Harris&Ewing Underwood Typewriter Co., Washington, DC 1919

Globalization is a times of plenty phenomenon.

• Borders Closing And Banks In Retreat; Is Globalisation Dead? (Guardian)

Globalisation is under attack. It was meant to be the unstoppable economic force bringing prosperity to rich and poor alike, but that was before the financial crisis ripped up the rulebook. For the past four years, international trade flows have increased more slowly than global GDP – “an outcome unprecedented in postwar history”, as analyst Michael Pearce of Capital Economics put it in a recent note. Crisis-scarred global banks are retreating from risky cross-border lending, and multinationals are casting a sceptical eye over foreign opportunities as geopolitical tensions simmer. Populist politicians in a string of countries, not least the UK, are playing on public fears about migrant workers undermining their pay.

Global trade flows are still expanding: but they have never regained the breakneck pace of the 1990s and early 2000s. In the innocent days before the Great Recession, the dismantling of trade barriers between nation states often seemed inevitable. Yet more than 13 years after the Doha round of multilateral trade talks kicked off, with the aim of binding developing countries more closely into the international system, the idea of a global trade deal remains locked in the deep freeze. Some analysts are starting to ask: has globalisation come to a halt? The lesson many governments and companies learned from the turmoil that followed the collapse of Lehman Brothers was that there are risks to being too unthinkingly exposed to the ebbs and flows of the international system.

“There’s quite a fundamental shift going on here,” says Professor Simon Evenett, an expert on trade at the University of St Gallen in Switzerland. “You can’t say it’s across the board, but there are some sectors where globalisation is in substantial retreat.” He points to steel, for example, where his recent research shows that trade flows have never returned to pre-2007 levels. “I think the direction of travel is depressing,” he says.

“..the logic of buying and selling no longer applies to material goods alone. It increasingly governs the whole of life.”

• Capitalism Is Killing America’s Morals, Our Future (Paul B. Farrell)

Yes, capitalism is working … for the Forbes Global Billionaires whose ranks swelled from 322 in 2000 to 1,826 in 2015. Billionaires control the vast majority of the world’s wealth, 67 billionaires already own half the world’s assets; by 2100 we’ll have 11 trillionaires, while American worker income has stagnated for a generation. But for the vast majority of the world, capitalism is a failure. Over a billion live on less than two dollars a day. In his “Capital in the Twenty-First Century,” economist Thomas Piketty warns the inequality gap is toxic, dangerous. As global population explodes from 7 billion to 10 billion by 2050, food production will deteriorate. Pope Francis adds, “Inequality is the root of social ills,” fueling more hunger, revolutions, wars.

For years we’ve been asking: Why does the capitalist brain blindly drive down this irrational path of self-destruction? We found someone who brilliantly explains why free market capitalism is hell-bent on destroying itself and the world along with it: Harvard philosopher Michael Sandel, author of the new best seller, “What Money Can’t Buy: The Moral Limits of Markets,” and his earlier classic, “Justice: What’s the Right Thing to Do?” For more than three decades Sandel’s been teaching us why capitalism is undermining human morality … and why we keep denying this insanity. Why do we bargain away our moral soul? His classes number over a thousand. You can even take his course online free. He even summarized capitalism’s takeover of America’s conscience in “What Isn’t for Sale?” in the Atlantic. Listen:

“Without being fully aware of the shift, Americans have drifted from having a market economy to becoming a market society … where almost everything is up for sale … a way of life where market values seep into almost every sphere of life and sometimes crowd out or corrode important values, nonmarket values.” His course should be required for Wall Street insiders, corporate CEOs and all 95 million Main Street investors. Here’s a short synopsis:

“The years leading up to the financial crisis of 2008 were a heady time of market faith and deregulation — an era of market triumphalism,” says Sandel. “The era began in the early 1980s, when Ronald Reagan and Margaret Thatcher proclaimed their conviction that markets, not government, held the key to prosperity and freedom.” And in the 1990s with the “market-friendly liberalism of Bill Clinton and Tony Blair, who moderated but consolidated the faith that markets are the primary means for achieving the public good.”

So today, “almost everything can be bought and sold.” Today “markets, and market values, have come to govern our lives as never before. We did not arrive at this condition through any deliberate choice. It is almost as if it came upon us,” says Sandel. Over the years, “market values were coming to play a greater and greater role in social life. Economics was becoming an imperial domain. Today, the logic of buying and selling no longer applies to material goods alone. It increasingly governs the whole of life.”

“..big banks have now paid more than $60 billion in fines over the past two years.”

• America Has Become a “Banana Republic Run by Wall Street Criminals” (MM)

Wall Street criminals just won’t stop misbehaving. The latest crime was exposed Wednesday. Five of the biggest names in global finance agreed to pay billions to settle lawsuits alleging they illegally gamed the $5 trillion-a-day foreign exchange market. JPMorgan Chase, Citigroup, Barclays, UBS, and RBSpleaded guilty and settled for fines totaling roughly $5.7 billion. A sixth bank, Bank of America, will pay $210 million after being fined by the Fed. With this week’s settlements, big banks have now paid more than $60 billion in fines over the past two years.

“America has become a banana republic run by Wall Street criminals,” Money Morning Capital Wave Strategist Shah Gilani said on Wednesday. Of course, history dictates the fines will have no actual effect on business practices. “We all know the big banks are above the law,” Gilani said. “They are convicted, they admit their guilt (sometimes), and no one goes to jail – they just pay more fines.” Not including this week’s, just look at a few of the settlements too-big-to-fail banks have shelled out in the last five years alone:

In 2015, Deutsche Bank paid a $2.5 billion fine for manipulating benchmark interest rates.

In 2014, Credit Suisse paid $2.6 billion to the U.S. Justice Department for conspiring to aid tax evasion. It was the first financial institution in more than a decade to plead guilty to a crime.

In 2013, Bank of America, JPMorgan, Wells Fargo, and ten other banks paid $9.3 billion to the Office of the Comptroller of the Currency and the Federal Reserve for foreclosure abuses.

In 2013, JPMorgan paid $13 billion to the U.S. Justice Department for mortgage security fraud.

In 2012, JPMorgan, Wells Fargo & Co., Bank of America, Citigroup, and Ally Financial paid $25 billion in penalties for foreclosure abuses.

In 2012, HSBC paid $1.9 billion to U.S. authorities for shoddy money laundering regulations. It was the third time since 2003 HSBC assured the government it would correct its policies.

In 2012, UBS paid $1.5 billion and admitted it manipulated interbank lending rates.

In 2011, Bank of America paid $8.5 billion to mortgage bond holders related to Countrywide.

Resistance will grow.

• Tsipras Reiterates Red Lines But Faces Revolt Within Syriza (Kathimerini)

After a busy week of talks with European leaders aimed at securing support for a deal for Greece, Prime Minister Alexis Tsipras faces challenges on the home front amid tensions with SYRIZA over the terms such an agreement would entail. In a speech to his party’s central committee on Saturday, Tsipras said Greece is “in the final stretch of negotiations” and is ready to accept a “viable agreement” with its creditors but not on “humiliating terms.” He ruled out submitting to irrational demands on value-added tax rates and further labor reform, and called on lenders to make “necessary concessions.” “We have made concessions but we also have red lines,” he said, claiming that some foreign officials were counting on the talks failing.

Although Tsipras reiterated his commitment to the party’s so-called red lines in negotiations, pressure from within SYRIZA not to capitulate to creditors has grown amid rumors that a deal is in the works. In particular, members of the radical Left Platform led by Energy Minister Panayiotis Lafazanis have refused to approve any deal that departs from the party’s pre-election promises. The faction has been working on a counter-proposal for alternative sources of funding. Tsipras and other front-line cabinet members, meanwhile, remain focused on a deal by early June when the country’s next debt repayment to its creditors is due.

But as negotiations continue to drag, sources suggest that the likeliest scenario is a two-stage deal despite Tsipras’s recent insistence on the need for a “comprehensive agreement.” The two-stage deal would comprise an initial agreement that would unlock a portion of rescue loans in exchange for some reforms, most likely tax increases, to keep the country solvent; the second part of the deal would tackle the thorny issues of pension and labor sector reform.

“The problem is that Alexis Tsipras is riding a scooter and Wolfgang Schaeuble is driving an armored BMW.”

• Europe Said to Weigh Contingency Plans in Greece Impasse (Bloomberg)

German Finance Minister Wolfgang Schaeuble raised the possibility that Greece may need a parallel currency and European officials are making contingency plans for the Greek banking system as talks on unlocking aid remain stuck. Schaeuble mentioned the idea of parallel currencies at a recent meeting without endorsing it, according to two people who attended. The European Commission is looking at how to manage the possible failure of Greek financial firms and other events that may cause investor losses, two other people said. With Greece’s final €7.2 billion bailout installment on hold, Prime Minister Alexis Tsipras’s latest attempt to bypass finance ministers and secure a political deal failed on Friday.

As Greece faces payment deadlines in the next two weeks, some European policy makers are preparing for the worst while upholding the goal of keeping Greece in the euro. “We need to have the strongest and most complete agreement possible now to secure and facilitate talks for the next deadlines,” French President Francois Hollande said Friday in Riga, Latvia, after he and German Chancellor Angela Merkel met Tsipras. Merkel said there’s “a whole lot to do.” Merkel and Hollande this week gave Tsipras until the end of May to reach a deal to free up aid in return for policy changes demanded by Greece’s creditor. As time runs short, his government has to pay monthly salaries and pensions by next Friday and repay about €300 million to the IMF a week later.

Negotiators from Greece and its creditors are continuing technical talks in the so-called Brussels Group “over the coming days in order to accelerate progress,” European Commission spokeswoman Mina Andreeva said in Brussels on Friday. While Merkel and Schaeuble say they want to keep Greece in the 19-nation currency union, the finance minister has also said he wouldn’t rule out a Greek exit. Germany is “ready to take this brinkmanship very far,” with Schaeuble in the role of “attack dog,” Jacob Funk Kirkegaard, senior fellow at the Peterson Institute for International Economics in Washington, said by phone. “We’re in this game of chicken. The problem is that Alexis Tsipras is riding a scooter and Wolfgang Schaeuble is driving an armored BMW.”

No matter what happens, it won’t be easy. Not for Greece and not for Eruope.

• Neither Grexit Nor A Dual Currency Will Solve Greece’s Problems (Matthes)

A Grexit or the introduction of a dual currency is not a solution to Greece’s problems. On the contrary, it would be a worst-case scenario for Greece in the short term. Only in the medium to longer term, the resulting devaluation and improvement of price competitiveness would help businesses active in the export and import substitution sectors. For the euro area, a Grexit or dual currency would be a signal that the currency union is not made forever, even if the situation is much different from 2010-2012 as contagion effects to other euro periphery countries hardly exist today. The negative short-term impact from a Grexit or from a dual currency would push the Greek economy into a very deep crisis and lead to further impoverishment.

The Greek financial sector, which is already rather weak, would be severely affected, particularly by further withdrawals of euros from bank accounts in the course of bank runs (among other aspects). Capital controls can only partly stop this from happening. The problems of the financial sector would lead to a further drying up of credit supply and the danger of bank insolvencies. The risk of insolvency would go much beyond the banking sector and also include businesses and particularly the state. All private and public economic actors with sizeable debts in euros and under foreign law (debt which could not be converted to the new or dual currency) would suffer from higher debt counted in the dual or new currency. This is so because the dual or new currency would devaluate to a large degree versus the euro.

Imagine the balance sheet of a bank or of a company with significant euro debts under foreign law: These liabilities would remain in euro but significant parts of the assets would be converted to the dual or new currency, which then devaluates. This would cut a deep hole in the balance sheet and could well lead to insolvency. A government default is most likely, because foreign debts would remain to a large extent in euros but tax revenues would increasingly come from the new or dual currency. Insolvencies and the drying up of credit supply would lead to a significant rise in unemployment, costing even more people their job. A government default could mean that public wages and pensions cannot be paid for a certain period of time or only in the new weak currency. Moreover, the fiscal problems would further aggravate the state of the economy and of banks that hold government bonds.

Thank the troika.

• Hotel Contracts With A ‘Greek Default Clause’ (Kathimerini)

After the drachma clauses seen in tourism contracts, foreign tour operators are now forcing hoteliers in Greece to sign contracts with a Greek default clause. Foreign organizers of international conferences have been introducing default clauses to contracts forcing the non-payment of compensation in case the country defaults and they decide to cancel their events. That clause is reminiscent of insurance contracts which stop short of providing for compensation in case of natural disasters, acts of terrorism etc. Kathimerini understands that already one conference organizer, who is to hold an event in this country with the participation of foreign delegates next month, has imposed a “default clause” on the hotel enterprise in order to sign a contract, sparing him from having to pay compensation for canceling the event if Greece defaults.

In the next couple of months hoteliers will, as usual, also have to sign the bulk of their 2016 contracts with representatives of foreign tour operators. Some operators have already told Greek hoteliers that they require extra safety clauses in case the country drops out of the eurozone. Furthermore, the financial terms of contracts will depend on the planned value-added tax hikes on tourism. Hoteliers wonder on what terms they will be asked to sign the contracts, to what extent they can impose price hikes on tour operators and how they will retain their rates competitive in comparison with the hotel rates of other countries such as Turkey, Spain etc.

Representatives of tourism associations estimate that in the event more taxes are introduced, small and medium-sized hotel enterprises – which account for the majority of the country’s accommodation capacity – will see their negotiating position weakened against their foreign clients. The possibility of a VAT hike in Greece has also generated interest in the country’s rivals. A Lesvos hotelier reported that Turkish peers keep asking about any news on a VAT increase on Greek tourism for 2016, saying that a significant price increase on the Greek tourism package would signify a direct advantage for the neighboring country’s tourism market.

A comprehensive EU approach? Not going to happen.

• The Migrant Crisis on Greece’s Islands (New Yorker)

Greece, like Italy and Malta, has long been an entry point into the European Union for refugees and economic migrants making the journey by sea. This year, the Greek government expects a massive wave of migrants on the Aegean islands and Crete, fuelled by the protracted war in Syria. The Eastern Mediterranean route is not as deadly for migrants: thirty-one people are known to have drowned in the Aegean Sea this year, compared with an estimated eighteen hundred in the Central Mediterranean, according to figures from the International Organization for Migration. But the number of people arriving in Greece this year rivals the number of those coming to Italy: The I.O.M. says that at least 30,400 migrants have arrived in Greece as of May 12th, compared with thirty-four hundred in all of 2014.

At least 35,100 have arrived this year in Italy. Southern European countries have often felt poorly served by the Dublin Regulation, which dictates that the E.U. nations where migrants first arrive are ultimately responsible for them. Camino Mortera-Martinez and Rem Korteweg of the Centre for European Reform say that a deep divide between Northern and Southern E.U. states has resulted. “Northern member states want an asylum policy that keeps migrants in the South but treats them humanely,” they wrote recently, “while Southern member-states want the North to share the burden by accepting more migrants. The Mediterranean refugee crisis shows that this system is unsustainable.”

What’s also unsustainable, according to Eugenio Ambrosi, who directs the I.O.M.’s regional office for the European Union, Norway, and Switzerland, is the fact that migration has become an electoral issue “easily manipulated by populists who know that fear wins votes.” E.U. politicians have dithered on drafting a common migration and asylum policy because they’re worried about how voters will react. “There’s this attitude of: if your neighbor’s house is on fire, you watch and hope somebody else takes care of them so you don’t have to feed them and give them a blanket,” he said.

Ciudadanos is taking votes away from Podemos.

• Spain’s New Political Forces Seek To Make History (DW)

Outside a municipal sports building in Alcala de Henares, a small city east of Madrid, crowds are gathering and clusters of balloons are bobbing in the breeze. Just ahead of local elections across Spain, supporters of the new party, Ciudadanos, or “Citizens,” are in high spirits, believing that its phenomenal rise in recent months will soon make it one of the country’s most prominent political forces. Inside, a few minutes later, the party’s 35-year-old leader, Albert Rivera, bounds onto the stage to deliver a powerful message to his electoral rivals. “Some don’t understand what is happening in Spain – we’re not just facing an election day, we’re facing a new era,” he says.

“Whoever can’t understand that isn’t capable of leading the change. Spain is not doing well, it’s only doing well for a few.” This promise by a generation of young Spanish politicians to deliver a “new era” has already altered the country’s political landscape. But on Sunday, when elections are held for control of town and city halls across Spain and for 13 of its 17 regional parliaments, the political map is expected to be drastically redrawn. For the last three-and-a-half decades, the conservative Popular Party (PP) and the Socialists have dominated Spanish politics in a rigid two-party system. But the recent economic crisis and a torrent of corruption scandals have threatened to break that duopoly for the first time in Spain’s democratic period.

Ciudadanos and another new party with a young leadership, Podemos, or “We Can” in Spanish, are the beneficiaries of Spaniards’ disenchantment with the status quo and national polls show them in a four-way virtual tie with the PP and the Socialists. “This election represents a revolution because we’re going to go from having just two parties which are capable of governing, to having a political map on which there are four parties, all of which are capable of governing,” says Jose Ignacio Torreblanca, a political scientist who recently published a book about Podemos.

Elections today.

• Podemos Changing Spain’s Political Map (Telesur)

Pablo Iglesias, leader of the new left-wing party Podemos, says his movement has already “contributed to changing the Spanish political map. We can say that we have made irreversible changes. Nothing will ever be the same again.” Iglesias describes Podemos as a response to a “regime crisis,” in Spain in the aftermath of the global economic crisis and deep austerity politics and that Podemos was born out of “enormous frustration with the economic and political elites, He explained that the rise of Latin American left governments over the past decade represented a “fundamental reference” to the party, but one that cannot be easily reproduced.

While in the beginning, Podemos leaders believed that “a ‘Latin-Americanization’ of Southern Europe” was occurring, reality soon showed that European states were “very strong” meaning “the possibility of transformation |was| very limited.” In Iglesias’ opinion, this difficulty in creating such change explains why the party’s number two, Juan Carlos Monedero, recently resigned from the leadership. But he stressed the important role that social movement have in creating change, explaining that “these social movements allow |the party leaders| to go further, politically, in |their| demands,” referring to the movements against evictions in Spain, for example, or the movements defending education and public health. He added that criticism was a positive pattern inside the party, yet stressing that his leadership was backed by a great consensus.

Regarding differences with the situation in Greece, where the leftist Syriza now forms the government, Iglesias highlighted that because the economic crisis hit Greece much harder than in Spain, “the weakness of the state and the forces in power in Greece were greater,” making it easier for Syriza to make gains. He believes that the political and media establishment feared even more the rise of Podemos than Syriza because of Spain’s greater economic weight.

See below for link to the text of Draghi’s address.

• Eurozone Countries Should Unite For Economic Reforms: Mario Draghi (Reuters)

ECB President Mario Draghi has urged euro zone countries to unite in the task of reforming the bloc’s economies, saying sharing sovereignty was an opportunity and not a threat. Draghi is pushing governments not to waste the time ECB money printing has bought them. Saturday’s appeal to indebted countries to clean up their finances came the day after he warned growth would remain low in the face of unemployment and low investment. In a message read to attendees at a conference in Rome, he said countries should act quickly on recommendations the central bank has made to complete economic and monetary union, many of which have not been carried out.

“The current situation in the euro area demonstrates that this delay could be dangerous,” Draghi said, according to a text of the address released by the ECB, while acknowledging progress had been made, for example with banking union. But private risks need to be shared within the euro zone, with financial integration improving access to credit for companies and leading to a complete capital markets union, Draghi said. Draghi called for stricter and more transparent adherence to existing budgetary rules to help close the gaps among member states in employment, growth and productivity, but said this alone would not be enough.

Countries should observe common standards when implementing structural reforms but also take a country-specific approach, as part of a process of “convergence in the capacity of our economies to resist shocks and grow together”. Thirdly, Draghi said the euro zone should ask whether it had done enough to safeguard the possibility of using budgetary policy to counter the economic cycle, concluding: “I think not.” Many European countries realised only after the debt crisis exploded that their sovereign right to choose their own economic policy would be limited in the monetary union, Draghi said. But working to ensure long-term stability meant sharing control, Draghi said. “What can appear to be a threat is actually an opportunity,” he said.

Full speech with graphs etc.

• Structural Reforms, Inflation And Monetary Policy (Mario Draghi)

Structural and cyclical policies – including monetary policy – are heavily interdependent. Structural reforms increase both potential output and the resilience of the economy to shocks. This makes structural reforms relevant for any central bank, but especially in a monetary union. For members of monetary union resilience is crucial to avoid that shocks lead to consistently higher unemployment, and over time, permanent economic divergence. It therefore has direct implications for price stability, and is no less relevant for the integrity of the euro area. This is why the ECB has frequently called for stronger common governance of structural reforms that would make resilience part of our common DNA.

Structural reforms are equally important for their effect on growth. Potential growth is today estimated to be below 1% in the euro area and is projected to remain well below pre-crisis growth rates. This would mean that a significant share of the economic losses in the crisis would become permanent, with structural unemployment staying above 10% and youth unemployment elevated. It would also make it harder to work through the debt overhang still present in some countries. Finally, low potential growth can have a direct impact on the tools available to monetary policy, as it increases the likelihood that the central bank runs into the lower bound and has to resort recurrently to unconventional policies to meet its mandate.

But the euro area’s weak long-term performance also provides an opportunity. Since many economies are distant from the frontier of best practice, the gains from structural reforms are easier to achieve and the potential magnitude of those gains is greater. There is a large untapped potential in the euro area for substantially higher output, employment and welfare. And the fact that monetary policy is today at the lower bound, and the recovery still fragile, is not, as some argue, a reason for reforms to be delayed.

This is because the short-term costs and benefits of reforms depend critically on how they are implemented. If structural reforms are credible, their positive effects can be felt quickly even in a weak demand environment. The same is true if the type of reforms is carefully chosen. And our accommodative monetary policy means that the benefits of reforms will materialise faster, creating the ideal conditions for them to succeed. It is the combination of these demand and supply policies that will deliver lasting stability and prosperity.

Independence is not a matter of interpretation, gentlemen.

• Draghi and Fischer Reject Claim Central Banks Are Too Politicised (FT)

Two of the world’s most senior central bankers have hit back at charges that they have become too politicised, saying their calls for governments to take more aggressive steps to steer their economies towards a full recovery were necessary. Mario Draghi, the president of the ECB, and Stanley Fischer, the US Federal Reserve’s vice-chair, also disputed the idea that unelected technocrats should refrain from commenting on governments’ economic policies. The remarks, at the ECB’s annual conference in Sintra, came after Mr Draghi on Thursday called on lawmakers in the eurozone to implement politically unpopular structural reforms, or face years of weak economic growth. The ECB president on Saturday said his calls were appropriate in a monetary union where growth prospects had been badly damaged by governments’ resistance to economic reforms.

Mr Draghi said it was the central bank’s responsibility to comment if governments’ inaction on structural reforms was creating divergence in growth and unemployment within the eurozone, which undermined the existence of the currency area. “In a monetary union you can’t afford to have large and increasing structural divergences,” the ECB president said. “They tend to become explosive.” Mr Draghi’s defence of the central bank came after Paul De Grauwe, an academic at the London School of Economics, challenged his calls for structural reforms earlier in the week. Mr De Grauwe said central banks’ push for governments to take steps that removed people’s job protection would expose monetary policy makers to criticism over their independence to set interest rates.

The ECB president said central banks had a long tradition of commenting on governments’ economic policies, and that they had been right to speak out against wage indexation in the 1970s and fiscal excesses in earlier decades. He said central banks had been wrong to keep quiet on the deregulation of the financial sector. “We all wish central bankers had spoken out more when regulation was dismantled before the crisis,” Mr Draghi said. A lack of structural reform was having much more of an impact on poor European growth than in the US, he added. Mr Fischer said central bankers should think about structural reforms “in the context of what’s the expected growth rate in the economy”. The Fed vice-chair said it was appropriate for monetary policy makers to comment on spending in infrastructure and education because of the impact it had on US growth.

“There is general agreement that US infrastructure could do with a lot of investment. You just have to go on trains in the US or Europe to figure that out,” Mr Fischer told the audience of top academics and policy makers in Sintra on Saturday. He acknowledged there were limits on what was appropriate, saying he would “never talk about whether the defence budget was appropriate”. The passing of the Dodd-Frank Act was a “very massive change in the structure of the financial sector” and was “very important for financial stability going ahead”. Haruhiko Kuroda, the governor of the Bank of Japan who joined Mr Draghi and Mr Fischer on the panel, said he expected inflation to reach 2% around the first half of the 2016 fiscal year.

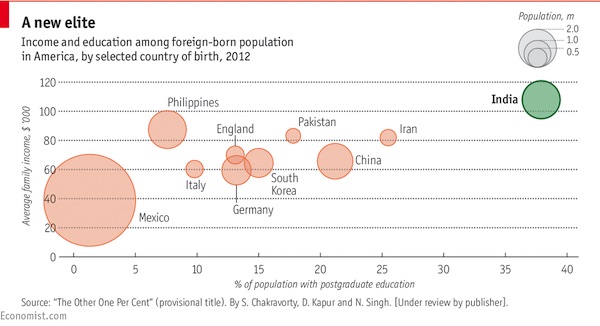

Waht makes India’s expats so successful? Provided, of course, that you see income levels as the measure of success.

• The Other One Per Cent (Economist)

Part of the secret of China’s success in the past four decades or so has been the clever use of its diaspora. Chinese manufacturers in Hong Kong who had long supplied American partners moved to the mainland and set up factories. Chinese nationals who succeeded abroad brought home trusted contacts, networks, experience, standards, technology and capital. India could do with more of that. Over 27m people of Indian origin, including some temporary migrants, live overseas, many of them in the Gulf. They remit $70 billion a year to their home country, more than any other group of expats. That adds up to 3.5% of India’s GDP, outstripping foreign direct investment. The biggest potential lies with the diaspora in the West. Mr Modi seems to be aware of that.

He has been courting it on visits to America, Australia, Germany and Canada, holding big rallies. Indians abroad heavily backed him in last year’s election, sending millions of dollars as well as people to help. Even in remote corners of Uttar Pradesh, your correspondent bumped into jovial volunteers with American accents. Indians in America are the most promising. They are increasingly prominent in tech companies, on Wall Street and in government, especially in the state department. Around 1% of America’s population, over 3.3m people, are “Asian Indians”. Perhaps 150,000 more arrive each year, and 90% of them stay permanently. Devesh Kapur, who has studied them, talks of a “flood”. He says over half of all Indian-born people in America arrived there after 2000. On the usual measures of success they outstrip all other minorities, including Jewish-Americans.

They are educated and rich. In 2012 some 42% held first or higher degrees; average family income was over $100,000, roughly double that of white Americans (see chart). Over two-thirds of them hold high-status jobs. They have done so well that many migrants from Pakistan or Bangladesh like to call themselves Indian, hoping that some of the stardust will rub off on them. The stereotype of Indians as keeping shops or running motels in their adopted country is thus outdated. An IT professional from Andhra Pradesh would be far more typical. Since the turn of the century America has slurped in highly skilled graduates as fast as India can produce them. America’s H-1B employment visa for skilled professionals tells the story. In a book under review by a publisher, provisionally entitled “The Other One Per Cent”, Mr Kapur and his co-authors note that between 1997 and 2013 half of those visas went to Indians. Since 2009 the share has been more than two-thirds.

And now there’s proof. What will happen with it?

• Secret Pentagon Report Reveals West Saw ISIS As Strategic Asset (Nafeez Ahmed)

A declassified secret US government document obtained by the conservative public interest law firm, Judicial Watch, shows that Western governments deliberately allied with al-Qaeda and other Islamist extremist groups to topple Syrian dictator Bashir al-Assad. The document reveals that in coordination with the Gulf states and Turkey, the West intentionally sponsored violent Islamist groups to destabilize Assad, despite anticipating that doing so could lead to the emergence of an ‘Islamic State’ in Iraq and Syria (ISIS). According to the newly declassified US document, the Pentagon foresaw the likely rise of the ‘Islamic State’ as a direct consequence of the strategy, but described this outcome as a strategic opportunity to “isolate the Syrian regime.”

The revelations contradict the official line of Western government on their policies in Syria, and raise disturbing questions about secret Western support for violent extremists abroad, while using the burgeoning threat of terror to justify excessive mass surveillance and crackdowns on civil liberties at home. Among the batch of documents obtained by Judicial Watch through a federal lawsuit, released earlier this week, is a US Defense Intelligence Agency (DIA) document then classified as “secret,” dated 12th August 2012. The DIA provides military intelligence in support of planners, policymakers and operations for the US Department of Defense and intelligence community. So far, media reporting has focused on the evidence that the Obama administration knew of arms supplies from a Libyan terrorist stronghold to rebels in Syria.

Some outlets have reported the US intelligence community’s internal prediction of the rise of ISIS. Yet none have accurately acknowledged the disturbing details exposing how the West knowingly fostered a sectarian, al-Qaeda-driven rebellion in Syria. Charles Shoebridge, a former British Army and Metropolitan Police counter-terrorism intelligence officer, said: “Given the political leanings of the organisation that obtained these documents, it’s unsurprising that the main emphasis given to them thus far has been an attempt to embarrass Hilary Clinton regarding what was known about the attack on the US consulate in Benghazi in 2012. However, the documents also contain far less publicized revelations that raise vitally important questions of the West’s governments and media in their support of Syria’s rebellion.”

The newly declassified DIA document from 2012 confirms that the main component of the anti-Assad rebel forces by this time comprised Islamist insurgents affiliated to groups that would lead to the emergence of ISIS. Despite this, these groups were to continue receiving support from Western militaries and their regional allies. Noting that “the Salafist [sic], the Muslim Brotherhood, and AQI [al-Qaeda in Iraq] are the major forces driving the insurgency in Syria,” the document states that “the West, Gulf countries, and Turkey support the opposition,” while Russia, China and Iran “support the [Assad] regime.” The 7-page DIA document states that al-Qaeda in Iraq (AQI), the precursor to the ‘Islamic State in Iraq,’ (ISI) which became the ‘Islamic State in Iraq and Syria,’ “supported the Syrian opposition from the beginning, both ideologically and through the media.”

Digging a deeper hole. Germans want to know.

• Germany Won’t Comment on Reported ‘Deep Freeze’ With US Intelligence (Reuters)

The German government declined to comment on a report that U.S. intelligence agencies were reviewing their cooperation with German counterparts and had dropped joint projects due to concerns secret information was being leaked by lawmakers. Bild newspaper reported on Saturday that U.S. spy chief James Clapper had ordered the review because secret documents related to the BND’s cooperation with the United States were being leaked to media from a German parliamentary committee. A spokesman for the U.S. embassy in Berlin said it does not comment on intelligence matters.

Allegations the BND intelligence agency helped the National Security Agency (NSA) spy on European companies and officials has been major news in Germany for weeks. It has strained Chancellor Angela Merkel’s coalition and damaged her popularity. “The German government puts great faith in the intelligence cooperation with the United States to protect our citizens,” a government spokesman said when asked about the Bild report. “The government doesn’t comment on the details of that cooperation in public but rather in parliament committees.” The newspaper said it had seen documents in which Clapper, director of national intelligence, expressed concern that information on the cooperation from Merkel’s chancellery to the parliamentary committee was leaked and harmed U.S. interests.

Clapper said Germany could no longer be trusted with secret documents, according to Bild, and as long as that is the case U.S. intelligence agencies should examine where to limit or cancel cooperation with Germany. Bild quoted a U.S. official saying the leaks were worse than those attributed to former NSA contractor Edward Snowden. “What the German government is now doing is more dangerous than what Snowden did,” the U.S. official was quoted saying.

Lovely.

• Leaked Report Profiles Military, Police Members Of US Biker Gangs (Intercept)

Nuclear power plant technicians, senior military officers, FBI contractors and an employee of “a highly-secretive Department of Defense agency” with a Top Secret clearance. Those are just a few of the more than 100 people with sensitive military and government connections that law enforcement is tracking because they are linked to “outlaw motorcycle gangs.” A year before the deadly Texas shootout that killed nine people on May 17, a lengthy report by the Bureau of Alcohol, Tobacco, Firearms and Explosives detailed the involvement of U.S. military personnel and government employees in outlaw motorcycle gangs, or OMGs.

The report lays out, in almost obsessive detail, the extent to which OMG members are represented in nearly every part of the military, and in federal and local government, from police and fire departments to state utility agencies. Specific examples from the report include dozens of Defense Department contractors with Secret or Top Secret clearances; multiple FBI contractors; radiological technicians with security clearances; U.S. Department of Homeland Security employees; Army, Navy and Air Force active-duty personnel, including from the special operations force community; and police officers. “The OMG community continues to spread its tentacles throughout all facets of government,” the report says.

The relationship between OMGs and law enforcement has come under scrutiny after it became known that law enforcement were on site in Waco bracing for conflict. The 40-page report, “OMGs and the Military 2014,” issued by ATF’s Office of Strategic Intelligence and Information in July of last year, warned of the escalating violence of these gangs. “Their insatiable appetite for dominance has led to shootings, assaults and malicious attacks across the globe. OMGs continue to maim and murder over territory,” the report said. “As tensions escalate, brazen shootings are occurring in broad daylight.”

The ATF report is based on intelligence gathered by dozens of law enforcement and military intelligence agencies, and identifies about 100 alleged associates of the country’s most violent outlaw motorcycle gangs and support clubs who have worked in sensitive government or military positions. Those gangs “continue to court active-duty military personnel and government workers, both civilians and contractors, for their knowledge, reliable income, tactical skills and dedication to a cause,” according to the report. “Through our extensive analysis, it has been revealed that a large number of support clubs are utilizing active-duty military personnel and U.S. Department of Defense (DOD) contractors and employees to spread their tentacles across the United States.”

Home › Forums › Debt Rattle May 24 2015