Underwood&Underwood Chicago framed by Gothic stonework high in the Tribune Tower 1952

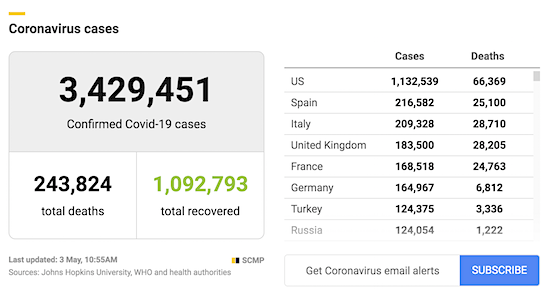

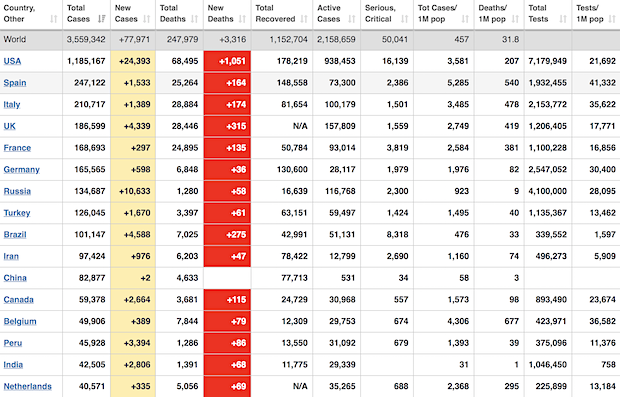

• U.S. CDC reports 1,122,486 coronavirus cases, 65,735 deaths

• Johns Hopkins University records over 1.15 million cases in the country as of 8:30 pm Sunday (0030 GMT Monday), with 67,674 deaths, with Sunday’s 24-hour toll, which was similar to Saturday’s, showing a decline after hitting 2,502 Wednesday

• Novel coronavirus deaths in the US climb by 1,450 in the past 24 hours, a tally by Johns Hopkins University shows

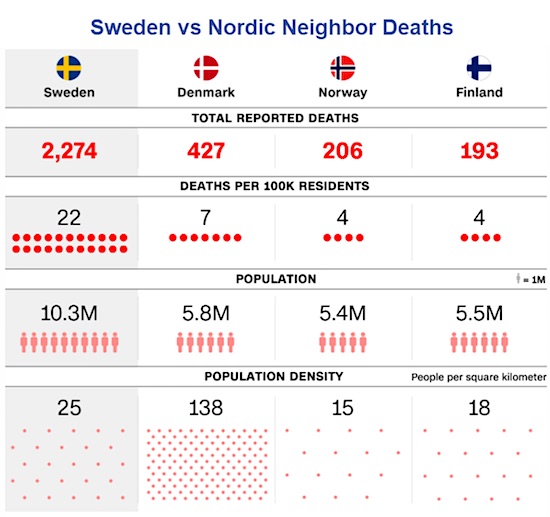

Deaths are lower at “only” 3,519, cases not so much.

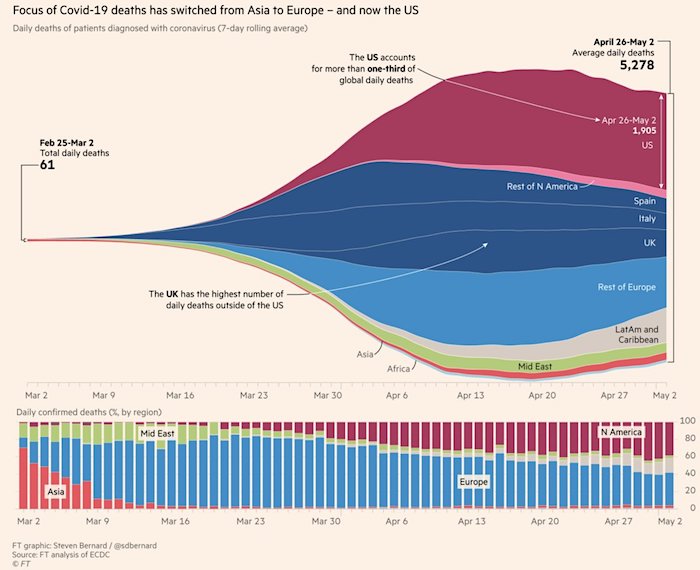

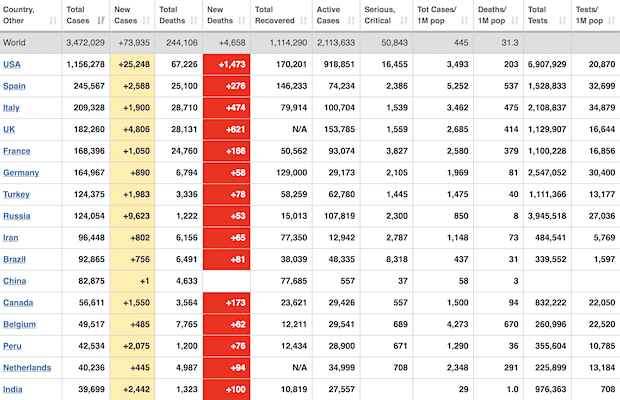

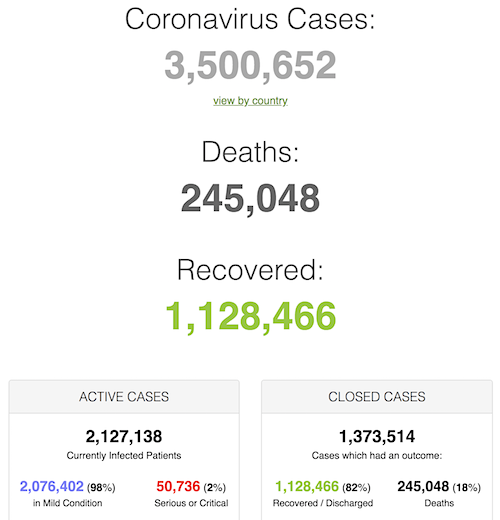

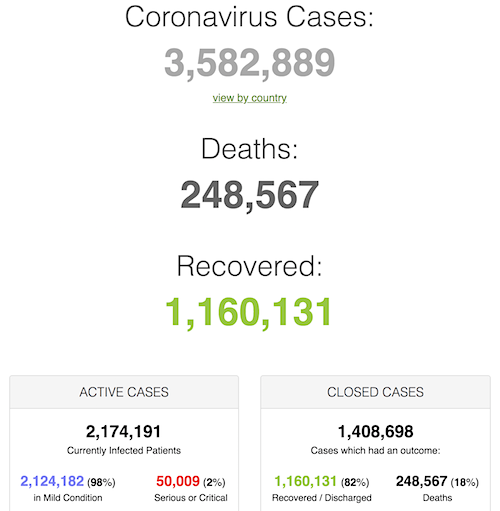

• Cases 3,582,889 (+ 82,237 from yesterday’s 3,500,652)

• Deaths 248,567 (+ 3,519 from yesterday’s 245,048)

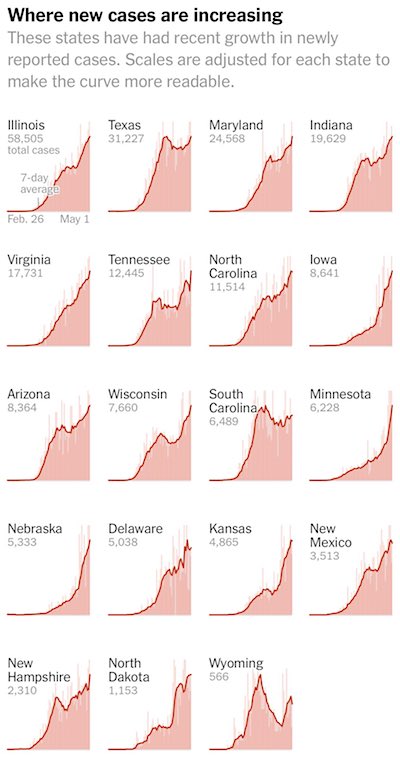

From Worldometer yesterday evening -before their day’s close-

From Worldometer

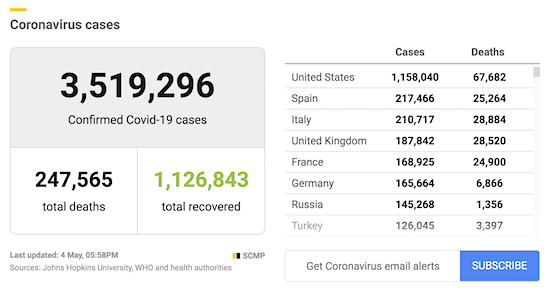

From SCMP:

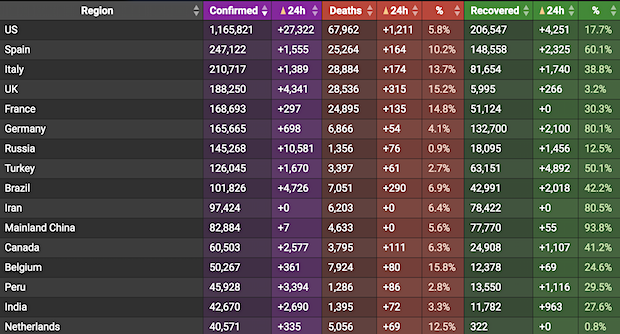

From COVID19Info.live:

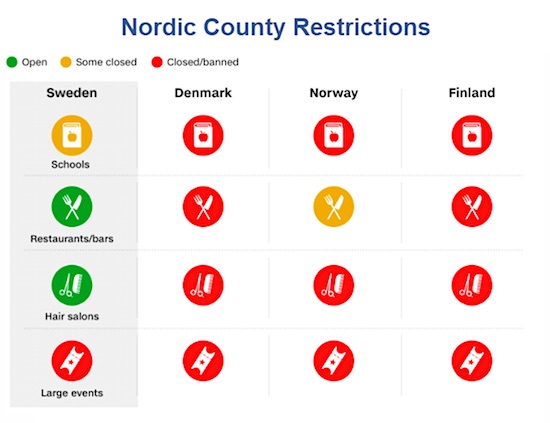

View from Australia.

• ‘Biggest Failure In A Generation’: Where Did Britain Go Wrong? (SMH)

Says Martin McKee, professor of European public health at the London School of Hygiene and Tropical Medicine and an adviser to the World Health Organisation: “The countries that moved fast have curtailed the epidemic. The countries that delayed have not. It’s as simple as that.” Dr Richard Horton, editor in chief of The Lancet medical journal, is even more damning: “The handling of the COVID-19 crisis in the UK is the most serious science policy failure in a generation.” Hancock and Johnson had their first discussion together about the virus on January 7. The government’s crisis committee, COBRA, would meet several times over the following weeks and the Scientific Advisory Group for Emergencies started crunching the numbers.

The government knew a threat existed but did it fully understand just how bad it could get? By March 12 a full-scale outbreak had taken hold in Italy and the illness was spreading across Europe. More than 1000 Italians had already died and thousands more were gravely ill in packed hospitals in the country’s hard-hit north. The deadly potential of an invisible killer was becoming more obvious by the hour. That day, Johnson announced Britain would move from the “contain” phase of the emergency to the “delay” phase. This decision would prove a pivotal moment. The shift meant contact tracing would be abandoned, and testing would be restricted to those only in hospital with symptoms. The move was at odds with the WHO, which urged countries to “test, test, test”, as well as Germany’s much-lauded program of mass testing.

The Prime Minister warned at the March 12 press conference that the “worst public health crisis for a generation” was about to hit the country and that “many more families are going to lose loved ones before their time”. What he did not announce was a lockdown. Or anything close to it. Tougher measures would come but not yet, Johnson said, citing the need to introduce measures when they would have the most impact. But his chief scientific adviser also cast serious doubt on whether closing schools, banning mass gatherings or stopping international flights would ever be effective levers to pull.

Instead, Brits were encouraged to wash their hands and stay home for seven days if they had symptoms. Schools remained open, restaurants and bars traded as usual, and visitors were still allowed into care homes. Flights were arriving from mainland China, even though Australia had banned them six weeks earlier. Heaving public events were still allowed. A Champions League match in Liverpool drew a crowd of 52,000, about 3000 of whom came from Madrid, where a partial lockdown was already in force. More than 250,000 tickets were sold for the Cheltenham horse racing festival. Both events are now being investigated by health officials who suspect they may have contributed to the rapid spread of the disease in the areas surrounding the venues.

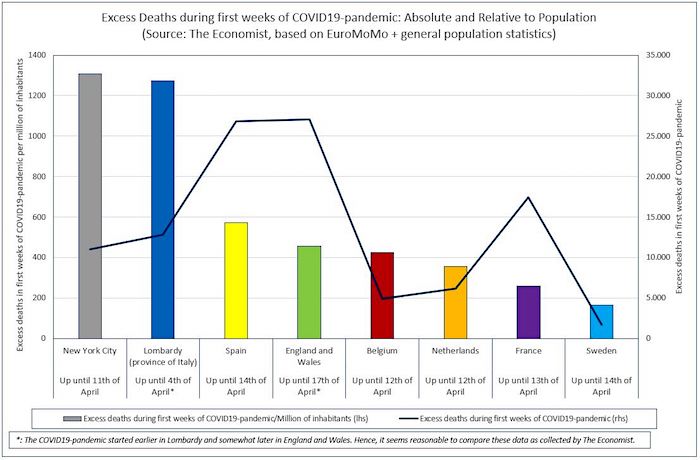

Yeah, it’s not fair! Lombardy has a much better health care system!

• UK Chafes At COVID19 Death Toll Comparison With Italy (R.)

The British government sought on Sunday to deflect questions over a coronavirus death toll that is Europe’s second worst after Italy, with officials saying it would take a long time before the full picture became clear. Deaths rose to 28,446 as of May 2 – just short of Italy – increasing pressure on the government which has been accused of acting too slowly in the early stages of the outbreak. Cabinet minister Michael Gove, leading a daily coronavirus briefing, sidestepped a question on whether many lives could have been saved if mass testing had been rolled out earlier. “This government, like all governments, will have made mistakes, but it will be impossible to determine exactly which were the areas of greatest concern until some time in the future, when we have all the information that we need,” he said.

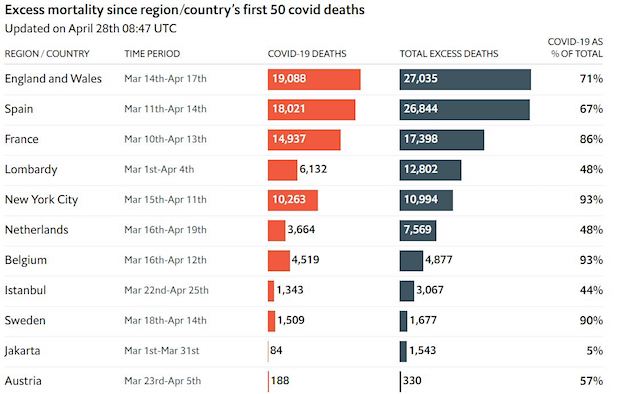

Only the United States has suffered more deaths than Italy and Britain. Ministers dislike comparisons of the headline death toll, saying that excess mortality – the number of deaths from all causes that exceed the average for the time of year – is a more meaningful metric. The most recent available data showed there were almost 12,000 excess deaths in England and Wales in the week to April 17. Of these, just under 9,000 were linked on death certificates to the COVID-19 respiratory disease. [..] the medical director of England’s health service, Stephen Powis, said during the briefing it would be some time before international comparisons of excess deaths could be made.

Earlier, the UK National Statistician Ian Diamond also cautioned against relying on rankings. “I’m not saying that we’re at the bottom of any potential league table – it’s almost impossible to calculate a league table – but I’m not prepared to say that we’re heading for the top,” he told BBC News.

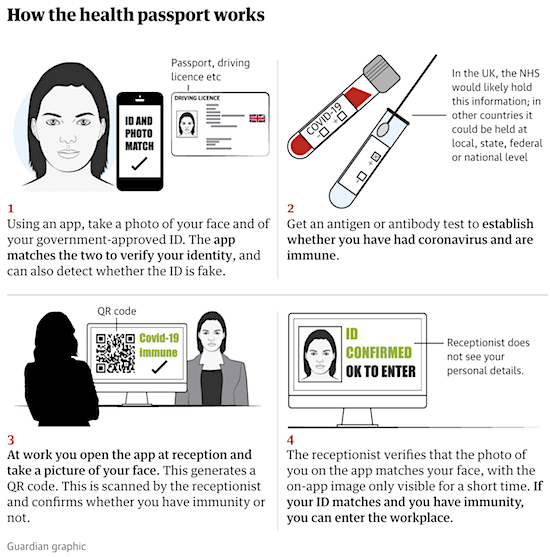

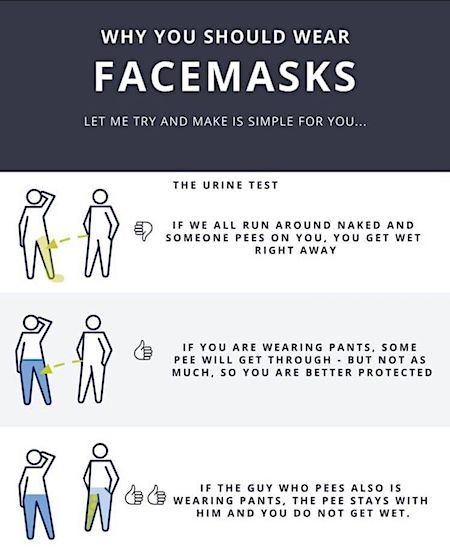

The UK wants to force people to use these things. What a great idea.

• UK Health Passports ‘Possible In Months’ (G.)

Tech firms are in talks with ministers about creating health passports to help Britons return safely to work using coronavirus testing and facial recognition. Facial biometrics could be used to help provide a digital certificate – sometimes known as an immunity passport – proving which workers have had Covid-19, as a possible way of easing the impact on the economy and businesses from ongoing physical distancing even after current lockdown measures are eased. The UK-based firm Onfido, which specialises in verifying people’s identities using facial biometrics, has delivered detailed plans to the government and is involved in a number of conversations about what could be rolled out across the country, it is understood.

Its proposals, which have reached pilot stages in other countries, could be executed within months, it says. The firm could use antibody tests – proving whether someone has had the virus – or antigen tests, which show current infections. Digital identity experts say they are in the “discovery stage” of what could be tailored for the UK government, but developing a type of health certificate through app technology is gaining traction. The government is understood to be moving away from the phrase “immunity passport” as evidence continues to emerge on exactly how immunity develops after someone has had Covid-19. The World Health Organization has also issued a stark warning over attempts to give people false assurance through a passport scheme.

It better not be. The track record on corona vaccines is dismal.

• Boris Johnson: COVID19 Vaccine Hunt ‘Most Urgent Endeavour Of Our Lives’ (PA)

The race for a coronavirus vaccine is “the most urgent shared endeavour of our lifetimes”, Boris Johnson will tell an international conference as he urges countries to “pull together” and share their expertise in a bid to halt the global pandemic. The UK prime minister is co-hosting the virtual coronavirus global response international pledging conference on Monday. As well as the UK, eight other countries and organisations are also co-hosting the forum which aims to bring in more than $8bn (£6.4bn) in funding to support the global response. The UK has pledged to give £388m in aid funding for research into tests, treatments and vaccines – part of a £744m commitment to help end the pandemic and support the global economy.

Johnson is expected to say: “To win this battle, we must work together to build an impregnable shield around all our people and that can only be achieved by developing and mass producing a vaccine. “The more we pull together and share our expertise, the faster our scientists will succeed. The race to discover the vaccine to defeat this virus is not a competition between countries but the most urgent shared endeavour of our lifetimes. “It’s humanity against the virus – we are in this together and together we will prevail.” The government believes tackling the virus globally is crucial to preventing a second wave reemerging in the UK and it will speed up the creation of vaccines, tests and treatment.

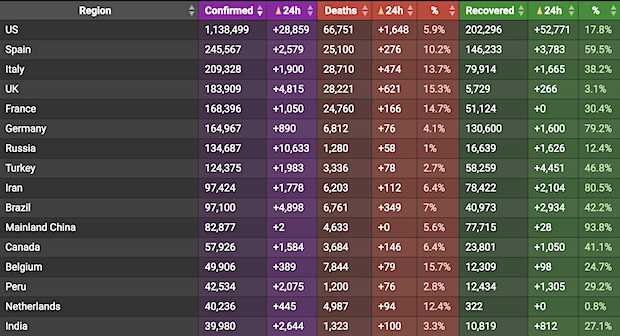

A growing consensus appears to see 20,000 new US cases and 1,000-2,000 new deaths everyday through the summer.

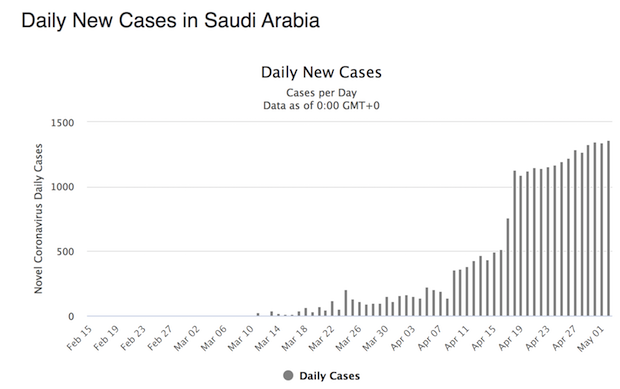

• As Lockdowns Ease, Some Countries Report New Infection Peaks (SCMP)

US President Donald Trump has revised upwards the number of Americans he expects to die from the coronavirus to as many as 100,000, as global cases surpassed 3.5 million on Monday, with deaths nearing a quarter of a million. North America and European countries accounted for most of the new cases reported in recent days, but numbers were rising from smaller bases in Latin America, Africa and Russia. India, second in population only to China, reported its biggest single-day jump yet with more than 2,600 new infections. And in Russia, new coronavirus cases exceeded 10,000 for the first time. The confirmed death toll in Britain climbed near that of Italy, the epicentre of Europe’s outbreak, even though the UK population is younger than Italy’s and Britain had more time to prepare before the pandemic hit.

The United States continues to see tens of thousands of new infections each day, with more than 1,400 new deaths reported Saturday. Health experts warn that a second wave of infections could hit unless testing is expanded dramatically after lockdowns are eased. But pressure to reopen economies keeps building after the weeks-long shutdown of businesses worldwide plunged the global economy into its deepest slump since the 1930s and wiped out millions of jobs. China, which reported only three new cases on Monday, has seen a surge in visitors to newly reopened tourist spots after domestic travel restrictions were relaxed ahead of a five-day holiday that runs through Tuesday. Nearly 1.7 million people visited Beijing parks on the first two days of the holiday, and Shanghai’s main tourist spots welcomed more than 1 million visitors, according to Chinese media. Many spots limited daily visitors to 30 per cent of capacity.

BREAKING: Coronavirus Outbreak

Good news in Turkey in cases and deaths declining

Explanation for very rapid decline (mirroring increase): 5,800 contact tracing teams identified 468k close contacts asked to self-isolate and regularly contacted for health condition. Also lockdown pic.twitter.com/tWdhBIlJeZ

— Yaneer Bar-Yam (@yaneerbaryam) May 3, 2020

Just a terribly sad story. Junks and hookers.

• DOJ Intervenes For Church In Virginia Restrictions Challenge (Solomon)

The Justice Department on Sunday intervened on behalf of a church fighting Virginia Gov. Ralph Northman’s virus restrictions in a federal court case that may determine whether religion is an essential service. The department filed a Statement of Interest in federal court in support of Lighthouse Fellowship Church, a congregation in Chincoteague Island, Virginia, that serves, among others, recovering drug addicts and former prostitutes. The church says it held a 16-person worship service in its 225-seat sanctuary on Palm Sunday while maintaining rigorous social distancing. At the end of the service, Chincoteague police issued Lighthouse’s pastor a criminal citation and summons, based on the Northam’s executive order.

Lighthouse sued on Friday, but a judge denied the church’s request for preliminary relief, ruling that “[a]lthough [professional-services] businesses may not be essential, the exception crafted on their behalf is essential to prevent joblessness.” DOJ’s filing argues the church can’t be treated differently than other businesses and that faith is essential during a pandemic. “For many people of faith, exercising religion is essential, especially during a crisis,” Assistant Attorney General Eric Dreiband said. “The Commonwealth of Virginia has offered no good reason for refusing to trust congregants who promise to use care in worship in the same way it trusts accountants, lawyers, and other workers to do the same.”

Pompeo has played good cop bad cop all his life. But it only works for a while. Then people stop taking you serious.

• Pompeo: ‘Significant’ Evidence New Coronavirus Emerged From Chinese Lab (R.)

Secretary of State Mike Pompeo said on Sunday there was “a significant amount of evidence” that the new coronavirus emerged from a Chinese laboratory, but did not dispute U.S. intelligence agencies’ conclusion that it was not man-made. “There is a significant amount of evidence that this came from that laboratory in Wuhan,” Pompeo told ABC’s “This Week,” referring to the virus that emerged late last year in China and has killed about 240,000 people around the world, including more than 67,000 in the United States. Pompeo then briefly contradicted a statement issued last Thursday by the top U.S. spy agency that said the virus did not appear to be man-made or genetically modified.

That statement undercut conspiracy theories promoted by anti-China activists and some supporters of President Donald Trump who suggest it was developed in a Chinese government biological weapons laboratory. “The best experts so far seem to think it was man-made. I have no reason to disbelieve that at this point,” Pompeo said. When the interviewer pointed out that was not the conclusion of U.S. intelligence agencies, Pompeo backtracked, saying: “I’ve seen what the intelligence community has said. I have no reasonto believe that they’ve got it wrong.” China’s Global Times, run by the ruling Communist Party’s official People’s Daily, said in an editorial responding to Pompeo’s Sunday interview that he did not have any evidence the virus came from the lab in Wuhan and that he was “bluffing,” calling on the United States to present the evidence.

Leaving globalization and just-in-time behind will take a lot of effort.

• Trump Administration Pushing To Rip Global Supply Chains From China (R.,)

The Trump administration is “turbocharging” an initiative to remove global industrial supply chains from China as it weighs new tariffs to punish Beijing for its handling of the coronavirus outbreak, according to officials familiar with U.S. planning. President Donald Trump, who has stepped up recent attacks on China ahead of the Nov. 3 U.S. presidential election, has long pledged to bring manufacturing back from overseas. Now, economic destruction and the massive U.S. coronavirus death toll are driving a government-wide push to move U.S. production and supply chain dependency away from China, even if it goes to other more friendly nations instead, current and former senior U.S. administration officials said.

“We’ve been working on [reducing the reliance of our supply chains in China] over the last few years but we are now turbo-charging that initiative,” Keith Krach, undersecretary for Economic Growth, Energy and the Environment at the U.S. State Department told Reuters. “I think it is essential to understand where the critical areas are and where critical bottlenecks exist,” Krach said, adding that the matter was key to U.S. security and one the government could announce new action on soon. The U.S. Commerce Department, State and other agencies are looking for ways to push companies to move both sourcing and manufacturing out of China. Tax incentives and potential re-shoring subsidies are among measures being considered to spur changes, the current and former officials told Reuters.

“There is a whole of government push on this,” said one. Agencies are probing which manufacturing should be deemed “essential” and how to produce these goods outside of China. [..] “This moment is a perfect storm; the pandemic has crystallized all the worries that people have had about doing business with China,” said another senior U.S. official. “All the money that people think they made by making deals with China before, now they’ve been eclipsed many fold by the economic damage” from the coronavirus, the official said.

Not a great take. Japan is furthest ahead in this.

• Post-Coronavirus, Expect Manufacturing To Make A Mass Exodus From China (SCMP)

Already a few years ago, rising manufacturing costs in China along with weakening domestic economies in Japan and Taiwan had prompted some repatriation of manufacturing and decentralisation of supply chains. In 2016 the Japan External Trade Organisation estimated, based on its annual surveys of everything made and sold by Japanese companies, that goods “made and sold” overseas peaked at 58.3 per cent. That year foreign direct investment into China from Japan fell by 14.3 per cent. This year, we may see a mass exodus from China as the Japanese government tries to encourage Japanese firms to hasten the move of their factories back home, something the Europeans and Americans are also keen to do.

With unemployment surging and companies furloughing a significant percentage of staff, less money and more debt will linger after the coronavirus crisis. Like many governments, the UK is pumping enormous amounts of money into businesses to support cashflows and salaries, and Downing Street expects that the funds will put firms in a stronger position to tackle future crises. In my opinion, there are three strategic changes that investors will need to see take place to feel comfortable with business continuity risk.

1. Managers of small and medium-sized businesses as well as the planning departments of large firms will have realised the need to pay greater attention to supply-chain risk. The evidence of this would be some kind of “supply chain continuity planning”, much the same as Business Continuity Planning which has been a fixture of the finance industry for the last 30 years. I expect this to be particularly prevalent in pharmaceutical and medical industries, but it will affect all companies sourcing small and cheap, but critical, components overseas.

2. The dependence on logistics will have been reduced, resulting in greater sourcing of local components and suppliers integrating vertically with manufacturing. Additionally, production of goods will need to move closer to target markets. This year we have seen shipping severely hampered, and airfreight unable to pick up the slack, despite higher costs, due to border restrictions. This especially impacts perishable goods, as highlighted by the problems facing farmers in Europe.

3. Companies will have stocked up on more emergency cash. Due to the coronavirus crisis, the bankruptcy rate of well-known and smaller firms alike is set to rise, and this is likely to continue long after we return to some kind of “normal”.

Activist investors who have long criticised cash hoarding and have pushed for distributions to shareholders will face stronger headwinds. Company management will have good reason to simply say they are saving for a rainy day and point to the cash crisis of 2020. Inefficient use of capital – by activist investor standards – may just become the normal again.

Nice letter from an Amazon VP.

May 1st was my last day as a VP and Distinguished Engineer at Amazon Web Services, after five years and five months of rewarding fun. I quit in dismay at Amazon firing whistleblowers who were making noise about warehouse employees frightened of Covid-19. What with big-tech salaries and share vestings, this will probably cost me over a million (pre-tax) dollars, not to mention the best job I’ve ever had, working with awfully good people. So I’m pretty blue. What happened · Last year, Amazonians on the tech side banded together as Amazon Employees for Climate Justice (AECJ), first coming to the world’s notice with an open letter promoting a shareholders’ resolution calling for dramatic action and leadership from Amazon on the global climate emergency. I was one of its 8,702 signatories.

While the resolution got a lot of votes, it didn’t pass. Four months later, 3,000 Amazon tech workers from around the world joined in the Global Climate Strike walkout. The day before the walkout, Amazon announced a large-scale plan aimed at making the company part of the climate-crisis solution. It’s not as though the activists were acknowledged by their employer for being forward-thinking; in fact, leaders were threatened with dismissal. Fast-forward to the Covid-19 era. Stories surfaced of unrest in Amazon warehouses, workers raising alarms about being uninformed, unprotected, and frightened. Official statements claimed every possible safety precaution was being taken. Then a worker organizing for better safety conditions was fired, and brutally insensitive remarks appeared in leaked executive meeting notes where the focus was on defending Amazon “talking points”.

Warehouse workers reached out to AECJ for support. They responded by internally promoting a petition and organizing a video call for Thursday April 16 featuring warehouse workers from around the world, with guest activist Naomi Klein. An announcement sent to internal mailing lists on Friday April 10th was apparently the flashpoint. Emily Cunningham and Maren Costa, two visible AECJ leaders, were fired on the spot that day. The justifications were laughable; it was clear to any reasonable observer that they were turfed for whistleblowing.

Management could have objected to the event, or demanded that outsiders be excluded, or that leadership be represented, or any number of other things; there was plenty of time. Instead, they just fired the activists. At that point I snapped. VPs shouldn’t go publicly rogue, so I escalated through the proper channels and by the book. I’m not at liberty to disclose those discussions, but I made many of the arguments appearing in this essay. I think I made them to the appropriate people. That done, remaining an Amazon VP would have meant, in effect, signing off on actions I despised. So I resigned.

Will we have such bubbles everywhere? Frannce has said its new quarantine rules don’t count for EU, UK.

• Australia, New Zealand Mull Creating ‘Travel Bubble’ (SCMP)

New Zealand and Australia are discussing the potential creation of a “travel bubble” between the two countries, sources said on Monday, even as Australia reported its highest number of coronavirus cases in two weeks. New Zealand Prime Minister Jacinda Ardern will take part in a meeting of Australia’s emergency coronavirus cabinet on Tuesday, the Australian government said, stoking speculation that two-way travel could be permitted in the near future. “The idea of a bubble with Australia was floated two weeks ago, and this is an example of the sort of action that could happen within it, while always ensuring the protection of public health,” New Zealand Foreign Minister Winston Peters said in a statement. “Officials in both countries are considering all aspects of the trans-Tasman concept, and planning how this could happen more broadly.”

The prospect of two-way travel was first proposed by Peters, though Ardern in April insisted it was a “long-term goal” and would need to include other Pacific countries. Australia and New Zealand have both slowed the spread of coronavirus in recent weeks to levels significantly below the those reported in the United States, Britain and Europe. Both governments attribute their success to social distancing restrictions and widespread testing. However, Australia on Monday reported 26 new cases, including a seven-year-old boy, its biggest daily jump in two weeks. That could rise as more states report throughout the day. Overall, Australia has recorded around 6,800 infections and 95 deaths, and New Zealand 1,137 cases and 20 fatalities.

Going down due to the success of the lockdown.

• Greece Sees Economy Tanking This Year On Coronavirus Impact (R.)

Greece expects its economy to contract by 4.7% to 8.9% this year under baseline and adverse scenarios taking into account the impact of the coronavirus pandemic, the government’s 2020-21 stability programme submitted to the EU Commission projects. “The coronavirus outbreak has imposed a burden on the Greek economy as on the rest of the world economy, reversing the initial favourable short-term forecast,” the finance ministry said. The pandemic clouds the outlook for the global economy with a high degree of uncertainty. Demand, supply and liquidity shocks to the world economy set the stage for a deep global recession, worse than that of the 2008 financial crisis, the report said.

The Greek economy is exposed to external shocks due to a considerable dependency on tourism and transportation receipts,” it said, noting that the government’s main goals now were to bridge the growth gap caused by the health crisis and attract investment. The baseline projection for a 4.7% contraction takes into account the impact of policy response measures and assumes that the public health crisis fades in the second half of 2020. But under an alternative set of more adverse assumptions, the programme projects a significantly deeper contraction of up to 8.9% due to a steeper drop of exports and broader negative spillover effects. Either way, the primary budget balance, which excludes debt servicing outlays, will be in the red, according to the ministry projections – with a deficit of 1.9% under the baseline assumptions and a 2.8% hole under the adverse scenario.

A Twitter thread. “You die alone from COVID. And you will be buried alone. Stay home.”

• My Dad Is An ICU Doctor Treating COVID-19 Patients (Bess Kalb)

My dad is an ICU doctor treating COVID-19 patients. In the past WEEK he has set more “I’ve never seen a heart rate/RBC count/etc. like this” records than in his decades-long career. What this virus does to the body is like “sticking your finger in an electric socket.” Stay home. He had a patient who needed 8 blood transfusions in a morning even though he wasn’t bleeding. The coronavirus was just eating his red blood cells faster than his bone marrow could make them. It’s fucking mystifying and brutal. EIGHT. Eight blood transfusions. If you are lucky enough to make it off a ventilator (the equivalent exertion required for that is running a marathon without training), you will likely get put on dialysis and a feeding tube next.

It’s a nightmare. It’s hell. It’s what you’re risking on your beach day. Young, healthy people are dying from a COVID-19 effect called a “cytokine storm.” Basically, you make it off a ventilator (maybe!), you get your appetite back a little, you think you’re turning a corner, and then your immune system rips through your lung tissue and you drown. The other common way young people are falling off the face of the earth from this are the random strokes it causes. Talking one minute, stroking out the next, and then the nurses have to go through the cell phone to find “Dad” because “Mom” usually insists on coming.

There have been a few “Papa Bear”s or “Daddy-O”s in the cell phones who have tried to come in to hold the bodies. They can’t, of course. You die alone from COVID. And you will be buried alone. Stay home. Send this thread to any idiot fucker who posts an Instagram at the beach or a crowded park. Tell them my dad says see you later.

Not as bad as we think. But still bad. Another Twitter thread.

• How Bad is Belgium Doing? (Roosens)

For all those at home and abroad who think that small and densely populated Belgium has been worst hit by COVID19 on a per capita basis, and at the same time wonder why you haven’t seen pictures of flooded hospitals and/or field hospitals being set up in our country. A thread. 1/ As a densely populated country at the crossroads of all big transport axes in Europe, Belgium has indeed been hit severely by COVID19. We had our share of COVID19-outbreaks in care homes, but COVID19-hospital capacity was never filled more than 2/3rds. 2/

How come then we get the highest per capita numbers of officially registered COVID19-patients? Well, that’s because we count the COVID19-victims in an extremely correct and exhaustive way. Including in care homes and including the non-confirmed (but suspected COVID) cases. 3/ As a result, at the moment we are one of the rare countries where COVID19-death count is roughly a match with the excess deaths reported through mortality statistics. Indeed, between mid March and mid-April our official COVID19 death count, accounted for 93% of excess deaths. 4/

This of course makes us jump up in international ‘worst hit’-rankings of ‘officially recorded’ COVID19-deaths on a per capita basis. But that’s because we’re about the only country with correct figures… The only good comparison that can be done, is on excess death-figures…5/ So that’s what we’ve done for the mid March-mid April periode, based on The Economist-Euro MoMo figures on excess deaths. We just added population statistics to get to a per capita result. And this is what we then get as a reasonable comparison of the worst hit countries/regions.

They’re all up against Sidney Powell. Flynn will be exonarated just to get rid of her role in digging up the dirt.

• Scrutiny Of FBI Behavior In Russia Case Increases Pressure On Wray (Solomon)

The IG report in December and subsequent declassified information showed the FBI engaged in 17 major mistakes and acts of misconduct in seeking a FISA warrant to spy on the Trump campaign starting in October 2016, including the falsification of a document, the submission of false information to a court, and the submission of unsubstantiated evidence in a warrant application marked as “verified.” In addition, newly declassified footnotes from the report showed the FBI had strong reasons to distrust the information in Christopher Steele’s dossier — including denials from his main source and warnings he was being fed Russian disinformation — but nonetheless proceeded to use the dossier as the key evidence in seeking a year’s worth of surveillance warrants.

The problems exposed during the Russia case started with the Comey regime, but have stretched into Wray’s watch. An IG report last fall flagged widespread failures in the FBI’s handling of confidential human sources like Steele. And a new IG report a few weeks ago found that 29 of 29 FISA applications — many filed during Wray’s tenure — contained significant flaws that violated the bureau’s own rules designed to ensure the accuracy of evidence submitted to the courts. The concerns about Wray were exacerbated by the revelations last week — from documents long withheld from a federal court — that FBI agents had recommended in January 2017 closing down a Russia-related probe of Trump National Security Adviser Michael Flynn for lack of evidence, only to be overruled by the bureau’s leadership.

The extraordinary intervention of FBI leaders — then under the command of Comey and his deputy Andrew McCabe — led one official to write handwritten notes questioning whether the bureau was “playing games” and trying to get Flynn to lie “so we could prosecute him, or get him fired.” The double-barreled revelations about FISA and Flynn have left Republican lawmakers with grave concerns about Wray’s leadership and his willingness to recognize the magnitude of problems inside the bureau exposed by the Russia case fallout. “Director Wray owes the American people an explanation about the FBI’s misconduct with General Flynn,” said Rep. Jim Jordan, R-Ohio, the top Republican on the House Judiciary Committee. “It’s becoming more and more apparent that the FBI ruined the life of a respected general in its goal to take down President Trump.”

Jordan added: “The FBI’s actions were part of a larger pattern of wrongdoing, which were all directed against the president and his advisers. If they can do it to a president, they can do it to any of us.” Flynn’s lawyer, Sidney Powell, was even more harsh in her assessment, accusing Wray’s FBI of hiding the truth. “Wray knew about the evidence we were requesting for General Flynn,” Powell told Just the News. “My request was even discussed in the Director’s meeting. Most of what has been produced so far and what will be produced has been in FBI files all along–now more than three years. If the Prosecutors refused to produce it, he should have taken it to the AG or filed a whistle blower complaint himself. Instead, it would appear he was part of a conspiracy to obstruct justice and Congress, and we don’t know what else.”

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thank you.

I just called to say I love you pic.twitter.com/40m6S5jB5w

— Life on Earth (@planetpng) May 3, 2020

bleu is a golden retriever who has loved singing to wind chimes since she was a puppy

(Ana Brown via viralhog) pic.twitter.com/pA8TG8LC90— Humor And Animals (@humorandanimals) May 3, 2020

So you claim to honor people for saving lives, with machines designed to kill.

U.S. Air Force planes staged flyovers in various parts of the country to honor healthcare workers pic.twitter.com/1TpcwnIyDI

— Reuters (@Reuters) May 4, 2020

Support the Automatic Earth for your own good.