by itself, but both are for sure hugely risky notions, which tells me when a blow comes many investors will be taken off guard.

But let’s some other people talk. First, Ron Paul, that very rare sound voice:

What Have We Accomplished in Iraq?

We have been at war with Iraq for 24 years. Shortly after Iraq’s invasion of Kuwait that year, the propaganda machine began agitating for a US attack on Iraq. We all remember the appearance before Congress of a young Kuwaiti woman claiming that the Iraqis were ripping Kuwaiti babies from incubators. The woman turned out to be the daughter of the Kuwaiti ambassador to the US and the story was false [..]

The second Iraq war in 2003 cost the US some $2 trillion. According to estimates, more than one million deaths have occurred as a result of that war. What have we accomplished? Where are we now, 24 years later? We are back where we started, at war in Iraq!

The US overthrew Saddam Hussein in the second Iraq war and put into place a puppet, Nouri al-Maliki. But after eight years, last week the US engineered a coup against Maliki to put in place yet another puppet. [..] … what really irritated the US government was his 2011 refusal to grant immunity to thousands of US troops …

Hm. Perhaps what really really irritated the US government was that al-Maliki demanded better deals for Iraq in negotiations with western oil companies operating in the country.

Early this year, a radical Islamist group, ISIS, began taking over territory in Iraq. The organization had been operating in Syria, strengthened by US support for the overthrow of the Syrian government. ISIS obtained a broad array of sophisticated US weapons in Syria, very often capturing them from other US-approved opposition groups. Some claim that lax screening criteria allowed some ISIS fighters to even participate in secret CIA training camps in Jordan and Turkey.

This month, ISIS became the target of a new US bombing campaign in Iraq. The pretext for the latest US attack was the plight of a religious minority in the Kurdish region currently under ISIS attack. The US government and media warned that up to 100,000 from this group, including some 40,000 stranded on a mountain, could be slaughtered if the US did not intervene at once.

US bombs began to fall. Last week, however, it was determined that only about 2,000 were on the mountain and many of them had been living there for years! They didn’t want to be rescued!

The humanitarian situation was cynically manipulated by the Obama administration – and echoed by the US media – to provide a reason for the president to attack Iraq again. This time it was about yet another regime change, breaking Kurdistan away from Iraq and protection of the rich oil reserves there, and acceptance of a new US military presence on the ground in the country.

President Obama has started another war in Iraq and Congress is completely silent. No declaration, no authorization, not even a debate. After 24 years we are back where we started.

Then, Eric Draitser:

‘Islamist State A Pretext For US-Sponsored Regime Change In Iraq’

The ousting of Iraqi Prime Minister Nouri al-Maliki is part of a broader US plan for Iraq and the Middle East as a whole. Against the backdrop of the war against the Islamic State, Washington has managed to kill two birds with one stone. Not only has the US removed a political leader who had proven to be problematic due to his opposition to US military presence in Iraq, as well as his staunch support for Syria and President Assad, they have also created the conditions for the dismemberment of the Iraqi state.

The US and its allies are supporting de facto ‘independence’ for the Kurdish region in the north of the country, using the IS as a convenient pretext for openly arming and supporting Kurdish forces. Naturally, one should not look for altruism in Washington’s motives. Rather, this strategy is to benefit western oil companies with dollar signs in their eyes, licking their lips in anticipation of being able to deal directly with Kurdish President Barzani. Additionally, Maliki’s ouster deprives Syrian President Assad of a key ally, thereby emboldening the IS and the other militants waging war against Syria. It provides further evidence, as if more were needed, that the political future is bleak for any Iraqi leader who dares to break from the script written for him by Washington.

Perhaps most importantly, it allows the US and its allies to be the leading force politically in the war against the IS, an organization created by US policy and covert operations in the region. In the sales and marketing industry, there is a term known as ‘solution selling’ whereby the salesperson either creates or exaggerates a problem, then presents his or her product as the invaluable solution.

[..] [Al-Maliki] also challenged Western oil companies looking to make massive profits off of Iraq’s vast energy deposits. Perhaps the best-known instance occurred in 2012 when ExxonMobil signed an oil exploration deal with the semi-autonomous Kurdistan region in northern Iraq. Maliki rejected the validity of the deal, noting that any oil contracts must be negotiated with the central government in Baghdad, rather than Barzani’s US-aligned government in Arbil. Maliki’s spokesman noted at the time that:

“Maliki views these deals as representing a very dangerous initiative that may lead to the outbreak of wars… [and] breaking up the unity of Iraq…Maliki is prepared to go to the highest levels for the sake of preserving the national wealth and the necessary transparency in investing the wealth of the Iraqis, especially oil… [He] sent a message to American President Barak [sic] Obama last week urging him to intervene to prevent ExxonMobil from going in this direction.”

It is no secret that Maliki’s strong-willed resistance to this deal, in addition to his refusal to pay ExxonMobil upwards of $50 million to improve production at one major southern oilfield led directly to the oil company pulling out of the lucrative West Qurna-1 project. Essentially then, Maliki took on the very powerful oil corporations (BP is no friend of Maliki either), seeking to get a better deal for Iraq.

The US should, and could, have taken care of business in Iraq at any point since 1990. It didn’t. And it’s hard for me to accept that it never wanted to. It’s much more likely that hubris got in the way, that there was the idea all along that it never had to know all the ins and outs of the territory to be invaded. That having the biggest guns is always enough in the end. And now it’s clear that that didn’t work the last few times around, and what do you think the ‘new approach’ is? Right, more of the same.

There are scores of groups and militias and private armies and factions and fractions the US supported with billions in cash and training and guns and talks in Iraq alone, and it looks like more often than not it ends up fighting its own arms. The Kurds are the latest fad, but don’t underestimate their hatred of Turkey, which also happens to be a US ally. Who to choose when they restart their feud?

A very similar story, just on a smaller scale, is playing out with regards to American meddling in Ukraine. Really, what are they thinking? And what is Europe thinking? This could throw it back 50 years in time, before you know it someone start building a wall. RT:

Far-Right Right Sector Threatens Armed March On Kiev

The far-right Ukrainian group Right Sector has threatened its armed forces will raid Kiev unless authorities release all its members and end all criminal investigations against them. They accused the police of being “anti-Ukrainian.” Right Sector also accused the Interior Ministry of “unlawful detentions, arrests, beatings, confiscation of arms taken in battle” in moves targeting dozens of fighters of Right Sector’s volunteer battalion, which was formed with the stated goal of fighting armed militias in the east of the country.

The far-right group called on President Petro Poroshenko to fire Yevdokimov and his men from the service and investigate them for “their criminal activities.” As for detained members of Right Sector, all of them should be released and criminal cases launched against them must be closed, Yarosh demanded. “Unless our demands are met within 48 hours, we will be forced to call off all our units on the front line, start a general mobilization of reserve battalions and launch a march on Kiev to enact a ‘swift reform’ of the Interior Ministry. The columns of the Right Sector will march in full gear.”

A handful of billionaires with private armies who pay all sorts of people on the side who happen to want what they want, and wave swastika banners. That’s the western side of this conflict. That’s us.

‘West Has More Influence Than Kiev On Private Armies In Ukraine’

Moscow believes the West has more influence on various paramilitary forces in Ukraine – sponsored by local oligarchs – than Kiev does, the Russian FM said citing the latest bickering between Right Sector and the Interior Ministry. “The authorities in Kiev are not in control of the numerous paramilitary forces, including Right Sector, which, we estimate, comprises a large portion of the National Guard.

The march of Right Sector towards the Ukrainian Interior Minister speaks for itself,” Sergey Lavrov said, adding that the existence of armed groups sponsored by Ukrainian oligarchs, such as the Azov and Dnepr battalions, poses a great security threat. “We work with our Western partners in Europe and the United States who can really influence those paramilitary units that don’t answer to the central government in Kiev. We know the West has such influence,” he added.

Lavrov was referring to the weekend ultimatum of the far-right group, which threatened to pull out its troops from eastern Ukraine and march on Kiev unless President Petro Poroshenko fires several police officials, including a deputy interior minister. The group later reduced its demands, saying that the release of its activists previously arrested by the police was sufficient. [..]

Lavrov cited the latest claim by Kiev on Friday, when the Ukrainian military said it had destroyed a column of Russian armor after an incursion into Ukraine.“What really happened was a Ukrainian column moved in the Lugansk Region, obviously to intercept the rout of a potential humanitarian aid delivery. That column was destroyed by the militia,”he said. “If such episodes are presented as glorious successes of the Ukrainian army, then please don’t accuse us of anything.”

And then, what is the US doing at home? According to multiple media reports, there were all of 200 protesters on the streets of Ferguson last night. Police were firing teargas and rubber bullets into that ‘crowd’ even before the curfew. And it looked like the army had invaded. Armored personnel carriers and all.

And even that was not enough against 200 people who were simply pissed off because a cop emptied his gun, 6 bullets were found in the body alone, into an unarmed kid. 200 people, most of whom only wanted to protest. That there are a few dozen among them who are armed and/or looking for trouble is to be expected. So you pick them out of the crowd and cool things down. Right?

Does nobody in the States know anything about crowd control anymore? Or is this an attempt to make a small incident grow into something much bigger, so Americans get used to seeing the National Guard in their streets? I don’t know, but I look at all these things, and I wonder what’s going on.

As I said yesterday, you could be forgiven for thinking that America went looking for trouble.

• What Have We Accomplished in Iraq? (Ron Paul)

We have been at war with Iraq for 24 years, starting with Operations Desert Shield and Storm in 1990. Shortly after Iraq’s invasion of Kuwait that year, the propaganda machine began agitating for a US attack on Iraq. We all remember the appearance before Congress of a young Kuwaiti woman claiming that the Iraqis were ripping Kuwaiti babies from incubators. The woman turned out to be the daughter of the Kuwaiti ambassador to the US and the story was false, but it was enough to turn US opposition in favor of an attack. This month, yet another US president – the fourth in a row – began bombing Iraq. He is also placing US troops on the ground despite promising not to do so. The second Iraq war in 2003 cost the US some two trillion dollars. According to estimates, more than one million deaths have occurred as a result of that war. Millions of tons of US bombs have fallen in Iraq almost steadily since 1991. What have we accomplished? Where are we now, 24 years later? We are back where we started, at war in Iraq!

The US overthrew Saddam Hussein in the second Iraq war and put into place a puppet, Nouri al-Maliki. But after eight years, last week the US engineered a coup against Maliki to put in place yet another puppet. The US accused Maliki of misrule and divisiveness, but what really irritated the US government was his 2011 refusal to grant immunity to the thousands of US troops that Obama wanted to keep in the country. Early this year, a radical Islamist group, ISIS, began taking over territory in Iraq, starting with Fallujah. The organization had been operating in Syria, strengthened by US support for the overthrow of the Syrian government. ISIS obtained a broad array of sophisticated US weapons in Syria, very often capturing them from other US-approved opposition groups. Some claim that lax screening criteria allowed some ISIS fighters to even participate in secret CIA training camps in Jordan and Turkey.

This month, ISIS became the target of a new US bombing campaign in Iraq. The pretext for the latest US attack was the plight of a religious minority in the Kurdish region currently under ISIS attack. The US government and media warned that up to 100,000 from this group, including some 40,000 stranded on a mountain, could be slaughtered if the US did not intervene at once. Americans unfortunately once again fell for this propaganda and US bombs began to fall. Last week, however, it was determined that only about 2,000 were on the mountain and many of them had been living there for years! They didn’t want to be rescued!

• ‘Islamist State A Pretext For US-Sponsored Regime Change In Iraq’ (RT)

The ousting of Iraqi Prime Minister Nouri al-Maliki is part of a broader US plan for Iraq and the Middle East as a whole. Against the backdrop of the war against the Islamic State (IS, formerly ISIS/ISIL), Washington has managed to kill two birds with one stone, as the saying goes. Not only has the US removed a political leader who had proven to be problematic due to his opposition to US military presence in Iraq, as well as his staunch support for Syria and President Assad, they have also created the conditions for the dismemberment of the Iraqi state. The US and its allies are supporting de facto ‘independence’ for the Kurdish region in the north of the country, using the IS as a convenient pretext for openly arming and supporting Kurdish forces. Naturally, one should not look for altruism in Washington’s motives. Rather, this strategy is to benefit western oil companies with dollar signs in their eyes, licking their lips in anticipation of being able to deal directly with Kurdish President Barzani.

Additionally, Maliki’s ouster deprives Syrian President Assad of a key ally, thereby emboldening the IS and the other militants waging war against Syria. It provides further evidence, as if more were needed, that the political future is bleak for any Iraqi leader who dares to break from the script written for him by Washington. Perhaps most importantly, it allows the US and its allies to be the leading force politically in the war against the IS, an organization created by US policy and covert operations in the region. In the sales and marketing industry, there is a term known as ‘solution selling’ whereby the salesperson either creates or exaggerates a problem, then presents his or her product as the invaluable solution. Indeed, this sort of sales strategy is precisely the approach Washington has taken in the region, and specifically in Iraq.

The IS has only very recently become an internationally recognized epidemic of militant Islamist extremism that must be eradicated at all costs. That international recognition came only when the organization began taking control of territory in Iraq, threatening Western oil and gas interests. While the IS was waging its brutal and vicious war against the Syrian people and government however, the IS was merely an afterthought, simply a group of extremists fighting the ‘brutal dictator’ Assad. It seems then that the danger of ISIS and the necessity to eradicate it is directly correlative to US interests. Put another way, the IS is a useful tool in Syria and southern Lebanon where it creates chaos to the detriment of Assad and Hezbollah respectively, while in Iraq, the IS is dangerous where it threatens the US client regime in Kurdistan and Western oil interests. But of course, the detail consistently left out of most analysis of the IS problem is the simple fact that it is a creation of US intelligence and its covert war on Syria.

• Far-Right Right Sector Threatens Armed March On Kiev (RT)

The far-right Ukrainian group Right Sector has threatened its armed forces will raid Kiev unless authorities release all its members and end all criminal investigations against them. They accused the police of being “anti-Ukrainian.” In a statement published on Right Sector’s website, the group’s leader, Dmitro Yarosh, and the commander of the its volunteer battalion, Andrey Stempitsky, accused Deputy Interior Minister General Vladimir Yevdokimov of heading “a criminal police group of separatist stooges and a Moscow puppet.” Right Sector also accused the Interior Ministry of “unlawful detentions, arrests, beatings, confiscation of arms taken in battle” in moves targeting dozens of fighters of Right Sector’s volunteer battalion, which was formed with the stated goal of fighting armed militias in the east of the country.

The far-right group called on President Petro Poroshenko to fire Yevdokimov and his men from the service and investigate them for “their criminal activities.” As for detained members of Right Sector, all of them should be released and criminal cases launched against them must be closed, Yarosh demanded. “Unless our demands are met within 48 hours, we will be forced to call off all our units on the front line, start a general mobilization of reserve battalions and launch a march on Kiev to enact a ‘swift reform’ of the Interior Ministry. The columns of the Right Sector will march in full gear,” the statement said.

• ‘West Has More Influence Than Kiev On Private Armies In Ukraine’ (RT)

Moscow believes the West has more influence on various paramilitary forces in Ukraine – sponsored by local oligarchs – than Kiev does, Russian FM said citing the latest bickering between Right Sector and the Interior Ministry. “The authorities in Kiev are not in control of the numerous paramilitary forces, including Right Sector, which, we estimate, comprises a large portion of the National Guard. The demarche of Right Sector towards the Ukrainian Interior Minister speaks for itself,” Sergey Lavrov said, adding that existence of armed groups sponsored by Ukrainian oligarchs, such as the Azov and Dnepr battalions, poses a great security threat. “We work with our Western partners in Europe and the United States who can really influence those paramilitary units that don’t answer to the central government in Kiev. We know the West has such influence,” he added.

Lavrov was referring to the weekend ultimatum of the far-right group, which threatened to pull out its troops from eastern Ukraine and march on Kiev unless President Petro Poroshenko fires several police officials, including a deputy interior minister. The group later reduced its demands, saying that the release of its activists previously arrested by the police was sufficient. The comments from the top Russian diplomat came as he reported on the progress achieved during the Sunday meeting with his counterparts from Ukraine, Germany and France. The roundtable produced no concrete agreements, but the parties involved said some progress was made on the issues of humanitarian aid and border control. Speaking to journalists on Monday, Lavrov said Moscow would welcome the observer mission of the Organization for Security and Cooperation in Europe (OSCE) deploying drones to control the Russian-Ukrainian border from the Ukrainian side.

Lavrov said Russia is working with the OSCE on giving more transparency in the border region, which is important, considering how often Kiev voices false reports on alleged violation of the border from the Russian side. He cited the latest claim by Kiev on Friday, when the Ukrainian military said it had destroyed a column of Russian armor after an incursion into Ukraine.“What really happened was a Ukrainian column moved in the Lugansk Region, obviously to intercept the rout of a potential humanitarian aid delivery. That column was destroyed by the militia,”he said. “If such episodes are presented as glorious successes of the Ukrainian army, then please don’t accuse us of anything.”

• Autopsy Finds Unarmed Teen Killed By Police Shot At Least 6 Times (Reuters)

A preliminary private autopsy report found that Michael Brown, the black teen killed by a police officer in the suburban St. Louis city of Ferguson, was shot at least six times, the New York Times reported on Sunday night. Citing Dr. Michael M. Baden, former chief medical examiner for the City of New York who was asked to perform the autopsy by Brown’s family, the newspaper reported that Brown, 18, was shot twice in the head, and that the bullets that hit him did not appear to have been fired from very close range. Four shots hit Brown in his right arm and one entered the top of his skull, the Times said, citing findings by Baden, who it said flew to Missouri on Sunday at the family’s behest and waived his usual fee in view of the extraordinary circumstances. The bullets, some of which left as many as five wounds, did not appear to have been fired from very close range, the Times reported, because no gunpowder was detected on his body. That conclusion could change, however, if gunshot residue is found on Brown’s clothing, the newspaper said.

[..] “People have been asking: How many times was he shot? This information could have been released on Day 1,” Baden told the Times in an interview after performing the autopsy. “They don’t do that, even as feelings built up among the citizenry that there was a cover-up. We are hoping to alleviate that,” the newspaper quoted him as saying. Baden said his autopsy was not intended to determine whether the shooting was justified. “In my capacity as the forensic examiner for the New York State Police, I would say, ‘You’re not supposed to shoot so many times’,” he told the Times. “Right now there is too little information to forensically reconstruct the shooting.”

• Russia Widens Ruble Basket to Complete Free Float by End of Year (Bloomberg)

Russia is making its currency more flexible by widening the range in which it trades freely and reducing the amount of foreign exchange bought and sold by the central bank. Russia widened the band in which the ruble trades against the target basket of dollars and euros to 9 rubles from 7 rubles previously, the central bank in Moscow said in a website statement. The regulator also abandoned all interventions while the ruble is trading in the band. It used to buy or sell $200 million per day at certain levels. The changes are intended to help complete the switch to a freely floating ruble from the current managed rate by the end of this year, which is needed to shift to inflation targeting, the central bank said. Policy makers are loosening their hold on the ruble even as volatility rises and inflation risks increase because of Ukraine-related sanctions. “This decision will not have a significant impact on current ruble fluctuations,” because the currency is trading in the neutral zone, the central bank said in the statement.

• The Biggest Economic Risk? You May Be Living In It (CNBC)

As a spate of housing data are released in the coming week, Wall Street will attempt to answer a burning question: Is the housing market becoming a big drag on economic growth? “We are laser-focused on this housing data coming out, because we have seen that the backbone of the recovery was housing. Now it’s faltering slightly. So if we see another mishap here, maybe that adds to the slowing global growth—especially domestically,” said Jeff Kilburg, chief executive of KKM Financial. The data start to emerge on Monday morning, when the National Association of Home Builders releases the latest reading on its housing market sentiment index. That widely watched gauge of the housing market rose to a six-month high in July, but is still down on the year. On Tuesday, the all-important housing starts number will reveal how many residential buildings began construction in July. The July number will follow a big disappointment from June, when 893,000 homes were started on a seasonally adjusted annualized basis—a nine-month low.

Thursday’s existing home sales data will round out the week. Recent indicators have not squelched concerns about housing. On Wednesday, the Mortgage Bankers Association reported applications to buy a house fell to a six-month low in the week prior. Still, there are some reasons for optimism. According to Freddie Mac, 30-year mortgage rates have fallen to just 4.12%, which brings it back to its lowest levels on the year. Given the decline in interest rates, as well as this year’s impressive employment growth, “I would have expected more out of housing,” said Stuart Hoffman, chief economist at PNC Financial Services. The weak housing market “is a disappointment, and somewhat of a downside risk to the economy. But with mortgage rates coming down and credit standards loosening, I would expect housing to have a better second half of the year.”

• London Home Asking Prices Plunge Most in More Than Six Years (Bloomberg)

London home sellers cut asking prices by the most in more than six years this month, adding to signs that the property market in the U.K. capital is coming off the boil. London values fell 5.9% from the previous month to an average £552,783 ($922,300), the biggest drop since December 2007, property website Rightmove Plc said today. Nationally, prices declined 2.9%, a record for an August. While property demand usually weakens during the summer, Rightmove said the slump this year was steeper than it expected. Tougher new mortgage rules introduced by Bank of England Governor Mark Carney, as well as anticipation of higher interest rates, are putting pressure on the market after a surge in values raised concerns that a bubble may develop. “Buyers and sellers are becoming increasingly aware about personal finances, given that the cost of mortgages are going up and regulators are trying to bring availability down,” said Miles Shipside, a director at Rightmove. “This limits what buyers are willing or able to pay, and helps moderate sellers’ price expectations.”

Some of the biggest price declines in London were recorded in affluent boroughs including Kensington and Chelsea, Camden, Hammersmith and Fulham, according to the report. Among the “million-pound plus” districts, Kensington saw asking prices drop 7% on the month to an average £2.2 million, while Camden fell 7.2%. From a year earlier, values in Kensington were down 1.4%, the only borough recording an annual decline. The average London price is up 10.3% in that period. “Top-end sellers are very much discretionary ones, so can delay marketing till a more active time of year,” Shipside said. “That tends to depress property prices more in the higher-priced boroughs.” Nationally, the annual pace of growth in prices slowed to 5.3% in August from 6.5% in July. The average asking price was £262,401. Rightmove said the drop in monthly prices is a “lead indicator of a slower market in the second half.”

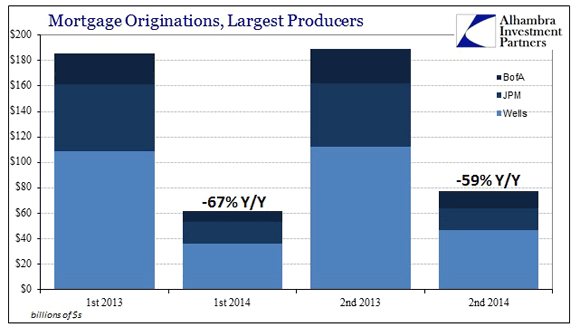

• US Mortgage Market Continues To Falter: Q2 Originations Down 59% (Alhambra)

The Mortgage Bankers Association’s refi index is at a level not seen in a very long time, far lower than anything of this “recovery” period. There has been a clear disassociation of refi activity and interest rates, which is itself a clear break from the close correlation of the prior paradigm (before taper threats). That is a woeful sign for consumerism, as even though the trickle of refis likely had a relatively muted impact on the monetary goal of spending, it will now be completely reversed going forward – regardless of interest rates it appears. In terms of real estate and new home construction or home sales, purchasing activity has been far less provoked by all of this but no less in terms of direction.

Mortgage applications for home purchases are running nearly 15% below year ago levels, and this despite that favorable direction in mortgage rates. At the three largest mortgage providers, there was some increase in originations and volume in the second quarter over the first, but nothing that would indicate a sharp reversal on the horizon. Where total mortgage lending volume at these three banks was off by two-thirds Y/Y in Q1, in Q2 the decimation was only 59%. We will have to see about how that plays out in Q3, though mortgage pipelines entering the quarter were still way down vs. last year’s levels (about 65% on average). The current view of applications doesn’t bode well for it.

• Yellen Dashboard Warning Light Glows as Millions Work Part Time (Bloomberg)

Federal Reserve Chair Janet Yellen has a stubborn warning light blinking on her labor market dashboard: A group of Americans larger than Washington state’s population can find only part-time work. As Yellen heads to this week’s Fed symposium in Jackson Hole, Wyoming, where the focus will be on the labor market, those 7.5 million part-time workers who want full-time jobs are inflating the broad measure of underemployment she watches to gauge job market health. Involuntary part-time workers have gained by 325,000 from February’s five-year low. With employment and inflation nearing Fed goals, Yellen has consistently cautioned some labor market measures still show enough slack to warrant keeping interest rates low.

In the shadow of the Teton Range of the Rocky Mountains, she’ll have a chance to highlight soft spots such as the crowded pool of part-timers as investors try to decipher the timing of the Fed’s first rate increase-rate increase since 2006. “We still have quite a long ways to go,” said Aneta Markowska, chief U.S. economist at Societe Generale SA in New York. In the discussion of monetary policy, “I’d be surprised if the message is anything other than dovish.” Yellen, 68, is delivering a speech titled “Labor Markets” at the Jackson Hole symposium Aug. 22 at 10 a.m. New York time. The three-day meeting of central bankers and economists begins Aug. 21 with a topic of “Re-evaluating Labor Market Dynamics.”

• China’s July Home Sales Fall 28% as Easing Yet to Boost Demand (Bloomberg)

China’s home sales fell 28% in July, the biggest monthly decline this year, as tight mortgage lending outweighed efforts by local governments to ease property curbs as prices and demand weakened. The value of homes sold fell to 424.2 billion yuan ($69 billion) last month from 591.2 billion yuan in June, according to the difference between the National Statistics Bureau’s data for the first seven months and the first half of the year. The value of sales in the first seven months fell 10.5% to 2.99 trillion yuan from a year earlier, the data showed. “Today’s data will hurt sentiment as the property market has no fundamental recovery yet as investors imagined,” Edison Bian, a Hong Kong-based property analyst at UOB Kay Hian Ltd., said in a phone interview today. “Developers are still very cautious even as local governments are easing policies. Mortgages should ease further, so that reluctant developers will supply more homes.”

Chinese cities began relaxing local property restrictions in June amid sluggish sales and as an oversupply in second- and third-tier cities drove prices lower. Thirty-six Chinese cities eased their policies as of the end of last week, Centaline Property Agency Ltd., China’s biggest real estate broker, said in a report. While more cities are set to follow, buyers remain hesitant as the central bank maintains mortgage restrictions, according to Centaline. In Beijing and Shanghai, first-home mortgage rates were the same as the benchmark rate in July, while in the southern business hub of Guangzhou they were 5% to 10% higher than the benchmark rate, Centaline said.

• China Home Prices Fall in Majority of Cities on Weak Demand (Bloomberg)

China’s new-home prices fell in July in almost all cities that the government tracks as tight mortgage lending deterred buyers even as local governments eased property curbs. Prices fell in 64 of the 70 cities last month from June, the National Bureau of Statistics said today, the most since January 2011 when the government changed the way it compiles the data. Beijing prices fell 1% from June, posting the first monthly decline since April 2012. “The falling trend of China’s property market has no sign of improving,” Shen Jian-guang, Hong Kong-based chief Asia economist at Mizuho Securities Asia Ltd., said in a phone interview today. “The key issue is the mortgages, despite all types of local government easings. The high rate is damping sentiment of owner occupiers.”

China’s property market has become a drag on the world’s second-biggest economy, prompting cities to start easing local curbs in June. Thirty-six cities had loosened measures as of the end of last week, according to Centaline Property Agency Ltd., while developers have cut prices since March to lure buyers. The International Monetary Fund has urged China to target slower expansion in 2015, saying the economy faces a “web of vulnerabilities” from rising debt and financial institutions’ exposure to real estate. [..] Worse times for China’s real estate sector are still ahead, wrote Standard Chartered Plc economists led by Lan Shen in an Aug. 6 report, after surveying managers of 30 Chinese developers in six cities. Developers are offering “moderate discounts,” while buyers are still very cautious regardless of how much developers cut prices, Standard Chartered found.

• Blow To Global Banks’ Living Wills Over Fed’s Lending Window (FT)

Global banks can no longer assume continuing access to the Federal Reserve’s discount lending window as an element of their living wills, people familiar with the process have warned. US regulators set out the specific guidance in confidential letters on August 5 detailing why they recently rejected the living wills of the world’s largest banks. Hundreds of banks took advantage of the discount lending window on multiple occasions during the 2008 credit crunch. Critics say that instead of creating an environment for an orderly resolution that would avoid the kind of panic that ensued after the failure of Lehman Brothers, regulators are creating more risk by making a bank’s failure theoretically inevitable. They added that the prohibition defeats the purpose of the discount window and the role of the Fed as the lender of last resort.

“How are you supposed to write these living wills if the assumptions regulators are making are false and inaccurate?” asked one UScommentator. “They are disconnected from what would happen in the real world.” But the Fed and the Federal Deposit Insurance Corporation, which are under pressure to avoid government bailouts in any future crisis, want to force the banks to come up with emergency plans that do not involve any government aid, even when it comes to the discount window, which is available only to banks that are in trouble rather than failing. For the 2013 living wills, 11 banks ranging from Citigroup to Barclays were told they made unrealistic assumptions about how customers, counterparties and investors would behave in a crisis. In addition, they were informed that they failed to make or identify the kinds of structural changes that would be needed to ensure an orderly resolution.

• US Banks Plan Ahead For UK Exit From EU (FT)

Wall Street banks are drawing up preliminary plans to move some London-based activities to Ireland to address concerns that the UK is drifting apart from the EU People familiar with Bank of America, Citigroup and Morgan Stanley told the Financial Times that they considered Ireland a favorable location for some of their European business if they needed to move them out of the UK. One said he was already planning to move some activities to Ireland. The people said their plans were in most cases still at very early stages. But they said the US banks had started preparing for the euro zone’s impending banking union that threatens to isolate Britain and, ultimately, for a possible UK exit from the EU. “I’m frankly looking at moving some activities to Ireland,” said one senior UK-based manager at a Wall Street bank. “I think the Irish central bank and government would welcome this. It is not so much Brexit, more about legal entity optimization.”

Most US and Asian banks have chosen to base their main European operations in the UK, giving them an automatic passport to carry out their services across all 28 countries in the EU. But senior US banking executives said the UK was unlikely to be granted the same “passporting” rights if it left the EU – the so-called “Brexit” scenario. Prime Minister David Cameron has promised to hold a referendum on a renegotiated EU membership if his Conservative party wins next May’s election. Executives at American banks in Europe are reluctant to speak publicly about the issue for fear of upsetting the UK regulators. One said: “I don’t think people are making enough of it – a lot of passported activities that cannot take place in London will not exist here any more.” As the European Central Bank prepares to take charge of the biggest banks in the euro zone later this year, there are fears among some executives at US banks that this will drive a wedge between the UK and the rest of Europe’s financial system.

Great teachers!

• EU Trains for Bank Closures With US Agency That Shuttered 500 (Bloomberg)

When a bank fails, regulators need two qualities above all: Speed and agility. That’s the message U.S. Federal Deposit Insurance Corp. officials are sending to their colleagues in Brussels working out how the European Union will shut down insolvent lenders. Regulators need to move fast enough to limit disruption to the financial system, while staying nimble so they can pull back at the last minute if another solution emerges, Pamela Farwig, deputy director of the FDIC’s resolution and receivership division, said in a phone interview this month. “If you had to tell them to stand down, you must be able to do that in very, very short order,” said Farwig, one of four U.S. officials who spoke at private workshop on bank closures with EU officials in June.

The FDIC’s practical tips and advice for Europe are borne of hard-won experience: it handled more than 500 bank closures during the financial crisis. Its seminar, part of a trans-Atlantic exchange, tackled issues like how to market a failing bank, and how to sneak up and close it on a Friday night. “They were surprised at some of the things that can happen at the very last minute,” she said. “They just have not had that experience yet.” When a lender is on the brink, the FDIC needs to fly under the radar to avoid roiling the markets or alarming depositors. Officials will try to line up a buyer in advance and then they even book hotel rooms and rental cars without mentioning the agency’s name. “You have a team going into a very small town where everyone knows everyone — when they see those different cars you have to be very careful,” Farwig said. “The last thing you want is a marquee that says ‘Welcome FDIC.’”

• Australia Misery Index Rises to Highest Level Since 2008 (Bloomberg)

A deepening gloom across the largest developed economy to escape recession during the global financial crisis is shaping up as one of the toughest challenges yet for Reserve Bank of Australia chief Glenn Stevens. Australia’s misery index – the sum of unemployment and inflation rates – is at 9.0, the highest since 2008, when the collapse of Lehman Brothers Holdings Inc. froze credit markets around the world and triggered the deepest recession in the U.S. since the Great Depression.

While policy makers from the U.S. Federal Reserve to the European Central Bank are still pumping stimulus into their economies at least in part to address job-market slack, Australia’s price pressures limit that option for the RBA. The upshot for the nation’s businesses and consumers: little prospect of lower borrowing costs from Stevens. “The hurdle to cut further is high,” said Su-Lin Ong, head of Australian economic and fixed-income strategy at Royal Bank of Canada in Sydney. “The RBA is likely to remain reluctant in the absence of an external driver, and the case to cut from an already historical low will need to be compelling.”

• Credit Suisse Caught Up in Espírito Santo Mess (WSJ)

Credit Suisse helped sell billions of dollars of securities that ultimately played a role in toppling Portugal’s second-largest bank. The Swiss bank was responsible for putting together securities that were issued by offshore investment vehicles and then sold to retail customers of Portugal’s Banco Espírito Santo SA. Many customers didn’t realize that these vehicles were loaded with debt issued by various Espírito Santo companies and apparently served as a mechanism to finance the family-controlled empire, according to corporate filings and people familiar with Portugal’s investigation into the Espírito Santo affair. It is unclear what, if any, direct role Credit Suisse had in selling the securities to bank customers. Now those investment products are at the center of an unfolding scandal. Banco Espírito Santo was bailed out and broken up this month. Other parts of the Espírito Santo group have filed for bankruptcy amid alleged fraud and accounting problems. In addition to sinking the Portuguese stock market, the episode has undermined confidence in the European banking sector, analysts say.

Portuguese regulators investigating the Espírito Santo mess have identified at least four offshore investment vehicles whose securities, mostly preferred shares, were sold with the help of Credit Suisse to Banco Espírito Santo customers. Portuguese regulators, who received complaints about the products from customers who didn’t understand what they were buying, are now making the bank buy back the securities. That caused crippling losses for the bank. The offshore vehicles used at least some of the proceeds from selling the securities to buy more Espírito Santo debt, according to corporate filings. Regulators suspect the sales were part of an effort to prop up the bank and other Espírito Santo companies, the people say. Three of the vehicles are based in Jersey, an island tax haven off France’s northern coast. Credit Suisse served as “arranger and dealer” for those three vehicles, a role that included not just underwriting securities but also handling administrative and financial needs, according to corporate records filed with the Jersey Financial Services Commission.

• China’s First Bond Default in Focus as Debtholders Meet (Bloomberg)

Holders of China’s first corporate bond to default onshore plan to meet today in Shanghai, as investors look for clues on how the government will balance market liberalization with steps to maintain stability. Investors in notes of Shanghai Chaori will gather this afternoon as they seek repayment, Vice President Liu Tielong said by phone. Shanghai marked a milestone in corporate bankruptcy in June when a court accepted a restructuring application for the solar-panel maker. While Premier Li Keqiang said defaults may be unavoidable in some cases after Chaori failed to make a full coupon payment on March 7, the country has averted similar cases since. Widespread bond nonpayments would cause financial market turbulence, which can’t be allowed when the economy faces “relatively heavy” downward pressure, according to a front-page commentary in a central bank publication today. Chaori only paid 4 million yuan ($650,755) of an 89.8 million yuan coupon due in March on its 2017 bonds, becoming the first company to default on a yuan note onshore.

The Shanghai No. 1 Intermediate People’s Court accepted the restructuring application from Chaori’s supplier, Shanghai Yihua Metal Materials Ltd., because the solar-panel maker can’t repay overdue debt, according to a statement posted on the court’s website on June 27. As of March, Chaori’s liabilities were more than 700 million yuan greater than its assets, according to the statement. The Shanghai court appointed local branches of law firm King & Wood Mallesons and accounting firm KPMG Huazhen as the administrators, according to a July 10 statement. A meeting of Chaori’s noteholders set for March was delayed after the underwriter of the securities couldn’t find enough bondholders to attend for resolutions to be effective. China’s broadest measure of new credit plunged last month to the lowest since the global financial crisis, adding risks to growth as the government grapples with a property slump.

• US Losing Its Interest In Buying Chinese Companies (MarketWatch)

U.S. companies, and really companies all around the world, are losing interest in buying up their Chinese counterparts, according to a Dealogic report out Friday. Even as U.S. mergers and acquisitions volume abroad is up 47% year-to-date, American purchases of Chinese companies seem to have fallen off a cliff, dropping to just $611 million so far in 2014, down from $2.3 billion at this time last year, and marking the lowest level in 12 years, Dealogic said. Part of the problem involves a lack of big ($500 million or more) deals. The report showed no transactions of that size so far this year, while last year, there were already two such deals worth a combined $1.3 billion.

But it’s not just a U.S. issue: China’s total inbound M&A volume year-to-date is 10% less than it was at this time in 2013. And on a “deal activity” basis, the situation is even more stark: There have been just 271 agreements to buy Chinese companies this year, making Chinese M&A from abroad the weakest it’s been since 2003, Dealogic reported. The drop-off in U.S. merger interest in the world’s No. 2 economy could cap a decade of thirst for Chinese targets, with M&A volume by this point in the year coming in below the $2 billion mark only once (2012) in the 2004-2013 period. Although Dealogic didn’t offer a reason for the sudden chill in U.S. acquisitions into China, it did note that deals for Chinese health-care firms plunged from last year — $30 million year-to-date compared to $1.1 billion at this point in 2013.

• China Finds Mercedes-Benz Guilty Of Price Manipulation (Reuters)

German car maker Daimler AG’s luxury brand division Mercedes-Benz has been found guilty of manipulating prices for after-sales services in China, the official Xinhua news agency reported, citing authorities in Jiangsu province. An array of industries, from milk powder makers to tech firms, have been coming under the spotlight in recent years as China intensifies its efforts to bring companies into compliance with a 2008 anti-monopoly law. That legislation allows the country’s anti-trust regulator, the National Development and Reform Commission, to impose fines of up to 10% of a company’s Chinese revenues for the previous year. The auto industry has been under particular scrutiny, with a wave of investigations in the world’s biggest auto market prompting carmakers such as Mercedes-Benz, Volkswagen AG’s Audi, and BMW to slash prices on spare parts in recent weeks.

The Jiangsu Province Price Bureau, which launched its investigation last month, found evidence of anti-competitive practices after raiding Mercedes-Benz dealerships in the eastern coastal province as well as an office in neighboring Shanghai, Xinhua said in its report on Sunday. On Aug. 5, Mercedes-Benz said it was assisting the authorities in their investigation. A spokesman for the German brand was not immediately available to comment on the Xinhua report. “It is a typical case of a vertical monopoly in which the carmaker uses its leading position to control the prices of its spare parts, repair and maintenance services in downstream markets,” Zhou Gao, chief of the anti-trust investigation at the Jiangsu bureau, told Xinhua.

Home › Forums › Debt Rattle Aug 18 2014: Oh, What A Tangled Mess We Weave