NPC Minker Motor Co, 14th Street NW, Washington, DC 1922

Nice concept.

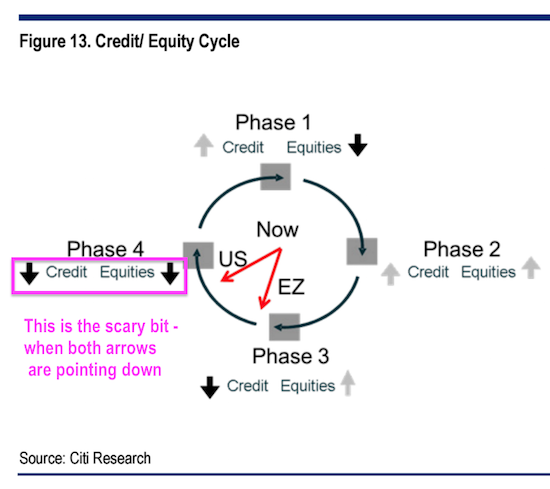

• The Citi Market-Crash Clock Says It’s 5 Minutes To Midnight (BI)

Citi published a scary update to its market clock chart at the end of last month. According to Citi’s analysis, the economy has moved into Phase 4 of the economic cycle, the point at which both credit and equities move into recessionary downward cycles. The US is further along in the clock rotation than the eurozone is. But both are heading into the dreaded Phase 4.

The last time Business Insider looked at the Citi clock, in August 2014, it was still in Phase 3. Here is how the clock works, according to Citi global strategy analyst Robert Buckland:

• Phase 1: This begins at the end of a recession, when interest rates have fallen, money is cheap, but stocks are still battered.

• Phase 2: A bull market sets in during phase 2, when stocks start to rise as easy credit lubricates the economy.

• Phase 3: This is the tricky part. Stocks are still flying high, but credits spreads are widening as investors become increasingly unwilling to finance further risk. Corporate CEOs have now experienced a lengthy period of gains and become risk-happy. (And we’d note that central banks are already talking about tightening credit by raising interest rates.) Bubbles can form in Phase 3, as the high-flying stock market ignores the early warning signs of the deteriorating credit market. Hello, tech startup IPOs!

• Phase 4: Stocks react to the lack of available credit by collapsing, and we see the kinds of things you get in a recession: “This is the classic bear market, when equity and credit prices fall together. It is usually associated with collapsing profits and worsening balance sheets,” Buckland said last year.

“At the moment they won’t impose losses on anybody..”

• Time Running Out For China On Capital Flight, Warns Bank Chief (AEP)

China is rapidly losing the confidence of global lenders and capital outflows risk turning virulent if the current policy paralysis continues, the world’s top banking body has warned. “There is a perception that the renminbi could weaken drastically,” said Charles Collyns, the managing-director of the Institute of International Finance in Washington. Mr Collyns said the authorities have so far failed to articulate a coherent strategy, and there are serious worries that outflows of capital could accelerate, broadening into a flood beyond Beijing’s control. “The Chinese have not been rigorous and they have not been very convincing,” he told The Telegraph. Mr Collyns said China has already allowed the renminbi (yuan) to weaken against the country’s new trade-weighted basket of currencies, stoking suspicions that the recent shift from a crawling dollar-peg to a more opaque foreign-exchange regime is really a cover for devaluation.

The IIF, the chief global body for the banking industry, calculates that capital outflows from China reached $676bn last year. The central bank has been burning through foreign exchange reserves to offset the bleeding and shore up the currency, culminating in intervention of $140bn in December, by some estimates. A big drop in the yuan would send a deflationary shockwave through a fragile world economy already on the cusp of a debt-deflation trap, and do so at a time when the eurozone and Japan are actively driving down their currencies. It would risk a pan-Asian currency storm along the lines of 1998, but on a much bigger scale. China is not just another country. Its fixed capital investment has been running at $5 trillion a year, matching the combined total of North America and Europe.

This has led to excess capacity across swathes of industry that casts a shadow over the entire global system. Chinese officials insist solemnly that the new basket rate is the “decided policy of China” and will be upheld come what may, but concerns are mounting that they may be overwhelmed by market forces. The crucial question is whether the exodus of money is chiefly a one-off move by Chinese companies and investors to pay off dollar debt – and to unwind “carry trade” positions in dollars – as the US Federal Reserve raises interest rates and drains liquidity. If so, the outflows are largely benign and should make the world’s financial system safer. Mark Tinker, head of equities for AXA Framlington in Asia, said the bulk of the outflows are to pay off liabilities. “Chinese corporates are issuing corporate bonds in record quantities and using the capital to restructure their balance sheets, both onshore and offshore. This is not capital flight, it is asset liability matching, both duration and currency. It is a good thing being presented as a bad thing,” he said.

The IIF’s Mr Collyns, a former assistant US Treasury Secretary, is less sanguine. He calculates that total dollar debt in China peaked at roughly $1.5 trillion in late 2014, if all forms of exposure are included. “We think they have paid off a third of this. Half of the outflows are to repay dollar debt,” he said. “What is worrying is that there could be a broadening of the outflows. There has been a surge in ‘errors and emissions’ and this is ominous. A lot of this is a capital outflow below board through inflated trade invoices and other forms of subterfuge, and some of it is ending up in the London property market,” he said.

Mr Collyns said there is no guarantee that the outflows will slow even if all the dollar debt is paid off since Chinese companies may start taking out “long” dollar positions (short renminbi) in the currency markets if they fear that Beijing is losing control. “The Chinese have to restore confidence by pushing through reforms. There must be greater transparency in fiscal and monetary policy, and they must tackle excess industrial capacity. At the moment they won’t impose losses on anybody,” he said.

“..it is estimated that for every job lost in steel, another 3 jobs are lost in related and supporting industries.”

• China Announces 400,000 Steelworker Job Cuts, 3 Million More Expected (WSWS)

An estimated 400,000 steelworkers in China will lose their jobs, in line with plans to slash crude steel production capacity by between 100 million and 150 million tons. The announcement was posted Sunday on government web sites, and reports a decision made by the State Council on January 22 to cut steel, coal and other basic industrial production in response to the global slump and declining growth in China. Li Xinchuang, head of the China Metallurgical Industry Planning and Research Institute, said that the cuts in production would translate into 400,000 steelworkers losing their jobs. “Large-scale redundancies in the steel sector could threaten social stability,” Li Xinchuang told the official Xinhua News Agency Monday.

The State Council did not say when the cuts would be made, but China, which produces half of the world’s steel, has already cut capacity by 90 million tons in response to the growing slowdown in the Chinese and world economy, and is under enormous pressure to do more. Along with the cuts already made, the new cuts will amount to about a 20% reduction in steelmaking capacity. The reductions will have an enormous impact on Chinese workers. In addition to those directly employed in steel making, it is estimated that for every job lost in steel, another 3 jobs are lost in related and supporting industries. Three million workers in the steel, coal, cement, aluminum and glass industries are expected to lose their jobs in the next few years as these industries seek to cut production by 30%.

Many of these employees are first-generation workers who migrated from impoverished rural villages with hopes of a better life. Often their families are dependent upon money these workers are able to send home. As in the United States and every other country, investors responded to the announced job cuts with joy. The stock price of China’s largest steelmaker, Hebei Iron & Steel, rose 4.3% on the news, and the second-biggest, Baoshan Iron & Steel, rose by 5.3%. The stock prices of China’s coal producers also rose on the news of the layoffs. According to the World Steel Association, China’s steel production in 2014 amounted to 822.7 million tons, or 49.4% of the world output of steel. Japan is the second largest steel producer, at 110.7 million tons, followed by the United States at 88.2 million tons and India at 86.5.

Square peg in a round trap.

• Hong Kong Property Sales Slump To 25 Year Low (BBG)

In a city that saw demand propel property prices to a record last year, the estimate that transactions reached a 25 year-low in Hong Kong shows how quickly sentiment has turned. Home prices have slumped almost 10% since September and monthly sales in January fell to the lowest since at least 1991, according to Centaline Property. Amid a spike in flexible mortgage rates this month and anemic demand for new developments, the low transactions volume for January is the latest evidence that prices have further to fall. “The danger is that when sentiment turns negative, it’s very hard to turn things around,” Michael Spencer, Deutsche Bank’s Hong Kong-based Asian chief economist, said in a telephone interview. “Developers realize they missed the best opportunity to sell.”

Hong Kong’s property market has been showing signs of weakening amid a rising supply of homes, higher short-term interest rates and slowing growth in China. Developers have been slow to make outright price cuts to move real estate while would-be buyers are delaying purchases in anticipation of further price declines, creating a standoff that could put more pressure on prices and drag down the city’s economy. Falling property prices may create a negative wealth effect on consumption by prompting buyers to cut back on their purchases, Deutsche Bank’s Spencer said. That could deal a huge blow to an already vulnerable economy where half the population owns homes and consumption accounts for nearly two-thirds of gross domestic product.

Based on housing and economic growth data going back to 2000, Spencer said that consumption growth declined on average by one percentage point for every 10% decline in housing prices. That suggests economic growth in Hong Kong could be halved to 1.1% this year assuming a 20% drop this year, he said. [..] Housing prices are down 9.5% since their September peak, according to the Centaline Property Centa-City Leading Index and may fall another 20% in 2016, according to some estimates. Centaline estimates that transactions reached 3,000 units last month. The previous low was 3,786 units in November 2008, according to a Jan. 31 release.

How can Beijing stop this one?

• Hong Kong Short Sellers Could Find The Weak Link In Real Estate (MW)

Hong Kong’s monetary chief warned Monday that speculators are wasting their time trying to short the Hong Kong dollar. But could Hong Kong’s property market be the government’s weak spot as more hedge funds line up to short China? The Hong Kong dollar has recently come into the spotlight amid reports that U.S. hedge funds are stepping up bets against the Chinese yuan. This comes after capital outflows have extended from China to Hong Kong in recent weeks as investors’ lack of confidence spreads. Since last week, Beijing’s job to hold the line on the yuan became even more difficult,thanks to the Bank of Japan’s surprise move to negative interest rates on a portion of bank reserves, which sent the yen on a renewed downward trend.

The move by the world’s third-largest economy to effectively target its exchange rate came only hours after Premier Li Keqiang pledged that China would not engage in a trade war by depreciating its currency. This is inconvenient as the market already views the yuan as overvalued as shown by accelerating foreign currency outflows. The latest move to weaken the yen just adds to the yuan’s perceived overvaluation. As well as unhelpful currency moves, confidence in the yuan is unlikely to be helped by renewed signs that China’s extended debt binge will be followed by a messy hangover.

New reports have emerged of multiple arrests after the discovery of a 50 billion yuan ponzi scheme, which may have seen 900,000 people lose money in a people-to-people lending scam. This comes on the heels of a 3.9 billion yuan loss at Agricultural Bank of China after staff reportedly devised a scam where bills of exchange were illegally funneled into the stock market before it crashed. The concern is that this is just the tip of the iceberg and that authorities will have a sizable cleanup bill as they deal with the aftermath of the stock market bubble and the loosely regulated shadow-banking sector. Still, for those with a bear view on China’s economy and currency, this is only likely to strengthen the conviction that the yuan will need to go lower.

It’s not tactics, it’s sheer desperation.

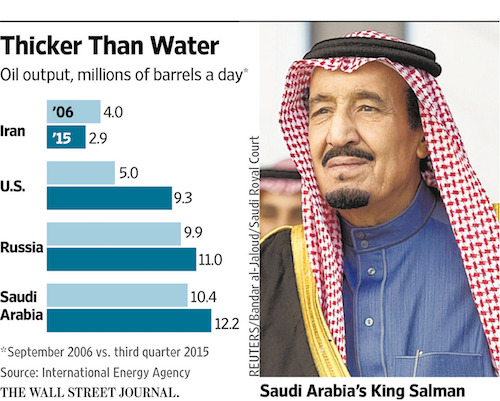

• Oil-Price Poker: Why the Saudis Won’t Fold ‘Em (WSJ)

The game being played in the global oil market today bears more than a passing resemblance to poker. Nobody wants to quit while they’re losing. That is important for investors to keep in mind as they ponder what have become almost daily spikes and drops in the price of crude. So, too, is the role of Saudi Arabia in the game. It remains within Saudi Arabia’s ability to foster at least a partial recovery in crude prices on its own. A sharp rally in prices last Thursday morning was based on comments from Russia’s energy minister that the Saudis might get the ball rolling on 5% output cuts. That was quickly refuted and oil gave up much of the gains. All major producers are suffering financially at today’s low prices—while oil has bounced from its sub-$30 nadir of January, it is still down nearly 7% in 2016 and nearly 70% from its 2014 peak.

And Saudi Arabia hasn’t forfeited only a couple of hundred billion dollars and counting in forgone revenue, but also market share. That has mainly been to a relative newcomer, U.S. shale producers. But going forward it may be to an old adversary: Iran. The Shiite powerhouse is ramping up production following the lifting of nuclear sanctions. And its export surge is occurring against the backdrop of ongoing proxy wars in Syria and Yemen. Those make it difficult for Sunni champion Saudi Arabia to take the lead with output cuts. Russia, meanwhile, is pumping the most crude ever, hitting a post-Soviet Union peak. But it may have difficulty maintaining today’s pace given a lack of investment in its aging Siberian fields. The chief executive of Russian oil giant Lukoil predicted that Russian output would drop in 2016 for the first time in several years.

Nervous boardrooms.

• BP Reports 91% Decline In Fourth-Quarter Earnings (BBG)

BP reported a 91% decline in fourth-quarter earnings after average crude oil prices dropped to the lowest in more than a decade. Profit adjusted for one-time items and inventory changes totaled $196 million, the London-based company said Tuesday in a statement. That missed the $814.7 million average estimate of 10 analysts surveyed by Bloomberg, and compares with year-earlier profit of $2.24 billion. Crude’s collapse has driven BP’s market value below $100 billion for the first time since the Gulf of Mexico oil spill in 2010. CEO Bob Dudley has cut billions of dollars of spending, removed thousands of jobs and deferred projects in an attempt to protect the balance sheet. Dudley was one of the first of his peers to start preparing for a prolonged slump and that puts BP in a better position, according to Barclays.

Profit has been lower year-on-year for six consecutive quarters as oil prices tumbled. The average price of benchmark Brent crude slumped 42% in the fourth quarter from a year earlier to $44.69 a barrel, the lowest since 2004. PetroChina said last week it expects 2015 profit to fall at least 60%. Chevron Corp. on Friday reported its first quarterly loss since 2002, while Royal Dutch Shell said last month that fourth-quarter profit is likely to drop at least 42%. The European oil major is scheduled to report full earnings on Thursday. BP started cutting costs and selling assets following the 2010 oil spill. In October, it lowered its 2015 capital-spending forecast to about $19 billion after investing about $23 billion in 2014. The company said then it expects to spend $17 billion to $19 billion a year through 2017.

But: “We’re making good progress in managing and lowering our costs and capital spending, while maintaining safe and reliable operations..”

• BP Posts Biggest Loss In 20 Years, Axes 7000 Jobs, Shares Lose 5% (Guardian)

BP is to cut another 3,000 jobs after reporting a loss of $6.5bn, its worst annual loss in at least 20 years. The latest job cuts are in addition to the 4,000 job cuts already announced. The group also said it has set aside a further $440m (£305m) over the last three months for liabilities associated with the Deepwater Horizon disaster, bringing the total bill so far to $55bn. The latest financial blow from the US Gulf accident nearly six years ago helped to drag BP into a fourth quarter loss of $2.2bn and an annual loss of $6.5bn.. Shares in the group fell by more than 5% as the results underlined the impact of falling oil prices. Despite this, Bob Dudley, BP’s chief executive, blamed low oil prices for the losses but gave an upbeat message saying the company was continuing to move rapidly to “adapt and rebalance” to cope with a changing environment.

“We’re making good progress in managing and lowering our costs and capital spending, while maintaining safe and reliable operations and continuing disciplined investment into the future of our portfolio.” The underlying profit for the last three months, not counting the Gulf and other factors, was down from $2.2bn last time to $196m, much worse than analysts had expected. A consensus among 17 analysts ahead of the results predicted that underlying profits would fall in the final three months to $730m down almost 70% on the same period a year earlier. The biggest problem for BP has come from low crude prices with Brent averaging $44 a barrel across the fourth quarter compared with $77 for the same period 12 months earlier. Brent is now down to just above $33, 42% less than a year ago.

Deflation.

• Flood Of Oil Asset Writedowns Across Asia (BBG)

Investors in Asian oil and gas companies should prepare for a wave of writedowns after a collapse in crude prices. CNOOC, Santos and Inpex are among explorers and producers that may report full-year net losses because of writedowns that may be equal to as much as 10% of book value, analysts at Sanford C. Bernstein in Hong Kong wrote in a report Tuesday. “The future value of oil and gas properties has been significantly reduced,” according to the Bernstein analysts, including Neil Beveridge. “The impairment loss will likely be larger than earnings for the year for some companies, pushing several E&P’s in the region into a loss.” Oil prices have tumbled almost 70% in the past two years, weighing on earnings and forcing explorers to cut spending.

Writedowns at Santos, the Adelaide-based energy company that built the $18.5 billion Gladstone liquefied natural gas project in Australia, may exceed A$3.4 billion ($2.4 billion), according to UBS. Companies including PTT Exploration & Production that have been active in mergers and acquisitions over the past five years also are expected to write down the value of assets, the analysts wrote. Writedowns at Chevron last week pushed the company to its first quarterly loss in 13 years. “Investors should look through impairment losses at the underlying earnings or cash flow for each company,” according to the Bernstein analysts, who expect a recovery in oil in the second half of the year. “Assuming an oil price of greater than $50 a barrel, we see value in the sector.”

Iceland remains a unique and interesting story.

• Iceland Central Bank Preparing New Weapons To Fight Capital Rush (Reuters)

Iceland is drawing up plans to tax foreigners who buy its bonds or to remove certain interest privileges to keep from being overwhelmed by a flood of money drawn by the highest interest rates in western Europe. The country is about to start the tricky process of removing the capital controls that have been in place since what the central bank governor, Mar Gudmundsson, calls “the third biggest bankruptcy in the history of mankind”. With its economy recovering and interest rates at 5.75% compared with virtually zero in the rest of Europe, concern is growing about a destabilizing rush of cash coming in. “The conditions are good for lifting capital controls – they have never been better,” Gudmundsson said in an interview with Reuters. “A current account surplus, high level of reserves, a fiscal surplus and, hopefully, inflation that is still not too high.”

He expects the first stage of that process to come in the next few months, which is to remove restrictions on foreigners’ ‘offshore crown’ funds, which are worth around 14% of Iceland’s annual economic output. Once that it is done, the bank has said, it will use some of its foreign exchange reserves to prevent any bad reaction, before taking the more uncertain step of lifting controls for the wider population. “Possibly in the Autumn or hopefully at least before the end of the year” controls on domestic residents can be lifted, Gudmundsson said. With interest rates higher in Iceland than in virtually every other developed economy in the world, Gudmundsson said, it was unlikely locals would be rushing to take their money out of their bank accounts. It was more likely foreign investors will put more in.

Foreign cash flowing into the country’s banks was one reason Iceland got into so much trouble in the first place. It has introduced a raft of measures to prevent those kind of problems. But now has a different one: so many people are buying its government bonds that interest rate increases are losing their effect. As a result, it is drawing up some counter measures. “We are working on designing certain tools that hopefully we do not need to use often but are there on the shelf if capital inflows into the bond market are making it very difficult for us to run our own monetary policy,” Gudmundsson said. “Theoretically we can do it through a tax, so instead of having an interest rate of say 6%, you are getting an interest rate of 3 or 4% in effective terms.

“The message is that a country can keep most of its economic freedoms within the EU (provided it does not join the euro)..”

• World Index Of Economic Freedom Tells Us That EU Should Be Broken Up (AEP)

Britain has overtaken the United States in the global index of economic freedom, jumping three points to 10th place. What is striking about the 2016 index released today by the Heritage Foundation is the shockingly “unfree” state of the European Union. “Greece has dropped to 138 because it has lost control over its economic levers and monetary policy” What you have is a northern free-zone clustered around the UK, Ireland (7), the Netherlands (16), and the Nordic-Baltic region of the old Hanseatic League, with Switzerland (4) as ever near the top, and safely beyond the clutches of Brussels and regulatory asphyxiation. Or put another way, it is the Protestant alliance that battled reactionary Habsburg absolutism in the late 16th and early 17th Centuries – with Germany split within, torn in both directions.

This Northern grouping is roughly that which would emerge as a closely linked area of prosperity if Britain left the EU. In my view most of these states would also pull out within 10 to 15 years – de facto, if not jure – once Britain had set the ball rolling. Germany would be left trying to manage two deeply troubled blocs with demographic crises: a poor sphere to the East where a fragile rule of law is breaking down in one country after another; and a heavily indebted bloc in the South that is trapped in deflation and labour hysteresis, and has yet to claw back its lost competitiveness within the structure of monetary union. The index shows that EU countries are on average less free than other countries with a comparable per capita income and level of development, an indictment that should give cause for thought. Several of them are disasters.

Greece is ranked “mostly unfree” and is deteriorating five years after it crashed into the arms of the Troika, which claimed to be pushing through reforms to make the country more efficient, transparent, modern and competitive – but was in reality collecting debts for northern creditors under false guise. Greece has dropped to 138 – sandwiched between Bangladesh and Mozambique – precisely because it has lost control over its economic levers and monetary policy. Capital controls have been relaxed somewhat since the banking crisis last summer, yet Greeks are still limited to ATM withdrawals of €420 a week. Italy is only “moderately free” at 86. Heritage says it is plagued by high taxes and rigid labour laws. It has yet to sell off the rump of state-owned industries. Court procedures are “extremely slow”. State contracts are tainted by “high-level corruption scandals” and the “involvement of local organized crime.”

“..this sucker could go down so much further than they imagined, that whatever fortunes they gain from its descent will be foiled by the destruction of the very economic system needed for them to enjoy their gains.”

• Ground Control to Captain Zhou Xiaochuan (Jim Kunstler)

Why would anybody suppose that the Peoples Bank of China might want to tell the truth about anything that was within their power to lie about? Especially the soundness of any loan portfolio vested unto the grasp of its tentacles? Of course, most of what China has done in speeding toward the wall of financial crack-up, it learned from watching US bankers slime their way into Too Big To Fail nirvana — most particularly the array of swindles, dodges, and frauds constructed in the half-light of shadow banking to hedge the sudden, catastrophic appearance of reality-based price discovery. When so many loans end up networked as collateral in some kind of bet against previous bets against other previous bets, you can be sure that cascading contagion will follow.

And so that is exactly what’s happening as China’s rocket ride into Modernity falls back to earth. Like most historical fiascos, it seemed like a good idea at the time: take a nation of about a billion people living in the equivalent of the Twelfth Century, introduce the magic of money printing, spend a gazillion of it on CAT and Kubota earth-moving machines, build the biggest cement industry the world has ever seen, purchase whole factory set-ups, and flood the rest of the world with stuff. Then the trouble starts when you try to defeat the business cycles associated with over-production and saturated markets. Poor China and poor us. Escape velocity has failed. Which raises the question: escape from what, exactly? Answer: the implacable limits of life on earth.

The metaphor for all this, of course, is the old journey-into-space idea, which still persists in the salesmanship of Elon Musk, the ragged remnants of NASA, and even the nightmares of Stephen Hawking. Get off this messed-up home planet and light out of the territories, say Mars. Of course, this is a vain and stupid idea, since we already have a planet engineered to perfection for all the life systems associated with the human project. We just can’t respect its limits. So now, that dynamic duo, Nature and Reality, the actual owners of the planet, have showed up to read the riot act to the renters throwing a wild party.

The fourth and perhaps ultimate financial crisis of the last twenty years begins to express itself in terms that only the raptors and vultures can see from on high. George Soros, Kyle Bass, and the other flocking shadow banking scavengers prepare to short the living shit out of the old Middle Kingdom. The immortal words of G.W. Bush ring in their ears: “This sucker is going down,” and they are sure to win big by betting on the obvious. Trouble is, this sucker could go down so much further than they imagined, that whatever fortunes they gain from its descent will be foiled by the destruction of the very economic system needed for them to enjoy their gains.

Refugees are back on sale.

• Progress On Migration Could ‘Facilitate’ Greece’s Bailout Review (Kath.)

Greek authorities are scrambling to set up screening centers for migrants and refugees as soon as possible as German officials have made it clear to Athens that more efficient management of the refugee crisis could help along creditors’ review of the country’s third bailout, Kathimerini understands. According to sources, German Chancellor Angela Merkel has indicated to Prime Minister Alexis Tsipras that success in tackling the migration crisis could boost the country’s prospects for progress with the review, which Athens hopes could ease the way for debt talks. Combined with a burgeoning debate about Greece’s future in the passport-free Schengen area, the message from Berlin is said to have encouraged action by Greek officials.

A source close to Tsipras who participated in a meeting of government officials on the refugee crisis over the weekend told Kathimerini that the prospect of a “European solution” to the migration crisis and Schengen issue was “becoming increasingly remote” as EU governments face a backlash from their own people about rising migrant arrivals. Tsipras is expected to meet Merkel on the sidelines of a Syria donors’ conference in London on Thursday where Greece’s response to the refugee crisis is likely to be the key topic of conversation. A broader meeting including Turkish Prime Minister Ahmet Davutoglu and key officials from other European countries, among them Austria and the Netherlands, is also probable, sources indicated.

On Monday Tsipras met in Athens with visiting European Home and Migration Commissioner Dimitris Avramopoulos and reassured him that the Defense Ministry, despite initial objections, would actively participate in finding a solution for accommodating thousands of migrants and refugees arriving in Greece. He insisted, however, that others must also share the burden, indicating other European states.

Nice try, but Mason drops the ball somewhere.

• Europe’s Refugee Story Has Hardly Begun (Paul Mason)

The refugee story has hardly begun. There will be, on conservative estimates, another million arriving via Turkey this year and maybe more. The distribution quotas proposed by Germany, and resisted by many states in eastern Europe, are already a fiction and will fade into insignificance as the next wave comes. Germany itself will face critical choices: if you’re suddenly running a budget deficit to meet the needs of asylum seekers, how do you justify not spending on the infrastructure that s supposed to serve German citizens, which has crumbled through underinvestment in the Angela Merkel era? But these problems are sideshows compared with the big, existential issues that a second summer of uncontrolled migration into Greece would bring.

[..] Greece is not going to push back or sink inflatables containing refugees. However many compromises Alexis Tsipras s government made over austerity, it is full of human rights lawyers, criminology professors and people who spent their lives fighting fascism. There is outrage at Europe s demands inside the Greek political establishment, ranging well beyond the radical-left party Syriza and its small nationalist coalition partner. Eastern Europe is, by and large, going to let the refugees go to hell. There is very little compassion in the media coverage of the refugees east of the former Iron Curtain. Poland, Hungary and Slovakia have swung towards populist nationalism. While there are tens of millions of liberal-minded, largely young people who are prepared to show compassion and adhere to international obligations, they do not control east Europe’s governments.

As for Turkey, it has, to date, taken no visibly stronger measures to keep Syrian refugees inside its own borders and prevent the deadly traffic across the sea to Greece. For a state that can arrest its own newspaper editors at will and bomb its own cities, that demonstrates a clear set of priorities. So there are only two variables: what the EU does next and what the European peoples do. If Germany has given up trying to organise the orderly distribution of refugees inside the EU, then free movement itself is on borrowed time. Everybody understands this, except the political and media classes who have to maintain the fiction that everything is fine. Germany had, by December, registered just over half the 900,000 asylum claims it is facing. The hard-right AfD party has sprung from sixth to third in the polls. Angela Merkel seems frozen in the headlights of the oncoming train.

Which leaves the people. Quietly, and without rhetoric, one of the most spectacular, cross-border solidarity movements ever formed has emerged to help the refugees. Churches, NGOs, communities, police forces and social services – plus ordinary people with no big agenda – just got on and saved people, moved them along, gave them water, food and clothing, and are right now helping them to settle in.

Solid.

• Where Are Our Principles? (Boukalas)

When neo-Nazis are seen heading out in force on a new kind of safari, hunting down and assaulting refugees and migrants, preferably young Africans, in Sweden, a country regarded as a paradigm of prosperity and openness, Europe has a duty to have a good think about what it represents – all of Europe, together, honestly and methodically, not alone, hypocritically and intermittently. When in Germany, which has seen successive neo-Nazi attacks against refugee camps, the head of the anti-immigration Alternative for Germany party – polling at 13% – demands that refugees be stopped from entering the country by use of force if necessary, we should all be afraid. We should be afraid that not enough people in Europe would mind if Greece were to allow migrant boats to sink, as some of the harder cynics have suggested with a hint of blackmail, even though their problem would not be solved by 244 drowned in January alone.

When European states and regions are caught up in competing over who will further reduce the amount of money refugees are allowed to keep on them (from what wasn’t lost to the extortionate greed of people smugglers and thieves en route) and seize what’s left over so that the beleaguered Asians and African don’t get too comfortable, then “something is rotten in the state of Denmark.” Denmark here extends to various parts of Europe: to Denmark proper, where the maximum “fortune” a refugee is allowed has been set at €1,340, to Switzerland, where it’s €915, Bavaria, €750, and Baden-Wurttemberg, where it’s just €350. Many already regard this as too much. When in Italy noble merchants are selling “boy and girl refugee costumes” for the Carnival, then every European, not just the Italians, ought to wonder how much longer we will allow our masks to present us as sympathetic champions of a culture that is about solidarity and hospitality.

When countries of the European Union intervene in a non-member state (our neighbor the Former Yugoslav Republic of Macedonia) wielding a whip in one hand and a carrot of monetary reward and diplomatic support in the other in order to force it to control the flow of migrants and refugees to Northern Europe at the pace the north sees fit, then many of the principles touted as being inviolate in the EU are exposed as a myth: solidarity between partners and avoidance of unilateral decisions and intervention in third countries. What solidarity is there to talk about when instead of admitting that the refugee crisis is a huge added weight on the exhausted shoulders of Greece and, looking for ways to ease the burden, many Europeans are using it as another opportunity to blackmail the country? Even if Greece has delayed in setting up “hot spots,” who gave the tough guys of Europe the moral authority to threaten it with drowning?

Home › Forums › Debt Rattle February 2 2016