Unknown Crack salesmen ‘Going East’ on streamliner City of San Francisco 1936

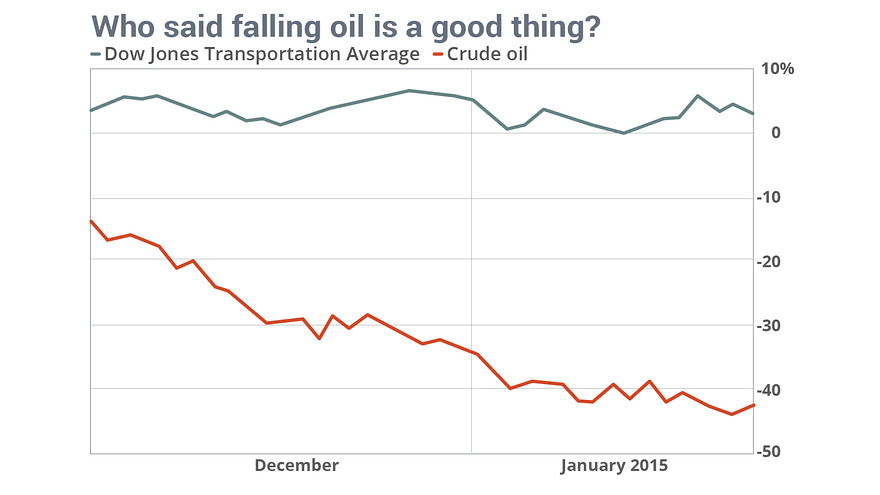

“If you want to know whether lower oil prices are benefitting the economy, take a look at the Dow Jones Transportation Average. The picture isn’t pretty.”

• What The Oldest Stock Market Index Is Telling Us (MarketWatch)

If you want to know whether lower oil prices are benefitting the economy, take a look at the Dow Jones Transportation Average. The picture isn’t pretty. Consider what’s happened over the five weeks since I last devoted a column to the Dow Transports, the oldest stock market index in widespread use today. (The Dow Industrials are the second-oldest.) Since then, oil prices have dropped 20%. If cheaper oil were a net positive for the economy, one of the first places you’d expect to see it show up is the transportation sector. Yet it hasn’t: Over this same five-week period, the Dow Transports have fallen nearly 2%. The Transports’ surprisingly poor performance is worrisome for at least two reasons. The first is that the Transports are a leading indicator of economic downturns.

The transportation sector’s track record as a leading indicator was documented several years ago by the Bureau of Transportation Statistics in the U.S. Department of Transportation, titled “The Freight Transportation Services Index as a Leading Economic Indicator.” The study found that the department’s index over the past three decades “led slowdowns in the economy by an average of 4-5 months.” Unfortunately, we don’t know where the Freight Transportation Services index currently stands, since it is reported with a significant time lag. The latest data, for example, are for November. But it is significantly correlated with the Dow Jones Transportation Average, so that average’s weakness is definitely worrying.

The other reason the Transports’ weakness is ominous: It is one of the two stock market averages that are the focus of the Dow Theory, the oldest stock market timing system in widespread use today. The other average, of course, is the Dow Industrials. To be sure, not all Dow Theorists agree on the hurdles over which the two Dow averages must jump before the Dow Theory would issue a “sell” signal. But suffice it to say that the further they retreat from their highs, the further the market gets from confirming that the bull market is still alive — and the closer it gets to signaling that a bear market has begun. As of Tuesday’s close of trading, the Dow Industrials were 4% below its all-time high, and the Transports were 4.1% below.

“This condition has happened two other times, in March 2000 and December 2007. In each of the following years, the market lost more than 30%.”

• I Am So Bearish, I Am Growing Fur! (MarketWatch)

The recent bubble that burst in the oil market has been the talk around the world. What would people say if the stock market fell 40% in 2015? The U.S. market’s foundation is crumbling, according to my calculations — just as it did in 2000 and in 2008. My proprietary daily indicator, called The Cook Cumulative Tick indicator, or CCT, measures several internal market components, the strongest of which is the duration of buying versus the duration of selling. A healthy bull market sees mostly buying, indicated by the NYSE tick. But when the duration of the plus-column NYSE tick is less than the duration of the minus tick, this suggests weakening buying volume for stocks. A second component of the CCT focuses on the NYSE “big block” buying and selling.

A bullish market has numerous big blocks of buying. A print on the NYSE tick in excess of plus-1000 signifies fund buying by numerous entities, which accompanies a healthy bull market. Nowadays the big institutional money has dried up. Market action in both December 2014 and January 2015 have given a short-term sell signal. I believe the correct way to gauge a market condition is by measuring the strength or weakness of a rally. The S&P 500 futures registered a triple-top in the range between 2,088 and 2,089, on December 26th, December 29th, and December 30, 2014 respectively. The resulting pullback took the index to the 1,970 price area. The gauge of measurement following the lows of 1,970 is the rally strength generated in the rally phase, which carried prices to 2,062.

This last rally covered approximately 90 S&P futures points. A rally of this magnitude under normal market conditions would record a net Daily CCT reading of plus-9.0. This means that there would be a recorded reading of 9 more incidences of plus-1,000 NYSE tick readings than minus-1,000 tick readings. Yet the actual readings during this period registered a minus CCT reading, not a plus. This condition has happened two other times, in March 2000 and December 2007. In each of the following years, the market lost more than 30%. I am so bearish, I am growing fur!

“There is no way of fixing this mess without a lot of saber-rattling on both sides. The real issue is not going to be the Greek debt burden. The payment terms have already been extended, and the interest payments reduced, so that the annual payments are hardly onerous. ”

• The Euro Is Crashing Below Parity And Will Get Cheaper Still (MarketWatch)

Now the fun part begins. After months of speculation, the radical antiausterity party Syriza has now taken power in Athens. Its platform of staying within the euro while overthrowing the conditions of membership is going to test the leadership of the European Union to the limit. The euro has already plunged to a multi-year low against the dollar, partly on account of the potential for chaos that the election result has unleashed But it is about to go a lot lower still. Why? Because there will be a tense game of brinkmanship between Brussels and Athens before a compromise is worked out. Because Syriza’s victory will encourage other antiausterity parties, especially in Spain. And because the ECB will throw more quantitative easing at the problem.

The euro will crash through parity with the dollar before the end of the year — and when it does, eurozone assets, and equities in particular, will be a bargain for foreign investors. The mandate secured by the new Greek Prime Minister Alexis Tsipras was as decisive as it could be in the circumstance. He soundly beat the moderate center-right incumbent, and will now govern in coalition with a small far-right party that is even more determined in its opposition to the austerity package Greece agreed to in return for a bailout. Over the next few weeks, he will attempt to renegotiate the terms of that bailout, postponing or re-scheduling the country’s debt, and freeing up space for the government to increase wages and welfare benefits, and, it hopes, start to lift the country out of the most savage recession any country has experienced since the 1930s.

The market took that – perhaps surprisingly – in its stride. That may have been because the result was so widely expected. Greek bond yields shot up, but in the rest of the peripheral eurozone states, they barely moved. The euro itself hardly showed any reaction, and equities traded as if it was a normal day. Over the next three months, however, the euro is going to take a big hit. Here are the three reasons why. First, there will be a game of chicken between Brussels, Berlin and Athens. There is no way of fixing this mess without a lot of saber-rattling on both sides. The real issue is not going to be the Greek debt burden. The payment terms have already been extended, and the interest payments reduced, so that the annual payments are hardly onerous.

“Despite the large declines in commodity prices, we see risks as still skewed to the downside over the near-term. Lower oil prices are also driving cost deflation across the broader commodity complex..”

• Goldman Cuts Outlook For Whole Commodity Sector (CNBC)

After countless oil price downgrades, analysts at Goldman Sachs have cut their outlook for the commodity sector as a whole. Goldman downgraded commodities on Wednesday—including energy, metals, agriculture and livestock—to “underweight” from “neutral” on a 3-month basis. “Despite the large declines in commodity prices, we see risks as still skewed to the downside over the near-term. Lower oil prices are also driving cost deflation across the broader commodity complex,” Goldman strategists led by Christian Mueller-Glissmann said in a research note. The strategists forecast WTI crude oil prices would remain at around $40 per barrel for most of the first half of the year, which would “slow supply growth, keep further capital investment in U.S. shale sidelined, and “We think the oil market is experiencing a marginal cost re-basement,” they said.

Mueller-Glissmann and colleagues forecast that “balance” would return to global oil markets by 2016 and they upgraded their 12-month view of the commodity sector to “overweight” from “neutral”. “By the end of 2015, we see inventories closer to a neutral level and prices rising to the marginal cost of production, which we estimate to be US$65 for WTI and US$70 for Brent. However, the timing of normalizing inventories and prices remains highly uncertain, in part due to ongoing cost deflation in shale,” they said. Barclays also revised down its forecasts for oil prices on Wednesday, in its second substantial revision in recent months. The bank now forecasts Brent and WTI will average $44 and $42 respectively over 2015. Less than two months ago, Barclays’ forecasts were $93 and $85 respectively.

Mehreen Khan reveals some interesting points. Things are not what they seem.

• Three Myths About Greece’s Enormous Debt Mountain (Telegraph)

€317bn. Over 175pc of national output. That’s the enormous debt mountain that faces the new Greek government. It is the issue over which the country is set to clash with other countries in the eurozone. As it stands, Greece’s debt-to-GDP ratio is the highest in the currency bloc. It has been steadily rising as the country has undergone painful austerity and experienced a severe contraction in economic output. The new far-left/right-wing coalition is now demanding a write-off of up to 50pc of its liabilities. The government argues that this is the only way Greece can remain in the single currency and prosper.

According to the newly appointed finance minister, who first coined the term “fiscal waterboarding” to describe Greece’s plight, the EU has loaded “the largest loan in human history on the weakest of shoulders – the Greek taxpayer”. So far, the rest of the eurozone is adamant that it will not meet demands for debt forgiveness. And yet, the value of Greece’s debt mountain has been called a meaningless “accounting fiction” by Nobel laureate Paul Krugman. So what does Greece’s €317bn debt really mean for the country and its creditors? And can it ever be paid back?

“A freshly elected government cannot allow itself to be intimidated by threats of Armageddon..”

• Investors Have Woken Up To Greece’s Nuclear Risk (AEP)

Markets have woken up to Greek nuclear risk. Bank stocks in Athens have crashed 44pc since Alexis Tsipras swept into power this week with a mandate to defy the European power structure. Contrary to expectations, Mr Tsipras has not resiled from a long list of campaign pledges that breach the terms of Greece’s EU-IMF Troika Memorandum and therefore put the country on a collision course with Brussels and Berlin. He told his cabinet he is willing to negotiate on demands for debt relief but will not abandon core promises. “We will not seek a catastrophic solution, but neither will we consent to a policy of submission,” he said. If anything, he is upping the ante, going into coalition with a nationalist party even more hostile to the Troika, clearly gambling that Germany and the creditor powers will not let monetary union break apart at this late stage having already committed €245bn (£183bn), for to do so would shatter the illusion that the eurozone crisis has been solved.

“We will immediately stop any privatisation,” said Panagiotis Lafazanis, leader of the Marxist Left Platform, the biggest bloc in the Syriza pantheon. Plans to sell the PPT power utility and the Piraeus Port have been halted. The minimum wage will be raised from €500 to €751 a month as a first order business, an explicit rejection of Troika austerity terms. We are witnessing a revolt. Never before have the EMU elites had to face such defiance on every front, and they have yet to experience the lacerating tongue of Yanis Varoufakis, a relentless critic of their 1930s ideology of debt-deflation and “fiscal waterboarding”. Mr Varoufakis told me before becoming finance minister that Syriza will not capitulate even if the European Central Bank threatens to cut off €54bn of liquidity for the Greek banking system, a move that would force Greece to nationalise the banks, impose capital controls, and reintroduce the drachma within days.

“A freshly elected government cannot allow itself to be intimidated by threats of Armageddon,” he said. His first act in office today was to announce that 600 cleaners in the finance ministry will regain their jobs, paid for by cutting financial advisers. Whether you are “staunchly” Left or “unashamedly” Right – as the BBC characterises opinion – it is hard not to feel a welling sympathy for this revolt. If it takes a neo-Marxist like Alexis Tsipras to confront the elemental folly of EMU crisis strategy, so be it. The suggestion that Syriza is retreating from “reform” is laughable. There has been no reform. The two dynastic parties in charge of Greece for three decades have treated the state as a patronage machine and seem unable to shake the habit. At least Syriza are outsiders.

Mr Varoufakis has vowed to smash the “rent-seeking” kleptocracy that have turned state procurement into an enrichment scam. “We will destroy the bases which they built for decade after decade,” he said. What Syriza is really retreating from is a scorched-earth austerity regime that has cut investment by 63.5pc, caused a 26pc fall in GDP, pushed the youth jobless rate to 62pc, and sent debt spiralling up to 177pc of GDP. We have witnessed “The Rape of Greece”, to borrow the title of a new book by Nadia Valavani, suddenly catapulted into power as deputy finance minister. IMF officials privately agree. The fund confesses that the Troika fatally under-estimated the violence of the fiscal multiplier. It is true that Athens lied about the true state of public finances in the years leading up to the crisis, but this is a distraction in macro-economic terms.

The flood of French, German, Dutch, and British capital into Greece was so vast that the drama would have unfolded in much the same way even if Greek politicians had been angels. The greater lie was the silent complicity of the whole eurozone in allowing a deformed monetary union to incubate disaster. What has happened to Greece since then is a moral scandal. Leaked documents from the IMF board confirm the country needed debt relief at the outset. This was blocked by the EU for fear it would set off contagion at a time when the eurozone did not have a lender-of-last resort. Greece was sacrificed to buy time for the euro.

“Talks won’t be easy, they never are in Europe..”

• Tsipras Aims to Avert Catastrophe But Greek Markets Sink Further (Bloomberg)

Greek Prime Minister Alexis Tsipras and his finance chief pledged to avoid a standoff with creditors as stock and bond markets tumbled on the prospect of a prolonged fight with fellow European governments. “There will neither be a catastrophic clash, nor will continued kowtowing be accepted,” Tsipras, 40, said on Wednesday, in comments broadcast live. The new Greek leadership “will not be forgiven” if it betrays its pre-election pledges to renegotiate the terms of the country’s bailout, he said. The new premier convened his cabinet that includes a foreign minister who raised questions over European Union sanctions against Russia and a finance minister who has called Greece’s bailout a trap.

Germany warned the Mediterranean nation against abandoning prior agreements on aid, after analysts said that setting Greece on a collision course with its European peers might lead to its exit from the euro region. The Syriza-led government came to power on a platform of writing down Greek public debt, raising wages and halting spending cuts while remaining in the euro. “Talks won’t be easy, they never are in Europe,” Finance Minister Yanis Varoufakis, 53, said as he took over from his predecessor. “There will be no duel, no threats, or an issue of who blinks first.” Greek stocks and bonds slumped for a third day, after new ministers said they will cease the sale of some state assets and increase the minimum wage. Yields on three-year bonds rose 2.66 percentage points to 16.69%.

The benchmark Athens General Index decreased 9.2% to its lowest level since 2012, led by a collapse in the value of banks. Yields on 10-year bonds rose back above 10% after being as low as 5.7% in September. In mid 2012, they exceeded 30%, the highest since the country’s debt restructuring, the largest in history. Statements of newly appointed ministers “imply confrontation and tense negotiations in the near future,” Vangelis Karanikas, head of research at Athens-based Euroxx Securities, wrote in a note to clients. The country has about €330 billion of outstanding borrowings. It has to refinance Treasury bills on Feb. 6 totaling €1 billion and another €1.4 billion on Feb. 13, according to data compiled by Bloomberg. The government typically would do that mostly through local banks.

“The country has suffered economic ruin on a scale usually seen only in times of war. The crisis has shorn away nearly a quarter of Greece’s GDP. The unemployment rate is 26%, higher than that of the United States at the height of the Great Depression.”

• Greece Wants a Debt Break. What About Its Poorer Neighbors? (Bloomberg)

Alexis Tsipras’s first official act as Greece’s new prime minister was to lay a small bouquet of roses at the site of a World War II memorial. It marks the execution by firing squad of 200 mostly communist activists by Nazi soldiers. The move was highly symbolic, and not only because Tsipras heads a party named Syriza, an acronym for The Coalition of the Radical Left. The 40-year-old prime minister’s rise to power has put him on a collision course with Germany, as he struggles to deliver on his campaign promises to renegotiate his country’s debt and overturn the painful austerity demanded by Greece’s creditors. But if Tsipras is to bring home the deal he feels Greece deserves, he will have to more than face down the Germans. He’ll have to win over skeptical taxpayer in other euro zone countries, reassure European leaders worried about insurgent challenges of their own and make the case that – in a Europe still reeling from the 2008 global financial crisis – Greece is uniquely deserving of assistance.

Even after seven year of devastating recession, Greece remains much richer than most of its neighbors. Its gross domestic product is $22,000 a person. Albania’s is $4,000, Macedonia’s $5,000. In Bulgaria – like Greece, a member of the European Union – it’s $8,000. “It’s very difficult to make the point to a worker in Bulgaria that they should give part of their taxes to help people in Greece who are richer than they are,” said Ruslan Stefanov, director of the economic program at the Center for the Study of Democracy in Sofia. “If you are spending money like that in Greece, you should spend money in Bulgaria and other Eastern European countries. This is an argument that is being made by politicians here.”

There’s no denying that the situation in Greece is heart-wrenching. The country has suffered economic ruin on a scale usually seen only in times of war. The crisis has shorn away nearly a quarter of Greece’s GDP. The unemployment rate is 26%, higher than that of the United States at the height of the Great Depression. Among the young, it has topped 50%. Families have been plunged into poverty. The private sector has been gutted. The public sector is in shambles. And yet the alternative to austerity is money, and the money has to come from somewhere. Just as Tsipras would suffer if he tried to return empty-handed to the Greeks who elected him, so would politicians in countries like Germany if they tried to sell debt forgiveness to national parliaments and voters.

“Hardest hit were banks, falling as much as 30% on Wednesday because of concern about their supply of funds.”

• Investors Turn On Tsipras’s Campaign to End Austerity in Greece (Bloomberg)

Investors gave their verdict on the new Greek government, selling the country’s stocks and bonds in a signal to Prime Minister Alexis Tsipras of the price he will pay for sticking to promises to end austerity. Hardest hit were banks, falling as much as 30% on Wednesday because of concern about their supply of funds. In the run-up to Sunday’s election, Greek deposit outflows accelerated last week to levels not seen even at the peak of the debt crisis, totaling €11 billion ($12.5 billion), according to a person familiar with the matter. Tsipras’s plans to boost the minimum wage and halt the sale of state assets helped win him a decisive endorsement from voters.

He then formed a coalition with a party that also wants to ditch Greece’s bailout terms and appointed a finance minister who has called them a trap, alarming investors that he’s set for a protracted clash with fellow European leaders. “The market was expecting most of it was going to be political posturing ahead of the elections,” said Gianluca Ziglio, executive director of fixed-income research at Sunrise Brokers in London. Instead, “there’s walk after the talk, and a good deal of it,” he said. Standard & Poor’s said it may cut Greece’s credit rating, already five levels below investment grade, should the new government fail to agree with official creditors on further financial support for the country. Stocks and bonds slumped after Germany and the Netherlands warned Tsipras against abandoning prior agreements on aid and analysts said his policies might lead to Greece’s exit from the euro region.

“Shares of Bank of Piraeus, Alpha Bank, National Bank of Greece and Eurobank all fell by more than 25% on Wednesday.”

• Greek Bank Stocks And Deposits Hit By Default Fears (CNBC)

Greece’s already-fragile banking sector has taken a hammering as fears of a debt default have hit lender’s stocks—and deposits. Following the victory of anti-austerity Syriza in the polls at the weekend, traders are seriously considering the possibility of a default on Greece’s sovereign debt. It’s not the first time Greece has defaulted—the first one was around 450 BC and, more recently, private bond-holders were forced to take a haircut on their debt back in 2012. But Greece’s banks are ill-prepared for another one. Shares in the country’s four main banks have tumbled since Friday, when polls indicated a victory for Syriza. Shares of Bank of Piraeus, Alpha Bank, National Bank of Greece and Eurobank all fell by more than 25% on Wednesday. Meanwhile, Greek banks have hemorrhaged deposits since December, when a Syriza victory was seen as increasingly likely. On Wednesday, Citi Bank economists cited estimates suggesting that around €3 billion euros flew out of Greek banks in December, followed by a further €8 billion in January.

Syriza’s fiery young leader Alexis Tsipras has consistently argued that Greece’s sovereign debt burden of 320 billion euros ($364 billion) is unsustainable, and that the country must be offered some form of debt relief—a policy that Germany, among other lenders to Greece, has dismissed. “Europe and Germany is prepared for accepting the worst case of a Greece default,” Friedrich Heinemann, head of the department for public finance at Munich’s ZEW research institute, told CNBC on Wednesday. “A big name is starting now… They are sending out signals of a very tough stance in the upcoming negotiations. But I think it is important that Europe now also sends out a signal that it cannot be blackmailed, because the Greek government, I think it has the expectation that Europe is very anxious to avoid any stopping of payments from the Greek side.”

“Since the financial crisis all major advanced economies have been in a debt trap where low growth deepens the burden of debt..”

• Bank Of England Governor Attacks Eurozone Austerity (Guardian)

The Bank of England governor, Mark Carney, has launched a strong attack on austerity in the eurozone as he warned that he single-currency area was caught in a debt trap that could cost it a second lost decade. Speaking in Dublin, Carney said the eurozone needed to ease its hardline budgetary policies and make rapid progress towards a fiscal union that would transfer resources from rich to poor countries. “It is difficult to avoid the conclusion that, if the eurozone were a country, fiscal policy would be substantially more supportive,” the governor said. “However, it is tighter than in the UK, even though Europe still lacks other effective risk-sharing mechanisms and is relatively inflexible.” Carney’s remarks come just three days after the election of the Syriza-led government in Greece presented a direct challenge to the austerity policies championed in the eurozone by Germany’s Angela Merkel.

While not mentioning any eurozone country by name, Carney made it clear that he thought the failure to complete the process of integration coupled with over-restrictive fiscal policies risked driving the 18-nation single currency area deeper into a debt trap. “Since the financial crisis all major advanced economies have been in a debt trap where low growth deepens the burden of debt, prompting the private sector to cut spending further. Persistent economic weakness damages the extent to which economies can recover. Skills and capital atrophy. Workers become discouraged and leave the labour force. Prospects decline and the noose tightens. “As difficult as it has been, some countries, including the US and the UK, are now escaping this trap. Others in the euro area are sinking deeper.”

“Will individual governments be forced to re-capitalize, or bail out the central banks, which are trying to bail out the very countries they are trying to help?”

• The Really Scary Thing About Europe’s QE Plan (CNBC)

The European Central Bank’s plan to, along with each member country’s central bank, launch a $1 trillion bond-buying program raises as many questions as it answers. The most important of which is not whether it will boost European Union growth and inflation, but whether it will create an unexpected problem, the likes of which the Federal Reserve never need deal with. Will the ECB and individual central banks make or lose money on their bond buys? Remember when the Fed launched its zero interest-rate policy (ZIRP) and the first round of quantitative easing (QE), many said the Fed would take a bath buying both U.S. Treasury bonds and mortgage securities? The difference was that the Fed, almost by definition, was “buying the bottom” in mortgages, whose prices were so distressed, and the market so illiquid that the Fed could virtually only make money on the transactions.

So, too, with Treasurys. The Fed started buying bonds when interest rates were considerably higher and, thus, since the start of QE I, all the way through QE III, the Fed has logged large capital gains on its bond portfolio and remitted back to the Treasury the interest payments from both mortgage securities and Treasury bonds. However, in the case of the ECB and other individual central banks, they will be buying sovereign debt with yields at historic lows and, as bond math goes, prices at historic highs. In some cases, European bond yields are negative, suggesting that it will be impossible for some of the central banks to ever make money on their QE programs.

Rather ironically, QE is designed to bring about lower interest rates, something the Fed’s program was quite successful at. With the exception of Greece, European rates had already greatly discounted the well-telegraphed ECB program, leaving no room for the “shock and awe” that could move markets in a desired direction. The larger question, which only a handful have thought to ask, is what happens to the central banks if they do, indeed, lose money on their bond buys? Larger balance sheets, with portfolio losses could reduce the available capital of the individual central banks and the ECB. Will individual governments be forced to re-capitalize, or bail out the central banks, which are trying to bail out the very countries they are trying to help?

Yellen just makes it up by cherry picking data.

• Federal Reserve Paves Way For Earlier-Than-Expected Rate Hike (Guardian)

The Federal Reserve appeared to be paving the way for an earlier-than-expected increase in interest rates on Wednesday night, as it highlighted the recent strength of the US economy. After its two-day meeting, the Fed announced that borrowing costs would remain unchanged, at 0-0.25%; but seasoned Fed-watchers pointed out that in the accompanying statement, it had upgraded its assessment of the strength of the world’s largest economy. “Economic activity has been expanding at a solid pace,” the Fed said. “Labour market conditions have improved further, with strong job gains and a lower unemployment rate.” Janet Yellen, who took over as Fed chair a year ago, has stressed that with oil prices plunging, she wants to see evidence that inflation is returning to its 2% target before she agrees to a shift in rates. But markets saw the relatively upbeat language about growth and jobs as a sign that opinion at the Fed is shifting towards an increase in borrowing costs.

Economists are bitterly divided about when monetary policy should be tightened. Some Fed policymakers are nervous that falling unemployment could soon spark inflation. But outside experts, including Nobel prizewinner Paul Krugman, have warned that high levels of debt among many US households would make an early rate rise risky. Krugman said in Dubai last month that he believed the Fed could even delay a rate rise until next year. “When push comes to shove, they’re going to look and say: ‘It’s a pretty weak world economy out there, we don’t see any inflation, and the risk if we raise rates and it turns out we were mistaken is just so huge.’” Unlike December’s no-change decision, the Fed said Wednesday’s meeting was unanimous, after the new year saw a reshuffle among the chairs of the various regional federal reserve banks, who take turns to vote.

“My idea is the Fed raises rates for philosophical reasons. That may be short-lived.”

• Jeffrey Gundlach: Fed Is on the Brink of Making a Big Mistake (Bloomberg)

Jeffrey Gundlach says the Federal Reserve is on the brink of making a big mistake. U.S. central bankers have been talking about raising benchmark borrowing costs this year even though the outlook for global growth is worsening as oil prices tumble. If Fed Chair Janet Yellen goes ahead with this plan, she runs the risk of having to quickly reverse course and cut interest rates, according to Gundlach. “There’s no fundamental reason to raise interest rates,” Gundlach, chief executive officer at DoubleLine, said at a conference yesterday in Hollywood, Florida. “My idea is the Fed raises rates for philosophical reasons. That may be short-lived.” Policy makers concluded a two-day meeting in Washington today.

The Fed maintained its pledge to be “patient” on raising interest rates and boosted its assessment of the economy and labor market, even as it expects inflation to decline further. Yellen said in December that being patient meant such a tightening wouldn’t happen “for at least the next couple of meetings,” or not before late April. Bond traders would seem to share Gundlach’s concern that the Fed may be getting ahead of itself with its road-map for an exit from six years of near-zero interest rates. They are pricing in annual inflation of about 1.33% during the next five years, short of the Fed’s 2% goal, based on break-even rates for Treasury Inflation Protected Securities. Oil prices have fallen to $44.28 a barrel from $107.26 in June. “I would bet a great deal of money that oil’s not going to go to $90 by year-end,” Gundlach said.

“The Fed and its friends in the financial industry are frantically hoping their next mandate or strategy for managing the system will continue to bail them out of each new crisis.”

• ‘Two Percent Inflation’ and The Fed’s Current Mandate (Ron Paul)

Over the last 100 years the Fed has had many mandates and policy changes in its pursuit of becoming the chief central economic planner for the United States. Not only has it pursued this utopian dream of planning the US economy and financing every boondoggle conceivable in the welfare/warfare state, it has become the manipulator of the premier world reserve currency. As Fed Chairman Ben Bernanke explained to me, the once profoundly successful world currency – gold – was no longer money. This meant that he believed, and the world has accepted, the fiat dollar as the most important currency of the world, and the US has the privilege and responsibility for managing it. He might even believe, along with his Fed colleagues, both past and present, that the fiat dollar will replace gold for millennia to come.

I remain unconvinced. At its inception the Fed got its marching orders: to become the ultimate lender of last resort to banks and business interests. And to do that it needed an “elastic” currency. The supporters of the new central bank in 1913 were well aware that commodity money did not “stretch” enough to satisfy the politician’s appetite for welfare and war spending. A printing press and computer, along with the removal of the gold standard, would eventually provide the tools for a worldwide fiat currency. We’ve been there since 1971 and the results are not good. Many modifications of policy mandates occurred between 1913 and 1971, and the Fed continues today in a desperate effort to prevent the total unwinding and collapse of a monetary system built on sand.

A storm is brewing and when it hits, it will reveal the fragility of the entire world financial system. The Fed and its friends in the financial industry are frantically hoping their next mandate or strategy for managing the system will continue to bail them out of each new crisis. The seeds were sown with the passage of the Federal Reserve Act in December 1913. The lender of last resort would target special beneficiaries with its ability to create unlimited credit. It was granted power to channel credit in a special way. Average citizens, struggling with a mortgage or a small business about to go under, were not the Fed’s concern. Commercial, agricultural, and industrial paper was to be bought when the Fed’s friends were in trouble and the economy needed to be propped up. At its inception the Fed was given no permission to buy speculative financial debt or U.S. Treasury debt.

“People have no confidence in the central banks being able to fight off deflation..”

• Who Doubts Yellen’s Policies? Summers for One. Investors too (Bloomberg)

Janet Yellen is betting she has the formula for fending off deflationary forces. Investors and some of her fellow economists aren’t so sure. The Fed chair says history and theory suggest wages will pick up as the job market tightens, and prices will rise in line with the Federal Reserve’s 2% target. Former Treasury Secretary Lawrence Summers argues policy makers can’t count on this, while Richard Clarida of Columbia University in New York says it hasn’t happened in the last few economic expansions. Investors have their doubts, too: They expect inflation will run well below the Fed’s target for the next decade, based on trading in U.S. Treasury securities.

“People have no confidence in the central banks being able to fight off deflation,” said Marvin Goodfriend, a former Fed official who is now a professor at Carnegie Mellon University. The Fed chair and her colleagues said Jan. 28 that inflation probably will ebb further in the next few months, driven lower by falling energy prices. Over the medium term, they see it rising “gradually toward 2%” as the labor market tightens and oil’s impact fades, according to the statement released after their Jan. 27-28 meeting. Yellen’s predecessor, Ben S. Bernanke, won plaudits in monetary-policy circles when he finally got the Fed to sign on to an inflation target in early 2012. There’s just been one small hitch: Since April of that year, inflation has failed to hit the central bank’s objective. It was 1.2% in November.

“The irony is that Bernanke got his inflation target in January 2012, and in almost every month since then they’ve fallen below it,” said Clarida, who is also executive vice president at Pacific Investment Management Co. in Newport Beach, California, which oversees some $1.7 trillion in assets Summers said the Fed shouldn’t base its interest-rate decisions on a theory that links changes in inflation to developments in the labor market. That theory, known as the Phillips Curve, posits that wages and prices rise as unemployment falls.

“..banks have been told to tighten lending supervision to avoid loans being funneled into stock markets.” Yeah, but what about the shadow banks?

• China Regulator To Inspect Stock Margin Trading At 46 Firms (Reuters)

China’s stock regulator will inspect the stock margin trading business of 46 companies, the official Xinhua news agency said, amid concerns that the country’s stock markets are becoming over-leveraged and vulnerable to a sudden reversal. Sources told Reuters on Wednesday that Chinese regulators would launch a fresh investigation into stock margin trading, and banks have been told to tighten lending supervision to avoid loans being funneled into stock markets. “The inspection belongs to normal regular supervision and should not be over-interpreted,” Xinhua said late on Wednesday, quoting the China Securities Regulatory Commission (CSRC). Chinese stocks have climbed by around 40% since November, raising some concern that the rally is out of step with a marked slowdown in the world’s second-largest economy. The tide of money into stocks follows a recent cut in interest rates and a weak property market, which is traditionally a strong investment destination for household savings.

The outstanding value of margin loans used to purchase shares has hit record highs for the past three days, reaching 780 billion yuan ($124.5 billion) on Wednesday. The CSRC punished three of the nation’s largest brokerages this month for illegal conduct in their margin trading businesses. At the same time, banking regulators moved to curb abuse of short-term forms of credit in the interbank market that were seen as being used for stock market speculation. Reports of previous investigations and regulatory clampdowns caused a dramatic plunge in stocks on Jan. 19, with main indexes tumbling over 7% in a single day. Regulators followed up by reassuring the market they were not trying to suppress the rally, one of the few bright spots in Chinese capital markets.

“It just doesn’t bode well.”

• Kern County CA Declares Fiscal Emergency Amid Plunging Oil Prices (LA Times)

Kern County supervisors declared a state of fiscal emergency at their weekly meeting Tuesday in response to predictions of a massive shortfall in property tax revenues because of tanking oil prices. Surging oil supplies domestically and weak demand abroad have left Kern, the heart of oil production in California, facing what could be a $61-million hole in its budget once its fiscal year starts July 1, according to preliminary calculations from the county’s assessor-recorder office. Oil companies account for about 30% of the county’s property tax revenues, a percentage that has been declining in recent decades but still represents a critical cushion for county departments and school districts.“It affects all county departments – every department will be asked to make cuts,” said County Assessor Jon Lifquist in an interview this month. “It just doesn’t bode well.”

Soaring pension costs also influenced the fiscal emergency declaration, which allows supervisors to tap county reserves. Operating costs expected at a new jail facility in fiscal 2017 and 2018 factored into the decision as well. Looking at an operational deficit of nearly $27 million for the 2015-16 fiscal year, supervisors adopted a plan to immediately begin scaling back county spending rather than making deep reductions all at once in July. The Service Employees International Union Local 521 urged officials in a statement to “not adopt drastic cuts that could cripple vital community services.” The union said that although temporary wage cuts and hiring freezes “may be an obvious solution,” such tactics “are never the sole answer to economic problems.”

”Shell warned there could be more to come should crude prices remain relatively low..”

• Shell Cuts $15 Billion of Spending as Profit Misses Expectations (Bloomberg)

Royal Dutch Shell Plc will cut $15 billion of spending over the next three years as the crash in oil prices saw fourth-quarter profit miss expectations. Shell, the first of the world’s largest oil companies to report earnings following the slump in crude to a five-year low, will review spending on about 40 projects worldwide, Chief Executive Officer Ben van Beurden said in an interview. “We see pressure on our investment program,” van Beurden said on Bloomberg TV. “It’s a game of being prudent but at the same time not overreacting.” Profit excluding one-time items and inventory changes was $3.3 billion in the quarter, up from $2.9 billion a year earlier, Shell said today in a statement. That missed the $4.1 billion average of 13 analyst estimates compiled by Bloomberg. Shell shares dropped as much as 4.4% in London. The global industry is scurrying to respond as oil below $50 a barrel guts cash flows. Statoil, Tullow and Premier have delayed projects or cut exploration spending. BP has frozen wages and Chevron delayed its 2015 drilling budget.

By cutting spending, companies aim to protect returns to investors. Shell, based in The Hague, will pay a quarterly dividend of 47 cents a share, the same as the previous three months. It will pay the same in the first quarter. The payout is an “iconic item at Shell, I will do everything to protect it,” the CEO said in the television interview. In addition to the $15 billion of cuts in planned spending over three years, Shell warned there could be more to come should crude prices remain relatively low. “Shell has options to further reduce spending but we are not over-reacting to current low oil prices,” it said. The drop in oil prices has put investment levels “under severe pressure in the near term.” While declining to speculate about where crude prices are headed, he warned that canceling or delaying too many projects could risk putting in jeopardy supply over the longer term.

Home › Forums › Debt Rattle January 29 2015